Gold World News Flash |

- GLD/SLV Ponzi Scheme – GET Physical Gold/Silver

- Gold, Trump and Rates: Bank That Foresaw Rally Flags $1,500

- Hans-Hermann Hoppe: "Put Your Hope In Radical Decentralization"

- End of an Era: The Rise and Fall of the Petrodollar System

- More Deflation Ahead: Silver, Gold And Their Mining Stocks A Must-Have

- Breaking: Cruz Delegates Stealing Nomination From Trump

- There Will Be No Second American Revolution: The Futility Of An Armed Revolt

- EXPOSED: SGE & The REAL Silver to Gold Ratio — a SGT Report Micro-doc

- Signs In The Heavens And On Earth: END TIMES SIGNS Pt.17

- The Hamptons Housing Market Has Crashed: Luxury Home Sales Drop By Half As Prices Plunge

- Paul Craig Roberts : Best Interview Economic Collapse JULY 2016

- Alex Jones Epic Speech Live At RNC

- Collapse Warning BREXIT Could DETONATE Deutsche Bank in JULY 2016 -- Jim Willie

- Silver Prices and Gold Prices are Going Higher: Silver Price Continues to Rise Faster than Gold Price

- Ted Butler: The greatest lie ever told

- Warning: WW3 is Soon, The End of The World is Coming

- Hillary Worse Than Obama -- Jerome Corsi

- If Hillary wins, America loses.

- Gold Daily and Silver Weekly Charts - Same Old

- China vs USA WW3 South China Sea

- Near Term Gold Producer K92 $KNT.V $KNTNF Breaksout into New Highs on Increased Investor Interest

- All AMERICANS MUST See This – These Are The Last Days 2016-2017: The CLASH of Civilizations

- After Brexit, ordinary Britons warm to gold as safe haven

- Gold: Never a Great Investment Hedge?

- Alex Jones Speaks Live at RNC Rally

- America in 2017: Something Strange is Going On Worldwide!

- Keep an Eye on ‘Bitcoin’ as the Next ‘Financial Crisis’ Starts!

- From Gold Chains for Men to Gold Reserves: Who has All of the Gold?

- Gold Stocks 101

- More Deflation Ahead: Silver, Gold And Their Mining Stocks A Must-Have

- Will AUD/USD Selling Continue?

- Breaking News And Best Of The Web

- Gold And Silver – NWO-Created Tragedies Will Never End, Seek Truth

| GLD/SLV Ponzi Scheme – GET Physical Gold/Silver Posted: 19 Jul 2016 01:30 AM PDT by Dave Kranzler, Investment Research Dynamics:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Trump and Rates: Bank That Foresaw Rally Flags $1,500 Posted: 19 Jul 2016 01:00 AM PDT by Mark O'Byrne, GoldCore:

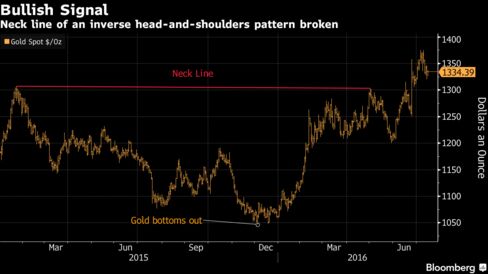

"Gold has seen four major bull markets since 1970: this is another one," Benjamin Wong, foreign exchange strategist at the Singapore-based bank's Chief Investment Office, said in an e-mail. "The market has yet to deal with the political uncertainty going into the Nov. 8 presidential election." Fears surrounding Brexit saw gold rally to the recent highs of $1,375. However, as the uncertainty created in the wake of the "Leave" vote wanes, global equity markets have rallied, helped in no small part by surprisingly strong employment numbers from the U.S. However, some feel that the gold market retracement is only temporary and that,"the market has yet to deal with the political uncertainty going into the Nov. 8 presidential election." Wong is advising clients that any dips to $1,296 to $1,300 would be opportunities to accumulate. The next rebound may top resistance at about $1,380 and move prices toward $1,437 to $1,455, he believes. "Longer term, if the full force of the inverse head-and-shoulders pattern is applied, there remains scope for $1,525." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hans-Hermann Hoppe: "Put Your Hope In Radical Decentralization" Posted: 19 Jul 2016 01:00 AM PDT [An interview with Hans-Herman Hoppe in the Polish weekly Najwy?szy Czas!] What is your assessment of contemporary Western Europe, and in particular the EU?

But what about the EU?

Can one say, then, that the politicians running the EU are even worse than the politicians running national affairs?

What do you predict, then, will be the future of the EU?

Is there anything that an ordinary citizen can do in this situation?

Can you give a comparative assessment of the USA and the situation in Europe?

Finally, how do you evaluate the economic success of formerly communist countries such as China, that combine one-party dictatorships with partly free markets?

In conclusion, then: Don’t put your trust in democracy, but neither should you trust in a dictatorship. Rather, put your hope into radical political decentralization, not just in India and China, but everywhere. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End of an Era: The Rise and Fall of the Petrodollar System Posted: 18 Jul 2016 11:30 PM PDT by Claudio Grass, Acting-Man.com:

Ron Paul The intricate relationship between energy markets and our global financial system, can be traced back to the emergence of the petrodollar system in the 1970s, which was mainly driven by the rise of the United States as an economic and political superpower. For almost twenty years, the U.S. was the world's only exporter of petroleum. Its relative energy independence helped support its economy and its currency. Until around 1970, the U.S. enjoyed a positive trade balance. Oil expert and author of the book "The Trace of Oil", Bertram Brökelmann, explains a dramatic change took place in the U.S. economy, as it experienced several transitions: First, it transitioned from being an oil exporter to an oil importer, then a goods importer and finally a money importer. This disastrous downward spiral began gradually, but it ultimately affected the global economy. A petrodollar is defined as a US dollar that is received by an oil producing country in exchange for selling oil. As is shown in the chart below, the gap between US oil consumption and production began to expand in the late 1960s, making the U.S. dependent on oil imports. And while it led to the U.S. Dollar being established as the world's premier reserve currency, it also contributed to the country's increase in debt. The oil embargo of 1973-74 was a major hit that exposed the vulnerability of the U.S. economy. Nevertheless, under the banner of "national security" the future policy course was firmly set: in a 1973 National Security Council (NSC) paper, it was stated that "U.S. leverage in energy matters resulted from its economic and political influence with Saudi Arabia and Iran, the two leading oil exporters". | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Deflation Ahead: Silver, Gold And Their Mining Stocks A Must-Have Posted: 18 Jul 2016 10:30 PM PDT by Hubert Moolman, GoldSeek:

Due to the size of the cycles involved, it is very difficult for most to comprehend the continued decline in the prices of commodities and oil, while silver and gold rockets higher. In other words, since gold and silver have, for the most part, been moving in the same direction as commodities since about 1971 (and especially since 2001), most people think that this relationship will continue. However, it will not. A major divergence has been in the works since about 2008/2009, and it is about to escalate. The change that this divergence has already brought about, is exactly what gold and silver miners needed to start performing well. Here are a few charts to support the continued deflation: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking: Cruz Delegates Stealing Nomination From Trump Posted: 18 Jul 2016 08:00 PM PDT Ted Cruz delegates are planning another walkout after Cruz speaks at the RNC on Wednesday in an attempt to stop Trump. Kit Daniels reporting. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| There Will Be No Second American Revolution: The Futility Of An Armed Revolt Posted: 18 Jul 2016 07:10 PM PDT Submitted by John Whitehead via The Rutherford Institute,

America is a ticking time bomb. All that remains to be seen is who - or what - will set fire to the fuse. We are poised at what seems to be the pinnacle of a manufactured breakdown, with police shooting unarmed citizens, snipers shooting police, global and domestic violence rising, and a political showdown between two presidential candidates equally matched in unpopularity. The preparations for the Republican and Democratic national conventions taking place in Cleveland and Philadelphia—augmented by a $50 million federal security grant for each city—provide a foretaste of how the government plans to deal with any individual or group that steps out of line: they will be censored, silenced, spied on, caged, intimidated, interrogated, investigated, recorded, tracked, labeled, held at gunpoint, detained, restrained, arrested, tried and found guilty. For instance, anticipating civil unrest and mass demonstrations in connection with the Republican Party convention, Cleveland officials set up makeshift prisons, extra courtrooms to handle protesters, and shut down a local university in order to house 1,700 riot police and their weapons. The city’s courts are preparing to process up to 1,000 people a day. Additionally, the FBI has also been conducting “interviews” with activists in advance of the conventions to discourage them from engaging in protests. Make no mistake, the government is ready for a civil uprising. Indeed, the government has been preparing for this moment for years. A 2008 Army War College report revealed that “widespread civil violence inside the United States would force the defense establishment to reorient priorities in extremis to defend basic domestic order and human security.” The 44-page report goes on to warn that potential causes for such civil unrest could include another terrorist attack, “unforeseen economic collapse, loss of functioning political and legal order, purposeful domestic resistance or insurgency, pervasive public health emergencies, and catastrophic natural and human disasters.” Subsequent reports by the Department of Homeland Security to identify, monitor and label right-wing and left-wing activists and military veterans as extremists (a.k.a. terrorists) have manifested into full-fledged pre-crime surveillance programs. Almost a decade later, after locking down the nation and spending billions to fight terrorism, the DHS has concluded that the greater threat is not ISIS but domestic right-wing extremism. Meanwhile, the government has been amassing an arsenal of military weapons for use domestically and equipping and training their “troops” for war. Even government agencies with largely administrative functions such as the Food and Drug Administration, Department of Veterans Affairs, and the Smithsonian have been acquiring body armor, riot helmets and shields, cannon launchers and police firearms and ammunition. In fact, there are now at least 120,000 armed federal agents carrying such weapons who possess the power to arrest. Rounding out this profit-driven campaign to turn American citizens into enemy combatants (and America into a battlefield) is a technology sector that is colluding with the government to create a Big Brother that is all-knowing, all-seeing and inescapable. It’s not just the drones, fusion centers, license plate readers, stingray devices and the NSA that you have to worry about. You’re also being tracked by the black boxes in your cars, your cell phone, smart devices in your home, grocery loyalty cards, social media accounts, credit cards, streaming services such as Netflix, Amazon, and e-book reader accounts. All of this has taken place right under our noses, funded with our taxpayer dollars and carried out in broad daylight without so much as a general outcry from the citizenry. It’s astounding how convenient we’ve made it for the government to lock down the nation. We’ve even allowed ourselves to be acclimated to the occasional lockdown of government buildings, Jade Helm military drills in small towns so that special operations forces can get “realistic military training” in “hostile” territory, and Live Active Shooter Drill training exercises, carried out at schools, in shopping malls, and on public transit, which can and do fool law enforcement officials, students, teachers and bystanders into thinking it’s a real crisis. The events of recent years—the invasive surveillance, the extremism reports, the civil unrest, the protests, the shootings, the bombings, the military exercises and active shooter drills, the color-coded alerts and threat assessments, the fusion centers, the transformation of local police into extensions of the military, the distribution of military equipment and weapons to local police forces, the government databases containing the names of dissidents and potential troublemakers—have all conjoined to create an environment in which “we the people” are more distrustful and fearful of each other and more reliant on the government to keep us safe. Of course, that’s the point. The powers-that-be want us to feel vulnerable. They want us to fear each other and trust the government’s hired gunmen to keep us safe from terrorists, extremists, jihadists, psychopaths, etc. Most of all, the powers-that-be want us to feel powerless to protect ourselves and reliant on and grateful for the dubious protection provided by the American police state. Their strategy is working. The tree of liberty is dying. There will be no second American Revolution. There is no place in our nation for the kind of armed revolution our forefathers mounted against a tyrannical Great Britain. Such an act would be futile and tragic. We are no longer dealing with a distant, imperial king but with a tyrant of our own making: a militarized, technologized, heavily-financed bureaucratic machine that operates beyond the reach of the law. The message being sent to the citizenry is clear: there will be no revolution, armed or otherwise. Anyone who believes that they can wage—and win—an armed revolt against the American police state has not been paying attention. Those who wage violence against the government and their fellow citizens are playing right into the government’s hands. Violence cannot and will not be the answer to what ails America. Whether instigated by the government or the citizenry, violence will only lead to more violence. It does not matter how much firepower you have. The government has more firepower. It does not matter how long you think you can hold out by relying on survivalist skills, guerilla tactics and sheer grit. The government has the resources to outwait, out-starve, outman, outgun and generally overpower you. This government of wolves will not be overtaken by force. Unfortunately, we waited too long to wake up to the government’s schemes. We did not anticipate that “we the people” would become the enemy. For years, the government has been warning against the dangers of domestic terrorism, erecting surveillance systems to monitor its own citizens, creating classification systems to label any viewpoints that challenge the status quo as extremist, and training law enforcement agencies to equate anyone possessing anti-government views as a domestic terrorist. What the government failed to explain was that the domestic terrorists would be of the government’s own making, whether intentional or not. By waging endless wars abroad, by bringing the instruments of war home, by transforming police into extensions of the military, by turning a free society into a suspect society, by treating American citizens like enemy combatants, by discouraging and criminalizing a free exchange of ideas, by making violence its calling card through SWAT team raids and militarized police, by fomenting division and strife among the citizenry, by acclimating the citizenry to the sights and sounds of war, and by generally making peaceful revolution all but impossible, the government has engineered an environment in which domestic violence has become inevitable. What we are now experiencing is a civil war, devised and instigated in part by the U.S. government. The outcome for this particular conflict is already foregone: the police state wins. The objective: compliance and control. The strategy: destabilize the economy through endless wars, escalate racial tensions, polarize the populace, heighten tensions through a show of force, intensify the use of violence, and then, when all hell breaks loose, clamp down on the nation for the good of the people and the security of the nation. So where does that leave us? Despite the fact that communities across the country are, for all intents and purposes, being held hostage by a government that is armed to the teeth and more than willing to use force in order to “maintain order,” most Americans seem relatively unconcerned. Worse, we have become so fragmented as a nation, so hostile to those with whom we might disagree, so distrustful of those who are different from us, that we are easily divided and conquered. We have been desensitized to violence, acclimated to a military presence in our communities and persuaded that there is nothing we can do to alter the seemingly hopeless trajectory of the nation. In this way, the floundering economy, the blowback arising from military occupations abroad, police shootings, the nation’s deteriorating infrastructure and all of the other mounting concerns have become non-issues to a populace that is easily entertained, distracted, manipulated and controlled. The sight of police clad in body armor and gas masks, wielding semiautomatic rifles and escorting an armored vehicle through a crowded street, a scene likened to “a military patrol through a hostile city,” no longer causes alarm among the general populace. We are fast becoming an anemic, weak, pathetically diluted offspring of our revolutionary forebears incapable of mounting a national uprising against a tyrannical regime. If there is to be any hope of reclaiming our government and restoring our freedoms, it will require a different kind of coup: nonviolent, strategic and grassroots, starting locally and trickling upwards. Such revolutions are slow and painstaking. They are political, in part, but not through any established parties or politicians. Most of all, as I make clear in my book Battlefield America: The War on the American People, for any chance of success, such a revolution will require more than a change of politics: it will require a change of heart among the American people, a reawakening of the American spirit, and a citizenry that cares more about their freedoms than their fantasy games. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EXPOSED: SGE & The REAL Silver to Gold Ratio — a SGT Report Micro-doc Posted: 18 Jul 2016 06:55 PM PDT by SGT, SGT Report.com: This ia a SGTreport.com PRECIOUS METALS SPECIAL REPORT. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Signs In The Heavens And On Earth: END TIMES SIGNS Pt.17 Posted: 18 Jul 2016 06:26 PM PDT Events are happening on a daily basis that prove we are in the End Times. Time Is Running out, repent before its too late! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Hamptons Housing Market Has Crashed: Luxury Home Sales Drop By Half As Prices Plunge Posted: 18 Jul 2016 05:34 PM PDT It is not looking good for the US housing market. One week ago, when we reported that "On Manhattan's "Billionaire's Row", A Death Knell Just Tolled For Luxury Real Estate", we documented the sudden trapdoor that opened beneath the ultra-luxury segment in the Manhattan housing market. Then several days later, we observed that it is not just the luxury NYC market that is in trouble, but the broader market across all of the US, when we noted three "Red Flags" that the broader US housing market was starting to roll over, among which i) a surge in inexperienced, third-party "mom and pop" auction buyers who were arriving just as institutional investors are starting to flee the auction market, ii) a collapse in retail purchases for home goods and furniture - traditionally a coincident or slightly lagging indicator of home purchasing activity, and iii) a plunge in housing buyer traffic according to the Credit Suisse real-estate agent survey. Then this afternoon, another flashing red flag emerged when we learned that overall sales in the Hamptons plunged by half and home prices fell sharply in the second quarter in the toniest enclaves of the Hamptons, New York's weekend haunt for the wealthy. Reuters blamed this on "stock market jitters earlier in the year" which damped the appetite to buy, however one can also blame the halt of offshore money laundering, a slowing global economy, the collapse of the petrodollar, and the drastic drop in Wall Street bonuses. In short: a sudden loss of confidence that a greater fool may emerge just around the corner, which in turn has frozen buyer interest. And frozen it has. According to realtor Town & Country Real Estate, total sales volume in East Hampton fell 53% from a year ago to $44.7 million as the median sale price fell 54% to $2.38 million. In fact, a drop this steep has not been observed since the financial crisis. A beachfront residence is seen in East Hampton, New York, March 16, 2016. In Southampton, total sales fell 48% from the second quarter of 2015 to $45.3 million, with the median sale price falling 21 percent to $1.65 million, data showed. In East Hampton, only 12 homes were sold and 17 in larger Southampton, due to a lack of inventory and because sales typically lag when the stock market underperforms, said Judi Desiderio, chief executive at Town & Country. "This is just a shift of the needle that I expected because 2014 was a high cycle for the high end," said Desiderio, who says luxury home sales in the Hamptons run in seven-year cycles. The stock market surged 30 percent in 2013, with record sales in excess of $100 million set the following year. In the 12 submarkets that make up the Hamptons, sales volume slipped 18 percent from a year ago, with the median price falling to $999,000 from $1.1 million, Town & Country data showed. Sales in the Hampton submarkets of Shelter Island and Sag Harbor surged after several years of poor performance. The median sale price in Sag Harbor jumped 37 percent to $1.43 million, and 27 percent to $950,000 in Shelter Island. Despite the clear crash, local tealtors remain hopeful: third-quarter sales should pick up, in part because Wall Street touched record highs the past week and because the summer months are usually better, Desiderio said. Then again, if they don't, what is merely a trickle of selling now will become an all out liquidation as the greater fool bid is now officially dead. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts : Best Interview Economic Collapse JULY 2016 Posted: 18 Jul 2016 05:30 PM PDT Dr. Paul Craig Roberts Assistant Secretary of the US Treasury Dr. ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Epic Speech Live At RNC Posted: 18 Jul 2016 05:00 PM PDT Alex Jones demolishes the globalists and their plans to steal the election from the people and Donald Trump. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collapse Warning BREXIT Could DETONATE Deutsche Bank in JULY 2016 -- Jim Willie Posted: 18 Jul 2016 04:32 PM PDT Jim Willie CB Proprietor, GoldenJackass.com Editor, Hat Trick Letter The man behind the name Jim Willie has experience in three important fields of statistical practice in the 23 years following completion of a PhD in Statistics at Carnegie Mellon University. He spent time since 2001 in a private... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Jul 2016 04:21 PM PDT

Sorry I missed sending y'all a commentary last two days. Thursday I was speaking in Huntsville & Friday had an appointment with my foot doctor in Chattanooga. Weekend was a tidal wave of emergencies, so here I am, hat in hand, apologising. I wanted to send y'all this week-long wrap up. Although I was wrong about silver & gold rising on Thursday & Friday, this little correction will work to our greater advantage. More of that momentarily. In currencies, the dollar is flat, the euro is broken-backed, and the yen has been collapsing. US dollar index rose two basis points today to 96.58, about as high as it's been since 24 June, a month ago. Has formed a rising flat triangle, which usually breaks out upside by the height of the triangle. If so, that targets 98.30, OR HIGHER. Can't shake the suspicion the Nice Government Men are suppressing the dollar in favor of the euro. Or else, there are even more fools in the world than I suspect. Chart, http://schrts.co/OkJ5UT Euro has nothing to recommend it, & now hath formed an even sided triangle that promises to break out downside. See for yourself: http://schrts.co/HcRUv0 Yen chart looks like it's been sliced with a samurai sword, gapping down thrice. What was left behind looks like an island reversal, but awfully gappy. Today the yen closed 94.21, down 1.18% today and down from 100 six days ago, six percent. Owch. Hath reached the 50 DMA, so might rebound. Stocks pushed their all time high a little higher today. Dow hit 18,533.05, up 16.50 or 0.09%. S&P rose 5.15 or 0.25% to 2,166.89. This won't last. This upward reaction in the Dow in Gold has risen to the 50 Day Moving Average, which is another argument that the rise in stocks is ending along with gold's correction. Closed today at 13.94 oz. The US 10 year treasury note 5 July reached a high at 133.212, highest since 134.97 in 2012. That bond price high was also the yield low (prices & yields move opposite) but the yield has since climbed back to the channel line it fell through in June. In other words, it is close to proving that the rise in bonds/fall in yields is about to turn. Gold/Bank Index spread has reached the upper channel line it left behind when it broke out upside in June. Also about time to turn around & head up, implying gold is about to rise. Chart's at http://schrts.co/PBJpq4 Gold today closed up $1.90 at $1,328.40 which silver gainsaid gold, dropping 8.1¢ to 2004.4¢. Now I am no more'n a nat'ral born durned fool from Tennessee & don't claim a durned thing more, but I'll be switched if I don't see a pennant or flag on the silver chart. Look for your own self, http://schrts.co/xNvUQl I know the Commitments of Traders are negative, I know the MACD is high, I know the RSI is over bought, but durn! There 'tis, a pennant. And it's flying off a 540¢ flagpole. Rule of thumb says that "flags always fly at half staff." Thus if that 540¢ is half of the run, and I add 540¢ to the roughly 2000¢ it's likely to take off from, I come up at a durn fool target of 2540¢. And if that makes me so nervous I want to run through briars shirtless, I can move that pole over and say, Naw, it began at 1717¢, & still come up with a 2406¢ target. Heaven he'p me, I still can't help seeing that pennant! Can y'all see it? Then I turn to the gold chart. Blamed if there ain't a bullish flag there, too. For that I get a puny $1,452.70 target ($124.70 + $1,328), which agrees with targets calculated by other means. Looky here, http://schrts.co/pI1ZgR Well, y'all can mark me down and chalk me up for a nat'ral born durn fool sure enough if gold closes below $1,320 or silver below 1980¢, 'cause that would knock my flags in the head. Otherwise, they're good. I see 'em. Another witness silver & gold are going higher: silver continues to rise faster than gold, tugging that gold/silver ratio down Friday to 65.913. Today it closed the End of the Day at 66.22, down 20.3% from the March 1 high at 83.04. I reckon some fool ought to have told y'all to buy more silver than gold. Durn. He did, didn't he? Y'all enjoy your weekend (coming up next weekend). Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler: The greatest lie ever told Posted: 18 Jul 2016 04:12 PM PDT 7:10p ET Monday, July 18, 2016 Dear Friend of GATA and Gold: Silver market analyst and manipulation foe Ted Butler writes today that the concentration of the short position in the silver futures market is proof of the manipulation that has been perpetrated there for decades -- and that it can be beaten even if the U.S. Commodity Futures Trading Commission continues to fail to protect investors. Butler's analysis is headlined "The Greatest Lie Ever Told" and it's posted at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/greatest-lie-ever-told-15774 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Warning: WW3 is Soon, The End of The World is Coming Posted: 18 Jul 2016 04:00 PM PDT Warning: WW3 is Soon, The End of The World is Coming The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Worse Than Obama -- Jerome Corsi Posted: 18 Jul 2016 03:00 PM PDT If you thought Obama was bad, Hillary would be worse as WND journalist Jerome Corsi reveals. Kit Daniels reporting. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If Hillary wins, America loses. Posted: 18 Jul 2016 02:00 PM PDT Political Correctness Kills Being a progressive that defends islam is like being a jew that defends the nazis. When will these people realize how idiotic they are? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Same Old Posted: 18 Jul 2016 01:52 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China vs USA WW3 South China Sea Posted: 18 Jul 2016 01:00 PM PDT US dollar is great for America. However, it in the short-term it will not only negatively affect earnings, but also place extreme duress on the over $9 trillion worth of debt borrowed by non-financial companies outside of the United States.Iran sanctions to be lifted Saturday Recent data confirms... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Near Term Gold Producer K92 $KNT.V $KNTNF Breaksout into New Highs on Increased Investor Interest Posted: 18 Jul 2016 12:52 PM PDT (Originally Published for Premium Subscribers on July 15th, 2016) Precious metals are taking a healthy breather after an impressive first half move as I expected. Look for pullbacks to the 20 and 50 day moving average to add to positions. Remember in bull markets in junior miners if you hit a double or triple take partial profits especially when very overbought so one can play with the house’s money and look to add into positions which are correcting to their upward trends. For instance, take a look at K92 Mining (KNT.V or KNTNF). Since K92 went public in May and had its initial run-up to a $1.30 it has been basing for six weeks between $1.30 and $1. Notice the bullish MACD Crossover and increase in volume. This could indicate a breakout past $1.30 into new highs. K92 just announced news that they increased their financing from $5 million CAD to $12.5 million CAD. This tells me big money is gaining interest in this near term producing gold asset and believe this project will get back into production in the near term possibly this year. http://www.k92mining.com/2016/07/k92-mining-increases-financing-to-12-5-million/ See my recent interview with K92 Mining (KNT.V or KNTNF) CEO Ian Stalker by clicking on the following link: https://www.youtube.com/watch?v=cPSq_8LsQHU Ian has around four decades of mine development expertise successfully starting eight major mines. Ian became famous in the summer of 2007 when he sold his company UraMin to Areva for $2.5 Billion executing a great exit for shareholders at the top of the uranium bull market. Could K92 be Ian’s next big win in the mining sector as the project comes back into production? “I think the Kainantu project is one of the most prospective in Papua New – ALEX DAVIDSON, K92 Mining Advisor & Former Executive Vice President Best wishes, Jeb Handwerger Disclosure: Jeb Handwerger owns K92 Mining and the company is an See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or I am biased towards my sponsors (Featured Companies) and get paid in either You must do your own due diligence and realize that small cap stocks is an _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All AMERICANS MUST See This – These Are The Last Days 2016-2017: The CLASH of Civilizations Posted: 18 Jul 2016 12:30 PM PDT All AMERICANS MUST See This – These Are The Last Days 2016-2017: The CLASH of Civilizations The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After Brexit, ordinary Britons warm to gold as safe haven Posted: 18 Jul 2016 12:25 PM PDT By Clara Denna LONDON -- When Britain voted to leave the European Union, the thoughts of Yorkshire teacher Grace Hall immediately turned to her family's bottom line. Three days later, as UK stocks and sterling plummeted, she put those thoughts into action and deposited part of her life savings -- 25,000 pounds -- into gold. "My husband and I are both worried about bank failures and our cash getting swallowed up," she said. "I'm also worried about our kids' jobs and their future." Hall was not alone. Dealers are seeing an unprecedented amount of interest in gold, much of it from first-time buyers, to take advantage of its role as a safe haven in times of stress or unexpected "black swan" events like Brexit. ... The surge in gold buying is in contrast with Brexit's effect on the London property market, considered an ironclad bet for the past 20 years. More than 18 billion pounds of property funds aimed at retail investors was frozen in early July following a tide of redemption requests after the Brexit vote. ... ... For the remainder of the report: http://www.reuters.com/article/us-britain-eu-gold-retail-insight-idUSKCN... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Never a Great Investment Hedge? Posted: 18 Jul 2016 11:04 AM PDT Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Speaks Live at RNC Rally Posted: 18 Jul 2016 10:52 AM PDT Alex Jones Speaks Live at RNC Rally The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America in 2017: Something Strange is Going On Worldwide! Posted: 18 Jul 2016 09:18 AM PDT SHOCKING EVENTS are playing out across america and the rest of the world end times bible prophecy world news strange events k2 flakka drug overdoses The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Keep an Eye on ‘Bitcoin’ as the Next ‘Financial Crisis’ Starts! Posted: 18 Jul 2016 09:17 AM PDT ‘Bitcoin’ is on a tear away rally. Its’ performance, over the last year, has been outstanding and it has outperformed most ‘asset classes’, by a wide margin. It is probably the only asset class which beats out both gold and silver, in 2016. Why is it shooting into outer space? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From Gold Chains for Men to Gold Reserves: Who has All of the Gold? Posted: 18 Jul 2016 08:50 AM PDT Karus Chains writes: At Karus Chains we love to write about anything associated with gold chains for men and what could be more central to gold chains than gold itself. So we asked the question- who owns most of the gold? Of course an open question like this will only throw up more questions. Should we look at the countries that mine the most gold, or the countries that buy the most gold? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Jul 2016 01:35 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Deflation Ahead: Silver, Gold And Their Mining Stocks A Must-Have Posted: 18 Jul 2016 01:26 AM PDT Are you ready for the next leg of deflation? Where the real pain will be felt (mainly) because the collapse of commodities and oil, in particular, will be accompanied by the collapse of the US stock market. Due to the size of the cycles involved, it is very difficult for most to comprehend the continued decline in the prices of commodities and oil, while silver and gold rockets higher. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will AUD/USD Selling Continue? Posted: 18 Jul 2016 12:27 AM PDT Currency markets have seen some interesting moves over the last few weeks and one of the better trading setups can now be seen in the AUD/USD. These scenarios have come largely as a result of recent developments within the central bank. The Reserve Bank of Australia (RBA) recently announced that it would be willing to take extensive and unorthodox measures to right the economy, if the need arose. The current interest rate is 1.75%. If this turned out to be the case and the RBA opted to decrease the base interest rate to 1%, then options like government bond-buying would be likely considered. Such a measure would likely reduce the value of the Australian Dollar, which is presently trading near 0.76 USD. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 17 Jul 2016 06:44 PM PDT Helicopter money is coming. Attempted coup fails in Turkey. Stocks recover on promise of massive new stimulus from Japan and UK and suspiciously good growth numbers from US and China. Gold corrects and interest rates rise. Banks report pretty good earnings, trucking firms and oil companies not so much. Another big terrorist attack in France […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And Silver – NWO-Created Tragedies Will Never End, Seek Truth Posted: 16 Jul 2016 01:50 AM PDT Nice, France weighs heavily and brings home the point, tomorrow is promised to no one. The tragic mass-killing of Bastille Day celebrants in Nice, France may not have been a planned terrorist attack, but its consequences are no less extremely sad and equally infuriating. We heard about comments made from neighbors of the truck driver that he was not that religious, was undergoing a divorce and was not handling it very well and apparently snapped. It matters not if that explanation makes sense in the wake of a senseless act of running over a hundred or so people, killing around 84, including children. The man was shot dead by police, so little else will ever be directly known from the Tunisian known mostly for petty criminal acts but no known terrorist affiliations. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

A lot of investors have invested in GLD and SLV under the mistaken assumption that they are investing in "gold." In the latest episode of the Shadow of Truth, we discuss why GLD/SLV are Ponzi schemes created as a mechanism to control the price of gold/silver. We also report the latest on China's massive investment in the new Silk Road and why it will change the world – The Daily Coin published and extensive article on this topic:

A lot of investors have invested in GLD and SLV under the mistaken assumption that they are investing in "gold." In the latest episode of the Shadow of Truth, we discuss why GLD/SLV are Ponzi schemes created as a mechanism to control the price of gold/silver. We also report the latest on China's massive investment in the new Silk Road and why it will change the world – The Daily Coin published and extensive article on this topic:  Financial Market Strategists are advising their clients to "buy gold on dips".

Financial Market Strategists are advising their clients to "buy gold on dips".

The Transition

The Transition Are you ready for the next leg of deflation? Where the real pain will be felt (mainly) because the collapse of commodities and oil, in particular, will be accompanied by the collapse of the US stock market.

Are you ready for the next leg of deflation? Where the real pain will be felt (mainly) because the collapse of commodities and oil, in particular, will be accompanied by the collapse of the US stock market.

No comments:

Post a Comment