Gold World News Flash |

- Dominic Chappell faces MPs over collapse of BHS

- Something Big That Always Happens Right Before The Official Start Of A Recession Has Just Happened

- UK's Royal Mint will sell pension investors gold they can never see

- The Logic of Paper Money, Debt, and Gold

- US Jobs Report Changes the Landscape for Gold

- Gold, Silver, Bitcoin, & The Dow Market Trading

- Nigel Farage -- This EU is the New Communism

- The New "Hope"

- 7 Charts One Hedge Fund Is Watching

- Economic Indicators Are Now Signalling The Collapse Is Well Underway

- Is the Gold Pullback Complete?

- Gold Price Closed at $1244.40 Down -0.20 or -0.2%

- Secrets From the Reagan Revolution, Part II

- In The News Today

- Sorry, Janet… But You’re No Hero

- The Agenda For Bilderberg 2016

- The Crash Of All Crashes Is Headed Our Way

- Bilderberg 2016 Security Perimeter Erected To Protect Globalists

- We’re Ready to Hike Rates, But It’s Just Not Time Yet!

- Must Listen: The Economy Is Scheduled To Collapse The Second Half Of This Year: Bix Weir

- Jim Willie NEW Interview Deutsche Bank Could Collapse Entire Bankıng System

- Gold Bullion, Texas Is Taking on a New Battle…Against the Entire Financial System

- US Housing Market - It Looks Like the Dumb Money’s at It Again

- Mike Kosares: Former Bank of England head joins Greenspan as gold advocate

- China paused monthly gold purchases in May after prices surged

- Obama to endorse Clinton?

- #Bilderberg 2016 to decide on #Brexit and on #Trump

- Gold Prices Surge After Poor Jobs Number, Increased Risk Of BREXIT

- Former Bank of England head Mervyn King joins Alan Greenspan in advocating Gold Ownership

- These Stocks are Ready to Double… Again!

- Fed's Interest Rate Normalization Will Be Far From Normal

- Gold Stocks Be Prepared

- Jobs Report Changes the Landscape for Gold

- Breaking News And Best Of The Web

| Dominic Chappell faces MPs over collapse of BHS Posted: 08 Jun 2016 12:42 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||

| Something Big That Always Happens Right Before The Official Start Of A Recession Has Just Happened Posted: 07 Jun 2016 08:21 PM PDT by Michael Snyder, The Economic Collapse Blog:

You see, when economic conditions start to change, temporary workers are often affected before anyone else is. Temporary workers are easier to hire than other types of workers, and they are also easier to fire. In this chart, you can see that the number of temporary workers peaked and started to decline rapidly before we even got to the recession of 2001. And you will notice that the number of temporary workers also peaked and started to decline rapidly before we even got to the recession of 2008. This shows why the temporary workforce is considered to be a "leading indicator" for the U.S. economy as a whole. When the number of temporary workers peaks and then starts to fall steadily, that is a major red flag. And that is why it is so incredibly alarming that the number of temporary workers peaked in December 2015 and has fallen quite a bit since then…

In May, the U.S. economy lost another 21,000 temporary jobs, and overall we have lost almost 64,000 since December. If a new economic downturn had already started, this is precisely what we would expect to see. The following is some commentary from Wolf Richter…

Another indicator which is pointing to big trouble for American workers is the Fed Labor Market Conditions Index. Just check out this chart from Zero Hedge, which shows that this index has now been falling on a month over month basis for five months in a row. Not since the last recession have we seen that happen…

Of course I have been warning about this new economic downturn since the middle of last year. U.S. factory orders have now been falling for 18 months in a row, job cut announcements at major companies are running 24 percent higher up to this point in 2016 than they were during the same time period in 2015, and just recently Microsoft said that they were going to be cutting 1,850 jobs as the market for smartphones continues to slow down. As I have been warning for months, the exact same patterns that we witnessed just prior to the last major economic crisis are playing out once again right in front of our eyes. Perhaps you have blind faith in Barack Obama, the Federal Reserve and our other "leaders", and perhaps you are convinced that everything will turn out okay somehow, but there are others that are doing what they can to get prepared in advance. It may surprise you to learn that George Soros is one of them. According to recent media reports, George Soros has been selling off investments like crazy and has poured tremendous amounts of money into gold and gold stocks…

George Soros didn't make his fortune by being a dummy. | |||||||||||||||||||||||||||||||||||||||||||||||||

| UK's Royal Mint will sell pension investors gold they can never see Posted: 07 Jun 2016 08:01 PM PDT Royal Mint Opens Gold Vault to Pension Investors By Josephine Cumbo The Royal Mint is to open up its gold vaults to UK pension investors for the first time. From Wednesday, Royal Mint will make some of its gold bars available to investors wanting to hold it in tax-efficient pension pots. "For UK citizens, this is the first time that Royal Mint gold bullion has been authorised by HM Revenue & Customs ... for holding in specific pensions," said Chris Howard, the Royal Mint's director of bullion. ... ... Dispatch continues below ... ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Investors are to be offered a choice of bullion, from Royal Mint Refinery 100-gram and 1-kilogram bars, to Signature Gold -- a service that allows customers to purchase and own a share of a 400-ounce gold bar. ... Investors will not be able to opt for less expensive Royal Mint bullion coins to hold in their pensions because the products have not been authorised by HMRC. ... Pension investors purchasing gold bars through the Royal Mint will not be able to take delivery of their purchases as they will be placed in storage in "The Vault," the Royal Mint's secure storage facility in Wales. ... ... For the remainder of the report: http://www.ft.com/cms/s/0/458731ea-2cb2-11e6-a18d-a96ab29e3c95.html Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Logic of Paper Money, Debt, and Gold Posted: 07 Jun 2016 07:20 PM PDT by Gary Christenson, Deviant Investor:

Two red-shouldered hawks are nesting in our backyard along with several squirrels. Hawks hunt squirrels – death from above via flying predators. Conclusion: We will soon have fewer squirrels. Politicians get elected by telling people what they want to hear. Politicians are (usually) funded by large corporate interests, particularly the banking industry and military contractors. It takes $ billions to buy a Presidential election. Large corporate interests expect favorable access and legislation as a result of their huge contributions. Conclusion: Politicians tell voters what they want to hear but do what they must to repay contributors and solicit money to win the next election. Promises to voters become collateral damage. Bonds rise in price as the yield falls. Over $7 Trillion in sovereign debt currently "yields" negative interest. The bond purchaser lends currency to an insolvent government and pays for the privilege, even though the government has assured the lender that the bond will be repaid in devalued currency units. This is clearly a bubble. Bubbles always pop, though predicting when is difficult. Conclusion: $Trillions of paper "wealth" will vanish when the bond bubble implodes. Central banks want debt based currencies because they are easily created. Consequently the currency in circulation and total debt drastically increase and prices follow, sooner or later. Compare the cost of medical care, college tuition, an ounce of gold, a gallon of gas, a six-pack of beer, or a week's groceries today versus the cost for the same items in 1971. Massive debt, caused by politicians and bankers, also acts as a drag on economic growth. To create more growth the conventional answer is stimulus and more debt, which, at best, delays and aggravates the excess indebtedness problem. Bad policy produces bad results. | |||||||||||||||||||||||||||||||||||||||||||||||||

| US Jobs Report Changes the Landscape for Gold Posted: 07 Jun 2016 07:16 PM PDT Gold soars as chances for a Fed rate hike this month evaporate. Brien Lundin, editor of Gold Newsletter, details what that means for investors. Perhaps the lesson is this: Don't count gold out. Last week, I was expecting another thrust downward for gold, with the metal losing perhaps another $35–$60 to the $1,150–$1,175 range. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver, Bitcoin, & The Dow Market Trading Posted: 07 Jun 2016 07:00 PM PDT from FutureMoneyTrends: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Nigel Farage -- This EU is the New Communism Posted: 07 Jun 2016 06:00 PM PDT Nigel Paul Farage is a British politician and former commodity broker. He is the leader of the UK Independence Party, having held the position since November 2010, and previously from September 2006 to November 2009. Wikipedia The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jun 2016 05:40 PM PDT Submitted by Ben Hunt via Salient Partners' Epsilon Theory blog, A policy-controlled market, whether it’s today’s investment environment or the 1930s or the 1870s, places enormous pressure on investors … for yield and consistent return, to be sure, but even more so for a resurrection of the investment beliefs that held sway in “normal times”, for an escape from the prison of extraordinary monetary policy and its grip on market behavior. Pressure and time. That’s all it took for the Shawshank Redemption and that’s all it takes for our modern market redemption. Or it least that’s all it takes for the hope and the escape attempt. Let’s see if we’re as successful as Andy Dufresne. When suitably crystallized, an investment hope takes on a different form. It becomes an investment theme. Today the investment hope that has crystalized into an investment theme is the notion that soon, just around the corner now, perhaps as a result of the next mystery-shrouded meeting of the world’s central bankers, perhaps as a result of the U.S. election this November, we will enjoy a coordinated global infrastructure spending boom. Of course, this isn’t deficit spending or another trillion dollar layer of debt, but is “investment in our crumbling infrastructure.” This isn’t a mirror image of China’s massive over-build in empty cities or of Obama’s shovel-ready infrastructure projects from 2009-2010, but is “really a free lunch“, to quote Larry Summers, where there’s never a Bridge-to-Nowhere or an Airport-of-One. Or so the Narrative goes. A Narrative theme is a theme of hope, pure and simple. And because hope can and will emerge without any evidence or support from the real world, a Narrative theme can work from an investment perspective even if it’s a non-event in the real world or, stranger yet, an abject failure in the real world. In exactly the same way that you can invest alongside central bank efforts to prop up markets and drive asset prices higher without believing in your heart-of-hearts that anything these bankers say is even remotely true, so can you invest alongside a Narrative theme without believing a single word of the Narrative itself. And to be clear, my personal belief is that Larry Summers and the rest of the “public infrastructure projects are great investments!” crowd are sniffing glue. You’re pulling forward future economic activity, that’s all. Read the latest from Howard Marks if you don’t believe me. I’m not saying that government spending is bad — on the contrary, government spending is absolutely necessary to preserve life, liberty, and the pursuit of happiness, and there’s certainly a societal “return on investment” from government spending — but don’t tell me that there’s this huge productivity-enhancing, non-quotation-marked economic return on investment generated by the government building stuff that the private sector doesn’t want to build. Don’t tell me that what China is doing with their infrastructure is “mal-investment”, but that if we do it … well, that’s different, because, you know, our infrastructure is “crumbling” instead of “gleaming” the way it is in … umm … China. Yes, LaGuardia is a miserable airport. So stipulated. But there are infinitely greater productivity gains to be had from changing our insane TSA regulations and reducing security lines than by building a new Terminal B. If you want a massive Keynesian deficit spending program on top of our massive current debt … fine, make the argument. There’s an argument to be made. But don’t put a specious “investment” wrapper around it.

But it’s exactly that specious wrapper — the Narrative — that makes all of this work as an investment theme. If a massive public works program were couched in its traditional Keynesian or neo-socialist form (you don’t see Bernie Sanders talking about the economic ROI of his infrastructure proposals), it wouldn’t have a chance with the Wall Street Journal crowd. But, hey, if a public works program is “a smart investment” … never mind that this is about as smart an investment as Moonbase Alpha (yes, I had the Space: 1999 lunchbox) or perhaps a gigantic hole in the ground … well, then, let’s muster up the usual suspects at CNBC and the Wall Street Journal op-ed staff to get behind this, and let’s convince ourselves that Donald Trump wouldn’t be a nut job president, even though every shred of evidence and plain common sense screams the contrary, because he’s, you know, a “builder.” It’s all based on hope for real economic growth and an escape from policy-controlled markets, a hope that springs in every investor’s heart given enough pressure and enough time. It’s a hope that, as Sir Francis Bacon said, makes for a good breakfast but a bad supper. We’re in the breakfast phase of this Narrative theme still, as Missionaries (to use the game theory term) like Larry Kudlow beat the drum louder and louder for a big infrastructure spend, and it’s a drumbeat that will continue to grow until there’s a reality check or a powerful Missionary creating Common Knowledge to knock it back. That will be the dinner portion of this Narrative theme, and it will be an unpleasant meal. But I don’t see dinner being served until well after the U.S. election, no matter who takes the White House or how the balance of power shifts in Congress, and it might be a year or two later before the thin gruel of dashed hopes is served up to markets. So even though I think this U.S. public infrastructure build has barely a whiff of merit from an economic policy perspective, even though I think its net effect once implemented will be to make the ultimate debt reset that much more horrific, I also think it’s a highly investable idea. Because that’s the way you play the Common Knowledge Game. Common Knowledge is information that everyone believes everyone has heard. It’s why executions were once held in public, not so a big crowd can see the guy getting hanged, but so the crowd can see the crowd watching the guy getting hanged. It’s why political debates are filmed in front of a live audience. It’s why sitcoms have laugh tracks. It’s how a relatively small but highly televised protest in Cairo’s Tahrir Square toppled Mubarak. It’s why the Chinese government still cracks down on media pictures of the Tiananmen Square protests, now more than 25 years old. Common Knowledge is the game theoretic concept behind the irresistible power of the crowd watching the crowd, and as a result Common Knowledge construction by governments, corporations, and yes, central bankers is one of the most potent instruments of social control on Earth. The Common Knowledge Game is the game of markets, and it’s been internalized by good traders for as long as markets have existed. What you think about the market doesn’t matter. What everyone thinks about the market (the consensus) doesn’t matter. What matters is what everyone thinks that everyone thinks about the market, and the way you get ahead of this game is to track the “Missionary statements” of politicians, pundits, and bankers made through the four media microphones where the Common Knowledge of markets is created: The Wall Street Journal, The Financial Times, Bloomberg, and CNBC. It’s what Keynes called The Newspaper Beauty Contest, and it drove the policy-controlled markets of the 1930s exactly as it drives markets today. Is it an easy game to play? Nope. But you don’t have to be a professional poker player to avoid being the sucker at your local game. You don’t have to be a wizard trader to be aware that the Common Knowledge Game is being played, and that it’s driving market outcomes. Red and Andy survived more than 20 years in Shawshank prison because they never lost hope. But they were smart about the concept of hope. They didn’t let hope consume them to take stupid chances. In Red’s words, they never let hope drive them insane. That’s the same balancing act we all need to adopt here in Central Bank prison. Hope is a good thing. Hope is a human thing. But hope is also a social construct that is used intentionally by others to shape our behaviors, in markets as in life. That’s the awareness we need to be hopeful survivors here in the Silver Age of the Central Banker, and that’s the awareness I’m trying to create with Epsilon Theory. | |||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Charts One Hedge Fund Is Watching Posted: 07 Jun 2016 05:12 PM PDT Fasanara Capital's Francesco Filia sends over the following list of things he is watching, as well as the following seven charts he believes will show the upcoming key inflection points. THINGS TO WATCH

CHARTBOOK: The GERMAN AVERAGE GOVERNMENT BOND YIELD now below zero for the first time in history

GERMAN 10yr and 30yr YIELDS keep falling, curve may flatten further from here

Banks over-performed yields recently, gap may narrow from here Italian banks underperformed the EU banking sector in May by most in 2016

BTP vs. BUND & FTSEMIB vs. EUROSTOXX: Italian underperformance is visible also in the fixed income and broader equity market

USD/CNH grinding higher, despite broad US Dollar weakness

OIL and BASE METALS decoupled in May | |||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Indicators Are Now Signalling The Collapse Is Well Underway Posted: 07 Jun 2016 05:00 PM PDT The Royal Canadian Mint has smashed all precious metals records. Ralph Lauren closing stores and laying off employees. American worker productivity declines. Factory orders revised down and continue to decline. Fed is starting to purchase stocks outright to keep the system propped up. IMF confirms... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Is the Gold Pullback Complete? Posted: 07 Jun 2016 04:00 PM PDT The Gold Report | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1244.40 Down -0.20 or -0.2% Posted: 07 Jun 2016 03:19 PM PDT

The lowest risk place to buy a rallying market is the bottom of Wave 2. It's not safe to buy tumbling toward the bottom, where the first wave up begins. Wherever you buy, you have no signal that it won't drop further. Even after it has bottomed & begun to climb, there's little indication it won't collapse to a lower low. Ahh, but once that climb peaks (Top of Wave 1 up), the market corrects in Wave 2 down. AFTER that Wave 2 bottoms you have the very lowest risk place to buy, because when Wave 2 bottoms and turns up into Wave 3 up, it proves that it isn't aiming for a lower low than where Wave 1 up began. Looking at the gold chart, Wave 1 up began on 17 December 2015 at the $1,046.80 intraday low. It topped at an intraday high of $1,306.00 on 2 May, & began dropping in Wave 2 down. If (if, note) I am correctly identifying that as Wave 2's bottom, then right now gold and silver are at the lowest risk buy points. They have just finished posting a bottom to Wave 2, and next come what is usually the strongest, wildest leg of a rally, Wave 3 up. Remember, however, both may move sideways through the next two months before they begin rallying in earnest. This explains why I am so strongly recommending buying metals right now. But, of course, I could be wrong. Buttressing the case for a low in the gold and silver correction are platinum, http://schrts.co/tSKBZW and Palladium, http://schrts.co/xqRb5m Both dropped steadily into January lows, both climbed strongly off that low, both as May opened. Drawing trading channels up from those lows, both have not touched back to their bottom boundaries. From there both have moved higher, and should move higher still. Silver & gold are hanging fire at the 50 day moving averages. Today on Comex gold backed off a measly twenty cents to $1,244.40 while silver lost 5.1¢ to 1637.7¢. Drawing a new (blue dashed) downtrend line for silver, chart looks like this, http://schrts.co/xqRb5m Silver trampolined off its lower channel boundary up to its 50 & 20 day moving averages, which now coincide roughly with the downtrend line from 1 May. Tomorrow that line stands at 1649¢ so silver needs to close above that to improve Friday's gain. Cramped into a small ($12.10) range today, gold couldn't go forward but refused to go back. Tomorrow the downtrend line from the 1 May high stands at $1262. Gold must punch through that 50 DMA & move higher or squander its gains from last Friday. Sort of like heroin addiction, the stock market works until it doesn't. Dow today added 17.95 (0.1%) to 17,938.28. S&P500 made another high close for 2016 at 2,112.13, up 2.72 or 0.13%. Not sure where it's going, but I don't want a ride. US dollar index tossed back another 6 basis points today to land at 93.83. Can't get any traction. Down below keep an eye on 92.50, which for a year has served as the bottom range boundary. If the dollar stumbled through that, it would be fatal. Remember that summer historically is a low season for precious metals, slow and quiet usually. Only upcoming event that might change that is Brexit. If the British vote to leave the EU, the euro & pound sterling will tank and gold and the dollar should soar. SPECIAL OFFERS Here are two Special Offers, based on spot gold at $1,244.40 & spot silver at $16.377 SPECIAL OFFER No. 1: SWISS TWENTY FRANCS When Napoleon Bonaparte took over France, he publicly burned the engraving plates that had been used to print the Revolution's inflationary paper money, and said, "I will pay cash or pay nothing." To his credit, he established a gold & silver money & never resorted to paper. On his 90% fine (21.6 karat) 20 franc coin containing 0.1867 tr. Oz. gold, was founded the Latin Monetary Union. All the nations who joined that union minted their gold coins to the same standard: French 20 francs, Swiss 20 francs, Belgian 20 francs, Italian 20 Lira, Greek 20 drachmai, Serbia, Bulgaria, Albania, and on and on. 20 Franc coins remain among the most popular and common in the world, traded all over the globe. I have sixteen lots of ten each SWISS 20 francs, the "Helvetia." I am offering them at $246.00 each, a 5.9% premium over their gold content, based on spot gold at $1,244.40 One lot contains Ten (10) Twenty franc gold coins at $246.00 each or a total of $2,460.00, plus $35 shipping for a total of $2,495. I have only 16 lots, and, YES, you may order multiple lots. Offer good only while supply lasts. Ordering multiple lots? We charge shipping only once. The last order filled will include One (1) Belgian or French 20 francs & 19 Swiss. OFFER NO. 2, GOLD KRUGERRAND The clever South Africans revolutionized the gold coin world when in 1967 they introduced their Krugerrands, 22 karat (91-2/3% pure gold) containing exactly one ounce of fine gold. It took the world by storm. Today Krugerrands are $15 - $25 cheaper than American Eagles, minted to exactly the same specifications but with a different impress. I have six lots of five coins each at $1,293.00 each (a 3.9% premium), or $6,465.00 per five coin lot, plus $35 shipping for a total of $6,500. Ordering multiple lots? We charge shipping only once. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. Sorry, we will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will delay your email. Your email must include your complete name, address, & phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail, till supply is exhausted. 4. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 5. You must send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. Sorry, no credit cards. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. Secrets From the Reagan Revolution, Part II Posted: 07 Jun 2016 02:40 PM PDT This post Secrets From the Reagan Revolution, Part II appeared first on Daily Reckoning. Above the initials ZU, we are dealt with as follows: "Your beloved Ronald did more damage to the U.S. than any other politician in the history of the country." The reader refers to our interview yesterday with two men who played prominent roles in Ronald Reagan's 1980 election, Elliott Curson and Jeff Bell. No small feat that, working more damage than any other politician in the history of the country. The competition is brutal, and Olympic-level. But continue: He moved the Republicans to a party based on reactionary social issues as a smoke screen to cover preferential treatment of the mega-wealthy. Now we have an oligarchy, and never in history has an oligarchy peacefully given up power. In a sense, he single-handedly undid the American Revolution. Of course, for the few extra dollars you received in tax savings, you will all look the other way and either make believe this never happened or blame it all on those “evil socialists”! We don't seem to recall receiving much in the way of tax savings. Regardless, we don't blame "evil socialists" for the American body politic's indifferent state of repair. No, we cast a much wider net. And many of the leading suspects precede Ronald Wilson Reagan. Some by a good deal. Another president with a "Wilson" in his name springs to mind. That one signed the Federal Reserve into existence over 100 years ago. He also horse-collared America into the war to end all wars. That led to "the peace to end all peace." And in the spirit of bipartisanship, it was Nixon who severed the dollar's tethering to gold. Today the U.S. national debt clocks in at $20 trillion. Coincidence? But perhaps we shouldn't be too hard on anyone in particular. We are all slaves to the circumstances of our day. And no one can calculate the effects of their actions to more than one or two decimal points. History is read backward but lived forward. "Institutions have a way of evolving over time," our co-founders Addison Wiggin and Bill Bonner write in their best-seller Empire of Debt. "After a while, they no longer resemble the originals. Early in the 21st century, the United States is no more like the America of 1776 than the Vatican under the Borgia popes was like Christianity at the time of the Last Supper, or Microsoft in 2009 was like the company Bill Gates started in his garage." No, it isn't… Below, Part II of our conversation with Elliott Curson and Jeff Bell. You'll find more about Ronald Reagan's battle with his party establishment, David Stockman's role in the Reagan White House, the coming showdown between Donald Trump and Hillary Clinton and more. Read on… A conversation between Brian Maher, Elliott Curson and Jeff BellBrian Maher: Yesterday, we talked a lot about the campaign ads you two gentlemen produced for Ronald Reagan in 1980. They turned his campaign around, and many credit those ads for saving Reagan's candidacy. We also talked about Reagan's advocacy of a gold standard and some of the resistance he faced from the establishment. Reagan even filmed a pro-gold campaign ad that he asked not be aired because he didn't want to alienate certain people. Today we're going to get a bit more into Reagan's agenda, and who opposed it within his administration. We'll also see where our own David Stockman fit into all this. Then we'll talk a bit about this year's election and the leading candidates. Jeff, it seemed like the Republican Party establishment tried to block a lot of Reagan's economic agenda right off the bat, especially his supply side economic agenda. Jeff Bell: That's true. They didn't like a lot of what Reagan had in mind. At one point, they tried to have the 3-year tax cut of 10% a year changed to 1 year tax cut at 10%, for example. Brian Maher: They thought tax cuts were inflationary. That was one of the main arguments. Jeff Bell: Yes, they did. It's hard to imagine that letting people keep more of their money was going to kick off a major bout of inflation. Of course, it didn't. What it did do was cause a huge rally in the dollar. Cutting taxes helped with the inflation problem by strengthening the dollar so much. The dollar actually had to be brought back down to planet Earth in the 1985 Plaza Accord, negotiated by Treasury Secretary James Baker. Brian Maher: Who would you say were the main obstacles to Reagan's economic plans? Would you care to name some names in the Republican establishment who really stood in his way? Jeff Bell: There were so many, including people in the administration, that it's just hard to single anyone out. It's probably better to tell you who in the high command liked the economic plan rather than who disliked it. I should mention that David Stockman lost enthusiasm for supply side economics and went over to the other side. That was probably because he was the Budget Director and didn't want the deficit blowing up on his watch. For a combination of reasons, David stopped being an advocate of the tax cuts. Some of the White House staff were not that enthusiastic. The center of advocacy of the economic plan was in the Treasury Department led by Don Regan. Brian Maher: Let's stick with David Stockman for a second. We have a relationship with David here at The Daily Reckoning and he's written extensively about his experiences in the Reagan White House, plus and minus. How was your relationship with him, Jeff? Jeff Bell: I got to know David quite well. I remember I drove down from the New York area to Washington one time. We talked the entire time. I think it was right after the election, and he was heading into a big meeting with Reagan and his advisers. So I was briefing him on the various players, who was good, who wasn't so smart, who to watch out for, etc. I felt very close to David. I got to talk to him a lot at the Republican convention in '80. To the naked eye, Dave was a big supporter of Jack Kemp's supply-side economics. It could be that he pulled away from it because of the nature of the position that Reagan had chosen for him, which was Director of the Office of Management and Budget. That put him in charge of the federal budget. And his primary interest was to cut the federal budget. Others of us emphasized cutting taxes over spending cuts. I think David always understood that government money-printing is the original sin of monetary policy. He still has a very dark view about political elites and what can be expected from them. I'm a little more optimistic. I just think that something like the Trump nomination poses as many opportunities as it does dangers. Brian Maher: Trump, ha, we'll get to him in a minute. Sticking with Stockman for the moment, you'd agree that he was more interested in budget cuts initially than the tax cuts, correct? Jeff Bell: That's for sure. I guess you could say that was his beat. Obviously, the tax cuts are the things that people are going to remember. I think he did a good job in keeping domestic spending under control. Brian Maher: If you read David these days, he lowers his horns against what he calls the whole bubble finance crony capitalist scheme on Wall Street. Jeff Bell: Yes, it's very interesting. And he brings a lot of passion to his work. After a certain time, even the real growth is going to start to disappear if everything gets bound up with bubble economics. It doesn't seem like it can go on forever, that's for sure. Brian Maher: OK, getting back to Reagan, did anyone lead him astray or sabotage him? Did Bush have anything to do with it? Jeff Bell: No. I think Bush, as vice president, Bush was a team player. He didn't try to step on Reagan. Others did. Others were very skeptical of Reagan, including many in Congress. But Bush was not a problem as his vice president. Reagan picked him and he immediately changed his position on abortion. He also changed his position on the tax cuts, which he'd earlier called voodoo economics in the primaries. He was a team player. I don't think Mr. Bush was particularly an ideological man, but he was loyal to Reagan as his vice president. Brian Maher: What about others like Don Regan and James Baker? Jeff Bell: Regan was an important player. Baker did a great job as Secretary of the Treasury. Jim Baker is the first to say that he was skeptical of Reagan's economic agenda and his tax cuts. He has been Bush's campaign manager in the 1980 primaries. He was skeptical of Reagan's supply-side element, but he came around. He realized he has been wrong to be skeptical. As both Chief of Staff and as Treasury Secretary, he may not have fully understood or agreed with supply-side economics, but he pushed for both the tax cut of '81 and the Tax Reform Act of 1986. By then, he was Treasury Secretary and Regan had become Chief of Staff. The two of them were instrumental in getting those bills to fruition which, of course, cut the top rate on income from 70% to 28% over the Reagan years. That was an accomplishment so amazing and so unexpected at that time that I still marvel at it. Brian Maher: Was Reagan a great president? Jeff Bell: I think it's fair to say that he was … People who worked with him did not necessarily think he was a great man. What amazes me, in looking back on my experiences with him, was how many times he was right about things that his advisers didn't agree with. I mentioned yesterday the consensus against a confrontational policy towards the air traffic controllers. And when he walked out of the summit in Reykjavik with Gorbachev, none of his advisers wanted him to do it, even the most conservative ones. Yet, he turned out to be right, again and again. He was very self-effacing. He wasn't a man who found it easy to be intimate. If you start getting into personal things, he might tell an old Hollywood story, a joke, but he was very thoughtful. He read a lot about ideas and political philosophy. That's what led him to drift away from the Democratic Party and towards being the leader of the conservative movement. One thing about Reagan was that he was very much in touch with his voters. Reagan answered a lot of his personal letters. He would get a lot of correspondence. I was with him when he was California governor for a few months in 1975. I couldn't understand why he would spend so much time answering his mail. I later realized that he didn't want to talk to politicians. He wanted to talk to average people who appealed to him, and he learned from them. His secretary, Helene Von Damm, actually produced a book based on these letters called "Sincerely, Ronald Reagan". The Panama Canal issue was another example of Reagan connecting directly with voters. That's not one that Reagan started out wanting to emphasize, but when he would mention the giveaway of the Panama Canal, the audiences would explode. He realized he had touched some kind of nerve. It wasn't that the Panama Canal was an all-important issue. It's just that it symbolized, for a lot of voters, what was going wrong in the Cold War, that we were giving away too much. Now Trump is in many ways doing the same thing, with the way the immigration issue resonates with a lot of his followers. You can just see the wheels turning in his head when he's addressing one of his rallies. Elliott Curson: I had a feeling with Reagan that he didn't have to become President of the United States to feel good about himself. He was secure with who he was and the presidency didn't define him the way it might define others. Brian Maher: His name keeps popping up here, so let's finally get to Donald Trump. Elliott, let's say Trump comes to see you tomorrow and asks you to do an ad. What would be your advice for him? Elliott Curson: I'd say look at the commercials we did with Reagan in 1980. Would you be open to doing the same thing, explaining issues without shouting and screaming? That's what he does in his commercials now. The good thing about Trump is that he communicates. He gets straight to the point. He's not afraid. He's not trying to play it down the middle so he can reach everybody. He knows he's not going to win everybody. He says, "I'm going to throw it out there. I'm going to see who follows me." There's a possibility that Trump could come around on an issue and say, "I was against this but I was wrong. This is what I think and this is what we have to do." That could possibly win him some converts. I think there's a correlation between Trump and Reagan in the fact that Reagan was always underrated. When he ran against Brown for California governor, the candidate the opposition wanted to run against was Reagan. They thought he was one guy they certainly could beat. They didn't. Then they said Reagan was unelectable as president in 1980. Wrong again. You can bet that a lot of Democrats were pulling for Trump to win the Republican primaries for the same reason. They figured he'd be a cakewalk in the general election. A lot of them might be having second thoughts about that now. Some polls are starting to show Trump slightly ahead of Hillary. Brian Maher: What's your take on Trump, Jeff? Jeff Bell: I think that people who are saying "Never Trump" are going to come around. For one thing, if they'd try to start an independent movement, they don't have a popular base. The establishment and the more conventionally conservative candidates didn't win the primaries. Trump won most of them. Cruz won 4 or 5. Rubio, the only one he won was the Puerto Rico primary. The only one that Kasich won was his home state. It's all coming down to a race between Trump and Hillary. A lot of the more conservative voters who were saying, "Never Trump" have to choose a side. Elliott Curson: One more thing, if I may. I would say to Trump, if I was doing his campaign, let these other people come in. Give them a face-saving reason to join your team. Throw them a bone, so to speak. Brian Maher: OK, Elliott, what if Hillary Clinton comes to you tomorrow and asks you to run a campaign commercial for her? Assuming you'd want her to be elected, what would be your advice? Elliott Curson: The same advice for any campaign, really. I think Hillary has so much baggage, aside from all the negative publicity about the e-mail scandal, and we don't know how that's going to turn out. But when people see her, she's always shouting, which is very unnerving, very disconcerting. The first thing an advisor has to do with Clinton is to make her look human because she has a hard time relating to people. She has a very difficult time getting people to believe her on anything. Her focus isn't clear and she's all over the place. She has to know what she stands for before any consultant could help her. Brian Maher: Hillary probably thought she was going to cruise into the nomination with no resistance. She did not count on the Bernie uprising. It's made her work a lot harder than she intended. Elliott Curson: That's because Sanders comes across as authentic, as Reagan did. They feel that he says what he believes, not what he thinks people want to believe. Everything about him is so apolitical. Brian Maher: One of our editors, Jim Rickards, thinks there's a chance that Hillary might not even make it to the nomination because of the e-mail scandal. Even if she doesn't get prosecuted, this could be enough bad press surrounding it that she may have to ultimately drop out. He thinks they're keeping Joe Biden on ice in case she doesn't make it to the finish line. Elliott Curson: Well, Joe Biden has said he's not a candidate, but who knows, really. Obama is staying right by Biden's side. He's glaring down on him like a kid who did something wrong. He thought Biden would carry on his legacy. Also, I noticed that Al Gore hasn't come out to endorse anybody. He said I will support the Democratic nominee, but maybe he feels that there's a chance he could get in. Jeff Bell: Having run for office before is usually a plus because candidates know the process. Of all the candidates, Hillary is the only candidate who had run before. Everyone was a first-time candidate on the Republican side. It's highly unusual for somebody in Republican presidential politics to win the nomination without experience. It's usually somebody who had run before and finished second, or somebody with a big name. Thinking ahead to the general election, we've seen exit polls from the Democratic primaries where about a fifth of the Sanders' voters said they'd vote for Trump. It shows that voters don't want more of the same. They want to try something new, and that plays right into Trump's hands. I just don't think that Hillary lines up with the political mood of 2016. Elliott Curson: I agree with that. There is that anti-establishment feeling among the Sanders voters as well as Trump backers. Brian Maher: Well, we've covered a lot of terrain here. Reagan, gold, Trump, Hillary and more. I appreciate you two gentlemen taking the time to join us today. But one last thing before you go. Who is going to win the election this fall? Elliott? Elliott Curson: My crystal ball is in for repairs. Brian Maher: Taking the fifth, eh? OK, how about you, Jeff? Jeff Bell: I've been wrong about so many things in the last year, I'm officially out of the prediction business. But if I had to guess, it's not going to be Hillary, it will be Trump. But I'm ready to be surprised because life is more fun that way. Elliott Curson: I certainly wouldn't rule Trump out. Brian Maher: Elliott Curson, Jeff Bell | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jun 2016 01:44 PM PDT Bank of Montreal warns against other banks in gold businessBy: Chris Powell, Secretary/Treasurer, GATA Dear Friend of GATA and Gold: A year ago February, Bank of Montreal announced plans to start a physical gold fund – http://www.reuters.com/article/us-bank-of-montreal-gold-idUSKBN0L80BQ201… – and today the bank filed a prospectus with the U.S. Securities and Exchange Commission signifying intent to... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Sorry, Janet… But You’re No Hero Posted: 07 Jun 2016 01:33 PM PDT This post Sorry, Janet… But You’re No Hero appeared first on Daily Reckoning. BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn't throw in the towel in a whimpering surrender to superior force. Instead, he used his famous "rope-a-dope" technique. He let the feds wear themselves out punching him until he was ready to fight again. Ali could have joined the army. He would have been a celebrity in uniform, like Elvis, doing PR work for the Pentagon. Far from the hot sweats of Da Nang and the Mekong Delta, he would have been a cool spokesman and ambassador for the emerging empire… helping the U.S. military gin up support for its dead-head war in Southeast Asia. By refusing to go along, Ali, the world boxing champ, had everything to lose and nothing to gain. It was just a matter of principle. "I ain't got no quarrel with the Viet Cong," he said. The blabbagentsia back home accused him of being unpatriotic. The feds said he was a lawbreaker. But coming into focus is a different picture of what heroism is all about. And it calls into question whether patriotism and do-goodism are just forms of cowardice… and whether Bernie Sanders is a sanctimonious grump. But this is a deeper subject than we manage today. Besides, we won't have time to read all the howls of protest from readers. Instead, we jump for solid ground… Smack in the FaceAs you recall, dear reader, we believe the Fed will never "normalize" interest rates. We got a quarter-point bump in December. Then nothing. Fed chair Janet Yellen had let it be known that another rate hike might be coming this month. But then, on Friday, the big U.S. jobs report came out. Reported the Financial Times: "Weak jobs growth is 'smack in the face' for U.S. economy and Fed rate increase." Instead of the 160,000 new jobs that were widely expected in May, nonfarm payrolls rose by a seasonally adjusted 38,000. Plus, the Bureau of Labor Statistics revised the figures down for March and April, too, dealing another blow to the optimists at the Fed. When you don't want to do something, you find plenty of reasons not to do it. In the present case, the Fed doesn't want to normalize interest rates. Under a classic gold standard, interest rates go up and down depending on supply and demand. When the supply of savings goes up, and other things remain as they were, interest rates should go down. Then when the lower interest rates do their work… and economy heats up… the demand for credit increases, too. Again, assuming other things remain as they were, the price of credit – interest rates – should go up along with it. Supply and demand move in cycles. High interest rates encourage savings… which add to the amount of available credit… which depresses interest rates. Then the lower interest rates discourage saving… until the price of credit goes back up. Up, down, constantly correcting on both sides. That's the way it's supposed to work. No need to remind us that it hasn't worked that way for a long time. The Fed and its banking system now create credit (money) out of thin air; savings have nothing to do with it. The corrective feedback loop we have just described no longer works. Not only can the feds manipulate the price of credit… but also they can do it for a long time, severely distorting the whole system. Then, blind and crippled, the economy barely limps along… always in danger of tripping and falling. No way is Ms. Yellen going to stick out her foot. Yellen's BacktrackHere's the Fed chief, speaking yesterday, as reported by Bloomberg:

Ms. Yellen and her predecessors have conducted the largest experiment ever in monetary central planning. Since 1998, central banks have increased their balance sheets (which serve as the world's monetary footings) by 1,600%. And last week, the total amount of debt trading at negative yields went over $10 trillion. We sit on the edge of our seats and wonder what will happen next. Normalization? Nah… Janet Yellen, Ben Bernanke, Alan Greenspan – they have been called the "heroes" of the world monetary system. Are they really? Did they face up to the debt problem? Or dodge it? More to come… Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post Sorry, Janet… But You’re No Hero appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Agenda For Bilderberg 2016 Posted: 07 Jun 2016 01:00 PM PDT In this video Dan Dicks of Press For Truth breaks down the agenda that the Bilderberg group just published. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Crash Of All Crashes Is Headed Our Way Posted: 07 Jun 2016 10:30 AM PDT The Crash Of All Crashes Is Headed Our Way The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Bilderberg 2016 Security Perimeter Erected To Protect Globalists Posted: 07 Jun 2016 10:00 AM PDT Quick video of the preparations being made for Bilderberg 2016 being held in Dresden Germany The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| We’re Ready to Hike Rates, But It’s Just Not Time Yet! Posted: 07 Jun 2016 09:44 AM PDT This post We’re Ready to Hike Rates, But It’s Just Not Time Yet! appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a Tom terrific Tuesday to you! Today I’m ready and willing to take on Janet Yellen’s latest speech, and show you some data that will have you believing you see the train pulling out of the station and heading to recessionville. Front and Center this morning, the currencies which as the morning went along gave up some of their Friday gains, but as Janet Yellen began to speak, and the dovish tone in her voice sent the dollar back down the slippery slope, the currencies gained back lost ground earlier in the day, and ended the day looking like they are ready to go on a long run. They are stretching and loosening up right now, but the long run appears to be on the agenda. And now, the time is near, and so it’s time for the June rate hike to face the final curtain. I told you yesterday that the Fed’s LMCI (Labor Market Conditions Index) was going to print and it has printed four consecutive months of declines. Well, make it five consecutive months now. The May LMCI fell 4.8 points, the largest monthly decline since 2009, and let’s not stop there, if you order in the next 15 minutes, I’ll tell you that the previous two months declines were further revised downward. I’m going to talk about Janet Yellen’s speech for a while now, so if you have no use for that, go ahead and skip ahead, but, I do believe you’re going to want to read what I have to say. I had to stop and laugh – laugh out loud at that – when I read yesterday, when Janet Yellen said that, “one should never attach too much significance to any single month report.” And I agree! Don’t I always say “one swallow doesn’t make a summer”? But come on Janet! “This one number” regarding the awful jobs print last week for May? Did they hide the fact that the previous two months saw HUGE downward revisions from her? Yes, the BLS had to back out some of their “adjustments” when they didn’t materialize to the tune of 59,000. But just playing along with the BLS, let’s just use the headline numbers from the BLS and in Feb job growth was 233,000, March it 186,000, April it was 123,000 and then May 38,000. Me thinks me detects a trend. And if I can see it (my wife contends I can’t see much!) then she can see it, and everyone else can see it, if they just take a step back, and look at the last four months, and then add in the last five months of the LMCI. They will see that this was not just a “one month” event. Remember, the trend is your friend, that is when you realize that it is a trend! In the end, I think the markets were surprised by her somewhat upbeat tone to her speech. She was very positive in her forecast for the economy, and saw “good reason to expect that the positive forces supporting employment growth and higher inflation will continue to outweigh the negative ones. So, in essence, she sees the expansion as continuing, labor markets continuing to be strong, and inflation moving toward 2%… In other words, the Fed’s bias to higher interest rates remains and recent soft economic reports have not changed her mind from this view. I do believe that the June rate hike is out, but if by some miracle on ice the economy rebounds and the data improves by the end of summer, she could be back in the rate hike business. But if the economy does what I suspect it will, and I have some validity to this statement later in the letter, I do believe that she’s not going to get that chance to hike rates this year, and in the end, she’ll be reversing the one rate hike from December. Is her “outlook” too Pollyanna? Well, let’s talk about what Chuck sees in the economy, vs. what Janet sees, because quite frankly, the Fed’s track record at making forecasts has been a bit shady in recent years, don’t you think? Green shoots anyone? In my recent interview with the Daily Reckoning I said that I believed that the U.S. was heading to a recession if not already there (at that time first QTR GDP was just 0.7%). Well, now one of the most respected economists in the world (in my opinion) David Rosenberg of Gluskin Sheff, recently put out a press release that “goods producing employment has contracted for four months in a row, with 77,000 jobs lost over the time period. That’s the kind of decline last seen in Nov. 1969, May 1974, Dec. 1979, Oct. 1989, Nov. 2000, and May 2007 – all of which predated recessions by an average of five months” I also read where the great economic mind himself, James Grant, thinks that we’re already in a recession. I’m talking about an “official recession”, the kind the NBER (national bureau of economic research) announces to the world. Because if we were just going by the numbers on the back of a cocktail napkin, I would say what I’ve said for seven years now, that we never really left the Great Recession. Sure there are no soup lines now, instead the unemployed get their pre-paid charge cards and checks in the mail, no need to go stand in line and receive the assistance. That might make them feel bad, and hurt their feelings. The currency traders have taken the Yellen speech, for what it is. I remain silent here, and let that sink in. The dollar is getting sold like funnel cakes at a State Fair this morning. The price of oil is knocking on the door to $50, but gold is off by $3 in early morning trading. The Dollar Index is back below 94, and everything is about as it should be this morning, except the price of gold. UGH! In a currency roundup from around the globe. The euro is soaring on the news that German Industrial Production just keeps pumping out great data. IP in Germany, the Eurozone’s largest economy, for April increased 0.8% and beat the forecasts, when compared to the previous month, which was revised upward by 0.2%! IP in Germany remains resilient, and is seeing a 6.9% increase in auto production. Given the Global slowdown, it’s amazing that German IP is so resilient, but then this goes back to everyone buying a new car, apparently it’s not just a U.S. thing. The Reserve Bank of Australia (RBA) left rates unchanged, and that caused a short squeeze in the Aussie dollar (A$) due to traders thinking that the RBA would opt to go back-to-back with rate cuts. But RBA Gov. Stevens said, that “In Australia, recent data suggests overall growth is continuing, despite a very large decline in business investment. Other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend.” And the A$ is best performer overnight! Pound sterling/pound, saw a roundtrip yesterday. OK, on Friday, the pound was 1.45 and change because the latest poll showed the “don’t leave” vote in the lead, then yesterday morning the pound had lost 1.5-cents on a weekend poll showing the “leave vote” in the lead, so guess what the latest poll showed? That’s right, that the “don’t leave vote” was back in the lead. And the pound is back above 1.45! I got a kick out of a headline story on Bloomberg, that said, “Pounds round trip shows trader fickleness as Brexit vote nears” See there? Haven’t I always told you that currency traders are “fickle”? In China, their latest report on their FX reserves showed that the FX reserves level fell $28 billion to $3.192 trillion. But most of the drain was caused by FX revaluations dropping, and not because the Chinese were spending reserves to defend the renminbi, or implementing any stimulus measures. I was sent an email from a dear reader, who forwarded an email that he received from a friend of his that lives in China. And the friend pointed out that the info that I had told you about with the steel tariffs increasing for Chinese steel sent to the U.S. was old news, that it had been announced in March. Hmmm… Well, I won’t argue with him on that, but I could have bet the farm that I read that it was just announced last week. Oh well, the fact remains the same, it was done, and I don’t think it was a good idea. And again, I’ll point out that trade wars have caused major problems for the country that started the trade war. And again, I’ll point out Smoot-Hawley. And President Bush attaching a huge tariff on Japanese steel right after he took office. And China continues to weaken the renminbi stealth-like. Small moves downward each night, keeps the wolves that want a stronger renminbi (like the U.S. and Eurozone), at the door. And with the dollar now seeing more days down than up, no one is for the wiser with regards to what China is doing, because everyone is focused on the dollar. The petrol currencies led by the Russian ruble, and followed by the Canadian dollar, Norwegian krone, and Brazilian real are all on the rally tracks this morning. The Central Bank of Russia (CBR) is scheduled to meet this week, and I don’t think that they’ll use this meeting as an opportunity to cut rates. Interest rates in Russia should remain very high, as inflation in Russia is real problem right now. And the Brazilian real continues to book gains vs. the dollar. I had thought that after the impeachment of Rousseff, that real traders would take some of the gains out of the currency. But that hasn’t happened, and now we’re getting closer to the Olympics. What does that have to do with the currency’s value? Ahhh, grasshopper, I’ve pointed this out before, but we’ve found that historically, when the Olympics come around the host country sees their currency rally. We saw it with Greek drachma, Spanish pesetas, and so on. So, I’m not saying that this is carved in stone, I’m just saying that historically this has happened, and it could happen again. Gold gained $4 yesterday, and is down $3 this morning, so, if things remain unchanged today, and they won’t, but if they did, the two days would be a wash. I’m surprised by gold’s inability to add on by large chunks to the $33 move on Friday. One would think that all that manipulation getting gold down by nearly $100 in May was over with, as we turned the calendar to June. Oh well.. demand for physical gold and silver is strong, and eventually, there’s going to be investors that want gold and can’t find it, is how I see things working as we go along and the Central Banks of the East continue to horde physical gold production. The U.S. Data Cupboard has the Productivity data for us today, and the Consumer Credit (read: debt) numbers. Productivity has become a real “key word” for economists, and once again it was the kind of talking about productivity, Big Al Greenspan himself, that got everyone talking about it again. Productivity has dropped here in the U.S. and Big Al says that this is something that will hurt the U.S. economy. Was it “Good Al” or “Bad Al” that said that? I’ll let you decide. I have nothing but warmth in my heart for Al Greenspan. NOT! Almost had you there didn’t I? HA! For What It’s Worth. I found this yesterday, and it plays so nicely in the sandbox with the other things I talked about today, so I thought it would be quite appropriate to have it as my featured FWIW today. I found this on MarketWatch, and it’s about five things that could turn America into another collapsed empire, and can be found here, and for your snippet, I’ll just give you the introductory paragraph, and then list the five factors for you!

Chuck again. I found this article to be very interesting indeed, and would have to say that we’re borderline having all five truly entrenched. That’s it for today. I hope you have a Tom terrific Tuesday! And be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post We’re Ready to Hike Rates, But It’s Just Not Time Yet! appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Must Listen: The Economy Is Scheduled To Collapse The Second Half Of This Year: Bix Weir Posted: 07 Jun 2016 09:30 AM PDT Trump is already the leader of the conservative USA. Even if he gets cheated in the election. He doesn't need to be sitting in the White House to do it. He is the recognized conduit for the people. In fact, he is more dangerous to the power structure if he doesn't win. Because Americans will... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Willie NEW Interview Deutsche Bank Could Collapse Entire Bankıng System Posted: 07 Jun 2016 08:30 AM PDT Jim Willie NEW Interview Deutsche Bank Could Collapse Entire Bankıng System The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion, Texas Is Taking on a New Battle…Against the Entire Financial System Posted: 07 Jun 2016 08:24 AM PDT 200 men against 1,500 enemy troops. They were never going to win. They fought anyway. Everyone died. It’s a story that most Americans are vaguely aware of, but the tale of the Alamo is seared into the heart of every Texan. In losing the battle in such heroic fashion, the defenders rallied others to the cause, helping the Tejanos defeat the Mexican army in 1836. Like that, the country of Texas was born. Nine years later, the young nation joined the United States and became the only state to join the union by treaty. | |||||||||||||||||||||||||||||||||||||||||||||||||

| US Housing Market - It Looks Like the Dumb Money’s at It Again Posted: 07 Jun 2016 08:17 AM PDT New home sales just went up a staggering 16.6% in April. 619,000 new homes were sold – the most since early 2008 just before the worst of the housing meltdown, and the highest rate of growth in 24 years. So is this a sign that the economy is back on track? | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: Former Bank of England head joins Greenspan as gold advocate Posted: 07 Jun 2016 08:16 AM PDT By Michael J. Kosares In "The End of Alchemy," Mervyn King, the former head of the Bank of England, writes of central banks' frustration in dealing with the stagnant global economy. "Central banks," he says, "have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced." Similarly, former International Monetary Fund chief economist Olivier Blanchard was recently quoted in the Financial Times as saying: "And so the question is why is it, that with no fiscal consolidation and banks in decent shape, at least in terms of lending, and zero interest rates, we don't have an enormous demand boom? That is now the puzzle." ... ... For the remainder of the commentary: http://www.usagold.com/cpmforum/2016/06/07/former-bank-of-england-head-m... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| China paused monthly gold purchases in May after prices surged Posted: 07 Jun 2016 08:12 AM PDT By Bloomberg News China, the world's biggest producer and consumer of gold, took a break from adding bullion to reserves in May after prices soared 22 percent in the first four months of the year. The People's Bank of China kept assets unchanged after boosting them for 10 straight months through April following the disclosure of a 57 percent increase since 2009. Holdings had expanded 9 percent since the start of July to 58.14 million ounces or about 1,808 metric tons, according to central bank data. ... "I wouldn't read too much into one month of data but higher prices have probably played a role in the slowdown in accumulation," Simona Gambarini, a commodities economist at Capital Economics Ltd. in London, said by e-mail. "That said, the case for reserve diversification away from the dollar remains strong. With around a third of global government debt yielding negative interest rates, gold remains a valuable alternative." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-06-07/china-paused-monthly-g... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jun 2016 08:00 AM PDT Robert Wolf, outside advisor to President Obama, on the 2016 presidential race. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| #Bilderberg 2016 to decide on #Brexit and on #Trump Posted: 07 Jun 2016 07:28 AM PDT "Bilderberg" 2016 "European Migrants, Trump, Riots, Brexit Can Bilderberg stop Donald Trump from being President as they meet in Dresden, Germany The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Surge After Poor Jobs Number, Increased Risk Of BREXIT Posted: 07 Jun 2016 06:53 AM PDT Gold prices surged nearly 3% after the very poor jobs number on Friday, have maintained those gains and appear to be consolidating as concerns about the U.S. economy and BREXIT deepen. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Former Bank of England head Mervyn King joins Alan Greenspan in advocating Gold Ownership Posted: 07 Jun 2016 06:44 AM PDT In The End of Alchemy, Mervyn King, the former head of the Bank of England, writes of central banks’ frustration in dealing with the stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced.” Similarly, former IMF chief economist, Olivier Blanchard was recently quoted in the Financial Times as saying: “And so the question is why is it, that with no fiscal consolidation and banks in decent shape, at least in terms of lending, and zero interest rates, we don’t have an enormous demand boom? That is now the puzzle.” | |||||||||||||||||||||||||||||||||||||||||||||||||

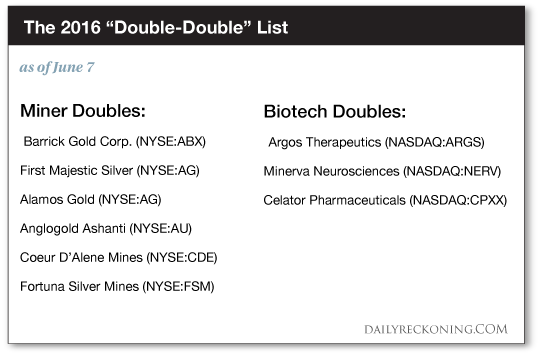

| These Stocks are Ready to Double… Again! Posted: 07 Jun 2016 06:44 AM PDT This post These Stocks are Ready to Double… Again! appeared first on Daily Reckoning. Yesterday, we discussed one of the most important forgotten laws of the stock market: stocks that have already doubled are more likely double again. And with the major averages surging this week, it's time to turn our attention to breakouts. In a breakout market, you want to pounce on these potential "double-double" stocks as they harness the momentum surge from a deluge of eager buyers. If you're serious about attempting to double your money with a single long-term trade, pay close attention. But be warned: What you're about to learn isn't your grandfather's value strategy… I know it's not easy buying stocks that have already generated triple-digit returns. Pulling the trigger on a stock that's jumped from $10 to $20 in less than 12 months can feel like a suicide mission. It's not. Here's the truth: You're far better off harnessing the momentum of a trending stock than scouring the sewers for a "cheap" play that could take years to even find a floor—if it ever does. It's no secret that the stock market hasn't been very cooperative this year. But the prospects of the major averages are improving by the hour. Riskier assets are catching a bid. Breakouts are starting to stick. It's time for you to take action… You already know that only one S&P 500 component has doubled so far this year. That stock is Southwestern Energy Company (NYSE:SWN). The fact that an energy company holds this lonely post is somewhat surprising. While many energy companies have lifted off their lows, it's important to remember that they took a beating during the first six weeks of the year. Crude didn't bottom out until February—and many of these stocks are still fighting off their January losses. On the other hand, mining stocks are having a field day thanks to a little calendar kismet. Precious metals stormed out of the gate to start the year and haven't looked back. So as we build our list of doubling stocks I promised I'd share, you'll immediately notice that most are in the mining biz. Another standout sector is biotech. These two sectors don't have much in common—except that both have endured painful bear markets as recently as 2015. But that's not stopping them from dominating our "double-double" list. Check it out: