Gold World News Flash |

- ALERT! More Proof Of A Global Meltdown: Prepare For Impact

- Stagflation Coming — Safety To Be Found In Assets Like Gold and Silver

- “ROOTING FOR ARMAGEDDON”

- Stand Aside JP Morgan, A New Player In The Silver Market Has Arrived

- In The News Today

- Republican Strategist: “Cancer” of Talk Radio Responsible for Rise of Trump

- How A Collapse In South America Could Trigger Martial Law In The U.S.

- A Few Facts About Gold That Nay-Sayers Conveniently Ignore

- Jim Sinclair: Have you been damaged by the manipulation of gold and silver ?

- Alasdair Macleod — Taking the Petro Out of the Dollar

- Hong Kong to gain as China streamlines cross-border gold trade

- The "Casino" Is Opening!

- Hillary Seeks Funds To "Save The World From Donald Trump"

- Jim’s Mailbox

- Armageddon NOW in Alberta - 80,000 Evacuate as Entire City Burns to Ground

- Gold Daily and Silver Weekly Charts - Smarter Money Moving Out of Equities and Into Gold

- Price of Gold Closed at $1273.30 Down $17.40 or -1.35%

- When It Comes to Trading, You Could Be Your Worst Enemy

- TF Metals Report: Bullion banks creating infinite paper gold on Comex

- A Trump Landslide in November?

- Podcast: Easy Money From China, Japan and Europe Has Failed. What’s Next?

- Breaking News And Best Of The Web — May 5

- The U.S. Issues its “Monitoring List”

- 2016 Economic and Social Collapse in Socialist Venezuela

- Scholes Sees Stagflation Coming, Suggests Safety To Be Found In Assets Like Gold and Silver

- Fear Not Gold Bugs, Gold Ratios Well Intact

- Watching for an Undercut Bottom in the US Dollar

- Silver Bullion Has Key New Player – China Replaces JP Morgan

- Barclays Launches 100% Mortgage to Compete with Bank of Mum and Dad - Video

- Silver Bullion Market Has Key New Player – China Replaces JP Morgan

- Gold Stock Picks Up Over 400%, What's Next ?

| ALERT! More Proof Of A Global Meltdown: Prepare For Impact Posted: 04 May 2016 11:00 PM PDT from GregoryMannarino: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stagflation Coming — Safety To Be Found In Assets Like Gold and Silver Posted: 04 May 2016 10:30 PM PDT from Jesse's Café Américain:

Myron Scholes, of the Black-Scholes Risk Pricing Model, said in an interview from the Milken Conference this morning that stagflation is the most likely outcome for the economy. Stagflation! And what did Myron suggest that people invest in to protect themselves? Gold and silver, among other hard assets. He thinks that stocks are due for a decline. Stagflation is coming, so buy gold and silver to protect at least some of your wealth. Where have we heard that forecast before? I think a forward thinking person, looking at the nature of the Fed’s serial policy errors and the economic abuses that the monied interests have been inflicting on the real economy for quite some time, could have seen this outcome coming some years ago. And some did. But it is nice to see the models catching up. The only surprise is that it has gone on as long as it has. Never underestimate the venality of unscrupulous greed, and the power of thinking in herds. And this comes a day after Ken Rogoff has suggested that the emerging markets invest their surpluses in the safety of gold! Which of course any but the most casual observer knows very well that they have been doing, and in size, for some time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 May 2016 09:42 PM PDT by Andy Hoffman, Miles Franklin:

I have a LOT to speak of today, mostly from the heart – as I havenever been angrier at the state of the world, and those that have destroyed it for both our generation, and generations to come. To that end, I never would have thought so, but I'm actually rooting for Donald Trump now. As whether his brand of "change" is good or not – and most likely, it won't be – at least it's different than the political, economic, and social hells brought to us by the Democrats, Republicans, and others, worldwide, of their ilk. First, let's get the ignominy of the past few days' "trading" out of the way – particularly in response to "analysts" that think markets are anything but Central bank-planned gambling dens. In which, the "house" always wins – but in the process, destroys not only the gamblers, but its own ability to survive. So for those that think "markets" move because the Bank of Japan or U.S. Exchange Stabilization Fund intervene in the USD/JPY exchange rate; or "investors" believe more, or less, "QE" is coming, I hope your heads don't hurt too much. And don't think anyone's going to cry for "traders" – most of whom are brainless parasites, unknowingly piggy-backing on government manipulations, but still too dumb to realize how to profit from it.

"We're condemned to serial bouts of severe volatility – having been trained to dismiss real and knowable risks as just improbable black swans." LOL, "severe volatility" – whilst the VIX, or Volatility Index, trades near its all-time low, as the "Dow Jones Propaganda Average" is propped by the volatility-less "dead ringer" algorithm each day. And yet, "hedge funds" – or as I deemed them four years ago, "hedge bombs," are going out of business as rapidly as overleveraged energy firms, retailers, and minimum-wage saddled fast food franchisees. Not to mention, "U.S. territories" like Puerto Rico. Again, it just shows how incomprehensibly dumbed down Wall Street has become, like the rest of the world, at large. I mean, the head "Global Economic Advisor" at PIMCO, one of the world's largest hedge funds, made a "big presentation" yesterday, in which he actually "advised" the Fed to monetize stocks! To that end, "markets" – like Japanese stocks, which will shortly be owned entirely by the government – have become 100%manipulations. And sadly, even when such facts are made public, like Deutschebank's last month that it has suppressed PM prices – with the help of other "too big to fail" banks – for 15 years, no one seems to care. Likely, as so few actual market participants remain, after having been destroyed by rigged markets and debt-burdened, over-regulated economies over the past two decades. I mean, just how much more obvious can it be that the Cartel was using its time-honored DLITG, or "don't let it turn green" algorithms on gold and silver yesterday… Or heck, this morning; first, at the usual "2:15 AM" for the 631st time in the past 725 trading days; next, via the prototypical "Cartel Herald" algorithm, following the horrifying ADP employment report, which just happened to be reported as the COMEX opened; and finally, after the "slightly better than expected" – and completely fabricated – "PMI Service Index" was reported an hour later. Funny how the far more watched, and horribly weak, labor report, was suddenly ignored when a barely "better than expected," absolutely weak, and patently meaningless "diffusion index" was published – what a shock, at the time-honored "key attack time #1" of 10:00 AM EST, when the physical PM market closes. Regarding the former, let's see how many "seasonal" and "birth/death" adjustments the BLS will require to report its usual 200,000 jobs Friday – which quite obviously, it has been ordered to do, like when Obamaneeded votes for his 2012 re-election. That said, it won't be long before the NFP report, like the government that fabricates issues it, will be entirely discredited. And wouldn't you know it, yet another "dead ringer" algorithm for the Dow – just like yesterday, the day before, and at least three-quarters of all trading days since I first wrote of it four years ago. FYI, yesterday's chart – in which the Dow's bottom was an hour later than usual, is what I call a "variations thereof" algorithm; in which, the same general result is achieved, even if the actual "dead ringer" algo is not used. The reason being, in yesterday's case, that commodities were being destroyed, so the PPT had to spend an extra hour supporting the Dow at its "ultimate limit down" level of -1.0%, before bringing it back to higher levels. image: godsofadvertising | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stand Aside JP Morgan, A New Player In The Silver Market Has Arrived Posted: 04 May 2016 09:22 PM PDT by Steve St. Angelo, SRS Rocco:

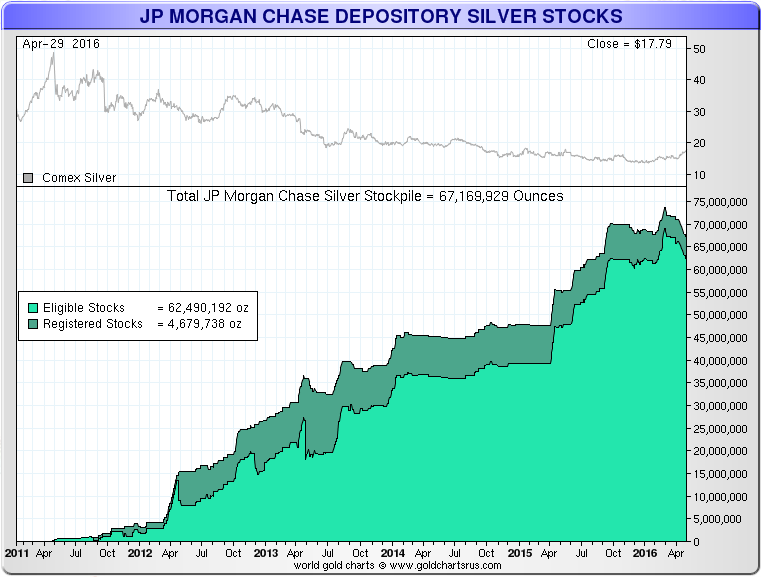

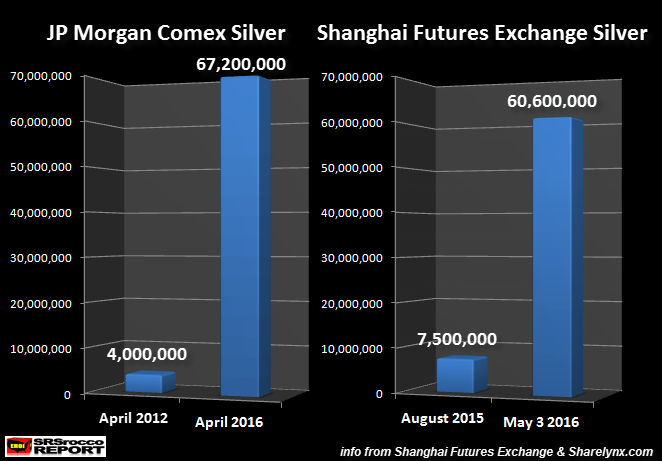

The days of JP Morgan controlling the silver market may be numbered as a new player in the silver market has arrived. For the past several years, JP Morgan held the most silver on a public exchange in the world. While the LBMA may hold (or did hold) more silver, their stockpiles are not made public. Regardless, JP Morgan held the most silver at nearly 74 million oz (Moz) in its warehouse, up until recently. Over the past two month, JP Morgan's silver inventories have fallen nearly 7 Moz to 67.1 Moz today:

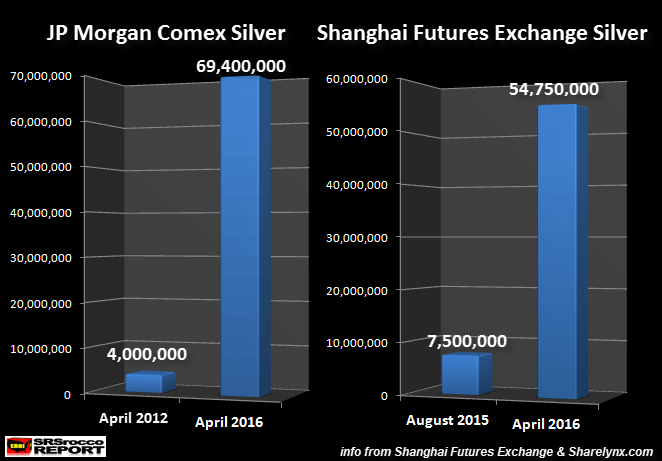

As I mentioned in my previous article, Why Are The Chinese Stockpiling Silver? Big Move Coming?, JP Morgan increased their silver inventories from 4 Moz in April 2011 to 69.4 Moz April 19, 2016. However, the Shanghai Futures Exchange silver inventories surged from 7.5 Moz in August 2015 to 54.7 Moz on April 19, 2016:

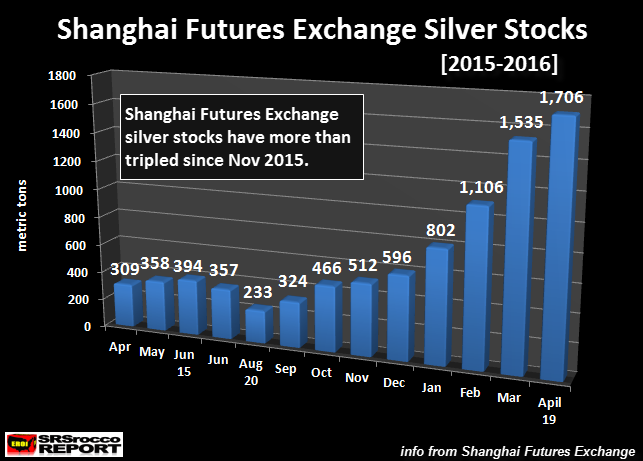

Basically, JP Morgan added an average 16.3 Moz of silver each year for the past years, whereas the Shanghai Futures Exchange added nearly 7 Moz per month. Furthermore, the majority of gains came since the beginning of 2016. Again, here is my previous Shanghai Futures Exchange silver stock chart from the article linked above:

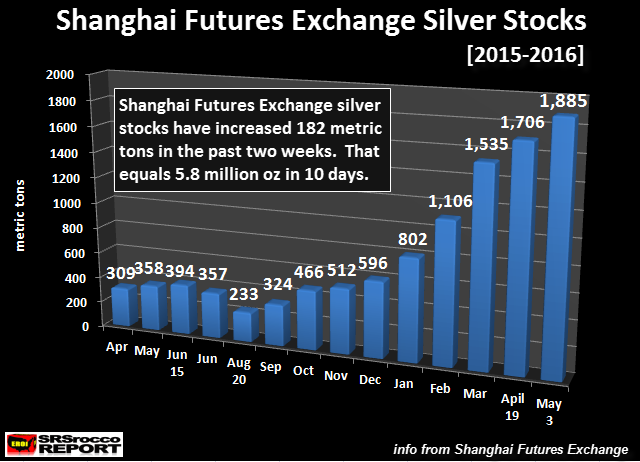

As we can see from this chart dated April 19th, the Shanghai Futures Exchange more than tripled their silver inventories since November 2015. What is even more interesting is the continued buildup over the past two weeks. Here is an updated chart based on data for May 3rd:

Over the past two weeks, the Shanghai Futures Exchange added another 179 metric tons (mt) or 5.8 Moz. Now, if we update the JP Morgan and Shanghai Futures Exchange silver stock chart (from above) we have the following:

Here we can see that JP Morgan's total silver inventories have declined from 69.4 Moz to 67.2 Moz, while the Shanghai Futures Exchange silver stocks have increased from 54.7 Moz to 60.6 Moz. If the Shanghai Futures Exchange continues to add silver at this rate, it will surpass JP Morgan in a two to three weeks. Comex Registered Silver Inventories Drop Nearly 4 Million Ounces YesterdayWhen the CME Group published the recent silver inventory change on the Comex yesterday, nearly 4 Moz were transferred from the Registered to Eligible Category. The majority of the transfer came from the CNT Depository at nearly 3.5 Moz with 485,325 oz from HSBC: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 May 2016 09:08 PM PDT Bill Holter's Commentary Mr. Druckenmiller is brilliant, but Bloomberg runs this article? Sacrilege! Druckenmiller Loads Up on Gold, Saying Bull Market Exhausted Katherine Burton Stan Druckenmiller, the billionaire investor with one of the best long-term track records in money management, said the bull market in stocks has “exhausted itself” and that gold is his largest... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Republican Strategist: “Cancer” of Talk Radio Responsible for Rise of Trump Posted: 04 May 2016 08:20 PM PDT from Infowars:

He characterized talk radio as a form of cancer that "has spread" and "infected the whole of the [Republican] party." Schmidt's diatribe against talk radio is yet another indication the party is out of touch with millions of Americans who will no longer tolerate business as usual from both establishment parties. Steve Schmidt, Republicans, and Democrats are responsible the disenfranchisement of the American people from the political process, not talk radio. The people are sick and tired of a political class that serves the financial elite, multinational corporations and continually supports endless war and conflict. Popular support for Donald Trump and Bernie Sanders reflects a decisive move away from the political class and its corporatist prerogatives. Schmidt may lament the rejection by the American people of top-down politics and dissatisfaction with the political merry-go-round between two largely indistinguishable parties, but nothing the Republicans do at this point will stem the tide of rejection. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How A Collapse In South America Could Trigger Martial Law In The U.S. Posted: 04 May 2016 07:50 PM PDT Submitted by Brandon Smith via Alt-Market.com, If an economic system collapses in the woods and no one is paying attention, are there any consequences outside the woods? Well, yes, of course. As with most situations financial and global, however, consequences are not usually taken very seriously until they have spawned a vast bog of sewage we all have to then swim through. The issue is and always will be “interdependency,” and the dissolution of sovereign borders. Take a close look at the European Union, for example. You have a large network of fiscally interdependent nations struggling to maintain a sense of principled identity and heritage while participating in the delusion of multiculturalism. You have a system in which these nations are admonished or even punished for attempting to become self-reliant. You have a system which encourages a Cloward-Piven-style forced integration of incompatible cultures. You have unmanageable debt. You have a welfare addicted socialist population plagued by naive assumptions of entitlement. And on top of it all, you have a political structure dominated by cultural Marxists who would like nothing better than to see the whole of the old world go down in a blazing inferno. This EU dynamic can only end in one of two ways - the complete dismantling of the supranational body and a return to sovereignty, or, a socio-economic crisis followed by even more centralization and the end of all remnants of sovereignty. Either way, the consequences will not be pretty. In the EU there are particular nations that are being exploited by globalists to initiate greater disaster in the overall region. As Wikileaks exposed in transcripts of IMF discussions on Greece, the plan has always been to create enough chaos to drive fear into the general populace. Fear that can be used to manipulate the masses towards handing even more administrative power over to those same globalists. They know that a fiscally-tiny nation like Greece can still do kinetic damage to its neighbors because its neighbors have weak foundations. One domino sets off the chain. The same strategy may also be used in the Western hemisphere; more specifically, the collapse in South America that almost no one in the mainstream seems to be paying much attention to. While mainstream coverage sometimes looks at each South American nation as an isolated case, none of the coverage examines these crises as an interconnected breakdown, and they certainly do not suggest any future ill effects to the U.S. First, lets take a look at some of South Americas most important economies and why they are on the verge of an epic catastrophe. VenezuelaThe crash of oil prices from more than $100 per barrel down to around $40 per barrel or less has annihilated oil-dependent Venezuela, a country already in financial turmoil. Overprinting of currency has been the only “solution” offered so far. Hyperinflation is now taking hold with the IMF warning of a 720 percent increase this year. Currently, necessities are being rationed while a growing number of citizens are left empty handed. Many food purchases in Venezuela require an electronic ration card. Shoppers are forced to wait in long lines for hours just for a chance to purchase staple items that may be sold out by the time they get their turn. The government under Socialist President Nicolas Maduro has nationalized all food and medicine distribution, and is currently instituting rationing of electricity, and even time! A two-day work week for public sector workers is now in force. Private companies are being asked to use their own generators to continue operations rather than relying on the grid. Finally, Venezuela is so close to implosion that they no longer have the money to pay for the work of currency printers they rely on outside the country. Meaning, they no longer have the money to pay for printing more money. Disaster in the nation is inevitable and a general collapse is likely to occur this year. BrazilBrazil is simply a mess, and a perfect example of why the recently-established BRICS “bank” has always been a farce and will never be competition to the IMF (Not that this was ever the intention, as I have proven in numerous articles on the false East/West paradigm. The BRICS bank works WITH the IMF, not against it). Brazil’s national debt has doubled in the past five years and officially the economy is set to shrink by 3.5 percent in 2016. In the meantime, Brazil’s currency has recently hit record lows against the U.S. dollar as devaluation begins to sting. At the same time, currency devaluation has done nothing to help Brazil's ailing exports. The country can barely keep its own economy stable, let alone participate in a global banking venture in "competition" with the IMF. As often happens during economic crisis, political chaos is taking hold. A whole host of criminal misconduct and corruption charges are being fielded against president Dilma Rousseff as impeachment proceedings gain momentum. Perhaps not surprisingly, at least three of the politicians in line to take over Rousseff’s position are ALSO under investigation for criminal activity. Brazil is set to host the Summer Olympics in Rio this year, but all indicators suggest that they will be fiscally incapable of adequately paying for the infrastructure improvements required for the games to proceed. ArgentinaArgentina has been in and out of economic crisis consistently since 2002, and beholden to the IMF for almost as long. Argentina’s original collapse in 2001/2002 is a commonly-used example of a modernized and westernized economic system suffering from a high speed financial disaster that was mostly hidden from the public until it was too late. Today, Argentina’s new government has yet again chosen to do what most establishment controlled governments do when the economy is in decline — they hide the numbers. Though government officials have claimed a reduction in Argentina’s poverty rate, other sources indicate it has actually soared this year to more than 32 percent of the population. This poverty is compounded by heavy price inflation. Most goods and services in Argentina currently inflate in price by approximately 35 percent annually. Though Argentina has recently restructured its debts and is now able to issue treasury bonds for sale again, essentially all of the capital gained through bond sales is used to pay back creditors from past economic crises. Under these conditions, it is only a matter of time before the country suffers yet another breakdown. A Chain Reaction Leading To Martial LawMuch of South America is on the verge of financial chaos, but I have focused on the three countries above because they are the most influential on the continent as a whole. As goes Venezuela, Brazil and Argentina, so goes South America. That said, what does any of this have to do with the U.S.? Why should we care? Various nations within South America are always experiencing intermittent crisis, and one might argue that this mattered little to the U.S. in the past. But what we are witnessing now is not an isolated collapse in a single country, but collapse conditions in all of South America’s major economies with weakness prevalent in most other nations. Like the EU, South America seems to be a powder keg waiting for a spark. The U.S. itself is not far behind in terms of an economic breakdown and this could be exacerbated by fiscal chaos in the south. As for how this effects the U.S. in other ways, here’s where things get a little weird… In the wake of the Iran/Contra hearings, the exposure of documents pertaining to a program called “Rex 84”, part of "Operation Garden Plot", hit the mainstream news. Rex 84 stood for “Readiness Exercise 1984,” and was a continuity of government program designed to lock down the U.S. under martial law during “civil disturbances.” This included the power of government to forcefully relocate large populations from their homes or even detain large populations at will. You can read the original Rex 84/Operation Garden Plot documents in PDF form here. Though Rex 84 was launched decades ago, the program never actually went away. All responsibilities pertaining to Rex 84 are now under the oversight of the Department of Homeland Security and Northcom. One of the primary “disturbances” mentioned as a rationale for Rex 84 was a “mass exodus” of immigrants from Central or South America across the U.S.-Mexico border. The exposure of Rex 84 was probably the primary catalyst for the growing concern over “FEMA camps,” as the program demanded mass internment of “dissidents” and immigrants. As we know well after the events in New Orleans during Hurricane Katrina, FEMA “camps” are not necessarily places that are pre-established. Rather, an internment camp or detention facility can be erected in mere days by federal agencies anytime, anywhere. For those that think the idea of internment camps is a thing of the past, watch as Gen. Wesley Clark offers this very idea as a response to those he considers “disloyal to the U.S.”

I would suggest that the provisions of Rex 84 are an integral part of the establishment apparatus, and that they fully plan to utilize them in the near future. For Europe, Rex 84-style measures may very well be used in response to the continuing flood of millions of Muslim immigrants with no intentions of integrating with the existing European population. And certainly, many people might cheer those measures. A few more terrorist attacks and watch how quickly the socialist majority rescinds their welcome. Keep in mind, though, history shows us that the destruction of freedom for one broad group invariably leads to the destruction of freedom for all. In the West, a South American collapse will likely lead to our own mass flood of illegal immigrants in addition to the millions already crossing our borders. One must also consider the probability of ISIS fighters mingling with these immigrants. This would be a crisis in direct proportion to that of Europe. Take note that in the U.S. and Europe the respective governments have ENCOURAGED mass migrations from cultures with little to no respect for the values and principles of the host nations. An economic crisis would only expedite the disasters they have already started. Again, many Americans might cheer for mass detentions in the wake of an immigration threat, but in the end, the “defense” of U.S. borders would be used by the establishment to rationalize unconstitutional actions against everyone. I have outlined the threat of a South American exodus to our borders in the hopes that if and when it occurs, people are not so stupid as to turn to the government for help, the same government that aided in creating the calamity in the first place. Expanded government power solves nothing in the long run, regardless of who is in office at the time (this includes Trump). Independent and sovereign action is the only answer. Individuals, counties and states securing their own borders. Whether it be in the face of a collapse in South America, or any other Black Swan event. Keep the feds out no matter the supposed threat. Never invite the vampire into your house. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Few Facts About Gold That Nay-Sayers Conveniently Ignore Posted: 04 May 2016 07:08 PM PDT We continue to see articles by so called “experts” trashing Gold and Silver as investments. Gold is everything from a “Pet Rock” to a “Dumb Investment” or “Barbarous Relic.” Do these people even bother doing research? Or are they just stock shills? First and foremost, you cannot compare Gold’s performance relative to stocks anywhere before 1967. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Sinclair: Have you been damaged by the manipulation of gold and silver ? Posted: 04 May 2016 06:46 PM PDT By Jim Sinclair I have been exploring and analyzing the present and proposed litigation of gold and silver precious metals. I have reached some conclusions and want to share my views and offer you an important opportunity to join with me to address this problem in a never-before-used litigation approach. Are you a precious metals share investor? A precious metals producer? A company whose business was injured as a result of the manipulation and suppression of the price of gold or silver? If so, please e-mail me as soon as possible and provide contact information for me to confer with you. If your entity meets the above criteria, I will speak with you as soon as possible. I have investigated class-action suits and other conventional causes of action. I have not been satisfied by my findings. We need not only a cause of action; we need a prevailing case. We need a winning plan of action, not just another lawsuit on top of the heap of other emerging lawsuits. ... ... For the remainder of the commentary: http://www.jsmineset.com/2016/05/03/have-you-been-damaged-by-the-manipul... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod — Taking the Petro Out of the Dollar Posted: 04 May 2016 06:40 PM PDT from JayTaylorMedia: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hong Kong to gain as China streamlines cross-border gold trade Posted: 04 May 2016 06:36 PM PDT By Enoch Yiu Gold trading between Hong Kong and China is expected to rise with the People's Bank of China announcing today a rule change from June 1 to simplify cross-border shipment procedures that would help speed up gold imports into the country. Companies that frequently import and export gold and gold products will be allowed to apply for a single permit that can be used for up to 12 shipments, the central bank said in a statement on its website. China currently has only 15 authorised gold importers, including major banks such ICBC, which need to register every single shipment. Gold traders said the rule change would benefit not just mainland Chinese gold importers but also Hong Kong gold traders that deal with mainland importers. ... ... For the remainder of the report: http://www.scmp.com/business/money/investment-products/article/1941353/h... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 May 2016 06:07 PM PDT Dear CIGAs, We have had a run in gold/silver and the shares far greater than nearly anyone had anticipated. And as you know, the buildup of “commercial shorts” particularly in silver are at all-time highs. By rights, if history is any guide we should experience a sharp pullback. This has been the case for several... Read more » The post The "Casino" Is Opening! appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Seeks Funds To "Save The World From Donald Trump" Posted: 04 May 2016 05:45 PM PDT Having heard from President Obama that his legacy will be having "saved the world from another Great Depression," it appears the next great white hope of the Democrat party envisions her role as no less challenging.

As Washington Times reports, in a fundraising email Wednesday morning, after Mr. Trump ousted his final major opponent the night before, Mrs. Clinton's team said a year ago it was "unimaginable" that the maverick businessman would capture the GOP nomination.

Mrs. Clinton, who has advocated for cutting the influence of money in politics, is nonetheless hoping her own prolific fundraising can be an advantage as she faces Mr. Trump, who so far has done little to actively solicit others’ money.

Having seen a myriad of #NeverTrump-ians dump millions of dollars in negative ads only to spur support among his core, and interestingly noting one poll this week putting Trump ahead of Clinton nationally, it seems comical that Hillary with her 10s of millions of Wall Street sponsorship would be reaching out to mom and pop at home for more money... unless of course it is in the vain hope of reducing the average donation amount to counter at least one root of attack from trump? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 May 2016 05:39 PM PDT Jim/Bill, This is very bullish for gold going forward. Kneejerk reaction by weakening of Euro. In reality, the less currencies for income to hide, the greater the value of gold as a proxy. (Actually, currencies are a proxy for gold!) CIGA Wolfgang Rech The War On Paper Currency Officially Begins: ECB Ends Production Of €500... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Armageddon NOW in Alberta - 80,000 Evacuate as Entire City Burns to Ground Posted: 04 May 2016 04:58 PM PDT Armageddon NOW in Alberta, Canada - 80,000 Evacuate as Entire City Burns to the Ground. WildFire is still ongoing as firefighters and army joins to fight the llargest fire in the History of Alberta, Canada. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Smarter Money Moving Out of Equities and Into Gold Posted: 04 May 2016 04:58 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Price of Gold Closed at $1273.30 Down $17.40 or -1.35% Posted: 04 May 2016 04:26 PM PDT

Never disremember that currency exchange rates cannot be trusted. Why? Central banks manipulate the rates. Wherefore the extremest caution is in order when resting any decision on the direction of exchange rates, for they can abruptly reverse & cream you like mashed potatoes. Now 'tis true that the US dollar appears to have turned up & back from the lip of hell. It posted a Key Reversal yesterday & tomorrow (regardless of the market, I'd like to add one more day's confirming close to that). But I remind y'all that on 14 April the dollar seemed to have turned, & numbrous other times I could name. If the colluding central bank criminals have agreed to let the US dollar drop much lower, they will not pull the props out all at once, lest an unseemly panic damage all scrofulous fiat currencies. Rather, they play the market like a master fisherman plays a bass, now giving him line, now taking it away, but always deceiving the poor fish, doomed for the frying pan. I'm saying this not to alibi for falling gold & silver, merely to remind y'all that exchange rate movements are generated in wildly unpredictable political criminal central bank minds, and not in nature. Besides, I want y'all to ruminate on something else: central banks are fast losing credibility. Now measles is not a "credible" disease in that everyone scorns it, but it can still kill you. So, before central banks breath their longed-for final stinking breath, they are still dangerous, especially when fighting for their lives. That doesn't alter, however, the metals' December change in trend from five-years-down to UP. So whatever shenanigans the CB criminals may pull, silver & gold will keep steadily rising over the next 5-8 years. Disbelieve that at your financial peril. Stocks keep on rolling headlong downhill. Dow lost another 99.65 (0.56%) today and closed at 17,651.26. S&P500 held hands with the Dow, losing 12.25 (0.59%) to 2,051.12. Stocks have now fallen out of a rising wedge, broken down through their up-channel line, poked through the 20 day moving average, and perched unsteadily just above their 50 day moving averages. Can some shiny-pointy-toed-shoe Wall Streeter to 'splain to me how this is coming back? I'm such a nat'ral born durned fool I can't figger it out, bless my heart. Gold lost $17.40 (1.35%) today for a $1,273.30 close. Low came at $1,273.60. Silver peeled off 19.7¢ (1.13%) to close Comex at 1727.7¢. Clearly gold has topped for the moment, but aside from that brilliant observation, what do it mean?? Is this a large correction starting, or only a tee-tiny one? Durned if I know. If it's only a small correction in a larger rally, then the correction will be short & shallow, maybe dropping to $1,245. If a larger degree correction, gold could fall to $1,200. Today it stopped at the uptrend line from the January low. http://schrts.co/PyOpGt Gold has everything going for it that an overbought market need to accumulate before a correction: terrible Commitments of Traders, height above 200 DMA, overbought RSI, and multitudinous hot money speculators that have piled on to take their bite out of the "inflation trade." But none of that tells me whether it will be a short or long correction, at least, not yet. Price will tell us in the next few days. If gold is overbought, silver is overboughter, and enjoys all the drawbacks & warts of gold. However, the question remains, Will this be a large or small correction? A small one would work off the overboughtness so the rally could continue. For right now, some indecision remains. However, both metals are entering a correction. That leaves us waiting for some turn-around signal. Keep watching. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| When It Comes to Trading, You Could Be Your Worst Enemy Posted: 04 May 2016 01:50 PM PDT This post When It Comes to Trading, You Could Be Your Worst Enemy appeared first on Daily Reckoning. "If you take emotion — would be, could be, should be — out of it, and look at what is, and quantify it, I think you have a big advantage over most human beings." — John W. Henry, trend follower who went from being a farmer to owning the Boston Red Sox When shares of Enron collapsed in 2001, a lot of investors got wiped out. I'm sure you remember what happened with Enron, one of the biggest frauds in corporate history. The firm used creative accounting to hide huge debts and heavy losses on its trading businesses. Once the fraud became evident in 2001, Enron quickly went from being one of the biggest corporations in America to being one of the biggest debacles in history. More than 20,000 employees were thrown out on the streets. In a matter of months, the stock dropped from $90 to $0. More than $60 billion in shareholder value vanished. Thousands of investors and employees who had big chunks of their retirement savings in the stock were wiped out. People like Charles Prestwood, a pipeline operator who had been with Enron since day one. After retiring in 2000 with a portfolio worth $1.3 million, he thought he was set for life. But his life savings (and retirement dreams) evaporated during the collapse. After his account balance dropped to $13,000 (that's a 99% loss), he testified in front of a Senate hearing: "All those dreams are gone now. I've lost everything I had. I'm just barely surviving." Or look what happened with Janice Farmer, another retired Enron worker, from Florida. At one point she thought her nest egg of $700,000 would guarantee a comfortable retirement. But once the fraud became evident, she watched her life savings go from $700,000 all the way down to $20,416—in a matter of months. She's now trying to survive on a ridiculous $63 monthly Social Security check. Diana Peters, who lost her entire $75,000 retirement portfolio, is now also completely dependent on Social Security checks. She now gets by on a skimpy $1,300 monthly check and by picking up the occasional odd job. Something very similar happened when the dot-com bubble burst … or when Lehman Brothers went under in 2008 … or when gold stocks plunged from 2011 to 2015. Even though these are completely different scenario, there's one thing in common: investors failed to cut their losses short. Maybe this has happened to you before. You've held onto a losing position for too long because you're telling yourself, "Maybe if I leave it alone it will go back up." That's just the way our brains are wired. We tend to take profits from a winner quickly on the assumption that the profits won't last. And we tend to hold onto a loser in the hope it will bounce back. Dalbar, a Wall Street research firm, reports that the average investor earned just 3.17% from equity funds from 1990 through 2009. In comparison, the S&P 500 averaged 8.2%. Investors failed to capture all the gains largely because they are terrible at timing. They take profits too soon, and hold on to losers for too long. This irrational behavior of holding onto losers for too long is called the disposition effect. This phenomenon has also been documented by researchers from UCLA and the Ohio State University. Odean, another researcher, looked at the trading records of 10,000 individual investors. And he found that this disposition effect cost investors, on average, 4.4% in annual returns. This number is very close to what the Dalbar study I mentioned above found. I recently talked to Princeton professor Daniel Kahneman about this phenomenon. He's the first psychologist to win the Nobel Prize in economics. People typically love to win and hate even more to lose. Winning is rewarding; it makes people feel good about themselves. Correlatively, losing is not only a disappointing outcome with a certain cost; it can be sharply experienced as a self-inflicted insult to the ego, particularly if the one who loses has narrowly framed the competition as a singularly important event. Daniel Kahneman says, "When you sell a loser, you don't just take a financial loss; you take a psychological loss from admitting you made a mistake. You are punishing yourself when you sell." In other words, pocketing a small winning trade makes you feel good. That's why people tend to take profits way too soon, instead of following the trend for as long as it lasts. On the other hand, nobody likes to close a losing trade and admit they were wrong. It's painful. Which is why when a stock you hold starts to move lower, you hold on to it, hoping for a recovery. Instead of cutting losses short and letting profits run, you end up doing the opposite. And that's a sure way of losing a boatload of money — or even getting wiped out. As you can see, trend following goes against human nature. See, this strategy is all about cutting your losses short and letting your profits run. That's what allows you to make big bucks. But it's very hard for humans to do that. Instead, we tend to do the opposite: take profits too soon, and hold onto losers for too long. Here's the bottom line: without a computerized trading system, it's very hard for humans to follow a trend. And that's why the best traders in the world use computer systems. And it's why I've developed my own proprietary trading system to identify trends — the one I use in my research advisory service, Trend Following With Michael Covel. Introducing a system component into trading is the only way for you to reach the discipline needed to possibly make the big money. Most retail investors blow up or have a short-lived trading career because they don't have the discipline to stick with their system. They are always looking for the quick buck, or the quick fix. Sadly, every year millions of accounts literally collapse from basic mistakes. What is the most common mistake? You put a trade on, it starts losing money, but your gut tells you to hang on because it's going to work out and go your way. You end up holding on too long to a losing trade. But it has to come back up? No, it doesn't. A trading system takes that emotion out. It takes the wishing and wanting out of the equation. This type of thinking appeals to everyone once they understand it. My system prevents you from taking profits too soon and holding onto losers for too long. Regards, Michael Covel P.S. Will the Fed raise rates at its next meeting? Is China preparing to shock global markets by devaluing the yuan? You'll find the answers to these questions and more in the free daily email edition of The Daily Reckoning. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post When It Comes to Trading, You Could Be Your Worst Enemy appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Bullion banks creating infinite paper gold on Comex Posted: 04 May 2016 01:32 PM PDT 4:29p ET Wednesday, May 4, 2016 Dear Friend of GATA and Gold: Bullion banks, the TF Metals Report's Turd Ferguson writes today, are allowed to create infinite amounts of "paper gold" for sale on the New York Commodities Exchange and indeed are doing so to hold the price down. Of course these short positions are almost certainly either central bank positions or underwritten in some way by central banks. But of course as gold market expert Bron Suchecki wrote a few years ago, while the sellers may not have the gold they're selling, the speculators who are buying the paper probably probably don't have the money to take delivery -- or at least they haven't done so yet. Ferguson's commentary is headlined "Comex Gold Open Interest" and it's posted at the TF Metals Report's Internet site here: http://www.tfmetalsreport.com/blog/7605/comex-gold-open-interest CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Trump Landslide in November? Posted: 04 May 2016 12:56 PM PDT This post A Trump Landslide in November? appeared first on Daily Reckoning. BUENOS AIRES, Argentina – First, we would like to thank you, dear reader, for your many words of encouragement, sympathy, and pity. We read the Mailbag every day. [Scroll down for today's batch.] We're sorry we cannot respond, but we get ideas… thoughts… suggestions. Many readers have offered helpful thoughts on how to run the ranch more profitably… or how to get more water… or how to make the electrical system function better. We can't implement all these suggestions… but we listen! Objective RealityAfter spending three weeks with objective truth at the ranch, we are now forced to return to the world of myths, delusions, and claptrap. Yes… we are in Buenos Aires looking at a TV! And there they are… talking about the world of politics, money, culture… the world of Facebook and CNBC… of Trump and Clinton… of ZIRP and NIRP… and of Game of Thrones. Some people don't believe in objective reality. Descartes, for example. "I think, therefore I am," he said, famously. But he would have existed whether he thought or not. It wasn't because he thought that he existed; it was the other way around. At least, we think so. That is why we like life at the ranch. We don't have time for Descartes. Objective reality presses against us like a fearful cow in the manga. The sun. The wind. The drought. It hardly matters what you think. You have to live with it… adapt to it… and protect yourself from it. When a bull charges you, or your horse throws you, it doesn't matter what you think; whether you are a Republican or a Democrat… a Roman Catholic or a Buddhist… a prescriptivist or a descriptivist. You just have to do what you have to do. But back in the more sophisticated, more civilized, more modern and technologically advanced world… it is all moonshine. The bull is cut into pieces and sold at the meat counter. What matters is subjective reality. What we think is, often, what we get. Extravagant ConfectionsTake the U.S. presidential primaries, for example. Elections are real. But they wouldn't exist if we stopped believing in them. They are features of subjective reality… extravagant confections created by the human mind. Without our collective thoughts, we would have no elections… no candidates… no government… no president… nobody to tell us what to do. The whole idea of it is monumentally blockheaded. Millions of people stand in line to cast their votes for someone whom almost none of them really knows, whose policies few of them understand, which may or may not be pursued, and with consequences that are usually unknowable. Then, the person chosen by this process gets to tell us what to do! The voters elect a man who pledges to keep them out of war; the next thing you know, he's sending the "doughboys" to Europe. They vote for someone who says, "Read my lips: no new taxes"; the next thing you know… they're facing a tax hike. Then, learning nothing from the experience, they put his son into the White House – a "fiscal conservative" who promises a "humble" foreign policy. A few years later, you turn around and find he's run up the biggest deficits… and gotten us into the longest and second most expensive war in U.S. history. The system is so riddled with preposterous hallucinations and outrageous conceits that it needs the "willing suspension of disbelief" on the part of practically every sentient human being in the nation to hold it up. If they ever caught onto what a scam and a farce it is, the whole thing would fall down in a heap. There is no objective reality to it. It is all "lies, lies, lies," as Republican frontrunner Donald Trump would say. Trump Landslide?"Trump is amazing," began a conversation with a group of Americans last night. "When he started his campaign, people thought he was just a spoiler or a buffoon. But now, I think he's going to win the White House. Nobody likes Hillary." "I thought the polls showed Hillary winning by a landslide," we replied, a bit behind the news cycle. "Want to bet?" At our table of six Americans, at least four were so sure that Trump would take the White House that they were willing to put money on it. "Look, a lot of his program is amateurish and silly. But he understands the soul of the American people much better than Hillary. Just wait until he starts going after her. "Hillary has never had a job. She has a long history of corruption. She has no idea what life is like for ordinary Americans. And those Sanders voters… they're never going to go for Hillary. Hillary is an insider, through and through. The Sanders voters, like Trump voters, want an outsider. "And there are now as many millennials as there are baby boomers. The boomers may go for Hillary. She's safe. She's practically the definition of the Establishment. She'll protect Social Security and free pills. "But the millennials know the system is screwing them. They will have to pay for it… to keep us old f**** living in the style to which we've become accustomed." Addicted to IllusionsHillary is the Deep State candidate. Mr. Trump's relationship to the Deep State has yet to be determined. All we know for sure is that his recent foreign policy speech must have upset the neo-con empire builders, the beribboned pencil pushers at the Pentagon, the think-tank heroes, and New World Order enforcers. Mr. Trump said, in effect, he could turn the country's attention back to its own interests. "America first," Trump says, echoing a foreign policy theme not heard for half a century. "After Reagan, our foreign policy began to make less and less sense. Logic was replaced with foolishness and arrogance, which ended in one foreign policy disaster after another." The elite won't like that. They caused those disasters. They profited from them. They want them to go on. The elite depend on the illusions of the system – especially, the scammy, credit-backed dollar – for the objective reality of their jobs, their wealth, their reputations and power. They won't give up easily. Regards, Bill Bonner P.S. "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post A Trump Landslide in November? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Podcast: Easy Money From China, Japan and Europe Has Failed. What’s Next? Posted: 04 May 2016 12:33 PM PDT China’s most recent borrowing binge didn’t work. Japanese and European negative interest rates resulted in their currencies going up rather than down. Global growth is slowing. Inflation is nonexistent and debt keeps rising. Only gold and silver are looking strong. Calls are being heard for bigger deficits. The world’s governments are about to panic. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web — May 5 Posted: 04 May 2016 10:34 AM PDT The global economy is “at stall speed.” Money is pouring out of hedge funds — and into gold and silver ETFs. Japan and China keep reporting bad numbers. US and Europe continue to slow down. Italy and Japan lobby for bigger deficits. Gold and silver get their correction. Cruz drops out, giving Trump the nomination. […] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The U.S. Issues its “Monitoring List” Posted: 04 May 2016 09:44 AM PDT This post The U.S. Issues its “Monitoring List” appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! The dollar’s taking back of some lost ground continued throughout the day yesterday, and the overnight sessions into this morning’s early trading. The Japanese yen is taking the brunt of the dollar’s rebound, along with the Aussie dollar (A$), while the euro remains pretty much in a trading range around 1.15. But that’s 1-cent below yesterday’s level! Gold has really tumbled after hitting $1,303 a couple of days ago. And what do we have to point to for the reason the dollar has bounced back? Well, it was words. Words spoken by a Fed member, Dennis Lockhart, that got the rate hike campers coming out of the walls once again. I shake my head in disgust because this guy knows as well as I do that the U.S. economy can’t deal with another rate hike at this time, so why is he talking so optimistically about the chances of a rate hike in June, now? Beats me. Well, actually I do know, and I think you do too! The markets are so confused as to what the Fed has up its sleeve. The Fed would do a Bullwinkle and tell you “nothing’s up my sleeve”. For they are transparent, right? Well, maybe transparent to themselves, but not to the markets or us poor humble investors trying to figure out what’s going on! In April, the Fed met, and did the old reversaroo. They had gone from a Central Bank that was beating the drum optimistically, and loud, because they just knew that the U.S. economy was going to take off back in December, to a Central Bank that sounded dovish, no let’s say if they sounded optimistic at one meeting, they sure sounded pessimistic at the next meeting! And that had really set the tone in the currencies, equities and bonds, and even the commodities that interest rates weren’t going to be hiked again any time soon. So, just when everyone was feeling safe about putting their toes back in the investment waters, along comes a BIG Shark! And he tells everyone that the June Fed meeting will be a “live” meeting, and that he doesn’t see any reason why the Fed would delay a rate hike past June. Uh-Oh! From “walking on sunshine” to “oh woe is me, nobody likes me, everybody hates me, think I’ll eat some worms” to back to “walking on sunshine”. My neck is sore from all the twisting and turning I’m doing would you please stop, Fed members? I know, I know, we’re all humans, and we do human things, which is why I’ll stop right here, and move on. I’ve got bigger fish to fry in the FWIW section today. But really, all I’m doing is to report on what has factually happened, nothing more. Well, the Aussie dollar (A$) got a double dose of stimulation, and this time the markets didn’t like it. Go figure! Remember when traders were rewarding currencies from countries that implemented stimulus? Well, the A$ received a double dose of stimulus, and got taken to the woodshed for it. Of course, I agree with the latter of the twos outcomes, because Central Banks have no business getting their hands in the economy’s cookie jar! So, you already know that the Reserve Bank of Australia (RBA) cut rates on Monday night for the first time in a year, but I’m not letting them off the hook for that delay. But then the Aussie Treasury announced their budget just hours after the RBA announced their rate cut. The Aussie Treasurer, Scott Morrison unveiled a plan to cut company taxes, boost infrastructure spending, and provide income tax relief, and then reported that the deficit would be A$37 billion for the 12 months through June 2017. This would bring net debt in Australia to 18.9% of GDP through June 2017, and rise again to 19.2% in the ensuing 12 months. And while that doesn’t sound all that bad given the high numbers that are sprinkled around the Eurozone, Japan, U.K. and of course the U.S., it’s the trajectory that’s the bad thing for Australia. Of course all this bad stuff goes away, when China recovers, but for now, we have to look at China as a drag. At this point, I have to wonder about the so-called Shanghai Accord that was put in place (despite official denials by the countries) in March, having lasting affect like the Plaza Accord did in 1985. I would think that this so-called Shanghai Accord was to stop the negative feedback loop and thereby prevent a sharp devaluation of the yuan; however, it was meant to curtail the rise of the dollar, not sharply reverse it. But that’s what was happening, the dollar’s strength was getting reversed, and the five year strong dollar trend looked to be ending. But a funny thing happened on the way to the forum, and that is the dollar fought back, and in a not so loudly announced report the U.S. printed their “monitoring list”. What’s that, Chuck? Well, grasshopper, come sit and I’ll explain. As a part of the Trade Facilitation and Trade Enforcement Act of 2015 (that’s right I never heard of it before now either) the U.S. decided to point out some problem countries. You see the “ACT” specifies that there are three criteria to qualify for a special attention. 1. A “significant” trade surpluses with the U.S., 2. a “material” current account surplus and 3. “persistent one-sided intervention in the foreign exchange market.” While five countries made the list by triggering two alarms — China, Japan, Korea, Taiwan, and Germany — the Treasury said no one “currently meets all three criteria.” The report did, however, wag its finger at the currency policies of the first four countries. And what region has the currencies that have performed the best vs. the dollar since the so-called Shanghai Accord? The Asian currencies. So what does this tell us about where we go from here? Well, I think the Dennis Lockhart speech yesterday was just a warning signal to the markets to not drive the value of the dollar down too far. But once again, a funny thing normally happens when Central Banks attempt to direct currency markets. The currency markets are known for going for the whole nine yards, folks. So, the Lockhart and Treasury Monitoring announcement might hold the dollar steady for a few days, and then we’ll have to see where it goes from there. My thought is that IF the U.S. continues to push the “stop, we’ve had enough weakness envelope” then a return to the Currencies War could ensue. IF they don’t, then we’ll return to removing the value from the dollar. Like I said above the euro remains in a trade range around 1.15. There are a ton of PMI’s (manufacturing indexes) due to print in the Eurozone, and outside the Eurozone today, and in fact some of them have just come across the screen. Let’s go see what they look like! Well, Spain and Italy both added to their flash estimates and Germany and France saw reductions to their flash estimates, but overall the Eurozone aggregate remained steady at 53. For the newbies, freshmen, new jays, and so on, to the Pfennig. The PMI indexes have a line in the sand of 50, any number above 50 represents expansion and any number before 50 represents contraction. The piece of data that I found the most interesting in the PMI’s was the confidence piece, and here we saw Spain’s confidence rise in spite of the Political logjam that’s going on there, so the economic side of the equation must be looking perky to overcome the Political mess there! Sweden and the U.K. will also print PMI’s this morning. So, it’s PMI Day in Europe! Also, there was another survey taken on the BREXIT referendum that will take place at the end of next month, and the survey showed the “don’t leave” vote to have edged ahead of the “leave” vote. And again for those of you new to this BREXIT stuff, it’s all about the U.K. dropping out of the European Union (EU). The “leave” vote was pretty strong a couple of months ago. and that had weighed heavily on the pound, but with this latest survey, the pound can breathe a little easier. The price of oil slide another whole figure since yesterday and now trades with a $43 handle. Just a week ago, it appeared that $50 was in oil’s future. The Petrol Currencies led by Russian rubles continue to get taken to the woodshed whenever the price of oil drops, and today is no exception. UGH! Today’s Data Cupboard has a couple of items worth looking into, leading off with the ADP Jobs report for April. This is supposed to be a precursor to the Jobs Jamboree, and it’s calling for 195,000 jobs in April, right now, the print later will confirm that number. You know, a lot of traders, economists, and analysts prefer to use the labor component of the ISM Services report, which will also print today. I’m not one of those that prefer the ISM report on labor, I prefer the ADP report. For who else knows about new payrolls than the company that nearly does payroll for entire country? We’ll also see a piece of “real economic data” in the form of March Factory Orders. UGH! Any old way, Factory Orders might print a positive, albeit nascent, number for March, after months of negative numbers each month. Remember, we saw the PMI’s for March (last month) print stronger, so it only makes sense that Factory Orders would be stronger too in the same month. Before I go to the discussion on gold, I have one more item for the Data Cupboard talk. I was reading my Casey Dispatch yesterday, which you can find here and in it there was a quote that I just had to cut and paste for you: “We’re now living in an “Alice in Wonderland” economy where stocks and bonds soar while the “real” economy barely grows.” – Doug Casey Gold has really tumbled since reaching $1,303 on a couple occasions earlier this week. The shiny metal is down $8 this morning, after losing over $5 yesterday, and the metal’s move doesn’t look so shiny right now. And the other precious metals follow suit. Is this a “dip” that should be looked at seriously, or should we wait to see if there’s more selling going on? I’ve said this before and I’ll say it again, and again, so here goes. I’m not one to get too involved with the price of gold when looking to buy. If I feel like buying some gold, I buy it, and I don’t get all influenced by charts, prices, and what have you. For to me, if I feel like buying gold, then I have no other idea in my head other than I’ve added to my store of wealth. period! This is a very important piece today folks. I will NOT be breaking in with songs, lyrics, or facetious comments. This is serious. Well, let me restate that, this is as serious as you want it to be. It comes from the Daily Reckoning yesterday, and is about how the Global Elites want to fund their battles with low growth and no inflation, with a cry to fix global warming. The U.S. can’t fund it because it would mean $6 trillion in new debt per year, so the IMF is going to pick up the ball on this, and issue SDR’s. Here’s Jim Rickards explaining it all:

Chuck again. I have to thank Addison Wiggin, Peter Coyne, and new editor, Brian Maher, at the D.R. for printing this for us yesterday. And to James Rickards for bringing this to light. What it’s being called, what it will be used for, and who gets stuck with holding the bag in the end. And don’t shoot me, I’m just the messenger, but could this really be happening right now? I really don’t know folks, I’m just attempting to bring this to your attention, so you can research and do the work needed to find out if this is going to happen or not. Just a public service announcement, if you will! With that, I’ll ask you to please go out and have a wonderful Wednesday and remember to: be good to yourself! Regards, Chuck Butler P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoning website and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post The U.S. Issues its “Monitoring List” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 Economic and Social Collapse in Socialist Venezuela Posted: 04 May 2016 09:00 AM PDT The lights have been switched off, so have fridges, air conditioners and a whole lot more all across Venezuela. The government ordered power cuts because the main dam which produces 70 present of the countries power does not have enough water to meet the nation's demands. Al Jazeera's John Holman... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Scholes Sees Stagflation Coming, Suggests Safety To Be Found In Assets Like Gold and Silver Posted: 04 May 2016 08:22 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fear Not Gold Bugs, Gold Ratios Well Intact Posted: 04 May 2016 07:55 AM PDT What has been going on since mid-February is a burst of the ‘inflation trade’ as evidenced by silver’s leadership in the precious metals sector. This opened the barn door for all kinds of inflated animals to flee into the light of day, and for commodity and inflation boosters to do their thing. As often happens with silver, things were pushed to and even through their limits. Silver went up, oil went up, base metals went up and stocks went up. But what we should do is retire back to some of the things that actually indicated bullish for the gold sector well before the mini hysteria (and market relief) cropped up. A pullback/correction in gold stocks would be an opportunity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Watching for an Undercut Bottom in the US Dollar Posted: 04 May 2016 07:50 AM PDT Undercut bottom in the dollar coming next? Maybe. Currencies are tricky SOB’s. Be aware we may still get one more drop to form an undercut low and catch shorts on the wrong side of the market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Bullion Has Key New Player – China Replaces JP Morgan Posted: 04 May 2016 05:10 AM PDT The silver bullion market has a key new player – Enter the Dragon. The Shanghai Futures Exchange in China is replacing JP Morgan bank and its clients as the most significant new source of demand according to a very interesting blog with some great charts and tables published by SRSrocco Report yesterday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barclays Launches 100% Mortgage to Compete with Bank of Mum and Dad - Video Posted: 04 May 2016 05:06 AM PDT Transcript Excerpt: hi it's out Wednesday's the 4th of May 2016 I'll be talking about Barclays Bank here in the UK they've just launched the first hundred percent mortgage since the 2008 crisis if you remember well Northern Rock collapse because you know their lending recklessly so now Barclays Bank is doing the same thing I do have to say though that it's not surely a hundred percent because it's also called a guarantor mortgage which basically means that the parents of the young couple or young person taking on that mortgage they put down 5% the mortgage in an account with Barclays for three years to guarantee that mortgage and you know and and the border wars they keep paying the interest and the guarantor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Bullion Market Has Key New Player – China Replaces JP Morgan Posted: 04 May 2016 04:32 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stock Picks Up Over 400%, What's Next ? Posted: 04 May 2016 02:45 AM PDT A battle royale is brewing between gold bulls and commercial traders who are short gold, says Brien Lundin, publisher of Gold Newsletter. That tug of war, which should play out in the coming weeks, could result in either a severe correction or a spectacular rise in the price of gold and silver. No matter which way it goes, in this interview with The Gold Report, Lundin recommends that investors continue to look at companies with world-class resources that are still being priced at a fraction of what their values should be. Lundin should know; some of his recommendations are up more than 400% from December and January. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

A banquet of consequence is coming, but I am afraid that justice is taking a more circuitous route, thanks in large part to the credibility trap. And the masters of the feast never seem to be around to pick up the check for their revels.

A banquet of consequence is coming, but I am afraid that justice is taking a more circuitous route, thanks in large part to the credibility trap. And the masters of the feast never seem to be around to pick up the check for their revels.

Republican strategist and former McCain aide Steve Schmidt went on MSNBC with Chris Matthews and Rachel Maddow to blame talk radio and its 40 million listeners for the political success of Donald Trump. "The tone is disgusting around our political discourse," Schmidt said. "You look at the intellectual collapse of the conservative movement, the fading of giants such as William F. Buckley, the replacement of purveyors of blogs and polemics… it's all collapsed."

Republican strategist and former McCain aide Steve Schmidt went on MSNBC with Chris Matthews and Rachel Maddow to blame talk radio and its 40 million listeners for the political success of Donald Trump. "The tone is disgusting around our political discourse," Schmidt said. "You look at the intellectual collapse of the conservative movement, the fading of giants such as William F. Buckley, the replacement of purveyors of blogs and polemics… it's all collapsed."

No comments:

Post a Comment