saveyourassetsfirst3 |

- Gold & Silver Premiums Update

- Sprott’s Market Wrap With Andrew Maguire: The Importance of $1308 Gold

- Italian Banking Crisis In Danger of Erupting! -Alasdair Macleod

- Preparing to Collapse in Place with Permaculture

- Shortage Or No Shortage? Renowned Silver Expert David Morgan Presents the Data

- Venezuela's 'Meltdown': Oil Disruptions Happening

- Are Dollar Fundamentals Lagging The Technical Improvement?

- Gold Miners’ Fundamentals

- Charts Warning – Buckle In!

- The Foundation Of The Financial Markets Took A BIG HIT In 2015

- Financial Analyst Warns: “What We’re Looking At Is An Event You’re Not Going To Be Able To Recover From”

- Forensic Examination of the Gold Carry Trade

- Casey Research Warns: “What’s Coming At You Is A Historic Event…And It’s Going To Result In Disaster”

- A Sale On Silver Eagles You Have to See to Believe!

- Misreading the CoTs, Again

- This Is How Bad It Really Is!

- Gold Price Drifting Lower after Key Reversal

| Posted: 15 May 2016 12:00 PM PDT Gold big bar shortage indicators show mixed signs of shortage, and big-bar silver premiums jumped higher… Submitted by Peak Prosperity: On Friday gold rose +9.60 [+0.76%] to 1274.30 on moderately heavy volume, while silver climbed +0.13 to 17.13 on moderate volume. Gold and silver both managed to overcome strong headwinds from a good-sized rally in USD; […] The post Gold & Silver Premiums Update appeared first on Silver Doctors. |

| Sprott’s Market Wrap With Andrew Maguire: The Importance of $1308 Gold Posted: 15 May 2016 10:18 AM PDT Andrew Maguire joins us from London for a MUST LISTEN SHOW, discussing the importance of the $1308 level in gold, and how the SGE is changing the global gold market landscape: From Craig Hemke: With Eric unavailable this week, I was able to line up a special guest appearance from our pal, Andrew Maguire. The resulting […] The post Sprott’s Market Wrap With Andrew Maguire: The Importance of $1308 Gold appeared first on Silver Doctors. |

| Italian Banking Crisis In Danger of Erupting! -Alasdair Macleod Posted: 15 May 2016 09:00 AM PDT Meanwhile, In Europe… Buy 2016 Silver Maples Lowest Price Ever! Submitted by Alasdair Macleod: Yesterday, the World Gold Council released its estimate of gold demand for the first quarter of 2016, which compared with supply estimated at 1,081 tonnes. While the WGC collects its figures assiduously, the demand figures are only those that are […] The post Italian Banking Crisis In Danger of Erupting! -Alasdair Macleod appeared first on Silver Doctors. |

| Preparing to Collapse in Place with Permaculture Posted: 15 May 2016 08:45 AM PDT |

| Shortage Or No Shortage? Renowned Silver Expert David Morgan Presents the Data Posted: 15 May 2016 08:30 AM PDT Throughout 2015’s Severe Retail Investment Silver Shortage, Skeptics Claimed That Silver Itself Was In Abundant Supply & the Shortage Was Merely a Production Issue. Is There In Fact A Massive Shortage of Physical Silver Metal Developing in the Market? Renowned Silver Expert David Morgan Joined the Show to Present the Cold Hard Data: Best Quarter […] The post Shortage Or No Shortage? Renowned Silver Expert David Morgan Presents the Data appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Venezuela's 'Meltdown': Oil Disruptions Happening Posted: 15 May 2016 08:26 AM PDT |

| Are Dollar Fundamentals Lagging The Technical Improvement? Posted: 15 May 2016 08:12 AM PDT |

| Posted: 15 May 2016 07:00 AM PDT The gold miners' stocks have skyrocketed this year as investors started returning to this long-abandoned sector. Many have doubled since January, with plenty tripling or even quadrupling. Naturally such fast gains raise concerns about whether they are actually fundamentally justified or merely the product of fleeting sentiment that could reverse. Gold miners' latest quarterly results […] The post Gold Miners' Fundamentals appeared first on Silver Doctors. |

| Posted: 15 May 2016 05:00 AM PDT The last two times this happened, carnage followed… Buy Silver Coins Bars and Rounds at SDBullion From Tyler Durden, ZeroHedge Via NorthmanTrader.com, Despite the large February – April rally stocks are down year over year (May 6 2015- May 6 2016). $SPX is down over 1%, the Nasdaq is down over 4% and small caps are down […] The post Charts Warning – Buckle In! appeared first on Silver Doctors. |

| The Foundation Of The Financial Markets Took A BIG HIT In 2015 Posted: 14 May 2016 09:01 PM PDT The Foundation Of The Financial System Took A Big Hit In 2015: 2016 Silver Shield Silver Trump at SD Bullion From SRSRocco: The Global Financial Market took a big hit in 2015 and most investors have no idea why. The U.S. and global financial system both sit on a foundation that continues to erode […] The post The Foundation Of The Financial Markets Took A BIG HIT In 2015 appeared first on Silver Doctors. |

| Posted: 14 May 2016 03:00 PM PDT Are we ON THE BRINK of an economic collapse and the total breakdown of U.S. society as we know it? Buy Silver Coins and Bars at SDBullion "Things are breaking down, something big is happening," according to leading alternative news web site SGT Report. Citing the recent emergency meeting between the Federal Reserve and President […] The post Financial Analyst Warns: "What We're Looking At Is An Event You're Not Going To Be Able To Recover From" appeared first on Silver Doctors. |

| Forensic Examination of the Gold Carry Trade Posted: 14 May 2016 03:00 PM PDT Kirby Analytics |

| Posted: 14 May 2016 02:20 PM PDT They don’t want your gold, they want your CASH… From Casey Research via WolfStreet.com: "Negative interest rates" have become a phenomenon with economists and the media. But I'm writing to tell you something about negative interest rates you haven't heard. You certainly won't hear about it in the mainstream press. What's coming at you is a historic event. […] The post Casey Research Warns: "What's Coming At You Is A Historic Event…And It's Going To Result In Disaster" appeared first on Silver Doctors. |

| A Sale On Silver Eagles You Have to See to Believe! Posted: 14 May 2016 02:19 PM PDT SD Bullion just dropped 2016 Silver American Eagles to the lowest price in over a year… *$2.29 Over Spot SAE Sale Price Effective 5 pm EST 5/13 While Supplies Last 2015 Silver Shield FLASH SALE 1 oz Freedom Girl $1.99 Over Spot Silver Bull Just $1.49 Over Spot! New Releases: Hand Poured 5 oz Viking Silver […] The post A Sale On Silver Eagles You Have to See to Believe! appeared first on Silver Doctors. |

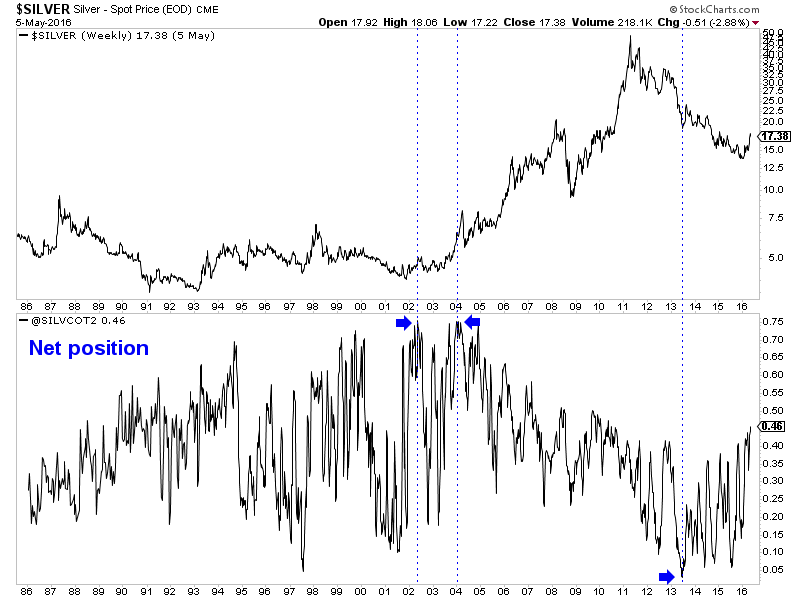

| Posted: 06 May 2016 01:00 PM PDT Nearly two months ago I published a video in which I discussed conventional CoT analysis and the mistake many investors might make assuming Gold and gold stocks would undergo a big correction. The fact is a bull market that follows a nasty bear usually stays very overbought throughout its first year and therefore sentiment indicators remain in bullish territory. As a result of the primary trend change, conventional CoT analysis fails and requires an adjustment. Today we look at the Gold and Silver CoT's while harping on a few of the mistakes people are making. The first mistake people are making (and I've seen this quite a bit recently) is painting the commercial traders as smart money. This completely mischaracterizes that group. Commercial hedgers are the users, producers or consumers of the commodity. They are using the futures market to hedge in some way. As Steve Saville writes in his explanation of the CoTs, the commercials usually do not bet on price direction. Generally speaking they tend to fade the trend while speculators drive or follow the trend. Risk certainly rises for bulls when speculators increase long positions aggressively and we should be aware of that. However, we should look beyond nominal figures to get a better reading of the degree of speculation. The second mistake is looking at the CoT's in only nominal terms and not as a percentage of open interest. The nominal net speculative position in Silver is at an all time high, which sounds scary. However, as a percentage of open interest the net speculative position is nowhere close to an all time high. In the chart below we plot Silver and its speculative position as a percentage of open interest. The current position is 45.7%, which is nowhere near the all-time highs seen in 2002 and 2004 of nearly 75%. Also note how the net speculative position does not tell us anything about the primary or long-term trend. Speculators were most bullish in 2002 and 2004 just after the start of a secular bull market. Speculators were least bullish in 2013. Silver bounced but continued to make new lows for a few more years!  Silver & Silver CoT

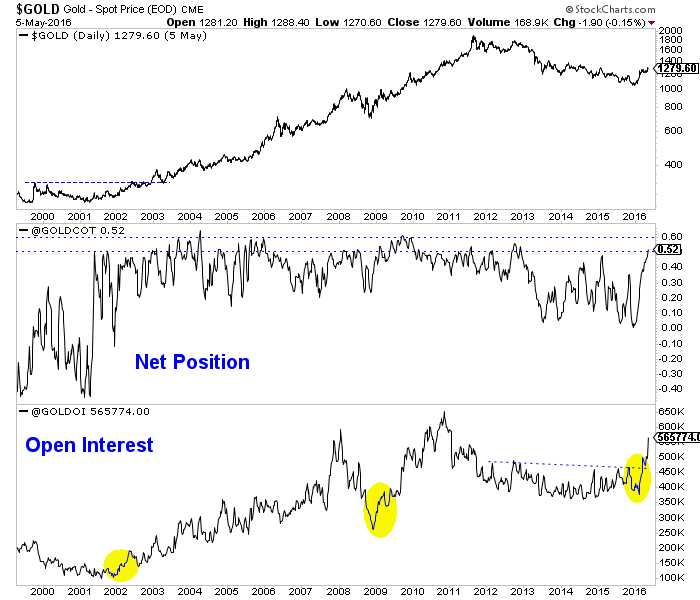

When considering open interest, Gold's primary trend change has been confirmed yet the net speculative position in Gold is much closer to extremes than Silver's. Take a look at the chart below and note the huge increases in open interest that immediately followed the lows in 2001, late 2008 and late 2015. A rise in open interest confirmed the trend change at those points. As of Tuesday, the net speculative position in Gold was 52.1%. Note that from 2003 to 2012 the net speculative position often peaked at 55% to 60%. Keep in mind, we do not know if Gold's next peak will be at 55% or even 70%.  Gold CoT

Overall, the CoT is one of a handful of tools we use and we learned how to interpret and analyze it the hard way. Remember, the speculators drive the trend and it's best to judge their position in terms of open interest. I do not see anything in the CoTs or price action of the metals or the miners that says they are about to endure a large correction. That will change at somepoint but for now weakness or consolidation is a buying opportunity. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

|

| Posted: 06 May 2016 04:35 AM PDT Silver Price Forecast: The 1929 Dow crash marked the start of the infamous Great Depression. We currently have a repeat of the pattern that led to that great crash in 1929. This pattern is basically a huge stock market rally (after a period of stagnation) that is driven by a huge expansion of the money… |

| Gold Price Drifting Lower after Key Reversal Posted: 05 May 2016 04:05 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment