Gold World News Flash |

- Two Powerful, Simple Facts Giving Gold a Major Boost

- Should the Gold Price Keep Up with Inflation?

- What Will The Global Economy Look Like After The ‘Great Reset’?

- Jim’s Mailbox

- Surging North American PHYSICAL SILVER Investment Demand Pushes Supply Deficit To New Record

- An Important CLUE On The “Fake Rally”

- DOLLAR DEMISE: SILVER MOVES TO CHINA — David Morgan

- What Will The Global Economy Look Like After The "Great Reset"?

- Getting It All Straight - Trumpism, Nationalism, Patriotism, & Libertarianism

- In China, Nobody Wants To Be A Bagholder

- Exclusive Inside ISIS Terror Weapons Lab By SKY NEWS

- 11 Signs That The U.S. Economy Is Rapidly Deteriorating Even As The Stock Market Soars

- The 45-Year Record of Gold-Silver Ratios

- Linking the 1930’s Great Depression to Today’s Inflation Collapse

- London Elects Muslim Mayor Sadiq Khan

- Gold Price Closed at $1274.60 up $10.70 or 0.85%

- SIGNS OF THE END PART 168 - LATEST EVENTS MAY 2016

- Lars Schall Matterhorn Interview with Ronan Manly

- A Geologist’s Case for Gold

- Global Monetary Elites Scream, “Buy Gold”

- Gold Daily and Silver Weekly Charts - The Gathering Storm

- Donald Trump Wants to Do the Unthinkable

- Why The Dollar Will Certainly Collapse on 28 May 2016 ?

- Trump vs. Clinton -- Miller Time

- The Coming War of Central Banks

- Gold Up $10 This Morning

- Stocks Bull Market Is Exhausted; Make the Move to Gold

- Silver: Bull Bear Debate – Interview with Future Money Trends

- Wednesday Morning Links

- Gold Bullion Is “Long Term Insurance Policy†– HSBC’s Steel

- Breaking News And Best Of The Web — May 12

- Inflationist Gold Bugs Have Driven the Rally

| Two Powerful, Simple Facts Giving Gold a Major Boost Posted: 11 May 2016 10:30 PM PDT from The Daily Bell:

When we simplify the terms of the argument, we can understand it. In this case, gold's escalating value against the wounded dollar has little to do with oil prices or China's economic vitality. There are two reasons actually. Let's explain. Well over $100 trillion has been printed by central banks since 2008 in a vain attempt to generate economic momentum. Nothing much has happened. Economies around the world are in various stages of recessions and depressions. This is a momentous occurrence. From academia to industry, and government too, people should be proclaiming that Keynes is dead. Instead … nary a peep. But it is true. If these past seven years have shown us anything, they have shown us that Keynesianism is a dead letter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Should the Gold Price Keep Up with Inflation? Posted: 11 May 2016 10:23 PM PDT by Keith Weiner

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true? Most people define inflation as rising prices. Economists will quibble and say technically it's the increase in the quantity of money, however Milton Friedman expressed the popular belief well. He said, "Inflation is always and everywhere a monetary phenomenon." There you have it. The Federal Reserve increases the money supply and that, in turn, causes an increase in the price of everything, including gold. It's as simple as that, right? Except, it doesn't work that way. Just ask anyone who has been betting on rising commodities prices since 2011. Certainly the money supply has increased. M1 was $1.86T in January 2011, and in March it hit $3.15T. This is a 69 percent increase. However, commodities have gone the opposite way. For example, wheat peaked at $9.35 per bushel in July 2012, and so far it's down to $4.64 or about 50 percent. And the price of gold fell from $1900 in 2011, to $1050 late last year, or 45 percent. Would you say that inflation is +69%, or is it -45% or -50%? Most people look at retail prices, not raw commodities or gold. Retail prices have not followed into the abyss. Love it or hate it, the Consumer Price Index registers a cumulative 8 percent gain from 2011 through 2015 inclusive. Let's consider an example to help understand why. Suppose you own a coffee shop in a central business district. The city enacts a new regulation that limits the hours for delivery trucks. This forces you to pay overtime wages to your staff to unload the trucks, and of course, the carrier charges more for delivery too. Next, the city allows poor people to stop paying their water bill. So to compensate, they raise the water rates on businesses. While they're at it, they raise the fees for sewer, garbage, gas line hookups, fire inspections, and sign permits. The state passes a higher minimum wage law. The building inspector requires that you increase the size of your bathroom to accommodate wheelchairs, and you lose revenue-generating floor space. There are hundreds of ways that government increases your costs. Is this inflation? Not yet, costs are up but not prices. Sooner or later, all of the affected coffee shops try raising their prices. Consumers don't necessarily want to pay more for coffee, so a few shops fail. The survivors are now charging 15% more for coffee. They have their higher prices, at the cost of lower sales volume. The burden of government bearing down on the coffee business only increases. Every day, three constituencies conspire to drive up costs. We'll call them the "there oughtta be a law" crowd, the "government needs more revenues" mob, and the "they served 10oz of coffee plus 4oz of ice so let's sue them" racket. Regulation, taxation, and litigation drive up price. Friedman was wrong. The rising price of lattes is not a monetary phenomenon (the monetary system is pressuring prices lower right now, and in my theory of interest and prices I discuss why). Rising retail prices are a fiscal, regulatory, and judicial problem. There is no reason for the price of gold to follow retail, because there is no mechanism that connects gold to these non-monetary costs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Will The Global Economy Look Like After The ‘Great Reset’? Posted: 11 May 2016 09:45 PM PDT by Brandon Smith, Alt-Market:

A few goals are certain and openly admitted. The globalists ultimately want to diminish or erase the U.S. dollar as the world reserve currency. They most definitely are seeking to establish the International Monetary Fund's Special Drawing Rights basket system as a replacement for the dollar system; this plan was even outlined in the Rothschild run magazine The Economist in 1988. They want to consolidate economic governance, moving away from a franchise system of national central banks into a single global monetary authority, most likely under the IMF or the Bank for International Settlements. And, they consistently argue for the centralization of political power in the name of removing legislative and sovereign barriers to safer financial regulation. These are not "theories" of fiscal change, these are facts behind the globalist methodology. When the IMF mentions the "great global reset," the above changes are a part of what they are referring to. That said, much of my examinations focus on these macro-elements; but what about the deeper mechanics of the whole scheme? What kind of economic system would we wake up to on a daily basis IF the globalists get exactly what they want? This is an area in which the elites rarely ever comment, and I can only offer hypothetical scenarios. I am basing these scenarios on the measures that the establishment most obsessively chases. If they want a particular social or economic change badly enough, the signs become obvious. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 May 2016 09:13 PM PDT Jim/Bill, There’s more to this than meets the eye. It’s not just international trade for corporate profitability. Consider: -commodity pricing-gold pricing-oil-equity markets-interest rates-unemployment-unwinding of cross currency carry trades The Central Banks are boxed into a corner. Triffin’s Paradox: learn it! Let the currency races (to the bottom) begin! CIGA Wolfgang Rech The Coming War Of... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surging North American PHYSICAL SILVER Investment Demand Pushes Supply Deficit To New Record Posted: 11 May 2016 09:05 PM PDT by Steve St. Angelo, SRS Rocco Report:

