Gold World News Flash |

- Peter Schiff: “This Is the Match That Ignites the Powder Keg”: Gold Surges As Brexit Sparks Huge Financial Crisis

- Imports Collapse At East Coast Ports

- Rotten To The Core

- "The British Woke Up!" Paul Craig Roberts Asks "Can The Americans?"

- Gerald Celente: Global Economy On The Brink Of Record Collapse

- Brexit Aftermath - Here's What Will Happen Next

- Teachers Unions Vs Hedge Funds: The Battle Over Billions

- One American's True Story: "How I Went From Middle Class To Homeless"

- "Deutsche Bank Poses The Greatest Risk To The Global Financial System": IMF

- How BREXIT Changes Globalism, the NWO and the Alien Agenda

- Infographic - The Best Reasons To Own Gold

- Prophecy Update End Time Signs 6/29/16

- Gold Price Closed at $1323.90 Up $8.60 or 0.65%

- Brexit isn't end of the world, just end of elites, Embry tells KWN

- Gold Daily and Silver Weekly Charts - The Men Who Sold the World

- Biotech Is Floundering — But One Industry Is About to Explode

- BREAKING NEWS !! • DONALD TRUMP vs HILLARY CLINTON !! • BREAKING NEWS !!

- Goldmans Sachs rejects any blame for BHS collapse

- HILLARY CLINTON • VS • DONALD TRUMP !! #Hillary #DonaldTrump

- Here’s Who Made a Killing From Brexit…

- #Brexit and the Fate of the UK

- GLBAL ELITE WARN: "Brexit will BREAK UP the European Union & MUST be Stopped" - George Soros

- The World’s Ignoring the Biggest Breakout of the Year. Here’s How it Could Net You 40% Gains…

- Silver Wildcats Part 4 - A Murder of Crows

- The True Nature of Gold Is Liberty

- Breaking News And Best Of The Web

- Bond Mechanics in a Negative Interest Rate World

| Posted: 30 Jun 2016 12:30 AM PDT by Mac Slavo, SHTFPlan:

The crisis has reached a tipping point, and is about to unfold in a massive way. And with it, the price of gold will began to soar, as it serves a time-tested safe haven from extreme currency manipulations and, at least to some extent, global shock events. That's what economic expert Peter Schiff explains here in this crucial interview with Greg Hunter of USA Watchdog:

Financial expert Peter Schiff goes on to say, "This is going to be a huge crisis. Alan Greenspan was on CNBC saying this is the worst thing he has seen in his career. He's not talking about what has already happened. He's talking about what is about to happen. He understands how screwed up the economy is because he helped screw it up. . . . One of these days, you are going to see gold moving up at $100 clips routinely when people really perceive the dangers in the fiat world and come to grips with how much money these central banks are going to print. None of them have any integrity to honestly default, so they are going to take the coward's way out and print." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Imports Collapse At East Coast Ports Posted: 30 Jun 2016 12:00 AM PDT If anyone needed another indicator that global trade is collapsing, look no further than the latest Port Authority of New York and New Jersey report on loaded imports for May. On Tuesday the Port Authority of New York and New Jersey reported that May loaded imports fell to 268,861 twenty-foot equivalent units, down 4.7% y/y. The total volume of containers passing through the port fell by 6.1% in May as well. Additionally, other major ports saw y/y declines as well. As the WSJ reports, loaded import volumes fell 2.3% y/y in May at the Port of Virginia, and total volumes were down 4.7%. At the port of Savannah, the East Coast's second largest port of entry for goods after New York, loaded imports fell 5% y/y, while total throughput was down 7.3% the Georgia Ports Authority said. With imports imploding, ocean shipping lines have been reducing the number of regular service calls in recent months, a clear indicator that they believe demand will remain weak for the foreseeable future until the new school year begins, which is typically when imports peak. However, that may not be the case this year says Ben Hackett, CEO of Hackett Associates, LLC, a research firm.

Said otherwise, demand has slumped and companies have too much inventory as it is - which is precisely what we showed earlier this month when we reported that wholesale inventories had the biggest monthly jump in 10 months, with sales disappointing. The absolute spread between inventory and sales continues to remain wide And although the inventory-to-sales ratio did drop modestly in April, the only time this ratio was higher was in the immediate aftermath of Lehman * * * Just when the "everything is fine" narrative was on its last legs... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Jun 2016 11:00 PM PDT Submitted by Robert Gore via Straight Line Logic blog, Coercion is inseparable from corruption. When a group coerces with impunity, it steals from, lies to, defrauds, and enslaves the subjugated. The dominant group invariably develops a morally comforting ideology of its superiority and the subjugated’s inferiority. Such relationships are the essence of corruption. Every square inch on the planet is subject to the jurisdiction of one or more coercive regimes, with their attendant corruption and fraud. Trillions of dollars, euros, pounds, and yen, et al., are extracted from the productive and diverted to governments, who buy political support. Trillions more are borrowed. Central banks issue fiat debt units backed only by laws mandating their acceptance and extract funding for governments via the hidden tax of debt depreciation and the hidden theft of debt monetization and interest rate suppression. Regulation allows governments to reward cronies and extort and terrorize the unfavored. Perpetual wars benefit militaries and those who supply the armaments, with part of their profits recycled to those championing war. This is pervasive, legal corruption. One can only guess at the extent of sub rosa criminality, which may dwarf it. Last week’s Brexit vote, in particular financial markets’ reaction, underscore the corruption and fraud, and the inevitability of its failure. Brexit is a victory for Britain’s honest producers; those who work in districts far removed from The City, London’s financial precinct. They will be freed from onerous European Union mismanagement, bureaucracy, regulations, and taxes that have contributed to Europe’s economic stagnation, dearth of innovation, and persistently high unemployment, especially among its youth. The European Central Bank’s debt monetization and negative interest rates, while obscuring the sorry state of the European economy, have only made it sorrier. Chronic debt issuance has left many European governments, and their banks, which own much of that debt, one economic or financial crisis away from insolvency. British voters chose to free themselves from the EU albatross, although they will still be plagued by numerous home-grown albatrosses. The pound, euro, equity markets, and oil plunged, while perceived safe havens gold, the dollar, yen, and US Treasury debt rose. (The yen is not really a safe haven, but much of the world’s “carry” trades—borrowing to fund nominally higher yielding, but risky speculations—are funded at low Japanese interest rates. When those highly leveraged trades go south, margin calls create a demand for yen to repay the underlying loans.) There were telling details amidst the carnage. Continental equity markets, particularly those of Spain and Italy and their banks, suffered far larger percentage drops than the British stock market. The British, were they to remain in the EU, would be expected to help support the Europe’s southern tier. When the high and mighty sing the same tune—Great Britain needs the EU more than the EU needs the British—the opposite is assuredly true. The British economy has outperformed most of Europe’s sluggards. Trying to get a fix on large banks is always a crap shoot—their financial statements are usually next to useless—but it appears that British banks and their regulators took more steps to address the problems exposed by the last financial crisis than their continental counterparts and may better withstand the coming stresses. Then again, British banks were hit just as hard as continental ones in the two days after the vote. Never underestimate the petulance of humiliated Eurocrats, or other poobahs for that matter. What terrifies the Eurocrats is the virtual certainty that the British economy will outperform Europe’s after the Brexit. They may cut off their constituents’ noses to spite their own faces, erecting trade barriers against British goods and services, for which Europe’s consumers will pay the price. However, trade barriers are a two-way street. Britain is an important export market, especially for the de facto leader of the EU, Germany, so cooler heads may prevail, a hope expressed by Nigel Farage in a remarkable speech to the European Parliament. Can anything be more corrupt than the desire to gratuitously harm another to preserve one’s power? Such corruption is the rotten core of the global economic and financial system. Its pilots are determined to fly it into a mountain, but will fight to the death any attempt to wrest away the controls. The financial markets’ reaction to Brexit has been appropriate, but anyone expecting asset prices to take one-way rides down or up in the directions they were pushed by Brexit will be disappointed. Global finance and global statism are Siamese twins joined at the brain, a fact made abundantly clear during the last financial crisis. Heavily indebted governments depend on the machinations of central banks and the acquiescence of markets to perpetuate their economic misrule. Governments, in turn, coddle and succor their indispensable allies. Too big to fail, bail outs, and deposit insurance are their backstops for the inherent risks of fractional reserve banking, turning it into a heads-we-win, tails-the-taxpayers-lose proposition. Central banks provide emergency fiat liquidity on preferential terms—financial market “puts”; promote cartelization, and serve the constituent banks they were meant to regulate, acting as the banks’ agents within governments. Brexit is a shot across the bow, but it is only a shot across the bow. Financial asset prices will continue to be supported or suppressed as the powers see fit. There is not one price in the entire firmament of markets and finance that is not pegged to continuing regimes of corruption and fraud. To transact based on such prices is a bet that a rigged game will stay rigged. The belief that it will is understandable, but a house of cards must fall. Political winds—Brexit and what’s sure to follow—may blow this one over; it may collapse due to its structural deficiencies, or, most likely, some combination of the two will render it rubble. The important point is that rotten-to-the-core economies and finances, resting on foundations of coercion, corruption, and fraud, have to be rendered rubble before freer, more honest, and more durable structures can be erected. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "The British Woke Up!" Paul Craig Roberts Asks "Can The Americans?" Posted: 29 Jun 2016 07:35 PM PDT Authored by Paul Craig Roberts, In our time to be truthful is to be provocative. To write provocatively leaves little room for error or mistatement as today’s euphemism terms it. I could shill for the establishment and be wrong 98% of the time and nothing ever would be said about it. But there is no forgiveness for a provocative truth-teller. You have open inquiring minds and you want to know. Your motives are not to protect your illusions and delusions or to reinforce your emotional needs. This is why I write for you. If no one knows or respects truth, the world is lost. But it only takes a few to change the world. The cultural anthopologist Margaret Mead said: “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.” Change can be for better or worse. President Reagan and a committed few overcame the resistance of the CIA and military-security complex and reduced tensions among nuclear powers by negotiating the end of the Cold War with Soviet leader Gorbachev. During the reign of the last three US presidents, a few neoconservatives resurrected the nuclear tensions and took them to a higher level than at the peak of the Cold War. There are hopeful signs that the neoconservative drive to World War III can be derailed. It seems that finally the Russians have caught on that America is not the Holy Grail but a government reminiscent in its aggression of Nazi Germany. Hopefully, Russian countermeasures will make even the crazed neocons think twice. The British people, or rather a majority of those who voted, surprised the Establishment, which was confident of the success of its propaganda, by voting to save their ancient and distinguished country, the font of liberty, from disappearing into the EU, a dictatorship ruled by unaccountable appointees. The British had enough of that with kings and decided that the future did not lie in going backward. The British vote to exit the EU could bring the unintended consequence of unravelling the EU and NATO, thus reducing Washington’s ability to foment war. Americans need to decide that they, like the British, do not appreciate being led backward to worse times. The Clintons and the Republican Senator from Texas, Phil Gramm, led America back to Robber Baron days by deregulating the financial system. http://content.time.com/time/specials/packages/article/0,28804,1877351_1877350_1877330,00.html The senator was rewarded with a multi-million dollar banking job for overturning Great Depression era legislation that made financial capitalism workable. Americans need to understand that capitalists do not care if capitalism works for you as long as it works for them. The collapse of the Soviet Union, due to the arrest of Gorbachev by hardline elements in the Communist Party, gave rise to the American Neoconservatives, a double handful of people closely tied to the Israeli government. These few people have involved America, for Israel’s benefit, in 15 years of warfare that has destroyed seven counries, with the cost to Americans of approximately $7 trillion dollars, according to Joseph Stiglitz and Linda Bilmes. The obviously false excuse for this destruction of peoples and resources is the myth of “terrorism.” Most “terrorist events” in the US have been sting operations organized by the FBI in order to collect the multi-billion dollar bounty that Congress gives for preventing terrorist events. How best to keep this bounty flowing than to organize a terrorist event and prevent it? It is debatable whether such events as 9/11, the Boston Marathon bombing, Sandy Hook, San Bernandino, and Orlando are false flag events or drills staged by crisis actors and presented to the public as real. The debt associated with 15 years of Washington’s wars is now being used to attack Social Security and Medicare. The One Percent and their “free market” apologists are determined that the elderly will pay for the wars that enabled Israel to reduce Palestine to a ghetto and for the wars that enriched the profits and power of the military-secutity complex, while inflicting a massive refugee problem on Europe. If the British, or enough of them, woke up, perhaps something similar can happen in America. From many of you I hear your frustrations with family, friends, and associates who are content with what they hear from the BBC, Fox “News,” CNN, and the New York Times. Obviously, if everyone was intelligent and could think for themselves or even had time to consider what they are told, we would not be in the state that we are in. Our job is to get enough people into the habit of thinking for themselves that we have the few required to change the world. (“Few” is relative. In a country of 300 million people, “few” is probably several million.) Arguing with friends doesn’t work. Arguments generate hostility and competitiveness. Avoid arguing. Your friends and family do not know anything. They sit in front of Fox “News” and CNN. They are brainwashed. Perhaps one way to approach friends and family is to ask questions. For example, how can there be 103 casualties in Orlando and no visible evidence of the massive number of ambulances and EMT personnel necessary to deal with such a massive number of casualties? I asked my readers to help me prove the official story line, and no one could come up with convincing visible evidence. How can there be such a massive event without abundant evidence? How can powerfully constructed skyscrapers, built to withstand airplane collisions, suddenly explode allegedly as a result of minor asymmetrical damage and scattered low temperature office fires? How can the entire contents of the towers be pulverized when there is insufficient gravational energy to accomplish such pulverization? How is it possible that WTC 7 came down in free fall acceleration in the absence of controlled demolition? Why doubt that there was controlled demolition when the owner of the WTC said on TV (still available online) that “the decision was made to pull the building?” In case you have forgotten, you “pull” a building with controlled demolition. It takes a long time to wire a building for demolition. Obviously, Building 7 was not wired on September 11, 2001. We are constantly informed by the President, Vice President, Secretary of State, numerous senators and representatives, by NATO commanders, by EU politicians, by presstitutes, and others, that “Russia has invaded Ukraine.” Take a minute and think about this extraordinary lie. Clearly, evidence is no longer a factor in determining what is occuring. Assertion only rules. Take a second to look outside The Matrix. Is it really possible that Ukraine would still exist if Russia invaded? I would bet my life that within 60 hours of a Russian invasion of Ukraine, Ukraine would again be part of Russia. Remember August 2008 when the US and Israeli trained and equipped Georgian army invaded the peacekeeping realm of South Ossetia, killing Russian peace-keeping troops and Ossetian civilians. Putin was at the Beijing Olympics, but Russian armed forces quickly smashed the American/Israeli trained and equipped Georgian army. Putin held Geogia in his palm. What did Putin do after delivering this lesson in the superiority of Russian arms? He released Georgia and returned home. So how is it that Putin, according to the entirely of the Western political establishment and media whores, is determined to rebuild the Soviet Empire? Putin held Georgia. No power on earth could have forced him to release Georgia. But Putin withdrew Russia’s forces and released the country. The former Georgian president is now an American operative in Ukraine. If you consider the number of outsiders, including US citizens and the former president of Georgia, who serve in the Ukrainian government, it raises questions about the so-called “Maidan Revolution” in February 2014. If this really was a popular uprising, and not a Washington orchestrated coup, why is there such a shortage of Ukrainians to form the new government that foreign citizens have to be brought in to rule the country? Do not believe any official explanation of anything. Things are not true just because the government and presstitutes say so. Keep in mind that official explanations can be cover for hidden agendas. If Washington and the media have their way, we will live in a world constructed out of lies designed to hide from us the real interests being served. That is not the kind of world that any of us want to live in. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente: Global Economy On The Brink Of Record Collapse Posted: 29 Jun 2016 07:00 PM PDT from THElNFOWARRlOR: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit Aftermath - Here's What Will Happen Next Posted: 29 Jun 2016 06:45 PM PDT Submitted by Brandon Smith via Alt-Market.com, In my article 'Brexit: Global Trigger Event, Fake Out Or Something Else?', published before the U.K. referendum vote, I outlined numerous reasons why I believed the Brexit was likely to pass. As far as I know, I was one of very few analysts that stuck to my call of a successful Brexit right up until the day of the referendum instead of slowly backing away as the pressure of conflicting polls increased. My prediction was verified that evening. In my post-Brexit commentary, which can be read here, I then outlined why so many analysts in the mainstream and even in the liberty movement were caught completely unaware by the referendum results. Today, however, I now see hundreds of analysts using the same talking points I argued before the Brexit, but still missing the first and most VITAL underlying truth. The core reason why I was able to discern the Brexit outcome was because I accepted the reality that the Brexit does not hurt globalists — in the long run, it actually helps them. Now, I fully understand the excitement surrounding this event. For many people it was a complete surprise because they assumed that international financiers and the ever-pervasive global elites would do anything to stop it from happening. It feels like a kind of revolution; a pointy stick in the eye of the beast. While I applaud the people of the U.K. for their ongoing battle for sovereignty, I can assure you that the Brexit is NOT an obstacle to the plans of globalists. What is rather amazing to me is the number of people that, before the referendum vote, were arguing that the elites would "never allow" the Brexit to continue and were thoroughly convinced they would use their influence to disrupt it. Now, in the face of a successful vote, those same people now argue that the elites had no influence over the Brexit, and do not benefit from its passage. I would remind readers that it was actually "pro-EU" globalist puppet David Cameron himself that presented the prospect of a referendum to exit the EU. While some may argue this was bungling on the part of Cameron, I think this is a rather foolish notion. Cameron does what he is told like every other elitist owned politician. Furthermore, the behavior of internationalists leading up to the Brexit was rather strange, hinting to me that they were preparing for a Brexit surprise. Globalist financiers like George Soros jumped into the markets and bet in favor of stocks going negative, indicating prior knowledge. Hilariously, Soros' advisers are now playing damage control by claiming that Soros "lost money" on bets on the English Pound. While they admit he did "make profits" on all of his other investments due to the Brexit, they will not say what the magnitude of those investments were, nor have they provided evidence supporting any of the information they have given to the media on his losses on the Pound. Truly, a slapdash lazy play at spin control. The Federal Reserve’s Janet Yellen used the Brexit as the primary reason for the latest rate hike delay, mentioning that such conditions may have influence "for some time to come". This indicates she may have had prior knowledge of its coming passage. And the world’s central bankers all convened in Basel, Switzerland to take marching orders from their masters at the Bank for Internationals Settlements right before Brexit voting commenced, something they most likely would not do if the Brexit was destined to fail rather than prevail. Not only did the globalists through David Cameron originally introduce the concept of the Brexit vote, they also apparently knew that the U.K. referendum would succeed. As I originally stated in my prediction article:

