Gold World News Flash |

- Is A New Banking Crisis Imminent? Recent Rise In Delinquency Rates Is Shocking

- The True Nature of Gold Is Liberty

- Get On The Goldwagon To $10,000

- Guerrilla Update: BREXIT. An Exit To The Gold Standard

- Incrementum's 'In Gold We Trust 2016' report

- Doug Casey Debunks The Common Excuses for "Staying" In One Country

- In Gold We Trust, 2016 Edition

- Gerald Celente -- Globalists Are Going To Collapse World Economy

- Prophecy Update End Time Signs 6/28/16

- The Brazil Olympic Games are Cursed

- Will migrants flood Britain before Brexit is enforced?

- Gold Daily and Silver Weekly Charts - Pouting Plutocrats and Their Pampered Professionals

- SPECIAL REPORT: CRITICAL ALERT "DEBT MARKET WARNING." By Gregory Mannarino

- Brexit may cause a Stock Market Crash

- EU was a CIA Project

- Chinese investors join gold rush for haven after Brexit turmoil

- Jim’s Mailbox

- Gold is sending a dark sign that 'almost everything has changed' in the market

- #Brexit good for #Russia ?

- Brexit sends Europe into Political and Economic Crises

- Black Swans, AntiFragile and Profit from Chaos

- Brexit: The Big Picture - Mike Maloney

- Recession expected in the U.S.?

- If only they were buying real metal

- Stock Market Meltdown Likely to Drive Gold Towards $1,500 )

- Greenspan Warns "Early Days Of A Crisis," Inflation Coming, Urges Return To Gold Standard

- A Stunning Email About Brexit Vote As Elites Panic And Global Collapse Edges Closer

