Gold World News Flash |

- George Soros Making Big Bets on Gold

- Does Fort Knox Have the Gold? What Would Happen if Audited — Gary Christenson

- 'X' Marks The Spot - Wages Started Losing When The Dollar Delinked From Gold In 1971

- Global Financial Collapse Accelerates

- Bionic Leaf Turns Sunlight Into Free, Liquid Fuel 10x Faster Than Plants

- Gold Price Closed at $1284.40 up $11 or 0.86%

- Golden Arrow Targets a Promising Mining Merger With Silver Standard in Argentina

- Does the Fort Knox Gold Really Exist?

- Orlando Shooting HOAX Desperate Crisis Actor Fake Crying EXPOSED

- This Gold Miner Wants To BANK PHYSICAL Instead of Selling At Artificially LOW Prices

- George Soros Making Big Bets on Gold

- How to Survive The Coming Economic Collapse

- This European Union is The New Communism -- Nigel Farage

- Breaking “The Bond Barrier”

- Gold Daily and Silver Weekly Charts - Flight to Safety

- Who was Omar Mateen The Orlando Shooter ?

- This Record High is Terrible News for Stock Bulls

- Orlando FL Shooting - EXPOSED AND EXPLAINED

- Fed Week Begins

- MEGA FALSE FLAG - ORLANDO PULSE NIGHT CLUB SHOOTING - EXXXPOSED

- Fake gold and silver coins 'flooding' market

- Why the euro is a long way from challenging the dollar's dominance

- David Wilcock, The War has Gone Hot!

- Risks of more terrorism in the U.S. on the rise?

- 'Keiser Report' hosts interview GoldMoney execs Thursday at Toronto theater

- World Extinction Level Event Coming!

- Ronan Manly: Central banks and governments and their gold coin holdings

- Is a $10 Trillion “Supernova” About to Explode?

- Donald Trump Full Interview On Fox & Friends - Fox News (6-13-16)

- Does the Fort Knox Gold Really Exist?

- Gold In Sterling Up 1.7% On BREXIT Jitters - Surges 10% In June

- Your Instincts are Wrong: Trade Like This Instead…

- Gerald Celente -- Central Banks Have no Solution to this Crisis Now

- Breaking News And Best Of The Web

- BNEF Report Says Solar Energy, Batteries, Wind Will Dominate, Fossil Fuel Usage to Collapse

- George Soros Making Big Bets on Gold

| George Soros Making Big Bets on Gold Posted: 14 Jun 2016 01:19 AM PDT Michael Ballanger | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Does Fort Knox Have the Gold? What Would Happen if Audited — Gary Christenson Posted: 14 Jun 2016 01:00 AM PDT from CrushTheStreet: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'X' Marks The Spot - Wages Started Losing When The Dollar Delinked From Gold In 1971 Posted: 14 Jun 2016 01:00 AM PDT Submitted by Ralph Benko via The Pulse2016.com, About a year ago, Stan Sorscher, Labor Representative, Society for Professional Engineering Employees in Aerospace, published a frighteningly important blog at The Huffington Post (where I also blog on a regular basis) headlined “Inequality — “X” Marks the Spot — Dig Here.” It was as important for what it gets right as for what it misses. Sorscher writes:

The author is exactly right regarding “X” and exactly wrong in getting cause and effect backwards. At “X” Marks the Spot, he notes “[s]omething happened,” and the wages of goods-producing workers flatlined, never to recover. He is right and perceptive in this too little appreciated fact. Yet he attributes this to some kind of mystical “shift in our country’s values. Our moral, social, political and economic values changed in the mid-70’s.” As it happens, “X” correlates with Nixon shutting down the Bretton Woods gold standard in 1971 and the epic failure to get it fixed and restored in 1973. The drag, after a modest lag, filtered into the working economy. The rest is persistent stagnation for median families. It was the destruction of the (dilute) gold standard which precipitated the death, or at least long coma, of the American Dream. That, in turn, caused the ensuing degradation “in our moral, social, political and economic values” as America turned Hobbesian. Keynes, the great economic icon of the left, understood how subtle and insidious the processes at work during an earlier instance of monetary disorder. In his 1919 classic The Economic Consequences of the Peace, Keynes wrote:

Copernicus, who kind of invented (or anticipated) the gold standard — and really was a pretty bright guy, earning the grudging respect even of right wing Flat Earther geocentrists — made a comparable point in his Essay On The Minting of Money (whose modern translation I commissioned and served as lead co-editor):

The GOP is beginning to come around to the gold standard. The academic (though not the ethnic or labor) left remains resistant. Getting the gold standard wrong could be catastrophic. In getting the gold standard back in place the right way — a way that will be at least, and preferably more, beneficial to labor than to capital — it would be invaluable for the left to begin to come to terms with the crucial role the gold standard played, and again can play, in restoring a climate of equitable prosperity. Therefore, I respectfully ask that progressives open their hearts to exploring the possibility, just the possibility, that the gold standard would go a long way toward restoring both economic prosperity and economic justice for all — the American Dream. America, and the world, greatly would benefit from participation from the Donks in making sure that the Pachyderms don’t do a wrongheaded pro-Ebeneezer Scrooge version of the gold standard. Help us write a wonderful pro-Bob Cratchit version that will restore justice as well as prosperity. God bless us every one! (Including you, atheists!) If we get this right, afterward there still will be much to argue about. We can have merry and spirited arguments as to whether all the extra tax money pouring in from all those new great jobs and businesses should be spent on family leave or abolishing the estate tax. The thing is… if we get the gold standard right there will be plenty of money to do both. And more. According to a grounded assessment I made a few years ago at Forbes.com there’s probably at least $6 trillion (with a T!) of new federal tax revenues hidden in there, without raising tax rates. Visualize federal surpluses! And there will be maybe 10X that for the private economy. Win-win! “X” indeed marks the spot! By following Mr. Sorscher’s invitation to “Dig Here” one discovers that therein lies a buried, and lost, treasure chest of gold that can be leveraged to the common good rather than a mysterious “shift in our country’s … moral, social, political and economic values.” Putting that gold — and yes, Uncle Sam has plenty of it, the most, by far, in the world — back to work in the right kind of way is highly likely, perhaps even certain, to restore wage growth, end privilege-based inequitable income inequality, and restore our moral, social, political and economic values like nothing else possibly could. This isn’t partisan. Historically, progressive Democrats like Grover Cleveland were as committed to gold as were Republicans like William McKinley. The left is invited to participate. So, my progressive friends, let’s grab our shovels, and let’s dig together. “X” marks the spot. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Financial Collapse Accelerates Posted: 13 Jun 2016 11:00 PM PDT from Peter Schiff: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bionic Leaf Turns Sunlight Into Free, Liquid Fuel 10x Faster Than Plants Posted: 13 Jun 2016 09:30 PM PDT by Christina Sarich, Underground Reporter:

Though their claims are imbued with hubris, the researchers are confident they've stumbled on something profound that could change global warming, and other environmental concerns. Harvard Professor Daniel Nocera's lab teamed up with microbiologists led by biochemist and systems biologist Pamela Silver, of Harvard Medical School. "This is a true artificial photosynthesis system," says Nocera, a leading researcher in renewable energy. "Before, people were using photosynthesis for water-splitting, but this is a true A-to-Z system, and we've gone well over the efficiency of photosynthesis in nature." The bionic leaves work by utilizing a hybrid system based on cobalt-phosphorus alloy catalyst partnered with bacteria called Ralstonia eutropha, which splits water into oxygen and hydrogen at low voltages. They say that the bionic leaf would allow them to capture CO2 but bypass the vegetative state. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1284.40 up $11 or 0.86% Posted: 13 Jun 2016 09:26 PM PDT

I would make fun of today's news, but how do you satirize people who are already disconnected from reality? It's impossible to exaggerate enough to out-do their lunacy. Muslim radical walks into a homosexual bar and shoots 49 people. Muslim is pledged to ISIS. However, Huffington Post says, "Don't Throw the Blame On Muslims for the Pulse Shooting." Goofier yet, the Chicago Tribune mumbles profoundly, "The target was all of us." What do the acolytes of the great god Diversity do when one diverse element kills 49 other, dissimilar diverse elements? Why, it threatens to homogenize diversity! In a blender. The snake is eating his own tail. Country is becoming ungovernable. A specter is haunting markets, and that specter is the Brexit vote. I smell a rat. US dollar index today fell 21 basis points (0.22%) to 94.42. However, the 10 year US treasury T-note yield fell 1.4% to 1.616%/ which is to say, the UST-note price rose. With Brexit in view on 23 June, don't y'all imagine folks would be selling pounds and euros & buying dollars and US treasuries? And yen? Yet the dollar keeps sinking. A NGM operation to discourage a panic out of euros into dollars? Euro actually climbed 0.37% to $1.1293. This remains nowhere, above the 20 DMA but below the closely aligned 50 DMA. Yen, safely around the globe from Europe, jumped 0.74% to 94.21, which means that zillions of investors around the world are blind to what the Bank of Japan has done to Japan's government bond market, equities market, and economy. Disconnected from reality. On Wall Street today they ran out of waste baskets. So many had been filled with puke & had to be sent out to empty, they just ran slap out. Like a meteor from a summer sky, Dow fell 252.71 (1.41%) to 17,732.84, winding up below both the 50 DMA and 20 DMA, and headed toward that head-&-shoulders neckline about 17,300 where it will begin to fall like a Holstein cow pushed from a C-5 cargo plane. S&P500 plunged 36.92 (1.72%) to 2,079.06, below the 20 DMA but not quite the 50. Destined for lower things. What's holding oil up I can't imagine. Chart is here, http://schrts.co/KvfGnd It traced out a usually-deadly rising wedge, walked through the bottom boundary, but only today fell through its 20 DMA. Some fall approacheth. Gold spurred its horse & jumped another $11.00, up 0.86% to $1,284.40. Silver leapt 11.3¢ to 1742.8¢, up 0.65%. Today gold hit a new high for the move at $1,290.40. Look at it here, http://schrts.co/ZOy3jH The rise is not over. Rising volume confirms rising price. RSI is not yet overbought. Momentum points up. Rate of change is steep, & all this hu-hu about Brexit leaves me nervous. If that's the only thing driving gold, what happens when that's removed? If the Brits elect to stay in the EU, all the pressure dissipates. If they vote to leave, gold may pound through $1,306 and into the stratosphere. Latest polls show more in favor of leaving. As gold, so silver. Silver made a new high for the move at 1247¢, volume is rising with price, RSI is not yet overbought. In other words, plenty of room remains for further rises. But again I caution, nobody knows how much of this is occasioned by fear of Brexit. Long as that fear holds & the dollar keeps falling, gold and silver prices will keep rising. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Golden Arrow Targets a Promising Mining Merger With Silver Standard in Argentina Posted: 13 Jun 2016 08:30 PM PDT from The Daily Bell:

The Daily Bell: Give us some background on your company, Golden Arrow Resources. Joseph Grosso: Golden Arrow is a Vancouver-based explorer and prospect generator focused on identifying, acquiring and advancing precious and base metal discoveries with the goal of defining world class deposits. I believe strongly in the mineral potential of Argentina and have focused our exploration efforts there since 1993 when the country opened to foreign investment. The Group's success at mineral discovery, as well as its achievements in community and government relations has made it a highly regarded and trusted explorer throughout Argentina.

Golden Arrow's current focus is on advancing its flagship Chinchillas Silver Project located in Jujuy moving rapidly towards production with our partner Silver Standard. The Chinchillas discovery is our third major discovery. The Daily Bell: Tell us more about Chinchillas Silver. Joseph Grosso: Golden Arrow holds a 100% interest in the Chinchillas project which hosts a resource of 100 million ounces of silver/155 million ounces silver equivalent (AgEq) in the Measured & Indicated categories and 44 million ounces silver /90 million ounces (AgEq) in the Inferred category. The resource estimate is part of the Chinchillas Project prefeasibility study, funded by Silver Standard, which is being undertaken to evaluate the combination of Silver Standard's producing Pirquitas mine and our Chinchillas deposit, as announced October 1st, 2015. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Does the Fort Knox Gold Really Exist? Posted: 13 Jun 2016 07:20 PM PDT by Gary Christenson, Deviant Investor:

REALITY: The gold is listed on paper and in official pronouncements. However, it has also been officially pronounced that:

It is wise to question official pronouncements and remain skeptical.

According to reliable sources the Fort Knox Bullion Depository has not been properly audited since the 1950s. Much has happened in six decades. For example: Many gold bars could have disappeared long ago yet remain on official paper records. DELUSIONS: Gold is no longer an important asset in our global debt based digital and paper currency system. If the Treasury says the gold still exists, then it must be safely stored in Fort Knox. What difference does it make? ******************* I previously wrote about various scenarios regarding the Fort Knox Bullion Depository in "Fort Knox Paradox." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando Shooting HOAX Desperate Crisis Actor Fake Crying EXPOSED Posted: 13 Jun 2016 07:00 PM PDT Orlando Shooting HOAX Desperate Crisis Actor Fake Crying EXPOSED The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Gold Miner Wants To BANK PHYSICAL Instead of Selling At Artificially LOW Prices Posted: 13 Jun 2016 06:46 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| George Soros Making Big Bets on Gold Posted: 13 Jun 2016 05:23 PM PDT George Soros has joined fellow billionaire investors Stan Druckenmiller and Ray Dalios on investing big in gold. Precious metals expert Michael Ballanger explains what is behind these moves. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Survive The Coming Economic Collapse Posted: 13 Jun 2016 05:00 PM PDT This amazing new manual which is called the "SURVIVE AFTER COLLAPSE Manual" reveals the survival secrets you could never find anywhere else. This new MANUAL teaches you how to "jump start" your new survival skills overnight...in a very explicit... and 100 times more detailed way than anything... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This European Union is The New Communism -- Nigel Farage Posted: 13 Jun 2016 02:00 PM PDT Nigel Paul Farage is a British politician and former commodity broker. He is the leader of the UK Independence Party, having held the position since November 2010, and previously from September 2006 to November 2009. Wikipedia The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Jun 2016 01:47 PM PDT This post Breaking "The Bond Barrier" appeared first on Daily Reckoning. On Oct. 14, 1947, American test pilot Chuck Yeager took flight above Muroc Dry Lake, in California's Mojave Desert. He broke the sound barrier in a small, streamlined aircraft called X-1. However, after reviewing flight data, engineers realized that supersonic flight had potential to rip the wings off an airplane. This was a problem, and we'll discuss it more in just a moment. Meanwhile, in January 2016, central bankers across the world also broke another "barrier" of sorts. Collectively, they rolled down a road that's unfamiliar to modern finance. We've never seen this new issue before; in fact, it has potential to "rip the wings" (so to speak) from high-end finance across the world. It's a major problem, and we'll address that in a moment, as well. It was Tuesday morning. Sky was clear and the sun shone bright above Muroc. At 10 a.m., a large, four-engine B-29 bomber rolled down the runway carrying a small shape underneath one wing, an aircraft that looked much like a .50-caliber bullet, but with fairly straight, stubby wings. After climbing to altitude, at 10:26, the bomber dropped small aircraft, the latter flown by a seasoned pilot named Chuck Yeager. Yeager engaged systems and fired a series of "reaction motors" that took his aircraft — the above-noted Bell X-1 — toward so-called "transonic" flight regime. Shock diamonds formed behind four rocket nozzles of the engine, and Yeager's X-1 soon approached Mach 0.85, a point beyond which there existed no wind tunnel data on the problems of flight. At 40,000 feet altitude, X-1 finally leveled off; Yeager fired another rocket motor. The aircraft's Mach meter moved smoothly through 0.98, 0.99, to 1.02, and then jumped to 1.06. A strong "bow shockwave" formed in the air ahead of the needlelike nose of the X-1. Yeager recorded that his aircraft reached a velocity of 700 miles per hour, Mach 1.06, at 43,000 feet. The flight was smooth, and the small, sleek Bell X-1, with Yeager at controls, became the first successful supersonic airplane in the history of flight. Yeager had The Right Stuff, in the words of Tom Wolfe and his fabulous 1979 book of that title. After Yeager and X-1 landed, engineers reviewed flight data and realized that they faced immense challenges when designing and operating super-fast airplanes. One critical issue was that as an airframe approaches "sound barrier," stress builds up on leading edges of the nose and wings. In fact, if engineers had not intentionally "overdesigned" X-1, it's likely that aerodynamic stress would have torn off the wings. As time went on and new aircraft designs rolled out, many test pilots died as they flew into the wild unknown of the sky, especially in supersonic realms. These are lessons "written in blood," as we used to say in the Navy. The long and short is that to go supersonic, engineers had to redesign aircraft from the inside out. Every structural element had to be stronger than even the toughest aircraft of World War II. Airframe shapes had to transform as well, to deal with supersonic airflow. All this demanded new materials, too — such as advanced metals and superalloys that could withstand the stress of operating beyond the speed of sound. Today, we have a new "Bond Barrier." My point here is to illustrate how dramatically things change when you break certain barriers — like the sound barrier. Now let's redirect that same kind of thinking to another barrier that's currently being shattered, the "bond barrier." What do I mean? A bond represents debt: often as not, "secured" debt. The idea is that one party loans money to another — say, a government — and after a certain time, that second party pays interest and eventually returns all principal to lender. Interest rates can vary, but principal is sacrosanct. The lender always wants the money back. For many years, one of the safest forms of investment has been a U.S. government bond, backed by the proverbial "full faith and credit" of the U.S. government. Loan money to Uncle Sam, and then hold the bond to term, and you will recover all principal, plus interest along the way. Now, however, rules of this bond game are changing. Central bankers are moving toward "negative interest rates." We've seen it in Europe and elsewhere. Recently, for example, the government of Japan sold long-term bonds with a negative yield. Specifically, Japan raised $19.4 billion at auction, offering a 10-year benchmark bond at -0.024% average yield. Think about that… It means holders of this bond will "pay" the Japanese government for the privilege of lending it money. Buy a government bond, and make a (so far) small donation, so to speak. Bizarre, no? One way or another, we're witness to governments breaking the "bond barrier." This will rock our world, I suspect. Now the wings are coming off. That is, I view this as a "transonic" moment here. With negative interest, the wings are about to come off of government finance. In essence, governments propose to "borrow" money from lenders and declare right up front that they won't pay back all principal. That's nuts. Who came up with this crazy idea? It's the Wrong Stuff, to coin a different phrase. Wherever this negative interest idea came from, it's no wonder there's a global rush to buy gold and other precious metals and invest in basic resource plays. In January, as negative interest rates gained traction, gold prices lifted off of recent lows and moved up strongly. Same with silver, platinum, palladium and even beaten-down copper. Heck, even iron ore recently moved. Hard assets, in other words. Gold's rallied from $1,060 to $1,285 today. Clearly, there's strong gold buying at work, indicating a rally with breadth, depth and volume. And it's happening now. For now, you should understand that negative interest rates reignited the commodity sector and spun a major turn in the investment cycle. Just as engineers had to use new designs and metals to break the sound barrier, this "bond barrier" move seems to be good for gold, that's for sure. Best wishes, Byron King P.S. The Federal Reserve is determined to drive down the dollar. And owning gold is the best way to preserve your wealth against a depreciating dollar. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. We'll send it to you when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post Breaking "The Bond Barrier" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Flight to Safety Posted: 13 Jun 2016 01:31 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Who was Omar Mateen The Orlando Shooter ? Posted: 13 Jun 2016 01:30 PM PDT Who was Omar Mateen? Early on Sunday, June 12, a man walked into a gay club and shot dead at least 50 people. This is what we know about the Orlando shooter. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Record High is Terrible News for Stock Bulls Posted: 13 Jun 2016 01:30 PM PDT This post This Record High is Terrible News for Stock Bulls appeared first on Daily Reckoning. BALTIMORE – Not much action in the stock market last week. A few little steps ahead… over the 18,000 line for the Dow. Then a few little steps back. At writing, the index sits at 17,865. Fed chief Janet Yellen has made it clear she won't do anything to disturb investors' sleep. But that doesn't mean they won't have nightmares. Downside RiskOur research department – headed by Nick Rokke and Chad Champion – reports that you get less for your money in America's capital markets today than at any time in history. This is not good news. It tells us there is far more downside risk than potential upside. Meanwhile, the U.S. economy continues to slow. From the high-water mark of 3.9% annual GDP growth in the second quarter of 2015, the latest figures (for the first quarter of this year) show the economy expanding at an annual rate of just 0.8%. [See today's Market Insight below for more.] And last week, we learned job creation tumbled in May… with just 38,000 new jobs added versus the 162,000 new jobs Wall Street was expecting. It was the worst report in six years. And it took the labor participation rate – the percentage of the working-age population either working or looking for work – back to a level not seen since 1976. These things do not justify high stock prices. Instead, they buzz in your ear like mosquitoes at an evening picnic. The Zika virus cannot be far off. Most likely, the economy has already begun to get the shakes. If not, the recession will probably begin sometime in the next 12 months. Nick checks the netting:

Past PatternsThe EV/EBITDA ratio for the Russell 2000 is about 19. This is only slightly below its all-time high of 21 set at the start of the year. Typically, the index trades on a ratio of about 12. That suggests a fall of 38% for U.S. small caps… a plunge equal to the fifth worst bear market in the past 90 years. Of course, we've been wrong before. And whatever youthful bravery might have accompanied our earlier guesswork, it left us when arthritis moved in. Now, we make no predictions and offer no forecasts. We simply note that based on where valuations are, now is unlikely to be a good time to increase your exposure to U.S. stocks. Remember, our investment strategy is based on ignorance, not knowledge. We have no knowledge of the future. All we have is some dim awareness of the past. What we see in the past are patterns. And since those patterns can be seen in many different markets over many years, we presume them to be fairly reliable. So, although we can't predict that the stock market will go down… or when… or to where… we can still note that it always has in the past, though not according to any reliable schedule. Maybe this time is different. Most likely, it's not. U.S. stocks are expensive. The best bet is probably that they will be less expensive in the future. Then they will be expensive again. Note that these cycles are extremely long. The U.S. stock market hit a high in 1929. It didn't do so again until 1954. There have been a couple of highs, in 2000 and 2007, but this is higher than any of them. That's right. While this could be the big one! Coming up this week… It was 50 years ago last week that we graduated from high school. What has happened since? We review the play Arguing with God. And we continue to wonder who the real cowards are… Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post This Record High is Terrible News for Stock Bulls appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando FL Shooting - EXPOSED AND EXPLAINED Posted: 13 Jun 2016 01:00 PM PDT I see The connection is 50 victims, 50 weeks=Shavuot. But of course this event was staged to further an agenda. May God have mercy on America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Jun 2016 12:39 PM PDT This post Fed Week Begins appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a marvelous Monday to you! Well the BREXIT stuff is really playing havoc with pound sterling/pound, as I said it would, and that the direction would gyrate with the results of each poll. Well the latest poll over the weekend had the “leave the EU vote” at 55% and the “don’t leave vote” at 45%. And the pound is getting whacked. The currencies are mixed this morning, with the pound leading the pack for the currencies under water to the dollar, and Japanese yen is leading the currencies with their heads above water. Every time I see yen on the move to stronger value vs. the dollar, I have to laugh/chuckle/snicker thinking about Bank of Japan (BOJ)’s Kuroda, and PM Abe, just going banana’s because yen is not weaker, and gaining instead. I guess that the James Rickards’ call that there was a Shanghai Accord is holding water with yen. not so much with euros, but with yen it looks real. Well, the Central Bank of Russia (CBR) did cut rates on Friday. I had thought they would skip this meeting, and wait to see what the Europeans did with their vote on whether to extend the economic sanctions against Russia. But they didn’t. (Maybe they know something?) And they cut rates by 50 Basis Points (1/2%) leaving their internal rate at 10.5%… I guess the CBR figured that they had better get this party started, since they forecast that inflation is going to fall to 4% by the end of 2017. That could mean lots more rate cuts folks. And put additional pressure on the ruble. That is, IF the Europeans don’t drop the sanctions. Another thing weighing on the ruble right now is the slippage we’ve seen the past few trading days with the price of oil. Oil’s price this morning is trading with a $48 handle, that’s $3 dollars less than its price last week. The lofty levels of all the Petrol Currencies on that day that oil traded at $51, have taken a few hits in recent trading. The ruble, Norwegian krone, Canadian dollar and Brazilian real (and we can even throw in the Mexican peso) have all backed off their stronger looking levels from last week. Well, the craziness in bonds continues. On Friday morning, the 10-year yield had fallen to 1.65%, and from what I could gather from bond guys is that the liquidity couldn’t keep up with the pace of the yield drop. That’s a disaster just waiting to happen folks. Liquidity is no big deal, until there isn’t any liquidity! And today’s level in the 10-year Treasury’s yield is 1.62%, so the fun times keep rolling for the bond boys. Just remember this: the lower that yield goes, the more pain it will cause when it reverses. Of course when it reverses is the big question that’s on everyone’s minds (that follow bonds), and has caused Chuck many a headache over the years. Remember what I just said there folks… Liquidity is no big deal, until there isn’t any liquidity! That’s when you’ll wake up one morning, and turn the TV on, and hear and see chaos going on with rising yields. I’ve awakened quite a few days in the past seven years thinking that’s what I’ll see, and so far, nothing even close! UGH! The Aussie (A$) and New Zealand (kiwi) dollars respectively are both attempting to recover lost ground from Friday. I’m still not accepting the idea that the A$ could fall to record lows, which would be below 47-cents, as stated by a fund manager in Sydney, that I told you about on Friday last week. UGH! That’s the kind of thinking that gets a currency in trouble! Sure, the A$’s direction can be heavily influenced by the Chinese economy, and that would mean that this fund manager is joining the ranks of analysts that believe China won’t be able to pull itself out of its recession. I just don’t get these people who don’t believe that China can’t work itself out of the recession. It’s just a recession! Countries used to have them all the time! Booms and Busts! And get this, now this is another novel idea by the Chinese, Oh the Humanity! There are reports that China is ready to accept the volatility that would likely follow should they allow troubled banks to go bankrupt! Are you kidding me? No bailouts? How can they get away with that? I’m shocked that the rest of the countries that no longer believe in booms and busts aren’t just going bananas and calling the Chinese officials names! I can hear these countries saying, “Where do the Chinese get off thinking that just letting failed banks go bankrupt?” I read a piece in the CFA bulletin on Friday that made me want to scream, “Who are you trying to kid?” First of all I’ve had readers tell me not to listen to or read the Economist before, they had their reasons, but now I have mine. The Economist ran an article titled “U.S. Economy Might Not Be As Shaky As Jobs Data Suggest.” Well, that might be true, but at the same time I was looking at 10 charts on the U.S. right now. The charts range from Student Loans, to Food Stamps, to Federal Debt, and so on. Well, Student loans, Food Stamps, Federal Debt, money printing, and Healthcare Costs all show nearly straight lines going up the chart, while Labor Force Participation, Median Family Income, and Home Ownership all have charts with the arrows pointing downward. These are not good things for the U.S. economy, so don’t let the Economist steer you in the wrong direction folks. They base their findings on a report by the Federal Reserve. You know those renowned authors that also found green shoots, and the Fed said that 69% of the Americans they surveyed think they are doing OK or living comfortably. What a Crock! I’m ashamed of the Economist for taking this Fed report Carte Blanche. Where did they do this survey, and who did they talk to, etc., etc. And were there any hedonic adjustments made to the data? Well, gold had “fair day” on Friday closing up $3, but this morning gold is up nearly $11 (10.80) as I write. I know I keep telling you that one of my fave writers is Grant Williams, he of the Things That Go Hmmm, letter, and one of the people responsible for the successful “Real Vision”. Well, he made a comment about the gold manipulation, that got me really going the other day, while he was being interviewed in Switzerland. Let’s listen to what Grant Williams says:

The U.S. Data Cupboard is empty today. It’s been three straight days with only a couple of second and third tier reports in the hopper. But tomorrow that all changes, with the May Retail Sales. I’ll tell you right here, right now, that the BHI tells us that May Retail Sales will be quite a bit slower than the blowout number of April. What will the Fed do with that? Probably the same they would have done with a strong number. Nothing, absolutely nothing, say it again! This is the week that the Fed will be meeting tomorrow and Wednesday. Longtime readers know that when the Fed has one of these two-day meetings that the Fed members get the board games out, and you can hear them shouting “You’ve sunk my battleship” and other things. I just don’t get what takes two-days to do. You meet, exchange pleasantries, grab some coffee, and a donut, and then take a vote. Aye, or nay for a rate hike. Then formulate a statement to explain what you did. A couple of hours, max! But, they won’t be letting us in on their vote until Wednesday afternoon. Boy, don’t they know that everyone is waiting? Just to bring you up to date. There’s little chance the Fed will hike rates in June now, thus wiping out weeks of talks by Fed members that led the markets into believing that a rate hike was coming at this meeting. Credibility? It’s fading away. I’ve been keeping tabs on the Puerto Rico debt problem for months now, and it looks like it’s going to be kicked down the road, just like everything else, right? The House passed a bill to rescue Puerto Rico, and the article can be found here, or here’s your snippet:

Chuck again. What a fiasco. A fluster cuck. I have to think that while no one would benefit from a collapse of the bond market in Puerto Rico, I also think that kicking the can down the road is not the answer! Take your licks now, and then start to rebuild, that’s the answer I think should have been on the minds of lawmakers. But that wouldn’t get them reelected, so we kick the can down the road. That’s it for today. I hope you have a marvelous Monday, and be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Fed Week Begins appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| MEGA FALSE FLAG - ORLANDO PULSE NIGHT CLUB SHOOTING - EXXXPOSED Posted: 13 Jun 2016 12:00 PM PDT BREAKING NEWS & CURRENT EVENTS this was an all out attack on our soverignty. disguised as a muslim against lgbt community. dont fall for it people. its getting ready to get bumpy...hold on and fight. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fake gold and silver coins 'flooding' market Posted: 13 Jun 2016 11:59 AM PDT By Herb Weisbaum In these uncertain economic times, you don't have to be a miser to consider putting some of your money into precious metals, and gold and silver coins are an easy way to do that. But this increased demand for bullion coins -- like the American Eagle, South African Krugerrand, and Canadian Maple Leaf -- has created a golden opportunity for forgers. Counterfeit coins are "flooding the market at an astonishing rate," and compromising the investments of collectors, according to the American Numismatic Association. "It's a very serious problem and it's really scary," said Rod Gillis, ANA's education director. "With improved technology the fakes are getting better. It's gotten to the point where even people who deal with coins all the time may not be able to recognize a counterfeit coin right away." ... ... For the remainder of the report: http://www.nbcnews.com/business/business-news/glitters-not-gold-fake-gol... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why the euro is a long way from challenging the dollar's dominance Posted: 13 Jun 2016 11:53 AM PDT By Matthew Lynn The phrase is sometimes attributed to the post-war French President General De Gaulle, but in fact it was coined by his then-finance minister, and later successor at the Elysee Palace, Valery Giscard D'Estaing. In 1968, in the midst of a campaign by his leader against role of the dollar in the global monetary system, Giscard came up with the term "exorbitant privilege" to describe the special status the American currency has long held in the world economy. When the euro was created a couple of decades later, one of the implicit goals, at least to the French, was to challenge that. A single European currency would be big enough and strong enough to take on the mighty greenback, and eventually even topple it from its throne. It hasn't happened. According to the latest calculations from the European Central Bank, the euro is not making any progress against the dollar at all. Instead, its share of global currency reserves is declining steadily every year. Extraordinarily, on some measures, it is now even less important than the old German Deutschmark used to be all by itself -- in effect, the other 18 national currencies have been turned into nothing. ... ... For the remainder of the report: http://www.telegraph.co.uk/business/2016/06/13/why-the-euro-is-a-long-wa... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Wilcock, The War has Gone Hot! Posted: 13 Jun 2016 11:30 AM PDT The War has Gone Hot! Part One, Cargo Cults and the Secret Space Program Part two, Time and Space by David Wilcock May 28, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risks of more terrorism in the U.S. on the rise? Posted: 13 Jun 2016 11:00 AM PDT FNC national security analyst KT McFarland on the shooting at a nightclub in Orlando, Florida and the Obama Administration's handling of radical Islam. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Keiser Report' hosts interview GoldMoney execs Thursday at Toronto theater Posted: 13 Jun 2016 10:48 AM PDT 1:47p ET Monday, June 13, 2016 Dear Friend of GATA and Gold: Max Keiser and Stacy Hebert, hosts of the Russia Today television network's internationally broadcast program "The Keiser Report," will visit Toronto this Thursday to interview the top executives of GoldMoney, Chief Executive Officer Roy Sebag and Chief Strategy Officer Josh Crumb. The interview will be open to the public and will be held at the Isabel Bader Theatre at 93 Charles St. West in Toronto. Admission will be free with advance registration. The announcement for the event says: "Financial markets all over the world are bloated with unprecedented government-created liquidity and political manipulation, cloaked in a fog of media hype. Global financial debt has reached staggering levels. Emerging market debt, subprime auto debt, shaky corporate debt, and student loans are growing daily with almost no chance of being repaid. Negative interest rates and signs of looming rapid inflation have already begun, and for most people, the crisis only has one ending. The current banking system is failing -- this is certain." And few journalists in the news media expose that failure better than Keiser and Hebert. For more information about the interview and to register for free admission, please visit: https://www.eventbrite.com/e/goldmoney-presents-keiser-report-live-with-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| World Extinction Level Event Coming! Posted: 13 Jun 2016 10:30 AM PDT Alex Jones warns the public about the globalists endgame plan for humanity and how it's going to be an extintion level event! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: Central banks and governments and their gold coin holdings Posted: 13 Jun 2016 10:20 AM PDT 1:20p ET Monday, June 13, 2016 Dear Friend of GATA and Gold: Gold researcher Ronan Manly reports today that while central banks are understood to hold their gold reserves mainly in large bars, some central banks also hold a fairly substantial tonnage in gold coins. This, he writes, "demonstrates that central banks and sovereigns continue to view gold as a strategic reserve asset and as the ultimate money." Manly concludes: "Luckily, private individuals too can replicate the holdings of these giants by also acquiring and accumulating gold bars and gold coins for the same reasons as sovereign entities and monetary authorities do. Doing as central banks do, not as they say, is certainly a better strategy than blind faith in today's distorting and reckless centrally planned monetary policies." Manly's report is headlined "Central Banks and Governments and Their Gold Coin Holdings" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/central-banks-and-governme... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is a $10 Trillion “Supernova” About to Explode? Posted: 13 Jun 2016 10:06 AM PDT This post Is a $10 Trillion "Supernova" About to Explode? appeared first on Daily Reckoning. Legendary bond guru Bill Gross predicts a disaster of astronomical proportions is coming to the financial markets… He calls it "a supernova that will explode one day." It's a massive bubble created by global central banks… The likes of which we haven't seen in 500 years of recorded history… Is your portfolio prepared for the blowup? Financial ArmageddonGross gained the media reputation as the "Bond King" as the then manager of Pacific Investment Management's $270 billion Total Return Fund. Today, he manages the Janus Global Unconstrained Bond Fund. And here's his logic about a coming market meltdown… The flight to safety in global financial markets combined with negative interest rate policy (NIRP) by global central banks have helped create more than $10 trillion of government debt now trading below zero. And with financial uncertainty increasing, more people want to buy "safe" government bonds, pushing prices up. But since yields have an inverse relationship to price, increased demand pushes yields down. That leaves investors like Gross concerned that once rates finally go up, bondholders will incur massive losses. As yields go up, prices go down. In fact, a recent report by Goldman Sachs indicated that a 1% increase in yield on U.S. Treasuries could cost investors as much as $1 trillion in losses. Let that settle in your cerebral cortex for a moment… A mere 1% increase in yield on U.S. sovereign debt could cause more losses than the entire sub-prime mortgage crisis of 2008? You bet. Seat belts on. What's Your System?So is Gross right about a coming explosion in sovereign debt? Look, the key part of his statement is "one day." That day could come 10 days… or 10 months… or 10 years from now. And that's why I am not in the prediction game. You can't make consistent money using a crystal ball, even if said mythical ball is owned by one of the richest people in the world. But here's what we do know… Ruthless central bankers are creating these nonstop "boom, bubble and bust" cycles through carefully planned monetary experiments all designed to redistribute wealth from your account to the elites. And there's no sign of them letting up… For example, negative interest rates are their latest scam to steal. Shout out to Yellen for that one. You think you win there? Hell no. You are the target of their opportunity. The real question should be: Do you have an investment system in place to not only survive any implosion but also make money in the face of the next monetary Ponzi scheme? I'm talking about an investment approach that allows you to catch the trend going up with a bubble and to exit when it starts to burst. There is absolutely no reason you should be sitting at the bottom after the bubble has burst down over 50%… trusting that everything will come back. It might not come back. You need a plan for whatever happens next. Think about the dotcom bubble… Value investors were calling for it to pop in the mid-90s. But those investors ended up missing the most explosive gains as the Nasdaq went up 100% in 1999 alone. And when the bubble did pop in early 2000, "buy and holders" had no system to tell them that price trend had reversed and they were pulverized. Remember, the Nasdaq ended up dropping 77%. Only now, in 2016, is the Nasdaq back to those high levels in 2000. What would have been the best way to capture the fat part of the Nasdaq's massive gains on the way up… while protecting you from its dramatic decline when the dotcom bubble burst? Trend following would have allowed you to profit from its gains in the sweet spot of the bubble. But it also would have signaled you when the price trend had reversed to prevent huge downside losses.

Does your investment strategy allow you to do that? If not, you're not prepared for what's coming. And with more booms, bubbles and busts on deck, do you really want to face the possibility of losing more than 50% of your retirement account? Please send me your comments to coveluncensored@agorafinancial.com. How prepared are you for what's next? Regards, Michael Covel The post Is a $10 Trillion "Supernova" About to Explode? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump Full Interview On Fox & Friends - Fox News (6-13-16) Posted: 13 Jun 2016 09:09 AM PDT Donald Trump FULL Interview (6-13-16) Donald Trump One-On-One Full Interview With George Stephanopoulos - ABC (6-13-16) Donald Trump Full Interview With Savannah Guthrie Today Show NBC (6-13-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Does the Fort Knox Gold Really Exist? Posted: 13 Jun 2016 08:32 AM PDT The Fort Knox Bullion Depository OFFICIALLY contains 147.3 million ounces of gold. REALITY: The gold is listed on paper and in official pronouncements. However, it has also been officially pronounced that: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold In Sterling Up 1.7% On BREXIT Jitters - Surges 10% In June Posted: 13 Jun 2016 08:13 AM PDT Gold in sterling has risen another 1.7% today due to deepening BREXIT jitters with just 10 days left until the referendum on June 23. The flight to gold and sell off in sterling came as Asian and European stock markets fell and European equities headed for their lowest close since February. Gold in sterling has risen from £892.50/oz to £908/o today and is up 10% in the first 9 trading days of June, from £827 to £908/oz, as investors diversify into safe haven gold due to concerns Britain will vote to leave the European Union. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

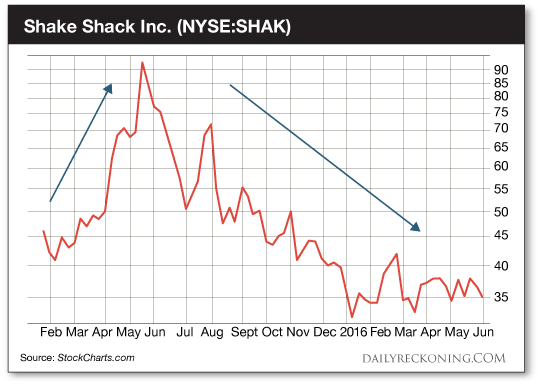

| Your Instincts are Wrong: Trade Like This Instead… Posted: 13 Jun 2016 06:45 AM PDT This post Your Instincts are Wrong: Trade Like This Instead… appeared first on Daily Reckoning. In an unpredictable market like we're experiencing right now, a gutsy call can cost you a fortune. Listening to your heart (instead of your mind) is a great way to lose money— and even confidence in your trading abilities. On the other hand, sports are all about gutsy plays. Last-minute drives, buzzer-beating shots, and walk-off homeruns are what make the games interesting. Players often talk about being in the zone and letting their instincts and training take over during these critical moments. And because we love sports analogies so much, we often try to apply these ideas to life and business. But when it comes to trading, this stuff just doesn't work. The stock market is a manipulative machine. It will twist your mind—and your wallet if you aren't careful. That's why it's so important to have trading rules. Your rules will keep you from following your guts down the wrong path. They'll maintain your sanity. And get this, knucklehead: If you're doing it right, your set of rules will lead you to consistent profits. Of course, you don't have to take my word for it. Ask any successful trader and they'll tell you they've concocted a set of rules that have helped them along the way. Recently, Barry Ritholtz conducted a lengthy interview with legendary technician Walt Deemer. And as usual, Deemer delivered plenty of funny, insightful, and thoughtful advice. But when it comes down to how Deemer operated during his storied career with Merrill Lynch and Putnam, he always brings it back to the rules laid out by his mentor, Bob Farrell. In his book Deemer on Technical Analysis (which is an excellent read, by the way), he lays out Farrell's 10 rules—plus an extra one from the man himself. Even if you never look at another stock chart again in your life, these rules will "make you look at the market intellectually, not mechanically," Deemer writes. Most importantly, they are as true now as they were fifty years ago. Here are Paul Farrell's 11 market rules to remember. I've made some notes for you in italics and added some charts, as well: 1. Markets tend to return to the mean over time. 2. Excesses in one direction will lead to an opposite excess in the other direction. Hmmm, where have we seen phenomenon recently? Perhaps this Shake Shack chart will jog your memory:

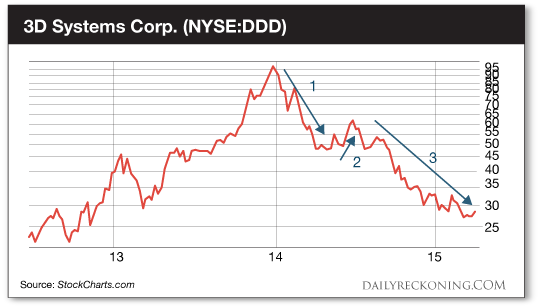

3. There are no new eras– excesses are never permanent. Does the dot-com bust ring a bell? 4. Exponentially rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways. Biotech, anyone? Sure, this epic rally might still have legs. But when it's over, don't expect these stocks to tread water. Parabolic moves don't plateau. 5. The public buys the most at a top and the least at a bottom. 6. Fear and greed are stronger than long-term resolve. 7. [Bull]… markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names. Breadth matters. It's not a perfect timing tool– but you shouldn't go all-in on the long side when most stocks have already broken trend. 8. Bear markets have three stages– sharp down, reflexive rebound, [and] a drawn-out fundamental downtrend. DDD's 2014-2015 meltdown is a great example of a three-stage bear:

9. When the experts and forecasts agree– something else is going to happen. Don't be a contrarian just to go against the grain. Look for sentiment extremes to gauge when it's time to bet against the crowd. 10. Bull markets are more fun than bear markets. 11. Though business conditions may change, corporations and securities may change, and financial institutions and regulations may change, human nature remains essentially the same. We aren't going to wake up tomorrow to a rational market. Emotions reign supreme– whether stocks are moving up, down, or sideways. Add these gems to your trading rulebook today… if you have the guts. Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Your Instincts are Wrong: Trade Like This Instead… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente -- Central Banks Have no Solution to this Crisis Now Posted: 13 Jun 2016 05:48 AM PDT Gerald Celente -- Market Crash, Currency Wars, Trade War, World War Coming TOPICS IN THIS INTERVIEW: 01:10 Introduction for Gerald Celente 01:55 Government Debt Yielding Negative 03:50 No US Economic Recovery, Gold Price & Jobs Report 05:30 Approaching Fascism 06:30 NIRP Hurting the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 12 Jun 2016 06:20 PM PDT Orlando shooting shocks the world. Soros and Gross turn bearish. Stocks fall, gold continues to rise. Debt, as usual, continues to grow. Corporations start selling zero-percent bonds. Warren backs Clinton, attacks Trump. Global bond yields still falling, China’s debt still rising. Best Of The Web What went wrong? – David Rosenberg Weekly commentary: Historic […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BNEF Report Says Solar Energy, Batteries, Wind Will Dominate, Fossil Fuel Usage to Collapse Posted: 12 Jun 2016 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| George Soros Making Big Bets on Gold Posted: 11 Jun 2016 01:00 AM PDT George Soros has joined fellow billionaire investors Stan Druckenmiller and Ray Dalios on investing big in gold. Precious metals expert Michael Ballanger explains what is behind these moves. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Scientists think they've just outsmarted the process of photosynthesis created by Mother Nature over a 3 billion year span with a bionic leaf. Harvard University labs have created a leaf that processes light faster than a real Maple leaf, and could deliver biofuels to an energy-hungry world.

Scientists think they've just outsmarted the process of photosynthesis created by Mother Nature over a 3 billion year span with a bionic leaf. Harvard University labs have created a leaf that processes light faster than a real Maple leaf, and could deliver biofuels to an energy-hungry world. Joseph Grosso is Executive Chairman, CEO & President of a leading junior mining firm in Argentina, Golden Arrow Resources. He has successfully formed strategic alliances and negotiated with mining industry majors such as Barrick, Teck, Newmont, Viceroy (now Yamana Gold) and Vale S.A., and government officials at all levels. Mr. Grosso's specialty is financing, negotiations, corporate and marketing strategy, and he was an early and passionate adopter of best practices in environmental protection and socio-economic development through mineral exploration. He is the founder and president of Grosso Group Management Ltd.

Joseph Grosso is Executive Chairman, CEO & President of a leading junior mining firm in Argentina, Golden Arrow Resources. He has successfully formed strategic alliances and negotiated with mining industry majors such as Barrick, Teck, Newmont, Viceroy (now Yamana Gold) and Vale S.A., and government officials at all levels. Mr. Grosso's specialty is financing, negotiations, corporate and marketing strategy, and he was an early and passionate adopter of best practices in environmental protection and socio-economic development through mineral exploration. He is the founder and president of Grosso Group Management Ltd. The Fort Knox Bullion Depository

The Fort Knox Bullion Depository

No comments:

Post a Comment