Gold World News Flash |

- How Will a Brexit Vote Impact Gold and Silver Prices?

- FED Leaves US Interest Rates Unchanged, Gold and Silver Bounce

- China's Hard Landing Has Already Begun!

- China dumping more than Treasuries as U.S. stocks join fire sale

- The Rush to Gold!

- Blueprint for a Bright British Future Post-Brexit

- Gold Price Higher For 5th Session On BREXIT and FED

- Rick Rule — How Will We Know When to Sell our Gold Stocks?

- GATA Chairman Murphy interviewed on volatility in monetary metals

- “The Business of America Isn’t Business Anymore.” It’s Tricked Up Financial Engineering.

- How Will You Cope With A Lower Standard Of Living?

- Currency-nado: Yen, Yuan Surge; Gold Tops $1300; Bitcoin Spikes To 28-Month Highs

- Alex Jones on Reddit "Ask Me Anything" Tuesday 6/14/16

- Pulse Shooting Hoax: DEMO~RATS FILIBUSTER FOR GUN CONTROL!

- Full Event: Donald Trump Holds Rally in Atlanta, GA (6-15-16)

- All Signs Point to Big Financial Crash in 2016-Bill Holter

- BUSTED! OMAR MATEEN IS AN ACTOR CONFIRMED: Was In Afghan Gay Comedy WOW!

- China’s Hidden Plan to Accumulate Gold

- Gold Daily and Silver Weekly Charts - Seriously? - $28 Silver and $1490 Gold

- MSCI Decides To Wait

- The Rush to Gold: A New Respect Is Growing

- Saville has no time to answer challenging questions

- Alignment Of The Dow, Interest Rates, Debt and Silver Cycles Will Deliver A Fatal Blow

- Will Brexit Give The US Negative Interest Rates?

- The Financial Argument for #Brexit (#VoteLeave #VoteRemain #StrongerIn)

- ORLANDO FALSE FLAG OPERATION

- Dollar Collapse is coming in 2016 Trump about Economy Money Bubble

- Countdown to the End of the World: 8 Days

- Gerald Celente -- As Economic Outlook Dims, Gold Glows

- Here’s Why You Must Watch Gold Miners on “Fed Day”

- China & Russia Buying Gold as Safe Haven

- Gold Bull Or Bear Market: Why June 2016 Is The Most Important Month Of The Decade

- Gold Price Rally

- Why June 2016 Is the Most Important Month of the Decade for Gold

| How Will a Brexit Vote Impact Gold and Silver Prices? Posted: 16 Jun 2016 12:58 AM PDT The June 23 referendum on whether or not the UK should leave the EU is fast approaching. New polls show that those favoring a leave vote or “Brexit” are leading by 10 to 20 points.This has sent ripples through the markets, as a Brexit is likely to cause economic chaos in the EU, cripple European banks and lead to a Recession. It is not that voters in the United Kingdom want nothing to do with the EU. Instead, they prefer a mutually-beneficial economic relationship, rather than an economic and political arrangement with the Europenan Union: |

| FED Leaves US Interest Rates Unchanged, Gold and Silver Bounce Posted: 16 Jun 2016 12:56 AM PDT Gold and silver both erased morning declines and pushed higher today after FED chair Janet Yellen announced they would leave interest rates unchanged. Policy makers gave a mixed picture of the U.S. economy, citing growth in some sectors but slowing job gains. While the median forecast of 17 policy makers remained at two quarter-point hikes this year, the number of officials who see just one move rose to six from one in the previous forecasting round in March. The market now sees less than a 50 percent chance of even one rise by year-end. I also expect a maximum of one rate hike this year from the Fed Chair Who Keeps Yellen’ Wolf. |

| China's Hard Landing Has Already Begun! Posted: 16 Jun 2016 12:52 AM PDT The Financial Repression Authority is joined by Richard Duncan, an esteemed author, economist, consultant and speaker. FRA Co-founder, Gordon T. Long discusses with Mr. Duncan about the current Chinese situation and the ramifications being imposed on the global economy. Richard Duncan is the author of three books on the global economic crisis. The Dollar Crisis: Causes, Consequences, Cures (John Wiley & Sons, 2003, updated 2005), predicted the current global economic disaster with extraordinary accuracy. It was an international bestseller. His second book was The Corruption of Capitalism: A strategy to rebalance the global economy and restore sustainable growth. It was published by CLSA Books in December 2009. His latest book is The New Depression: The Breakdown Of The Paper Money Economy (John Wiley & Sons, 2012). |

| China dumping more than Treasuries as U.S. stocks join fire sale Posted: 16 Jun 2016 12:47 AM PDT By Andrea Wong and Oliver Renick For the past year Chinese selling of Treasuries has vexed investors and served as a gauge of the health of the world's second-largest economy. The People's Bank of China, owner of the world's biggest foreign-exchange reserves, burnt through 20 percent of its war chest since 2014, dumping about $250 billion of U.S. government debt and using the funds to support the yuan and stem capital outflows. While China's sales of Treasuries have slowed, its holdings of U.S. equities are now showing steep declines. The nation's stash of American stocks sank about $126 billion, or 38 percent, from the end of July through March, to $201 billion, Treasury Department data show. That far outpaces selling by investors globally in that span -- total foreign ownership fell just 9 percent. Meanwhile, China's U.S. government-bond stockpile was relatively stable, dropping roughly $26 billion, or just 2 percent. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-06-15/china-dumping-more-tha... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 15 Jun 2016 11:01 PM PDT Guest post from: Guy Christopher, Originally Published on Money Metals Exchange You didn’t come here today for bad news. There’s plenty of that everywhere you look, and even where you... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Blueprint for a Bright British Future Post-Brexit Posted: 15 Jun 2016 11:00 PM PDT by John Butler, GoldMoney:

