Gold World News Flash |

- Goldcorp Is Back and Spending: Could West Red Lake Gold Mines Be Next?

- Gold & Silver Demand Skyrockets as “Chinese Floor†Ensures Upward Price Moves

- Propaganda club: IMF Christine Lagarde Talks Brexit

- Gold Price Closed at $1271.90 and Silver Price Closed at $17.50

- Welcome to the Recovery – Poultry Workers Claim They’re Denied Bathroom Breaks and Wear Diapers on the Job

- Canaccord Founder Sells $31 Million Vancouver Mansion To Chinese Student

- The Elite Are Crapping Their Pants In Fear Of 28 Pages

- MARTIAL LAW Run to The Hills

- Friday 13th, Your Big Awakening

- The Real Oil Limits Story - What Other Researchers Missed

- FRIDAY 13th 2016: Warning! GOV is classifying elected citizens for MARTIAL LAW and FEMA Camps (NEWS)

- Gold’s Paradigm Shift

- Gold: The Ultimate Insurance

- How Gold Gets to $10,000/Oz.

- AMERICA’S FUKUSHIMA: IS THIS THE 4th RECENT NUCLEAR DISASTER to STRIKE U.S.?

- SIGNS OF THE END PART 169 - LATEST EVENTS MAY 2016

- David Wilcock : The plan to TAKE DOWN the #ILLUMINATI

- The Refugee Crisis was Created By Our #NWO Government

- In The News Today

- John McAfee - Presidential Candidate

- There's a world war against gold, economist Fekete says

- Another Dollar Rally

- MSM admits U.S. headed toward Recession

- Why Is This Multibillionaire Betting on a Market Collapse?

- Jason A Warning - Something Scary is Going On Worldwide 2016-2017

- Gold Miners’ Q1’16 Fundamentals

- Gold, Silver and the Stock Market

- Stock Market Challenging the 50-day Moving Average

- Gold Lease Rates and Gold Prices

- Gold Stocks Correction or Final Push Higher?

- FTSE 100 slides as oil rally fades on dollar strength

- Goldcorp Is Back and Spending: Could West Red Lake Gold Mines Be Next?

- Breaking News And Best Of The Web — May 14

| Goldcorp Is Back and Spending: Could West Red Lake Gold Mines Be Next? Posted: 13 May 2016 11:24 PM PDT Goldcorp is fresh off an announced transaction of $520M for Kaminak Gold, which is a big win for the industry. The company has been quietly putting dollars in juniors, like $16M in Gold Standard Ventures, and there could be more to come. In this article, Resource Maven Gwen Preston discusses possible target West Red Lake Gold Mines and how this company is shaping up to take advantage of the initial turnaround in the market. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Demand Skyrockets as “Chinese Floor†Ensures Upward Price Moves Posted: 13 May 2016 11:20 PM PDT Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. There’s been some big news out of China lately, and today we’ll dive deeper into the discussion when I welcome in Gordon Chang. Mr. Chang is one of the foremost experts on the Chinese economy and has written a book titled The Coming Collapse of China. He’ll tell us why he believes an epic collapse is imminent and what it all means for the Western financial world and why he believes there is what he calls a Chinese floor on the gold price. Don’t miss an incredibly enlightening interview with Gordon Chang, coming up after this week’s market update. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Propaganda club: IMF Christine Lagarde Talks Brexit Posted: 13 May 2016 08:30 PM PDT from Silver The Antidote: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1271.90 and Silver Price Closed at $17.50 Posted: 13 May 2016 07:47 PM PDT

'Twas a grueling week for stocks and a grind for precious metals. US dollar index broke out of its downtrend. Now, can it make good on the promise? Stocks will see a big break soon. Woeful weeping draweth nigh. Stocks barely got their nose above water this morning, then began to sink, sink, sink. After one little bobble up for air around 11:30, they sank the rest of the day. Dow tacked a 185.18 point (1.05%) loss today onto a 217.23 point loss Wednesday, & closed down the third week running at 17,535.32. S&P500 ditto, down 17.5 (0.85%) at 2,046.61. Behold the charts, & tell me what y'all see: http://schrts.co/Q6KUW0 and http://schrts.co/vtdPMb Right, a head and shoulders pattern. Look at the S&P500, and you'll see that like the Dow, it fell through its 50 day moving average today & is knocking on the neckline. Only about 34 points lower stands the 200 DMA. The fall will accelerate once it cracks that 200. Also, the MACD shows momentum has turned down, as does the RSI. Lo, I know not when, but soon, soon stocks will tumble sharply. Stoking my expectation stocks will fall, the Dow in Gold & Dow in Silver have resumed their downtrend, having corrected upward from February to mid-April. Charts are at http://schrts.co/8Sv0tc and http://schrts.co/ohwLZP Yea, the US dollar index finally broke out of that downtrend that hath reigned & ruled since March. It cracked the upper boundary line and almost touched the 50 DMA (94.87), rising 47 basis points (0.49%) to 94.59. I have the same interest in watching the dollar, the yen, and the euro that you would have watching three scrofulous, ragged, louse-infested beggars on crutches run a race down a garbage-strewn alley. That gives you a better picture of the essential nature of what you're watching. But my loathing leads me astray in digression. Back to the point, the scurvy dollar, destroyer of economies, looter of the globe, vampire slave of the banks, did prove by that breakout that it turned up at the 3 May low. However, its lethargy, sloth, & laziness thusfar do not conjure notions of a brave advance in my mind. More like a lurk, or slink. Mercy, I hate central banks worse than a mongoose hates a cobra or a mockingbird hates a tomcat, and for the same reasons: they are destroyers, and evil. Yen unaccountably rose 0.40% today to 92.05. Euro accountably fell 0.58% to $1.1308. Gold floated up $1.60 to $1,271.90 on Comex in lackluster trading from $1,264 to $1,277.70. Silver added a tee-tiny, wee 2.8¢ for a 1711.5¢ close. Gold/silver ratio dipped to 74.315. Best thing I can say for silver & gold today is that they held and rose in the teeth of a rising dollar. True, 'twas no astounding performance, but positive. Go look at silver's chart: http://schrts.co/EavWIe Lo, this is a mighty chart. It broke out of a bowl in February, traded sideways for what appears to be the handle of a cup & handle pattern, then broke out of that for another run to the highest price since January 2015. But this chart is also weary, ready to sit down & rest & blow a minute. Now look at gold, http://schrts.co/Q87QYo Also a mighty strong chart, slung up out of that bowl like a shot, then staying up there. But that trading channel points up, which loudly whispers a correction is coming. Note these chars prove that the December bottoms ended the post 2011 correction. I don't doubt that, or that a 5-8 year upmove has begun. What eats at my immediate expectation? Those Commitment of Traders reports for both metals. Large Speculator positions are larger than they have been for, oh, 16 years. Thus both are severely overbought. Yes, I know overbought can get overboughter, but at some point a correction must work off that large spec position. It's hot money with no loyalty. What if I'm worrying about nothing? What if silver & gold have puffed out those speculator positions because of something the market sees, but we can't see individually? Well, you'll know because Gold will break out through $1,308 & silver through 1805¢. Won't be any question. Durned if a customer didn't ask me again today did I think he ought to buy now or wait. I tremble at that question, because on any given day there's a 50% chance he's right, and a 50% chance I'm right, so I have no business substituting my judgment for his. Besides, that, sure as I say, "I think it may correct" he'll not buy and forget to come back to it, and miss a gigantic bull market. My calling, my mission in life is to persuade people to buy silver & gold. It's the only way out of the central bank trap. Listen, folks, what I do here from day to day is entertainment, guessing at what the market will do the next day, but it's all short term focused. Truth is, the difference between your buying $17 silver and $16 silver won't look as big as a gnat's toenail a year or two years from now. Y'all are not trading in & out every day, you're investing for a 5-8 year move. If that doesn't promise to be big enough to make that $1 difference between $16 & $17 laughable, there's no point buying it. Yesterday Susan & I got to Chattanooga in time to eat at our favourite restaurant in the world, The Boathouse, last night. I went to the foot surgeon today for my one week post-op bandage change, and other than having what looks like Frankenstein toe with all the stitches, I am healing very well. Thank you all for your prayers. Driving back I've been thinking about y'all all day, and the two most important things I could possibly impart to you. First, EAT CLEAN. Stop eating poisoned, processed, sugar-crammed food and start eating fresh, locally-grown, nutrient dense food. Find local farmers to buy meat and eggs & vegetables from, no herbicides, no pesticides, no hormones, grass-fed meat. Look your farmer in the eye & know who is raising your food. Shop local farmer's markets. You'll get sticker shock at the prices, but after you've eaten just one pasture raised chicken, you'll pay it every time -- the taste is that good, & your body is longing for those nutrients, 7 your family's health is worth the price. If you have no clue what I'm talking about, start at the Weston A. Price Foundation website, westonaprice.org. Second, GET OUT OF DEBT. You are not free as long as you're in debt. Write down all your debts and start a DEBT CASCADE. Pay the minimum on every bill but the smallest, & pay the most extra you can on that until it's paid off. Then attack the next largest, & the next, & suddenly you'll be able to see your mortgage paid off. Never work for you? Try this. Write down everything you and your spouse spend for one month, every penny. Add it up in categories at month's end, then make an envelope budget. On each envelope write the category and amount. Cash your paychecks & divide the money among the envelopes. When the envelope is cleaned out, you can't spend any more that month on that category. The envelope budget will straighten out your finances and get you on the road to debt freedom in two measly months. If you're in debt, you ain't free. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 06:40 PM PDT from Liberty Blitzkrieg:

– From the 2013 post: The Stock Market: Food Stamps for the 1% Eh, so what? It's good for stocks. Bloomberg reports:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canaccord Founder Sells $31 Million Vancouver Mansion To Chinese Student Posted: 13 May 2016 05:57 PM PDT Everybody loves a good Vancouver real estate horror story. Here is a great one. In the endless series of reports about wealthy Chinese oligarchs, billionaires, money launderers, or mere criminals, never have we encountered anything quite like this yet, because according to The Province, the majority owner of this Point Grey mansion located at 4833 Belmont Avenue and which was recently ranked 16th among the most expensive homes in Vancouver, was sold earlier this year by Canaccord founder Peter Brown for a record $31.1 million is a "student," property records show. A Chinese "student"... of course.

Land title documents list Tian Yu Zhou as having a 99-per-cent interest in the five-bedroom, eight-bathroom, 14,600 square-foot mansion on a 1.7-acre lot at 4833 Belmont Ave. Zhou's occupation is listed as a "student." The other owner of the property, which boasts sweeping views of the North Shore mountains and Vancouver, is listed as Cuie Feng, a "businesswoman." Feng has a one-per-cent interest in the property, which was assessed this year as having a total value of about $25.6 million, records show. Efforts to reach Zhou and Feng through the lawyer listed on the land title documents were not successful, and realtor Cherry Xu, who reportedly served as the buyer's agent, did not want to comment on the sale, citing privacy considerations. As the Province amusingly puts it, NDP housing critic David Eby said the fact that a student was able to buy one of the most expensive homes in the city contradicts the government's messaging that "everything is under control in the Vancouver real estate market." Eby said it also links to a theme uncovered in a 2015 study by Andy Yan, an adjunct professor at the University of B.C., which found homemakers and, to a lesser extent, students, are often the listed occupations of the owners of many newly purchased multi-million dollar Vancouver properties. "It's incredibly strange that a student would be able to afford such a luxurious and multi-million-dollar property," said Eby. "This is part of a trend of homemakers and students mass-buying property. I don't know how that can be possible with the income of homemakers and students typically have, which is close to zero." We can only hope he was being serious: that would make his statement all the more fun. Mortgage documents attached to the land title papers show that a mortgage of $9.9 million was taken out by Zhou and Feng from the Canadian Imperial Bank of Commerce on April 28. The bi-weekly payments are listed as $17,079.41. Now this may be a first: traditionally Chinese kleptocrats pay all cash - what is the point of taking out a mortgage when the whole purpose of buying ridiculously overpriced real estate is to park hot or stolen cash. We will have to mull this one over. Where The Province article gets interesting is where Eby suggests that the government's messaging and slow response to the housing crisis in Metro Vancouver could be because party donors, like Brown, are directly benefiting from the red-hot market. According to financial records, Brown has donated $62,500 to the B.C. Liberal Party in the past two years, and Eby further noted that Brown is a longtime Liberal fundraiser. "I think we shouldn't underestimate the connection between the government saying there is no issue with the real estate market in Vancouver at the same time one of their major fundraisers is selling his home to a student for $31 million and significantly over the assessed value," said Eby. "The government's donors are directly profiting from this crazy real estate market while a lot of hard-working families are suffering." While the government has been cautious in its approach to tackling the housing issue in Metro Vancouver, saying more data needs to be compiled, some action has been taken. "I always think more information is better in helping us understand that nature of what's happening out there, rather than less," Premier Christy Clark said Wednesday. "Let's find out how many homes are being purchased in the market by people who aren't residents of Canada, whoever they may be in the world. I think that information will help us come up with the right solutions." Earlier this week, the government introduced regulations to clamp down on unethical real estate practices, including the legal use of assignment clauses to crank up the final sale price of a property, a practice known as shadow flipping. The government also said it will introduce amendments to the property transfer tax forms that will require, as of June 10, buyers of B.C. real estate to include their principal address and whether they are Canadian citizens or permanent residents. We are confident absolutely nothing will change and as more Chinese are desperate to park their cash in Canada, soon stories such as this one will become an (even more) everyday occurence. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Elite Are Crapping Their Pants In Fear Of 28 Pages Posted: 13 May 2016 05:33 PM PDT Alex Jones talks with 9/11 investigator Les Jamieson about why the elites fear the release of the 28 pages. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 05:00 PM PDT Friday 13th 2016 Terrifying ANONYMOUS msg to Obama and Illuminatis - MARTIAL LAW Run to the hills The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Friday 13th, Your Big Awakening Posted: 13 May 2016 04:30 PM PDT Friday 13th, Your Big Awakening by Tania Gabrielle May 13, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Real Oil Limits Story - What Other Researchers Missed Posted: 13 May 2016 04:30 PM PDT Submitted by Gail Tverberg via Our Finite World blog, For a long time, a common assumption has been that the world will eventually “run out” of oil and other non-renewable resources. Instead, we seem to be running into surpluses and low prices. What is going on that was missed by M. King Hubbert, Harold Hotelling, and by the popular understanding of supply and demand? The underlying assumption in these models is that scarcity would appear before the final cutoff of consumption. Hubbert looked at the situation from a geologist’s point of view in the 1950s to 1980s, without an understanding of the extent to which geological availability could change with higher price and improved technology. Harold Hotelling’s work came out of the conservationist movement of 1890 to 1920, which was concerned about running out of non-renewable resources. Those using supply and demand models have equivalent concerns–too little fossil fuel supply relative to demand, especially when environmental considerations are included. Virtually no one realizes that the economy is a self-organized networked system. There are many interconnections within the system. The real situation is that as prices rise, supply tends to rise as well, because new sources of production become available at the higher price. At the same time, demand tends to fall for a variety of reasons:

The potential mismatch between amount of supply and demand is exacerbated by the oversized role that debt plays in determining the level of commodity prices. Because the oil problem is one of diminishing returns, adding debt becomes less and less profitable over time. There is a potential for a sharp decrease in debt from a combination of defaults and planned debt reductions, leading to very much lower oil prices, and severe problems for oil producers. Financial institutions tend to be badly affected as well. If a person looks at only past history, the situation looks secure, but it really is not.  Figure 1. By Merzperson at English Wikipedia – Transferred from en.wikipedia to Commons, Public Domain, https://commons.wikimedia.org/w/index.php?curid=2570936 Substitutes aren’t really helpful; they tend to be high-priced and dependent on the use of fossil fuels, including oil. They cannot possibly operate on their own. They add to the “oversupply at high prices” problem, but don’t really fix the need for low-priced supply.

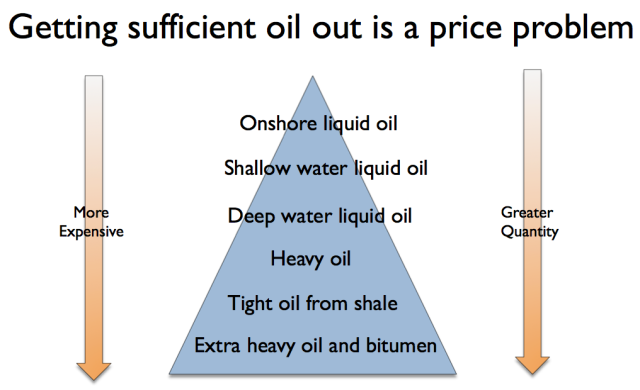

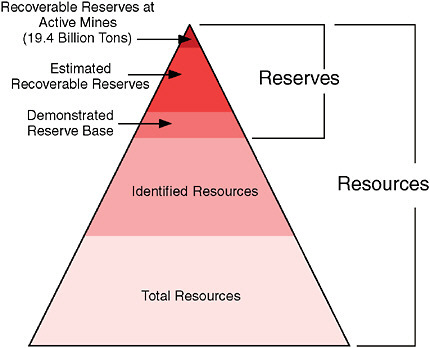

Why supply tends to rise as prices riseFor any non-renewable commodity, there are a wide variety of resources that will “sort of” work as substitutes, if the price is high enough. If the price can be raised to a very high level, the funds available will encourage the development of more advanced (and expensive) technology. If it is possible to raise the price to a very high level, it is likely that a very large quantity of oil will be available. Figure 1 shows some of the types of oil available: I got my idea for Figure 2 from a natural gas resource triangle by Stephen Holditch.

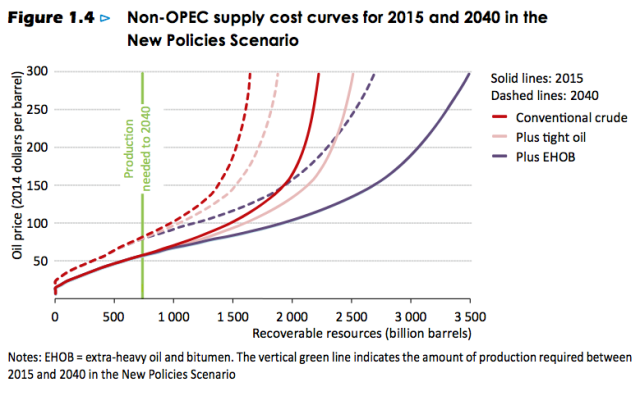

A similar resource triangle is available for coal (from National Academies Press; Coal Resource, Reserve, and Quality Assessments): Because of the availability of an increasing amount of resources, we are likely to get more oil, natural gas, and coal, if prices rise. We associate high prices with scarcity; instead, high prices tend to make a larger quantity of energy product available. The International Energy Agency (IEA) has a different way of illustrating the likelihood of huge future oil supply, if prices can only rise high enough. The implication of this chart is that the IEA believes that oil prices can rise to $300 per barrel, giving the world plenty of oil to extract for many years ahead. Can consumers really afford very high-priced energy products?In my view, the answer is “No!” If oil is high priced, then the many things made with oil will tend to be high priced as well. Wages don’t rise with oil prices; most of us remember this from the oil price run-up of 2003 to 2008. Because of this affordability issue, the limit to oil production is really an invisible price limit, represented as a dotted line. We can’t know in advance where this is, so it is easy to assume that it doesn’t exist. The higher cost of extraction is equivalent to diminishing returns.As we are forced to seek out ever more expensive to extract resources, the economy is in some sense becoming less and less efficient. We are devoting more of our human labor and other resources to extracting fossil fuels, and to extracting minerals from ever-lower-quality ores. In some sense, we could just as well be putting these resources into a pit and burying them–they no longer help us grow the rest of the economy. Using resources in this way leaves fewer resources to “grow” the rest of the economy. As a result, we should expect economic contraction when the cost of oil extraction rises. In fact, economic contraction seems to happen when oil prices rise, at least for oil importing countries. Economist James Hamilton has shown that 10 out of 11 post-World War II recessions were associated with oil price spikes. A 2004 IEA report says, “. . . a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. Inflation would rise by half a percentage point and unemployment would also increase.” Energy products play a critical role in the economy.Economic activity is based on many kinds of physical changes. For example:

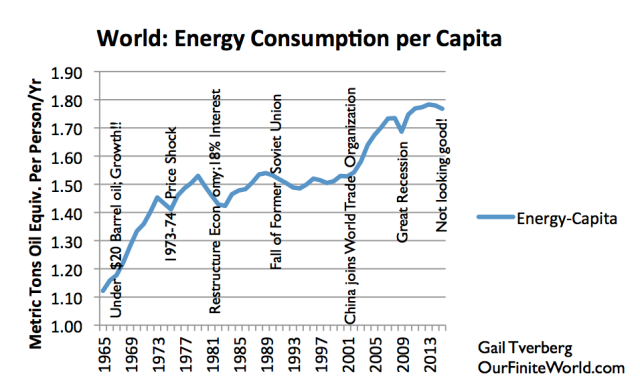

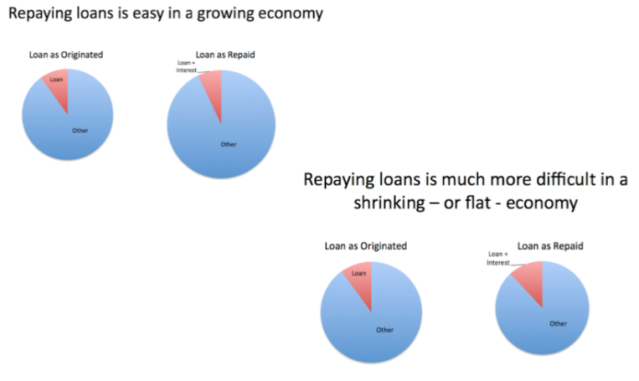

A human being, by himself, exerts only about 100 watts of power. A human being is also quite limited in what he can do; he can provide a little heat, but no light, for example. Energy products are very helpful for making capital goods such as buildings, machines, roads, electricity transmission lines, cars and trucks. We can think of energy products, and capital goods made using energy products, as ways of leveraging human energy. If per capita energy consumption increases over time, leveraging of human labor can grow. As a result, humans can become ever more productive–think of new and better machines to help humans do their work. Dips in this leveraging tend to correspond to economic contraction (Figure 7).  Figure 7. World energy consumption per capita, based on BP Statistical Review of World Energy 2105 data. Year 2015 estimate and notes by G. Tverberg.

To have a growing economy, wages of non-elite workers need to be growing.Our economy is in a sense a “circular economy,” in which non-elite workers (less educated, non-managerial workers) play a pivotal role because they are both producers of goods and potential consumers of the output of the economy. Because there are so many non-elite workers, their demand for homes, cars, and electronic goods plays a critical role in maintaining the total demand of the economy. If the wages of these non-elite workers are growing, thanks to increased productivity, the economy as a whole can grow. If the wages of these workers are shrinking or are flat (in inflation-adjusted terms), the economy is in trouble. The recycling process cannot work very well. If there is not enough economic growth–often caused by not enough growth in energy consumption to leverage human labor–then we tend to get a growing imbalance between the sector on the left with businesses, governments, and elite workers, and the sector on the right, with non-elite workers. Part of this wage imbalance comes from sending jobs to low-wage countries. As jobs are shifted to low-wage countries, the workers of the world increasingly cannot afford the goods that they and other workers are producing. If the wages of non-elite workers are not rising sufficiently, rising debt can be used to hide this problem for a while. The way this is done is by allowing workers to buy goods at ever-lower interest rates, over ever-longer time periods. This strategy has an endpoint, which we seem to be close to reaching. Debt is a key factor in creating an economy that operates using energy.A generally overlooked problem of our current system is the fact that we do not receive the benefit of energy products until well after they are used. This is especially the case for energy used to make capital investments, such as buildings, roads, machines, and vehicles. Even education and health care represent energy investments that have benefits long after the investment is made. The reason debt (and close substitutes) are needed is because it is necessary to bring forward hoped-for future benefits of energy products to the current period if workers are to be paid. In addition, the use of debt makes it possible to pay for consumer products such as automobiles and houses over a period of years. It also allows factories and other capital goods to be financed over the period they provide their benefits. (See my post Debt: The Key Factor Connecting Energy and the Economy.) When debt is used to move forward hoped-for future benefits to the present, oil prices can be higher, as can be the prices of other commodities. In fact, the price of assets in general can be higher. With the higher price of oil, it is possible for businesses to use the hoped-for future benefits of oil to pay current workers. This system works, as long as the price set by this system doesn’t exceed the actual benefit to the economy of the added energy. The amount of benefits that oil products provide to the economy is determined by their physical characteristics–for example, how far oil can make a truck move. These benefits can increase a bit over time, with rising efficiency, but in general, physics sets an upper bound to this increase. Thus, the value of oil and other energy products cannot rise without limit. Using hoped-for benefits to set oil prices is likely to lead to oil prices that overshoot their maximum sustainable level, and then fall back. A debt-based system of setting oil prices is different from what most of us would have considered possible. If wages of non-elite workers had been growing fast enough (Figure 9), increasing debt would not even be needed, because the whole system could grow thanks to the increased buying power of the many non-elite workers. These workers could buy new houses and cars, have more meat in their diet, and travel on international vacations, adding to demand for oil and other energy products, thereby keeping prices up. As wages of non-elite workers fall behind, an increasing amount of debt is needed. For the US, the ratio of the increase in debt to the increase in GDP (including the rise in inflation) is as shown in Figure 10:  Figure 10. United States increase in debt over five-year period, divided by increase in GDP (with inflation!) in that five-year period. GDP from Bureau of Economic Analysis; debt is non-financial debt, from BIS compilation for all countries. Thus, the increase in debt has never been less than the corresponding increase in GDP over five-year periods, even when oil prices were low prior to 1970. In general, the pattern would suggest that the higher the oil price, the higher the increase in debt needs to be to generate one dollar of GDP. This is to be expected, if economic growth depends on Btus of energy, and higher prices lead to the need for more debt to cover the purchase of necessary Btus of energy. We are reaching a head-on collision between (1) the rising cost of energy production and (2) the falling ability of non-elite workers to pay for this high-priced energy.The head-on collision we are reaching is what causes the potential instability referred to at the beginning of this article, as illustrated in Figure 1. Of course, such a collision has the potential to cause debt defaults, as it becomes impossible to repay debt with interest.  Figure 11. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy. Turchin and Nefedov in the academic book Secular Cycles analyzed eight agricultural economies that eventually collapsed. The problem that these economies encountered was exactly the same one we are now encountering: falling wages of non-elite workers at the same time that the cost of producing energy products (food, at that time) was rising. Rising costs were often an end result of too many people for the arable land. A workaround could be found, such as building irrigation or adding a larger army to conquer a neighboring land, but it would add costs. As the problems of these economies progressed, debt defaults became more of a problem. Governments found it hard to collect enough taxes, because so many of the workers were increasingly impoverished. Often, workers became sufficiently weakened by an inadequate diet that they became vulnerable to epidemics. Governments often collapsed. In the economies analyzed by Turchin and Nefedov, food prices temporarily spiked, but it is not clear that this was the final outcome, given the inability of workers to pay the high prices. Debt defaults would tend to further reduce ability to pay. Thus, it would not be surprising if prices ended up low (from lack of demand), rather than high. We know that ancient Babylon is an example of one economy that collapsed. Revelation 18:11-13 seems to describe the situation after Babylon’s collapse as one of lack of demand.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FRIDAY 13th 2016: Warning! GOV is classifying elected citizens for MARTIAL LAW and FEMA Camps (NEWS) Posted: 13 May 2016 03:30 PM PDT The government know that if a rifle was put into the hands of a homeless person, he/she would fight against the system for a bowl of oatmeal.. no disrespect.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 01:30 PM PDT Gold Stock Bull | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 01:30 PM PDT This post Gold: The Ultimate Insurance appeared first on Daily Reckoning. In my ZIP code of Darien, Connecticut, it's not unusual to bump into a billionaire every now and then. When I ask what they own, they'll start to list stocks and bonds of various types. At that point in the conversation, I'll interrupt and say, "You don't own stocks; you own electrons." Most wealth today is in digital form recorded on hard drives and transferred through routers and servers in dispersed locations. What if those servers were hacked and your electronic wealth were erased? Where would you go to get it back? If you think this can't happen, guess again. SWIFT is a "secure" global messaging network used by banks and other financial institutions to send payment instructions. It's become a vital part of the global payments system, serving 11,000 banks. And it's been hacked, as has the "safest" bank in the world, the New York Federal Reserve. So the most secure financial message traffic system in the world and the safest bank in the world were both hacked, and $81 million disappeared into thin air. If it can happen to them, it can happen to you. The solution is to own physical gold. It's one asset that can't be hacked, erased or made to disappear. That's not to say you should call up your broker and tell him to sell all your stocks. Not at all. Stocks form an important part of a well-balanced portfolio. And I strongly recommend select gold stocks right now, as an example. But you should also have physical gold as insurance. Below, I show you why gold might be the best form of insurance you can buy. Your wealth is far more vulnerable than you think. How vulnerable? Read on… I recently returned from Switzerland where I met with the head of the world’s largest gold refinery. A refinery takes gold in one form, processes it and sells it in a different form, usually a more pure form. He told me he has a waiting list of customers. Those customers want to buy more gold than he can produce. He’s working at three shifts, twenty-four hours a day, to produce gold and he still has a waiting list for customers. His problem is he can’t find enough gold, whether it comes from miners or existing gold bars that aren’t quite the quality the buyers want. And my contact is a very senior veteran of the gold market who’s been in the business for 35 years. My talk with him showed that the physical shortage of gold is already showing up. China is certainly contributing to that shortage. China's holding $2 trillion of U.S. Treasurys and other debt. But the dollar has no greater friend — China wants a strong dollar. It wants a strong dollar because it's holding $2 trillion worth of securities, and it doesn't want them to lose value. But China doesn’t trust the United States, and it shouldn’t. It knows the United States historically has devalued the currency through inflation to get out from under the debt. So China is highly vulnerable to inflation because it owns so many U.S. dollar-denominated securities. Why doesn’t China simply dump them? The answer is that it can’t dump them. The U.S. Treasury market is not that deep. It’s not very liquid. China can’t dump that quantity of Treasury securities even in the market we have. And the President could actually stop them if they tried to do it. So the Chinese are stuck holding that paper. They want a strong dollar but fear that we’re going to inflate the dollar. And they’re probably right about that. And since they can’t dump the Treasurys, they're buying gold as a hedge. If the dollar is steady, the securities retain their value. The gold may not increase much. But if we inflate the dollar and it loses value, they’ll lose on the paper side. But they’ll make it up on the gold they own. The price of gold is going to soar. So they’re creating a hedge position. Again, they prefer a strong dollar. But with their gold purchases, they’re ready for a weak dollar. My advice to you as an investor is, if it’s good enough for China, it’s also good enough for you. If you want to understand gold, it’s fairly simple. If the dollar's going to get stronger, you might not want gold. But if the dollar's going to weaken, you definitely want gold. We’ve had a strong dollar since 2011. It’s been a drag on the U.S. economy, harmed exports and imported deflation from around the world. It’s defeating the Fed's efforts to create inflation. These are all the consequences of a strong dollar. We couldn’t have a strong dollar for much longer. And it looks like we're in for a weaker dollar… The trigger for a weaker dollar took place in late February in Shanghai, China. The global financial elites devised a plan to weaken the yuan without having China officially devalue its currency. Surprise devaluations by Beijing rocked global markets last August and this January. To avoid that outcome, it was decided the dollar had to be weakened. That lets China maintain its unofficial dollar peg, while also creating a cheaper yuan to boost its economy. Essentially, the world's monetary authorities decided the U.S. and China can devalue relative to Europe and Japan. This could play out over years. My outlook going forward is therefore for a weaker dollar, and that means a higher dollar price of gold. That’s one of the reasons gold has been performing so well this year. It’s the best performing asset class in 2016, and also the best performing asset class in the 21st century. Since 2000, gold has greatly outperformed every other asset you can think of, including major stock indexes and bonds. So in that sense, gold performs an important insurance function. It's comparable to fire insurance on a house. Nobody wants their house to burn down. But if it does burn down and you have fire insurance, having that fire insurance was invaluable. It’s the same with gold… If you have a 10% gold allocation, it's like owning fire insurance. If the stock market goes to new all-time highs, and gold goes nowhere, that 10% allocation won't hurt you. But if the markets collapse, which I do expect, and the price of gold skyrockets, that 10% allocation will increase by multiples. That profit will protect you against losses in the rest of your portfolio. So gold has that insurance function. And that can't be downplayed. There's another reason to own gold, which is actually fairly new. That's because there are new threats, especially cyber financial warfare. Vladimir Putin has a 6,000-member cyber brigade working day and night to hack, destroy, disrupt, and delete digital systems, whether it be banks, exchanges, payment systems, etc. In 2010, the FBI and Department of Homeland Security located an attack virus planted by Russian security services inside the Nasdaq stock market system. There have been several unexplained stock market outages and flash crashes in recent years. Some of these events may have been self-inflicted damage by the exchanges themselves in the course of software upgrades. But others are highly suspicious and the exact causes have never been disclosed by exchange officials. During one financial war game exercise I took part in at the Pentagon, I recommended that the SEC and New York Stock Exchange buy a warehouse in New York and equip it with copper wire hardline phones, hand-held battery powered calculators and other pre-Internet equipment. This facility would serve as a nondigital stock exchange with trading posts. The SEC would assign 30 major stocks each to the 20 largest broker-dealers, who would be designated specialists in those stocks. This would provide market making on the 600 largest stocks, covering over 90% of all trading on a typical day. Orders would be phoned in on the hardwire analogue phone system and put up for bids and offers by the specialists to a crowd of live brokers. This is exactly how stocks were traded until recently. Computerized and algorithmic trading would be banned as nonessential. Only real investor interest would be represented in this nondigital venue. In the event of a shutdown of the New York Stock Exchange by digital attack, the nondigital exchange would be activated. The U.S. would let China and Russia know this facility existed as a deterrent to a digital attack in the first place. If our rivals knew we had a robust nondigital Plan B, they might not bother to conduct a digital attack in the first place. Bottom line: you may think you have wealth because you own stocks and bonds. But you really don’t. What you have are electrons. Your so-called wealth is actually digital wealth. And if those stock exchanges and account records are wiped out you have nothing. And I wish you luck trying to reestablish it. Much of your wealth, including money in the bank, is in digital form and the Russians — or any decent hacker — are perfectly capable of wiping that out. One of the things I like about gold is that it’s physical. It’s tangible, so it can’t be hacked, erased or deleted. So if your digital wealth is no different than an email, and Putin hits the delete button, your email is going to disappear. Your wealth is going to disappear. Most people don't think it can happen to them. But recently, the country of Bangladesh, one of the poorest countries in the world, lost $100 million. $100 million simply disappeared. But it wasn’t in a no-name bank in Bangladesh. That money was on deposit at the Federal Reserve Bank in New York. The Federal Reserve Bank in New York is arguably the safest bank in the world. It’s the main regional office of the central bank of the United States. Here is one of the poorest countries in the world, with $100 million on deposit at the central bank of the United States called the Federal Reserve, and the money disappears. If they had had that money in gold, they'd still have it. And this type of incident is happening with increasing regularity. So you can't assume your digital wealth is secure. Let me repeat what I said earlier: I'm not recommending you sell all your stocks. Stocks are part of a well-diversified portfolio. And I think certain gold stocks are offering you once-in-a-decade returns right now. But having 10% of your portfolio in physical gold is the best form of insurance. Regards, Jim Rickards P.S. Gold is the top performing asset class so far this year. And it will only soar higher as market instability and central bank recklessness drive gold higher. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. It shows you how to preserve your wealth as the dollar loses value. We'll send you the report when you sign up for the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. Click here now to sign up for FREE and claim your special report. The post Gold: The Ultimate Insurance appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 01:14 PM PDT This post How Gold Gets to $10,000/Oz. appeared first on Daily Reckoning. Is gold a commodity, an investment, or money? The answer is… Gold is a chameleon. It changes in response to the environment. At times, gold behaves like a commodity. The gold price tracks the ups and downs of commodity indices. At other times, gold is viewed as a safe haven investment. It competes with stocks and bonds for investor attention. And on occasion, gold assumes its role as the most stable long-term form of money the world has ever known. A real chameleon changes color based on the background on which it rests. When sitting on a dark green leaf, the chameleon appears dark green to hide from predators. When the chameleon hops from the leaf to a tree trunk, it will change from green to brown to maintain its defenses. Gold also changes its nature depending on the background. Golden ChameleonRight now, gold is behaving more like money than a commodity or investment. It is competing with central bank fiat money for asset allocations by global investors. That's a big deal because it shows that citizens around the world are starting to lose confidence in other forms of money, such as dollars, yuan, yen, euros, and sterling. This is great news for those with price exposure to gold. The price of gold in many currencies is going up as confidence in those other currencies goes down. Confidence in currencies is dropping because investors are losing confidence in the central banks that print them. For the first time since 2008, it looks like central banks are losing control of the global financial system. Gold does not have a central bank. Gold always inspires confidence because it is scarce, tested by time, and has no credit risk. Gold's role as money is difficult for investors to grasp. One criticism of gold is that is has no yield. Gold has no yield because money has no yield. In order to get yield, you have to take risk. Bank deposits, and so-called money market funds, have yield, but they are not money. A bank deposit is subject to default by the bank, as we saw recently in Greece and Cyprus. A money market fund is subject to collapse of the fund itself, as we saw in 2008. Gold does not have these risks. Lost confidence in fiat money starts slowly then builds rapidly to a crescendo. The end result is panic buying of gold and a price super spike. We saw this behavior in the late 1970s. Gold moved from $35 per ounce in August 1971 to $800 per ounce in January 1980. That's a 2,200% gain in less than nine years. A "Super Spike" in GoldWe may be looking at the early stages of a similar super spike that could take gold to $10,000 per ounce or higher. When that happens, there will be one important difference between the new super spike and what happened in 1980. Back then, you could buy gold at $100, $200, or $500 per ounce and enjoy the ride. In the new super spike, you may not be able to get any gold at all. You'll be watching the price go up on TV but unable to buy any for yourself. Gold will be in such short supply that only the central banks, giant hedge funds, and billionaires will be able to get their hands on any. The mint and your local dealer will be sold out. That physical scarcity will make the price super spike even more extreme than in 1980. The time to buy gold is now, before the price spikes and before supplies dry up. What signs do we see that gold is now behaving like money? For one thing, gold price action has diverged from the price action of other commodities. This divergence first appeared in late 2014 but has become more pronounced in recent months. Gold observers know that gold measured in dollars is down significantly from its all-time high in 2011. COMEX gold peaked at $1,876 per ounce on Sept. 2, 2011. And recently traded as low as $1,056 per ounce on Nov. 27, 2015. That's a 44% decline in just over four years. Yet in the same time period, broad-based commodities indices fell even more. One major commodities index fell 53%. The contrast between the behavior of gold and commodities is even more extreme when we narrow the time period. From June 20, 2014 to Jan. 15, 2016, the broad-based commodity index fell 63%, while gold fell only 17%. The recent collapse in commodity prices was almost four times greater than the decline in gold prices. From mid-January to mid-February 2016, gold rallied 14% while commodities still languished near five-year lows.   The Monetary System Is Going WobblyRight now, investors around the world are losing confidence in Chinese yuan, Saudi rials, South African rand, Russian rubles, and a long list of other emerging market currencies. Investor preferences are shifting toward gold. This accounts for gold's outperformance of the rest of the commodity complex when measured in dollars. What is interesting is that when the price of gold is measured not in dollars but in rubles, yuan, or rials, the percentage price increase in gold increases as currencies decline against the dollar. When you understand that gold is money and competes with other forms of money in a jumble of cross rates with no anchor, you'll know why the monetary system is going wobbly. It's important to take off your dollar blinders to see that the dollar is just one form of money. And not necessarily the best for all investors in all circumstances. Gold is a strong competitor in the horse race among various forms of money. Normally, I recommend a 10% allocation of investible assets to physical gold for your permanent portfolio. But when short-term trading opportunities arise, certain gold trades, such as exchange traded funds (ETFs), are a great way to get dollar price exposure to gold and book 100% or more profits. This chameleon has changed color recently. And the new color is gold. Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post How Gold Gets to $10,000/Oz. appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AMERICA’S FUKUSHIMA: IS THIS THE 4th RECENT NUCLEAR DISASTER to STRIKE U.S.? Posted: 13 May 2016 01:04 PM PDT I heard rumors about leakage as early as 2008 from the large storage vats The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 169 - LATEST EVENTS MAY 2016 Posted: 13 May 2016 12:30 PM PDT People need to wake up. Judgement is coming. Government works under Satanism the church age is over America is demonized government is demonized The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Wilcock : The plan to TAKE DOWN the #ILLUMINATI Posted: 13 May 2016 12:00 PM PDT David Wilcock is an American New Age author. Wilcock is originally from Rotterdam, New York, and currently resides in Los Angeles, California. Two of his books have appeared on The New York Times Best Seller list. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Refugee Crisis was Created By Our #NWO Government Posted: 13 May 2016 11:30 AM PDT The lunatics who run and control Governments and intelligence agencies are sitting on a Throne, Those who are dripping in gold and diamonds want War and invasion of other lands with the intent to rape that land of Oil and natural resources, this is the principal practice of the hired mercenary... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 10:10 AM PDT Every drop of blood spilled to save this worthless currency will haunt every father and grandfather for generations to come.–Nivek Bill Holter's Commentary From the “gold bulls” at Kitco …have not retail stocks been hammered one by one all week long as they reported horrible earnings and even worse guidance? This is “Alice in... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John McAfee - Presidential Candidate Posted: 13 May 2016 10:00 AM PDT John McAfee shares the concerns that have driven him to become a Libertarian Party presidential candidate. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| There's a world war against gold, economist Fekete says Posted: 13 May 2016 09:37 AM PDT 12:36p ET Friday, May 13, 2016 Dear Friend of GATA and Gold: Interviewed by Mexican financial journalist Guillermo Barba, the economist and gold standard advocate Antal Fekete explains how negative interest rates constitute the destruction of both financial and physical capital. Fekete also argues that central banks are waging a longstanding world war against gold. He adds that he has developed a mechanism of profiting from investing in gold by buying and selling calls and puts depending on central bank policy. The interview is headlined "There Is a Global War Against Gold" and it's posted at Barba's Internet site here: http://www.guillermobarba.com/mleikengroupbrands-net/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2016 09:31 AM PDT This post Another Dollar Rally appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a happy Friday to one and all! The dollar is back at the front of the class today again, which is putting the cart before the horse if you ask me, because the dollar is getting bought on the thought that U.S. Retail Sales, for April will be a blowout number, and put the rate hike back on the June Fed meeting’s agenda. A leap of faith is what I call this – when the markets get ahead of themselves and begin to think they know what’s going to happen, and trade accordingly. Shoot Rudy, April Retail Sales might be a blowout as they are anticipating, and then again it might not. So the risk in the markets today is the Retail Sales print. And why would the markets think that this “one report” on Retail Sales that isn’t negative like most of the previous reports have been, either that or very disappointing, is going to be the key to a Fed rate hike in June? Because they are the markets. They may not always be rocket scientists, but it sure doesn’t pay to take the other side of their trade. It’s always better to stand on the sidelines and let the markets figure out their mistake on their own, and then trade with them as they reverse their call. Even the Brazilian real which had seen some very strong positive moves in recent weeks due to the pending impeachment, which is now a done deal, is feeling the dollar’s strength this morning. You don’t think that the Brazilian real traders woke up this morning and had a revelation that Rousseff is gone, but who’s going to take over? And are there any quick fixes to the Brazilian economy? The answer is NO! So all this unknown is hurting the real this morning, and I taught you many years ago, that Currency Traders don’t like “unknowns”. In Germany this morning, their Flash first QTR GDP report printed and showed a nice increase from the previous quarter, printing at 0.7% vs. 0.4% in the previous quarter. But the euro has lost the 1.14 figure again, dropping to 1.1350 this morning. And as I look over most of the currencies and metals this morning, the dollar has their attention. In New Zealand overnight, N.Z. first QTR retail sales printed, and should have been enough to underpin kiwi, through this U.S. dollar strength today, but that’s not so. UGH! First QTR retail sales for New Zealand printed better than expected at 1.0% vs. 0.8% consensus. Calmer heads will return to the markets folks. We just have to ignore this one-off day of dollar strength. And haven’t I told you we would see stuff like this, as an asset ends its time in a strong trend, like the dollar, it will have days where all the dollar bugs come out of the wallboards and parade around like they are 20 game winners, only to have to go back to where they came from in a day or two. Gold got whacked again yesterday, this time by $13. And this morning it’s down another $3 as I write. Cheaper levels equal cheaper levels to buy. That’s how I look at this, because to me, gold is ready to go on a long strong run. Think about this for a moment. We have multiple countries currently with negative rates. We have multiple countries with as easing bias, which means they are cutting rates, and economic growth is nascent around the world. And then you have Central Bankers shouting from the rooftops that they need to take large bills out of circulation in their respective countries (the ban on cash). Now, add in that fact that we’re not just talking what’s going on here in the U.S. folks. People/investors around the world buy gold, not just U.S. investors. Need I say more? The price of oil slipped back below $46 in the past 24 hours. The “high” from the supply numbers didn’t last too long for oil did it? And well, this slippage in price below $46 has been nasty on the petrol currencies, with the Russian ruble performing badly overnight, and all the other members of this club falling in behind the ruble. I would like to direct your attention to this next passage as I really get on my soapbox regarding debt. Here’ goes! Debt is everywhere folks. I’ve said this before, but I think there are times when things need to be said again and again, until everyone, and I mean everyone, including those knuckleheads that still believe that debt doesn’t matter realize the error in their thinking. And that is that too much debt is bad for an economy. An economy with too much debt will not be able to grow because the debt drains away vital resources from economic growth. But what do the mental giants in this country claim that we need to do? Issue more debt! Fighting debt with more debt has been a losing equation since the Great Recession (which never really ended in my opinion, but officially ended 7 years ago) and there’s nothing that would indicate that fighting debt with more debt would work in the future! Did you see where Consumer Credit (read: debt) exploded higher in March to $29.7 billion!? That’s a 10% annualized pace for debt increases. OMG! And it wasn’t the usual suspects of car loans or student debt that was responsible for this HUGE increase. Try Credit Card Debt rising at a 14% pace or $11.1 billion! Household debt rose at 6.4% in the first QTR, which is three times the pace at which hourly earnings grew. And I ask you this – how can that be sustainable? And it’s not just here in the U.S. that debt is growing. Worldwide debt is spiraling out of control folks. A recent McKinsey report showed global growth had increased by $57 trillion from 2007 to 2014. So, let me get this straight… 2007 and 2008, the financial meltdown occurred, and too much debt was deemed to be one of the problems, and how did the world go about correcting that? They added $57 trillion in new debt to the already deemed “too much debt” total in 2007! Wait, What? So, does this all come crashing down tomorrow, or the next day, next week, next month? I don’t think so. I think this is going to continue growing at unsustainable levels until it no longer does. That’s when we will have our Minsky Moment. I know, I know, that sounds vague, but in reality that’s how these things work. It goes on until it no longer goes on. One day, I’ll wake up, and get ready for work, I don’t check the news on the car radio on my drive into the office, because I don’t want to know anything yet. No distractions when driving! But when I get to the office and turn on the TV and screens and everything is chaos, and gold is soaring by hundreds of dollars a pop, and stock futures are sinking faster than a boat without a hull, and the news anchors are screaming, “Oh the humanity”. Then I’ll know that this accumulation of debt no longer goes on. So. How’d you like that? You did? Well, if you like that, you’ll like this next passage too. Today, we’ll get some “real economic” data, in Retail Sales. But there’s also “real life economic happenings”. That’s when something happens to you personally and the light goes on and you say, “I see now”. So, here goes… Want some “real life economic happenings”? Let’s look at these because they are “real like economic happenings”. First, close your eyes, and clear your mind. Now imagine if you will an Arizona desert, with a rail line/train tracks running through it. And on those train tracks you see not one, not two, but 292 Union Pacific Locomotives, just sitting there baking in the hot, hot sun. What would your thoughts quickly shift to? Well, mine shifted to the thought that apparently they aren’t being used. And if they aren’t being used, that means rail shipments aren’t being made. Well, I saw the picture of the 292 locomotives lined up on the train tracks in the Arizona desert. Saw it on Google Earth, so it’s visible from space! So, that got me thinking. What about these rail shipments? Well Rail Freight tonnage was down 11% in April vs. a year ago. Obviously, there must be another graveyard that contains the railroad cars that used to carry the freight somewhere, eh? And it’s not just Rail Freight. Shipping freight is also looking for shipments. Maersk Line, the world’s biggest container operator, Hyundai Merchant Marine, and Hanjin Shipping Co. are all having major problems, with the last two in talks with their bankers to restructure their debts, and Maersk announcing layoffs and collapsing freight rates. I couldn’t find anything on Plane shipments, but planes, trains and ships all seem to be in the same boat. No economic growth anywhere. The U.S. is supposed to be the economic engine of the world, and it’s failing miserably. The U.S. consumer, you know, you and me (and especially my wife HA!) is expected to save the economy. The problem is that because of the zero interest rates policy, consumers don’t have any money to spend, they spend it all on healthcare, insurance, food and shelter. And what they used to have as disposable income came from interest on their savings. Not any more. And while I’m at it, I’ll step into the batter’s box and take a swing at the low interest rates. They are killing the economy. Yes, low interest rates are good for stocks, I get that, everybody does. But they aren’t good for nothing else! Think about savers. They used to be able to retire with their nest egg and live off the interest, vowing to not touch the principal unless it was absolutely necessary. It’s not good for the Trusts and administrations in charge of Pensions. They used to be able to buy high yielding bonds to help them with their returns to make pension payments. And we now know how badly the Pension system is underfunded. And it’s not good for Insurance Companies. I’m wondering which one will be the first to announce bankruptcy because they can’t buy bonds that give them yield any longer. And the list goes on and on folks. The U.S. Data Cupboard today has the aforementioned Retail Sales for April today. In addition Consumer Sentiment for the first two weeks of May will print. And in the oil sector, there will be the Baker-Hughes rig count, which is has been trending down for months now. I received an email yesterday from the World Gold Council (WGC) which I had signed up for, but had not received anything, until yesterday. The WGC waited until they had news of a strong first QTR in gold demand to report, I guess. Anyway, there were several news outlets to pick up this story. But I got my info directly from the WGC, which you can go to find if you like by clicking here, or here’s the snippet:

Chuck again. This is the type of physical demand that we need to drive the short paper/price manipulators out of the metals markets. I got a kick out of something else I read on this, and that is an interview that Juan Carlos Artigas, director of investment research at the WGC had, where he was asked about this surge in demand, and he replied that he “wasn’t completely surprised”. Well, no duh! You wouldn’t be surprised as long as you were aware of negative rates, zero interest rates, and no global growth! And with that, I need to get off this bus today, and head to fantastico Friday corner. I hope I meet you there, and remember to be good to yourself! Regards, Chuck Butler P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoning website and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post Another Dollar Rally appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MSM admits U.S. headed toward Recession Posted: 13 May 2016 09:11 AM PDT Skybridge Capital founder Anthony Scaramucci says according to macro hedge fund manager John Burbank, there's a high chance of a U.S. recession within the next 6 to 12 months. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Is This Multibillionaire Betting on a Market Collapse? Posted: 13 May 2016 09:00 AM PDT This post Why Is This Multibillionaire Betting on a Market Collapse? appeared first on Daily Reckoning. Carl Icahn is a modern day E.F. Hutton. When he talks, people listen. More important, when he invests, people follow. That's because the legendary activist investor has amassed a personal fortune north of $25 billion. So why is his latest position making Wall Street banksters crap their pants? Well, a recent disclosure of Icahn's investments reveals he's placed a massive bet on a stock market collapse. Here's why this storied investor is so insanely bearish… Financial Reckoning DayJust recently, Icahn took to the airwaves of CNBC to declare that a "day of reckoning" was coming for the U.S. stock market. He said exceedingly low interest rates from the Fed have created a huge artificial asset price bubble that can't be justified by the underlying economy. He thinks it's about to burst. And he's put a whole lot of money where his mouth is… Zerohedge recently reported that Icahn’s investment vehicle, Icahn Enterprises LP (in which he has $4 billion personally invested), has an historic 150% net short position. This means his portfolio will see a big increase in value if the stock market craters. It's extraordinarily rare to see a fund outside a dedicated short fund with such a large bearish stance. Icahn reminds me of Michael Burry in the film "The Big Short," and we all know how he did in 2008. Look, just one year ago, Icahn was still 4% long the stock market when he first started expressing deep concern about valuations. But since then he's waged billions of his own money on a massive bet to short the market. That's stunning. But Icahn's not the only legendary investor who thinks a collapse is coming. Stanley Druckenmiller is one of the world's most successful hedge fund managers. He generated an incredible 30% average annual return for clients from 1986 to 2010. And just last week, Druckenmiller told attendees at the Sohn Investment Conference to "get out of the stock market" and own gold, which is his family office's largest currency allocation. So are these two investing wizards correct? Is the market headed for an epic fall? I have no idea. And neither does anyone else. There are no legitimate stock market fortune-tellers… only the illegitimate ones you see blathering on CNBC. But ask yourself a question… If the smartest moneymen in the world are betting big on a huge market decline, what's your best strategy right now? Is it smart to just be sitting in stocks right now… holding on and hoping for the best… trusting your mutual fund manager who has never beaten the market once? How did that work out during the last crash? And the one before that? Remember, a 50% decline in your portfolio requires a 100% return just to get to breakeven. During the dot-com bubble implosion, the Nasdaq dropped 77%. It could take years or even decades for you to recover from the next crash. Or you may never recover. So just being long stocks right now and holding on for dear life isn't a sound strategy for such an uncertain environment. There's a better option… If you just follow the trend, you'll be ready to profit, regardless if Icahn and Druckenmiller are right or wrong. And you'll sleep much better at night. My Conversation With Ben HuntDr. Ben Hunt knows the perils of "buy and hold" investing extremely well. I recently spoke with him on my podcast. He's the Chief Risk Officer at Salient Partners and the author of "Epsilon Theory," a unique take on markets and investing that's grounded in game theory, history and behavioral analysis. Ben brings a deep understanding of economics, politics, international relations, state power and human nature to his work. And what he's discovered is that following a "buy and hold" philosophy with knowledge of how central banks function and how the political class operates is nothing short of insane. Here's what you'll learn in today's podcast…

Click here to listen to my conversation with Ben Hunt. Please send me your comments to coveluncensored@agorafinancial.com. Let me know about your past experiences with "buy and hold" investing… and what you think of my talk with Ben Hunt. Regards, Michael Covel The post Why Is This Multibillionaire Betting on a Market Collapse? appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jason A Warning - Something Scary is Going On Worldwide 2016-2017 Posted: 13 May 2016 08:30 AM PDT Dont expect anything to get any better people, we are in the last days and Prophesy must be fullfilled, things are going to get a lot worse just as the Bible Predicted it would! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners’ Q1’16 Fundamentals Posted: 13 May 2016 08:24 AM PDT The gold miners’ stocks have skyrocketed this year as investors started returning to this long-abandoned sector. Many have doubled since January, with plenty tripling or even quadrupling. Naturally such fast gains raise concerns about whether they are actually fundamentally justified or merely the product of fleeting sentiment that could reverse. Gold miners’ latest quarterly results offer great fundamental insights. Companies trading on the US stock markets are required by the Securities and Exchange Commission to file quarterly earnings reports four times a year. For normal quarters that don’t end fiscal years, these 10-Q reports are due 45 calendar days after quarter-ends. They are a great boon to financial-market transparency and investors seeking to understand companies, yielding a treasure trove of information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver and the Stock Market Posted: 13 May 2016 05:15 AM PDT I could write a long, detailed post trying to encompass global stock markets (generally bearish), commodities (bounce very mature) and bonds (mixed views, depending upon the flavor) but that is what I get paid to do each weekend in NFTRH reports and in private posts at the site. The beauty of public posts is that I can write as much or as little as I feel like writing. Today I feel like writing a little about gold (and silver) and the stock market. I also feel like using daily charts because I think time frames are pinching in for upcoming pivotal moves. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Challenging the 50-day Moving Average Posted: 13 May 2016 05:02 AM PDT The SPX Premarket shows it challenging the 50-day Moving Average. How the market opens will tell us whether that support is broken. The odds of a break of the Cycle bottom and Head & shoulders neckline would be high once the 50-day is behind us. ZeroHedge reports, “Global stocks have started Friday the 13th on the wrong foot, with not only Hong Kong GDP unexpectedly tumbling by 0.4%, the worst print in years while retail sales fell for a thirteenth straight month in March, the longest stretch since 1999 as the Chinese hard landing spreads to the wealthy enclave, but also following a predicted collapse in Chinese new loan creation, which will reverberate not only in China but around the globe in the coming weeks. The latest overnight drop in the Yuan hinted that should the recent USD strength continue, China will have no choice but to repeat its devaluation from last summer and winter.“ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Lease Rates and Gold Prices Posted: 13 May 2016 03:58 AM PDT Are gold lease rates (GLR) really one of the major drivers of the price of gold, as is often cited? A lease rate is the market price for borrowing or lending the particular asset. Obviously, the gold lease rate is the cost of borrowing gold. In much the same way that individuals borrow dollars, pay interest, and then return dollars to the lender, gold bullion participants borrow gold, pay a borrowing cost, and return the gold to the lender. So much for the Buffet's claim that gold has no yield. Surely, gold stored in a vault does not yield, but when it is lent, it accrues interest. No matter how counterintuitive it may sound, some gold owners (the lending and borrowing of gold is generally reserved for the entities operating in the wholesale market, such as bullion bankers, mining companies, jewelry producers, etc.) do earn interest on gold. This proves that gold is more like currency rather than other commodities, because just like any currency, it can be lent and earn interest. Such lending transactions in the gold market are often referred to as lease transactions and interest rate applied to such lending is called gold lease rate (GLR). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Correction or Final Push Higher? Posted: 13 May 2016 03:55 AM PDT Despite maintaining an overbought condition and despite the recent bearish posture of many sector pundits, the gold stocks have yet to correct more than 11%. Since the end of January the gold stocks have held above their 50-day moving averages, which is often support during a strong trend. If the gold stocks break their lows of the past two weeks then it should usher in a 20% correction and correct the current overbought condition. However, if gold stocks do not break initial support they could begin a melt-up that would lead to a more serious correction in the summer. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FTSE 100 slides as oil rally fades on dollar strength Posted: 13 May 2016 02:09 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||