Gold World News Flash |

- The US Economy Priced in Gold

- Analyze this (technically)

- Fulfilling The Economist Magazine Prophecies & Discovering the Road to Roota

- Central banks ready to defeat markets if Britain chooses independence

- US Negative Interest Rate Bets Surge To Record Highs

- Silver ETF Holdings Soar To Record Highs

- Gold Price Closed at $1296.10 Up $10.30 or 0.80%

- The Fed Has Brought Back "Taxation Without Representation"

- Alasdair Macleod: Brexit is getting the blame

- Daesh terrorists serving Western imperialism

- Orlando Pulse Shooting Hoax: Crisis Actor Sitora Yusufiy Sells Omar Mateen as Closet Homosexual BS!

- “Creditism” and the Death of Capitalism, Part I

- Gold Daily and Silver Weekly Charts - The New Normal

- The Disaster of De-Industrialization

- Stock Market, Iron Ore, Bitcoin – Is Silver Next for Chinese Momentum Investors?

- Brexit Crisis: Gold in 5 Historic Shocks

- #BREXIT COULD COLLAPSE THE WORLD - Elites Fear Brexit Would Reverse Their Globalist Agenda

- URGENT: "Markets Stumble As UK Exit Of EU Surfaces" Black Horsemen May Ride

- 2016 Will be a Complete Bloodbath in the Markets -- Jeff Berwick

- Gold Soars to New 2016 High, Breaking Through Key Resistance

- Global Meltdown Is In The Numbers!! -- Gerald CELENTE

- Gold to Yellen, Brexit: “Me Likey”

- The Fed Just Sparked Gold’s Next Leg Higher

- Canada experiments with digital dollar on blockchain

- Thursday Morning Links

- The Fed Giveth and the Bullion Banks Taketh Away…

- Gold Could Advance 900% as Central Banks go NUCLEAR During the Next Crisis

- How Will a Brexit Vote Impact Gold and Silver Prices?

- FED Leaves US Interest Rates Unchanged, Gold and Silver Bounce

- China's Hard Landing Has Already Begun!

- Top Ten Videos — June 16

| Posted: 16 Jun 2016 11:01 PM PDT We all know the debt load in the US economy is horrendous and unsustainable. The US government runs deficits of approximately $1 Trillion per year, even with interest rates at historical lows.... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Jun 2016 10:16 PM PDT 1:29a ET Friday, June 17, 2016 Dear Friend of GATA and Gold: Well, there it was Thursday, out in the open, reported by a mainstream financial news organization, Bloomberg, if without any recognition of its meaning. All the major central banks are plotting coordinated intervention in the financial markets if the United Kingdom votes next week to reclaim its independence by withdrawing from the European Union: http://www.bloomberg.com/news/articles/2016-06-16/global-central-banks-s... Citing a television interview he gave in Bern, Bloomberg reported that Thomas Jordan, president of the Swiss National Bank, said "officials could act in global markets to prevent any 'exaggerations.'" ... Dispatch continues below ... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling A member of the governing council of the European Central Bank, Ewald Nowotny, was quoted by Bloomberg as saying that central bank currency swap arrangements will ensure that lenders "have access to liquidity during any 'disturbances on the market.'" How much "exaggeration" and "disturbance" will be allowed? That is, what range of prices will be permitted in which financial instruments? At what points will central banks intervene? Of course only they and their agents will be permitted to know that; ordinary traders and investors will have to guess. Market manipulation works much better if it is concealed. And when the crisis -- if there is one -- passes, no doubt the "technical analysts" among the financial letter writers will haul out their silly jargon and enormous egos in an attempt to demonstrate that there has been no intervention at all and not even the threat of it and that everything that has happened can be explained by the tried-and-true formulas they long have been using to explain market movements. Doug Casey of Casey Research would say that nothing central banks do matters, though they are authorized to create infinite money and deploy it in secret without any accountability. Steve Saville of the Speculative Investor would produce four charts "proving" that there had been no government intervention in markets anywhere since the Reichswirtschaftsminister took control of pricing stocks on the Berlin Stock Exchange in February 1943. Market analyst Dan Norcini would insist that the Thomas Jordan interviewed by Bloomberg Television was a different Thomas Jordan, not the Swiss central banker. And newsletter writer Avi Gilburt would expand on Casey's posture, declaring that market rigging and the deception and cheating of investors by government mean nothing to humanity and the only important thing in life is how much money his subscribers have made with his recommendations since last Tuesday. In the face of these central bank proclamations of their plans for intervention, all these market analysts are invited to analyze a great scene from one of the "Naked Gun" movies to see if they can identify the character they most resemble: https://www.youtube.com/watch?v=rSjK2Oqrgic CHRIS POWELL, Secretary/Treasurer Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fulfilling The Economist Magazine Prophecies & Discovering the Road to Roota Posted: 16 Jun 2016 09:45 PM PDT by Bix Weir, Road to Roota:

Here’s the news: BREXIT Campaigns Suspended After British Lawmaker Critically Shot By “Britain First” Shouting Assailant “With tensions in the UK already running high ahead of next week’s historic Brexit vote, moments ago the Guardian reported that Jo Cox, the MP for Batley and Spen, was in critical condition after she was shot and stabbed in her West Yorkshire constituency. The Labour politician was injured in the attack and there is an ongoing police operation in the area, a witness told the Press Association. It is unclear who the assailant was or the motive.”