- Breaking News And Best Of The Web

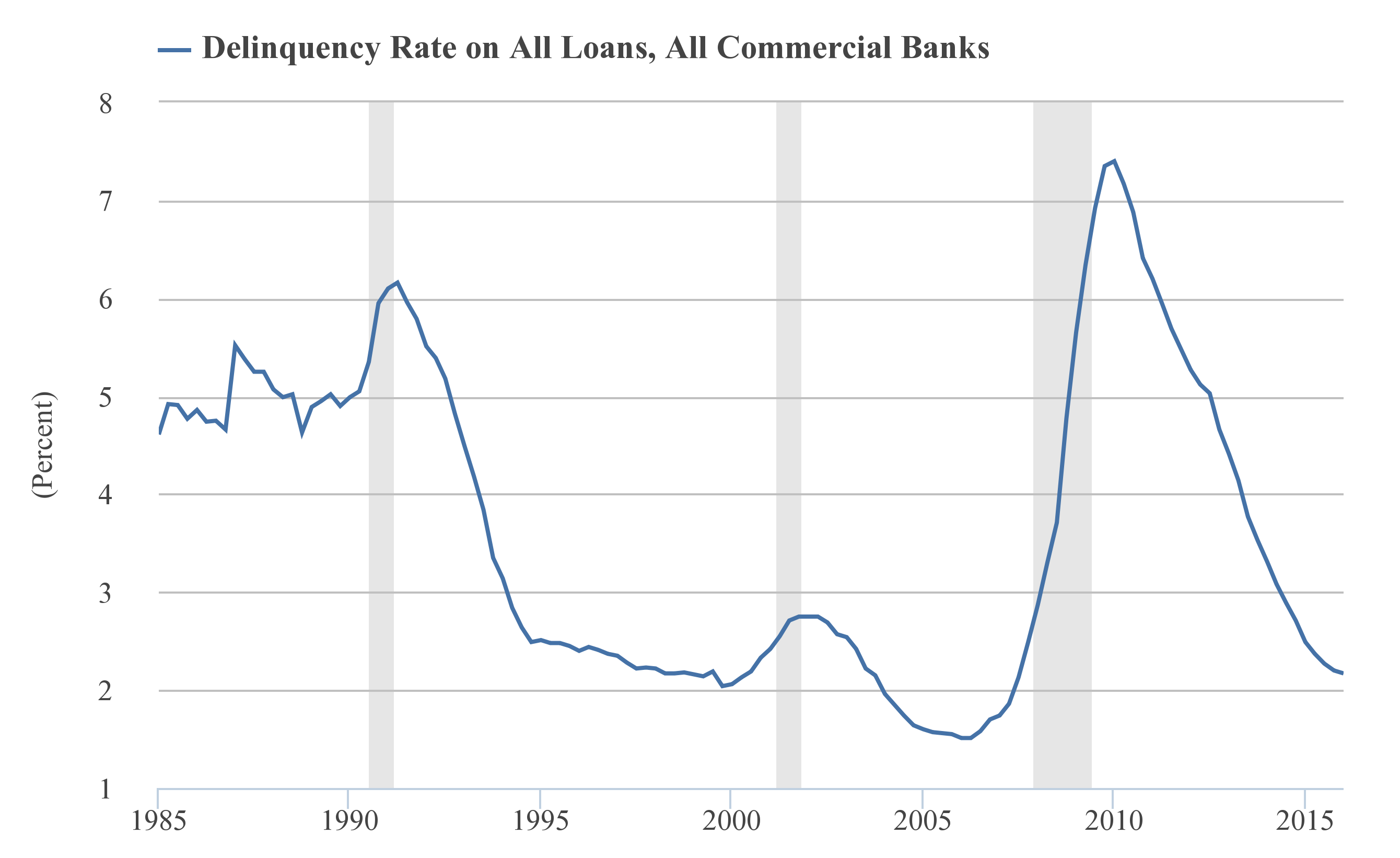

| Is A New Banking Crisis Imminent? Recent Rise In Delinquency Rates Is Shocking Posted: 29 Jun 2016 01:00 AM PDT Submitted by Olav Dirkmaat via UFM Market Trends, The delinquency rate on loans is key in understanding banking. It answers one question: what percentage of loans is overdue for payment? The delinquency rate is by far the most useful indicator for “credit stress.” It seems, however, as if delinquency no longer counts. Few are paying attention to the quick and sudden rise of the delinquency rate. What does it tell us and is a new banking crisis imminent? This Is What Happened after Janet Yellen Hiked the Fed Funds Rate in DecemberI have said it many times over and I will repeat it here: the last time around, it took Fed-chairman Alan Greenspan over two years and seventeen rate hikes to bring the Fed funds rate from a then all-time-low of 1% to 5.25%, before the U.S. economy suffered the worst recession since the 1930s. We are not so lucky this time. Greenspan’s rate hikes didn’t affect delinquency rates straight away. Credit stress was subdued until a year after Greenspan’s last hike. Only in the first quarter of 2007, delinquency rates began to move higher. The reason is as clear as the water surrounding the Bahamas: in the years preceding the Great Recession credit growth was mainly focused on the U.S. housing market. Credit growth was mostly driven by mortgage lending. Mortgages were generously provided by banks, but increasingly to subprime borrowers (subprime referring to their poor credit). Yet these subprime borrowers didn’t pay higher interest rates on their mortgages the moment Alan Greenspan began hiking rates. But as soon as their (promotional) teaser rates resetted, they started “feeling the Alan.” Delinquency rates went through the roof and the U.S. economy into recession. Teaser rates, the low initial interest rate a borrower pays for the first few years, were responsible for the lag between Greenspan’s rate hikes and the 2008 recession. More FragileToday, the Federal Reserve is ignoring a very inconvenient truth: the global economy is much more fragile than the last time around. And we have no teaser rates in today’s subprime credit (unless we of course consider oil producers that hedged oil prices by buying futures as something akin to “teaser rates”). This time around, we will certainly not need seventeen rate hikes or three years before pushing the economy into recession. In fact, we now know what happened after Janet Yellen increased the Fed funds rate with a mere quarter-percentage point: the delinquency rate on commercial and industrial loans increased 50%. That is right. In a single quarter delinquency rates in the U.S. banking sector exploded from 1% to 1.5%. The cycle has turned. This Is Why Nobody Is Paying AttentionWhy is nobody paying attention to this seemingly undeniable shift in the credit cycle? Why does the Federal Open Market Committee (FOMC) not even mention it? Why are the alarm bells not ringing in both Fed board rooms and the financial press? The only answer to these questions is that the Fed is committing a capital sin. The headline number, the delinquency rate on all loans, decreased in the first quarter of 2016 from 2.20% to 2.17%. That ignores, however, the underlying pressures building up inside banks’ balance sheets. Fed-officials seem to focus on the headline number, while ignoring the deteriorating fundamentals. With rising home prices, a vibrant housing market, increasing employment and interest rates at the lowest levels in world history, defaults on mortgage and credit card debt are reaching all-time lows. Yet delinquency on mortgages and credit cards tend to lag the business cycle. Typically, they only rise when we already are in recession, just as unemployment tends to be a lagging indicator.

The headline number is fooling Fed-officials; delinquency rates are still declining. But the delinquency rate on all bank loans (the headline number) has no predictive power; it just follows a random pattern. Source: St Louis Fed

Even if we are on the verge of a new banking crisis, the headline number will never tell us so. Which Loans Are Increasingly Overdue?If delinquency rates on consumer credit (mortgages and credit card debt) will not help us in estimating how probable a new banking crisis is, then which delinquency rates do matter? And why did I call them “shocking”? Let’s first break down a bank portfolio. Bank loans can we divided into three groups:

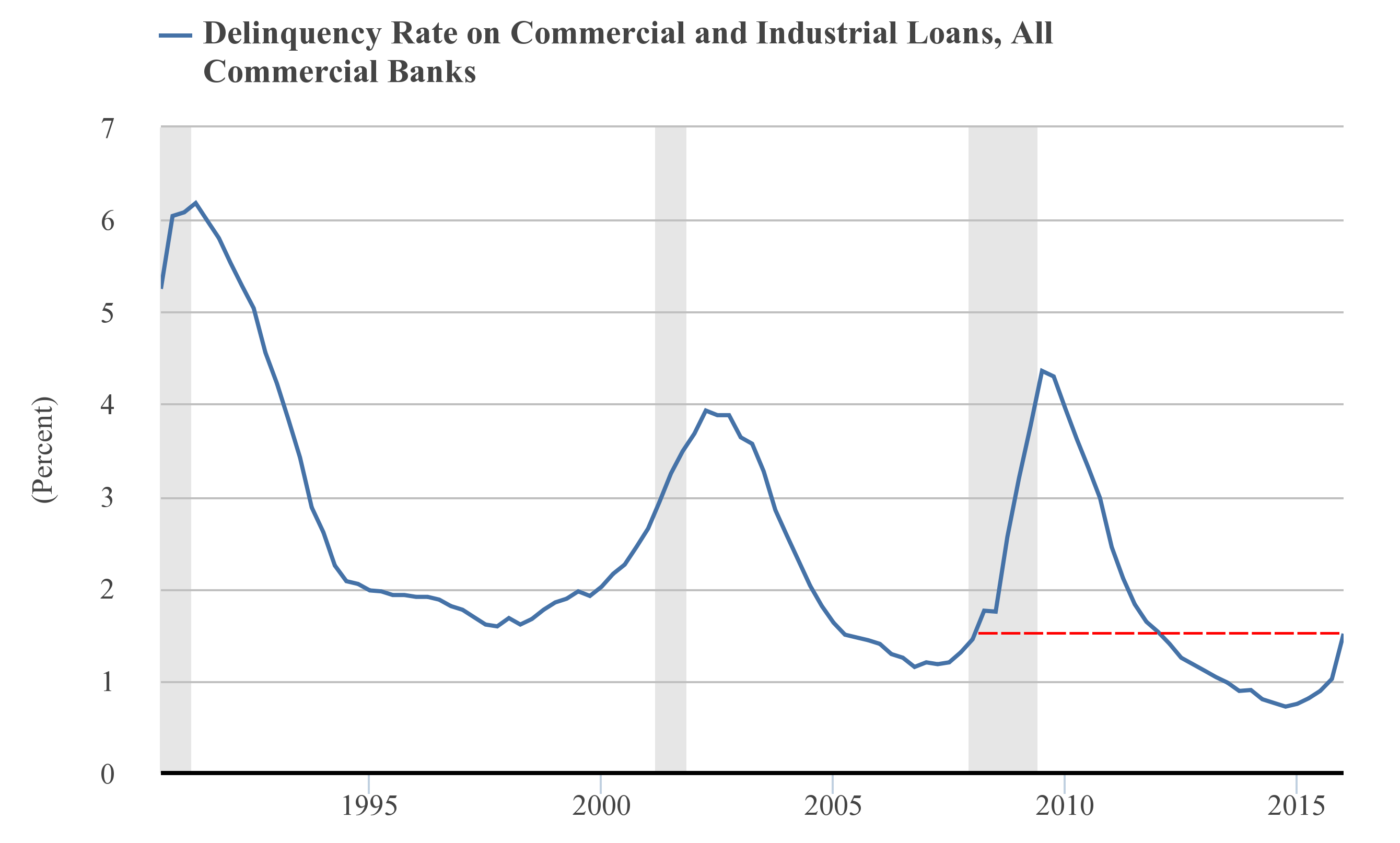

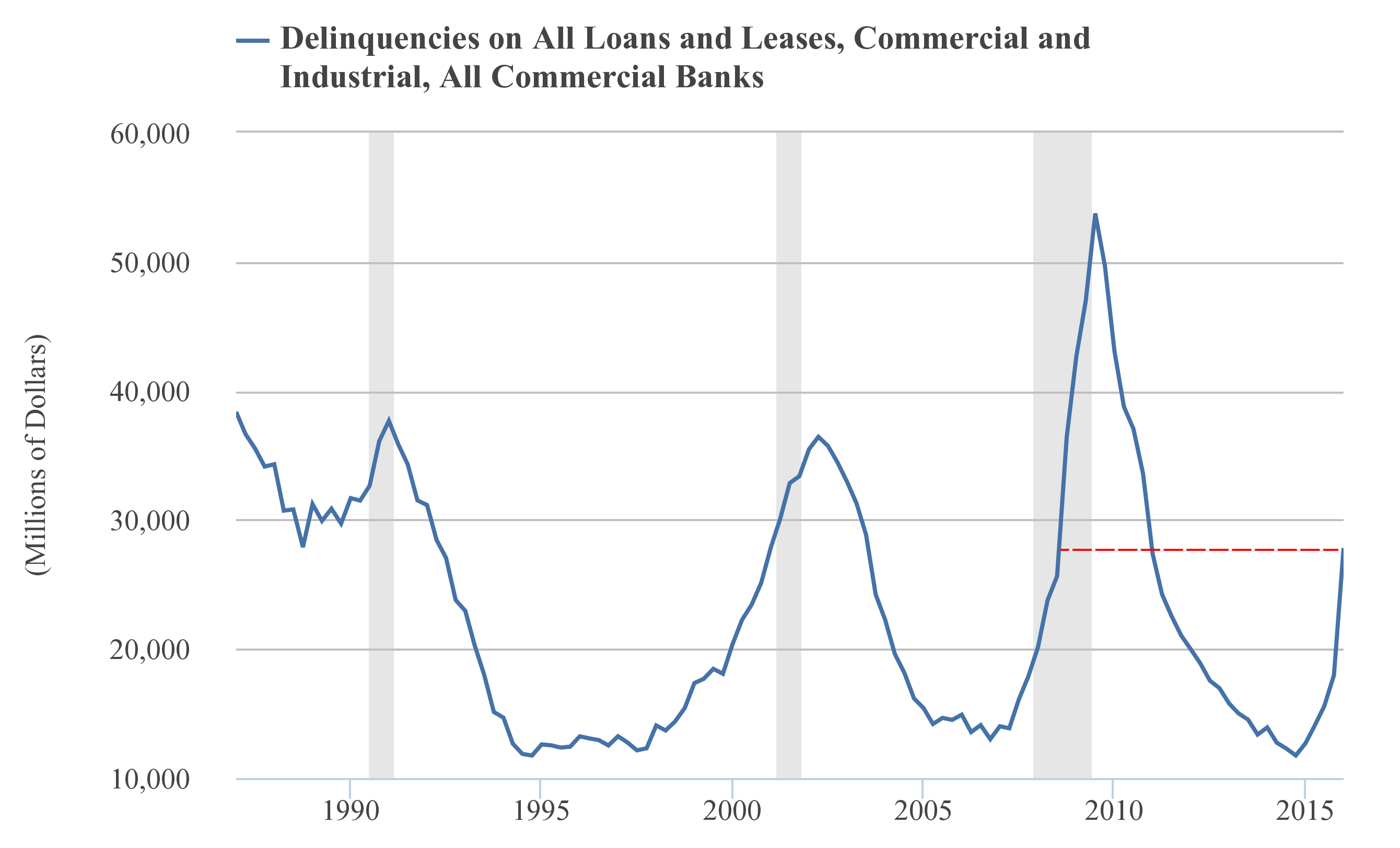

(Just for the sake of comparison, U.S. banks currently hold $1,300 billion in consumer debt, $1,810 billion in commercial and industrial debt, and over $3,000 billion in real estate debt.) Banks lend money to consumers for buying homes (mortgages) or consumer goods (credit card debt). We concluded that delinquency rates on those loans tend to lag the business cycle. What’s left? Loans to businesses, in whatever form or shape they come. Most of these loans are pegged to an interest rate benchmark, for instance the LIBOR. After the Fed’s first rate hike in December, the U.S. dollar 12-month LIBOR went up from approximately 0.8% to 1.3%. Marginal borrowers are slowly getting pushed into bankruptcy. December’s rate hike clearly resulted in a change of tides: delinquency rates have bottomed and are on their way up. And do not forget the following: the fact that delinquency rates no longer decrease but began to increase, has always been a clear warning signal for a recession — at least during the past twenty years. And over that same period, this indicator never gave a “false positive,” in contrast to many other (recession) indicators.

A clear danger sign: delinquency rates on commercial and industrial loans are creeping up. Source: St Louis Fed

In dollar terms the shift is even more pronounced. This is of course the result of our staggering debt levels, which are not apparent in the relative numbers. Source: St Louis Fed

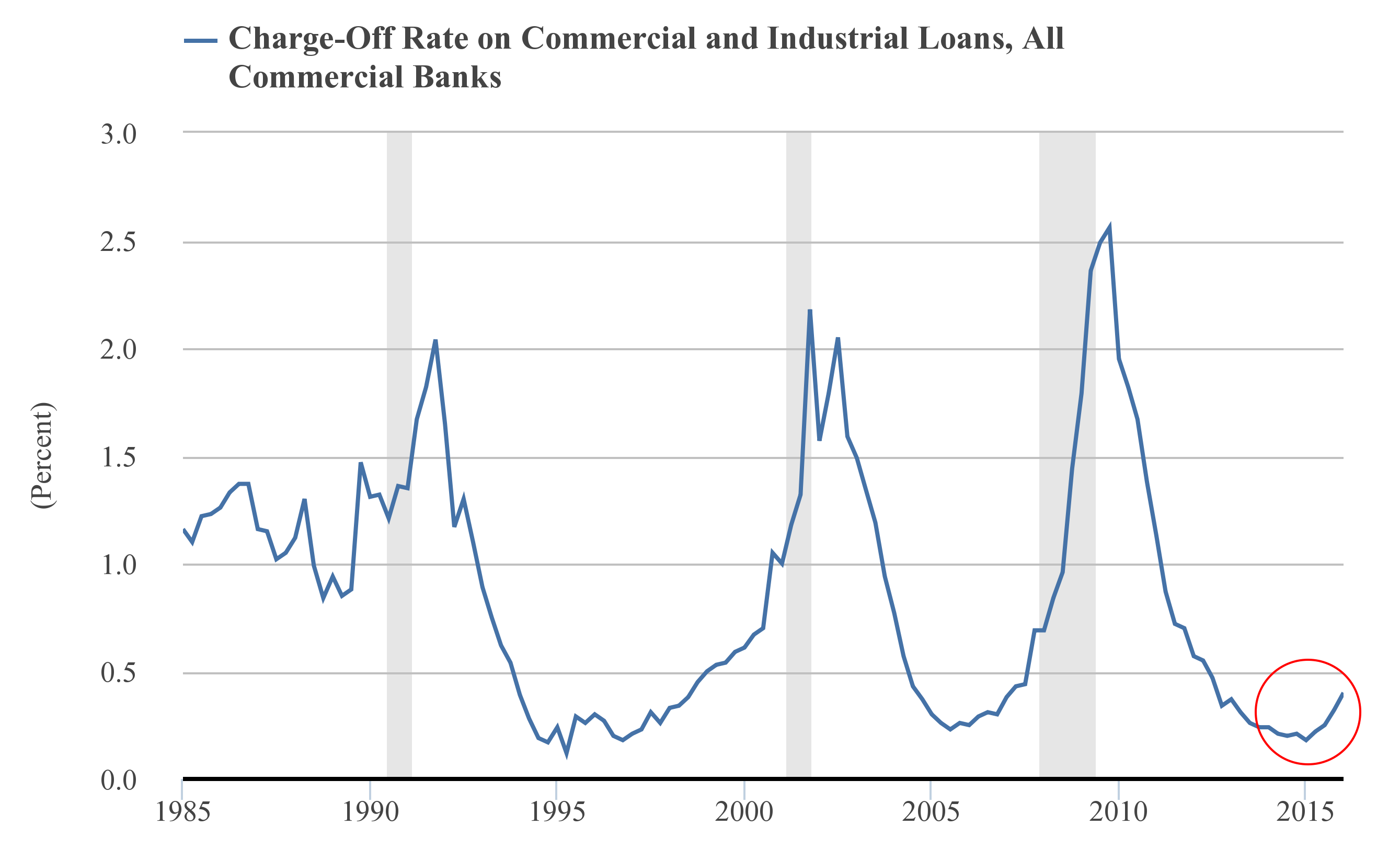

In line with increasing loan delinquencies, charge-off rates on commercial and industrial loans are picking up as well (charge-off rates tend to lag somewhat). Source: St Louis Fed

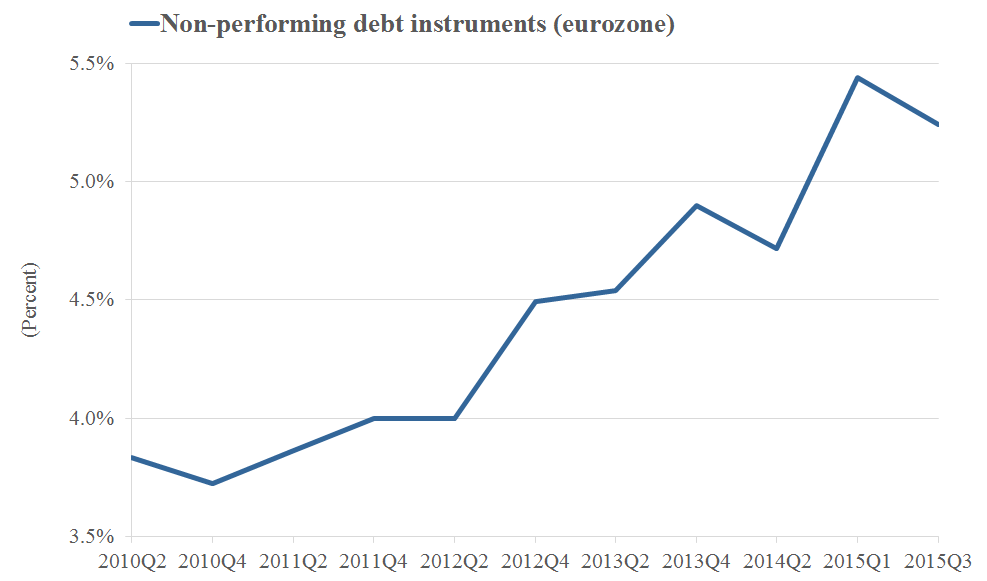

Delinquency Rates in EuropeThe delinquency rate in Europe is also on the rise. Yet, we do have to single out the countries that skew this eurozone average. Italian banks in particular are suffering from an unbelievably high delinquency rate. The delinquency rate in Italy is at such extreme levels that the country might turn the euro crisis in front page news again (if for once Greece remains on the sidelines).

The delinquency rate on bank loans in Europe is also on the rise; here too, at least in the periphery countries, it appears the credit cycle has turned. Source: European Central Bank (CBD2, ‘gross non-performing debt instruments’)

Keep a Close Eye on DelinquencyWhat is next? We will have to wait and see to find out what delinquency rates have done in the second quarter. However, it is clear that the tide has turned. It is irrelevant whether the Federal Reserve will hike rates in July or September. Consensus currently says we should expect two more rate hikes this year. If that is true, we can expect delinquency rates to move up further in the coming quarters. In 2006 it was exactly twelve months after delinquency rates bottomed that the recession began. If the same period applies, we are due for a recession. In the first quarter of the Great Recession in 2008, delinquency rates were only 1.45%. We are already above that level. On the flipside, however, we should not ignore that it took three years of rising delinquency rates before the economy entered into recession in 2001. Credit cycles are not an exact science. Yet the trend is clear and Fed chair Janet Yellen should be terrified about this disturbing development. The fact that increasing loan delinquency coincides with mountains of debt maturing in 2016 and 2017 is a topic for next time. |

| The True Nature of Gold Is Liberty Posted: 28 Jun 2016 11:11 PM PDT “Look at that screen,” exclaimed Fox Business Network's Stuart Varney, referring to the television graphic showing markets crashing across the globe. “The only thing going up is the price of gold!” “It's always a dangerous thing when you leave democracy up to the people,” joked Varney's guest – venture capitalist and author Peter Kiernan, as they watched Britain vote Thursday night to escape the European Union. |

| Get On The Goldwagon To $10,000 Posted: 28 Jun 2016 11:04 PM PDT Get On The Goldwagon To $10,000 |

| Guerrilla Update: BREXIT. An Exit To The Gold Standard Posted: 28 Jun 2016 08:00 PM PDT from Rogue Money: V Breaks down the insane news of the day and the litany of data spewing out from world governments. |

| Incrementum's 'In Gold We Trust 2016' report Posted: 28 Jun 2016 07:00 PM PDT 10:13p ET Tuesday, June 28, 2016 Dear Friend of GATA and Gold: Liechtenstein-based asset-management firm Incrementum AG this week published its "In Gold We Trust" report for 2016 and was quite bullish for both the monetary metal and gold mining equities. The report, written by Ronald-Peter Stoeferle and Mark J. Valek, includes a chapter titled "The Fix Is In -- Gold Price Manipulation Exposed," which is prefaced by your secretary/treasurer's remark at GATA's Washington conference in 2008: "There are no markets anymore, just interventions." The report says: "What most market participants once considered a crude goldbug conspiracy theory, reflecting dissatisfaction with the precious metal's price trend and sour grapes on account of missing the rally in the stock market, has now become a certainty." As for gold equities, the report adds: "Relative to the gold price, the gold stocks in the Gold Bugs Index are at the same level as in 2001, when the gold bull market began. This is by itself strong evidence that gold mining stocks are cheap relative to gold. "However ... mining stocks were able to outperform gold only between 2001 and 2004. We have discussed the reasons for the disappointing performance of the sector in the period after 2004 and its fundamental problems in detail in last year's report under the heading 'Why Have Gold Mining Stocks Performed So Badly?' We also mentioned on that occasion that the gold mining industry had gone through a process of creative destruction and fundamental restructuring. "As a result of this, we expect that in coming years, mining stocks will once again become the kind of leveraged bet on gold that investors crave." At 144 pages, complete with charts, Incrementum's "In Gold We Trust 2016" report is serious stuff. It's posted in PDF format here: http://www.incrementum.li/wp-content/uploads/2016/06/In_Gold_we_Trust_20... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Doug Casey Debunks The Common Excuses for "Staying" In One Country Posted: 28 Jun 2016 06:50 PM PDT Submitted by Doug Casey via InternationalMan.com, Tell a person that it's a big beautiful world, full of fresh opportunities and a sense of freedom that is just not available by staying put and you will inevitably be treated to a litany of reasons why expanding your life into more than one country just isn't practical. Let's consider some of those commonly stated reasons, and why they might be unjustified. While largely directed at Americans, these are also applicable to pretty much anyone from any country (for example, Britain... or Germany). "America is the best country in the world. I'd be a fool to leave." That was absolutely true, not so very long ago. America certainly was the best – and it was unique. But it no longer exists, except as an ideal. The geography it occupied has been co-opted by the United States, which today is just another nation-state. And, most unfortunately, one that's become especially predatory toward its citizens. "My parents and grandparents were born here; I have roots in this country." An understandable emotion; everyone has an atavistic affinity for his place of birth, including your most distant relatives born long, long ago, and far, far away. I suppose if Lucy, apparently the first more-or-less human we know of, had been able to speak, she might have pled roots if you'd asked her to leave her valley in East Africa. If you buy this argument, then it's clear your forefathers, who came from Europe, Asia, or Africa, were made of sterner stuff than you are. "I'm not going to be unpatriotic." Patriotism is one of those things very few even question and even fewer examine closely. I'm a patriot, you're a nationalist, he's a jingoist. But let's put such a tendentious and emotion-laden subject aside. Today a true patriot – an effective patriot – would be accumulating capital elsewhere, to have assets he can repatriate and use for rebuilding when the time is right. And a real patriot understands that America is not a place; it's an idea. It deserves to be spread. "I can't leave my aging mother behind." Not to sound callous, but your aging parent will soon leave you behind. Why not offer her the chance to come along, though? She might enjoy a good live-in maid in your own house (which I challenge you to get in the U.S.) more than a sterile, dismal, and overpriced old people's home, where she's likely to wind up. "I might not be able to earn a living." Spoken like a person with little imagination and even less self-confidence. And likely little experience or knowledge of economics. Everyone, everywhere, has to produce at least as much as he consumes – that won't change whether you stay in your living room or go to Timbuktu. In point of fact, though, it tends to be easier to earn big money in a foreign country, because you will have knowledge, experience, skills, and connections the locals don't. "I don't have enough capital to make a move." Well, that was one thing that kept serfs down on the farm. Capital gives you freedom. On the other hand, a certain amount of poverty can underwrite your freedom, since possessions act as chains for many. "I'm afraid I won't fit in." The real danger that's headed your way is not fitting in at home. This objection is often proffered by people who've never traveled abroad. Here's a suggestion. If you don't have a valid passport, apply for one tomorrow morning. Then, at the next opportunity, book a trip to somewhere that seems interesting. Make an effort to meet people. Find out if you're really as abject a wallflower as you fear. "I don't speak the language." It's said that Sir Richard Burton, the 19th century explorer, spoke 10 languages fluently and 15 more "reasonably well." I've always liked that distinction although, personally, I'm not a good linguist. And it gets harder to learn a language as you get older – although it's also true that learning a new language actually keeps your brain limber. In point of fact, though, English is the world's language. Almost anyone who is anyone, and the typical school kid, has some grasp of it. "I'm too old to make such a big change." Yes, I guess it makes more sense to just take a seat and await the arrival of the Grim Reaper. Or perhaps, is your life already so exciting and wonderful that you can't handle a little change? Better, I think, that you might adopt the attitude of the 85-year-old woman who has just transplanted herself to Argentina from the frozen north. Even after many years of adventure, she simply feels ready for a change and was getting tired of the same old people with the same old stories and habits. "I've got to wait until the kids are out of school. It would disrupt their lives." This is actually one of the lamest excuses in the book. I'm sympathetic to the view that kids ought to live with wolves for a couple of years to get a proper grounding in life – although I'm not advocating anything that radical. It's one of the greatest gifts you can give your kids: to live in another culture, learn a new language, and associate with a better class of people (as an expat, you'll almost automatically move to the upper rungs – arguably a big plus). After a little whining, the kids will love it. When they're grown, if they discover you passed up the opportunity, they won't forgive you. "I don't want to give up my U.S. citizenship." There's no need to. Anyway, if you have a lot of deferred income and untaxed gains, it can be punitive to do so; the U.S. government wants to keep you as a milk cow. But then, you may cotton to the idea of living free of any taxing government while having the travel documents offered by several. And you may want to save your children from becoming cannon fodder or indentured servants should the U.S. re-institute the draft or start a program of "national service" – which is not unlikely. But these arguments are unimportant. The real problem is one of psychology. In that regard, I like to point to my old friend Paul Terhorst, who 30 years ago was the youngest partner at a national accounting firm. He and his wife, Vicki, decided that "keeping up with the Joneses" for the rest of their lives just wasn't for them. They sold everything – cars, house, clothes, artwork, the works – and decided to live around the world. Paul then had the time to read books, play chess, and generally enjoy himself. He wrote about it in Cashing In on the American Dream: How to Retire at 35. As a bonus, the advantages of not being a tax resident anywhere and having time to scope out proper investments has put Paul way ahead in the money game. He typically spends about half his year in Argentina; we usually have lunch every week when in residence. I could go on. But perhaps it's pointless to offer rational counters to irrational fears and preconceptions. As Gibbon noted with his signature brand of irony, "The power of instruction is seldom of much efficacy, except in those happy dispositions where it is almost superfluous." Let me be clear: in my view, the time to internationally diversify your life is getting short. And the reasons for looking abroad are changing. In the past, the best argument for expatriation was an automatic increase in one's standard of living. In the '50s and '60s, a book called Europe on $5 a Day accurately reflected all-in costs for a tourist. In those days a middle-class American could live like a king in Europe. But those days are long gone. Now it's the rare American who can afford to visit Europe except on a cheesy package tour. That situation may actually improve soon, if only because the standard of living in Europe is likely to fall even faster than in the U.S. But the improvement will be temporary. One thing you can plan your life around is that, for the average American, foreign travel is going to become much more expensive in the next few years as the dollar loses value at an accelerating rate. Affordability is going to be a real problem for Americans, who've long been used to being the world's "rich guys." But an even bigger problem will be presented by foreign exchange controls of some nature, which the government will impose in its efforts to "do something." FX controls – perhaps in the form of taxes on money that goes abroad, perhaps restrictions on amounts and reasons, perhaps the requirement of official approval, perhaps all of these things – are a natural progression during the next stage of the crisis. After all, only rich people can afford to send money abroad, and only the unpatriotic would think of doing so. How and WhereI would like to reemphasize that it’s pure foolishness to have your loyalties dictated by the lines on a map or the dictates of some ruler. The nation-state itself is on its way out. The world will increasingly be aligned with what we call phyles, groups of people who consider themselves countrymen based on their interests and values, not on which government's ID they share. I believe the sooner you start thinking that way, the freer, the richer, and the more secure you will become. The most important first step is to get out of the danger zone. Let’s list the steps in order of importance.

