Gold World News Flash |

- Switzerland Prepares To Vote On "Free Lunch" For Everyone

- The Global Monetary System Has Devalued 47% Over The Last 10 Years

- Gold Price Closed at $1228.90 Down $22.30 or -1.77%

- Will The Swiss Guarantee 75,000 CHF For Every Family?

- Currency War Resumes - China Devalues Yuan To 5-Year Lows

- Private Lawsuit Can Bring 16 of the World’s Largest Criminal Banks to Their Knees

- What It Takes To Be President Of The American Police State

- The gold mine Barrick might regret selling

- Venezuelan Collapse-Lessons for America -- Michael Snyder

- Wheelbarrow Economics

- How to Take Advantage of Multi-Week Correction in Gold and Silver

- UPDATE: Q1 2016 Canadian Silver Maple Sales Surge To Highest Record Ever

- #Brexit -- Why Does The UK Want To Leave The EU?

- Will China Clash With The U.S And Cause Economic Collapse?

- Embry sees dollar vulnerable, expects change in market sentiment

- Chicago pension crisis deepens

- Bin Laden’s Advice on Gold?

- Gold Daily and Silver Weekly Charts - Pre-Options Expiration Posturing on the Comex

- New Secret Snowden files leak coming – activist Miranda

- The Biggest Fools on the Planet

- Alex Jones Show (VIDEO Commercial Free) Tuesday 5/24/16: Lauren Southern, Larry Nichols

- TTIP, TISA Explained | Wikileaks | Jeremy Corbyn | Bernie Sanders | Julian assange

- Gold Mining Buy-Out Binge Coming, And That’s A Mixed Blessing

- Anti-austerity Protesters Clash with Police in Belgium

- Hugo Salinas Price: Mechanical 'economics'

- Bitcoin Trading Alert: Bitcoin Price Stays below $450

- Australian Tax Office Declares War On Bullion

- "We're in the Biggest Financial Bubble Ever", say James Turk - Video

- The Dollar Takes Ahold of the Rate Hike Talk

- Armageddon Drones: Radiation-Detection UAVs to be Tested at Nevada Nuke Desert

- Former IMF economist asserts that gold is money as good as government bonds

- A Bright Brexit Future -- Dan Hannan

- When The Economy Collapses It Will Be Fast And Hard: V The Guerrilla Economist

- The Beginning of a US Dollar Crash?

- First Soros... Now Jim Rogers Predicts Trillion-Dollar 'Biblical' Market Crash

- How to Take Advantage of Multi-Week Correction in Gold and Silver

- Fed Raising Interest Rates in June? Marc Faber Says No, Is Bullish on Gold and Oil Stocks

- Gold Rush Losing Glitter

| Switzerland Prepares To Vote On "Free Lunch" For Everyone Posted: 25 May 2016 01:00 AM PDT Submitted by Claudio Gras via Acting-Man.com, Will the Swiss Guarantee CHF 75,000 for Every Family?In early June the Swiss will be called upon to make a historic decision. Switzerland is the first country worldwide to put the idea of an Unconditional Basic Income (of $2,500 per month for every man, woman, and child for doing absolutely nothing) to a vote and the outcome of this referendum will set a strong precedent and establish a landmark in the evolution of this debate.

The Swiss Basic Income Initiative in a demonstration in front of parliament. As we have previously reported (see “Swiss Parliament Shoots Down Socialist Utopia” for details), Switzerland’s parliament has already rejected the idea, with even the socialists voting against it (proving that they are still in possession of most of their marbles and quite likely in possession of an abacus as well).

The Swiss public will have to approve or reject a change in the constitution that would allow for the introduction of an Unconditional Basic Income (UBI), or a preset, monthly minimum income to be paid out by the government to every adult and child in the country if their income falls below a specific threshold. Even though details of this proposal have been few and far between, the most commonly cited amount of this guaranteed income would be 2,500 Swiss Francs for adults and 625 francs for children. The architects of the proposal stress that this government-guaranteed payment, unlike the current benefit programs, will be entirely “no questions asked”, i.e., it will not be means-tested and will apply to every person legally living in Switzerland. Currently, these are all the details that the Swiss have at their disposal to make their decision. No plan has so far been put forward to specify how such a proposal would be financed, whether an increase in income tax or VAT will have to be enforced, which specific existing welfare programs it would replace or how the glaringly obvious exploitation possibilities of such a plan would be avoided, without any kind of means test – or without “asking any questions”, according to one of the campaign’s catchphrases. The main argument of the supporters of this initiative is that it would support the people that will, or already do, lose their jobs to automation and technological progress; a defensive move against “the rise of the robots” as they put it. They also claim that such a measure will give people the opportunity to grow, to learn and to pursue skills or professional goals that are now rendered prohibitive by their current meaningless and mundane jobs, that they are forced into in order to simply pay their bills. “What would you do if your income were taken care of?” asked the pro-UBI campaign in Geneva, with a poster that officially made it into the Guinness Book of Records as the world’s largest.

Meet the world’s largest poster ever. As to the answer to the question, a number of people would likely immediately proceed to party. The poster unfortunately fails to ask “who is going to pay for it?” – or better said, who will be robbed at gunpoint to pay for it.

The Free Lunch – A Fantasy as Old as MethuselahThe promise of a free lunch is by no means a new thing in politics. Getting “something for nothing” is an age-old shiny trinket that has been dangled before the eyes of the public since time immemorial. In fact, it has appeared so excruciatingly often in our political history, for centuries on end, that one would think that it wouldn’t work anymore; not in 2016, surely. And yet it does. UBI is the proof that there are still people who choose to believe that “no strings attached” freebies and gifts are promises one can rely on and build an economy on, especially when they are coming from their government and rulers. However, there are always some strings attached to such gifts and if history has taught us anything on this matter, it is the distinction between a gift and a bribe. Unsavory political ideologies and catastrophic cultural philosophies often tend to make their debut in front of the public hidden inside a Trojan gift horse. Unrealistic yet enchanting promises have always been a reliable political tool and it has never been a big strategic challenge to corrupt the people by granting the majority something that was stolen from minorities.

Another recent demonstration by UBI supporters in Switzerland – this one suggests that “robots” will actually pay for it all. This is based on a combination of the popular Luddite error that “machines will make us all jobless” (an idea proven consistently wrong since the early 19th century when the original Luddites went around to break machines, but who cares about evidence when changing the world is at stake!) and the fantasy that the world of Star Trek has already arrived, and machines will simply produce everything we need and want “for free” at the push of a button, in a kind of economic perpetuum mobile. Thus, we can now get serious about erecting the long dreamed of socialist Utopia – and this time, we’re going to get it right, you just wait and see!

We can easily spot the parallel in the promotion of Basic Income: Even though the architects of UBI in Switzerland, quite wisely, omit any reference to the realistic and structural aspects of their scheme, at the end of day, someone will have to pay for it. “Tax the 1%!”, argue their international fellow travelers, which, rather predictably, makes UBI even more attractive to a large portion of the public. This whole discussion about UBI reminds us of the following quote by Thomas Jefferson:

Thomas Jefferson knew a thing or two about the true nature of government. By accepting a “free lunch” offered by the government, one is no longer free, but becomes dependent on the whims of the ruling elite – which is of course precisely what the ruling elite wants. In other words, what happens in reality is the exact opposite of what the UBI supporters imagine will happen. They assert that a basic income distributed by the State will “free people”, as they will no longer be forced to deal with the drudgery of having to earn a living. Thus, in a quite Orwellian twist, dependency is marketed as “freedom”.

The Cultural Argument for CollectivismKey figures of the pro-UBI camp take pride in claiming that the main motivation behind the campaign is not economic but cultural. They say this proposal aims to make people think about the nature of life and work, it is a way to liberate them from the jobs they don’t like but need, a status which the scheme’s advocates, quite unhistorically, equate to the indignity of slavery. On top of this, they claim, UBI will help society survive the imminent unemployment apocalypse: they believe that with the help of automation and artificial intelligence 50% of all the existing jobs will be taken over within the coming decade by computers and machines.

The original Luddites were slightly less imaginative: instead of demanding a basic income, they simply went and smashed the machines they thought would take away their jobs. The underlying notion was simply anti-economic: it asserted that the very goal of economic activity, namely producing more with less, was somehow “evil”. Taken to its logical conclusion, this means one would have to reject civilization altogether and return to the “noble savage” life of cavemen and jungle dwellers bereft of tools (a life that would be nasty, brutish, very short and marked by a distinct lack of iPhones).

Such an argument might sound superficially rational, but it goes deeper than that: It presupposes that we as human beings see ourselves downgraded and equated to a machine, like just another cog that can be replaced at any time, in a system where man is literally defined as a human resource. The truth is that it is indeed a cultural debate, far more than it is an economic one. The only conceivable aim of such a factually unhinged and unfounded proposal can be to gauge the mind-set of the Swiss people in this moment in time. The outcome of this referendum can provide a valuable insight into the Swiss mentality, and whether the Swiss actually prefer collectivism over individualism. Such a signal could serve as cue for a further escalation of government empowerment: After all, the collapsing centralized system is bound to show symptoms of desperation by “doubling down” and accelerating and maximizing its centralization efforts. Thus focusing on the symptoms and secondary effects is futile; a real difference can only be made by addressing the root cause, the system itself.

Since the collapse of the Soviet system (of which many prominent Western economists asserted as late as the 1980s that it would eventually overtake capitalism and free markets – which goes to show how utterly blinded by ideology and statolatry the profession has become), most socialists have stopped making economic arguments in favor of socialism, realizing they are no longer credible. Instead they are now making moral and cultural arguments in favor of collectivism. Allegedly, although it will make us poorer, socialism is “morally superior” to the free market system. One might want to ponder the victims of the Chinese Cultural Revolution in this context – when the protection of individual rights is abandoned in favor of vague and pious notions of the “collective good”, things often tend to get real ugly very quickly.

Despite the economic non-sequiturs and the plain Utopianism that lie at the core of the idea of a Universal Basic Income, the concept seems to be gaining popularity worldwide. Canada is set to conduct an experiment with this idea later this year. The city of Utrecht in the Netherlands is launching a pilot program, Finland is planning a two-year trial and a British proposal is gathering interest, while the nonprofit group Give Directly will start providing a guaranteed income to 6,000 Kenyans this month in a decade-long scheduled program and track the results. The idea seems to be gaining traction due to the Western Left’s efforts, however the polls in Switzerland are painting a dramatically different picture: the UBI initiative is projected to suffer a crushing defeat.

A Bastion of LibertyThe Swiss have been voting counter-intuitively for years: When they held a referendum for or against six weeks of vacation, or when they were called upon to vote for an initiative advocating fewer working hours, or even when they made their choice on the issue of the minimum wage, they always delivered outcomes that seemed surprising to the rest of the West, especially the rest of Europe. Up to now, the Swiss have consistently rejected interference by the state when it came to such topics and have refused to grant more powers to their government. Even in recent years, when the trend in favor of aggressive state expansionism seems to be stronger than ever, Switzerland appears to still hold the line as the last bastion of liberty that remains standing. So what is so different about the Swiss then? Switzerland is indeed very different, because it became a nation by its peoples’ own will, based on limited government, strong private property rights and a direct democracy founded on the principles of subsidiarity. This has always required open dialogue and being exposed to different ideas and values: Vigorous debate itself leads to an enlightened society. Thus, the essential difference lies in the nation’s culture, mentality and philosophy.

High up in the Swiss Alps, where they are playing strange instruments. The Swiss have always stood up for the rights of the individual against the State. They successfully defended themselves against the Hapsburg dynasty and other would-be conquerors, and attempts to introduce collectivist decay from within have been consistently rejected as well.

The Swiss have grown up in an environment in which the people were always able to decide for themselves, but they also have a long tradition of doubt and of dissent. Every critical issue is discussed and decided by the people, the actions of government are subject to the judgment of and limited by the citizenry. All viewpoints are heard, even anti-establishment voices have their say, and critical thinking provides the basis for society’s future. However, this is only possible when people rely on their own mind to think about the issues individually and independently. Switzerland is therefore quite a hostile terrain for those who wish to promote “free lunches” and “no strings attached” gifts. A long history of independent thinking, of consequential analysis and of government limitation, makes it very easy for the Swiss to see past the populism-fueled empty promises and the associated publicity stunts. The upcoming rejection of the UBI proposal on June the 5th will and should serve as a reminder that the Swiss still remain the exception to the rule. | ||||||||||||||||||||||||||||||||||||||||||||||||