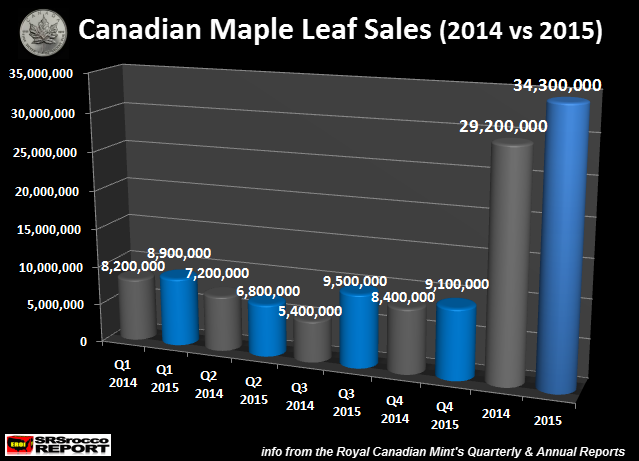

North American silver investment via its domestic supply suffered another large deficit in 2015. How big was the deficit? It was huge, surging 70% compared to 2014… and this only includes silver investment from two Official coin sales. Let me explain. We need to start off by showing the total Canadian Silver Maple Leaf sales for 2015. The Royal Canadian Mint finally published their 2015 Annual Report in which they stated that sales of Silver Maples jumped 18% from 29.2 million (Moz) in 2014 to 34.3 Moz in 2015:

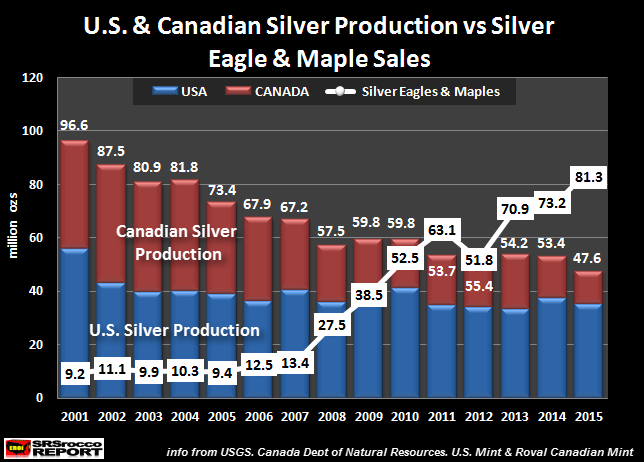

Sales of Canadian Silver Maples started off strong in Q1 2015, but declined in Q2 2015 by falling 400,000 oz compared to the same period in 2014 (7.2 Moz Q2 2014 vs 6.8 Moz Q2 2015). However, things turned around significantly in the Q3 and Q4 2015 during the silver retail investment shortage (July-Oct). Sales of Silver Maples were a record 18.6 Moz in the second half of 2015 versus 13.8 Moz in the second half of 2014. If we add Canadian Silver Maple Leaf sales to U.S. Mint Silver Eagles for 2015, it jumped to a stunning 81.3 Moz compared to 73.2 Moz in 2014. I discussed this in my THE SILVER CHART REPORT which was released in June 2015. Here isCHART #37 of a total of 48 charts in the report:

As we can see, combined U.S. and Canadian domestic silver production was 96.6 Moz in 2001 while total Silver Maple & Eagle sales were only 9.2 Moz. Thus, the total Silver Maple & Eagle sales only accounted for 9% of the two countries silver mine supply. This trend started to change significantly in 2008 as Silver Maple & Eagle sales consumed nearly half of U.S. and Canadian silver mine supply. However, this trend turned into a deficit 2011 as Silver Maple & Eagle sales were 9.4 Moz higher than domestic silver mine supply (63.1 Moz Official Coins vs 53.7 Moz supply). Even though Silver Maple & Eagle sales declined in 2012, the net investment supply deficit resumed again in 2013 and 2014. Matter-a-fact, Silver Maple & Eagle sales were nearly 20 Moz more than U.S. and Canadian domestic silver mine supply in 2014. Surging North American Silver Investment Pushes Domestic Supply Deficit To New Record In 2015Well, if you think 2014 was a banner year for the silver investment domestic supply deficit, take a look at my updated chart including the data for 2015:

Here we can see that total Silver Maples & Eagles of 81.3 Moz is 33.7 Moz more than domestic silver mine supply of 47.6 Moz from the U.S. and Canada. Moreover, this only includes the manufacture of these two Official Silver Coins. This does not include the estimated 40-50 Moz of private rounds and bars now including in the 2016 World Silver Survey. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| An Important CLUE On The “Fake Rally” Posted: 11 May 2016 09:02 PM PDT by Jeff Nielson, Bullion Bulls:

“…gold can go a lot higher from here. We’re actually recommending to our clients to position for a new and very long bull market for gold.” Who uttered those bullish words this morning? Was it Eric Sprott? No. It was someone named Solita Marcelli, and she works for a company called JPMorgan. When is it time to duck-and-cover if you’re a precious metals bull? WhenJPMorgan (appearing on CNBC) publicly calls for “a new and very long bull market for gold.” Let’s put aside the fact that a new and very long bull market for gold is extremely threatening to the Big Banks’ own organized crime activities. Let’s put aside the fact that (given their near-omnipotence) they would never allow a very long bull market for gold (again). Instead, ask yourself this one question. If we were in “a new and very long bull market for gold”, do you think the Big Banks would advertise that fact, onCNBC, and thus encourage more ordinary investors to climb on the bandwagon, at the very beginning?

So, the one thing we know with absolute certainty today is that we have not just begun a new and very long bull market for gold. But this is the Wonderland Matrix. In the Wonderland Matrix, what we’re told by the mainstream media isn’t simply wrong, but it is generally the EXACT OPPOSITE of the truth. So, if we’re told that gold has just begun “a very long bull market”, then look out below! The bottom could fall out of this “rally” as soon as tomorrow. P.S. Let me also add a point which I haven’t discussed previously regarding this topic: seasonality. Way back when the precious metals “market” behaved at least somewhat like a market (i.e. 5+ years ago), there was a very strong “seasonality” to the price of gold (and silver). Specifically, gold was very much a “sell in May, and go away” trade. Don’t come back until September, when Indian festival season is guaranteed to juice gold demand. Even if readers believe this “rally” to be genuine, the normal expectation would be (at best) several months of sideways, choppy trading, or (more likely) a retreat to a higher-low than the absurd, sub-$1100 dollar price we saw last year. Given that the Big Banks tended to be the loudest voices of “sell in May, and go away”, readers should be very, very suspicious when they see one of the Big Bank mouthpieces talking about a “very long bull market for gold” on May 11th. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLAR DEMISE: SILVER MOVES TO CHINA — David Morgan Posted: 11 May 2016 07:31 PM PDT by SGT, SGT Report.com: Clif High’s web bot project has been long been predicting that silver and gold would skyrocket higher as the US Dollar loses its dominion as the world’s reserve currency. And as the once formidable Dollar ultimately begins to hyperinflate as nations lose all confidence in the Federal Reserve Note, the web bots predict triple digit silver prices and eventually even a 1 to 1 silver to gold ratio in coming years. Will it really happen? No one can say with certainty, but there are very concrete signs that the cracks in the western banking system and fiat Dollar are about to turn into gaping fissures. Meanwhile, China is hoarding PHYSICAL silver at the Shanghai Gold Exchange and openly encouraging Chinese citizens to acquire physical silver and gold as a way to protect their wealth. It’s a paradigm shift of epic proportion, away from paper Dollars and into PHYSICAL metal. David Morgan from the The Morgan Report is here to discuss it all. Thanks for tuning in. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Will The Global Economy Look Like After The "Great Reset"? Posted: 11 May 2016 07:30 PM PDT Submitted by Brandon Smith via Alt-Market.com, A very common phrase used over the past couple years by the International Monetary Fund’s Christine Lagarde as well as other globalist mouthpieces is the “global reset.” Very rarely do these elites ever actually mention any details as to what this “reset” means. But if you take a look at some of my past analysis on the economic endgame, you will find that they do, on occasion, let information slip which gives us a general picture of where they prefer the world be within the next few years or even the next decade. A few goals are certain and openly admitted. The globalists ultimately want to diminish or erase the U.S. dollar as the world reserve currency. They most definitely are seeking to establish the International Monetary Fund’s Special Drawing Rights basket system as a replacement for the dollar system; this plan was even outlined in the Rothschild run magazine The Economist in 1988. They want to consolidate economic governance, moving away from a franchise system of national central banks into a single global monetary authority, most likely under the IMF or the Bank for International Settlements. And, they consistently argue for the centralization of political power in the name of removing legislative and sovereign barriers to safer financial regulation. These are not “theories” of fiscal change, these are facts behind the globalist methodology. When the IMF mentions the “great global reset,” the above changes are a part of what they are referring to. That said, much of my examinations focus on these macro-elements; but what about the deeper mechanics of the whole scheme? What kind of economic system would we wake up to on a daily basis IF the globalists get exactly what they want? This is an area in which the elites rarely ever comment, and I can only offer hypothetical scenarios. I am basing these scenarios on the measures that the establishment most obsessively chases. If they want a particular social or economic change badly enough, the signs become obvious. Here is what the world would probably look like after a global economic reset... Initial CrisisWho knows what the trigger will be? There are so many potential catalysts for economic instability that there is no way to make a prediction. The only thing that is certain is that one or more of these catalysts will be triggered. A Saudi depeg from the U.S. dollar, a large scale terrorist attack, a general rout in stock markets due to a loss of faith in central bank policy, a confrontation between Eastern and Western powers. It doesn’t really matter much. All of it is designed to produce one outcome — chaos. To which the globalists will offer “order,” their particular order using their particular solutions as “objective mediators.” In our highly interdependent system in the West in which more than 80 percent of the population has been domesticated and is psychologically incapable of self-reliance, it is very likely that a disruption of normal supply chains and services would result in considerable poverty and death. Such a threat would invariably lead frightened and unprepared people to demand increased government controls so that they can return to the level of comfort they have grown accustomed to within the grid. One important factor to note is the rationale globalists will offer for increased centralization and control in the hands of a few. In my article, The Linchpin Lie: How Global Collapse Will Be Sold To The Masses, I study the clever narrative of Rand Corporation member John Casti and his “Linchpin Theory.” In Casti’s theory (more propaganda than theory), collapse is inevitable in what he calls “overly complex systems.” The more independent elements within any system, the more chance there is for unpredictable events that lead to supposed disaster. Ostensibly, the solution would be to streamline all systems and remove the free-radicals. That is to say, complete centralization is the answer. What a surprise. In a post-reset world, the elites will argue that the banks and bankers are not necessarily to blame. Rather, they will accuse the “system” of being too complex and chaotic, leaving itself open to greed, stupidity and overall unconscious sabotage. The fact that the crisis was engineered from the very beginning will never be mentioned. Centralization will be championed as the cure-all to the barbaric relic of complexity. Almost all other changes to our economic environment will stem from this single lie. Thinning Of The Financial HerdYou are going to see long standing financial institutions sacrificed in the name of rehabilitating the global system. Do not assume that certain major banks (Deutsche Bank?) will not be brought down, or that certain central banks will not be toppled (Federal Reserve) as the reset progresses. Also do not assume even that certain geopolitical structures will not be brought into disarray (European Union). In the push towards total globalization and one world economic governance, the elites have no loyalty to any single corporation, nation or even central bank. They will chop off almost any appendage if they can achieve a one world system in the trade. What this means on a micro-level is the activation of bail-ins; that is to say, the legalized confiscation of bank accounts, pension funds, stock holdings, etc. as a method for prolonging a collapse event. We have seen this already to some extent in Europe, and it will happen in the U.S. eventually. Some people (socialists/communists) may even cheer the action as the end of “capitalism” and a step toward economic “harmonization”; which is easy for them to cheer for since most of them have never worked hard enough to earn property or assets worth confiscating. Currency DevaluationEveryone who is aware expects this, but it is important to realize that currency devaluation will probably occur across the board in every region of the world. Some currencies will simply be hit harder than others. The dollar is a primary target of the globalists and WILL be brought down. It won’t disappear, but it will become progressively irrelevant on the global stage. If the projections of 'The Economist' are the correct timetable, then the end of the dollar will be well underway before 2018. While the initial scenario we face in America will be one of stagflation, many necessities and the means to produce those necessities will skyrocket in cost. There may not be inflation in every sector of the economy because imploding demand could offset some of the effects of falling currency value, but there will be extreme inflation in the areas that hurt common people most. The Digitization Of All TradeDespite all the failings and control mechanisms involved in fiat money, there are still worse systems to be had. Last month more than 100 executives from the world’s largest financial institutions met privately at the Times Square office of Nasdaq Inc. to discuss the future of money; more specifically a software apparatus called “Blockchain.” The goal is to implement Blockchain as a medium to fully digitize monetary transactions around the world and in a way that is traceable and foolproof. In other words, the goal is put an end to all transactions involving physical cash. The establishment of a cashless society would mark the end of all privacy in trade. Even supposedly anti-centralization digital currencies like Bitcoin are hindered by the blockchain feature, which requires the tracking of ALL transactions in order for the currency to function. While methods for anonymity could be argued, the fact of the matter is, digital currency by its very nature is a destroyer of the truly private trade offered by cash and barter. When all trade is tracked, and all savings digitized, whoever owns the keys to the core of the blockchain will have the power to wreak havoc on the life of any participant at will. To be sure, the “blockchain” that the elites have in mind will never allow for anonymous transactions, because digital currency is not about anonymity or “convenience,” it is about control. Consolidation Of Government PowerCorrupt government is the tool by which globalists can extort goods and labor from a population as well as exert force to subdue rebellion. It is highly unlikely that the global reset will result in a collapse of government. On the contrary, it is usually during economic collapse that governments grow in power to the point of totalitarianism. There will always be a new currency mechanism or financial structure to replace the old, and the globalists will always have a way to pay off armies and useful idiots to do their bidding. No one should be counting on the idea that the elites face collapse as we face collapse. This is naive. The elites created the collapse; they plan to be ready to use it to their advantage. The End Of Private Production And BusinessAfter the reset and the opening crisis it is probable that resource allocation will become a major issue. Production of goods on the massive scale seen today will not ever be allowed to return if the elites have their way. This will create a perpetual lack of supply (by design). The only methods for dealing with lost production on an industrial level would be to either encourage localized production in every community, or to force people to reduce their standard of living and demand in the extreme. The elites will certainly press for the latter. Localized production in every community would kill any means of financial control the globalists might have on a population. In fact, I believe they will attempt to make any local production impossible, first through taxation so high that only the largest still-surviving corporations can afford to operate, and second, by confiscation of raw resources needed to manufacture goods on a scale that would grow wealth for a community. The government will claim that such resources must be managed by the authorities for the good of everyone rather than “wasted” by independent businesses in the “pursuit of personal wealth.” You won't even see children running lemonade stands, let alone common people operating small factories, farms and store fronts. Eventually, they will also have to limit or outlaw barter and alternative currencies in order for the digitized economy to work. Carbon Output And Environmental ExtortionNo matter how much information is released which completely contradicts the fraud of man-made global warming, the establishment continues to charge full steam ahead with the creation of a carbon-based economic model. Why? Because the idea of the “carbon footprint” is the ultimate weapon for domination. A “carbon tax” is a tax on life itself. There is no way around it. In my article 'Ecological Panic: The New Rationale For Globalist Cultism' I dissect the elitist think-tank propaganda of Council on Foreign Relations member Timothy Snyder. Snyder argues in his writings that nearly all man-made disasters are a product of high or extravagant living standards. Though his definition of "high living standards" is rather vague, I expect that he sees the vast majority of Western society as people that need to be taken down several pegs. He also argues that tyrants and mass murderers often ignore scientific authority in the pursuit of greater productive wealth, and that people who ignore "climate science" are contributing to future holocausts. So, to summarize, we all must stop producing, stop pursuing personal wealth and achievement and sacrifice our own individual progress in the name of progress for the collective and the safety of the planet. Like Casti, Snyder's narrative requires the populace to bow down to a central authority in the name of the greater good. And surely it is mere coincidence that the globalists these men work for will be at the helm of that central authority. Remember, in order to fully centralize, the elites must streamline. This does not only mean streamlining economic governance, but also streamlining the size of the system they seek to dictate. The larger and more diverse the system, the harder it is to wrap your tentacles around it. This means greatly diminished production, but also by extension greatly diminishing the population. Population controls then become vital. If the production of carbon can be taxed and administrated, then the production of life can be taxed and administrated. The establishment becomes godlike; the purveyor of all means of sustainment. The carbon boogeyman can be used to frighten the now crisis weary public into complete sublimation, for if mere carbon can cause the end of the world as we know it, then people, by their very existence, become a threat to the future that must be regulated. Anthropogenic climate change is THE model the elites must assert if they hope to convince the citizenry that a concrete ceiling on production and population is acceptable. If we ever get to the point where human society becomes so self-loathing as to seek its own enslavement and destruction through carbon controls, it may be a thousand years before we ever see freedom again. We’re Not There YetAll of the dangers described above are NOT set in stone. Some may claim that the “end is nigh” - these people are idiots. The end is never nigh. Humanity has faced calamity after calamity for generations; our calamity just happens to be historically epic by comparison. It is not the last calamity. Centuries from now, there will be new disasters and new idiots telling everyone “the end is nigh.” Through it all, courageous people have risen to the occasion. Some are successful and some are not, but we do not live in a New World Order, yet, and that is saying something. Today is nowhere near as terrible as tomorrow could be if we do not act accordingly. The globalist reset needs a trigger, a crisis which admittedly we do not have the ability to avoid. But, the reset also depends on the right people in place to rebuild the system after the crisis unfolds. Here is where the future can be determined. Whoever is left standing after the opening salvo will have a choice: to hide and hope for the best, or to fight for the position to choose who builds tomorrow. Will it be the psychotic globalist cabal, or will it be free people of conscience? It may not seem like it now, but the end result is up to us. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Getting It All Straight - Trumpism, Nationalism, Patriotism, & Libertarianism Posted: 11 May 2016 06:30 PM PDT Submitted by Justin Raimondo via Anti-War.com, I was struck by a tweet from libertarian Republican congressman Justin Amash, who has become the “new Ron Paul” now that the three-time presidential candidate and libertarian icon has taken a well-deserved rest from politics. The other day he tweeted:

Amash, who has vowed to never support GOP frontrunner and likely presidential nominee Donald Trump, undoubtedly had the New York real estate mogul in mind, but no matter what one thinks of The Donald, Amash is quite wrong about the nature of American nationalism and the meaning of “patriotism.” To begin with, Hayek was clearly talking about European nationalism, not the American variety. I’ll get to the difference between them, but I want first to point out the irony of Amash’s citation of this particular Hayek quote, because the great libertarian theorist was here talking about the problem of centralization: that is, the growing tendency of smaller political units to be subordinated to and swallowed up by bigger entities. If we place Hayek’s discussion in the present context, then it becomes clear that nationalism is not the enemy but a (potential) friend of liberty. For the modern trend is toward supra-national entities, like the European Union, the UN, and the North American “Free Trade” Agreement, which are engaged in erecting precisely that “society which is consciously organized from the top” so abhorred by Hayek. When nationalism is arrayed against globalism, i.e. against the concept of a regional super-state, or even a World State, libertarians must clearly take sides with the former. Furthermore, what is a “nation,” exactly? The libertarian theorist Murray Rothbard takes on this question in his trenchant essay “Nations By Consent: Decomposing the Nation-State,” and his ability to cut through to the heart of any question underscores the error made by Amash and anti-nationalist libertarians in general:

In short, the “nation” consists entirely of non-governmental structures and institutions: it is the web of social interactions and cultural context which the government spends most of its energy trying to bend to its will. In a free society, this effort is largely unsuccessful: in a dictatorship, the state has replaced the nation and substituted its own “culture,” imposed from the top, for the traditions and values that have been established over time by the voluntary actions and decision-making of individuals. What Amash forgets, or never knew, is that from a libertarian perspective American nationalism is sui generis. Nationalism, after all, is by definition the valorization of a nation’s heritage, its traditions, and most especially its origins. And how did the American nation originate? Why, in the first – and only – successful libertarian revolution in world history. “Constitutional conservatives” of Amash’s sort are constantly invoking the Constitution as some sort of sacred canon, the libertarian ur-text through which all issues must be viewed. We’ll pass over just how libertarian this document is – there’s a large and persuasive school of libertarian thought that views the adoption of the Constitution as a counterrevolution – and ask: where does Amash think that holy writ came from? It was made possible by those who had fought a revolution and established a nation, one founded on the supremacy of individual liberty. This is what differentiated it from the nations of Europe, and what, in the end, separated American nationalism out from the European varieties. In Europe, nationalism inevitably meant the growth of State power at the expense of regional autonomy and individual liberty: in America, it meant the victory of a libertarian revolution and the establishment of a government that respected both the rights of the separate states and individual autonomy. Walled off by two oceans from a world dominated by monarchs and aggressors, born in a revolt against imperialism, imbued with a culture that nurtured the free individual, America is truly the exceptional nation, albeit not in the way today’s purveyors of “American exceptionalism” usually mean it. An American nationalist isn’t a Bismarckian: he’s a Jeffersonian. Mutants like Teddy Roosevelt – and his contemporary fan club, the neoconservatives – are the exception that proves the rule. Speaking very generally, American libertarianism is consistent nationalism: not the expansionist, militaristic nationalism of Europe, but that of the Founders. In this country, a nationalist necessarily upholds the American tradition of limited government, the rule of law, and – yes – “isolationism” (“She goes not abroad in search of monsters to destroy”). No wonder John Kerry preaches the virtues of a “borderless world,” and warns graduating students of the dangers of “looking inward”! Empires aspiring to world hegemony don’t recognize the legitimacy of borders, and as for looking inward – why do that when we have a whole world to conquer? In a world where supranational bureaucracies – who want to centralize economic and political decision-making and put it in the hands of a trans-national elite – are actively subverting the very idea of national sovereignty, nationalists are on the right side of the barricades. Should Catalonia be forced to be a part of Spain? Should England be dragooned into the European Union? Should the American economy be ruled by a World Central Bank? What “libertarian” can answer yes? I am struck, in the Rothbard quote cited above, by the phrase a “much-neglected aspect of the real world.” Libertarians, all too often, have to be constantly reminded of the real world, as opposed to the world of floating abstractions they sometimes seem to inhabit. It is one thing to have principles: it’s quite another, however, to apply those principles to reality – not by compromising them, but by recognizing that one-dimensional models of human behavior will not chart a course to liberty. And now a word about “patriotism”: this concept has been used as a bludgeon against opponents of every war in American history, and is trotted out to smear government critics as “unpatriotic,” if not outright traitors. Such expressions of “patriotism” as the Pledge of Allegiance (authored by a socialist), and the odious maxim “My country right or wrong,” are nothing more than state-worship, the very opposite of true nationalism in the American sense. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| In China, Nobody Wants To Be A Bagholder Posted: 11 May 2016 06:00 PM PDT With the frenzied speculation that drove levels and volumes in Chinese commodities off the charts having dawned on everyone from Cramer to Chinese Securities regulators as 'not real', it appears everyone is scrambling to not be the bagholder for this bubble as authorities crackdown on Chinese asset managers pooling retail investor funds, warning of the rise of "ponzi schemes." While nobody knows for sure how much of the trading surge has been driven by individuals, but the evidence suggests retail punters are playing a big role, and as Bloomberg reports, the average holding period for contracts including rebar and iron ore was less than 3 hours in April! China's asset managers were warned of "Ponzi scheme" risks from pooling investor funds intended for different products, as an industry association said a joint venture between Citic Trust and Citic-Prudential Fund Management was being punished for violating restrictions on such practices. As Bloomberg details,

Of course, with the now famous Chinese propensity for gmabling on any and everything that is going up, as evidenced by the stunning collapse of average trading periods in commodity futures...

One would suspect the Chinese do in fact need protecting from themselves as lessons learned from the stock market's bubble burst, the corporate bond bubble's burst, and the real estate bubble's burst still led them to pile into Chinese commodities... and deal with that bursting too...

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exclusive Inside ISIS Terror Weapons Lab By SKY NEWS Posted: 11 May 2016 05:30 PM PDT Experts describe the footage obtained by Sky News of a "jihadi technical college" as an intelligence gold mine.By Stuart Ramsay, Sky News Chief CorrespondentTerror group Islamic State is employing scientists and weapons experts to train jihadists to carry out sophisticated "spectacular" attacks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 Signs That The U.S. Economy Is Rapidly Deteriorating Even As The Stock Market Soars Posted: 11 May 2016 05:30 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, We have seen this story before, and it never ends well. From mid-March until early May 2008, a vigorous stock market rally convinced many investors that the market turmoil of late 2007 and early 2008 was over and that happy days were ahead for the U.S. economy. But of course we all know what happened. It turned out that the market downturns of late 2007 and early 2008 were just “foreshocks” of a much greater crash in late 2008. The market surge in the spring of 2008 was just a mirage, and it masked rapidly declining economic fundamentals. Well, the exact same thing is happening right now. The Dow rose another 222 points on Tuesday, but meanwhile virtually every number that we are getting is just screaming that the overall U.S. economy is steadily falling apart. So don’t be fooled by a rising stock market. Just like in the spring of 2008, all of the signs are pointing to an avalanche of bad economic news in the months ahead. The following are 11 signs that the U.S. economy is rapidly deteriorating…

But you never hear Obama talk about that statistic, do you? And the mainstream media loves to point the blame at just about anyone else. In fact, the Washington Post just came out with an article that is claiming that the big problem with the economy is the fact that U.S. consumers are saving too much money…

So even though half the country is flat broke, I guess we are all supposed to do our patriotic duty by going out and running up huge balances on our credit cards. What a joke. Of course the U.S. economy is actually doing significantly better at the moment than almost everywhere else on the planet. Many areas of South America have already plunged into an economic depression, major banks all over Europe are in the process of completely melting down, Japanese GDP has gone negative again despite all of their emergency measures, and Chinese stocks are down more than 40 percent since the peak of the market. This is a global economic slowdown, and just like in 2008 it is only a matter of time before the financial markets catch up with reality. I really like how Andrew Lapthorne put it recently…

I couldn’t have said it better myself. Look, this is not a game. So far in 2016, three members of my own extended family have lost their jobs. Businesses are going under at a pace that we haven’t seen since 2008, and this means that more mass layoffs are on the way. We can certainly be happy that U.S. stocks are doing okay for the moment. May it stay that way for as long as possible. But anyone that believes that this state of affairs can last indefinitely is just being delusional. Gravity beckons, and the crash that is to come is going to be a great sight to behold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The 45-Year Record of Gold-Silver Ratios Posted: 11 May 2016 05:29 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Linking the 1930’s Great Depression to Today’s Inflation Collapse Posted: 11 May 2016 05:20 PM PDT from Silver The Antidote: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| London Elects Muslim Mayor Sadiq Khan Posted: 11 May 2016 05:05 PM PDT Stefan Molyneux comments on the news that London has elected its first ever Muslim Mayor Sadiq Khan. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1274.60 up $10.70 or 0.85% Posted: 11 May 2016 04:18 PM PDT

I make it a point never to say, "I told y'all so," but remember what I said about the sudden stock rally yesterday? Well . . . All the air went out of stocks today, nearly all that had pumped them up yesterday on rumors of the Chinese government's magical measures to continue the bubble. Dow lost 217.23 (1.21%), leaving it exactly 5.21 points higher than day before yesterday and effectively erasing the 222.44 point gain Tuesday. S&P500 could not stand, either, and lost 19.93 (0.96%) to 2,064.46. Memorize: Bear market rallies are sudden, sharp, & short. They quickly give back all their gains. Dow in Gold and Dow in Silver have resumed their downward flight, after a small correction. They testify with one voice: Stocks are about to lose value against metals. Charts are at http://schrts.co/8Sv0tc and http://schrts.co/ohwLZP US dollar index fainted at that top range boundary & 20 day moving average. Here's the chart, http://schrts.co/OkJ5UT This tells us the dollar index has not yet repudiated its downtrend, because the range has been trending down. Of course, after rising for six days running, today was likely not much more than a normal correction. Dollar lost 48 basis points or 0.51%. Yen climbed 0.81% to 92.26. Euro added 0.46% to $1.1428. OIL (WTIC) rose today 4.99% to $46.75, but remains within a lethal rising wedge, and can only negate that danger by closing above & outside the wedge, way around $49. Chart's at, http://schrts.co/KvfGnd Dollar fell, gold & silver rose. Silver added 22.7¢ (1.33%) to 1730.2¢. Gold advanced $10.70 (0.85%) for a $1,274.60 Comex close. Today was thrilling, but answered no questions & proved no intents. Silver & gold remain trapped within trading ranges, and short term downtrends. Now closes above $1,306 and 1806¢ are needed to prove a rally dependable. Still, both stubbornly refuse to collapse in the face of terrifyingly bad Commitments of Traders reports, and both remain above their 20 day moving averages, first tripwire of a decline. How does that fit together with the bearish sign of gold walking through its uptrend line from January? Beats me. Here's a gold chart, http://schrts.co/0vM4CX and here's silver, http://schrts.co/t9IUae The gold silver ratio chart speaks plainly, though. http://schrts.co/kh9gOy March first the ratio peaked at the top of its trading range (green lines) at 84.38. Then it deteriorated, painting an even-sided triangle and plunging out of that with a Thump and a gap. Fell straight down through the 200 DMA. Plunged more, then gapped down through the bottom range boundary to 70.40 as April ended. Since then it has rallied, but only to the lower boundary line, and today has fallen again below its 20 DMA. All this says, "Silver is relatively strong, so a rally should continue." Whole picture shows a change of quality from the last 5 years. and one more witness that the December 2015 lows were THE bottom of the post-2011 correction. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 168 - LATEST EVENTS MAY 2016 Posted: 11 May 2016 03:56 PM PDT America will be consumed with the wrath of God! Damn your pride Gay America. Repent and be saved or you will burn. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lars Schall Matterhorn Interview with Ronan Manly Posted: 11 May 2016 02:59 PM PDT Bullion Star | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 May 2016 01:52 PM PDT This post A Geologist's Case for Gold appeared first on Daily Reckoning. Something big is happening with gold. Over the past few years, if you bought and owned gold and gold mining shares, it's been frustrating with gold prices in the doldrums of 2015, 2014, 2013, 2012. That's four years of downside correction. But, that was then, and this is now. Let's discuss what's happening and nail down some serious opportunity… Follow the money and right now money is moving into gold and select miners. In fact, there's so much interest in "paper" gold that physical supply has utterly broken down. As in… crashed and about to burn in a roaring fireball! This is critical. The amount of physical gold in storage in Comex versus the number of registered "owners" against each ounce is nuts. From a few owners per ounce, it jumped to 542 by this March! Just check out this remarkable chart:

Look at what's happening. From the early 2000s to not long ago, the number of "owners" per ounce — people who bought a "paper" gold contract, supposedly backed by real metal at Comex — was basically flat, just a handful of claimants for each ounce. Plus, there were literally millions of ounces of gold on deposit in Comex. There was gold in the vault, in other words. If you showed up with a contract, you could walk away with gold. That's how markets ought to work. Then starting in 2014 and trending to mid-2015, the number of registered "owners" moved strongly up, to about 100 per ounce, and then 300 per ounce. Note that this was also a period when Comex sold down significant amounts of physical inventory, from several million ounces in vaults to well under 1 million ounces. Most of this gold moved out of the West (London, Zurich, New York) to the East (China, Russia, India, Middle East). It's gone forever… certainly from the West. It was nice while it lasted. By late 2015 and now into 2016, registered "owners" against Comex gold spiked to a nosebleed level of 542-to-1. Thus if even one claimant shows up for an ounce of yellow metal, the cupboard will be bare — and there are 541 other claimants as well! By comparison, your child has about 30 times better odds of applying and getting admitted to Harvard, Yale AND Stanford than does a Comex contract holder have of walking away with one ounce of gold. Good luck with that! "Uncovered" speculation has gone exponential. There's lots of "paper" gold and almost no "real" gold, which makes for a high-risk scenario — certainly if you don't hold gold. It's high return if you do hold gold. (Feel free to smile if you do.) In essence, all hell has broken loose in gold trading pits. Naturally, the mainstream media (MSM) have not discussed it. No, MSM is too busy telling you how great things are again with Amazon, Tesla, Facebook, etc. That, and how inflation and unemployment are super-duper under control. Economy is growing nicely, thank you… Relax. Go shopping at the mall. Take a cruise. Buy something else you don't need, with money you don't have. MSM would never bother you with the fact that there's almost no gold in trading vaults. Nor never mind that it would take years' worth of new mine and mill production to refill Comex to anything approaching old levels. Face it, there "ain't" no gold! It's gone! Any working, functioning "futures" market requires physical supply to backstop against calls for delivery. Makes sense, right? That's how it works for corn, wheat, orange juice, cattle, hog bellies, everything else. You can trade cattle futures until the proverbial cows come home; at some point though, cows wind up as hamburger on supermarket shelves. Yet with gold, there are almost no ounces of Comex gold available for the paper market. Thus is risk exploding for paper gold traders. A collapse may not happen literally overnight… but we're looking at a very dangerous situation. By comparison, look at oil markets. With oil, there's ample supply from six continents. I've read of tankers from Middle East nations literally slow-sailing the long route around Africa, to buy time for cargo owners to find a buyer at refineries in Europe or North America. Oil prices may be low by recent standards, but at least paper barrels are aligned with physical reality at wellheads and loading terminals. The cupboard is so bare for gold that Comex could collapse into the equivalent of a "run" on vaults. If that happens — rather, "when" that happens — watch gold prices spike. On that golden day of reckoning, you'll see more than a buying frenzy or even a panic. It'll be utter pandemonium. When this bomb explodes, gold prices will melt upward in ways we can scarcely imagine. Instead of a few dollars up or down on the ticker, you'll see hundred-dollar moves in a matter of minutes. Of course, it'll be a good day for investors who own physical metal and a strong hand of mining shares. Here's what to do now… Own physical gold. If you don't have some, get some. Go for basic bullion coins. Don't worry about numismatic coins. Don't pay big premiums. Just get U.S. Gold Eagles, Canadian Maple Leafs, South African Krugerrands, etc. Build your stash while you can, because some day, you won't be able to get gold, period. Second, you should strongly consider quality mining stocks. Right now, my stock-buying focus is on well-capitalized miners in production with a solid reserve base. Some of these companies have been beaten up so badly over these past few years, their upside is practically unlimited when gold really takes off. It's been so bad that it's actually getting good. It's called a "buyer's market." My view is that we're in a sweet spot. Any rebound (short or long term) can vault you high and far when the turnaround hits. And it will hit. Sooner or later, it will hit. Best wishes, Byron King P.S. The Federal Reserve is determined to drive down the dollar. And owning gold is the best way to preserve your wealth against a depreciating dollar. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. We'll send it to you when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post A Geologist's Case for Gold appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Monetary Elites Scream, “Buy Gold” Posted: 11 May 2016 01:37 PM PDT This post Global Monetary Elites Scream, "Buy Gold" appeared first on Daily Reckoning. The gold debate is usually conducted between global monetary elites who disparage gold and so-called "gold bugs" who stack coins in their basements awaiting the end of the world. Both sides go too far. But what happens when a bona fide member of the elite endorses gold? That's an earthquake, and it just happened! Kenneth Rogoff, Harvard professor, chess grandmaster and author of the widely acclaimed book This Time Is Different, just sent shock waves through the global elite by recommending that emerging-market central banks buy gold to diversify their portfolios away from dollar holdings. And JP Morgan's Private Bank is also recommending its clients "position for a new and very long bull market for gold.” This bank is only open to wealthy clients with at least $5 million of investable assets. Later this year, the bank will require at least $10 million of investable assets. This is not for everyday Americans. The super rich and the elites are now selling stocks and buying gold. And for good reason. Gold has fundamental support from Chinese and Russian efforts to get away from the dollar system. It also has technical support from scarcity on the physical supply side. Gold is flying off the shelves. When elites say dump dollars and buy gold, what are you waiting for? The good news is that there's still time to diversify your portfolio into gold if you haven't already. Now is the time to complete your gold allocation (I recommend 10% of investible assets) before it's too late. I don't recommend you day-trade gold or buy the dips. Don't get too upset if the dollar price goes down, and don't get too euphoric if the dollar price goes up. You need to focus on the big picture, not the day-to-day fluctuations. And the big picture ultimately leads to $10,000 gold. Read on to find out more… Regards, Jim Rickards P.S. Gold is the top performing asset class so far this year. And it will only soar higher as market instability and central bank recklessness drive gold higher. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. It shows you how to preserve your wealth as the dollar loses value. We'll send you the report when you sign up for the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. Click here now to sign up for FREE and claim your special report. The post Global Monetary Elites Scream, "Buy Gold" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Gathering Storm Posted: 11 May 2016 01:22 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump Wants to Do the Unthinkable Posted: 11 May 2016 01:06 PM PDT This post Donald Trump Wants to Do the Unthinkable appeared first on Daily Reckoning. NORMANDY, France – The Dow rose 222 points yesterday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull. Speaking at an investment conference in New York last week, George Soros' former partner warned that…

But we promised to return to the scene of our crime today… Heresy!In these pages, we recently committed heterodoxy… even heresy! We don't know what got into us… and we are deeply sorry for our misdoings, the remembrance of which is grievous unto us… …but in a moment of weakness (oh, ye gods of democracy, why have you forsaken us?) we dared to question whether voting makes any damned sense. We concluded that it didn't. We don't know the candidates well enough to know who is really better. We don't have any idea what challenges the next president will face, nor which candidate would be better equipped to deal with them. We don't know if the candidates believe what they say they believe or whether they will do what they promise to do. We only know our vote, statistically, won't make a bit of difference. And that we don't want the "lesser of two evils." And that we don't feel any obligation to play this game! Dear readers cancelled their subscriptions… and heated up their irons. "What about the 'social contract'?" a reader wanted to know. We'll come back to that in a minute. First, we want to touch on a remarkable statement, by a remarkable candidate, in a remarkable election. Donald's Debt "Discount"Donald Trump let it be known last week that if the U.S. federal debt begins to weigh too heavily on his shoulders, he will do what he does best – renegotiate. He will get a "discount." "WHAT??!!!" The question flew down Wall Street and around the back alleys of lower Manhattan… across the City of London… and through other major financial centers all over the world. "What did he say? Did he just say he was going to default on the U.S. debt? I can't believe it!" "Renegotiating" the terms of debt… getting a discount… is what you do when you can't pay. It's what Argentina just did, after years of wrangling in the courts, in which its creditors seized one of its naval vessels in a foreign port. The idea of discounting U.S. Treasury bonds – the world's safest credits – was beyond remarkable… It was unthinkable. The New York Times was on the case immediately, claiming Trump's proposal would create "cracks in investor confidence" and cost the country "a lot of money" (in higher interest charges). The Washington Post followed up, pointing out that confidence in U.S. debt was the "glue that holds global finance together." Any doubt about the glue, it said, would "instantly destabilize" the whole world economy. Poor Donald. He had broken another taboo. He had to backtrack and explain himself. Trump doesn't seem to understand how the scam works, but he was right about what it means. The U.S. federal government is the monopoly issuer of the world's reserve currency. It doesn't have to renegotiate. It doesn't have to ask for a discount. And it even influences – by way of its central bank, the Fed – the value of the currency in which its debt is denominated. That means it gets to rip off the world's investors without saying a word. For now, the dollar is riding high… and buyers stand in line to get more U.S. Treasury debt. Later, the shoe will be on the other foot. But the U.S. will not be standing on one foot, begging for discounts on its debt. Instead, owners of U.S. Treasury bonds – retirees, mostly – will be begging on street corners. The True "Social Contract"But let's return to the wild and wonderful world of the U.S. presidential elections. Why not just hold your nose… and go along gracefully, and with good humor… with the gag? Why not just "do your duty," as one reader put it in yesterday's Mailbag? According to the "social contract theory," we all have our roles and responsibilities. As citizens, we have a duty to inform ourselves, pay our taxes, rat out our neighbors, vote, volunteer for military service, get frisked by the TSA… and let ourselves get robbed and bullied by every jackass in a position of power. Our leaders have responsibilities, too. They are supposed to respect the constitution, except when it is inconvenient for them… …they are supposed to uphold the Law of the Land… or pass new laws, as it suits them… …they are supposed to protect the country and provide for the general commonweal… …and then collect millions in speaking fees from Goldman Sachs and General Dynamics. That is the true "social contract." We don't remember signing such a contract. Do you remember signing it? If it were laid in front of you, wouldyou sign? Our "leaders" – aka the Deep State – can change the terms any time they want. What kind of contract is it where one party can change the deal and the other can't? And where the other party was never given the opportunity to negotiate it… or even approve it? It's not a contract at all. It's just part of the mythology of modern democracy. It imposes "duties," but they only make sense if you swallow the whole enchilada of minor insults and major delusions that keep the Deep State in business. What are our real duties? Shouldn't your editor, under torture of course, confess his sins, renounce his apostasy, and register to vote before it is too late? Isn't democracy – for all its faults – still the best game in town? More to come… Regards, Bill Bonner P.S. "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Donald Trump Wants to Do the Unthinkable appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The Dollar Will Certainly Collapse on 28 May 2016 ? Posted: 11 May 2016 11:00 AM PDT Why The Dollar Will Certainly Collapse on 28 May 2016 ? This collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets. The repercussions to this... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump vs. Clinton -- Miller Time Posted: 11 May 2016 10:30 AM PDT The latest on the 2016 presidential race and Michael Bloomberg booed at the University of Michigan; Dennis Miller sounds off on 'The O'Reilly Factor' The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming War of Central Banks Posted: 11 May 2016 09:41 AM PDT This post The Coming War of Central Banks appeared first on Daily Reckoning. Welcome to a currency war in which victory depends on your perspective. History has shifted, and we’re leaving the era of central bank convergence and entering the era of central bank divergence, i.e. open conflict. In the good old days circa 2009-2014, central banks acted in concert to flood the global banking system with easy low-cost credit and push the U.S. dollar down, effectively boosting China (whose currency the RMB/yuan is pegged to the USD), commodities, emerging markets and global risk appetite. That convergence trade blew up in mid-2014, and the global central banks have been unable to reverse history. In a mere seven months, the U.S. dollar soared from 80 to 100 on the USD Index (DXY), a gain of 25%–an enormous move in foreign exchange markets in which gains and losses are typically registered in 100ths of a percent. This reversal blew up all the positive trades engineered by central banks: suddenly the yuan soared along with the dollar, crushing China’s competitiveness and capital flows; commodities tanked destroying the exports, currencies and economies of commodity-dependent nations; carry trades in which financiers borrowed cheap USD to invest in high-yielding emerging markets blew up as currency losses negated the higher returns, and global risk appetite vanished like mist in the Sahara. The net result of this reversal is global markets have struggled since mid-2015, when the headwinds of the stronger dollar finally hit the global economy with full force. In one last gasp of unified policy convergence, G20 nations agreed to crush the USD again in early March 2016, to save China from the consequences of a stronger yuan and the commodity markets (and lenders who over-extended loans to commodity producers).

That Shanghai Accord lasted all of two months. The engineered collapse has already reversed, and the USD is gaining ground, reversing the gains in risk assets, commodities and China’s export-dependent, debt-based stability. The problem is there is no win-win solution to this foreign exchange battle. Japan and the Eurozone benefit from a stronger USD as the euro and yen weaken, but China loses as the USD soars. Commodities lose when the USD gains, but the domestic U.S. consumer’s purchasing power increases as the USD strengthens. It’s Triffin’s Paradox writ large: As the primary global reserve currency, The USD plays both a domestic and an international role, and each set of users has a different set of priorities. No matter what policy the Federal Reserve pursues, there will be powerful winners and losers. This sets up a war between central banks everywhere in which winning may be as disastrous as losing. The conventional central bank policy is to lower interest rates to weaken their currency, as a means of boosting exports. But the unintended consequence of lowering rates is capital flight, as capital flees devaluation and negative returns and seeks higher returns elsewhere. This is a self-reinforcing process, as capital flight causes the currency to lose value, reducing the purchasing power and wealth of all who hold the currency. This motivates everyone who anticipates this devaluation to get their money out of the depreciating currency, which further weakens the currency which then triggers even more capital flight, and so on. The only way to avoid the devaluation is to pull your cash out of that currency and put it into a currency that’s strengthening. For many, that currency will be the USD, due to its ubiquity and the liquidity of its capital markets. Nations such as China are boxed into a lose-lose choice. If they lower rates to weaken their currency (to maintain a competitive export sector), they trigger capital flight, which weakens the domestic economy and creates a self-reinforcing feedback loop. If they do nothing and their currency rises as other nations aggressively devalue their currencies, their export sectors whither as competing exporters take market share. Any central bank that dares to raise rates will make their nation a magnet for capital seeking a higher return–both in yield and in currency appreciation. The Fed is boxed in, too: if the Fed can’t raise rates after seven years of “growth,” then its credibility suffers. If it raises rates, that accelerates the capital flow into USD and the U.S., pushing the dollar higher, which then triggers mayhem in China, emerging markets, commodity markets and U.S. corporate profits earned overseas. Welcome to a currency war in which victory depends on your perspective. If the USD continues strengthening, the winners will be those holding USD, as their currency will increase its purchasing power as other currencies devalue. As I always note: no nation ever devalued its way to hegemony or empire. Regards,

P.S. The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Coming War of Central Banks appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 May 2016 07:52 AM PDT This post Gold Up $10 This Morning appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Well, it looks like we’ve got a range bound currency market today. We have some currencies that have carved out gains, and others that have losses, but everything is within a very small range, except gold, which is up nearly $10 this morning! Wait until the boys and girls in NYC arrive at their desks this morning and see that! I see where L-O-L-A, Lola (aka Goldman Sachs) is saying that the dollar is going to continue to rally, maybe even 15% over the next two years. They point at the dollar’s reaction to the weak jobs report last Friday, (it didn’t drop as one would have expected) as proof that this dollar rally is good to go on. Lola also thinks that the markets have been too negative about the potential Fed rate hikes. Of course, I could point out that Lola also called for the euro to reach parity and the Japanese yen to reach 130, and had to reverse those calls to their clients. You can’t be right all the time, I guess. I’m not knocking them for these calls.. Short term forecasts for currencies are bound to be the opposite of what you think. What I’m more concerned about is this call by them now that they see the dollar rally lasting two more years. Shoot Rudy, I’m not even sure that the dollar will be around in two years! But that’s their prerogative. And they are Lola, and what Lola wants, Lola gets, right? Well, I had a dear reader send me a couple of notes yesterday, chastising me for talking about the impeachment of Brazilian President, Dilma Rousseff. The reader thought I was cheering for the impeachment, and told me to stick to things that I know about. That’s fair. But as I pointed out to him, I’m no fan of Rousseff for the policies she brought forward that damaged the value of the real, which during the Lula years as president, the real was the best performing currency a couple of years. But that I was really just attempting to bring real holders the news that effects their currency holdings. And that is the impeachment, which is weighing heavily on which way the real goes each day. And while the currency traders think the impeachment will be a good thing for Brazil, I’ll point out that at least two times in the past couple of weeks, I’ve said that the real rally could be short-lived once the impeachment is completed (could be tonight) given that no one has offered up a new monetary and fiscal plan for the country. If it’s just going to be the same-o, same-o for the economy, then why go through all this hand wringing to oust the President? And that’s my take on the whole thing… And I’m not attempting to be an expert into Brazilian politics. Shoot Rudy, I’m not even an expert into U.S. politics, and that’s by choice! Well, the gag order that was placed on Japanese officials, governmentt, Finance Ministry, and Bank of Japan (BOJ) was pushed aside last night when the Finance Minister warned the markets that he will take action to stop the “one-sided” situation in yen. This reversed the downward slide the yen had been in for three days, and it has moved back under the 109 figure. I have to question the yen traders on this move to strengthen yen on those comments. I really think that the BOJ has no teeth, no bite to its bark, nothing left in the tank, and any other description you can think of to say that they washed up, beaten, a “has been”, and so on. In fact, the BOJ could walk away and dissolve, and nothing in Japan would change. Their demographics would still be rotten to the core, their economy probably would be better off without a Central Bank putting their hands in the cookie jar and crumbling up the cookies every time the economy shows signs of strength.. The New Zealand dollar/kiwi is firmly on the rally tracks today after a very interesting twist to things overnight. Let me explain. The Reserve Bank of New Zealand (RBNZ) released their Financial Stability Report last night. But it wasn’t anything in the report that got kiwi on the rally tracks, that came later when RBNZ Gov. Wheeler told a parliamentary Committee that the RBNZ was “seriously looking at measures to restrict housing related lending, such as further restrictions on loan to value ratios.” Now, what in that comment got kiwi traders all lathered up? Ahhh, grasshopper, this is the train of thought so stick with me here. This comment implies the RBNZ is looking for ways to stop the housing sector from becoming a real problem, and that means the scope for interest rate cuts has narrowed greatly. In Australia overnight, Consumer Confidence jumped by 8.5% so far this month. I guess Consumers are excited about the Reserve Bank of Australia (RBA) rate cut at the beginning of the month. I would question their thoughts there. Why would you be confident when the Central Bank is telling you that things aren’t so great and that’s why they had to cut rates? Aussie dollar (A$) traders weren’t fooled into believing anything different about the economy, and the A$ failed to gain on this strong Consumer Confidence report. The A$ didn’t lose ground either, as it is flat on the day. The price of oil recovered a bit in the past 24 hours, and that has helped the Russian ruble keep its recent rally going in the right direction. The other petrol currencies have moved too, but their moves are very small. Gold moved higher by just $1.90 yesterday, so basically a flat day. But as I said earlier in the letter, gold is up nearly $10 this morning so far. I told you yesterday that I would talk to our metals guru, Tim Smith, about physical demand and I did! Tim tells me that leading up to a couple of weeks ago, physical demand was very strong to start the year, but the last couple of weeks, as the price of gold has range traded, the demand has faded. I read last night that John Hathaway, who runs Tocqueville Gold Fund, thinks that the bottom for gold has been reached. And just like I did above, I’m going to point out that Lola had to close their “short Gold” recommendation with a 4.5% loss. I got this info from ZeroHedge that back on February 15th, Lola announced its latest trading recommendation. Short Gold at $1,205 with a target of $1,000 and a 7% loss. Well, once again, Lola didn’t get what Lola wanted did she? I’m going to just simply say that I only point this stuff out to show you that just because a Big Boy Brokerage House like Goldman and all their economists and researchers says that an asset is going to go up or down, doesn’t always pan out. You should listen to yourself, and not a brokerage house that’s going to make money on your trades whether you do or not! And when you listen to yourself, you will have wanted to do all the reading on the facts that you can find. But let’s see here… strike one was the euro, strike two was the yen, and strike three is gold. Three strikes and you’re out Lola! O-U-T, out! Go grab some bench! If only they would take their bat and ball and glove and go home! And I see where The Perth Mint (Australia) sold 47,542 ounces in gold coins and bars in April, which is 0.9% lower than March, but 79.1% higher than a year ago! And year to date, gold sales total 180,312 ounces which is an increase of 55.5% over the first four months of 2015. And for all of you who prefer silver to gold (I love both!), the Perth Mint also report some very lofty numbers for silver ounces sold in April (1,161,766 ounces) and year to date (5,440,474 ounces). In 2015, The Perth Mint sold 2,088, 897 ounces of silver for the period Jan through April, and this year they sold 5,440,474 ounces of silver in the same period, which is a 160.5% increase! So, belly up to the bar and be one of the millions of investors buying physical gold and silver. The U.S. Data Cupboard is still looking for crumbs and not finding any. We will see the Treasury Budget today, but who really cares about that? I was doing some reading last night and came across something that quite interesting. How many of you recall that before Alan Greenspan, our Fed Chairman was Paul Volcker? Remember him? Recall his “Saturday Night Special”? (a rate hike out of meeting on a Saturday night). Well, he also called for a change in the target by the Fed. For years, the Fed targeted Fed Funds Rate. But Volcker thought it would be better to target Monetary Base. Good thing that change didn’t last past a few years, given the Fed’s Monetary Base these days! There’s something happening here, what it is ain’t exactly clear, there’s a man with a gun over there, telling me I’ve got to beware. Who’s the man with the gun over there? Ahhh, grasshopper, it’s not really a gun, it’s a make believe gun that’s pointed at U.S. Corporations playing funny games with their revenue calculations, which if put into check, would hurt the stock market more than any 25 Basis Points rate hike. Yesterday, Tony Sagami’s Connecting the Dots letter that can be found on www.mauldineconmics.com addressed what’s going on here. This is a snippet from his letter yesterday, “SEC Ready to Stop Accounting Shenanigans”:

Chuck again. Boy oh boy, that sounds like a double whammy on the horizon for stocks doesn’t it? If corporations can’t fudge their revenue numbers, and retail sales/spending continues to flounder, and the Fed finally gets around to hiking rates (now their talking about September, yeah, right two months before the election? Give me a break!) stocks will need some shelter from all the debris being thrown at them. But then I’m not your last pick as a stock jockey, which is why I only talk about the stock market as a whole and not individual issues! That’s it for today. I hope you have a wonderful Wednesday, and be good to yourself! Regards, Chuck Butler P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoningwebsite and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post Gold Up $10 This Morning appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||