Gold World News Flash |

- The Federal Reserve is Not Going to Raise Rates and Destroy Gold

- Buy Silver – “Best Precious Metals Trade”

- The Gold Chart That Has Central Banks Extremely Worried

- Gerald Celente – Trends In The News – TREND ALERT: Oil, Gold & Equities: Hits And Misses

- It’s a Long Hard Journey …

- WWIII? A "Hybrid Geo-Financial War" Between NATO and Russia Is Dangerously Escalating

- Stock Share Buybacks Now Bought Out — American Enterprise in Decline

- In The News Today

- Suddenly Trump And Hillary Is All Goldman's Clients Want To Talk About

- Anonymous - The Movement

- Donald Trump - The 2nd Amendment

- Deutsche Bank Could Collapse Entire Banking System Jim Willie

- Will Venezuela Be Forced to Embrace the US Dollar?

- America Is The Next Venezuela!! -- Peter Schiff

- Signals: From Gold and the S&P - Gary Christenson

- Gerald Celente -- TREND ALERT: Oil, Gold & Equities: Hits And Misses

- Gold And Silver 11th Hour: Globalists 10 v People 0

- David Morgan: There Will Soon Be a Run to Gold Like You've Never Seen Before

- Breaking News And Best Of The Web — May 22

| The Federal Reserve is Not Going to Raise Rates and Destroy Gold Posted: 22 May 2016 12:30 AM PDT by Mike Swanson, MineWeb.com:

The Federal Reserve did not raise interest rates at that meeting, but the minutes showed that some Federal Reserve Board members hope to raise interest rates in June. Back in December the Federal Reserve raised interest rates and predicted that it would raise rates four times in 2016. Then the stock market dumped in January and banks in Europe showed signs of stress so the Federal Reserve got scared and was unable to raise rates at any of its meetings so far this year. Fed fund futures contracts also pushed out any rate hikes to the Fall. After the release of yesterday's minutes though CNBC talking heads began to talk as if the economy were about to boom in the United States in the coming weeks and rates could go up in June or July. However, the Fed fund futures contracts are still pricing in only a 28% chance of a June interest rate hike. The thing is though that the media news and quick price drop in gold has scared a lot of people out of gold. Iím hearing from people in a pure panic over gold. Some are long and wondering if they should sell and try to buy in at a cheaper price. Some watched it go up and then bought in at the top and are now on losses feeling like they are getting punched and afraid that the Federal Reserve is going to demolish gold. | |||||

| Buy Silver – “Best Precious Metals Trade” Posted: 22 May 2016 12:23 AM PDT Buy Silver – "Best Precious Metals Trade""Buy silver, sell gold" is the bold call of currency, bullion and money analyst Dominic Frisby in the latest edition of best selling Money Week. Frisby looks at the relative value of silver to gold and comes to the conclusion that silver is a better buy right now. We share his bullish view on silver and hence our current campaign regarding VAT free silver coins. From the article:

Dominic kindly mentions us as a bullion dealer who will buy gold bullion from you and sell silver coins and bars to you:

We make a market in all popular bullion formats from small gold sovereigns to large 400 ounce gold bars and at the risk of doing ourselves out of business, we would caution against selling gold bullion right now. Sell paper and digital gold, like Bullion Vault, maybe but not physical gold coins and bars. Rather both physical gold and silver bullion should be owned as financial insurance and hedges against currency debasement, bail ins, systemic and counter party risks and the myriad other risks today. There is the possibility that gold continues to outperform silver in the short term. This is quite likely if we get another bout of severe deflation and the next stage of the global financial crisis. There is also the real chance of the currency reset where gold prices are revalued by the global monetary authorities to $5,000 to $10,000 per ounce. This could see silver underperform in the short term. Silver remains severely undervalued versus gold but more particularly versus stocks, bonds and other financial – digital and paper – assets and we believe will outperform most assets in the coming years. Allocations to both depend on risk appetite and motivations for buying. Read the full article by Dominic Frisby on MoneyWeek here.

Market Updates This Week

Gold and Silver Prices and News Warning signs everywhere that the British housing bubble is about to go POP! – This Is Money Gold Prices (LBMA AM) Silver Prices (LBMA)

| |||||

| The Gold Chart That Has Central Banks Extremely Worried Posted: 21 May 2016 10:02 PM PDT by Steve St. Angelo, SRSRocco Report:

I advise precious metals investors not to focus on the short-term gold price movement, rather they should concentrate on the long-term trend changes. This is where the ultimate payoff will be by investing in gold. Now, I say "INVESTING", in gold because that is what we are doing. Many analysts such as Jim Rickards don't believe that gold is an investment. Mr. Rickards looks at gold as money or insurance on the collapse of the U.S. Dollar and fiat monetary system. However, I look at gold as an investment due to the collapse of U.S. and World energy production. While I have been a broken record on this, many investors still don't understand what I am trying to get across here. Gold and silver are more than money today because of the 40+ year funneling of investors funds away from REAL ASSETS and into PAPER CLAIMS on future economic activity. Thus, 99% of investors have sent their money into the largest Ponzi Scheme in history. Jim Rickards fails to understand this principle because he doesn't' factor in energy into the equation. I find most precious metals analysts do the same thing as they forecast the future gold price based on how much fiat currency (or money supply) is outstanding. Folks…. it won't matter how much money is floating around in the future as energy production plummets. Who cares if there are trillions of M2 or M3 outstanding, when we won't have the energy to continue running a system that only can function by a growing energy supply. To base the future value of gold on outstanding currency is FOLLY. Which is precisely why I label gold and silver as INVESTMENTS. Their values will surge as most paper and physical asset values collapse. The revaluation of gold and silver will occur well beyond the collapse of fiat money… they will also rise in value due to the disintegration of most physical and paper assets. This is well beyond the scope of money or insurance. The Gold Chart That Has Central Banks Extremely Worried

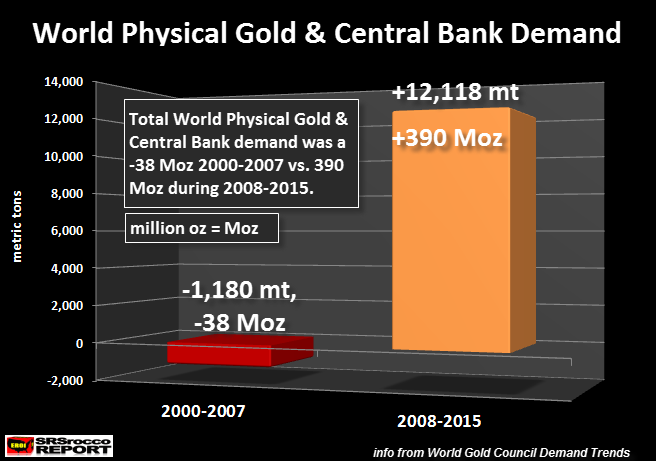

This chart represents the change of physical Gold Bar & Coin demand including Central Bank net purchases. Before the first collapse of the U.S. and Global markets in 2008, Central Banks dumped approximately 3,956 metric tons (mt) of gold on the market. I have figures for 2002-2015 from the World Gold Council, but I estimated a total of 800 mt for 2000 and 2001. This is based on data from the chart in the article, Germany Stops Selling Gold, Eurozone Sales Fall To Zero. If we subtract the Central Bank dumping of 3,956 mt of gold from total Gold Bar & Coin demand of 2,776 mt, we get a net negative 1,180 mt during the 2000-2007 period. Thus, Central Bank sales added 1,180 mt more gold supply than was consumed by investor physical gold purchases. NOTE: These figures do not include Gold ETF or similar product demand. I decided to exclude this data as it is impossible to know if the gold held by these Electronic Traded Funds or similar products is not oversubscribed to one or more owners. We know that when someone purchases either physical Bar & Coin or Central Bank gold.. there is more of a guarantee that this gold is likely unencumbered. However, this situation changed drastically since 2008. Even though Central Banks still sold 235 mt of gold in 2008 and 34 mt in 2009, this changed to net purchases in 2009. If we add up all Central Bank gold sales and purchases from 2008 to 2015, it turned out to be 2,657 mt. While this was a big change from Central Bank net sales of 3,956 mt (2000-2007), the real winner was the increase of Gold Bar & Coin demand. Gold Bar & Coin demand surged to 9,461 mt from 2008-2015 versus 2,657 mt during 2000-2007. Thus, physical gold investment and Central Bank demand totaled a whopping 12,118 mt from 2008-2015. This equals a massive 390 million oz (Moz) for total physical gold and Central Bank demand since 2008 compared to a net supply of 38 Moz in the first period.

| |||||

| Gerald Celente – Trends In The News – TREND ALERT: Oil, Gold & Equities: Hits And Misses Posted: 21 May 2016 09:00 PM PDT from TrendsJournal: | |||||

| Posted: 21 May 2016 07:30 PM PDT by Dr Jerome, TF Metals Report:

Good thing we still have time. So, I thought that yet another prepping perspective might be in order… Gotta stay on the cutting edge, you know. Back in 2011, when I began stacking and figured I'd be very wealthy very soon, my wife's sister came to stay for a week. She was an uber-prepper. We had begun to stock up on a few items, but she kicked us into high gear upon her arrival. She and my wife canned, dehydrated, sealed and stored away a year's worth of food that week. Her urgency was palpable. And she said we were just getting started. At Christmas, she sent a gift box complete with survival tools, gas masks and camp-cooking utensils. We were prepped… or so we thought. A year later, her husband—a policeman in a large US city who thought his wife was crazy for prepping, was trained for crowd control about the time the police were becoming militarized. (I think that might be him ln the left.) He changed his tune and told her to just keep prepping and bought her a pink handgun for Christmas. As the fury of prepping subsided and we settled back to normal life to wait for the end, and waited, and waited, we recognized, after some thought, that things may unfold differently than we thought. The collapse might happen slowly. And these growing kids of ours would need to be fed for more than just a few months… in fact, if the unthinkable occurred, we would have to feed the whole family indefinitely. Well, that part was easy, we bought about a hundred dollars of Heirloom seeds sow we could grow all our own food if needed. Now we were ready. Just go out back and plant those seeds and we would be eating well forever. | |||||

| WWIII? A "Hybrid Geo-Financial War" Between NATO and Russia Is Dangerously Escalating Posted: 21 May 2016 07:00 PM PDT Submitted by Mac Slavo via SHTFPlan.com, Russia is preparing for war against the West. Putin is being urged to do so because the U.S. and NATO have been preparing for war themselves. Syria and Ukraine have just been warm ups. The real thing could be around the corner, and other proxy flashpoints are ready to line up. The rising tensions for military conflict are sharply complicated by the stealthier financial war that is nonetheless taking a serious toll across the globe, in particular as collapsing oil prices put incredible pressure on those regimes who have cast a big social benefits net financed primarily by $100/barrel oil. As SHTF previously reported, that made Venezuela the most vulnerable, and it is plain today that the oil rich nation is collapsing. However, the manipulation of these prices was also meant to put pressure on Russia (as well as other countries)… while the attempt to undercut Russian natural gas by taking over Ukraine and have NATO supply gas to Europe instead of Russia has so far failed. It is a sophisticated geopolitical gamble that perhaps no one is winning, apart from who manages not to topple over.

A detailed, but nonetheless alarming article by Alastair Crooke reports that there is significant pressure on Putin from other Russian leaders to take a hard line in the days ahead. via the Huffington Post:

There is every reason to think that the clashing interests of NATO and Russia can and will spark more flashpoints across the map and around the arc that generally surrounds the former Soviet empire, which the United States hopes to contain in order to maintain its own crumbling empire. While President Obama, now officially the president to oversee the longest period of war (albeit somewhat contracted), may be reluctant to pursue in form of open conflict with Russia, a president like Hillary Clinton may be all-too willing to do so. She has already called in recent days for an escalated ‘war against ISIS,’ which handily also gives an open ended pretext to challenge NATO-Russian conflict points wherever they might appear. Donald Trump’s positions here are as yet unclear, but he is beginning to surround himself with the same type of advisers – including Henry Kissinger – that have brought us to this point. With economic decline and a definite fatigue for war, Americans face an end of the dollar as the world currency standard and an era where the BRICS nations, and in particular the militaries of Russia and China, pose an existential threat to the world that the U.S. and Britain carved out in the WWII era and which they essentially won away from the Soviets by the end of the Cold War. These waxing and waning empires are dangerous as their vulnerabilities and short-comings become exposed, and their territories challenged. That fact that Putin is being prodded from within Russia to be less diplomatic and more aggressive in posturing for war is downright unsettling. Many of our most dangerous American leaders are all-too willing to poke the bear and evoke a reaction. Ukraine and Syria, as well as the Georgian conflict before it in 2008, prove that the U.S. will continue waging war and posturing for global domination in spite of the lack of a coherent narrative (but there’s ISIS), or any convincing pretext for sending troops and sponsoring proxy armies. The American people are sick of war, but the misleaders in Washington are eager enough to reinvigorate their sense of power and entitlement to control the affairs here and abroad. After all, war – in a sick kind of way – is good for the economy, and a big one means a mandate of emergency powers and a period of unquestioning obedience from the domestic population. The threat is all-too real, and a serious provocation, like the false flag attacks that have sparked most of the wars in the past, could be on the horizon. That all basically points to WWIII… or at least a full second Cold War. It could be a long way off, but the sense is that the scent is in the air. | |||||

| Stock Share Buybacks Now Bought Out — American Enterprise in Decline Posted: 21 May 2016 06:42 PM PDT Published originally on The Great Recession Blog

I have pointed out in previous articles how most of the growth in stocks over the past few years has been due to stock share buybacks. Without this hideous (and at one time illegal) practice, there would have been no bull market over the last few years. That's right. Research from no other place than Wall Street, itself, indicates that almost all of the returns since 2009 have been due to stock share buybacks!

Stock share buybacks are winding down

But you cannot do share buybacks forever. Companies have been using profits and loading up on debt to make these share buybacks for so long that the law of diminishing returns is kicking in here, too. First, it is kicking in because companies are nearing the end of their capacity to keep eating themselves. Earnings have been falling while debt has been stacking up, and so the capacity just isn't there any more. (And I mean even the doctored earnings — as almost all major corporations have moved away from GAAP reporting policies — have been falling badly.) Secondly, buybacks have gone insane to the point where the practice is even starting to reek of death to market bulls who are growing wary of them. Over the past five weeks, the value of shares bought back has fallen 42% (yoy). The number of scheduled buybacks has fallen off substantially this year (35% below last year's pace). So, we can anticipate the market will lose the hot air that once kept it aloft.

Stock share buybacks have transformed America into the Alzheimer's ward of enterprise

We are now a nation full of companies with much bigger piles of debt and much less capacity to keep propping up their share prices with buybacks because those companies are rotting from within. Buybacks syphoned money away from capital expansion and research and development in order to deliver candy to investors now at the cost of crippling the company down the road. All of that was smiled upon (until now) by Wall Street and government for saving the day while losing the decade. Yes, a decade of potential recovery has been consumed by milking corporations dry, and there will be hell to pay as a result of this self-consuming greed. Former Republican presidential candidate, Carly Fiorina, championed this kind of corporate management during her stint at Hewlett-Packard until the Crowned Executive Officer was forced off her throne. During her brief reign, HP bought back $14 billion of stocks, which was more than its entire profits during that same period ($12 billion). That was total self-cannibalism, as during that time HP practically eliminated research and development, caving in to the idea that it was no longer capable of innovation and dominance in the consumer electronic field that it had long dominated. They gave up and walked away from their staple market of personal computers and home printers. Then they rejigged this plan into severing off separate companies. Contrasting this to Apple, can you even think of the last thing HP invented? Can you even remember the last thing that someone else invented that HP successfully produced and popularized? Because of her great accomplishment at HP, Fiorina believed she was qualified to become president of the United States. Having successfully gotten rid of her, did HP learn anything? Of course not. Her successor tripled down on all of this, buying back $43 billion in shares on $36 billion in profits! Following him, Leo Apotheker did the same thing, buying back nearly a billion dollars in stock every month of his brief eleven-month reign. This is a company that knows how to eat itself one leg at a time.

And this is the new corporate norm for America. Last year, corporations spent almost a trillion dollars on share buybacks and dividends, even though it was largely a year of declining profits. Maybe I should say because it was a year of declining profits. So, they weren't doing it because they had the money to spend. Like HP, many spent money they didn't earn. That's what you do when your business stinks so bad no one wants your stock because you have started to smell like the toe fungus and old urine that odorizes a bad nursing home. When the company is selling its own limbs on the meat market, it might not be in the healthiest of shape. When profits are in perpetual decline, you cover the stink of your own slow death with the sweet smell of candy. You throw grain (dividends) to the market bulls to get them to gather.

What have stock buybacks gotten us?

No wonder corporate stock buybacks were illegal until Reagan changed that during his tenure of deregulation. Yes, that deregulation did wonders for the stock market for a long time. It's amazing how rich shareholders can become (especially the board members and CEOs) when they dine for years on their own company. It's also amazing how rich you can become when no one is paying for the largess because it is bought on credit. However, greed and self-delusion among America's corporate leaders has finally reached the zenith that comes just before self-annihilation. That is what happens when you get carried away with taking the regulations off of avaricious activity. Greed gets bolder and bolder as it explores the outer limits of its success. Evil contains the seeds of its own destruction. It always reaches too far. Responsible use of credit buys innovation (research and development) or production expansion for the future. Greedy and irresponsible use buys profit sharing for the present when profits are down. That lack of rigorous self-discipline is the new American leadership norm. For all of this, corporate bosses get bigger and bigger pay and eventually rise to become presidential candidates. That's because they are best suited to run a country that advocates this kind of business by stripping away the laws that once governed such greed. Those laws were created because past experience taught us that humans couldn't be trusted to act in the company's (and the nation's) long-term best interest, instead of their own immediate self-interest. Left on their own, many would reap and run. We always forget the lessons of the past, so we ditch those laws when they seem to restraining our progress. However, the buybacks aren't yielding the returns they once were, and the corporations have already taken on a load of debt for past buybacks that is even threatening the credit rating of some. Earnings have declined steadily as money spent on building for the future has dropped dramatically. It looks like the golden years when companies buy themselves are winding down, and we shall all convalesce together. With so many American corporations on their sickbeds, it's a good thing we have Obamacare. | |||||

| Posted: 21 May 2016 06:19 PM PDT Jim Sinclair's Commentary Every step forward for the Yuan and a step backwards for the dollar. Foreign banks to start China yuan trade settlement on Friday Thu May 19, 2016 4:57am EDT The first batch of foreign commercial banks has registered to directly trade yuan CNY=CFXS used for overseas trade settlement and can begin doing... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | |||||

| Suddenly Trump And Hillary Is All Goldman's Clients Want To Talk About Posted: 21 May 2016 05:00 PM PDT A little over a month ago, conventional wisdom (and overrated pundits) said that Trump has no chance of being the republican nominee. They were all wrong, but so was the market which continued to ignore the possibility of a Trump presidency until well after the fact. And, as always happens, now is when if not the market, then certainly Goldman's clients are finally trying to catch up. As Goldman strategist David Kostin (who just one week ago warned that there is now a substantial risk of a market drop ahead of the year end), writes "Politics is now a topic in every client discussion." Kostin remains short-term bearish, and still sees the S&P sliding as low as 1850 in the next several months, but he appears more focused on the the impact of the next president on the market and the economy, now that suddenly the market is starting to price it in. So for all those curious, this is how Kostin is responding to all of Goldman's clients questions about the upcoming presidential election and how to trade it. * * * United we stand, divided we fall: Equity strategies ahead of a rise in political uncertainty The US Presidential election will take place in 170 days on November 8, 2016. Politics is now a topic in every client discussion. Last week we argued the S&P 500 was vulnerable to a 5%-10% drawdown and the index could fall to 1850-1950 during the next several months although it would end the year at 2100, roughly 3% above the current level. Rising political uncertainty was one of the risks we identified as a potential catalyst for a market drawdown. Prediction markets assign a 60% probability that Hillary Clinton will win the general election. Polls tell a different story: the Real Clear Politics (RCP) average of the most recent national polls shows a 3.1 point spread in favor of presumptive Democratic nominee former Secretary of State Clinton (45.8) versus presumptive Republican nominee businessman Donald Trump (42.7). The RCP spread has narrowed from 9.3 points just one month ago (48.8 vs. 39.5 on April 20, 2016). Some polls such as the May 18th Rasmussen Reports show a spread of 5 points in favor of Trump (42) vs. Clinton (37). Polls in prior presidential elections tightened as voting day approached. But thus far 2016 has hardly followed a regular election playbook. Our view is the closeness of the current race is underpriced by the market. We believe that the contest will become more competitive – or at least will be perceived as more competitive – than it is currently. The upcoming party conventions (Republicans on July 18-21 and Democrats on July 25-28) will raise political uncertainty as the competition enters the home-stretch. Equity market uncertainty will almost assuredly climb during the next several months in concert with rising political uncertainty. The US Equity Market Uncertainty Index tracks articles in more than 1,000 domestic newspapers that use the terms "uncertainty," "economics," and "equity market" or "stock market". Exhibit 1 shows the path of stock market uncertainty during the past seven US presidential election years. The 2016 path is tracking below any previous election year since 1988. But the trend will soon reverse and equity uncertainty will rise as Election Day approaches.

When equity market uncertainty rises, Consumer Staples typically outperforms while Information Technology lags (see Exhibit 2). From a factor perspective, the past decade shows that when equity market uncertainty increases, stocks with high dividend yield and low volatility outperform. In contrast, both high growth stocks and low valuation companies underperform their respective counterparts (see Exhibit 3) Equity portfolio managers should focus on the investment implications of the economic, trade, and tax policies of the presumptive nominees. A rise in protectionism would represent a broad risk to the stock market because 33% of aggregate S&P 500 revenues is generated outside the US. Donald Trump has stated that if elected President he would threaten to impose tariffs on various imports to offset what he deems unfair competition in the form of state subsidies and currency manipulation. A protectionist US trade policy raises the risk of retaliation by other countries. The Trans-Pacific Partnership (TPP) is a multilateral trade agreement with 11 other nations on the Pacific Basin that awaits Senate approval. The Office of the US Trade Representative believes the agreement will facilitate the sale of Made-in-America products abroad by eliminating more than 18,000 taxes and trade barriers on US products across TPP nations. The US Chamber of Commerce supports the deal. Hillary Clinton supported the trade agreement while it was being negotiated but now she opposes it. Protectionist rhetoric will become louder as election season progresses and stocks with high US sales will outperform firms with foreign sales. Our sector-neutral basket of 50 stocks with 100% US sales (GSTHAINT) will outperform our corresponding basket of stocks with 72% non-US revenues (GSTHINTL). The long US sales/short foreign sales trade benefits from a strengthening US Dollar, which explains why the strategy has returned -350 bp YTD as our basket of high US sales (-1.3%) has trailed our foreign sales basket (+2.2%). Domestic stocks have faster growth and a lower P/E. Looking forward, a hawkish Fed relative to expectations will boost the USD. Taxes are a perennial election year debate topic. However, any tax reform plans would require Congressional approval. According to the independent Tax Foundation, Donald Trump proposes to reduce the federal corporate tax rate to 15% from the current rate of 35% and repeal most preferences. Hillary Clinton seeks to impose an "exit tax" on tax inversions and limit earnings stripping via interest deductions. In general, firms with high effective tax rates would benefit most from any changes in the tax code while companies with low tax rates would be more at risk. Constituents in our high tax rate basket (GSTHHTAX) have a median effective federal and state tax rate during the past 10 years of 38% compared with 18% for firms in our low tax rate basket (GSTHLTAX) and 31% for the median S&P 500 stock. See Exhibit 5 for a list of 16 stocks that are constituents of both our high US sales and high tax rate baskets that should outperform the 11 stocks with both high foreign sales and low tax rates as Election Day draws near. | |||||

| Posted: 21 May 2016 01:00 PM PDT "We do not forgive... We do not forget. Expect us" my life policy. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||

| Donald Trump - The 2nd Amendment Posted: 21 May 2016 12:00 PM PDT May 20, 2016: Donald Trump stakes out his stance on the 2nd Amendment after receiving the NRA's endorsement. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||

| Deutsche Bank Could Collapse Entire Banking System Jim Willie Posted: 21 May 2016 11:00 AM PDT Jim Willie CB Proprietor, GoldenJackass.com Editor, Hat Trick Letter The man behind the name Jim Willie has experience in three important fields of statistical practice in the 23 years following completion of a PhD in Statistics at Carnegie Mellon University. He spent time since 2001 in a private... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||

| Will Venezuela Be Forced to Embrace the US Dollar? Posted: 21 May 2016 09:56 AM PDT Daniel Fernández Méndez writes: The country of Venezuela is dangerously approaching hyperinflation. At 2015’s year-end, official figures had yearly inflation at or above 180 percent (some private sector sources estimated it at 330 percent). The technical definition of hyperinflation is when inflation is at 50 percent or more per month, meaning that Venezuela is not yet at this point, but does seem to be approaching at an accelerated pace. The South American country finds itself with inflation rates at their worst in its history (1996 saw 103 percent yearly inflation) and the highest in the world (Ukraine is second with 50 percent yearly inflation). | |||||

| America Is The Next Venezuela!! -- Peter Schiff Posted: 21 May 2016 09:00 AM PDT Alex Jones talks with Peter Schiff about the coming economic collapse and how America could easily become the next Venezuela. Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||

| Signals: From Gold and the S&P - Gary Christenson Posted: 21 May 2016 09:00 AM PDT Sprott Money | |||||

| Gerald Celente -- TREND ALERT: Oil, Gold & Equities: Hits And Misses Posted: 21 May 2016 08:30 AM PDT Gerald Celente - Trends In The News - TREND ALERT: Oil, Gold & Equities: Hits And Misses - (5/18/16) "This week's Trend Alert is released, Federal Reserve says "June hike likely IF economy picks up" & "77 energy companies have now declared bankruptcy since the start of... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||

| Gold And Silver 11th Hour: Globalists 10 v People 0 Posted: 21 May 2016 03:54 AM PDT At the proverbial 11th hour, the globalists have a shut out going for themselves with people unable to mount any meaningful opposition. While the word “hour” is referenced, the time could be measured in months, even a few more years. Whatever the duration is, the time frame continues to shorten. Rather than provide supply/demand facts for gold and silver, amply illustrated with lots of graphs and charts, provide information on Commitment of Traders data, and so much more, we prefer to engage in other situations that may be having more of an effect as to why gold and silver prices are not rallying to price levels that would reflect the true supply/ demand circumstances. These are the more pragmatic reasons for owning and holding either or both physical metals. | |||||

| David Morgan: There Will Soon Be a Run to Gold Like You've Never Seen Before Posted: 21 May 2016 03:31 AM PDT Mike Gleason: I'm happy to welcome back our good friend, David Morgan, of TheMorganReport.com. David, it's always a pleasure to talk with you. How have you been? David Morgan: Mike, I've been well and thank you for the interview. Mike Gleason: We've seen some very positive and encouraging market action in the metals this year with silver up close to 19% year-to-date, and gold up 18% as we're talking here on Thursday morning. Although, the precious metals are pulling back sharply this week. Assess the market action so far here in 2016, and talk about what's driving this recent pullback. | |||||

| Breaking News And Best Of The Web — May 22 Posted: 19 May 2016 06:34 PM PDT Global stocks recover. Gold and silver stabilize. US angers China with huge steel tariff. The data indicates no Fed rate increase in June. Saudi Arabia starts acting like Chicago, paying bills with IOUs. Brexit, The Movie, crushes the European project and a former European spymaster wonders if the EU has “run its course”. China's debt […] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Yesterday the stock market and gold prices fell into their closing bells after the release of minutes of the Federal Reserve's April meeting.

Yesterday the stock market and gold prices fell into their closing bells after the release of minutes of the Federal Reserve's April meeting.

This gold chart should have Central Banks extremely worried. Why? Because the change in physical gold and Central Bank demand since the first crash of the U.S. and global markets in 2008 is literally off the charts.

This gold chart should have Central Banks extremely worried. Why? Because the change in physical gold and Central Bank demand since the first crash of the U.S. and global markets in 2008 is literally off the charts. Since recent events, like the Shanghai Gold Exchange, eminent margin hikes from the CME, Deutsch Bank paying 5% interest for a limited time, and other crazy shi… stuff that Jim Willie explains so well, it really might be different this time… maybe… at least getting closer

Since recent events, like the Shanghai Gold Exchange, eminent margin hikes from the CME, Deutsch Bank paying 5% interest for a limited time, and other crazy shi… stuff that Jim Willie explains so well, it really might be different this time… maybe… at least getting closer

No comments:

Post a Comment