Where to go? The personal conclusion I came to was Argentina (followed by Uruguay), where I spend a good part of my year and even more now that my house at La Estancia de Cafayate is completed. In general, I would suggest you look most seriously at countries whose governments aren't overly cozy with the U.S. and whose people maintain an inbred suspicion of the police, the military, and the fiscal authorities. These criteria tilt the scales against past favorites like Australia, New Zealand, Canada, and the UK. And one more piece of sage advice: stop thinking like your neighbors, which is to say stop thinking and acting like a serf. Most people – although they can be perfectly affable and even seem sensible – have the attitudes of medieval peasants that objected to going further than a day's round-trip from their hut, for fear the stories of dragons that live over the hill might be true. We covered the modern versions of that objection a bit earlier. I'm not saying that you'll make your fortune and find happiness by venturing out. But you'll greatly increase your odds of doing so, greatly increase your security, and, I suspect, have a much more interesting time. Let me end by reminding you what Rick Blaine, Bogart's character in Casablanca, had to say in only a slightly different context. Appropriately, Rick was an early but also an archetypical international man. Let's just imagine he's talking about what will happen if you don't effectively internationalize yourself now. He said: "You may not regret it now, but you'll regret it soon. And for the rest of your life." |

| In Gold We Trust, 2016 Edition Posted: 28 Jun 2016 05:50 PM PDT Submitted by Pater Tenebrarum via Acting-Man.com, The 10th Anniversary Edition of the “In Gold We Trust” ReportAs every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below.

Gold, daily, over the past year – click to enlarge. The report celebrates its 10th anniversary this year. As always, a wide variety of gold-related topics is discussed, providing readers with a wealth of valuable and intellectually stimulating information. This year’s report inter alia includes a detailed discussion of gold’s properties in terms of Nicholas Nassim Taleb’s “fragility/ robustness/ anti-fragility” matrix, as well as close look at the last resort of mad-cap central planners that goes by the moniker “helicopter money”. Since falling to a new multi-year low amid growing despondency and a crescendo of bearishness late last year, gold has celebrated a rather noteworthy comeback. As our regular readers know, we pointed to many subtle signs that indicated to us that a trend change might soon be afoot as the low approached (particularly in gold stocks, see e.g. “Gold and Gold Stocks, it Gets Even More Interesting” or “The Canary in the Gold Mine” for some color on this). Ronald and Mark are inter alia looking into the question whether gold’s recent comeback marks the resumption of the secular bull market, and which factors are likely to drive precious metals in coming years. As they correctly argue, the increasing desperation of central bankers and their willingness to boost inflation at all cost is going to lead to a plethora of unintended consequences, all of which are likely to boost the gold price. They also shed light on one issue that – apart from a handful of exceptions – is clearly not on anyone’s radar screen at the moment: namely the possibility that central banks might finally “succeed”. In other words, the possibility that gold’s recent rise is actually the harbinger of another event widely regarded as “impossible” – the return of price inflation. In this context, we want to reproduce a chart from the report, which shows the proprietary Incrementum inflation signal vs. the gold price and a number of other inflation-sensitive assets. As can be seen, the signal has flipped rather forcefully toward inflation, after having been stuck for several years in “disinflation/ deflation” territory. The Incrementum Inflation Signal vs. inflation-sensitive assets – click to enlarge.

This incidentally jibes with the ECRI Future Inflation Gauge, which has recently reached a new multi-year high as well. As can probably be imagined, if the message of these signals is actually borne out, central banks will be facing quite a quandary. It also has potentially far-reaching implications for investors of all stripes, which the report discusses extensively as well.

Conclusion and Download LinkWe are certain that our readers will find this year’s In Gold We Trust report just as interesting and entertaining as its predecessors. In fact, we believe the anniversary report is an especially well done issue. Enjoy! Full PDF can be downloaded here, or read below... |

| Gerald Celente -- Globalists Are Going To Collapse World Economy Posted: 28 Jun 2016 05:00 PM PDT Gerald Celente gives Infowars his dire predictions for the world economy after the globalists were shocked by Brexit. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Prophecy Update End Time Signs 6/28/16 Posted: 28 Jun 2016 03:44 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Brazil Olympic Games are Cursed Posted: 28 Jun 2016 03:30 PM PDT Brazil Is Broke Busted Disgusted The mayor of Rio still says the city is broke and may not be able to provide security or transit for the Olympic games The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Will migrants flood Britain before Brexit is enforced? Posted: 28 Jun 2016 03:00 PM PDT Former Deputy Assistant Secretary of The Army Van Hipp and FBN's David Asman discuss the near future of Britain's open borders policy after the Brexit vote. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Pouting Plutocrats and Their Pampered Professionals Posted: 28 Jun 2016 01:33 PM PDT |

| SPECIAL REPORT: CRITICAL ALERT "DEBT MARKET WARNING." By Gregory Mannarino Posted: 28 Jun 2016 12:30 PM PDT Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decisions and any consequences thereof. Please invest wisely. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Brexit may cause a Stock Market Crash Posted: 28 Jun 2016 12:00 PM PDT Shaffer Asset Management's Dan Shaffer discusses the effects of a volatile market over the Brexit vote. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 28 Jun 2016 11:30 AM PDT The European Union (EU) was a CIA project whose purpose was to make it easy for the United States to exercise political control over Europe, an American author and radio host says. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Chinese investors join gold rush for haven after Brexit turmoil Posted: 28 Jun 2016 10:25 AM PDT From Bloomberg News Chinese investors are rushing to gold as a haven after the U.K.'s vote to quit the European Union. Turnover in Huaan Yifu Gold ETF, China's top exchange-traded fund backed by bullion, jumped to a record 1.27 billion yuan ($191 million) Friday after Britain's vote, said David Xu, managing director for indexing and quantitative investments division at the Huaan Asset Management Co., the manager of the fund. Outstanding shares of Huaan also reached a record 1.6 billion on June 20, jumping five-fold from the start of the year, he said. "We saw a record trading of our fund immediately after the Brexit vote as it fueled bets that the global and local economies may suffer," Xu said by phone from Shanghai Monday. Turnover rose as investors expect the U.S. may hold off raising interest rates and Japan, the EU and China may maintain accommodative monetary policy for longer, he added. China, the biggest gold buyer, is joining a rush for the precious metal after the Brexit referendum disrupted global markets, boosting demand for haven assets. Holdings in bullion ETFs globally surged to the highest level since October 2013, according to data compiled by Bloomberg. Prices gained 25 percent this year. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-06-27/chinese-investors-join... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 28 Jun 2016 10:21 AM PDT Jim/Bill, This is exactly what you gentlemen have been espousing for quite some time now. “So, with a NET position of 180,000 contracts short and with every contract representing 100 ounces of paper gold, the paper losses to these Banks for every $10 move in the gold price amounts to about $180,000,000. Multiplying that out…When... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Gold is sending a dark sign that 'almost everything has changed' in the market Posted: 28 Jun 2016 10:18 AM PDT By Julia LaRoche Gold and the U.S. dollar are no longer behaving normally and it's crucial that investors pay attention to this move, Raoul Pal and Grant Williams said during a discussion about the Brexit on Real Vision Television, a subscription financial news service they cofounded. Gold is widely considered a hedge against the U.S. dollar. When the dollar falls in value, gold prices often rise. However, this relationship has been breaking down. Pal, a former macro fund manager and author of the research letter "The Global Macro Investor," recently said that a dollar rally along with a gold rally is "a sure sign that almost everything has changed." Williams, the author the research letter "Things That Make You Go Hmmm. ...," agreed that it's a "sign that there's some move toward an end game of sorts." Following the stunning Brexit vote last week, investors simultaneously piled into gold and the U.S. dollar, which are both considered safe-haven assets in the international financial markets. Both gold and the dollar have rallied. For gold and the dollar to move in the same direction is not normal. It's actually a sign of uncertainty or financial stress. ... ... For the remainder of the report: https://finance.yahoo.com/news/why-investors-should-pay-attention-to-mov... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 28 Jun 2016 10:00 AM PDT Russia's president says the Brexit result is a concern for the global economy. But Vladimir Putin says he won't interfere with the process. Al Jazeera's Rory Challands reports from Moscow. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Brexit sends Europe into Political and Economic Crises Posted: 28 Jun 2016 09:30 AM PDT Heiner Flassbeck says the UK is in a leadership crisis without a ruling party leader to implement the will of the people, and the Eurozone is also in a crisis that Germany is largely responsible for causing The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Black Swans, AntiFragile and Profit from Chaos Posted: 28 Jun 2016 09:20 AM PDT Gold Stock Bull |

| Brexit: The Big Picture - Mike Maloney Posted: 28 Jun 2016 08:00 AM PDT oes Brexit mean the end of the world? It's a world-leading educational series by Mike Maloney, the bestselling author of the Guide to Investing in Gold & Silver. As Mike explains in the series and his book, we live in an economic system that is made complicated by design. Basically, it's... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Recession expected in the U.S.? Posted: 28 Jun 2016 07:30 AM PDT MacroMavens President Stephanie Pomboy on the state of the economy. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| If only they were buying real metal Posted: 28 Jun 2016 05:22 AM PDT Investors Keep Piling Into Gold Funds By Stephanie Yang As the price of gold has soared, funds that track the precious metal are also reaching new heights. The two largest gold funds, SPDR Gold Trust and iShares Gold Trust, now own more physical gold combined than all but seven nations, according to analysis from Convergex. With about 1,037 metric tons altogether, the amount of gold in the two funds outpaces reserves of notable holders such as the European Central Bank and Saudi Arabia. Following Britain's vote to exit the European Union, the third largest U.S. gold ETF, ETFS Physical Swiss Gold Shares, announced on Monday that its assets have surpassed $1 billion. ... ... For the remainder of the report: http://blogs.wsj.com/moneybeat/2016/06/27/investors-keep-piling-into-gol... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Stock Market Meltdown Likely to Drive Gold Towards $1,500 ) Posted: 28 Jun 2016 04:21 AM PDT I'm sure you are well aware of the big stock market drop that hit the US stock market on Friday as the DOW fell over 600 points following the UK BREXIT vote. Almost every sector of the stock market fell except for gold and Treasury bonds. I believe that what we saw on Friday was the simple start of a big drop that is going to turn into a total stock market meltdown in the coming weeks. In fact the whole drop may not end for a few months. |

| Greenspan Warns "Early Days Of A Crisis," Inflation Coming, Urges Return To Gold Standard Posted: 28 Jun 2016 03:11 AM PDT Alan Greenspan, the former Chairman of the Federal Reserve has warned that Brexit was a “terrible outcome in all respects” and that we are in the “early days of a crisis.” U.K. policy makers miscalculated and made a “terrible mistake” in holding a referendum on whether to quit the European Union, Greenspan said. |

| A Stunning Email About Brexit Vote As Elites Panic And Global Collapse Edges Closer Posted: 27 Jun 2016 11:10 PM PDT A Stunning Email About Brexit Vote As Elites Panic And Global Collapse Edges Closer |

| Breaking News And Best Of The Web Posted: 27 Jun 2016 06:00 PM PDT UK Votes to leave EU, markets stunned. Stocks plunge worldwide, gold soars, volatility spikes, pound tanks. Gold COTs are “over the top.” Central banks seem to be losing control of the narrative. Bitcoin jumps. Trump campaign in chaos while polls show dead heat in battleground states. Best Of The Web In the wake of […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment