Gold World News Flash |

- Gold Mixed Signals or a Clear Path Forward?

- Hillary’s Email Revelation: France and US Killed Qaddafi For His Gold And Oil

- Gold, Silver, Bitcoin, & The Dow Market Trading

- Goldman Finds That China's Debt Is Far Greater Than Anyone Thought

- Weekend Edition: The Tipping Point Is Quickly Approaching

- In The News Today

- Time Is Short To Kick Your Prepping Into High Gear – Food, Medicine Shortages Indicate The End Is Here

- The Structure of Collapse: 2016-2019

- The Startling Truth About How Working Families Are Truly Faring In This Economy

- Von Greyerz mocks U.S. employment reports

- Who Has Donated The Most Money To Bernie Sanders: The Unemployed

- TITANIC MATH 101

- Gerald Celente Predicts Imminent Global Economic Collapse 2016-2017

- Tom Horn & Steve Quayle EMP attack, Nibiru & AntiChrist

- First Majestic Silver Soars

- Collapse 2016-2019: When Will the Recession Start? Deutsche Bank's Disturbing Answer!

- Swiss voters 'reject basic income grant for all'

- "Apocalyptic Weather" Hits USA From Washington DC To California

- WARNING: SATANIC CALENDAR FOR JUNE EXPOSED!

- 17 y/o YouTuber faces years in jail for insulting Islam and Christianity #FreeAmosYee

- Traders Panicking EVerywhere, Gold Chart

- The Christian Whistleblower, Jeffrey Daugherty

- "Illuminati Exposed" | New Age Deception and The Galactic Federation of Light

- Breaking News And Best Of The Web

- Top Ten Videos — June 5

| Gold Mixed Signals or a Clear Path Forward? Posted: 05 Jun 2016 11:41 PM PDT Last week’s opening paragraph: “If we are going to highlight improving fundamentals, which we did as gold out performed commodities and stock markets, then we also have to highlight and respect eroding fundamentals; no ifs, ands or buts.” This week’s opening paragraph: If we are going to highlight eroding fundamentals, which we did as gold under performed commodities and stock markets and Semi Equipment made an early positive economic indication, then we also have to highlight and respect improving fundamentals; no ifs, ands or buts. |

| Posted: 05 Jun 2016 11:01 PM PDT Goldpreises http://www.kopp-verlag.de/Gold:-10.000-Dollar%3f.htm?websale8=kopp-verlag&pi=952000&ci=000338 https://www.amazon.de/Gold-10-000-Dollar-Gary-Christenson/dp/3864453011 Gary... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Hillary’s Email Revelation: France and US Killed Qaddafi For His Gold And Oil Posted: 05 Jun 2016 10:00 PM PDT by The Resistance, Gold and Liberty:

During the 2011 Libyan uprising, the United Nations Security Council passed Resolution 1973 which called for a ceasefire and authorized military action to protect civilian lives. A coalition formed, centered around NATO with the March 17, 2011 passing of the Resolution. Its purpose — a so-called "no-fly zone" over Libya. The irony that the U.S.-dominated NATO military organization would be concerned with "protecting" Arab civilians is all too obvious since the United States is the nation most responsible for killing Arab civilians. The real reasons for the attack have been dealt with most directly by America's famous reformed "economic hitman," John Perkins. Perkins points out that the attack on Libya, like the attack on Iraq, has to do with power and control of resources, not only oil, but gold. Libya has the highest standard of living in Africa. "According to the IMF, Libya's Central Bank is 100% state owned. The IMF estimates that the bank has nearly 144 tons of gold in its vaults," Perkins wrote. NATO went there like modern Barbary Coast Pirates — to loot Libya's gold. The Russian media, in addition to Perkins, reported that the Pan-Africanist Qaddafi, the former President of the African Union, had been advocating that Africa use the gold so plentiful in Libya and South Africa to create an African currency based on a gold dinar. "It is significant that in the months running up to the UN resolution that allowed the U.S. and its allies to send troops into Libya, Muammar al-Qaddafi was openly advocating the creation of a new currency that would rival the dollar and the euro. In fact, he called upon African and Muslim nations to join an alliance that would make this new currency, the gold dinar, their primary form of money and foreign exchange. They would sell oil and other resources to the US and the rest of the world only for gold dinars," Perkins explained. |

| Gold, Silver, Bitcoin, & The Dow Market Trading Posted: 05 Jun 2016 09:30 PM PDT from CrushTheStreet: |

| Goldman Finds That China's Debt Is Far Greater Than Anyone Thought Posted: 05 Jun 2016 07:13 PM PDT When it comes to China's new credit creation, at least the country is not shy about exposing how much it is. To find the credit tsunami flooding China at any given moment, one just has to look up the latest monthly Total Social Financing number which include both new bank loans as well as some shadow banking loans. As we reported in April this amount had soared to a record $1 trillion for the first quarter ...

... although as we followed up last month, it tumbled in April as suddenly Beijing slammed the brakes on uncontrolled credit expansion. It is unclear why, although the following chart may have had something to do with it: increasingly less of credit created is making its way into the broader economy. No matter the reason for these sharp swings in credit creation, one thing that was taken for granted by all is that unlike China's GDP, or most of its "hard" macroeconomic data, at least its credit creation metrics were somewhat reliable, and as such provided the best glimpse into Chinese economic inflection points. That appears to no longer be the case. In an analysis conducted by Goldman's MK Tang, the strategist notes that a frequent inquiry from investors in recent months is how much credit has actually been extended to Chinese households and corporates. He explains that this arises from debates about the accuracy of the commonly used credit data (i.e., total social financing (TSF)) in light of an apparent rise in financial institutions' (FI) shadow lending activity (as well as due to the ongoing municipal bond swap program). Tang adds that while it is clear that banks' investment assets and claims on other FIs have surged, it is unclear how much of that reflects opaque loans, and also how much such loans and off-balance sheet credit are not included in TSF. By the very nature of shadow lending, it is almost impossible to reach a conclusion on these issues based on FIs' asset information. Goldman circumvents these data complications by instead focusing on the "money" concept, a mirror image to credit on FIs' funding side. The idea is that money is created largely only when credit is extended—hence an effective gauge of "money" can give a good sense of the size of credit. We construct our own money flow measure, specifically following and quantifying the money flow from households/corporates. Goldman finds something stunning: true credit creation in China was vastly greater than even the comprehensive Total Social Financing series. To wit: "a substantial amount of money was created last year, evidencing a very large supply of credit, to the tune of RMB 25tn (36% of 2015 GDP). This is about RMB 6tn (or 9pp of GDP) higher than implied by TSF data (even after adjusting for municipal bond swaps). Divergence from TSF has been particularly notable since Q2 last year after a major dovish shift in policy stance."

As Goldman concludes, its finding suggests that the Chinese economy's reliance on credit has deepened significantly, and adds that "our projection of China's debt/GDP ratio for coming years has turned more unfavorable as a result." * * * For those curious about the details, here's more from Goldman:

As the second chart from the top shows, M2 has become disconnected from loan creation in China. This has important consequences:

Goldman then proceeds to explain how it comes up with its own, adjusted, version of a comprehensive debt creation number in China, aka following the money trail. This process, while complex, can be summarized as follows:

And quantitatively boils down to the following: This is how Goldman explains the variation:

What about in 2016?

Goldman's conclusion, which probably does not need much explanation because it is simple enough: China's debt is far greater than anyone expected, is the following:

In other words, not only was China lying about everything else, it was also fabricating its broadest credit creation aggregate, with the underlying "new credit" number turning out to be far greater than anyone had expected (or believed). And for someone as traditionally conservative and Goldman to warn that "that the trend of China's leverage has probably deteriorated ", that "that the economy's dependence on credit has deepened significantly and that it likely needs sizeable flow of credit on a persistent basis to maintain a stable level of growth" and that "such a scale of deterioration certainly increases our concerns about China's underlying credit problems and sustainability risk", must mean that China's economy is about to fall off a cliff. Because once the rest of Wall Street catches up to Goldman's most striking observation that "the possibility that there is such a large amount of shadow lending going on in the system that is not captured in official statistics also points to regulatory gap, and underscores the lack of visibility on where potential financial stress points may lie and how a possible contagion may play out", then all those concerns about Chinese credit (and FX, and economic, and bubble) contagion will promptly return front and center to the global arena. * * * One final point: in recent days it almost seems that Goldman has been doing all in its power to precipitate a mini Chinese meltdown, whether short or long-term (recall "Goldman Unveils The FX Doom Loop: Turns "Outright Negative" On Yuan Due To "Weak Link"" from Thursday night). To be sure, the narrative over the past 6 months from everyone, has been "how stable" China has been. Well, Goldman just broke away from that very fragile game theoretical equilibrium in which everyone was desperately lying to preserve asset prices, by actually telling the truth and precipitating what will be the next crash. Why, we don't know. However, with China now the fulcrum in any local or global central bank decision, and also the underlying catalyst for any marketwide risk-off bout, we do know that what Goldman "discovers" and warns about, soon everyone else on Wall Street will do too, until it becomes common knowledge and risk assets reprice correspondingly. Trade accordingly. |

| Weekend Edition: The Tipping Point Is Quickly Approaching Posted: 05 Jun 2016 07:00 PM PDT from Casey Research:

Today and tomorrow, Doug will share his thoughts on this coming crisis…and why it will be much worse—and last much longer—than most people expect… "Making the chicken run" is what Rhodesians used to say about neighbors who packed up and got out during the '60s and '70s, before the place became Zimbabwe. It was considered "unpatriotic" to leave Rhodesia. But it was genuinely idiotic not to. I've written many times about the importance of internationalizing your assets, your mode of living, and your way of thinking. I suspect most readers have treated those articles as they might a travelogue to some distant and exotic land: interesting fodder for cocktail party chatter, but basically academic and of little immediate personal relevance. I'm directing these comments toward the U.S. mainly because that's where the problem is most acute, but they're applicable to most countries. Now, in 2016, the U.S. is in real trouble. Not as bad as Rhodesia 40 years ago—and definitely a different kind of trouble—but plenty serious. For many years, it's been obvious that the country was eventually going to hit the wall, and now the inevitable is rapidly becoming imminent. What do I mean by that? There's plenty of reason to be concerned about things financial and economic. But I personally believe we haven’t been bearish enough on the eventual social and political fallout from the Greater Depression. Nothing is certain, but the odds are high that the U.S. is going into a time of troubles at least as bad as any experienced in any advanced country in the last century. I hate saying things like that, if only because it sounds outrageous and inflammatory and can create a credibility gap. It invites arguments with people, and although I enjoy discussion, I dislike arguing. It strikes most people as outrageous because the long-running post-WWII boom has been punctuated only by brief recessions. After 70 years, why should it ever end? The thought of a nasty end certainly runs counter to the experience of almost everyone now alive—including myself—and our personal experience is what we tend to trust most. But it seems to me we’re very close to a tipping point. Ice stays ice even while it's being warmed—until the temperature goes over 32° F, where it changes very quickly into something very different. That point—economic bankruptcy accompanied by financial chaos—is quickly approaching for the U.S. government. With deficits over a trillion dollars per year for as far as the eye can see, the U.S. Treasury will very soon be unable to roll over its maturing debt at anything near current interest rates. The only reliable buyer will be the Federal Reserve, which can buy only by creating new dollars. Within the next 24 months, the dollar is likely to start losing value rapidly and noticeably. Foreigners, who own over 7.3 trillion of them (including T-bills and other IOUs), will start panicking to dump them. So will Americans. The dollar bond market, today worth $40 trillion, will be devastated by much higher interest rates, a rapidly depreciating dollar, and an epidemic of defaults. And that will be just the start of the trouble. Since the U.S. property market floats on a sea of debt (and is easy to tax), it's also going to be hit very hard, again, this time by stifling mortgage rates. The next step is up for interest rates. Forget about property owners paying their existing mortgages; many won't be able to pay their taxes and utilities, and maintenance will be out of the question. The pain will spread. Insurance companies are invested mostly in bonds and real estate; many will go bankrupt. The same is true of most pension funds. If the stock market doesn't collapse, it will only be because money is looking for a place to hide from inflation. The payout for Social Security will drop significantly in real terms, if not in dollars. The standard of living of most Americans will fall. This rough sequence of events has happened in many countries in recent decades, and they've survived the tough times. But it has the potential, at least in relative terms, to be more serious in the U.S. than it was in Argentina, Brazil, Serbia, Russia, Mozambique, or Zimbabwe for two main reasons. First, many people in those countries knew they couldn't trust their government and acted accordingly, even in contravention of the law, by accumulating assets elsewhere. So, there was a significant pool of capital available for rebuilding. Americans, on the other hand, tend to be much more insular, law-abiding, and trusting in their government. When they lose their U.S. assets, they’ll have lost everything. Second, those societies were significantly more rural than the U.S. is today. As in the America of 100 years ago, much of the population lived quite close to the land and had practical skills and habits that helped them get through the tough times. For 21st-century Americans, it’s a different story. Shortages and disorder are going to hit commuters who live in suburbs, and urban dwellers who think milk appears in cartons magically, like a ton of bricks. |

| Posted: 05 Jun 2016 06:38 PM PDT Jim Sinclair’s Commentary Mr. Williams shares the following with us. - As Happy Economic Data Evaporate, Chances for an FOMC Rate Hike and Perpetual Fed Propping of the Dollar and Stocks Will Diminish - Net of Downside Revisions to April, May Payrolls fell by 50,000 (-50,000), by More than the 35,000 Striking Telecommunication Workers; Full-Time... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Posted: 05 Jun 2016 06:30 PM PDT by Susan Duclos, All News Pipeline:

Stefan Stanford recently reported on a CEO’s warnings of upcoming shortages and how the U.S. government has been preparing the often-talked about bunker under the Denver International Airport according to UK news, but when we step back and look at other recent reports in conjuntion with those, we note shortages already occurring, from medicine to food, with multiple items reportedly increasing in price, and we are reminded of how quickly the end is nearing. ‘IT’ IS COMING SOONER THAN YOU THINK Mutiple experts have been issuing dire warnings for months about a number of potential disaster scenarios facing the U.S. from EMP, to a total economic or market crash. In line with those warnings we see today that a Marine veteran sent an emergency alert to Steve Quayle after speaking to a man that said he was a former “chief critical infrastructure advisor” to the pentagon, with the vet stating that after speaking to this man he was “sleeping far less than normal and having nightmares regularly.” A portion of what he related shown below:

Read the entire alert at Quayle’s website. We also note that recently Barack Obama offered a strange warning in recommending having an “evacuation plan” and a “fully stocked disaster supply kit,” ready, with his reasoning claiming it is to prepare for more powerful and devastating hurricanes, just one in many possibilities, in our opinion, of why everyone should be kicking their prepping into high gear.

MEDICINAL SHORTAGES In early May 2016 NPR reported on the critical drug supply shortage at hospital ER’s across America, where drugs for non-acute or chronic care have eased to a point, the shortage of drugs that “are essential in emergency care,” have increased in the same time frame. The FDA keeps track and lists drugs that are in short supply on their website, but recent reports of tuberculosis(TB) cases rising in America for the first time in 23 years, and measles outbreaks in the U.S., and other deadly diseases making a comeback due to the illegal immigration issue and a lack of proper medical screening with the Refugee Resettlement Program, along with reports from 2015 on shortages of drugs to treat things like TB, which is a highly communicable disease. We also just ran across a new report that drug to treat syphilis runs short as infection rates in LA County soar. These are just some examples of why we believe we will see widespread disease rip across the U.S. in the case of any upcoming event or disaster. The shortages in and of themselves indicate an economy that is breaking down. |

| The Structure of Collapse: 2016-2019 Posted: 05 Jun 2016 05:30 PM PDT by Charles Hugh Smith, Of Two Minds:

The end-state of unsustainable systems is collapse. Though collapse may appear to be sudden and chaotic, we can discern key structures that guide the processes of collapse. Though the subject is complex enough to justify an entire shelf of books, these six dynamics are sufficient to illuminate the inevitable collapse of the status quo. 1.Doing more of what has failed spectacularly. The leaders of the status quo inevitably keep doing more of what worked in the past, even when it no longer works. Indeed, the failure only increases the leadership's push to new extremes of what has failed spectacularly. At some point, this single-minded pursuit of failed policies speeds the system's collapse. 2.Emergency measures become permanent policies. The status quo's leaders expect the system to right itself once emergency measures stabilize a crisis. But broken systems cannot right themselves, and so the leadership is forced to make temporary emergency measures (such as lowering interest rates to zero) permanent policy. This increases the fragility of the system, as any attempt to end the emergency measures triggers a system-threatening crisis. 3.Diminishing returns on status quo solutions. Back when the economic tree was loaded with low-hanging fruit, solutions such as lowering interest rates had a large multiplier effect. But as the tree is stripped of fruit, the returns on these solutions diminish to zero. 4.Declining social mobility. As the economic pie shrinks, the privileged maintain or increase their share, and the slice left to the disenfranchised shrinks. As the privileged take care of their own class, there are fewer slots open for talented outsiders. The status quo is slowly starved of talent and the ranks of those opposed to the status quo swell with those denied access to the top rungs of the social mobility ladder. 5.The social order loses cohesion and shared purpose as the social-economic classes pull apart. The top of the wealth/power pyramid no longer serves in the armed forces, and withdraws from contact with the lower classes. Lacking a unifying social purpose, each class pursues its self-interests to the detriment of the nation and society as a whole. 6.Strapped for cash as tax revenues decline, the state borrows more money and devalues its currency as a means of maintaining the illusion that it can fulfill all its promises. As the purchasing power of the currency declines, people lose faith in the state's currency. Once faith is lost, the value of the currency declines rapidly and the state's insolvency is revealed. Each of these dynamics is easily visible in the global status quo. As an example of doing more of what has failed spectacularly, consider how financialization inevitably inflates speculative bubbles, which eventually crash with devastating consequences. But since the status quo is dependent on financialization for its income, the only possible response is to increase debt and speculation—the causes of the bubble and its collapse—to inflate another bubble. In other words, do more of what failed spectacularly. This process of doing more of what failed spectacularly appears sustainable for a time, but this superficial success masks the underlying dynamic of diminishing returns: each reflation of the failed system requires greater commitments of capital and debt. Financialization is pushed to new unprecedented extremes, as nothing less will generate the desired bubble. Rising costs narrow the maneuvering room left to system managers. The central bank's suppression of interest rates is an example. As the economy falters, central banks lower interest rates and increase the credit available to the financial system. This stimulus works well in the first downturn, but less well in the second and not at all in the third, for the simple reason that interest rates have been dropped to zero and credit has been increased to near-infinite. |

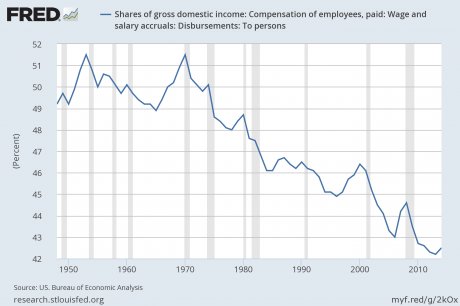

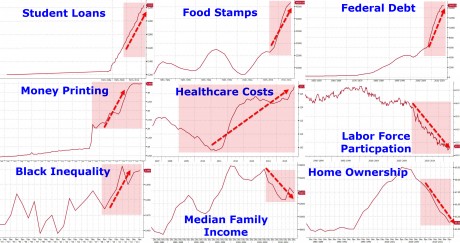

| The Startling Truth About How Working Families Are Truly Faring In This Economy Posted: 05 Jun 2016 05:15 PM PDT Submitted by Michael Snyder via The End of The American Dream blog, It is hard to live the American Dream when the deck is stacked against you. Our politicians stood idly by as millions of good paying jobs were shipped overseas, our economic infrastructure was absolutely gutted and multitudes of small businesses were choked to death by miles of red tape. Now, we are reaping the consequences. In America today, nobody has a job in one out of every five families, and there are more than 100 million working age Americans that are currency not working. And thanks to our transition to a “service economy”, many of those that are actually working are deeply struggling too. According to the Social Security Administration, 51 percent of all American workers make less than $30,000 a year. And the Federal Reserve says that 47 percent of all Americans could not pay an unexpected $400 emergency room bill without borrowing the money from somewhere or selling something. That means that about half the country is flat broke, and things get even more precarious for working families with each passing day. Of course the plight of working families is not something that is new. Back in the 1950s and 1960s, wages and salaries earned by workers accounted for around half of all gross domestic income. But since 1970 there has been a precipitous decline, and during the Obama administration we hit an all-time low. In other words, the share of the pie being enjoyed by working families just keeps getting smaller and smaller and smaller. All over the country, median incomes have been falling for years. This is putting an incredible amount of financial stress on working families, and we have seen poverty grow explosively in the United States during the last couple presidential administrations. According to one study, median incomes have fallen in over 80 percent of the major metropolitan areas in this nation since the year 2000…

Once upon a time, the middle class was a solid majority in this country. In fact, 61 percent of all Americans were considered to be middle class back in 1971. But now, the middle class in the United States is becoming a minority for the first time ever…

One of the big things that is destroying the middle class is the death of entrepreneurship. For decades, small business creation was one of the primary engines that helped fuel the growth of the middle class, but in recent years small business creation has fallen to depressingly low levels…

Of course just about every other economic indicator shows the dramatic decline of the middle class as well. As you can see from this set of charts from Zero Hedge, median family income, the labor force participation rate and the rate of homeownership are all way down over the last decade. Meanwhile, the U.S. national debt, the number of Americans on food stamps and healthcare costs are way up. Does that sound like a “healthy economy” to you? Unfortunately, this is about as good as things are going to get. A major new economic downturn is already brewing, and layoff announcements at major firms are running 24 percent higher this year than they were last year. The America that most of us grew up in is dying, and what we have seen so far is just the tip of the iceberg. I believe that much, much worse is coming. But our leaders just continue on with business as usual. They keep doing the same things over and over again, but they keep expecting different results. What they are doing to “fix” things is not going to work, and that should be exceedingly apparent to everyone by now. We need to start valuing working families again, and that means encouraging the growth of small businesses and encouraging the creation of middle class jobs. Sadly, we have already entered the early stages of the next great economic crisis, and so things are going to get a whole lot worse for the working class before there is any chance of them getting better. |

| Von Greyerz mocks U.S. employment reports Posted: 05 Jun 2016 05:00 PM PDT 8p ET Sunday, June 5, 2016 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz, interviewed by King World News, calls attention to the fraud of the U.S. government's employment reports, which fail pathetically to make a declining workforce look good. There will be no return to worldwide growth, von Greyerz adds, until the unsustainable and ever-growing debt burden is liquidated. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/legend-warns-crisis-is-going-to-spread-like-wil... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Who Has Donated The Most Money To Bernie Sanders: The Unemployed Posted: 05 Jun 2016 04:50 PM PDT The grassroots support Bernie Sanders has amassed throughout his campaign to become the Democratic presidential nominee is undeniable. Sanders has been supported by small-dollar contributions throughout his campaign, and since donors who give $200 or less don't have to have names publicized, little has been known about the donors. More than 1 million small-donor contributors gave nearly two-thirds of Sanders' funding. However, since Sanders relies on a fundraising tool called ActBlue, all donors must be disclosed regardless of the size of contribution. This has allowed the LA Times to perform an analysis on the donors behind the man who has given (and continues to give) Hillary Clinton so much trouble, and the result is stunning. The study found that many donors resemble Emily Condit, 40 of Sylmar, who has contributed three times, $5 each. Condit, who has several physical disabilities, is among the largest single group of Sanders' donors - those who don't have a job. Out of the $209 million given to the senator's campaign, about one out of every four dollars came from those not in the workforce, who include the unemployed or retired. For the last 15 years since Condit left a job at NASA, her ailments have kept her from working. She depends on Social Security and lives on a tight budget but has found money for Sanders because she was drawn to his populist message. "I know very well now what it's like to be a have-not, both financially and physically, and to fall through the cracks of society. Bernie Sanders is running on a platform to lift up the have-nots and to The study also found that Sanders received just 2% from Wall Street, which shouldn't surprise anyone. Because Sanders' backers tend to donate multiple times, the average donar gave a total of $96 - the typical donor gave three times, but some gave far more frequently. Not all were small however. Jeremy Abramowitz, a recent graduate from the College of William and Mary in Virginia, gave Sanders' campaign more than $5,000 in more than 200 separate donations. Abramowitz said he started sending money after reading negative posts about Sanders on Facebook, and lost track of how much he was giving. "When somebody said something that annoyed me, I'd give an extra dollar. It just all added up." - it's unclear if Jeremy is living at home and can afford to donate due to not having to pay any rent. So in an interesting if not incredibly ironic turn of events, Sanders is financing his campaign primarily through the government - and we have now come full circle. |

| Posted: 05 Jun 2016 03:30 PM PDT by Vic Patane, SRSRocco Report:

The long Memorial Day weekend provided some real excitement in the Bitcoin world. The Crypto's total market value increased by roughly $1.5 billion in less then a week. Silver; however, managed to misbehave, again (why not it's the rule on three-day weekends). Folks were clearly selling AG and buying Bitcoin. Just for fun, lets assume total above ground silver is in the range of 4 billion ounces. Furthermore, say 3 billion ounces represent actual physical bars and coins while the balance of 1 billion ounces is represented by market traded products, like SLV. At $16 silver total above ground silver value would be $64 billion. Is that a lot? Nope. You could do any ONE of the following:

Pay off most of Apple's debt leaving just $5.3 billion outstanding The math is just stupid, but stupid has been working for a long, long time. Finally because municipal bonds occupied far too many of my working days, I just wanted to share a true story. A dear friend, highly respected New York City attorney with an IQ multiples of mine shuns risk. His dad shunned risk twice as much. For years I offered to assist my buddy with his Dad's muni portfolio. "Nope", "but thanks, he does all his own stuff", "He's extremely conservative, wants his triple tax exemption and has to be able to sleep at night!" Pop recently passed away, he never owned stocks, or packaged products. But Pop did place the majority of his holdings in Puerto Rico municipals. My buddy just sold the last one at 16 cents on the dollar. For decades Wall Street's calling card was "buy the Implied Moral Obligation of the United States" when purchasing Puerto Rico municipals. "Who would ever let those go bad?" Many PR bonds were sold as secondary lien, certificates of participation and just plain junk and were always pushed to retail with the moral obligation talon. Even the sales commissions on PR debt were juicy and salesmen always got paid. The bonds, however paid for years and years then didn't. Buying stuff is always easy; selling however always requires another willing participant. What could go wrong? The point is the system is in its terminal phase of failure on all fronts, currency, debt and trust. Algorithms, no matter how powerful, can never be a substitute for trust. Without trust the system dies and quickly. |

| Gerald Celente Predicts Imminent Global Economic Collapse 2016-2017 Posted: 05 Jun 2016 03:00 PM PDT "The United State created only a mere 38,000 jobs in May, Gold jumps 30$ in value & "US companies hired at the slowest pace in 5 years". The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Tom Horn & Steve Quayle EMP attack, Nibiru & AntiChrist Posted: 05 Jun 2016 02:30 PM PDT Tom Horn & Steve Quayle EMP attack, Nibiru & AntiChrist The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 05 Jun 2016 01:03 PM PDT Zealllc |

| Collapse 2016-2019: When Will the Recession Start? Deutsche Bank's Disturbing Answer! Posted: 05 Jun 2016 12:00 PM PDT This is what JPM said: "This morning's employment report also raised the recession probabilities, although for counterintuitive reasons. We do not include the payrolls number in the recession model because it is subject to larger revisions than other labor market data. But the unemployment rate... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Swiss voters 'reject basic income grant for all' Posted: 05 Jun 2016 11:30 AM PDT Swiss voters have flatly rejected a radical proposal to provide to provide universal basic income grant to all citizens. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| "Apocalyptic Weather" Hits USA From Washington DC To California Posted: 05 Jun 2016 11:00 AM PDT Apocalyptic Era Has begun across the world including the United States of America The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| WARNING: SATANIC CALENDAR FOR JUNE EXPOSED! Posted: 05 Jun 2016 10:30 AM PDT EVERYONE, DON'T FORGET TOMORROW IS 6-6-16. STAY STRONG IN PRAYER. IT DOESN'T FALL ON THE SATANIC CALENDAR BUT OBVIOUSLY WE ALREADY KNOW THEY ARE PERFORMING RITUALS. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| 17 y/o YouTuber faces years in jail for insulting Islam and Christianity #FreeAmosYee Posted: 05 Jun 2016 09:59 AM PDT so now people cant have an opinion ? this is what all this is ! hes just giving his opinion on religion .big deal if he insults any religion .i bet if a muslims insults any religion ..i bet thats ok The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Traders Panicking EVerywhere, Gold Chart Posted: 05 Jun 2016 08:36 AM PDT I see traders everywhere panicking. People are acting like they’ve gotten left behind. Nothing could be further from the truth. While I’m skeptical that gold has made a final intermediate cycle low because it hasn’t dropped far enough to break the intermediate trend line yet, and the dollar should still have another leg up this month, the reality is that gold is only on day 3 of this daily cycle. |

| The Christian Whistleblower, Jeffrey Daugherty Posted: 05 Jun 2016 07:58 AM PDT All Abrahamic beliefs are dangerous totalitarian dogmas based on the biggest lie in human history and that is the creator talks to men and gave them his message to humanity ....that by itself is a nasty claim .... The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| "Illuminati Exposed" | New Age Deception and The Galactic Federation of Light Posted: 05 Jun 2016 07:38 AM PDT "Illuminati Exposed" | New Age Deception and The Galactic Federation of Light , There is a lot of information, and dis-information, conspiracy theory circulating the internet. Learn the truth about the 'Greater Darkness' in our world, today The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Breaking News And Best Of The Web Posted: 05 Jun 2016 12:00 AM PDT US jobs report misses big, stocks decline, gold soars, odds of interest rate hike fall. Car sales, oil prices, mortgage applications, US construction spending, China and Japan manufacturing all fall hard. Alhambra Partners on why apathy is a bigger risk than stupidity. Charles Hugh Smith on why pension funds (that is, your retirement) are doomed. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 04 Jun 2016 06:00 PM PDT David Stockman and Felix Zulauf on how we got ourselves into this mess. Lots of opinion on the return of the gold bull market. Gerald Celente sees the global bubble bursting now. Ray Dalio on the failure of current monetary policy and what has to happen next. Jay Taylor shows up twice. […] The post Top Ten Videos — June 5 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

With the recent release of Hillary Clinton's emails by Wikileaks, the public now knows exactly how the North Atlantic Treaty Organization (NATO) went from a collective defense organization to the new Barbary Coast Pirates of imperialism.

With the recent release of Hillary Clinton's emails by Wikileaks, the public now knows exactly how the North Atlantic Treaty Organization (NATO) went from a collective defense organization to the new Barbary Coast Pirates of imperialism.

Casey Research founder Doug Casey knows it sounds outrageous—and he’ll probably get a lot of backlash—but he believes every American needs to be concerned right now…

Casey Research founder Doug Casey knows it sounds outrageous—and he’ll probably get a lot of backlash—but he believes every American needs to be concerned right now… Looking through articles reported on locally, along with some stories reported on by the MSM nationally, as well as a couple of things recently highlighted here at ANP, we are seeing signs that time might be short to supplement prepping basics such as foods, water, medicines, precious metals, and other items that could be needed for survival or even for bartering purposes at a later date.

Looking through articles reported on locally, along with some stories reported on by the MSM nationally, as well as a couple of things recently highlighted here at ANP, we are seeing signs that time might be short to supplement prepping basics such as foods, water, medicines, precious metals, and other items that could be needed for survival or even for bartering purposes at a later date.

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system.

It is a great pleasure to offer my prospective to Steve and his readers. I'm not suggesting to compete with SRSrocco regarding his unparalleled level of diligence and fact finding yet perhaps I can add an additional perspective on certain topics.

It is a great pleasure to offer my prospective to Steve and his readers. I'm not suggesting to compete with SRSrocco regarding his unparalleled level of diligence and fact finding yet perhaps I can add an additional perspective on certain topics.

No comments:

Post a Comment