Gold World News Flash |

- Junior Gold and Silver Mining Funds or Individual Gold and Silver Mining Stocks

- Gold Vs Manipulated Stocks & Real Estate

- Is Dodd-Frank Wall Street Reform Legislation a Hoax?

- Derivatives Chain Breaking; Market Collapse Soon; 2016 Election Suspension? – Bill Holter

- Will They Come For Your IRA?

- AUD-USD Wave B HighÂ

- The Upside Potential in Junior Gold Stocks

- The Fundamental Reason The Silver Price Will Explode Much Higher Than Gold

- India's 'Gold Shirt Man' Stoned-And-Sickled To Death By Mob

- If Silver Breaks $21.50, Commercial Short Squeeze Likely! – Steve St. Angelo of SRSRoccoReport.com

- The Global Plague Of Terrorism

- UK Luxury Property Sales Collapse Post-Brexit

- Is Turkey Coup the Start of European Civil War?

- Stocks and Bonds Are on a Collision Course

- What Is Helicopter Money? Goldman Explains

- F**k France Say Black Lives Matter Supporters

- BREAKING! TURKISH MILITARY ANNOUNCES MARITAL LAW!

- BREAKING : Turkish Military declares takeover of country (Special coverage)

- BREAKING NEWS -- Military Coup in Turkey

- Bank Run Red Alert -- GET YOUR MONEY OUT!

- Gold Daily and Silver Weekly Charts - Comex Expiry Next Week, Military Coup Underway In Turkey

- NICE, France TERROR ATTACK: Europe NWO POLICE STATE/"State of EMERGENCY"/MARTIAL LAW INDEFINITE!!!

- Nice Attack -- False Flag & Hoax

- A True Mega-Prediction

- Benjamin Fulford -- Gold Bounty and Names Released For The Capture of Khazarian Terrorists

- END TIMES SIGNS: LATEST EVENTS (JULY 15TH, 2016)

- How would Trump Fight Terrorism?

- Gold’s Record Selling Overhang

- Donald Trump comments on Nice, France Terrorist Attack (FULL Interview | O'Reilly 7/14/2016)

- Gold Price Could Hit $5,000 or Even $10,000 in a Few Years

- Economic Collapse in Venezuela -- Soaring Inflation and Crime

- Jeff Berwick on Future Money Trends: Next Level Madness

- The Fed’s Final Solution

- The Financial Markets End Game

- Bernanke recommended 'helicopter money' option to Japan

- BANKERS ORCHESTRATE RAID ON GOLD AND SILVER IN AN ATTEMPT TO LOWER OI IN SILVER/SILVER IS THE BANKER’S ACHILLES HEEL

- Why is the gold price rising? Five forces driving the precious metal

- Junior Gold and Silver Mining Funds or Individual Gold and Silver Mining Stocks

- The Broad Stock Market, Helicopters and Gold

- The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

- New York and Shanghai Gold Deliveries

- Breaking News And Best Of The Web

- Gold Daily and Silver Weekly Charts - Coiling For a Move

- After 8 months India's government has paperized only 3 tonnes of gold

- What voters have created

- In The News Today

| Junior Gold and Silver Mining Funds or Individual Gold and Silver Mining Stocks Posted: 15 Jul 2016 11:32 PM PDT Background

We will start with a quote that is sometimes attributed to Sir Winston Churchill, the British Prime Minister, who led Britain during the Second World War.

“If you’re going through hell; keep going”

With the enemy at the gate Sir Winston Churchill didn’t have much choice other than to stick it out. For gold bugs such as me |

| Gold Vs Manipulated Stocks & Real Estate Posted: 15 Jul 2016 11:00 PM PDT from Fabian4Liberty: |

| Is Dodd-Frank Wall Street Reform Legislation a Hoax? Posted: 15 Jul 2016 10:30 PM PDT by Pam Martens and Russ Martens, Wall Street On Parade:

For years now, Republicans have been screaming that the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in 2010 by President Obama is a fraud on the public. Few have examined Dodd-Frank's failed promises as carefully as Wall Street On Parade. The legislation promised to rein in derivatives – it didn't. It promised to end the future need for taxpayer bailouts of too-big-to-fail banks. It didn't. It promised to institute the Volcker Rule to prevent banks from gambling with insured deposits. It didn't. It promised to reform the practices of the ratings agencies that played a pivotal role in the 2008 collapse. It didn't. Dodd-Frank did two great things: it created the Consumer Financial Protection Bureau (CFPB) which has played a major role in exposing and disciplining companies that abuse consumers in areas like credit cards, auto loans, student loans, and mortgages. Dodd-Frank also created the Office of Financial Research in the U.S. Treasury Department – which has been sending out regular warnings that Wall Street is still a dangerous, toxic brew of interconnectedness while putting a bright light on how the Fed is mismanaging its stress tests of the mega Wall Street banks. But these two agencies which are valiantly working in the public interest are no match for how Wall Street has been allowed by the Obama administration to game the designed-to-be-gamed provisions of Dodd-Frank. Take this morning's news from Bloomberg News. The so-called Volcker Rule provisions of Dodd-Frank that barred the Wall Street banks holding insured deposits from owning private-equity funds (where they could inflate asset values with little push-back) and hedge funds (where they could dump or hide their own losses) have been repeatedly pushed forward and now are not set to go into effect until July of next year – an outrageous seven years after Dodd-Frank was signed into law. |

| Derivatives Chain Breaking; Market Collapse Soon; 2016 Election Suspension? – Bill Holter Posted: 15 Jul 2016 10:00 PM PDT from CrushTheStreet: |

| Posted: 15 Jul 2016 09:55 PM PDT from Dr. Jeffrey Lewis, Silver-coin-investor:

Doc, Thank you for your kind words. I do have a question for you. You only need to read the first paragraph of this article for my question: "It is an incredibly common occurrence. It has happened in numerous countries in just recent memory. Poland, Hungary and Bolivia are a few in the last years where retirement funds have been seized.

Total funds currently held in private IRA and 401K accounts in the US are estimated to be in the neighborhood of $10 trillion. That number looks awfully enticing to the US government which is currently indebted to the tune of $19 trillion and holding liabilities of over $100 trillion. As we dance on the brink of a massive collapse, the government's already empty coffers will be even further decimated as the economy contracts massively and tax receipts plummet. In that moment, rather than reducing expenditures and doing massive layoffs and closures of departments, like any regular business would do, politicians will nationalize retirement funds for the "good of the country. And we continue to see movements in that direction”. I don’t imagine the government will outright steal IRA accounts but force IRA owners to buy government bonds with funds in their accounts and portfolios. I can’t seem to get an answer to this question: Does this list of accounts to be “confiscated” also include Roth IRA’s? I have a Roth IRA account that I’m trading/investing in mining stocks. Would you know if Roth IRA’s are included is such a list? Also, I find it highly unlikely that the government would invade IRA owners’ accounts and the number of senior citizens and baby boomers approaching retirement would go ballistic and vote every representative and senator out of office. Even if the government were to declare martial law, the number of voters over the age of 50 is enormous in this country. Also, whoever thought up this idea didn’t give it much thought. Imagine if you will that you were 80 years old and had your IRA account “converted” into a 30 year treasury bond. No doubt, you would become a very serious suicide case. Serious enough to take the last of your savings, rent a U-Haul, fill it full of manure, and ignite it in some government building. As an 80 has lived his life and the government has rendered him “broke,” he has nothing to lose. Anyway, back to my original question…. Do you know if Roth IRA’s are included in this list? **** My response: Any kind of retirement account would be on that list. But I think they will create hyperinflation in the ultimately futile attempt to keep .gov open as things really start unraveling. That would be the worst case. Along the way, it could be an overnight devaluation that cuts the value of everything dollar-denominated in half or more. With so-called Helicopter drops to keep the masses distracted. This could trigger the positive feedback loop ignited by rising treasury yields and ongoing fiscal monetization. That’s confiscation of wealth. And what’s crazy, is that a majority will be supportive of it in the name of doing ‘something’. A majority will beg for them to do more. |

| Posted: 15 Jul 2016 09:44 PM PDT The Aussie dollar looks to have made a reaction high today and I remain bearish about its short term prospects. Let’s review the daily chart. |

| The Upside Potential in Junior Gold Stocks Posted: 15 Jul 2016 09:36 PM PDT Our research continues to argue that the current, record rebound in gold stocks will continue. Every time we’ve predicted a correction, the weakness in the sector has been only a fraction of what we expected in both price and time. New bull markets that follow epic bear markets typically show exceptional strength in their first year. This bull has been no different. Thus, we expect the strong performance to continue. Today, we share a few reasons why the junior sector is poised to outperform in nominal and real terms. |

| The Fundamental Reason The Silver Price Will Explode Much Higher Than Gold Posted: 15 Jul 2016 08:45 PM PDT by Steve St. Angelo, SRSRocco Report:

This critical factor is based upon a certain supply versus demand component of the gold and silver markets. Actually, I came across this data while working on the research for a completely different article. However, the more I compared the figures, the more surprised I was by the results.

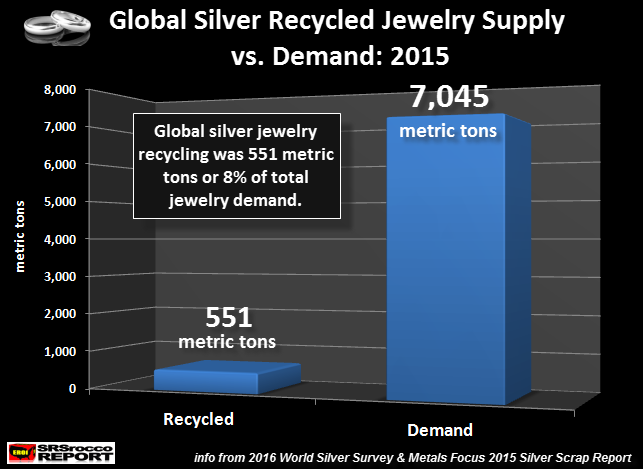

One of the important aspects of my work here at the SRSrocco Report is to take data, figures and information and to look at them in a different way than most analysts. By doing this, I can spot interesting trends and factors unnoticed by the majority of analysts. However, before I get into the critical reason why silver will outperform gold in a big way going forward, let's dissect some of the underlying factors THE HUGE DISCONNECT: Silver vs Gold Jewelry Recycled Supply vs Demand While most investors realize that gold and silver scrap supply are used to help supplement the market, very few understand the huge disconnect between these two precious metals when it comes to recycled jewelry scrap. First, let's take a look at silver jewelry scrap supply. According to the Metals Focus: Silver Scrap Report, the world recycled approximately 551 metric tons (mt) of silver jewelry in 2015. This may seem like a substantial amount until we compare it to total world silver jewelry demand of 7,045 mt:

Thus, recycled silver jewelry supply of 551 mt accounted for only 8% of global silver jewelry demand in 2015. Why so little? Because, very few people will take the time to go down to a pawn shop or precious metal dealer and sell a couple of pieces of silver jewelry for a few bucks. It's just not worth the effort. This is the very reason why very little silver jewelry is recycled. However, gold jewelry is a much different animal all together. Matter-a-fact, the majority of global gold scrap supply comes from recycled gold jewelry. It was difficult to obtain the data on global gold jewelry scrap supply, but I was able to provide an approximate figure based on the data in the Metals Focus: 2015 Silver Scrap Report:

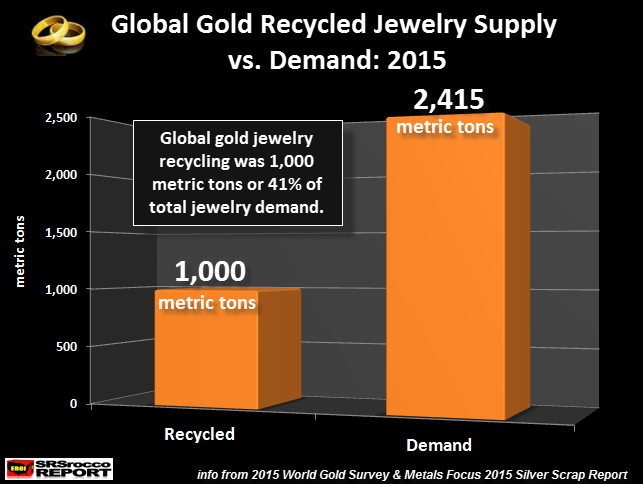

Second, according to data from the World Gold Council's Full Year Demand Trends, and based upon my calculations, global gold jewelry scrap supply was approximately 1,000 mt versus 2,415 mt of total gold jewelry demand in 2015:

Thus, global gold jewelry scrap supply comprised 41% of total gold jewelry demand in 2015. This is an astonishing figure as gold jewelry scrap supply versus gold jewelry demand is five times greater in percentage terms (41% gold vs 8% silver) than its silver counterpart. Again, this is due to the fact that gold jewelry owners are well rewarded for their time to sell a few gold rings for say $500-$1,000 versus $5-$15 for several pieces of silver jewelry (based on metal content only).

Now that we have an idea just how out of balance silver jewelry scrap supply is compared to gold jewelry scrap, let's look at pathetic figures in the next component. |

| India's 'Gold Shirt Man' Stoned-And-Sickled To Death By Mob Posted: 15 Jul 2016 07:34 PM PDT Datta Phuge took the interwebs by storm three years ago when we introduced the $250,000 22-karat-gold-shirt-wearing 32-year-old Indian who proclaimed "I know I am not the best looking man but surely no woman could fail to be dazzled by this shirt?" showing the world that gold is much more than a barbarous relic. Sadly, as The BBC reports, "the gold man" was murdered overnight - found stoned-and-sickled to death near his home in Dighi, India.

The motive behind the killing is not known, but police preliminary suspect it may be linked to some business rivalries and are investigating all angles. The Pune Police have launched a manhunt to nab the assailants, roadblocks erected at all exit points and within the city limits as well as district boundaries. The police have recovered the sickle used in the crime and have sent Phuge’s body for an autopsy. Besides his primary business of lending money, he ran the Vakratund Chit Fund Pvt. Ltd. along with his wife and there were complaints of financial misappropriation against him in recent times. |

| If Silver Breaks $21.50, Commercial Short Squeeze Likely! – Steve St. Angelo of SRSRoccoReport.com Posted: 15 Jul 2016 07:00 PM PDT from FutureMoneyTrends: |

| The Global Plague Of Terrorism Posted: 15 Jul 2016 07:00 PM PDT Authored by Gulam Asgar Mitha via The Oriental Review,

Pakistan is a nation in chaos as are many other Muslim countries whose citizens are victims of terrorism, tyranny, corruption, oppression and injustice. These will be illustrated as several epitomes in the following paragraphs.

The corruption, tyranny, oppression, religious intolerance, terrorism and injustice in Pakistan are representative across the entire Muslim world. Muslims are fleeing from their own countries and seeking sanctuary anywhere where they can escape the horrific crimes being perpetrated against innocent men, women and children by their leaders and extremist groups like Al-Qaeda, Islamic State and Taliban. Ask Muslims about the roots of terrorism and they’re quick to point the fingers at the USA or Israel. They’re not thinking. They’re not thinking inwardly. The plague of terrorism is homemade, not foreign. The western countries however prop up the Muslim perpetrators with bribes and political protection so that they can extract economic benefits from the mayhem. Why not exploit the homegrown situation? Terrorism was born predominantly in Saudi Arabia and Pakistan as a tool to expel Soviets from Afghanistan in 1980s. The other day I was asked about these three countries. The official descriptions of Pakistan and Afghanistan are THE ISLAMIC REPUBLIC OF PAKISTAN and ISLAMIC REPUBLIC OF AFGHANISTAN. I posed a question to several Muslims: are these two countries Islamic or republics or democracies as their leaders and politicians claim? The answers were unanimously ‘no’ in each case. They are hypocrisies and mirror reflections of Saudi Arabian monarchy in every respect. These countries are namesake Islamic only, not in principle or in spirit. The blame also lies with the clergy who mislead Muslims and appease the political leaders for personal gains and power sharing. The current Prime Minister Nawaz Sharif owes much to the Saudi monarchy as it had granted him sanctuary during his 9 year exile from Pakistan in 1999 following a military coup. Saudi Arabia has granted sanctuary to other heads of Muslim countries known for their extremities of corruption, oppression, tyranny, murder, mayhem and injustice against their peoples. A case is that of Idi Amin President of Uganda from 1971-1979, an incredibly disturbed psychotic who is on record to have killed half million citizens. Another corrupt tyrant-dictator who was granted sanctuary in Saudi Arabia was the former President of Tunisia Zain El-Abedin bin Ali (1987-2011). He fled with his notorious wife Leila bin Ali and nearly 1.5 tons of gold valued at $75 million. Why has the Saudi monarchy granted sanctuary to such tyrants? One can only surmise that “birds of a feather flock together”. The plague of terrorism was born and nurtured in Afghanistan and Pakistan in prayer houses (mosques) of God under control of fundamentalist clergies trained and funded by the same country that has supported and granted sanctuary to tyrants, dictators, political criminals, unjust rulers, oppressors and murderers. One of them was President Zia-ul-Haq of Pakistan, a religious zealot, who together with Saudi Arabia aspired to promote Wahhabism- an extremist belief far removed from mainstream Islam which preaches humanity and tolerance – across the Muslim world. Fortunately his aspirations died with him in a military airplane crash in 1988 but the monarchy and Wahhabism continues to survive and grow like a cancerous plague of radicalism, terrorism and terrorists. The plague spans not only the Muslim countries but even the USA and European nations. The only Muslim country which has successfully prevented terrorism within its borders is Iran. Whether they belong to Al-Qaeda, Taliban or the Islamic State (IS), these bearded terrorists are products of extremism and religious fundamentalism, brainwashed in mosques by the Saudi trained clergy to indiscriminately kill men, women and children. Then they vanish in the crowds and find sanctuary in the mosques. They call themselves Muslims who believe that God has chosen them to do His bidding and that they’ll be rewarded in Paradise. Let us now consider in a couple of paragraphs how to eliminate the global plague. The US and European NATO partners have a grand plan for Saudi Arabia, a nation that cannot defend itself but would willingly pay other Muslim countries to do its dirty job. It has hopes that Pakistan, Afghanistan, other Arab monarchies would send regular army troops to defend the country and the two holy sites in Mecca and Medina. It has thus formed a coalition of Sunni Muslims including Al-Qaeda, IS and Taliban to counter the growing influence of Shia axis (Iran, Iraq, Syria and Hezbollah) in the Middle East. The grand plan is to start a civil war between Shias and Sunnis (both Muslims) and thus contain the plague in US and EU while Muslims will be engaged in throat cutting. As to the timing of the civil war, it might just well be in less than two years following the US elections. Donald Trump, the Republican Party presidential nominee, is the circus clown who has been thrown into the ring to gauge the sentiments of the Americans towards Muslims while the “terrorists” unleash chaos in the US. Behind the scenes is the juggler, Hillary Clinton (endorsed as the Democratic Party presidential nominee), as she spins a web that will lead to the Shia-Sunni civil war in the Middle East. Iran’s Supreme leader Khamenei warned his nuclear negotiators that under the N-deal is a “half nuclear bowl” suggesting caution that the US-EU has an ulterior motive. Now that the sanctions are gradually being lifted, Iran is economically and militarily preparing towards the eventuality of the civil war that it has foreseen in the “half nuclear bowl”. I perceive that the civil war will be a major regional conflict that will prolong many years till terrorism and fundamentalism will be defeated and peace will prevail but the human toll among Muslims will be massive. |

| UK Luxury Property Sales Collapse Post-Brexit Posted: 15 Jul 2016 06:20 PM PDT Things just went to '11' on the Spinal Tap amplifier of Britain's property market. Having detailed the numerous 'dominoes' that have begun to fall, and the start of forced real asset liquidations, the hard data from Britain's Royal Institute of Chartered Surveyors suggests Brexit just killed the British housing market... and even more crucially, as Bloomberg reports, a measure of London (luxury) home-price changes crashed to its weakest since the financial crisis as the U.K.’s vote to leave the EU sent shock waves across the nation. Having previously shown the following chart as an example of the 'liquidity gap' between fund-level liquidations and the exuberant UK real estate market, warning that things could get ugly very quickly...

Bloomberg reports, they just did! The index by the Royal Institution of Chartered Surveyors dropped to minus 46 in June from minus 35 the previous month, showing that more real-estate agents are recording lower prices in the capital than higher ones. The reading was the weakest since early 2009. All responses were received after the EU referendum on June 23. A separate report from Acadata Ltd. and LSL Property Services Plc showed home values in the capital were already being hurt ahead of the vote, with prices decreasing 1.4 percent in May, the biggest monthly fall since June 2011.

RICS’s survey provides the first insight into the impact the decision to leave the EU is having on the housing market. It shows nationwide demand falling to its lowest level since the middle of 2008, while the number of properties put up for sale plunged to a record low. A gauge of sales expectations for the next three months was at its weakest in 28 years.

The Brexit vote has “clearly unnerved many buyers and sellers, and it is evident that some are reevaluating what they do and/or are attempting to renegotiate the price,” they said. |

| Is Turkey Coup the Start of European Civil War? Posted: 15 Jul 2016 04:30 PM PDT Is Turkey Coup Is Start European Civil War? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Stocks and Bonds Are on a Collision Course Posted: 15 Jul 2016 04:21 PM PDT This post Stocks and Bonds Are on a Collision Course appeared first on Daily Reckoning. One of the following is correct: A)The stock market is lying. They both can't be true. Consider: The stock market has sprung to record highs this week. Shocking, given the world was coming to an end after Brexit. But it's true. Both the S&P and the Dow eclipsed previous records this week. What does that normally indicate? A rollicking economy in high gear, stability, investor belief in the future. Maybe some "healthy" inflation into the bargain. Now consider: Bonds are also trading at record highs. Meaning yields are at historic lows (prices and yields move in opposite directions — the higher the price, the lower the yield, and vice versa). Yields on 10-year Treasuries plunged to all-time lows this month. Same with 30-year Treasuries. That would normally signal an economy on the brink of ruin and investors panicking into government bonds. It also means deflation of the hide-the-women-and-children variety. The Telegraph: "Bond markets are signaling something very nasty coming down the road at us — an all-encompassing, worldwide deflation." Two completely different narratives. One wrong, one right. Someone's in for a nasty shock — and probably soon. Says analyst William Koldus, founder of The Contrarian: The tug of war between inflationary and deflationary assets is likely to be resolved in 2016. Either U.S. stock prices, which have been an outlier to the upside, are wrong, and a significant correction awaits stock investors, or U.S. bond prices, and global sovereign bond yields, which have priced in a significant deflationary head wind, are wrong, and safe-haven bondholders are set for losses. Who's the jury to believe? Generally, the bond market. As Neil Irwin of The New York Times explains, "Savvy economic analysts have always known the bond market is the place to look for a real sense of where the economy is going, or at least where the smart money thinks it is going." Here he dumps more rain on the parade: "And right now, if the bond market is correctly predicting the economic path ahead, we should all be terrified." Disconcerting. But is the bond market correctly predicting the economic path ahead? The optimists say the bond market has overreacted to Brexit. That the current situation is an anomaly, a one-off, a temporary detour. Markets have jumped to record highs, they remind us. Stocks are right, and bonds will get their comeuppance. It is true that the yield on the 10-year Treasury has crept higher since its low almost two weeks ago. But assuming the future isn't nearly as grim as bonds are saying, doesn't that mean the bond market is horribly imbalanced… and due for a rather unpleasant correction? The Telegraph again: "Let's hope [bond markets] are wrong, but the end result is scarcely more appetizing if they are, for it would mean bonds are massively mispriced, leaving the financial system facing potentially huge losses." So… the good news is that the economy might not be nearly as bad as bonds are saying. The bad news is that bonds are a disaster in waiting. Then there's the worst-case scenario: What if bonds are right after all? Below, David Stockman shows you why a multitrillion-dollar bond implosion is an "absolute certainty." Read on. Regards, Brian Maher Bubbles in Bond LandDavid StockmanLast year Japan lost another 272,000 of its population as it marches steadily toward its destiny as the world's first bankrupt old age colony. At the same time, the return on Japan's 40-year bond during the last six months has been an astonishing 48%. That's right! We aren't talking Tesla, the biotech index or the FANGs. To the contrary, like the rest of the Japanese Government Bond (JGB) yield curve, this bond has no yield and no prospect of repayment. But that doesn't matter because it's not really a sovereign bond, anyway. It has actually morphed into a risk free gambling chip. Leveraged front-runners are scooping up whatever odds and sots of JGBs that remain on the market and are selling them to the Bank of Japan (BOJ) at higher, and higher and higher prices. At the same time, these punters face virtually no risk. That's because the BOJ already owns 426 trillion yen of JGBs, which is nearly half of the bonds outstanding. And it is buying up the rest at a rate of 80 trillion yen per year under current policy, while giving every indication of sharply stepping up its purchase rate as it segues to outright helicopter money. It can therefore be well and truly said that the BOJ is the ultimate roach motel. Virtually every scrap of Japan's gargantuan public debt will go marching into its vaults never to return, and at "whatever it takes" bond prices to meet the BOJ's lunatic purchase quotas. Surely, BOJ Governor Kuroda will go down in history as the stupidest central banker of all-time. But in the interim the man is contributing — along with Draghi, Yellen and the rest of the central bankers guild — to absolute mayhem in the global fixed income market. That's because these fools have succeeded in unleashing a pincer movement among market participants that is flat-out suicidal. That is, the leveraged fast money gamblers are chasing prices ever higher as sovereign bonds become increasingly scarce. At the same time, desperate bond fund managers, who will lose their jobs for just sitting on cash, are chasing yields rapidly lower on any bond that still has a positive current return. This is the reason the 30-year U.S. treasury bond has produced a 22% return during the last six months. To say the least, that's not shabby at all considering that its current yield is just 2.25%. Yesterday's Wall Street Journal piece entitled, "35-Year-Old Bond Bull on Its Last Legs," quotes a European fund manager that explains why everything is going haywire: Neil Dwayne, global strategist at Allianz Global Investors, is still buying. "Every piece of analysis we do on the bond market tells us they are structurally overvalued," he said. But he is buying Treasurys anyway. "That's what you have to do when you have the ludicrous valuations in Europe and Japan." Exactly. The poor man is buying a bond he hates because Draghi and Kuroda have driven him out of what amounts to a $15 trillion corner of the sovereign debt market. The frenzied flight of yield seeking fixed-income investors is even more dramatically evident in the case of Japan. As Zero Hedge recently demonstrated, Japanese investors have been frantically buying foreign bonds at record rates, as they scour the planet for yield. This planetary scramble for yield puts Janet Yellen right in the financial dunce chair where she belongs. She and the rest of her posse keep insisting that 90 months of zero interest rates and $3.5 trillion of bond-buying have so far produced no serious signs of over-valuation or bubbles. Over the last seven years, the Fed has done its level best to drive U.S. treasury yields into the basement of economic plausibility. Now the other major central banks are finishing the job. Needless to say, this can't go on much longer. The weighted average yield in the entire developed market (DM) government bond market has now skidded to just 40 basis points. At the current rate of decline, the entire global market will be in subzero land by the end of the year. You could call this central bank-driven yield stripping. That would be bad enough if its effects were limited to just the vast moral hazard it poses to governments and politicians all over the world. After all, we are now entering the zone in which government debt is tantamount to free money. And in fact, Germany actually issued new ten-year debt this week which bears a negative coupon. In just the last three years, bund auctions have gone from what were all-time low yields in the 2% range at the time, to the netherworld of subzero. Undoubtedly, whatever remaining financial discipline left among the nations of the world will soon be extinguished in a frenzy of "helicopter money" style fiscal stimulus. Keynesian snake oil salesman like former Treasury Secretary Larry Summers even make the utterly bogus argument that now is the time for an orgy of spending on infrastructure, social improvements, and even pyramids for that matter, because government borrowing rates have never been lower. That is true enough. The 10-year treasury closed a few days ago at a yield of 1.34% — the lowest rate since 1790! But how does the good professor think government bond yields got to this ridiculous level, and what will happen after an orgy of spending and borrowing when rates return to normal sometime down the road? They never say. But in the meanwhile, it is not just politicians that are being lulled into the delusion of free money. The central bank-driven stampede for yield has spilled over into every nook and cranny of the fixed income and equity markets around the world. Anything yielding just a sliver more than sovereign debt has been drastically overvalued. It now appears that U.S. corporate bond issues will hit a record $1.7 trillion this year — or 55% more than the last blow-off in 2007. And that is due to one reason alone — bond managers are desperate for yield and are moving further out the risk spectrum exactly as our monetary central planners have ordained. But here's the thing. Real net business investment in the U.S. is still 10% below its turn-of-the century level. Accordingly, this massive fund-raising spree by corporate America is being cycled right back into the stock market in the form of stock buybacks, M&A deals and other financial engineering maneuvers. In fact, during the most recent quarters the S&P 500 companies have cycled back into the Wall Street casino upwards of 125% of their net incomes in the form of dividends and buybacks. Yet Janet Yellen and her merry band see no bubbles. Needless to say, you do not need a Ph.D. in econometrics to see that this fact goes a long way toward explaining an especially relevant mystery of the moment: How is it that the S&P 500 could be trading at an all-time high at 25X reported earnings at the very time that retail equity fund outflows have sharply intensified? During the last six months in fact, equity fund outflows have even exceeded levels experienced after the 2001–2002 dotcom bust. Yes, the buyer of last resort is the stock trading rooms in America's corporate C-suites. Our stock option-crazed CEOs and boards are doing nothing less than de-equitizing their balance sheets and eating their seed-corn. Someday the due bill will arrive. But in the interim it is useful to contemplate the starting point. Corporate finances are being ransacked owing to the scramble for yield set in motion by central banks and the $13 trillion of subzero sovereign debt that has been generated in the last two years. In short, the global bond market has become a giant volcano of uncollectible capital gains. For example, long-term German bonds issued four years ago are now trading at 200% of par. Yet even if the financial system of the world somehow survives the current mayhem, the German government will never pay back more than 100 cents on the dollar. Can you say multi-trillion dollar bond implosion? Better try. Its eventual arrival is an absolute certainty. Regards, David Stockman Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Stocks and Bonds Are on a Collision Course appeared first on Daily Reckoning. |

| What Is Helicopter Money? Goldman Explains Posted: 15 Jul 2016 04:20 PM PDT Whether Japan admits it or not, helicopter money - thanks to Ben Bernanke - is here, and the market's reaction this week was simply the first stage of pricing it in, as confirmed by the biggest drop in the Japanese currency this century.

Incidentally, we are "confident" that the SEC will inquire whether Citadel- Ben Bernanke's official employer - was actually short the Yen ahead of its employee going to Japan and advising the Bank of Japan what to do, and how to crush its currency. Obviously that would be a grandiouse, and criminal, conflict of interest. We won't be holding our breath, but while we wait here is a useful primer for all those wondering just what is coming, courtesy of Goldman Sachs, which explains the nuances of monetary policy's endgame: Helicopter Money. Q1: What does helicopter money refer to in the first place? A1: Literally, it is a policy whereby the government or central bank supplies large amounts of money, as if it were scattering money from a helicopter. A more practical definition, however, is a policy whereby the central bank has primary responsibility for funding to facilitate more flexible and active fiscal spending by the government. The concept of helicopter money has been around for years. Professor Milton Friedman was first to propose the idea in 1969, and in the early 2000s then Federal Reserve Board Governor Ben Bernanke raised it as one prescription to prevent deflation.[1] Very recently, a July 13 Sankei Newspaper article suggesting Prime Minister Abe and his advisers were considering helicopter money sparked debate on the subject in Japan. According to Adair Turner (former chairman of the UK FSA), there are two specific schemes: (1) the BOJ directly underwriting JGBs, and (2) converting JGBs purchased by the BOJ on the secondary market into zero-coupon perpetual bonds.[2] The first scheme is referred to as monetization. This was actually done in Japan under Takahashi fiscal policy in the 1930s, which served as a model for Abenomics (see Q4 for details). The second scheme, although not involving direct JGB underwriting, is in effect very similar to the first one because it is no longer necessary for the government to pay interest on JGBs or even redeem them. Either way, it would theoretically allow the government to fund fiscal spending of any amount it deemed necessary. It can be thought of as the ultimate form of fiscal and monetary policy unification. Q2: Why is this a hot topic in Japan now? A2: This is closely associated with the fact that Abenomics, which has monetary policy as its central plank, is faltering. The BOJ, under Governor Kuroda, launched unprecedented easing in April 2013, with the initial aim of achieving 2% inflation in two years by doubling base money. It has now pushed back the timeline for achieving this inflation target to the end of FY2017, and we, along with many other observers, believe it will take even longer. The core CPI (excluding fresh foods) fell into negative territory in the most recent reading in May 2016, at -0.4% yoy. The BOJ's new core CPI (excluding fresh foods and energy), which the BOJ has emphasized recently as a gauge of price trends, also slowed to +0.8% in May 2016, after printing strongly at +1.3% in December 2015. On top of this, the 2016 shunto spring wage negotiations ended on a sour note for the BOJ too, even though it had hoped for stronger wage hikes.[3] The real economy, meanwhile, is sluggish, oscillating between positive and negative growth since 2015. . We also think the BOJ's unprecedented easing policy is approaching its limits. Qualitative easing (ETF purchase in particular), part of the BOJ's three-dimensional monetary easing, still has relative scope for expansion, but many observers are skeptical about the sustainability of the BOJ's quantitative target of increasing the monetary base by ¥80 tn a year through JGB purchases.[4] The negative interest rate policy introduced by the BOJ in January 2016 as well has been met with a critical eye not only by financial institutions but also the general public. If Prime Minister Abe and his advisors are indeed giving consideration to helicopter money, as the Sankei Shimbun article suggests, this may indicate that they are also sensing limitations to the BOJ's three-dimensional easing. Q3: Is helicopter money legally feasible? A3: It is prohibited, in principle, but there is a gray zone here. Article 5 of Japan's Public Finance Law prohibits the BOJ from underwriting any public bonds. However it goes on to say that in special circumstances, the BOJ may be able to do so within limits approved by a Diet resolution. The first sentence prohibits the underwriting of JGBs in principle. This is based on lessons learned from the bitter experience, under the Takahashi fiscal policy in the 1930s, of JGB underwriting by the BOJ leading to a complete loss of fiscal discipline and ultimately to hyper-inflation (see Q5). The gray zone is the proviso in the second sentence. "Special circumstances" are usually interpreted to be limited to JGBs bonds issued to refinance JGBs held by the BOJ, and not ones issued to support active government fiscal stimulus measures. However, proponents of BOJ underwriting tend to believe that this proviso can be interpreted more broadly to include a more active role for the BOJ in financing fiscal measures. Q4: What kinds of benefits are proponents of this policy expecting? A4: We believe proponents are focused on two main benefits. The first is the direct demand-generating effect that comes from the ability to freely increase fiscal spending with no concern over how it will be funded. While households may opt to direct this money into savings rather than spend it if the policy is only in place for a very short period of time, the possibility of consumption picking up increases the longer the policy is in effect. The second benefit is the "announcement effect" targeting the markets generated by the decision itself to adopt a very radical policy such as the BOJ directly underwriting public debt, long considered taboo (see Q5). For the currency markets, we expect this policy to place a downward pressure on the yen. Q5: What are the risks? A5: The largest risk is that once helicopter money is adopted it may not be able to be stopped. If the markets take the view that the policy cannot be reined in, there is a risk the government and BOJ may trigger a substantial collapse in confidence in the yen, resulting in excessive currency depreciation. Under the Takahashi fiscal policy of the 1930s, on which Abenomics is modeled, the BOJ actually took the step of underwriting JGBs. Then Minister of Finance Korekiyo Takahashi attempted to pull Japan out of a period of severe deflation by supplementing the weaker yen that accompanied the exit from the gold standard with aggressive fiscal stimulus via the underwriting of JGBs.[5] While the BOJ's underwriting of public debt was also viewed as taboo at that time, Finance Minister Takahashi considered it just a short-term expedient, and planned to rapidly exit the policy once Japan had escaped the deflationary cycle. The Takahashi policy breathed life into the Japanese economy, but contrary to the Minister's intentions, the BOJ continued to underwrite JGBs unabated. After the assassination of Minister Takahashi in 1936, what started out as a short-term expedient became the fiscal norm and the fiscal deficit grew sharply, ultimately leading to hyper-inflation. While the era of militarism only further accelerated the loss of fiscal discipline, it all began with giving the government a really convenient tool of the BOJ's underwriting of public debt. While some promoting helicopter money highlight the possibility of building a framework that will ensure fiscal discipline, such as linking the policy to the inflation target, given past Japan's experiences noted above, many including us are skeptical about whether or not an effective framework can really be built. Q6: Is helicopter money likely to be used in Japan? A6: While we think the overt adoption of helicopter money is highly unlikely in Japan, we see a possibility that the market could come to associate future large-scale fiscal and monetary policy mix as a step toward helicopter money. As explained in Q5, the main reason why we think helicopter money is unlikely in Japan is that the BOJ is acutely aware of the difficulty of exiting such a policy once it has been set in motion. Governor Kuroda is a notable proponent of fiscal consolidation, and is in our view unlikely to agree to a policy that is highly likely to result in a future loss of fiscal discipline. That said, the point at which helicopter money begins is extremely vague. The BOJ's net purchasing of JGBs is currently running at ¥80 tn per year. Although these purchases are made via the market and therefore do not amount to the underwriting of government debt in the strictly defined sense, the economic principle is the same. The government issues bonds that are purchased by private sector financial institutions who quickly sell them on to the BOJ. In terms of fund flow, the only difference from the direct underwriting of government debt is that in this case the bonds pass through private sector financial institutions. Accordingly, if the Japanese government decides to implement a massive fiscal stimulus package and the BOJ concurrently steps up three-dimensional easing (particularly if it increases JGB purchasing), we think the market could react as if this is a step toward helicopter money in all but name. * * * And here are some schematics from Jefferies |

| F**k France Say Black Lives Matter Supporters Posted: 15 Jul 2016 04:00 PM PDT Countless Black Lives Matter supporters have disrespected France after the horrific events Thursday night at Bastille Days. Have a look at what these despicable people are saying. Media analyst Mark Dice has the story. © 2016 by Mark Dice The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING! TURKISH MILITARY ANNOUNCES MARITAL LAW! Posted: 15 Jul 2016 03:16 PM PDT BREAKING! TURKISH MILITARY ANNOUNCES MARITAL LAW! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING : Turkish Military declares takeover of country (Special coverage) Posted: 15 Jul 2016 02:45 PM PDT Military helicopters are flying over Turkey's capital Ankara, with shot fired, according to witness reports. Turkish Prime Minister Binali Yildirim says a group within the military engaged in an attempted coup, The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING NEWS -- Military Coup in Turkey Posted: 15 Jul 2016 02:19 PM PDT Fox News military analyst Chuck Nash and former U.S. Navy SEAL David Sears an attempted military coup in Turkey. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bank Run Red Alert -- GET YOUR MONEY OUT! Posted: 15 Jul 2016 02:00 PM PDT GET YOUR MONEY OUT! World's oldest bank faces uphill battle trying for another bailout The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Comex Expiry Next Week, Military Coup Underway In Turkey Posted: 15 Jul 2016 01:28 PM PDT |

| NICE, France TERROR ATTACK: Europe NWO POLICE STATE/"State of EMERGENCY"/MARTIAL LAW INDEFINITE!!! Posted: 15 Jul 2016 01:00 PM PDT Terror Attack in FRANCE 7/14/16. MARTIAL LAW/POLICE STATE/"STATE OF EMERGENCY" will continue in FRANCE for who knows how long. WAKE UP AMERICA!!! This is a preview for what will go down "State-Side". The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Nice Attack -- False Flag & Hoax Posted: 15 Jul 2016 12:28 PM PDT Nice Attack Bastille Day Truck Attack Hoax? - Not so fast... Nice Attack The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 15 Jul 2016 12:00 PM PDT This post A True Mega-Prediction appeared first on Daily Reckoning. In a moment, I'll reveal the biggest prediction I've ever made in Tomorrow in Review. First, I want to show you why I'm finally ready to "go public" with this huge prediction. Yesterday I downloaded Pokémon Go. Go ahead… roll your eyes. Laugh out loud. I'll wait. Now I'll show you why Pokémon Go is the future. And why the tech behind the hottest app of 2016 could make you huge new wealth. Pokémon Go seamlessly blends the real world with a virtual world. The game uses geolocation on your smartphone to put Pokémon characters in the world around you. You "capture" these characters as you move around. Digital information blended with the real-world is Augmented Reality (AR). Virtual Reality (VR) is you entering a different world – someplace that's fully digital. Augmented Reality is the digital world blending seamlessly with the real world around us. TechCrunch says VR and AR together will be a $150 billion a year business by 2020. Even better, it took Pokémon Go less than two weeks to be downloaded onto more than 5% of the Android phones in America. As you read this, it's probably close to 10%. That's one Android phone in ten in America, in less than two weeks. And it only took two hours to become the #1 download at Apple's iTunes store. Plus, as of yesterday, Pokémon Go has already broken the record for peak daily active users at over 20 million – besting the record set by Candy Crush Saga in 2013.  In two weeks, Pokémon Go is the biggest US mobile game in history. Not impressed? Here's a deeper look at why Pokémon Go is the future. Pokémon Go means Google gets a second chance at Google Glass. It means Google's $500+ million investment in Magic Leap's VR / AR platform could already have millions of AR-familiar users when it debuts. Google Glass Version 2 will eliminate the smartphone and make AR part of your everyday life. No adoption curve. No explaining why AR's amazing. Just world domination from day one. Truly widespread AR will be the biggest thing since the launch of the iPhone or the introduction of the personal computer. It'll have profound impacts on medical research, business travel, art, and education. But we're just getting started… Pokémon Go also means Microsoft's breakthrough HoloLens technology, Sony's VR device for the new PlayStation gaming console… … Plus HTC's Vive, Samsung's Gear, and Facebook's Oculus all get more exposure, interest, and attention. Watch the news in the weeks ahead and see if I'm right. It means VR and AR are here to stay. Here, today, now, is our breakthrough moment. Thank you, Pokémon. Still not impressed? Let's look even deeper. Nintendo stock (the company behind Pokémon) doubled in the two weeks since the game's launch, according to CNET. The move added over $9 billion in market cap. CNN Money reported investor interest in everything having to do with mobile gaming also spiked in the wake of the Pokémon Go launch. Bloomberg called it a "big win" and Inc. Magazine said AR's an approaching "gold rush." This is all in the last two weeks. And while the future might look like Pokémon today, rest assured AR tech will only grow from here and spawn dozens of enormous investing opportunities in the months ahead. In fact, I'm going to go on record right now with a prediction. A big one. The future's coming so fast – due to rapid advances like AR – that it might be 1993 again. What I mean is, we could be on the verge of another 5-7 year bull run in the markets. One fueled by compounding tech advances. Sure, there'll be bumps and corrections. But the trend is up. And tech will lead the way. You can bet every app developer, game company, and device maker from Shanghai to Silicon Valley is paying attention to what happened in the last two weeks. This time, instead of Yahoo and AOL… a new generation of tech stocks will lead the way. If the opportunities I'm finding every day are any indication, we're in for one heck of a profitable ride. To a bright future, Ray Blanco The post A True Mega-Prediction appeared first on Daily Reckoning. |

| Benjamin Fulford -- Gold Bounty and Names Released For The Capture of Khazarian Terrorists Posted: 15 Jul 2016 12:00 PM PDT Benjamin Fulford, Gold Bounty and Names Released For The Capture of Khazarian Terrorists by Benjamin Fulford July 15, 2016 benjaminfulford.net The Chinese government seems to think they are OK since they have told the heads of over 20 countries they favor a Rothschild/White Dragon Society... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| END TIMES SIGNS: LATEST EVENTS (JULY 15TH, 2016) Posted: 15 Jul 2016 10:30 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| How would Trump Fight Terrorism? Posted: 15 Jul 2016 09:18 AM PDT Trump Campaign National Spokesperson Katrina Pierson on the attack in France, the fight against terrorism and Donald Trump's potential running mate. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold’s Record Selling Overhang Posted: 15 Jul 2016 08:51 AM PDT Gold’s mighty new bull market this year has been amazing, the result of heavy buying by investors and speculators alike. But these latter traders have pumped so much capital into gold futures that this metal now faces a record selling overhang. Since the hyper-leveraged nature of futures trading demands an ultra-short-term focus, speculators’ excessive bullish bets on gold pose major near-term downside risks. Gold’s price trends are overwhelmingly dominated by global investment demand. Even though it has only accounted for about 1/5th of total demand in recent years, investment is wildly variable. With the rest of gold demand relatively stable, it is fluctuating investment demand that ultimately sets gold prices at the margin. Gold’s young bull in 2016 is largely the result of an influx of massive investment buying. |

| Donald Trump comments on Nice, France Terrorist Attack (FULL Interview | O'Reilly 7/14/2016) Posted: 15 Jul 2016 08:00 AM PDT Full Interview with Donald Trump On The O'Reilly Factor. (July 14th, 2016) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Price Could Hit $5,000 or Even $10,000 in a Few Years Posted: 15 Jul 2016 07:35 AM PDT BY JARED DILLIAN : You have to be careful writing about gold. You come out in favor of gold and you get maligned as some kind of doomsday-prepping, knuckle-dragging wingnut. Then you never get to go on TV. They don’t invite the crazy gold guys on TV. I’ve been long gold since 2005. Rode it all the way down from 2011 to 2016. If you ride something down 45%, you are a moron. I’ll own it. I am a moron. I actually had a pretty good idea that there would be a correction in 2011, but I vastly underestimated how severe it would be. |

| Economic Collapse in Venezuela -- Soaring Inflation and Crime Posted: 15 Jul 2016 07:00 AM PDT The state of emergency in Venezuela is being extended for another 60 days because of the economic crisis. Many Venezuelans stand for hours in endless queues waiting to buy food. Prices are soaring because of the world's highest inflation rate. Al Jazeera's Virginia Lopez reports from... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Jeff Berwick on Future Money Trends: Next Level Madness Posted: 15 Jul 2016 05:00 AM PDT from TheDollarVigilante: Topics include: Brexit chaos and volatility, plans for a one world government, an uprising going on now, Bilderberg gets hard core this year, collapse of the E.U. and formation of a European super-state, uncertainty in the markets, women in top power positions and the use of feminism to keep the system going a little longer, the terrible mass crimes of Killary Clinton, the hideous spectre of her presidency, the Gold and silver bull market and gold stocks, peaceful parenting and unschooling. |

| Posted: 15 Jul 2016 04:40 AM PDT by Dave Kranzler, Investment Research Dynamics:

It's ironic that the course of the U.S. Government, and it's original "Bill of Rights" foundation upon which the French "Declaration of the Rights of Man and of the Citizen" was based, is going in the opposite direction of the gift given to us by the Founding Fathers. The 3rd massive stock market bubble in 16 years is emblematic of the fraudulent Ponzi scheme that has engulfed the United States political, economic and financial system. The Fed now as much as openly admits that it is driving the stock market higher, ostensibly with the goal of stimulating economic growth. However, I the elitists who control the Fed are not stupid. They have ignited the third stock market bubble specifically for purpose of a final effort to confiscate public wealth and destroy the middle class. For purposes of this discussion, "middle class" is defined as anyone not in upper .5% (point five percent) of wealth in the U.S. In today's episode of The Shadow Truth, we discuss the stock bubble as a wealth confiscation mechanism and explain why we believe an explosive move in gold and silver is going to occur this year. |

| The Financial Markets End Game Posted: 15 Jul 2016 04:20 AM PDT by Andy Hoffman, Miles Franklin:

To wit, amidst the unequivocally worst global economy of our lifetimes, featuring record, parabolically surging debt; a full-blown currency crisis; geopolitical instability unparalleled in the post-war era; an expanding European banking crisis, to the point that governments and corporations alike are begging for bailouts; and the lowest commodity prices since the 2008 crisis; no financial shock is unworthy of catapulting "last to go" stock indices like the "Dow Jones Propaganda Average" to new all-time highs. That is, when QE, ZIRP/NIRP, and even "helicopter money" have become official, nearly universal government policies.

As I wrote yesterday, it is no longer supposition as to how this occurs – particularly when institutional equity flows have been negative for four months, and corporate buybacks have dramatically declined. As, at this point, many Central banks – such as the Japanese, Chinese, and Swiss – are overtly purchasing stocks; whilst those that aren't doing so overtly – like the Fed – are clearly doing so covertly. To wit, the "dead ringer" algorithm on the "Dow Jones Propaganda Average," which I first wrote of four years ago. Which, in some way, shape, or form, occurs on roughly 75% of all trading days; with yesterday's being particularly egregious – as amidst oil prices plunging below key support; horrific Chinese trade data; plummeting European bank stocks; and a nearly full reversal of the prior day's Treasury yield gains; the PPT still managed to close the Dow in positive ground, at a new nominal high.

As for Precious Metals, the powerful strength the paper silver market has demonstrated – against a Cartel desperate to cover record short positions – has been something we haven't witnessed since 2011. This is why I have for the first time in 14½ years started to believe the Cartel's demise is imminent, even if we still have to endure financial ignominy on the way to our inevitable "victory." Such as last night; when, in the ultra-thin Globex paper market, it again stopped silver from breaching the all-important $20.50/oz level – i.e., its 50-month moving average – that will ultimately prove to be the Cartel's undoing. Which subsequently, was followed by this morning's equally blatant attempt to re-establish $20/oz as resistance, amidst an essentially "news-less" backdrop. Since silver "shocked" the Cartel by surging above $21/oz on Independence Day Eve, it has been "repelled" from $20.50 a whopping 12 times, amidst what may well be the "final battle" for Precious Metal market control.

Today, on a day when Germany sold negative yielding 10-year Bunds for the first (and decidedly NOT last) time, I want to follow-up yesterday's commentary, in response to a reader's comment suggesting that due to my statement that Central bankers' will hyperinflate financial markets if need be, their manipulation can continue indefinitely. To the contrary, what I said was not that they will "win," but simply that the "end game" of their world-destroying – and suicidal – actions would be financial market hyperinflation, as opposed to 2008-style "deflation." In other words, a Venezuelan-style crash, in real-terms. Which throughout history, has proven to been how essentially all fiat regimes have met their demise; let alone, this, history's largest; most destructive; and for the first time, global fiat Ponzi. And again, I am simply speaking of the end game for financial markets, not economies; the latter of which will, in a world of hyperbolic money printing, experience equally terrifying surges in "need versus want" prices, and plunges in those of hopelessly oversupplied goods and services.

In the aforementioned reader's email, he asked if "Central bank and corporate buybacks can provide a 'Bridge over Troubled Waters' until business and profits recover." Regarding the former – yes, Central banks can monetize stocks until the cows come home. However, per the Venezuelan stock market chart above, that doesn't mean the economy will recover, or that the currency will maintain its purchasing power – particularly when debt goes "supernova" in the process. Regarding the latter, corporate buybacks have already slowed dramatically – amidst the highest corporate debt levels in U.S. history, and rapidly weakening economic activity. Unlike Central banks, corporations cannot print money to buy stock back with. Thus, whilst Central bank's "monetization limit" relates to hyperinflation, corporations' limits are there balance sheets. And oh yeah, that little old thing called fiduciary duty! Moreover, there are other "practical" issues Central banks run into when attempting to manipulate markets, starting with the "myth of QE to infinity." Which is, the inevitable scarcity of things to monetize that the ECB is running into in the government bond markets (causing it to add corporate bonds to its "buyable" list); and the Bank of Japan in the stock markets, per the recent news that it owns more than 50% of all Japanese ETFs, and a "top ten holding" in more than 90% of the largest 225 stocks. Heck, through its "QE3" program of 2012-14, the Fed became the not-so-proud owner of 50% of all U.S. mortgage-backed securities, and more than a third of all outstanding Treasuries. |

| Bernanke recommended 'helicopter money' option to Japan Posted: 15 Jul 2016 04:05 AM PDT Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda By Toru Fujioka and Keiko Ujikane Ben S. Bernanke, who met Japanese leaders in Tokyo this week, had floated the idea of perpetual bonds during earlier discussions in Washington with one of Prime Minister Shinzo Abe's key advisers. Etsuro Honda, who has emerged as a matchmaker for Abe in corralling foreign economic experts to offer policy guidance, said that during an hour-long discussion with Bernanke in April the former Federal Reserve chief warned there was a risk Japan at any time could return to deflation. He noted that helicopter money -- in which the government issues non-marketable perpetual bonds with no maturity date and the Bank of Japan directly buys them -- could work as the strongest tool to overcome deflation, according to Honda. Bernanke noted it was an option, he said. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-07-14/bernanke-floated-japan... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 15 Jul 2016 03:00 AM PDT from Harvey Organ:

For the July gold contract month, we had a monstrous 612 notices served upon for 61,200 ounces. The total number of notices filed so far for delivery: 4,677 for 467,700 oz or 14.547 tonnes In silver we had 57 notices served upon for 285,000 oz. The total number of notices filed so far this month for delivery: 1383 for 6,915,000 oz The following is what I said yesterday and it fully pertains to events on Thursday: |

| Why is the gold price rising? Five forces driving the precious metal Posted: 15 Jul 2016 01:37 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Junior Gold and Silver Mining Funds or Individual Gold and Silver Mining Stocks Posted: 14 Jul 2016 11:48 PM PDT Background We will start with a quote that is sometimes attributed to Sir Winston Churchill, the British Prime Minister, who led Britain during the Second World War. “If you’re going through hell; keep going” |

| The Broad Stock Market, Helicopters and Gold Posted: 14 Jul 2016 11:16 PM PDT There has been a stunning post Brexit turnaround in the markets, says technical analyst Clive Maund. Far from leading to chaos, the markets have taken it in their stride, and are now rising in anticipation of "helicopter money." |

| The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her Posted: 14 Jul 2016 10:55 PM PDT The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. |

| New York and Shanghai Gold Deliveries Posted: 14 Jul 2016 07:23 PM PDT |

| Breaking News And Best Of The Web Posted: 14 Jul 2016 06:44 PM PDT Stocks recover on promise of massive new stimulus from Japan and UK and suspiciously good growth numbers from US and China. A growing number of name-brand investors are skeptical of current valuations. Gold corrects and interest rates rise. Banks report pretty good earnings, trucking firms and oil companies not so much. Another big terrorist attack […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Gold Daily and Silver Weekly Charts - Coiling For a Move Posted: 14 Jul 2016 01:27 PM PDT |

| After 8 months India's government has paperized only 3 tonnes of gold Posted: 14 Jul 2016 10:55 AM PDT Government Mobilizes 3.1 Tonnes of Gold under Monetization Scheme By the Press Trust of India NEW DELHI -- Government today said it has netted 3.1 tonnes of idle household and temple gold under the monetization scheme since its launch in November 2015. "As of now 3.1 tonnes of gold have been deposited under the Gold Monetization Scheme," the joint secretary in the Finance Ministry, Saurabh Garg, said. This is much lower than 800-1,000 tonnes of annual gold imports, he said, adding that estimates say 300 tonnes are for investments, while the balance is jewellery. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: "We are hoping that the investment part can shift to the Gold Monetisation Scheme," he added. Under the scheme, banks are authorized to collect gold for up to 15 years to auction them off or lend to jewellers from time to time. Depositors will earn up to 2.50 percent interest per annum, a rate lower than savings bank deposits. Currently, there are 46 assaying and hallmarking centers qualified to act as collection and purity testing centers for handling gold under the scheme. All gold deposits under the scheme have to be made at centers. Banks can also accept deposits at designated branches, especially from larger depositors. India imports about 1,000 tonnes of gold every year and the precious metal is the second-highest component of the imports bill after crude oil. An estimated 20,000 tonnes of gold are lying with households and temples. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 14 Jul 2016 09:35 AM PDT I offer the following movie clips from two dark comedies as a cram course in political science. They also alert us to the futility of handing over our lives at the ballot box. Domestic policy: The Distinguished Gentleman (1992) From Wikipedia: A Florida con man named Thomas Jefferson Johnson uses the passing of the longtime Congressman from his district, Jeff Johnson (who died of a heart attack while having sex with his secretary), to get elected to the United States Congress as a freshman Congressman, where the money flows from lobbyists. Omitting his first name, and abbreviating his middle name, he calls himself "Jeff" Johnson. He then manages to get on the ballot by pitching a seniors organization, the Silver Foxes, to nominate him as their candidate for office. Once on the election ballot, he uses the dead Congressman's old campaign material and runs a low budget campaign that appeals to name recognition, figuring most people do not pay much attention and simply vote for the "name you know." He wins a slim victory and is off to Washington, a place where the "streets are lined with gold." Foreign Policy: Wag the Dog (1997) From Wikipedia: The film follows a Washington, D.C. spin doctor (De Niro) who, mere days before a presidential election, distracts the electorate from a sex scandal by hiring a Hollywood film producer (Hoffman) to construct a fake war with Albania. Wag the Dog was released one month before the outbreak of the Lewinsky scandal and the subsequent bombing of the Al-Shifa pharmaceutical factory in Sudan by the Clinton administration, which prompted the media to draw comparisons between the film and reality. |

| Posted: 14 Jul 2016 08:28 AM PDT Tokyo Commodity Exchange to launch Physical Gold MarketBy: Valentina Kirilova July 14, 2016 The Tokyo Commodity Exchange Inc. (TOCOM) has announced today that July 25th will be the start date of new Gold Physical Transaction, pending regulatory approval. Gold is the most actively traded commodity at the Exchange with both futures and options contracts... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The problem with stereotyping Republicans is that when they are screaming from the rooftops about a legitimate fraud, Democrats don't believe them — even when the evidence is overpowering that they are right.

The problem with stereotyping Republicans is that when they are screaming from the rooftops about a legitimate fraud, Democrats don't believe them — even when the evidence is overpowering that they are right. I received this note from a reader regarding the confiscation of retirement accounts:

I received this note from a reader regarding the confiscation of retirement accounts: Investors need to understand an important fundamental reason why the silver price will explode much higher than gold. While many analysts state several reasons why silver will outperform going forward, I believe one vital fundamental factor is overlooked.

Investors need to understand an important fundamental reason why the silver price will explode much higher than gold. While many analysts state several reasons why silver will outperform going forward, I believe one vital fundamental factor is overlooked.

Today is Bastille Day in France which celebrates the overthrow of the French feudal monarchy and the establishment of a Constitutional Monarchy. The storming of the Bastille was a key event in the French Revolution.

Today is Bastille Day in France which celebrates the overthrow of the French feudal monarchy and the establishment of a Constitutional Monarchy. The storming of the Bastille was a key event in the French Revolution. Yesterday (Wednesday) morning, I wrote "

Yesterday (Wednesday) morning, I wrote "

JAPAN DOES NOT HAVE LEGAL AUTHORITY TO COMMENCE "HELICOPTER MONEY"/CHINA INTRODUCES A NEW GUIDED MISSILE DESTROYER IN THE SOUTH CHINA SEA AS TENSIONS ESCALATE

JAPAN DOES NOT HAVE LEGAL AUTHORITY TO COMMENCE "HELICOPTER MONEY"/CHINA INTRODUCES A NEW GUIDED MISSILE DESTROYER IN THE SOUTH CHINA SEA AS TENSIONS ESCALATE

No comments:

Post a Comment