Gold World News Flash |

- This Will Push The Gold Market Over The Edge

- Beijing Is Falling... Literally

- THE BREXIT PSYOP: GREENSPAN FALSELY BLAMES THE BRITS FOR THE CRASH AND CHAOS TO FOLLOW

- THE ELITE DON’T WANT YOU TO KNOW: GOD IS REAL – HERE’S THE PROOF.

- FULFORD: The EU is Bankrupt, The ROTHSCHILDS Made $2.5 Trillion on Brexit

- Economic Predictions for Summer 2016: The Epocalypse Keeps Crashing

- European Banks Have Their Worst Two Day Stretch EVER As The Global Financial Crisis Intensifies

- In The News Today

- Operation Freedom – Sunday, June 26, 2016 with Craig Hemke and John Titus

- The Basics Of What You Need To Know To Survive The Collapse Of The Dollar

- Jim Rogers: Brexit Blowback "Worse Than Any Bear Market You've Ever Seen"

- Brexit: Global Economic Fallout | Peter Schiff & Stefan Molyneux

- "Back Into The Hurricane" - Doug Casey Warns "Gold Will Go Higher Than Most People Can Imagine"

- Greenspan Warns A Crisis Is Imminent, Urges A Return To The Gold Standard

- The End Game Of Bubble Finance - Political Revolt

- The Brexit Psyop: Greenspan Falsely Blames the Brits for the Crash and Chaos to Follow

- Brexit Psyop: Greenspan Falsely Blames the Brits for the Crash and Chaos to Follow

- BREXIT “Yesâ€, Now What for Stocks and Gold?

- Gold Price Closed at $1322.50 Up $2.50 or 0.19%

- Brexit: Huge Leap In Defeating Globalists

- The Post-Brexit Meltdown

- Jim Rogers Picks Dollar Over Gold as Haven in Brexit Tumult

- SIGNS OF THE END PART 182 - LATEST EVENTS JUNE 2016

- Outperformance of tangible assets indicates inflationary pressures, Turk says

- SPECIAL REPORT. Stock Market Meltdown: Is The Worst Over? By Gregory Mannarino

- The BREXIT Conspiracy

- Gold Daily and Silver Weekly Charts - Wizard of Finance

- Alex Jones Show (VIDEO Commercial Free) Monday 6/27/16: Lord Christopher Monckton

- Bloomberg interviews Greenspan but evades the crucial gold question

- We Just Witnessed The Greatest One Day Global Stock Market Loss In World History

- Now French voters call for FREXIT after Germany face demands for EU referendum

- Dear Europe: Piss Off. Love, Britain

- British Pound BrExit Crash Wins Britain Currency War!

- Here’s Your Complete Brexit Trading Guide…

- Gold Surges 20% In GBP In 2 Days On Brexit Fallout

- Buying Brexit Gold at £1,000? Who, What, How

- Gold-to-Platinum Ratio

- Social Security Changes For 2016/2017 Must Watch

- Major Debt and Dow Collapse Will Set Ideal Conditions For Silver

- RBS shares crash to lowest level since 2009 collapse

- Breaking News And Best Of The Web

- Top Ten Videos — June 27

| This Will Push The Gold Market Over The Edge Posted: 28 Jun 2016 12:30 AM PDT by Steve St. Angelo, SRSRocco Report:

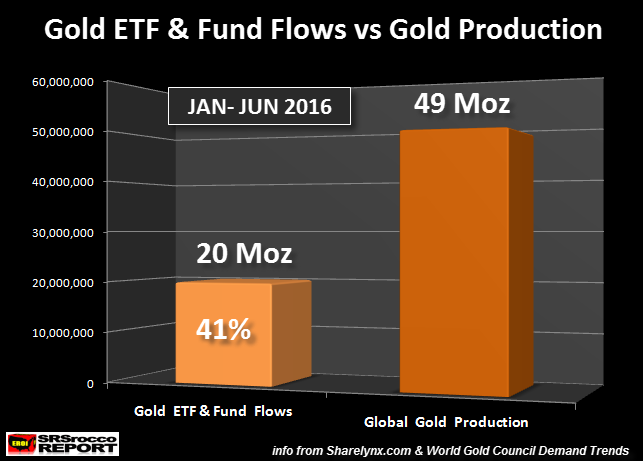

Why? Because the diehard precious metal investors don't have the sort of leverage as do the mainstream investors, which account for 99% of the market. I have stated several times in articles and interviews that it will be the surge of gold buying by the mainstream investor that will finally overwhelm the gold market. This next chart shows just how much leverage the mainstream investor has on the gold market. When the Dow Jones Index fell a lousy 2,000 points during the first quarter of 2016, mainstream investors flooded into Gold ETF's & Funds. This continued into the second quarter, including the surge in buying after the BREXIT "Leave Vote" this past Friday:

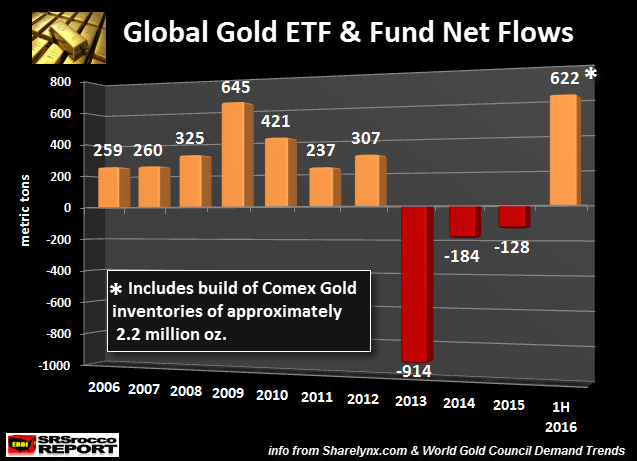

According to the data put out by Nick Laird at Sharelynx.com, total transparent global gold holdings increased nearly 20 million oz (Moz) since the beginning of 2016. Nearly half of that figure, 9.7 Moz (supposedly) went into the GLD ETF. This is an amazing amount of gold as it represents 41% of total global mine supply. For those investors who don't trust the amount of gold backing these Gold ETF's, I don't either. However, I could care less if the GLD has all the gold it reports. What is more important is the mainstream investor LEVERAGE on the market and price. This is the Key. This next chart shows the annual net flows of gold into ETF's & Funds:

The record amount of flows into Gold ETF's & Funds took place in 2009. The majority of the 645 metric ton (mt) figure took place during the first quarter of 2009 when the broader markets were crashing to their lows. In Q1 2009, a record 465 mt of gold flooded into Gold ETF's & Funds that quarter, accounting for 72% of the year's total. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beijing Is Falling... Literally Posted: 27 Jun 2016 11:45 PM PDT If you've ever been to Beijing and gotten that sinking feeling (no, not the one that those get when being disappeared), then you're not alone because the city is literally sinking. According to a new study, Beijing is sinking 11cm (4 inches) a year because the city is using too much ground water. Some areas of Beijing are sinking by as much as four inches a year due to the over-pumping of groundwater from beneath China's capital the International Business Times reports. As the International Business Times explains

As the population grows, the pace at which the city sinks accelerates. Sputnik has more

It's not just Beijing either, according to the study 45 other cities across China are also sinking, including Shanghai. * * * The silver lining to this bizarre occurrence is the fact that now China has another GDP boosting project to undertake. In addition to constructing more ghost towns and high speed rail projects, Beijing can now begin work on a $64 billion project to reduce its reliance on the groundwater by building a 2,400km network of tunnels and canals to eventually channel 44.8 billion cubic meters of fresh water annually from the Yangtze River in Southern China. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BREXIT PSYOP: GREENSPAN FALSELY BLAMES THE BRITS FOR THE CRASH AND CHAOS TO FOLLOW Posted: 27 Jun 2016 11:30 PM PDT by Jeff Berwick, The Dollar Vigilante:

On Monday, the markets continued to collapse, with every major European stock market down 2-3% and the Dow currently down 300 points following Black Friday which, we now know, was the worst sell-off in worldwide stock markets in history, losing a combined $2 trillion. The previous largest sell-off in history occurred 7 years, 7 months, 7 weeks and 7 days prior, on the Shemitah end day of September 29, 2008, when $1.9 trillion was erased in one day.

Of course, if you are a TDV reader, or especially a subscriber, you knew this was all going to occur this Jubilee Year. And, as we said, they'd look to blame it on anything but themselves. It appears they have chosen Brexit to be the "reason" for this collapse. Alan Greenspan just confirmed this to CNBC, blaming Brexit for every horrible thing that is about to happen, which makes perfect sense. CNBC quotes Greenspan as follows:

Of course, Greenspan moderated his tone as well. Stagnation, he indicated, was probably the biggest challenge as regards the aftermath of Brexit. But what stagnation means, no doubt, is the awful period of "stagflation" in the 1970s when the market whipsawed and inflation could double the price of real-estate in a few months. The game is over. Blame it on Brexit! Greenspan was in full cry, of course. He knew just what to say. Britain's leave-taking, he told CNBC, would enhance the tensions in Europe and further the antagonism between Germany and France. Greenspan even noted that France and Germany had gone to war with each other on several occasions! The real problem he explained, was that real-income growth was slowing throughout the West, including the US. His explanation: a decline in productivity and a "huge contraction" involving capital investment. This is such a Keynesian explanation, of course. Describe the results without mentioning the causes. Don't mention the torrents of money that central banks have been printing. Don't mention the impossible destruction of the derivatives markets – one you've made an impending reality. Don't mention the true reasons for sovereign debt, which have to do with the availability of fiat money and the easy terms offered to any tinpot dictator or corrupt political leader who wanted to grab the money and run. Oh, they know what's coming. The fake prognostications are underway. The takedown of Europe has begun and the insiders are beginning to blame Brexit . Just As Planned. In his interview, Greenspan even acts like he's been putting thought into how the catastrophe can be averted. Predictably, ridiculously, he suggests entitlements ought to be cut. And that "protectionist sentiments" need to be combated. This is just a continuation of the psyop. Greenspan and his paymasters now intend to provide us with a story-line that Brexit is responsible for the collapse of "free trade." It's part of a "growing tide" of protectionist sentiment, you see. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE ELITE DON’T WANT YOU TO KNOW: GOD IS REAL – HERE’S THE PROOF. Posted: 27 Jun 2016 11:29 PM PDT by SGT, SGT Report.com: The global elite are now in the process of unveiling that which they have been hiding for centuries. There is a spiritual war taking place on planet earth at this very moment. Look no further than the Goothard Tunnel opening ceremony on June 1st in Switzerland. The nearly $9 million dollar occult riddled ritual featured Baphomet copulating with human women, the bride of satan giving birth, all seeing eyes and an endless amount of other Satanic symbology. Meanwhile over at CERN’s Large Hadron Collider project in the same country we see Shiva the God of Destruction standing proudly in front of CERN’s headquarters. And the CERN movie ‘Symmetry’ makes their aims perfectly clear, they are actively trying to break the barrier between that which is seen and unseen. Again, the elite seem Hell bent on ushering in their NWO Beast system and at this point they have stopped hiding it.

Would it really surprise any of you who understand this information if you were to find out that Darwin’s theories on the Origins of Species are also nothing more than lies based on deplorably bad “science” in order to get the world’s population to dismiss the notion of a Creator altogether? If the elite could get the whole world to believe this beautiful planet and all who inhabit are nothing more than a random accident, they could get human beings to lower their spiritual shields thereby making it far easier to usher in the global system they seek, helmed by the one they secretly serve, Satan. Spiritual warfare on planet earth is alive and well – and you have been lied to. Author James Perloff joins me to deconstruct Darwin. and share proof that God is real. You can support James by visiting his site and buying his books, here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FULFORD: The EU is Bankrupt, The ROTHSCHILDS Made $2.5 Trillion on Brexit Posted: 27 Jun 2016 11:05 PM PDT Did the ROTHSCHILDS make $2.5 Trillion on the Brexit vote this past Friday by going long gold and shorting global stock markets? from The Phaser:

The emerging consensus view is, as Pentagon analysts put it, "Brexit may lead to Frexit (French exit), the collapse of banks, populism, nationalism and anti-globalism." This is also likely lead to an end to Khazarian mafia sponsored Mulsim immigration. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Predictions for Summer 2016: The Epocalypse Keeps Crashing Posted: 27 Jun 2016 10:35 PM PDT This article by David Haggith was first published on The Great Recession Blog.  Brexit — the second major landslide in the Year of the Epocalypse — has bankers all over the world scrambling to pick up and prop up their crumbled facades this week. This is one more jolt in the developing global economic collapse that I predicted for 2016. The ground of an entire nation just dropped several feet. Aftershocks from a drop that size will be felt frequently throughout the summer and to some extent for years to come. As I've said before, US politicians will find it increasingly difficult this year to keep shoring up the US economy until the end of the election cycle. This collapse just made things a lot worse for them. Brexits, Grexits and other exits, oil defaults, job decay, manufacturing malaise and a host of other planet-sized problems are piling up so fast that it will become almost impossible to hold off collapse much longer as global problems press in on the US and other nations.

Entire nations are now making for the exits

Near the start of 2016, I described the anti-establishment forces that were shaping up to define the year ahead and the impact those nationally divisive forces would have on the world's banking system this year:

Later in May, I focused on the immigration tensions that were amplifying the anti-establishment discontent in Europe and here at home:

In other words, I wouldn't bet back then on exactly what national breakaway would happen first in the EU, but was certain national tensions would heat up to where Europe started falling apart this summer, particularly over immigration tensions. The falling apart began right on cue. One cannot always see what section of land will give way first, but one can certainly see that so many pieces are ready to give way that collapse is certain and imminent.

Banks and bankers are trembling all over the world

To sum up where we are now now, I'll turn to former Fed Chair Allan Greenspan who said that the Brexit event "may be just the tip of the iceberg" for Europe's problems. When asked what he meant by that, he responded with the following:

While Greenspan was one of the absent-minded architects of the Great Recession with his rabid debt-expansion policies, I quote him because he is speaking against his own longtime centrist bias when he claims that Grexit is certain for its own reasons and that the euro "is failing." In other words, if even Greenspan says Europe is falling apart and the euro "is failing," it must be bad. He's a centrist saying the center is not holding. It's not the nature of a central banker — even a former one — to be alarmist by saying an entire economic zone run by his comrades, which he has applauded, is now collapsing into chaos. Don Quijones, an editor of Wolf Street, adds a note to Greenspan's candid observations:

Spain's banks suffered as badly as Italy's, with Bankia shares losing 20% of their value. Spain's largest bank, Santander, already suffering heavy losses from its operations in Brazil, also lost 20% of its value overnight, as did a third mega bank in Spain, Sabadell. Expect to see more major bank bailouts in Europe. In the UK, Barclay's shares plunged 20.5%. HSBC dropped 9%, and the Royal Bank of Scotland fell off a cliff, taking a 27.5% pounding.

Bankers are shaking in their hip waders as they congregate in a swamp full of alligators. As individual bankers bemoaned what they see as a crushing shock, central banks ran in for emergency rescues. The Bank of England offered a quarter of a trillion pounds plus substantial access to foreign currencies, promising additional measures as required. The US Federal Reserve assured the entire world it was standing by to supplement liquidity through its swap lines with global funding markets. The ECB said it would provide additional liquidity to protect euro stability, and the People's Bank of China assured other nations it would maintain a stable yuan (though on Monday, China weakened the yuan by its most since the big sell-off last August). Even neutral Switzerland ran to the rescue.

The Epocalypse is here

As I quoted David Stockman in an earlier article,

When I say "the Epocalypse is here" or "the end is here," I don't mean we are now on the final leg down or that there will be no leveling off or no rally — that its finished. Heck, the central bankers aren't going to give up the show that easily, and this is an election year in the US where they can expect totally subservient assistance from establishment politicians on both sides of congress. The majority of elected politicians clearly deplore the possibility that Donald Trump could not only be proven right about economic collapse but could be hoisted to a success big enough to give him a political mandate to tear the establishment apart in 2017! What I mean when I claim "the end is here" is that this is one more enormous jolt like we saw in January that is a part of&n | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| European Banks Have Their Worst Two Day Stretch EVER As The Global Financial Crisis Intensifies Posted: 27 Jun 2016 10:25 PM PDT by Michael Snyder, Economic Collapse Bog:

Over the last two trading days, European banks have lost 23 percent of their value. Let that number sink it for a bit. In just a two day stretch, nearly a quarter of the value of all European banks has been wiped out. I warned you that the Brexit vote "could change everything", and that is precisely what has happened. Meanwhile, the Dow was down another 260 points on Monday as U.S. markets continue to be shaken as well. Overall, approximately three trillion dollars of global stock market wealth has been lost over the last two trading days. That is an all-time record, and any doubt that we have entered a new global financial crisis has now been completely eliminated.

But of course the biggest news on Monday was what happened to European banks. The Brexit vote has caused financial carnage for those institutions unlike anything that we have ever seen before. Just check out this chart from Zero Hedge… I knew that things would be bad if the UK voted to leave the European Union, but I didn't know that they would be this bad. Prior to all of this, a whole bunch of "too big to fail" banks all over Europe were already in the process of imploding, and now this chaotic financial environment may push several of them into full-blown collapse mode simultaneously. Just consider the following commentary from Wolf Richter…

One institution that I have been warning about for months is German banking giant Deutsche Bank. On Monday, their stock fell another 5.77 percent to a fresh all-time closing low of 13.87. I have been convinced that Deutsche Bank is going to zero for a long time, but these days it seems in quite a hurry to get there. Of course Deutsche Bank is far from alone. The following are other "too big to fail" European banks that have lost at least one-fifth of their value over the past two trading days… -Barclays This is what a full-blown financial crisis looks like, and U.S. banks have been getting hit very hard too…

Meanwhile, the British pound continues to get absolutely pummeled. As I write this, the GBP/USD is down to 1.32, and some are now warning that the British pound may hit parity with the U.S. dollar by the end of the year. One of the reasons why I expect the British pound to continue to tumble is because the global elite have to show the British people that they made the wrong decision, and they need to scare off any other countries that would consider holding similar votes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jun 2016 10:02 PM PDT BREXIT BODY COUNT — Bill Holter Bill Holter's Commentary If you lived in bubble and could get no other news whatsoever, THIS alone is a flashing red signpost pointing you toward gold and silver! European Banks Crash To Worst 2-Day Loss Ever As Default Risk Soarsby Tyler Durden Jun 27, 2016 1:19 PM So... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operation Freedom – Sunday, June 26, 2016 with Craig Hemke and John Titus Posted: 27 Jun 2016 09:40 PM PDT by Dave Janda, Dave Janda:

Manipulation of financial markets, Benghazi, New World Order Syndicate, Obama Care, Free Market Health Reform,Putin, The Ukraine, ISIS, Syria, The Constitution, Natural resources, Reserve currency, Corruption, gold, silver Global Elite, International Banking Cabal, debt, Federal Reserve, Too Big To Fail Banks, Crony Capitalism, Debt Ceiling, Financial implosion, Recession, Economic Depression, Freedom, Liberty Click HERE to Listen to Craig Hemke Click HERE to Listen to John Titus | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Basics Of What You Need To Know To Survive The Collapse Of The Dollar Posted: 27 Jun 2016 09:20 PM PDT from BugOut News:

The current administration would like for you to believe that the economy is on the mend and that the economy is actually expanding and growing. Frankly, that's just a lie and most economists and basically anyone with a grain of sense will tell you otherwise. The drop in oil prices may seem like a good thing when it's time to gas up the SUV, but the free fall in oil prices is actually very bad news in the long run. And when you take a look at how the Federal Reserve has been artificially stimulating the economy with quantitative easing and the continued printing of ever-more-worthless dollars, it's not difficult to see that there is a huge economic bubble being created, and it will burst sooner or later. My guess is sooner, but maybe I'm just a pessimist — time will tell… Many are predicting that 2016 will be the year the dollar collapses, and few of us are truly ready to face what some are forecasting will be a financial "bloodbath" or "Armageddon." Despite the Obama Administration and the Fed's attempts to paint lipstick on a pig by cooking the books, the fact remains that more than 100 million Americans are unemployed — the highest percentage since the Great Depression. And with oil prices expected to drop even further, more Americans can expect to lose their jobs — if they are lucky enough to have one in the first place. And let's not forget the effects of Obamacare, which is driving employers to cut hours for their workers so that they can avoid having to meet the ACA requirements. In short, we are headed for an economic collapse that will make the 2008 crisis pale in comparison. So, how to survive the coming crash? Daisy Luther, creator of The Organic Prepper website, offers some useful advice on how to cut costs and prepare as much as possible for the inevitable collapse of the dollar. As Luther notes: "The key to economic survival is requiring less of things that cost money." She urges readers to realize the difference between essentials and luxuries, and get rid of the things that aren't necessary to survival. Her list of essentials includes: Water Beyond these basics, all else are luxuries. Luther recommends looking for ways to cut monthly costs. Among her suggestions: moving to a smaller home, relocating to a smaller town, getting rid of monthly car payments by buying a cheaper used vehicle with cash, stop using credit cards, eat at home instead of dining out, and generally becoming as frugal and self-reliant as possible. The more you can provide for yourself, the better off you will be. Do whatever you can to reduce your reliance on the power grid — harnessing solar energy and limiting the use of electricity to powering actual necessities is a good start. The more food you can grow or produce, the more money you'll save and the healthier you'll be — not to mention the fact that you'll be more self-reliant when the SHTF. It is essential to establish a mindset that will get you through any crisis. The core philosophy of prepping is to be ready before things go sideways. Luther also urges everyone to build a "preparedness library." If the power grid goes down, you'll need books to help you develop and maintain survival strategies — websites are of no use if you can't get online. Even if the economy turns around (which is highly doubtful at this point), it makes sense to be prepared for the worst. Don't wait until the proverbial wolves are at the door — make plans now for facing what could prove to be a very challenging situation when the current economic bubble finally bursts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rogers: Brexit Blowback "Worse Than Any Bear Market You've Ever Seen" Posted: 27 Jun 2016 08:15 PM PDT When it comes to being direct and offering up some truth, one can rest assured that Jim Rogers is a prime candidate to do both. In an interview with Yahoo! Finance, the legendary investor had some candid and quite unnerving things to say about the global market in the aftermath of Brexit.

If that was too upbeat, Rogers unveils his bear scenario:

Regarding where EU will be five years from now, Rogers doesn't believe it will even exist:

On how to play this market now,

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit: Global Economic Fallout | Peter Schiff & Stefan Molyneux Posted: 27 Jun 2016 08:00 PM PDT from Stefan Molyneux: With Global Economic Markets responding strongly to the United Kingdom’s European Union Referendum vote – many are concerned about en economic collapse related to Brexit. Peter Schiff joins Stefan Molyneux to discuss the market reaction to the United Kingdom’s vote to leave the European Union, the fall of the British Pound, the rise in the price of gold and how Brexit will be used as a scapegoat for already existing economic problems. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Back Into The Hurricane" - Doug Casey Warns "Gold Will Go Higher Than Most People Can Imagine" Posted: 27 Jun 2016 07:35 PM PDT Submitted by Mac Slavo via SHTFPlan.com, As fears of England leaving the European Union came to a head on voting day, a stunning scene emerged on the streets of London. Though it was completely ignored by the mainstream media, the fact that Brits were lining up in droves in front of gold and silver shops spoke volumes about financial assets of last resort during a real or perceived crisis. It is within this context that legendary resource investor Doug Casey warns that the hurricane which took the world by storm in 2008 is still a significant threat. While we’ve spent the last several years in relative peace and calm inside the eye of the storm, we’ll be entering the other side of the hurricane wall later this year, says Casey. And as we’ve seen in London, Greece, and Argentina in the past decade, when financial hurricanes wreak havoc across the economic landscape, the only safe haven to be had is in precious metals:

Casey shares his concerns, warnings and strategies in a must-hear interview with Future Money Trends:

What’s most notable about the awakening of the gold bull market, according to Casey, is that very few people have actually realized what’s happening and why. It is for this reason that Casey has been investing heavily into mining companies like Brazil Resources, a move that’s been mimicked by other well-known investors including famed financier George Soros and business magnate Carl Icahn who are also piling into precious metals related assets. And though this asset class has been largely ignored by the broader investing public, Casey suggests that the eventual result will be widespread mania and panic buying into gold assets as the global economic and monetary climate gets markedly worse going forward.

George Soros previously warned of the same, having noted in 2010 that gold will become the ultimate bubble before all is said and done. Incidentally, this is right around the time he began making his first major acquisitions. Since then scores of other well known investors, institutions, and private family funds have made similar moves, many of them in secret, ahead of what could be an unprecedented bull market in precious metals. That gold is still considered a relic by many of the best and brightest economists out there is indicative of an asset that is nowhere near its potential highs. Once you hear those same processionals, financial advisers, your neighbors, your friends and the local shoeshine boy talking about gold investments at cocktail parties, you’ll know it’s time to sell. For now, they still have no idea what’s coming, making this an optimal time to consider the one asset that has survived the test of time throughout history and the many varieties of crises that have been wrought upon humankind. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greenspan Warns A Crisis Is Imminent, Urges A Return To The Gold Standard Posted: 27 Jun 2016 07:05 PM PDT from ZeroHedge:

“This is the worst period, I recall since I’ve been in public service. There’s nothing like it, including the crisis — remember October 19th, 1987, when the Dow went down by a record amount 23 percent? That I thought was the bottom of all potential problems. This has a corrosive effect that will not go away. I’d love to find something positive to say.” Strangely enough, he was not refering to the British exodus but to America’s own economic troubles.

Today, Greenspan was on Bloomberg Surveillance where in an extensive, 30 minutes interview he was urged to give his take on the British referendum outcome. According to Greenspan, David Cameron miscalculated and made a "terrible mistake" in holding a referendum. That decision led to a "terrible outcome in all respects," Greenspan said. “It didn't have to happen." Greenspan then noted that as a result of Brexit, “we are in very early days a crisis which has got a way to go”, and point to Scotland which he said will likely have another referendum on its own, predicting the vote would be successful, and Northern Ireland would "probably" go the same way. His remarks then centered on the Eurozone which he defined as a truly "vulnerable institution," primarily due to Greece's inclusion in its structure. "Get Greece out. They're a toxic liability sitting in the middle of a very important economic zone.” Ironically, the same Eurozone has spent countless hours doing everything in its power to show just how unbreakable the union is by preserving Greece, while it took the UK just one overnight session to break away. Luckily the UK was not part of the monetary union or else it would be game over. But speaking of crises, Greenspan warned that fundamentally it is not so much an issue of immigration, or even economics, but unsustainable welfare spending, or as Greenspan puts it, “entitlements.”

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End Game Of Bubble Finance - Political Revolt Posted: 27 Jun 2016 06:45 PM PDT Submitted by David Stockman via Contra Corner blog, During Friday’s bloodbath I heard a CNBC anchor lady assuring her (scant) remaining audience that Brexit wasn’t a big sweat. That’s because it is purportedly a political crisis, not a financial one. Presumably in the rarified canyons of Wall Street, politics doesn’t matter much. After all, when things get desperate enough, Washington caves and does “whatever it takes” to get the stock averages moving upward again. Here’s a news flash. That’s all about to change. The era of Bubble Finance was enabled by a political abdication nearly 50 years ago. But as Donald Trump rightly observed in the wake of Brexit, the voters are about to take back their governments, meaning that the financial elites of the world are in for a rude awakening. To be sure, the apparent lesson of the first TARP vote when the bailout was rejected by the House in September 2008 was that politics didn’t matter so much. Wall Street’s 800 point hissy fit was all it took to prostrate the politicians. Indeed, the presumptive free market party then domiciled in the White House quickly shed its Adam Smith neckties and forced the congressional rubes from the red states to walk the plank a second time in order to reverse the decision. There was a crucial predicate for this classic crony capitalist capture of the authority and purse of the state, however, that should not be overlooked. Namely, that in the mid-cycle period of the world’s 20-year experiment in central bank driven Bubble Finance the rubes had not yet come to fully appreciate that they were getting the short end of the stick. Indeed, the earlier phases of the bubble era witnessed an enormous inflation of residential housing prices. For instance, between Greenspan’s arrival at the Fed in August 1987 and the housing bubble peak in 2007, the value of residential housing rose from $5.5 trillion to $22.5 trillion or by 4X. The greatest extent of the housing bubble occurred in the bicoastal precincts, of course. But it did lift handsomely the value of 50 million owner occupied homes in the flyover zone, as well. Accordingly, the latter did not yet see that the new regime was stacked in favor of the top 10% of the economic and wealth ladder, which owns 85% of the non-housing financial assets. Nor was it yet evident as to the degree to which massive money printing under conditions of Peak Debt almost exclusively stimulates Wall Street speculation, not main street production, jobs, incomes and spending. In any event, by the eve of the great financial crisis, the GOP was actually controlled by the racketeers of the Beltway and the Wall Street gamblers, not the red state voters who had elected it. In fact, Goldman’s Sach’s plenipotentiary to Washington, Hank Paulson, was in complete command of the elected side of government. At the same time, the Bush White House had populated the central banking branch of the state with proponents of monetary activism, who were more than ready to authorize “heroic” measures to reflate the bubble. Needless to say, the leader of the pack, Ben Bernanke, had been groomed for the role of chief bailster by none other than Milton Freidman. The latter, in turn, had led Nixon astray at Camp David 37 year earlier when he persuaded Tricky Dick to default on the dollar’s link to gold, thereby opening the door to fiat money, massive credit expansion and the modern era of Bubble Finance. There is a straight line of linkage from that great historical inflection point to Friday’s Brexit uprising. Namely, Nixon’s abandonment of the Bretton Woods gold exchange standard, as deficient as it had been, was also a profoundly political act. It resulted in the abdication of economic and financial policy to an unelected elite and their eventual capture by Wall Street and the forces of speculation and financialization unleashed by unanchored central bank money and credit. Nixon’s destruction of Bretton Woods was the enabling event. It turned central bankers and financial officialdom loose to operate a dictatorship of bailouts, bubbles and financialization of economic life. And to spread this baleful regime to Europe, Japan and the rest of the world, too. To be sure, it took more than two decades to fully materialize. There were deeply embedded institutional cultures and ideologies among policy-makers that restrained opened-ended resort to the printing press and financial bailouts. The Paul Volcker interlude in the US and the determined sound money regime of the Bundesbank are cases in point. But eventually the old regime gave way. There emerged Greenspan’s dotcom and housing bubbles, the rise of the ECB and the financial rulers of Brussels, the massive bailouts triggered by the global crisis of 2008-2009, the hideous expansion of central bank balance sheets during the era of QE and ZIRP, the emergence of the destructive “whatever it takes” regime of Draghi and the current financial lunacy of subzero interest rates across much of the planet. But here’s the thing. The rubes are on to the rig. Twenty-years of Bubble Finance have made the City of London an oasis of splendor and prosperity, for example, but it has left the hinterlands of Britain hollowed-out industrially, resentful of the unearned prosperity of the elites and fearful of the open-ended flow if immigrants and imports enabled by the superstate in Brussels. As on observer put it, the geography of the vote said it all:

The rise of Trumpism in the US reflects the same social and economic fracture. To wit, Bubble Finance has also drastically unbalanced the US as between the bicoastal zones of prosperity it has enabled and the fly-over zones its has effectively left behind. It goes without saying that massive debt monetization and 90 months of zero interest rates has been a boon for the Imperial City. With almost no restraints on its ability to borrow and spend, the military/industry/security/surveillance complex has prospered like never before, as has the medical care cartel, the education syndicate and the lesser beltway rackets such as green energy and the farm subsidy/food stamp/ethanol alliance. Likewise, asset gatherers, financial intermediaries, brokers, punters, financial engineers and corporate strip-miners have prospered enormously because the market has been rigged every since Black Monday in October 1987. That is, the cost of debt and carry trades have been falsified, downside hedging insurance in the casino has become dirt cheap and time after time the Fed’s put has bailed-out speculations gone bust. Even what passes for entrepreneurial breakouts in the world of social media and new tech isn’t really. It’s just another variant of the dotcom bubble in which a few good innovations are being drastically over-valued (e.g. Uber) while a tsunami of worthless and pointless start-ups have become giant cash burning machines (e.g. Tesla). Taken altogether, they are funding a ephemeral complex of pseudo businesses, pseudo jobs and pseudo start-up networks that are attracting tens of billions in venture capital that amount to malinvestment. Meanwhile, the main street economy has atrophied. The first round of Bubble Finance buried the middle class in debt, while the post-crisis intensification has turned the C-suites of America into a giant stock trading and financial engineering arena. Contrary to the bubblevision patter, in fact, there has been no business deleveraging at all. On the eve of the crisis in Q4 2007, total non-financial business debt outstanding was $11 trillion, and it is now $13.5 trillion. But on the margin, ever dime of that massive swelling of the business debt burden represents real economic resources cycled out of the flyover zones and pumped back into the financial casino’s and the bicoastal elites which fatten on them. The recent studies of the Census Bureau data which show that just 20 counties have generated half of all start-ups since the financial crisis provides another take on the underlying fissure:

In short, Bubble Finance is a giant engine of reverse Robin Hood redistribution. It embodies a sweeping fiscal intervention in the natural flows of the free market that punishes savers, laborers, self-funded main street entrepreneurs and the retired populations in favor of speculators and the holders of existing financial assets. Bubble Finance is an affront to both democratic governance and true prosperity. The Trump voters, the Brexit voters, the masses rallying to the populist banners throughout Europe above all else represent a reactivation of the political machinery in a last ditch campaign to stop the financial elite and their regime of Bubble Finance. Yes, this time is different, and this time there will be no reflation of the financial bubble like there was after Black Monday, the S&L bust, the dotcom crash and the great financial crisis of 2008-2009. Needless to say, the Wall Street dip-buyers and perma-bulls who take their cues from the modern day financial ruling class are in for a shock. And today’s statement by Martin Schulz, the President of the EU parliament good not more aptly explain why. Said Schulz,

We think not. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Brexit Psyop: Greenspan Falsely Blames the Brits for the Crash and Chaos to Follow Posted: 27 Jun 2016 06:00 PM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie,Paul Craig Roberts, and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit Psyop: Greenspan Falsely Blames the Brits for the Crash and Chaos to Follow Posted: 27 Jun 2016 05:48 PM PDT This Jubilee Year is advancing just as I have predicted, with all the major elements of a worldwide catastrophe now in place. On Monday, the markets continued to collapse, with every major European stock market down 2-3% and the Dow currently down 300 points following Black Friday which, we now know, was the worst sell-off in worldwide stock markets in history, losing a combined $2 trillion. The previous largest sell-off in history occurred 7 years, 7 months, 7 weeks and 7 days prior, on the Shemitah end day of September 29, 2008, when $1.9 trillion was erased in one day. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT “Yesâ€, Now What for Stocks and Gold? Posted: 27 Jun 2016 05:40 PM PDT I was one of the few last week who said the stock market would fall on Friday. It has also fallen farther than even I expected. So what’s next? The chart below shows a counter trend rally likely on Tuesday, perhaps back to 2049/50 SPX and then one more drop into June 30 to around 1926/27, for about a 9% total decline. The whole pattern is bullish, once resolved. So now, when everyone is getting bearish, I’m starting to get bullish, but like I said, not just yet. I still see new highs by early Autumn of 2016 and then a late Fall decline of about 22%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1322.50 Up $2.50 or 0.19% Posted: 27 Jun 2016 05:37 PM PDT

Turmoil continued to boil & roil stock markets today. Dow in Gold has simply collapsed. Both the Dow 7 the SP500 closed below the necklines of those head and shoulders formations, AND below their 200 day moving averages, a poisonous cocktail. Dow lost 260.51 (1.5%) to close at 17,140.24 while the S&P plunged 36.87 (1.81%) to 2,000.54. Whoa. Dow in gold has broken down from its megaphone pattern and closed today at 12.91 oz, less than half an ounce above the February low at 12.56 oz. Stocks have only begun to fall -- around the globe. 2008 Part 2 may have begun. US dollar index rose another 113 basis points (a huge 1.185) to 96.70. Euro sank, of course, 0.7% to $1.1026, more evidence that central banks manipulate the snot out of currency markets. Yen rose 0.24 to 98.06. When they weren't heavy lifting the dead weight of the euro today, the Nice Government men must have been bashing gold. It did reach a high at $1,340, and closed $2.5 higher at $1,322.50, but needs to step on out! Silver lost 4.5 cents today to 1774.4. People keep asking me why silver hasn't risen as much as gold. Plainly, because this rally is being driven by financial panic. In part that panic is a REVULSION against fiat currencies and in favor of gold. Silver will ride along, be patient. This leg up has NOT ended. Gold does need to stay above $1,300, and silver needs to wipe out that little non-confirmation by busting out over 1800¢. Sorry, no commentary tomorrow. I'll be finish up my monthly Moneychanger newsletter for paid subscribers. On 27 June 1893 the New York Stock Market crashed. By year end, 600 banks and 74 railroads had turned hooves up to the sky. Now I wonder why so many BANKS, of all things, and RAILROADS would go bust? Couldn't have anything to do with fractional reserve banking, the same old overindebtedness credit bubble we are watching today, could it? And railroads? Could have anything to do with government involving themselves with railroads and even financing them. Nawww. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit: Huge Leap In Defeating Globalists Posted: 27 Jun 2016 05:30 PM PDT Alex Jones talks with Lord Monckton about the devastating victory for freedom, Brexit. What does this mean for the future of Europe? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jun 2016 05:00 PM PDT Spain's general elections ended with another inclusive vote, adding to Europe's political chaos in the wake of Britain's decision to leave the EU. Ameera David has details. Then, Ameera talks to Edward Harrison about the fallout from both Spain and Britain politically, economically, and on... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rogers Picks Dollar Over Gold as Haven in Brexit Tumult Posted: 27 Jun 2016 04:45 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 182 - LATEST EVENTS JUNE 2016 Posted: 27 Jun 2016 04:30 PM PDT SIGNS OF THE END PART 182 - LATEST EVENTS JUNE 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outperformance of tangible assets indicates inflationary pressures, Turk says Posted: 27 Jun 2016 04:30 PM PDT 7:30p ET Monday, June 27, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk, interviewed by King World News today, says inflationary pressures are indicated by the recent outperformance of tangible assets over other assets. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/james-turk-global-market-turmoil-continues-grea... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SPECIAL REPORT. Stock Market Meltdown: Is The Worst Over? By Gregory Mannarino Posted: 27 Jun 2016 02:40 PM PDT Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decisions and any consequences thereof. Please invest wisely. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jun 2016 02:19 PM PDT City of London has spoken.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Wizard of Finance Posted: 27 Jun 2016 01:50 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Show (VIDEO Commercial Free) Monday 6/27/16: Lord Christopher Monckton Posted: 27 Jun 2016 01:09 PM PDT -- Date: June 27, 2016 -- Today on The Alex Jones Show On this Monday, June 27 edition of the Alex Jones Show, WND's Joseph Farah discusses the globalist collapse worldwide and the impending fall of the EU. Also, Dr. Steve Piecznik reveals the latest strategies the elite will unleash as they lose... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bloomberg interviews Greenspan but evades the crucial gold question Posted: 27 Jun 2016 12:34 PM PDT 2:15p ET Monday, June 27, 2016 Dear Friend of GATA and Gold: Bloomberg Radio and Television today interviewed former Federal Reserve Chairman Alan Greenspan for more than a half hour -- http://www.bloomberg.com/news/articles/2016-06-27/greenspan-calls-brexit... -- but while at the 18:25 mark he praised the gold standard and called himself a "gold bug," his questioners declined to ask him the crucial question, the question about surreptitious trading in the gold market by the U.S. government and other governments. Documentation of that market intervention and its objective of suppressing the gold price has been delivered to Bloomberg by GATA many times and can be found here: http://www.gata.org/node/14839 A similar question was posed to New York Fed President William Dudley at a public forum in Virginia in March, and he evaded it with a clumsy non-sequitur that would have caught the attention of financial journalism around the world if there was any: http://www.gata.org/node/16341 So maybe posing the question would have made this one Bloomberg's last interview with Greenspan. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Just Witnessed The Greatest One Day Global Stock Market Loss In World History Posted: 27 Jun 2016 12:00 PM PDT We Just Witnessed The Greatest One Day Global Stock Market Loss In World HistoryBy Michael SnyderJune 27, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now French voters call for FREXIT after Germany face demands for EU referendum Posted: 27 Jun 2016 11:30 AM PDT The problem with Europe is that politicians want a United States of Europe but Europe is not made up of states its made up of Countrys with there own rich culture The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dear Europe: Piss Off. Love, Britain Posted: 27 Jun 2016 09:00 AM PDT This post Dear Europe: Piss Off. Love, Britain appeared first on Daily Reckoning. It looks like the always boozed-up European Union chief Jean-Claude Juncker really has something to get drunk about now… The U.K.'s historic decision to exit ("Brexit") the European Union has the establishment in full meltdown… They're thrashing about like a possessed Linda Blair in "The Exorcist" when splashed with holy water… "The will of the people… it burns… it burns." European elites now want a re-vote until the Brits get it "right"… or perhaps they ignore the referendum altogether. But that's not going to stick. The British people have spoken. And I don't think the world will ever be the same. Elites Be DamnedCNN's teleprompter reading dolts spent months calling the Brits xenophobes, racists, fascists and stupid. All because they wanted to reclaim the right to govern themselves. Well, the Brits sent everyone a clear message last week: Piss off. They rejected the establishment's "hair on fire" fear campaign to keep the U.K. under the oppressive thumb of Brussels' unelected bureaucracy. And frankly, if you're not feeding at the Eurocrat trough, Brexit is easy to understand and appreciate. Brits simply voted to restore local government rule that had been outsourced to drunken party boys living off trust funds in other countries. If you believe that's racist or fascist, then perhaps a call to your shrink with a major load up on lithium is in order. Did you know that the EU has unaccountable commissioners with the power to legislate and overrule the elected parliaments of member states? That set up would have worked well for Stalin circa USSR's heyday… but it's not a good fit for the British. And contrary to media narratives straight out of Hollywood scriptwriters, the Brexit movement wasn't hijacked by some tiny, far-right faction of Hitler youth. Nearly one-third of left-leaning Labour voters voted for Brexit. Turnout? 72.2%! That's higher than any U.K. general election since 1992. And the 52% total vote cast for Brexit is higher than any winning governing party since 1931. Elites be damned. The British have had enough of the erosion of sovereignty, 10 years of interest rate manipulation and politicians bought and paid for by sketchy Middle Eastern "new" money. Uncertainty Is the Only CertaintyWhat does the Brexit mean to the markets? One word: Uncertainty. Nobody knows what will happen next. Don't be surprised if the British pound and British stocks have a rocky summer. Don't be surprised if all markets get rocky. Could Brexit lead to another collapse like 2008? Sure, it's possible. But let's not forget the role of central banks. After Friday's chaos, global central banks announced they stand at the ready to intervene should any liquidity issues arise. What if they all decide to deploy their "helicopter money?" Instead of a collapse, we could get a melt up. Actually typing that makes me chuckle. "Trusting" central banks to take care of us… My point is… you can't make investment decisions based on the assumption that a market collapse is not guaranteed. There's also a larger point that many market analysts are ignoring… The Real Reason Why the Markets Are Spooked…I believe the U.K. will be fine. It's the world's fifth-largest economy. And it will only get more competitive as it escapes from the EU's "one world government" fantasy. The real question is what happens to the EU from here? That's what markets are worried about. The German and French markets fell almost twice as much as British markets on Friday. And that's because Brexit is far worse for the EU than it is for the U.K. Matthew Lynn of MarketWatch nails it… Much of the EU is in far worse economic shape [than the U.K.] Italy's economy is smaller now than it was way back in 2000. Spain has been close to the edge of bankruptcy, and has seen unemployment soar past 20% of the workforce. France is stuck in endless recession, and struggling to maintain competitiveness against Germany… In those countries, people have genuine reasons to be angry with the EU. If the British can get out and the economy survives, as it will, then why not the Italians or the French? It will be harder and harder to make the case for staying. That's where the real danger and opportunity lies. A Eurozone break-up would be a major market event with implications as serious as the global financial crisis. Many large European banks would fail. That could lead to a Lehman Brothers-type crisis writ large. I actually see something possible far beyond Lehman. We could see so-called respected nation states literally disintegrate like Syria, becoming borderless "Mad Max" swaths of land where "Lord of the Flies" becomes the law. So how should you prepare? Not Everyone Lost Money From BrexitWell, the last thing you want to do is listen to the mainstream predictions that Brexit will cause apocalyptic biblical plagues. As trend followers, we're prepared for any and all eventualities. For example, trend following made huge money during the stock market crash of 1973–74, Black Monday in 1987, the Long-Term Capital Management implosion and the Asian Crisis in 1998, the dotcom stock market crash of 2000, the Great Recession of 2008-09, the oil market crash of 2014-16 and Brexit. Even Brexit was a great opportunity? Yes. Two of the most famous trend followers, David Harding and Larry Hite, made 3% and 4% on Friday alone. I reached out to yet another trend following associate – one based in London. He told me bluntly: "Plus 17% on Friday – our best day ever, surpassing October 10, 2008, when we made 16.6%." All that fear, dread and hang-wringing by the media hacks? Forget that. We are here to protect ourselves and profit. We're happy to ride trends wherever they take us in whatever unpredictable market climate we face. And we're also happy that the Brits took a historic stand for freedom and self-determination. Let's hope that's contagious as hell. Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post Dear Europe: Piss Off. Love, Britain appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| British Pound BrExit Crash Wins Britain Currency War! Posted: 27 Jun 2016 08:58 AM PDT The mainstream press is in a state of hysteria, panic even following the plunge in the British Pounds from a Thursday night high of £/$1.50 to currently stand at £/$ 1.32. Whilst yes the 12% downwards plunge from £/$1.50 is in forex markets terms HUGE, a move not seen the likes of for many decades that takes the dollar exchange rate down to levels last seen in 1985. Nevertheless the mainstream press has missed one fundamental fact for the obvious reason that they just DO NOT understand the financial markets and what the market movements actually mean or translate into. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

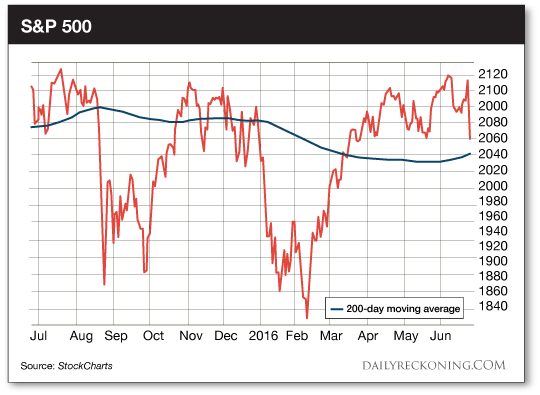

| Here’s Your Complete Brexit Trading Guide… Posted: 27 Jun 2016 07:07 AM PDT This post Here’s Your Complete Brexit Trading Guide… appeared first on Daily Reckoning. After taking the weekend to mull things over, European investors continue to sell everything in sight post-Brexit vote. Led lower by bank stocks, European shares picked up the selling right where they left off on Friday. RBS and Barclays shares were briefly halted in London as they dropped 10%, according to Business Insider. Sterling also resumed its historic slide. The pound fell below Friday's 31-year low earlier this morning. That's making the selloff we're seeing here in the U.S. look positively ordinary by comparison… On Friday, the Dow Jones Industrial Average coughed up more than 600 points to finish lower by nearly 3.5%. It looks like we'll see more of the same as we begin the new trading week. Dow futures are down more than 100 points early this morning. Gold is up $11, oil is slipping and the dollar index is hitting 3-month highs. But today you're going to learn three trading strategies that'll help you steer your trades toward safe harbor to ride out this storm. More on this in just a minute. First, we need to take a quick assessment of the market's key levels… After Friday's tumble, the S&P 500 is quickly approaching its 200-day moving average.

Remember, choppy trading is standard when the major averages are stuck below their 200-day moving averages. So you can expect plenty of seesaw action moving forward if we see a material fall below these levels. As of right now, futures are indicating that we'll probably see a break below the long-term moving average today. Remember, we don't own a crystal ball. We still don't know if these lows are going to hold or if stocks will continue to sell off as the week progresses. Heck, we might even see a rally. We have to be prepared for just about anything. That's means we're going to stick to our game plan as this trading week unfolds. Here are the three main strategies we'll rely on—no matter what the market throws our way:

Countless mainstream analysts and economists are going to be tripping all over themselves trying to predict what will happen next as Britain stumbles toward splitting with the European Union. But no one has any idea how it will all play out. All we know right now is investors are using the Brexit vote as an excuse to sell. You simply must be more judicious with your trades in this type of market environment. There's no way around it… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Here’s Your Complete Brexit Trading Guide… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Surges 20% In GBP In 2 Days On Brexit Fallout Posted: 27 Jun 2016 06:31 AM PDT Gold has surged over 20% in sterling terms in the last two trading days due to the fallout of the UK’s monumental decision to leave the European Union. Gold has extended the biggest price gains since 2008 as market turmoil and sharp falls in stocks globally and especially bank stocks led to safe haven demand for bullion coins and bars, especially in the UK and Ireland. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buying Brexit Gold at £1,000? Who, What, How Posted: 27 Jun 2016 06:26 AM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jun 2016 06:18 AM PDT The gold-to-silver ratio is the most popular ratio among the precious metals. However, we can also link gold prices to platinum prices. Mathematically, the gold-to-platinum ratio is the price of gold divided by the price of platinum. It describes how many ounces of platinum are needed to purchase one ounce of gold, indicating the relative strength of gold prices compared to platinum prices. The indicator works just as the gold-to-silver ratio, so we will not explain its mechanics, but move straight to analysis of the long-term trends in the ratio. Let’s examine thoroughly the chart below, which presents the number of platinum ounces it took to buy a single ounce of gold since 1975 (we use futures prices, as data series of London fix for platinum is available only from 1990). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Social Security Changes For 2016/2017 Must Watch Posted: 27 Jun 2016 05:36 AM PDT Please Get This Video Out. These Are Extremely Important Changes To Social Security That Will Occur Over The Next 2 Years And You Must Watch It, Your Parents Must Watch It. You Must Keep Informed. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major Debt and Dow Collapse Will Set Ideal Conditions For Silver Posted: 27 Jun 2016 03:22 AM PDT The current silver bull market is similar to the bull market of the 70s in many ways. Despite the similarities, silver will ultimately perform much better than during the 70s. One of the big reasons for this is the fact that debt levels are so much higher today, than during the 70s. Not only are debt levels higher on an absolute basis, but also on a relative basis. For example, Total Us Debt as a Percentage of GDP is about 360% today, whereas, in the 70s it was around 150%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| RBS shares crash to lowest level since 2009 collapse Posted: 27 Jun 2016 03:00 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 26 Jun 2016 06:00 PM PDT UK Votes to leave EU, markets stunned. Stocks plunge worldwide, gold soars, volatility spikes, pound tanks. Gold COTs are “over the top.” Central banks seem to be losing control of the narrative. Bitcoin jumps. Trump campaign in chaos while polls show dead heat in battleground states. Best Of The Web Majority mad as hell […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Jun 2016 05:15 PM PDT David Morgan on silver, Nick Barisheff, Marin Katusa and Doug Casey on gold. Max Keiser on economic anxiety. And another chance to watch Brexit, The Movie, in light of that side’s victory. The post Top Ten Videos — June 27 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

This could be the year that the mainstream investor finally pushes the gold market over the edge. While a fraction of investors continue to acquire a lot of physical gold, the mainstream investor is the key to driving the gold market and price going forward.

This could be the year that the mainstream investor finally pushes the gold market over the edge. While a fraction of investors continue to acquire a lot of physical gold, the mainstream investor is the key to driving the gold market and price going forward.

The real reason for the ongoing trouble in the European Union, including the recent vote by the British people to leave the bloc, is that the EU is bankrupt. We know in retrospect that the bankruptcy of the Soviet Union was the real reason the Warsaw pact fell apart, with Poland acting as the first domino. For the same reason, we can predict England was the first domino in the collapse of the European Union.

The real reason for the ongoing trouble in the European Union, including the recent vote by the British people to leave the bloc, is that the EU is bankrupt. We know in retrospect that the bankruptcy of the Soviet Union was the real reason the Warsaw pact fell apart, with Poland acting as the first domino. For the same reason, we can predict England was the first domino in the collapse of the European Union. We have now entered a global period of bailouts heaping up against the back of earlier bailouts and attempted recovery coming on the back of already failed recovery. Why? Because it is all the same Great Recession, and as I've maintained since I began this blog several years ago the "recovery" is nothing but a prop under the Great Recession's monstrous belly. That prop, I said would fail this year, and we would slide into the abyss of an economic apocalypse in a series of jolting plunges and rallies.

We have now entered a global period of bailouts heaping up against the back of earlier bailouts and attempted recovery coming on the back of already failed recovery. Why? Because it is all the same Great Recession, and as I've maintained since I began this blog several years ago the "recovery" is nothing but a prop under the Great Recession's monstrous belly. That prop, I said would fail this year, and we would slide into the abyss of an economic apocalypse in a series of jolting plunges and rallies.

Topics Discussed

Topics Discussed We've talked a lot in recent months about the tanking economy and how it has steadily worsened under President Obama, but we haven't discussed at length what you'll need to do to survive in a society where the dollar is no longer worth much, so today we're rectifying that.

We've talked a lot in recent months about the tanking economy and how it has steadily worsened under President Obama, but we haven't discussed at length what you'll need to do to survive in a society where the dollar is no longer worth much, so today we're rectifying that.

On Friday afternoon, after the shocking Brexit referendum, while being interviewed by CNBC

On Friday afternoon, after the shocking Brexit referendum, while being interviewed by CNBC

No comments:

Post a Comment