Already, this narrative is being presented by internationalists in the aftermath of the referendum. Bloomberg writes that the Brexit “casts a dark shadow on the world’s great move to openness,” as if globalism is a bastion principle of free markets rather than the murderer of free markets and the outright tyrannical socialization and centralization of everything. European elites are out in droves admonishing the Brexit as a move towards dangerous nationalism and isolationism. The Chinese premier is in the media warning of a “butterfly effect” in global markets caused by instability in “certain countries,” obviously referring to the U.K. and the EU. His solution? He wants even more “enhanced coordination” among all the economies of the world (Interpretation: more centralization). EU officials only continue to strengthen my predictions by calling for an EU superstate in response to the Brexit; in other words, a completely centralized Europe. And, Bloomberg has reported on Mario Draghi's recent call for a "new world order" in response to the UK referendum in which central bank policies around the globe are completely coordinated. Bloomberg removed the word "NEW" from the article's title an hour after it was published. Go figure; I guess mentioning the "new world order" was just a little too honest. Of course, Draghi does not mention that all central banks are ALREADY coordinated through the Bank for International Settlements, which is why numerous central bank heads were at the BIS when the Brexit vote was underway. What Draghi is pushing for is open centralization among the world's central banks - the next step towards a single global central bank and a single global currency system. For more information on why the elites desire an economic crisis and what they hope to gain from it, read my article 'The Economic End Game Explained'. In my prediction article I also stated in part reference to the Jo Cox murder:

The concept of a dangerously volatile and destructive populist movement for sovereignty is being heavily pushed in the mainstream media. The racist angle is now being implemented, with the MSM warning that racism is on the rise in the U.K. due to the Brexit campaign. Most if not all of the developments I warned of when I predicted the Brexit are also coming true. So, if I am as correct about the motives behind the Brexit as I was correct about the outcome of the Brexit, here is what will probably happen in the coming months as the drama unfolds.

The Long GameThe great weakness among economic analysts and many independent analysts is their refusal to examine the long game of the elites. They become so obsessed with the day to day parade of stock tickers and the month to month central bank policy meetings that they miss the greater trends. We can focus intently on each drop of water that makes up a tidal wave and forget that we are at the edge of the beach staring down death. The Brexit is part of a globalist long game that is designed to finally and completely demonize sovereignty movements. Think about it for a moment — what better way to remove the only obstacle in their path? The globalists create an economic crisis and then foster conditions by which their primary opponents (liberty activists) get BLAMED for it. They then swoop in as the heroes of their little cinema after the damage is already done and offer their solution: complete globalization. With enough people destitute from a global financial calamity, they may very well be begging the elites for help. This is not to say that the elites will ultimately succeed (I believe they will fail), but that does not stop them from making the attempt. I realize this is not what many in the liberty movement want to hear, but this is reality. This does not diminish the value of a British movement for sovereignty, but it does demand that we temper our celebration and recognize when we are being targeted with fourth-generation warfare. If we accept the fact that the Brexit is an event the elites plan to exploit for their own ends, t | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Teachers Unions Vs Hedge Funds: The Battle Over Billions Posted: 29 Jun 2016 06:20 PM PDT Randi Weingarten is the president of the American Federation of Teachers, and is a name that hedge fund managers and those on Wall Street are beginning to learn quite well. About a decade ago, some liberals joined conservatives in pushing to expand charter schools. As the WSJ reports, those efforts received financial support from hedge fund managers including Dan Loeb, Paul Singer and Paul Tudor Jones, who together kicked in millions of dollars toward the effort. Some involved in the effort to push for the expansion of chartered schools portrayed public school teachers and their unions as obstacles to improving education, and thus the reputation of unions took a beating. Enter Randi Weingarten. Weingarten was elected president of the American Federation of Teachers in 2008, and her aim was to restore public trust in public school teachers and their unions. Weingarten's federation represents about two dozen teachers unions whose retirement funds have a total of $630 billion in assets, a large portion of the more than $1 trillion controlled by all teachers unions according to the WSJ. Although the unions themselves control where the money is invested, Weingarten can make recommendations. Weingarten instructed investment advisers at the federation's Washington headquarters to sift through financial reports and examine the personal charitable donations of hedge fund managers, focusing on those who want to end defined benefit pensions, and entities backing charter schools and the overhauling of public schools. In early 2013, the union federation published a list of roughly three dozen Wall Street asset managers it says donated to organizations that support causes opposed by the union, and the federation wanted union pension funds to use the list as a reference guide when deciding where to invest (or not invest) their money. Said otherwise, if asset managers don't support unions, the unions won't invest with the funds. The Manhattan Institute for Policy Research, a think tank that supports increasing school choice and replacing defined benefit pension plans with 401(k)-type plans is one of the groups that wound up on the list. Lawrence Mone, its president, said the tactics amount to intimidation, and that "I don't think that it's beneficial to the functioning of a democratic society." To signify the importance of Weingarten's list, after KKR & Co. president Henry Kravis made the list in 2013, Weingarten received a call from Ken Mehlman, an executive at KKR. Mehlman said KKR had a record of supporting public pension plans, and Weingarten agreed - KKR was then taken off the list. Cliff Asness of AQR Capital Management went as far as hiring a friend of Weingarten and paying $25,000 to be a founding member of a group KKR was starting with Weingarten to promote retirement security. Asness was removed from the list. Asness continued to serve on the board of The Manhattan Institute, however in September of last year an aide to Weingarten spoke to a California State Teachers' Retirement System (Calstrs) official about Asness's continued service - one phone call later and Asness said that he was stepping down from the Manhattan Institute board. One hedge fund manager has been more combative however - Dan Loeb. The founder of Third Point is a donor to the Manhattan Institute and chairman of the Success Academy, which operates a network of charter schools in New York City. A bit more combative is an understatement - Loeb pushed back on Weingarten, and didn't seem to care about the influence she had over where funds were directed. As the WSJ explains

As part of the punishment, Loeb eventually lost $75 million from a Rhode Island pension fund. Around that same time, a giant billboard appeared above Times Square that was not kind to Weingarten - perhaps not a coincidence. "We all guessed it had to be people like Dan Loeb" Weingarten said. After the billboard, Weingarten and the union group launched an advocacy group called Hedge Clippers, that lobbied against proposed New York legislation to increase the charitable deduction for donations to public and private schools. The group also published a report called "All That Glitters Is Not Gold," that among other things, claimed that the high fees charged by hedge funds made them unattractive investments. Furthermore, the union group is funding a campaign to eliminate the carried interest tax rate on investment income earned by asset managers, as well as filing a class action lawsuit accusing 25 Wall Street firms of violating antitrust law and manipulating Treasury bond prices. Other large pension funds such as an Illinois public pension fund and one of New York City's public pension funds have cut hedge fund investments. However, Loeb may have had the last laugh, as when Weingarten tried to convince a large Ohio fund to follow suit, it voted to remain invested in hedge funds, including Loeb's. * * * Regardless of a stance on this topic, this battle between Weingarten and the targeted hedge funds such as Third Point will remain an epic story to watch unfold. Also, as readers know, pension funds are severely underfunded, and given that NIRP and other insane central bank policies have created an environment where risk assets are a necessity if one wants to generate higher target returns, hedge funds may be one avenue that pension funds need to consider, whether the funds support charter schools or not. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| One American's True Story: "How I Went From Middle Class To Homeless" Posted: 29 Jun 2016 06:16 PM PDT Meet Joe. He used to make a steady income in manufacturing, but the work has disappeared. Now, he is selling everything and moving into his van. Joe is one of the 71% of Americans who think the U.S. economic system is "rigged in favor of certain groups," according to a new poll by Marketplace and Edison Research. The poll asked a simple question: Which of the following comes closer to your opinion on the economic system in the U.S. People could select between three options:

Most selected rigged economy. As CNN adds, it didn't matter if the person was white, black or Hispanic or whether they identified as Republican, Democrat or Independent. The majority feel the American Dream comes with huge asterisk that reads "only for the favored few." Americans have good reason to think this way. The typical middle class family is earning about the same amount of money adjusted for inflation, just under $54,000, as they did in 1996. That means that as the rich get richer, the middle class hasn't seen an improvement in its way of life in 20 years. On top of that, the Great Recession knocked out many people's safety net savings as they lost jobs or homes or both. Even people who have jobs say they feel one step away from financial ruin. They fear a life of "dead-end crap jobs with crap wages." People like Joe, 60, who lives in a mobile home ith his mother outside of Philadelphia and is desperate. He last held a job in early 2013: "The first seven weeks I was there we were busier than I've ever seen a small company be, and then like someone flipped a switch. The work just stopped." "I would like to work" he says. "I still have skills and abilities and I still know how to use them. I have two associate degrees, one's in electrical engineering, one's in mechanical engineering." He then discusses the impossible dream for the lower middle class of which he would like to be part of: "I consider $15/hour to be lower middle class. If i had been able to go permanently with a company, probably I would have reached middle class in a few years. I'd settle for lower middle class right now but even that's almost the impossible dream." So what does Joe's future hold? "If I don't hear back from any of these applications, if I'm not working I'll be out of here. With out last couple of thousand dollar we got the minivan. I'll have enough room for a sleeping back and some clothes. My mom said if you ever have to sell the house, I want you to take the lamp. I can't take the lamp either." And his morbid conclusion: "Poor people have significantly shorter lifespans than more affluent people. In fact I keep having this argument with my doctor. He keeps telling me 'you have another 30 years.' I tell him no, I don't expect to make it past seventy." In other words, Joe thinks he has another 10 years of working class purgatory before he can finally rest. In the video below, he is wearing sunglasses to disguise his identity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Deutsche Bank Poses The Greatest Risk To The Global Financial System": IMF Posted: 29 Jun 2016 05:58 PM PDT Over three years ago we wrote "At $72.8 Trillion, Presenting The Bank With The Biggest Derivative Exposure In The World" in which we introduced a bank few until then had imagined was the riskiest in the world. As we explained then "the bank with the single largest derivative exposure is not located in the US at all, but in the heart of Europe, and its name, as some may have guessed by now, is Deutsche Bank. The amount in question? €55,605,039,000,000. Which, converted into USD at the current EURUSD exchange rate amounts to $72,842,601,090,000.... Or roughly $2 trillion more than JPMorgan's."

So here we are three years later, when not only did Deutsche Bank just flunk the Fed's stress test for the second year in a row, but moments ago in a far more damning analysis, none other than the IMF disclosed that Deutsche Bank poses the greatest systemic risk to the global financial system, explicitly stating that the German bank "appears to be the most important net contributor to systemic risks." Yes, the same bank whose stock price hit a record low just two days ago. Here is the key section in the report:

The IMF also said the German banking system poses a higher degree of possible outward contagion compared with the risks it poses internally. This means that in the global interconnected game of counterparty dominoes, if Deutsche Bank falls, everyone else will follow.

The IMF concluded that Germany needs to urgently examine whether its bank resolution, i.e., liquidation, plans are operable, including a timely valuation of assets to be transferred, continued access to financial market infrastructures, and whether authorities can ensure control over a bank if resolution actions take a few days, if needed, by imposing a moratorium:

Here is the IMF's chart showing the key linkages of the world's riskiest bank:

And while DB is number 1, here are the other banks whose collapse would likewise lead to global contagion. Considering two of the three most "globally systemically important", i.e., riskiest, banks just saw their stock price scrape all time lows earlier this week, we wonder just how nervous behind their calm facades are the executives at the ECB, the IMF, and the rest of the handful of people who realize just close to the edge of collapse this world's most riskiest bank (whose market cap is less than the valuation of AirBnB) finds itself right now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How BREXIT Changes Globalism, the NWO and the Alien Agenda Posted: 29 Jun 2016 05:30 PM PDT How BREXIT Changes Globalism, the New world order, and the Alien Agendaby Gary VeyJune 29, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Infographic - The Best Reasons To Own Gold Posted: 29 Jun 2016 05:00 PM PDT Perth Mint Blog. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prophecy Update End Time Signs 6/29/16 Posted: 29 Jun 2016 04:14 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1323.90 Up $8.60 or 0.65% Posted: 29 Jun 2016 03:51 PM PDT

Don't miss the point: the goal of the panic has changed. In 2008 everything -- gold, silver, stocks -- tanked while the US dollar & bonds soared. Brexit hit and some ran into US dollars, a few into yen, but many ran for gold. Change of quality. Sea change. Never be the same again. Disregard the last two days' stock market rise. Nice Government Men strapped on their hernia trusses & started lifting with all their might, sending eraser boogers & paper scraps & memo pads flyin' every which way. They are trying to lift stocks & the euro, and smother the dollar. Don't even bother to sneer at me, history responds with one voice that central banks & governments manipulate markets, and never more readily than when their toe is in the wringer. All their manipulation won't extract that toe. Brexit licked the globalists like Forrest licked yankees. Expect counterattacks political and economic. Economic already arrived with market manipulation, including S&P's downgrade of the UK's credit rating. Media is hot as a cast iron stove denouncing economic doom to fall on Great Britain. Laughable, if you have the patience to listen to it without slamming your hand on the off knob. Political counterattack already began in Brussels, with full propaganda offensive. Elitists are moving within the EU to close off all possibility of any other country following the UK's example. I was simply wrong. Didn't believe the British would do it -- God bless 'em! -- & underestimated the following panic. Brexit was not a cause, but a mighty catalyst. Can't put broken eggs back together, Humpty Dumpty. Today stocks rose vigorously again, leaving behind their 200 DMAs & crossing back above those head & shoulders necklines they broke on Monday. In the past two days the Dow has gained 554.44, gaining 284.96 (1.64%) today & closing at 17,694.68. S&P500 has done even better, up today 34.68 (1.7%) to 2,070.77. What doth it say? Don't say squat. Can't put broken eggs back together, & this plunge was simply waiting for a trigger. Don't blame it on Brexit. Something -- not gravity or nature -- has been pushing back the dollar last two days. Gave up 53 basis points yesterday and 48 more today (0.49%) to end today at 95.86. Nice Government Men are trying to shove hair spray back into the aerosol can. Dollar will rise much higher. Therefore I am not impressed by the euros 0.51% rise to $1.1121 today. Chart looks like 5 miles of bad Georgia road and even today it can hardly get over its 200 DMA. Doom has its icy claws deep into the euro's flesh, & will not let go till it's shredded. Before it's all over, the euro will vanish. Look for yourself, http://schrts.co/HcRUv0 Yen slid 0.05% to 97.27. Looks like it has run out of go-juice & may reverse. Gold tested support at $1,308 yesterday & today & passed the test with flying colors. Rose 0.7% or $8.60 today to close Comex at $1,323.90. Silver, O SILVER, finally caught up to gold today & vaulted through the May high (18.06) & closed above that resistance. Silver added 51.9¢ (2.9%) today to 1836.2¢, confirmed by high volume. High reached 1858¢. Events are validating my interpretation that the December 2015 lows marked the final lows & end of the bear phase from August 2011, AND that a rally began in January, AND that the 1 May tops were merely the top of the first leg up, AND that the lows at end-May marked the beginning of the next leg up. Get out of silver & gold's way. They'll run y'all down. I don't want to tell y'all how far I expect this rally to reach, 'cause y'all won't believe me anyway. Time to buy silver & gold, on this silver breakout today, & time to sell stocks & put the proceeds into gold & silver. I'm not going to tell y'all my downside targets for stocks, either, 'cause y'all will just hoot & disbelieve. Just let's say they will dwindle -- like your hairpiece in a windstorm. Silver chart is right here, http://schrts.co/uZ4qEN Gold is here, http://schrts.co/iOtTZn Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit isn't end of the world, just end of elites, Embry tells KWN Posted: 29 Jun 2016 02:30 PM PDT 5:30p ET Wednesday, June 29, 2016 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that the European elites are acting as if Britain's withdrawal from the European Union is the end of the world. In fact, Embry says, it's the end only for the elites and their banks. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/50-year-veteran-warns-market-turmoil-threatens-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Camino Minerals Signs a Letter of Intent Company Announcement VANCOUVER, British Columbia, Canada -- Camino Minerals Corp. is pleased to announce the signing of a letter of intent with Minas Andinas SA, pursuant to which it can acquire through a wholly owned subsidiary, Camino Resources SAC, a 100-percent interest in the Los Chapitos project. The property consists of seven claims, totaling 3,200 hectares (7,900 acres), and is located 15 kilometers north of the coastal city of Chala, Department of Arequipa, Peru. At Los Chapitos all the known mineralization is associated with structurally controlled breccia zones with moderate to intense potassium alteration. Small-scale mining was active on the western side of the property in the 1940s and '50s, which produced high-grade copper oxide mineralization from the El Atajos Zone. This zone ranges in width from 8 meters to 20 meters and grade from 0.8 percent to +2 percent copper oxides over a strike length of 400 meters. Approximately 6 kilometers to the east are three additional zones which outcrop along a 1-kilometer trend and were previously sampled by the vendor. ... ... For the complete announcement: https://finance.yahoo.com/news/camino-minerals-signs-letter-intent-09000... Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Men Who Sold the World Posted: 29 Jun 2016 01:47 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Biotech Is Floundering — But One Industry Is About to Explode Posted: 29 Jun 2016 12:00 PM PDT This post Biotech Is Floundering — But One Industry Is About to Explode appeared first on Daily Reckoning. [Editor's note: We have an exciting announcement coming your way on Friday. Our team of analysts is growing, and the new voice we've added has over 30 years of insight to share with you. The man you'll meet Friday is a trend forecasting expert… and he's scary accurate. He predicted events like the '87 stock market crash, the recession of '07 and the rise of social networking. We can't wait for him to share his forecasts on the current events in tech and biotech that could create major wealth for investors. Keep an eye on your inbox. We'll reveal the latest addition to the Agora Financial tech team… how his predictions can affect your health and wealth… and how you can use his forecasts to play the best trends in the tech and biotech market. You won't want to miss it. We'll see you Friday at 3 p.m. for the big reveal.] Dear Reviewer, Chances are you feel a little down in the dumps about biotech right now. While May was a decent month for biotech, June has been downright awful. Take a look at this chart:

Biotech has been up and down since the second half of 2015. Sure, we've experienced hopeful upticks, but this month is a humble reminder that we're not in the clear just yet. But don't throw in the towel. There's an important rule you can use when the markets are in turmoil to avoid the pain and keep zeroing in on the biggest opportunities. Editor Ray Blanco follows this proven strategy in his Agora Financial's FDA Trader portfolio. "We don't buy the whole market," he says. "What we buy are individual biotech companies with the potential for posting hugely profitable breakout moves." And there is one "breakout move" that's about to blow the roof off biotech. It's not often we see new industries emerge, but the opportunity to take part in one such move is here right now. We're talking the potential for a multibillion-dollar industry… an industry that has already lined the pockets of a select few investors… an industry that could soar starting later this summer… but that also has its fair share of controversy. We're talking about pot, folks. By the end of summer, the Drug Enforcement Administration (DEA) is set to make a decision on possibly reclassifying marijuana on a federal level. Before anyone goes running for the hills at the thought of MJ becoming legal (only slightly legal, might I add), make sure you read on… First, let's break down the opportunity: Marijuana is currently considered a Schedule I drug, meaning it has no proven medical use, a high potential for abuse and serious safety concerns. OK. Other Schedule I drugs include LSD and heroin… Oy. Currently, according to the feds, marijuana is considered more dangerous than methamphetamine, oxycodone, Percocet and fentanyl. Those last three drugs, of course, can be blamed for the epidemic-level opioid addiction crisis in the United States. Let me repeat that. As a Schedule I drug, marijuana supposedly has no proven medical use and is considered more addictive than opioids. Try telling that to people with Parkinson's disease. Cancer. Chronic pain disorders. All serious diseases, all with side effects evidence has shown can subside with the help of medical marijuana. If the DEA decides to follow through with reclassifying cannabis, it would consider the plant a Schedule II drug, which means it would be available by prescription only. But it would mean so much more… A reclassification would open the floodgates for medical marijuana research. As it stands now, its Schedule I title limits the type of research that can be conducted on cannabis and its components. Researchers are required to fill out endless forms and applications to receive approval to conduct studies using marijuana. If and when they are given the green light, strict limitations apply, and all the marijuana used in studies comes from one garden, housed at the University of Mississippi. Reclassifying to Schedule II would mean fewer restrictions when it comes to research and development. "I think it's just common sense to allow good science to be done," said Congressman Jared Polis to USA Today. He's just one of many members of the House and Senate who support marijuana reform in the United States. Fortune estimates the legal pot market — sales of marijuana in states like Colorado, Washington and Oregon, where it's legal — could hit $6.7 billion this year. Investors who played pot right have already made a fortune off the recreational marijuana boom that happened when states started passing individual laws on the drug. Now it's time to benefit from the potential boom ahead if the DEA decides to reclassify cannabis by Aug. 1. Estimates say the marijuana biotech industry could reach $20 billion — and investors are scrambling to get in before the decision is announced and select stocks take off. Companies seeking further research on the compounds that make up marijuana — and how they can be of use in a medical setting — are set to make huge profits come Aug. 1. Like Ray says, it's playing individual events like this that will keep the heads of biotech investors above water, not relying solely on the ups and downs of the market. All the best, Amanda Stiltner The post Biotech Is Floundering — But One Industry Is About to Explode appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING NEWS !! • DONALD TRUMP vs HILLARY CLINTON !! • BREAKING NEWS !! Posted: 29 Jun 2016 11:36 AM PDT DONALD TRUMP vs HILLARY CLINTON !! • BREAKING NEWS !! Donald TRUMP vs Hillary INDICTMENT #Hillary #HillaryClinton, #DonaldTrump, #Trump, #Benghazi, #HillaryEmails, The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldmans Sachs rejects any blame for BHS collapse Posted: 29 Jun 2016 09:56 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| HILLARY CLINTON • VS • DONALD TRUMP !! #Hillary #DonaldTrump Posted: 29 Jun 2016 09:30 AM PDT HILLARY CLINTON • VS • DONALD TRUMP !! Donald TRUMP vs hILLARY Clinton, Benghazi Turkey Hillary INDICTMENT, #HILLARY #TRUMP, #DONALDTRUMP, #BENGHAZI #HILLARYCLINTON The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here’s Who Made a Killing From Brexit… Posted: 29 Jun 2016 09:00 AM PDT This post Here's Who Made a Killing From Brexit… appeared first on Daily Reckoning. After Brexit, you'd think by the 24/7 media blathering that anyone in the markets got wiped out… The media reported that European stocks closed Friday with huge losses, with some seeing the steepest drop since 2008. Stocks in Asia and the U.S. also fell sharply, with the Dow Jones Industrial Average sinking 610 points. According to Standard & Poor's, more than $2 trillion of stock market value was wiped out, surpassing the turmoil of Lehman Brothers' bankruptcy in 2008. Brokers, financial advisors and media hacks will tell you that no one made money last Friday. They'd have you believe that everyone was "buy and hold" only… and then wandering the streets begging for spare change after the Brexit carnage. But guess what? That's a bald-faced lie. Some made a killing from Brexit… Making Bank When Markets CrashWhile the media was hyping Brexit's losers, there were a number of sectors that thrived during the panic. Benchmark 10-year Treasury notes rallied to yield 1.5702% on Friday, down from 1.74%. Thirty-year bonds rallied to yield 2.4229%, down from 2.56%. (Declining yields means rising bond prices. The price and yield of a bond move inversely.) Gold prices soared to a two-year high on Friday, closing at $1,322. My Trend Following subscription service gold miner recommendation Barrick Gold (NYSE:ABX) was up a stout 6%. And the Japanese yen climbed 13% against the British pound and 5% against the U.S. dollar. Bottom line, there were a number of ways to prosper from Brexit. But here's the critical point… The post-Brexit winners were mostly sectors that were already in an uptrend, which is why trend following traders did so well last Friday. Once these big market shifts happen, they tend to boost already established trends that trend following systems have clearly identified. That's why trend following is so successful during major market events. For example, when Lehman Brothers collapsed in 2008, stocks were already in a downtrend… and safe-haven assets were already in an uptrend. Trend followers were already riding those waves when Lehman hit. And they made a fortune during the final trigger moment when everyone else was getting crushed. Brexit's Big WinnersThat's not the only reason trend following thrives in times of wild price swings. Here are two more… 1) Trend followers make money from many different markets… from oil to bonds to currencies to stocks to commodities. There are always sectors trending higher when others are trending lower. 2) Trend following trading systems programmed into computers can make calculated, emotionless buys and sells that human traders can't. Just my opinion? No, it's the foundation for Daniel Kahneman's pioneering work in behavioral finance that won the Nobel Prize. A perfect investment example of this is David Harding, the billionaire founder of Winton Capital Management and one of the world's most successful trend following traders. Interestingly, David supported "remain." He donated millions to a group that tried to persuade Brits to stay. But his support for that cause never interfered with his programmed trend following system. And that's why the Winton Diversified fund gained 3.1% on Friday when most of the rest of the world's big funds were licking their wounds. David trusted his system and was a big winner. And he wasn't the only trend follower that was… Mulvaney Capital, a trend following hedge fund with hundreds of millions in assets under management, was up 17% on Friday, marking its best day ever. And ISAM's Systematic Master fund, co-launched by my friend Larry Hite, gained 4%. Break Free From LosingLook, millions of people lost trillions of dollars when their long-held "buy and hold" strategies imploded last Friday. But not trend followers. However, the winners are always missing from the mainstream media post-game analysis. The media has to stay fixated on the losers and the dramatic narratives they create. They must keep the fear gauge for the masses on high at all times. The media's mission is to keep investors conditioned to believe that there's only one way to invest: Trust the Fed, no questions asked. That means making sure average investors accept big losses inside stock market meltdowns every five years as the unavoidable part of the game of having daddy government running their lives. But again, that's simply not the only way to invest… Trend followers have been making big money in up and down markets for literally decades… and that's in every type of market condition imaginable. Look, you can't protect yourself from the next big event, surprise or crash after it happens. You have to act now before the next big one hits. And if you're willing to break free from the propaganda slopped onto your plate by Wall Street, the media and government bureaucrats, you have the chance to avoid "cat food retirement." Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post Here's Who Made a Killing From Brexit… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Brexit and the Fate of the UK Posted: 29 Jun 2016 08:30 AM PDT Economist Bill Black says the arrogance, incompetence, and ignorance by the elites was a major factor in pushing people to vote to leave the EU The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLBAL ELITE WARN: "Brexit will BREAK UP the European Union & MUST be Stopped" - George Soros Posted: 29 Jun 2016 07:53 AM PDT Brexit will BREAK UP the European Union and MUST be stopped, billionaire George Soros says. ~~ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The World’s Ignoring the Biggest Breakout of the Year. Here’s How it Could Net You 40% Gains… Posted: 29 Jun 2016 07:47 AM PDT This post The World’s Ignoring the Biggest Breakout of the Year. Here’s How it Could Net You 40% Gains… appeared first on Daily Reckoning. Brexit is devouring the financial press like a fat guy at an all-you-can-eat fish fry. Check out this screenshot I grabbed from a popular financial news site yesterday:

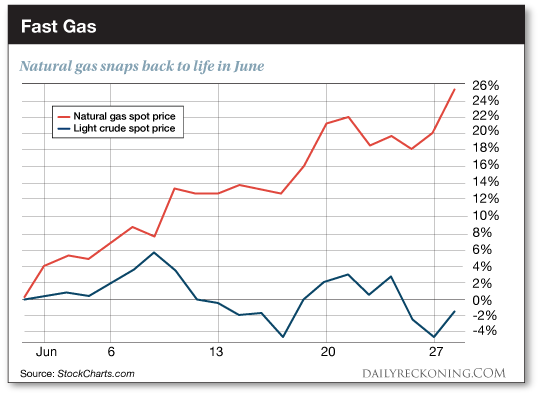

For the record, that's nine Brexit-related headlines, one about Benghazi, and one on gold (the gold story was bullish—so we can't complain too much about that one). I think it's safe to say that we could all use a Brexit break. While every investor on the planet remains trapped in Brexit's trance, the market continues to pump out new signals for anyone willing to listen. Despite what you may have heard, the entire world didn't crash during the Brexit stampede. In fact, some assets actually went up. Today, the market's flashing another strong buy signal in the face of political turmoil. One of the most powerful comeback trends in the world is breaking out again, giving you another opportunity to bank gains of up to 40% by 2017—no matter how Britain's hasty exit from the European Union plays out… I'm talking about natural gas. Natty is laughing in Brexit's face. Even as crude lurched below $50 as world markets tumbled a few days back, natural gas marched to new 2016 highs. While light crude is down about 1.5% during the month of June, natural gas has surged more than 25%…

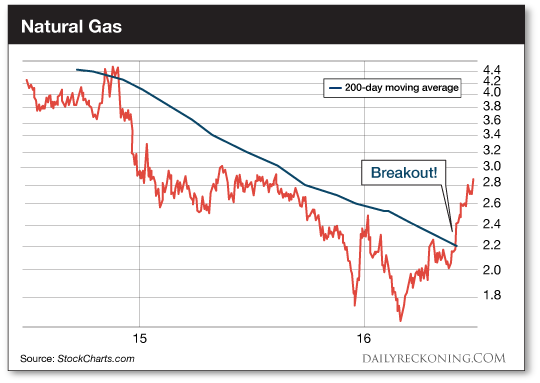

That's one heck of a rally. And most folks weren't even paying attention. After all, natty had been absolutely trounced since early 2014. By February, it had sunk to prices not seen since the late 1990s. No one wanted anything to do with it. But we figured natural gas had probably found rock bottom. Why? Over the past 20 years, natty has staged powerful rallies every time its spot price has sunk below $2. Even back in 2012 (when natural gas was still blowing off steam from its 2008 peak) natty ripped off a yearlong rally that sent the spot price from $2 to $6. Sure enough, natural gas caught a bid and rocketed back above $2 back in April. By early June, natty was off to the races. And after yesterday's 4% rally, we have a nice secondary breakout that should help propel this trade to new highs as we head into the second half of the year. Here's an updated look at natty's big breakout:

This exciting action is happening right under the nose of most investors. And they aren't even paying attention! We continue to see natural gas as a powerful contrarian trade—even as it approaches its 2015 highs. Everyone's too caught up in geopolitical "uncertainty" to take advantage of this screaming buy… As I've said before, natty's comeback isn't going to be a smooth ride. But if you have the stomach for a bumpy ride higher, you could be handsomely rewarded by the end of the year. Natural gas isn't going to streak back to prices we saw back in 2005 or 2008 anytime soon. But an extended bounce off the extreme lows we've experienced this year could offer up some serious gains… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post The World’s Ignoring the Biggest Breakout of the Year. Here’s How it Could Net You 40% Gains… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Wildcats Part 4 - A Murder of Crows Posted: 29 Jun 2016 03:00 AM PDT Jeffrey Lewis | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The True Nature of Gold Is Liberty Posted: 28 Jun 2016 09:11 PM PDT “Look at that screen,” exclaimed Fox Business Network's Stuart Varney, referring to the television graphic showing markets crashing across the globe. “The only thing going up is the price of gold!” “It's always a dangerous thing when you leave democracy up to the people,” joked Varney's guest – venture capitalist and author Peter Kiernan, as they watched Britain vote Thursday night to escape the European Union. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 28 Jun 2016 06:00 PM PDT UK in turmoil post-Brexit as Labour votes to oust leader. Stocks recover worldwide. Interest rates continue to fall while central banks consider deeper cuts. Greenspan warns of major crisis. Gold and silver rise, COTs are “over the top.” Clinton campaigns with Warren, fueling VP speculation. Best Of The Web In gold we trust 2016 […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bond Mechanics in a Negative Interest Rate World Posted: 28 Jun 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment