Gold World News Flash |

- The Gold to Silver Ratio is Bullish for Both Gold and Silver

- Americans Are Now The Top Silver Investors In The World

- Neel Kashkari: The Shadow Over Janet Yellen’s Head as She Testifies to Congress

- Is This The Big One? Large-Scale Motion Detected Near San Andreas Fault

- Japanese Mint Employee Stole 15Kg Gold Bar "To Cover FX Trading Losses"

- Paul Craig Roberts : EU Was A CIA Creation To Trigger War With Russia

- Euroclear looks to apply blockchain to gold market

- Gold Price Closed Down $19.50 or -1.51%

- Brexit fears prompting savers to stuff gold bars in safes at home

- British Man Arrested During Assassination Attempt On Donald Trump In Las Vegas

- Fed's Powell warns that dollar-based Libor could disappear

- THEY ARE COMING FOR YOUR GUNS!

- Robert Appel: Gold price suppression is government policy

- Why You Should Vote #Brexit

- Switzerland gold exports jump 20% in May, highest this year

- This Video Will Stop Gun Control - If It Goes Viral

- Gold Daily and Silver Weekly Charts - Paper Chase

- Gerald CELENTE : As The ECONOMIC Outlook Dims, GOLD Is Shining !!

- #Brexit Britain to Lose its Sovereignty forever if it stays in The EU #EUref

- End Times Bath Salts & Demonic Possessions Exposed

- Chindia Takes 207 Tonnes of Gold In March

- Major Rise in Demand For Physical Gold Imminent

- Gold Falls As UK Gold Demand “Rockets†– Investors “Seek Stabilityâ€

- Is It Time to Dump Gold and Buy Platinum?

- $GOLD vs. Brexit

- Breaking News And Best Of The Web

- Top Ten Videos — June 21

| The Gold to Silver Ratio is Bullish for Both Gold and Silver Posted: 21 Jun 2016 11:01 PM PDT Examine the 30+ year graph of the gold to silver ratio – this is the Big Picture perspective. The ratio moves from low to high and back to low in long term patterns. I have shown the large scale... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Americans Are Now The Top Silver Investors In The World Posted: 21 Jun 2016 09:55 PM PDT by Steve St. Angelo, SRSRocco Report:

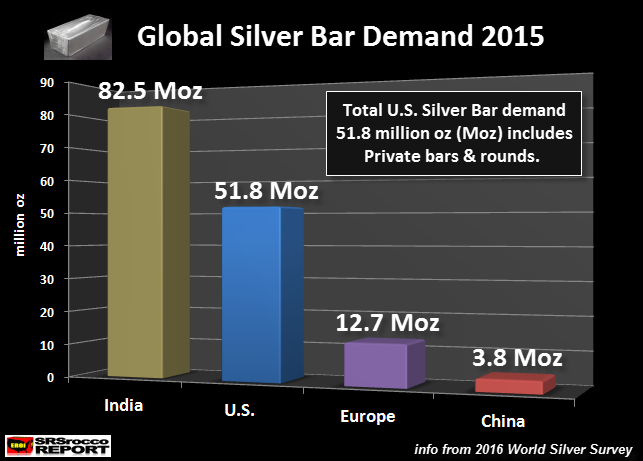

For example, Indians purchased more than 100 million oz (Moz) of silver bar in 2008 of the approximate world total of 125 Moz. However, silver bar demand is only one segment of total global physical silver investment. There is also Official Coin demand. If we look at the data for 2015, India continues to rank as the largest source of silver bar investment int he world:

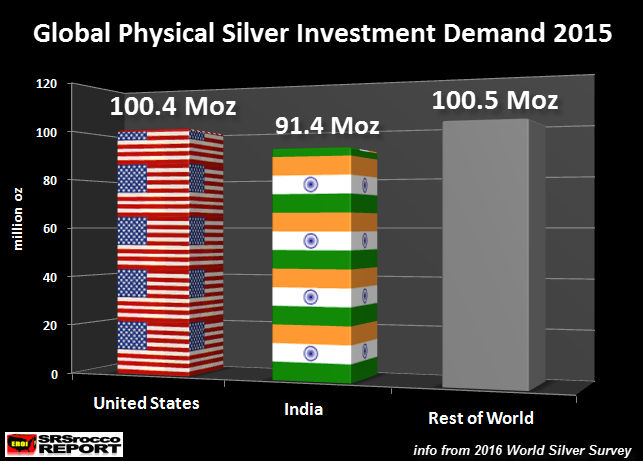

India purchased 82.5 Moz of silver bar in 2015 while the U.S. ranked second with 51.8 Moz, Europe came in third with 12.7 Moz and China placed last at 3.8 Moz. (2016 World Silver Survey, pg. 22 & 23). The United States experienced a huge increase in silver bar demand in 2015 due to the inclusion of "Private rounds and bars" now in the data. So, all private silver bar and rounds sold are lumped into the Silver Bar category. Even though India ranked first place when it comes to silver bar demand, if we include Official Coin sales, the U.S. is now the global leader of physical silver investment:

In 2015, the U.S. Mint sold 48.6 Moz of Official Silver coins while India ranked fifth at 8.9 Moz. If we add silver bar demand to these figures, the U.S. was the leader at 100.4 Moz while India came in second at 91.4 Moz. (2016 World Silver Survey, pg. 25). The rest of the world accounted for the remaining 100.5 Moz of the total 292.3 Moz of Silver Bar & Coin demand. I could not break down Silver Bar & Coin demand in the 'Rest of World" category because there isn't enough data. The World Silver Survey's do a much better job than the CPM Group's Silver Yearbook in reporting silver investment figures. However, they only publish the amount of Silver Coins sold by each of the Official mints, not the actual demand. There is no way of knowing how many U.S. Silver Eagles end up in foreign hands, or how many Canadian Maples or Australian Kangaroos are purchased by Americans. The data is not that accurate. However, I do believe Indians purchased the overwhelming majority of their own Official Silver coins. Furthermore, the Silver Bar & Coin demand of 100.4 Moz for the United States may be quite conservative. Why? Because, I believe Americans buy a heck of a lot more foreign Official Silver Coins to more than make up for the amount of U.S. Silver Eagles exported abroad. We must remember, Americans don't have to pay a vat tax when they buy silver. What is also interesting about the data is that China ranked fourth behind Europe in silver bar demand. Even if we assume that the Chinese purchased all of their Official Silver coin sales of 10.7 Moz in 2015, their total Silver Bar & Coin demand would only be 14.5 Moz. While the Chinese are the biggest buyers of gold in the world, silver still hasn't caught on as it has in the U.S. or India. Lastly, according to the data from the 2016 World Silver Survey, Indians purchase their silver bar as a short-term investment vehicle by taking advantage of lower prices or to profit from any differences in the spot or futures market. However, the majority of Americans purchase their silver for a long term BUY & HOLD strategy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Neel Kashkari: The Shadow Over Janet Yellen’s Head as She Testifies to Congress Posted: 21 Jun 2016 09:00 PM PDT by Pam Martens and Russ Martens, Wall St On Parade:

There will be a shadow wafting over Yellen at both hearings. The shadow is being cast by Neel Kashkari, who took the reins as President of the Federal Reserve Bank of Minneapolis this past January and has effectively transferred the debate on too-big-to-fail banks from the hands of Yellen to his own regional institution. Kashkari has been conducting symposiums and delivering speeches on the issue and has promised a formalized plan to deal with the problem by the end of this year. Just yesterday, Kashkari spoke at the Peterson Institute in Washington, D.C. and shot full of holes Yellen's plan to shore up big bank capital with convertible debt (the so-called Total Loss-Absorbing Capacity or TLAC plan). Kashkari, who worked at the U.S. Treasury during the 2008 financial crisis and oversaw the Troubled Asset Relief Program (TARP), offered this critique yesterday on why the convertible debt plan will not prevent more taxpayer bailouts of the mega banks: "Do we really believe that in the middle of economic distress when the public is looking for safety that the government will start imposing losses on debt holders, potentially increasing fear and panic among investors? Policymakers didn't do that in 2008. There is no evidence that their response in a future crisis will be any different…. "A policy analyst recently asked me if we really could resolve a large bank during a crisis. I responded by asking him if he thought we could dismantle an aircraft carrier in the middle of a hurricane. It's not a perfect analogy, but he got my point… "I object to this approach for two reasons. First, it immediately reinforces my concern about complexity. Second, this approach assumes that all-knowing, well-intentioned regulators, seizing a bank earlier, will somehow reduce the total losses the bank ultimately faces. I vividly remember the collapse of Bear Stearns in March 2008. In a couple of weeks, Bear Stearns went from normal operations to insolvency." The only quibble we have with Kashkari on the above point is that he had a much more powerful bank meltdown to offer. Citigroup, a banking monster compared to the diminutive Bear Stearns, melted away in one week, not a couple of weeks. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is This The Big One? Large-Scale Motion Detected Near San Andreas Fault Posted: 21 Jun 2016 08:08 PM PDT Submitted by Mac Slavo via SHTFPlan.com, As if California doesn’t have enough problems already... The big one is believed to be due every century or so along major fault lines – and California is long overdue. Eventually, there is just too much built up pressure that must be released. Although experts don’t know when a major earthquake may hit the San Andreas fault, they expect that it is simply inevitable and have warned for years about mitigating the disaster to come. Sadly, few of those warnings have been heeded, and major destruction is likely to someday affect, directly or indirectly, most of the tens of millions of residents who live in or near Los Angeles and the surrounding area. Here are some of the simulations of what they officially say could happen. In reality, the damage and the secondary effect on social order could have an even greater impact:

And the real world data is troubling as well. Now, researchers have been able to model that build up of pressure along the tectonic plates of the San Andreas using new GPS techniques that have allowed more information:

As SHTF recently reported, the news is not good.

Scientists have renewed their warnings that the faultline “looks like it’s locked, loaded and ready to go.” As the L.A. Times reported:

If/when a major earthquake does hit the L.A. metro area, there will be a significant danger of societal collapse – with every major service from water, food, gas, electricity, transportation, sewage and more under threat of severe – and potentially prolonged – disruption. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japanese Mint Employee Stole 15Kg Gold Bar "To Cover FX Trading Losses" Posted: 21 Jun 2016 06:05 PM PDT With USDJPY collapsing in fits and starts and the nightly nattering nabobs of Japanese officialdom sparking mini risk flare-ups in FX markets, we can easily comprehend a part-time currency trader mounting up some losses. But it appears 54-year-old Japanese Mint employee Yutaka Umeno turned the leverage dial to 11 and having lost it all, decided the appropriate solution was to to steal a 15 kilo bar of gold "to cover his FX losses." As Asahi.com reports, a Japan Mint worker is accused of swiping a 15-kilogram gold bar valued at around $650,000 from under the noses of his colleagues...

Perhaps even more intriguing is The Mint did not realize the large gold ingot was missing for five months!!

We wonder why the Mint worker did not steal share certificates or Yen... maybe it's a 'tradition' to steal 'valueless' yellow rocks? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts : EU Was A CIA Creation To Trigger War With Russia Posted: 21 Jun 2016 05:30 PM PDT Dr. Paul Craig Roberts reveals that in 2000, it was released that the EU was a CIA invention as a control mechanism as well as another bond between NATO countries. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Euroclear looks to apply blockchain to gold market Posted: 21 Jun 2016 05:10 PM PDT By Philip Stafford Euroclear, one of the world's largest settlement houses, is to make its first foray into emerging blockchain technology by exploring creating a new settlement system for the London gold market. The Belgium-based settlement house, which houses more than E27 trillion of bonds, equities, funds, and derivatives for customers, has partnered US start-up itBit to explore ways to modernise trading in the precious metal. The group will look at ways to harness itBit's blockchain-based clearing and settlement network Bankchain for gold. ... ... For the remainder of the report: http://www.ft.com/cms/s/0/79cf65fe-379c-11e6-a780-b48ed7b6126f.html ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed Down $19.50 or -1.51% Posted: 21 Jun 2016 05:06 PM PDT

Several futures brokerages in the US and Europe -- NOT the exchanges -- have DOUBLED margins on silver, gold, and currencies. The change was scheduled to take place with yesterday's close, but after customers complained some brokers put it off until tonight. It's to be rescinded after Friday's close. This allegedly will prevent speculation on the Brexit outcome. Right. Sure. Some of the cynical say the real purpose is to suppress silver & gold. Me, I ain't got a cynical bone in my whole loose-jointed, raw-boned body. Yesterday I neglected to observe something. Y'all remember that big jump in stocks that everybody was jubilatin' about? Truth is, the Dow shot up 271 points, but gave back half of that to end the day up only 129.71. Spongy, folks, spongy. Today the Dow barely stayed above its intertwined 20 & 50 day moving averages. Rose 24.86 (0.14%) to 17,829.73. S&P500 added 5.65 (0.27%) to 2,088.90. Hurts me to think about the pain coming when stocks hit the skids. Soon. Y'all ever notice that when there's a fly in the room, he's never content to mind his business & let you mind yours? Always has to buzz around your head & land on your head & fly into your face until finally, with all the philosophical humanitarianism in the world you have to pull out the swatter and SMACK him. I hate to do that, because the fly is the national bird of my county. US dollar index found some go-juice today and rose 42 basis points (0.45%) to 94.11. That closes it right on the upper channel downtrend line, blowing hot & cold out of both sides of its mouth. Dollar index will prove nothing until it rises & soars above the June high at 95.905. Sorry, scurvy euro, which rose 0.28% yesterday in the Fantasyland Frenzy, sobered up today with a 0.53% drop to 41.1251, just above the 20 DMA & looking ready to die. Japanese yen plumped down a massy 0.93% to close today at 95.38. Needs one more gap down to complete that island reversal, but it's trying hard. Glance at Gold's chart here, http://schrts.co/JQ6RvS Silver's chart hideth here, http://schrts.co/JQ6RvS Big break came in metals today. Gold like a meteor swooped $19.50 (1.5%) nearer the earth. Silver tumbled 19.2¢ (1.1%) to 1731.1¢. I expect this to be a shallow correction, say to $1,260 gold, where lieth roughly the 50 day moving average and a 50% correction of the last rise. For silver, look for 1685¢ to 1660¢, a little beneath the 50 DMA. If they exceed those marks, then we are dealing with a different sort of correction, and deeper. At most that might extend to 1600¢ & $1,250. Don't fuss at me, I'm just the reader and trying hard to be a realist. This is the very short term (next week) outlook. Brexit might skew everything in a way we don't yet know to expect. A vote FOR Brexit surely wouldn't hurt silver & gold, but go or stay, the effect won't last long. On 21 June 1834 Cyrus McCormick patented the first practical mechanical reaper. His invention allowed farmers to more than double their crop size. Whether this was a good thing or not depends on your viewpoint. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit fears prompting savers to stuff gold bars in safes at home Posted: 21 Jun 2016 05:04 PM PDT By Kate Morley and Richard Dyson Worried savers are buying gold bars and stuffing them in safes at home, data suggests, as fears mount that a Brexit-induced financial meltdown could be just around the corner. Google searches for the term "home safe" are running at 61 percent of the level at which they peaked in November 2008, the point of the financial crisis, and are now higher than at any point since. Royal Mint, Britain's official producer of gold and silver coins and bars, said sales have soared by 32 percent over the past month, with customers rushing to buy sovereign and Britannia bullion coins and signature gold bars in particular. ... ... For the remainder of the report: http://www.telegraph.co.uk/news/2016/06/21/brexit-fears-prompting-savers... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| British Man Arrested During Assassination Attempt On Donald Trump In Las Vegas Posted: 21 Jun 2016 05:00 PM PDT British Man Arrested During Assassination Attempt On Donald Trump In Las Vegas The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed's Powell warns that dollar-based Libor could disappear Posted: 21 Jun 2016 04:55 PM PDT By Jason Lange and Jonathan Spicer Financial markets need to consider the risks of relying heavily on the dollar-based London Interbank Offer Rate because this reference rate could stop being published, Federal Reserve Governor Jerome Powell said on Tuesday as a Fed-convened committee continued to zero in on an alternative to the so-called Libor. "Market participants are not used to thinking about this possibility, but benchmarks sometimes come to a halt," Powell said in prepared remarks in New York for a roundtable discussion on a report on alternative reference rates. Libor is one of the world's most important benchmarks and about $300 trillion in contracts reference it. But Libor has come under scrutiny since traders at several large banks were accused of rigging its daily rates. ... ... For the remainder of the report: http://www.reuters.com/article/us-usa-fed-libor-idUSKCN0Z72LQ ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THEY ARE COMING FOR YOUR GUNS! Posted: 21 Jun 2016 03:54 PM PDT Government has intervened in the individuals ability to reproduce, raise their young naturally and keep guns. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Robert Appel: Gold price suppression is government policy Posted: 21 Jun 2016 03:05 PM PDT 6:04p ET Tuesday, June 21, 2016 Dear Friend of GATA and Gold: Writing at Profit Confidential and recommending a highly leveraged gold-related stock, Profit Confidential's Robert Appel notes that gold price suppression is no longer mere "conspiracy theory" but admitted fact. Appel writes that gold price suppression is "a tolerated form of illegal and immoral activity clandestinely fostered by Western governments in the fervent belief that a lower gold price makes the world a safer place for their unbacked paper fiat currencies." His commentary is headlined "JNUG Stock: 100%+ Upside for Direxion Daily Jr. Gold Miners ETF?" and it's posted at Profit Confidential here: http://www.profitconfidential.com/gold/jnug-stock-100-upside-for-direxio... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jun 2016 02:45 PM PDT Why the UK Should have their Freedom & Independence #BREXIT - #CTSECN with #KennethAmeduri The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Switzerland gold exports jump 20% in May, highest this year Posted: 21 Jun 2016 02:44 PM PDT From Platts, London LONDON -- Gold exports from Switzerland totaled 177.3 metric tonnes in May, up 20 percebt from 147.8 metric tonnes reported in April, and the highest level since December, Swiss federal customs data showed Tuesday. The figure is 69 percent higher than 105.1 metric tonnes reported a year earlier. Exports to China were 36 percent higher on the month at 19 metric tonnes in May, while exports to Hong Kong were 2.5 times as large at 24 metric tonnes. Exports to the United States were also up on the month to 18.9 metric tonnes in May, from just 2.3 metric tonnes in April. ... ... For the remainder of the report: http://www.platts.com/latest-news/metals/london/switzerland-gold-exports... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Video Will Stop Gun Control - If It Goes Viral Posted: 21 Jun 2016 02:00 PM PDT A Houston, Texas, gun range offering free CHL classes to members of the LGBT community was overwhelmed by the response, and the manager reveals how to win over millions of people into supporting the Second Amendment. Kit Daniels reporting. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Paper Chase Posted: 21 Jun 2016 01:32 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald CELENTE : As The ECONOMIC Outlook Dims, GOLD Is Shining !! Posted: 21 Jun 2016 01:30 PM PDT About Gerald Celente : Founder of The Trends Research Institute in 1980, Gerald Celente is a pioneer trend strategist. He is author of the national bestseller Trends 2000: How to Prepare for and Profit from the Changes of the 21st Century and Trend Tracking: The System to Profit from Today's... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Brexit Britain to Lose its Sovereignty forever if it stays in The EU #EUref Posted: 21 Jun 2016 10:16 AM PDT #EUref: The Sovereignty Argument for #Brexit If Britain remains in the EU, it will lose it's status as a sovereign nation. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Times Bath Salts & Demonic Possessions Exposed Posted: 21 Jun 2016 08:30 AM PDT This is from the (NWO synagogue church of all nations) - the false prophet of it is The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chindia Takes 207 Tonnes of Gold In March Posted: 21 Jun 2016 06:43 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major Rise in Demand For Physical Gold Imminent Posted: 21 Jun 2016 06:33 AM PDT Major Rise in Demand For Physical Gold Imminent | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Falls As UK Gold Demand “Rockets†– Investors “Seek Stability†Posted: 21 Jun 2016 06:09 AM PDT Gold fell again today despite very robust physical demand in western markets and especially the UK. Gold fell to a ten-day low as the recent global share rally showed signs of exhaustion. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is It Time to Dump Gold and Buy Platinum? Posted: 21 Jun 2016 06:00 AM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jun 2016 05:55 AM PDT I see traders everywhere worrying about how the Brexit vote will effect gold. Folks, forget about the Brexit. By this time next week the Brexit will already be fading into memory and the market will go back to doing what it was doing before the vote. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 20 Jun 2016 06:20 PM PDT Brexit polls tighten again and Yellen addresses Congress. US stocks and interest rates flat, gold falls. Central banks seem to be losing control of the narrative. Bitcoin is correcting. The Rio Olympics are looking more and more chaotic, as is the Trump campaign. Best Of The Web Imagine – Hussman Funds Why the Imperial […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Jun 2016 12:00 PM PDT Doug Casey and Marin Katusa on why gold has to rise going forward. Jim Sinclair on history’s biggest bubble. Unusual shows from Peak Prosperity and Max Keiser. GATA’s Bill Murphy explains how central banks manipulate the price of gold and why they’re destined to fail. […] The post Top Ten Videos — June 21 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

According to the figures in the 2016 World Silver Survey, Americans now lead the world in physical silver investment. This is quite an interesting change as India has been the number one market for silver bar demand in the past.

According to the figures in the 2016 World Silver Survey, Americans now lead the world in physical silver investment. This is quite an interesting change as India has been the number one market for silver bar demand in the past.

At 10 a.m. this morning, Federal Reserve Chair Janet Yellen will take her seat before the U.S. Senate Banking Committee to deliver her semi-annual testimony on monetary policy. She'll perform the same task tomorrow before what is likely to be

At 10 a.m. this morning, Federal Reserve Chair Janet Yellen will take her seat before the U.S. Senate Banking Committee to deliver her semi-annual testimony on monetary policy. She'll perform the same task tomorrow before what is likely to be

No comments:

Post a Comment