FIVE ELEMENTS FOR POST-BREXIT ECONOMIC SUCCESS Britain was at the center of the industrial revolution which over the course of roughly a century completely transformed the European and North American economies. While associated naturally with technological advances, the industrial revolution nevertheless required a high rate of investment. This was enabled in large part by strong British private property rights and economic policies such as the gold-standard which encouraged a high rate of saving. While many new and promising technologies are coming online today and promise to do so in future, without sufficient savings Britain will not be able to sustain the rates of investment required to realize their potential. Moreover, it stands to reason that you aren't saving sufficiently if you carry around a massive, accumulating national debt. Debt service is also a drag on future growth. Thus if the British want to prosper long-term, whether inside or outside the EU, they are going to need to reduce the national debt as a share of national income. This is the first, essential element for an independent Britain to thrive. |

| Gold Price Higher For 5th Session On BREXIT and FED Posted: 15 Jun 2016 10:00 PM PDT by Mark O'Byrne, GoldCore:

Watch Gold Jump To $1,400 If U.K. Votes To Brexit (Marketwatch) |

| Rick Rule — How Will We Know When to Sell our Gold Stocks? Posted: 15 Jun 2016 08:30 PM PDT from JayTaylorMedia: |

| GATA Chairman Murphy interviewed on volatility in monetary metals Posted: 15 Jun 2016 07:46 PM PDT 10:45p ET Wednesday, June 15, 2016 Dear Friend of GATA and Gold: Interviewed by Elijah Johnson of Finance and Liberty, GATA Chairman Bill Murphy discusses the increasingly volatile trading in gold and silver, signs that the suppression of monetary metals prices is weakening, the U.S. government's involvement in price suppression, and the possibility that the physical market for the metals will break the paper market. The interview is 17 minutes long and can be heard at You Tube here: https://www.youtube.com/watch?v=LRF7dORZpwQ&index=2&list=PLNwUWnJgSq_LsS... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| “The Business of America Isn’t Business Anymore.” It’s Tricked Up Financial Engineering. Posted: 15 Jun 2016 07:20 PM PDT by Pam Martens and Russ Martens, Wall St On Parade:

Foroohar, who has been a financial journalist for 23 years, correctly concludes that Wall Street has come to "rule" rather than to "fuel" the real economy. This has created a "dysfunctional financial system" that is doomed to another collapse, "taking us all down with it," unless critical repairs are made soon. Foroohar maps out exactly what those repairs must be in her last chapter.

The author gives a litany of examples to show how "finance has transitioned from an industry that encourages healthy risk-taking, to one that simply creates debt and spreads unproductive risk in the market system as a whole." One case study Foroohar examines is the technology company, Apple, and its use of share buybacks built on borrowed money. Unfortunately, Apple is part of a mushrooming trend in such financial engineering. Foroohar writes: "…Apple's behavior is no aberration. Stock buybacks and dividend payments of the kind being made by Apple – moves that enrich mainly a firm's top management and its largest shareholders but often stifle its capacity for innovation, depress job creation, and erode its competitive position over the longer haul – have become commonplace. The S&P 500 companies as a whole have spent more than $6 trillion on such payments between 2005 and 2014, bolstering share prices and the markets even as they were cutting jobs and investment." The flip slide of this financial trickery (she calls it "financialization') says Foroohar is that "our economy limps along in a 'recovery' that is tremendously bifurcated. Wage growth is flat. Six out of the top ten fastest-growing job categories pay $15 an hour and workforce participation is as low as it's been since the late 1970s. It used to be that as the fortunes of American companies improved, the fortunes of the average American rose, too. But now something has broken that relationship." |

| How Will You Cope With A Lower Standard Of Living? Posted: 15 Jun 2016 07:00 PM PDT Submitted by Tom Chatham via Project Chesapeake, The forces are mounting that will eventually overwhelm most Americans and send their standard of living to unknown depths. Americans that have only known the post WWII prosperity are ill equipped and educated to deal with depression level living. Easy credit and instant gratification have created a nation of whining, self absorbed, entitlement minded people with no moral or mental toughness. Doug Casey believes we are headed for what he calls a super depression created by the ending of a debt super cycle. The bigger the debt cycle the bigger the depression that follows. That’s how reality works and most people are not prepared for reality. When this depression, which has already started, gets momentum, it will overwhelm the plans of a society that is expecting to get things like social security, pensions and payouts from retirement plans they have paid into for many years. All of those things will disappear almost overnight and leave society gasping and stupefied over what to do. Their reactions will be to yell and scream and try to identify who to blame but the only person they should blame is the one in the mirror. Many very smart people have raised the alarm and done their best to warn the sleeping public, but those slumbering masses have ignored the warnings and hit the snooze button one more time. The masses do not understand economics, do not want to understand economics and they will pay dearly for that ignorance in the coming days. When the real unemployment rate becomes common knowledge as it increases substantially, people will be left to survive on what resources they have saved up outside the banking system that cannot be stolen by the politicians and bankers. That is a key point here. The assets you have outside the system that cannot be stolen from you with a few key strokes on some computer. Those hoping for some miraculous event that will send the U.S. back to the days of manufacturing might and jobs for all will never see it happen. Those days are gone. The west line theory tells us our economy will slow down and become more modest as the shipping center of the world moves west to the next powerhouse region which is Asia. This is what history teaches us. When people suddenly wake up one morning and they have no job, their retirement is gone and they need to care for their family, what will they do? When government services have collapsed and they suddenly realize they are now living in a third world country with few government services, what will they do? When the banks are closed and only a select few connected people have any type of money or access to goods, what will they do? This is the reality that many people will face in the future and they have no idea how bad it can get. They refuse to contemplate the harsh reality they will be living in and take steps to mitigate the effects. To do so would be to acknowledge it could happen and they are taking personal responsibility. Personal responsibility is a dirty phrase in today’s entitlement society. To see some of the effects one only has to look at the collapse of society in Venezuela today to see what awaits. When it happens it will all fall back to you to take responsibility for your family and take care of them for the duration. To do that you need to plan now for that eventuality and build up the resources you will need to provide food, shelter, clothing and security when the system fails to do it for you. You need to be Noah on his ark not the people watching as he floated away. Having resources stored up is a must but it may not get you all the way through if the situation lasts for many years. That is why you need some type of plan to replace those resources as time goes by and have some way to generate some type of income or at least items to trade. Usable goods are for the short term and things like gold ,silver and production equipment are for the long term to help you get through the crisis with the least amount of pain. Even with proper planning the days ahead will not be easy as the standard of living of society will fall substantially to levels only seen in failed third world countries or old pictures. The assets actually owned by people today is very small compared to how they live. They will default on their home loan, their car loan, and their credit card debt leaving them with very few real possessions and few ways to move what they have left even if they have some place to go. Ultimately these people will become the new serfs to the wealthy class that will take possession of anything of value. Feudalism will once again rule. The lack of planning by society will make this a reality if it is allowed. What will you do when everything you have worked a lifetime for is suddenly taken away? Do you have a plan to keep what you have? Do you have a plan to make money when you cannot find a job? Do you have a way to take care of your family until things stabilize? Do you have a home you will not lose if the whole system breaks down? What will you do if electricity or fuel is too expensive to buy or not available to the general population? These are the questions you should be asking yourself now and you better have a good answer because your family will be asking them when the greater depression sets in. |

| Currency-nado: Yen, Yuan Surge; Gold Tops $1300; Bitcoin Spikes To 28-Month Highs Posted: 15 Jun 2016 06:23 PM PDT The US Dollar continues to slide (after bouncing off Fed statement plunge lows), as it appears a rush to other 'currencies' is under way. USDJPY is plumbing new depths beyond Oct 2014's lows (before the end of QE3 and start of QQE2), offshore Yuan is rallying (back below 6.60), gold just hit $1300 (pushing May highs back to Jan 2015 highs), and finally Bitcoin is spiking as China opens once more (now above $700), its highest since Feb 2014. Japanese bonds are at new record low yields (and Treasuries are pushing lower with 10Y at 1.55% near Feb's flash-crash lows). JGB yields are plumbing record lows...

And the 10Y Treasury is near flash-crash lows...

As money flows into Yen...

And Yuan...

And it seems its not just 'normal' currencies, market participants are running from fiat in general... As Bitcoin soars over $730 - 28 month highs....

And Gold tops $1300 once again...

Charts: Bloomberg |

| Alex Jones on Reddit "Ask Me Anything" Tuesday 6/14/16 Posted: 15 Jun 2016 06:00 PM PDT Reddit if people died in Orlando it was a blood sacrifice to distract the Bilderberg meeting and all the Hitlery shit,,,,,so obvious,,,,either fake or a sacrifice,,,,It is Gematria,,numerology is their language,,follow the numbers The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Pulse Shooting Hoax: DEMO~RATS FILIBUSTER FOR GUN CONTROL! Posted: 15 Jun 2016 04:36 PM PDT After folks awaken to 9/11, Sandy Hoax, and the Boston Hoaxathon, these traitors are gonna have "a bit of trouble" taking anyone's guns. That's why they're in such a hurry. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Full Event: Donald Trump Holds Rally in Atlanta, GA (6-15-16) Posted: 15 Jun 2016 03:30 PM PDT Wednesday, June 15, 2016: Full replay of the Donald J. Trump for President rally in Atlanta, GA at the Fox Theater. Full Event: Donald Trump Holds Rally in Atlanta, GA (6-15-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| All Signs Point to Big Financial Crash in 2016-Bill Holter Posted: 15 Jun 2016 02:57 PM PDT By Greg Hunter's USAWatchdog.com Dear CIGAs, Financial writer Bill Holter says there are many signs that are signaling big trouble. Holter's list starts with the troubled banking giant Deutsche Bank and says it is his top candidate for the next Lehman style financial meltdown. Holter explains, "It would make sense that they are the candidate... Read more » The post All Signs Point to Big Financial Crash in 2016-Bill Holter appeared first on Jim Sinclair's Mineset. |

| BUSTED! OMAR MATEEN IS AN ACTOR CONFIRMED: Was In Afghan Gay Comedy WOW! Posted: 15 Jun 2016 02:30 PM PDT Omar Mateen is an ACTOR Who Appeared in "The Big Fix" - Pulse Shooting Hoax Omar Mateen appeared in a documentary about BP oil spill six years before Orlando shooting (VIDEO) www.nydailynews.com/news/national/omar-m The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| China’s Hidden Plan to Accumulate Gold Posted: 15 Jun 2016 01:52 PM PDT This post China's Hidden Plan to Accumulate Gold appeared first on Daily Reckoning. China wants to do what the U.S. has done, which is to remain on a paper currency standard but make that currency important enough in world finance and trade to give China leverage over the behavior of other countries. The best way to do that is to increase its voting power at the IMF and have the yuan included in the IMF basket for determining the value of the special drawing right. Getting those two things requires the approval of the United States because the U.S. has veto power over important changes at the IMF. The U.S. can stand in the way of Chinese ambitions. China accomplished that last November when the IMF agreed to include the yuan in its basket of currencies. The rules of the game also say you need a lot of gold to play, but you don't recognize the gold or discuss it publicly. Above all, you do not treat gold as money, even though gold has always been money. The members of the club keep their gold handy just in case, but otherwise, they publicly disparage it and pretend it has no role in the international monetary system. China will be expected to do the same. It's important to note that China will not act in the best interests of gold investors; it will act in the best interests of China. Right now, China officially does not have enough gold to have a "seat at the table" with other world leaders. Think of global politics as a game of Texas Hold'em. What do want in a poker game? You want a big pile of chips. Gold serves as political chips on the world's financial stage. It doesn't mean that you automatically have a gold standard, but that the gold you have will give you a voice among major national players sitting at the table. For example, Russia has one-eighth the gold of the United States. It sounds like they're a small gold power — but their economy's only one-eighth as big. So, they have about the right amount of gold for the size of their economy. The U.S. gold reserve at the market rate is under 3% of GDP. That number varies because the price of gold varies. For Russia, it's about the same. For Europe, it's even higher — over 4%. In China, that number is about 0.7% officially. Unofficially, if you give them credit for having, let's say, 4,000 tons, it raises them up to the U.S. and Russian level. But they want to actually get higher than that because their economy is growing, even if it's at a much lower rate than before. Here's the problem: If you took the lid off of gold, ended the price manipulation and let gold find its level, China would be left in the dust. It wouldn't have enough gold relative to the other countries, and because the price of gold would be skyrocketing, they could never acquire it fast enough. They could never catch up. All the other countries would be on the bus while the Chinese would be off. When you have this reset, and when everyone sits down around the table, China's the second largest economy in the world. They have to be on the bus. That's why the global effort has been to keep the lid on the price of gold through manipulation. I tell people, if I were running the manipulation, I'd be embarrassed because it's so obvious at this point. The price is being suppressed until China gets the gold that they need. Once China gets the right amount of gold, then the cap on gold's price can come off. At that point, it doesn't matter where gold goes because all the major countries will be in the same boat. As of right now, however, they're not, so China has though to catch-up. There is statistical, anecdotal and forensic evidence piling up for this. All of it is very clear. I've also spoken to members of Congress, the intelligence community, the defense community and very senior people at the IMF about it. China is our largest trading partner. It's the second largest economy in the world. The U.S. would like to maintain the dollar standard. I've described some catastrophic scenarios where the world switches to SDRs or goes to a gold scenario, but at least for the time being, the U.S. would like to maintain a dollar standard. Meanwhile, China feels extremely vulnerable to the dollar. If we devalue the dollar, that's an enormous loss to them. That's why, behind the scenes, the U.S. needs to keep China happy. One way to do that is to let China get the gold. That way, China feels comfortable. If China has all paper and no gold, and we inflate the paper, they lose. But if they have a mix of paper and gold, and we inflate the paper, they'll make it up on the gold. So they have to get to that hedged position. Gold is liquid, but it's a fairly thin market. If I call JP Morgan and say, "Hey, I want to buy 500 tons of gold," I can't do it. That would be a huge order. An order like that has to be worked between countries and central banks behind the scenes. It's done at the BIS, the Bank for International Settlements, in Basel, Switzerland. They're the acknowledged intermediary for gold transactions among major central banks and private commercial banks. That's not speculation. It's in the footnotes of the annual BIS report. I understand it's geeky, but it's there. They have to acknowledge that because they actually get audited. Unlike the Fed and unlike Fort Knox, the BIS gets audited, and they have to disclose those kinds of things. The evidence is there. China is saying, in effect, "We're not comfortable holding all these dollars unless we can have gold. But if we are transparent about the gold acquisition, the price will go up too quickly. So we need the western powers to keep the lid on the price and help us get the gold, until we reach a hedged position. At that point, maybe we'll still have a stable dollar." The point is that is that there is so much instability in the system with derivatives and leverage that we're not going to get from here to there. We're not going to have a happy ending. The system's going to collapse before we get from here to there. At that point, it's going to be a mad scramble to get gold. Gold is still the safest asset, and every investor should have some in their portfolio. The price of gold will go significantly higher in the years ahead. But contrary to what you read in the blogs, gold won't go higher because China is confronting the U.S. or launching a gold-backed currency. It will go higher when all central banks, China's and the U.S.' included, confront the next global liquidity crisis, worse than the one in 2008, and individual citizens stampede into gold to preserve wealth in a world that has lost confidence in all central banks. When that happens, physical gold may not be available at all. The time to build your personal gold reserve is now. Regards, Jim Rickards P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post China's Hidden Plan to Accumulate Gold appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - Seriously? - $28 Silver and $1490 Gold Posted: 15 Jun 2016 01:45 PM PDT |

| Posted: 15 Jun 2016 12:18 PM PDT This post MSCI Decides To Wait appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Front and center this morning is the news from the MSCI (we talked about this yesterday) where they declined to include Chinese A shares in their Emerging Market Indices. They gave a laundry list of reasons why they were going to review the inclusion next year, but in the end, it’s a real blow to the Chinese who were looking for two things here: 1. A boost to the Shanghai Stock Exchange, that’s the worst performing exchange the past 12 months, and 2. And this is where I was excited. If all those Chinese A shares were going to be purchased, the currency/renminbi, was going to have to be purchased to settle the trades, and that would have meant another step toward openness in China’s Capital Markets. But all that was put on hold by the MSCI decision to wait and review it again next year. UGH! The dollar is taking a breather today, and the for the most part, the currencies are trading the in the same clothes as yesterday. With the exceptions being the Aussie dollar (A$) , New Zealand dollar/kiwi, Brazilian real, and Russian ruble, which are all vying for best performer overnight vs. the dollar. It’s a Fed rate decision day, and with all the focus now on no rate hike today, these relatively speaking, high yielders have been given some love by the traders. And there was no new Poll on the BREXIT referendum so the last poll showing the “leave vote” in the lead is still on the minds of pound sterling traders and investors. I had a meeting yesterday with Joseph Stolzer and Chris Gaffney, as it was time for our monthly Managed Currency Committee to meet. I mentioned to them that the Swiss franc was really perking up but that we had missed this opportunity to buy it cheaper. I also mentioned what I’ve told you here in the Pfennig, and that is that I think a lot of the franc buying is coming from investors leaving the pound, in fear that BREXIT will take place. So, that brings up a good question… Should an investor just walk away and forget about buying as asset if it has already had a nice bump up? I’ve always been someone that looks at buying an asset differently than most people. I’ve always been the guy that if he likes something and wants to own it, he just goes out and buys it, no worries on the entry price. Of course something has to have “opportunity buy” written all over it first! So, why did I make such a big deal out of missing the opportunity to buy francs cheaper? Another good question! The answers to those and many more questions will be given in future Pfennigs! HA! So, make sure you read each day! HA! So, the Big Kahuna deal today is the Fed rate decision that ends their two days of playing board games to pass the time. I suspect that Fed chair, Janet Yellen, will be fair and balanced in the statement following the meeting, where the Fed will leave rates unchanged. She’s still hanging her hat on the resurgence of the labor market, and just tries to sweep the inflating of the economy under a rug so that no one notices what a failure it has been. I mentioned yesterday that with everyone on board with the idea that the Fed will leave rates unchanged today, that they could throw a cat among the pigeons and surprise the markets with a rate hike today. Talk about causing chaos! We would need to call Maxwell Smart! But not to worry, that’s got a snowball’s chance in hell of happening today. Speaking of Inflation… I was watching a video by Wall Street Daily of an interview with Jim Rogers, and in the interview, Jim said something that made me laugh. The conversation was about how consumers feel the weight of inflation every day, but the official government figures, supplied by the BLS, show that inflation barely exists. Jim said, ” Well, the BLS has a secret place to shop, where there’s never any inflation”. And he must be right, because the inflation I’ve seen in insurance, health care, tuitions, travel, and the list goes on, is strong. But the BLS keeps telling us that we should move along, for these are not the droid we’re looking for. While we’re talking about the U.S. Well, we’ve known about the debt problems of Michigan, Illinois, New York, and California for a few years now, but now we have to add a new one to our watch. Just last week it was reported that the city of Honolulu is short $1.4 billion in their retiree’s pension Benefits. I’m beginning to get the feeling that there aren’t any pension plans that are fully funded, and that’s a pretty ugly place to go to, so I stay away from there, but it’s information like this that sends me there. NO! I don’t want to go there! You can’t make me go there! There’s another Central Bank meeting today. The Bank of Japan (BOJ) will meet tonight, and once again the markets are wishin’ and hopin’ and thinkin’ and prayin’ (Ahhh, the lovely Dusty Springfield) that the BOJ announces additional stimulus. It’s been this way for a few months now, that the markets believe the BOJ will announce additional stimulus, and then they get nothing, absolutely nothing, say it again! At this point, who cares if the BOJ implements additional stimulus? They’ve been implementing stimulus measures for over two decades now, I think the chance of any of those working some magic on the Japanese economy have had a slim chance of doing any good, and Slim left town! So, now it’s like piling on in football, they are just piling on, but as guys jump on the pile, it makes no difference the ball carrier is still down, and so it is with additional stimulus here, as they add stimulus to the economy that’s already down it makes no difference! Tomorrow the Swiss National Bank (SNB) and the Bank of England (BOE) will meet. Nothing special about these meeting will take place as far as I can see, but just wanted to get them on the docket. The price of oil seems to be stuck at $48 and change where it has traded for the three trading days this week. What it’s waiting for beats me, unless the oil traders are still holding out thinking that the Fed will hike rates today. The EIA weekly petroleum supply prints today, and last week we had crude supply fall, but the products like gas increase. The price of gas sure has reacted to the move in the price of oil. I don’t recall it moving down as fast as it is moving up when the price of oil plunged last year. Do you? But isn’t that like just about everything else? Take interest rates. They sure go up fast, but go down slow. Gold added a buck-seventy yesterday ($1.70) but is down $4 bucks in the early trading today. I told you about the three things that Central Banks could do to inflate their economies, and one of those things was a repricing of gold. The more I thought about this yesterday, the more the idea came to me that what if the two countries (China and Russia) that have been hoarding gold production in the past 10 years were planning on implementing this “gold repricing” themselves and thus taking over the gold market? Hmmm, it would take a country with a large gold reserve, and both China and Russia have that, and it keeps growing all the time too! I know, I know this could be viewed as conspiracy theory, but I look at it like this. I see it as a “possibility” And gives another answer to why these two countries have been hoarding gold all these years! The U.S. Data Cupboard had the May Retail Sales data for us yesterday, and the data surprised a bit to the upside with a 0.5% increase. I had half-expected this to print at 0.3%, but the difference is miniscule so I won’t complain about the number. I would say that this number is curious, given the fact that Department Store Sales fell -0.9% in May. Online sales must be the rage these days. And I guess when I think about it, I bought three different things this month, and bought them all online. But what happens to all those bricks and mortar stores when no one goes there any longer? The comedian Chris Rock has a funny routine centered around what happens to mall stores when no one goes to the mall any longer. To follow up on the stronger than expected Retail Sales for May. and just in time I might add, is the Connecting Dots letter by Tony Sagami at www.mauldineconomics.com who tells us that Credit Card Debt is rising at a pace that Credit Card Watchdog: CardHub, estimates that American Credit Card balances will hit $1 trillion in 2016, a level of debt that has never been reached before. And not only are Americans borrowing more on their credit cards, they are paying it back at a snail’s pace. In the first quarter of this year $71 billion was put on credit cards, and only $26.8 billion was repaid. The smallest paydown for a quarter since 2008. So, in essence this is exactly what I thought was going to begin to happen. We are Americans! We see things and want to buy them, now! We don’t wait for sales! Ok, some of you do, but for the most part it’s like I said it was. And if we don’t have the cash in the bank to pay for what we want, we put it on credit cards. Have you ever seen someone pull out two cards and say, “put “X amount” on this card and the rest on this other card? Well, that’s where we are heading. Aye, aye, aye. Heaven’s to Murgatroid! And we ran up this debt, for what? For years now, I’ve told people, and even wrote about this here and in the old Currency Capitalist newsletter I wrote for the Sovereign Society, that The U.S. would never suffer decades of deflation like the Japanese are doing, because we like to buy things. But sooner or later, you have to pay the piper. The Credit Card companies have interest rates around 15%, so you’ll never get ahead by allowing the debt to grow on your credit card. And that’s when the card companies and the banks that issue the cards will have problems. But don’t let that worry you. That’s what bailouts are for! Once again I turn to Ed Steer’s letter this morning to find this article that can be found on Reuters, and is about how DoubleLine’s Gundlach say’s Central Banks are losing control. Sounds like something I’ve said once or twice before doesn’t it? Oh well, you can read it here, or here is your Snippet:

Chuck again. Notice the article says “the first of heavyweights” to say Central Banks are losing control? Well, I would certainly be considered a “heavyweight” if we were just talking about physical presence! HAHAHAHAHA! But I guess I’m not a “heavyweight” like the Gundlach, Gross, Rickards, Casey, etc. I’m just a country boy trying to make it in the big city! That’s it for today. I hope you have a wonderful Wednesday, and remember to be good to yourself. Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post MSCI Decides To Wait appeared first on Daily Reckoning. |

| The Rush to Gold: A New Respect Is Growing Posted: 15 Jun 2016 12:18 PM PDT You didn't come here today for bad news. There's plenty of that everywhere you look, and even where you don't look. So here's the good news. A new rush to gold has begun. To see where we're headed, let's first see where we've been. Gold and silver owners in the first ten years of this new century were in for quite a ride, watching gold soar to $1,895 and silver to $49 by 2011. Even those who jumped in midway saw their paper money values zoom. |

| Saville has no time to answer challenging questions Posted: 15 Jun 2016 12:18 PM PDT 3:19p ET Wednesday, June 15, 2016 Dear Friend of GATA and Gold: Yesterday your secretary/treasurer tried to put to newsletter writer Steve Saville 11 questions to dispute his assertion this week, in an essay headlined "Four Charts that Invalidate the Gold Price Suppression Story" -- http://tsi-blog.com/2016/06/four-charts-that-invalidate-the-gold-price-s... -- that complaints about manipulation of the gold market are nonsense. Your secretary/treasurer's challenge to Saville was headlined "Saville Loves His Charts But They Don't Answer the Market-Rigging Question": http://www.gata.org/node/16512 Your secretary/treasurer's questions largely involved GATA's extensive documentation of surreptitious intervention in the gold market by governments. In a short posting at his Internet site today, headlined "I Don't Love Charts!," Saville replied that responding to the questions "would not be a good use of my time." Instead he simply professed his good intentions and integrity: http://tsi-blog.com/2016/06/i-dont-love-charts/ Of course the questions for which Saville lacks time are only the questions for which all writers who provide technical analysis of the markets generally and the gold market particularly never have time. For honest answers would put their craft out of business. These writers make sweeping assertions on a subject about which they are supremely uninformed but can't defend them. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Alignment Of The Dow, Interest Rates, Debt and Silver Cycles Will Deliver A Fatal Blow Posted: 15 Jun 2016 11:58 AM PDT Since the inception of the debt-based monetary system (with its fractional-reserve banking), the banks have been playing a nasty game of Russian roulette. The only reason that the system has not blown-up is because the relevant cycles have not adequately lined up to deliver a fatal blow. They have been allowed to play it long enough, and it now appears that the fatal blow will be delivered soon (just like Russian roulette when you play it long enough). The coming Dow crash is the likely trigger that will deliver this blow. |

| Will Brexit Give The US Negative Interest Rates? Posted: 15 Jun 2016 10:58 AM PDT One of the oddest things in this increasingly odd world is the spread of negative interest rates everywhere but here. Why, when the dollar is generally seen as the premier safe haven currency, would Japan and much of Europe have government bonds — and some corporate bonds — trading with negative yields while arguably-safer US […] The post Will Brexit Give The US Negative Interest Rates? appeared first on DollarCollapse.com. |

| The Financial Argument for #Brexit (#VoteLeave #VoteRemain #StrongerIn) Posted: 15 Jun 2016 10:30 AM PDT Britain will be in a better financial position if it unshackles itself from the stagnant Eurozone. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 15 Jun 2016 09:30 AM PDT I always thought that this shooting was too planned out wake up Americans us is being PURGED 50 here, 4000 there, maybe entire cities at this rate! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Dollar Collapse is coming in 2016 Trump about Economy Money Bubble Posted: 15 Jun 2016 09:00 AM PDT Here are some of videos about US economy in 2016 Current Economic Collapse News Brief - Episode 995 Must Listen: The Economy Is Scheduled To Collapse The Second Half Of This Year: Bix Weir We Won't Get Through The Elections Without Major Disruptions To The Finanical System: John Williams Why... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Countdown to the End of the World: 8 Days Posted: 15 Jun 2016 09:00 AM PDT This post Countdown to the End of the World: 8 Days appeared first on Daily Reckoning. In eight days, the world will end in a blinding flash. We will all be vaporized. At least that's the feeling "someone" wants me to get with the incessant and apocalyptic headlines regarding the U.K. You see, on June 23, the Brits take to the ballot box to decide their future. And if current polls hold true, it's the day the U.K. will vote to end its membership in the European Union (EU). According to mainstream media prostitutes, the British have lost their ever-loving mind… and will trigger a global financial Armageddon by voting for their sovereignty. And that's exactly what the elites want you to believe. Utter Contempt for DemocracyWhen the European Union was established under its current name in 1993, its stated purpose was to "enhance European political and economic integration." That sounds so warm and fuzzy. But that well-meaning "happy talk" has since spawned a blood-sucking monster… Like all centrally planned states, the EU has metastasized… expanding its tentacles and power immensely. It has become its own quasi-nation-state… with its own flag, currency, anthem, capital (Brussels) and a massive bureaucracy that doesn't give a damn about voters. For decades, unelected EU bureaucrats, known as Eurocrats, have created stifling rules and regulations that they themselves are exempt from. And for them, it's all one big party. These sleazy Eurocrats have no problem getting drunk at official ceremonies and chasing hookers. Doubt me? Go look at the video of a stumbling drunk Jean-Claude Juncker, the European Commission President, slapping and kissing other men and women in the middle of the day for the world to see. They act this way because they know they are untouchable. These "Gods" in Brussels have been aided and abetted by big banks and multinational corporations. The special interests support EU leadership in exchange for unfair regulations that destroy all competition. Think of the EU as the Deep State's satellite European office. It's a home away from home. Bottom line, international corporations and their elite handlers are fat and happy from unfettered bureaucratic state expansion… all the while the standard of living of average Europeans has disintegrated. In the past, when European voters tried to break up this corrupt system, the EU literally halted democracy… When citizens rejected the EU constitution and bailout, Eurocrats either forced a re-vote or just ignored the vote. But now, it appears the Brits have reached their boiling point. They're close to leaving the EU, in what's being called a "Brexit"… Project FearNot surprisingly, elites that oppose Brexit have resorted to what the Deep State always does when its power is threatened: unadulterated fear that you will die tomorrow. They've been using their hyperventilating cronies in the media to warn that a Brexit will bring economic catastrophe… a currency meltdown… mass poverty… and literally the end of the Western world. British Prime Minister David Cameron has said it could cause World War III. And if the polls remain in favor of Brexit in the coming days, I'm sure we'll hear that it will lead to nuclear war. All this because the British people want their sovereignty back from perverted unelected elites in Brussels? No. There's something much more powerful at work here. And the Deep State knows it… You see, Brexit strikes at the root of bureaucratic and corrupt governmental power. The British people are rebelling against both of their main political parties. Writer Peter Hitchens summed it up perfectly when he wrote: "Labour doesn't love the poor. It loves the London elite. The Tories don't love the country. They love only money." That's the crux. Like we are seeing in the U.S., the two main political parties in Britain are at war with their own people. But with this election cycle, the war is no longer secret or unfocused. The voters finally know thy enemy. Does that mean there is a chance for the elite power grip to be broken? Who Wins This War?My money is on the Deep State and its cronies by hook or crook. They play to win. And they've got the money and power to take what they want or kill off the opposition. But for the first time in a long while, the Deep State is on "high alert." That's because the existing political order is in danger of being swept away. Consider this… A Pew Research Center poll found that 61% of usually Eurocentric French voters have an "unfavorable" view of the EU, with a clear majority preferring that power be returned to the French parliament. When the EU has lost the French, it's in grave danger. And if the Brits manage to wrest control of their country back, that will only empower the French… the Germans… the Italians… That's what makes June 23 such a huge day. Will the first salvo in the Deep State revolt succeed? You know who I'm rooting for. And if the Brexit does cause short-term market chaos… well, we'll be ready to profit by following whichever trends emerge… either up or down. Please send me your comments to coveluncensored@agorafinancial.com. Are you for or against Brexit? Regards, Michael Covel The post Countdown to the End of the World: 8 Days appeared first on Daily Reckoning. |

| Gerald Celente -- As Economic Outlook Dims, Gold Glows Posted: 15 Jun 2016 07:32 AM PDT Gerald Celente - Trends In The News - "As Economic Outlook Dims, Gold Glows" - (6/14/16) "Renewed global growth concerns", "foreign buyers flee Tokyo market" & "Big Bet of 2016: Buy Gold". The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

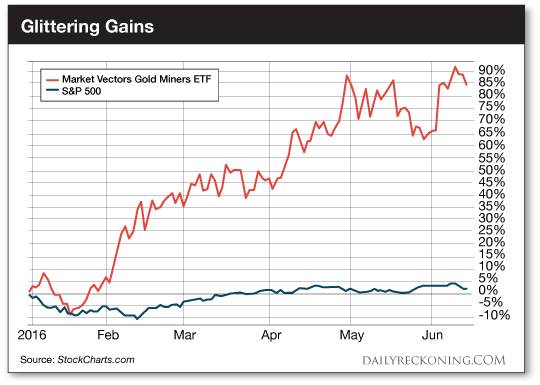

| Here’s Why You Must Watch Gold Miners on “Fed Day” Posted: 15 Jun 2016 06:50 AM PDT This post Here’s Why You Must Watch Gold Miners on “Fed Day” appeared first on Daily Reckoning. If you're looking for a new way to invest in gold, you should consider flying to Japan to take advantage of the country's latest fast food promotion. McDonalds franchises aren't faring well in Japan. So in an effort to gin up some business, the world's biggest burger chain is resorting to some rather unique offers… "In April, the fast food giant created a big mac with three times the amount of meat," Quartz reports. "Now, the company has launched a Willy Wonka-style competition, in which a lucky customer can win an 18-karat gold chicken McNugget valued at $1,500." Just don't accidentally try to eat the thing… Of course, you don't actually have to fly to Japan and enter some wacky contest to play gold's rise. Playing gold mining stocks is easier—and more profitable. Today, we're going to take a look at how the sector is setting up. And you'll see when you should look to get in for a fresh trade to ride the next leg higher. While stocks have chopped back and forth, gold miners are having a banner year. The Market Vectors Gold Miner ETF (NYSE:GDX) is up a staggering 85% year-to-date. Yes, the gold miners could be overextended at this point. But for a downright difficult year for stocks they've offered plenty of trading opportunities.

But here's the thing… No one's paying attention to gold anymore. Everyone's mesmerized by the Brexit vote, the Fed and some renewed volatility in stocks over the past week. Absolutely no one is watching gold. And that's a big mistake… To be fair, gold trading started to get difficult last month. In late April, we alerted you to a breakdown in the dollar that had the potential to propel gold to new highs. Not only did this dollar slump fuel the gold rally—it also slammed the U.S. Dollar Index back toward early 2015 levels. Slipping below its 2015 lows meant the risk of a much bigger drawdown for the Greenback. But the dollar wasn't finished screwing with our plans. After feigning a breakdown move, the buck stormed back. An oversold bounce turned into a May rally that tossed a bucket of cold water on gold's run up. Of course, gold's weakness in May was all thanks to the dollar's freak move back from the brink of destruction. And it perfectly illustrates one of the reasons the market has been so difficult to trade this year. Any definitive move has sharply reversed. Now, the dollar looks like it's running into trouble again ahead of the Fed's rate decision this afternoon. That shouldn't shock anyone. The chances of a rate hike today are slim to none… With precious metals quietly pulling back again this morning, I suspect we will see a hot new trade emerge very soon. Remember, mining stocks held up well when gold futures dropped almost $100 a few weeks ago. If they can ride out a few more bumps, another powerful leg higher could materialize. Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Here’s Why You Must Watch Gold Miners on “Fed Day” appeared first on Daily Reckoning. |

| China & Russia Buying Gold as Safe Haven Posted: 15 Jun 2016 04:24 AM PDT Bullion Vault |

| Gold Bull Or Bear Market: Why June 2016 Is The Most Important Month Of The Decade Posted: 15 Jun 2016 03:34 AM PDT Gold is said to be in a bull market again, but we disagree with that. According to our methodology, gold will only enter a bull market if it will trade for at least 5 consecutive days above $1291. So far, that has not happened, but could happen in June of 2016. The reason why $1291 is such a hugely important price point for gold can be derived from gold’s long term chart seen below. Basically, $1291 is both a key Fibonacci retracement level for gold’s secular uptrend (from 2001 till 2011) and the resistance line of the bear market. The combination of both has an extremely high importance. |

| Posted: 15 Jun 2016 03:24 AM PDT A solid bid returned to the Gold sector this past week as the market saw a solid Gold Rally. And the GLD ETF alone added more than 15 tons of Gold. The precious metals Miners, which had fallen 10% from their recent Cycle highs, rallied to recover all of their losses, and to print new 2016 highs. Considering that the Dollar also moved sharply higher last week (and continued to start the week) out of its own Cycle Low, the action in the Gold market is surprisingly bullish. If Gold were destined to decline for one more Daily Cycle into an Investor Cycle Low (ICL), I would have expected a rising Dollar to be the catalyst to send it lower. |

| Why June 2016 Is the Most Important Month of the Decade for Gold Posted: 14 Jun 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

As polls are beginning to show a growing lead for the 'Leave' campaign in the upcoming Brexit referendum, investors need to consider the potential implications of a 'Leave' vote for the British and EU economies, sterling and euro currencies and financial markets generally, as there could be potentially broader spill-over or contagion effects. Most mainstream financial media conclude that Brexit would be almost unambiguously bad. This facile view fails to imagine the possibility, however, that unshackled from the increasingly bureaucratic and highly-regulated EU, Britain might use her renewed independence to undergo a dramatic economic restructuring, thereby restoring the dynamism and high growth rates of Victorian times. In this report we consider what actions Britain could take in this regard, focusing on five policy areas. The results could be dramatic.

As polls are beginning to show a growing lead for the 'Leave' campaign in the upcoming Brexit referendum, investors need to consider the potential implications of a 'Leave' vote for the British and EU economies, sterling and euro currencies and financial markets generally, as there could be potentially broader spill-over or contagion effects. Most mainstream financial media conclude that Brexit would be almost unambiguously bad. This facile view fails to imagine the possibility, however, that unshackled from the increasingly bureaucratic and highly-regulated EU, Britain might use her renewed independence to undergo a dramatic economic restructuring, thereby restoring the dynamism and high growth rates of Victorian times. In this report we consider what actions Britain could take in this regard, focusing on five policy areas. The results could be dramatic.

Rana Foroohar has written the equivalent of a public guide to why Americans remain mad as hell at Wall Street and Washington and why a lot worse than a political revolution may ensue if the plutocrats don't wake up soon. Foroohar is an assistant managing editor at Time magazine and its economics columnist. In "

Rana Foroohar has written the equivalent of a public guide to why Americans remain mad as hell at Wall Street and Washington and why a lot worse than a political revolution may ensue if the plutocrats don't wake up soon. Foroohar is an assistant managing editor at Time magazine and its economics columnist. In "

No comments:

Post a Comment