And this from my book “The Road Awakens” that was published in January 2016 BEFORE the BREXIT vote was scheduled… “On another chilling note, there is only 1 arrow that hit anything in the picture and that is the debate pulpit with the UK Flag on it. Notice the city of "London" is written across the flag for some reason. This may be forecasting a terrorist attack THREAT near the time of the UK Elections on May 5, 2016 if the UK decides to include a vote on an exit from the European Union. Currently, the vote to stay or leave the EU is not scheduled but has to happen sometime before the end of 2017. There have been rumors that the EU vote may be included during the May 2016 elections in London if the European Union continues to struggle economically.” END Yes, I was off by 1 month but analyzing these things is not an exact science. I would note that there is A LOT MORE chaos barreling our way as I discuss in the Book including the REAL war over the Grand Canyon Gold. You can buy Book 3 here: Book 3: “The Road Awakens” – by Bix Weir And if you would like to know the entire story of the Road to Roota theory, here it is, in full! Discovering the Road to Roota: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks ready to defeat markets if Britain chooses independence Posted: 16 Jun 2016 08:42 PM PDT Global Central Banks Sound Brexit Alarm as 'Leave' Jitters Grow By Jeff Black and Matthew Campbell Global central banks sounded the alarm over the risks posed by a British departure from the European Union, as polls continued to show the "Leave" campaign ahead with a week to go before the June 23 referendum. In a 15-hour relay of comments, the chiefs of the U.S. Federal Reserve the Bank of Japan, the Bank of Canada, and the Swiss National Bank all cited the referendum on EU membership as being potentially disruptive to the global economy. The BOJ said central banks are in contact over a so-called Brexit, and the Bank of England repeated its warning on the risks in its final monetary-policy decision before the vote. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: We are "closely exchanging opinions with the Bank of England and other central banks," BOJ Governor Haruhiko Kuroda told reporters in Tokyo on Thursday, adding that his institution can respond to any potential surge in dollar-funding costs. "We want to coordinate closely with domestic and overseas authorities and carefully watch how the vote will affect the international financial market and the global economy, including Japan." With almost all recent polls showing "Leave" in the lead, investors are focused on how financial guardians at the Fed, European Central Bank, and BOJ can stem market panic if the U.K. takes such a step. Officials stress that liquidity facilities left over from the crisis era are available, and central bankers in countries like Switzerland and Denmark say they're ready to act to stabilize their currencies. It is "possible that we'll have turbulences" in reaction to a Brexit, SNB President Thomas Jordan said in a Bloomberg Television interview in Bern. "We have a very good exchange among all major central banks so that the information is here, so that we understand the developments in the market." In the first instance, officials could act in global markets to prevent any "exaggerations," Jordan said. ECB Governing Council member Ewald Nowotny said in Vienna on Thursday that swap agreements between central banks will ensure lenders have access to liquidity during any "disturbances on the market." "We'd expect major central banks to intervene to push back against this volatility," Steven Barrow, a strategist at Standard Bank Group Ltd. in London, said in a note to clients. "Policy makers will feel they already have the tools in place to try to limit wider disruption." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-06-16/global-central-banks-s... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Negative Interest Rate Bets Surge To Record Highs Posted: 16 Jun 2016 07:00 PM PDT As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging it ever closer to the negative rate realities of Switzerland, Japan, and Germany. As rate-hike odds collapse, along with The Fed's credibility, so investors are increasingly betting on the chance that the inevitable negative interest rate washes ashore in a US money-market-crushing manner. While bets on 'NIRP' in 2016 have faded modestly, expectations for a 'below-zero' rate in 2017 (and implictly a stock market crash) have never been higher... We suspect the words "it could never happen here" were uttered numerous times in Switzerland, Japanese, and German halls of officialdom over the past few years...

And with The Fed rapidly losing faith...

It appears not only are Treasury yields attractively 'cheap' (and "safe") to the rest of the world's bonds...

But their relative moves to stocks also suggest something is amiss in equity land around the world...

And so, traders are increasingly positioning for negative rates in 2017... or, as we explain below, positioning cheaply for a stock market crash... [the chart shows the cumulative open interest in par calls on eurodollar futures contracts that expire in 2016 and 2017 - basically options on short-term interest rates with a strike price of zero, such that they pay out if the Fed takes rates negative] As we explained previously, when queried whether this is indeed a trade to bet on a market drop, Michael Green responded as follows:

Loking at the chart above, one wonders if The Fed tries QE in 2016 first, and/or increases its war on cash before negative rates are forced upon Americans. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver ETF Holdings Soar To Record Highs Posted: 16 Jun 2016 06:25 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1296.10 Up $10.30 or 0.80% Posted: 16 Jun 2016 05:31 PM PDT

Yesterday afternoon a gigantic summer storm blew in, with high winds & rain & thunder & lightning, everything needed for a great show, but it also blew out our internet & email at my office & at home. That's why y'all received no commentary yesterday. Office remained internetless all day save a 20 minute respite, but at home the internet is smokin', almost as fast as dial-up. FIRST, TWO MESSAGES: Y'all can follow this link to the Gold Summit, http://bit.ly/263gp7N The Gold Summit offers 20 different interviews with 19 different people, and one nat'ral born durn Tennessee fool among 'em. If you are interested in gold and silver investing, better take a look. You can watch them for free June 16 through June 18, or you can buy and download podcasts. Just so y'all know, if you do buy anything, I receive a small commission. Before I get started, those US $5 gold commems are such a great low-premium buy & have been so popular, we will continue the special one more day, through Friday, 17 June. But when you call, try (888) 218-9226 first, then (931) 766-6066. NEXT, let's review the damage done by Janet and her Dwarves yesterday. Once again the Federal Reserve did its best to de-stabilize markets. Thru the curling lips and nasal whine of Janet Yellen the FOMC announced no move in its discount rate, and implied they're likely to raise it once later, this year. Yeah, sure, in a pig's eye. Yesterday gold closed Comex at $1,285.80, up only 20¢, then as soon as Yellen pontificated, shot to $1,297. Silver had closed at 1748.9¢, only 7.9¢ higher than yesterday, but it jumped to 1762¢. Janet managed to rabbit chop the US dollar index, too, talking it down 38 basis points (0.4%) to 94.66. Euro rose 0.46% to $1.1261, which no doubt was part of the reason behind the FOMC's flinching. They're scared of Brexit, scared just the anticipation of it can created a stampede out of euros & hasten its eventual centrifugal fate. Yen was flat at 94.34. What will be the outcome if the UK votes to leave the EU? My guess is that the pound sterling would tank, although in the end Brexit will help the British economy. The euro would tank, probably never to recover. Refugee money would flow into dollars, yen, and gold. However, a sinking US stock market, which seems to lie close ahead in the future, would tug the dollar downward. Brexit would accelerate the trend begun more than a decade ago for gold to edge out the fiat currencies, as more and more the public views them as untrustworthy. If the Brits vote no to Brexit, then short term the pound would rise along with the euro. But the euro rising at any time is like you attaching jumper cables from your car battery to a corpse. You can make it jump, but it ain't never coming back to life. Brexit failure would probably also pull money away from dollars, yen, and gold. By the ways, the polls now show a majority favoring Brexit. TODAY'S MARKETS: Markets were passing strange today. In what way? Dollar index shot way up, then closed up on 5 basis points. Intraday gold made a new 2016 high, but couldn't hold on there. In other words, all pop and no corn. All vine, no taters. After a new high for the move at 95.54 & a huge jump for the day, the dollar retreated & closed up only five (5) basis points. Once again, the 95.50 resistance made it flinch & flee like Kryptonite. Ended below the 20 day moving average but above the 20. Six basis points less & it would have posted the first half of a key reversal. It is trying to advance, but just got sick at its itty tummy today. Behold the chart, http://schrts.co/2om5Sn Euro nearly fell through bottom boundary of its rising trading channel & the 200 DMA not far below Ended down 0.29% at $1.1228. Yen gapped up today, probably marking the end of its run. Rose 1.64% to 95.89. http://schrts.co/UuqBFa Gold was a mad dog this morning, raging to a new 2016 high at $1,318.90. Remained up over $1,306 from 3:00 a.m. Eastern (i.e., in European trading) but about noon began tumbling. Comex still closed up $10.30 (0.8%) over yesterday at $1,296.10, but in the aftermarket slipped below $1,280. Here's the conundrum: A push to a new high intraday with a lower close makes the first half of a key reversal, but that's not exactly what gold did. It closed Comex HIGHER on the day, but on the End of Day chart closed lower. Volume was light years greater than yesterday. Chart, http://schrts.co/pI1ZgR Today was not fatal to gold's rally, but must be made up tomorrow (if the rally is to continue) by closing higher. Mumbling under his suspicious breath, some nat'ral born Tennessee fool is thinking that the Nice Government Men shore don't want that dollar to run away topside and leave the euro draining away down the sewer. Likewise they wouldn't want gold to run away. And was it coincidental that central bankers staged a tag-team jawboning match around the world, denouncing doom against Brexit, time zone by time zone? Globalists have a LOT riding on the FrankenUnion. Ever more volatile silver reached a high of 1788¢ but in step with gold began falling Closed Comex 10.5¢ higher at 1759.4, but in the aftermarket right now is trading at 1727¢. Look, the chart, http://schrts.co/0csUZ9 Silver shows the same new high (although not highest in 2016) & lower close on big volume. Silver is not running this train, gold is. If gold can recover tomorrow & close above $1,308, it will jump toward $1,350 & take silver with it. Nice Government Men would rather not see that happen, so there's a good chance it won't. Meanwhile I want y'all to look at recent events in the U.S. & in the UK, & ask yourselves, "Is it real, or Memorex?" Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed Has Brought Back "Taxation Without Representation" Posted: 16 Jun 2016 05:30 PM PDT Submitted by Simon Black via SovereignMan.com, In February 1768, a revolutionary article entitled “No taxation without representation” was published London Magazine. The article was a re-print of an impassioned speech made by Lord Camden arguing in parliament against Britain’s oppressive tax policies in the American colonies. Britain had been milking the colonists like medieval serfs. And the idea of ‘no taxation without representation’ was revolutionary, of course, because it became a rallying cry for the American Revolution. The idea was simple: colonists had no elected officials representing their interests in the British government, therefore they were being taxed without their consent. To the colonists, this was tantamount to robbery. Thomas Jefferson even included “imposing taxes without our consent” on the long list of grievances claimed against Great Britain in the Declaration of Independence. It was enough of a reason to go to war. These days we’re taught in our government-controlled schools that taxation without representation is a thing of the past, because, of course, we can vote for (or against) the politicians who create tax policy. But this is a complete charade. Here’s an example: Just yesterday, the Federal Reserve announced that it would keep interest rates at 0.25%. Now, this is all part of a ridiculous monetary system in which unelected Fed officials raise and lower rates to induce people to adjust their spending habits. If they want us little people to spend more money, they cut rates. If they want us to spend less, they raise rates. It’s incredibly offensive when you think about it– the entire financial system is underpinned by a belief that a committee of bureaucrats knows better than us about what we should be doing with our own money. So this time around the grand committee decided to keep interest rates steady at 0.25%. Depending on where you sit, this has tremendous implications. If you’re in debt up to your eyeballs (like the US government), low interest rates are great. It means the government can continue to borrow even more money and go even deeper into debt. Low interest rates are also good for banks, because they can borrow for nothing from the Fed, then earn a handsome profit on that free money. But if you’re a responsible saver, low interest rates are debilitating. Banks only pay their depositors about 0.1% interest. Yet according to the US Labor Department, inflation is at least 1.1%, and has averaged 2.23% since 2000. This means that when adjusted for inflation, anyone who bothers saving money is losing at least 1% every single year. That might not sound like much. But compounded over a longer period, it can lead to a substantial difference in your standard of living. Maybe that’s why the government’s own numbers show that wages, when adjusted for inflation, are far lower than they were even 15 years ago. Or why wealth inequality is now at a level not seen since the Great Depression. Or why alarming data from Pew Research last year show that the middle class is now no longer the dominant socioeconomic stratum in the United States. Back during his days as a presidential candidate, Ron Paul used to frequently remark that inflation is an invisible tax on the middle class. And he’s right. The combination of inflation and low interest rates benefits certain people, while it causes middle class people’s savings to lose purchasing power. This constitutes a transfer of wealth from savers to debtors. In other words, it’s a tax. Yet unlike a normal tax which is passed by Congress, this inflation/interest rate tax is created by the central bank. You and I don’t get to vote for the twelve members of the Federal Reserve Open Market Committee (FOMC) who dictate interest policy. In fact, based on the way the Federal Reserve works, the majority of the committee members are actually appointed by commercial banks. Here’s the quick version: there are twelve Federal Reserve banks in the US banking system. They’re located in major cities like New York, San Francisco, St. Louis, Dallas, etc. And each Federal Reserve bank has its own separate Board of Directors. Yet two-thirds of the board members for each Federal Reserve bank are appointed by big Wall Street banks like JP Morgan and Goldman Sachs. And oh, hey, what a surprise, the last three major appointments to the Federal Reserve were all former high-level Goldman Sachs employees. These guys aren’t even trying to hide the fact that Wall Street banks control the Fed. So, Wall Street banks control the boards of directors at the Fed banks. The Fed bank boards of directors appoint the committee members who set monetary policy. And the monetary policy they set ends up being a gigantic tax… a transfer of wealth from the middle class to a tiny group of beneficiaries, including the US government and the banks themselves. This is an unbelievable scam… and it truly is taxation without representation. Unelected bureaucrats impose their will over the entire financial system in a way that benefits a handful of people at the expense of everyone else. And we have absolutely no say in the matter. Well, actually we do. Even though we can’t vote for the boards of directors at the various Federal Reserve banks like Citigroup and Goldman Sachs can do, we are able to vote with our dollars. Think about it: every single dollar that you keep in this poor excuse for a financial system is a tacit vote in favor of the corruption. Every dollar you take out of the system is a vote against it. And as we’ve explored before, there are substantial options for your savings– precious metals, cryptocurrencies, productive real estate, safe P2P arrangements with strong yields, and well-capitalized banks abroad that actually pay sufficient interest to keep up with inflation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Brexit is getting the blame Posted: 16 Jun 2016 04:14 PM PDT 7:12p ET Thursday, June 16, 2016 Dear Friend of GATA and Gold: Britain's departure from the European Union is not the biggest problem facing the financial markets, GoldMoney's Alasdair Macleod writes today. Rather, he maintains, the biggest problem is the insolvency of Europe's banks. Macleod's commentary is headlined "Brexit Is Getting the Blame" and it's posted at GoldMoney here: https://www.goldmoney.com/research/goldmoney-insights/brexit-is-getting-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daesh terrorists serving Western imperialism Posted: 16 Jun 2016 04:03 PM PDT The recent warnings by American officials about the surge in threats posed by the Daesh Takfiri terrorist group amount to nothing but "fear-mongering" as Daesh is a Western creation, says an American political analyst in Chicago. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando Pulse Shooting Hoax: Crisis Actor Sitora Yusufiy Sells Omar Mateen as Closet Homosexual BS! Posted: 16 Jun 2016 02:30 PM PDT Ex-wife of gunman: In my mind I questioned his sexuality The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Creditism” and the Death of Capitalism, Part I Posted: 16 Jun 2016 02:06 PM PDT This post "Creditism" and the Death of Capitalism, Part I appeared first on Daily Reckoning. "I don't think the outlook is encouraging at all." We recently had the opportunity to interview the thought-provoking economist and author Richard Duncan. Richard captains the highly influential economics blog Macro Watch. He's also written best-selling books like The Dollar Crisis, The Corruption of Capitalism and The New Depression. Richard keeps his being in Thailand these days. When we asked Richard for his take on the global economy, he gave the cheery answer that opened today's reckoning. Below, you'll see why. You'll also see why Richard thinks laissez-faire capitalism is long dead — and why there's no going back. He argues it's been replaced by what he calls "creditism," which he says is the only economic system that can lift the world out of depression. His explanation might raise your eyebrows. Gold is not the answer to our economic woes, in Richard's view. Far from it. Want to slash government spending? Then prepare for an economic collapse that will dwarf the Great Depression. Here's a brief sketch:

You may not agree with Richard's arguments. But you cannot afford to ignore them. Read on for the first part of our discussion… Brian Maher: Good morning, Richard. Good evening actually, since you're in Thailand, which is 10 hours or so ahead of us here in Baltimore. And welcome back to The Daily Reckoning. We read your blog, Macro Watch, all the time. It's fascinating. Richard Duncan: My pleasure. Thank you for having me on, and it's nice to speak with you from the other side of the world. Brian Maher: Richard, you argue that capitalism as it was historically known, is now dead. In its place stands something you call "creditism." Can you explain briefly what creditism is and how it came to replace capitalism? Richard Duncan: Yes, and this is very important. Capitalism was driven by investment, savings, capital accumulation, reinvestment, and capital accumulation. Hence the term, capitalism. Economic progress was more gradual, but the economic system in all likelihood would have been much more stable had traditional capitalism remained in place. But history got in the way. We no longer have capitalism. I really trace the breakdown of the capitalist system to World War I, when the European countries went to war with each other. They didn’t have enough gold to fight the war, so they went off the gold standard and printed money to finance government debt used to buy war materials. The Allies won the war. But all the government money that was created at that time, all the government debt, set off a worldwide credit bubble called the roaring '20’s. Then in 1930, the mountain of credit collapsed since it couldn’t be repaid. The international banking system collapsed. International trade collapsed. The Great Depression started. That went on for 10 years. There was no end in sight until World War II started, largely as a result of the depression. At that point, what was the U.S. going to do, let Germany and Japan take over the world? The Germans were already taking over all of Europe and Japan was expanding throughout the Pacific. U.S. government spending increased 900% in 1940 to prepare for the war. Then the U.S. was attacked by Japan in late 1941. The government then took over complete control of the economy to run the war effort. Manufacturing, production, distribution, pricing, labor, everything. And it's important to realize that we never really went back to a capitalist system once the war ended. The government was so terrified that reducing spending would lead us back into the Great Depression, which it probably would have, that they maintained high levels of spending. The economy has remained heavily government-directed ever since. So if you really want to know when creditism began in earnest, it was 1940. Were there alternatives? I’m not really so certain that there were. You have to keep in mind that first of all, during the Depression, fascism and communism swept across Europe and Asia. And when World War II ended, the Soviet Union was in control of half of Europe. A few years later, the communists took over China. Communism was spreading everywhere. Did U.S. policy makers really want to return to a laissez-faire type economy and risk having the U.S. fall back into depression? And potentially go communist? Most people today don't realize the dilemma policy makers faced in those days. It seemed too big a risk at the time. They didn’t take it. So they kept spending and spending. Later on, this came down to a showdown with the Soviet Union. President Reagan dramatically ramped up government spending and government borrowing by cutting taxes to go along with the increased military spending. It’s really from that point in the 1980’s that the level of debt-to-GDP started moving up very sharply. Where it had been 150% of GDP for decades, it very rapidly started accelerating. Eventually by 2007, it appreciated to 370% of GDP. That credit growth became the lead driver of global economic growth. We won World War II and defeated the Soviet Union on the back of this new economic system, which I call creditism. Again, it’s not capitalism in the traditional sense. We haven't had real capitalism in many decades. And we probably won't again, at least not anytime soon. Our system is now almost completely driven by credit creation and consumption. Brian Maher: But doesn't the type of system you describe, creditism, lead to a series of artificial booms and busts? It seems highly unstable compared to traditional capitalism and an international trading regime backed by a gold standard. Richard Duncan: I really do think that the Austrian school of economics had it right, that credit creates an artificial boom. Things would’ve been certainly more stable if we remained on the gold standard throughout. I don't disagree with that. But World War I didn’t permit that. World War II didn’t allow it. We were overtaken by events. It’s hard to see how we could’ve played it any other way. Brian Maher: We went off Bretton Woods in 1971, which severed the dollar's tethering to gold. Debts and deficits ballooned afterwards. Wasn't that the final nail in capitalism? Richard Duncan: I think that most people are very familiar with the Bretton Woods System breaking down in 1971. That was certainly the final end of the gold standard, or the gold-backed monetary system. Actually, an even more important date in my opinion is 1968, when President Johnson asked Congress to pass a law that the Fed would no longer have to maintain any gold backing for the dollar. Up until then at that stage, the Fed had to maintain 25% gold backing for every dollar that it issued. Congress did change the law. Afterwards, the Fed was free to print as many dollars as it wanted without any gold backing whatsoever. But yes, once they stopped backing dollars with gold, it removed one of the major constraints on how much credit could be created. Afterwards, credit absolutely exploded. Brian Maher: Ever since the breakdown of Bretton Woods, the U.S. economy, and the world economy, have become so completely dependent on credit growth, which is really another term for debt, it needs to constantly expand to sustain economic growth, correct? Richard Duncan: Yes. In fact, one of my major themes for a long time now has been that credit growth drives economic growth in the United States. That's very important to understand. For decades, the U.S. drove global economic growth, fueled by very rapid credit expansion. And this is also a very important point, one readers should chew on for a minute. Since around 1950, any time that U.S. credit growth, adjusted for inflation, grows by less than 2%, the U.S. has gone into recession. I refer to that 2% figure as the "recession threshold." Now, the credit's no longer expanding. Since 2008, when the crisis started, most of the time credit has grown bless than 2%, or just barely 2%. Therefore, the U.S. economy’s very weak. It's too weak to drive global economic growth and consequently, world trade is contracting sharply. Keep in mind, this is adjusted for inflation. Last year, there was only 0.1% inflation. Still we barely got above the 2% credit growth level. And debt grew 3 times more than the economy. So we've had very little real growth for the past six years or so, despite a 140% increase in government debt, $3.6 trillion of quantitative easing, and interest rates near zero. Looking ahead, it’s hard to see how credit growth is going to pick up significantly in the U.S. Look at all sectors — the household sector, the government sector, the financial sector, and the corporate sector. Project them forward, it just doesn’t look like we’re going to have significant credit growth at all. And that means little economic growth. For example, the Atlanta Fed's GDPNow forecast places first quarter GDP growth at just 0.3% And based on my credit growth projections, I see little relief in sight. Brian Maher: If you say the U.S. requires 2% credit growth just to avoid recession, that's a lot of credit we're talking about. You can grow credit 2% fairly easily when an economy's starting from a low debt level, even though it might be artificial. But total levels of government, business and personal debt in this country today exceed $60 trillion. To keep generating 2% credit growth on a consistent basis with that amount of existing debt, the amount of new debt required to keep the ball rolling soon becomes astronomical. Richard Duncan: That’s right. The total credit in the U.S. first went through $1 trillion in 1964. By 2007, it had expanded 50 times, to $50 trillion. In 2008, Americans had so much debt and their income had been stagnant for so long because of globalization, they just couldn’t repay it. They buckled under the debt and were cut off from additional credit. Credit started to contract. At that point, the government had to step in with extraordinarily aggressive fiscal and monetary policy. Since that time, government debt has increased by $9 trillion. Almost all of the increase and debt on a net basis has been an increase in U.S. government debt. And total U.S. debt now is up to about $63 trillion. And yes, that $63 trillion base is so enormous that it's very hard to grow credit 2% a year, adjusted for inflation. And since credit needs to grow at least 2% to avoid recession, as has been the case since around 1950, I'm not optimistic at all. Brian Maher: Would you then say, Richard, that what you call "creditism" has been a net positive for the U.S.? And the world? Richard Duncan: At least for two generations, it created a very powerful global economic boom. It ushered in the age of globalization. It allowed countries like China to go from being very poor third world countries into where they are now. China’s now the second largest economy in the world. None of this would’ve been possible if we had even stayed on the Bretton Woods System or a gold-based international trading system. Under the Bretton Woods System, trade between countries had to balance, or one side faced severe consequences. The whole purpose of the system was to insure that trade balanced, as it did under a gold standard. Under a gold standard, if one country had a very big trade deficit with another country, they had to pay for the deficit with their gold. If they had a deficit for long enough, they would run out gold. They would stop buying things from other countries. Trade would return back into balance again. The Bretton Woods System was designed to work the same way. Once the Bretton Woods System broke down, the old rules went out the window. After it broke, the United States quickly discovered it could buy things from other countries without having to pay with gold anymore. That was the beginning of the dollar standard the world's been on ever since. It ushered in globalization. It created a massive global boom. The U.S. could pay for foreign goods with dollars and Treasury bonds denominated in dollars. There was no limit to how many of those it could issue. The U.S. started running large trade deficits with first, Japan in the 1980’s. Later, with almost everyone else, especially China. Brian Maher: Richard, can you briefly explain how the new dollar standard created that massive global boom? Richard Duncan: It prevented the automatic adjusted mechanism of the gold standard from working properly. Trade didn’t return to balance. The world sent America goods, but the world didn't get American goods in return. It got paper dollars. Under the dollar standard, central banks accumulated hundreds of billions, ultimately trillions of U.S. dollars in this way. Suddenly, it became possible for countries like Japan to manipulate their currency to keep it more depressed than it otherwise would be. They accumulated dollars in exchange reserves. That benefited them by allowing them to keep their currency undervalued so that they can continue to have a trade surplus with the U.S. The huge inflow of dollars also created investment booms in those countries. That seemed like a great deal for the trade surplus countries. Look at the boom in Japan in the mid-'80s and China until recently. Brian Maher: The dollars flowing into nations like Japan and China led to massive booms in those countries. But they also led to a massive bust in Japan's case. And now China could be unraveling in the same way. Richard Duncan: That's true. You could really call the dollar standard the great dollar boom and bust standard. The abandonment of a gold-backed international trade regime fueled an explosion of credit creation that has ultimately destabilized the global economy. That credit creation, backed only by paper dollar reserves, led to a worldwide credit bubble, with economic overheating and severe asset price inflation. So the credit creation that the dollar standard made possible led to over-investment on a massive scale in almost every industry. As countries like Japan and later China accumulated those dollars, they ended up having to reinvest them back into U.S. dollar assets like Treasury bonds, Fannie and Freddie bonds, or other corporate bonds. This pushed up the price of those bonds and drove down their yields. The U.S. economy became overheated and heavily indebted as a result. It also caused the Fed to lose control over U.S. interest rates. These depressed U.S. interest rates, fuelling the U.S. property bubble that popped in 2008. This happened largely because the trade imbalances that came about from the automatic adjustment mechanisms inherent to a gold-based system broke down. And for many of these countries, the rapid accumulation of dollar reserves proved to be a curse, rather than a blessing. That sharp growth in reserves created a domestic investment boom, accompanied by rampant asset price inflation that eventually ended in financial disaster. The bubble economy that developed in Japan during the '80s is a perfect illustration, as is the Asian Miracle bubble that followed in the '90s. I wrote all about this in my 2005 book, The Dollar Crisis. All these booms blew into bubbles, and ultimately all the bubbles popped. China has been an important driver of global economic growth for two decades. Now, China’s popping. The world has never seen an economic boom like the one that transformed China over the past 25 years, made possible by the dollar standard. Between 2011 and 2013, China produced more cement than the United States did during the entire 20th century, for example. But after the U.S. went into crisis in 2008, it became the driver of economic growth. Now that the Chinese bubble is bursting, the global economy is very weak. Neither China nor the U.S. has the ability to drive global growth. Consequently, the global economy is in danger of falling back into severe crisis and political tensions are reaching the breaking point. So where is that growth going to come from? The global economy certainly would have evolved very differently if Bretton Woods, or some other form of gold-based system, remained in place. We wouldn't have these dramatic boom/bust cycles that we've had under the dollar standard. But we're far beyond that point now. Of course the dollar standard also had a number of other undesirable consequences. It caused the United States to de-industrialize, which has kept American wages stagnant. In the U.S. now, the 70’s, the middle class is losing ground. This arrangement was very good for corporate profitability because the corporations could move their factories to ultra low wage locations in China and other countries. That caused the share of profits going into capital to become much larger than it traditionally had been. It squeezed the share of profits going to labor by holding down wage rates. That caused income inequality to become much worse than it had been since at least the 1920’s. Now, we’re beginning to see the political price of all of this. There’s a huge backlash against this loss in the standard of living and the downward momentum of the middle classes. The Republican elite has just lost control of his party. His party has been conquered by Donald Trump. Brian Maher: Thanks Richard. Tomorrow, we'll return with part two of our conversation. We'll pick up on that note… and talk some more about where we stand today. R | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The New Normal Posted: 16 Jun 2016 01:18 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Disaster of De-Industrialization Posted: 16 Jun 2016 12:46 PM PDT This post The Disaster of De-Industrialization appeared first on Daily Reckoning. By now, we all know what’s happening in Venezuela: hyperinflation, empty stores, a regime in denial. The Trajectory of Venezuelan Hyperinflation Looks Frighteningly Familiar… (Zero Hedge)

My contacts in Venezuela tell me that merely posting the black market exchange rate of bolivars to USD can get you arrested. So yes, Venezuela’s regime has gone full Orwell-1984: whatever is true is outlawed. Venezuela is imploding not because of hyper-inflation, but as a result of policies that led to hyper-inflation: policies that generate perverse incentives, disincentives to produce goods and services and incentives to depend on government subsidies. But one of my correspondents nailed a key cause that is rarely discussed: Venezuela has been effectively de-industrialized. Capital that should have been invested in the electrical grid and the oil industry has been diverted to other pet projects (and the pockets of regime insiders). There’s no food in the markets because government-set prices don’t make it worthwhile to grow anything. Farmers take their produce to neighboring countries if they can, where they can actually get paid for producing food. But de-industrialization is the result of more than perverse policies. De-industrialization results when a citizenry is denied access to the tools and capital needed to produce goods, and when government subsidies sap the will to take the risks that are part and parcel of making real stuff. De-industrialization is also the result of currency exchange and trade policy. When it becomes cheaper to import goods and services from other nations, the domestic populace loses the will and the skills needed to produce goods and services. But a funny thing happens when a nation loses its capacity to produce real goods in the real world: when the currency and trade policies that made importing everything financially sensible blow up, there’s nobody left to actually make essential goods, grow food or maintain critical infrastructure. De-industrialization is a gradual process. The loss of key industries is gradual; the loss of supply chains is gradual; the loss of local suppliers and jobbers is gradual; the loss of skilled workers is gradual; the decline of local capital is gradual; the loss of the willingness to get out there and take risks to make real goods in the real world is gradual. This is a chart of industrial production in the United Kingdom. many nations share the same basic trajectory: given a strong currency and restrictive policies, it no longer makes sense to produce goods, food, transport, etc. Financialization and free-spending governments borrowing billions create the illusion that a nation that was once a nation of makers can become a nation of takers with no downside.

