Gold World News Flash |

- Mervyn King's Alarmist Warning: "All China's Assets In The US Might Be Annulled"

- Former Bank of England Head Mervyn King Joins Alan Greenspan in Advocating Gold Ownership

- The Coming Collapse of The EU -- Mike Rivero

- The Federal Reserve's Strange Behavior Makes Perfect Sense

- Secret Science of Electromagnetism -- Herbert Dorsey

- Now Obama Warns Americans to 'Be Prepared' For Disaster... What Does He Know?

- The Economy Heading For Total Collapse

- Gold Price Closed at $1259.80 Up $15.40 or 1.24%

- Breaking News: Shootings in D C

- Breaking News And Best Of The Web

- Podcast: Gold Will Soar, Marijuana Will Be Legal

- David Icke - The Money Hoax

- Dollar Collapse 2016 Financial Global AmeriGeddon

- The Gold Bull Is Back

- Will President Trump Trigger a Recession?

- Bilderberg 2016 Does Not Want Free Media Around

- Forget Dominic Chappell - it is Sir Philip Green who has a lot of explaining to do over the collapse of BHS

- Oil Jumps to $51

- The COLLAPSE of the ECONOMY in the second half of this year is expected!! -- Bix Weir

- How Hillary’s Going to Beat Trump

- Nigel Farage: Hillary Clinton is a Crook

- Commerzbank may hoard billions to avoid ECB charges, Reuters says

- Gold and Silver Look Set for a Major Move Higher in June! - Video

- Oil Bears Have Lost Their Bite – It’s Time for Energy Stocks to Soar

- Fed Stance Likely to Pressure US Dollar, GBP Chart View

- Jobs Report Changes the Landscape for Gold

- Top Ten Videos — June 8

- The Fall in Commodity Prices Hits the Canadian Banks

| Mervyn King's Alarmist Warning: "All China's Assets In The US Might Be Annulled" Posted: 08 Jun 2016 10:05 PM PDT What is it about former central bankers who first destroy the fiat system with their monetarist policies, only to go into retirement, and preach the virtues of the one compound they spend their entire professional careers trying to destroy: gold. To be sure, when it comes to polar reversals of opinion, nobody comes even remotely close to Alan Greenspan: the former Fed chairman who is not only instrumental in launching the "Great Moderation", which unleashed the current unprecedented global debt wave which will lead to unprecedented disaster sooner or later, has in recent years become one of gold's biggest advocates as demonstrated most recently in "Greenspan's Stunning Admission: "Gold Is Currency; No Fiat Currency, Including the Dollar, Can Match It." Now it's the turn of his former colleague at the Bank of England, Mervyn King, who in an interview with the WGC's Gold Investor monthly, pours cold water over Bernanke's "explanation" that gold is merely a tradition, and says the following:

The then innocently pointed out that when it comes to defense against hyperinflation, gold remains the, well, gold standard:

But the most interesting observation from Mervyn King's interview comes courtesy of an observation by The Money Trap's Robert Pringle, who writes the following about "Mervyn King's alarmist warning":

All we can add to this is that with Icahn, Druckenmiller, and Soros, and now Mervyn King too, all warning that major trouble is coming, we are confident that the algos and the 17-year-old hedge fund managers will be right in betting it all on central banks to keep pushing the S&P to new record highs and beyond even as the global economy grinds to a halt. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Former Bank of England Head Mervyn King Joins Alan Greenspan in Advocating Gold Ownership Posted: 08 Jun 2016 10:01 PM PDT by Michael J. Kosares, GoldSeek:

Similarly, former IMF chief economist, Olivier Blanchard was recently quoted in the Financial Times as saying: "And so the question is why is it, that with no fiscal consolidation and banks in decent shape, at least in terms of lending, and zero interest rates, we don't have an enormous demand boom? That is now the puzzle." Alan Greenspan, in a recent interview with Fox Business News, offers the beginnings of an answer to Blanchard's question – a question which happens to be on the minds of not just policy-makers but ordinary investors as well. "Our problem," he said, "is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries. The western world, he concludes, is headed to "a state of disaster." The problem at its core is demographic. Retiring baby boomers are paying off debt, not borrowing more. As time goes by, they willl increasingly become consumers of government largesse, as Greenspan points out, rather than its suppliers. The Millennials and GenXers are struggling with student debt, low incomes and paltry savings. For them, owning a home, the traditional means to stimulating overall demand, is more a future consideration than anything imminent. (In 1960 62% of 18 to 34-year-olds lived in their own households. By 2015, that number had dropped to just under 32%.) Outstanding mortgage debt, as a result of these demographic shifts, has gone into a free-fall. (See chart immediately below.) Simply put, the problem for the global economy, as King's successor Mark Carney recently pointed out, boils down to the lack of demand – for goods and services and for money itself in the form of credit. Fiat paradigm falling apart In short, the whole fiat paradigm of lending money into existence is falling apart, and no one seems to know what to do about it. If you would have told me in 2007 that within a decade we would be facing the possibility of a deflationary breakdown, I would not have believed you. King concludes that "without reform of the financial system, another crisis is certain… sooner rather than later." King's use of the word alchemy in connection with central banks' policies conjures all sorts of allusions. As we all know, the purpose of alchemy was to transform base metals to gold. Likewise, the contemporary central bank is alchemic in nature in that it professes to replace gold-backed money with sound and effective monetary policies. Those who believe that the central banks are capable of delivering consistently on that promise are not likely to become gold owners. Those who question it will continue to own gold and silver in their investment portfolios as a countermeasure, and in fact add to those holdings as circumstances require. It is quite clear that the former Fed chairman and the former governor of the Bank of England are in agreement that the global economy is tacking against some heavy headwinds. The demographic shift Greenspan cites and King's admission of policy-makers failure in dealing with it point to continuing long-term demand for gold and silver not just among private investors, but among funds, institutions and central banks as well. In addition, it is the failures (or potential for failure) in policy, as cited by both King and Greenspan, that will give pause even to those who most ardently profess undying faith in the central banks. Along these lines, it is interesting to note that Greenspan has already suggested gold as "a good place to put money these days given the policies of governments." Mervyn King may not be far behind.

Post publication editor's note (6-7-2016): No sooner had the ink dried on the June issue of our newsletter (of which this article was a part) than Mervyn King was quoted in the World Gold Council's Gold Investor magazine as advocating gold ownership at a time of what he calls "radical uncertainty." Some might think that we had an inside track on the World Gold Council interview released this morning, but we did not. Though we have a relationship with the World Gold Council that goes back decades, it does not send us advance copies of its publications. The similarities between King's views and those of his old friend, Mr. Greenspan, were striking thus the conclusion that logically the former BoE governor might be headed in gold's direction. "If we don't quite know what the future holds," says King, "there is little point in getting carried away by very fancy mathematical calculations of optimal portfolios. Don't rely on past data to be a good guide. Try to think through what mix of assets gives you the best chance of surviving some big event. That must mean including assets that are negatively correlated or uncorrelated in your portfolio." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming Collapse of The EU -- Mike Rivero Posted: 08 Jun 2016 07:30 PM PDT What Really Happened Show: Michael Rivero Wednesday 6/8/16: (Commercial Free Video) -- Date: June 08, 2016 -- Michael Rivero is the webmaster of http://whatreallyhappened.com/ and host of the What Really Happened radio shows on the Genesis Communications Network. Formerly with NASA,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Federal Reserve's Strange Behavior Makes Perfect Sense Posted: 08 Jun 2016 06:40 PM PDT Submitted by Brandon Smith via Alt-Market.com,

I have made this comment many times in the past, but I think it needs to be stated again here: If you think the Federal Reserve’s goal is to maintain or repair the U.S. economy, then you will never understand why they do the things they do or why the economy evolves the way that it does. The Fed’s job is not to protect the U.S. economy. The Fed’s job is to DESTROY the U.S. economy to make way for a truly global system. There seems to be a collective delusion within certain parts of the liberty movement that the “globalists” (the banking and political elites that promote total global centralization of finance and power) are a purely American or Western problem, and that they have some kind of loyalty to the success, or perceived success, of the U.S. “empire.” This is nonsensical when you look at the progression of the American fiscal system after the Fed was established over a century ago. In the past 100 years, the U.S. has suffered a gradual but immense devaluation in the dollar’s real buying power. We witnessed the first long-term fiscal depression in the nation’s history. We saw the removal of the gold standard. We saw the dismantling of the greatest industrial base in the history of the world. We have struggled through the implosion of the derivatives and credit bubble, which Fed officials have openly admitted responsibility for. And now, we are on the verge of the final implosion of a massive equities bubble and the collapse of the dollar itself. All of these developments require careful planning and staging, not recklessness or random chance. Free-market economies tend to heal and adapt over time. Only constant negative manipulation could cause the kind of steady decline plaguing the U.S. ever since the Federal Reserve was forced into being. The Fed has had multiple opportunities to strengthen the economic lifespan of America, but has ALWAYS chosen to take the exact opposite actions needed, guaranteeing an inevitable outcome of crisis. The goal of internationalists and international bankers is to acquire ever more centralized authority, and thus, ever more centralized power. The U.S. is an appendage to the great vampire squid, an expendable tool that can be sacrificed today to gain greater treasures tomorrow. Nothing more. But this reality just does not seem to sink into the skulls of certain people. They simply cannot fathom the idea that the Fed is a saboteur. Not a bumbling greed fueled monster, or even a mad bomber, but a careful and deliberate enemy agent with precise destruction in mind. Case in point; the recent institution of the Fed rate hike program. No one really gets it and no one is asking the right questions. Why, for example, did the Fed begin raising rates in December? No one asked them to take such measures. Certainly not day traders in the market casino; they were too busy enjoying the fiat inflation of biggest equity bubble in the encyclopedia of humanity. The politicians weren’t demanding any drawback of Fed stimulus, they were too busy enjoying the fraudulent recovery afforded by the recapitalization of too-big-to-fail banks. So, again, why bother promoting rate hikes that are essentially guaranteed to cause a market crisis? Some might argue that the Fed must raise rates slightly so that they have room to cut them again when their stimulus schemes eventually fail. This is certainly possible, however, such an action only reinforces the position that the Fed is deliberately undermining the U.S. system. To hike rates now only to then cut them immediately after would result in the end of faith in the central bank’s ability to administer our financial structure. A crash would occur regardless. I do not believe the Fed intends to cut rates again, at least not until it is already too late to stall a full spectrum breakdown in stock markets. Even though the majority of analysts, mainstream and independent, hold the position that the Fed is unlikely to raise rates for a second time (or ever again), I am not convinced that this is the plan. The question remains — why begin raising rates at all if the goal is not to bulldoze forward and squeeze the U.S. economy? As I wrote in my article “The Global Economic Reset Has Begun,” the Fed has a habit of doing exactly what it says it is going to do. They may fool the public as far as the exact timing of policy changes, but they never back away from the policy changes themselves. I cannot find a single instance in the history of the central bank in which they announced future measures and then didn’t eventually follow through within the year. This is how I predicted the first rate hike in December of last year, and it is why I believe another rate hike is coming this summer. Fed officials today have been adamant that at least two more rate hikes will be initiated in 2016. If they do not enact these hikes, it will be the first example that I will have witnessed or seen in research in which they “backed off” completely from a policy initiative. Some analysts argue that this makes no sense. The Fed has spent the better part of the past eight years trying to keep equities markets alive. Why would they now risk crashing the same markets with rate hikes that will cut off corporations and banks from cheap or free overnight loans? Why would they strangle the steady stream of stock buybacks that have been supporting the markets for the past few years? Why risk the fragile rice paper psychology of the markets? Why would they kill the “golden goose”? As the recent jobs report from the Bureau of Labor Statistics shows, our fiscal foundations are crumbling and eventually, the fundamentals of our economy will overwhelm central bank orchestrated optimism anyway. Keep in mind, the report of only 38,000 jobs added in May does not paint the full picture of the unemployment problem in America. The BLS and the mainstream media consistently gloss over the REAL job loss statistics including U-6 measurements which indicate that more than 664,000 working age Americans were removed from unemployment rolls and are no longer “counted” as jobless. This brings the grand total number of workers without jobs or that are underemployed to nearly 95 MILLION! The BLS ignores these people in their primary calculations for the national unemployment rate, which magically dropped again last month to 4.7 percent. While the “official” jobs numbers are bad enough to cause concerns among mainstream traders and economists, the real numbers are far worse. Nearly every base economic indicator globally, from raw materials demand, to manufacturing and exports, to corporate earnings, to retail sales and employment are printing negative this year. Despite all of this, markets remains levitated (for now) because the insane assumption within the mostly inane world of stocks is that bad economic news ensures the fed will bow to market forces and support the equities bubble for another quarter. When the entirety of investment markets embraces a singular assumption, when the markets has "no doubts", this is when bad things happen. I have to laugh when I hear the claim that the Fed “cannot raise rates” in light of the new data. The fed is not "trapped"; rather, it is the U.S. economy that is trapped with the Fed as the instigator. Obviously, the Fed was well aware of the real unemployment problem as well as numerous other negative data when they hiked rates the first time in December. So, let’s just say it plainly — The Fed is NOT dependent on data when making its decisions. The Fed does whatever it wants to do whenever it feels like doing it, and it is very likely that Fed policy decisions are made months in advance, while publicly scheduled policy meetings are designed just for show. They may claim that they care about the latest dismal jobs report, or other detrimental fiscal developments, but they don’t. They have their own agenda and their own data points, many of which we will never be privy to. I would also mention the fact that the Fed has raised rates during recessionary economic conditions on several occasions, including during the onset of the Great Depression; a move which Ben Bernanke later publicly admitted was the ultimate cause of the prolonged depression event. You can read my analysis of this in my article “What Fresh Horror Awaits The Economy After Fed Rate Hike?” With May’s job report so negative even with all the BLS manipulation, it is presumed that the Fed will not hike rates again at their June meeting. I believe that the Fed is certainly capable of raising in June. The timing of the meeting, right before the vote in the UK on the Brexit referendum, is perhaps not a coincidence. While I understand the argument that the Fed would be “better off” taking its time and raising in July or September, I want readers to entertain another possible scenario for a moment. Imagine if the Fed raised rates in June to everyone’s shock and surprise. Market turmoil is almost a guarantee. A hike in June BEFORE a Brexit event would also be easier to rationalize to the public than a hike after a Brexit event. Imagine then that, again, to everyone’s shock and surprise, the Brexit vote is successful and the UK leaves the European Union (a supposed black swan that the IMF has warned will cause a global equities crisis). At this point, who gets blamed for the resulting equities crash? The Fed? The citizens of the UK? Who? If the globalists wanted to trigger the next leg down in the global economy, I can’t think of better circumstances or a better smokescreen. I also acknowledge the possibility that only one of these events might be necessary to increase market turmoil. But from the perspective of an evil-minded internationalist, wouldn’t it be spectacular to have both? I could be wrong, but it is something to think about… If you want answers to questions on why the Fed takes the risks it does, or why internationalists engineer crisis events, I suggest you read my article “The Economic End Game Explained.” Suffice to say, the Fed serves the interests of globalists and Fabian socialists, not the interests of America as a nation, and the globalists know that chaos is the best method for influencing populations to accept a “new order.” I would also say that they are pulling the plug simply because this year is most opportune. I don’t pretend to fully understand every detail of the timelines of globalists and the motivations behind them, but I do know that the evidence shows they have such timelines, and according to recent actions the clock appears to be running out. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Secret Science of Electromagnetism -- Herbert Dorsey Posted: 08 Jun 2016 06:30 PM PDT Jeff Rense & Herbert Dorsey - Secret Science of Electromagnetism The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now Obama Warns Americans to 'Be Prepared' For Disaster... What Does He Know? Posted: 08 Jun 2016 06:00 PM PDT I recommend a premium subscription the Dollar Vigilante news letter. We are reminded daily from multiple sources what is coming Jeff if the only one I have found that gives financial strategies to have a fighting chance in the next Great Depression. Thanks Jeff The Financial Armageddon Economic... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economy Heading For Total Collapse Posted: 08 Jun 2016 05:30 PM PDT The Economy Heading For Total Collapse The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1259.80 Up $15.40 or 1.24% Posted: 08 Jun 2016 05:09 PM PDT

As I was saying yesterday, "The lowest risk place to buy a rallying market is the bottom of Wave 2." Today markets seconded that with a LOUD Amen. After yesterday's lows Silver & Gold came today ready to PARTY. Most of it happened while we slept. At 1:00 a.m. Eastern, gold was still below $1,250, but it steadily rose and rose to $12,55 by 9:00, then shot up to $1,267.30 about 11:00. Time I got in here early this morning, gold was already at $1,260. To late to hop on for that leg, but not too late for the LONG ride. Silver outperformed gold. Gold rose $15.40 (1.2%) to close Comex at $1,259.80. Silver vaulted 59.1¢ (3.6%) to 1696.8¢. Gold/Silver Ratio sank 2.3% to 74.246. Story doesn't stop there by any means. Gold pierced those 20 & 50 DMAs like a 20 gauge needle punching through cowhide, and closed right on that downtrend line that yesterday seemed to hover so far above. Turns out gold needed only one day to reach it. Look for yourself, http://schrts.co/wlImC2 Behold silver, http://schrts.co/QMvKqM After Friday's leap, silver hunkered down for two days then jumped for all it was worth today, brushing through 50 day moving average, 20 DMA, & downtrend line like they were bead curtains. All this has the manic feel of a wild Wave 3 beginning. Yes, there's more resistance to be conquered at 1760¢ and 1806¢, and at $1,265 and $1,287, but gold has already jumped two resistance levels. Doesn't seem to bother it or slow it down. As I said yesterday, I would be buying metals now. Platinum and palladium look much like silver & gold, trading right up to the downtrend lines but not quite punching through. Confirming silver & gold. US dollar index hurt itself badly today, falling 22 basis points (0.23%). It has now sunk to the area that caught it earlier this year (93.62), for a while. Watch 92.50, where the dollar must hold or perish. Stocks millimetered up again, completing the right shoulder of a head & shoulders top. Within that, both the S&P500 & Dow are forming rising wedges, which I recall usually resolve dirtward. Dow closed at 18,005.05, up 66.77 (0.37%) S&P500 added 6.99 (0.33%) to 2,119.12. Confucius says, "When plug is pulled, water will speedily drain out, taking stock profits with it." Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News: Shootings in D C Posted: 08 Jun 2016 04:20 PM PDT Breaking News: Shootings in D.C. Several people shot in Washington, DC, in neighborhood near Capitol building and Union Station. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 08 Jun 2016 04:20 PM PDT US markets stop worrying about Fed rate hike; stocks, oil, gold rise. Corporations start selling zero-percent bonds. Clinton wins California, clinches nomination. Major US/China trade war breaking out. Global bond yields still falling, China’s debt still rising. Doug Noland’s latest Credit Bubble Bulletin and David Stockman’s proposal to fix the big banks and by extension […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Podcast: Gold Will Soar, Marijuana Will Be Legal Posted: 08 Jun 2016 04:10 PM PDT John Rubino and Financial Survival Network’s Kerry Lutz on why the gold bull market has legs and how to play it. Also why Libertarians will have at least one thing to celebrate after November’s election, when California legalizes marijuana. The post Podcast: Gold Will Soar, Marijuana Will Be Legal appeared first on DollarCollapse.com. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jun 2016 04:00 PM PDT David Icke - The Money Hoax - Turning of the Tide (1996) David Icke exposing the world money hoax in 1996, 20 years later the scam is still the same, your money isn't real. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Collapse 2016 Financial Global AmeriGeddon Posted: 08 Jun 2016 02:00 PM PDT Stock-market crash of 2016: The countdown begins It's time to start the countdown to the crash of 2016. No, this is not a prediction of a minor correction. Plan on a 50% crash. Most investors don't want to hear the countdown, will tune out. Basic psychology. They'll keep charging ahead with a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jun 2016 01:50 PM PDT This post The Gold Bull Is Back appeared first on Daily Reckoning. We know that central banks and governments have lost the plot. When the crisis started in 2006, U.S. short rates were 5%. In 2008 they were down to zero and have virtually stayed there ever since. A crisis package of $25 trillion was thrown at the financial system. This is what the likes of JP Morgan and Goldman told the Fed they had to do to save the bank(-ers). Ten years later the world financial system is in a mess that is exponentially greater. World debt has exploded, most governments are running deficits and the financial system is balancing dangerously on the edge of a precipice. $8 trillion of government debt is now negative and $16 trillion is below 1%. Negative yields are supposed to stimulate a deflationary global economy and also save bankrupt nations which can't afford to pay a market interest rate on their exploding debts. But as usual, the central bankers have got it wrong again. Negative rates are increasing the risks for the financial system and the world economy. Bank profitability is crashing due to the low rates and forces them to take greater risks. For savers, they kill the incentive to save. And without savings, there will be no investments and no growth in the economy. But the biggest disaster is hitting the pension sector. Virtually all pension funds are seriously underfunded, especially if they applied realistic rates of return. Pension funds hold three principal investments: stocks, bonds and property. These are all bubble assets inflated by the credit explosion that central banks have orchestrated. As these assets implode, there will be no pensions left for anybody. People who are about to retire in coming years have no understanding of the fate that is going to hit them. They will receive no pension or a pension that is worthless. As the economy deteriorates, the unemployment rate will also rise dramatically. The combination of retirees with no pension and a high percentage of the population without a job will lead to severe human disasters around the world. Governments will of course print unlimited amounts of money, but this will have no effect as manufactured money can never create wealth. This is all the result of central banks interfering in the natural cycles of the economy by financial repression, and thus interfering with nature's law. So instead of having minor booms and busts, the manipulation of markets and the economy creates the most massive super booms and busts. It is not the first time it happens in history and it will continue to happen. It will sadly lead to a period of very difficult adjustments and misery for current generations and possibly even future ones. In addition to all the negative fundamental factors, there are certain indicators that are telling us that we are now getting nearer to the next phase of the downturn that started in 2006, from which has had a temporary reprieve. One is the Dow/Gold ratio. This ratio peaked in 1999 when the Dow was at a high and Gold at the $250 low. The ratio then declined by 87% until September 2011. This means that the average investor in the U.S. stock market was a massive 87% worse off compared to owning gold instead. Between 2011 and the end of 2015, the ratio recovered 25% of the fall since 1999. Technically it is very clear that the dead cat bounce in this ratio is now finished and that it is on the way to new lows. Since December last year the Dow has fallen about 20% against gold. Eventually, I see the ratio going well below the 1 to 1 ratio in 1999 (Dow 800 and Gold $800). But even if the ratio only went to 1 that would mean a fall of the Dow versus gold of 92% from here. So gold in the next few years will not only preserve investors wealth but also enhance it. Holding stocks on the other hand will not only lead total despair but also to total wealth destruction. It looks like 2016 will be a year when volatility increases dramatically in the world. Not only are the risks now greater than ever in the world economy, but the geopolitical risk is now more serious than it has been for many decades. The U.S. and its allies have created anarchy in Afghanistan, Iraq, Libya and Syria with serious repercussions for world security. There are many other areas that could lead to major war(s) such as Ukraine, Saudi Arabia, North Korea and China (South China Sea). And as we know from history, bankrupt empires often start wars as a final act of desperation. Let's hope that this doesn't happen, although we must be aware that the risk is major. The bottom line is that economic, financial and geopolitical risk is greater than ever in the world today. Let us hope that the worst case scenario doesn't materialise, because if it does, life on Earth will be very different for a very long time. We must remember that since we have had the biggest bubble in history over the last 100 years, the end game is likely to lead to the biggest implosion in history of the world economy and financial system. Whatever the outcome of the crisis that the world will find itself in over coming years, it is absolutely essential to insure wealth against these risks. The best financial insurance available and by far the cheapest is physical gold and silver stored outside the banking system. This is the only insurance available where the premium, invested in metals, doesn't have to be paid annually at higher rates but instead appreciates as risk increases. We don't know of course when these risks will turn to reality. And I admit that it has taken longer than I expected. But when risks are major, it is critical to protect yourself against them. We all know that we can't buy fire insurance after the fire. It is not a coincidence that some of the most successful investors in the world are recommending physical gold as insurance against the risks that I have just discussed. Ray Dalio, the founder of an extremely successful hedge fund recently said "If you don't own gold you know neither history nor economics". And Stan Druckenmiller, a hedge fund manager that returned an average of 30% a year over 25 years recently told investors to sell stocks and buy gold. It seems clear that gold finished the correction at $1,046 in December 2015. We are now around $1,260 and will probably move to the $1,400 level quite soon. But short term movements are totally irrelevant. Gold at $1,300 is an absolute bargain. It is the most cost effective insurance that anyone can buy against geopolitical instability, a bankrupt world economy and unstable financial system. The beauty of buying gold as insurance is that the "premium" you pay for the insurance, i.e. the price of gold, is very likely to increase substantially in value in coming years. Could there be a more perfect insurance against global risk than gold. I doubt it! Regards, Egon Von Greyerz Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post The Gold Bull Is Back appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will President Trump Trigger a Recession? Posted: 08 Jun 2016 01:27 PM PDT This post Will President Trump Trigger a Recession? appeared first on Daily Reckoning. BALTIMORE – It is a bright summer day outside. A dry breeze sweeps down Cathedral Street and blows away the hot, humid air. It is hard for us to imagine that anything bad could happen today. But bad things do happen – even on nice days. The weather was fine when General Custer rode out to the Little Bighorn, too. Home of the Brave?Over the weekend, we worked at putting up a board fence – with half-round treated posts and four 6-inch-by-5/4-inch boards. It was grim work. On a small farm, nothing works as it should. The augur got stuck on a root and sheared a bolt… and the tractor slipped on the greasy clay. After a few minutes, our shirt was drenched. Ticks were already crawling up our legs. What's worse, we barely made a dent in the job. In two days, we only got about 20 posts in place… with 130 to go. Progress was slow. But at least it was real. We were thinking about cowardice… the kind of cowardice that runs rampant in the Home of the Brave. The voter, the patriot, the investor, the churchgoer – there are few Muhammad Alis among them. [See today's Mailbag below for more on Ali.] Many readers are annoyed with us. Ali was one of the few real heroes of the Vietnam era, we said. How could we believe it? Ali challenged the system. He said what all of us must have thought: None of us had a real quarrel with the Viet Cong. But the typical man hides in solemn conceits and flattering fantasies. He would rather die than challenge the system. He believes that he is running the country… his sons and daughters, protecting it, are heroes… the Fed will make sure nothing goes too far wrong in the economy… And as for God… he's always on our side. Culp's HillAn expert tells us that the world's climate is changing. He says he cares. It is not that we don't believe him; we just don't know what it means. Is it good? Is it bad? Will it spoil a picnic? Or increase grain harvests? Is it a fence or a fantasy? We don't know. We know only that the sun is shining, right here, right now. You put up Old Glory on Memorial Day; you remembered those who died in the service of their country. Yes, of course, you did. But who and why? Did you remember the soldiers who fought for the 1st Maryland Infantry, CSA? Or the Yankees who killed them? On a hot summer day in 1863, in the fight over Culp's Hill near Gettysburg, the Marylanders were ordered to attack. Their commander, Brigadier General Steuart (a distant relative) protested. It would be suicide, he said. Then, he put his head in hands and cried: "My poor boys!" More than half were killed. Which side are you on… or is he on? What "country" do you serve? Manhattan? Death Valley? The rednecks of South Georgia? Or the home decorators of Marin County? Blue states or red states? Fundamentalist Christians or fundamentalist Muslims? Watch and WaitThere was not much forward momentum in the U.S. stock market yesterday, either. Still, stocks remain near an all-time high. Fed chief Janet Yellen reassured investors. If rates rise, and stocks tank, it won't be her fault. She'll bide her time before hiking rates. And so, we remain in "watch and wait" mode. It is one of those things economist Herbert Stein must have had in mind. As he famously put it, "If something cannot go on forever, it will stop." The Fed cannot stay in a permanent state of emergency. It will have to come to an end sometime. What is amazing is that it hasn't come to an end already… and there's no telling how much longer it will continue. In the meantime, the claptrap flows, like beer at an Orioles game. Trump RiskOne of the most prominent (among many) purveyors of myth and fraud is MIT wunderkind and former U.S. Treasury secretary Larry Summers. Writing in the Financial Times – a bastion of narrative delusion – he takes aim at the presumptive Republican presidential nominee, Donald Trump. There are many good reasons to think Trump is a mountebank, but none of them seem to occur to Mr. Summers. Instead, he refers to the "Trump risk," which he believes measures the damage that Trump would do to the U.S. economy if he were elected. "The economic consequences of a Trump win would be severe," claims Mr. Summers in the headline. But he has no way of knowing what the consequences would be, let alone if they would be severe. Would they be worse than if Ms. Clinton were elected? No one knows. "If he is elected, I would expect a protracted recession to begin within 18 months." Huh? Look at the numbers. Over the past 12 months, U.S. GDP growth has been falling steadily, quarter after quarter. From 3.9%… to 2%… to 1.4%… to 0.8%. Within 18 months there should be a protracted recession no matter who is elected to the White House. Convenient LiesMr. Summers also picks up Hillary's theme: It would be unsafe to have Mr. Trump in charge. "Who will rest secure with President Trump controlling the Federal Bureau of Investigation and the Central Intelligence Agency?" he asks. He's got a point. But wait, no one should feel safe anyway – no matter who is in the White House. These agencies are plainly out of control… and have been for many years. Remember, it was rogue elements of the CIA that launched the Bay of Pigs Invasion – apparently, without informing President Kennedy. And that was more than a half-century ago. Kennedy vowed to "splinter" the organization into a thousand pieces and throw them "into the wind." Instead, it was JFK who was splintered. Since then, the Deep State has grown as fast as the credit that supports it. But that's the difference between politics and putting up a fence… The bigger the scale, and the farther away, the less we really know what is going on. So, we resort to convenient lies to fill in the blanks… until the "poor boys" die. Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post Will President Trump Trigger a Recession? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bilderberg 2016 Does Not Want Free Media Around Posted: 08 Jun 2016 12:00 PM PDT Bilderberg 2016 Does Not Want Us Here! Dan Dicks of Press For Truth along with Lauren Southern of The Rebel Media and Luke Rudkowski of We Are Change explore the hotel and site of Bilderberg 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jun 2016 11:46 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jun 2016 09:38 AM PDT This post Oil Jumps to $51 appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Well, yesterday, was pretty much a nothing day. Gold close down $1.50, the Dollar Index continued to drop, but this time by just a few points, and the euro found a way to climb to 1.1370, but that’s about it. All the excitement and hoopla from the Friday Jobs Jamboree, and the Yellen speech on Monday, has been digested, and just like economies, that experience the booms, they need to experience the busts also, and so it was with the currencies and metals yesterday. They didn’t have a “bust” but they also didn’t experience any more “boom”! The number of very well respected economists/analysts, coming out and dissing on the Fed is beginning to grow. Yesterday it was James Grant, and David Rosenberg. I don’t think you can get much more heavyweight than those two when it comes to analyzing what’s going on in the economy, and then comparing their thoughts with those coming from the Fed. For instance, James Grant said

And David Rosenberg said:

I got both of those quotes from Ed Steer’s letter this morning. I really think that this dissing the Fed is going to continue, and take big chunks of their credibility armor away from the Fed. And then I’ll be looking like a genius, the old Swami for saying that this was going to happen way before it did. But that only lasts until the next thing I say and get wrong! HA! The U.S. economy is heading to Recessionville, and soon, (relatively speaking) the Fed will have to undo its December rate hike, and the chickens will come home to roost, like I said yesterday. The big mover in the past 24 hours has been the price of oil, which climbed past $50 and went straight to $51, without passing Go, and without collecting $200! WOW! Yesterday morning the price of oil was knocking on the door to $50, at $49.90, and this morning, we’re looking at a price of $51.04! The Petrol Currencies should be boarding a rocket ship to Mars, but apparently they won’t be joining the Most Interesting Man in the World for that trip. Sure, the Petrol Currencies are bit stronger this morning, but I think that given the dollar drifting lower, that their strength is tied to that and not the move in the price of oil, because, like I just sort of said, the Petrol Currencies should be taking this rise in the price of oil and soaring. They’re up, just not soaring. Maybe that comes later today. The Reserve Bank of New Zealand (RBNZ) meets tonight, and like I told you on Monday, it is widely believed that the RBNZ will cut rates at this meeting. But that thought hasn’t stopped kiwi was driving higher to the 70-cent handle, like it has this morning! The lackluster dairy prices in New Zealand I believe, will lead the RBNZ to cut rates tonight. But then when has a Central Bank really done what we thought they would do lately? I’m pleasantly surprised that the currency traders have gone out on a limb and pushed the currency appreciation envelope of kiwi this morning. The euro has a tiny gain overnight, and has lagged the other currencies and their collective reactions to the U.S. Jobs report and the Yellen speech. The euro, which I used to call the “Big Dog on the porch” has really backed off its importance to the dollar. It is still the offset currency to the dollar, but in a recent report the European Central Bank (ECB) announced that the global use of the euro had declined slightly in 2015 and early 2016, as the Chinese renminbi has started to take a larger role in reserves and trade in the international monetary system that is becoming more multipolar. The euro accounted for 19.9% of international reserves in 2015, down 0.6% from the previous year. The Swiss franc has had a nice couple of weeks recently. I know I leave the franc out of most daily discussions about currencies, because not much goes on there, except referendums on everything. But in recent trading the franc has gained at a faster pace than the euro, and that hasn’t happened in some time. I do believe though that the franc is getting some love right now from those that fear the BEXIT referendum will not go in favor of the pound, and so they are doing their PEXIT (I made that up!) Pound exit to francs. And the Canadian dollar/loonie, is the best performer this so far this week. We have neighbors at our place in Florida that are from Canada, and this winter they were lamenting the fact that the loonie had fallen to 70-cents vs. the dollar. And each day I would see them I would tell them that the loonie was getting stronger. The last time I saw them was at the end of February, and the loonie had risen to 72-cents and we all celebrated with champagne on the deck! Well, I bet they’re happier now to see the loonie nearing 79-cents. That’s quite a rise in six months, don’t you think? Nearly 9-cents. And it’s not all about the rise in the price of oil. it has a lot to do with the fact that Bank of Canada (BOC) Gov. Poloz, hasn’t, yet, talked about how the strength of the loonie was hurting the economy, and blah, blah, blah. And then add in the fact that the new PM Trudeau, hasn’t opened his deficit spending checkbook yet. But he did promise to do that, so these are two things that could stop the loonie in its tracks, unless the price of oil continues to rise. The U.K. got some economic news that wasn’t gloom and doom this morning as April Industrial Production surprised the markets to the upside, printing growth of 2% vs. March, with the main driver of the growth being manufacturing.. But don’t run out and get in line to look to buy pound sterling. Most observers are looking at this data as a one-and-done print as there are just too many one-time inputs to the data. So watch out here, this could be a false dawn, and in fact I can’t believe this potentially one-and-done report was so strong! The Aussie dollar (A$) continues yesterday’s rise after the Reserve Bank of Australia (RBA) left rates unchanged on Monday night (Tuesday morning for them!). I think that the RBA sees things getting better for the economy, and no longer sees any significant downside risk. That all bodes well for the A$… But we have to hope that A$ traders don’t go hog wild here, and keep the currency appreciation envelope from crossing the desk. For if the A$ gets out of line with appreciation, the RBA will have to react negatively. Gold lost $1.50 yesterday, but is up $8 this morning, crossing the $1,250 level in the process! Did you hear about how U.K. pensions are now able to buy and hold gold? The Royal Mint was approved for holding in specific pensions, gold bullion. Right now, investors are allowed to buy 100-gram and 1-kilogram bars, or pooled gold into a 400 ounce gold bar. Coins have not been approved at this time. This just opens up another avenue for gold that had not been open before, and should increase the demand for more physical gold. And did you hear that former Bank of England (BOE) Gov. Mervyn King came out and said that:

So, like Big Al Greenspan, now Mervyn King, is coming clean about their respect for gold, something they could never and didn’t say while they ran their respective Central Banks. The U.S. Data Cupboard yesterday had the Productivity data, which has been a real problem here in the U.S. as it shows weakness, and the quarterly print showed a drop of -0.6%, to go along with the 1% drop in the previous quarter. And Consumer Credit (read: debt) slowed in April to $13.4 billion from the March number of $28.4 billion! This was a little surprising to me, and I wouldn’t doubt for one minute that it won’t be revised upward next month, as April saw Retail Sales rebound. Today’s Data Cupboard is basically empty with only the JOLTS data (job openings). So, this empty data cupboard adds to the Nothing kind of day so far. This article came from the Bloomberg, and is titled: China Gives First Investment Quota to U.S. to Boost Yuan Use. Well, you knew by reading that title that I would be all over that like a cheap suit. And so you can read the whole article here, or here is your snippet:

Chuck again. Now, don’t you think that it would have been a better time to announce this when the renminbi was appreciating nearly every day, instead of depreciating nearly every day? I do. But I know that the timing just wasn’t right here. And so it’s being announced now, which probably won’t lead to long lines to buy, right now. That’s it for today. Now go out and have a wonderful Wednesday, and be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Oil Jumps to $51 appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The COLLAPSE of the ECONOMY in the second half of this year is expected!! -- Bix Weir Posted: 08 Jun 2016 09:30 AM PDT The monopoly system was designed by God which was set up as Gold and Silver.If you don't believe this just put two and two together..EVERYTHING that God has either designed or established the ungodly have tried to destroy .These demon possessed people will stop at nothing to try an exalt... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Hillary’s Going to Beat Trump Posted: 08 Jun 2016 09:00 AM PDT This post How Hillary's Going to Beat Trump appeared first on Daily Reckoning. The picture above is from the most famous political ad ever created… In it, a little girl walks through a field and picks up a daisy… She starts plucking its petals and innocently counting: "One… two… three…" Then, a man's doom-laden voice drowns her out and starts counting backwards: "Ten… nine… eight…" The countdown ends. And the screen erupts in an atomic explosion. Then you hear President Lyndon B. Johnson's words: "These are the stakes… to make a world in which all of God's children can live, or go into the dark. We must either love each other or we must die." It's known as the "Daisy Girl" ad. And it gives you a taste of exactly how Hillary Clinton is going to defeat Donald Trump… Fear WinsThe "Daisy Girl" ad aired only once… but it fundamentally changed the landscape of American politics. In short, it showed how effective fearmongering could be… Barry Goldwater made the mistake of saying he wanted to make it easier for the armed forces to use nuclear weapons if needed. So Deep State President Johnson used America's Cold War anxieties against him… and it devastated Goldwater's campaign. Regular readers are familiar with the Deep State, of which Johnson was a card-carrying member. It's the shadow government of elites, lobbyists, bureaucrats, politicians, cronies and military-industrial complex members who pull the levers of power behind the scenes. The Deep State has turned to the fear card often to keep its lucrative war machine moving forward and to cement its wealth and power… It told us we needed to invade Iraq because Saddam Hussein had weapons of mass destruction. If we didn't there'd be a nuclear mushroom cloud in Manhattan. It told us we needed to bailout Wall Street in 2008 because the entire global financial system would collapse if we didn't. And it told us the NSA needed warrantless snooping on hundreds of millions of unsuspecting Americans in order to keep us safe from terrorism. But all of those interventions just made the Deep State richer and more powerful… not the American people. The fact is fear works. It touches on some of the deepest anxieties voters have about their own security. And that's why Hillary Clinton and her Deep State cronies will use it to destroy Donald Trump… Trump Will End the WorldClinton started her fear-based "hair on fire" attack on Trump with this gem: "This is not someone who should ever have the nuclear codes. It's not hard to imagine Donald Trump leading us into a war just because somebody got under his very thin skin." Trump = nuclear war. Nicely played, Clinton. Then she wheeled out Larry Summers to keep the fear train barreling down the tracks. If you recall, Summers was Treasury Secretary in her husband's administration. He's basically family. Summers took to the Financial Times to warn that the economic consequences of President Trump would be "severe" and would start the "worst trade war since the Great Depression." Sounds scary, doesn't it? Trump = economic catastrophe. Nicely played, Larry. See how they execute their game plan? Insiders vs. OutsidersIn Senator Elizabeth Warren's book, A Fighting Chance, she recounts a dinner with Larry Summers. Here's what he told her… "I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don't listen to them. Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say. But insiders also understand one unbreakable rule: They don't criticize other insiders." That disgusting pathology perfectly captures why Larry Summers is excoriating Trump… Trump's not an insider. And he's made no bones about his desire to turn insiders like Clinton and Summers into outsiders. Look, Clinton has been inside the Deep State's corridors of power for decades. She and her intern-based husband have cashed in on those connections to make a $150 million personal fortune through phony Wall Street speeches and their "charity" slush fund bankrolled by third-world dictators. And Summers has gotten rich making multiple passes through the revolving door of government and Wall Street. They both need to keep the gravy train flowing. Not surprisingly, they've played the fear card to annihilate Trump. So be prepared for the ultimate Trump "Daisy Girl"-type ad soon to come from the Clinton camp. It's guaranteed. What Does This All Mean to You?It means that instead of facing criminal charges for her server illegalities, Hillary is set to assume control of the White House. That means the current American status quo, which is already off the rails, is about to go hyper-drive nuts. The Clinton chaos agenda means… Genderless college kids confused into submission… Racially segregated "safe spaces"… More welfare addicts… More stock market bubbles… Retirements destroyed by negative rates… More disastrous wars… And a new round of Clinton scandals led by her bored husband looking for a good time. Sadly, millions of Americans will stand and cheer for the $12,000 Armani pantsuit as she launches this ambitious agenda to complete America's transition to a full-blown idiocracy. Meet your new President! She is here to help the downtrodden! Excuse me for a moment while I clear the vomit from my throat. What are our options in the face of the Clinton blitzkrieg? There is one option. Only one… Self-reliance. In the investment world, that means having a strategy that’s specifically designed to weather any storm and perform well in any type of market environment… like trend following. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of the coming Clinton blitzkrieg. Regards, Michael Covel The post How Hillary's Going to Beat Trump appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nigel Farage: Hillary Clinton is a Crook Posted: 08 Jun 2016 08:40 AM PDT Nigel Farage MEP, Leader of the UK Independence Party (UKIP), Co-President of the Europe of Freedom and Direct Democracy (EFDD) Group in the European Parliament The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commerzbank may hoard billions to avoid ECB charges, Reuters says Posted: 08 Jun 2016 07:45 AM PDT By Arno Schuetze and Andreas Kroner FRANKFURT, Germany -- Commerzbank, one of Germany's biggest lenders, is examining the possibility of hoarding billions of euros in vaults rather than paying a penalty charge for parking it with the European Central Bank, according to sources familiar with the matter. Such a move by a bank part-owned by the German government would represent one of the most substantial protests yet against the ECB's ultra-low rates, which have been criticized by politicians including Finance Minister Wolfgang Schaeuble. Although no decision has yet been taken, the lender has held discussions on the matter with German authorities, said two officials, who asked not to be named because of the sensitivity of the matter. ... ... For the remainder of the report: http://www.reuters.com/article/us-commerzbank-ecb-idUSKCN0YU1HW ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Look Set for a Major Move Higher in June! - Video Posted: 08 Jun 2016 06:34 AM PDT hi it's Wednesday jun 8 2016, here home of alternative economics and contrarian thinking this morning i'm going to be talking about gold and silver they made some knife nice moves on friday afternoon on farm payroll june third it looks to me technically like when stay tuned first was the short term bottom here for now in gold and silver and we've had a bit of consolidation yesterday and on Monday gold and silver didn't really go anywhere but this morning silver is up to . 3 % @ 1675 it's a around midday london time so seven o'clock new york time gold is at 1253 so up almost ten dollars up . seven eight percent and i'm going to do a little bit of technical analysis and i'll start out with with silver and looking first at the short term chart of silver and to me it looks like we bottomed on june first act 1582 and now I brought up the short term chart here and you can see that from april we moved from 1478 on the first of april that was the low end to a high of 1801 in on may first so that was... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

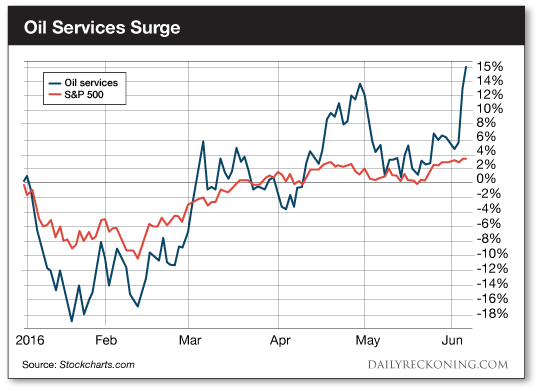

| Oil Bears Have Lost Their Bite – It’s Time for Energy Stocks to Soar Posted: 08 Jun 2016 06:29 AM PDT This post Oil Bears Have Lost Their Bite – It’s Time for Energy Stocks to Soar appeared first on Daily Reckoning. Nineteen measly points. That's all that separates the S&P 500 from topping its all-time closing highs. A routine move of less than 1% will get the Big Board over the hump—and it could happen as soon as this afternoon. But not all stocks are playing nice… The biotech sector rattled traders yesterday with another whipsaw session. The iShares Nasdaq Biotech ETF posted its fourth reversal day in a row, sinking to the red for the week and dragging the entire Nasdaq down with it. The culprit? A multiple sclerosis therapy from industry giant Biogen (NASDAQ:BIIB) flunked its study goals. That was enough to drag down the entire sector for the day. Even within spitting distance of new highs, the market will continue to throw you curve balls. That's why it's imperative to know which stocks to buy as the major averages march toward their highs. So while the media distracts the masses with presidential primaries and the Brexit vote, you should turn your attention to the energy sector. Oil prices finished Tuesday's session above $50 a barrel. That's the first time oil has closed above the $50 barrier since last July. U.S. stockpiles are down and China demand is stronger than anticipated, according to MarketWatch. This bullish data helped catalyze the move. And we're seeing more positive follow-through this morning. Crude is topping $51 in early trade. If the move holds, it will be the third day of significant gains for black gold. Now that Mr. Market has declawed the oil bears, it's time for energy stocks to soar. Oil services stocks kicked off the week with an insanely strong move out of the gate Monday morning. The VanEck Vectors Oil Services ETF has risen nearly 10% on strong volume since Friday's close. As of this morning, this group of stocks is posting new year-to-date highs. The oil services sector has gone from laggard to leader in just 48 hours…

The market rally we've witnessed over the past few weeks continues to feed off of the energy sector's red-hot performance. That's a welcome change from the past 18 months—when energy names acted as the market's cement shoes during the oil meltdown. Of course, this also means that the entire energy sector is ripe with fantastic trade setups. The independent oil and gas firms took the baton from the oil services firms yesterday. All but one independent oil and gas stock in the S&P 500 finished the day well in the green. Across the market, 20 of these stocks posted gains of 4% or more on Tuesday. A small handful of these stocks have even doubled from their February lows. Remember the forgotten law of the stock market we've hammered home this week: stocks that have already doubled are more likely double again. You'll find plenty of trading options in the oil and gas space this week. It's a great way to play one of the market's leading sectors as the major averages fight for new highs… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Oil Bears Have Lost Their Bite – It’s Time for Energy Stocks to Soar appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed Stance Likely to Pressure US Dollar, GBP Chart View Posted: 08 Jun 2016 06:21 AM PDT Financial markets always have an overriding story and if we look at the news headlines that have been generated over the last few months, we can see that the focus is once again back on the Federal Reserve. Market opinions are still sharply divided: If incoming data is consistent with labor market conditions strengthening, an interest rate hike could be foreseen sooner than we think. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jobs Report Changes the Landscape for Gold Posted: 08 Jun 2016 12:00 AM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jun 2016 06:00 PM PDT The slow death of markets, the truth about gold and silver mining stocks, the elimination of physical cash, how to rescue your local economy, and of course some bad news from China. The post Top Ten Videos — June 8 appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fall in Commodity Prices Hits the Canadian Banks Posted: 07 Jun 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

In The End of Alchemy, Mervyn King, the former head of the Bank of England, writes of central banks' frustration in dealing with the stagnant global economy. "Central banks," he says, "have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced."

In The End of Alchemy, Mervyn King, the former head of the Bank of England, writes of central banks' frustration in dealing with the stagnant global economy. "Central banks," he says, "have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced."

No comments:

Post a Comment