Gold World News Flash |

- Bullion Banks Are Starting to Lose Control of Silver

- The Prospects for Money

- Keiser Report: Market Freak Show (E934)

- The Italian Job: "How Did Things Go So Bad?"

- BREXIT BODY COUNT — Bill Holter

- RED ALERT: NOW THEY’RE COMING FOR OUR RETIREMENT MONEY

- Why The Collapse Of The U.S. Economic & Financial System Has Accelerated

- Gold Daily and Silver Weekly Charts – The Men Who Sold the World

- The Collapse Of Western Democracy

- The New Narrative For Earnings: Blame Brexit

- FREXIT : France EU exit referendum possible -- Le Pen

- British bonds go negative as Bank of England plans more money creation

- "Off The Grid" Indicators Reveal True State Of U.S. Economy

- Warning -- Police To Turn Off Your iPhone

- Silver and Gold Prices will Move Much, Much Higher - Better Buy Your Ticket Now, or you'll Miss the Train

- Prophecy Update End Time Headlines 6/30/16

- Silver Surges To 21-Month Highs, Gold-Ratio Crashes

- Full Speech: Donald Trump Delivers Remarks on Trade in Manchester, NH (6-30-16)

- Janet Yellen Warms up the Helicopters

- BREXIT ENDGAME of ALL PAPER CURRENCIES Andy Hoffman

- Alasdair Macleod: The prospects for money

- Market Freak Show -- Max Keiser

- Islam Exposed -- BREAKING Masses of ISLAM muslim refugees converting to Christianity June 30 2016

- Cheap gold mines disappear as buyers splurge for surging bullion

- Gold Daily and Silver Weekly Charts - Hi Yo Silver!

- London gold trade agrees on reforms to boost transparency

- Breaking News And Best Of The Web

- Peter Schiff: “This Is the Match That Ignites the Powder Keg”: Gold Surges As Brexit Sparks Huge Financial Crisis

- Investment Banks Excited Over Future of Electric Vehicles Using Lithium Ion Batteries

- Brexit Part Of Elite's Predesigned Collapse - Daryl Bradford Smith

- #Brexit Global Economic Fallout PETER SCHIFF and STEFAN MOLYNEUX

- News media won't report market rigging by government even when it's admitted

- Right Now: The Case Against Gold

- #BREXIT 2016: #ILLLUMINATI-FREEMASON Struggles

- Gold, Silver, Bonds and Stocks Path Towards Inflation

- Nigel #Farage on #Brexit and Donald #Trump (Full CNN interview)

- The Greatest Stock Market Crash Ever Imagined Will Happen, Here's Why. By Gregory Mannarino

- Here Comes $20 Silver!

- Ron Paul: The End (of the EU) is Near

- Silver Surges, Up 16% In Dollars In Month as Breaks Out Above $18

- JPMorgan beats traders in silver futures rigging lawsuits

- John Crudele: Sure looks like governments rigged stocks after Brexit vote

- Gold and Silver Precious Metals Bull Market Update

- Silver Is Not Buying the Risk Asset Bounce

- Silver Wildcats Part 4 - A Murder of Crows

- Marc Faber: Holding Gold Is a 'No Brainer'

| Bullion Banks Are Starting to Lose Control of Silver Posted: 01 Jul 2016 01:00 AM PDT from Shadow Of Truth: In this episode of the Shadow of Truth’s Market Update, we dig into the signals being given by the market which indicate that the silver manipulation scheme is becoming unmanageable. In addition, we discuss the ongoing global systemic financial and economic collapse. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2016 12:30 AM PDT by Alasdair Macleod, GoldMoney:

If I'm right, a long-expected collapse in the purchasing power, and of the very concept of fiat currency, will evolve from current events. The purpose of this article is to explain why monetary theory predicts a currency collapse. The question at the heart of today's market instability is the validity of fiat currency; that is to say, forms of money issued and sanctioned by individual governments, with no backing other than faith in those governments' creditworthiness, and the enforcement of its use by law. The risks they impose on all of us will be evidenced one day by both the speed of the fall in each individual fiat money's purchasing power, and inevitably by their comparison with gold's more stable purchasing power. Essentially, an awareness of the dangers of unsound money will gradually become evident to every economic actor. So far, or at least since the days when fiat money was freely exchangeable for gold, central banks have managed to enforce upon us their currencies as money, originally on the basis they were gold substitutes. That pretence was finally dropped in 1971. The purchasing power of fiat currencies has never been seriously challenged since, except in relatively few extreme cases, such as Zimbabwe and Venezuela. Not even the financial crisis eight years ago threatened a collapse in fiat currencies, when banks had to be rescued with unlimited extra quantities of money and credit. The current crisis has commenced while there are determined efforts to stop the purchasing power of the major currencies from rising, even leading to the deployment of negative interest rates in this quest. None of the central banks' policies appear to have worked. The increasing purchasing power of the yen, despite all attempts to lessen it, is the clearest example of the abject failure of a central bank to achieve its monetary objectives. The same can be said of the ECB and the euro, a currency even more synthetic than those it replaced. It is clear that the central banks are setting monetary policy more in hope than in a true appreciation of their own hopelessness. They place an undue emphasis on empirical evidence. That's why charts and statistics are so important to them and all their epigones. When you don't understand and cannot explain something, you turn to the so-called evidence. And when very few people actually have a reasonable grasp of what money is about, you can rely on empirical evidence being unchallenged. For monetary policy, this tells us two things: central banks are clueless about monetary theory, and in the event of a second systemic crisis, they will be misguided by their experiences of the last one. Today's empirical evidence reflects the bail-out of the global banking system in 2008/09. Neo-classical monetarists were initially worried by the potential for price deflation in the wake of the banking system's rescue, and so central bankers expanded narrow money by unprecedented quantities to counter credit deflation, real and anticipated. These were intended to be short-term measures, to be replaced with more normal monetary policies as soon as the immediate crisis was over. These short term measures are still in place today eight years later. The impact on the gold price After the Lehman shock, which led to a temporary flight into both money and short-term government debt, the purchasing power of currencies relative to that of gold rose, with the gold price falling from $930 to $690. Subsequently, when it became apparent that monetary expansion had succeeded in curbing deflationary forces, this trend reversed, taking the gold price to over $1900. That then changed in September 2011, following concerted central bank intervention to supress the gold price. The dollar-gold relationship has now turned once again, signalling that the tide of confidence is moving against currencies. The purchasing power of currencies measured against that of gold is now falling. We now have a banking crisis in the making, if the share prices of major banks are any indication. The UK's decision by referendum to leave the EU points to Europe's political disintegration. Increasing market volatility tells us that another systemic crisis may well be imminent, and government bonds reflect a continuing flight to safety. Already, the Bank of England has announced that a further £250bn in monetary support will be made available to the banks, and that additional swap lines have been agreed between the major central banks. We can take this as evidence that the central banks, relying on empirical evidence, are preparing a new round of monetary expansion as the solution to any future crisis, confirmed in their belief that the risk to the credibility of their currencies is unlikely to be a problem. This is not what gold, when priced in these currencies, is telling us. To understand why and where the central bankers are mistaken, we must consider some fundamental points about how money actually works. The theory of money and its purchasing power To prepare our minds for a comprehensive understanding of monetary theory, we must at the outset dispense with any idea that statistical analysis is relevant. It is not, because there are no constants involved. Valid statistics require at least one constant, usually the purchasing power of money. In the whole field of economics, let alone money, there are none. The purchasing power of money is to a large degree independent of its quantity, and depends on a fluctuating acceptance that it is exchangeable for goods. Quack monetarists that believe in the equation of exchange, despite all evidence it does not work, overlook the subjective factors that qualify something as money. When we set out to understand money, we must acknowledge there are three major influences at work, besides a general acceptance that a particular form of money is exchangeable for goods. There is the subjective value of the goods for which an exchange is considered, there are the fluctuations in the relative quantities of goods and money in the exchange process, and there is the balance of relative desires in the population as a whole to increase or decrease the quantity of money held, relative to goods. All these factors are the unknowable decision of every single economic actor, and fluctuate accordingly. This self-evident truth continually risks undermining the very function of any particular form of money, which in order to be acceptable to the parties in any transaction must have a commonly accepted value, even though one party will want money more than the other at a given price. This commonly accepted value has been described by the economist, von Mises, as money's objective exchange value. It is the one thing that parties to a transaction can agree upon. A dollar is a dollar, a euro is a euro, and so on, even though different individuals will want these forms of money more or less than other individuals. So far, we have addressed only one out of four dimensions of the money problem. A second dimension is that demand for some goods is always greater than demand for other goods, so money's purchasing power will differ for every good and class of good exchanged for it. It is never sufficient to just assume that, for instance, the price of housing is rising solely due to demand for housing. It also rises because people place a lower value on money than they do on bricks and mortar. On reflection, this truth should be self-evident. But it also holds true for every other good for which any particular form of money is exchanged, and it is too simplistic to assume that changes in price come from the goods side alone. A third dimension to consider is that the products and quantities of goods and services purchased yesterday will not be the same as the products bought tomorrow. Besides making the point again, that statistics are wholly irrelevant to understanding money, we can also add that what money will be used to buy tomorrow and in what proportions cannot be predicted, beyond perhaps some broad generalisations, such as people will buy food, they will use energy, and they will enjoy some leisure time. Such platitudes are of no practical value to understanding monetary theory, and disqualify the use of price indices and aggregates such as gross domestic product. The fourth dimension is one of time. The injection of money into an economy will start at a point, typically the banks creating loans, or governments through unfunded spending. Money therefore enters an economy unevenly, benefitting some at the expense of others. This is known as the Cantillon effect, and is universally ignored by the neo-classical economic community. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Keiser Report: Market Freak Show (E934) Posted: 01 Jul 2016 12:00 AM PDT from RT: In this episode of the Keiser Report from Toronto, Max and Stacy discuss the housing market 'freak show' put on by central bankers. In the second half, Max interviews Roy Sebag and Josh Crumb of Bitgold.com/Goldmoney.com about their unique gold platform and the latest in the gold market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Italian Job: "How Did Things Go So Bad?" Posted: 30 Jun 2016 11:00 PM PDT Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “You’re only supposed to blow the bloody doors off!” That one line, spoken on the big screen by Michael Caine was crowned, according to a 2003 Daily Telegraph survey, Britain’s favorite one-liner of film. That kind of staying power is remarkable considering The Italian Job, the original that is, was released in 1969, two years before Mark Wahlberg, who portrayed Caine’s character, Charlie Croker, in the movie’s 2003 remake, made his 1971 debut. As for the film’s American version and one-liners, the crown for favorite was won when Charlie’s 2003 on-screen nemesis Steve taunted: “You blew the best thing you had going for you. You blew the element of surprise.” Charlie’s reaction? A knock-out punch followed seamlessly by the understated comeback, “Surprised?” The element of surprise was on full display in the hours and days that followed Britain’s voters’ decisive move to Leave the EU. The Brexit referendum succeeded in blowing off a different set of doors, leaving taunting politicians and policymakers alike flat-footed, with a whole new fear, that of contagion, beginning to the south in Italy. Might the Italians pull of a Job of their own, following Great Britain’s lead in stealing back their own country? The hope, stated diplomatically by Gluskin Sheff’s inimitable David Rosenberg, a dear friend, is that Brexit will prove to be a, “wakeup call for the long-awaited fundamental changes with regards to the EU – make it more democratic and make it less bureaucratic and embark on immigration rules that do not sacrifice regional security.” Rosenberg’s concerns on security are more than justified in the case of Italy. According to the Italian Coast Guards’ latest tally, the 3,324 migrants rescued June 26 brought the total rescued in just four days to 10,000. Four days! Calm seas have triggered fresh waves of migrants, bringing the total thus far this year to 66,000. The forecast calls for 10,000 more to arrive every week until year’s end. Some 300,000 in total for 2016. The ease with which migrants can cross the seas to Italy means that country takes in 13 to 14 times more than Turkey and Greece. Is it any wonder Italians are exhausted? At a Brussels Summit, EU leaders were urged to “speed up and increase” the return of migrants deemed to not be bona-fide refugees. In actuality, many making the crossing are simply looking for economic opportunity rather than escaping any real danger. Estimates vary, but only between six and 19 percent of those ordered back to their home countries actually leave. It is patently apparent that the EU does not have sufficient measures in place to combat the problem on behalf of its disgruntled member nations, and must become much more vigilant in its approach. As economically and culturally debilitating as the migrant crisis has become, it’s critical to take a step back from this particular issue to understand the depth of Italy’s economic plight. The reality is, there’s something greater than just poorly managed migration underlying the unrest in Italy and its EU neighbors. While the migrant crisis clearly played into Brexit, the vote revealed much deeper anxieties driven by a very visible fact of British life, especially life after the financial crisis. The briefest of visits to the City of London, its streets lined with chauffeured Mercedes, offers ample prima facie evidence of what so many Brits know in their bones – that the distance between “them” and “the rest of us” has grown since the crisis broke. The average Brit knows they didn’t wake up yesterday ripe to pillory the “elite,” a word that’s crept back into the vernacular like a slowly spreading disease. But they do know they’re not among those who have risen to the creamy top in recent years but have rather been demoted to the ranks of those left behind. The fairy tale of the wealth effect, that what is good for those at the top of the pecking order is good for the masses, is apparently an international phenomenon. The one saving grace on this count is the British never succumbed to pressure to join single currency. That, however, is certainly not the case for the beleaguered Italians. Back in the summer of 2012, when Greece appeared poised to leave the EU and escape the euro currency via devaluation of the drachma, Merrill Lynch released a report ranking the countries who stood the most to gain economically from dropping the euro. Can you guess who came in at the top spot? More than any of its peers, the Italian economy has suffered since joining the euro in 1999. Since 2007, its economy has contracted by 10 percent and suffered not one, not two, but three recessions. Competitive export-led growth has been deeply impaired by virtue of Italy’s being effectively yoked to the massive German economy. Despite the rise of China, Germany has been able to maintain its top three ranking among world exporters. The secret weapon? That would be the euro. In 1998, the year before Germany switched to the euro, the country exported $540 billion. By 2015, that figure had swelled to $1.3 trillion. Italy’s exports have also grown, but not nearly as robustly, coming in last year at $459 billion compared to $242 billion the year before it joined the euro. Just as it once was the case with China, Germany benefits from its relatively weak currency. If Germany was not tethered to its weaker-economy neighbors and was still on the Deutsche Mark, it would have a significantly stronger currency and substantially lower exports due to the price of its exports being much more expensive for world markets. Back in 2011, UBS put pencil to paper and figured that losing the common currency would trigger an immediate effective tax increase for the average German citizen of about €7,000 and between €3,500 to €4,000 euros every single year going forward. By contrast, swallowing half the debt of Greece, Ireland and Portugal at that time would have generated a little over €1,000 tab per citizen. Now you see why bailing out is so easy to do, though the Germans do put on a great show of irritation at having to foot such bills. But let’s be honest. Consider the alternative. Reverse that effect and, with all else being equal, you begin to appreciate why Italy’s exports have become relatively more expensive, burdened as they are with a more expensive currency than they would have had. Consider that globalization had already done a number on the country’s once magnificent industrial base when Italy opted into the euro and left the lire behind. Since then, the country’s industrial capacity has been further decimated, shrinking by 15 percent. To take but one example, in 2007, Italy manufactured 24 million appliances; by 2012 it had declined to 13 million. Add up the economic consequences and you begin to understand why Italian unemployment is running north of 12 percent while putting four-in-ten young Italians are out of work. To the Italians, if anyone’s managed to pull off a Job, it’s those smug Germans. Three years ago, the Merrill report warned that Italy’s current account deficit would be an impediment to returning to the lire in that the deficit required foreign capital to keep current on its bills. Flash forward three years and Italy is running a current account surplus of 1.9 percent, a fairly recent phenomenon and more a reflection of its economic atrophy than a competitive trade position. Nevertheless, that is one obstacle to leaving the euro that’s disappeared. That is not to say that Italy will be able to ride off into some glowing economic sunset. Italy’s banks are thought to be the Continent’s weakest. There are $408 billion in past due loans sitting on Italian bank balance sheets. Investors value these loans at 20-30 cents on the dollar if they are secured, and as little as 5 cents if they are unsecured while banks have marked them at between 50-65 cents on the dollar. The yawning gap between market pricing and that of Italy’s banks is reminiscent of how unrealistically Lehman valued its loans before going under. Unicredit, Italy’s largest bank, has seen its stock price halved this year as investors worry its capital is insufficient to handle the Brexit fallout. Leaving the EU and being unshackled from the euro could well lead to an Italian debt default, which is meaningful given Italy is the third largest sovereign debt market in the world. But local laws also provide plenty of leeway for the government to restructure its debts without triggering a default. The one thing that is not in doubt is that the lire would provide the Italians with the relief they have so desperately needed since joining the single currency. On the flipside, the damage to Germany’s manufacturing sector could be sufficient to catalyze a Continental recession. Angela Merkel has probably lost considerable sleep being a unified Europe is her treasured baby. In all, Germany’s annual economic growth is boosted by a half-percentage point courtesy of its euro membership. While there is no denying the economic challenges facing Italy, the potential for its exiting the EU was hugely increased by the Brexit. After all, some 58% of Italians were already calling for a referendum vote. If those voters are angry today, imagine how much angrier they will be if the Brexit throws Europe into a recession that Mario Draghi cannot effectively battle given that he already has his stimulus measures running full throttle. Tellingly, the anti-establishment Five Star Movement, which has risen rapidly in power in recent months, has not called for a referendum to leave the EU, but rather to get rid of the euro. Beppe Grillo, the stand-up comedian who founded the party said the Brexit, “sanctions the failure of EU policies based on austerity and the selfishness of member States, which are incapable of being a community.” Yes, Stunad, it really is about the economy. The shame is Italy is its own bureaucratic basket case with little rule of law (think Mafia, tax avoidance and the impossibility of legislating anything from theory into practice). Brexit has lowered the odds Matteo Renzi’s government will stand the test of time and last until October, the date by which his referendum to streamline Italy’s bloated government must be taken up by the Italian electorate. Even if Renzi stands, Italy’s future in the EU looks to be at risk. The collapse in bank shares in the trading days following the Brexit has created an immediate crisis. Within 72 hours of the vote results, Italy was reported to be preparing a €40 billion rescue of its financial system. A direct recapitalization of the banks, funded by a special bond issue was on the table. But the Italians are also pleading for a moratorium of ‘bail-in’ rules and bondholder write-downs, both of which are prohibited under existing EU laws. Hate to go out on any limbs here, but odds are pretty good that those rules will be relaxed, all things considered. How on earth did things go so wrong? Could it be as simple as power-mongering and greed? To rob a line from the 2003 Italian Job, “There are two kinds of thieves in this world: The ones who steal to enrich their lives, and those who steal to define their lives.” Could it be that average working Italians, especially those who have been around for a good long while, feel as if they’ve been victims of both of the two kinds of theft, doubly wronged? “Basta!” their voices scream in defiance. Enough is enough! | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT BODY COUNT — Bill Holter Posted: 30 Jun 2016 10:35 PM PDT by SGT, SGT Report.com: BREXIT: Does it signal a tidal wave of rising sentiment against the international criminal banking syndicate and its Globalist agenda, or is it merely a Trojan horse designed by the Rothschild banksters to further ensnare humanity in their NWO spider’s web? After all, Rothschild puppet George Soros was very publicly shorting stocks and going long gold in the months leading up to the Brexit vote. Did he know something the rest of us didn’t? Regardless, Bill Holter says there are dead bodies that need to be carried out as the result of the global financial chaos we saw on Friday, June 24th – and we will know a lot more about who those bodies belong to, on Monday morning. Bill Holter from JS Mineset joins us to discuss. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| RED ALERT: NOW THEY’RE COMING FOR OUR RETIREMENT MONEY Posted: 30 Jun 2016 09:29 PM PDT by SGT, SGT Report.com: I received a document from Paychex today which is the administrator of one of my 401K accounts… and they have announced that they are going to move all cash in NON-government ‘Federated CASH Obligation’ money market accounts to ‘Federated Government Obligations‘. Since my 401K money is invested in three different precious metals funds this announcement does not affect me, however it will impact many other unsuspecting would-be retirees who falsely believe that their money is “safe” and “liquid” in a money market account. This is the slippery slope into government forcing account holders to invest in government debt (Treasuries), and it’s exactly what we’ve been warning about. As for me, I’m going to roll that particular account over and away from the control of Paychex. Dave Kranzler from Investment Research Dynamics joins me to dissect the document and to shed some light on the recent huge moves in silver. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The Collapse Of The U.S. Economic & Financial System Has Accelerated Posted: 30 Jun 2016 09:25 PM PDT by Steve St. Angelo, SRSRocco Report:

