Gold World News Flash |

- Which U.S. Stooge is “better for gold”?

- Flashback: The System Is Highly Unstable, It Could Meltdown Very Quickly — Jim Rickards

- UN Plots War On Free Speech To Stop "Extremism" Online

- Gold Price Closed at $1252.40 -$1.80 or -0.14%

- Gold Price Closed at $1254.20 Down -$19.50 or -1.53%

- Beijing Astronomers Advise Residents Of "Rare Event" Tomorrow Morning

- Gold: Glittering Choice Whether Interest Rates Go Up or Down

- Secret G-20 Meeting In Ireland this Summer to Manage the Collapse of America

- Why we don’t need a Gold Standard; there is a better alternative

- Gold Stocks Following Bull Analogs

- The Gold Chart That Has Central Banks Extremely Worried

- Markets, Manias and Cranks, Part II

- Donald Trump NRA Speech

- NRA Endorses Trump

- Counterfeit gold and silver coins burning buyers

- Silver Miners’ Q1’16 Fundamentals

- Venezuela: A Nation on the Brink

- Venezuela IMMINENT COLLAPSE as Civil Unrest, Riots, Panic, Looting!

- Bad News From the Ranch

- The Inflation Targeting Scam That Will Guarantee The Mother Of Financial Meltdowns

- Will Gold Standard Return?

- FALSE FLAG ALERT -- EgyptAir MS804 Went Right Through 'Phoenix Express' Exercise In Mediterranean Sea

- Egyptian Air 804 Wreckage Found

- George Soros Was Once a Dollar Vigilante, Now a Ring Wraith Buying Gold

- Silver Miners’ Q1’ 2016 Fundamentals

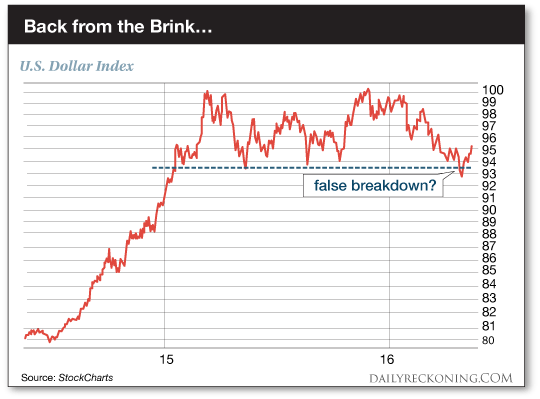

- King Dollar Unleashes Bizarro Market Attack!

- Why We Don’t Need a Gold Standard; there is a better alternative

- GOFO and Gold Prices

- Stock Market Rally At the End of the Road?

- Friday Morning Links

- Breaking News And Best Of The Web — May 21

- The Federal Reserve is Not Going To Raise Interest Rates and Destroy Gold

| Which U.S. Stooge is “better for gold”? Posted: 20 May 2016 08:00 PM PDT by Jeff Nielson, Bullion Bulls:

The latest inane drivel from the mainstream media on the gold market is the talking heads TELLING US “who is best for gold” between the U.S.’s two puppet candidates for the presidential election. While normally I shun the mainstream media’s inane drivel, it is worthwhile to cover this inane drivel, in order to show why it is being produced. 1) To distract people from the real fundamentals for the precious metals market, primarily the rampant/extreme dilution of our fiat paper currencies. 2) To create the mythology that precious metals markets depend upon ridiculous trivialities, like which Puppet in the White House would be “better for gold”. Of course (1) is a constant theme in much of the propaganda/disinformation about the gold market. The Corporate media can’t rebut the real fundamentals for the gold (and silver market). So, instead, they completely ignore the real fundamentals, INVENT their own pseudo-fundamentals, and then tell us (again and again) that precious metals depend upon these pseudo-fundamentals Does it have ANY (real) impact on the gold market if the Federal Reserve raises its interest rate from 0.25% to 0.50%? Of course not.

U.S. interest rates would have to rise to at least 2 – 3% just to reach a meaningful/legitimate level. Only then would interest rates actually become relevant to precious metals prices. Does anyone in the mainstream media evenREMEMBER what a legitimate interest rate is? If not, they should look around the Rest of the World, which does have legitimate, non-fraudulent interest rates. Similarly, does it make the slightest difference (to precious metals) whether a puppet from the Red House or a puppet from the Blue House is taking its orders from the One Bank? Of course not.

Was there any “difference” between the presidency of George Bush Jr. and Barack Obama? Only one. Obama didn’t continually sound like a complete idiot as he followed his orders. Equally we are continuously brainwashed with propaganda that tries to imprint the mythology that the VALUE of an ounce or gold or an ounce of silver is primarily dependent on the vacuous rhetoric of the Compulsive Liars of the Federal Reserve, or how many phantom “jobs” the BLS pretends were created in the U.S. in the previous month. Gold and silver are “monetary metals”. Most people are familiar with this fact; few understand it. A monetary metal (or any monetary good) will have its value driven primarily by ONE fundamental: inflation. Here I am talking about real inflation, meaning an increase in the money supply. Not the nebulous, mythological concept of “inflation” we get from the mainstream media, where (supposedly) “inflation” is some mysterious, exogenous, capricious force. This is inflation: When B.S. Bernanke perpetrated his infamous “helicopter drop” of funny-money, and QUADRUPLED the U.S. monetary base, the price of gold and the price of silver had to duplicate that rise. This is the definition of “a monetary metal” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Flashback: The System Is Highly Unstable, It Could Meltdown Very Quickly — Jim Rickards Posted: 20 May 2016 07:40 PM PDT [Ed. Note: Jim Rickards’ close tie to the IMF, CIA and Pentagon make him much more of an establishment mouthpiece than a truth teller. In fact, his April 2014 appearance on the Keiser Report in which he claimed that insider trading on 9/11 was "IRRELEVANT" revealed much about Rickards. With that said, we post Jim Rickards interviews in order to monitor what Jim’s aforementioned clients are thinking.] from ECOnomist Channel: Jim Rickards: “A monster box (500 one-ounce Silver Eagles from the U.S. Mint) is like a flashlight and batteries. Everyone should have one.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UN Plots War On Free Speech To Stop "Extremism" Online Posted: 20 May 2016 07:30 PM PDT Submitted by Alex Newman via The new American (h/t Brandon Smith), The United Nations Security Council wants a global “framework” for censoring the Internet, as well as for using government propaganda to “counter” what its apparatchiks call “online propaganda,” “hateful ideologies,” and “digital terrorism.” To that end, the UN Security Council this week ordered the UN “Counter-Terrorism Committee” — yes, that is a real bureaucracy — to draw up a plan by next year. From the Obama administration to the brutal Communist Chinese regime, everybody agreed that it was time for a UN-led crackdown on freedom of speech and thought online — all under the guise of fighting the transparently bogus terror war. The UN, ridiculed by American critics as the “dictators club,” will reportedly be partnering with some of the world's largest Internet and technology companies in the plot. Among the firms involved in the scheme is Microsoft, which, in a speech before the Security Council on May 11, called for “public-private partnerships” between Big Business and Big Government to battle online propaganda. As this magazine has documented, Google, Microsoft, Yahoo, and other top tech giants have all publicly embraced the UN and its agenda for humanity. Many of the more than 70 speakers also said it was past time to censor the Internet, with help from the “private sector.” At the UN meeting this week, the 15 members of the UN Security Council, including some of the most extreme and violent dictatorships on the planet, claimed they wanted to stop extremism and violence from spreading on the Internet. In particular, the governments pretended as if the effort was aimed at Islamist terror groups such as ISIS and al-Qaeda, both of which have received crucial backing from leading members of the UN Security Council itself. Terrorism was not defined. Everybody agreed, though, that terror should not be associated with any particular religion, nationality, ethnicity, and so on, even though at least one delegation fingered the Israeli government. In its “presidential statement” after the session, the UN Security Council claimed that “terrorism” could be defeated only with “international law” and through collaboration between the UN and emerging regional governments such as the various “unions” being imposed on Europe, Africa, Eurasia, South America, and beyond. “The Security Council stresses that terrorism can only be defeated by a sustained and comprehensive approach involving the active participation and collaboration of all States, international and regional organizations ... consistent with the United Nations Global Counter-Terrorism Strategy,” it said. Of course, the UN still has no actual definition of terrorism, but it is in the process of usurping vast new powers under the guise of fighting this undefined nemesis. However, the UN, in its ongoing war against free speech and actual human rights around the world, has offered some strong hints about its agenda. According to UN officials, the plan to regulate speech on the Internet will complement another, related UN plot known formally as the “Plan of Action to Prevent Violent Extremism.” As The New American reported last year, the plan calls for a global war on “ideologies.” That crusade will include, among other components, planetary efforts to stamp out all “anti-Muslim bigotry,” anti-immigrant sentiments, and much more, the UN and Obama explained. So-called “non-violent extremism” is also in the UN's crosshairs, as is free speech generally. It was not immediately clear how a UN-led war on “anti-Muslim bigotry” would stop ISIS. The savage terror group, which according to top U.S. officials was created and funded by Obama's anti-ISIS coalition, served as the crucial justification for the UN plan. However, based on the outlines of the UN extremism scheme released so far, it is clear that there will be no serious efforts to address the growing extremism of the UN or the violent extremism of many of its mostly autocratic member regimes. Instead, the “extremism” plan will serve as a pretext to impose a broad range of truly extremist policies at the national, regional, and international level. Seemingly oblivious to the totalitarian absurdity of the comments, top UN officials called for safeguards against “excessive punishment” wielded against those who express their views on the Internet. “The protection of free media can be a defense against terrorist narratives,” UN Deputy Secretary-General Jan Eliasson told the Security Council during the meeting this week in a stunning example of double-speak. “There must be no arbitrary or excessive punishment against people who are simply expressing their opinions.” It was not immediately clear what specific punishments for free speech would be considered non-excessive. But in the United States, despite UN claims about pseudo-“human rights” requiring censorship, any and all “punishment” for expressing one's views is strictly prohibited. Separately, the Communist Chinese dictatorship, which now dominates various UN bureaucracies, enthusiastically embraced the UN's efforts. Speaking on behalf of the brutal regime, Liu Jieyi, Beijing's permanent representative to the UN, said that institutions promoting “extremist ideologies” needed to be "closed down." Apparently he was not referring to the “extremist ideology” of the Communist Party of China or its brutal regime, which has murdered more innocent human beings than any other in history. Beijing alone has killed more than 60 million people, not including those butchered in forced abortions. Other communist governments allied with Beijing have murdered tens of millions more, just in the last century. While the UN has a major role to play, governments also need to help out in censoring the Internet and abolishing free speech, the communist regime said. “States must shut down some social media networks,” Liu continued, calling for the UN and its members to “cut off the channels for spreading terrorist ideologies.” He also touted terror decrees adopted recently by Beijing that target the Internet and purport to authorize the deployment of the communist dictatorship's armed enforcers all over the world. As The New American has documented previously, the Chinese dictatorship will be playing a major role in the UN's anti-freedom of speech crusade. In fact, the regime currently has its agents embedded all throughout the UN, and even at the top of the UN agency that globalists are working to empower as the global Internet regulator. He claims censorship is all in the eye of the beholder. Even as Communist China and other overtly dictatorial UN members emphasized censorship and regulation to stop ideologies and “propaganda” they dislike, the Obama administration, the European Union, and some of its formerly sovereign member states instead touted government propaganda to counter extremist propaganda. However, speaking for the EU, Alain Le Roy also celebrated the unaccountable super-state's own efforts to censor the Internet as something to be emulated. As this magazine reported last year, the EU's self-styled police force, Europol, even launched a whole unit aimed at censoring “extremist” content on the Internet. The EU spokesman pointed to, among other schemes, ongoing EU efforts to remove “propaganda materials” from the Internet, as well as EU propaganda efforts to “spread alternative messages.” The representative of Syria's brutal dictatorship, Bashar Jaafari, showed up to crash the party. He pointed out that multiple UN member states had used terrorist fighters and mercenaries in their quest to destroy Syria. And he is right. Indeed, as far back as 2012, U.S. Defense Intelligence Agency documents show that the Obama administration knew the “moderate Syrian rebels” it was supporting were led by al-Qaeda and the Muslim Brotherhood. The administration and its allies were also working to create what they described as a “Salafist principality in Eastern Syria” — today the principality is known as the Islamic State, or ISIS — in order to destabilize the Assad regime. Even top U.S. officials have openly admitted that Obama's “anti-ISIS” coalition was responsible for creating, arming, and funding ISIS. What role the Internet and “propaganda” may have played in that, if any, was not made clear at the UN meeting. In Libya, a similar situation occurred. The Obama administration, under the guise of enforcing an illegitimate UN resolution, openly partnered with self-declared al-Qaeda leaders to overthrow former U.S. terror-war ally and brutal dictator Moammar Gadhafi. Congress was never consulted, making Obama's war illegal and unconstitutional, in addition to the serious crime of providing aid to designated terror organizations. Today, thanks to that extremism, Libya is a failed state awash in heavy military weaponry and terror training camps. Much of the Obama administration-supplied aid for terror groups in Libya was transferred to supporting terror groups in Syria following the fall of Gadhafi's regime. Aside from governments, dictators, and international bureaucrats, Big Technology was also represented at the UN meeting. Microsoft Vice-President and Deputy General Counsel Steve Crown told the assembled representatives of governments and tyrants that there was no “silver bullet” to prevent terrorists and extremists from using the Internet. “If there were an elegant solution, industry would have adopted it,” he claimed, adding that Google, Facebook, and Twitter were coming together to prevent the Internet from being abused. Facebook was exposed just this week censoring conservative media outlets from its “trending” news section. And earlier this year, Google was exposed for having helping the U.S. government foment jihadist-led revolution in Syria. Echoing the UN's rhetoric, Crown claimed “international law” and fascist-style “public-private partnerships,” in which governments and Big Business join forces, were the appropriate response. He also said the “international community,” a deceptive term generally used to refer to the UN and its member governments, needed to “work together in a coordinated and transparent way.” The UN Security Council agreed, saying in its final declaration that there needed to be “more effective ways for governments to partner with ... private sector industry partners.” It is hardly a new agenda. As The New American reported previously, the technology giants — all of which are regularly represented at the globalist Bilderberg summits — have also emerged as enthusiastic supporters of the UN's radical “Agenda 2030.” According to the agreement, the goal is “transforming our world,” redistributing wealth at the international level, empowering the institutions of global governance, and more. Among the mega-corporations proudly backing the scheme are the world’s top three search engines: Google, Microsoft’s Bing, and Yahoo. It was not immediately clear whether those corporations’ support for the deeply controversial UN agenda would affect the supposed impartiality of their search results. But critics of the UN plan expressed alarm nonetheless. Of course, a handful of the more than 70 people who spoke at the Security Council confab paid lip service to freedom of speech and freedom of thought. The Iraqi government's delegation, for example, emphasized differentiating between “freedom of thought and extremist ideologies.” Others said the war on extremism could not be used to justify persecuting critics of governments. Some of the speakers no doubt had good intentions, too. However, putting the UN in charge of fighting extremism and dangerous ideologies would be like putting a mafia boss in charge of fighting crime — it is patently absurd, even grotesque. Most of the UN's member regimes are undemocratic, to be generous, and many of them are led by genocidal psychopaths who murder with impunity. Among other UN member states, those enslaving North Korea, Zimbabwe, Cuba, Sudan, China, and many more are run by criminals and mass-murderers who epitomize terrorism and violent extremism. Plus, virtually every terror group on earth today has its roots in state-sponsorship, including ISIS and al-Qaeda. The real solution to terror, then, is neither a stronger UN nor a global war on ideologies, extreme or otherwise. Empowering the UN to wage a global war on ideas, ideologies, propaganda, and speech is itself an extremist proposition riddled with extreme dangers. A far simpler answer to the scourge of terrorism would be to defund the UN, arrest those supporting terror groups, and stop propping up dictators and terrorists with taxpayer money. Anything else is a dangerous fraud. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1252.40 -$1.80 or -0.14% Posted: 20 May 2016 07:14 PM PDT Friday, May 20, 2016

Franklin Sanders has not published commentary today, if he publishers later today it will be updated here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1254.20 Down -$19.50 or -1.53% Posted: 20 May 2016 07:10 PM PDT

It's only 1:45 central time, but I have ot leave the office for a couple of days rest. First, an announcement, and thank you for your prayers yesterday. At about 5:30 p.m. yesterday was born Arthur Myles Sanders, first child of Zachariah and Victoria Sanders, safe and sound. For Susan and me, Arthur is the fifteenth grandchild and fourteenth grandson. He's an absolutely beautiful baby, and mighty pink. Thank God. The correction I've been expecting in silver & gold came to roost yesterday. The FOMC's announcement, with its garlic breath hint of raising interest rates, sent the dollar up & stocks, gold, silver, & commodities down. Before y'all panic, remember that IN GENERAL the dollar is on one end of a seesaw and metals and commodities on the other end. Dollar up, commodities down, and vice versa. Thus this should have surprised no one. By the way, note that the Fed will NOT be raising interest rates anytime soon. They tried that in December and crashed durn near every stock market in this sublunary globe. A mere whiff of lower rates Wednesday sent stocks tumbling again, and as I write this the Dow is down 113.1 (0.65%) and the S&P500 down 11.72 (0.57%). And oil and the other inflation markets were all set up for a fall in any event. The plunge awaited only a catalyst, and a higher dollar kindly & generously supplied that. Our only interest in all this, other than as spectators at the destruction of the world's economy to benefit banks, central banks, and globalists, is how far silver & gold might fall, and how great an opportunity to buy that will bring us. Lo, I can only guess, but am willing. Here's a dolled-up gold chart, http://schrts.co/uqgeGc Since mid-February gold has traded in an uptrending range. Bottom boundary thereof today lies about $1,240, not far below the often-supportive 50 DMA (1,251.86). A shallow correction would stop there. A more serious correction would sink to support between $1,190 and $1,208. A bruising & bloodying correction would reach the 200 day moving average at $1,158.50. My guess is that the fall will be enough to sift out the thick crowd of speculators, but not enough by far to wound gold seriously -- say, $1,190 to $1,208. Gold should reach this low fairly fast (assuming it breaks $1,240 - $1,245), maybe next week. Now look at silver, http://schrts.co/t9IUae The height of that triangle implies silver will fall at least to 1600¢. However, given silver's greater volatility, it could fall all the way to the 200 DMA at 1515. I expect something more like 1575 will catch it. Y'all must remember to buy when there's blood in the streets. You'll find your heart in your throat, but ignore it. Please remember the prices I am showing here today are closes for gold, silver, platinum, & palladium, but not for stocks or the US dollar index. See y'all Monday, God willing. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beijing Astronomers Advise Residents Of "Rare Event" Tomorrow Morning Posted: 20 May 2016 07:00 PM PDT BEIJING - Predicting ideal conditions for the rare sight, Chinese astronomers announced to Beijing residents Monday that the sky would be visible for a brief two-minute window tomorrow morning.

According to a statement from the China National Space Administration read in part, advising interested citizens to plan on waking early and to consider using a small telescope for better views of the sky.

The agency added that anyone who missed out on witnessing the occurrence tomorrow would have to wait a while, as the sky was not expected to be visible again until late 2024. While tongue in cheek - perhaps - not everyone is laughing and some are even attempting to combat the pollution. So here, as we noted previously, courtesy of VJ, are the 13 most head-scratching proposals intended to do just that: fix China's smog. Good luck. #13. Sky Watering Skyscrapers

Technically, it is called precipitation scavenging. In actuality all this means is turning skyscrapers into giant sprinklers in an effort to wash the skies of pollution. “If you can offer a half-hour watering your garden, then you can offer a half-hour watering your ambient atmosphere to keep air clean . . . ,” rings the sales pitch of this rather lo-fi geoengineering strategy. Basically, precipitation scavenging works on the premise that rain clears smog, so artificial rain should do the same. To create “rain,” giant sprinklers will be attached to the roofs of tall buildings in China’s most polluted cities. During times when the air pollution rises due to a lack of rain the sprinklers will turn on, pulling SO2, NOx, and other airborne poisons out of the sky and dropping them down to the ground below. Researchers estimate that even on China’s worst air days it would only take a few hours to a few days of artificial rain to drop the PM 2.5 content down to 35 µg m-3, the recommended WHO limit — leaving blue skies in its wake. As for where this water will come from, researchers say that it could easily be taken from nearby lakes and rivers, where it could be pumped up to the tops of skyscrapers, sprayed, collected, and then cycled back through the system. Though I have to admit that the thought of having the bubbling sludge from many of China’s polluted waterways being sprinkled out on top of my head doesn’t sound very appealing. The last thing we need is a second deadly aerial assault. As for the cost of precipitation scavenging, researchers estimate that it would only take 1 kilowatt hour of electricity to lift one ton of water 200 meters, which would apparently only cost around $0.05. “. . . the low-tech nature of this geoengineering approach has led us to believe that it will cost much less than many other interventions such as cutting emissions.” (Yes, that’s a direct quote.) Oh yeah, proponents of precipitation scavenging would also like to add that their system comes with a built in duel purpose bonus: it could also be used to fight fires. Read Shaocai Yu’s research on this geoengineering method. #12. Giant Floating Jellyfish-Like Acid Eating Membranes

If you don’t necessarily like the idea of artificial rain showers of potentially toxic Chinese river water knocking particulate matter out of the sky then here’s another solution you may prefer. It consists of launching squadrons of giant floating jellyfish-like membranes into the sky that eat SO2, NOx, and other pollutants which harm plants, animals, architecture, and humans, and then turning them into reclaimed water and chemical fertilizer. Floating jellyfish? Technically they’re called aerocysts. Aerocysts? Giant membranes filled with H2.

The H2 makes the aerocysts float and the long flowing tentacles hanging off of their bottoms make them look unequivocally like jellyfish. If this strategy is ever implemented on a large scale China’s urban skies will be full of these things hovering 200-300 meters off the ground, where the most acidic pollutants hang out. The membrane, which makes up the jellyfish-like “head” of the apparatus is porous and will suck in the acidic materials it touches, thus removing them from the environment. But these dystopian drones don’t stop there, as after the acidic materials are collected they are run through an on-deck purifier, which neutralizes them with with an on board microorganism produced alkaline substance. The now PH balanced gunk will then be transformed into a neutral, benign liquid with ammonium salt, which will conveniently be derived from the plants which will be growing off of the tentacles. When all filled up, the aerocysts will be programmed to return to port and deposit the liquid into a receptacle, where it can later be used as reclaimed water. #11. Smog Fighting Drones

While talking about unmanned aerial anti-pollution devices we can’t leave out the array of smog fighting drones that are being tested throughout China. The most promising is a parafoil drone, which basically looks like a generator hanging from a parachute, that is being developed by the Aviation Industry Corporation of China. It’s function is to soar through the air blasting PM 2.5 particles with a chemical which freezes them, thus making them fall to the earth below. Each of these drones can clean a five square kilometer area, which is about large enough to scrub the air around an airport, port, or, as the case may be, urban districts where select groups of influential citizens wish to have cleaner air. Apparently, the Chinese government has already been using fixed-wing drones to chemically remove smog for some years now, but this new design allows each one to carry far more ammunition. Though, of course, nobody really knows what effect these airborne “chemicals” will have on the humans and environment they will inevitably dust below. #10. Impregnating the Air with Liquid NitrogenIt is know that under the right circumstances artificially cooling particulate matter can disperse them from the atmosphere, and liquid nitrogen has been shown to be one of the best smog fighting chemicals yet available. Basically, the idea is to blast industrial coolant into the sky, which can cause crystals to form on PM 2.5 particles, whereupon gravity will do the rest. This method can also create a blanket of cool air which prevents warmer, polluted air from reaching the street surface. “It is possible in theory to create a smog-free zone with liquid nitrogen and a shield against air pollutants with man-made cold, but even in laboratories we handle liquid nitrogen with care due to its extremely low temperature,” Dr. Wang Xinfeng, a researcher out of Shandong University in Jinan, told the SCMP. #9. Cloud SeedingAs we’ve previously discovered, precipitation knocks smog out of the skies. So why not just create rain and snow? Cloud seeding, an anti-pollution measure which consists of blasting silver iodine packed rockets into clouds, is back. This was one of the ways that Beijing manufactured blue skies for the Olympics, and, according to a document published by the China Meteorological Administration, in 2015 local municipalities across China will be given the go ahead to use it at will. When the silver iodine is shot into the clouds it assists in the formation of ice crystals, which then melt and drop to the ground below as rain, cleaning the skies in the process. As a side note, silver iodide is toxic. #8. Just Vacuum It

It has been suggested by Dutch researcher Daan Roosgaarde that China could create patches of clean air by essentially vacuuming it up. The method consists of burying Tesla coils just beneath the ground, which would then create an electrostatic field that could create a shaft of clean air by sucking away particulate matter and depositing it on the ground. In laboratory tests at the University of Delft, Roosgaarde has been able to clear smog from a one cubic meter area in five cubic meter room. He currently has a deal with Beijing to test out one of these devices in one of the city’s parks. #7. Biodomes

A year or so ago a high-end school in Beijing offered my wife a job. Like so many others, she ultimately turned it down due to the atrocious quality of the city’s air. The school’s rebuttal was that they were building a giant bubble around their playground. This fact came off as more frightening than enticing: Is the air there really so bad that people are living in airtight domes? In China’s smog encapsulated wealthy cities biodomes may soon become a part of life. Well, they may someday become a part of life for those who can afford to go to institutions that can pick up the tab — as at $950 per square meter, biodomes don’t come cheap. These structures are essentially giant transparent domes that can enclose gardens, playgrounds, sports centers, schools yards — maybe someday even homes or entire neighborhoods. The ambient environment within these pods will be controlled, the air will be filtered of particulate matter and other pollutants, essentially creating an entire artificial environment.

From Dvice:

Though their builders are approaching them like any other project. “It’s just an infrastructure project like building metro stations and parks,” said Rajat Sodhi of Orproject, a British company that specializes in biodomes. (Yes, there are now companies specializing in biodomes). Perhaps more than anything else on this list, this strategy makes us realize that yes, it has really come to this. #6. Banning Outdoor Barbecues

Air pollution looks like smoke and, well, smoke looks like smoke. Cooking food produces smoke, so perhaps cooking could be partiality responsible for the atrocious state of China’s air? Apparently, this is the thinking behind Beijing’s ban on outdoor barbecues. According to the Global Times, almost 13% of the particulate matter in Beijing’s air comes from cooking. That doesn’t quite seem right, but as the GT is the international mouthpiece of the PRC who could deny it? The outdoor barbecue ban was first enacted in 2000 but was not enforced until recently, when the city’s chengguan have been going around smashing smoke emitting street food stales and fining their proprietors. #5. Removing 6 Million Cars

Calling the country’s environmental situation “extremely grim,” the PRC announced that it will remove nearly 5.3 million higher polluting cars off the roads this year. Basically, all vehicles manufactured before 2005 are going to get the boot. 330,000 will be removed from Beijing alone, and an incredible 660,000 will be decommissioned in Hebei Province, which is one of the smoggiest regions in the world. China currently has 240 million automobiles on the road, half being passenger cars. Though, in rather typical Chinese fashion, the decree lacks a disclosure as to how this measure is going to be put into effect. Along with this initiative comes a plan to require gas stations in Beijing, Shanghai, and a handful of other large cities to sell only the highest grade, lowest polluting fuel available. Actually, this doesn’t seem to be that deranged of a pollution fighting method after all. #4. Removing Mountains

In 1997, Lanzhou’s Daqingshan Project aimed to remove a 1,689 meter high mountain that encased the city improve its air quality — as well as to create a little extra land that could be sold to developers. Lanzhou also has some of the worst air on the planet, which is partially a result of the fact that it sits deep down in a valley and is hemmed in on all sides by mountains. So to increase circulation a little and whisk away some smog the city decided to just remove one of the largest mountains that rose above it. They actually removed half of it before it became obvious that it just wasn’t going to work: the air quality remained as sordid as ever. This is not a potential “solution” that has yet been replicated elsewhere. #3. Coal by WireOut of sight out of mind. Or, more poignantly, if it’s far away from major cities then who gives a shit seems to be the philosophy behind China’s coal by wire initiative. This is one of the most massive infrastructural projects going in the world today, and consists of building large amounts of coal fired power plants way out in remote places in China’s north and west and sending the energy over thousands of miles to big cities. The initiative is a continuation of an ongoing movement to decentralize and disperse heavy polluting industries into the hinterlands of the country, where less people will see them and feel their immediate effects. So in-focus places like Beijing and Shanghai will become less and less polluted while previously pristine areas that hardly anybody knows even exist, like Hulunbuir, will become wastelands. Already, the wide open grasslands of Inner Mongolia are speckled with expansive arrays of power plants, and this looks to be a trend that will be intensified over the coming decades. The biggest problem with coal by wire, besides environmentally assaulting millions of innocent bystanders and destroying China’s last unpolluted frontiers, is the fact that the places most of the power plants are going tend to have a low supply of water. As coal fed power plants need incredible amounts of freshwater to function, there is a definite conflict of interests built into this initiative. #2. Turning Coal into Gas

China plans to cut down the particulate matter in the northern reaches of the country by 25 per cent by 2017. One of the main ways it intends to do this is by turning coal into gas. While coal is often blamed for the most of China’s air pollution woes, natural gas burns cleaner, creating less emissions. So why not just convert the coal to natural gas in order to use China’s abundant supplies of this energy source in a way that will create less air pollution? That’s the strategy behind China’s new initiative to raise synthetic coal-to-gas output to 50 Bcm a year by 2020, which would account for 12.5% of the country’s total domestic gas supply. To these ends, approval was given to build 18 new large scale synthetic natural gas (SNG) plants across China’s northern fringes.

Though this plan does not seem to be the environmental solution it’s initially billed to be:

According to the World Resources Institute (WRI), the production of synthetic gas could ultimately result in twice the total carbon emissions as coal-fired energy. Converting coal to natural gas is also takes an incredible amount of water. It takes 6-10 liters of water to produce one cubic meter of SNG. As most of the new coal to gas power plants are to be built in the China’s arid northern regions — Xinjiang and Inner Mongolia — they will further add stresses to a water table that’s already coming close to tapping out. Like the Coal By Wire initiative, SNG production is an effort to keep the big cities of China’s east running with cleaner skies by exporting environmental stresses out to the hinterlands:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Glittering Choice Whether Interest Rates Go Up or Down Posted: 20 May 2016 06:00 PM PDT from The Daily Bell:

The Federal Reserve may be eying its next rate hike as soon as this summer. Evidence of a possible June rate hike came Wednesday when minutes from the Fed's April meeting gave a more upbeat assessment of the U.S. economy. "Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter…then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June," according to the minutes. – CNN In this article, we will discuss why gold, and silver, too, are "golden" no matter where rates end up in June. Let's examine the surrounding circumstances. You see, there are three choices. Either the Fed raises rates, keeps them where they are or lowers them. Let Fed officials hint that they are changing the status quo and the mainstream media begins to churn out millions of words on the potential shift. The whole idea is for the Fed to be the center of attention. This supposedly justifies the current economic system. In fact, the current system is a disaster. A small group of people cannot decide on the volume and price of "money" with any accuracy. The result is a constant, cyclical wave of booms and busts. The booms grow larger as do the busts. Finally a bust comes along like the one in 2008, and the world economy cannot recover from it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Secret G-20 Meeting In Ireland this Summer to Manage the Collapse of America Posted: 20 May 2016 04:40 PM PDT by Dave Hodges, The Common Sense Show:

Who Is Walker Todd and Why Is This Important? Dr. Todd stated on the radio on March 12, 2015 that America will be taken down according to the following scenario: (1) A false flag, more than likely a scenario resulting in economic collapse and the destruction of the dollar (2) The implementation of martial law, perhaps involving the use of foreign troops; and (3) All out conflict. Dr. Todd is not to be taken lightly as he was an economic consultant with 20 years of experience at the Federal Reserve Bank of New York and the Federal Reserve Bank of Cleveland. He is also a member of the Cato Institute's new Center for Monetary Financial Alternatives as one of its Adjunct Scholars. Given his background, his expressed opinions should be given very serious consideration. If Dr. Todd's prediction is accurate, this fits in with what other sources are saying is coming in the very near future and it will result in the fall of America. It has always been my position that a false flag even would be used as a pretext to invoke martial law. Martial law would then be used as the excuse to begin gun confiscation. Gun confiscation will be used to disarm American citizens prior to subjugating the country by using foreign mercenaries. As viewers of this sight will readily recognize, I have extensively written on the topic of foreign mercenaries and I did so as recently as this past weekend. The Importance of Ireland After the Muslim "refugee" invasion of Europe, Ireland is one of the few places left in Europe that is safe. Further, Ireland is home to one of the most notorious criminal globalists, Peter Sutherland.

Meet your soon-to-be new United Nations Governor. He orchestrated the Gulf crisis and now he will be "managing" the border crisis. Many have asked if there was a central figure who coordinated this conspiracy. If I were an unencumbered investigator and not operating under the umbrella of an agenda, I would want to look closely at a globalist named Peter Sutherland as the possible mastermind. But you see, Sutherland is not just the architect of the Gulf Oil Spill, as you will soon note, he will be behind what is coming with the United Nations take down of the United States. Peter Sutherland Peter Sutherland is an insider's, insider. He is on the steering committee of the Bilderberg Group, he is an Honorary Chairman of the Trilateral Commission (2010-present), he was Chairman of the Trilateral Commission (Europe) (2001–2010) and Sutherland was Vice Chairman of the European Round Table of Industrialists (2006–2009). Sutherland was also the former head of the World Trade Organization and the related GATT. Sutherland is the ultimate insider. More to the point of this article, Peter Sutherland is the head of the UN Migration Council. This means that this elite insider will ultimately determine who will live where and under what conditions. And the G-20 is secretly meeting is his backyard is no coincidence. Precipitating Incident(s) Further, we have two important pieces which would factor into a planned collapse of the United States/Western Europe, namely, banking and population redistribution. Additional danger and trigger points would consist of computer vulnerability of the grid and the banks. Also, the looming global food crisis could be brought into play. Why not all three? I think that is a safe bet, but in terms of lighting the fuse, I would lean towards the food crisis Venezuela Is the Beta Test

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why we don’t need a Gold Standard; there is a better alternative Posted: 20 May 2016 03:31 PM PDT Resource Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||

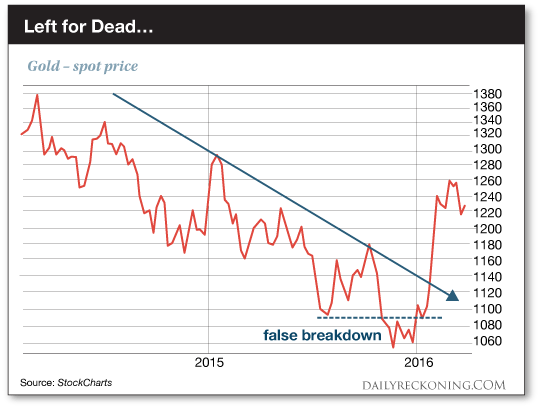

| Gold Stocks Following Bull Analogs Posted: 20 May 2016 02:24 PM PDT The gold stocks started to correct this week as large caps were off 13% at Thursday’s low. Both juniors and large caps have made tremendous gains since the January 19 bottom and are ripe for some profit taking. The Fed minutes provided the catalyst for such and we should also note the tendency for gold stocks, while in a bull market to peak in May. History argues that the miners could correct at least 20% now before moving higher. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Chart That Has Central Banks Extremely Worried Posted: 20 May 2016 02:17 PM PDT This gold chart should have Central Banks extremely worried. Why? Because the change in physical gold and Central Bank demand since the first crash of the U.S. and global markets in 2008 is literally off the charts. I advise precious metals investors not to focus on the short-term gold price movement, rather they should concentrate on the long-term trend changes. This is where the ultimate payoff will be by investing in gold. Now, I say “INVESTING”, in gold because that is what we are doing. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Markets, Manias and Cranks, Part II Posted: 20 May 2016 02:12 PM PDT This post Markets, Manias and Cranks, Part II appeared first on Daily Reckoning. In yesterday's reckoning, we brought you the first part of our interview with Chuck Butler. Chuck's the writer of the indispensable Daily Pfennig newsletter and the managing director of EverBank's Global Markets Group. We discussed how the U.S. economy is flirting with recession despite all the happy talk by the mainstream press… Britain leaving the European Union… the "Shanghai Accord"… and more. Chuck mentioned yesterday that he didn't foresee the Fed raising interest rates anytime soon, despite what seem to be good unemployment numbers. He added these comments in this morning's Daily Pfennig: Yellen is a dove at heart, and much of her academic studies prior to her appointment as the Fed chairwoman were centered on the labor markets. I continue to believe the FOMC will wait for a move higher in wages prior to pushing rates up; Yellen and company would rather error on the side of higher inflation than being blamed for killing the nascent recovery and fragile wage growth which has accompanied it. Despite some hawkish talk by some Fed members this week based on unemployment numbers, Fed fund futures data still only indicate a 30% chance that Yellen will raise rates in June. Today, we bring you Part II of our interview with Chuck. You'll see what he thinks is driving the price of gold higher… if we're really heading for a cashless society… if the Chinese economy is in for a major crash… and if the petrodollar is in serious trouble. Answers below…

Markets, Manias and Cranks, Part IIA conversation between Chuck Butler and Brian MaherBrian Maher: We've covered a lot of ground yesterday, from Brexit to China to the dollar. Now let's turn to gold, Chuck. Gold, as you know, has had a great year so far, the best year in 30 years. It's up something like 20% so far this year. What's your take on gold? Where's it going, and what do you think is pushing it higher? Chuck Butler: I think the driving force in gold right now is all these countries going with negative interest rates. And there's even talk of it happening here in the U.S. I'm not sure it'll happen here, but important people are seriously discussing it. And just talking about negative interest rates here in the U.S. gets people concerned about their cash. If they're not going to earn any money on their cash, or they're going to have to pay banks to store their cash, they might as well put it in gold. So I think all this talk about negative interests rates is what's driving gold right now. And then, you've always got the geopolitical stuff going on around the world. There's just a lot of uncertainty in the world. Brian Maher: We saw how the Japanese reacted to negative rates. Instead of going out and spending like the government expected, the only thing they bought were safes to hoard their cash. Many also bought gold. Chuck Butler: Yup, and the talk of a ban on cash is also another thing. That just scares the bejesus out of me, it really does. There are so many other things that could happen if they started banning cash. Ever since I started writing about this issue, people have been sending me emails telling me, for example, that they were in Italy and tried to pay for their hotel room in cash and were told they couldn't. And this ban on cash is going to really drive the price of gold higher, I think. Right now you've got Mario Draghi fighting with the Bundesbank, the German Central Bank, about stopping printing of the 500 euro note. I was surprised that the Bundesbank was against him on that, but still, the point is that he's trying to get rid of cash and doing it under the guise of stopping money launderers, criminals and terrorists. But it won't. Brian Maher: Isn't that always the excuse, though? Chuck Butler: Yup, it's very similar to some other arguments that have been used over the years to get rid of something. So anytime you see talk about banning cash, negative rates or even interest rate cuts, it should drive the price of gold higher. Brian Maher: It seems like things are inexorably headed in that direction, that they're going to succeed ultimately. I don't know how long it's going to take, but it seems like we're heading for the cashless society, the banning of physical cash. It's going to be the new barbarous relic, like gold was called. I don't know how long it will take, but once these things start they just don't stop. Agree? Chuck Butler: Oh yeah, absolutely. And to me it's like a government program that's put in temporarily, it never goes away. Brian Maher: Nothing's so permanent as a temporary government program, right? Chuck Butler: Right. And when Nixon removed the gold backing from the dollar, it was only supposed to be a temporary move. Most people don't realize that. Brian Maher: I'm sure those who orchestrated it knew otherwise, but it's the old frog in the pot scenario. The elimination of cash is already well advanced in places like the Scandinavian countries, there are hardly any transactions conducted these days in cash. So once a whole economic area goes cashless, ultimately it has to be coordinated on a larger scale. For practical reasons, you can't have one area using cash and the other doesn't. So eventually there's going to have to be a convergence. Chuck Butler: Exactly, and that was my point in one of my recent issues. You may not think that's going to happen here in the U.S. But if all the other countries in the world are getting rid of cash, how's it going to work for the U.S. to have cash? It's not. So we'll have to go along with everyone else. Brian Maher: Scary. But do you think the Japanese experience has frightened some of these bankers out of negative rates, because the Japanese people's reaction was the complete opposite of what was expected? So do you think that gave Janet Yellen and the rest of these people pause going forward? Chuck Butler: No, in fact, I think what it tells them is that they probably need to do more of it. It's sort of like the Krugman argument that when we were doing quantitative easing. We just didn't do enough of it, that's why it didn't work. Brian Maher: When theory confronts reality, they go with theory every time. They all attend the same schools, they have the same theories, and they just will not adjust their theories to reality. And their arrogance is really overwhelming. Chuck Butler: Well, I truly don't believe that the economists and everybody else at the Federal Reserve, are stupid. I really believe that they realize that all their Keynesian economic theory and everything else that they've done hasn't worked for decades. However, I just don't think that they have the courage to take a different course. Brian Maher: God forbid the market is free to decide. Chuck Butler: That's always been my take, that we don't need a central bank. We just need markets to set the interest rates. Brian Maher: I read an interesting quote yesterday from an ECB official dismissing the idea that central banks have run out of powder as it were, or ammunition. He said, I think the quote was, we are magic people, we can, we have far more tools at our disposal than people realize, or we can do much more. It's amazing. Just the incredible arrogance of it just struck me as really unhinged. Chuck Butler: Yeah, the whole thing has gotten out of control as far as I'm concerned. Brian Maher: Jim Rickards, unlike that ECB official, warns that when the next crisis strikes, the banks won't have anything left to handle it. Then it's on to the IMF and special drawing rights to the rescue. Chuck Butler: Yeah, I've read that, too. I can't argue with him, but at the same time I'd like to think that it's not going to happen. Brian Maher: So what about China, do you think it's got more air in the tire or do you think it's going down? Chuck Butler: I think China's fine. They grew way too fast for too long and they have to go back and clean out those excesses. They have to take some lumps now and endure a period where they simply clean out the excesses. But they'll work it out. I really do believe that they will and they've got a huge treasure chest of reserves, which I always remind people. It has $3.4 trillion worth of reserves. It has decreased from over $4 trillion. But it's still $3.4 trillion. And they can do a lot of things with that amount of money to correct problems in their economy. Brian Maher: Interesting. China has a very long history cycling back between fragmentation and centralization. So they have a whole different view of history than we do. So their main concern is having these millions of single unemployed men in these cities, and the civil unrest that can cause. So you have to figure they're going to pull out every stop to ensure some kind of soft landing. Chuck Butler: Exactly, exactly. But at the same time, I think they really do want to try to stay out of it and let the markets go where they're going to go. That's towards more of a market-driven, domestic demand-driven type economy. I think that they realize now that their export driven economy worked great for a while, but if all the other countries they export to slow down, it's not a reliable model. So they need to increase their domestic demand, and they're really working towards that. Brian Maher: It's really a major transition from an export-based, mercantilist model to a domestic consumption type model. Obviously there's going to be some rough patches along the way, it's not going to happen overnight. But you're confident they will get it right ultimately? Chuck Butler: Yes, I am very confident that they will. Brian Maher: OK, what about emerging markets? What about emerging market currencies in the near future? Chuck Butler: Well, they just have so much dollar-denominated debt that they scare me right now. But when things are good, they're responsible for the majority of the economic growth in the world. But I don't think right now is a good time for them. I'm talking about emerging markets as a whole, not individual countries. But they're working towards having better balance sheets and that will help them get through this dollar-denominated debt that they've got. That reminds me of this book I read by a paid assassin if you will, that would go in and show these emerging market countries how they needed to run up debt. When they couldn't pay them, these people would go in and gobble up their assets like vultures. I believe it was called, Confessions of an Economic Hit Man. It just boggles my mind that so many countries fell for that type of talk. Greece did it, they were shown by the Goldman Sachs of the world that they could have all this debt. Why not? But getting back to the emerging markets, they're still working out their problems, and so it's probably not a really good time to look at them. But when they do get their problems worked out, they will be responsible for the majority of the growth in the world, like they were before. And that's when you'll want to look to countries like India, Brazil, South Korea, and some of these other countries that have such great potential for growth. Brian Maher: Makes sense. Chuck, I wanted to ask you about the petrodollar. It's an important source of dollar strength since the world is forced to buy so much of its oil in dollars. Does the petrodollar have a future? Chuck Butler: No, I don't think the petrodollar has a future. I think that Russia's going to start pricing their oil in rubles and I don't think we're going to send any missiles through Putin's tent like we did Gaddafi's when he decided to price his oil in his currency. I think Saudi Arabia probably is going to, at some point, it could be this year, maybe next year, reach a point where it just doesn't make any sense for them to price their oil in dollars any longer. Brian Maher: Well, especially now that the U.S. is much less dependent on Saudi oil than it used to, and we're making deals with Iran. Iran's their sworn enemy. And the Saudis see China as a more important customer than the U.S. going forward, so the old system is showing cracks. Anyway, as Jim Rickards has explained, currency systems last 30 or 40 years on average, so the petrodollar system could be near the end of the line, if you go by history. Chuck Butler: Yes, I agree. I just don't see it lasting that much longer. I've historically been notoriously early in when I see this type of thing. And so then I talk about them and then six months to a year later it happens. By that point, most people forget about what I said. Oh well. But I believe it will happen soon enough. Brian Maher: Thanks Chuck. Now let's quickly turn to how our readers can can profit from the market conditions we've discussed. As the managing director of EverBank's Global Markets Group, I know you offer some great products for investors they won't find anywhere else. I believe you're offering a special commodities CD that you're really excited about. Please tell our readers why you like it so much. Chuck Butler: Well, since 2005, we've issued what we call MarketSafe CD's. And they have 100% principal protection and an underlying asset, or group of assets, with substantial potential for gain. That means if they don't gain over the period of the CD, which is usually three to five years long, you get 100% of your principal back. That's why it's called a MarketSafe. So over the years we've picked different categories, or underlying assets for them, and they have a theme if you will. Our first ones were a gold CD and a silver CD, and those saw unbelievable returns. But we've issues them on Japanese REITs and on interest rate increases, for example. So, I was sitting around in January looking at commodities, and thought man, they've had a tough four or five years. And I've always told people, and I have to remind myself of it all the time, is that you buy on weakness. But you've got to have a reason why that weakness is not going to last. And to me, commodities just looked like they were the most hated things on earth, and that is always an indication to me that it's time for them to turn around. And when commodities move, their trends last quite a long time. So having them in a market safe, five year CD actually works out pretty well because if commodities were going to go on a long run, this would be the type of vehicle you would want. So we put together eight commodities in an indexed CD. We have a west Texas crude, gold, silver, soybeans, corn, sugar, copper and nickel, all in this one CD. And basically how it works is every year you reach the annual anniversary of the CD's issuance, we check the prices of those commodities versus where they were when we issued it. If they're up, then you book that gain and hold it. Then in the second year, we check all those prices again. So at maturity, you have five interim performance measures, capped at 70% each, and you average them up. The CD is capped at a 70% return, for the record. Brian Maher: I think anyone can live with a 70% return. Chuck Butler: I think so, yes. And if the commodities didn't gain a nickel over those five years, then you get 100% of your principal back. And EverBank is a member FDIC. Brian Maher: So you can't really lose. You have 70% potential upside, and your principal is guaranteed. And with practically zero inflation, even if you don't gain much, you still maintain your principal. That's not so bad. Chuck Butler: Exactly. If you don't earn anything during the five years, you still get all your principal back. You do have to pay an original issue discount (OID) tax every year that you can potentially get back at the end of the five years. That's just a little caveat I sometimes forget to mention. But these are good for IRA's or individual accounts, they're a very interesting way to go about looking at commodities without having to take a position and face a loss on it if it doesn't work out. Brian Maher: That sounds like a great deal, Chuck. You're guaranteed the principal back, no matter what. How often do you get the opportunity for enormous gains while guaranteeing your principal? If commodities go in your favor, you can really come out far ahead.. You don't find that too many places these days, that is for sure. Chuck Butler: Yup, so that's the CD. Now, it technically had a funding deadline of yesterday, May 19th. But if you contact us and mention that you learned about it in The Daily Reckoning, we'll extend the offer a few days for you. So don't be discouraged that the official cutoff was the 19th. But yes, you have to hurry to take advantage. Brian Maher: Well Chuck, it's been a pleasure speaking with you. Thanks a lot for taking the time to share your insights today with Daily Reckoning readers. I think we all learned some things today. I really appreciate it. Chuck Butler: No problem. I always enjoy talking with you guys. Regards, Brian Maher Managing editor, The Daily Reckoning P.S. As Chuck described, EverBank is offering y | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2016 12:49 PM PDT LIVE Donald Trump Speaks at NRA Leadership Forum in Louisville Kentucky FULL SPEECH LIVE HD STREAM ✔ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2016 12:39 PM PDT Infowars Reporter Joe Biggs is at the NRA Annual Meeting in Louisville, Ky where Donald Trump just spoke and was endorsed by the NRA The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Counterfeit gold and silver coins burning buyers Posted: 20 May 2016 11:07 AM PDT By John Matarese The price of gold is heading up again in 2016, as investors worry about the safety of the stock market. As a result, you may be noticing more radio commercials and online ads for gold coins. But before you invest, coin experts are warning you to beware counterfeits that are flooding the market right now. At Coins Plus -- a downtown Cincinnati landmark for 40 years -- owner Brad Karoleff now spends a lot of his time checking for counterfeits. In one hand, he held up a 1-ounce U.S. eagle gold coin, worth over $1,000. In the other: an identical looking Chinese knockoff, worth maybe a dollar. "Some off them are getting pretty good," Karoleff said. "They will fool the average person, and, worse, even some professionals have been fooled." ... ... For the remainder of the report: http://www.wcpo.com/money/consumer/dont-waste-your-money/counterfeit-gol... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Miners’ Q1’16 Fundamentals Posted: 20 May 2016 11:00 AM PDT Zealllc | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela: A Nation on the Brink Posted: 20 May 2016 10:30 AM PDT The Chavez revolution in Venezuela is in trouble. Food shortages are hurting the poor, inflation is at 141% per cent, and the economy in meltdown. Chavez's successor, President Nicolas Maduro, lacks his charisma and the government is now being accused of underestimating the scale of the Zika... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela IMMINENT COLLAPSE as Civil Unrest, Riots, Panic, Looting! Posted: 20 May 2016 10:00 AM PDT Not so long ago, Marxists were still boasting about Venezuela as being a successful communist country. This shows what a lie the progressive communist islamist NWO message amounts. A big deception. Western European culture still produces the best societies in the world. The Financial... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2016 10:00 AM PDT This post Bad News From the Ranch appeared first on Daily Reckoning. BALTIMORE, Maryland – An alarming email came on Tuesday from our ranch in Argentina: "Bad things going on… We thought we had the originarios problem settled. Not at all. They just invaded the ranch." A Revolution Going OnTo bring new readers fully into the picture, Northwest Argentina, where we have our ranch, has a revolution going on. Some of the indigenous people – that is, people with Native American blood – believe they have a claim on the land, simply because their ancestors once lived on it. You can see easily what a slippery claim this is. Most of the people in the area have ancestors who may or may not once have lived on our ranch. Nobody knows. Which of them should have title to which land? And wouldn't the same principle apply to all the land of Argentina… and America, too? Are there no Native Americans with an ancestral claim to Manhattan? Yes, the history books say the island was purchased for $24 dollars' worth of geegaws. "We were cheated," the redskins could say. And what about the rest of us? We had ancestors, too. Where did they live? What rights do we have? As a matter of law, it has been settled for 400 years: The Spanish stole the Chalcachi Valley fair and square. Since then, land has changed hands in the customary way – by voluntary purchase and sale. That is a system that is not likely to change. But… the report from the ranch continued:

Foxes and FedsOn Thursday, our lawyer contacted the authorities in the capital. He got the Minister for Human Rights and the person in charge of "Indigenous Affairs" to agree to go up to the ranch. They are supposed to meet with the revolutionaries and explain that Santos doesn't have any authority with the government and that his claims are completely bogus. Meanwhile, the lawyer filed civil charges against the ringleaders in local court, claiming that they were unlawful trespassers who were interfering with our property rights. But wait… not everyone is sympathetic to the plight of landlords. One reader writes:

Now hold on. If it is a crime to be in the top 5% of income, we plead guilty. Throw the book at us. But we don't think it is wrong to make money. We don't think it is wrong to own property. We don't think it is wrong to try to increase the world's real wealth – and our own – by playful acts of reckless capitalism. On the other hand, we do think it is wrong to take money or property from other people without their permission. That's what the foxes do. That's what the feds do. And that's what the revolutionaries are trying to do to us in Argentina. Fortunately, the foxes that were supporting the revolutionaries (with taxpayer money) were just booted out of office in Argentina. And now, we seem to have the law on our side. Still, the war goes on… Which way will it go? How will it turn out? We don't know. But we know which side we're on… the side of law and order… of European-style property rights… We're on the side of the landlords! Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post Bad News From the Ranch appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Inflation Targeting Scam That Will Guarantee The Mother Of Financial Meltdowns Posted: 20 May 2016 09:43 AM PDT This post The Inflation Targeting Scam That Will Guarantee The Mother Of Financial Meltdowns appeared first on Daily Reckoning. The estimable Martin Feldstein put the wood to the Fed in a recent op ed and in so doing hit the nail directly on the head. He essentially called foul ball on the whole inflation targeting regime and its magic 2.00% goalposts in part due to the measuring stick challenge.

That problem is plainly evident in the chart below. You could very easily make the argument that goods prices are beyond the Fed's reach because they are set in the world markets and by the marginal cost of labor in China and the EM. Therefore the more domestically driven CPI index for services such as housing, medical care, education, transportation, recreation etc. is the more relevant yard stick. Alas, if there is something magic about 2.00%, why then, mission accomplished! On a five year basis, services inflation is up at 2.2% annually, and during the past year it has heated up to 3.2%.

Then again, if the Fed were not comprised of power-hungry apparatchiks looking for any excuse to intrude in the financial markets and dominate their hourly behavior, it might well recognize the merit of what we have termed "CPI Using Market Rent" (box). That's because the regular CPI gives a 25% weighting to the OER (owners equivalent rent), which is more than a little squirrely. The BLS actually asks a tiny sample of homeowners what they would charge per month if they were to rent out their castle. They have no clue! So the BLS plugs some survey questionnaire noise into an algorithm and calls it 25% of the entire damn index! To improve upon this nonsense, we just swapped out the OER in the chart above and replaced it with an asking rent index that a private vendor provides to real clients in the housing rental business. The results get us exactly to the title of Feldstein's post called "Ending the Fed's Inflation Fixation". After all, can any adult really believe that there is any significant difference between 2.0% and 1.9% on a five-year trend basis? Or even that the 1.6%rate posted in the latest 12 months constitutes a significant "miss" that adversely impacts an $18 trillion economy during a year where the global collapse of oil and commodities has clearly temporarily depressed the overall CPI index? So why does the Fed insists on the PCE deflator less food and energy to measure its inflation policy target? Is it technically or theoretically superior to the dozens of alternative measures available, including the internet based Billion Prices Project index, which is based on scrapping massive numbers of high frequency transaction prices from the internet each day? Not in the slightest. Bernanke and his disciples and successors embraced the PCE less food and energy deflator solely because at least in recent years it has been the shortest inflation measuring stick around. It thereby facilitates staying in the "stimulus" game, period. These people are all about justifying a regime of financial market domination that is a complete historical anomaly and a wellspring of price falsification, malinvestment, rampant speculation and dangerous trolling for yield. And the smoking gun, in fact, is the data scrapped from the billions of actual transactions prices which course through cyberspace daily. The chart below shows that consumer inflation has long been running above 2.0% in the real world of transactions. The light orange line plunged below the 2% marker only when global crude oil dropped from $100 per barrel to $40. Folks, that's not missing the target from below. That plunge reflects, in fact, just the opposite. Namely, that the world's central banks have enabled so much cheap, uneconomic credit in recent years that massive excess energy and commodity investments have generated a condition of chronic over-supply, and therefore deflationary commodity price trends. The temporary flattening in the consumer prices index, therefore, is yesterday's monetary policy errors at work, not a reason for central banks to keep interest rates lashed to the zero bound today.

Indeed, the rank intellectual dishonesty of the Fed's "2 percenters" is even more dramatically demonstrated below. The level of the overall consumer inflation index, regardless of which one you choose, is a function of its components. That is, the overall index value is a weighted average statistical derivative. Yet the two driving forces on the CPI since inflation targeting was officially adopted in 2012 have been medical care services and consumer energy products like gasoline and heating oil. As it happened, during the 48 month period ending in April 2016, the medical services component rose by 2.9% per annum while energy hasdropped by 7.7% per year. Neither of these component changes are driven by some Keynesian either called "aggregate demand" in the domestic economy, or anything else the central bank can remotely influence or manipulate. Instead, energy prices are driven by long-cycle supply, demand and capacity balances and short-cycle inventory movements in the $80 trillion global GDP; and medical prices are driven by third party payer machinations in the nation's $3 trillion bureaucracy-encrusted medical care delivery system. Indeed, throw in the BLS's phony OER component with these two items and you have 40% of the weight in the CPI and only slightly less in the PCE deflator. Given this, is it even remotely rational to believe that the deliberations and interventions of the FOMC have anything to do with the second decimal place outcome on the overall CPI of 1.19% annually during the last four years? You might conclude that our monetary politburo consists of feckless and befuddled academics and apparatchiks who are tilting at inflation windmills, but you would be mainly wrong. The truth is, these are power-hungry bureaucrats who have usurped their charter in manner so brazen and excessive as to be fairly described as a coup d etat. There is absolutely nothing in the elastic and aspirational language of the Humphrey-Hawkins Act that requires this kind of fanatical pursuit of 2.00% inflation or a 4.99% U-3 rate, either.

And that gets us to the even more important point in Feldstein's post regarding the real function of the Fed with respect to inflation. That is, its true inflation mandate, if it has one at all, is not about two-decimal point undershooting from below on a monthly basis; it's about being vigilant for a break-out of inflation to the upside on a trend basis.

Here's the thing. Feldstein has been at this game since the late 1960s and knows a thing or two about how economies work and what central banks can and cannot do with their primitive tools of money market pegging, yield curve management and wealth effects pumping and puts. What they can't do is micromanage the GDP or fine-tune the short-term rate of wage, price, production and job gains on domestic ledgers that are rooted in an integrated global economic and financial system. Attempting to do so, will only result in more price falsification in the financial markets and inflation of financial asset values. That's because at Peak Debt, the central bankers' one-time parlor trick doesn't work and actually backfires. Making credit artificially cheap previously induced households and business to tap their balance sheets and ratchet up their leverage ratios in order to supplement the natural sources of consumption and investment spending from wages and business cash flow, respectively, with the proceeds of incremental borrowings. But now cheap credit doesn't even get to main street; it only induces more collateralized borrowing and speculation on Wall Street. Stated differently, when household and business balance sheets run out of capacity to absorb more debt, the repo man takes over. That is, speculators push the price of tradable financial assets ever higher, enabling them to be carried with higher and higher amounts of cheap wholesale funding. In theory, there is no limit to how much 25 basis point repo money can be applied to carry 10-year treasury notes yielding 190 basis points. Needless to say, the effect of this Peak Debt blockage of the old monetary transmission channel to households and business is that cheap credit never leaves the canyons of Wall Street; it unnaturally and energetically causes the systematic mis-pricing of financial assets. As Feldstein cogently argued,