Gold World News Flash |

- Gold – Major Cycle Lows

- A Passion for Precious Metals

- Gold & Diamond Jewelry Slump

- The Bail-In: Or How You Could Lose Your Money in the Bank

- Why Technical Analysis Does Not Work for Gold and Silver

- Felix Zulauf: Monetary Stimulation Creates Bubbles, Not Prosperity Nor Growth

- Gold and another Fed rate hike

- On the Road to Panicville

- Is OPEC About To Surprise The Oil Markets?

- Jim Rickards on Bulls and Bears

- Gold Infographic: Exchange Volume, Storage, Mining Statistics

- To Vote Or Not To Vote – Walter Block And Jeff Berwick on PFT Live

- TOP THREE SOVEREIGN MINTS REPORT 32% SILVER SALES GROWTH IN FIRST QUARTER

- Gold Price Closed at $1211.90 Down $2.90 or -0.24%

- The truth about Islam

- Auto, housing debt worsens as petrodollar fades, Embry tells KWN

- SIGNS OF THE END PART 174 - LATEST EVENTS MAY 2016

- Michael Savage Donald Trump Interview - June 1, 2016

- Gold Daily and Silver Weekly Charts - The Lesser of Two Evils - Non Full time Payrolls

- UCLA Shooting -- Students hide out at UCLA after deadly shooting on campus

- WHAT? 666 ʻMark Of The Beastʻ Just Got REAL! (2016)

- Bernie Sanders – The Best of a Bad Bunch?

- Ron Paul: Censorship, Trump 2016, & Global Meltdown

- Clinton Email Scandal - The Middle of the End

- Mike Kosares: Global mints report record silver coin sales for 2015

- DONALD TRUMP FULL INTERVIEW WITH SEAN HANNITY (5/31/2016)

- SITUATION CRITICAL: More Proof of A Massive Stock Market Bubble. By Gregory Mannarino

- EU Economic Collapse -- Greece : Scuffles in Food Bank

- GoldSeek Radio interviews GATA Chairman Bill Murphy

- ALERT -- Flesh-eating migrant virus hits Europe

- Consumer Spending Rebounds

- Jim Marrs - Are They Planning A Fake ET Invasion?

- Gold Cup and Handle Targets 1490 On a Breakout, With New All Time Highs Likely In Silver

- Here’s What You Trade When Stocks Pull a “Switcheroo”

- GDX Adjusted Cycle, Projection and Chart

- Global Mints Report Record Silver Coin Sales for 2015

- Gold and Silver - Are you still waiting for a pullback, so you can take part in the bull market?

- Now Japanese Prime Minister Abe Predicts Imminent Global Economic Catastrophe

- Why Technical Analysis Does Not Work for Gold and Silver

- Breaking News And Best Of The Web

| Posted: 01 Jun 2016 11:01 PM PDT Gold bottomed in December 2015 at a major cycle low. Or did it? Financial Sense published in May an article by Tom McClellan, an excellent analyst: "Major Cycle Low Upcoming in Gold." The low may... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jun 2016 11:00 PM PDT by Larisa Sprott, Sprott Money:

I certainly never thought I'd be running a company or selling precious metals. My goal was to become a teacher or university professor. However, growing up, I was inundated with constant conversation and lectures about smart investing, company earnings, the stock market, and the economy. When I was 10, my dad taught me how to read the stock charts in the newspaper. My first stock purchase was Coca-Cola – it went up 15% before I sold it! I never really considered a career in finance until I took a summer internship at Cormark Securities many years ago. I sat close to the trading desk and it was there that I fell in love with the world of finance and never wanted to leave.

In February 2010, my father asked me to take over what was a tiny and struggling company of only two people and run it. And despite my misgivings, I did, and the world of precious metals soon became one of my passions. That's how you succeed in finance, in a nutshell: you need to be willing to take risks, step out of your comfort zone, and work hard. At Sprott Money, we value creativity and innovation, and are proud to be one of the best companies in the industry. We especially focus on great service and satisfaction. Our company would be nothing without our clients. Sprott Money is more than just precious metals. A proudly Canadian company, we employ 11 people, all of whom have a passion for their work and are proud to serve our clients. Through our finance writers and contributors, we've established a following on high profile websites such as Zero Hedge and Steve Quayle and are seeing a growing presence on four social networks (Facebook, Twitter, LinkedIn, and Instagram). Though we started out with only selling investment grade bullion to a small clientele, we've seen major growth since 2008. We're looking at expanding our storage locations and numismatic product offerings, and looking into new mints and new services to bring only the best to our clients. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jun 2016 09:23 PM PDT LewRockwell | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bail-In: Or How You Could Lose Your Money in the Bank Posted: 01 Jun 2016 09:20 PM PDT by David Chapman, Gold Seek:

What that means is that shareholders, bondholders and depositors, rather than taxpayers, are responsible for the bank's risks in the event of a failure. During the 2008 global financial crash, banks that were deemed “too-big-to-fail” were bailed out by the government, meaning the taxpayer footed the bill. None of the banks were Canadian banks, but it does need to be noted that Canadian banks received some $114 billion from Canada's federal government. This was against the background of Canadian banks being declared “the most sound banking system in the world.” At the time, the government denied there was any bailout, preferring to use the term “liquidity support.” To put the amount in perspective, $114 billion is roughly 7% of Canada's GDP. The 2016 budget notes that in implementing a “bail-in” regime, it will strengthen the bank resolution toolkit in Canada and ensure Canadian banking practices are consistent with international best practices endorsed by the G20. Bail-in regimes are being instituted in the Western economies especially – in the EU, the USA, Japan, Australia and, of course, Canada. This isn't the first time that a bail-in has been introduced, as the previous government came forward with one in 2013, and in 2014 presented a consultation paper. Initially it was thought that depositors would be excluded. Surprisingly, in the budget, depositors are not mentioned specifically. It should be noted, however, that depositors have paid a price in bail-ins that have already occurred in Cyprus and in Italy. So the risk to depositors cannot be ignored. First of all let's dispel a myth surrounding bank accounts. Most Canadians hold their funds in chequing and savings accounts. These are known as “demand” deposits. Most people mistakenly believe that their monthly bank statements show them how much they own. Au contraire. They are in fact a statement of what the bank owes its clients. Under Canada's fractional reserve system, the banks promise to keep some cash on hand in the event of withdrawals, but the reality is that they lend out the funds or use the funds to purchase assets or incorporate into their global trading operations. The funds on deposit are no longer the property of the depositor. Instead the depositor becomes an unsecured creditor or lender to the bank. Banks pay you interest, but their real purpose is to use your funds to earn a spread. They put your funds at risk in the global markets through lending, syndication and trading. If things do go wrong, depositors get nervous and run to the bank to withdraw their funds. This is known as a “bank-run.” A “bank holiday” could also be declared in the event of a massive bank-run. What happens, essentially, is that the bank closes its doors and the ATM machines. This happened during the Great Depression, and also happened most recently in Cyprus. Effectively what happens with a bank holiday is that the bank bails itself in. And even that was insufficient to save many banks in the Great Depression and in Cyprus. Canada does have an insurance safety net to protect depositors from bank failures. In 1967 Parliament created the Canadian Deposit Insurance Corporation (CDIC). The CDIC is a federal crown corporation similar to the Federal Deposit Insurance Corporation (FDIC) in the US. The CDIC is charged with maintaining public confidence in Canada's financial system. It pays to know which financial institutions are covered and which ones are not. Most Canadian banks, loan companies and trust companies are CDIC members. Some banks and credit unions, and foreign banks that have branches in Canada, are not covered. Check the CDIC's website if you are unsure www.cdic.ca. The CDIC covers up to $100,000 in deposits. That could include individual accounts, joint accounts, trust accounts and bank savings in a registered retirement savings plan (RRSP), registered retirement income funds (RIFs) and savings to pay realty tax on mortgage payments. Diversifying accounts among financial institutions helps ensure as wide a coverage as possible. Eligible products include chequing and savings accounts, guaranteed investment certificates (GICs) and term deposits that mature fewer than five years from date of purchase, money orders and drafts, certified cheques and traveler's cheques. It doesn't cover foreign currency accounts, GICs that mature more than five years from date of purchase, government bonds, treasury bills, mortgage backed securities (MBS), stocks, mutual funds and gold certificates issued by a Canadian bank. Note that it covers deposits only in Canadian dollars. Canada does not have an extensive history of bank failures, not even during the Great Depression. Banks or financial institutions tend to be merged or taken over, even ones that could be on the verge of failure. The last failures were Northland Bank and Canadian Commercial Bank in 1985. Prior to that, the last one was Home Bank in 1923. Confederation Life Insurance Co. (CLIC) collapsed in 1994, but that was an insurance company. Canadian banks are generally well rated, but they are not what one would call AAA. The following are the credit ratings of Canada's banks (Standard & Poor's): Toronto-Dominion Bank (TD) – AA- Royal Bank of Canada (RBC) – AA- Bank of Nova Scotia (BNS) – A+ Canadian Imperial Bank of Commerce (CIBC) – A+ Bank of Montreal (BMO) – A+ National Bank of Canada (NBC) – A Caisse centrale Desjardins (Caisse) – A+ Laurentian Bank of Canada (Laurentian) – BBB Canada Western Bank (CWB) – Not rated | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Technical Analysis Does Not Work for Gold and Silver Posted: 01 Jun 2016 09:17 PM PDT Michael Ballanger, a precious metals expert, says he believes technical charts were created by bullion bank traders to lull the "chartists" into a false sense of security. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Felix Zulauf: Monetary Stimulation Creates Bubbles, Not Prosperity Nor Growth Posted: 01 Jun 2016 09:01 PM PDT This is an interview with Felix Zulauf by Global Gold about key developments when it comes to monetary policies, market outlook, investment decisions, and precious metals. Felix Zulauf gave an outstanding interview with a lot of valuable insights that, undoubtedly, savvy investors will greatly appreciate. Welcome to the first Global Gold podcast. My name is Claudio Grass and joining us today is Felix Zulauf, Founder and President of Zulauf Asset Management. He is here to share with us his outlook on the state of our economy, recent developments in the financial markets and his views on current political changes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and another Fed rate hike Posted: 01 Jun 2016 08:59 PM PDT Speculative Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jun 2016 08:40 PM PDT by Pater Tenebrarum, Acting Man:

In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan's exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging market currencies, but more importantly, it is seen as a symptom of accelerating capital flight from China. USD-CNY, daily (a rising price denotes yuan weakness) – slowly creeping toward Panicville again? Resistance is between 6.60 and 6.65 – we suspect that if that level is exceeded, all hell could break loose again – click tro enlarge. Why is it considered important whether or not China's foreign exchange reserves are increasing or declining? Similar to Japan, China has become a major cog in the global fiat money Ponzi game, in which foreign central banks monetize US treasury bonds by recycling dollar-denominated trade surpluses. Now, it should be clear that the term "monetization" does not refer to the creation of additional US dollars in this case – those can only be created by the Fed and the US banking system. Rather, foreign CBs are boosting their domestic money supply when they buy dollars from their exporters – since they are paying for these dollars with domestic currency they create out of thin air. In China the effect of dollar inflows on the domestic money supply is especially pronounced. In fact, in order to stem the pace of money supply and credit growth lest it get out of hand completely, the PBoC has imposed one of the highest minimum reserve requirements in the world and is regularly altering it to influence credit and money supply growth in the country. By way of the minimum reserve requirement the PBoC intends to at least brake additional growth of the yuan money supply (beyond the growth caused directly by its USD purchases) to some extent, i.e., money supply growth which its fractionally reserved banks are generating by granting ever more inflationary credit. It should be obvious though that the PBoC has actually remarkably little control over inflationary credit growth through its official "toolkit", as the effect is only indirect. Luckily (from the perspective of the central planners), it can also simply issue orders to the (largely state-owned) big banks and can by and large be certain that it will be obeyed. Achilles Heel Market participants worry though about capital flows. Assorted liquidity junkies rightly see China's forex reserves as an Achilles heel. The reason is that a decline in these reserves hampers the PBoC's ability to manipulate money supply growth in an upward direction. This in turn is regarded as very important in order to keep various bubble activities intact – not only in China, but also in the rest of the world, e.g. through the effects China exerts on commodity prices.

China's narrow money supply M1. This may be one of the world's most important data points for the global posse of liquidity junkies. As of April 2016, the situation is still fine from their perspective – click tro enlarge. As we have described in "The Pitfalls of Currency Manipulation", China's authorities have recently resorted to all sorts of tricks in order to mask the pace of the outflow of foreign exchange from China – primarily with the help of derivatives transactions (yuan forwards have been employed to surreptitiously support the exchange rate). Such manipulations tend to work great in the short term, but they are also making devastating calamities in the long term far more likely. But we're all dead in the long term anyway, so who cares, right? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is OPEC About To Surprise The Oil Markets? Posted: 01 Jun 2016 07:42 PM PDT Submitted by Nick Cunningham of OilPrice.com A day before the OPEC summit kicks off, top officials from the oil cartel say that the markets are moving in the right direction, a sign of confidence that suggests little could emerge from this week’s meeting. Few expected the June 2 meeting to result in some sort of agreement on supply cuts or even a production freeze, given the enmity between several of the group’s top members. The collapse of the Doha summit in April, a meeting that only sought to implement a very modest freeze deal, suggests that any cooperation is almost certainly off the table. However, even since April the chances of a deal have narrowed. That is because oil prices have continued to climb, trading just below $50 per barrel on the eve of the semi-annual OPEC meeting in Vienna.

“From the beginning of the year until now, the market has been correcting itself upward,” U.A.E. oil minister Suhail Al Mazrouei told reporters from Vienna on May 31. “The market will fix itself to a price that is fair to the consumers and to the producers.” Oil prices have moved up nearly 90 percent since the February lows of $27 per barrel. This extraordinary rally has taken the pressure off of OPEC to take coordinated action on cutting or freezing output. Nevertheless, it might still be a bit early for OPEC to claim victory. The major supply outages in Canada and Nigeria helped to push up crude oil prices over the past month. Canadian oil producers, led by Suncor Energy, are getting back to work. The prospect of a return in large sources of supply has halted the price rally just short of $50 per barrel. "I think the market trends are better now” Emmanuel Ibe Kachikwu, Nigeria’s oil minister said in Vienna. Oil prices are moving “in the right direction” but he said that he thinks “it needs more acceleration of the pace.” While he may want prices to rise faster, OPEC members appears unwilling to cooperate in order to make that happen. Instead, the goals for the OPEC meeting are much more modest: to patch up broken relationships and cobble together some sort of foundation for cooperation. All eyes will be on Saudi Arabia’s new oil minister Khalid al-Falih, who replaced the well respected and long-time former minister Ali al-Naimi. Mr. Naimi worked well with the group, even though Saudi Arabia has competing and sometimes hostile relations with other members (namely, Iran). Bloomberg reports that al-Falih comes to the meeting with the goal of mending fences with its fellow OPEC members, hoping to restore trust after Saudi Arabia killed off the Doha deal. Saudi Arabia wants to reassure OPEC that it will not flood the market, and may even be open to reinstating production targets. It is hard to see how OPEC could agree on such an outcome, unless the production targets were substantially higher than the previous ones. Several OPEC members, including Saudi Arabia, are producing in excess of those former targets, and Riyadh has shown no willingness to cut back on production unless Iran does as well. Iran, of course, has refused to limit its output until it brings production back to pre-sanctions levels. The IEA said in its May Oil Market Report that Iran succeeded in boosting oil production to 3.6 million barrels per day, a level not seen since before the harsh 2012 sanctions. Iran insists it still has some lost ground to recover and has not expressed an interest in production limits. In short, not much has changed since the April Doha summit collapsed in acrimony. If anything, the rise in oil prices has erased the urgency to make collective sacrifice. Bloomberg surveyed 27 oil analysts, polling them on what they expect to happen in Vienna. All but one of them project that the group will fail to set a production target. Perhaps the best the group can hope for is a restoration of some trust that could lay the groundwork for cooperation at some point in the future. On the other hand, the past few OPEC meetings have defied expectations, ending with surprise announcements. One should not entirely rule out another unexpected result. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards on Bulls and Bears Posted: 01 Jun 2016 07:40 PM PDT by Dominic Frisby, ACast:

Please enjoy, share and read Jim’s book. You can follow Jim on Twitter – @JamesGRickards Click HERE to Listen | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Infographic: Exchange Volume, Storage, Mining Statistics Posted: 01 Jun 2016 07:00 PM PDT Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| To Vote Or Not To Vote – Walter Block And Jeff Berwick on PFT Live Posted: 01 Jun 2016 06:00 PM PDT from Press For Truth: Today on Press For Truth Live we are joined in studio by professor Walter Block an Austrian School economist and anarcho-capitalist theorist who recently launched “Libertarians For Trump” in an effort to mobilizing massive support for Donald Trump within the libertarian community. We are also joined on the line by Jeff Berwick of The Dollar Vigilante to get his views on using political platforms to express ideas as well as voting for the lesser of evils argument. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOP THREE SOVEREIGN MINTS REPORT 32% SILVER SALES GROWTH IN FIRST QUARTER Posted: 01 Jun 2016 05:40 PM PDT by Louis Cammarosano, Smaulgld:

Perth Mint silver sales climb 165% in the first quarter. The U.S., Canadian and Perth Mints sold nearly 30 million ounces of silver in the first quarter. Top Mints sell 45.66 ounces of silver to every ounce of gold sold in the first quarter- up from 38.27 to 1 in 2015. First Quarter 2016 – A Record Quarter for Silver Sales The Royal Canadian Mint released its first quarter 2016 report last week. The report showed that the Royal Canadian Mint first quarter 2016 silver sales of 10,600,000 ounces set a quarterly record and increased 19.3% year over year from the first quarter 2015 sales of 8,900,000 ounces. The U.S. and Perth Mint report their sales monthly and contemporaneously at the end of each month. The U.S. Mint reported selling 14,842,500 one ounce American Silver Eagle coins in the first quarter of 2016, up 23% from 12,071,000 ounces sold in the first quarter of 2015. The Perth Mint reported selling 4,278,708 ounces of silver in the first quarter of 2016 up 165% from 1,616,604 ounces sold in the first quarter of 2015. Collectively, the U.S. Canadian and Perth Mints sold 29,721,208 ounces of silver in the first quarter up nearly 32% from the first quarter of 2015 when the three miints sold 22,587,604 ounces.

The Perth Mint led the three top sovereign mints with a silver sales increase of 165% in the first quarter of 2016. 2015 – A Record Year For Silver Sales The record quarterly silver sales in the first quarter of 2016, follow record silver sales in 2015 at each of the Perth, Canadian and United States Mints. Collectively, the top three mint's silver sales of 93,075,927 ounces were up 15% in 2015 from 80,673,467 ounces sold in 2014.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1211.90 Down $2.90 or -0.24% Posted: 01 Jun 2016 04:08 PM PDT

I don't know Doug McKelvey and I've never been to Ponca City, Oklahoma, but I most earnestly urge you to read his essay, "100-Year Vision." He captures all we have been trying to do over the past 17 years to live on a 100 year time horizon. When our community built a church, we built it to last and to be beautiful, specifically, to last at least 100 years. About everything we do and undertake, we try to ask, "What will this look like in 100 years? What will be the 100 year outcome?" McKelvey's article captures all that and more. US dollar index tucked tail & ran again today. Lost 50 basis points (0.52%) to 95.38. Not to say it won't go higher or has stopped rising, but I wonder why it has been so weak and lazy on this rise. Yen rose 0.51% to $1.1186 but the yen gapped up 1.09% to 91.31. I search for rationality in the currency markets, but in vain. Finding value there is like a water man trying to climb a water ladder out of an ocean. No traction. Speaking of water, Stocks were underwater most of the day until the now-accustomed 3:00 "Friendly" time when Big Friends come in to buy so the indices will close up on the day. Why, yes, yes, the Dow rose 2.47 points (0.01%) to 17,789.67, having at one point been languishing nearly 125 lower at 17,665. S&P500 rose 2.37 (0.11%) to 2,099.33, coming up off a low of 2,085.10. Lest ye be fooled, all these aforenamed tops come at lower levels than foregoing recent tops. Falling tops define a downtrend, I note in passing. Gold got its head shaved today $2.90, down 0.2% to $1,211.90. Low today again fell at $1,206, so there are buyers clustered there, waiting. Whether they can overcome the sellers remains to be seen. Silver fell back 6.6¢ (0.4%) to 1590.6¢. A lower low today came at 1583¢. Gold fell from a high at $1,222.90 around 9:30 to $1,206+ at 1:00. The bounce afterwards wasn't convincing. Silver peaked about the same time, but didn't reach at 1583¢ low until 1:30. Both are simply weak & dropping; indicators do not yet signal a turnaround. Not really anything clever to say today. The Gold/Silver Ratio closed Comex at 76.191, and has climbed back to that lower range boundary it fell through in April. Chart is here, http://schrts.co/kh9gOy That Gold/Silver Ratio has reached its 200 DMA. That may satisfy the correction due from its long fall from 84.38 at end-march to 70.40 at end April. Yes, it might rise to 77.42 for a 50% correction. It catches my eye that the Ratio has formed an up-pointing or rising wedge. That usually resolves earthward. Keep an eye on it. That nearly complete pattern may be pointing to the end of the silver & gold correction. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jun 2016 04:00 PM PDT Ayaan Hirsi Ali and Bill Maher are speaking it out The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto, housing debt worsens as petrodollar fades, Embry tells KWN Posted: 01 Jun 2016 03:26 PM PDT 6:25p ET Wednesday, June 1, 2016 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that auto loan debt in the United States has gotten junkier than mortgage debt, which is pretty junky itself, while the U.S. dollar is losing support from the oil trade. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/50-year-veteran-warns-we-are-headed-for-another... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 174 - LATEST EVENTS MAY 2016 Posted: 01 Jun 2016 03:00 PM PDT It's crazy how people are ripping down parts of the Amazon for gold, the local eco system will not be able to recover with uncontrolled mining everywhere. This gold mining, fracking, forest clearing, coal mining etc etc.. will have knock on effects around the world, we will see even more extreme... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Savage Donald Trump Interview - June 1, 2016 Posted: 01 Jun 2016 02:33 PM PDT June 1, 2016 - Michael Savage Donald Trump Interview The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Lesser of Two Evils - Non Full time Payrolls Posted: 01 Jun 2016 02:08 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UCLA Shooting -- Students hide out at UCLA after deadly shooting on campus Posted: 01 Jun 2016 01:40 PM PDT Students at UCLA hunker-down after a gunman opened fire in the Engineering IV building at the campus in Los Angeles. Police are calling the shooting a murder-suicide. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WHAT? 666 ʻMark Of The Beastʻ Just Got REAL! (2016) Posted: 01 Jun 2016 01:19 PM PDT This is a Big Deal, and a Big Signal..... 666 ʻMark Of The Beastʻ Just Got REAL! (2016) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bernie Sanders – The Best of a Bad Bunch? Posted: 01 Jun 2016 01:01 PM PDT This post Bernie Sanders – The Best of a Bad Bunch? appeared first on Daily Reckoning. BALTIMORE – "Tommy… who are you voting for?" We put the question to a local bulldozer operator whom we've known for at least half a century. Tommy, now 80 years old, is the last of a dying breed. He grew up plowing the earth to grow tobacco on Maryland's Tidewater, on the western shore of the Chesapeake Bay. In the 1970s, when tobacco farming became unprofitable, he switched from plowing the earth to moving it around. He is still at it. And as near as we can tell, he will go on with it until his eyes give out… or his mind fails… and he knocks over a suburban house by accident. In the meantime, he pushes dirt in the same spirit we write these Diary entries – with the happy nonchalance of a hen laying an egg. Grasping ParasitesIt was Memorial Day weekend. Hot and humid already. We had asked him to come over to see about taking out some trees. In Maryland, trees grow fast. If you leave them on either side of a field, pretty soon you don't have any pasture left… just a shady spot between the tall trees. Tommy's family has been in this area for about 300 years. Like the few old-timers left in the area, he speaks with a distinctive accent – more like the Deep South than the Baltimore metropolitan area. "Vote? I 'ow know. None uv'em worth a damn, near's I kin tel." Bloomberg has a "unity tracker" that tells us how well Donald Trump is doing at getting Republicans in line behind him. It is a survey of Republican politicians, large donors, and otherwise important "conservatives." So far, 65% are with "The Donald." Only 1.8% are abstaining. Our guess is the list of Trump's supporters will grow. Elections, like lotteries, bring in the crowds. People know that you gotta play to win. A Trump donor has about 50-50 odds that his investment will pay off. An abstainer will get nothing. So, the cronies… the zombies… the Deep State operatives… contractors… suppliers – all are hitching themselves to the bright star of reality TV's Donald Trump… or the twinkling of the coy Planet Clinton. Roger Stone, Corey Lewandowski, Steven Mnuchin, Paul Manafort, and Laurance Gay – the Trump team overflows with hacks, lobbyists, and insider dealers already. They are busy making promises to line up even more support: a new highway for one district… a new prison for another… more drones… more benefits for federal retirees… more drugs… more this… more that. All of it at someone else's expense, of course. Ms. Clinton has even more promisers on her team. Mr. Trump says his campaign team numbers only about 75 people. Ms. Clinton will have 800 grasping parasites to look out for if she wins the White House. Best of a Bad LotAt the Diary, we favor lost causes, die-hards, and underdogs. Neither Clinton nor Trump fill the bill. But Sanders? Tommy rated the candidates: "Bernie Sanders is prolly the best uva bad lot. His ideas are turrble, but he seems like a decent fella. And since nobody ever thought he'd git this fahr, I reckon he didn't haf to make no promises along the way. "Besides, dere ain't no way Congress would do anything he wanted anyhow. The people who run things don't care what he thinks. What's more, he'll prolly be dead in a few yeeahs. Then he won't be able to do no more harrm." Tommy may be the only voter to see Sanders' shorter life expectancy as a campaign plus. But he's not the only one to see that it doesn't matter what Sanders' thinks or wants. The Deep State calls the important shots. The only thing we're pretty sure of is that the "people who run things don't care what he thinks." The system changed in 1971, when President Nixon took the dollar off the gold standard. Since then, the powers that be no longer depended on Congress… or savers… or voters… to raise the funds they needed. The feds could run huge deficits – no matter who was in office. Wall Street could earn huge fees, too, from lending out money that no one ever saved. "I remember in the '70s," said Tommy, as the conversation turned to money. "The banks used to want your binez. They'd give you a free toaster oven just for opnin an account. Now, they act like they don't know me or evn want my money. If I had any money. I'm 80 yeeahs old, and I'm workin' just like I did 50 yeeahs ago. 'Cept now I got less money den I had den." Why don't the banks want our money? They no longer need it. When banks make a loan, they create new deposit balances on the spot, using nothing more than a few keystrokes on a computer. There's no need for pre-existing savings. But real resources – time and money – are limited. Pretending otherwise, by lending empty credit as though it were real savings, misled investors and consumers. Instead of carefully applying their precious capital to projects that would pay off, they began throwing it around – on zero-down mortgages, executive bonuses, share buybacks, McMansions, and multimillion-dollar "art." The "seed corn" that should have increased productivity and higher wages was squandered. Instead, we have financially modified pseudo credit-corn; it looks just like the real thing, but it produces no crop. "Misallocation of resources," we said to Tommy, explaining why we are no richer today than we were 40 years ago… and how "free" money poisons an economy. "I dunno 'bout dat. But if ya want dem trees pooshed down, I'll poosh 'em for ya." Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post Bernie Sanders – The Best of a Bad Bunch? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul: Censorship, Trump 2016, & Global Meltdown Posted: 01 Jun 2016 12:18 PM PDT Ron Paul: Censorship, Trump 2016, & Global Meltdown Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Clinton Email Scandal - The Middle of the End Posted: 01 Jun 2016 12:00 PM PDT Hillary's email investigation moves into the final phase. America is about to find out if the rule of law applies to all The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: Global mints report record silver coin sales for 2015 Posted: 01 Jun 2016 11:54 AM PDT By Michael Kosares Global investors snapped up a record 89.6 million 1-ounce silver coins in 2015, according to USAGold's annual survey of global bullion coin sales. The strong 2015 showing follows an equally impressive 2014 for silver coins at 77.9 million ounces and 2013 at 85.4 million ounces. Year over year, silver bullion coin demand was up 14 percent from 2014. Last year was a banner year for gold bullion coin sales as well -- the third best since 2002. National mints sold 3.3 million ounces in 2015 -- an impressive 30 percent increase over 2014. ... ... For the remainder of the report: http://www.usagold.com/cpmforum/2016/06/01/global-mints-report-record-si... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DONALD TRUMP FULL INTERVIEW WITH SEAN HANNITY (5/31/2016) Posted: 01 Jun 2016 11:30 AM PDT DONALD TRUMP FULL INTERVIEW WITH SEAN HANNITY (5/31/2016) Fox News The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SITUATION CRITICAL: More Proof of A Massive Stock Market Bubble. By Gregory Mannarino Posted: 01 Jun 2016 11:00 AM PDT Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decisions and any consequences thereof. Please invest wisely. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| EU Economic Collapse -- Greece : Scuffles in Food Bank Posted: 01 Jun 2016 10:30 AM PDT Greece: Scuffles break out between austerity victims at EU food bank Tension arose at Pavilion 16 of the international exhibition & congress centre TIF HELEXPO centre in Thessaloniki, after scuffles broke out between people collecting EU food aid at the site, Wednesday. People were... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GoldSeek Radio interviews GATA Chairman Bill Murphy Posted: 01 Jun 2016 10:17 AM PDT 1:15p ET Wednesday, June 1, 2016 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek today interviews GATA Chairman Bill Murphy about the changing dynamics of gold and silver trading. The interview is 11 minutes long and can be head at GoldSeek here: http://radio.goldseek.com/nuggets/murphy.05.31.16.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALERT -- Flesh-eating migrant virus hits Europe Posted: 01 Jun 2016 10:00 AM PDT A flesh-eating disease is spreading across Europe due to the impact of the Syrian Migrant crisis. Dr. Marc Siegel of the Fox News Medical A-Team with more. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jun 2016 09:30 AM PDT This post Consumer Spending Rebounds appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! And welcome to June! Well, the markets have had a day to see where the marbles ended up from the Janet Yellen speech on Friday. I talked about that speech yesterday, so I’m not going there again, except to say that although on Friday afternoon in thinly holiday traded markets, she moved the dollar stronger, it has been a case of “let’s wait-n-see what the Fed actually does”, and the dollar’s strength from Friday has faded against most currencies, not all, but most. So, the data becomes quite important, in my opinion, to what we will end up seeing what the Fed actually does. And even with all the rate hike rhetoric, there’s still only a 28% chance of a June rate hike according to the Fed Funds Futures. The dollar today, is soft against the euro, Aussie dollar (A$), kiwi, krone, franc, krona, koruna, zloty, yen, and a few others, and the green/peachback is stronger today vs. the ruble, renminbi, pound sterling, and a few others. Gold is flat and the price of oil has slipped back below $49 this morning. First things first. The A$ is stronger this morning after a better than expected first QTR GDP print, which came in at 1.1% vs. the previous quarter, and 3.1% year on year. The Consensus was for just 0.8% growth in the first QTR. Now, do you think that the Reserve Bank of Australia (RBA) is trying to find something to hide behind, after they cut rates last month? I do. But maybe not, these Central Bankers have become so brazen about their moves. I was reading an article that dear reader, Bob, sent me by Charles Hugh Smith, that talks about the Kubler-Ross Famed Stages of loss: Denial, Anger, Bargaining, depression, and acceptance. His theory is that Central Banks are in the “Denial” phase because they realize but won’t admit that all their trillions of dollars, euros, and yen have completely and utterly failed to achieve the desired result: “organic” (unmanipulated by central banks) expanse of productivity, investment and household earnings. Okay, back to the currencies and metals. Japanese yen is much stronger today, after falling through 110 to 111 yesterday, it’s back to trading with a 109 handle today. It’s pretty interesting to me how yen has become a “volatile currency”. You used to be able to have more fun watching paint dry, than watching the moves in yen. But that’s all changed in today’s trading, where one little piece of data, or some words mumbled by an official can get the traders all lathered up and buying or selling a currency like funnel cakes at a State Fair. The European Central Bank (ECB) will meet tomorrow, and it is widely expected that ECB President, Mario Draghi, will keep all things unchanged. A couple of weeks ago, he might have been sweating bullets because of the strength of the euro, but since then the euro has gone from 1.15 to 1.11, 1.12-ish, and that’s much more acceptable to him. I’ve long said that Germany, the Eurozone’s largest economy, would be happy with a euro at 1.20, of which I call the Goldilocks level, not too strong, not too weak, just right! But not Draghi. He’s not from Germany, and doesn’t share their fear of runaway hyper-inflation. And I would bet my bottom dollar that Germany’s Bundesbank members rue the day they allowed Draghi who ran the Italian Central Bank to lead the ECB. Just my opinion and I could be wrong. Pound sterling is getting sold this morning on the latest poll taken that showed the “leave the EU” vote gaining on the “don’t leave the EU” vote. This is all posturing to me, these polls are about as useful as the G in lasagna. The U.K. is not going to leave the European Union/EU, but we are going to see one poll after another until the referendum at the end of this month. And with each poll we will see the gyrations in the pound. I would think that if you own the pound you would simply batten down the hatches and see what comes of the referendum. But that’s just me. Gold was able to hold its early morning gains yesterday and add to them as the day went along, gaining back $10 of its nearly $100 of losses in May. That’s right, that’s what I said. Gold saw nearly $100 of losses in May (on May 2nd gold traded above $1,300, and on May 31 – before the $10 gain – gold was down to $1,208 in early morning trading). But I have to say that it sure does appear to me that $1,200 is the new base/foundation for the price of gold, given that it has not fallen below that level since overtaking it earlier this year. I sure hope I didn’t just put the Chuck’s kiss of death on the $1,200 level. The price of oil slipped back below $49 to a $48 handle in the past 24 hours. I don’t think this is any cause for concern to the “Oil investors”. Just gyrations. I read a report on Bloomberg yesterday about how oil discoveries have shrunk to a six-year low. “About 12.1 billion barrels of oil reserves were found in 2015, marking the fifth consecutive year of decline and the smallest volume since 1952. Wait, What? 1952, that’s before I was born! So, that’s old! I tell you this about these discoveries, not in attempt to get you to see that the price of oil is going higher now. Shoot Rudy, only the shadow knows that. I’m telling you this now, because of the effects that this declining oil discoveries will have on the future of the oil price. Well, if data is going to be so important these next two weeks leading into the Fed meeting June 14 & 15, then let’s look at some of the recent data. Yesterday’s Data Cupboard yielded the Personal Income and Spending for May, the S&P/CaseShiller Home Price Index, Consumer Confidence and a regional PMI from Chicago. Consumer Confidence dropped in May, to 92.6 from 94.7 with respondents noting that jobs were harder to get. Hmmm. The Chicago PMI fell below the 50 level at 49.3 in May, and seems to be stuck in neutral for several months now. The Case/Shiller HPI was good, rising 0.9% in March, and as long as interest rates remain so low, I don’t see this changing. And then finally the Personal Income ticked higher in May 0.4%, But Personal Spending really outdid Income, as Personal Spending rose 1.0% in May. Holy credit card expenditures Batman, how did that happen? And where did all the money come from? Ahhh, Robin, my good sidekick, we need to look under the hood, and see what consumers were spending their money on. Uh-Oh, I see a problem… Rising gas prices. Just last week, I overheard a conversation on the desk between Aaron Stevenson and Mike “Cisco” Harrell, and they were discussing the huge jump in gas prices in just two days in the past couple of days. I had too filled my tank that morning, and noticed that I was paying 50-cents more per gallon than I was a couple of months ago. Hmmm, I thought to myself, “I wonder what that’s going to do to Personal Spending.” And voila! Guess what went up in the past month? Personal Spending! Well, we can’t blame it all on rising gas prices, but we can say it’s a mixture of rising gas prices, and strong auto sales. Remember those auto sales? I keep giving you loan data showing that everybody is buying a new car, and streeeeeccccchhhing the loan term. So, they can buy, “more car”. And car “subprime loans” are the rage. Remember when Home Subprime loans were the rage? I think I recall how that all worked out. Do you? In other data. Personal Income grew 0.4% in April, and that’s a good thing, for consumers that are paying through the nose for new cars and gas! But the biggest piece of data yesterday was the PCE (Personal Consumption Expenditures) and PCE, the Fed’s preferred method of tracking consumer inflation, stayed Steady Eddie at 1.6% this month, same as last month, and when you go back 12 months, is only up 0.3% from a year ago. A good thing to stop and remember here is that the Fed’s inflation target is 2%, and the last time I checked, and I know that nowadays you can get credit in math just for having the right formula but not the correct answer, I’m pretty sure that 1.6% is a far cry from 2%. On a side bar, that getting credit for having the correct formula to a math problem but not the correct answer is going to go far at let’s say NASA, or APPLE, or Google, or the list could go on for miles, and it makes no sense whatsoever to yours truly. Today’s Data Cupboard has the ISM Manufacturing Index for May, which in April finally wrapped a tourniquet around the bleeding in this data that had begun in August 2014. And the index number had fallen each month since the August 2014 print. I don’t expect a huge rebound of any sorts this month, and would not be surprised to see the index number slip toward the 50 level again in May. The regional prints haven’t been good, but they never really seem to play into the National number. I know, doesn’t make sense to me either! For What It’s Worth… Well, I searched and searched for something I could use here this morning, and then I remembered that colleague and soccer great, Ty Keough had sent me a link on something yesterday afternoon, and it plays well here, so this is about how the Fed will be data dependent and can be found here, or, here’s your snippet:

Chuck again. Well, I think they pretty much are telling you the same things I’ve been telling you, that the U.S. economy is going nowhere fast. It’s always nice to see someone else on my bandwagon! That’s it for today. Thank you for reading the Pfennig, and I hope you have a wonderful Wednesday. Be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Consumer Spending Rebounds appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Marrs - Are They Planning A Fake ET Invasion? Posted: 01 Jun 2016 09:30 AM PDT Jeff Rense & Jim Marrs - Are They Planning A Fake ET Invasion?Clip from January 28, 2014 - guest Jim Marrs on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Cup and Handle Targets 1490 On a Breakout, With New All Time Highs Likely In Silver Posted: 01 Jun 2016 07:44 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

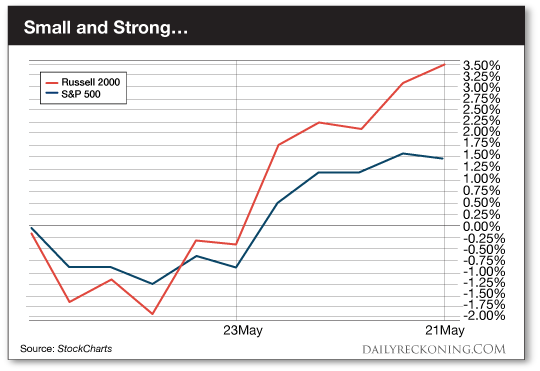

| Here’s What You Trade When Stocks Pull a “Switcheroo” Posted: 01 Jun 2016 07:17 AM PDT This post Here’s What You Trade When Stocks Pull a “Switcheroo” appeared first on Daily Reckoning. Sell in May and go away is the oldest investing trick in the book. It rhymes—so it must work, right? But what the heck are we supposed to sell? Not stocks. The major averages looked ready to roll over until a late rally pushed them back into the green. Not oil. Crude continued its climb toward $50. Even the Almighty Dollar enjoyed a powerful May rally, pushing the red-hot precious metals lower for the month. Just when you think you have something figured out, this ornery market pulls the ol' switcheroo and stomps your trade into the ground. Now that May is in the can, we're ready to see what the market throws our way. Stocks around the world are slipping into the red to begin the new trading month. But we're seeing some rumblings under the market's surface that prove investors aren’t quite ready to throw in the towel just yet… A couple of speculative sectors are hinting that the late May rally might not roll over just yet. They're also telling us exactly where to plan our next move as traders hint that they're willing to accept more risk. And right now, risk is the name of the game. Last year you saw firsthand what happens when investors shun risk and flee to big, "safe" stocks. Small-caps, biotechs and other speculative names got crushed. It makes sense. These are the stocks you'd normally knock down a few pegs when the going gets tough. But these are also the first groups to put in a meaningful rally when the markets begin turning around. We talked a lot about the market's broken stepchildren as the market launched off its lows earlier this year. The major averages had recovered after double-digit corrections. But those poor souls that had been mired in bear markets were actually leading the way higher. Take the small-cap Russell 2000. These forgotten small-caps helped tell a big story about the market's recovery off its February lows. The Russell endured a true bear market over the past eight months—a 20% correction. But the Russell jumped back into action in April, breaking above its 200-day moving average. It was the index's first move above this important level since last August. Small-caps are sneaking back to the front of the pack after last week's rally. Over the past ten trading days, the Russell 2000 has jumped nearly 3.5%, compared to a 1.5% gain in the S&P 500.

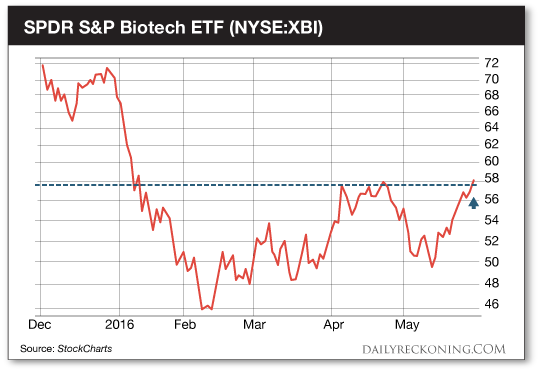

And small-caps aren't the only forgotten names to catch a break. Remember biotechs? These sickly stocks are finally showing some signs of life after putting in a choppy bottom. It took some extra time for biotechs to join the party this year. While every other sector and industry enjoyed a nice pop since the market bottomed this winter, biotech stocks continued to lag. A sharp April rally fizzled almost immediately. But biotechs were able to hold just above their March lows. Now they're once again outperforming the major averages. Over the past 10 trading days, the SPDR S&P Biotech Index is up more than 10%. And it looks ready for higher prices…

While the market's whipsaws rip apart most investors, you have an opportunity to ride out the chop with a couple of quick trades. Sincerely, Greg Guenthner P.S. Make money from biotech's comback — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Here’s What You Trade When Stocks Pull a “Switcheroo” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GDX Adjusted Cycle, Projection and Chart Posted: 01 Jun 2016 06:54 AM PDT GDX and gold look to make their low around June 24, not June 17th as I had reported earlier. The cycles are following gold’s and not GDX’s cycle. June 2nd is a cycle change point (either a low or high) and happens to be the 16 TD low for gold. The chart below shows GDX’s wave count ending an (x) of B wave on June 2 near 21.81 and rallying to 25.42 by June 8th to finish (y) of B. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Mints Report Record Silver Coin Sales for 2015 Posted: 01 Jun 2016 06:52 AM PDT Gold coin sales register third best year since 2002, 30% increase over 2014 Global investors snapped up a record 89.6 million one ounce silver coins in 2015, according to USAGOLD’s annual survey of global bullion coin sales. The strong 2015 showing follows an equally impressive 2014 for silver coins at 77.9 million ounces and 2013 at 85.4 million ounces. Year over year, silver bullion coin demand was up 14% from 2014. Last year was a banner year for gold bullion coin sales as well – the third best since 2002. National mints sold 3.3 million ounces in 2015 – an impressive 30% increase over 2014. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver - Are you still waiting for a pullback, so you can take part in the bull market? Posted: 01 Jun 2016 06:35 AM PDT Well, your time has come! Gold is in the process of testing the February breakout at a very important moving average. Whenever the market tests a breakout, it affords those who missed the breakout an opportunity to get onboard, and it enables those who helped to create the breakout, an opportunity to double up. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now Japanese Prime Minister Abe Predicts Imminent Global Economic Catastrophe Posted: 01 Jun 2016 03:32 AM PDT We continue to report on important mainstream investors, professional and private, who have warned about an impending, global financial catastrophe. Now, add Japanese Prime Minister Shinzo Abe to that list. George Soros, Stanley Druckenmiller, and Carl Icahn among others have all made dire statements. They’ve also reconfigured their portfolios and taken positions in gold and silver and shorted the market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Technical Analysis Does Not Work for Gold and Silver Posted: 01 Jun 2016 01:00 AM PDT Michael Ballanger, a precious metals expert, says he believes technical charts were created by bullion bank traders to lull the "chartists" into a false sense of security. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 01 Jun 2016 12:00 AM PDT Car sales, oil prices, mortgage applications, US construction spending, China and Japan manufacturing all fall hard. China’s credit risk grows. Japan ramps up stimulus, rest of world soon to follow. Charles Hugh Smith on why pension funds (that is, your retirement) are doomed. Great interviews with James Rickards and Helen Chaitman. Oil and gold stable. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

What did you imagine you'd do with your life?

What did you imagine you'd do with your life? Buried in the Liberal Federal Budget that was introduced on March 22, 2016, under Chapter 8 – Tax Fairness and a Strong Financial Sector, was a section titled “Introducing a Bank Recapitalization 'Bail-in' Regime.” Simply stated, in the unlikely event of a large bank failure, the Government proposed it would reinforce that bank shareholders and creditors are responsible for the bank's risks – not taxpayers.

Buried in the Liberal Federal Budget that was introduced on March 22, 2016, under Chapter 8 – Tax Fairness and a Strong Financial Sector, was a section titled “Introducing a Bank Recapitalization 'Bail-in' Regime.” Simply stated, in the unlikely event of a large bank failure, the Government proposed it would reinforce that bank shareholders and creditors are responsible for the bank's risks – not taxpayers. An Alert for the Global Posse of Liquidity Junkies

An Alert for the Global Posse of Liquidity Junkies

For the first time in far too long, Frisby’s Bulls and Bears is back. We’re talking to Jim Rickards about his latest book, The New Case For Gold. And he isn’t given an easy ride.

For the first time in far too long, Frisby’s Bulls and Bears is back. We’re talking to Jim Rickards about his latest book, The New Case For Gold. And he isn’t given an easy ride. Top Three Sovereign Mints, The U.S., Canadian and Perth Mint report collective first quarter 2016 silver sales up 31.6%

Top Three Sovereign Mints, The U.S., Canadian and Perth Mint report collective first quarter 2016 silver sales up 31.6%

No comments:

Post a Comment