Gold World News Flash |

- Marc Faber: Holding Gold Is a No Brainer

- Why the Money in Your Wallet Isn’t Safe

- Bill Clinton’s Airport Meeting With Attorney General Casts More Distrust of Elites

- Answer This!

- Paper Currency Doomed, Gold In Pound Sterling £1,000

- Silver Cup and Handles Project to a Potential Price of $54

- Breakouts Galore in Gold and Silver

- Max Porterfield – Callinex Mines is on the Move

- ELON MUSK IS AN OBVIOUS FRAUD

- “Physical” Silver Market Manipulation

- Gerald Celente – TREND ALERT: Bigger than Brexit: Market Mayhem. Will Gold Glow?- (6/29/2016)

- Grant Williams: Brexit Could Lead to EU Collapse or Even War!

- Why The Collapse Of The U.S. Economic & FInancial System Has Accelerated

- “Key Resistance in Silver Has Been Broken” – Mornings With “V” (07/01/2016)

- Gold Price Closed at $1336.70 UP $18.30 or 1.4% - Silver Price Closed at $19.54 UP $0.96 or 5.2

- Clinkle Goes Clunk

- Beyond Brexit – More Earthquakes on the Way

- Silver Cup and Handles Project to a Potential Price of $54

- Gold Daily and Silver Weekly Charts - That Was The Week That Was

- Silver Cup and Handles Project to a Price Target of $54

- Forecasts, Commentary & Analysis on the Economy and Precious Metals

- Gold, Silver and Bitcoin Bull Markets Being Driven by NIRP - Video

- Warning: This Video Will Make Your Blood Boil

- The EU Is Breaking Up Politically And Financially

- 2016 The Last Summer Before The Collapse?

- #BREXIT will result in The Break Up of the EU and NATO -- Dr.Paul Craig ROBERTS

- Gold-to-Palladium Ratio

- Gold's Final Warning of Impending Monetary Collapse

- China Can and Will Confiscate Gold When it Suits Them!

- Wondrous Aesthetic Effects of Light and Color

- Dollar's share of global reserves slips, euro's rises, in first quarter, IMF says

- Gold-to-Palladium Ratio

- Gold, Silver Reaction Following Brexit, Central Bank Desperation Never More Evident…

- Top Ten Videos — July 1

- Diving Into Deutsche Bank’s “Passion to Perform” Balance Sheet

| Marc Faber: Holding Gold Is a No Brainer Posted: 02 Jul 2016 01:00 AM PDT The Gold Report | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why the Money in Your Wallet Isn’t Safe Posted: 02 Jul 2016 12:30 AM PDT by Doug Casey, Casey Research:

We're not talking about the stock market or the bond market. This market is 40 times bigger than the stock market—yet you rarely hear about it in the mainstream media. Without it, the global economy couldn't function. And right now, it’s undergoing a massive shift. In today’s Dispatch, we’re taking a close look at the global currency market. As we’ll show you, all of the early warning signs of a global crisis are there…but the good news is that it’s not too late to start protecting yourself today…

As you probably know, Great Britain voted to leave the European Union (EU) last week. The "Brexit," as the media is calling it, wiped out more than $3 trillion from the global stock market between Friday and Monday. According to Standard & Poor’s, it was the biggest global stock selloff in history (surpassing the previous record of $1.9 trillion set in September 2008). The decision sent shockwaves throughout the global currency market. The British pound plunged 8% on Friday. It was one of the pound's worst days ever. It's now trading at the lowest level in three decades. Other major currencies experienced wild moves too. The euro fell 2.4% on Friday. The yen surged 4.5%. And the U.S. dollar rose 2.2%. These are enormous one-day swings. But it wasn’t just last week… • These extreme moves have been happening for two years now… Since 2014, we’ve seen major fluctuations in the world’s most important currencies. The value of the euro has swung 33%. The U.S. dollar has swung 27%. The Japanese yen has swung 24%. Currencies in commodity-producing countries have been even more erratic. The Australian dollar's value has swung 38% since 2014. The Canadian dollar has fluctuated 37%. • The global currency market wasn’t always this volatile… That's because America, the owner of the world's most powerful paper currency, once used the gold standard. Under this system, the value of the U.S. dollar was directly linked to gold. Every dollar was worth a fixed amount of gold. Since gold has real value, this gave the dollar a true, stable value. But the U.S. government ended the gold standard in 1971. The U.S. and every other country on the planet now use a "fiat" money system, meaning the value of their paper money is based on nothing but confidence. Governments can now print money at will. • World governments have "printed" more than $12 trillion since September 2008… Central bankers created this cash using a radical policy known as quantitative easing (QE). That's when a central bank creates money from nothing and pumps it into the financial system. The U.S., the European Union, and Japan have all tried to stimulate their economies with QE. It's failed every time. The U.S. and Europe are growing at the slowest pace since World War II. Japan's economy hasn't grown in two decades. Unfortunately, central bankers haven't just manipulated the supply of money. • They've warped interest rates too… Dispatch readers know interest rates aren't just some arbitrary number. They're the "price of money." When rates are high, money is expensive. That tells folks it's a good time to save money. When rates are low, money is cheap. That's when you want to borrow money. Interest rates are the traffic signals of the economy. They direct money to where it should go. But interest rates only work when the market sets them. When governments manipulate rates, they send false signals, tricking people into making bad decisions on how to invest, save, and spend money. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Clinton’s Airport Meeting With Attorney General Casts More Distrust of Elites Posted: 01 Jul 2016 11:30 PM PDT by Pam Martens and Russ Martens, Wall St On Parade:

Now, President Obama's newest head of the Justice Department, Loretta Lynch, has come under withering criticism for conducting a private meeting with former President Bill Clinton on her government plane at the Phoenix Sky Harbor International Airport while his wife, presidential candidate Hillary Clinton, is under an active criminal investigation by her office for transmitting classified government material over her private email server while Secretary of State in the Obama administration. President Obama's two terms have been filled with personnel from the Bill Clinton presidency, leading to the appearance of continuity government between the two camps. The current U.S. Attorney General, Loretta Lynch, was appointed by Bill Clinton in 1999 during his Presidency to head the U.S. Attorney's office for the Eastern District of New York, where she worked until 2001. According to her official bio, she joined the corporate law firm, Hogan & Hartson LLP (now Hogan Lovells) in 2002 and remained there until January 2010 when President Obama nominated Lynch to once again head the U.S. Attorney's office for the Eastern District of New York. The American Lawyer reported in 2008 that while Lynch was employed as a partner at Hogan & Hartson, a tax attorney at that firm, Howard Topaz, handled the Clintons' tax returns since at least 2004. According to the article, the law firm was also a major contributor to Hillary Clinton's political campaigns. Both Republicans and Democrats are now questioning the inexplicable lack of judgment on the part of Lynch. CNN legal analyst, Paul Callan, a former media law professor, wrote the following last evening:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 11:15 PM PDT By Chris at www.CapitalistExploits.at I've been inundated with questions from many of you following the recent events. Brexit, that is, not Justin Timbertrouser's latest antics. While I can't publish all of them, I've selected what I think are some of the most important ones. A lot of questions were related to positioning during and post Brexit. I hate to mention it as I may choose to trade out of whatever I mention at any given moment so please bare that in mind.

Ok, onto the questions...

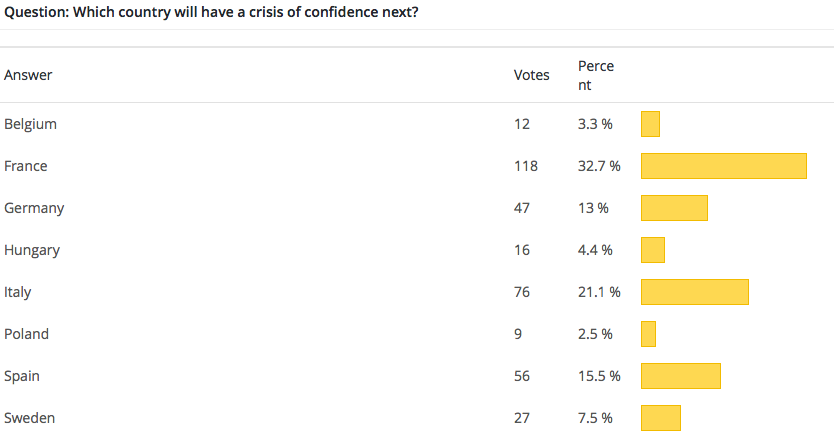

Excellent points on the historical situation with Germany and Italy, and pinpointing the currency aspect. Not everyone agreed with Italy as it came in a close second to France, as you can see below from the poll I ran in the recent World Out Of Whack. We're actually dealing with two drifferent problems here - the EU and the currency. Let's take a closer look at both. The EU was originally designed to stop Europeans killing each other (something they've been doing for centuries) and to foster closer ties between European countries by eliminating barriers to trade. As the old adage goes, "When goods don't flow, bullets do." And this was at the core of the EU idea. Giuseppe always loved BMWs, didn't care for sauerkraut (I don't blame him), and - while being infuriated with Hans who is as punctual as Big Ben - saw no reason not to make the buying of his BMW any easier. Hans, on the other hand, still believed that all Italian woman were smoking hot, all Italian men were plumbers, and though he couldn't understand how pasta could be eaten everyday without causing some sort of digestive problem, he welcomed the idea of shooting down to Puglia for a weekend's sun - sans silly visa requirements. So why not allow Hans and Giuseppe to manage all this with less friction? Increasingly though, the EU has become a barrier to trade rather than an enabler. Today there are restrictions and laws governing how bendy a banana must be. Not bendy enough and it doesn't meet regulation. Cucumbers can't be too bendy, on the other hand. Not straight enough and they too are in the tip. Then there is the famous case of the EU directive stating that water does in fact NOT hydrate you. Retailers of water were banned from suggesting water would in fact hydrate you. Prunes are not laxatives (contrary to anyone who tests the theory), turnips are not allowed to be called swedes, and eggs are not allowed to be sold by the dozen. Instead, they must be sold by weight only. Powerful vacuum cleaners are banned. You see, they chew up too much energy. Diabetics should be banned from driving and the list goes on and on. It's enough to make blood shoot out of your eyes. When looking at the sheer weight of unexplainable laws, you're left thinking that only a mentally ill person could have put them together. And you'd be right. The European Parliament is mentally ill and though Britain's exit from this "fustercluck" will have immediate negative consequences, I'm all for a controlled demolition rather than a supernova which is where the EU is most assuredly headed. The single currency, on the other hand, was always as terrible an idea as walking through Damascus with an "I hate Muslims" T-shirt would be. You just knew it would cause pain and suffering. Each European country experiences unique business and credit cycles which are often independent of one another. They always had a shock absorber, allowing for economies to adjust to the economic bumps of the business cycle. That shock absorber was their own currency. Let's use an admittedly simplistic example. Let's say that Greece becomes uncompetitive in terms of trade. It would then experience weakening corporate profits, leading to less investment, leading to higher unemployment. This could then be met with weakening the currency, which in turn leads to lower operating costs, higher profit margins, renewed employment growth, and a renewal in investment. The reason Greece is clocking a 51% youth unemployment and Spain a 45% youth unemployment rate is directly tied to the fact that the currency as a shock absorber has been taken away. Instead, these countries are forced into a straight jacket where rather than a weak currency they get a persistent weak economy.

Here's the next one:

Well, it's back up at $674 as I'm writing this which simply demonstrates how volatile it is. Think about it like this: Bitcoin market cap is about $10bn. Around $3bn of that is reportedly owned by founders and early adopters, leaving around $7bn actively traded. Of that, over 80% is traded in China which is a black box. It is one reason I'm paying a lot of attention to China and goes back to my devaluation argument. One other thing to consider... Do you know of any other asset with a market cap of say $6bn which has anywhere near the airtime that Bitcoin has? Right now the ability for institutional money to get into Bitcoin is still somewhat limited. It is clear that market acceptance amongst the suited and booted is on the rise so it's not just Molly dealers and kiddy fiddlers who are using it. If we get a real ETF in this space watch out! Bottom line: I think Bitcoin either goes to zero or it goes supernova. I've spoken at length around the geopolitical environment which is highly conducive to Bitcoin doing well. Next question...

I didn't respond to this clown but I did remove the idiot from my mailing list. Aside from the vitriolic response and the fact the guy needs to be fed a brick, there are some key points any sane investor should consider as the only arbiter at the end of the day is the market. Whenever I look at any market I try to form an opinion based on data sans opinions. I always find I come down with a basic viewpoint and I know it's biased in some regard. It might be bullish or it might be bearish. The next step is to find credible people who think the OPPOSITE. The reason this works for me is due to something called first confirmation bias. It's been proven that the first conclusion we come to is very difficult to remove, and the longer we hold that viewpoint the greater the risk of us identifying ourselves with it. The risk is that once you've reached a certain viewpoint you do what fully 90% of people do - you seek confirmation. You'll find it, I assure you. If you want to believe that Elvis is alive and you search for evidence to support this viewpoint, you'll find others agreeing with you. They may be mentally ill or 4 but you'll find them. So yes, right now I'm bullish on the dollar and I don't at this point in time work for anyone at all. As for Jews, why are they any different from Armenians, for example? Capitalist Exploits is not a home to xenophobic bigots or people who wear their socks with sandals (kidding). So if you're reading this and are a xenophobic bigot with a small brain and a large mouth, do me a favour and close this page please. Otherwise, you're welcome to stay with us and tell your friends to come and join us - even if they wear their socks with sandals. Onto the penultimate one:

I could write an entire chapter of articles on this so let me try be brief. I'll be covering many of these aspects over the coming weeks and months. Contagion in EU and China looking bad are in my mind bullish the dollar. Why would this be bearish dollars? Also, if you look at global yields right now the US 10-year sports a higher yield than the UK, Germany, France, Italy, and Spain. Right there is a fantastic arbitrage opportunity which I've been plying for the last 3 weeks and one which you get paid for. Carry is on your side: short European bonds and long US bonds allows you to get paid for the trade. You do take currency risk but I'm struggling to find reasons why I'd be bullish the Euro. As to bonds, too much to talk about so let me cover that in future missives. And the final question:

I see too many risks for my own liking given the global macro landscape. I'll still be doing very specific private deals. I mentioned some questions to consider on this topic in my article last week but here's some further bullet points to consider, namely a shift in risk capital. If you're a young startup company looking to raise capital without a clear path to revenue (not growth) then you're dead. Forget it. I'm not interested. Funding companies which will need to be going back to the trough in another 12 months elevates the risk MASSIVELY for me. And right now VCs are still living in la-la land because many are 20-somethings who don't understand global macro capital trends. After having done over 50 deals and diligencing hundreds more, I can promise you that every company underestimates its time to revenue, overestimates its revenues, underestimates its cash burn, and overestimates its ability to raise additional cash. Structuring and knowing what risks you're taking is absolutely critical and never more so going forward into the macro environment lying before us. Add to this the kind of valuations that are still legacy 2014 and you've got a lot of new deals which will be entering a market they don't actually understand. Additionally with the type of asymmetry being exhibited in the macro space and the opportunities available everything for me is relative. Other than that I'm very focussed on doing less and having time to think every day. This requires elimination of non-essentials and private investing is incredibly time consuming if you're doing it properly. Sure, you can throw money at a bunch of deals that you've perused the pitch decks on but proper due diligence takes months, not a couple hours on the sofa. And with that I wish you all have an awesome weekend and I will see you next week. I'm off to take my wife on a date. - Chris "Women need a reason to have sex, men just need a place." - Billy Crystal ============ Liked this article? Don't miss our future articles and podcasts, and get access to free subscriber-only content here. ============ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paper Currency Doomed, Gold In Pound Sterling £1,000 Posted: 01 Jul 2016 11:00 PM PDT from Junius Maltby: Junius Maltby discussion and Summer update on Gold performance and the future of paper money as told by Marc Faber. As we repeat often – Paper Money Is DOOMED. Gold just blew passed the £1,000 mark! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Cup and Handles Project to a Potential Price of $54 Posted: 01 Jul 2016 10:23 PM PDT I know some of you have been projecting these nested 'cup and handle' formations on your own, because several readers have sent their examples to me and have asked for comments. My first comment is the most important and I wish you to take it to heart. Projections such as this are not forecasts, because the chart formations in these examples for the most part have not been 'activated' and are therefore merely potential things, possibilities, lines on a page subject to a great many exogenous forces and variables, including human and institutional decisions. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breakouts Galore in Gold and Silver Posted: 01 Jul 2016 10:18 PM PDT Gold broke-out last week on Brexit while Silver waited a week to join the party. The miners, meanwhile cleared 2014 resistance today. There are breakouts across the board in the precious metals space. The weekly candle charts of Gold and Silver are plotted in the image below. Gold appears to have digested the Brexit pop well as it gained another 1.5% on the week to $1339. If it holds above monthly and quarterly resistance ($1330s) then it should be on its way to $1380-$1400. Meanwhile, Silver surged 9.9% on the week to $19.59. It has broken out from an inverse head and shoulders pattern to nearly a 2-year high. The pattern projects to a target of $22. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Max Porterfield – Callinex Mines is on the Move Posted: 01 Jul 2016 10:01 PM PDT by Kerry Lutz, Financial Survival Network:

Click HERE to Listen | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 09:20 PM PDT Something that all of his companies rely upon is continued gub'mint cheese. Without the largesse of the state, his entire empire would have already collapsed. from DSSK:

Often a huckster with a veneer of unshakable confidence comes along and the social cost of his fraud becomes a burden to civilization at large. So powerful is the allure of personality cults to investors that many of those that many of the same funds that have lost fortunes to them will instantly jump into bed with another.

In 2012 a Brazilian business magnate named Eike Batista had his net worth measured at 32 billion dollars. He was named the world's 8th richest man. Investors poured billions into his companies. He was an actual golden child, having ascended to wealth and influence on a stroke of luck by being in the gold mining industry during a historic rise in the value of gold. He leveraged that position to break into many new industries that were perhaps more difficult than simply taking existing gold mines and seeing their margins rise. Not content with being just a gold magnate, he decided he would raise large amounts of public money and get in the business of iron mining, solar energy, coal mining and power generation, offshore oil drilling, and international logistics and shipping. He had no unique special knowledge to lead him into these industries— just the charm to convince institutional investors and his home government to grant him gigantic infusions of cash. One by one Batista's businesses fell. Batista's oil wells only pumped 1/50th of the barrels he predicted they would and OGX, the company that owned them, filed for bankruptcy. The power generation company he founded, MPX, lost 400 million dollars a year until it filed for bankruptcy in 2014. OSX, his offshore drilling equipment manufacturer, was contingent upon the success of OGX and also went bankrupt. MMX, his iron mining venture, fell completely flat after losing billions in investments. LLX, his attempt at a global shipping and logistics enterprise, found few customers. All his stock tickers ended in X, "to symbolize the multiplication of wealth". He is now potentially the single greatest destroyer of wealth that ever lived. The fallout of Batista's collapse was massive. Its brush tainted not only the economy of Brazil but all emerging markets. For the next two or more decades one man's incompetence is going to make it far more difficult for ventures in tens of countries to find investment. Many of the institutional investors which put their faith in Batista's schemes were pension funds left holding double-digit stakes in enterprises whose liabilities were a multiple of their assets. There were a bunch of warning signs. The biggest red flag is taking on a multitude of projects each of which would need a full-time commitment from any man, no matter how brilliant and resilient. It speaks of a personality in the throes of mania, jumping into the founding of one business after another with disregard for their ability to push them into the black. The second is a man's transition from great success borne chiefly of luck, charm, and market conditions in simpler industries to far more complicated industries requiring long-term capital influx from both public and private sources. There's no businessman that exhibits these characteristics today more than Elon Musk. He made his initial success in an unrepeatable environment of the dotcom boom. Making web applications is ridiculously simple compared to any one of Elon's new ambitions: automobiles, space travel, solar energy, and public transit. Any single one of these would be a massive undertaking, requiring the full focus of any CEO. To take them on all at once reeks of foolish pride and mania. There's something innately childish about trying to be the king of cars, space, and trains all at once as well. It's like he's picking everything preteen boys might decorate their room with.

The financials and market realities make it obvious that Tesla is doomed to fail. Elon Musk has failed to capture the potential centers of profit in the new transit economy. Uber has captured the user experience of personal transit, and Google is leaps and bounds ahead of anyone else in overcoming the legal and technical hurdles of autonomous vehicles. These are the parties best suited to profiting in a burgeoning new economy of technology-enhanced transit. Tesla leveraged itself to the hilt on batteries in a prediction of rising gas costs forcing a switch to electric vehicles, but fracking and shale oil drove crude prices from $146 from their peak in June of 2008 to pretty consistently under $50 these days. Oil might drop even further. Tesla's level of leverage leaves anything other than a significant market share in the car market as a fatal outcome. It has no room for competitors, which is why I believe that Musk got so defensive in a German newspaper when confronted with rumors of Apple's self-driving car project and began to so aggressively attack them: "Important engineers? They have hired people we've fired. We always jokingly call Apple the Tesla Graveyard. If you don't make it at Tesla, you go work at Apple. I'm not kidding." J.B. Straubel, Tesla's CTO, said that employees can "get afraid" of Musk. A former Musk employee said to of him, "Elon's worst trait by far, in my opinion, is a complete lack of loyalty or human connection. Many of us worked tirelessly for him for years and were tossed to the curb like a piece of litter without a second thought. Maybe it was calculated to keep the rest of the workforce on their toes and scared; maybe he was just able to detach from human connection to a remarkable degree. What was clear is that people who worked for him were like ammunition: used for a specific purpose until exhausted and discarded." How many of these new Apple employees are arriving from Tesla with a strong desire to give as big of a fuck you to Musk as possible after being fired for failing to meet increasingly unreasonable product requirements and deadlines demanded by a foolhardy sociopath? Tesla's entire future is bound in the hope that Google takes only the low end of next generation vehicles. If Apple creates a luxury electric car, that alone is likely to destroy any hope of success. His current level of leverage leaves no room for the smallest of setbacks, or him scaling up operations in a crowded market with significantly capitalized competitors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Physical” Silver Market Manipulation Posted: 01 Jul 2016 09:02 PM PDT *NOTE the mirrored image and open-sky warehouse that was photo shopped in on this “silver inventory” picture used by the Mainstream Media! by Bix Weir, Road To Roota:

So yes, the electronic market rigging apparatus is fully operational and running 24/7 and with a “Click of a Mouse” they can set the price of silver at $0/oz or $1M/oz.

But there is another part of the silver market rigging that needs to be addressed and although it counts for less than 0.025% of the entire silver market it is vital… The PHYSICAL SILVER market must be kept in check as well and that’s not as easily done. The following article is about the JP Morgan silver manipulation lawsuit that was just dismissed by another corrupt NYC judge. It it tells the story of how the physical manipulation of silver works… JPM Silver Decision Flawed by Vince Lanci 1. You physically remove the silver from the warehouse – because of the physical work involved a receiver can take almost 6MM oz of Silver daily. Why? Because it’s just not that easy to move silver out of the vault and onto a receivers vehicles. So when you see “30MM oz removed” it’s not physically possible. 2. You take delivery, store it nearby and bring it back when you are out of your long futures position – Be long 30MM oz of silver in futures. – Take delivery of 20 MM in physical using borrowed money – Store the metal in a warehouse in RedHook Brooklyn and wait for the news to spook the market. – Tell your pals with long positions to make their own silver unavailable for delivery. as prices will go up soon 3. You throw a sheet over the silver still in the warehouse and say, “this is mine, it is no longer here. I’ll pick it up tomorrow- – Phibro was to have employed all 3 methods in 1997 after filling Warren on his buys.- Andy Hall was a genius when he had order flow to front run 4. Buy the last 1,000 contracts for the customer as sloppily as you can. 5. Tell the customer you beat the VWAP, i.e. last price on the board is higher than the average price you bought for client. END I love all the “cover-up drama” that goes on behind the scenes to hide traders REAL positions. The key to a successful professional trader is to NEVER let anyone know your position…especially if you are short. Lie, cheat and steal is the mantra of commodity traders. In my opinion, commodity traders are usually half genius and half criminal…but when the criminal half is supported and protected by the government – there can be no “free markets.” Here’s my favorite part of the article: “During my career, I’ve been victim, observer, perpetrator and now despiser of market manipulators and the market structure that rewards corporate greed at the expense of free markets. The little guy can no longer compete. Organizations that speak for him (GATA etc) get shouted down because they don’t have a PAC. Watch, homogeneous counterparties will be the death of the markets. TBTF means too big to exist IMHO.” END Yes, in the end the COMEX and LBMA and all other silver exchanges will be shut down. There will be no final settlement of contracts and the criminals will walk away from their short positions with their physical silver in hand. And that day will be here soon so time to load up on physical in your own possession! May the Road you choose be the Right Road. Bix Weir PS – If you are watching the markets, the silver price is now being “allowed” to rise so I guess it’s time to pull out an Oldie but Goodie that I first debuted at the 2011 Silver Summit! SILVER MANIPULATION SONG | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente – TREND ALERT: Bigger than Brexit: Market Mayhem. Will Gold Glow?- (6/29/2016) Posted: 01 Jul 2016 09:00 PM PDT from Gerald Celente: “The latest Trend Alert is released, Gold continues to glow and "US home sales fell a more than expected 3.7% in May". | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Grant Williams: Brexit Could Lead to EU Collapse or Even War! Posted: 01 Jul 2016 07:20 PM PDT by Erik Townsend, Macro Voices:

Grant's experience and insights from observing Brexit outside of the UK | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The Collapse Of The U.S. Economic & FInancial System Has Accelerated Posted: 01 Jul 2016 07:11 PM PDT

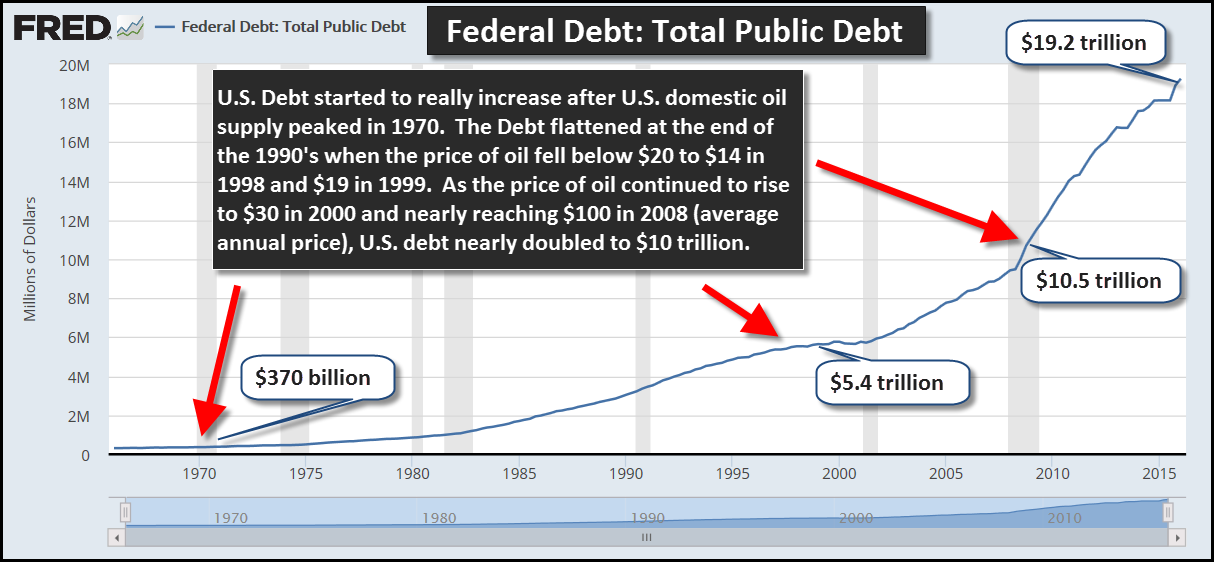

By the SRSrocco Report, The collapse of the U.S. economic and financial system accelerated this year, thus pushing the country closer to a third-world status. Most Americans are unaware of the dire consequences facing the nation, so they continue to believe business as usual will continue indefinitely. Unfortunately, lousy reporting by the Mainstream media along with the public's denial and delusional thinking is a recipe for disaster for most Americans over the next several years. The U.S. economy is being propped up by a great deal of monetary printing, Fed stock and bond purchases and extreme leverage in all areas of the market. While these policies have given the "ILLUSION" of continued prosperity, or at best a sustainable slow growing economy, the debt now in the system is unsustainable. Still to this day, most investors (including precious metals investors) do not understand the real reason for the massive increase in U.S. Federal debt. They believe the debt was either increased to enslave Americans or to fund continued economic growth. While the second reason is more accurate, they still fail to understand the "ROOT CAUSE" of the debt increase. The Massive Increase In U.S. Debt Tied To Falling U.S. Oil Production & Rising Oil Prices This chart puts the huge increase in total U.S. debt in perspective:

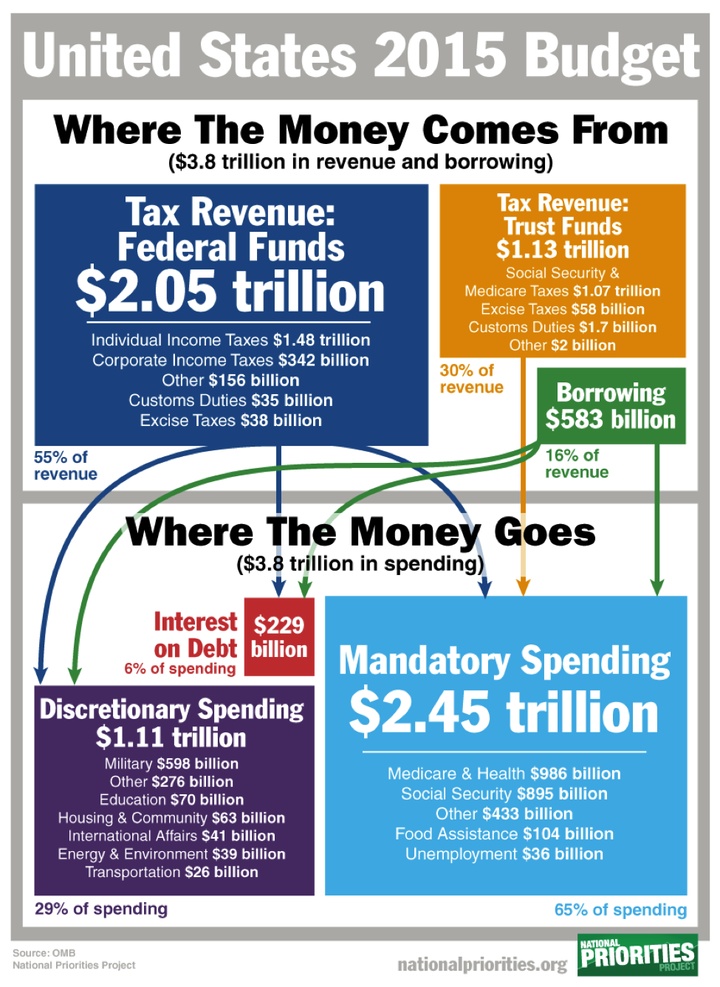

The annual increase in U.S. debt was very small up until the 1970's. This was due to the peak of cheap U.S. domestic oil production. U.S. oil production peaked in 1970 at about 10 million barrels per day (mbd). That year, total U.S. debt was $370 billion. That's hilarious, because the annual deficits today are larger than the entire U.S. debt in 1970. As the oil price increased in the 1980's and as U.S. oil production declined, total U.S. debt continued to increase. However, in the late 1990's, the U.S. debt leveled off. This was due to the price of oil declining below $20, reaching $14 in 1998 and $19 in 1999. In 1999, U.S. debt had increased to $5.4 trillion. Then as the price of oil increased from $30 in 2000 to nearly $100 in 2008, total U.S. debt nearly doubled to $10.5 trillion. In addition, U.S. domestic oil production declined nearly 4 million barrels per day from 1985 to 2008. This also had a negative impact on U.S. debt levels. ------------------------------------ IF YOU ARE PAYING MORE THAN 30 BASIS POINTS A YEAR TO STORE PRECIOUS METALS, YOU ARE PAYING TOO MUCH. If you haven't checked out our new new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page on our site, I highly recommend you do. ----------------------------------- While it's true that the cost of energy is only a small part of U.S. GDP, its impact is multiplied when the U.S. economy and government try to provide the same standard of living as it did prior to 1970. Furthermore, the EROI- Energy Returned On Invested of U.S. oil production declined significantly since the 1950's. The EROI of U.S. oil and gas production in 1970 was 30/1, however shale oil comes in at a low EROI of 5/1. Thus, the falling EROI means less profitable barrels to provide the same (higher) standard of living as Americans enjoyed before 1970. The U.S. Economy Is Propped Up By Massive Govt Spending In fiscal 2015, the United States Govt. (supposedly) spent $3.8 trillion on mandatory, discretionary funding and interest on the debt. Total revenues were only $3.18 trillion, so the U.S. Govt had to borrow $583 billion to pay its bills:

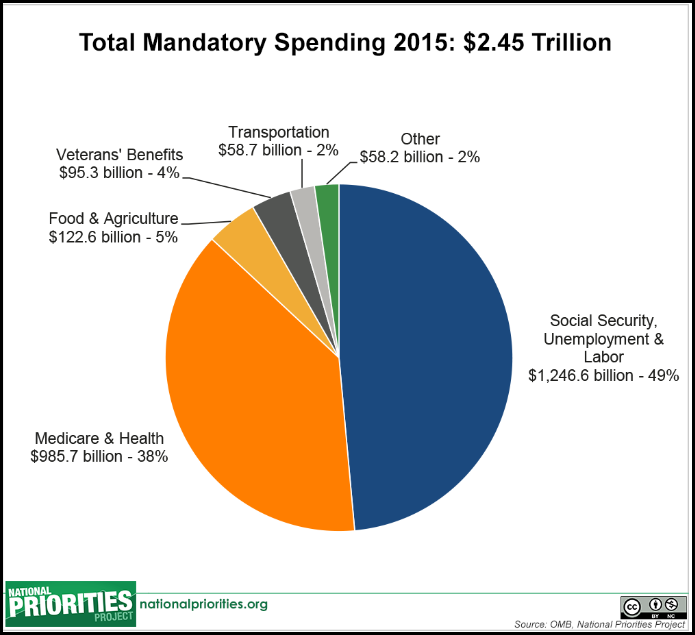

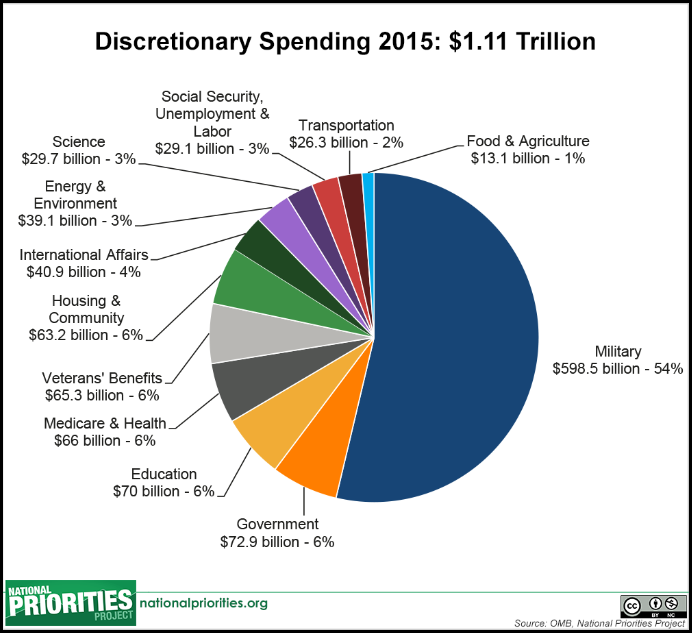

These next two charts break down the "Mandatory" and "Discretionary" spending:

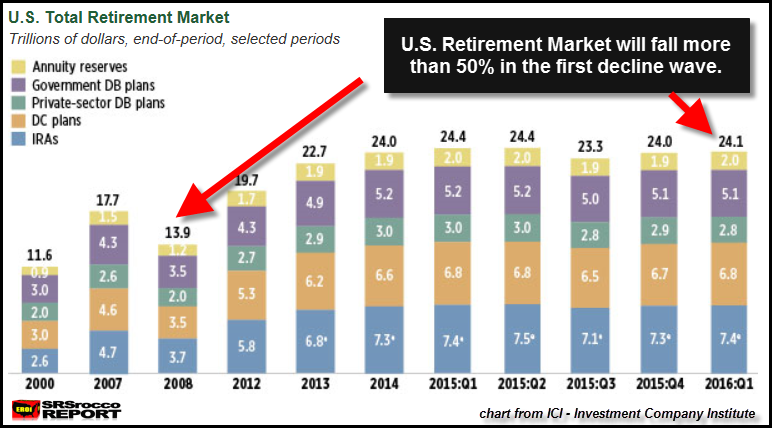

The $3.8 trillion in U.S. Govt spending is 21% of total U.S. GDP for fiscal 2015. Even though the U.S. Govt spends a lot of money on many different areas, let's focus on Social Security and Medicare-Health. These two parts of the mandatory spending equal $2.2 trillion of the $3.8 trillion total Federal budget. This is nearly 58% of the total budget. That $2.2 trillion spent in the U.S. economy has a "MULTIPLIER EFFECT". This is the reason the Fed and U.S. Govt won't allow a collapse in stock, bond or real estate values. The revenues collected by the U.S. Govt depend on elevated stock, bond and real estate prices. Once these start to collapse, then revenues plummet causing the annual budget deficit to balloon higher. If the budget deficit was $583 billion (that's what the Govt reports) in 2015 ,then what happens when the market cracks and highly inflated stock, bond and real estate prices collapse? Well, we already experienced that in 2008. Here is the most recent update of the U.S. Retirement Market as of Q1 2016:

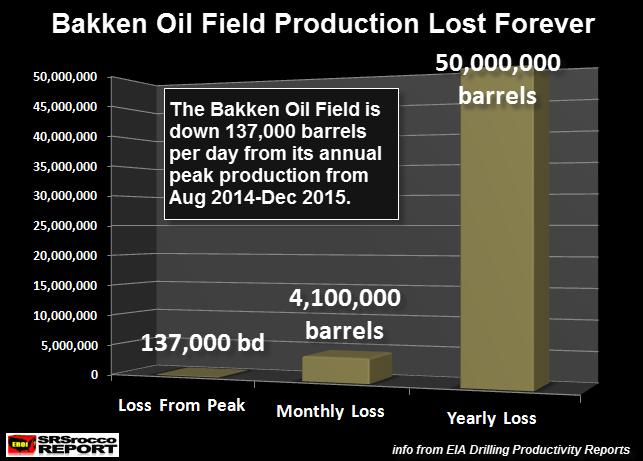

The total U.S. Retirement Market collapsed 21% from 2007 to 2008 ($17.7 trillion down to $13.9 trillion). The current U.S. Retirement market is valued at $24.1 trillion. When the U.S. broader markets finally crack, I forecast a 50% decline in the U.S. Retirement market in the first wave. This could take place over a few years. A 50% decline would put the U.S. Retirement market at $12 trillion, a little less than what it was in 2008. This is highly likely as the markets have been propped up with a lot of leverage since 2009. A 50% decline in the stock and real estate prices will cause serious trouble to the entire U.S. economy and financial system. ...... THIS IS THE CRASH WE NEVER COME OUT OF. U.S. Financial & Economic Market Suffered Two Big Blows As I mentioned in the beginning of the article, ENERGY has been the key in pushing the U.S. debt to record levels. Now, you would think that the huge increase of domestic U.S. shale oil production would have helped stabilize the annual increase of U.S. debt..... IT DIDN'T. Actually, it did the opposite. Unfortunately, the addition of U.S. shale oil production came at a huge cost. It only added more overall debt to the system. Even though the price of oil remained above $100 for three years, most of the shale oil companies made no real profit. Which means, the increase of U.S. domestic oil production from 5 mbd in 2008 to a peak of 9.6 mbd last year, did nothing to keep the U.S. debt from rising. This was due to two reasons: 1) The U.S. Govt continued to print money while suffering even larger annual budget deficits to provide a standard of living for Americans that it really couldn't afford. While the situation for the United States became even worse as domestic oil production surged higher, the consequences will be even more dire as oil production plummets over the next several years. Top Two Shale Oil Fields Suffer Hugh Production Losses The top two shale oil fields in the U.S. suffered huge production losses over the past year... especially over the last six months. The Bakken Oil Field in North Dakota was touted to make the U.S. energy independent. While the author of this article never believed the hype by the U.S. Energy Industry, many Americans fell for this delusion. As the price of oil declined on top of exceedingly high decline rates, Bakken oil production has dropped significantly. How much??

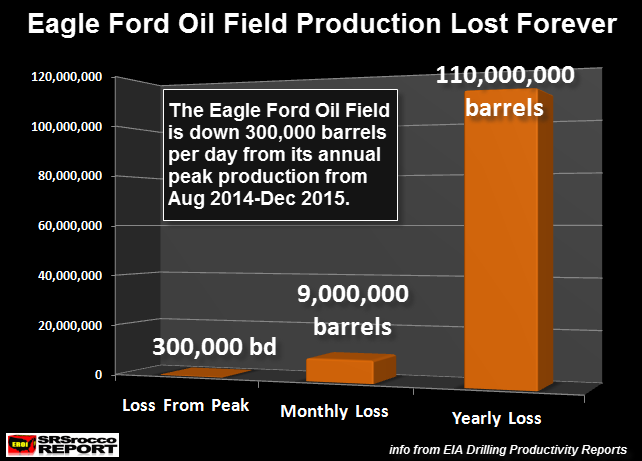

If we go by the minimum production between August 2014 and December 2015, the Bakken is down 137,000 barrels per day (bd). While the Bakken achieved a much higher production peak, I am going by the minimum oil production achieved in that time-frame. Thus, the Bakken will now lose 4.1 million barrels of oil in a month and 50 million barrels in a year compared to what it was producing last year. A loss of 50 million barrels in a year from the North Dakota industry is a BIG DEAL. That being said, the Bakken will continue to lose production going forward so the annual production loss will be even greater than 50 million barrels. At $50 a barrel, North Dakota is losing $2.5 billion a year. NOTE: A small part of the Bakken is located in Montana, but this doesn't really change the overall situation for North Dakota all that much. Now, if you think the loss of production from the Bakken is bad, you need to take a look at the disaster taking place at the Eagle Ford Field in Texas:

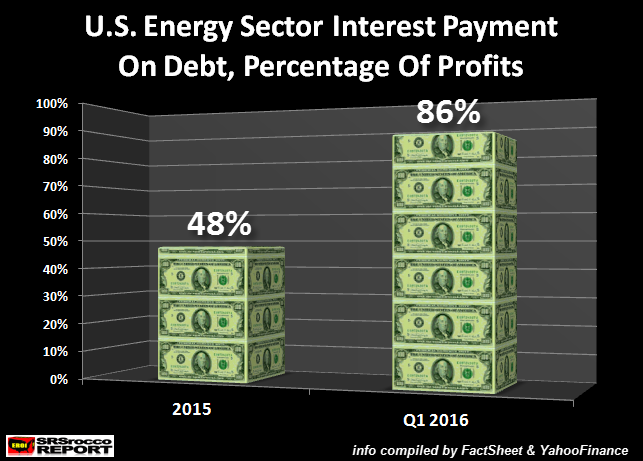

The Eagle Ford has lost 300,000 barrels per day since its minimum production between Aug 2014 and Dec 2015. That's one hell of a lot of oil. In Dec 2015, the Eagle Ford was producing 1,508 thousand barrels per day (1.508 mbd) and is forecasted to decline to 1,212 thousand barrels per day in June. This is a 20% decline in six months. Thus, the Eagle Ford will now lose 9.1 million barrels of oil per month and a whopping 110 million barrels annually. Again, this is only if production stabilizes. That figure continues to increase as Eagle Ford production continues to decline. While some individuals believe the decline in U.S. shale oil production was due to falling oil prices, this was only part of the reason. According to the energy analysts that I have been reading, these two shale oil fields were going to peak between 2015-2017, even with higher oil prices. So, yes... the low oil price forced the peak a little sooner than later. What happens as U.S. shale oil production continues to decline?? Well, it puts more pressure on the U.S. energy sector that is saddled with debt up to their eyeballs. Here is a chart I published in one of my articles a few weeks back:

If the U.S. Energy sector is paying about 50% of its operating profits just to pay the interest on its debt (2015)... WHAT HAPPENS AS OIL PRODUCTION DECLINES?? Correct... it just makes a bad situation WORSE. Americans have no clue the dire situation they face. No longer will we be able to offer U.S. Treasuries in the future for oil. Of course, this won't end overnight, but the trend is not on our side. The healthy U.S. economy and financial system in the 1950's-1960's was powered by its cheap domestic rising oil production. This is why we were the powerhouse of the world. However, as the years went by and domestic oil production declined as prices increased, we were forced to use the ENERGY CREDIT CARD. While this worked for many decades, the ENERGY CREDIT CARD BALANCE now is unsustainable. The decline of U.S. shale oil production will speed up the demise of the U.S. economy and empire. If Americans haven't connected the DOTS by purchasing physical precious metals, the majority of their supposed wealth will EVAPORATE into thin air. Even though owning precious metals doesn't guarantee an individual will make it through the coming economic and financial collapse unscathed, it will at least offer better options than 99% of the Americans out there. Please check out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page. Check back for new articles and updates at the SRSrocco Report. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Key Resistance in Silver Has Been Broken” – Mornings With “V” (07/01/2016) Posted: 01 Jul 2016 07:00 PM PDT from Rogue Money: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1336.70 UP $18.30 or 1.4% - Silver Price Closed at $19.54 UP $0.96 or 5.2 Posted: 01 Jul 2016 06:29 PM PDT

Gloat. Gloat, gloat, gloat. Gloat. Gloat, gloat. Whew. I just couldn't hold that in any longer. Sorry. I know I'm not supposed to gloat, but I'm a moneychanger, not a plaster saint. Week's big gainer was ---- PALLADIUM PRICE, up 10.5%. Next came the SILVER PRICE, $2.00 higher in the last four days and up 9.9% this week. GOLD PRICE rose 1.3%, but was marching in place compared to the other metals. Stocks rose 3.2%, but that ain't much to crow about next to silver & gold. US dollar index managed again to spike its own rise. Here at the end of the first half of 2016, I want to point to some results, compared to 31 Dec 2015. Dow Industrials, + 2.9% S&P500, up 2.7% Nasdaq Comp, - 3.3% Nasdaq 100, -3.8% Dow in Gold, -17.2% Dow in Silver, - 23.7% Gold Price, +24.3% Silver Price, + 34.9% Platinum Price, +14.6% Palladium Price, +6.7% US dollar index, -2.7% XAU gold stock index, 115.5% HUI gold stock index, +122.7% Now I'm jes' a nat'ral born durn fool from Tennessee, & I don't know Sic 'em from Come yere, but it 'pears to me them Wall Street smarties are running a mite behind the pack. But shucks, I know they'll figure out some way to 'splain things that I'm jes' too ignurunt to see. Stocks today halted their manic rise. Dow gained 19.38 (0.11%) to 17,949.37 as it drew nearer and nearer the Kryptonite laden 18,000 level. S&P500 rose 4.09 (0.19%0 to 2,102.95. Law, law, the run-up these last four days has set the stage for the bloodiest mess y'all have ever seen. Worse than hog killin', when stocks fall over that cliff. Here's the Dow in Gold, down 17.2% since December 2015 ended, http://schrts.co/8Sv0tc Y'all know I ain't got a lick ah sense but durned if it don't look like them stocks is jes' a-falling & a-falling against gold. Ended the week at 13.35 oz, having bounced off the downtrend line from the December 2015 high. Hear my words: GREAT slide comin'. Watch for it. And ef y'all have stocks still, y'all might think about selling 'em for gold. Dow in Silver has even more soundly whupped stocks, down 23.7% so far this year. Go look, http://schrts.co/arS25e Mark carefully that the Dow in Silver has fallen plumb through the support from the last two lows about 992 oz, and collapsed to 904.02 oz, a new low for the move that began in December. Don't delude yourselves: this is no flash in the pan. Stocks will continue to lose value against metals for the next 5 years or more, 85% from that December high. US dollar index lost 48 basis points (0.5%) to end at 95.72. Say what you will, that don't make no sense a'tall. And when thangs don't make no sense, you can look for a Nice Government Man behind the curtain. In a world where the US 10 year T note just hit a 3-1/2 year high, the US dollar shouldn't be unable to make new highs, or at least hold on to gains. But in a world where criminal central banks, the natural enemies of all decent men, manipulate currency exchange rates for political goals, it makes perfect sense that after Brexit and the euro's Incredible Shrinking Currency act, the Nice Government Men would prop up the euro & slap down the Samolean. Potemkin markets. Euro rose (wink, wink!) 0.27% to $1.1138. Of all the nasty things I don't want to own in the world next to a glassful of fresh cholera juice, the euro heads the list. Folks, it will blow up. Yen also rose 0.7% to 97.54 & looks to me it's thinking about belly flopping a couple of stories. I don't know what to say about SILVER & GOLD? Haven't I been telling y'all that in a bull market, all the surprises come to the upside? Well, slap my jaws and call me Sally if that didn't happen again this morning. Near first light I turned on my cell phone and looked at the price. I shook that cell phone a couple of times cause I knew that silver price couldn't be right. Somebody made a typo, putting $19 for $18. I shook the durned thing again, but there it was, 1935¢. Looky here at the chart, http://schrts.co/NNTujU Today on the Comex gold rose $18.30 (1.4%) but silver leapt, nay, pole-vaulted 96.2¢ -- five point two percent -- to 1954.4¢. Lo, not even I, the arch-silverbug of all silverbugs, expected that. In the last four days, silver has risen $2.00. It is trading at its highest price since August 2014. Things waxed feverish in the Aftermarket. GOLD PRICE rose $7.00 to $1,343.30 but silver rose 26.1¢ as NOBODYwanted to go home short over a long holiday weekend, the classic time for a government surprise party. Don't even get me started talking about the gold/silver ratio. That ended the Comex at 68.39, down 7.2% in the last four days. Y'all reckon we hit a good lick with those gold for silver swaps? Ratio is down 18.9% from the March high, & this downmove is only beginning. 'Tain't over yet. If you are waiting for a correction, stop waiting. This move has not ended, and will carry well over $20, perhaps as high as . . . Aww, never mind. Y'all will jes' think I'm crazy. I'm going to back up an inch. Silver hit the upper channel boundary today. UNLESS it punches clean through that next week, it ought to back off a little. That overbought RSI needs some chastening rest, too. However, this upmove has NOT ended so any correction will be shallow. Glance at the gold chart here, http://schrts.co/9ks4L3 RSI and MACD give it plenty of room to move higher. Once it punches through today's high, which is about on the overhead channel line, it could run $110. Yeah, I know, crazy. There are some times that waiting makes sense, but other times when waiting can be fatal. It will be fatal here, because silver and gold are NOT looking back. The markets see something we don't -- yet -- but that's coded all in those rising prices. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smo | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 05:18 PM PDT We begin with this photograph of Lucas Duplan, entrepreneur extraordinaire:

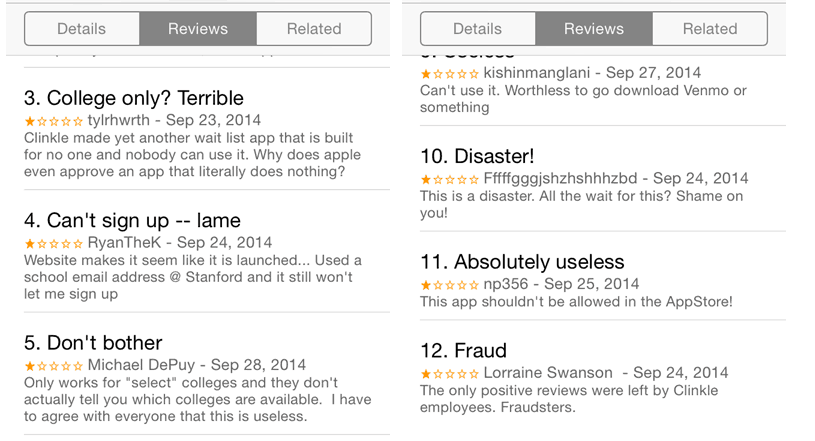

I first wrote about young Mr. Duplan in this post nearly two years ago. My post was about this new firm, Clinkle, garnering tens of millions of dollars in funding to create an app which would let you give little goodies (they called them "treats") to your friends based on how much you used your credit card. It seemed like a moronic idea to me, and when at last the product was launched, the reviews were - - how shall I put this - - chilly:

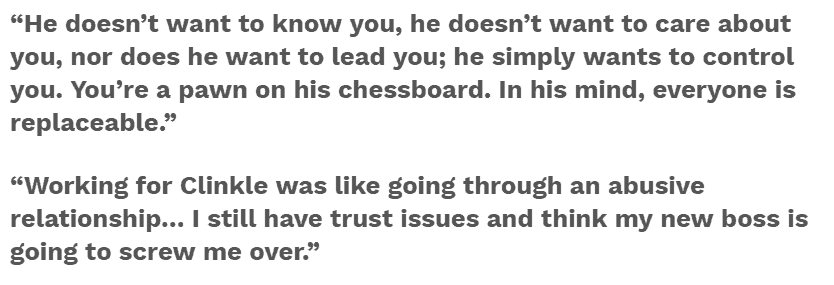

Lucas saw things differently, however. When describing his firm and its product, he stated: "Clinkle is a movement to push the human race forward by changing how we transact." Let's take that one sentence and focus on two of its bits: first off, "movement". Clinkle is (or was, as you shall soon read) a "movement". To which my only intelligent reply is: go fuck yourself. The Bernie Sanders campaign is a movement. The growth over the past twenty years of organic produce is a movement. Putting out some lame-ass app no one uses is not a movement. Sorry, sweetie. The second bit - "push the human race forward" - is, of course, ten times worse. I am compelled to guzzle down a bottle of ipecac syrup, vomit into a bucket, and invert the aforementioned bucket on top of Mr. Duplan's arrogant, self-aggrandizing head. But, again, as you shall soon see, none of this is necessary anymore. Because, as you might guess, Clinkle and its $40 million of funding has yielded nothing more than a puddle of piss evaporating in the midday summer sun of 2016. This should come as no huge surprise, however, given some of the earlier assessment of Duplan's management prowess:

And the above headline wasn't apparently the view of just some crank; employees seem to chime in with similar feelings as well:

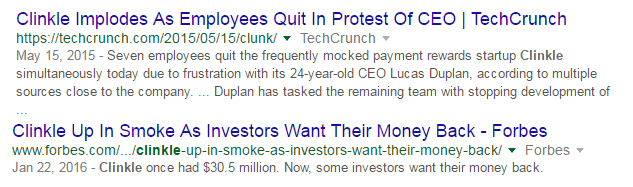

And, thus, the combination of a ridiculous, useless app and ham-handed management yields different Google results than I suspect Duplan dreamed he would be seeing these days:

There are some more self-aware societies when the instigator of such a mess would have committed seppuku, but the Silicon Valley is famously forgiving, so if you hop onto LInkedIn, you'll find Lucas' smiling face, ready for action. Take note of the portion I highlighted above, however. "Low margin, high cost business so discontinued." Do you sniff the faint stench of non-responsibility here? Does it seem rather astonishing a person would brush off this multi-zillion dollar fiasco with a shrug of their shoulders. It's almost like the synopsis of a failed blind date ("Yeah, she looked hot in her picture, but when I met her, she was 300 pounds, so we just went to Chipotle's.") But I guess putting "Product laughed off the face of the planet and investors left behind choking in the midst of scorched earth." doesn't lend itself to a good LinkedIn profile. But his explanation (as if anyone was asking) seems awfully goddamned flippant. Of course, I was naturally curious to see what the former CEO of Clinkle was doing, and right there on his page it shows he is in fact the CEO of Treats (which, I suppose, could be considered a lateral career move, what with being a CEO and all). There's one problem, though. As far as I can see, there's no such thing as Treats, Inc. Well, there is, but I don't think it's what this guy is claiming to be the leader of.......... ......nor do I think it's this one........... What I do know, however, is that the $40 million (or whatever the figure ultimately turned out to be) has resulted in the following home page for Clinkle. For every success in Silicon Valley, there are a thousand failures. I only hope in sharing this example of one of them, I've managed to help push the human race forward. It's what I do. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beyond Brexit – More Earthquakes on the Way Posted: 01 Jul 2016 02:12 PM PDT This post Beyond Brexit – More Earthquakes on the Way appeared first on Daily Reckoning. On Monday, June 20, 2016, I stood in the London Eye Ferris wheel. I was just across the Thames from the UK Houses of Parliament, standing with a film crew to record an urgent warning. I said that the Brexit vote, coming just three days later on June 23, could produce a financial earthquake. I recommended the exact strategies to avoid losses and to profit from the catastrophe to come. These strategies included shorting sterling, buying gold, and increasing cash allocations so our readers could "go shopping among the ruins." As a result, my readers were prepared for what happened — unlike the elites and so-called "smart money" who were totally unprepared. I wish that were the end of it, but it's not. New earthquakes are coming soon as part of the Brexit aftershocks. By now, you're familiar with the basic outline of the Brexit story. On June 23, UK subjects voted by a 52% to 48% margin to leave the European Union. Markets had clearly priced for a "Remain" victory. The result was an instantaneous and violent repricing. Gold gained over $40 per ounce, stock markets fell 4%, sterling crashed almost 10%, and the euro sank 4% all in a single day. These are large percentage moves for a full year. To happen in one day is the financial equivalent of a 7.0 earthquake on the Richter Scale. The key question for investors is whether this is a one-time repricing of assets, or whether it's the start of something with a long way to run. If the latter view is correct, then it's not too late to profit from some of our favorite plays including long positions in gold, short positions in sterling, and long positions in U.S. Treasury notes. At Intelligence Triggers, we don't believe that markets are efficient or that forecasting is impossible. Quite the opposite. Our proprietary models allow us to make long-run and intermediate-run forecasts that give you time to profit ahead of the crowd. Wall Street will tell you that you cannot foresee shocks and you cannot "beat the market." Don't believe it. While most market participants were shocked at the Brexit vote, we saw it coming a mile away using our proprietary models. On March 2, 2016, almost four full months before the Brexit vote, I gave an interview to Bloomberg TV in which I predicted that "Leave" would win and recommended that investors short sterling, buy gold, and buy U.S. Treasury notes. All of those trades have been huge winners. At Intelligence Triggers, we use a method called causal inference to make forecasts about events arising in complex systems such as capital markets. Causal inference methodology is based on Bayes' Theorem, an early 19th century formula first discovered by Thomas Bayes. The formula looks like this in its modern mathematical form:

In plain English, this formula says that by updating our initial understanding through unbiased new information, we improve our understanding. I first learned this method while working at CIA, and we apply it at Intelligence Triggers today. The left side of the equation is an initial estimate of the probability of an event happening. New information goes into right hand side of the equation. If it's consistent with our estimate, it goes into the numerator (which increases the odds of our expected outcome). If it's inconsistent, it goes into the denominator (which lowers the odds of our expected outcome). This is the method we used to correctly forecast the outcome of the Brexit vote. Now we are using it again to forecast the aftermath of the Brexit earthquake. Our expectation is that sterling has much further to fall, perhaps to as low as $0.80, a full 40% drop from current levels. We also expect gold to go much higher. Gold was already headed higher for reasons unrelated to Brexit, including the Fed's new dovish stance on interest rate hikes. But Brexit uncertainty gives added impetus to the uptrend already underway. What are some of the data points included in the equations behind our updated forecast?

The list goes on but you get the point. Only a small portion of the impact of these events has been priced into markets already. This means that the market trends we identified, short sterling, long gold, etc., have a long way to run. Above all, these trends mean uncertainty. Markets have ways to price risk on a probabilistic basis, but markets have no way to price uncertainty where almost anything can happen. In these situations, markets go to the safest of safe havens and that means cash, U.S. Treasuries, and gold. The slump in gold and gold related stocks from 2011 to 2015 is no mystery. It had to do with the Fed's tightening policies and strong dollar policies after the dollar hit an all-time low in August 2011. Now that the Fed is pursuing a dovish weak-dollar policy, gold is poised to go much higher. Regards, Jim Rickards The post Beyond Brexit – More Earthquakes on the Way appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Cup and Handles Project to a Potential Price of $54 Posted: 01 Jul 2016 01:50 PM PDT Le Cafe Américain | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - That Was The Week That Was Posted: 01 Jul 2016 12:37 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Cup and Handles Project to a Price Target of $54 Posted: 01 Jul 2016 09:42 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forecasts, Commentary & Analysis on the Economy and Precious Metals Posted: 01 Jul 2016 09:40 AM PDT Shanghai settles 96% of gold trades in physical metal Absorbs 90% of global gold mine production In the World Gold Council's Gold Investor magazine, Jiao Jinpu, Chairman of the Shanghai Gold Exchange, reports that "In its first month, the Shanghai Gold Benchmark Price’s trading volume was 105.91 metric tons of gold kilo bars, corresponding to a turnover of [renminbi] 27.94 billion and an average daily trading volume of 4.81 metric tons. 102.10 metric tons of gold were physically settled, addressing the market’s need for physical gold." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver and Bitcoin Bull Markets Being Driven by NIRP - Video Posted: 01 Jul 2016 09:16 AM PDT minako 64 here home of alternative our economics and contrarian views ah this is a gold and silver and bitcoin update i'm going to talk about the technical picture for the precious metals and bitcoin and also a little bit about the fundamentals behind that the moves we've seen i made a video a couple days ago it was wednesday morning and silver is breaking out through 18 and that look really positive and silver has continued and that today we broke through 19 we went very quickly through the 1850s level which was the high from january 2015 the max target i think is 2150 which is the high from july two thousand fourteen and as you can see here now this weekly silver chart going back to 2011 when we had the high of just under 50 at 4975 roughly and then if you take the low from december 2015 at 1365 the first big important... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Warning: This Video Will Make Your Blood Boil Posted: 01 Jul 2016 08:39 AM PDT This post Warning: This Video Will Make Your Blood Boil appeared first on Daily Reckoning. You're about to watch a video that may cause you to smash your screen. It's a stunning clip that's gone viral recently. In it, you'll see a CNN "journalist" you have known for years, who arguably looks drunk. No joke. Her name is Christiane Amanpour. She's the hack CNN dispatches whenever a major global story breaks. And her arrogant "perspective" in this video reveals why so many revile the mainstream media as dishonest charlatans. She Can't Handle the TruthConsider this quote from Amanpour in 2006: “You’re either for that [truth] or you’re in the propaganda business. Our objective is the truth, as close to it as we can get. We don't want to be assailed by ideology, partisan politics or the monopoly of one party.” Now keep those words in mind when you watch this video of her interviewing Daniel Hannan, a leader of the pro-Brexit movement: For an "objective" journalist, she sure seems opinionated and emotional about one side of the argument. And in mere seconds she resorts to rank demagoguery and propaganda straight out of Joseph Goebbels' playbook. But Amanpour's activism didn't start with that video… She's been a "Remain" booster posing as a journalist for months. She's routinely taken to CNN to categorize the Brits' desire to leave the European Union as racist and xenophobic. Keep in mind, more than 17 million Brits voted to control their own borders, laws and sovereignty in a democratic vote. They clearly want their future determined by their elected parliament. Imagine that. However, to Deep State elitists like Amanpour, Brexit supporters can't be honest people with different views. They must be evil and deceptive actors. And she won't let facts get in the way of that twisted narrative. You can see how she misrepresents Hannan's positions over the course of the clip and attempts to paint him as a proponent of hate crimes, and a racist and a bigot. That's pure garbage posing as journalism. But Hannan wasn't having any of it… And when he calmly refuted her shrill attack with facts, she turned into a shrieking toddler seemingly in need of a diaper change. Amanpour's epic fail unfolded because she approached Hannan not as an unbiased journalist, but as a bully who expected him to roll over, take it and admit his "error." I didn't know of Hannan in advance of seeing this clip, but his calm and cool demeanor in the face of Amanpour's meltdown sure made me smile. But for us, this clip serves an even larger purpose beyond showing Amanpour's disgust for Hannan's liberty. It shows how proper decision-making can be ruined by human bias. How to Beat Back Bias for Winning TradesThis is especially true in investing. Cognitive biases can cost you money if you’re not aware of them. History shows that losing traders' biases seep into their decision-making, while successful traders like trend followers recognize and minimize their biases. I want you to be the latter, not the former. I talked about this in a podcast I recorded last year, where I revealed how many of the human biases that lead to poor investing decisions… and how you can avoid them to make a killing in the markets. Here's what you'll learn:

Click here to listen to the podcast. Please send me your comments to coveluncensored@agorafinancial.com. I'd love to hear your thoughts. Don't sugar coat it! Regards, Michael Covel The post Warning: This Video Will Make Your Blood Boil appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The EU Is Breaking Up Politically And Financially Posted: 01 Jul 2016 08:22 AM PDT The EU Is Breaking Up Politically And Financially | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 The Last Summer Before The Collapse? Posted: 01 Jul 2016 08:19 AM PDT The neo Liberal capitalist system is over. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| #BREXIT will result in The Break Up of the EU and NATO -- Dr.Paul Craig ROBERTS Posted: 01 Jul 2016 07:44 AM PDT Dr.Paul Craig ROBERTS : BREXIT, what happens then ? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 06:28 AM PDT Just behind the podium of precious metals (occupied by gold, silver and platinum) is palladium – an important, but often overlooked investment commodity. Like in case of silver and platinum, the gold-to-palladium ratio indicates the current state of the precious metals market. Investors may benefit from watching a ratio, as it helps to determine the strength of gold compared to palladium. Technically, the number is the price of gold divided by the price of palladium. It shows how many ounces of palladium one ounce of gold can buy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold's Final Warning of Impending Monetary Collapse Posted: 01 Jul 2016 06:10 AM PDT Gold is currently trading in excess of $1300 an ounce. This is well above the 1980 all-time high. However, this is an incomplete representation of what gold is trading at relative to US dollars. When you look at the gold price relative to US currency in existence (US Monetary Base), then it is close to the lowest value it has ever been. This in itself is a major warning regarding the sustainability of the current monetary system. In other words, the monetary system is the most debased it has ever been. Furthermore, not only is the monetary system at an all-time high stress-point, but also, this comes at the worst possible time relative to other key conditions. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Can and Will Confiscate Gold When it Suits Them! Posted: 01 Jul 2016 06:03 AM PDT China can and will confiscate gold from the SGE, banks and Chinese citizens, when it suits them By far the greater bulk of gold owned in China is under the control of the Shanghai Gold Exchange and they are controlled by the Chinese Central Bank, the People's Bank of China. Should they wish to confiscate their citizen's and institution's gold, it can be done overnight. This includes gold held in Hong Kong. We see Singapore bowing to the will of China in such an event too. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wondrous Aesthetic Effects of Light and Color Posted: 01 Jul 2016 05:16 AM PDT Per this story at Scientific American, they’ve been writing about fireworks for 170 years now, digging into their archives today in advance of Monday’s national birthday. There’s some real fireworks going on in precious metals markets lately, particularly for silver that has embarked on another violent ride higher. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar's share of global reserves slips, euro's rises, in first quarter, IMF says Posted: 01 Jul 2016 05:12 AM PDT By Gertrude Chavez-Dreyfuss The U.S. dollar's share of international currency reserves slipped in the first three months of the year as China's economic slowdown and falling global stock markets prompted investors, including central bankers, to seek relief in other safe havens, such as the yen. The greenback's share of allocated reserved dipped to 63.6 percent in the first quarter, equivalent to $4.57 trillion, from 64.3 percent in the last quarter of 2015, data from the International Monetary Fund showed on Thursday. Not coincidentally, the dollar fell 4 percent against a basket of currencies in the first three months of 2016. ... ... For the remainder of the report: http://www.reuters.com/article/us-currency-reserves-imf-idUSKCN0ZG29M ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 04:21 AM PDT SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver Reaction Following Brexit, Central Bank Desperation Never More Evident… Posted: 01 Jul 2016 03:02 AM PDT Precious metals expert Michael Ballanger discusses market reactions post-Brexit vote. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2016 05:15 PM PDT Brexit from every possible angle. The new gold/silver bull market and why it’s got legs. The post Top Ten Videos — July 1 appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diving Into Deutsche Bank’s “Passion to Perform” Balance Sheet Posted: 30 Jun 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The world's most important financial market is unraveling.

The world's most important financial market is unraveling. A rigged system of justice that protects elites was a constant theme under President Obama's former U.S. Attorney General at the Justice Department, Eric Holder, who failed to prosecute a single Wall Street bank executive over the epic corruption that led to the financial collapse in 2008.

A rigged system of justice that protects elites was a constant theme under President Obama's former U.S. Attorney General at the Justice Department, Eric Holder, who failed to prosecute a single Wall Street bank executive over the epic corruption that led to the financial collapse in 2008.

Max Porterfield is a man on the move recently. Callinex Mines has been raising capital and making acquisitions. It's hard to believe but so far this year Zinc has been the best performing commodity, ahead of gold, silver and lithium. Increased demand and lower production has led to higher prices. Right now the price is at 93 cents a pound and forecasts call for prices to reach $1.60 per pound in the not too distant future. That means that the race is on to find more of this base metal and Callinex is ideally situated. Fortunately, Max recognized the potential early on and Callinex should reap the rewards.

Max Porterfield is a man on the move recently. Callinex Mines has been raising capital and making acquisitions. It's hard to believe but so far this year Zinc has been the best performing commodity, ahead of gold, silver and lithium. Increased demand and lower production has led to higher prices. Right now the price is at 93 cents a pound and forecasts call for prices to reach $1.60 per pound in the not too distant future. That means that the race is on to find more of this base metal and Callinex is ideally situated. Fortunately, Max recognized the potential early on and Callinex should reap the rewards. The seemingly limitless capacity of men to be utterly consumed by the foolish worship of idols can cost billions of dollars.

The seemingly limitless capacity of men to be utterly consumed by the foolish worship of idols can cost billions of dollars.

I have tried to understand and explain silver price manipulation from a broad perspective. There are limitless amounts of electronic silver available to the big players to rig the electronic price of silver up, down or sideways at any moment in time. The US Government has constructed this mechanism through the Exchange Stabilization Fund (ESF) and the Working Group on Financial Markets(WGFM). The ESF holds the limitless funds and the WGFM pulls the trigger when needed. Given that the WGFM comprises both the leaders of the monetary and market system (head of Fed and head of Treasury) as well as the leaders of the regulating bodies (head of SEC and CFTC) their operations are above reproach.

I have tried to understand and explain silver price manipulation from a broad perspective. There are limitless amounts of electronic silver available to the big players to rig the electronic price of silver up, down or sideways at any moment in time. The US Government has constructed this mechanism through the Exchange Stabilization Fund (ESF) and the Working Group on Financial Markets(WGFM). The ESF holds the limitless funds and the WGFM pulls the trigger when needed. Given that the WGFM comprises both the leaders of the monetary and market system (head of Fed and head of Treasury) as well as the leaders of the regulating bodies (head of SEC and CFTC) their operations are above reproach. Erik Townsend welcomes Grant Williams to MacroVoices. Erik and Grant discuss:

Erik Townsend welcomes Grant Williams to MacroVoices. Erik and Grant discuss:

No comments:

Post a Comment