Gold World News Flash |

- Delayed Consequences: Germany Angers Turkey With Genocide Vote

- The US Government Cares More About Silver Than Gold: David Morgan

- The Biggest Bubble In History Will Lead To An Even Bigger Collapse

- Goldman Unveils The FX Doom Loop: Turns "Outright Negative" On Yuan Due To "Weak Link"

- The CFPB Plans On Regulating Payday Lenders, But What Will The Unintended Consequences Be?

- 2016 Silver Prices 'Will Rise Further on Ultra-Loose' Rates

- Hillary and Bill Clinton Busted!!!

- Gold Price Closed at $1209.80 Down -$2.10 or -0.17%

- City Link and Better Capital attacked by tribunal over courier company's collapse

- On the Price of Oil

- Junior Precious Metals Miners: Go With Who You Know

- The Welfare State is Doomed

- America Heading Towards a Collapse Worse Than 2008

- Gold Daily and Silver Weekly Charts - Big Deliveries, Small Price Action - Payrolls

- Michael Ballanger: Why technical analysis does not work for gold and silver

- 2 Advanced Near Term Gold Producers in BC Canada

- DALAI LAMA WARNING : Germany is becoming an Arab Country

- UCLA Shooting: Gunman Mainak Sarkar had 'kill list,' police chief says

- Junior Precious Metals Miners: Go With Who You Know

- June Gold: 775,000 Ounces of Gold 'Delivered' On Comex In First Three Days

- Torgny Persson: Offshore bullion storage or three eggs?

- Alasdair Macleod: Gold -- a reasonable correction?

- Ted Butler: Hidden in full view

- Silver Coin Sales Have Record Year in 2015

- A Glimpse Into The Future Of What The Economic Collapse Might Look Like

- Noam Chomsky - The Internet II

- Government Makes You Poorer

- Gold – a reasonable correction?

- Junior miner Hummingbird Resources raises £45.8m to kick-start Mali gold mine

- Chaos Across The World Is A Good Thing For Oil

- These Two Quick Tips Will End All Your Stock Market Worries…

- The Federal Reserve Hacked more than 50 times between 2011 and 2015

- The Gold Bull Market – Is it Time Yet?

- Gold – a reasonable correction?

- Dollar Bubble: The Three Reasons The US Dollar Will Soon Crash

- Global mints report record silver coin sales for 2015

- Are you still waiting for a pullback, so you can take part in the gold and silver bull market?

- The Biggest Bubble In History Will Lead To An Even Bigger Collapse

| Delayed Consequences: Germany Angers Turkey With Genocide Vote Posted: 02 Jun 2016 11:00 PM PDT Submitted by Michael Shedlock via MishTalk.com, A year ago, Germany’s Green Party wanted to hold a vote on responsibility for the Ottoman massacres, a systematic expulsion and annihilation of over 1 million ethnic Armenians in 1915. Germany delayed the vote, not wanting to upset Turkey... until yesterday, when Germany held the vote, upsetting Turkey much more. After a near-unanimous vote, Turkey recalled its ambassador to Germany calling the vote, “null and void”. Turkish Protest in Berlin

Germany Angers Turkey with Genocide VotePlease consider Germany Angers Turkey with Genocide Vote.

Lie of the DayGerman chancellor Angela Merkel immediately sought to limit the damage, saying ties with Turkey were “broad and strong”. As proof of the “strength” of the relationship, Turkey pulled its ambassador and Erdogan is “considering actions”. The “test of friendship” clearly failed. Will Turkey cancel its refugee agreement with the EU? If so, that would be a positive outcome for Europe, albeit one that would cause a lot of short term pain. The benefit is the EU would have to come up with a real solution to the refugee mess rather than making a bargain with the devil. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The US Government Cares More About Silver Than Gold: David Morgan Posted: 02 Jun 2016 10:00 PM PDT from The Morgan Report: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Biggest Bubble In History Will Lead To An Even Bigger Collapse Posted: 02 Jun 2016 08:00 PM PDT Matterhorn AM | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Unveils The FX Doom Loop: Turns "Outright Negative" On Yuan Due To "Weak Link" Posted: 02 Jun 2016 07:17 PM PDT When we first presented the so-called "Nightmarish Merry Go Round", dubbed so by Bank of America because of the reflexive, recursive bond - and trap - that has formed between the Fed and markets...

... in which neither can break free from the other, and yet each is more dependent on the other than ever, we said that instead of looking at the relationship as one between the Fed and the market, one can further simplify the relationship as one between the USD, a proxy for Fed tightening or easing intentions, and the Chinese Yuan, a proxy for the Chinese economy, capital outflows and general volatility. Today, Goldman has released a note which lays out precisely this relationship in what it calls the "RMB-FOMC Monetary Policy Loop", but before we introduce yet another firm's realization of just how circular the relationship between central banks and markets has become, here is Goldman's abrupt reversal on what it think will happen to the Yuan in the near-future, because as Goldman's Robin Brooks - who has been relentless bullish on the USD - now says that "we shift to an outright negative view on the RMB, in line with this week's Asia Views and our bearish RMB forecast." The reason for Goldman's sudden bearishness is "because there is a weak link in China's management of its currency." This is how it explains the link:

One need look no further than the recent spike in bitcoin driven by Chinese buying to see this in action, as the local have been scared out of their wits by relentless PBOC intervention in the FX market. Gpldman goes on:

The implication: sliding CNY means risk off:

Which brings us to what may be the biggest topic of 2015: the collapse in China's FX reserves, something which Goldman believes is about to be repeated:

Essentially, what Goldman is saying is that the same "risk off" wave that followed the sharp devaluation episodes of mid and late-2015 is about to return, even though so far the market has been largely sanguine as it still does not really believe that the Fed will follow through with another hike. Which brings up to the topic of Goldman's monetary policy "doom loop", which carries an uncanny resemblance to the "nightmarish merry go round" chart shown top. To wit:

And the chart.

And there you have it: Goldman just went bearish on the one currency which can destabilize the entire house of cards. Which begs the question: is Goldman then quietly selling the USD and buying the Yuan, as it is has an alleged tendency of doing by frontrunning its clients... or is its reco genuine this time, and is actually seeking to cause the risk off avalanche. Recall that over the past month, Goldman has gotten both tactically and strategically bearish. It just needed the spark to unleash the fall. By telling clients to sell the Yuan, it may have just found it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The CFPB Plans On Regulating Payday Lenders, But What Will The Unintended Consequences Be? Posted: 02 Jun 2016 06:55 PM PDT The Consumer Financial Protection Bureau (CFPB) plans to crack down on payday lenders, moving to regulate high-interest, low dollar loans that are made by storefront lenders to an estimated 12 million lower-income households living paycheck to paycheck. The $38.5 billion market is currently left to the states to regulate, but now the government wants to get involved. The payday rule, proposed by the CFPB will impose a complex set of requirements on the payday industry, mandating that lenders assess a borrower's ability to repay and making it harder for lenders to roll over loans, a practice that often heads to escalating borrowing fees the WSJ reports. The rule will go through a 90-day public comment period, with a formal rollout expected early next year. From the WSJ

Congress prohibited the CFPB from setting a direct interest rate cap for federal rules, so the agency is seeking to change the lending practices by other means. To regulate payday lending, the bureau is for the first time relying on its authority to prohibit "unfair, deceptive, or abusive acts and practices." Marking an area of regulation that is much more nuanced than where it had been given a clear mandate by congress such as mortgages and credit cards. Payday lenders of course oppose the pending rule, saying it would force many out of business and leave low-income borrowers without much needed credit. Opponents of the rule also cite a January survey by Bankrate.com showing that only 37% of adult Americans have the necessary savings to cover a $500 car repair or $1,000 emergency room bill. "Congress told the CFPB to regulate payday, not annihilate it, and so much of what they are proposing represents annihilation" said Dennis Shaul, chief executive of the Community Financial Services Association of America, the primary industry group of payday lenders. Even some advocates of new federal regulations on payday lending criticize the rules, saying the complexity and tight strings would discourage banks and others from entering the market, possibly leaving a void. "The CFPB proposal misses the mark" said Nick Bourke, director of small-dollar loan research at Pew Charitable Trusts, who was briefed on the proposal. Bourke added that the rules effectively lock out small-dollar loans from banks. CFPB Director Richard Cordray said that "too many borrowers seeking a short-term cash fix are saddled with loans they cannot afford and sink into long-term debt. It's much like getting into a taxi just to ride across town and finding yourself stuck in a ruinously expensive cross-country journey." Cordray is correct in his assessment, but the critical element here is how to help those low income earners if payday lending goes away. If those individuals get frozen out of financial institutions, where will they turn for short term cash in order to pay those one-off emergency items. This is the question that will ultimately have to play itself out throughout this process. It is a potential issue because as more and more of the only available jobs are on the lower end of the pay scale, or worse, the jobs for rural Americans disappear as we discussed previously, there will be a need for those individuals to access credit, and if it's not there, real social unrest will manifest itself. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 Silver Prices 'Will Rise Further on Ultra-Loose' Rates Posted: 02 Jun 2016 06:14 PM PDT Submitted by Goldbug on Thu, 06/02/2016 - 16:16

Silver prices jumped 30% from 6-year low. More coming says Metals Focus...

SILVER PRICES will hold firm and rise further in 2016 according to the leading analysts behind a new report, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary and Bill Clinton Busted!!! Posted: 02 Jun 2016 05:12 PM PDT Lying, Cheating,Stealing and Murder, a path of blood and money. It is time for it to end. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1209.80 Down -$2.10 or -0.17% Posted: 02 Jun 2016 04:44 PM PDT

Well, Mercy! I told y'all about Douglas Kaine McKelvey's "100-year Vision" article yesterday & urged y'all to read it, then neglected to give you a URL. Here it is, http://bit.ly/1Zgt57x Delightful to read & ponder. I've tortured & killed a lot of electrons writing and thinking about silver & gold, so it's time to throw it all up in the air & see if we can't find a new angle. First, the closes. Metals refused to fall off a cliff today. Gold lost $2.10 (0.2%) to $1,209.80, but that was about the low. Silver gained 9.9¢ (0.6%) to 1600.5¢. Here's a revised, stripped down gold chart, http://schrts.co/zi8k5q WHAT IF gold is trading in a range, bounded by those pink lines? What if the bottom of that range is about $1,200? If gold really is strong, indeed, has entered a new bull phase, then it wouldn't weaken off to fall all the way to the 200 DMA (now $1,165). And why is volume drying up as gold refuses to inch lower? Why is downward momentum slowing? Okay, maybe gold needs one good spike down still, but then again, maybe not. Maybe we've become so used to gold weakness since 2011 that we don't expect gold strength now -- and markets love to surprise. Does silver agree? Chart's here, http://schrts.co/txiQM8 WHAT IF the ruling pattern in silver is that rising range bounded by the green lines, defined by the uptrend from the January low? Silver today is only pennies off that line, which coincides with another support line from last year. Volume is drying up, not increasing. Momentum is slowing -- barely, but slowing. Rate of change is flattening. This alternative interpretation is easily tested. If silver closes below 1590¢ or gold below $1,200, it's hogwash. On the other hand, if they bounce along this support & then begin rising, maybe 'tain't hogwash after all. Consistent with a "metals won't drop much from here" outlook, the gold/silver ratio has stalled in a touchback to the lower boundary line it punched down through in April. That boundary line is also running roughly parallel to the 200 DMA. A rising ratio goes with metals falling, a falling ratio with metals rising. US dollar index remains dazed, confused, & bumfuzzled. Rose 8 lousy basis points to 95.54. Is it rolling over earthward, or consolidating sideways? Pretty mealy-mouthed for a big, strong world class currency, I'd say. On Wednesday Japan's PM Shinzo Abe announced he would delay imposing the sales tax. Some interpret that as a sign the central bank won't keep flooding the world with more yen. For whatever reason or none, the Yen rose today to 91.86 (0.61%). Euro lost 0.35$ to $1.1151. Yea, & what of stocks? They rose modestly, in about as great a hurry as a Washington state driver in the left lane. Dow added 48.89 (0.27%) to 17,838.50. S&P500 edged up 5.93 to 2,105.26, up 0.28%. How do you spell u-n-r-e-p-e-n-t-a-n-t? That is I, looking at stock chart indices. Still see a head and shoulders top appearing. Here's the Dow, http://schrts.co/Q6KUW0 and the S&P500, http://schrts.co/vtdPMb Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| City Link and Better Capital attacked by tribunal over courier company's collapse Posted: 02 Jun 2016 04:01 PM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Jun 2016 02:04 PM PDT Since its high of almost $108/bbl in June of 2014, we have witnessed a stunning collapse in the price of oil. Indeed, in February 2016, a barrel of West Texas Intermediate (WTI) was trading at $26/bbl, a 76 percent plunge from the June 2014 highs. It has since clawed its way back to $49/bbl (May 24th). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Junior Precious Metals Miners: Go With Who You Know Posted: 02 Jun 2016 01:55 PM PDT The first few months of this year gave a little taste of what’s to come for the junior precious metals miners, if this is indeed the start of a new gold/silver bull market. Some sample charts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Jun 2016 01:38 PM PDT This post The Welfare State is Doomed appeared first on Daily Reckoning. BALTIMORE – No whining and kvetching about the Deep State today. Instead, we sit at its feet, admire the cut of its jaw, and sing its praises. We are grateful to it… and not just as a source of amusement. In short, we delight in its incompetence. Preposterous InitiativeWhat brings this to mind is a small item in the news, which, like a pool ball careening across a felted table, knocked two or three others in their pockets before coming to rest. We had to go pluck each one out of its hole and examine it. And what a marvelous fraud each one is! Democracy! Central banking! Welfare statism! We think of the Swiss as prudent, careful people. They have their feet on the ground and their heads screwed on straight. But they have undertaken a pathetic and preposterous initiative, one so hopelessly ill-conceived, it is worthy of American economists… or French intellectuals. Specifically, next week the Swiss will vote on a proposal to give a "basic income" to all Swiss residents, whether they work or not: a guaranteed annual income of $30,000. You may have the same reaction we did: This is crazy! If you can earn $30,000 a year without working, it will be hard for anyone earning less than $60,000 (about the same as $30,000 after taxes in many places) to get up in the morning and put on his overalls. Why bother? The waiters will abandon us at our tables, our glasses unfilled and our dirty dishes still in front of us. The valet parkers will drive off in their own new cars. The burger flippers will leave their hot patties in midair as they head home. All the low-paying jobs, and more than a few middle-income posts, too, will be vacated. New War on PovertyBut this proposal taps into several faddish worries and is finding many supporters… First, there are the zombies. Ever eager to get something for nothing, they see more something here to get. 'Nuff said. Second, the "good government conservatives" imagine that government can function more rationally and more efficiently. They see the feds flailing around with their welfare programs. They figure this will be a simpler, more effective way to deliver something for nothing to the undeserving multitudes. If you're going to spend trillions fighting a war on poverty, they believe, you might as well win it. Third, the elites of all faiths and persuasions are eager for any pretext to give money to the zombies in exchange for their votes. It's a way for them to manipulate the masses, gain control of the police power of the state, and use it for their own aims. Fourth, those whose hearts bleed over "inequality" imagine that they can get the feds to staunch the wound. But they've missed the point. The insiders who control the Deep State don't want to eliminate inequality; they want to add to it. They use government to get more money, power, and status. And they can only get these things by taking them away from their rightful owners. (This is a key reason why the welfare state is doomed to failure… about which, more tomorrow.) Fifth, there are those who are concerned about robots! What? Yes, there is growing concern that robots will take over the world's work. For example, there are 3.5 million truck drivers in the U.S. Many or most of those jobs may soon be history, thanks to self-driving trucks (which are already operational). So, too, will millions of other jobs now held by human beings. Lawyers, accountants, actuaries, architects, physical trainers – any career that involves routine procedures is vulnerable to disruption by the new generation of smart "bots." Robots are getting better and cheaper; by comparison, humans are becoming dumber and more expensive. Some people believe robots will gradually replace all but the most creative, most entrepreneurial, and best educated workers. Here Come the Robots!We've reported that the wages of 9 out of 10 U.S. workers are no higher today than they were 40 years ago after you adjust for inflation. It could get a lot worse: 9 out of 10 workers could be permanently out of work. Here's journalist James Neilson writing in the Buenos Aires Herald:

What then? How will most people support themselves when most people have no jobs? That's what Swiss politicians think they have figured out. The idea of a guaranteed income is hardly new. And hardly far out. The Romans had their panem et circenses(bread and circuses). The working classes of Rome were put out of work by "robots," too – slaves captured in Rome's many successful conquests. The slaves gradually took over all the menial work – especially on the large latifundia (landed estates) – leaving a large, idle, and restless population in Rome. In order to keep them docile, the Romans handed out wheat and staged gladiator combats in the Colosseum. (Today, we have welfare payments and presidential debates.) More recently, American economist Milton Friedman proposed a negative income tax (NIT). He was trying to make the welfare system more efficient. The Nixon and Carter administrations proposed a guaranteed income program in the 1960s and 1970s, with the aim of making the system fairer, as well as more effective. And the Green Party included a NIT proposal in its 2010 platform, for God knows what reason. What's wrong with these proposals? What's wrong with the state the Welfare State is in? Stay tuned… Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post The Welfare State is Doomed appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| America Heading Towards a Collapse Worse Than 2008 Posted: 02 Jun 2016 01:00 PM PDT The NWO Banksters have never been Progressive, they are in fact hard core Corporate Oligarch Fascist Thieves! Social Progressives are the Common Citizens United in Solidarity for the shared benefit of the Working People! The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Big Deliveries, Small Price Action - Payrolls Posted: 02 Jun 2016 12:59 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Ballanger: Why technical analysis does not work for gold and silver Posted: 02 Jun 2016 12:55 PM PDT By Michael Ballanger I often include charts in my weekly missives for a number of reasons, but the truth of the matter is that they add a little color to what would normally be a pretty drab bombardment of opinion delivered via text. By adding charts, it creates the illusion that I actually understand technical analysis (which I don't other than what I gleaned during a two-week training program in 1977 while in the employ of McLeod Young and Weir) and that it is useful in the forecasting of price trends in gold and silver over the long term. Well, I have a secret to tell you-"T.A." (as it is called by the "in crowd") is useless. "Cup and handles," "hanging Chinamen, "engulfing knickers," "tombstone dojis" -- you can fire them all in the waste bin because that is precisely where they belong. Last night I was reading a certain metals report where, sure enough, the author missed the top by a country mile, although he admitted it and apologized to his subscribers (which was truly admirable). I found it interesting that for him to get a clue to the next move in gold, he would have to "turn to the charts." So what I will do now is turn to my charts and demonstrate why charts are created by the bullion bank traders to trap the "chartists" (and their subscribers) into false senses of security. ... ... For the remainder of the commentary: http://news.goldseek.com/GoldSeek/1464876000.php Or: http://www.24hgold.com/english/news-gold-silver-why-technical-analysis-d... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

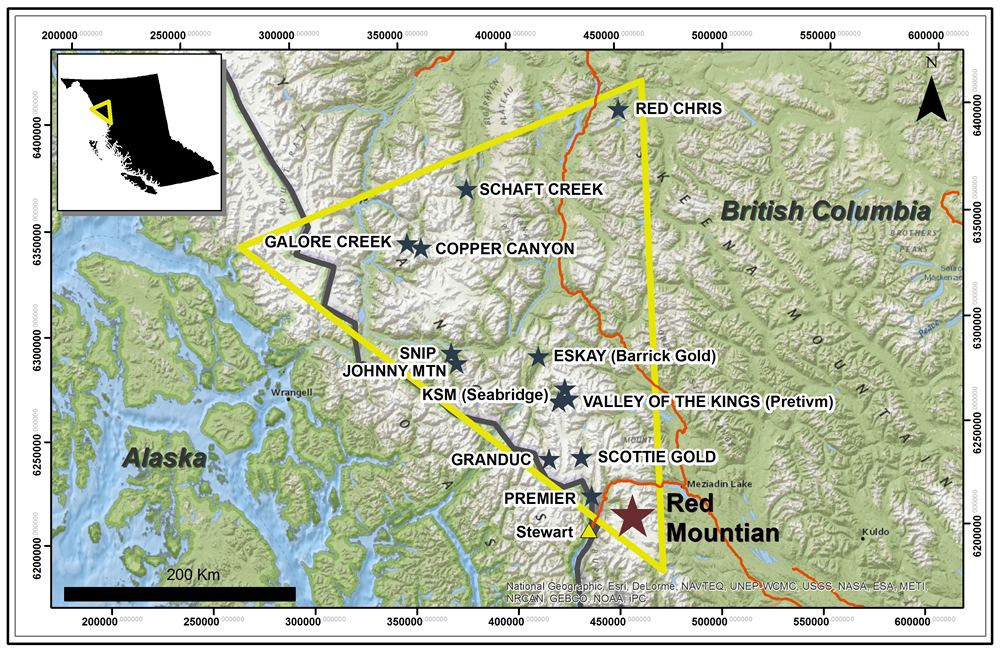

| 2 Advanced Near Term Gold Producers in BC Canada Posted: 02 Jun 2016 12:45 PM PDT (Premium Update from 5-31-16) In early March, I highlighted a couple of gold stocks in British Columbia to my premium subscribers which I believed was on the verge of taking off after the Osisko investment in Barkerville Gold Mines in February and the success of Bob Quartermain's Pretium (PVG) Brucejack Discovery. Remember British Columbia is known for some of the highest grade gold and silver deposits in the world. One of the companies I highlighted IDM Mining (IDM.V or RVRCF) took off and doubled in value over a two month time span. They released an updated larger resource and raised close to $11 million CAD. IDM attracted Premier (PG.TO) Gold as a shareholder.

The other company I highlighted which has not yet taken off yet and has remained flat is Discovery Ventures (DVN.V or DTVMF). They recently announced news that they will be changing their name to MX Gold. Earlier this year, Discovery Ventures (DVN.V or DTVMF) received a permit to mine a 10k ton bulk sample at the Willa Deposit and is working on a small mine permit to start underground mining. In the news release Discovery believed that once they receive the remaining permits it could take 4-5 month to start underground operations at a rate of 75k tons per year. http://www.discoveryventuresinc.com/s/news.asp?ReportID=741153 The company is continuing to upgrade the Max Mill and tailings facility in the Kootenay Region of British Columbia. The mill is 132 km north of the Willa Project. The company has gone through a major transition in 2015 attracting a new CEO Dan Omeniuk who also has given the company a $7 million line of credit. Dan also owns more than 7 million shares.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DALAI LAMA WARNING : Germany is becoming an Arab Country Posted: 02 Jun 2016 12:30 PM PDT DALAI LAMA TELLS GERMANS THAT THEY'VE GOT to CHANGE their FOREIGN POLICY! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UCLA Shooting: Gunman Mainak Sarkar had 'kill list,' police chief says Posted: 02 Jun 2016 12:00 PM PDT UCLA students recount the events surrounding the murder-suicide that brought the entire campus to a lockdown. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Junior Precious Metals Miners: Go With Who You Know Posted: 02 Jun 2016 11:31 AM PDT The first few months of this year gave a little taste of what’s to come for the junior precious metals miners, if this is indeed the start of a new gold/silver bull market. Some sample charts: There were dozens more like this, obscure little miners that soared when investors concluded that maybe they […] The post Junior Precious Metals Miners: Go With Who You Know appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| June Gold: 775,000 Ounces of Gold 'Delivered' On Comex In First Three Days Posted: 02 Jun 2016 11:10 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Torgny Persson: Offshore bullion storage or three eggs? Posted: 02 Jun 2016 10:51 AM PDT 1:50p ET Thursday, June 2, 2016 Dear Friend of GATA and Gold: Bullion Star proprietor Torgy Persson explains this week why Singapore, where Bullion Star is located, has become the superior jurisdiction for buying, selling, and vaulting gold. Persson's commentary is headlined "Offshore Bullion Storage or Three Eggs?" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/bullionstar/offshore-bullion-storage-o... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Gold -- a reasonable correction? Posted: 02 Jun 2016 10:43 AM PDT By Alasdair Macleod Gold weakened during May by about $100, from a high point of $1300 to a low of $1,200. This, for technical analysts, is entirely within the normal correction zone of a third to two-thirds of the previous rise, which would be 84 to 167 points. So the fall is technically reasonable, and doesn't in itself signify any underlying challenge to the merits of a long position in gold. However, when looking at short-term considerations, we should look at motivations as well. And those clearly are the profit to be made by banks dealing in the paper bullion market, which they can simply overwhelm by issuing short contracts out of thin air. This card has been played successfully yet again, with the bullion banks first creating and then destroying nearly 100,000 contracts, lifting the profits from hapless bulls in the Comex market. The banks get the money, the punters get the experience, and the evidence disappears. The futures market is demonstrably little more than a financial casino, where the house, comprising the establishment banks, always wins. Financial markets are not about free markets and purposeful pricing, which is why the vast majority of outsiders, including hedge funds, those Masters of the Universe of yore, usually lose. This leads us to an important conclusion: The fall in prices has less to do with a change in outlook for the gold price, and more with the way a casino-like exchange stays in business. ... ... For the remainder of the commentary: https://www.goldmoney.com/research/goldmoney-insights/gold-a-reasonable-... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler: Hidden in full view Posted: 02 Jun 2016 10:32 AM PDT 1:32p ET Thursday, June 2, 2016 Dear Friend of GATA and Gold: Silver market analyst Ted Butler today details his belief that JPMorganChase has cornered the silver market by rigging futures prices low while acquiring real metal in anticipation of running the price up. Butler's commentary is headlined "Hidden in Full View" and it's posted at GoldSeek's companion site, SilverSeek, here: http://silverseek.com/commentary/hidden-full-view-15617 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Coin Sales Have Record Year in 2015 Posted: 02 Jun 2016 10:15 AM PDT This post Silver Coin Sales Have Record Year in 2015 appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! The European Central Bank (ECB) is meeting while my fat fingers go to work here this morning. As I told you yesterday, I don’t expect anything market moving out of the ECB at this meeting, and the traders feel that way too, because the euro has climbed above the 1.12 figure this morning. That’s what I call “pushing the currency envelope”, for these traders are pushing the euro higher, in while the ECB meets. The Dollar Index, which hit a six-month high of 95.76 on Monday, had drifted lower the last two days, and sits at 95.26 this morning. I’ve told you before that the Dollar Index is heavily weighted with euros, so as the euro goes, usually the Dollar Index goes. It’s not a lock-step ratio, it’s more of a “back of the envelope” view of the Dollar Index. The Aussie dollar (A$), which yesterday saw some better than expected first QTR GDP data, and rallied on the print all the way to 73-cents, is taking it on the chinny, chin, chin today, as Aussie Retail Sales fell short of expectations, and so it was a one-day in the sun for the A$, and then back in the box! For those of you keeping score at home, Aussie April Retail Sales grew at 0.2% with the consensus at 0.3%. This was the first Retail Sales print of the second QTR, and since it was lackluster, it reminded traders that the Reserve Bank of Australia (RBA) still has rate cut arrows in its quiver. The price of oil climbed back over the $49 handle in the past 24 hours. I don’t know what caused the slippage yesterday, probably just profit taking, or a shot of manipulation, but whatever it was, it had no legs. Someone asked me via email the other day, why it seemed that I was rooting for a higher oil price. That’s Easy, I said. I in no way want to pay for gas ever again that has an oil price of greater than $100. But since the U.S. consumer didn’t come out of their shell with the savings from the drop in gas prices, I thought that it would be good to not have the financial problems of the oil companies weighing on the economy. That’s all, I’m not really rooting for a higher oil price, just sort of happy to see the shale producers not jumping off the cliff like a bunch of lemmings. So, with the price of oil higher this morning, the Russian ruble gets to pick itself off the mat and rally, alongside the Norwegian krone, Canadian dollar and Brazilian real. Speaking of Brazil, the Olympics are almost here! On a serious note though, I was reading an article that talked about how the writer believed that the impeachment of Brazilian President Dilma Rousseff was an orchestrated event, and then pointed to the problems that S. African President Zima is experiencing and said that those problems are orchestrated too, by the powers that be who are undermining the BRICS countries. Hmmm, well, that seems too much like a James Bond movie right now, but at some time in the future we find out that there was some validity to it, I wouldn’t be surprised. And speaking of the BRICS, the Big Dog, of the group, China, is on my mind this morning, so refill that cup of coffee and come back for this discussion on China and the renminbi. OK, ready? Let’s go! Well, James Rickards believes the so-called Shanghai Accord is still in force, but I have to think twice about that, given the weakness in yen and euros since the start of May, and the renminbi slowly slipping on a daily basis. The Chinese are testing the frog in the boiling water thing if you ask me. Yes, you know the old thing about if you put a frog in a pot of boiling water, it will just jump right out. But if you put it in a pot of water and slowly increase the heat until the water reaches boiling point, the frog won’t jump out, and end up being cooked. That’s what I think the Chinese are doing now instead of large devaluations. Knowing now what the last large devaluation did to the Global markets psyche, the Chinese have decided to slowly increase the heat and depreciate the renminbi on a slow heat setting. That way, no one will be the wise guy that sees what they are doing. I don’t believe the Chinese are happy with the U.S. for 1. Allowing their debt to get so large that it has ruined the value of the dollar, of which the Chinese own boat loads of, and 2. For hiking interest rates while the rest of the globe deals with zero or negative rates (save for the Russians and Brazilians of the world) and putting the global economy at risk. So, what do they do to let the U.S know? They devalue and depreciate their currency weaker when the U.S. wants the renminbi stronger. To that end, I wouldn’t be surprised to see the renminbi continue to depreciate the rest of the year. So, that gives us some opportunities to take advantage of this frog in the boiling water scenario. One could see the coming depreciation as an opportunity to take a gain now, and then buy back when the price is even cheaper. That’s an idea, but one that has tax implications so be careful before you leap. But in the end, it’s just better to have the one currency that has the potential for a gold backing of some kind in the future, don’t you think? Of course that’s my opinion, and I could be wrong! The price of gold gyrated yesterday, up a little, down a little, sideways for a while, and in the end the shiny metal was down $2.30. But this morning, gold is up $3 in early morning trading. I had to smile yesterday, mid-morning, I walked out to the trading desk and asked our metals guru, Tim Smith, what gold was doing, and then he responded, sounding like the words came out of my mouth. “Well, gold was up until the NY Traders came in and took it back down”. Ahhh, grasshopper, you have learned well, I thought. I don’t know if you noticed or not, but silver had dropped below $16 yesterday morning, and I thought that was important as it had not been below $16 since late last year. But this morning silver is back above $16. The amount of silver purchased last year was amazing, but yet the price of silver remained low. The GATA folks sent me a note that highlighted the fact that Global Mints recorded Global Investors buying 89.6 million 1-ounce silver coins in 2015, beating the previous year’s record amount of 77.9 million 1-ounce silver coins for 2014. That’s a 14% increase year to year, folks. And would reason that silver would have gone higher in 2015, but nooo! Oh well, in my opinion, which could be wrong, silver certainly has the potential to eventually go higher in price. Before I move on here I wanted share this quote with you from the great James Grant who said, “Gold isn’t a hedge against monetary disorder, it’s an investment in it.” Well, as I told you on Tuesday, I did believe that Japanese PM Abe, would announce that he was delaying the increased VAT tax that was supposed to go into effect this spring. This was part two of his new plan to stimulate the Japanese economy. Recall I told you on Tuesday that he announced a new 10-trillion yen stimulus package. I don’t get the traders that were fooled by this again, do you? Yen traders have taken the currency from 111 on Tuesday morning to a 108 handle, because they think that “this time, it’ll be different”. Crazy, eh? But, that’s what we have to deal with when it comes to currency traders. I’ve always told you that they are a fickle group. And apparently yen traders are the sharpest tools in the shed! The U.S. Data Cupboard yesterday was a mixed-bag-o-nuts. We had the ISM Manufacturing Index print at 50.7, vs. 50.8 in April, and I would just call that stuck in the mud. Construction Spending for April saw a big downturn of -1.5%. May vehicle sales remained steady at 17.4 million. And the Fed Beige Book showed little evidence of an economic pickup in the second QTR. Nothing here that would push the Fed to hike rates in two weeks. Today’s Data Cupboard has the ADP Employment Report, which will be used to give an indication of tomorrow’s Jobs Jamboree. And the usual Thursday fare of the weekly Initial Jobless Claims. In the end though, there’s nothing here, and all focus will be shifted to tomorrow’s Jobs Jamboree. For What it’s Worth. Well this is all me talking today about something that hasn’t gotten much press, but something that should be talked about at length, which is something I’m going to correct! Well, tomorrow is the May Jobs Jamboree. Going into tomorrow we have a consensus forecast of +158,000. This jobs thing has really taken on a life of its own, in that it is viewed by some as a “judgement day”, and that the markets’ participants sit and wait for this number to print every first Friday of each month. I’ve always contended that the number of jobs “created”, with the word “created” used loosely here, was not important, as the kind of jobs created or what they are paying wasn’t available. In a roundabout way they are now, but you have to be a good scavenge hunter to find them.. Instead I’ve always maintained that the Avg, Hourly Earnings and the Avg. Work Week Hours were more important, for the kind of inflation that the Fed fears would be found here first. But there was something I spotted in the newspaper last week that I thought, would surely be a problem for those that get hung up on the number of jobs created each month going forward. And that is the new overtime rules that were passed by the Dept. of Labor. They take effect on December 1, 2016, so employers have six months to prepare for the change. According to the Department of Labor (DOL), employers can: 1. Pay time and-a-half for overtime work over 40 hours 2. Raise worker’s salaries above the new threshold ($47,476 per year) 3. Limit worker’s hours to 40 per week 4. Some combination of the above So, here’s the skinny on all this. Employers have been able to skip paying overtime to workers that are deemed “salaried”, but going forward, an employer would have to either raise the “salaried” persons salary to the $47,476 per year, or take them off the “salaried” list and pay them for the hours over 40 they worked. Now if you are an employer, and you have 10 employees that are all making, let’s say.. $30,000 per year on a “salaried” basis. You can give them all essentially $20K raises, or begin to pay them for overtime. Or, you can fire them, and hire new employees at a lower salary, and pay them the +40 hours overtime pay. Or, you could cut them back to hourly, and then make them part time, and save money! Now, I know that everyone out there acts ethically, and morally sound, but there will be someone out that that sees this new overtime pay rule as an opportunity not only cut salary, but to cut benefits costs. Well, that’s that. I find that this new overtime rule is good in that workers that need the overtime pay and work the hours, will finally get it, but I’m really scared that employers will see this an opportunity to cut costs, with workers not benefitting from the new rule. I sure hope that doesn’t happen. And with that I’ll get out of your hair for today, and send you on your way to a tub thumpin’ Thursday… be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Silver Coin Sales Have Record Year in 2015 appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Glimpse Into The Future Of What The Economic Collapse Might Look Like Posted: 02 Jun 2016 09:30 AM PDT A Glimpse Into The Future Of What The Economic Collapse Might Look Like The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noam Chomsky - The Internet II Posted: 02 Jun 2016 09:00 AM PDT This talk by Noam Chomsky was filmed at Northeastern University, Boston on Dec. 5, 1997 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Jun 2016 08:26 AM PDT If you enjoyed watching this video, be sure to check out the Hidden Secrets of Money website at https://www.hiddensecretsofmoney.com/. It's a world-leading educational series by Mike Maloney, the bestselling author of the Guide to Investing in Gold & Silver. As Mike explains in the series and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold – a reasonable correction? Posted: 02 Jun 2016 08:07 AM PDT Finance and Eco. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Junior miner Hummingbird Resources raises £45.8m to kick-start Mali gold mine Posted: 02 Jun 2016 07:52 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

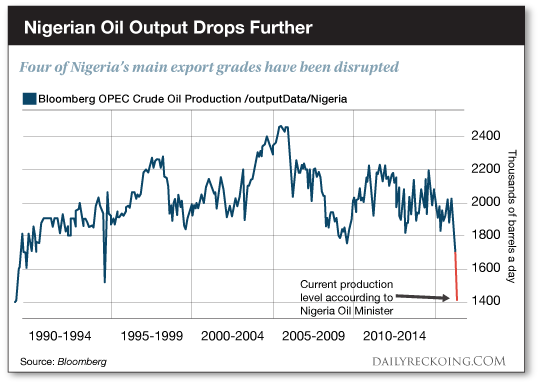

| Chaos Across The World Is A Good Thing For Oil Posted: 02 Jun 2016 07:50 AM PDT This post Chaos Across The World Is A Good Thing For Oil appeared first on Daily Reckoning. Dear Resource Hunter, This week, I felt I needed to sit down and put on paper all of the oil supply outages currently happening around the world. Combined, there is a lot of oil production off-line. Some of them would have been impossible to predict. Others… not so much. Oil prices are way up from the bottom that we saw in February, but I still believe the second half will be very good to those of us who are positioned to profit from rising oil prices. Nigeria — up to 800,000 Barrels Off-line I can't say that I wake up every day and remind myself how lucky I was to be born in Canada. When I spend 20 minutes reading the news, I quickly realize that I should. While it is missed by most of us living in Canada and the U.S., the unfortunate reality is that most of the world is a mess. Countries like Nigeria that are reliant on oil revenue increasingly so. Nigeria is a significant oil producer. Going back 25 years, Nigerian oil production has exceeded 2 million barrels a day a lot of the time. Today, a pipeline or key piece of oil infrastructure being blown up is a near-daily occurrence in Nigeria. Nigeria's new President Buhari was elected last year based on his stance against corruption. In an effort to end corruption, he put a stop to pipeline "security payments" that were being made to militants. The stated reason for those security payments was that the militants were protecting the pipelines. The truth is that the payments were to keep those same militants from blowing up the pipelines. Extortion would be the word, I believe. President Buhari tried to do the right thing and stopped the payments. The result of this being… you guessed it, the militants started blowing up pipelines.

Apparently, they are good at it, too. Nigerian production is down 800,000 barrels per day from the end of last year. That is a big number in the global scheme of things. I don't know how long the outages will last. It is going to depend on how willing the new Nigerian government is to take on some serious pain to do the right thing. I certainly wouldn't expect these militants are going to stop blowing up pipelines simply because they feel it is wrong. Venezuela — at Least 200,000 Barrels Down, More to Come I referred to Nigeria as a country that is a mess. Venezuela takes the idea of mess to an entirely new level. Like Nigeria, Venezuela is also a significant global oil producer. The first quarter of this year saw Venezuela's reported production at 2.5 million barrels per day. I say reported because who knows how reliable those numbers are. The oil price collapse has been a big part of the Venezuelan problem, but economic mismanagement over the long term is equally to blame. I guess revenues from $100 per barrel oil can keep big problems hidden. Today the country faces inflation in the triple digits and virtually no remaining cash reserves, and it is virtually certain to default on its debt. The population is facing food shortages, lack of medicine and violence. I've been watching the news from Venezuela for months trying to understand how the country's oil production hasn't completely collapsed. So far, it is down 200,000 barrels per day year on year. Venezuela's problems just keep getting worse. The country gets 60% of its power from hydroelectric dams. A long-lasting drought has water levels at the crucial Guri Dam so low that the entire country is being forced to curtail consumption of electricity. The Venezuelan government just mandated a two-day workweek to conserve electricity. Despite that, rolling blackouts are still being experienced. The entire country is on the cusp of a meltdown. International service companies like Schlumberger have abandoned operations in Venezuela. There is no telling how low Venezuela's production might go. A mass walkout of Venezuela's oil workers is a real possibility at any point. Saudi Arabia — Paying With IOUs Zero interest rates and eager lenders were the main original cause of this oil crash. Too much money thrown at American horizontal producers allowed U.S. production to soar. It is the Saudis, however, who have kept oil prices this low for so long. It must be wonderful to have the power that the Saudis do. They just keep pumping away without feeling any financial pain like Nigeria, Venezuela or the American oil producers. But are the Saudis really feeling no pain? Bloomberg just reported that the Saudi government is planning to use IOUs to pay contractors. That certainly does not sound like a plan from someone in good financial shape. I would imagine that policy won't go over pretty well with the contractors as well. This is, after all, a country where citizens are used to being paid for good behavior. Saudi production has been steady since they really cranked things up a year ago. There is very little room for the Saudis to increase production further but plenty of room for it to fall if the general population becomes restless. Even the strongest OPEC member is on shaky legs. Iraq — It Is Only Going to Get Worse From Here Along with Saudi Arabia, Iraq was the worst thing that happened to oil prices in 2015. Billions of dollars of investments that were made in the preceding years came to fruition and Iraq production soared. The next several years are going to look very different. The country is going to feel the effects of the lack of investment that has taken place since ISIS really got rolling and the oil price crashed. It only takes some pretty-simple math to figure out where Iraq production is headed. The oil ministry in the country has actually gone to the foreign oil firms operating in Iraq and asked them to slow their investment. The reason is that the Iraq government can't pay them for their work. Oil prices cut by two-thirds and huge amounts of money being spent on the war against ISIS have tapped the government coffers. Throw in the rampant corruption that exists within the Iraqi government and you have a real money problem. An official agreement has been reached with most foreign companies to reduce their investment by 50%. When you cut spending by that much, it isn't just going to put an end to production growth; it is going to make it nearly impossible to just maintain production. The Iraq oil production growth engine is stalled. Fort McMurray — 1.2 Million Barrels Down for How Long? Then there is this unexpected nightmare. It is hard to care about oil production when an entire city is on the verge of being destroyed. Estimates that I have seen are that production has been down by 1.2 million barrels per day for a couple of weeks so far. When all of this production comes back on stream is unclear at this point. This Fort McMurray situation is not like Nigeria or Libya or Venezuela where the countries are so messed up that the production could be down for years. This production will come back. Still, this is a huge amount of oil that has gone down, and it has happened at the same time that Nigeria has lost a similarly huge amount. What this forest fire outage is going to do at the very least is help pull 20 million-plus barrels of oil out of storage, which is a positive that the market never expected. I've been saying for months that daily oil supply and demand weren't too far out of whack and that the problem is the huge amount of oil in storage. Then There Is the Decline Everywhere Else The 2 million-plus barrels of outages listed above were all unexpected heading into this year. We knew that the low oil price was creating the potential for chaos, but I wouldn't have thought this much production would be lost. There are declines elsewhere, though, that we knew were coming, and they have transpired as expected.

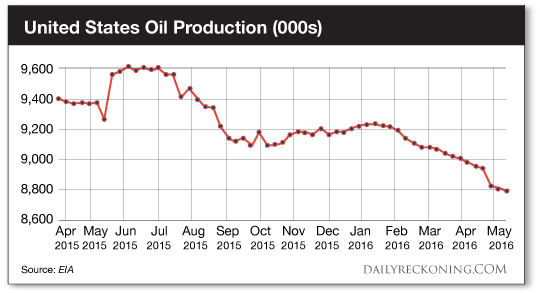

For the graph above, I pulled the EIA weekly U.S. production figures. The spring and early summer 2015 bounced around a bit, as the EIA was changing its data-gathering process. The key point to be aware of is that since peaking at 9.6 million barrels per day, U.S. production has dropped 800,000 barrels per day. Monthly production declines are currently roughly 100,000 barrels per day. Those declines haven't ended. They are likely accelerating due to the fact that hardly any drilling is going on. The Bakken rig count, which peaked at 206 rigs in 2014, is now at 25. That is 25! The U.S. could leave this year down another 800,000 barrels per day. The truth is that I've got more declines to report than I have space to write. Chinese production in April was down 5.6% year on year. That is another 200,000 barrels of production lost. With Pemex struggling (and admittedly having a liquidity problem), Mexican production is also down close to 200,000 barrels per day. Columbia can chip in another 100,000 barrels (with more coming with a recent pipeline bomb of their own). The former Soviet Union states are struggling, too. All This While Demand Marches Ever Higher Outside of Iran, there is no country with the ability to raise oil production significantly in the next 12 months. The list of countries with supply declining is long, and the declines are significant. Meanwhile, demand for oil shows no signs of slowing. In fact, the IEA just raised its estimates of demand growth for Q1 2016 to 1.4 million barrels per day as India, China and Russia were surprisingly strong. Since oil crashed in the second half of 2014, global oil demand has increased by 3 million barrels per day. Much has changed, folks. We are set up here for much higher oil prices over at least the next 18–24 months. Perhaps a lot longer as we start to see the true consequences of two full years of underinvestment in this sector. Keep looking through the windshield, Jody Chudley The post Chaos Across The World Is A Good Thing For Oil appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

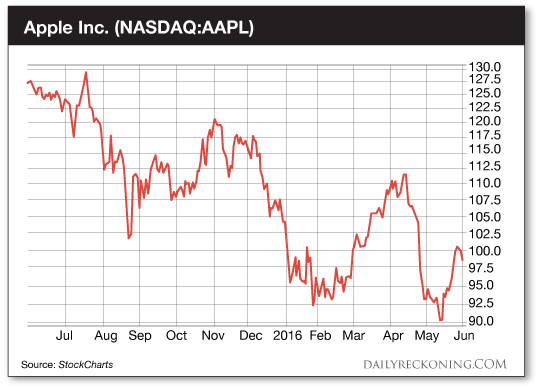

| These Two Quick Tips Will End All Your Stock Market Worries… Posted: 02 Jun 2016 06:46 AM PDT This post These Two Quick Tips Will End All Your Stock Market Worries… appeared first on Daily Reckoning. There's nothing worse than getting stuck holding a lame stock… But you don't have to deal with the emotional pain caused by the meltdown of one of your investments. If you learn the two simple market truths I'm about to reveal today, you could actually protect your brokerage account from big losses. I'll also show you how use these tips to spot a failing investment before you buy shares… Listen, I know how easy it is to get caught up in the story of an exciting company. In fact, nearly every person who has invested a dollar in the stock market has bet on an intriguing story. There are plenty of compelling businesses out there. However, we all know that most of these stories don't pan out-especially when it comes to futuristic technology. Don't feel bad– we've all laid money on a bold speculation that delivered terrible returns (I still can't believe hoverboards aren't a thing). Unfortunately, losing money on what you thought was a sure thing can be traumatic. You'll find yourself wondering why it all went wrong. You might even want out of the market for good… However, the two market truths I'm revealing today will hopefully put an end to your uncertainty. They don't require an advanced knowledge of economics or finance. And you can apply the tips to virtually any investing situation. Here's what you need to know… First, a stock can become "detached" from the company it represents. What this means is the share price can quickly drop—even if the company in question is releasing favorable news or impressive earnings. A sharp decline in share price on "good news" is one of the most gut-wrenching situations you'll experience when investing. It's frustrating. And it can cause you to think irrationally. There are countless reasons the stock of a seemingly good company can drop. The company could simply be too early along the development curve to attract more investors. Maybe the investing public has yet to grasp the company's potential. Or maybe a big fund is liquidating its shares. Any of these situations can drive down the share price no matter how good recent news has been for the stock. The truth is, promising companies can have bad weeks or even bad years. You have to prepare for this possibility that your idea might not translate to an obvious investment to the average speculator… Don't believe me? Just look at how Apple Inc. has performed over the past year…

Is Apple about to go out of business? Nope. But that's not stopping this stock from dropping 25% over the past 12 months. Sure, Apple is still a tech giant with more than $200 billion in cash on its books. But that's cold comfort for anyone who bought shares over the past 12 months. This brings us to the second market truth you need to remember… Strong selling usually won't abruptly stop and turn into buying. This is one of the most important investing lessons you'll ever learn. So pay attention… If the market collectively decides to sell a stock for any reason, the selling is likely to continue. Period. I don't care if the stock is selling off due to a rogue analyst chopping the company to bits or a clueless blogger trying to get his name out there by bashing random companies. I know it's tempting to talk yourself into holding a stock that just took a punch to the gut. But nine times out of ten, this is suicidal behavior. Rarely will you see a stock reverse course and move higher immediately following a strong selloff. Investors and traders won't want to buy a stock that's diving headfirst into a strong downtrend because they think they'll be able to get it cheaper if they wait. Think about it. Would you buy a stock that's dropping every single day? I didn't think so… When it comes to both of the situations we've discussed today, it's important to identify when sellers are taking control. If the price starts to move lower on high volume, you must act immediately to preserve your capital. After all, you can always wait and buy shares at a lower price if you still believe in the company. Hey, it's better than going broke chasing a losing stock… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post These Two Quick Tips Will End All Your Stock Market Worries… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Federal Reserve Hacked more than 50 times between 2011 and 2015 Posted: 02 Jun 2016 06:44 AM PDT Hackers take on the Federal Reserve The Wall Street Journal Chief Economics Correspondent Jon Hilsenrath on a report that Federal Reserve was hacked more than 50 times between 2011 and 2015 and the state of the U.S. economy. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Bull Market – Is it Time Yet? Posted: 02 Jun 2016 06:25 AM PDT Chart Freak writes: The Gold Bull Market Do you think the Gold Bull Market has returned? Obviously I do, and have been trading as if the Gold Bull Market has returned. You need to be aware of this opportunity and appreciate that another big move in this Gold Bull Market is again developing. If this next move is anything like the moves seen during past Gold Bull Market’s, then you will not want to miss the next buying entry after this current correction winds down. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold – a reasonable correction? Posted: 02 Jun 2016 06:07 AM PDT Finance and Eco. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Bubble: The Three Reasons The US Dollar Will Soon Crash Posted: 02 Jun 2016 04:23 AM PDT The Dollar Vigilante’s Senior Analyst, Ed Bugos, is a genius… but he’s also somewhat of a recluse. While we have gotten access to his incredible written insights for the last six years in The Dollar Vigilante newsletter, he has always shied away from the public spotlight. Until now! | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global mints report record silver coin sales for 2015 Posted: 02 Jun 2016 04:07 AM PDT USA Gold | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are you still waiting for a pullback, so you can take part in the gold and silver bull market? Posted: 02 Jun 2016 02:07 AM PDT Peter Degraaf | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Biggest Bubble In History Will Lead To An Even Bigger Collapse Posted: 02 Jun 2016 01:09 AM PDT The Biggest Bubble In History Will Lead To An Even Bigger Collapse |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment