Gold World News Flash |

- Gold: Maximize Profit in New Bull Market: State of the Art Discovery Technology – Wade Hodges

- Puerto Rico Default Bruises Dollar, Boosts Gold

- Gold Stocks in the Danger Zone

- Question for Dan Norcini et al.: Are central banks rigging gold or not?

- Jim Rogers – “The Impending Financial Crisis Will Be Much, Much Worse Than 2008″

- A Currency War Battle That Europe and Japan Can’t Afford To Lose

- Wall Street’s Kangaroo Courts Perpetuate a Business Model of Fraud

- Obamacare To Unveil "Price Shock" One Week Before The Elections

- Gold & Silver Rising Fast Amidst Coming Death of Fiat Currency – David Morgan Important Interview

- The First Casualty Is Truth

- Robert Appel: The brink of economic collapse -- How did this happen?

- Every Time This Has Happened, A Recession Followed

- Debt: The Key Factor Connecting Energy & The Economy

- Gold Price Closed at $1294.70 up $5.50 or 0.43%

- Ted Cruz debates with Trump supporter in Indiana

- Full Speech: Donald Trump Holds Rally in Carmel, IN (5-2-16)

- Jeff Berwick on the Collapse of the Current Societal Pardadigm: Gold, Dollar, Parenting & Anarchism

- Jonathan Cahn: Last Warnıng to Amerıca 100% Dollar Wıll Collapse End of 2016

- Shocking News by Imran Hosein | Armageddon -The Evilest of the Evil Times to Begin in 2016

- Gold Daily and Silver Weekly Charts - Reverse Algo Engines

- Donald Trump's Foreign Policy Address

- GoldSeek Radio interviews GATA Chairman Bill Murphy

- Puerto Rico Declares Bankruptcy today

- Illuminati have a SHOCKING plan for 2016

- Prepare for Total Collapse Moral, Economic, and Spiritual-Bob Griswold-

- A Currency War Battle That Europe and Japan Can’t Afford To Lose

- Gold Leaves $1,250 in the Rear View Mirror

- The Devil Is Coming to the White House

- Steve Quayle & Greg Evensen New World Order

- US Dollar Economic Collapse Inevitable In 28 May 2016

- Returning To A Gold Standard: Why Gold and Silver are Beginning This Historic Breakout

- Something Big is Happening Worldwide! (2016-2017)

- USD Still Declining...

- Craig Wright revealed as Bitcoin creator Satoshi Nakamoto

- Breaking News And Best Of The Web — May 2

- Even the Australian Financial Review warns about paper gold

- Gold & Silver Rally Huge as Central Bankers & Analysts Flub

- SILVER: Prospects for the Birth of a New Bull Run

- USD, Yen and an ‘Inflation Trade’ Update

- Did The Big Silver And Gold Market Event Arrive?

- Paper Gold Is Rising, Report 1 May, 2016

| Gold: Maximize Profit in New Bull Market: State of the Art Discovery Technology – Wade Hodges Posted: 03 May 2016 01:00 AM PDT from VisionVictory: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico Default Bruises Dollar, Boosts Gold Posted: 03 May 2016 12:30 AM PDT from The Daily Bell:

Puerto Rico is about to default on bond obligations today, but some of the largest bond funds in the world are starting to "nibble" on Treasuries again. This is after an April sell-off that The Wall Street Journal and other publications attributed to "improving sentiment toward the global economic outlook sapp[ing] demand for haven debt."

Over the past few weeks, investors have been easing up on government bonds and buying riskier assets: stocks, oil, junk bonds and emerging-market equity and bonds. Without belaboring the point, one wonders what it is that so attracts a variety of corporate investors to US debt. Saudi Arabia just threatened to sell off US$750 billion in US assets. The BRICS are doing everything they can to reduce dollar exposure. It is almost never discussed by the mainstream media, but the totality of US obligations has been estimated to run around US$200 TRILLION. That's not a feasible number for any sovereign entity to redeem: not even a nation that the prints the world's reserve currency. And now Puerto Rico is about to default. Here, from ZeroHedge: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks in the Danger Zone Posted: 02 May 2016 11:35 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Question for Dan Norcini et al.: Are central banks rigging gold or not? Posted: 02 May 2016 09:47 PM PDT 12:56a ET Tuesday, May 3, 2016 Dear Friend of GATA and Gold: Replying to your secretary/treasurer's speculation last night that central banks lately may have moved from gold price suppression to allowing gold to rise to help devalue currencies and debt -– http://www.gata.org/node/16427 -- market analyst Dan Norcini asserts that GATA has come over to his position: http://news.goldseek.com/DanNorcini/1462284120.php Not at all. In the first place, Norcini had just written that rather than helping central banks avert deflation, a dramatically rising gold price would actually signify the end of the world: http://news.goldseek.com/DanNorcini/1462129200.php That is, Norcini wrote: "I still cannot stomach so many of these gold cult members who seem not to understand that when they are cheering predictions of $5,000, $50,000, etc., gold prices, they are cheering the ruin of everything around them." Your secretary/treasurer's speculation had explicitly contradicted Norcini's assertion. So there's no agreement there. ... Dispatch continues below ... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Now Norcini writes: "I had been saying for some time that the Fed was not behind weakness in the gold price ever since the dollar embarked on its bull run back in 2014." Huh -- 2014? But GATA began complaining of gold market manipulation and suppression 15 years earlier, and Norcini goes on to concede that during much of that time he subscribed to GATA's views. So do GATA and Norcini disagree only as to exactly when in the last few years central banks generally or the Federal Reserve particularly may have discontinued gold price suppression? Once again, not really. In the first place, your secretary/treasurer's commentary last night was admittedly only speculation. GATA doesn't know that Federal Reserve policy has changed from gold price suppression to dollar devaluation. Indeed, that speculation arose in large part from suspicion that central banks may not have lost control of the gold market and that, if gold is rising again, it is only because that is what central banks now want it to do and how they are guiding the market with their surreptitious trading. That the Fed to this day remains up to its neck in gold market manipulation was confirmed at the central bank's highest levels just a few weeks ago when the president of the Federal Reserve Bank of New York, William Dudley, taking questions at a public forum in Virginia, clumsily refused to answer one about whether the Fed is involved in gold swaps. Then his press spokesman refused even to acknowledge GATA's follow-up question on the subject: http://www.gata.org/node/16341 Anyone who doubts that U.S. government policy toward gold prior to 2014 was a policy of suppression is implored to dispute, specifically, document by document, the official records compiled here -- http://www.gata.org/node/14839 -- and here: http://www.gata.org/node/16377 Norcini has not done that, though of course no one else who disparages GATA has done so either. In the absence of such dispute, it may be assumed that the records are genuine and that they are fairly construed as GATA has construed them. Just as GATA doesn't care much about price predictions for gold, positive or negative, it doesn't care much about the "technical analysis" offered by Norcini and other gold market commentators, "technical analysis" of rigged markets being mere hallucination. Rather, GATA cares mainly about free markets and limited, transparent, and accountable government, and so agreement or disagreement with GATA rests on the answers to these questions: -- Are central banks involved in the gold market surreptitiously or not? -- If central banks are involved in the gold market surreptitiously, is it just for fun -- for example, to see which central bank's trading desk can make the most money by cheating the most investors -- or is it for policy purposes? -- If central banks are surreptitiously in the gold market for policy purposes, are these the traditional purposes of defeating a potentially competitive world reserve currency? Or have these purposes lately expanded to include purposes like devaluing currencies and debt to avert a catastrophic worldwide debt deflation, the emergency policy anticipated in 2006 by the Scottish economist Peter Millar, whose study of gold revaluation often has been publicized by GATA?: -- If central banks, creators of infinite money, are surreptitiously trading a market, how can it be considered a market at all, and how can any country or the world ever enjoy a market economy again? Just as Norcini has not challenged GATA's documentation of gold market rigging, he also seems not to have addressed those questions. But then no other critic of GATA has addressed them either. For as Chesterton wrote a hundred years ago, "As is common in most modern discussions, the unmentionable thing is the pivot of the whole discussion." If central banks are surreptitiously trading markets, Norcini's "technical analysis" is the least of the casualties. In that case markets and even democracy itself are finished. CHRIS POWELL, Secretary/Treasurer Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rogers – “The Impending Financial Crisis Will Be Much, Much Worse Than 2008″ Posted: 02 May 2016 09:20 PM PDT from RT Shows: “Fed pushing us to financial catastrophe worse than 2008″ – billionaire investor Jim Rogers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Currency War Battle That Europe and Japan Can’t Afford To Lose Posted: 02 May 2016 09:00 PM PDT by John Rubino, Dollar Collapse:

After three years of the dollar being pretty much the only strong currency in the world, US corporate profits are falling (because it's hard to sell things abroad when you price them in an expensive currency) and growth is slowing (because an economy can't expand if corporate profits are falling). Presumably the plunging dollar will offer some relief on those fronts. But our relief comes at a high, potentially-catastrophic price for Japan and Europe, because a weak dollar by definition means a strong euro and yen. And those economies are totally unprepared for their exports becoming pricier and therefore harder to move. Here's what the yen and euro are doing while the dollar is falling:

Japan's 2016 GDP growth forecast is an anemic 1.2%. The eurozone's inflation rate is -0.2%. French unemployment is above 10%. The list goes on, but the scariest stats come from Italy where some major banks are trading at less than half of book value, implying that huge loan losses are expected. This is clearly not the time to tighten monetary policy by raising the value of one's currency. But that's exactly what Japan and Europe are doing. And the sense of panic is building:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wall Street’s Kangaroo Courts Perpetuate a Business Model of Fraud Posted: 02 May 2016 08:20 PM PDT by Pam Martens, Wall Street On Parade:

The answer, of course, is that there is no other industry on either side of the pond that has inflicted as much economic pain as Wall Street through "quantifiable wrongdoing." And yet, the U.S. government continues to allow this serially crime-infested industry to run its own private justice system where both its customers and its employees are barred from taking their lawsuits into a court of law so that the public and the press can monitor the proceedings and have future access to the detailed court records to analyze patterns of crimes or recidivism. Depending on which side you're on, this private justice system on Wall Street has various monikers. Wall Street firms and their lawyers call it "mandatory arbitration" or "pre-dispute arbitration agreements" and say it is fair and fast. Many plaintiffs who have been through the system call it "a kangaroo court." The plaintiffs' bar has in the past produced evidence of an intentionally rigged system. Feminist Gloria Steinem once dubbed it "McJustice." One veteran Wall Street reporter, Susan Antilla, has spent two decades chronicling the abuses occurring under Wall Street's private justice system while also writing on the myriad other ways Wall Street has tilted the playing field. In her 2002 book, Tales from the Boom Boom Room: Women vs Wall Street, published by Bloomberg Press, Antilla devoted a full chapter to the "No-Court System." The award winning book traversed a pitched five-year Federal court battle in which I and other Wall Street women sued the retail brokerage firm, Smith Barney, the New York Stock Exchange and the National Association of Securities Dealers (NASD) for effectively voiding the nation's civil rights statutes by forcing these employee claims into an industry-run arbitration forum. The lawsuit documented that serious sexual assaults were occurring, as well as an enshrined system of sexual harassment, because Wall Street correctly perceived it had built an impregnable wall of immunity around itself. Wall Street had not only masterminded a "No-Court System," it had carved out a no-law-zone for the financial securities industry. Just where this kind of no-law system can lead has found a textbook case in the corrupted culture and collapse of Smith Barney's parent, Citigroup, during the 2007-2010 financial crisis. To stay alive, Citigroup was propped up with the largest taxpayer bailout in U.S. history, including a $45 billion equity infusion; over $300 billion in asset guarantees; and more than $2 trillion in initially secret, low-cost loans from the Federal Reserve. Its thank you to the U.S. taxpayer was to be charged with, and admit to, a criminal felony on May 20, 2015 for rigging U.S. foreign currency markets. According to the details in the felony charge brought by the U.S. Justice Department, Citigroup's illegal behavior in the foreign currency rigging matter spanned a period from December 2007 through January 2013. Outrageously, that includes the period after 2008 when Citigroup was being kept alive with taxpayer money. (See Citigroup's broader rap sheet here.) The arbitration issues exposed by Antilla should have shamed the U.S. into legislative action. But as a testament to the power and money of Wall Street in Congress, bills to overturn Wall Street's no-court system have failed to make it out of committee for decades. In her 2002 book, Antilla provides specifics on how a female broker and a female sales assistant were sexually assaulted by the same male broker in a branch office of Smith Barney. In advance of the arbitration, Smith Barney "forced the two women to undergo examinations by a psychiatrist of the brokerage firm's choosing," writes Antilla. The female broker was "subjected to a grilling by Smith Barney's consultant that included questions about her sex life, the opening of her gynecological records, and queries about her menstrual periods, her marital counseling and her divorce." The female assistant, continues Antilla "was placed in a chair in the middle of a room, was similarly grilled with two-and-a-half hours of questions that ranged from her sexual experience to her childhood." Antilla adds that "in an utterly bizarre moment, he asked her to recite the names of all the U.S. presidents in reverse order," causing her to finally break down in tears. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obamacare To Unveil "Price Shock" One Week Before The Elections Posted: 02 May 2016 08:18 PM PDT The writing was on the wall long before the largest US insurer, UnitedHealth, decided to pull the plug on Obamacare in mid April. Then, just a week later, Aetna's CEO said Thursday that his company expects to break even, but legislative fixes are needed to make the marketplace sustainable. "I think a lot of insurance carriers expected red ink, but they didn't expect this much red ink," said Greg Scott, who oversees Deloitte's health plans practice. "... A number of carriers need double-digit increases." It gets better. One week ago Marilyn Tavenner, who until January 2015 ran the federal Centers for Medicare and Medicaid Services, aka the massive Federal agency that oversaw the rollout of Obamacare and the disastrous implementation of HealthCare.gov and who is now as an insurance lobbyist, said she sees big jumps in Obamacare insurance premiums. Translation: insurers are not making money, and they need to make money or Obamacare is doomed. Which means even more dramatic rate hikes are about to be unveiled. However, it's not the what but rather the when that is the shock. And, as Politico reports, the timing could not possibly come at a worse time for Democrats. "Proposed rate hikes are just starting to dribble out, setting up a battle over health insurance costs in a tumultuous presidential election year that will decide the fate of Obamacare." The headlines are likely to keep coming right up to Election Day since many consumers won't see actual rates until the insurance marketplaces open Nov. 1 — a week before they go to the polls. That's right: just one week before the election date, Americans will be served with what now appears will be double (if not more) digit increases in their insurance premiums. Politico is spot on in saying that "the last thing Democrats want to contend with just a week before the 2016 presidential election is an outcry over double-digit insurance hikes as millions of Americans begin signing up for Obamacare." They will have no choice: following years of actual delays to avoid a major public backlash on the critical mandate, this time the hammer is set to fall and it will do so at the worst possible time for Hillary Clinton. "Any reports of premium increases will immediately become talking points on the campaign trail," said Larry Levitt, senior vice president for special initiatives at the nonprofit Kaiser Family Foundation. "We're in an election where the very future of the law will be debated." Democrats say they will mount a vigorous defense of a law that has provided 20 million people with coverage — and point to Republicans' failure to propose any coherent alternative to Obamacare. Which is another way to say Democrats are near panic. "The Republicans will try to make Clinton own the higher prices, but the problem is that Republicans have no alternative or answer," said Anna Greenberg, a Democratic pollster. "They are in the position of taking away insurance if they repeal Obamacare." Somehow we doubt that would be such terrible news for all those millions of Americans whose mandatory "tax" (thank you Supreme Court) subsidies keep the program alive. We also doubt that anyone among America's middle class will shed a tear if Obamacare is gone. Which brings us to the key question: just how much of a shocker will be unveiled days before the election? According to Politico, and here we disagree as we have seen price increases in the high double digit ragne, "average rate hikes have been modest in the past despite apocalyptic predictions: premiums increased by an average of 8 percent this year, according to an administration analysis. That report "debunks the myth" that Obamacare customers experienced double-digit rate hikes, said Department of Health and Human Services spokesman Ben Wakana." Where we do agree with Politico is that "there are reasons to think the next round may be different." Blue Cross and Blue Shield plans, which dominate many state exchanges, saw profits plummet by 75 percent between 2013 and 2015, according to an analysis by A.M. Best Co. A chief reason for the financial woes: "the intensity of losses in the exchange segment." "I have to raise prices because I have to assume the worst," said Martin Hickey, CEO of New Mexico Health Connections, one of the surviving co-ops, which expects to increase prices by roughly a third for 2017. "Whether it stabilizes or not, we can't take the risk." Even New York-based Oscar, the much ballyhooed, tech-savvy startup bankrolled with billions in venture capital dollar, is sputtering. Medical costs for Oscar's individual customers in New York, where it has the most customers, outstripped premiums by nearly 50 percent last year, according to financial filings. "In some cases the hole is getting deeper rather than getting better," said Deloitte's Scott. In short: expect majour double-digit percent increases in premium prices, and not just because Obamacare is fatally flawed, but for two key reasons we warned about years ago when Obamacare was being rolled out: i) not enough participants to make it economically scalable and ii) those who did sign up are so sick that they promptly soaked up all the externalities. From Politico:

Then again, the healthy people have no incentive to sign up and would rather pay the penalty charge instead of spending far more to subsidize those who are not healthy. Sure enough, as with all epically flawed government projects, the cracks in Obamacare became apparent with time.

Ah, we get it now: only Obamacare had "enough of a hammer" it would work like a charm. And then there was the timing arbitrage. Health plans have complained that Obamacare's enrollment rules are too loose, allowing people to wait until they need medical care to sign up for coverage, and then to halt payments once they've received treatment. This may work for Netflix, but it is an absolute disaster when it affects a mandatory tax program that is supposed to benefit everyone.

Alas, such "real time fixes" also never work and end up being gamed by the consumers every step of the way. Which is why health plan officials say more needs to be done to stabilize the markets, for instance, by giving them greater flexibility to sell different kinds of policies. "We have real concerns about the next year or two based on the experience so far," said Ceci Connolly, CEO of the Alliance of Community Health Plans, which represents 22 plans. "Even for our members that are getting close to breaking even on this, they say that it's a really challenging and unpredictable environment." Most health plans remain optimistic the markets will eventually stabilize. Security Health Plan, which does business in 41 Wisconsin counties, attracted three times as many exchange customers as anticipated during its first year of Obamacare business. "Was it a financial winner? No," said John Kelly, the health plan's chief marketing and operations officer. "We expected to take losses and we did." But no more, which is why literally in the days heading up to the general election, the US population will be served a very unpleasant reminder of what happens when big state goes out of control, and that there is no such thing as "free healthcare." Just how much of a hit to Hillary's election chances the "Obamacare shock" will be, we will find out on November 8. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Rising Fast Amidst Coming Death of Fiat Currency – David Morgan Important Interview Posted: 02 May 2016 08:00 PM PDT from FutureMoneyTrends: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 May 2016 07:40 PM PDT by Jeff Thomas, International Man:

War, after all, represents a monumental failure of national leaders to serve the rightful national objectives of a citizenry – peace and prosperity. Of course, in the case of an empire going to war, this represents a monumental failure on steroids – the outcome may well be world war in such a case. Readers of this publication will no doubt be well-versed in the knowledge that, when an empire is nearing the end of its period of domination, war is almost always used by leaders as a last-ditch attempt to maintain order. (During wartime, a populace tends to focus more on the war than the failure of its leaders. In addition, they're likely to tolerate the removal of freedoms by their leaders to be "patriotic".) This being the case, we might surmise that an empire in decline would be likely to display similar symptoms to a country at war. One of those symptoms might well be the loss of truth, not just as it relates to warfare, but as it relates to the society as a whole. A nation in decline might even welcome the disappearance of truth, as it would allow the people to continue to feel good about themselves at a time when a truthful outlook would be too unpleasant to be tolerable. Further, the closer to collapse the country may be (economically, politically, and socially), the more extreme the self-created loss of truth would likely be. Let's have a look at a few cultural examples and see if that premise seems viable. Silver Versus Chocolate Only twenty years ago, people would have been far less likely to deny truth in favour of a falsehood that was more palatable – the instant gratification of candy. In effect, this is the abandonment of basic truth in favour of whatever perception is more pleasant. Kim Jong-Un on “Dancing With the Stars" Now, the video was clearly offered by Jimmy Kimmel to show his audience "how dumb people can be," but it demonstrates something more. It shows us that a significant segment of the population is quite prepared to simply abandon reality by, first, pretending to have witnessed something they have not and, second, offering firm and even complex opinions on something that did not occur. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Robert Appel: The brink of economic collapse -- How did this happen? Posted: 02 May 2016 06:39 PM PDT 9:38p ET Monday, May 2, 2016 Dear Friend of GATA and Gold: Profit Confidential's Robert Appel's commentary today is headlined "The Brink of Economic Collapse? How Did This Happen?" His answer is the ever-intensifying manipulation and distortion of markets by central banks and their agents. Appel's commentary is posted at Profit Confidential here: http://www.profitconfidential.com/economy/the-brink-of-economic-collapse... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Every Time This Has Happened, A Recession Followed Posted: 02 May 2016 05:58 PM PDT Three months ago the Fed released its Fourth Quarter "Senior Loan Officer Opinion Survey on Bank Lending Practices", which revealed something ominous. It showed that in Q4, lending standards tightened for the second consecutive quarter. This was a problem because as Deutsche Bank pointed out at the time two consecutive quarters of tightening Commercial & Industrial loan standards "has never happened before without it signalling an eventual move into recession and a notable default cycle. Once we have 2 such quarters lending standards don't net loosen again until the start of the next cycle." As of today, we now have three consecutive quarters of tightening lending standards. In fact, based on the latest survey, net lending standards tightened even more than during Q4 as shown in the chart below, and are now the tightest on net since the financial crisis. Needless to say, if a recession and a default cycle has always followed two quarters of tighter lending conditions, three quarters does not make it better. This is what the Fed said:

In other words, credit availability is bad and getting worse, and may explain why the ECB had no choice but to shock the credit pipeline into action when Draghi announced that the ECB would monetize corporate bonds (and soon enough, junk bonds). And while our focus looking at this data is on the implied probability (based on historical precedented, now at 100%) of a recession, Bank of America's high yield strategist Michael Contopoulos is looking at the implications of continued lending tightness on the credit market, where he has been uncharacteristically gloomy for many moths. This is what he said:

What all of the above means is simple: either lending standards will ease or the Fed will have no choice but to do what the ECB has done, and jam the credit channel open by actively backstopping bond - and loan - issuance. Either that, or the central banks will have to engage in more coordinated commodity manipulation attempts, since at the very core of the deteriorating lending standards is the collapse in the oil price which in turn has forced banks to collapse revolver availability and halt future issuance until they have some visibility on where the price of oil stabilizes. Perhaps instead of monetizing loans, Yellen will covertly greenlight whoever is the global activist central bank du jour, with a mission to monetize enough oil to push it another $10-20 higher. At that point we will eagerly look forward to Saudi Arabia's response as crude above $50 will mean virtually the entire shale patch is back online. On the other hand, if just like the BOJ last week the Fed does nothing , we have little reason to doubt the historical precedent in which case the countdown to the next recession can officially begin. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

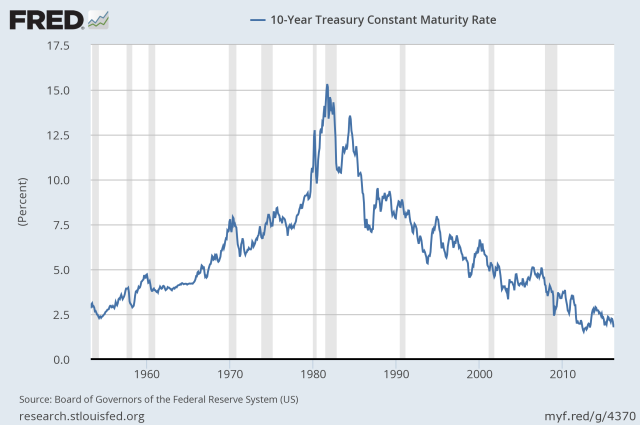

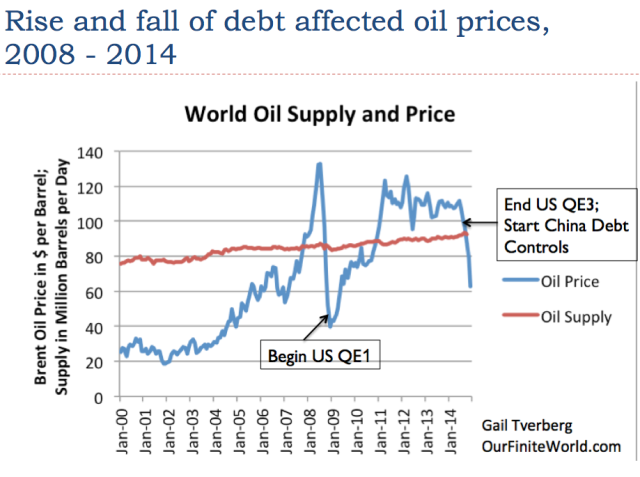

| Debt: The Key Factor Connecting Energy & The Economy Posted: 02 May 2016 05:35 PM PDT Submitted by Gail Tverberg via Our Finite World blog, There are many who believe that the use of energy is critical to the growth of the economy. In fact, I am among these people. The thing that is not as apparent is that growth in energy consumption is dependent on the growth of debt. Both energy and debt have characteristics that are close to “magic,” with respect to the growth of the economy. Economic growth can only take place when growing debt (or a very close substitute, such as company stock) is available to enable the use of energy products. The reason why debt is important is because energy products enable the creation of many kinds of capital goods, and these goods are often bought with debt. Commercial examples would include metal tools, factories, refineries, pipelines, electricity generation plants, electricity transmission lines, schools, hospitals, roads, gold coins, and commercial vehicles. Consumers also benefit because energy products allow the production of houses and apartments, automobiles, busses, and passenger trains. In a sense, the creation of these capital goods is one form of “energy profit” that is obtained from the consumption of energy. The reason debt is needed is because while energy products can indeed produce a large “energy profit,” this energy profit is spread over many years in the future. In order to actually be able to obtain the benefit of this energy profit in a timeframe where the economy can use it, the financial system needs to bring forward some or all of the energy profit to an earlier timeframe. It is only when businesses can do this, that they have money to pay workers. This time shifting also allows businesses to earn a financial profit themselves. Governments indirectly benefit as well, because they can then tax the higher wages of workers and businesses, so that governmental services can be provided, including paved roads and good schools. Debt and Other PromisesClearly, if the economy were producing only items for current consumption–for example, if hunters and gatherers were only finding food to eat and sticks to burn, so that they could cook this food, then there would be no need for the time shifting function of debt. But there would likely still be a need for promises, such as, “If you will hunt for food, I will gather plant food and care for the children.” With the use of promises, it is possible to have division of labor and economies of scale. Promises allow a business to pay workers at the end of the month, instead of every day. As an economy becomes more complex, its needs change. At first, central markets can be used to facilitate the exchange of goods. If one person brings more to the market than he takes home, a record of his credit balance can be kept on a clay tablet for use another day. This approach works as long as the credit can only be used at that particular market. If the credit balance is to be used elsewhere, or if the balance is to hold its value for a period of years, a different, more flexible approach is needed. Over the years, economies have developed a wide range of debt and debt-like products. For the purpose of this discussion, I am including all of them as debt, broadly defined. One type is what we think of as “money.” Money is really a portable promise for a share of the future output of the economy. It can provide time shifting, if this money is held for a time before it is spent. Another type of debt is a loan with a fixed term, such as a mortgage or car loan. Such a loan provides time shifting, allowing something to be paid for over a significant share of its life. Equity funding for a company is not really a loan, but it, too, allows time shifting. Those purchasing shares of stock do so with the expectation that they will be repaid in the future through price appreciation and dividends. It thus acts much like a loan, for the purpose of this discussion. There are many other types of promises regarding future funding that are closely related–for example, government loan guarantees, derivatives, ETFs, and government pension promises. All indirectly add to the willingness of people and businesses to spend money now–someone else has somehow made promises that remove uncertainty regarding future income flows or future payment obligations. The Magic Things Debt DoesIt is not immediately obvious how important debt is. In fact, neoclassical economists have tended to ignore the role of debt. I see several, almost magic, ways that debt helps the economy.

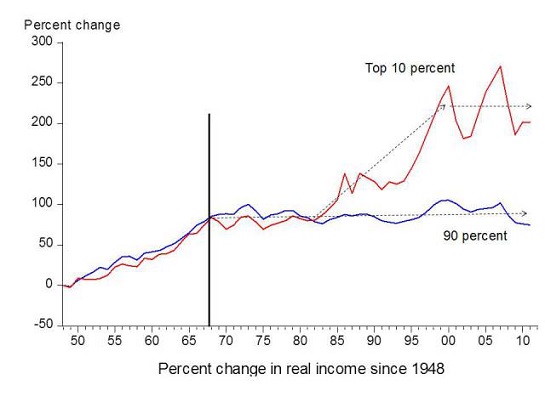

What Goes Wrong as More Debt Is Added?It is clear from the discussion so far that quite a few things go wrong. These are a few additional items. 1.There are limits to government manipulation of debt levels. First, interest rates eventually drop so low that they become negative in some countries. Negative interest rates tend to cause bank profitability to drop and lead to hoarding by those who planned to use savings for retirement. Second, government borrowing doesn’t work as well at stimulating the economy as investments made by the private sector. A likely reason is that private sector investments are made when the borrower believes that the return on the investment will be high enough to pay back the debt with interest, and still make a profit. Government investments often do not meet this standard. Some reports indicate that Japan’s government has used borrowed money to fund bridges to nowhere and houses with no one home. China’s centrally directed economy seems to lead to similar over-borrowing problems. Chinese businesses also borrow to cover interest on prior loans. 2. Ratios of debt to GDP tend to rise, worrying government leaders. Debt is a way of accessing the benefits of Btus of energy, in advance of the time they are really available. As the amount of easy-to-extract oil depletes, the cost of oil extraction gradually rises. Unfortunately, the amount of “work” a barrel of oil can perform–for example, how far it can make a truck travel–doesn’t rise correspondingly. As a result, the higher price simply reflects increasing inefficiency of extraction, and thus the need to use a larger share of the economy’s output to extract oil. The amount of debt needed to keep GDP rising keeps growing, in part because oil is becoming higher priced to extract, and in part because goods that use oil in their production also tend to rise in cost. As a result, the ratio of debt to GDP tends to spiral upward. 3. Rising debt allows for a temporary false valuation of the benefit of energy products. The true value of oil and other energy products comes primarily from the Btus of energy they provide, such as how far a truck can be made to travel. Thus we would expect that the true value of energy products would remain relatively constant over time. If anything, the value of energy products will tend to rise by a small amount (say, 1% per year) as technology improvements lead to growing efficiency in their use. What we think of as the magic hand of the economy determines a price for commodities at all times, based on “supply” and “demand.” This price clearly is not very close to the future energy profit that the energy products will actually provide, because it tends to vary widely over time. We don’t know what the true value of a barrel of oil to society is. If the true value is $100 per barrel (in today’s money), then back when oil prices were $10 or $20 per barrel (in today’s money), there would have been $80 to $90 (equal to $100 minus the actual price) of “energy profit” that could be pumped back into the economy as productivity gains for workers, interest on debt, and dividends on stock, tax revenue, and money for new investment. The economy could (and did) grow quickly. There was less need for added debt, because goods made with oil were cheap. Wages for workers could rise rapidly, as they did in the 1950 to 1968 period (Figure 4). If prices approach the true value of oil (assumed to be $100 per barrel), the extra energy profit would pretty much disappear. The economy would increasingly become “hollowed out.” Productivity gains that lead to wage gains would mostly disappear. Businesses would find it hard to earn adequate profits, and would cut back on dividends. Some companies might need to borrow money in order to pay dividends. World economic growth would slow. Prices can even temporarily overshoot their true value to the economy, then drop sharply back. This happens because prices are set by demand, and demand depends on a combination of wage levels and debt levels. Oil prices can be high for a while, if borrowing is temporarily high, and then fall back as it becomes clear that profitable investments are not really available if oil is at such a high price level. 4. Wages of non-elite workers tend to drop too low. Workers play a very special role in the economy: they both (a) provide the labor for the economy and (b) act as consumers for the economy. If workers aren’t earning enough, there is a problem with many of them not being able to buy the goods and services the economy produces. This is especially the case for purchases such as homes and cars, which are often bought using debt. Indirectly, this lack of ability to afford the output of the system puts a downward pressure on the price of commodities, particularly energy commodities. Prices may fall below the cost of production, or may not rise high enough. The reason that wages of the less educated, non-managerial workers tend to lag behind is related to the issue of diminishing returns. A workaround is a more “complex” society, with bigger businesses, bigger government, more capital goods, and more debt. In some cases, manufacturing is shifted to parts of the world with lower wages. Non-elite workers increasingly find themselves with too small a share of the output of the economy. Figure 7 shows some influences that tend to lead to too low wages for non-elite workers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1294.70 up $5.50 or 0.43% Posted: 02 May 2016 04:56 PM PDT

Y'all remember, of course, that the main driver of currency exchange rates is the relative interest rate. "Relative" here means "interest rate LESS expected loss from inflation." But that little fillip aside, interest rates drive exchange rates. And the Fed lured folks into believing they would raise rates. Blew smoke so effectively that the US dollar index rose from 80 in July 2014 to 100+ in March 2015. Alas, as every poker player knows, you can only blow smoke so long before you have to lay down cards. Last September, the Fed passed on raising rates, just flinched. Last December, they raised their discount rate a contemptible 0,.25%, but even that little spit in the wind nearly wrecked the world's stock markets. Since September the dollar has taken sucker punches from one palooka after another, trashy ECB and scummy BoJ. Finally last week the Fed flinched again, and the BoJ announced it would NOT take its rate lower into negative territory. Relatively, that was a RISE in Japanese rates, a higher rise since the Fed like a drunk trying to quit shoved off its deadline another four or five months into the always-disappearing future. In the last six trading days the US dollar index has dropped every single day, from 95.08 to 92.62 today, a 2.6% loss. That's big in the currency world. Thursday it dropped 69 basis points, Friday 70, and today another 41 (0.44%) for that 92.62 close. Lo, one beginneth to recall fondue, as the cubed cheese begins to heat up and deform in the pot. What's that called? Right, MELT-DOWN. At 92.62 the dollar stands on the very cliff's edge, backwards, balancing on its toes. Y'all go look for yourselves, http://schrts.co/O5dDKu Only thing going for the US dollar index is the Commitments of Traders reports, which argue for a reversal. However that won't argue very hard with a close below 92.50. And behold! From 92.50 back to the 2014 breakout at 80, no support appeareth, no, not none, leading on to deduce that cracking that 92.50 will bring an epic dollar plunge, or dare I say, melt down? Miss not this: if the dollar does turn around here, it raises suspicions it will run back to 100. While the dollar is melting down, the yen is melting up. It lost 0.07% today, but still closed at 94.10. Lo, the chart, http://schrts.co/UuqBFa Euro is profiting from the dollar's distress. Rose 0.75% to $1.1532. It has moved furiously sideways for the past 12 months, but today closed above 1.1500 for the first time since early 2015 (save for a one day spike). If it escapes thru the range's top at $1.1500+, it ought to run. Yet who can tell with currencies? It's a fool that tries to read intent in a central banker's heart. Stocks gained today, but when you lose 260 points over two days and gain back 117 points the third, that ain't progress. Well, maybe that's progress in socialist countries, but not in sane lands. Whoa. Come to think of it, there ain't no sane lands in the world today. Dow gained 117.52 (0.66%) to 17,891.16. SP500 added 16.13 (0.78%) to 2,081.43. I will forbear to mention my suspicions of Nice Government Men painting the tape or jimmying the prices. Shucks, y'all are probably already suspecting that all on your own. Gold & silver prices couldn't agree today. The gold price climbed $5.50 (0.43%) to $1,294.70 while silver price slid 13.3¢ (0.75%) to 1765.6¢. Meseemeth no problem lieth here. Gold is taking leadership out of silver's hands (the gold/ silver ratio jumped up today). The gold price backed up to the breakout point with a low at $1,289.60. Normal action, nothing to mourn & weep & shiver about. Touched $1,306 at its high, and the BIG TARGET is $1,308, the 2015 high. Should gold close above that point, 'twill be the first time since 2011 it has closed above a previous year's high. Y'all paying attention? This is a momentous step. Gigantic. Portentous. Silver did nothing to be ashamed of. It remains above every close in this move from December save Thursday's & Friday's. It's a well deserved pause before shooting higher. THE STICK IN THE SPOKES: Yes, there's always one. For gold & silver it is the frowning CoT reports, which favor not higher prices. However, remember that surprises in bull moves come to the Upside. Those CoT stats can stay out of whack quite a while before they wreak their vengeance. Overbought can always get overboughter. However, it behooves our peace of mind & equinimity to keep reminding ourselves that speculative buying is driving this, and if any of the drivers weaken or disappear (like the US dollar rallying), it could quickly end. Put it into perspective. I'm only talking about this current rally. Silver & gold completed their 2011-2015 correction in December. Next five to 8 years both will move so much higher I am loathe to name numbers, lest y'all send after me the men with the jacket that buckles in the back. My son Christian is trying to sell his house here on the Top of the World Farm & asked me to give y'all a link to it, so here 'tis, http://bit.ly/1pXfBBf It was built in 2011. Pretty place. Peaceful. Also, I have the temerity to remind y'all of my heartfelt request. I have to have foot surgery on Friday, 6 May, and would deeply appreciate y'all's prayers. Thanks in advance. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Cruz debates with Trump supporter in Indiana Posted: 02 May 2016 04:30 PM PDT While at a campaign stop in Indiana, Republican presidential candidate Ted Cruz ventured over to a gathering of Trump supporters and talked his own campaign versus Trump's with a voter. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Holds Rally in Carmel, IN (5-2-16) Posted: 02 May 2016 03:30 PM PDT Monday, May 2, 2016: Full replay of the Donald Trump for President rally in Carmel, IN at The Center for the Performing Arts. Full Speech: Donald Trump Holds Rally in Carmel, IN (5-2-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jeff Berwick on the Collapse of the Current Societal Pardadigm: Gold, Dollar, Parenting & Anarchism Posted: 02 May 2016 03:04 PM PDT TOPICS IN THIS INTERVIEW:00:30 Introduction for Jeff Berwick01:50 Donald Trump & 2016 Election, Jeff thinks Hillary Clinton will Win05:00 What do Mexicans think of US Politics06:45 Gold, Death of US Dollar, Bitcoin and Federal Reserve Interest Rates10:00 What is the Dollar Vigilante most... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jonathan Cahn: Last Warnıng to Amerıca 100% Dollar Wıll Collapse End of 2016 Posted: 02 May 2016 02:30 PM PDT Jonathan Cahn: Last Warnıng to Amerıca 100% Dollar Wıll Collapse End of 2016 Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking News by Imran Hosein | Armageddon -The Evilest of the Evil Times to Begin in 2016 Posted: 02 May 2016 01:30 PM PDT Shocking News by Sheikh Imran Hosein | Armageddon - The Evilest of the Evil Time to at the End of This Year Sheikh Imran Hosein Latest 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Reverse Algo Engines Posted: 02 May 2016 01:04 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump's Foreign Policy Address Posted: 02 May 2016 12:30 PM PDT Remarks from April 27, 2016 in Washington, D.C. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GoldSeek Radio interviews GATA Chairman Bill Murphy Posted: 02 May 2016 12:03 PM PDT 3p ET Monday, May 2, 2016 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek interviews GATA Chairman Bill Murphy, discussing, among other things, the refusal of the president of the Federal Reserve Bank of New York, William Dudley, to answer whether the bank is involved in gold swaps; the increasing accumulation of gold by central banks in China and Russia; and the recent strength in monetary metals prices. The interview is 12 minutes long and begins at the 32:07 mark at GoldSeek Radio here: http://news.goldseek.com/radio/1462213502.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico Declares Bankruptcy today Posted: 02 May 2016 12:02 PM PDT They won't even release the PR bankruptcy to MSM for brain dead population until AFTER the elections....and then only in as much as to inform us they have indebted us another 3 trillion in national debt. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Illuminati have a SHOCKING plan for 2016 Posted: 02 May 2016 11:30 AM PDT Exposed! The shocking plan for 2016 and beyond that has been secretly in the works for many years. The illuminati / Luciferian agenda of the anti-Christ is undeniable and this video shows one of its main schemes of deception and manipulation. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prepare for Total Collapse Moral, Economic, and Spiritual-Bob Griswold- Posted: 02 May 2016 11:00 AM PDT Bob Griswold of Ready Made Resources is back for the second half of our interview. We talk about the need to stay vigilant and be prepared for the inevitable wholesale collapse of American society. He discusses how to be medically prepared for disasters or a mass terrorist attacks which we also... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Currency War Battle That Europe and Japan Can’t Afford To Lose Posted: 02 May 2016 10:47 AM PDT The dollar is tanking lately. From a high of around 100 in December, the dollar index — which measures USD against a basket of foreign currencies — is down about 8%, and the decline is steepening. In counterintuitive currency war terms, that means the US is winning the latest battle. After three years of the […] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Leaves $1,250 in the Rear View Mirror Posted: 02 May 2016 09:23 AM PDT This post Gold Leaves $1,250 in the Rear View Mirror appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a marvelous Monday to you! Well, today is starting out slow, as most of Asia, and Pan Asia is closed for holidays, as is a lot of Europe, as they still celebrate May Day, which fell on a Sunday, so naturally, they take Monday off. And I don’t believe that things in the U.S . will get hopping wild today either, unless the ISM Manufacturing Index which is scheduled to print, has a rabbit in its hat… There are a ton of Central Bankers globally, out on the speaking circuit, headlined by the European Central Bank (ECB) President, Mario Draghi, who is probably going to throw the euro under the bus, as the currency trades nearer the 1.15 handle than it does the 1.14 handle this morning. There are a couple Fed members that will speak, and it will be interesting to see if they sing from the same song sheet. Historically, they don’t, but maybe this time they can share the same song sheet. The Reserve Bank of Australia (RBA) meets late this afternoon, (tomorrow morning for them) and the latest poll of economists have 45% of them thinking that the RBA will go ahead and get this last rate cut out of the way at this meeting. With the call very close to 50/50 for a rate cut or not, I’m still of the thought that the RBA would be prudent here, and wait to see if the latest inflation report was just a rogue report before cutting rates again. The A$ traders don’t seem to be on the same page as the economists, for they have pushed the A$ higher this morning ahead of the RBA meeting. You don’t see that every day! Once again the Japan yen is stronger this morning that it was on Friday morning, and overnight a Bank of Japan (BOJ) official (Aso) noted that he was concerned with the strong move of the yen. In the “old days” of currency trading, this kind of talk would be a precursor to intervention by the BOJ, but not any longer, the BOJ was handed their playbook at the Shanghai G20 meeting, and all the now have at their disposal to slowdown this move by yen traders is their mouths. And I don’t think the markets are concerned with what comes out of the mouths of the BOJ members. The Mighty Puff ceased his roar. Gold has really pushed past $1,250, and the figure now appears to be in gold’s rear view mirror. It sure took a few frustrating times before finally moving past $1,250 for good. Not that I’m complaining. Much. And what really surprises me with this move is that it comes when the physical gold demand has backed off its previous strength. Not that it has dried up or anything like that, but demand backs off and the price of gold soars. Hmmm… now, that’s a new one on me! But I’m not going to question the move, or sit here and tell you that it shouldn’t be happening, because all the time that physical demand was soaring, gold lingered and even lost ground, so that too was confusing to me! So, this makes up for the last four years of watching physical demand soar, but gold falter. The Big data print this week will be the Jobs Jamboree on Friday. Right now, the experts are thinking that the job creation for April will remain around 200,000 to 215,000. I don’t get involved in the guessing what the number will be any longer, because I could never get my arms around the adjustments that the BLS would make to their surveys. I’ll mention this once again, but why do the markets get all lathered up over “surveys” that the people that run the “surveys” then have to apply adjustments to? Seems all convoluted to me. Why wouldn’t we as a country use tax returns as a means of computing our total employment? Ok, that’s a discussion for some other day. But for this week, we’re stuck with the Jobs Jamboree as presented by the BLS on Friday. As usual, China printed data on the weekend. They love to do this, so that the data can be absorbed by the markets without market movement. I don’t agree with this method, but I don’t think they care. The Chinese printed their April PMI (manufacturing index) and for the second consecutive month, the index printed above 50 at 50.3, after a 50.2 print in March. I would say this is a stabilization of some degree for the Chinese and could mean that the country would hold off on further stimulus. And for this “stabilization” the renminbi saw depreciation in the overnight fixing. Yes, that’s opposite of what I would think would be the reaction by the Peoples Bank of China (PBOC), but remember, China boosted the renminbi by a large amount last week, and I’m sure they decided to make sure once again, that the markets didn’t think it was going to be a One-Way Street of appreciation. The Russian ruble is seeing another strong positive move this morning, as the price of oil hasn’t really moved much, but that seems to be a good thing for the Petrol Currencies like the ruble, which doesn’t need any oil price weakness for sure! The Central Bank of Russia (CBR) has pointed toward the high rate of inflation as a reason they can’t continue to cut rates further from their emergency rate hike levels. I think if the ruble continues to appreciate, that it will help with the inflation problem, and interest rates could get back to near normal, in Russia, which would still be above the majority of rates in the world. Well, I’ve been reading so much about negative rates lately. There are articles on it everywhere, and of course not all of them are in agreement. But I’ll pin my colors to the mast of analysts like Grant Williams, who believe that while things may not be rotten in Denmark just yet, they will eventually. Speaking of Denmark, where rates have been negative for four years now (yes, can you believe it’s been four years of negative rates here?) the private sector is saving more than it did before there were negative rates. Last week, I even played this out for you and said that while most economists thought that negative rates would get people to spend, it was doing the opposite and getting them to save more to make up for the “tax” of negative rates. You have to think about this deeper though, and that’s where I come in! Stop for a minute to really think about this. If the country you’re living in has decided that negative rates are necessary, wouldn’t you as a citizen of that country think that the sky was falling, and wonder where Chicken Little was? I know I would! And if the sky is falling what do you do as a citizen? Hunker Down, batten down the hatches, and run for cover, right? Now, did you think that the mental giants (NOT!) that come up with the idea for negative rates ever thought about this scenario? NO! They only saw the people pulling their money out of the bank and spending it. Well, that’s not working, and it’s not going to work either! And sooner or later, these countries, like Denmark, the Eurozone, Switzerland, Sweden, and Japan will realize that negative rates are counter-productive. I shake my head in disgust at these Central Planners that don’t see this a counter-productive. And when you think about it, the same is happening here in the U.S. But we don’t have negative rates, Chuck! OK, technically we don’t have negative rates, but we do have “real negative rates”. If the Fed Funds rate is 0.50% to .75% and inflation, using either method you want to use to calculate it is greater than the interest rate then the “real rate is negative”. And again, I think this is what’s happening here in the U.S. as citizens save more to protect future purchasing power. Well, I already spilled the beans and told you that the U.S. Data Cupboard has the ISM Manufacturing Index today, and I think it will show some slippage from the March rebound. But not much movement, so no real market reaction in my opinion. We’ll also see Construction Spending for March, which seems so long ago to me now. And Fed member Dennis Lockhart will give the first of his two speeches this week today. Tomorrow, Fed member Loretta Mester will speak and this is where I was talking about how we’ll have to see if they sing from the same song sheet. Well, gold is kicking tail and taking names later once again. I’m surprised at how silver, which had been outperforming gold up to last week, has lagged. But that’s OK, silver is still moving in the right direction, so no need to panic here. Gold is up $11.72 this morning, and has crossed the Rubicon. Gold is above $1,300 this morning, after adding $26 to its price on Friday. A nice day indeed, but as always, it could have been even better if not for some aftermarket selling by the you know whom. Before I go to the Big Finish, I wanted to share this with you. I have a friend, Sean Hyman, who is a technical guru. He’s asked to speak to groups all over the world, and he shared this thought with me regarding the Dollar Index:

The dollar index in case you don’t want to wait for the currency roundup is 92.87 this morning. Even a dull tool in the tool box like me, knows that’s below 93. Now it just has to close there. I was reading Ed Steer’s letter this weekend, and he mentioned an article on ZeroHedge and I just had to go there to see if for myself. You can find the article here, or here is your snippet:

Chuck again. Hmmm… Now I wasn’t trading currencies in 1985 when the Plaza Accord took place, and the dollar was set in motion to weaken for about nine years, but I bet it looked and sounded a lot like this, don’t you? That’s it for today. I hope you have a marvelous Monday, and be good to yourself! Regards, Chuck Butler P.S. Will the Fed raise rates at its next meeting? Is China preparing to shock global markets by devaluing the yuan? You'll find the answers to these questions and more in the free daily email edition of The Daily Reckoning. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Gold Leaves $1,250 in the Rear View Mirror appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Devil Is Coming to the White House Posted: 02 May 2016 09:04 AM PDT This post The Devil Is Coming to the White House appeared first on Daily Reckoning. At this weekend's White House Correspondents Dinner, President Obama made a prediction: "Next year at this time, someone else will be standing here in this very spot, and it's anyone's guess who SHE will be." You know I'm not a fan of predictions, but he's probably right. Considering that more and more Americans support socialism, are looking for "freebies" from the government, and expect someone else to take care of them… I think Hillary has a fantastic shot at the White House. And then Slick Willy can get back to the intern business. Oh, and if you thought Obama was bad, just wait until Wall Street's Devil in Prada assumes control of the Oval Office. Pathological Liar ExtraordinaireMark Twain once said: "Politicians and diapers must be changed often, and for the same reason." It's no secret that politicians lie. It's what they're designed to do. For example, Obama lied about Obamacare when he famously said, "If you like your insurance plan, you can keep your insurance plan." Not sure if that beats President Bill Clinton's now classic, "I did not have sexual relations with that woman, Miss Lewinsky." But it's pretty close. Obama also lied when he promised that Obamacare would reduce healthcare premiums by $2,500 per year. Instead, average premiums have skyrocketed. For some groups, the rate hike has been as much as 78%. And he lied when he said: "I didn't raise taxes once." Obamacare is jam-packed with more hidden taxes than we can count… or even figure out. And it's not just Obamacare. A few years ago, he said: "We have to turn the page on the bubble and bust mentality that created this mess," referring to the 2008 financial collapse. But he knows damn well how that mess was created. He knows the Federal Reserve is responsible for the bubbles and the busts of the last 15 years. And if you think he's bad, just wait until you see Hillary in the White House… When she gives a speech, the lies come so fast and so furious, I can't keep track. An encyclopedia of Hillary lies might be a bestseller… or just useful as toilet paper. Are You Ready for the Deep State's Candidate?Look, I think Hillary is a certified crook. From the cattle futures scam in the early days to the $153 million paid to her and Slick Willy over the last 15 years by Wall Street banks, it's corruption on par with the Sopranos. What's really shocking is that she has a real chance at getting to the White House… even though her email scandal should have already put her in prison. But not so fast… According to the latest Rasmussen Reports survey, Republican presidential frontrunner Donald Trump and Democratic presidential frontrunner Hillary Clinton are tied nationally. Is there a glimmer of hope? At this point, it could go either way. But Trump isn't just up against Hillary. He's also up against the immensely powerful Deep State. You see, for the past few decades, it hasn't really mattered who was in the White House. Presidents are mere marionettes controlled by the Wall Street bankers, the big corporations and the military industrial complex. That's no conspiracy, just fact. They give orders. Our elected "representatives" obey… then check their bank accounts for their snack money. This year could be different, though. Trump is a wild card. Nobody knows if he will take orders from the Deep State. And the powers that be are clearly concerned Trump might take their power levers. Meanwhile, Hillary is the establishment candidate. Even noted libertarian Charles Koch is touting her. She has been vetted by the Deep State and has amassed a massive fortune for her loyalty. However, if Trump can unmask her as the crook she is, maybe he'll have a chance. But it's going to be a tough fight. He's up against a massive amount of vitriol. Have you seen the Trump protest videos? They're loaded with topless girls screaming expletives, Mexican flag waving and the destruction of police cars. It's a sad narrative about modern day America. But don't get me wrong. I'm not ruling out Trump. I'm simply pointing out the system is rigged. It's likely we'll just get more of the same in the next eight years. I'm talking about more lies… More taxes… More market manipulations leading to boom and busts… More government boondoggles, like negative interest rates that will hurt retirees and the middle class. And there's nothing you can do to change that. The best we can do is to have a strategy that can profit from whatever is happening in the markets. That means we have to be ready for up, down and surprise markets. No one can predict the election. And no one can predict market direction. But there are ways to get on the right side of trends… and make some money. In a crazy world, where common sense has ceased to be common, that's the best we can do. Please send your feedback to coveluncensored@agorafinancial.com. Send me your thoughts on the upcoming election… and anything else. Regards, Michael Covel The post The Devil Is Coming to the White House appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Steve Quayle & Greg Evensen New World Order Posted: 02 May 2016 09:00 AM PDT Steve Quayle & Greg Evensen New World Order The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Economic Collapse Inevitable In 28 May 2016 Posted: 02 May 2016 08:36 AM PDT "Manufacture and transfer Risk?" is called gambling Forgive them.... for they know not what they say... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||