Unfortunately, lousy reporting by the Mainstream media along with the public's denial and delusional thinking is a recipe for disaster for most Americans over the next several years.

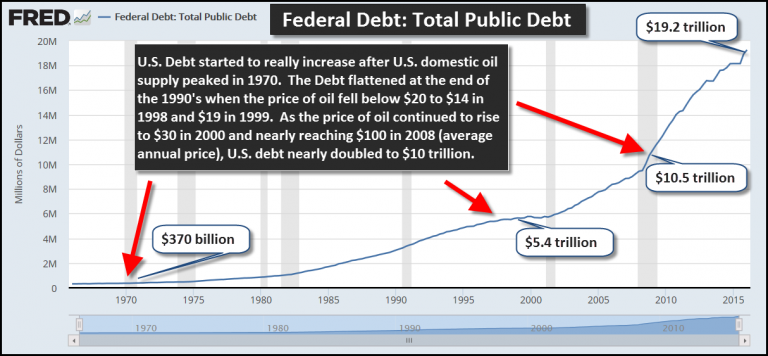

The U.S. economy is being propped up by a great deal of monetary printing, Fed stock and bond purchases and extreme leverage in all areas of the market. While these policies have given the "ILLUSION" of continued prosperity, or at best a sustainable slow growing economy, the debt now in the system is unsustainable. Still to this day, most investors (including precious metals investors) do not understand the real reason for the massive increase in U.S. Federal debt. They believe the debt was either increased to enslave Americans or to fund continued economic growth. While the second reason is more accurate, they still fail to understand the "ROOT CAUSE" of the debt increase. The Massive Increase In U.S. Debt Tied To Falling U.S. Oil Production & Rising Oil Prices This chart puts the huge increase in total U.S. debt in perspective:

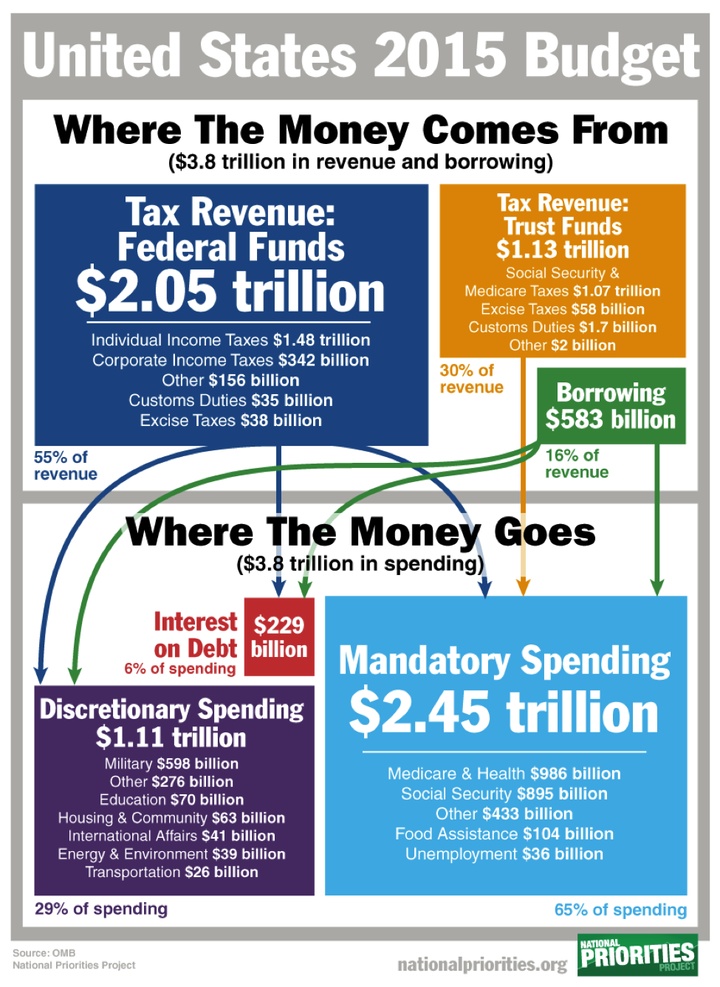

The annual increase in U.S. debt was very small up until the 1970's. This was due to the peak of cheap U.S. domestic oil production. U.S. oil production peaked in 1970 at about 10 million barrels per day (mbd). That year, total U.S. debt was $370 billion. That's hilarious, because the annual deficits today are larger than the entire U.S. debt in 1970. As the oil price increased in the 1980's and as U.S. oil production declined, total U.S. debt continued to increase. However, in the late 1990's, the U.S. debt leveled off. This was due to the price of oil declining below $20, reaching $14 in 1998 and $19 in 1999. In 1999, U.S. debt had increased to $5.4 trillion. Then as the price of oil increased from $30 in 2000 to nearly $100 in 2008, total U.S. debt nearly doubled to $10.5 trillion. In addition, U.S. domestic oil production declined nearly 4 million barrels per day from 1985 to 2008. This also had a negative impact on U.S. debt levels. While it's true that the cost of energy is only a small part of U.S. GDP, its impact is multiplied when the U.S. economy and government try to provide the same standard of living as it did prior to 1970. Furthermore, the EROI- Energy Returned On Invested of U.S. oil production declined significantly since the 1950's. The EROI of U.S. oil and gas production in 1970 was 30/1, however shale oil comes in at a low EROI of 5/1. Thus, the falling EROI means less profitable barrels to provide the same (higher) standard of living as Americans enjoyed before 1970. The U.S. Economy Is Propped Up By Massive Govt SpendingIn fiscal 2015, the United States Govt. (supposedly) spent $3.8 trillion on mandatory, discretionary funding and interest on the debt. Total revenues were only $3.18 trillion, so the U.S. Govt had to borrow $583 billion to pay its bills:

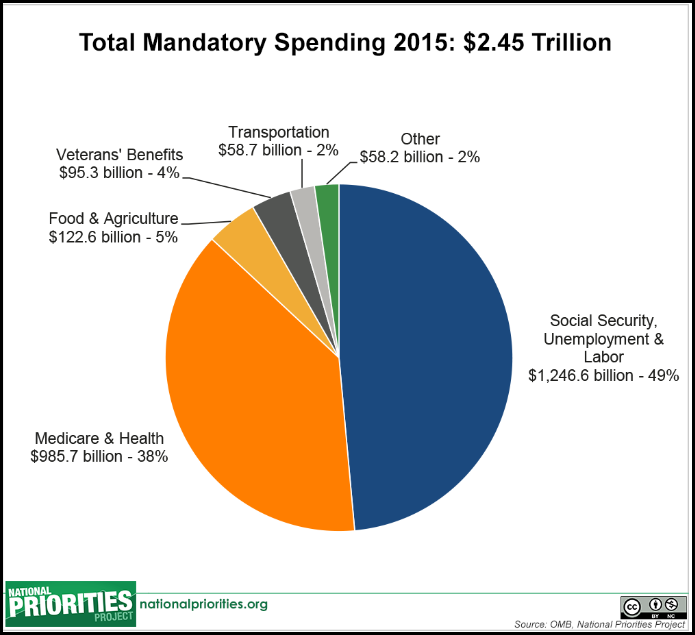

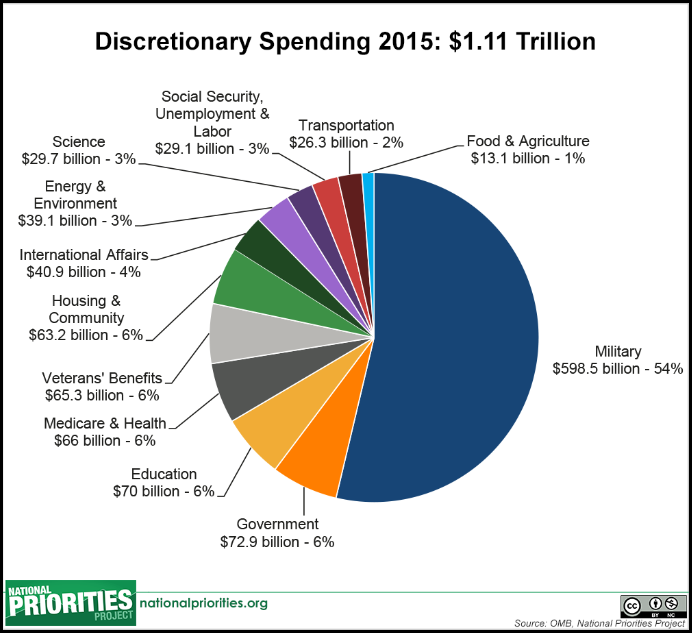

These next two charts break down the "Mandatory" and "Discretionary" spending:

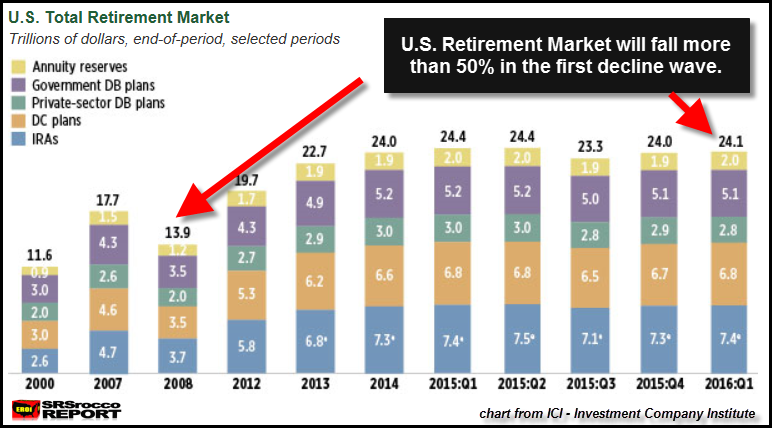

The $3.8 trillion in U.S. Govt spending is 21% of total U.S. GDP for fiscal 2015. Even though the U.S. Govt spends a lot of money on many different areas, let's focus on Social Security and Medicare-Health. These two parts of the mandatory spending equal $2.2 trillion of the $3.8 trillion total Federal budget. This is nearly 58% of the total budget. That $2.2 trillion spent in the U.S. economy has a "MULTIPLIER EFFECT". This is the reason the Fed and U.S. Govt won't allow a collapse in stock, bond or real estate values. The revenues collected by the U.S. Govt depend on elevated stock, bond and real estate prices. Once these start to collapse, then revenues plummet causing the annual budget deficit to balloon higher. If the budget deficit was $583 billion (that's what the Govt reports) in 2015 ,then what happens when the market cracks and highly inflated stock, bond and real estate prices collapse? Well, we already experienced that in 2008. Here is the most recent update of the U.S. Retirement Market as of Q1 2016:

The total U.S. Retirement Market collapsed 21% from 2007 to 2008 ($17.7 trillion down to $13.9 trillion). The current U.S. Retirement market is valued at $24.1 trillion. When the U.S. broader markets finally crack, I forecast a 50% decline in the U.S. Retirement market in the first wave. This could take place over a few years. A 50% decline would put the U.S. Retirement market at $12 trillion, a little less than what it was in 2008. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – The Men Who Sold the World Posted: 30 Jun 2016 08:30 PM PDT from Jesse's Café Américain:

And it’s not surprising then they get bitter, they cling to guns or religion or antipathy toward people who aren’t like them or anti-immigrant sentiment or anti-trade sentiment as a way to explain their frustrations.” Barack H. Obama, San Francisco Fundraiser, April 11, 2008 “The problem of the last three decades is not the ‘vicissitudes of the marketplace,’ but rather deliberate actions by the government to redistribute income from the rest of us to the one percent. This pattern of government action shows up in all areas of government policy.” Dean Baker “If the IMF's staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we're running out of time.” Simon Johnson, The Quiet Coup Today was a double-header of discouragement in how quickly the pampered plutocrats are dismissing any possible lessons they might have taken from the Brexit. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Of Western Democracy Posted: 30 Jun 2016 07:27 PM PDT Authored by Paul Craig Roberts, Democracy no longer exists in the West. In the US, powerful private interest groups, such as the military-security complex, Wall Street, the Israel Lobby, agribusiness and the extractive industries of energy, timber and mining, have long exercised more control over government than the people. But now even the semblance of democracy has been abandoned. In the US Donald Trump has won the Republican presidential nomination. However, Republican convention delegates are plotting to deny Trump the nomination that the people have voted him. The Republican political establishment is showing an unwillingness to accept democratic outcomes. The people chose, but their choice is unacceptable to the establishment which intends to substitute its choice for the people’s choice. Do you remember Dominic Strauss-Kahn? Strauss-Kahn is the Frenchman who was head of the IMF and, according to polls, the likely next president of France. He said something that sounded too favorable toward the Greek people. This concerned powerful banking interests who worried that he might get in the way of their plunder of Greece, Portugal, Spain, and Italy. A hotel maid appeared who accused him of rape. He was arrested and held without bail. After the police and prosecutors had made fools of themselves, he was released with all charges dropped. But the goal was achieved. Strauss-Kahn had to resign as IMF director and kiss goodbye his chance for the presidency of France. Curious, isn’t it, that a woman has now appeared who claims Trump raped her when she was 13 years old. Consider the political establishment’s response to the Brexit vote. Members of Parliament are saying that the vote is unacceptable and that Parliament has the right and responsibility to ignore the voice of the people. The view now established in the West is that the people are not qualified to make political decisions. The position of the opponents of Brexit is clear: it simply is not a matter for the British people whether their sovereignty is given away to an unaccountable commission in Brussels. Martin Schultz, President of the EU Parliament, puts it clearly: “It is not the EU philosophy that the crowd can decide its fate.” The Western media have made it clear that they do not accept the people’s decision either. The vote is said to be “racist” and therefore can be disregarded as illegitimate. Washington has no intention of permitting the British to exit the European Union. Washington did not work for 60 years to put all of Europe in the EU bag that Washington can control only to let democracy undo its achievement. The Federal Reserve, its Wall Street allies, and its Bank of Japan and European Central Bank vassals will short the UK pound and equities, and the presstitutes will explain the decline in values as “the market’s” pronouncement that the British vote was a mistake. If Britain is actually permitted to leave, the two-year long negotiations will be used to tie the British into the EU so firmly that Britain leaves in name only. No one with a brain believes that Europeans are happy that Washington and NATO are driving them into conflict with Russia. Yet their protests have no effect on their governments. Consider the French protests of what the neoliberal French government, masquerading as socialist, calls “labor law reforms.” What the “reform” does is to take away the reforms that the French people achieved over decades of struggle. The French made employment more stable and less uncertain, thereby reducing stress and contributing to the happiness of life. But the corporations want more profit and regard regulations and laws that benefit people as barriers to higher profitability. Neoliberal economists backed the takeback of French labor rights with the false argument that a humane society causes unemployment. The neoliberal economists call it “liberating the employment market” from reforms achieved by the French people. The French government, of course, represents corporations, not the French people. The neoliberal economists and politicians have no qualms about sacrificing the quality of French life in order to clear the way for global corporations to make more profits. What is the value in “the global market” when the result is to worsen the fate of peoples? Consider the Germans. They are being overrun with refugees from Washington’s wars, wars that the stupid German government enabled. The German people are experiencing increases in crime and sexual attacks. They protest, but their government does not hear them. The German government is more concerned about the refugees than it is about the German people. Consider the Greeks and the Portuguese forced by their governments to accept personal financial ruin in order to boost the profits of foreign banks. These governments represent foreign bankers, not the Greek and Portuguese people. One wonders how long before all Western peoples conclude that only a French Revolution complete with guillotine can set them free. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The New Narrative For Earnings: Blame Brexit Posted: 30 Jun 2016 07:00 PM PDT Every quarter there is always a fallback narrative put forth as to why companies fail to meet earnings expectations, and we now have that narrative for the rest of 2016 (and perhaps through 2025): Brexit. As we discussed yesterday, as we enter into Q2 earnings season the main focus on all earnings calls will be to what extent Brexit will impact business for the rest of the year. Will firms guide down materially due to the UK referendum, or will guidance largely not be impacted, this is going to be the main focus of analysts and investors. To wit:

Almost right on cue, here is Reuters today planting the seed that Brexit can now be used as an excuse for firms that need to lower guidance without any pushback. From Reuters

To add to the narrative, Reuters notes that some companies such as Carnival are already warning on the impact Brexit will have on full-year earnings targets.

While it is true that there may be some impact on earnings related to Brexit, shifting the narrative solely to Brexit in order to mask the fact that the global economy is already stunningly weak is a sad, yet predictable tactic. And as a reminder, 2016 outlooks have been tweaked to the downside long before the UK referendum. As we said, none of this really matters as any and all misses that do take place will conveniently be blamed on Brexit as a "one-off" event, and P/E multiples which are already in their 99th percentile will continue to all time highs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FREXIT : France EU exit referendum possible -- Le Pen Posted: 30 Jun 2016 06:40 PM PDT French National Front leader, Marine Le Pen, says that the British exit from the EU clears the way for a referendum in France as well. Richard Quest reports. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| British bonds go negative as Bank of England plans more money creation Posted: 30 Jun 2016 06:39 PM PDT Carney Prepares for 'Economic Post-Traumatic Stress' By Emily Cadman The Bank of England is preparing to unleash another round of monetary stimulus as it battles to contain the economic fallout of The UK's decision to leave EU. In a stark warning to politicians, governor Mark Carney said a downturn was on its way and Britain was already suffering from "economic post-traumatic stress disorder." He said the central bank would take "whatever action is needed to support growth," which probably included "some monetary policy easing" in the next few months, in an attempt to reassure the markets and the public. But Mr. Carney also said that central bankers could do only a limited amount to mitigate the pain. Sterling fell more than 1 percent to $1.32 as traders began preparing either for rates to be cut to historic lows, more quantitative easing, or a combination of both. The pound hit $1.50 just before the results of the referendum on EU membership last week. Equities rose, with the FTSE 100 index closing up 2.3 percent on the day. British government bond yields entered negative territory for the first time following Mr. Carney's speech, with the yield on one two-year bond hitting -0.003 percent. This put the UK alongside countries with negative yields including Germany and Japan. The global figure for government bonds in negative yield has soared to $11.7 trillion as borrowing costs around the world collapse. ... ... For the remainder of the report: https://next.ft.com/content/ec42a3ba-3ed3-11e6-8716-a4a71e8140b0 ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Off The Grid" Indicators Reveal True State Of U.S. Economy Posted: 30 Jun 2016 06:32 PM PDT By Nick Colas of Convergex Summary: Our basket of unorthodox economic indicators shows a U.S. economy that is growing, but at a very slow pace and with a notable sense of social unease. On the plus side, used car prices are defying all expectations by remaining robust – that helps trade-in values for new car purchases. Dealer inventories of new cars are also in good shape. Food stamp program participation is trending lower, although +44 million Americans (14% of the total population) still need government assistance to eat. On the cautionary side of the coin, large pickup truck sales have turned negative – a proxy for small business confidence in a range of industries. Consumer spending per day is declining, and our Bacon Cheeseburger Index is still flashing a deflationary warning. Lastly, the FBI reports that there have been 11.7 million background checks for firearm sales through May. At this rate, total year sales could reach 28 million, versus 8-9 million before the Financial Crisis. We've been doing these "Off the Grid" indicator reports for years, and the most common question we get about them is "Why"? As in "Why do we care about data points that policymakers don't talk about?" And "Why does any of this matter?" Now we have an example of why: Brexit. To look at the standard economic talking points, the British people should have been happy to go with the status quo and "Remain". Consider these customary measures of employment, inflation, output, and well-being:

On the plus side of the ledger:

And some points of concern:

We'll close on one point that isn't so much economic as social – the number of FBI background checks for firearm sales. This data is available monthly, and through May it shows that Americans have done the paperwork to make 11.7 million legal purchases of one gun or more. Taking that as a run rate for the year, 2016 could see 28 million firearm sales using the FBI check data as a proxy for transactions. That compares to a three year rolling average of 21.7 million. Since 2007, the FBI has processed over 150 million firearm purchase background checks. That is one for every two Americans. This is obviously a hot topic issue in a presidential election year, and we have no desire to touch this particular third rail of American politics. From an economic and social standpoint, however, we think it is important to understand the numbers behind the debate. Before the Financial Crisis, the FBI typically processed 8-10 million checks per year. This year, that number might be 3x higher. That is a lot of guns. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Warning -- Police To Turn Off Your iPhone Posted: 30 Jun 2016 05:44 PM PDT Yet another push is being to allow big brother access to your cellphone remotely to shut it off when they don't want you to record something that they are trying to hide. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2016 05:14 PM PDT

Cannot cover everything in one day, so some spilleth over from one day to the next. I mean, of course, the performance of platinum & palladium last 2 days. Yesterday platinum shot up $32.40 (3.3%), and another $10.20 today to close at $1,021.50. Chart's here, http://schrts.co/gP7sGo Platinum has completed a sloppy head and shoulders bottom that began last July. After a false breakout through the neckline in May, it fell back but today broke out above the neckline and above the 50 DMA. Ready to boogie. On Wednesday Palladium jumped $19.3 (3.4%) & added another $6.65 (1.1%) today, ending at 598.15. That close carried it above the 20, 50, and 200 day moving averages, and confirms an earlier breakout through the short term downtrend line. Also ready to boogie. Chart, http://schrts.co/dY8ozq If you're going to swap gold for platinum, you'd better get about it. The gold-platinum spread is screaming down, from $347.40 on 27 June to $296.30 today, and about to puncture the uptrend line. Prince Grigory Aleksandrovich Potemkin-Tavreski was a favorite of Catherine the Great, a little too favorite, in fact. When Catherine was about to visit the southern provinces he was governing, he (allegedly) constructed façades of houses & filled the fake streets with actors paid to look like happy villagers. While the official inspection procession slowly made its way to the next spot, the Potemkin village was dismantled and moved with the actors to that next spot, the village re-assembled, and the actors positioned. The region's prosperity & happiness impressed the inspectors & Catherine. Last three days our modern day Potemkins, the central banks, and the Nice Government Men, have been building their own Potemkin villages in stocks. It wouldn't do for the inspectors at the end of 2 Quarter 2016, the end of the first half, to see stocks at those Brexit rabbit-punched levels. So they spent three days straining themselves to pump those stocks up for respectable end-of-quarter numbers. Like Potemkin's village, 'twill disappear as soon as the inspection has passed. Actually comparing Potemkin to those criminal central bankers is an insult to a man who, on balance was a great leader. US dollar index came back today, rising 27 basis points (0.28%0 to 96.07. That took the euro down and killed its phony dead varmint bounce. It lost 0.21% to $1.1096. Yen lost 0.25 to 96.85. Dow added another 235.31 (1.33%) to end at 17,929.99. Interesting, when you view the 5 day chart, that both Tuesday and Wednesday began with a big jump up, as if some big buyer came in all at once, and that gulled the rest into buying. Never mind. S&P500 added 28.09 (1.36%). So far all this is no more than a successful transit back up to resistance. A failure here besmirches the chart with a trail of lower highs and lower lows on the chart. Gold closed down $5.50 (0.4%) at $1,318.40 but silver rose another 21.8¢ (1.2%) to 1858.2¢. Those were the Comex closes. That don't half tell the story. Silver's high today at 1875 was its highest price since 12 September 2014. In the aftermarket silver kept right on climbing that mountain, clutching handholds in the rocks and traded at 1877.5¢. One website I use quotes another market where the high was 1889¢. Silver has gained 100¢ in the last three days. 150¢ since the 21st. Silver's strength reflects in the gold/silver ratio, which dropped today 1.6% to 70.950. It has gapped down two days running, and is nearing a new low for the move that began over 84 in March. The ratio has plunged almost 16% since 26 February 2016. Look at the chart for yourself, http://schrts.co/kh9gOy It appears silver & gold are NOT going to snooze through the summer, as they usually do. Silver & gold will move much, much higher. Better buy your ticket now, or you'll miss the train. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prophecy Update End Time Headlines 6/30/16 Posted: 30 Jun 2016 04:50 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

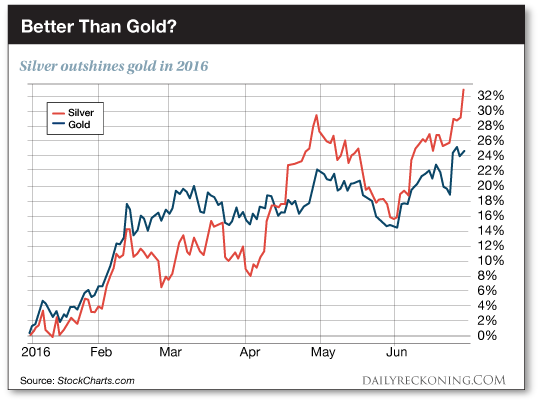

| Silver Surges To 21-Month Highs, Gold-Ratio Crashes Posted: 30 Jun 2016 03:35 PM PDT While gold surged to its highest since March 2014 on Brexit; Silver is nearing $19, up almost 9% since Brexit, breaking above Jan 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Delivers Remarks on Trade in Manchester, NH (6-30-16) Posted: 30 Jun 2016 03:23 PM PDT Thursday, June 30, 2016: Full replay of Donald Trump's remarks on trade in Manchester, NH at the Former Osram Sylvania Building. Full Speech: Donald Trump Delivers Remarks on Trade in Manchester, NH (6-30-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Janet Yellen Warms up the Helicopters Posted: 30 Jun 2016 02:55 PM PDT This post Janet Yellen Warms up the Helicopters appeared first on Daily Reckoning. Look, up in the sky! It's a bird! It's a plane! No, it's… it's… Janet Yellen in a helicopter with bags of cash. No kidding. That's the Fed's plan when the next recession hits. The Fed's Dear Leader coming to the rescue with airdrops of free cash for everyone. What could possibly go wrong? At a recent press conference, Federal Reserve Chairwoman Yellen admitted that the Fed would consider using "helicopter money" in an extreme downturn. What's "helicopter money"? It's a phrase used to describe when governments print massive sums of money and then "drop" them on the economy… hoping for the best. Sound insane? It is. But they're just trying to help by "stimulating" the economy… or what you could call their "Friends and Family Plan." But doesn't economic growth come from savings and investment? Silence. Today, you can supposedly create real economic growth right out of thin air. Just print the money and start giving it away for free. It's fake money of course, but we pretend it's real. See how easy it is to hoodwink the masses? To comfort the proletariat, Yellen said that "helicopter money" would only happen in "abnormal" circumstances. Kind of like the "abnormal" zero interest rates (soon to be negative) that we've had for an "abnormally" six-plus years. Abnormal is clearly the norm now. In other words, count on it. Helicopter money is coming the moment the S&P 500 takes a serious downturn. Ever since the dotcom bubble, the Fed and other central banks have tried to force banks to lend more to spur economic growth coming out of financial crises. What if the growth is fake or unsustainable? No matter. Pay for it another decade. They started with zero interest rate policy (ZIRP). But that money hasn't gone out into the real economy. It's remained with the banks. And what a great deal for them! They borrow for zero then use the cash to make billions scalping every day using high-frequency trading. When ZIRP didn't force people to invest in Timbuktu condos, central banks in Europe and Japan moved to negative interest rate policy (NIRP). The thinking goes that NIRP would surely force people to borrow, spend and buy those Timbuktu condos instead of paying interest on their savings. Think about how crazy all this is. Force average citizens to choose between paying interest on their savings or investing in casino investments engineered by the central banks to collapse at any moment. But none of this is working — whatever the hell "working" means to people like Yellen. Savings rates in NIRP countries are actually going up. And in Japan, fearful citizens have started hoarding cash. The Japanese are buying safes in record numbers? You bet. So what do you think people will do when Yellen makes like Santa Claus and starts handing out free money? Do you think that will instill confidence in consumers to spend more as opposed to saving for what they instinctively know is a coming meltdown? Do you think the Fed's actions will encourage companies to make additional capital investments in their businesses instead of hunkering down for the collapse they also know is coming? "Helicopter money" is the Fed signaling to the world: "Yeah, we've lost control. We have no idea what the hell we're doing." Since the financial crisis in 2009, central banks have printed $12.3 trillion of money and made 654 interest rate cuts to support the global economy. What do we have to show for it? Well, it's obviously been great for Wall Street billionaires and stock indexes. But the rest of the experiment has been a huge bust. It's devastated those who rely on interest income for survival. Plus, we now have $200 trillion in worldwide debt, asset bubbles galore and stagnant global economic growth. Usually, when the sink is overflowing, smart people turn off the faucet. But the Fed is looking to increase the water flow. And if the Fed doesn't come up with a new scheme to artificially goose the economy after NIRP failure, what's the alternative? A massive deleveraging of credit, a stock market collapse and a prolonged recession. A clearing out of the excesses of the business cycle used to be normal. But do you think Yellen & Co. are going to let "normal" happen on their watch? As soon as the U.S. economy slips into recession, it's only a matter of time before the debasement of paper money will continue unabated. And more people will be looking for the safety of gold as they have in recent months. Gold surged to a three-year high last week. I don't prefer chaos. But if it's going to happen, you should be ready… long before you hear the sound of helicopters in the sky. Regards, Michael Covel The post Janet Yellen Warms up the Helicopters appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT ENDGAME of ALL PAPER CURRENCIES Andy Hoffman Posted: 30 Jun 2016 02:30 PM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie,Paul Craig Roberts, and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: The prospects for money Posted: 30 Jun 2016 02:12 PM PDT By Alasdair Macleod In my view, this new bout of turmoil in financial markets is the prelude to the final demise of government currency. If I'm right, a long-expected collapse in the purchasing power, and of the very concept of fiat currency, will evolve from current events. The purpose of this article is to explain why monetary theory predicts a currency collapse. The question at the heart of today's market instability is the validity of fiat currency; that is to say, forms of money issued and sanctioned by individual governments, with no backing other than faith in those governments' creditworthiness, and the enforcement of its use by law. The risks they impose on all of us will be evidenced one day by both the speed of the fall in each individual fiat money's purchasing power, and inevitably by their comparison with gold's more stable purchasing power. Essentially, an awareness of the dangers of unsound money will gradually become evident to every economic actor. So far, or at least since the days when fiat money was freely exchangeable for gold, central banks have managed to enforce upon us their currencies as money, originally on the basis they were gold substitutes. That pretense was finally dropped in 1971. The purchasing power of fiat currencies has never been seriously challenged since, except in relatively few extreme cases, such as Zimbabwe and Venezuela. Not even the financial crisis eight years ago threatened a collapse in fiat currencies, when banks had to be rescued with unlimited extra quantities of money and credit. ... ... For the full commentary: https://www.goldmoney.com/research/goldmoney-insights/the-prospects-for-... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Freak Show -- Max Keiser Posted: 30 Jun 2016 02:07 PM PDT In this episode of the Keiser Report from Toronto, Max and Stacy discuss the housing market 'freak show' put on by central bankers. In the second half, Max interviews Roy Sebag and Josh Crumb of Bitgold.com/Goldmoney.com about their unique gold platform and the latest in the gold market.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Islam Exposed -- BREAKING Masses of ISLAM muslim refugees converting to Christianity June 30 2016 Posted: 30 Jun 2016 02:04 PM PDT REAKING Masses of ISLAM muslim iraq syria africa Afghanistan etc refugees converting to Christianity June 30 2016 News European churches say growing flock of Muslim refugees are converting to Christianity The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cheap gold mines disappear as buyers splurge for surging bullion Posted: 30 Jun 2016 01:39 PM PDT By Luzi-Ann Javier So much for the run on cheap gold mines. Producers who were forced by slumping prices to unload assets last year are regaining leverage. With bullion off to its biggest rally to start a year in four decades -- aided by the U.K.'s vote to quit the European Union -- mine buyers are paying higher premiums and the pace of deals is accelerating, data compiled by Bloomberg show. The value of reserves held by major producers has almost doubled since the third quarter of last year, according to Bloomberg Intelligence. The revival comes after a three-year slump led to losses, rising debt, and a fire sale of assets. With valuations dropping, private equity firms and companies including Zijin Mining Group Ltd. pounced. The number of acquisitions worth at least $1 million rose 14 percent last year to 192, the first increase since 2010, data compiled by Bloomberg show. But now investors are pouring money into gold funds, and prices are near the highest in more than two years, boosting premiums for available mining assets that are getting harder to find. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-06-29/cheap-gold-mines-disap... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Hi Yo Silver! Posted: 30 Jun 2016 01:37 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| London gold trade agrees on reforms to boost transparency Posted: 30 Jun 2016 01:34 PM PDT Will anyone ask them how much leasing and swapping business they're doing for central banks, so the new transparency regime can begin with a "no comment"? * * * By Clara Denina The London Bullion Market Association has taken steps to help to preserve London's role as a major global gold trading center by making its management more open and independent, documents seen by Reuters show. London currently dominates the global over-the-counter gold trade but is facing increasing competition from China. There are also more regulatory demands after scandals over attempts to rig interest rate and currency benchmarks. Several banks have run into trouble with regulators over misdemeanors in their precious metals trading business. ... The pressure for change is increasing also because China, the metal's largest consumer and producer, is competing with London to increase market share as a price setter with a yuan-denominated gold benchmark. Currently, the LBMA has a management committee made up of representatives from eight firms including six banks, which are also involved in the trading of bullion. But a majority of members, including banks, refiners and dealers, voted on Wednesday to create an independent board of directors comprising two bank market makers and three LBMA members. ... For the remainder of the report: http://www.reuters.com/article/us-lbma-gold-board-idUSKCN0ZG1LQ ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 30 Jun 2016 12:44 PM PDT Japan’s economy slows further. Deutsche Bank scares everyone. UK in turmoil post-Brexit as Labour votes to oust leader and Boris Johnson drops out of PM race. Stocks recover worldwide as Brexit fears wane. Interest rates continue to fall while central banks consider deeper cuts. Greenspan and Soros warn of major crisis. Gold and silver rise, […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2016 11:40 AM PDT ShtfPlan | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Banks Excited Over Future of Electric Vehicles Using Lithium Ion Batteries Posted: 30 Jun 2016 11:11 AM PDT (Originally sent out to premium subscribers of goldstocktrades.com on 6-20-16) See the update in video form by clicking here… https://www.youtube.com/watch?v=SsdPhVJSCYA&feature=youtu.be

Important developments are taking place in the lithium ion battery sector. For years we highlighted lithium as the new gasoline. I highlighted in this article entitled "Lithium-Ion Batteries becoming the fuel of the future" written over two years ago that demand could soar for electric vehicles. See the article on Seeking Alpha from more than two years ago. http://seekingalpha.com/article/2206003-are-lithium-ion-batteries-becoming-the-fuel-of-the-future Now two years later even the big player investment banks like Goldman Sachs are finally entering the sector. Listen to Bob Koort, head of Industrials and Materials research for Goldman Sachs Research, explains how lithium could unlock the mass market potential of electric vehicles. See the video by clicking on the following link: https://www.youtube.com/watch?v=gkMN8CN9OBY I recently sent out a video update highlighting Lithium Americas (LAC.TO or LACDF) and showing the bullish potential the chart was forming pulling back to the 50 Day Moving Average. The stock bounced off on great volume showing excellent support. https://www.youtube.com/watch?v=m4Sx2YtzRes It would not be a surprise to our readers if institutions are looking to add Lithium Americas as it is the most advanced lithium junior with the highest quality asset. They are partnered with the lowest cost producer SQM in Argentina and trading on the North American exchanges. This could become an institutional favorite.

Dr. Deak commented, “I am thrilled to join the executive team at LAC. The Company is on an important mission, and is well positioned to play a critical role in enabling sustainable transportation. The Company’s commitment to advancing its lithium projects comes at a time when the market requires additional sources of lower cost lithium supply. I have known the principals at LAC for several years, and they have consistently demonstrated a creative approach to solutions in both processing technologies and collaborative business structures." This appointment is a huge boost of confidence for Lithium Americas and may start getting attention from the Battery Investment Community. http://lithiumamericas.com/LAC_NR_May_2_2016.pdf Big news was released today by Graphite One (GPH.V or GPHOF) of performance tests on coin cells manufactured from the spheroidal graphite that shows high performance and stability. Graphite One is developing the Graphite Creek Project in Alaska which is the largest known large flake graphite deposit in the USA. The Company's PEA is expected to be completed in Q3 2016. Today's news may draw attention from the battery manufacturers who are looking to improve power output and efficiency. "Up to this point, EV battery end-users have had to make a choice between systems that deliver high-power (near 100 kW) and high-energy (tens of kW hours between each charge). Based on these new results and observations made when processing STAX graphite, we will focus our development work on determining whether our STAX-derived SPG can deliver both high-energy and high-power performance," said Graphite One CEO Anthony Huston. "We continue to be encouraged by the naturally occurring properties being revealed in our Graphite Creek graphite." Huston continued, "It is important to note that the economics of our project will not be known at any level of confidence before the completion of a preliminary economic assessment ("PEA"), preliminary feasibility study or feasibility study." See the full news release by clicking here… http://www.graphiteoneresources.com/news/index.php?&content_id=249 Finally I would like to revisit Nano One Materials (NNO.V) which may also be bouncing off the 50 day moving average as the investment community begins to see the unique qualities of this company. Earlier this month they reported that the design phase of the lithium battery material pilot plant has been completed. The pilot plant should be completed in early 2017 which could simulate full scale production of cathode materials for the lithium ion battery which are lower cost, cobalt free and better performing. "We have confidence in our piloting concepts," said Nano One Materials (NNO.V) CEO Mr. Blondal, "and they have materialized into a platform that should readily scale. With these activities on target and underway, we are well positioned to execute our business plan and advance our strategic objectives." See the full news release by clicking here… http://nanoone.ca/nr_jun7_2016/ Disclosure: I own securities in Lithium Americas, Graphite One and Nano One. They are also website sponsors. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Beware! Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. I own shares in all sponsored companies. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit Part Of Elite's Predesigned Collapse - Daryl Bradford Smith Posted: 30 Jun 2016 09:09 AM PDT The EU was destined to collapse and fail says France based radio host Daryl Bradford Smith The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Brexit Global Economic Fallout PETER SCHIFF and STEFAN MOLYNEUX Posted: 30 Jun 2016 08:30 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many specialists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||