Gold World News Flash |

- Gold is Positioned for a Very Long Run – and We Will Need It!

- Shock Brexit Victory Sends Pound Plummeting As Gold Soars: “All Hell Is Breaking Loose”

- Gold-to-Platinum Ratio

- Brexit as a Roadmap… For YOU!

- Greenspan: “This Is The Worst Period I Recall; There’s Nothing Like It”

- Will The European Union Just Dissolve?

- Ambrose Evans-Pritchard: The sky has not fallen after Brexit but we face years of hard labor

- Gold Price Closed at $1320 Up $58.80 or 4.7%

- BREXIT/NOW FRANCE/ITALY/NETHERLANDS CALL FOR EXIT VOTE

- Brexit Vote: A Pie in the Face to the Global Elites

- BREAKING Trump agrees BREXIT to close open borders European Union NWO June 24 2016 News

- Peter Schiff: "Brexit Is Just What The Doctor Ordered"

- Was This The Deciding Factor For Brits To Vote "Leave"?

- A Tale Of Two Asset Classes: Gold Miners Soar, Banks Crash

- Donald Trump’s Entire Financial History In One Short Video

- Brexit: Individualism > Nationalism > Globalism

- Brexit is no cause to buy gold but likely devaluations are, Lundin says

- So rule, Britannia -- Britannia, rule thyself

- WARNING #BREXIT to Collapse Eurozone

- Gold Daily and Silver Weekly Charts - Flight To Safety

- CANADIANS PANIC as Food Prices SKY ROCKET On Collapsing Currency !

- BREXIT SPECIAL REPORT: A Glimmer Of Hope For The World. By Gregory Mannarino

- Congratulations, Britain chooses Freedom over Fear

- Gold: Keep Calm and Carry On

- Gold Summer-Doldrums Risk

- BREXIT signals CHAOS to bring in New WORLD Order???

- BREXIT !! • GREAT BRITAIN • British Reactions & Donald Trump !! • BREXIT

- Gold, Silver And PM Stocks Summer Doldrums Risk

- Gold Price Breaking the 200 Week Moving Average

- #Britain is leaving the #EU. Here's what that means.

- A Tale Of Two Asset Classes: Gold Miners Soar, Banks Crash

- 'Buy gold' searches soar 500pc after Britain votes to leave EU: here's how to get your hands on the yellow metal

- London gold dealers report surge in coin, bar demand on Brexit vote

- CRASH! Brexit Triggers Global Meltdown. Here’s What to Do Now…

- Breaking News And Best Of The Web

- Alasdair Macleod: The consequences of leaving the party

- Brexit - Gold Note - Brexit Facts - Ramifications for UK, Ireland, EU - Conclusion

- Jubilee Jolt: Markets Crash, Gold Skyrockets as Britain Takes Brexit

- Famous Technical Analyst Now Predicting Financial Markets Crash During Jubilee Time Period

- A New Balance Of Power In The Gold Market

| Gold is Positioned for a Very Long Run – and We Will Need It! Posted: 25 Jun 2016 01:00 AM PDT by Gary Christenson, Deviant Investor:

Are Your Future Dollars Disappearing? Imagine you have a ten dollar bill in your wallet. How much is it worth? Right now I'll bet you're (metaphorically) looking at me like I'm a moron. "How much is it worth? Ten dollars is worth ten dollars!" Well, maybe. Certainly its face value is ten of today's dollars, and it'll buy "ten dollar's worth" of whatever you can get these days for ten bucks. But imagine you keep it in your wallet for five years, or ten. Imagine the government decides, for whatever reasons, to flood the market with thousands or millions of new dollars, in another round of what they call "stimulus" and economists call quantitative easing. How much will your ten dollar bill buy you then? Many Americans, especially those of us over fifty, have become somewhat inured to the gradual devaluation of our cash. It can become as anecdotal as comparing notes on how much a candy bar cost us when we were kids. For the record, my personal best was fifteen cents, although I'm often one-upped by slightly older friends who say, "In my day it was a nickel…" Well, thanks for both making my point for me and making me feel, comparatively, young. But our mistake is putting the blame on the candy bar, or the car, or the house, when the issue is the dollar. Our dollars are losing much-needed buying power. While we may not feel it acutely from one day to the next, this loss of buying power makes planning for a retirement that may last thirty years or more, during which our healthcare costs will skyrocket, very problematic indeed. One hundred thousand dollars, or even twice or three times that amount, simply won't buy you as much ten or twenty years from now. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shock Brexit Victory Sends Pound Plummeting As Gold Soars: “All Hell Is Breaking Loose” Posted: 24 Jun 2016 11:00 PM PDT by Mac Slavo, SHTFPlan:

The full meaning of Britain's decision to leave the EU will only be appreciated in due time, but already it is causing some earth-shattering side effect. The financial markets and central banks are trying to reassure investors to keep calm and carry on, insisting that the historic drops in the British Pound are only part of temporary turbulence. After all the highly dramatic and strange events leading up to the Brexit referendum – including the shock murder of MP Jo Cox and the bizarre heavy rains and lightning storms on the eve of the vote – it is somewhat surprising that Britain indeed voted to leave the European Union, however narrowly at 52-48%.

Figures great and small weighed in, and in many cases made dramatic pleas making the idea of leaving the EU seem like an earth shattering prospect. The world's most powerful bankers threatened financial chaos, too. The likes of Soros, Rothschild and several important figures at Bilderberg all warned that a Brexit would usher in great financial pain (one only wondered if it would be at their own hands). And it seems they were right – the victory for the "leave" campaign has triggered a massive shock response, which has only begun to play out for currencies and markets. Though there are many positive aspects to a sovereign nation reclaiming its sovereignty from a bureaucratic superstate, a wave of chaos has indeed been unleashed. It seems history was made last night. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jun 2016 10:00 PM PDT SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jun 2016 09:45 PM PDT by Bill Holter, JS Mineset, SGT Report.com:

First and foremost, the “people stood up and spoke”. The vote to exit is without a doubt the largest protest vote the world has seen in many years. It is important to note that the Brexit vote is symptomatic of what is happening worldwide. I would also say it is very similar to the Trump phenomenon here in the States, people are angry. (I would also say the results are very encouraging to the Trump camp). Next, we must wonder “who” is next? Italy, Spain, France?

Then, the next exit is the curtain for the EU experiment as a whole. It is only a matter of time before the next referendum (Italy in October), Brexit is only the beginning of an end where individual countries will prefer to steer their own destinies. “Globalization” has been dealt a huge blow! It should be noted, the vote yesterday was only a referendum and does not guarantee the Parliament will petition to leave the Eurozone. It will be interesting to see how the Brits react if Parliament defies their wishes. All of this will take “time” to occur, but time is not something I believe is available and will most likely be cut short by the markets short circuiting. As for markets, Brexit is being called a six sigma “Black Swan”. I had planned to write today that the entire system itself is the fabled Black Swan, I think we will soon see if this thought is correct. The world will wake up Monday morning to all sorts of margin calls. You must understand, the “carry trade” is held on very thin margin. No matter what market you are looking at, they all moved several percentage points versus 1% or much less used to carry positions. My point is this, many “counterparties” were outright blown up today and are dead entities unable to perform. Yes I am sure the Fed, ECB and BOJ will provide liquidity but that will not erase the losses, it will only postpone the pronouncement of death. I believe it is VERY important to look at the “direction” that all markets have taken since the Brexit news. THIS is the direction of Mother Nature versus the direction of the elite controllers. You can call the moves “out of control” if you wish, the important thing to understand is the control of markets was temporarily lost and went in “bad” directions. These “bad” directions are your road map as to which direction various assets will move in the upcoming re set. I say the above with one caveat, capital flowed into U.S. Treasuries and German bunds, a reset will not be kind to the owners of debt from any issuer. To finish, clearly today’s unanimous winner in ALL currencies was gold. As I wrote above, I believe the action today is your road map and a “tell” as to where we are headed. Financially, the system blew up behind the scenes and we will soon hear “who, where and how much”. We have gone nearly eight years with “unlimited paper” pushing, pulling and “pricing” markets in directions that supported the Alice in Wonderland world. The knee jerk reactions you saw today will only become more violent as today was only for starters. The only question remains, how long can they keep markets open? The carry trade unwind can only go so far without control being totally lost. Central banks will be mere straws in a hurricane of fear. A complete re set of “pricing” is not far off! This is a public article. If you would like to read and hear all of our work, please follow this link to subscribe. Standing watch, Bill Holter | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greenspan: “This Is The Worst Period I Recall; There’s Nothing Like It” Posted: 24 Jun 2016 09:26 PM PDT from Zero Hedge:

“This is the worst period, I recall since I’ve been in public service. There’s nothing like it, including the crisis — remember October 19th, 1987, when the Dow went down by a record amount 23 percent? That I thought was the bottom of all potential problems. This has a corrosive effect that will not go away. I’d love to find something positive to say.“ During a CNBC inteview today, when discussing the historic Brexit vote outcome, Alan Greenspan unleashed a fiery sermon that could have been prepared just by reading a random selection of posts from this website, the former Fed chairman told his shocked hosts that the current period, far from the raging “Obama recovery” spun every day by adaministration propaganda appratchicks and one that prompted the Fed to unleash a ridiculous rate hike cycle in December just as the US is sliding into a recession, and is instead the “worst period” he has seen, surpassing even the infamous Black Monday in severity. “This is the worst period, I recall since I’ve been in public service. There’s nothing like it, including the crisis — remember October 19th, 1987, when the Dow went down by a record amount 23 percent? That I thought was the bottom of all potential problems. This has a corrosive effect that will not go away. I’d love to find something positive to say.” Of course, what he is referring to was a market shock which was the result of a massive capital account imbalance resulting from the aftermath of the Louvre Accord coupled with the then trendy Portfolio Insurance (in which everyone was on the same side of the boat, much like now) and not so much an all out economic malaise. Which, however, does beg the question when a Black Monday-like market crash is coming? Rhetorical questions aside, Greenspan was referring to the unprecedented combination of economic stagnation, deteriorating demographics, insolvent entitlement programs, social inequity and wealth division, and of course, a historic debt overhang which could and should have been cleared out in the crash of 2008 but instead was preserved to avoid wiping out the same “equityholders” who also happen to be the Fed’s direct and indirect stakeowners. To be fair, Greenspan, who in recent years has become one of the loudest advocate of gold alongside billionaires such as Druckenmiller and Soros, did not say anything our readers did not know. The former Fed chairman said that the root of the “British problem is far more widespread.” He said the result of the referendum will “almost surely” lead to the Scottish National Party trying to “resurrect Scottish Independence.” Greenspan said the “euro currency is the immediate problem.” While the euro and the euro zone were major steps in a movement toward European political integration, “it’s failing,” he said. “Brexit is not the end of the set of problems, which I always thought were going to start with the euro because the euro is a very serious problem in that the southern part of the euro zone is being funded by the northern part and the European Central Bank,” Greenspan said. He then repeated a point that has been widely accepted in recent months, namely that monetary policy – while still the only game in town – is now impotent. Greenspan said the ECB is limited in what it can do because these fundamental problems like the stagnation of real incomes don’t have easy solutions. “There’s a certain amount that monetary policy can do, but our problem is fundamentally fiscal,” he said, adding that this is true in the United States as well as “every major country in Europe.” Part of the problem is that the “developed countries are all aging very rapidly,” which is leading to a higher ratio of government spending in the form of entitlements, Greenspan said. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will The European Union Just Dissolve? Posted: 24 Jun 2016 08:30 PM PDT by John Rubino, Dollar Collapse:

Last night Britons voted to leave the European Union, sending shock waves around the world — though not directly or immediately threatening the concept of European integration. But what comes next emphatically does. Emboldened by the Brits, nationalist parties across the Continent are gearing up for exit votes of their own. Some notables: Italy's Northern League To Launch EU Referendum Campaign Next (Zero Hedge) – Shortly after the final Brexit result was released, the head of Italy's Northern League Said "Now it's our turn' After U.K. As Dow Jones reports, Italy's anti-immigrant and euroskeptic Northern League will start a petition calling for a law that allows a referendum on whether the country wants to exit the European Union, its leader said on Friday. In a news conference following the announcement of the U.K.'s decision to leave the EU, Northern League's head Matteo Salvini said that it was time to give Italians a vote on their EU membership, as the citizens of Britain have just done. "This vote was a slap in the face for all those who say that Europe is their own business and Italians don't have to meddle with that," Mr. Salvini said. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ambrose Evans-Pritchard: The sky has not fallen after Brexit but we face years of hard labor Posted: 24 Jun 2016 07:45 PM PDT Ambrose Evans-Pritchard at his best at a world-historical moment demanding such. * * * By Ambrose Evans-Pritchard It is time for Project Grit. We warned over the final weeks of the campaign that a vote to leave the European Union would be traumatic, and that is what the country now faces as markets shudder and Westminster is thrown into turmoil. ... The stunning upset last night marks a point of rupture for the post-war European order. It will be a Herculean task to extract Britain from the EU after 43 years enmeshed in a far-reaching legal and constitutional structure. Scotland and Northern Ireland will now be ejected from the EU against their will, a ghastly state of affairs that could all too easily lead to the internal fragmentation of the Kingdom unless handled with extreme care. ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Just how traumatic Brexit will be depends on whether Parliament can rise to the challenge and fashion a credible trade policy -- so far glaringly absent -- to safeguard access to European markets and ensure the viability of the City, and it depends exactly how Brussels, Berlin, Paris, Rome, Madrid, and Warsaw react once the dust settles. Both sides are handling nitroglycerin. Angry reproaches are flying in all directions, but let us not forget that the root cause of this unhappy divorce is the conduct of the EU elites themselves. It is they who have pushed Utopian ventures, and mismanaged the consequences disastrously. It is they who have laid siege to the historic nation-states, and who fatally crossed the line of democratic legitimacy with the Lisbon Treaty. This was bound to come to a head, and now it has. ... Precisely because the political mood is so tense, my preference is for a national unity government of all parties, especially the Scots and the Ulster Catholics, to come up with a negotiating plan. Since David Cameron has honourably offered to stay on as a caretaker, he should lead this emergency administration. ... This referendum was never a fight between Britain and Europe, as so widely depicted. It was the first episode of a pan-Europe uprising against the Caesaropapism of the EU project and its technocrat priesthood. It will not be the last. ... For the complete commentary: http://www.telegraph.co.uk/business/2016/06/24/the-sky-has-not-fallen-af... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1320 Up $58.80 or 4.7% Posted: 24 Jun 2016 07:09 PM PDT

If y'all are planning a European vacation, I reckon it'll be a lot cheaper than last week. British voted 52 to 48% to leave the European union, with a 71.8% turn out, highest since the 1992 general election. It was a fist in the eye followed by a Bowie knife to the gut for the globalist Elite, topped off by a kick to the head. Markets roiled & boiled. Don't confuse a trigger with a cause. The Leave vote wasn't the cause markets came apart, only a trigger for shells already loaded, politically & economically. Never did the smug Elitist politicians expect the scruffy, unwashed people really to exercise their "democracy" and vote against the Elite. This ain't over by a long shot, & forecasts bad things for Hillary Clinton's job security. After setting themselves up for a fall yesterday, stock markets around the world tanked. All dropped furiously, but recovered somewhat before the close, the result no doubt of Nice Government Men's watchful efforts. Shanghai lost 1.3%, Nikkei 7.92%, German DAX 6.82%, French CAC 8.04%, and the London FTSE 3.15%. Dow Jones Industrial Average plunged 3.39% or 610.32 points to 17,400.75, closing within 45 points of the low. Not much recovery there. S&P500 sank 75.91 (3.59%) to 2,037.41. Here's the Dow chart, http://schrts.co/02VKh5 Note that momentum collapsed, volume shot up (confirming price decline), RSI tanked, and in one day the Dow managed to just about complete that Right shoulder of the Head and Shoulders top. Parlously near the 200 DMA at 17,235.41, which coincidentally is about where the H&S neckline resideth. Breaching 17,235 will pull the plug. A big plug. S&P500 chart is here, http://schrts.co/dqPY43 I've given y'all the longer term version with the S&P500 so you can see the bottom of the August & January/February breaks. S&P500 has traced out a vast Jaws of Death or Broadening Top formation with the top line about 2,115 and lower lows at 1,870 and 1,810. Present plunge promises to burst through that last (1,810) low. Yep, 'tis a long ways from 2,037.41 to 1,810.10. Did I mention that stocks will follow through today's breakdown? They will, count on it, although the Nice Government Men will be out Monday in force, manipulating their little grimy fingers off trying to boost stocks. Might as well be King Canute ordering the sea to recede. The volatility index ended at 25.76 today, up 49.33% [sic]. Top of the range is about 30, but last August it hit 52 in the panic. (Thanks, WR, for reminding me.) Lo, for us the payoff came in the Dow in Gold, seen here, http://schrts.co/8Sv0tc Observe that it fell 7.77% today (1.11 ounces) to 13.19. Mark also that it fell below the bottom boundary of that megaphone reversal formation. And below the downtrend from the December 2015 high. Another 0.65 troy ounce and it falls below the February 2015 low. Don't forget the Dow in silver, http://schrts.co/ohwLZP Stocks are in a more advanced state of decomposition against silver, as today the DiS crashed through the support line that had contained the February and April lows. Descent should now toboggan at light speed. Gag! US Dollar Index leapt tall buildings at a single bound. Added an eye & ear popping 205 basis points (2.19%) to end at 95.57. Cut through the downtrend's upper boundary, sliced through the 20 & 20 day moving averages, shot up to cut into the 200 DMA 996.50) for a high at 96.70, but then the Guardians Of Wall Street's Order woke up and it closed down at 95.57. Above 95.50 resistance. Pointed toward the March 2015 high at 100. Chart, http://schrts.co/OkJ5UT Yen completely erased its island reversal with a 4.51% gap up jump to 97.85¢/y100. Euro lost 2.8% to $1.1104. Y'all will find the yen chart at http://schrts.co/UuqBFa & the yen at http://schrts.co/HcRUv0 The CME a.k.a. Comex raised margins all around today, on stock futures, bond futures, currency futures, and sold futures. They also raised margins on butter futures, but y'all probably don't care about that. Last night about 10:00 central time as I was climbing into bed I couldn't resist looking at the gold price on my phone: $1,293, up already $32 from the close, so I knew the Leavers must be winning. I wasn't quite prepared for the panic into gold that took it to $1,362.60. There's a glitch on my chart I can't explain. Looks like about 6:00 or 7:00 last night that gold dropped to $1,206. Don't know if that's a glitch or reality. Doesn't show on StockCharts. Today gold closed Comex up $58.80 (4.7%) at $1,320. Silver rose 44.1¢ 92.5%) to 1778.9¢. Get this straight: today gold closed higher than the year before for the first time in FIVE years. Lock that in your brain, because it validates the conclusion that the December lows were the final lows for the 2011 - 2015 correction. Load up this fact, too. 2015's high came on 22 January 2015 at $1,302.10, with an intraday high at $1,307.80. A $1,320 close is not a mealy-mouthed, timid move above those levels, but an unequivocal victory. Bore this into your brain while you're at it. On the WEEKLY chart gold has broken out upside from a trading channel that began in mid 2013, and today it closed ABOVE the 200 week moving average ($1,311). More validation. Drop this into your brainpan, too. On the MONTHLY chart gold broke out in January from a bullish falling wedge, and has stayed out for 5 months and closed today about the 50 month MA (1,319.10). Am I making my point? Okay, add the Gold/Bank Stock Index. I guffawed when I saw this, http://schrts.co/PBJpq4 Remember this spread measures confidence in financial markets versus confidence in gold. Sinks when confidence in financials is growing, rises when confidence is draining away into gold. It shot up 13% today, jumped clean out of the Trading channel, ready to fly to the moon. Okay, Moneychanger, if everything's so hunky-dory, why didn't silver rise more than a measly 2.5%? Don't niggle. Back up and think. Silver has been stronger than gold most of the time since January. Today was fueled by panic, so gold led the way. Besides, silver's long term charts look better than gold's. On silver's weekly chart, http://schrts.co/DnvNAL the Mighty White Metal has broken ABOVE the post-2011 downtrend line, traded back to that line for a kiss good-bye, and headed back up. Has stayed above that trendline for 10 weeks. Once it climbs over 2025¢, the 200 week moving average, no doubt will remain. Silver's monthly chart showeth similar unconquerable vigor. Busted through the post-2011 downtrend line, and is trading above the 200 month moving average (yes, 1457¢) and the 20 month MA. Monthly rate of change, negative since 2012, is positive and climbing. I know, I know, y'all's next question is, "WILL IT HOLD? Will today's gold breakout hold? Will the stock breakdown hold?" I still remember the 2008 panic, and NEVER from Summer 2008 through December did gold perform like today. It was uniformly weaker than the dollar, miserably weak. Hear my words: today's panic ran not into fiat dollars alone, but into gold. This reflects a big change in investors' thinking. If stocks crumble terribly, the US dollar & US government bonds would benefit, sure, but today's performance suggests that a panic now won't play out as in 2008. Today, more folks, many more, will run into gold. So my answer is, "Yes, it will hold." It's a watershed turnaround, closing higher than the foregoing year. It sets the gold price up for a run to $1,367, the 2014 high, and then $1,394 and $1,434. But the big target is $1,550 where gold was trashed in April 2013. Behold, the gold & silver surprises are all coming to the UPSIDE. Plainly the character of a rallying market in a primary uptrend. Y'all better stop waiting for lower prices and buy. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. BREXIT/NOW FRANCE/ITALY/NETHERLANDS CALL FOR EXIT VOTE Posted: 24 Jun 2016 07:00 PM PDT The British public are overwhelmingly more interested in finding out about leaving the European Union (EU) than remaining within it, data from Google has shown, with immigration being the most searched referendum-related topic The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit Vote: A Pie in the Face to the Global Elites Posted: 24 Jun 2016 06:40 PM PDT by Pam Martens and Russ Martens, Wall Street On Parade:

The outcome slammed markets – leaving many wondering if big banks and hedge funds were going to take heavy losses this morning for placing wrong way trades. Futures markets were doing little to reassure that this wasn't the case with futures on the Dow Jones Industrial Average showing a loss of over 553 points before the market opened and major Wall Street banks like Citigroup, Morgan Stanley, Bank of America, and JPMorgan Chase off by 6 to 7 percent in premarket trading. In times of crisis, the still untamed mega Wall Street banks serve as proxies of all that remains wrong with global finance: lack of transparency; lack of a competent regulator; trillions of dollars in opaque derivatives; serial frauds against the investing public which have no end in sight, as the charges of outrageous abuses against its customers brought by the SEC against Merrill Lynch yesterday made clear. The Wall Street banks are also tanking this morning because their stealthy outposts in the City of London (the equivalent of Wall Street in the UK) which has allowed a lot of pillaging of the globe beyond the gaze of U.S. regulators (think JPMorgan's London Whale fiasco where it used U.S. bank deposits to gamble in exotic derivatives and lose $6.2 billion along the way) may no longer provide the access it once did to the whole of Europe under European Passporting rules. As the miscreant banks of global finance were soundly trounced, safe haven assets like gold and the ten-year U.S. Treasury were the beneficiaries. As the price of the 10-year Treasury soared, its yield dropped to 1.52 percent from more than 1.7 percent yesterday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING Trump agrees BREXIT to close open borders European Union NWO June 24 2016 News Posted: 24 Jun 2016 06:00 PM PDT Breaking Citizens of UK England Voted leaving NWO NEW WORLD ORDER Globalization European Union June 24 2016 News - The European Union in the New World Order The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff: "Brexit Is Just What The Doctor Ordered" Posted: 24 Jun 2016 06:00 PM PDT Submitted by Peter Schiff via Euro Pacific Capital, Janet Yellen should send a note of congratulations to Nigel Farage and Boris Johnson, the British politicians most responsible for pushing the Brexit campaign to a successful conclusion. While she’s at it she should also send them some fruit baskets, flowers, Christmas cards, and a heartfelt “thank you.“ That’s because the successful Brexit vote, and the uncertainty and volatility it has introduced into the global markets, will provide the Federal Reserve with all the cover it could possibly want to hold off on rate increases in the United States without having to make the painful admission that domestic economic weakness remains the primary reason that it will continue to leave rates near zero. For months the corner that the Fed has painted itself into has gotten smaller and smaller. It continues to say that rate hikes will be appropriate if the data suggests the economy is strong. Then its representatives continually cite (arguably bogus) statistics that suggest a strengthening economy, which cause many to speculate that rate hikes are indeed on the horizon. But then at the last minute the Fed conjures a temporary reason why it can’t raise rates “right now,” but stresses that they remain committed to doing so in the near future. But each time they conduct this pantomime, they lose credibility. Sadly, Fed officials are discovering that their supply of credibility is not infinite, even among those who would like to cut them a great deal of slack. But the Brexit vote saves them from all this unpleasantness. Now when critics question the Fed’s unwillingness to deliver on the suggested rate hikes, given what they believe to be a strong economy, all the Fed needs to do is point to the “uncertainty” that will be in play now that the world’s fifth largest economy is disengaging from the European Union. And since this process is bound to be long, messy, and fraught with uncertainties (as there is no precedent for a country leaving the EU), this will be a handy excuse that the Fed will be able to rely on for years. Brexit could also place severe strains and uncertainties on the global currency markets. The fear of financial losses could encourage investors to seek safe haven assets like gold and, at least for now, the U.S. dollar. Given that there is already much concern that the dollar is valued too highly against most currencies, and that this has created imbalances in the global economy, any surge in the dollar that results from Brexit may have to be fought by the Federal Reserve through lower interest rates and quantitative easing. This would rule out the potentially dollar-strengthening interest rate hikes that they supposedly planned on delivering. So as far as Janet Yellen is concerned, the British have given her the gift that keeps on giving. On another level, the vote in the UK illustrates the fundamental inefficacy of the monetary and financial policies that have been implemented by the world’s dominant central banks and central bureaucracies. For years, global elites have been telling us that deficit spending, government regulation, and central bank stimulus is the best way to cure the global economy in the wake of the 2008 Financial Crisis. To prove these points, elite economists associated with the government, academia, and the financial sector have pointed to all kinds of metrics to show how their policies have been successful. But the man on the street perceives a very different reality. They know that their living standards have fallen, their cost of living has risen, and that their job prospects have deteriorated. They see a loss in confidence and economic stagnation when they are being assured the opposite. This disconnect has fueled anti-establishment sentiment on both sides of the Atlantic. In the United States, it has given rise to the insurgent candidacies of both Donald Trump and Bernie Sanders. The unexpected successes of both reflect a deep distrust of the establishment. Such discontent would not be in play if the positive stories being told by the elites had made any resonance with rank and file voters. The same holds true with the unexpected strength of the anti-EU voters in Britain. The “Remain” camp had the support of virtually all the elite members of the major UK political parties, the media, and the cultural world. In addition, foreign leaders, including President Obama in a state trip to England, harangued British voters with warnings of economic catastrophe if the British were to make the grave error of defying the advice of their “best” economists. Given all this, poll numbers that suggested the vote could be close had been dismissed. The elites, as evidenced by recent drifts in currency and financial markets, had all but assumed that British voters would fall into line and vote to remain. Instead, the people revolted. After having been misled for so many years by the very elites who urged them to remain, the rank and file finally asserted themselves and voted with their feet. British voters may not know what they will get with an independent Britain, but they knew that something was rotten, not just in Denmark, but all over the European Union. The same holds true in the United States. Until our leaders can paint more realistic pictures of where we are and where we are going, we should expect more “surprises” like the one we got yesterday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Was This The Deciding Factor For Brits To Vote "Leave"? Posted: 24 Jun 2016 05:25 PM PDT While the blame for today's historic moment in the collapse of crony capitalism could be laid at many feet - from Brussels totalitarianism to Cameron and Osborne's scaremongering blowback - one look at the charts and it becomes pretty clear when exactly the inflection point occurred... April 22nd, Obama wrote his "Stay or screw the special relationship" Op-Ed followed by his apology tour visit. It appears The Brits don't like being told what to do by other nations' leaders... And then there is this little know fact...

Good luck Hillary! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Tale Of Two Asset Classes: Gold Miners Soar, Banks Crash Posted: 24 Jun 2016 04:50 PM PDT The following tables illustrate the dilemma of mainstream money management. The vast majority of legitimate financial advisors and portfolio managers are big fans of bank stocks because finance is a crucial, if not dominant, form of economic activity in the modern world. So the big names in the field — Goldman Sachs, Deutsche Bank, JP Morgan, etc. — are generally seen as safe places to put client capital. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump’s Entire Financial History In One Short Video Posted: 24 Jun 2016 04:43 PM PDT Courtesy of The Money Project, a collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. Donald Trump's Entire Financial History In One Short Video In this motion graphic video, we break down the full story behind Donald Trump's wealth. Not only do we examine his major business successes and failures, but we even look back at real estate's prominent role in the history of the Trump family. To conclude, the video breaks down Trump's net worth and financial history, while highlighting some of the help he has gotten along the way in building his fortune. Family Matters The story started well over a century ago with Donald's grandfather, Frederick Trump. Real estate runs deep in the blood of the Trump family, and Frederick was actually the first Trump to own a hotel. During the famous Klondike gold rush in Canada, Frederick owned an inn and restaurant that served gold miners. When he passed away, he left an estate worth just under $500,000 in today's dollars to his heirs. His eldest son, Fred Trump, carried on the Trump legacy by going into business with his mother, using the nest egg for seed money. Fred became a very successful builder in New York City's outer boroughs. He built single family houses in Queens in the 1920s, helped pioneer the supermarket with the "Trump Market" during the Great Depression, and even built barracks for the Navy during World War 2. But Fred's real cash cow came in 1949, when he got a government loan to build Shore Haven Apartments in Brooklyn. The Federal Housing Administration paid him $10.3 million, but he was able to build the apartments for significantly less. The government kept overpaying for houses in Brooklyn and Queens, and Fred kept building them. According to Donald, his father became "one of the biggest landlords in New York's outer boroughs". By the time of Fred's death in 1999, it's said that Fred Trump was worth between $250 and $300 million. Donald's Vision Born in Queens, Donald J. Trump would join his father's company early on in his career. His father's cash cow was now gone, but Donald had a different vision for the Trump name anyways. He envisioned the "Trump" brand as being synonymous with luxury worldwide. To do this, in the mid-1970s, Donald went into real estate in Manhattan. Relying on the business connections and creditworthiness of his old man, he borrowed a "small sum" of 1 million dollars to get started. Trump's Biggest Successes Trump's top three business successes include the Grand Hyatt, 40 Wall Street, and the Apprentice. 1. Grand Hyatt In 1976, Donald Trump and Hyatt partnered to buy the rundown Commodore Hotel near Grand Central Station. At the time, the whole neighborhood was in disarray with many nearby buildings on the verge of foreclosure. Trump negotiated contracts with banks and the city in an effort to fund the hotel and rejuvenate the area. The end result was the Grand Hyatt, a 25-story hotel, which Trump sold his share of for $142 million in 1996. 2. 40 Wall Street Another big win for Trump was with 40 Wall Street, once the tallest building in the world. He bought it for $1 million after years of vacancy. Today, it's prime real estate in the financial district, worth more than $500 million – a huge return. 3. The Apprentice The Apprentice was also a financial home run for Trump. As the show's host and executive producer, he raked in $1 million per episode for a whopping 185 episodes. Trump's Biggest Failures Like many businessmen, Donald Trump's career has also had his share of failures. 1. Atlantic City Donald's biggest failure may be his ill-fated venture into casinos in Atlantic City. The bleeding started in 1988 when he acquired the Taj Mahal Casino. Funded primarily by junk bonds, the massive casino would be $3 billion in debt within just a year of opening. Trump, who racked up $900 million in personal liabilities, had the business declare bankruptcy. To stay afloat, he ditched many personal assets such as half of his stake in the company, a 282-foot megayacht, and his airline. Things were dire, and Trump's dad chipped in by providing a $3.5 million loan in the form of casino chips to help make a loan payment. Trump's casino holding company would enter bankruptcy two additional times: in 2004, after accruing $1.8 billion in debt, and in 2009, after missing a bond payment during the Financial Crisis. Each time, Trump's stake in the company fell. 2. Other Businesses While three of Trump's four bankruptcies involved Atlantic City casinos, he has also struggled in other ventures outside of real estate: Trump airlines, Trump Vodka, Trump: The Game, Trump Magazine, Trump Steaks, and Trump University were all destined for failure. Trump Mortgages was launched in 2006 right before the real estate crash, and it also imploded. Trump's Net Worth According to Trump's campaign, he is worth "in excess of TEN BILLION DOLLARS". However, he has also been accused in the past of artificially inflating his net worth. Forbes and Bloomberg News both have drastically different estimates of his wealth at $4.5 billion and $2.9 billion respectively. Using the middle of the road figure from Forbes, here is how Trump's wealth breaks down:

The remainder includes other real estate assets outside of New York City, as well as the value of the licensing agreements for hotels, real estate, or other Trump products. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit: Individualism > Nationalism > Globalism Posted: 24 Jun 2016 04:20 PM PDT Submitted by Jeff Deist via The Mises Institute, Decentralization and devolution of state power is always a good thing, regardless of the motivations behind such movements. Hunter S. Thompson, looking back on 60s counterculture in San Francisco, lamented the end of that era and its imagined flower-child innocence:

Does today’s Brexit vote similarly mark the spot where the once-inevitable march of globalism begins to recede? Have ordinary people around the world reached the point where real questions about self-determination have become too acute to ignore any longer? Globalism, championed almost exclusively by political and economic elites, has been the dominant force in the West for a hundred years. World War I and the League of Nations established the framework for multinational military excursions, while the creation of the Federal Reserve Bank set the stage for the eventual emergence of the US dollar as a worldwide reserve currency. Progressive government programs in Western countries promised a new model for universalism and peace in the aftermath of the destruction of Europe. Human rights, democracy, and enlightened social views were now to serve as hallmarks of a post-monarchical Europe and rising US. But globalism was never liberalism, nor was it intended to be by its architects. As its core, globalism has always meant rule by illiberal elites under the guise of mass democracy. It has always been distinctly anti-democratic and anti-freedom, even as it purported to represent liberation from repressive governments and poverty. Globalism is not, as its supporters claim, simply the inevitable outcome of modern technology applied to communication, trade,and travel. It is not “the world getting smaller.” It is, in fact, an ideology and worldview that must be imposed by statist and cronyist means. It is the civic religion of people named Clinton, Bush, Blair, Cameron, and Lagarde. Yes, libertarians advocate unfettered global trade. Even marginally free trade has unquestionably created enormous wealth and prosperity for millions around the world. Trade, specialization, and an understanding of comparative advantage have done more to relieve poverty than a million United Nations or International Monetary Funds. But the EU, GATT, WTO, NAFTA, TPP, and the whole alphabet soup of trade schemes are wholly illiberal impediments masquerading as real commercial freedom. In fact, true free trade occurs only in the absence of government agreements. The only legislation required is a unilateral one-sentence bill: Country X hereby eliminates all import duties, taxes, and tariffs on all Y goods imported from country Z. And as Godfrey Bloom explains, the European Union is primarily a customs zone, not a free trade zone. A bureaucracy in Brussels is hardly necessary to enact simple pan-European tariff reductions. It is necessary, however, to begin building what globalism truly demands: a de facto European government, complete with dense regulatory and tax rules, quasi-judicial bodies, a nascent military, and further subordination of national, linguistic, and cultural identities. Which brings us to the Brexit vote, which offers Britons far more than simply an opportunity to remove themselves from a doomed EU political and monetary project. It is an opportunity to forestall the juggernaut, at least for a period, and reflect on the current path. It is a chance to fire a shot heard around the world, to challenge the wisdom of the “globalism is inevitable” narrative. It is the UK’s last chance to ask — in a time when even asking is an act of rebellion — the most important political question of our day or any day: who decides? Ludwig von Mises understood that self-determination is the fundamental goal of liberty, of real liberalism. It’s true that libertarians ought not to concern themselves with “national sovereignty” in the political sense, because governments are not sovereign kings and should never be treated as worthy of determining the course of our lives. But it is also true that the more attenuated the link between an individual and the body purporting to govern him, the less control — self-determination — that individual has. To quote Mises, from his 1927 classic (in German) Liberalismus:

Ultimately, Brexit is not a referendum on trade, immigration, or the technical rules promulgated by the (awful) European Parliament. It is a referendum on nationhood, which is a step away from globalism and closer to individual self-determination. Libertarians should view the decentralization and devolution of state power as ever and always a good thing, regardless of the motivations behind such movements. Reducing the size and scope of any single (or multinational) state’s dominion is decidedly healthy for liberty. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit is no cause to buy gold but likely devaluations are, Lundin says Posted: 24 Jun 2016 02:45 PM PDT Why Gold May Hit $1,500 by Year's End -- and It's Not Just about Brexit By Myra P. Saefong Gold's impressive rally Friday offered a taste of what may be in store for the precious metal, as some analysts say it's just a matter of time before prices top $1,500 or even $1,900 an ounce. ... But expectations for more rallies in gold aren't just borne from the Brexit news. What happens in other markets, including equities and currencies, will impact gold's outlook more directly. Brexit is "a global monetary event, with destructive effects in individual economies," said Brien Lundin, editor of Gold Newsletter. "The standard central-bank prescription is to ease, to depreciate their currency," he said. "But if everyone is trying to depreciate their currency, including the U.S., what can they depreciate it against?" "Only gold will stand tall during the turmoil. And over the long term, it won't because it's supposed to be a 'safe haven,' but because it's the only safeguard against fiat currency depreciation," said Lundin. ... There is "no reason" for gold to rise on such as event as Brexit itself, said Lundin. Such "geopolitical flashpoints" are short lived." Instead, sustained gains for gold are "based upon currency debasement almost exclusively," he said. ... ... For the remainder of the report: http://www.marketwatch.com/story/why-gold-may-hit-1500-by-years-endand-i... ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| So rule, Britannia -- Britannia, rule thyself Posted: 24 Jun 2016 02:21 PM PDT By Chris Powell http://www.journalinquirer.com/opinion/chris_powell/rule-britannia----br... Recognizing that the objective of the European project, ever-closer political and economic union, meant the destruction of democracy, sovereignty, and the country's very culture, Britain has voted in a great referendum to withdraw from the European Union. The majority arose from a remarkable combination of the free-market, limited-government political right, the core of the Conservative Party, with the working-class political left, the core of the Labor Party, both party cores repudiating their leaderships as well as the national elites. ... Dispatch continues below ... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling The result has enormous implications for the United Kingdom, starting with whether it can remain united, since Scotland -- formerly the most industrious and inventive province in the world, now perhaps the most welfare-addled -- probably will make a second attempt to secede, figuring that free stuff is more likely to flow through continued association with the EU than with England, which is growing resentful of the freeloaders up north. But there are enormous implications for the world as well. The EU project never has won forthright ratification by the people of its member states and indeed has sometimes refused to accept rejection by them. Indeed, the whole EU government is largely unaccountable. So the British vote quickly prompted demands for similar referendums in France and the Netherlands, where conservative populist movements have been gaining strength. The politically correct elites are portraying the British vote as a "xenophobic" response to free movement of labor across the EU and particularly as opposition to the vast recent immigration into Europe from the Middle East and Africa. This immigration is widely misunderstood as being mainly a matter of refugees from civil war. In fact this immigration has been mainly economic and it has driven wages down in less-skilled jobs while increasing welfare costs throughout Europe, which explains the British Laborite support for leaving the EU. But it is not "xenophobic" to oppose the uncontrolled and indeed anarchic immigration the European Union has countenanced. For any nation that cannot control immigration isn't a nation at all or won't be one for long. Since most immigration into Europe lately has come from a medieval and essentially fascist culture and involves people who have little interest in assimilating into a democratic and secular society, this immigration has threatened to destroy Europe as it has understood itself. Britain has been lucky to be at the far end of this immigration, but voters there saw the mess it has been making on the other side of the Channel. They wisely opted to reassert control of their borders. Their example should be appreciated in the United States, which for decades has failed to enforce its own immigration law and as a result hosts more than 10 million people living in the country illegally and unscreened. Fortunately few of this country's illegal immigrants come from a culture that believes in murdering homosexuals, oppressing women, and monopolizing religion. But the negative economic and social effects here are similar to those in Europe and properly have become political issues. The main lesson of Britain's decision may be an old one -- that nations have to develop organically, arising from the consent of the governed and a common culture, and that they can't be manufactured by elites. Having defended its sovereignty and indeed liberty itself against Napoleon and Hitler, Britain now has set out to defend them again. So rule, Britannia -- Britannia, rule thyself. The nations not so blest as thee ----- Chris Powell is managing editor of the Journal Inquirer. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WARNING #BREXIT to Collapse Eurozone Posted: 24 Jun 2016 02:14 PM PDT Think this is what they want? They deliberately overwhelmed the system with the immigrants around the world. I think that was our signal that they are ready. Hang on! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Flight To Safety Posted: 24 Jun 2016 01:35 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CANADIANS PANIC as Food Prices SKY ROCKET On Collapsing Currency ! Posted: 24 Jun 2016 01:00 PM PDT Food Prices Soar as the Canadian Dollar Collapses And NO, it's not just Nunavut: it from coast to coast. Think your grocery bill is high? Canadians paying $3 cucumbers, $8 cauliflower, and $15 Frosted Flakes. We are watching a Real Time Currency Collapse In Canada – Is This Is What It's Going To... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT SPECIAL REPORT: A Glimmer Of Hope For The World. By Gregory Mannarino Posted: 24 Jun 2016 12:30 PM PDT Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decisions and any consequences thereof. Please invest wisely. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Congratulations, Britain chooses Freedom over Fear Posted: 24 Jun 2016 11:30 AM PDT Congratulations, Britain. Britain chooses Freedom over Fear The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jun 2016 11:04 AM PDT SafeHaven | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jun 2016 11:03 AM PDT Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT signals CHAOS to bring in New WORLD Order??? Posted: 24 Jun 2016 11:00 AM PDT #BREXIT signals CHAOS to bring in New WORLD Order??? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT !! • GREAT BRITAIN • British Reactions & Donald Trump !! • BREXIT Posted: 24 Jun 2016 10:30 AM PDT BREXIT !! • GREAT BRITAIN • British Reactions & Donald Trump !! • BREXIT The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver And PM Stocks Summer Doldrums Risk Posted: 24 Jun 2016 09:57 AM PDT Gold’s recent weakness has dampened bullish sentiment, but the entire precious-metals complex has actually enjoyed record early-summer strength. The summer doldrums have always been a vexing time for gold, silver, and the stocks of their miners. Without any recurring seasonal demand surges in June and July, sideways-to-lower drifts are common in this seasonally-weakest time before big autumn rallies. Traders’ sentiment, their collective greed and fear, drives nearly all short-term price action. Most of the time, sentiment is heavily influenced by expectations. If gold rallies 5% in a month where traders expected 10% gains, disappointment and bearishness will flare. But if gold rallies that same 5% when the outlook was for no gains, traders will grow excited and bullish. Performance versus expectations colors reality. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Breaking the 200 Week Moving Average Posted: 24 Jun 2016 09:42 AM PDT Gold is breaking through the 200 week moving average this morning. Don’t forget the intermediate cycle is only on week 3. We should still have 12-15 weeks before the intermediate cycle tops. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Britain is leaving the #EU. Here's what that means. Posted: 24 Jun 2016 09:30 AM PDT Vox.com is a news website that helps you cut through the noise and understand what's really driving the events in the headlines The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Tale Of Two Asset Classes: Gold Miners Soar, Banks Crash Posted: 24 Jun 2016 09:26 AM PDT The following tables illustrate the dilemma of mainstream money management. The vast majority of legitimate financial advisors and portfolio managers are big fans of bank stocks because finance is a crucial, if not dominant, form of economic activity in the modern world. So the big names in the field — Goldman Sachs, Deutsche Bank, JP […] The post A Tale Of Two Asset Classes: Gold Miners Soar, Banks Crash appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jun 2016 08:51 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| London gold dealers report surge in coin, bar demand on Brexit vote Posted: 24 Jun 2016 08:23 AM PDT By Jan Harvey LONDON -- Gold dealers in London reported surging demand for coins and bars on Friday, with some saying stocks were tight, after a shock vote for Britain to leave the European Union sent financial markets into meltdown and drove the pound lower. Gold delivered double-digit percentage gains in sterling terms on Friday, topping 1,000 pounds an ounce for the first time in over three years, and soared as much as 8 percent in dollars. Volatility in the wider markets has left some retail investors scrambling to stock up on gold, dealers say. "We've already got queues forming," said Tony Dobra, executive director of bullion merchants Baird & Co., which has an outlet in London's Hatton Garden. "Sovereigns seem to be the most favoured at the moment." Mark O'Byrne, research director of Dublin-based gold broker Goldcore, said it had seen record online sales for the time of day in early trade. Sales of Britannia and sovereign coins have been extremely high, and inventories are being replenished, he said. The Royal Mint said visitor numbers to its bullion trading platform had surged by 550 percent from Thursday, while new account openings had trebled. Ross Norman, chief executive of Sharps Pixley, said his company had also seen a surge of online business on Friday, with gold Britannia coins and kilo bars selling out. "We've been forced to get emergency stocks from our German and Swiss offices," he said. "Gold is demonstrating well what it does best, which is wealth preservation." ... ... For the remainder of the report: http://www.reuters.com/article/britain-eu-gold-retail-idUSL8N19G463 ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

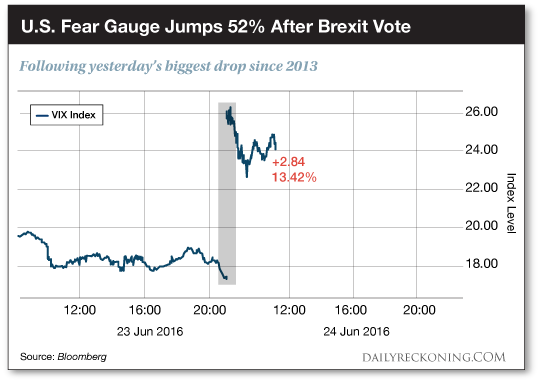

| CRASH! Brexit Triggers Global Meltdown. Here’s What to Do Now… Posted: 24 Jun 2016 08:02 AM PDT This post CRASH! Brexit Triggers Global Meltdown. Here’s What to Do Now… appeared first on Daily Reckoning. The British are leaving! The British are leaving! Britain voted to leave the European Union by a narrow margin last night. World markets are spiraling out of control on the news. In a historic move, the pound dropped 8% to its lowest level against the dollar since 1985. Gold is soaring. European stocks are heading for their worst day since October 1987, according to FactSet. Stateside, elation over yesterday's rally toward 2016 highs has quickly turned to panic. Dow futures are down more than 500 points. The S&P 500 is off by nearly 4%. Fear is spreading throughout the market as investors rush to safe havens. Just how freaked out are investors right now? According to Bloomberg, the VIX suffered its biggest drop since 2013 during yesterday's melt-up rally. After last night's vote, it rocketed more than 50%…

So what the hell are you supposed to do now? Yesterday, I told you we'd just have to do our best to tune out the insanity and hope that the market gives us some direction—whatever the outcome of this vote might hold. Now that we know the results, it's time to once again ignore the political pundits and wait for the market to show us our next move. Here's what we need to keep in mind today when the opening bell rings: Closing prices matter most We're going to see nothing but chaos when the clock strikes 9:30 a.m. Stocks are going to go crazy for the first hour of trading or more. But we don't have a crystal ball. We don't know if last night's panic lows are going to hold or if stocks will continue to sell off until the closing bell. Heck, we might even see a rally. Anything can happen. If you have trades you want to sell today, don't just throw an order out to the market a few minutes after the opening bell. The market is like an emotional child right now. Let it blow off some steam with morning temper tantrum and then take the time to reassess your positions. If you have trades that have hit your stops, you can jettison them once things settle down. Since it's Friday, we're going to get a nice new daily and weekly candle after today's close. That should give us a better idea as to where the market's important inflection points will be in the coming weeks… The Market's Big Themes Remain Intact Today's a great chance to go over our favorite market themes to determine what's vulnerable—and what has the chance to rally in the face of panic. Gold is obviously the big winner so far. But the yellow metal's rise above $1,300 on the Brexit vote didn't come out of nowhere. Gold and precious metals mining stocks have been some of the best places for your trading dollars this year. Last night's move was just another in a series of bullish breakouts. You already have two open trades that should benefit from the Market Vectors Gold Miner ETF (NYSE:GDX) and Silver Wheaton Corp. (NYSE:SLW). These should help soften the blow of a panicky market crash. Brexit Ain't Over Yet… So far we have a "leave" vote and a resignation from Prime Minister David Cameron. And if you think that's enough to get this Brexit nonsense out of the headlines, you are mistaken. Next comes two years of negotiations between Britain and the European Union in order to hash out the terms of the exit. This story isn't going anywhere. Nothing is priced in. Buckle up. We could be in for one heck of a ride… Sincerely, Greg Guenthner P.S. Cut through the whipsaw action — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post CRASH! Brexit Triggers Global Meltdown. Here’s What to Do Now… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 24 Jun 2016 08:00 AM PDT UK Votes to leave EU, markets stunned. Stocks plunge worldwide, gold soars, volatility spikes, pound tanks. Gold COTs are “over the top.” Central banks seem to be losing control of the narrative. Bitcoin jumps. Trump campaign in chaos while polls show dead heat in battleground states. Best Of The Web Brexit: The system cannot […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: The consequences of leaving the party Posted: 24 Jun 2016 04:36 AM PDT By Alasdair Macleod The collective decision of the British electorate is to reject the recommendation of its government, excepting those of its few dissenting ministers, that Britain should remain in Europe. It is a signal failure of government policy. Above all, it is a failure that undermines the state's control over ordinary people. Time will tell whether it is just a temporary setback for the world's economic planners, or the removal of a keystone supporting the whole structure of modern statism. There are, therefore, two aspects of this development that must be considered: domestic UK politics and the international economic and political consequences. ... ... For the remainder of the commentary: https://www.goldmoney.com/research/goldmoney-insights/the-consequences-o... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit - Gold Note - Brexit Facts - Ramifications for UK, Ireland, EU - Conclusion Posted: 24 Jun 2016 02:43 AM PDT We have seen record online sales for this time of day and the phones are ringing off the hook. It is nearly all buying with a preference for gold over silver. We may have to restrict trading to existing clients if we continue to see this level of demand. We are seeing more selling then expected and seeing some clients choosing to take profits after the very sizeable short term capital gains. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jubilee Jolt: Markets Crash, Gold Skyrockets as Britain Takes Brexit Posted: 24 Jun 2016 02:37 AM PDT As of the time of this writing most of the votes have been counted and it appears Britain has voted to leave the European Union. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Famous Technical Analyst Now Predicting Financial Markets Crash During Jubilee Time Period Posted: 24 Jun 2016 02:31 AM PDT The flurry of banksters, ex-banksters (Alan Greenspan), insiders (Soros) and billionaires all warning we are on the edge of collapse now continues with a famous technical analyst. In an interview with Business Insider, Sandy Jadeja just predicted market crashes in late August, late September and late October. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A New Balance Of Power In The Gold Market Posted: 23 Jun 2016 10:50 PM PDT Gold analyst Michael Ballanger just posted an article noting how much things have changed — perhaps for the better — in the gold market. Here’s an excerpt: Commercial Traders Have Just Gone Over the Top (24hGold) – With Friday’s Commitment of Traders Report, the ridiculous has just metastasized into the sublime as the Commercial Cretins […] The post A New Balance Of Power In The Gold Market appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Guest Post from

Guest Post from

BREXIT! I have to admit, I did not believe it would happen. Rather, I did not believe it would be “allowed” to happen. In retrospect I believe the elites will look back and wish they had “Diebold” doing the vote count. This vote has so many various ramifications, it is hard to wrap your head around what it means but let’s take a look at what stands out most.

BREXIT! I have to admit, I did not believe it would happen. Rather, I did not believe it would be “allowed” to happen. In retrospect I believe the elites will look back and wish they had “Diebold” doing the vote count. This vote has so many various ramifications, it is hard to wrap your head around what it means but let’s take a look at what stands out most.

Now the real fun begins.

Now the real fun begins. The anti-establishment trend has picked up its pace this morning, showing no signs of abating. Around 2:30 a.m. New York time, Wall Street traders were stunned by the news that U.K. voters had backed leaving the European Union by 51.9 percent versus a remain vote of 48.1 percent in the anxiously anticipated Brexit referendum held yesterday.

The anti-establishment trend has picked up its pace this morning, showing no signs of abating. Around 2:30 a.m. New York time, Wall Street traders were stunned by the news that U.K. voters had backed leaving the European Union by 51.9 percent versus a remain vote of 48.1 percent in the anxiously anticipated Brexit referendum held yesterday.

No comments:

Post a Comment