| The Global Monetary System Has Devalued 47% Over The Last 10 Years Posted: 24 May 2016 11:00 PM PDT Authored by Paul Brodsky via Macro-Allocation.com, We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at pre-arranged fixed exchange prices, which would raise the general price levels in their currencies and across the world to levels that diminish the relative burden of debt repayment (while not sacrificing debt covenants). The odds of this occurring seem to have risen, judging by the gold prices. Table 1 looks at gold performance over one, five and ten years in terms of the fifteen currencies representing the fifteen largest economies (about 77% of global GDP). The bold figures at the bottom show gold’s performance weighted for GDP. Gold is mostly quoted in US dollars, but it is also implicitly valued at each point in time in all currencies (as is everything that may be bought or sold across the world), simply by applying cross exchange rates to its USD price. Table 1 shows the experience of gold holders around the world has been quite different. A Russian would have had the currency he receives his wages in devalued to gold by almost 370% over the last ten years. Or, he could have generated a 370% gain by converting his ruble savings into gold. Anyone else in the world would also show a 370% gain by having owned gold and having been short the ruble. Meanwhile, gold in dollar terms, as it is quoted for capital market participants given London and US exchange dominance over fungible gold trading, is up far less – about 94%. (This performance also represents gold performance for currencies pegged to the dollar, like the Saudi Arabian riyal.) Gold in Chinese yuan terms and Swiss franc terms are only about 57% higher over the last ten years. The wide gap in gold’s performance is due to sharp differences in ongoing currency exchange rates. Gold is a currency hedge - the stable fulcrum around which fiat currencies fluctuate. Gold is not consumed and has no internal rate of return. Changing market quotes for gold – whether for spot gold, gold futures or gold bullion – merely represent currency exchange rates. The performance of gold in Table 1 is not the performance of gold at all, but rather the performance of the currencies in which it is quoted. The last line of Table 1 shows gold price changes adjusted for the relative importance of currencies, as determined by GDP. It implies that the global monetary system has been devalued against gold by 46.88% over the last ten years (1/1.8824), which was in line with the MSCI ACWI World equity index over this time.) One who produced a good or service anywhere in the world over the last ten years would have been wise to save the fruit of his labor in gold terms. Central BanksIf we were a central banker overseeing the fiat global monetary regime we would want to treat gold as a market-based indicator of inflation, not as a potential competitor to the currencies we established and promote. We would build econometric models in which we would define the relationships linking credit growth to demand growth, demand growth to production growth, and production growth to inflation and employment. We would establish economic mandates, like stable prices and full employment, and then we would model conditional scenarios and reaction functions in which to proceed. We would be very transparent in our communications policies, sharing assumptions and data from our models and our economic projections based on them. It would appear to all the world that we would be applying thoughtful, best efforts science to the vagaries of irrational human animal spirits – the irrationality of mass consumption and investment or the irrationality of short term decision making over what would be more sustainable. We would blanket our science in pedantic academic rhetoric and debate nuance with others interested in the same discipline. We would not question the moral nature of our pursuits because science is amoral. Nor would we question whether our models and actions might be unduly harmful because our position is clearly defined and its roadmap conditional and usually marked with precedent. We would not question our reason for being because we would be the very foundation upon which economies sit. We would not separate economics from finance because, well, because it would not reconcile with everything else we do. When asked about gold, we would testify before our congresses and parliaments that we hold it on our balance sheets merely as tradition, and that its relevance in our scientifically managed domestic economies and coordinated, financial-centric global economies is de minimus. Gold would be an afterthought to us, and most serious economists, politicians, policy makers and market observers. Those clinging to the relevancy of the barbarous relic would be generally perceived as sour pessimists, economic losers unwilling to change with the times, malcontents clinging to regressive social mores, Chicken Littles seeking to undermine centrist politics and policy in the face of contrary economic indicators, druids unwilling or incapable of using leveraged financial assets to save, provincial patriots unwilling to strive to live in a peaceful and prosperous international community. Ironically, it is this last point that holds the key to gold’s relevancy in modern times. The fact that gold remains on the balance sheets of central banks and is being aggressively bought by them suggests it is gaining, not losing, relevancy as a monetary asset. The fact that it can be used as the fulcrum against which to devalue currencies gives it purpose. The fact that allocations to gold and gold-related assets remains less than 3% of investment portfolios makes it a superior risk-adjusted portfolio allocation.

ExpectationsGraph 1, shows the relationship of US real yields and the USD gold price. Real (inflation adjusted) yields and gold have been tightly correlated. Non-income producing gold ebbs and flows inversely with yields available on financial assets. This is understandable, but ask yourself this: what happens now that global sovereign interest rates must go negative to give the impression that credit is becoming easier? The sound reasoning behind the tight correlation should break down if/when no amount of central bank stimulus, other than QE, produces inflation, and that inflation is limited to asset inflation. Then, the system would break and global monetary authorities would have to re-work it. Our view is that there will not be a switch to a fully-reserved banking system or even a reversion to a fixed exchange rate; however, there will be a significant increase in global currency devaluations against gold, and that it will be coordinated by monetary authorities. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1228.90 Down $22.30 or -1.77% Posted: 24 May 2016 09:41 PM PDT Tuesday, May 24, 2016

| ||||||||||||||||||||||||||||||||||||||||||||||||

| Will The Swiss Guarantee 75,000 CHF For Every Family? Posted: 24 May 2016 07:40 PM PDT by Claudio Grass, Gold and Liberty:

The Swiss public will have to approve or reject a change in the constitution that would allow for an Unconditional Basic Income (UBI), or a preset, monthly minimum income to be paid out by the government to every adult and child in the country if their income falls below a specific threshold. Even though details of this proposal have been few and far between, the most commonly cited amount of this guaranteed income would be 2,500 Swiss Francs for adults and 625 francs for children. The architects of the proposal stress that this government-guaranteed payment, unlike the current benefit programs, will be entirely "no questions asked", i.e. it will not be means-tested and it will apply for every person legally living in Switzerland. Currently, these are all the details that the Swiss have at their disposal to make their decision. No plan has so far been put forward to specify how such a proposal would be financed, whether an increase on income tax or VAT will be enforced, which specific existing welfare programs it would replace or how they would avoid the glaringly obvious exploitation possibilities of such a plan, without any kind of means test – or without "asking any questions", as is one of their campaign's catchphrases. The main argument of the supporters of this initiative is that it would support the people that will, or already do, lose their jobs to automation and technological progress; a defensive move against "the rise of the robots" as they put it. They also claim that such a measure will give people the opportunity to grow, to learn and to pursue skills or professional goals that are now rendered prohibitive by their current meaningless and mundane jobs, that they are forced into for simply paying the bills. "What would you do if your income were taken care of?" asked the pro-UBI campaign in Geneva, with a poster that officially made it to the Guinness Book of Records as the world's largest. The promise of a free lunch is by no means a new thing in politics. Getting "something for nothing" is an age-old shiny trinket that has been dangled before the eyes of the public since time immemorial. In fact, it has appeared so excruciatingly often in our political history, for centuries on end, that one would think that it wouldn't work anymore; not in 2016, surely. And yet it does. UBI is the proof that there are still people who choose to believe that "no strings attached" freebies and gifts are promises one can rely and build an economy on, especially when they are coming from their governments and rulers. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Currency War Resumes - China Devalues Yuan To 5-Year Lows Posted: 24 May 2016 07:25 PM PDT After a brief hiatus from the ongoing currency wars, China fired another salvo at The Fed tonight by devaluing the Yuan fix to 6.5693 - its weakest against the USD since March 2011. After eight days higher in a row for The USD Index, it seems PBOC has turned its currency liberalization plan off, stabilizing the broad Renminbi basket (which has been steadily devalued) and turning its attention to devaluing against the USD. Having unleashed turmoil in August (pre-Sept FOMC) and January (post Dec rate-hike), it appears the rising rate-hike probabilities jawboned by The Fed are decidedly disagreeable to "authoritative persons" in China.

The Yuan Fix was driven down to March 2011 lows... Front-running?

As it seems maintaining some 'stability' against the USD has lost its appeal as the USD surges once again...

What the chart above shows is that the Chinese currency (red) has been devaluing in an orderly and quiet manner for much of the year while maintaining the appearance of stability against the USD (blue). That appears to have changed now and the last time turmoil started to ripple through the CNHUSD markets - it didn't stop until Tom Cook lied to Jim Cramer and The PPT rescued the world. The irony of the apparent stability in the broad-based Renminbi basket (while devaluing against the USD) is that it comes after a desperate China has reportedly given up on its liberalization goals. As The Wall Street Journal notes,

In reality, though, the yuan’s daily exchange rate is now back under tight government control, according to meeting minutes that detail private deliberations and interviews with Chinese officials and advisers who spoke with The Wall Street Journal about the country’s currency policy.

The flip-flop is a sign of policy makers’ deepening wariness about how much money is fleeing China, a problem driven by its slowing economy. For now, at least, officials believe the benefits of freeing the yuan are outnumbered by the number of threats... though we note that a 3% depreciation of the yuan could add $25.6 billion to Chinese companies’ annual interest payments on dollar debts, according to estimates by analysts at BNP Paribas. So the question is - will the Yuan turmoil ripple through markets enough to spook The Fed once more and dissolve what little credibility they have left or will Janet and her henchmen stand up to the foreign forces, hike rates to spit their own face, and deal with the aftermath through some more Citadel-driven VIXtermination? With VIX futures near record shorts and S&P futures at their longest in almost 2 years - there's not much easy leveraged money to squeeze there - like there was in August. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Private Lawsuit Can Bring 16 of the World’s Largest Criminal Banks to Their Knees Posted: 24 May 2016 07:20 PM PDT by Matt Agorist, Activist Post:

Financial institutions, mortgage lenders, and credit card agencies around the world, set their own rates relative to it, and at least $350 trillion in derivatives and other financial products are tied to the LIBOR. These mega banks suppressed LIBOR, during the beginning of the collapse, to boost earnings and make their bottom lines appear healthier. This banking conspiracy to rig LIBOR was one of the key factors in bringing about the financial collapse of 2008. The scandal was so large, in fact, that it nearly bankrupt the planet.

After the dust had cleared, multiple investors launched lawsuits against these megabanks. However, in March of 2013, U.S. District Judge Naomi Reice Buchwald dismissed much, though not all, of this class action lawsuit directed at the banks. Buchwald argued in favor of the banks, saying that since the LIBOR-setting process was never meant to be competitive, the suppression of that process was not anti-competitive. | ||||||||||||||||||||||||||||||||||||||||||||||||

| What It Takes To Be President Of The American Police State Posted: 24 May 2016 06:30 PM PDT Submitted by John Whitehead via The Rutherford Institute,

Long gone are the days when the path to the White House was open to anyone who met the Constitution’s bare minimum requirements of being a natural born citizen, a resident of the United States for 14 years, and 35 years of age or older. Today’s presidential hopefuls must jump through a series of hoops aimed at selecting the candidates best suited to serve the interests of the American police state. Candidates who are anti-war, anti-militarization, anti-Big Money, pro-Constitution, pro-individual freedom and unabashed advocates for the citizenry need not apply. The carefully crafted spectacle of the presidential election with its nail-biting primaries, mud-slinging debates, caucuses, super-delegates, popular votes and electoral colleges has become a fool-proof exercise in how to persuade a gullible citizenry into believing that their votes matter. Yet no matter how many Americans go to the polls on November 8, “we the people” will not be selecting the nation’s next president. While voters might care about where a candidate stands on healthcare, Social Security, abortion and immigration—hot-button issues that are guaranteed to stir up the masses, secure campaign contributions and turn any election into a circus free-for-all—those aren’t the issues that will decide the outcome of this presidential election. What decides elections are money and power. We’ve been hoodwinked into believing that our votes count, that we live in a democracy, that elections make a difference, that it matters whether we vote Republican or Democrat, and that our elected officials are looking out for our best interests. Truth be told, we live in an oligarchy, and politicians represent only the profit motives of the corporate state, whose leaders know all too well that there is no discernible difference between red and blue politics, because there is only one color that matters in politics—green. As much as the Republicans and Democrats like to act as if there’s a huge difference between them and their policies, they are part of the same big, brawling, noisy, semi-incestuous clan. Watch them interact at social events—hugging and kissing and nudging and joking and hobnobbing with each other—and it quickly becomes clear that they are not sworn enemies but partners in crime, united in a common goal, which is to maintain the status quo. The powers-that-be will not allow anyone to be elected to the White House who does not answer to them. Who are the powers-that-be, you might ask? As I point out in my book Battlefield America: The War on the American People, the powers-that-be are the individuals and corporations who profit from America’s endless wars abroad and make their fortunes many times over by turning America’s homeland into a war zone. They are the agents and employees of the military-industrial complex, the security-industrial complex, and the surveillance-industrial complex. They are the fat cats on Wall Street who view the American citizenry as economic units to be bought, sold and traded on a moment’s notice. They are the monied elite from the defense and technology sectors, Hollywood, and Corporate America who believe their money makes them better suited to decide the nation’s future. They are the foreign nationals to whom America is trillions of dollars in debt. One thing is for certain: the powers-that-be are not you and me. In this way, the presidential race is just an exaggerated farce of political theater intended to dazzle, distract and divide us, all the while the police state marches steadily forward. It’s a straight-forward equation: the candidate who wins the White House will be the one who can do the best job of ensuring that the powers-that-be keep raking in the money and acquiring ever greater powers. In other words, for any viable presidential candidate to get elected today that person must be willing to kill, lie, cheat, steal, be bought and sold and made to dance to the tune of his or her corporate overlords. The following are just some of the necessary qualifications for anyone hoping to be appointed president of the American police state. Candidates must:

Clearly, it doesn’t matter where a candidate claims to stand on an issue as long as he or she is prepared to obey the dictates of the architects, movers and shakers, and shareholders of the police state once in office. So here we are once again, preparing to embark upon yet another delusional, reassurance ritual of voting in order to sustain the illusion that we have a democratic republic when, in fact, what we have is a dictatorship without tears. Once again, we are left feeling helpless in the face of a well-funded, heavily armed propaganda machine that is busily spinning political webs with which the candidates can lure voters. And once again we are being urged to vote for the lesser of two evils. Railing against a political choice that offers no real choice, gonzo journalist Hunter S. Thompson snarled, “How many more of these stinking, double-downer sideshows will we have to go through before we can get ourselves straight enough to put together some kind of national election that will give me and the at least 20 million people I tend to agree with a chance to vote for something, instead of always being faced with that old familiar choice between the lesser of two evils?” Remember, the lesser of two evils is still evil. | ||||||||||||||||||||||||||||||||||||||||||||||||

| The gold mine Barrick might regret selling Posted: 24 May 2016 04:59 PM PDT 8:04p ET Tuesday, May 24, 2016 Dear Friend of GATA and Gold: Resource company publicist Tommy Humphreys of CEO.CA today issued a report that may be most interesting for showing how insanely cheap the junior gold mining business remains despite the rise in the monetary metal's price since the start of the year. The report is about K92 Mining, which last year acquired a high-grade gold property in Papua New Guinea from Barrick Gold for $2 million, a tiny fraction of the $141.5 million Barrick paid for the property in 2007 before spending another $140 million developing the property, only to start casting off assets and reducing debt as the gold price was pounded down. Humphreys' report includes a 17-minute video interview with K92 Mining CEO Ian Stalker, a former executive with Anglogold Ashanti, who argues that Papua New Guinea, while at the edge of the developing world, actually has coherent and reliable mining law. Humphreys writes that K92 Mining will list tomorrow on the Toronto Venture Exchange, a bit of a frontier itself, but that's where discoveries come from, usually after a prolonged period when nobody wants even proved-up resources that are lying around in plain sight. It's a fascinating story, though no doubt there are many similar stories these days. It's headlined "The Gold Mine Barrick Might Regret Selling" and it's posted at the CEO.CA Internet site here: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Committee to Destroy the World: This new book by Michael E. Lewitt is a passionate and informed analysis of the struggling global economy. Lewitt, one of Wall Street's most respected market strategists and money managers, updates his groundbreaking examination of the causes of the 2008 crisis and argues that economic and geopolitical conditions are even more unstable today. Lewitt explains how debt has overrun the world's productive capacity, how government policies have created a downward vortex sapping growth and vitality from the American economy, and how greed and corruption are preventing reform. For more information: http://www.wiley.com/WileyCDA/WileyTitle/productCd-1119183545,subjectCd-... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuelan Collapse-Lessons for America -- Michael Snyder Posted: 24 May 2016 04:36 PM PDT Michael Snyder of The Economic Collapse Blog is on the show today to discuss what is happening with the collapse of Venezuela's currency and what it will look like when it happens in America.< i> The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 May 2016 04:00 PM PDT by Jeff Thomas, International Man:

At the time, I recommended to readers that they "watch the movie" as it was being played out in Venezuela, as it would offer them insight into what was on the way in their own country, should they reside in Europe or North America. The pattern followed by Venezuela is roughly the same as for the other jurisdictions; Venezuela is just a bit more advanced in the progression. Therefore, what we are observing in Venezuela is likely to be played out in other countries that have made the same mistake of taking on more debt than they can ever pay back. As predicted, Venezuela is now well along with regard to hyperinflation. The traditional definition of "inflation" is "the increase of the amount of money in circulation." Today, we think of inflation as an increase in the cost of goods, but this is merely a predictable by-product of inflation. If the amount of money increases, the cost of goods will always rise to meet it. Therefore, the issuance of large amounts of paper money has only a very temporary positive effect. Ultimately, it creates an increase in the price of goods and services, which, in turn, calls for further printing. In 1922, Germany was up to its eyes in debt, to the point that it was beyond repayment. The government, in attempting to overcome the dire poverty that had developed, decided to print more paper banknotes. The printing didn't (and couldn't) solve the problem, so they printed more. Then more again. They kept up the printing, until, by the autumn of 1922, the reichsmark was worth so little that new bills were being delivered to the banks in boxcars. A story of the time describes a man bringing a wheelbarrow of reichsmarks to a baker to buy a loaf of bread. Whilst in the shop, making the deal with the baker, he was robbed—the wheelbarrow full of money that he had left out on the sidewalk had been stolen. The thief dumped the reichsmarks on the pavement and made off with the wheelbarrow. Above, we see a photo from the time—a wheelbarrow full of reichsmarks. Next to it, we see a photo from present-day Venezuela—a wheelbarrow full of bolivares. So, are the leaders of Venezuela learning from the mistakes of other countries that have followed this pattern? Far from it. Recently, they took delivery of over five billion banknotes—enough to fill three dozen 747 cargo planes. At the same time, Venezuela is selling off its gold in order to pay for the new currency and other debts. Venezuela will soon run out of real money to pay for the fiat money, and that will bring the charade to a disastrous end. The reader may say to himself, "When will people learn?" Sadly, they don't. Incredibly, when the reichsmark collapsed in 1923, no one blamed the excessive printing. In fact, many people felt that if only the printing had continued just a bit longer, everything might have been all right. What we can take away from this is that what happened in Weimar Germany in 1922–1923 is happening now in Venezuela in 2016. (And has happened in some twenty other countries over the last hundred years, most recently in Argentina in 2000 and in Zimbabwe in 2008.) The same will occur in Europe and America in the fairly near future. That's not a "Chicken Little" overreaction; it's a virtual certainty. The same economic errors always bring the same catastrophic results. Ben Bernanke, just two years prior to being named head of the Federal Reserve, assured an audience that the Fed would react to any deflationary trend by printing as many currency notes as necessary. This was no idle threat. Remember, the owners of the Fed profit heavily from the hidden tax of inflation, but lose money if there is deflation. That assures us that, with the present unsustainable level of U.S. national debt (nominally, some nineteen trillion dollars, but actually some hundred trillion dollars, including unfunded liabilities), a collapse in the dollar is a given. And, of course, the severity of the crash is always commensurate with the level of the debt, which promises us that, since this debt load is by far the greatest the world has ever seen, the crash will be the greatest the world has ever seen. Those who have studied the histories of countries after they've experienced a hyperinflationary collapse will be aware of what's headed their way, if they reside in Europe or North America. Those who have not undertaken such a study might choose instead to watch the movie—to observe what happens in Venezuela as its hyperinflation plays out and learn what their own fate might be. Our predicted outcome, which may have seemed hypothetical in 2014, is now right around the corner in Venezuela. This will be of value to the reader who watches as the collapse occurs, then observes what follows. The events that unfold will be essentially the events that will unfold in Europe and North America when their respective collapses occur. This "movie" is not meant to be entertainment at the expense of others' suffering; watching it is a way to forewarn oneself as to what's coming to those countries that are irrevocably on the same path, but have not yet reached the same point. By watching, the reader may be forewarned as to how to prepare himself so that, whilst his country may be headed toward economic collapse, he may take action to assure that the impact to himself, his family and his investments are diminished. | ||||||||||||||||||||||||||||||||||||||||||||||||

| How to Take Advantage of Multi-Week Correction in Gold and Silver Posted: 24 May 2016 04:00 PM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||

| UPDATE: Q1 2016 Canadian Silver Maple Sales Surge To Highest Record Ever Posted: 24 May 2016 03:42 PM PDT by Steve St. Angelo, SRS Rocco Report:

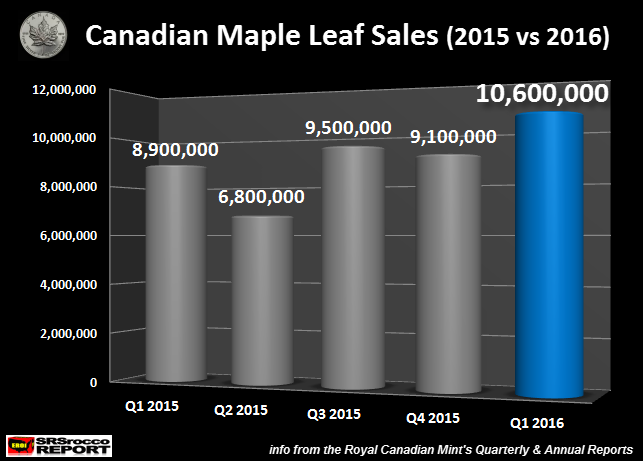

The Royal Canadian Mint just published its Q1 2016 Report, and the bullion coin sales figures were stunning to say the least. Not only did sales of Canadian Silver Maple Leafs surpass its previous record during the third quarter last year, it did so by a wide margin. Why is this such a big deal? Because Q1 2016 sales of Silver Maples topped the Q3 2015 record, without surging demand and product shortages. Last year, there was a huge spike in silver retail investment demand due to the supposed "Shemitah" or the collapse of the broader stock markets. Investors piled into silver in a big way as they perceived a year-end market crash was inevitable.

During last August and September, some websites stated 2 month delivery wait times for certain products such as Silver Eagles and Silver Maples. With the huge spike in demand, sales of Canadian Silver Maples reached 9.5 million oz (Moz) during Q3 2015. Although, once investors became more relaxed as the broader markets turned around, demand for physical silver investment cooled down. Thus, Silver Maple sales declined to 9.1 Moz in the last quarter of 2015. However, something very interesting took place during the first quarter this year. Sales of Silver Maples jumped to an all-time record high of 10.6 Moz:

Actually, I was quite stunned by the figures published in the recent Royal Canadian Mint Report. Sales of Silver Maples jumped 1.1 Moz in Q1 2016 vs Q3 2015, with no real spike in overall retail investment demand. Which means, investors bought more Silver Maples in Q1 2016 than any other quarter in history. Furthermore, if Silver Maple sales continue to be this strong, the Royal Canadian Mint is on track to sell over 40 Moz compared to the 34.3 Moz in 2015. If Silver Eagle sales also continue on their strong trend of 1 Moz per week, the U.S. Mint could sell over 50 Moz of these coins. Together, these two official mints could sell over 90 Moz of Silver Eagles and Maples in just one year. | ||||||||||||||||||||||||||||||||||||||||||||||||

| #Brexit -- Why Does The UK Want To Leave The EU? Posted: 24 May 2016 03:30 PM PDT The United Kingdom is expected to put forth a referendum on its EU membership. So what are the reasons for the UK's potential departure? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Will China Clash With The U.S And Cause Economic Collapse? Posted: 24 May 2016 03:00 PM PDT this video Luke Rudkowski breaks down the tense relationship the U.S has with the world's 2nd largest economy in the world China. We go over the military geopolitical moves regarding the man made south asian Chinese military bases, the new Chinese backed Yuan that cannot be traded with the dollar... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Embry sees dollar vulnerable, expects change in market sentiment Posted: 24 May 2016 02:36 PM PDT 5:35p ET Tuesday, May 24, 2016 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that the U.S. dollar is vulnerable because of the decline of its use in the oil trade. Embry adds that he thinks a major change in market sentiment is coming. An excerpt from the interview is posted at the KWN Internet site here: http://kingworldnews.com/50-year-veteran-warns-this-twisted-fantasy-is-a... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago pension crisis deepens Posted: 24 May 2016 02:30 PM PDT FBN's Jeff Flock breaks down Chicago's growing pension shortfall. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 May 2016 01:56 PM PDT This post Bin Laden's Advice on Gold? appeared first on Daily Reckoning. There have been more than a few awful people working on Wall Street and in the financial world. Bernie Madoff comes to mind. He ruined the lives of quite a few people with his colossal Ponzi scheme. The predatory lenders that created the U.S. housing crisis might also qualify. How about the guys at the top of Enron who sold boatloads of shares while the employee pension plan was directed into the sinking ship? All of them terrible, but none of them compare to one particular "financial adviser"….Osama bin Laden. In 2010, bin Laden and al-Qaida came into a $5 million cash windfall. Where did it come from? Ransom proceeds from a kidnapping. Noble work if there ever was some. Bin Laden had some very specific instructions on where that money should be kept for safe-keeping. He insisted that at least one-third of it be invested in gold. His exact words:

OK, enough about bin Laden. Thankfully, he's resting at the bottom of the sea. However, it is a great time to look at gold… With the Midas metal just having its best quarterly performance in 30 years (up 17%), there are some indications that $3,000 per ounce (or more) may yet see the light of day. Gold prices peaked in September 2011 at just under $1,900 an ounce. That peak marked the commencement of a pretty nasty bear market that lopped the price of gold in half. That peak was 55 months ago.

If we assume that the gold bear actually did end in December 2015, when prices started increasing, that would put that bear market at 52 months and a 44% decline. Those numbers are both nearly right on what we have historically experienced. If, in fact, we have started a new bull market for gold, our experience since 1970 would suggest we will easily be seeing bin Laden's gold price target of $3,000 per ounce in the coming years. A bull run that equals the median of the past five (451%) would see gold prices up around $4,500 per ounce in the next three or four years. My personal favorite way to invest my money has been real estate. There are just so many things to like about it:

Today, though, as a Canadian, I am faced with a problem. I think that the real estate up here is just too expensive to buy. I've benefitted from the price appreciation with the real estate I own, but incredibly low interest rates have pushed those prices to unreasonable levels. One of my favorite investing thinkers, Jim Grant, explains what has happened to Canada's real estate, amongst other things, very clearly:

Housing prices that we should not have seen for many years are upon many of us up here in Canada. Those prices have been pulled forward. It is amazing how big of a mortgage you can afford when interest rates are a third of the historical average. Grant was referring to Canada's real estate specifically, but his explanation applies to gold, too. For the last several years, Grant has been very bullish, and therefore wrong, about gold prices. Based on the data presented above, it is quite likely that he is about to become very right. He usually is. You may have followed the shocking collapse of Valeant Pharmaceuticals in recent months. From $260 per share, Valeant is now fighting to hold $25. A lot of pretty sharp investors have been burned badly by this one. Back in 2014, Jim Grant was telling people to stay away from Valeant and that shorting it could be a very profitable venture. Grant was very right about Valeant, but for the better part of 18 months, he looked very wrong. From his initial bearish call on Valeant, the stock is down 80%, but in the first 18 months after his call, it was up almost 70%. Mr. Grant had to endure a lot of pain before being proven correct. And for the past four-plus years, Grant has been very wrong about gold. His message, though, has not ever waivered during this time. Grant has repeatedly stated that while he did not understand why gold was falling, he absolutely knew that all of the elements were in place for gold prices to rise. My point to all of this is that Jim Grant and a few other very smart investors have a habit of being proven right over time. It often takes patience for what they are predicting to occur, but it usually happens. Grant himself can be credited with:

With the benefit of hindsight, none of these calls by Grant look particularly difficult to make. At each point in time, though, Grant's opinion was certainly not the norm. It could very well be that three years from now that it should have been obvious that gold was about to go on a tear in early 2016. I mean negative interest rates, a flip-flopping Fed and a near decade of financial experimentation would seem to be the perfect recipe for a huge burst in demand for gold, wouldn't it? Markets can do funny things for longer than we expect, but ultimately, actions do have consequences. Regards, Jody Chudley P.S. History proves there's no better way to preserve your wealth than owning gold. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. It tells you everything you need to know about owning gold. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Bin Laden's Advice on Gold? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Pre-Options Expiration Posturing on the Comex Posted: 24 May 2016 01:43 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||

| New Secret Snowden files leak coming – activist Miranda Posted: 24 May 2016 01:30 PM PDT David Miranda says the public has the right to see documents leaked by Edward Snowden, which he plans to release soon. However, Miranda told RT that he has been pressured from US and UK security agencies not to disclose the documents The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| The Biggest Fools on the Planet Posted: 24 May 2016 01:13 PM PDT This post The Biggest Fools on the Planet appeared first on Daily Reckoning. BALTIMORE, Maryland – Readers reacted strongly to reports from the ranch. (For the latest, scroll down to today's Mailbag.) Many have clearly gone over to the enemy's side – including some members of our own family. More on the insurrection at the ranch tomorrow… Gassy Hacks and Big QuacksToday, we recall the "commencement" at the end of four years at the University of Vermont. The university itself is imposing and a little intimidating. The rest of the world works in warehouses or common office spaces. Academia labors in hallowed "halls" and prestigious "centers." People in the Main Street world work for profits… and are subject to market economics. The professoriate is above it all; no profit and loss statements… no profit motives or incentive bonuses… and (for those with "tenure") no chance of getting fired, no matter how incompetent, irrelevant, or wrong they are. The private sector depends on output and results; academia harbors gassy hacks who may never produce much of anything at all. The ceremony on Sunday opened with the procession of the university luminati, led by bagpipers of the St. Andrews Society. Ordinary people – even presidents of the United States of America – wear common coats and ties; the academic elite are gussied up with all manner of robes, funny hats, cowls, tassels, honors… and a line of capital letters following their names like baby ducks behind a waddling quack. "All that brainpower… working on our Justin… it must have done him some good," parents say to themselves. Then, they have their doubts. Justin seems to think that "diversity" is what really matters… that Bernie Sanders has the right idea… and that eating gluten is a sin. Privately, they wonder if they haven't just been the biggest fools on the planet, spending more than $100,000 to put their boy through four years of brainwashing… with no visible improvement in his critical thinking. But this is no time to say anything. It's too late. So, they take their seats, along with thousands of others… At least… those were the dark thoughts gathering in our mind as we sat in a plastic chair on the green, waiting for the festivities to begin. Criticism and CynicismMr. E. Thomas Sullivan, university president, must have seen the clouds over our head. "Criticism and cynicism will not lead to a constructive solution," he said, looking right at us. But criticism and cynicism are just what the University of Vermont most lacks. Without them, the Yankees allow themselves to believe any self-congratulatory bunkum that comes along. They say on Wall Street: When everyone is thinking the same thing, no one is really thinking. That's the problem with the institution of higher learning on the banks of Lake Champlain. If anyone is doing any thinking there, they didn't let him say anything on Sunday. We're used to commencement claptrap. The typical graduation exercise is always a mixture of lies, pandering, blah-blah, and flattery. The only redeeming quality is that it is transparently insincere. Students are told how wonderful they are. They are assured that they are now equipped to go out into the world and be "leaders." They are urged to "maximize [their] potential." How? "Make a difference!" Make a "positive contribution." "Advance society…" "Advance humanity…" "Save the world…" Whoa… how do you do that? The suggestions weren't long in coming… "Who here doesn't believe that climate change is the most important challenge facing this graduating class?" asked the university president in his opening remarks. Out of thousands of arms, only a couple hands went up. Mr. Sullivan hardly needed to ask. For him and the rest of the jury, no further deliberations were necessary. The verdict has already been rendered. No need for any more evidence, testimony, or eyewitnesses. The matter was settled. There was not a single dissent. Not a single question. If there were any doubts about the difference between good and evil… or who should be elected president… none were mentioned… or how the world works… it was nowhere to be seen. I Care, Therefore I AmStudents were cited for special recognition… awards were given… speeches made… on and on… hour after hour. One student was lauded for his contributions to "eliminating racism"… Another was "building communities"… Still another was congratulated for his efforts to "save the world"… Another was supporting "gender confirmation surgery"… Every one of them was a world improver. Every one "cared." And every one of these inchoate idealists had a ticket to government employment. Only one will definitely not find a nest among the zombies – one whose degree was awarded posthumously. "I care, therefore I am," suggested Gail Sheehy, who gave the keynote address and neatly summed up the event's leitmotif. "Caring" is all you need to do. You must care about the poor, the excluded, the politically correct victims left behind by modern cutthroat capitalism. Don't worry about whether caring actually makes a damned bit of difference. Don't concern yourself whether meddling in others' lives really helps them. Ignore Adam Smith's insight… that it wasn't his love for humanity that got the baker up at 4 a.m. to warm his ovens. Most likely, Smith was right; world improvement is a by-product of trying to improve your own life, not trying to change the world itself. And Friedrich Hayek was probably right, too; trying to improve the world by inflicting your ideas on others does more harm than good. But at UVM, all you gotta do is care! And if you don't care; you don't exist. A Strange and Hostile New WorldNo student was encouraged to bake better bread. None was rewarded for improving the internal combustion engine. Not a single one was recognized for anything that might demonstrably and convincingly make peoples' lives better. Instead, the caring alumnae leave the university like drunks leaving a bar after closing time… their judgment impaired by the heady fumes of do-goodism. Will the world really be a better place a year from now… or two years… or however long it takes for these "carers" to work their magic? We don't know. But you'd think that a university would be a good place to at least ask. Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post The Biggest Fools on the Planet appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Show (VIDEO Commercial Free) Tuesday 5/24/16: Lauren Southern, Larry Nichols Posted: 24 May 2016 12:43 PM PDT -- Date: May 24, 2016 -- Today on The Alex Jones Show On this Tuesday, May 24 edition of the Alex Jones Show, we cover the continued meltdown of Glenn Beck as he blasts critics as "progressives on the right" and argues Facebook skews left simply because more left-wingers use social media. We also... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| TTIP, TISA Explained | Wikileaks | Jeremy Corbyn | Bernie Sanders | Julian assange Posted: 24 May 2016 10:00 AM PDT #WikiLeaks launches €100,000 crowd funding for hyper-secret #TTIP to be leaked. #TISA #TPP . This is why #Jeremy Corbyn John Pilger and #Bernie Sanders oppose these so vehemently. #julianassange The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Mining Buy-Out Binge Coming, And That’s A Mixed Blessing Posted: 24 May 2016 09:52 AM PDT This is a good news/bad news story. Say you’re one of the many people who bought junior gold and silver mining stocks a few years ago — and then watched in horror as they fell day after day, week after week, finally settling at pennies on your dollar. Then, just as they seem to be […] The post Gold Mining Buy-Out Binge Coming, And That’s A Mixed Blessing appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Anti-austerity Protesters Clash with Police in Belgium Posted: 24 May 2016 09:30 AM PDT Scuffles, explosions and blood-covered faces – anti-austerity protest in Brussels turns violent The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Hugo Salinas Price: Mechanical 'economics' Posted: 24 May 2016 09:17 AM PDT 12:15p ET Tuesday, May 24, 2016 Dear Friend of GATA and Gold Mainstream economics can't distinguish between quality and quantity, Hugo Salinas Price of the Mexican Civic Association for Silver writes today, adding that, as a result, most economists "do nothing 'scientific'" but rather just "impose upon whole nations their own personal value judgments while they destroy free markets." Salinas Price's commentary is headlined "Mechanical 'Economics'" and it's posted at the association's Internet site, Plata.com.mx, here: http://plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=288 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin Trading Alert: Bitcoin Price Stays below $450 Posted: 24 May 2016 09:13 AM PDT In short: short speculative positions, target at $153, stop-loss at $515. Bitcoin has enjoyed a spell of decreased volatility which has led some commentators to draw parallels between the currency and other asset classes, gold being an example. On the Wall Street Journal website, we read: In April, volatility in bitcoin’s price fell below that of gold for 28 consecutive days, the longest period in its history. Bitcoin volatility also briefly dropped below that of another flight-to-safety trade, the Japanese yen, according to data from FactSet and CoinDesk. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Australian Tax Office Declares War On Bullion Posted: 24 May 2016 09:01 AM PDT The Australian Tax Office has started aggressively auditing Australian bullion dealers. One smaller dealer who had their own range of bullion rounds manufactured has taken the drastic decision to close their business. In Australia, there has always been a goods and services tax (GST) on collectors coins eg: proof coins, but generic bullion coins and bars have not attracted the 10% GST. | ||||||||||||||||||||||||||||||||||||||||||||||||

| "We're in the Biggest Financial Bubble Ever", say James Turk - Video Posted: 24 May 2016 08:52 AM PDT ok ya Tuesday May 24 to 2016 I'm gonna be interviewing James Turk he's the founder of gold money and he also worked as an international bank of forty years at the Chase Manhattan Bank and the Abu Dhabi Investment Authority James would you like to see a bit more about your background well I got about 45 years of experience in international banking and finance but my specialty is really cold and investment strategy I say and one question I would like to ask you don't think is quite important for the listeners of my channel is why why is gold money you know like gold money and explain to people you know the history maybe of our involved as money | ||||||||||||||||||||||||||||||||||||||||||||||||

| The Dollar Takes Ahold of the Rate Hike Talk Posted: 24 May 2016 08:50 AM PDT This post The Dollar Takes Ahold of the Rate Hike Talk appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a Tom terrific Tuesday to you! Well, the BS (Big Shift) that I talked about yesterday, has really taken ahold of the markets. Bond yields are rising, stocks are getting sold, the commodities, minus oil, are seeing their recent gains slip away, and the currencies are folding like a lawn chair vs. the dollar. This has become more than just that “last gasp rally” that I’ve talked about for the dollar as I thought it was fading in the strong dollar trend. This rate hike talk has really taken the markets by surprise, and now has their undivided attention. The dollar is rallying again this morning, with only a small number of currencies, like the Russian ruble, gaining vs. the green/peachback. And all the focus is getting put on the Janet Yellen speech this coming Friday. Recall last week I told you that it was very curious that this speech was put on the schedule at the last minute, as the speech will come before the “black out date” ahead of the Fed meeting. And according to Fed member Williams, we had better pay attention to what she says, because, “she speaks for the committee.” So, right now, the odds of a June rate hike have gone from 10% to 65% in a week, and if Yellen follows up the recent pro rate hike in June talks from the Fed members, then I would expect that percentage for odds of a rate hike to rise significantly. All this talk about a rate hike in June is beginning to give me a rash. Need I remind everyone that on April 11th, Fed Chair, Janet Yellen was called to the White House for an unscheduled meeting with the President and VP. It was widely rumored afterward that Yellen was brought there to hear the President tell her face to face that there will be no rate hike before the election (read into that what you may). Now maybe that wasn’t the reason she was brought there, but really, couldn’t anything else that was discussed be done over the phone, via email, or even a card or letter? Old school, I know. And tea and crumpets don’t seem to be the president’s style. So, what is all this talk of a rate hike in June going to achieve if there is no rate hike June? Well, it slowed down the markets a bit from getting too cocky. So, maybe that was it. It also stopped the dollar selling on a dime, so add that in. But in the end, all this rate hike talk is just talk. I’ve told you this before but it works well here too. My dad always told me, “Chuck, money talks, and BS walks”. And in the words of Charlie Daniels, “sometimes I think that preacher man would like to do a little walkin’ too.” Have you ever heard the phrase: “A Two-handed economist”? You know the kind that says, “on one hand I see this happening. On the other hand I see this happening.” The “this” being something completely opposite of each other. Well, that’s what we received from Fed St. Louis President James Bullard yesterday in his speech, when he said, “that “below trend growth” is a prime reason a lower tightening path could be justified (so read from that no rate hike). Then he argued that “rates kept too low for too long could cause financial instability in the future and therefore stronger market expectations for a rate hike in June are probably good.” (read from that a rate hike). Which way are you going Mr. Bullard? Tell us, tell us, please! He did stray from the recent rhetoric from Fed speakers who go out of their way to tell their audiences that they are in favor of a rate hike in June. But, then the markets just take what they want from something a Fed member says, so they forgot all about the first part of Bullard’s speech and concentrated on the second part where he suggests a rate hike is coming. Really? Come on markets, why go down this rabbit hole? And now I’m going to take issue with something Bullard said. That “rates kept too low for too long could cause financial instability”. Really? Wait, what? You just now figured that out? Didn’t we figure that out in the last decade with Big Al Greenspan’s attempt to sell houses? I mean, promote growth. So, like I said earlier the markets have the dollar on top of the currency hill today, and even a nice print from Germany on GDP isn’t enough to stop the dollar from taking a pound of flesh from the euro this morning. Yes, in Germany, a pick-up of machinery and equipment investment of 0.9 points to 1.9% vs. the previous quarter, stronger imports and exports and a strong increase in construction investment, pushed the German first QTR GDP to 0.7% vs. the previous QTR. The only hiccup to the report was a weaker than expected contribution from personal consumption. I know that 0.7% GDP growth doesn’t sound like a things are looking up in the Eurozone’s largest economy, but it is. Recall that not that long ago, Germany was in a recession, and growth was 0, zero, nada, zilch, nothing. Germany also saw the Expectations Index as measured by the think tank ZEW fall in May from 11.2 to 6.4, and the Current Situation rise from 47.7 to 53.1. Hmmm, I guess it’s a case of everyone is happy now, but see storm clouds gathering. Hopefully those storm clouds dissipate. Did you hear about the antitrust lawsuits that are being filed against 16 of the world’s largest banks, including JP Morgan Chase, and Citicorp? The lawsuits are accusing the banks of hurting investors who bought securities tied to LIBOR by rigging the interest rate benchmark? The U.S. Courts of Appeals in NY said, “Requiring the banks to pay treble damages to every plaintiff that ended up on the wrong side of an independent LIBOR denominated derivative swap would not only bankrupt 16 of the world’s most important financial institutions, but also vastly extend the potential scope of antitrust liability in myriad of markets where derivative investments have proliferated.” Uh-Oh. I’ll be sure to keep my eye on this new folks, because this is HUGE! I know that sounds a lot like a FWIW article, but I had it on my mind right now, and had to get it out! The Aussie dollar (A$) took it on the chin again last night, as traders see interest rates here going in the opposite direction than those in the U.S. and even a speech by Reserve Bank of Australia (RBA) Gov. Stevens wasn’t enough to wrap a tourniquet around the A$. And as I said above the Russian ruble is one of the few currencies to carve out a gain vs. the dollar this morning. I don’t see anything moving the ruble in this direction, as the price of oil is pretty much flat overnight. The price of oil saw some slippage overnight, but not much and oil still maintains a handle of $47 this morning, so given all the dollar strength everywhere else, this slippage isn’t anything to be concerned with. Gold lost $3.70 yesterday and is down another $8.70 this morning. Like I said above, this dollar strength thing on the rate hike talk is nothing to stand in front of. I guess if Gold is going higher eventually, according to James Rickards, then these are buying opportunities. Speaking of James Rickards… Bullard and the other Fed speakers didn’t give gold traders/investors any reason to push the envelope on such a “nothing kind of day”. I actually slept through a lot of the day, so it was a nothing kind of day for me too! I was reading my 5 Minute Forecast, which can be found here (you’ll have to subscribe to read it, but I don’t go a work day without reading it!) and in the 5 Minute Forecast (The 5) editor, Dave Gonigam was going through the paces of explaining why James Rickards believes that gold will eventually end up with a price of $10,000 per ounce. So, I borrowed a shot piece of that, on the manipulators for you to read. here goes!

The U.S. Data Cupboard is darn near empty today. Yesterday, the Flash PMI’s for the U.S. manufacturing sector showed some real problems as the index number fell to a 7 year low, of 50.5. Just a rounding error from a sub-50 level. I would be worried about that if I were Janet Yellen, but then who knows what keeps her awake at night. For What it’s Worth. This is good… as it is an article on CNBC.com that’s title is “U.S. Warns Japan on yen interventions as G-7 reaffirms deal ‘no competitive devaluations'”. So, this sounds to me like it is about the so-called Shanghai Accord. You can read the entire article here, or here’s your snippet..

Chuck again. yeah, right, there’s no “accord”. But as I’ve said before, I do believe that the accord has started to fade, as the dollar strengthens, and the currencies that had gained on the accord have given back those gains. That’s it for today. I hope you have a Tom terrific Tuesday, and be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post The Dollar Takes Ahold of the Rate Hike Talk appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||