Once a nation no longer produces essential goods and services, and depends on financial games or commodities to pay for industrial goods and food produced elsewhere, it becomes vulnerable to a collapse in the financial games and the commodity markets that made it all too easy to succumb to de-industrialization. Regards, P.S. The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Disaster of De-Industrialization appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market, Iron Ore, Bitcoin – Is Silver Next for Chinese Momentum Investors? Posted: 16 Jun 2016 12:41 PM PDT The roulette game all started in the fall of 2014, about 2 years after Chairman Xi Jinping came to power and became the General Secretary of the Communist Party of China. Xi Jinping had campaigned for socialist economic reform, including a sweeping anti-corruption drive, cutting excess production capacity, tightening of housing credit, and clamping down on gaming in Macau. Public feedback was initially positive. However, largely as a result of those policies, Beijing was facing an increasingly grim economic growth outlook which was the worst in more than two decades*. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brexit Crisis: Gold in 5 Historic Shocks Posted: 16 Jun 2016 12:26 PM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #BREXIT COULD COLLAPSE THE WORLD - Elites Fear Brexit Would Reverse Their Globalist Agenda Posted: 16 Jun 2016 10:06 AM PDT The UK would be "better off without" the European Union, US presidential hopeful Donald Trump has said. As the EU referendum looms, a great counsel of war is gathering. Henri de Castries, the Chairman of the influential Bilderberg Group, has made his way to the highest hill above Dresden, placed a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| URGENT: "Markets Stumble As UK Exit Of EU Surfaces" Black Horsemen May Ride Posted: 16 Jun 2016 09:39 AM PDT The news of United Kingdom about to leave the EU is causing a ripple effect on world markets expect Gold to shoot up higher The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 Will be a Complete Bloodbath in the Markets -- Jeff Berwick Posted: 16 Jun 2016 08:30 AM PDT Jeff Berwick 2016 Will be a Complete Bloodbath in the Markets The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Soars to New 2016 High, Breaking Through Key Resistance Posted: 16 Jun 2016 08:26 AM PDT Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Meltdown Is In The Numbers!! -- Gerald CELENTE Posted: 16 Jun 2016 08:01 AM PDT About Gerald Celente : Founder of The Trends Research Institute in 1980, Gerald Celente is a pioneer trend strategist. He is author of the national bestseller Trends 2000: How to Prepare for and Profit from the Changes of the 21st Century and Trend Tracking: The System to Profit from Today's... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold to Yellen, Brexit: “Me Likey” Posted: 16 Jun 2016 08:01 AM PDT As the world’s smartest and most influential economists scratch their collective heads amidst the growing realization by investors that once omnipotent, omniscient central bankers don’t really understand what it is that they are doing (presumably, if they did understand how this all works, they would have fixed things by now) … gold just sits there. The [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

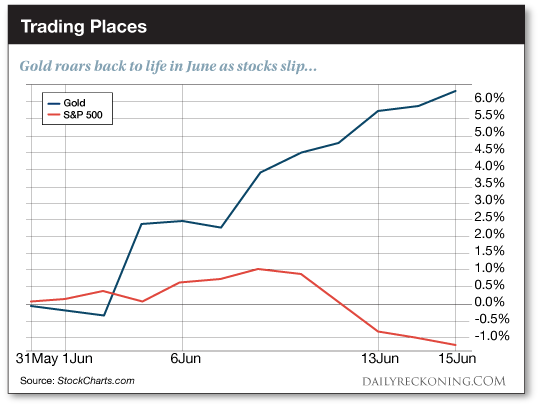

| The Fed Just Sparked Gold’s Next Leg Higher Posted: 16 Jun 2016 06:53 AM PDT This post The Fed Just Sparked Gold’s Next Leg Higher appeared first on Daily Reckoning. It's the least shocking news you'll hear all week: the Fed has decided to keep rates unchanged! We were treated to the usual mumbo jumbo at yesterday's presser. Household spending is up. But job gains have been soft. Auntie Janet even said next week's Brexit vote was one of the reasons the Fed decided to back off… To be clear, no one was expecting a rate hike this month. Fed fund futures gave 2% odds of a hike yesterday before the announcement. Anyone shocked that the Fed held steady needs his head examined. But that didn't stop the markets from pitching a temper tantrum… Stocks fell off a cliff with about a half an hour to go in yesterday's session. The S&P 500 finished lower for the fifth day in a row. It was a different story for gold and other precious metals. Gold futures have steadily advanced since yesterday afternoon. As of early this morning, an ounce of the yellow metal is trading at $1,308. That's a two-year high. Gold's run higher this month has caught many investors with their pants down. I told you yesterday that no one's paying attention to gold anymore. Everyone's freaked out about the Brexit vote and falling stock prices…

As of yesterday's close, gold futures are higher by more than 6% so far in June. The S&P 500 has dropped more than 1.2% over that same timeframe. Now that a June hike is off the table, everyone is speculating about whether the Fed will ditch the doves and hike next month. There are some analysts and economists out there that seem to think a July hike is possible if we get a strong jobs rebound,some positive revisions to the abysmal May report, or if the Britain votes to stay in the EU. Should you listen to these guesses? Of course not. The market's the boss. And right now, Mr. Market ain't buying a July hike. As of yesterday, Fed fund futures forecast the odds of a July rate hike at less than 25%… The stars are aligning in favor of another gold rally. With new two-year highs on the books this morning, we're ready to blast higher heading into the summer… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post The Fed Just Sparked Gold’s Next Leg Higher appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada experiments with digital dollar on blockchain Posted: 16 Jun 2016 05:36 AM PDT By Phillip Stafford Canada is experimenting with putting a digital version of its currency on the blockchain, the distributed-ledger technology that underpins the cryptocurrency bitcoin. The move to put a government-backed currency on blockchain and integrate it into the daily operations of a major central bank would mark a significant advance for the emerging technology. The Bank of Canada revealed it was developing the CAD-Coin, a digital version of the Canadian dollar, in a private presentation in Calgary on Wednesday. According to slides seen by the Financial Times, the initiative will involve issuing, transferring, and settling central bank assets on a distributed ledger. It is codenamed Project Jasper and is being carried out in conjunction with several of Canada's biggest banks, including Royal Bank of Canada, CIBC and TD Bank, as well as Payments Canada. The central bank is expected to reveal more details on Friday. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/1117c780-3397-11e6-bda0-04585c31b153.html ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Jun 2016 05:16 AM PDT MUST READS Wary Fed Rethinks Pace of Hikes – WSJ Dovish Fed tips German 10-year bond yield to record low – Reuters Yellen Says Forces Holding Down Rates May Be Long Lasting – Bloomberg Government bond yields tumble as Brexit retakes spotlight – CNBC Gold just scored a ticket to ride higher from Fed's Yellen – MarketWatch The British government hits [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed Giveth and the Bullion Banks Taketh Away… Posted: 16 Jun 2016 01:00 AM PDT Precious metal expert Michael Ballanger breaks down the gold price roller coaster surrounding the Fed's decision not to raise interest rates. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Could Advance 900% as Central Banks go NUCLEAR During the Next Crisis Posted: 16 Jun 2016 12:28 AM PDT Gains Pains & Capital | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Will a Brexit Vote Impact Gold and Silver Prices? Posted: 15 Jun 2016 09:58 PM PDT The June 23 referendum on whether or not the UK should leave the EU is fast approaching. New polls show that those favoring a leave vote or “Brexit” are leading by 10 to 20 points.This has sent ripples through the markets, as a Brexit is likely to cause economic chaos in the EU, cripple European banks and lead to a Recession. It is not that voters in the United Kingdom want nothing to do with the EU. Instead, they prefer a mutually-beneficial economic relationship, rather than an economic and political arrangement with the Europenan Union: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FED Leaves US Interest Rates Unchanged, Gold and Silver Bounce Posted: 15 Jun 2016 09:56 PM PDT Gold and silver both erased morning declines and pushed higher today after FED chair Janet Yellen announced they would leave interest rates unchanged. Policy makers gave a mixed picture of the U.S. economy, citing growth in some sectors but slowing job gains. While the median forecast of 17 policy makers remained at two quarter-point hikes this year, the number of officials who see just one move rose to six from one in the previous forecasting round in March. The market now sees less than a 50 percent chance of even one rise by year-end. I also expect a maximum of one rate hike this year from the Fed Chair Who Keeps Yellen’ Wolf. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's Hard Landing Has Already Begun! Posted: 15 Jun 2016 09:52 PM PDT The Financial Repression Authority is joined by Richard Duncan, an esteemed author, economist, consultant and speaker. FRA Co-founder, Gordon T. Long discusses with Mr. Duncan about the current Chinese situation and the ramifications being imposed on the global economy. Richard Duncan is the author of three books on the global economic crisis. The Dollar Crisis: Causes, Consequences, Cures (John Wiley & Sons, 2003, updated 2005), predicted the current global economic disaster with extraordinary accuracy. It was an international bestseller. His second book was The Corruption of Capitalism: A strategy to rebalance the global economy and restore sustainable growth. It was published by CLSA Books in December 2009. His latest book is The New Depression: The Breakdown Of The Paper Money Economy (John Wiley & Sons, 2012). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Jun 2016 06:00 PM PDT Marin Katusa on why the rich are snapping up gold. Peter Schiff says “just imagine what’s in store for us now.” Mike Maloney, Chris Hedges and Nigel Farage explore the various ways the system is failing. Andrew Hoffman on the end game for debt monetization. […] The post Top Ten Videos — June 16 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

News today that there was a “terrorist” attack in England got my email inbox fired up with people claiming that my analysis of The Economist Magazine “Year in 2016” at the back of Book 3 was fulfilled.

News today that there was a “terrorist” attack in England got my email inbox fired up with people claiming that my analysis of The Economist Magazine “Year in 2016” at the back of Book 3 was fulfilled.

No comments:

Post a Comment