saveyourassetsfirst3 |

- Dollar In The Week Ahead

- Dollar Stunner: Jim Willie Warns Chinese Preparing to Issue GOLD-BACKED Trade Notes!

- Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event

- Alasdair Macleod’s Market Report: Swaps to Target Silver Next?

- Breaking News And Best Of The Web

- London RAN OUT OF GOLD! – Harvey Organ

- Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver?

- Has The Industrial Silver Panic Begun? Major Japanese Electronics Firm To Lock In Silver Supply From First Majestic, Citing Supply Concerns

- Is THIS The End of the Road?

- Chilling Prophecy Predicts: “Obama Will Be Last U.S. President…Europe A Total Wasteland By End Of 2016”

- Goldcorp Is Back and Spending: Could West Red Lake Gold Mines Be Next?

- Correction or Final Push Higher?

| Posted: 29 May 2016 10:05 AM PDT |

| Dollar Stunner: Jim Willie Warns Chinese Preparing to Issue GOLD-BACKED Trade Notes! Posted: 29 May 2016 09:00 AM PDT That crackling sound you hear is a burning dollar about to go up in smoke… From Craig Hemke: The Memorial Day weekend marks the unofficial start of summer here in the U.S. This also means that another 3-day weekend is upon us and you know what that means. It’s Jackass season! Because we didn’t […] The post Dollar Stunner: Jim Willie Warns Chinese Preparing to Issue GOLD-BACKED Trade Notes! appeared first on Silver Doctors. |

| Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event Posted: 29 May 2016 07:00 AM PDT The reckoning has begun… Submitted by Jim Willie: The entire Western financial systemic, complete with USDollar-based foundation platforms, is breaking down. The breakdown is in full view, very noticeable, in almost every arena. What happened in 2008 with the Lehman Brothers failure event is currently underway with almost every single financial platform, structural entity, […] The post Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: Swaps to Target Silver Next? Posted: 29 May 2016 06:00 AM PDT Will the swaps target silver next? From Alasdair Macleod: Gold and silver drifted lower this week, dollar prices falling approximately 2.5% and 1.5% respectively. It is a continuation of the previous week's trend, which saw larger falls. To date, from 1st January the dollar price of gold this morning in early European trade is […] The post Alasdair Macleod’s Market Report: Swaps to Target Silver Next? appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 29 May 2016 12:00 AM PDT China’s growth slows further. Japan ramps up the stimulus, bolstering the thesis that huge deficits are the next big financial mistake. The government’s fake numbers become a campaign issue. Charles Hugh Smith on why pension funds (that is, your retirement) are doomed. Great interviews with James Rickards and Helen Chaitman. Oil stabilizes and gold continues […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| London RAN OUT OF GOLD! – Harvey Organ Posted: 28 May 2016 06:14 PM PDT LONDON IMPORTED 119 TONNES OF GOLD IN MARCH AND APRIL!! Why?? Because as Paul Mylcreest suggests, THEY RAN OUT OF UNALLOCATED GOLD!… NEWEST DATA STATES THAT LONDON IMPORTED 119 TONNES OF GOLD IN MARCH AND APRIL!! WHY? BECAUSE AS MYLCREEST SUGGESTS, THEY RAN OUT OF UNALLOCATED GOLD/WITH ONE DAY TO GO WE HAVE A HUGE […] The post London RAN OUT OF GOLD! – Harvey Organ appeared first on Silver Doctors. |

| Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver? Posted: 28 May 2016 01:30 PM PDT In this Critical Market Update, the Silver Admiral Eric Sprott discusses the big recent decline in metals prices caused by recent concerns of an imminent Fed rate hike. Can The Fed stop a “Totally Crazy” Bull Market? Take Advantage of Silver's Recent Dip With the Latest 5 oz Silver ATB Release: 2016 Harpers Ferry – […] The post Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver? appeared first on Silver Doctors. |

| Posted: 28 May 2016 12:05 PM PDT As regular readers know, we have long warned that the End Game for the banksters manipulation of the bond markets & interest rates via gold and silver manipulation will occur when industrial users of physical silver, namely the colossal electronics industry- sniff the first signs of a wholesale shortage of physical silver, and begin panic hoarding […] The post Has The Industrial Silver Panic Begun? Major Japanese Electronics Firm To Lock In Silver Supply From First Majestic, Citing Supply Concerns appeared first on Silver Doctors. |

| Posted: 28 May 2016 07:00 AM PDT This is a major RED WARNING ALERT… Submitted by Chris Vermelean: In May of 2008, there was a very similar stock market 'rally' as compared to today's 'rally'. Investors believed that the 'turmoil' during the latter part of 2007 and the early part of 2008 was permanently over and that we were headed towards […] The post Is THIS The End of the Road? appeared first on Silver Doctors. |

| Posted: 27 May 2016 08:14 PM PDT Though prophecies of destruction and mass die-offs are nothing new, Baba Vanga's date-specific predictions made twenty years ago seemingly coincide with events that are happening all around us. One foretells the collapse of the United States of America as we know it today. The other is perhaps EVEN MORE frightening… Submitted by Mac Slavo: It is […] The post Chilling Prophecy Predicts: "Obama Will Be Last U.S. President…Europe A Total Wasteland By End Of 2016" appeared first on Silver Doctors. |

| Goldcorp Is Back and Spending: Could West Red Lake Gold Mines Be Next? Posted: 13 May 2016 01:00 AM PDT |

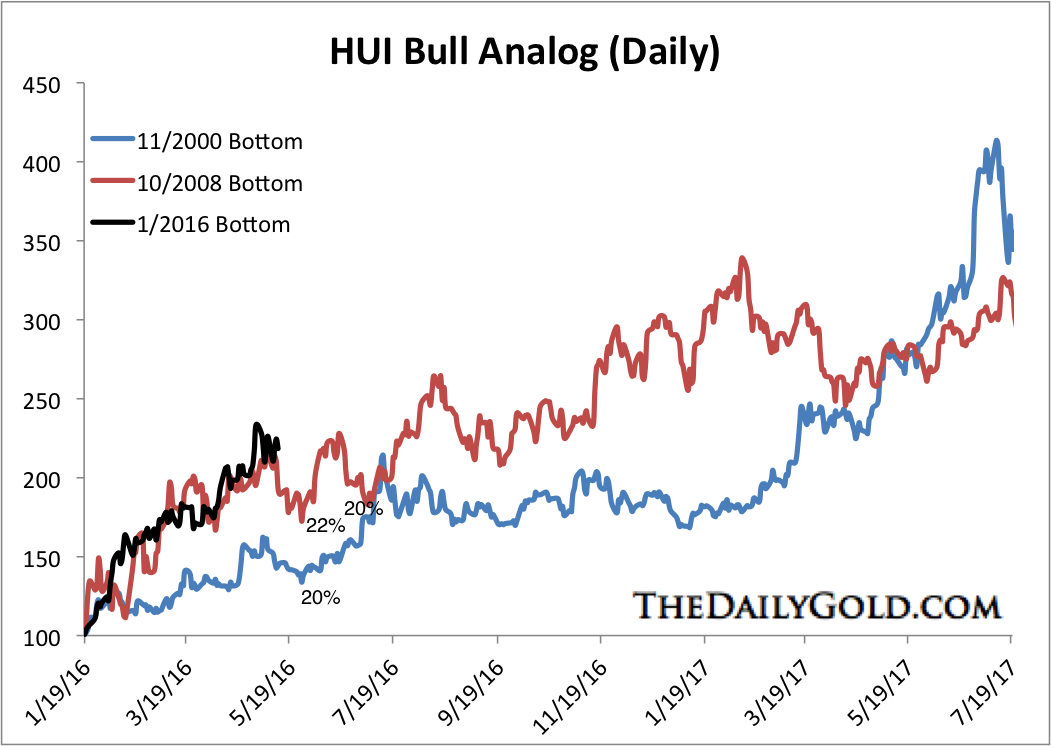

| Correction or Final Push Higher? Posted: 13 May 2016 12:03 AM PDT Despite maintaining an overbought condition and despite the recent bearish posture of many sector pundits, the gold stocks have yet to correct more than 11%. Since the end of January the gold stocks have held above their 50-day moving averages, which is often support during a strong trend. If the gold stocks break their lows of the past two weeks then it should usher in a 20% correction and correct the current overbought condition. However, if gold stocks do not break initial support they could begin a melt-up that would lead to a more serious correction in the summer. The chart below plots the three major rebounds in the HUI from the three most significant lows. The time and price scale begins from where the current rebound started. At this juncture, the two other rebounds corrected at least 20%. The current rebound has tracked the 2008 rebound very closely. That bull endured two 20% corrections over the next few months which proved to be good buying opportunities.

HUI Bull Analogs

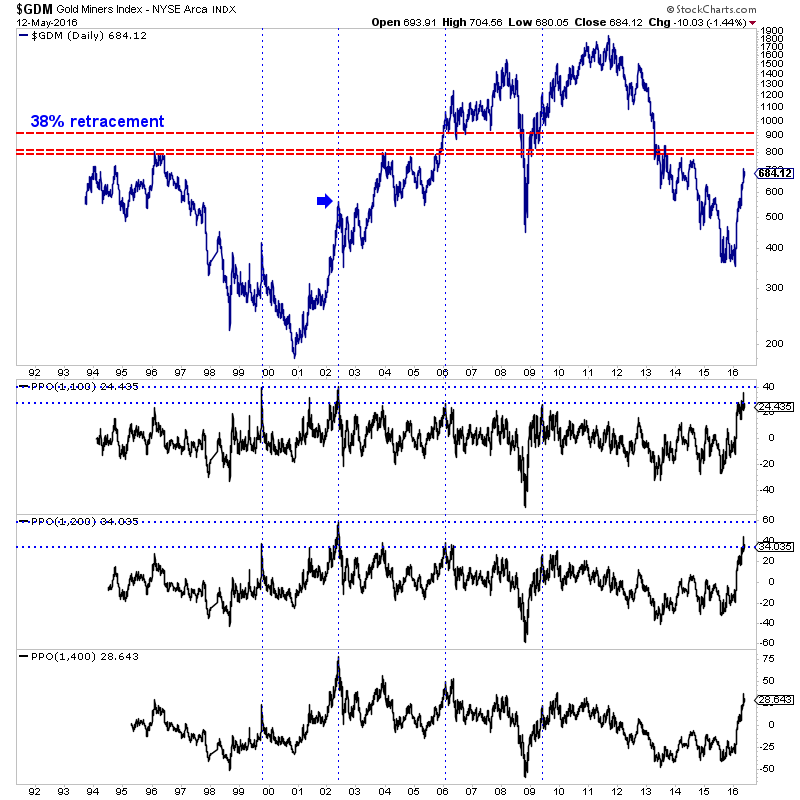

If the gold stocks do not break initial support and correct more, they would be at risk of a deeper correction following another push higher. The following chart is GDM, the parent index for GDX. Unlike GDX, GDM has a history that dates back to 1993. GDM closed Thursday at 684. It has a major resistance target at 800-810. A move to 800 is 17% upside while a move to 810 equates to GDX 29.

GDM Daily

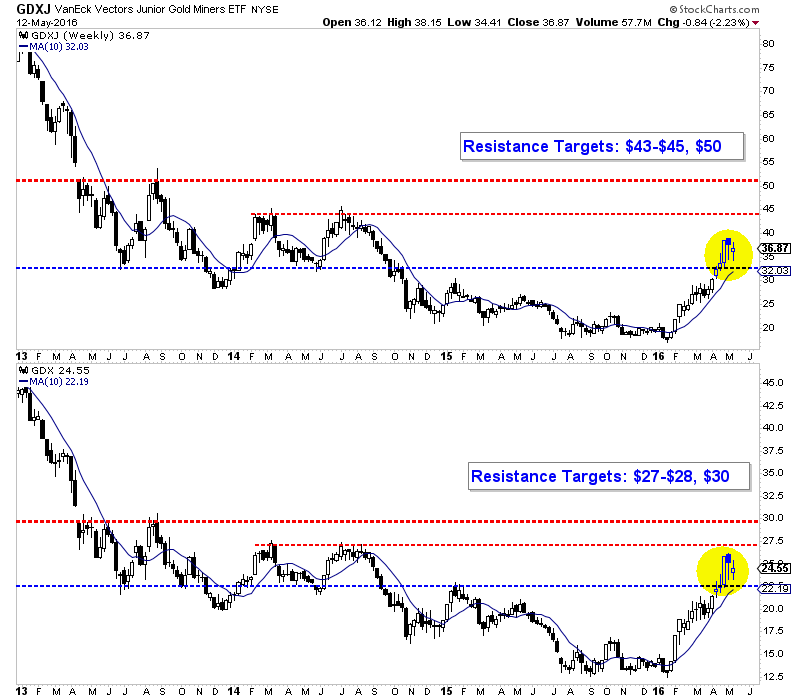

Also note the three oscillators at the bottom of the chart which plot GDM's distance from its 100-day, 200-day and 400-day exponential moving averages. The gold stocks are not as overbought as they were in 2002 but they are more overbought than at any other time in the past 23 years. That is a good sign considering we are early in a new bull market but it does warn of a probable sharp correction. The support and resistance for GDX and GDXJ continue to be clear. GDXJ has support at $32-$33 with upside targets at $43-$45 and $50. Meanwhile, GDX has support around $22 with upside targets at $27-$28 and $30. A final push higher (before a correction) could take GDX to $29-$30 and GDXJ to $45.

GDXJ & GDX

The past few months has been an amazing ride in the gold stocks but all good things come to an end. Unless the gold stocks break initial support and correct by 20% (from recent peaks) then the risk of a final push higher or melt-up type move increases. That is great for us bulls but the problem is it would likely lead to a 30% correction and a potential multi-month consolidation during the second half of 2016. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment