Gold World News Flash |

- The Federal Reserve Putting Direct Pressure On Gold & Silver. Here’s How. By Gregory Mannarino

- Silver demand hit record high in 2015

- Executive Order 6814 Required Turning in of Silver Bullion to the U.S. Government

- Trump vs. Clinton: the math & the map

- PROOF OF LIFE ON MARS? WHISTLE BLOWERS TELLS ALL!

- Doug Casey– Scary Rise in Gold Prices is Coming. More Explosive Move Coming in Silver

- The War On Cash Has Begun, ECB Fires The First Shot

- End Times News 2016 (World Events May 1-5) Prophecy In The News HD

- Will Turkey Become An "Islamic State"?

- Easy Money From China, Japan and Europe Has Failed. What’s Next?

- How Jeff Gundlach Is Preparing For A Trump Presidency

- Jim Grant Asks When The World Will Realize "That Central Bankers Have Lost Their Marbles"

- Why I Think there Will Be a “Dollar Panic”

- Coast To Coast AM - May 1, 2016 Myth of Positive Thinking & Electric Universe

- Silver and Gold Turned up in December After a Nearly 5 Year Downward Correction

- Dr. Richard Alan Miller - Ancient Aliens & The Coming Revolution

- ‘Apocalyptic’ Inferno Engulfs Canadian Tar Sands City - Why has Weather been so Warm there?

- Trumped! Why It Happened And What Comes Next, Part 1

- Gold Daily and Silver Weekly Charts - A Delivery in Gold - Payrolls Tomorrow

- Paul Craig Roberts The WARNING: Propaganda ıs Leadıng to WAR

- Could This Be the Start of an Early Bull Market in Precious Metals and Commodities?

- Tomorrow is Being Called “Judgment Day”

- CANADA ON FIRE -- Cataclysmic Wildfires & Record Temperatures

- The Plaza Accord, The Shanghai Accord, and Gold’s Future

- Peter Schiff Why Economic Collapse Will Happen

- Monetary Liquifaction, Gold And The Time Of The Vulture

- Gold and Silver Companies with the Potential to Move the Needle

- Breaking News And Best Of The Web — May 6

| The Federal Reserve Putting Direct Pressure On Gold & Silver. Here’s How. By Gregory Mannarino Posted: 05 May 2016 09:20 PM PDT from Gregory Mannarino: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver demand hit record high in 2015 Posted: 05 May 2016 08:20 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive Order 6814 Required Turning in of Silver Bullion to the U.S. Government Posted: 05 May 2016 08:20 PM PDT from Smaulgld:

Executive Order 6814 is not a fictional future act of government, like the passing of the 211th, 212th and 213th Amendments to the Constitution, but an actual Presidential Order by Franklin Delano Roosevelt in 1934. The order dated August 9, 1934, was entitled Executive Order 6814 Requiring the Delivery of All Silver to the United States for Coinage and required all persons to deliver silver to the U.S government pursuant to the Silver Purchase Act of 1934, subject to certain exemptions.

Following are frequently asked questions about Silver Confiscation Under Executive Order 6814:What Silver Had To Be Turned In? Silver "situated in the United States"; Silver of a fineness of 80% or more; and Silver held in quantities over 500 troy ounces by any one person. What Silver Was Exempt? U.S. silver coins (of which U.S. dimes, quarters, half dollars and dollar coins were 90% silver at the time) and foreign silver coins; Silver that was of a fineness less than 80%; Unprocessed silver (less than 80% fineness) that was mined in the United States after December 21, 1933; Silver contained in articles fabricated and held in good faith for a specific and customary use and not for their value as silver bullion (presumably silver ornaments, jewelry and/or silverware); and Silver held for industrial, professional, or artistic use in amounts less than 500 troy ounces per person. N.B. There was no "investment" exemption. Holding silver bullion of 80% of higher fineness in bar or round form in any amounts that was not for "industrial, professional, or artistic use" was required to be turned in. How Much Did People Get For Their Silver? People turning in their silver got $1.29 an ounce. Payment was made in the form of "standard silver dollars, silver certificates, or any other coin or currency of the United States." There was a catch however; there was fee of 61 8/25 percent (61.32%) taken from the $1.29 an ounce for "seigniorage, brassage, coinage, and other mint charges." After the fee, it worked out to a payment of about fifty cents an ounce. How Much Silver Was Confiscated? 1935: 112,301,335 ounces Source: Silver Money (Cowles Commission for Research in Economics Monographs, No. 4) What Did The Government Do With The Silver? The U.S. government presumably needed the silver to mint coins or to "print money". In 1918 pursuant to the Pittman Act, the U.S. melted down over a quarter of a billion U.S. Silver dollars and converted them into silver bullion and sold it to England who needed the silver to alleviate a silver coin shortage in India which was a colony of England's at the time. image: Goldcorecom | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump vs. Clinton: the math & the map Posted: 05 May 2016 08:00 PM PDT CNN's John King breaks down Trump's case that he can change the GOP math in a general election & what impact the "woman card" rhetoric has on female voters. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PROOF OF LIFE ON MARS? WHISTLE BLOWERS TELLS ALL! Posted: 05 May 2016 07:00 PM PDT Shaman, seer, healer, and teacher William Whitecrow discloses that his time in the military was spent training mars whistleblower Andrew D. Basiago for the full 3 hour show visit: http://truthfrequencyradio.com/mars-t... The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Doug Casey– Scary Rise in Gold Prices is Coming. More Explosive Move Coming in Silver Posted: 05 May 2016 06:40 PM PDT from The Power and Market Report: Doug Casey joins Albert on the Schiff Gold Videocast. Doug believes the next rise in gold prices will be scary with the metal topping $2,000-$3,000 per ounce. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The War On Cash Has Begun, ECB Fires The First Shot Posted: 05 May 2016 06:00 PM PDT from X22Report: Aeropostale file for Chapter 11. 90% of the households have lower net worth now than in the 70’s.Durable goods decline signalling a collapse of the economy. Trade deficit tumbles. Manufacturing continue declines. ECB fires the first shots and eliminates the 500 euro, the $100 is next. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Times News 2016 (World Events May 1-5) Prophecy In The News HD Posted: 05 May 2016 05:52 PM PDT Repent. Why choose death? Why have your destruction come in one day? Turn away from your sin children. No more cigarettes, weed, no porn. no sin. Live holy. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Turkey Become An "Islamic State"? Posted: 05 May 2016 05:50 PM PDT Submitted by Emad Mostaque via GovernmentsAndMarkets.com,

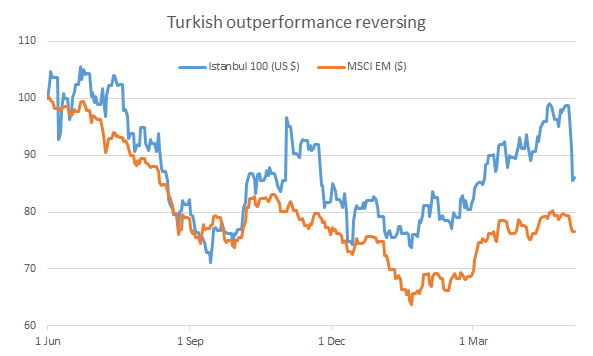

Tonight is H?drellez in Turkey, celebrating spring and the day on which the Prophets al-Khidr and Elijah. Traditionally wishes come true today and it would seem that President Erdo?an’s wish for an executive Presidency has come one step closer to reality with the resignation of Prime Minister Davuto?lu. When we downgraded Turkey in last week’s Governments and Markets update, it was primarily due to negative shifts in governance as the pressure to move to a Presidential system and crack down on the Kurds increased. We weren’t sure of the timing of these events, although key factors like the HDP being effectively banned and the President needing to assert control over more elements of the government seemed certain. Taking some cash off the table after a period of Turkish outperformance seemed sensible and we must now consider where we go from here with Turkish equities having fallen 10% this week alone. Fighting for the right not to be prosecuted AKP and HDP members of parliament express their disagreements While the resignation of the Prime Minister is the main headline news, the start of this week saw jitters following a brawl in the Turkish parliament as the process to strip MP’s of immunity to prosecution began, something that would impact HDP members given accusations of PKK ties, but also some MHP members. This move was in line with our expectations and unsurprising given the continued escalation of deadly suicide attacks by the Kurdish TAK, linked by the government to the PKK, who are in turn linked by them to the HDP. The March 13th suicide car bomb attack on Ankara was particularly alarming as it confirmed the return of Kurdish attacks on civilian targets, with 37 being killed. The Syrian civil war has dramatically increased the available ordinance for such attacks, designed to maximize casualties with the car in this case being packed with nails and pellets, injuring a further 127 individuals. The moves by the security forces to push Kurdish separatists out of their urban areas are likely to increase the frequency of such attacks, providing a grim echo of the 90s when they first started. This is a continuation of the process of reducing Kurdish political influence that we outlined in our notes “A Kurdish Conundrum” on July 31st last year and “Ankara: Cui Bono?” on 20th October 2015, where we predicted the AKP majority and continued political polarization that has occurred. We also saw continued developments in the chaos that has surrounded the MHP and efforts to oust Bahçeli as leader after 19 years, with the judiciary blocking the proposed extraordinary congress that could make the rule change necessary for a vote to kick him out and accusations by Bahçeli that Gülenist forces are behind this move. This puts the opposition to the AKP in a bad spot even as the leadership of the AKP becomes ever more streamlined, a process that we saw with Cabinet III and likely required after the public splits that we started to see last March with the running of Fidan and the Gökçek-Ar?nç feud. There can be only oneGiven the current constitutional powers of the President versus the Prime Minister, Davuto?lu was the only potential political force that could stop the President from exercising almost unlimited executive powers, although this would have amounted to a semi-coup within the AKP that Erdo?an officially left upon taking up the Presidency, but clearly still controls. The expectation of Davuto?lu that he would be able to exercise his constitutionally mandated powers versus being effectively a Vice President appears to have been the real catalyst that led to the current situation, something hinted at with the arrival of the “Pelican Brief” blog on May 1st, a pro-Erdo?an blog accusing Davuto?lu of helping the cause of Erdo?an’s enemies (conspiracy theories are popular in Turkey) and not doing enough to advocate the Presidential system. He was also accused of not protecting Erdo?an against attacks, notable when 1,800 have been charged with insulting the President as the space for public dissension continues to narrow, supporting Kurdish peace, something that Erdo?an no longer cared for and other such calumnies. While the blog is anonymous, it fit with news that broke shortly after that, after agreeing a politically important military base in Qatar for Turkey, Davuto?lu had been stripped of many of his powers as party leader by almost all of the members of the AKP’s Central Decision and Administration Board, backed by Erdo?an. This was referred to by Davuto?lu as a key reason for his resignation, although he still voiced his full support for Erdo?an. Any new Prime Minister is now certain to be a Erdo?an loyalist when the party congress meets at the end of May, raising the question as to why any constitutional amendment is now needed given the President controls almost all elements of governmental power and has consolidated influence over key institutions such as the central bank. We may see elections in October if they decided to try and kill off the HDP and MHP, for now it appears that, absent a possible reshuffling of some of the AKP ranks, this is merely the latest step in the formalisation of the President’s rule. Polls show support for a Presidential system isn’t tremendously high, which would argue against putting it to a public vote when the powers are all in place already. What foreign investors dislikeWhere does that leave Turkey in terms of governance and likely asset performance? Markets were troubled last year by the prospect of a shake up in the AKP as they lost their parliamentary majority, before jumping after elections and subsiding once more. By and large, the bourse, dominated by foreign investors, tends to favour a firm hand at the tiller and predictability, which should augur well for the Presidential system. Turkish assets have outperformed broader Emerging Markets since last summer’s elections as fears of decision-making chaos proved unfounded and double digit carry proved attractive, particularly on a Euro investor basis. This can be seen in the below chart of dollar returns for equities, although the performance has started to reverse dramatically with this week’s events

Source: Ecstrat, Bloomberg. Indexed to 1st June 2015, just before summer general elections

Economic policy is unconventional, but now quite predictable and Turkey has benefited from the tailwind of lower oil prices, although we are now starting to see pressures resume upon the economy and current account. What investors hate, however, are governance regimes in which the state interferes with private enterprise, something that we have seen in the crackdown on and seizure purported Gülenist companies and continued consolidation of the press, with the takeover of Feza Media and Zaman the latest in this series on terror support charges. It should now be the case that Erdo?an has sufficient support and has shown enough strength not to go after additional targets like Isbank, where the CHP has a 28% stake. If so, our neutral rating is optimistic. If not and we now get a period of relative stability as all challengers have been dealt with, then the market looks good here on a relative basis, with banks in particular the second cheapest in EM after Chinese banks and in a supportive rate policy environment, but still offers little upside on an absolute basis with most of the action likely continuing to be on FX and bonds. If this rally in EM is just that and not a secular turning point as we expect as Chinese vulnerabilities continue to expand, then the real test for the government and its relationship to the corporate sector will be when the market turns south once more. Will Turkey become an “Islamic” state?On a final note, we have had a couple of queries as to whether Turkey is headed toward Shariah law implementation as the Presidency is consolidated, particularly given Parliament Speaker Ismail Kahraman’s comments that secularism should be taken out of Turkey’s new constitution last week, moving it instead to a “religious constitution”. While we are dubious on the impact of any constitution (look at North Korea’s, its fabulous), we think that an overall shift to an Islamic state is unlikely in Turkey as the impact the AKP is looking to achieve, namely normalisation of Islamic practice in public as a foundational support for party control and roll back of the restrictions of prior governments. This doesn’t require a change in the constitution, nor does it require a formalisation of Islamic law within the country as a guide to government policy, something which is better served by the use of “public interest” (maslaha) doctrine by the government in any case, which provides significant flexibility in promulgating policy. This is similar to the interaction between religion and government we are seeing today in Russia and a sensible step to take as Turkey goes down a more conservative route for a leader who wants to consolidate control. The decisions made on state capitalism on this path will likely be the ones that determine the success of Turkey in the coming years and something the President will be judged on as he gets his wish. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Easy Money From China, Japan and Europe Has Failed. What’s Next? Posted: 05 May 2016 05:20 PM PDT from Dollar Collapse:

China's most recent borrowing binge didn't work, while Japanese and European negative interest rates sent their currencies up rather than down. The result: Global growth is slowing and governments are panicking. Look for fiscal stimulus to pick up the slack in the year ahead — that is, bigger deficits, more government borrowing and maybe even the fabled debt jubilee. Precious metals love this kind of thing, so after the coming correction, look out. Click HERE to Listen | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Jeff Gundlach Is Preparing For A Trump Presidency Posted: 05 May 2016 05:20 PM PDT Two weeks ago, long before the outcome of the Indiana primary was known, we first reported that it was Jeff Gundlach's opinion that Donald Trump would be the winner of the 2016 presidential race. For those who missed it, here are the key excerpts from his interview posted on April 22.

* * * Two weeks later, CNBC caught up with Gundlach to report essentially the same: following the Sohn Conference, Gundlach once again stated that he believes that Trump would become president. The CEO of DoubleLine, which manages $84 billion for clients, told CNBC he's apolitical but said, "I think it's important for investors to deal with reality." Repeating his previous comment, Gundlach said that Trump will have a very large deficit while in the Oval Office. "He's very comfortable with debt. We know that about Donald Trump." Gundlach added that the presumptive Republican presidential nominee is just like another man many in the GOP idolize: former President Ronald Reagan. "Reagan was a debt-based economic guy and I think Trump will be," Gundlach noted. "It will probably look like it's working at first. The question is, will the boost to the economy from infrastructure projects and the like off-set the potential drag from shrinking global trade." So how is Gundlach preparing and trading in advance "Trump presidency"? "Look at arms manufacturers, said Gundlach. He would avoid companies that are susceptible to global trade slowdowns, particularly those related to Mexico and China." A Trump presidency would also be perceived as negative by the market. Recall that on April 26, Gundlach told Reuters that Trump's protectionist policies could mean negative global growth: "As he gets the nomination, the markets and investors are going to worry about it more. You will see a downgrading of global growth based on geopolitical risks. You must factor this into your risk-management." In summary: buy guns, stay away from FedEx, start legging into market shorts, oh and also Gundlach seemed to fully agree with Druckenmiller's speech, which to us simply means Gundlach is yet another advocate for the Fed "dead end" trade which ultimately ends in gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Grant Asks When The World Will Realize "That Central Bankers Have Lost Their Marbles" Posted: 05 May 2016 04:50 PM PDT Authored by James Grant via Grant's Interest Rate Observer, April 15 comes and goes but the federal debt stays and grows. The secrets of its life force are the topics at hand— that and some guesswork about how the upsurge in financial leverage, private and public alike, may bear on the value of the dollar and on the course of monetary affairs. Skipping down to the bottom line, we judge that the government’s money is a short sale. Diminishing returns is the essential problem of the debt: Past a certain level of encumbrance, a marginal dollar of borrowing loses its punch. There’s a moral dimension to the problem as well. There would be less debt if people were more angelic. Non-angels, the taxpayers underpay, the bureaucrats over-remit and everyone averts his gaze from the looming titanic cost of future medical entitlements. Topping it all is 21st-century monetary policy, which fosters the credit formation that leads to the debt dead end. The debt dead end may, in fact, be upon us now. A monetary dead end could follow. As to sin, Americans surrender, in full and on time, 83% of what they owe, according to the IRS—or they did between the years 2001 and 2006, the latest period for which America’s most popular federal agency has sifted data. In 2006, the IRS reckons, American filers, both individuals and corporations, paid $450 billion less than they owed. They underreported $376 billion, underpaid $46 billion and kept mum about (“nonfiled”) $28 billion. Recoveries, through late payments or enforcement actions, reduced that gross deficiency to a net “tax gap” of $385 billion. This was in 2006, when federal tax receipts footed to $2.31 trillion. Ten years later, the U.S. tax take is expected to reach $3.12 trillion. Proportionally, the 2006 gross tax gap would translate to $607.7 billion, and the net tax gap to $520 billion. To be on the conservative side, let us fix the 2016 net tax gap at $500 billion. Then there’s squandermania. According to the Government Accountability Office, the federal monolith “misdirected” $124.7 billion in fiscal 2014, up from $105.8 billion in fiscal 2013. Medicare, Medicaid and earnedincome tax credits accounted for 75% of the misspent funds—i.e., of those wasted payments to which government bureaus confessed. “[F]or fiscal year 2014,” the GAO relates, “two federal agencies did not report improper payment estimates for four risk-susceptible programs and five programs with improper payment estimates greater than $1 billion were noncompliant with federal requirements for three consecutive years.” It seems fair to conclude that more than $125 will go missing in fiscal 2016. Add the misdirected $125 billion to the unpaid $500 billion, and you arrive at a sum of money that far exceeds the projected fiscal 2016 deficit of $534 billion. Which brings us to intergenerational self-deception. The fiscal outlook would remain troubled even if the taxpayers paid in full and the bureaucrats stopped wiring income-tax refunds to phishers from Nigeria. Not even a step-up in the current trudging pace of economic growth would put right the long-term fiscal imbalance. So-called non-discretionary spending, chiefly on Medicare, Medicaid and the Affordable Care Act, is the beating heart of the public debt. It puts even the welladvertised problems of Social Security in the shade. Fiscal balance is the 3D approach to public-finance accounting. It compares the net present value of what the government expects to spend versus the net present value of what the government expects to take in. It’s a measure of today’s debt plus the present value of the debt that will pile up if federal policies remain the same. To come up with an estimate of balance or—as is relevant today, imbalance—you make lots of assumptions about life in America over the next 75 years. Critical, especially, is the interest rate at which you discount future streams of outlay and intake. Jeffrey Miron has performed these fascinating calculations over the span from 1965 to 2014. The director of economic studies at the Cato Institute and the director of undergraduate studies in the Harvard University economics department, Miron has projected that, over the next 75 years, the government will take in $152.5 trillion and pay out $252.7 trillion —each discounted by an assumed 3.22% average real rate of interest. Add the gross federal debt outstanding in 2014, and—voila!—he has his figure: a fiscal imbalance on the order of $120 trillion. Compare and contrast today’s net debt of $13.9 trillion, GDP of $18.2 trillion, gross debt of $19.2 trillion and household net worth of $86.8 trillion. Compare and contrast, too, the estimated present value of 75 years’ worth of American GDP. Miron ventures that $120 trillion represents something more than 5% of that gargantuan concept. There’s nothing so exotic about the idea of fiscal balance. In calculating the familiar-looking projection of debt relative to GDP, the Congressional Budget Office uses assumed rates of growth in spending and revenue, which it also discounts by an assumed rate of interest. It’s fiscal-balance calculus by another name, as Miron notes. Nor is the fiscal-balance idea very new. Laurence J. Kotlikoff, now a chaired professor of economics at Boston University, has been writing about it at least since 1986, when he shocked the then deficit-obsessed American intelligentsia with the contention that the federal deficit is a semantic construct, not an economic one. This is so, said he, because the size of the deficit is a function of the labels which the government arbitrarily attaches to such everyday concepts as receipts and outlays. Thus, the receipts called “taxes” lower the deficit, whereas receipts called “borrowing” raise it. The dollars are the same; only the classification is different. Be that as it may, Miron observes that the deficit and the debt tell nothing about the fiscal future. Each is backward-looking. “The debt,” he points out, “. . . takes no account of what current policy implies for future expenditures or revenue. Any surplus reduces the debt, and any deficit increases the debt, regardless of whether that deficit or surplus consists of high expenditure and high revenues or low expenditure and low revenues. Similarly, whether a given ratio of debt to output is problematic depends on an economy’s growth prospects.” Step back in time to 2007, Miron beckons. In that year before the flood, European ratios of debt to GDP varied widely, even among the soon-to-be crisis-ridden PIIGS. Greece’s ratio stood at 112.8% and Italy’s at 110.6%, though Ireland’s weighed in at just 27.5%, Spain’s at 41.7% and Portugal’s at 78.1% (not very different from America’s 75.7%). “These examples do not mean that debt plays no role in fiscal imbalance,” Miron says, “but they illustrate that debt is only one component of the complete picture and therefore a noisy predictor of fiscal difficulties.” So promises to pay, rather than previously incurred indebtedness, tell the tale. Social Security, a creation of the New Deal, did no irretrievable damage to the intergenerational balance sheet. It was the Great Society that turned the black ink red. Prior to 1965, the United States, while it had run up plenty of debts related to war or—in the 1930s—depression, never veered far from fiscal balance. Then came the Johnson administration with its guns and butter and Medicare and Medicaid. From a fiscal balance of $6.9 trillion in 1965, this country has arrived at the previously cited $120 trillion imbalance recorded in 2014. And there are “few signs of improvement,” Miron adds, “even if GDP growth accelerates or tax revenues increase relative to historic norms. Thus, the only viable way to restore fiscal balance is to scale back mandatory spending policies, particularly on large health-care programs such as Medicare, Medicaid and the Affordable Care Act.” We asked Miron about the predictive value of these data. Could you tell that Greece was on the verge by examining its fiscal imbalance? And might not Japan be the tripwire to any future developed-country debt crisis, since Japan—surely—has the most adverse debt, demographic and entitlement spending profile? Miron replied that comparative statistics on fiscal imbalance among the various OECD countries don’t exist. And even if they did, it’s not clear that they would tell when a certain country would lose the confidence of its possibly inattentive creditors. The important thing to bear in mind, he winds up, is that the imbalances— not just in America or Japan or Greece but throughout the developed world—are “very big and very bad.” Of course, government debt is only one flavor of nonfinancial encumbrance. The debt of households, businesses and state and local governments complete the medley of America’s nonfinancial liabilities. The total grew in 2015 by $1.9 trillion, which the nominal GDP grew by $549 billion. In other words, we Americans borrowed $3.46 to generate a dollar of GDP growth. We have not always had to work the national balance sheet so hard. The marginal efficiency of debt has fallen as the growth in borrowing has accelerated. Thus, at year end, the ratio of nonfinancial debt to GDP reached a record high 248.6%, up from 245.4% in 2014 and from the previous record of 245.5% set in 2009. In the long sweep of things, these are highly elevated numbers. In the not-quite half century between 1952 and 2000, $1.70 of nonfinancial borrowing sufficed to generate a dollar of GDP growth. Since 2000, $3.30 of such borrowing was the horsepower behind the same amount of growth. Which suggests, conclude Van Hoisington and Lacy Hunt in their first-quarter report to the clients of Hoisington Investment Management Co., “that the type and efficiency of the new debt is increasingly nonproductive.” What constitutes a “nonproductive” debt? Borrowing to maintain a fig leaf of actuarial solvency would seem to fill the bill. Steven Malanga, who writes for the Manhattan Institute, reports that state and municipal pension funds boosted their indebtedness to at least $1 trillion from $233 billion between 2003 and 2013. Yet, Malanga observes, “All but a handful of state systems have higher unfunded liabilities today than in 2003.” Neither does recent business borrowing obviously answer the definition of productive. To quote the Hoisington letter: “Last year business debt, excluding off-balance-sheet liabilities, rose $793 billion, while total gross private domestic investment (which includes fixed and inventory investment) rose only $93 billion. Thus, by inference, this debt increase went into share buybacks, dividend increases and other financial endeavors, [although] corporate cash flow declined by $224 billion. When business debt is allocated to financial operations, it does not generate an income stream to meet interest and repayment requirements. Such a usage of debt does not support economic growth, employment, higherpaying jobs or productivity growth.” The readers of Grant’s would think less of a company that generated its growth by bloating its balance sheet. The composite American enterprise would seem to answer that unwanted description. Debt of all kinds—financial and foreign as well as nonfinancial— leapt by $1.97 trillion last year, or by $1.4 trillion more than the growth in nominal GDP; the ratio of total debt (excluding off-balance-sheet liabilities) to GDP squirted to 370%. The United States is far from the most overextended nation on earth. Last year, Japan showed a ratio of total debt (again, excluding off-balancesheet items) to GDP of 615%; China and the eurozone, ratios of 350% and 457%. Hoisington and Hunt, who dug up the data, posit that overleverage spells subpar growth. In support of this proposition (a familiar one in the academic literature), they observe thataggregate nominal GDP growth for the four debtors rose by just 3.6% in 2015. It was the weakest showing since 1999 except for the red-letter year of 2009. The now orthodox reaction to substandard growth is hyperactive monetary policy. Yet the more the central bankers attempt, the less they seem to accomplish. ZIRP and QE may raise asset prices and P/E ratios, but growth remains anemic. What’s wrong? Debt is wrong, we and Hoisington and Hunt agree. With the greatest of ease do the central bankers whistle new digital money into existence. What they have not so far achieved is the knack of making this scrip move briskly from hand to hand. Among the big four debtors, the rate of monetary turnover, or velocity—“V” to the adepts— has been falling since 1998. “Functionally, many factors influence V, but the productivity of debt is the key,” Hoisington and Hunt propose. “Money and debt are created simultaneously. If the debt produces a sustaining income stream to repay principal and interest, then velocity will rise because GDP will eventually increase by more than the initial borrowing. If the debt is a mixture of unproductive or counterproductive debt, then V will fall. Which is why, perhaps, radical monetary policy seems to beget still more radical monetary policy. Insofar as QE and ultra-low interest rates foster credit formation, they likewise chill growth and depress the velocity of turnover in money. What then? Why, policies still newer, zippier, zanier. Ben S. Bernanke, the former Fed chairman turned capital-introduction professional for Pimco, keeps his hand in the policy-making game with periodic blog posts. He’s out with a new one about “helicopter money,” the phrase connoting the idea that, in a deflationary crisis, the government could drop currency from the skies to promote rising prices and brisker spending. Attempting to put the American mind at ease, Bernanke assures his readers that, while there will be no need for such a gambit in “the foreseeable future,” the Fed could easily implement a “money-financed fiscal program” in the hour of need. No helicopters would be necessary, of course, Bernanke continues. Let the Fed simply top off the Treasury’s checking account—filling it with new digital scrip. The funds would not constitute debt; they would be more like agift. Or the Fed might accept the Treasury’s IOU, which it would hold “indefinitely,” as Bernanke puts it, rebating any interest received—a kind of zero coupon perpetual security. The Treasury would then spread the wealth by making vital public investments, filling potholes and whatnot. The key, notes Bernanke, is that such outlays would be “money-financed, not debt-financed.” The “appealing aspect of an MFFP,” says he, “is that it should influence the economy through a number of channels, making it extremely likely to be effective—even if existing government debt is already high and/or interest rates are zero or negative [the italics are his].” Thus, the thought processes of Janet Yellen’s predecessor. Reading him, we are struck, as ever, by his clinical detachment. Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? The former Fed chairman seems not to consider the question— certainly, he doesn’t address it. To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why I Think there Will Be a “Dollar Panic” Posted: 05 May 2016 04:20 PM PDT from Wolf Street:

Please remember this warning when you go to the ATM to get cash — and there is none. While we were thinking about what was really going on with today's strange new money system, a startling thought occurred to us. Our financial system could take a surprising and catastrophic twist that almost nobody imagines, let alone anticipates. Do you remember when a lethal tsunami hit the beaches of Southeast Asia, killing thousands of people and causing billions of dollars of damage? Well, just before the 80-foot wall of water slammed into the coast an odd thing happened: The water disappeared.

The tide went out farther than anyone had ever seen before. Local fishermen headed for high ground immediately. They knew what it meant. But the tourists went out onto the beach looking for shells! The same thing could happen to the money supply… There's Not Enough Physical MoneyHere's how… and why: It's almost seems impossible. Hard to imagine. Difficult to understand. But if you look at M2 money supply – which measures coins and notes in circulation as well as bank deposits and money market accounts – America's money stock amounted to $12.6 trillion as of last month. But there was just $1.4 trillion of physical currency in circulation – about only half of which is in the US. (Nobody knows for sure.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coast To Coast AM - May 1, 2016 Myth of Positive Thinking & Electric Universe Posted: 05 May 2016 04:13 PM PDT Coast To Coast AM - May 1, 2016 Myth of Positive Thinking & Electric Universe The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Turned up in December After a Nearly 5 Year Downward Correction Posted: 05 May 2016 03:20 PM PDT

I'll be away tomorrow, undergoing surgery on my toe, so I'm sending out the weekly wrap-up today. Silver & gold prices corrected most of the week, no surprise after recent huge gains. Stocks are well and truly fractured, and show it. US dollar index most likely turned up this year, but with politically motivated currency exchange rates, that can turn on a dime, & Janet Yellen will chip in the dime. US dollar index hit the bottom of the range (92.50) with a low at 91.88, then recovered with a key reversal that has lifted it for three days. Presumption floating in the air is that the dollar will now rush toward the range's top boundary (100). I still suspect the central banks have struck a deal to let the dollar sink a while, and with this dollar rise they are playing the market like you playing a big old bass on the line. But technically, at least, the dollar is forecasting higher prices. Here's the chart of the nasty thing, http://schrts.co/OkJ5UT Dow rose 9.45 (0.05%) to 17,660.71, but who do the Nice Government Men think they are kidding? Mercy, the Nasdaq, Nasdaq 100, S&P500, and Russell 2000 all fell. Dow's rise today is mere tape-painting for the headlines. Listen to my words: LOWER stock prices are coming soon. Stay in 'em at your own peril. Dow in gold and Dow in silver both reinforced their downtrends this week. Dow in gold fell through the uptrend from the 2011 low, Dow in silver came close to setting a new low. Look here, http://schrts.co/ohwLZP and here, http://schrts.co/8Sv0tc On Comex today gold fell $1.90 (0.15%) at the close, $1,271.40. Silver rose 2.5¢ to 1730.2¢, but those figures look a little low, judging by what I saw all day and by the aftermarket. There Gold is $1,277.70 and silver 1736¢. Only one issue with the precious metals right now: will this be a large or small correction? That is, will it correct the entire rise from January, or has another leg up begun which, after this short, shallow correction, will at once climb higher? Unhappily for the curious, markets didn't tip their hand today. Gold closed barely below the uptrend line, but did the same all through April's latter half without ever breaking down. Look, http://schrts.co/pI1ZgR Silver has backed off the top of a trading channel whose size was doubled when it broke through the upper boundary of the earlier channel, http://schrts.co/t9IUae Normally that says, "Expect lower prices." Several factors witness a lot of speculative froth in the metals, thanks to central bank meddling. Now that they're meddling the other way, strengthening the dollar rather than weakening it, we'll see how much sinew that gold & silver demand really has. Personally I expect to see them rising into June, but the market may slap my jaws for a nat'ral born durn fool from Tennessee. Of this much I remain sure: silver and gold turned up in December after a nearly 5 year downward correction. Stocks bull market topped in May 2015 and broke in August 2015. For the next 5 - 8 years expect higher, much higher silver & gold prices and lower, much lower stock prices. Count on it. Y'all pray for me, having to go under the knife tomorrow. I hope to send my next commentary on Monday, God willing. SPECIAL OFFERS: Here are Special Offers, based on spot gold at $1,277.50 & spot silver at $17.40. SPECIAL OFFER No. 1: ASSORTED TWENTY FRANCS Napoleon Bonaparte, as emperor of France, reformed the French monetary system after the Revolutionary inflation destroyed the currency. He settled on a 90% fine (21.6 karat) 20 franc coin containing 0.1867 troy ounce of gold, and on that founded the Latin Monetary Union. All the nations who joined that union minted their gold coins to the same standard: French 20 francs, Swiss 20 francs, Belgian 20 francs, Italian 20 Lira, Greek 20 drachmai, Serbia, Bulgaria, Albania, and on and on. Thanks to the big French empire, 20 franc coins of all the LMU nations rank among the most popular gold coins in the world, & are traded all over the globe. I have MOSTLY French 20 franc Roosters, with a few Swiss 20 francs, Belgian, and Napoleon III. I will sell mixed types (my choice of types) at $249.25 each, a 4.5% premium over their gold content, based on spot gold at $1,277.50. One lot contains Ten (10) Twenty franc gold coins at $249.25 each or a total of $2,492.50, plus $35 shipping for a total of $2,527.42. I have only 34 lots, and, YES, you may order multiple lots. Offer good only while supply lasts. If you order multiple lots, we only charge shipping ONCE. OFFER NO. 2, GOLD BRITISH SOVEREIGN The British empire's size and longevity made the British sovereign (one pound sterling) the most common and well-recognized gold coin in the world. Minted from 1818 until today, they are 22 karat (91-2/3% pure gold) & contain 0.2354 troy ounce fine gold. These are mildly circulated coins, in my choice of types: Jubilee Head Victoria, Veiled Head Victoria, Edward VII, George V, or even Elizabeth 1. All have the same reverse, Pistrucci's 1818 St. George slaying the dragon, with the reigning sovereign on the obverse. One lot is Ten (10) British sovereigns at $312.15 each for a total of $3,121.50 plus $35 shipping, a grand total of $3,156.50 for 2.3540 troy ounces fine gold. With spot gold at $1,277.50, that's a 3.9% premium. Offer lasts only as long as supply lasts. OFFER NO. 3, DIE STRUCK TEN OZ. SILVER BARS Based on Spot Silver at $17.36, I will sell lots of Twelve (12) ten troy ounce die struck silver bars, my choice of brands, at $183.60 each, or a grand total of $2,203.20 plus $35 shipping for a grand total of $2,238.20. Based on spot silver at $17.36, that's a 5.8% premium. Offer good for four lots only (plus one lot of 18 bars), and expires once those are spoken for. Yes, you may order multiple lots. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. Sorry, we will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Your email must include your complete name, address, & phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Please mention goldprice.org in your email. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will bu | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dr. Richard Alan Miller - Ancient Aliens & The Coming Revolution Posted: 05 May 2016 03:00 PM PDT Jeff Rense & Dr. Richard Alan Miller - Ancient Aliens & The Coming Revolution Clip from April 29, 2016 - guest Dr. Richard Alan Miller on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ‘Apocalyptic’ Inferno Engulfs Canadian Tar Sands City - Why has Weather been so Warm there? Posted: 05 May 2016 02:22 PM PDT Fracking Wildfire - 'Apocalyptic' Inferno Engulfs Canadian Tar Sands City - Why has Weather been so Warm there? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trumped! Why It Happened And What Comes Next, Part 1 Posted: 05 May 2016 01:55 PM PDT This post Trumped! Why It Happened And What Comes Next, Part 1 appeared first on Daily Reckoning. First there were seventeen. At length, there was one. Donald Trump's wildly improbable capture of the GOP nomination, therefore, is the most significant upheaval in American politics since Ronald Reagan. And the proximate cause is essentially the same. Like back then, an era of drastic bipartisan mis-governance has finally generated an electoral impulse to sweep out the stables. Accordingly, the Donald's patented phrase that "we aren't winning anymore" is striking a deep nerve on main street. But that is not on account of giant trade deficits or a faltering foreign policy and failed military adventures per se. Indeed, it has very little to do with any patriotic impulse with respect to America's collective polity, and everything to do with voter perceptions that they personally are not winning economically anymore, either. What is winning is Washington, Wall Street and the bicoastal elites. The latter prosper off finance, the LA branch of entertainment (movies and TV), the SF/technology branch of entertainment (social media) and the great rackets of the Imperial City—including the military/industrial/surveillance complex, the health and education cartels, the plaintiffs and patent bar, the tax loophole farmers and the endless lesser K-Street racketeers. Consequently, most of America's vast flyover zone has been left behind. Thus, the bottom 90% of families have no more real net worth than they had 30 years ago. By contrast, the real net worth of the top 9% stands at 150% its 1985 level, and the very top 1% is at 300% of its level three decades ago. Moreover, the wealth round trip of the bottom 90% depicted in the chart below was hardly real in the first place. Main Street net worth temporarily soared owing to Greenspan's 15-year housing bubble which culminated in the great financial crisis. What is left is mainly the mortgage debt.

The same pattern is evident in real household incomes and average real earnings of full time workers. In this case, the metric displayed in the chart encompasses men over 16 to control for changes in the work force mix, but the result is unmistakable. To wit, real median household incomes in 2014 were no higher than the level first reached in 1989, and real weekly full-time wages were actually 4% lower.

In a similar vein, Indiana was supposed to be Senator Cruz' last stand, but according to the pundits he ended up getting blown away by the "Carrier" vote. United Technology's plan to move its air conditioner factory to Mexico became Donald Trumps whipping boy, but the metaphor had deep resonance. Since the year 2000, the US has lost 20% of its highest paying full-time jobs in the goods producing economy—–that is, energy and mining, construction and manufacturing.

Even when you allow for the supposed shift to white collar jobs in finance, technology, entertainment and other domestic services, the story is pretty much the same. There are still nearly 2 million fewer full-time, full pay "breadwinner jobs" in the US today than when Bill Clinton was packing his bags to leave the White House in January 2001. These jobs currently pay an equivalent annual wage of $50,000 on average, which isn't affluence by any means. But the point is, these jobs are the best of what we have and the total has been going nowhere for the last decade and one-half, even as the adult population (over 16 years) has risen from 212 million to 250 million.

Stated differently, the Trump voters don't watch CNBC. Or if they do, they are savvy enough to dismiss it's specious celebration of America's phony bicoastal prosperity, and especially the monotonously stupid and profoundly misleading ritual of Jobs Friday. The voters know from experience that those millions of "new jobs" are mainly part-time gigs that come and go between the financial crashes that arise every seven years or so out of Wall Street and Washington. Indeed, these bread and circuses jobs may all be part of the "print" according to Keynesian windbags like Mark Zandi, but the flyover zone voters know the real truth. They pay cash wages of less than $20,000 per year on a full-time equivalent basis, offer virtually no benefits and are scheduled by the day and hour.

In fact, nearly 40% of all the net payroll jobs created since the year 2000 are in what we have called the Part Time Economy. Trump voters have gotten stuck in them, fear they will end up there or have friends and family who have no other opportunities. Needless to day, they know they are not winning.

Meanwhile, the bicoastal elites tend to their increasingly fanciful projects and provocations. That is to say, Imperial Washington's completely trumped up campaign against Russia and Putin is cut from the same cloth as Silicon Valley's pretension that there are ( or were until February) 147 "unicorn" start-ups that are each worth a billion dollars or more—notwithstanding that few of them have meaningful revenues, cognizable business models or any prospect of earning a profit. Everywhere the governing institutions are whistling past the graveyard, yet have become so insular and removed from accountability that they are clueless about their own impending doom. The Federal Reserve, for example, has now fueled the mother of all financial bubbles after seven years of non-stop money printing and radical interest rate repression, but nevertheless believes that the nirvana of full employment prosperity is just around the corner. Likewise, US military intervention has failed in every Muslim land it has bombed, droned or occupied. Yet the White House is still sending more bootless boots to these decimated lands, thereby insuring even more blowback and gifting jihadist recruiters with endless fodder for outrage and revenge. So too, a seven year "recovery" cycle has been squandered on the fiscal front. While Obama was taking bows for cutting the deficit in half and Republicans were joining in to gut the discretionary spending sequester, the fiscal time bomb of entitlements continued to tick unattended. The fact is, nominal GDP is now growing at only 3% per year, and in a world of relentless deflation owing to the end of the great central bank credit bubble, there is no prospect that it will accelerate. Accordingly, by 2026 GDP will be $24 trillion under the best of circumstances, while the national debt will rise by $9 trillion per CBO's Keynesian reckoning or upwards of $15 trillion if you believe the Fed has not abolished the business cycle. That's right. The virtually guaranteed national debt of $30-$35 trillion will reach an Italian style 140% of GDP just as the baby boom retirement wave hits full stride. So when Trump says that Uncle Sucker is broke, the public believes him. It happens to be true. Finally, the greatest bicoastal scam is the rampant Bubble Finance prosperity of Wall Street and Silicon Valley. Let's face it. Facebook——along with Instagram, Whatsapp, Oculus VR and the 45 other testaments to social media drivel that Mark Zuckerberg has acquired with insanely inflated Wall Street play money during the last few years——-is not simply a sinkhole of lost productivity and low-grade self-indulgent entertainment. "Faceplant" is also a colossal valuation hoax. Why? Because at bottom, Facebook (FB )is just an Internet billboard. It's a place where mostly millennials idle their time in or out of their parents' basement. Whether they grow tired of Facebook or not remains to be seen, but one thing is certain. To wit, FB has invented nothing, has no significant patents, delivers no products and generates no customer subscriptions or service contracts. Its purported 1.8 billion "MAUs" (monthly average users) are fiercely devoted to "free stuff" in their use of social media. Therefore, virtually all of its revenue comes from advertising. But ads are nothing like a revolutionary new product such as Apple's iPhone, which can generate tens of billions of sales out of nowhere. The pool of advertising dollars, by contrast, is relatively fixed at about $175 billion in the U.S. and $575 billion worldwide. And it is subject to severe cyclical fluctuations. For instance, during the Great Recession, the U.S. advertising spend declined by 15% and the worldwide spend dropped by 11%. And therein lies the skunk in the woodpile. Due to its sharp cyclicality, the trend growth in U.S. ad spending has been about 0.5% per annum. Likewise, the global ad spend increased from about $490 billion in 2008 to $575 billion in 2015, reflecting a growth rate of 2.3% annually. Yes, there has been a rapid migration of dollars from TV, newspapers and other traditional media to the digital space in recent years. But the big shift there is already over. Besides that, you can't capitalize a one-time gain in sales of this sort with even an average market multiple. And that's saying nothing about the fact that FB's current $340 billion market cap represents a preposterous multiple of 211 times its $1.6 billion of LTM free cash flow. In any event, the digital share of the U.S. ad pool rose from 13.5% in 2008 to an estimated 32.5% last year. But even industry optimists do not expect the digital share to gain more than a point or so per year going forward. After all, television, newspapers, magazines and radio and highway billboards are not going to disappear entirely. Consequently, there are not remotely enough advertising dollars in the world to permit the endless gaggle of social media space entrants to earn revenue and profits commensurate with their towering valuations and the sell side's hockey stick growth projections. In social media alone, therefore, there is more than $1 trillion of bottled air. But the social media billionaire brats are not the half of it. The central bank money printers have transformed Wall Street into a nonstop casino that has showered a tiny slice of hedge funds and speculators with unspeakable windfalls from the likes of monstrosities such as Valeant and hundreds of similar momentum bubbles. Just consider the shameless mountebank who has conjured the insane valuation of Tesla from the gambling pits of Goldman Sachs and Wall Street. The company has never made a profit, never hit a production or sales target and has no chance whatsoever of becoming a volume auto producer. Yet after posting another wider than expected $283 million loss in the first quarter, which was nearly twice last year's red ink, Elon Musk doubled-down on his snake oil offering. His promise that Tesla would finally become cash flow positive in 2016, after burning through $4 billion in cash since 2008, was abruptly declared inoperative. Instead, Tesla will do another giant dilutive capital raise in order to fund an acceleration of the Model 3 so that it can deliver 500,000 vehicles in 2018. That's a con job worthy of the seediest used car lot in America. In auto production land, today is already 2018 in the case of a mass production vehicle that has barely been designed, and which has not yet been production engineered, tooled, tested or sourced for components and materials. Indeed, the idea that a company which produced only 50,000 vehicles in the last 12 months can scale up to 10X that volume virtually over night on a production line and supply system that does not even exist is a laughable fiction. But what isn't laughable is that the Wall Street casino is so blinded by speculation, greed and Fed puts and liquidity pumping that it is enabling dozens of circus barkers like Elon Musk to inflate spectacular bubbles—–financial deformations which will end up destroying the main street homegamers who fall for them, and dissipating loads of scarce capital in the process. The fact is, the bicoastal elites have been showered with stupendous windfalls since the March 2009 bottom because the Fed has engineered through ZIRP, QEs and open mouth cheerleading a systematic falsification of financial prices and the diversion of massive amounts of new debt and other capital into rank financial speculation. On a net basis, for example, virtually the entirety of the $2 trillion in incremental business debt raised since 2007 (from $11 trillion to $13 trillion) has been cycled into stock buybacks, wildly over-priced M&A deals and other forms of financial engineering—–all of which result in the bidding up of existing equities, not the investment of new funds into productive assets. Indeed, the C-Suites of corporate America have been transformed into stock trading rooms. So it is no wonder that main street believes it is not winning anymore. Unfortunately, it is too late to reverse the tidal wave of system failure that has been brewing for two decades now and which is likely to end in a speculator implosion before election day on November 8th. To wit, the stock market is valued at a nosebleed 24X actual GAAP earnings—-earnings which have declined by 18% from their September 2014 peak and which are heading lower—— and is therefore a crash waiting to happen. Likewise, there is a $3 trillion bubble of junk bonds and loans that are heading for a day of reckoning soon. Finally, after 84 months of the weakest recovery in history, the signs of recession are emerging everywhere. By November it will be either declared or impossible to deny. The updated budget projections, therefore, will show a swift return to trillion dollar annual deficits. So there is a perfect storm of calamity brewing, and the rumbling sounds of its arrival are being heard by the plain people of America, even if the bicoastal elites remain clueless in their temporary world of bubble finance prosperity. Indeed, busily and self-righteously remonstrating against Trump's bombastic and politically incorrect style, they are not likely to see his potential landslide victory coming, either. If it happens, the nation is likely to become engulfed in a shitstorm of political conflagration, financial crashes and recessionary relapse. The Donald could easily turn into every bit of the scorched earth loose cannon that Hillary is now shrieking about. But there is a sliver of hope. If Donald Trump does not capitulate to the mainstream policies of the Wall Street/Washington/Bicoastal establishment now that he has won the nomination, there is a way forward for the great deal maker to move the whole mess out of the hopeless box that now afflicts the nation. A President Trump would need to make Six Great Deals. A Peace Deal with Putin for cooperation in the middle east, defeat of ISIS, withdrawal from NATO and a comprehensive worldwide disarmament agreement. A Jobs Deal based on slashing taxes on business and workers and replacing them with taxes on consumption and imports. A Federalist Deal to turn back much of Washington's domestic programs and meddling to the states and localities in return for a 4-year freeze on every single pending regulation and statue. A Health Care Deal based on the repeal of Obamacare and tax preferences for employer insurance plans and their replacement with wide-open provider competition, consumer choice and individual health tax credits. A Fiscal Deal to slash post disarmament defense spending, devolve education and other domestic programs to the states and cities and to clawback unearned social security/medicare entitlements benefits from the affluent elderly. And a Sound Money Deal to end the Fed's war on savers and retires, repeal Humphrey-Hawkins and limit the Fed's remit to a providing liquidity at a penalty spread over market interest rates, while limiting this constricted backstop to "narrow banks" which only take deposits and make loans, and have nothing to do with Wall Street trading, derivatives and other forms of financial gambling. (to be continued in Part 2, Trumped! What Comes Next) Regards, David Stockman P.S. "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Gold Daily and Silver Weekly Charts - A Delivery in Gold - Payrolls Tomorrow Posted: 05 May 2016 01:04 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts The WARNING: Propaganda ıs Leadıng to WAR Posted: 05 May 2016 12:30 PM PDT Paul Craig Roberts The WARNING: Propaganda ıs Leadıng to WAR Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

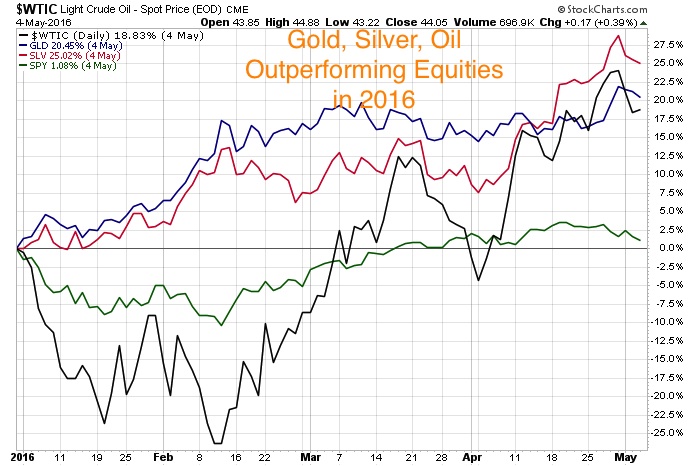

| Could This Be the Start of an Early Bull Market in Precious Metals and Commodities? Posted: 05 May 2016 10:46 AM PDT Can you believe the rebound in the junior mining sector and precious metals? This astonishing bullish reversal in the commodity sector does not come as a surprise to my readers. While the herd was panic selling last year, I took a strong contrarian stance and highlighted three reasons why gold prices should violently move higher to possibly $1600 USD per ounce by the end of the first half of 2016. That may have seemed like a crazy move but gold is now breaking into new 52 week highs above the critical $1300 price. A breakout above that level could see a measured move to approximately $1600. Back in late September, in this interview, I believed gold was going to make an explosive move for three major reasons. First off, global interest rates are negative meaning that currency is losing value in savings accounts across the world. The only place that was getting a bid was the US where investors mistakenly thought rates would go higher. That doesn’t seem to be the case and The Fed may actually lower rates to prevent a global deflation and pay off massive debts including a potential municipal and energy debt bubble bursting. I also believed stock market volatility and geopolitical terrorism would drive safe haven buying. Now for the first time in more than five years investors are returning to commodities and the junior miners in a big way. This quarter could be a record in terms of attracting a whole new group of investors into the sector. That is why I always urged patience and fortitude, not to panic sell, avoid margin and definitely do not short the junior miners or precious metals as so many mistakenly did. This could be a major turning point and transition from a historic bear market in the junior miners to what could be the beginning of a breathtaking move in precious metals, commodities and the junior miners. Looking at the returns year to date, silver is in first place followed by gold, platinum and oil. Smart contrarian investors have been accumulation precious metals and commodities at once in a generation price levels. The worse things got in 2015, the better they became in 2016. Despite the mainstream media distracting investors away from precious metals and commodities, contrarian investors concerned of a black swan similar to 2008 are positioning with precious metals and commodities which outperformed during the last crisis. I don’t believe this rally in junior miners will be short lived. This could be the early stage of a bull market which could last another 3 years. Although many gold stocks in the interview above have already moved higher there are still a few discounted opportunities which I highlighted in this recent article. The recent decline in precious metals and commodities over the past few years could completely revamp the entire landscape as the new bull market begins. Companies with strong balance sheets and share structures will be able to gobble up distressed assets and grow through acquisition. Over the next couple of years I expect to see strong financed companies build their assets for a discount. Oil is beginning to move higher and there could still be good deals found in this area but they aren’t easy to discover. Many of these companies have high levels of debt and their assets require much higher oil prices. Its been two rough years in oil, but we may start coming out of it as value contrarian investors return to the sectors where there is blood in the streets. Nowhere is that more evident than in oil. Over $1 trillion dollars have been lost in the US Energy Sector. Many companies are on the verge of going under and their bondholders who are many regional banks may lose a lot of money. I am looking for the oil companies that will be able to come out strong from this downturn. The downturn in the US Energy sector may force the Fed to keep interest rates low and possibly resort to another quantitative easing. One oil company I have featured for many months, just came out with their 2015 year end reserve report which showed a 277% increase of their proved and developed reserves. Even more exciting because of the energy downturn, the cost to find and develop these assets dropped 69%. The company spent around $6.29 million to acquire 760k barrels of oil equivalent in 2015. With these sort of fundamentals, I expect the company to make strong margins over the next few years especially if oil continues to base and turnaround.

The company recently raised close to $7 million and has no debt putting it in the rare category of growing oil companies with a strong balance sheet to hopefully continue to grow through acquisitions at distressed valuations. The stock is in strong hands with over 20% held by insiders who are blue chip caliber. If you find other oil companies that have cash, are debt free and growing their asset base please let me know. Disclosure: I own this oil stock, buying shares in the open market and recently participating in the private placement. The company is also an advertising sponsor of my website. There is a conflict of interest as I could benefit if the share price rises. Please do your own due diligence, consult with a registered financial advisor and be aware of many risks of investing in stocks. Be aware that I may need to sell without notice for many reasons as I have expenses. See full disclaimer by clicking here… _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tomorrow is Being Called “Judgment Day” Posted: 05 May 2016 08:20 AM PDT This post Tomorrow is Being Called “Judgment Day” appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! A quick look at the currencies and metals this morning tells me that the markets are already in a defensive shell awaiting Friday’s Jobs Jamboree. I’ve read quite a bit about this Friday’s Jobs Jamboree, and while I’m still committed to “not giving two hoots about what the BLS’s surveys and hedonic adjustments tell us” I still have to deal with the fact that the markets do give two hoots about it, and what I’m reading tells me that there are a lot of eggs being placed in this month’s Jobs report basket. I’ve even read where the markets are calling tomorrow’s Jobs Jamboree the “Judgment Day”. Well, the only “Judgment Day” I know of is in the Book of Acts 17:31. A lot of eggs have been placed in the Jobs report’s basket, as we’re back to the same stuff the markets were all lathered up about a few months ago, saying that this week’s jobs report will determine if the Fed feels that the economy is strong enough to hike rates in June. I can’t believe this is happening again! Didn’t the markets get the stuffing knocked out of them with this thought process being so wrong a few months ago? Then why get right back on that horse? Fool me once, it’s your doing, fool me twice it’s my doing. But, it is what it is, right? And if the markets want to get all lathered up over surveys that get run through the massaging table before going public, then we just have to sit and watch it all happen. But that doesn’t stop me from telling you that I think that they are all dolts! Judgment, Schudgment Day, is what I say! But, as I said above, the markets are already backing off on volume traded and positioning and the dollar is looking like it still has the conn, but not as strongly as the previous two days. Japanese yen is trading back over 107, the euro has lost another 1/2-cent but the Aussie dollar, which has spent the previous two days in the woodshed, as wrapped a tourniquet around the bleeding for now. Gold is down again this morning after losing $6.70 yesterday. Getting back to the Jobs Jamboree tomorrow, or “Judgment Day” according to the markets, I was exchanging emails with my friend, the retirementor, Dennis Miller, yesterday, and I got on my soapbox and started preaching to the choir. And then afterwards, I thought, this discussion would be better served, sharing it with you, dear Pfennig Reader! So… here goes…

And then I was reading an article on LinkedIn by Danielle DiMartino Booth, which I would like each and every one of you to take the time to read you can find it here. And she wrote something that plays well with my let the markets set the interest rates: