Gold World News Flash |

- Is Putting Physical Gold in an IRA a Smart Strategy?

- Silicon Valley Housing Market Hit as Chinese Money “Dried up”

- Jim’s Mailbox

- The Eurozone is the Greatest Danger

- Huge Trend Changes Point To Something Big In The Gold Market

- Gold vs Annual World GDP

- Signals – From Gold and the S&P

- Alasdair Macleod: The eurozone is the greatest danger

- Full Speech: Donald Trump & Chris Christie in Lawrenceville, NJ (5-19-16)

- Economic Collapse of Socialist Venezuela Explained

- Man, Markets & Manias, Part I

- Gold Daily and Silver Weekly Charts - No Substance

- The Federal Reserve is Not Going To Raise Interest Rates and Destroy Gold

- How the Deep State’s Cronies Steal From You

- EgyptAir Crash -- MSM already talking about a Terrorist Attack

- Gold: Intelligentsia - Youre Fired!

- False Flag Alert -- EGYPTAIR FLIGHT 804 GOES MISSING!

- Benjamin Fulford: May 19, 2016 Greetings From The Director General

- FOMC Meeting Minutes Surprise The Markets

- Trump Calls Missing EgyptAir Flight : Terrorism

- Gold - Pro-Inflation? Anti-USD?

- Two Overlooked Streaming Stocks with Huge Upside Potential

- Major Cycle Low Upcoming in Gold

- Gold Short term decision arriving for direction into June

- Breaking News And Best Of The Web — May 20

| Is Putting Physical Gold in an IRA a Smart Strategy? Posted: 19 May 2016 11:01 PM PDT Guest Post from James Cordelaine of Goldco Precious Metals With the stock market stumbling well into the second quarter, and reckless central bank experiments with low- to negative interest rates... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Silicon Valley Housing Market Hit as Chinese Money “Dried up” Posted: 19 May 2016 11:00 PM PDT by Wolf Richter, Wolf Street:

Money from Chinese investors "has dried up," a residential real-estate broker in San Francisco told me a few days ago, as he was fretting about the local housing market. It's a result of the crackdown by the Chinese government on capital flight, he said. Chinese investors have been buying about 5% to 7% of residential properties in San Francisco, possibly more in parts of Silicon Valley. And other brokers are now publicly chiming in about money from China drying up. "We've recently noticed a slowdown," Jack Woodson at Alain Pinel Realtors in Menlo Park in Silicon Valley, told Bloomberg. "Buyers are taking more time to decide about making offers." He fingered Chinese investors who've suddenly curtailed their purchases after they had "really been driving the market." Data coming out of China appear to support the thesis of a sudden money vacuum in some of the toniest West Cost Housing markets. In February, foreign exchange reserves had dropped to $3.20 trillion as a result of rampant capital flight and the central bank's efforts to prop up the yuan. It was the lowest level since December 2011, down $790 billion from the peak in June 2014, after a record plunge in 2015 of $513 billion. But in March, foreign exchange reserves rose to $3.21 trillion. And in April, instead of re-plunging, they rose again to the great surprise of the onlookers, hitting $3.22 trillion. And China's State Administration of Foreign Exchange (SAFE) reported that capital outflows have begun to ease. Net foreign exchange sales by commercial banks dropped to $23.7 billion in April, from $36.4 billion in March, and less than half of the $54.4 billion in January. This money vacuum is being felt in Silicon Valley. It coincides with the tech slowdown, the iffy stock market performance, and the swoon in the IPO market. Bloomberg:

In Palo Alto – where the median home price was $2.5 million in the first quarter, according to Zillow – the 11 listings of homes costing over $5 million as of May 14 have been on the market a median of 30 days. Gone are the bidding wars "when newly minted millionaires from tech initial public offerings raced against buyers from China to scoop up anemic inventory." And price cuts – the bane of the industry – are back in vogue. Bloomberg cites a home in a prime area of Palo Alto that, after sitting on the market since the end of March, had its price slashed by $500,000 to $7.5 million. It's still on the market, having joined "a growing inventory of high-end homes in the area that are taking longer to sell." |

| Posted: 19 May 2016 10:50 PM PDT Jim, Anyone with half a brain knows that if the US dollar is the major part of their reserves and the economy is sinking you had better get your reserves out of the dollar and into something more reliable that will hold its value. Like GOLD!!!! CIGA Larry U.S. debt dump deepens in 2016 by... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| The Eurozone is the Greatest Danger Posted: 19 May 2016 10:00 PM PDT by Alasdair Macleod, Gold Money:

With markets everywhere disrupted by interventions from central banks, governments, and their sovereign wealth funds, economic progress is being badly hampered, and therefore so is the ability of anyone to earn the profits required to pay down the highs levels of debt we see today. Money that is invested in bonds and deposited in banks may already be on the way to money-heaven, without complacent investors and depositors realising it. It should become clear in the coming weeks that price inflation in the dollar, and therefore the currencies that align with it, will exceed the Fed's 2% target by a significant amount by the end of this year. This is because falling commodity prices last year, which subdued price inflation to under one per cent, will be replaced by rising commodity prices this year. That being the case, CPI inflation should pick up significantly in the coming months, already reflected in the most recent estimate of core price inflation in the US, which exceeded two per cent. Therefore, interest rates should rise far more than the small amount the market has already factored into current price levels. Most analysts ignore the danger, because they are not convinced that there is the underlying demand to sustain higher commodity prices. But in their analysis, they miss the point. It is not commodity prices rising, so much as the purchasing power of the dollar falling. The likelihood of stagflationary conditions is becoming more obvious by the day, resulting in higher interest rates at a time of subdued economic activity. A trend of rising interest rates, which will have to be considerably more aggressive than anything currently discounted in the markets, is bound to undermine asset values, starting with government bonds. Rising bond yields lead to falling equity markets as well, which together will reduce the banks' willingness to lend. In this new stagnant environment, the most overvalued markets today will be the ones to suffer the greatest falls. Therefore, prices of financial assets everywhere can be expected to weaken in the coming months to reflect this new reality. However, the Eurozone is likely to be the greatest victim of a change in interest rate direction. |

| Huge Trend Changes Point To Something Big In The Gold Market Posted: 19 May 2016 08:41 PM PDT by Steve St. Angelo, SRSRocco Report:

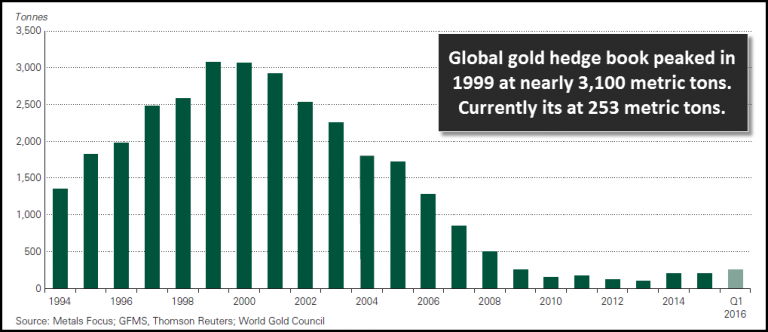

Let's start off with one segment of the gold market that has changed significantly in the past 15 years. The Global Gold Hedge Book hit a peak of nearly 3,100 metric tons (mt) in 1999:

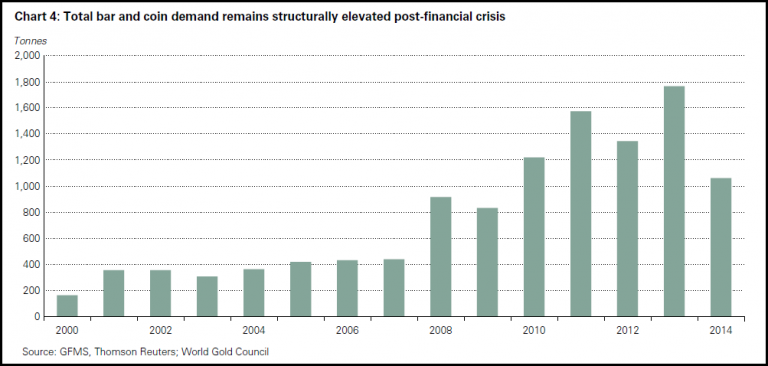

So, as the price of gold jumped five times from 1999 to 2013, the Global Gold Hedge Book fell 96%. Even though it increased a bit in the first quarter of 2016 to the present 253 metric tons, it's still a fraction of the massive hedge book the gold industry held in 1999. Now, if we add another segment of the gold market, we will see another large trend change. Global Gold Bar & Coin demand increased significantly since 2000. In 2000, total Global Gold Bar & Coin demand was 166 mt. However, this hit a record high of 1,705 mt in 2013:

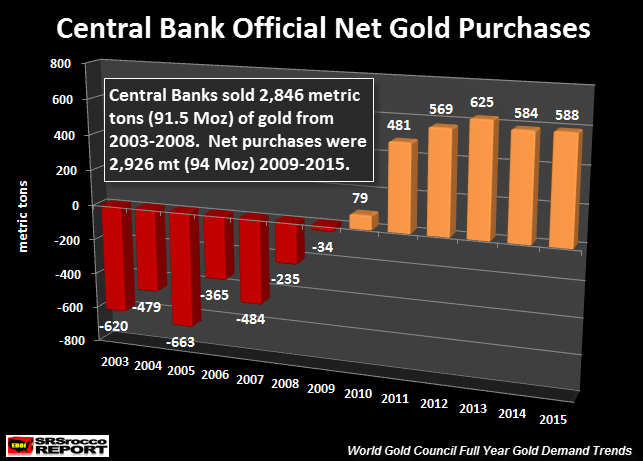

If we were to super-impose the Global Gold Hedge Book chart with the Gold Bar & Coin chart, we would see an interesting trend. As the gold industry's hedge book fell to a low in 2013, Global Bar & Coin demand hit a peak. Furthermore, if we consider the net change in Central Bank Gold purchases, it's even more interesting:

When the gold industry held a very large gold hedge book, Western Central Banks were dumping gold on the market HAND-over-FIST. I imagine this was a two-tiered approach in controlling the gold price. We can see that in 2003, Central Banks dumped 620 mt of gold into the market and another whopping 663 mt in 2005. However, this all turned around in 2010, when (Eastern) Central Banks became net buyers of gold at 79 mt. Moreover, Central Bank gold purchases also hit a record 625 mt in 2013 along with Gold Bar & Coin Demand of 1,705 mt. These two record gold demand figures took place the very year the Global Gold Hedge Book fell to a record low. While these three different segments of the gold market provide the investor with a different understanding when we look at them all together, there is another factor that is even more compelling. Global Gold ETF Demand Is The Major Trend ChangerEven though investors don't trust a lot of the figures coming out of the Gold ETF market, it is by far the most critical factor in the gold market going forward. Why? Because this is where the Main Stream Investors enter in BIG NUMBERS. |

| Posted: 19 May 2016 08:28 PM PDT |

| Signals – From Gold and the S&P Posted: 19 May 2016 06:00 PM PDT by Gary Christenson, Deviant Investor:

Thanks to High Frequency Trading and the rise of the machines in the electronic markets, gold and the S&P 500 Index are difficult for non-machines to understand and predict on a short term basis. What do they tell us in the longer term? It is an exponentially increasing world! Both gold and the S&P 500 Index have risen exponentially for fifty years. Since they often move counter to each other, take the sum of the gold price plus the S&P 500 Index and you can see the overall trend more easily. The exponential trend since 1990 is clear. We can reasonably expect they will continue to rise until we experience a massive reset in the financial systems. What about the RATIO of gold to the S&P 500 Index? Since 1990 the ratio (weekly data) has varied widely, from under 0.20 to 1.60. The two low points in the ratio are marked with green ovals, and the high point in 2011 is marked with a red oval. Conclusion: At green ovals buy gold and sell the S&P. At red ovals sell gold and buy the S&P. What about actual gold prices? |

| Alasdair Macleod: The eurozone is the greatest danger Posted: 19 May 2016 06:00 PM PDT By Alasdair Macleod Worldwide, markets are horribly distorted, which spells danger not only to investors, but to businesses and their employees as well, because it is impossible to allocate capital efficiently in this financial environment. With markets everywhere disrupted by interventions from central banks, governments, and their sovereign wealth funds, economic progress is being badly hampered, and therefore so is the ability of anyone to earn the profits required to pay down the highs levels of debt we see today. Money that is invested in bonds and deposited in banks may already be on the way to money heaven, without complacent investors and depositors realizing it. It should become clear in the coming weeks that price inflation in the dollar, and therefore the currencies that align with it, will exceed the Fed's 2 percent target by a significant amount by the end of this year. This is because falling commodity prices last year, which subdued price inflation to under 1 percent, will be replaced by rising commodity prices this year. That being the case, CPI inflation should pick up significantly in the coming months, already reflected in the most recent estimate of core price inflation in the US, which exceeded 2 percent. Therefore, interest rates should rise far more than the small amount the market has already factored into current price levels. ... ... For the remainder of the analysis: https://www.goldmoney.com/the-eurozone-is-the-greatest-danger?gmrefcode=... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Full Speech: Donald Trump & Chris Christie in Lawrenceville, NJ (5-19-16) Posted: 19 May 2016 05:41 PM PDT Thursday, May 19, 2016: Donald Trump joined Governor Chris Christie for a fundraising event in Lawrenceville, NJ at the Lawrenceville National Guard Armory. Full Event: Donald Trump & Chris Christie in Lawrenceville, NJ (5-19-16) The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Economic Collapse of Socialist Venezuela Explained Posted: 19 May 2016 03:00 PM PDT The Fall of Venezuela. Prepare Yourself Accordingly. Under the crippling weight of massive currency inflation, food shortages, power outages, increasing disease prevalence, a fall in oil prices, drought and political mismanagement – Venezuela has essentially become a failed state. What... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 19 May 2016 01:50 PM PDT This post Man, Markets & Manias, Part I appeared first on Daily Reckoning. We had an insightful conversation with our friend, Chuck Butler, of Daily Pfennig fame last Friday. Today, we publish the first part for your reading pleasure. The second comes tomorrow. If you're not familiar with him, Chuck is one of the longer-running voices in these reckonings. In addition to writing the Daily Pfennig, he's the managing director of EverBank's Global Markets Group. Chuck knows of which he speaks. "For 16 years," wrote our founder Addison Wiggin last year, "while variously writing The Daily Reckoning and The 5 Min. Forecast, Chuck's daily missives have been one of my first reads of the day." "Rummaging through the Data Cupboard with Chuck, digesting key insights he's picked up from across the wire and gleaning trading room secrets in the currency markets has helped set my own daily issues on track more times than I can count. Even his enthusiasm for St. Louis is infectious. I've almost become a fan of the Cardinals, and I don't even follow baseball." Over the phone, Chuck and I shine a light on man, markets, manias and their impact on your wealth today. Our full conversation is below and we think you'll find it worth your time. Read on… A conversation between Chuck Butler and Brian MaherBrian Maher: Morning, Chuck. And welcome back to The Daily Reckoning. It's an honor to finally speak with you live. I read the Daily Pfennig every morning – I consider it essential reading for any investor and I heartily recommend it to all DR readers. Chuck Butler: Thank you, I read your stuff all the time. Brian Maher: We've had a lot of new readers join The Daily Reckoning in the past year. So, let's start with some background for anyone who may not know you. In addition to penning the Daily Pfennig, you're the managing director of EverBank's Global Markets. You've also been one of our longer-running "characters" in these reckonings. Addison, Bill Bonner and you go back. How did you began your relationship with the DR? Chuck Butler: Well, actually, it's kind of funny. EverBank's former marketing person was David Galland. And David and Bill Bonner were very good friends from way back. And, Frank Trotter, my boss, knew Bill, too. But I had never met Bill or Addison. We were at the New Orleans Investment Conference. This is around 2003. I had walked away from our booth for a minute. When I came back, my colleague said, "Hey, there was a guy here by the name of Addison Wiggin who wants to talk to you. He's right over there." So I walked over there and introduced myself to him, and it turned out he'd been reading the Pfennig all the time. I'd been reading The Daily Reckoning too [laughs] you know and we just started kind of hitting it off and talking about our newsletters. Incidentally, Addison told me that whenever he hired new writers, he'd put them in a room and give them a week's worth of Daily Pfennig to read and tell them that's how he wanted them to write. I was flattered by that. I also met Bill Bonner at the conference. That's basically how I met them at the New Orleans Investment Conference. We had been reading each other's stuff but we had never met each other. Brian Maher: Well, you're definitely one of the livelier reads out there. The Daily Pfennig is not only informative, it's massively entertaining. OK, your time is valuable, Chuck, so let's get down to it. Your analysis is always fascinating. Can you tell our readers what you think will be the biggest market story over the next, say, six months? Not right now, or next week, but six months. Chuck Butler: Well, you know, I think, last year I did an interview with Peter (Coyne) and I said that I thought the U.S. economy was heading towards a recession. But obviously, that didn't happen. Although, I'd say, we're teetering, aren't we? I still think we're going into a recession. It's just been too many years since we've had one, and nothing that I see shows we have any type of sustainable economic growth. And that's the kind of growth that strong economies are built on. So therefore, I think we will head back into a recession. Then the Fed will stop with their talk of interest rate hikes and begin to cut again. And that's going to change a lot of things in the market. Brian Maher: You say we're heading into recession. A lot of people would say we're already in recession, even though it's not official. Chuck Butler: Yes, I think we are. I was talking about an actual, official recession, usually defined as two consecutive quarters of negative GDP growth. But I think when you only have .07% growth, that's pretty much a recession to me. Brian Maher: And didn't the IMF just downgrade U.S. growth estimates from 2.6% to 2.4% for the year? It seems like they're always revising their forecast downward. Who knows what it'll be next? Chuck Butler: Yeah, it's funny how they do that, isn't it? Every year they come out and they have these rosy predictions about how the years going to go, and they project all this growth. And then as the year goes by, they always seem to cut them under the cover of darkness, so that people don't see it. That seems to be the call to order almost every year now since 2009, that this is going to be the year that we come out of it. And then by June everybody's realized that it's not going to be the year that we come out of it. Rinse, repeat. Brian Maher: Since the end of WWII, there's been a recession I think every six or seven years, on average. So we're more or less due for a real one if history is a guide, no? Chuck Butler: Yes, we're due. Brian Maher: So the latest unemployment report doesn't exactly inspire you with confidence, does it? Unemployment held at 5% last month, officially, but overall hiring slowed. Chuck Butler: No, and the thing about the unemployment report it's just too ambiguous. They take a survey, then the number crunchers make these adjustments to the data. So you don't really ever really know what the labor picture is if you use the BLS report. But if you look at the labor conditions market index, which doesn't have any "hedonic" adjustments to it, the actual unemployment number has been down for four consecutive months. I just don't get the BLS reasoning. And so the whole BLS report is just something I just wish I didn't even have to deal with. The way they manipulate numbers is just amazing. If you read David Stockman, he's always hammering them about that. It's almost a daily occurrence on the Contra Corner Blog. It's entertaining. But it's not exactly a rosy picture. Brian Maher: That's for sure. Let's switch gears a bit, Chuck. What do you think about the whole Brexit scenario, with Britain threatening to leave the EU. I think the referendum is June 23rd. Do you place much stock in it? Chuck Butler: Well, there's a lot of words being thrown back and forth about Brexit. And boy, they like to take polls over there in Europe. They do one just about every week. But I don't think that the U.K. will leave the European Union. I think they see that the benefits of staying far outweigh the non-benefits, which are having to deal with the refugee problems and Greek debt, for example. But the benefits of belonging to the EU far outweigh those things, and I think they'll stay put. It reminds me of the whole Grexit scenario. Greece was never going to leave. What a lot of people don't understand is that with Greece, the changes that would have to be made in every retailer's system to accommodate drachmas instead of euros, would bring the country to it's knees. There's a whole laundry list of things that would have to take place if Greece left the European Union, or left the euro. I knew from the moment that they first started talking about it that, that wasn't going to happen. But to sum it up, no, I don't think Britain will leave the EU, either. Brian Maher: As a currency expert, Chuck, how do you think that's going to affect the pound? I imagine a decision to stay should calm the markets and give it a boost. Chuck Butler: The pound sterling has taken some hits because of the polls and the talk about Brexit, but yes, I think the referendum at the end of June will put that talk to bed. And you won't hear about it anymore. Brian Maher: So the pound could be a pretty good bet over the next few months? Chuck Butler: It could be, based on the selling that's taken place due to Brexit fears. But you have to remember that the U.K. economy isn't doing too well, either. So it's not like the Bank of England is going to start hiking interest rates and generating a lot of interest in the currency that way. But it could see some reversal of the recent selling, which would boost the pound. Brian Maher: OK, moving on from Brexit. There's a lot of talk lately about the Shanghai Accord, where the world's monetary honchos agreed to weaken the yuan through the backdoor, so China wouldn't devalue its currency. It would weaken the dollar, while strengthening the yen and the euro. Jim Rickards has written a lot about it. Some people don't agree that it even exists, that it's just a conspiracy theory. What's your take? How much credence do you lend it? Chuck Butler: Well, I think there probably was one, but when I write, my legal people always make me say the "so-called Shanghai Accord." And there's no real proof that there is one, you know. But to me, there had to be something that was done. Just look at the third week of February when the G20 met, and look at the performance of the euro and the yen and the Chinese renminbi versus the dollar since that time. It's been like night and day. So something must have happened. It just makes sense to me that an agreement between those countries was made to weaken the dollar a bit, just to give some relief to China, which was teetering on a major crisis. I'm not a coincidental type person. I understand they exist, but sometimes when you're talking about governments and markets, I don't think there's anything as coincidences there. Brian Maher: So it was all basically done to avoid another surprise devaluation by the Chinese essentially, because in August and January they surprised the markets with devaluations. The markets tanked. So, it's basically to avoid a replay of those scenarios. Chuck Butler: That is absolutely correct. The U.S. had to have seen that China was ready to devalue again. Brian Maher: Jim Rickards thinks the weaker dollar scenario will play out over the next few years. But we like to give our readers differing perspectives. How long do you see this playing out, the weak dollar and yuan, versus the stronger yen and euro? Chuck Butler: Actually I think it's already starting to fade. Brian Maher: Already? That didn't take long. Chuck Butler: No, it didn't take long, but we saw the yen rally a little bit. We saw the daily appreciations of the Chinese renminbi stop, and the euro has been hung up between 113 and 114 for the last couple of weeks. So it just seems like it's kind of faded now. Brian Maher: I guess we'll have to wait and see how it plays out going forward. These sorts of things can zig-zag instead of traveling in a straight line. But in the final analysis, there's only so much the monetary authorities can do to manipulate these currency markets, right? Chuck Butler: Well exactly, like I've always told my readers, the markets have far deeper pockets than any central bank. If markets decide they want to take a currency somewhere, they're going to do it and the central bank can stem those moves with intervention. But eventually they're going to run out of money. Brian Maher: So you think we're getting near that point? Chuck Butler: I think so, I think so. But here's the thing: I think the dollar was, and still is, overvalued. And I think that once this settles down a bit, which I think it's getting ready to do, then the markets will take a strong hard look at whether or not the dollar is still overvalued or not. And if they think it is, then we could see more dollar weakness. I for one think that the dollar has been in a strong trend for five years now, and it's pretty much run it's course in that direction. It could be nearing the end of that trend. But during the end of that strong trend you can find periods of dollar strength. It's like its last gasp holding onto strength. This could be one of those times. It used to be fundamentals that drove every currency. If one country had higher interest rates than the other, then their currency was better off than the other currency, and so forth. But nowadays,what drives currencies is market sentiment. Interest rate differentials don't really mean too much to the markets. If they did, the Russian ruble and the Brazilian real would be the strongest currencies on earth. But they're not. Brian Maher: Not by a mile. Thanks Chuck. Tomorrow, we'll return with part two of our conversation. We'll get more into the dollar, gold, the elites' plan for a cashless society and more. But first, as the managing director of EverBank's Global Markets Group, I know you offer some great products for investors they won't find anywhere else. I believe you're offering a special commodities CD that you're really excited about. Please tell our readers why you like it so much. Chuck Butler: Well, since 2005 I think, we've issued what we call market safe CD's. And they have 100% principal protection and an underlying asset, or group of assets with substantial potential for gain. That means if they don't gain over the period of the CD, which is usually three to five years long, you get 100% of your principal back. That's why it's called a market safe. So over the years we've picked different categories, or underlying assets for them, and they would have a theme if you will. Our first ones were a gold CD and a silver CD, and those saw unbelievable returns. But we've done them on Japanese REITs and on interest rate increases, for example. So anyway, I was sitting around in January looking at commodities, and thought man, they've had a tough four or five years. And I've always told people, and I have to remind myself of all the time, is that you buy on weakness. But you've got to have a reason why that weakness is not going to last. And to me, commodities just looked like they were the most hated things on earth, and that is always an indication to me that it's time for them to turn around. And when commodities move, their trends last quite a long time. So having them in a market safe, five year CD actually works out pretty well because if commodities were going to go on a long run, this would be the type of vehicle you would want. So we put together eight commodities. We have a west Texas crude, gold, silver, soybeans, corn, sugar, copper and nickel, all in this one CD. And basically how it works is every year you reach the annual anniversary of the CD's issuance, you check the prices of those commodities versus where they were when you issued it. If they're up, then you book that gain and you hold it. Then in the second year, you go out and you check all those prices again. So at the end you have these five annual prices, and average them up, and the CD is capped at a 70% return. Brian Maher: I think anyone can live with a 70% return. Chuck Butler: I think so, yes. Then you average them out for five years and whatever profit you have is yours. And if the commodities didn't gain a nickel over those five years, then you get 100% of your principal back. Brian Maher: So you can't really lose. You have 70% upside, and your principal is guaranteed. And with practically zero inflation, even if you don't gain much, you still maintain your principal. That's not so bad. Chuck Butler: Exactly. If you don't earn anything during the five years, and you do have to pay an original issue discount (OID) tax every year that you can obviously get back at the end of the five years. But that's just a little caveat that I forget to tell people a lot of the time. But these are good for IRA's or individual accounts, they're a very interesting way to go about looking at commodities without having to take a position and face a loss on it if it doesn't work out. Brian Maher: That's really a great deal, Chuck. You're guaranteed the principal back, no matter what. How often can you get that? And if commodities go in your favor, you can stand to reap some tremendous gains. You don't find that too many places these days, that is for sure. Chuck Butler |

| Gold Daily and Silver Weekly Charts - No Substance Posted: 19 May 2016 01:19 PM PDT |

| The Federal Reserve is Not Going To Raise Interest Rates and Destroy Gold Posted: 19 May 2016 01:10 PM PDT Yesterday the stock market and gold prices fell into their closing bells after the release of minutes of the Federal Reserve’s April meeting. The Federal Reserve did not raise interest rates at that meeting, but the minutes showed that some Federal Reserve Board members hope to raise interest rates in June. |

| How the Deep State’s Cronies Steal From You Posted: 19 May 2016 01:08 PM PDT This post How the Deep State’s Cronies Steal From You appeared first on Daily Reckoning. DUNMORE EAST, Ireland – We came down the coast from Dublin to check on our new office building. For this visit, we wanted to stay somewhere different than we normally do. So we chose a small hotel on the coast, called the Strand Inn. It is an excellent place for seafood and soda bread on a rainy day. Later, you can go to the bar, get in your cups, and sing sad songs about dead Irish heroes. Ireland has a literate, educated population. It is pleasant… pretty… and has a low corporate tax rate. So, we are expanding here. Apparently, companies escape taxes by moving their headquarters or their technology overseas. We would do the same, but we've never been able to figure out how it saves any tax money. Owners end up paying tax in their home countries. And Americans pay U.S. taxes no matter where the money is actually generated. Regardless, we bought a large, 19th-century mansion in the aftermath of Ireland's real estate bust… which took average property prices down by more than one-third. It seemed like a good deal. But every real estate investment we ever made has turned out to cost more… and take more time… than we imagined. This time is no exception. Still, it is a handsome, capacious place, which will house more than 150 employees. The Irish have charming and understandable accents. Many of these employees will be answering calls from all over the world. So, if you call us after September, your call might be routed to County Waterford. High on the HogNow, back to the Deep State… Much of its growth is recorded in the pages of the Code of Federal Regulations (CFR). This tracks all the laws laid down by successive governments. A privilege… a special tax break… a rule… a prohibition… a piece of meat here, a piece of meat there… and soon the foxes are eating high on the hog. But what's meat for the foxes is poison for the economy. Each piece requires paperwork, delays, permits, accountants, lawyers. You can't do this… you can't do that – with so many hurdles in their way, entrepreneurs think twice, capital investment declines, and the economy slows. Each favor to the foxes is an act of larceny… taking something away from the people who earned it to redistribute wealth, power, and status to the insiders. From fewer than 25,000 pages when President Eisenhower left the White House, the CFR now has nearly 200,000 pages – each one a honeypot for Deep State cronies. And who reads this stuff? Do you know what rules and regulations you are breaking right now? Most people are too busy earning their money and raising their families to spend much time tracking the federal bureaucracy and its cronies. But the foxes make it their business to pay attention… and make the rules that work for them. An honest person is at a great disadvantage. Rules and RegulationsThink you're going to change this system by voting for Hillary or Trump, Democrat or Republican? Maybe, but there's no evidence of it in the CFR. The number of pages kept rising, year after year, no matter who was in the White House. Twenty-five thousand pages were added during the Kennedy and Johnson years… another 25,000 under Nixon and Ford… and another 25,000 during the Reagan and George H.W. Bush administrations. Federal spending per capita shows the same basic trend, an almost unbroken uptrend – through Democratic and Republican administrations – stretching back from 2016 to 1952. Under President Eisenhower, domestic discretionary spending per person was under $500. Today it's over $4,500. Like the Federal Code, real spending per person has increased about nine times in the last 64 years. There were two presidents under whom spending went down – Ronald Reagan and Bill Clinton. Go figure. In neither case, however, did it stay down for long. Once Reagan and Clinton were out of the way, the foxes went to work and quickly brought spending back to the trend line. What will happen to the little foxes under Donald Trump? Or Hillary? The earnings of the top 5% – the "foxy five" – began to diverge from the earnings of everybody else in the mid-1970s. Since then, they increased alongside the FCR and government spending. Rules and regulations multiplied. Spending increased. The foxes got richer; everyone else got poorer. All this happened through both Republican and Democratic administrations. Most likely the foxes will continue to earn more through a Trump or Clinton administration too. Still to come… insurrection and rebellion down on the ranch… Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post How the Deep State’s Cronies Steal From You appeared first on Daily Reckoning. |

| EgyptAir Crash -- MSM already talking about a Terrorist Attack Posted: 19 May 2016 12:00 PM PDT Fox News Radio Host and licensed pilot Tom Sullivan on the missing EgyptAir flight. Will EgyptAir crash impact airport security? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold: Intelligentsia - Youre Fired! Posted: 19 May 2016 11:03 AM PDT SafeHaven |

| False Flag Alert -- EGYPTAIR FLIGHT 804 GOES MISSING! Posted: 19 May 2016 10:35 AM PDT Egypt Air Flight 804 has gone missing from radar Never autoplay videos An EgyptAir flight traveling to Cairo from Paris disappeared from radar with 66 passengers and crew members on board, the airline confirmed Thursday morning. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Benjamin Fulford: May 19, 2016 Greetings From The Director General Posted: 19 May 2016 09:40 AM PDT Benjamin Fulford - May 19, 2016 Greetings From The Director General The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| FOMC Meeting Minutes Surprise The Markets Posted: 19 May 2016 08:23 AM PDT This post FOMC Meeting Minutes Surprise The Markets appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! Well, just when I thought, and the markets pretty much thought, that a Fed rate hike in June had a slim chance of taking place, and Slim had left town, along came the Fed Speakers, followed by their April FOMC Meeting Minutes. Who knew the minutes would prove to be hawkish? After the April Fed meeting Chair Janet Yellen sounded like someone that had lost their puppy, as she was deemed to be very dovish, and almost apologetic for hiking rates to begin with. But the meeting minutes proved that this stature taken by Yellen after the meeting and again a week later when she spoke in public, was just a way to throw the markets off the scent of another rate hike. The dollar bugs are dancing in the street and crushing the currencies and metals this morning folks, and it’s all about the meeting minutes so, let’s look at what they said and then I’ll dissect it. Among a lot of other things that were dovish, this comment caught my attention:

I underlined the comment about the labor market conditions continuing to strengthen because it’s a load of crock! I pointed out to you last week that the Labor Market Conditions Index (LMCI) had fallen for the fourth consecutive month! But the Fed members seem to be on a mission from God, and are hell bent and whiskey bound to hike rates in June. Why you ask? Well, September would be too close to the election, heaven forbid they hike rates and be accused of being political. And I guess the fed members haven’t checked their emails lately to see that both HUGE Retailers, Target and Home Depot announced that consumption is faltering heading into the second QTR. They even made notes in the minutes about how some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June Meeting. They then made a note about the importance of communicating clearly this to the markets. And now you know why Williams and Lockhart were so hawkish in their speeches on Tuesday. I thought it pretty strange that these two members who normally lean to the doves side of the isle, were so hawkish. It was all in the plan. Can you see Janet Yellen wringing her hands and saying, I’ll get you markets, for not taking us seriously. HA! I guess this is a good place to talk about my new whipping boy, Central Banks. On Tuesday I gave you a hint of what I was going to focus on in the June Review & Focus regarding Central Banks. Then yesterday I ran across some thoughts that just played so well with my thought that Central Banks have lost control, that they do desperately want and need (according to them). If they haven’t lost control then explain these things: Growth, which was high, is now low. And there’s no excuse by the Krugman and Summers of the economist world as to why that is. Inflation, which was bad, and everywhere, is now good and nowhere. What on earth are these Central Banks doing here? Haven’t they ever heard of the saying, “let sleeping dogs (inflation) lie”? Helicopter Money Drops, which were mad, are now sane? And getting back to inflation… Central Banks used to fight and prevent inflation, now try to cause it. Tell me that you think they’re all on the right track and that this will all work out just fine, and I’ll send the paper work over to sell you a piece of swamp land I have. I’ve seen days like this, but haven’t seen one in a while. A day where the dollar kicks tail and takes names later. And again, I have to think that so-called Shanghai Accord has now been deep sixed, thrown in the circular bin, and is a forgotten piece of paper. The euro has dropped to 1.1205, and 1.1080 is the 200-day moving avg. It could very well slip through there today, given the dollar’s momentum. Yen is within’ spittin’ distance of 110, and the Aussie dollar (A$) continues to take on water, even though their latest employment report was solid. The lone wolf of the major currencies that is rallying vs. the dollar this morning is pound sterling. It’s pretty interesting that just yesterday I told you that the pound could see a rally when the BREXIT referendum was put to bed, and Britain remained in the European Union/EU. And traders beat the referendum to the punch! The latest polls show the “don’t leave” vote widening its lead vs. the “leave” vote. So, this is a case of buy the rumor, and probably sell the fact in June. And gold is getting whacked again this morning, and is down $19 as I write. I wish I could wrap a tourniquet around the shiny metal but the paper shorts are winning, and trying to stop them right now would be akin to catching a falling knife! Going down a different path with gold, I was reading the latest Rude Awakening yesterday, and they supplied a link to a video. In the video a fund manager was being interviewed and it’s not important who he was, but what he was saying about HSBC (Hong Kong Shanghai Banking Corp). He was concerned with the depository of the physical gold that backs ETF’s, and that they had booked a huge loss recently. He’s concerned about the health of the depository that holds the gold for ETF’s, and therefore he’s concerned with ETF’s as a whole, preferring, but of course, to buy and own physical gold. And I with him 100% I’ve always maintained that if you want to own gold, you need to own physical gold (pooled gold is physical gold, you just don’t have to hold it). The price of oil slipped back below $48 in the past 24 hours, but still looks like it wants to try its hand at hitting the $50 mark.. With all this dollar strength in the markets today, it will be a tough row to hoe for the price of oil. Just about 10 days ago, the Dollar Index was trading with a 93 handle and the thought was that if it traded below 94 for a few days, that the next move down in the dollar was about to happen. Well, this morning the Dollar Index is 95.25. WOW! Talk about a HUGE upward move! And it pretty much tells you how badly the euro has done in the last couple of days. I was sitting at my desk doing some reading about the dollar index yesterday, and it got me thinking. Why does the dollar have an index? The euro doesn’t have one. The Yen doesn’t have one, and neither does pound sterling or the renminbi. What on earth were the originators of this Dollar Index thinking of when they decided that there should be something to value the dollar? And the antiquated dollar index is out of touch with what’s really going on in the world today, one has to wonder why it’s even still quoted, charted, and talked about. But it is. UGH! And here I am talking about it! What a dolt I am some days! There’s really nothing else to talk about with regards to the currencies and metals this morning, they are all (sans pound sterling) getting whacked by a resurgent dollar that now appears to be getting pushed upward due to thoughts of a June rare hike. Nothing more to see here, move along. For What It’s Worth. Well, I don’t know what kind of value this FWIW will be today, but I thought when I read the title on the screen that I just had to read more. And the title is “The Commodity That No One Knows About But Everybody Wants To Buy.” That would pique your imagination too, right? OK, well it can be found on Bloomberg, here, and here’s your snippet:

Chuck again. Pretty interesting if you ask me! I’ve been around commodities going back to my days as the assistant Operations Manager at a commodities and securities brokerage in Des Moines Iowa, called R.G. Dickinson. And I had never heard of this commodity. So, see you can teach an old dog a new trick! That’s it for today. I hope you have a tub thumpin’ Thursday and be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post FOMC Meeting Minutes Surprise The Markets appeared first on Daily Reckoning. |

| Trump Calls Missing EgyptAir Flight : Terrorism Posted: 19 May 2016 07:27 AM PDT Trump reacts to missing EgyptAir flight? MSM '60 Minutes' Correspondent Lesley Stahl on Donald Trump's tweet about the missing EgyptAir flight and the 2016 presidential race. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold - Pro-Inflation? Anti-USD? Posted: 19 May 2016 06:51 AM PDT This is the opening segment from the May 15 edition of Notes From the Rabbit Hole, NFTRH 395. I am releasing it for public viewing because it seems, the title’s question has come roaring to the forefront this week. So the information (including the charts) is slightly dated, but becoming intensely relevant as of now. We anticipated an ‘inflation trade’ or Anti-USD asset market bounce and this has been going on since mid-February. That was when silver wrestled leadership from the first mover, gold (which bottomed in December and turned up in January), and a whole host of other global asset markets began to rise persistently. |

| Two Overlooked Streaming Stocks with Huge Upside Potential Posted: 19 May 2016 01:00 AM PDT Streaming/royalty stocks have been darlings of the commodity investment world. In the precious metals sector, this type of company provides financing for mining companies in the form of an upfront cash payment in exchange for a percentage of production or revenues from the mine. Jason Hamlin of Gold Stock Bull profiles two streamers often overlooked by investors. |

| Major Cycle Low Upcoming in Gold Posted: 18 May 2016 05:00 PM PDT |

| Gold Short term decision arriving for direction into June Posted: 18 May 2016 07:22 AM PDT Commodity Trader |

| Breaking News And Best Of The Web — May 20 Posted: 17 May 2016 06:34 PM PDT Glboal stocks falling on Fed fears, S&P now down for the year. Gold and silver get their long-awaited correction. Saudi Arabia starts acting like Chicago. Brexit, The Movie, crushes the European project and a former European spymaster wonders if the EU has “run its course”. China's debt bomb debated and visualized. The negative feedback loop […] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

"It doesn't mean the market is going to crash tomorrow."

"It doesn't mean the market is going to crash tomorrow." World-wide, markets are horribly distorted, which spells danger not only to investors, but to businesses and their employees as well, because it is impossible to allocate capital efficiently in this financial environment.

World-wide, markets are horribly distorted, which spells danger not only to investors, but to businesses and their employees as well, because it is impossible to allocate capital efficiently in this financial environment. Very few precious metals investors realize how recent trend changes will greatly impact the gold market going forward. The reason many investors fail to grasp the huge change in the gold market is that they look at data or information on an individual basis. To really understand what is going on, we must look at how all segments of the market compare to each other… a BIRD'S EYE VIEW.

Very few precious metals investors realize how recent trend changes will greatly impact the gold market going forward. The reason many investors fail to grasp the huge change in the gold market is that they look at data or information on an individual basis. To really understand what is going on, we must look at how all segments of the market compare to each other… a BIRD'S EYE VIEW.

No comments:

Post a Comment