Gold World News Flash |

- Is the Death of the Paper Gold Market Near?

- What You Need to Know About the Most Critical Election in Our Country’s History, Part II

- With A Historic -150% Net Short Position, Carl Icahn Is Betting On An Imminent Market Collapse

- American Billionaire Warns to Get Out of the Stock Markets & Run to Gold

- This is What Governments Do to People Who Try to Change the World

- Gold & Silver Conspiracy Theory Now a Proven Fact — Bill Murphy

- Asian stocks at 2-month lows as oil weighs; dollar up

- Report: 2008 Bank Bailouts Are Still Alive

- After COT Data Shocker, No Surprise Gold is Down $30 Today

- This Amazing Silver Trend Will Make Short Term Price Movements Irrelevant

- How Much Liberty Do Americans Have Left?

- The Agenda 21 Takedown of Uber and Lyft Exposed

- With A Historic -150% Net Short Position, Carl Icahn Is Betting On An Imminent Market Collapse

- Doomsday Canadian: What can we learn from Fort McMurray wildfire ? notregme

- SIGNS OF THE END PART 167 - LATEST EVENTS MAY 2016

- Fuck Political Correctness

- Robert KIYOSAKI -- Why the Ultimate STOCK MARKET CRASH Will Begin in 2016!!

- China eases gold trade rules in 6 cities

- Australia notices Deutsche Bank's agreement to settle gold, silver rigging claims

- Trumped! Why It Happened And What Comes Next, Part 3 (The Jobs Deal)

- Fort McMurray is a Ghost Town after Wildfire

- $12 Trillion Looted from Developing Countries and Hidden Offshore

- BHS collapse could cost pensions lifeboat £300m

- Trump’s Latest “Insane” Proposal

- Make Believe Money

- Commodities Overtake Stocks and Bonds with Best Rally Since 2010!

- Showdown: A Bull And A Bear Duke It Out: Will Silver And Gold Skyrocket… Or Collapse?

- Is Gold more Important than Silver?

- The Titillating and Terrifying Collapse of the Dollar...Again

- MPs bring in new advisers as BHS collapse enquiry begins

- Breaking News And Best Of The Web — May 10

| Is the Death of the Paper Gold Market Near? Posted: 09 May 2016 11:30 PM PDT Gold Stock Bull |

| What You Need to Know About the Most Critical Election in Our Country’s History, Part II Posted: 09 May 2016 11:00 PM PDT by Doug Casey, Casey Research:

Let's review them in decreasing order of disastrousness. Sanders is a lifelong government employee (like Hillary, Cruz, and Kasich). The self-declared socialist is an economically ignorant, hostile, mildly demented old man—the Democrats answer to John McCain. He gets traction by pushing the envy button effectively. This works in a world where many are not only ignorant of economics but have a distorted set of moral principles and no respect for property rights, while some others are cynically exploiting the system to become super wealthy. The machine approves of his basic principles, which are like Obama's. But he's probably just a bit too rabid to win a general election in 2016. Obama got in because, unlike Bernie, he seems so reasonable and nice. I know the pundits believe Hillary will win the Dem nomination and then the election, but I don't buy it. For one thing, she's (correctly) seen as the Establishment personified. And in a time of widespread resentment—especially if we're in the middle of a meltdown by November—that's the kiss of death. Assuming she's not already indicted for any of a number of crimes. I'm not just talking about Benghazi and the email brouhaha, although some think that alone will sink her ship of state. Additionally, there are the persistent rumors of health issues. So, if neither Hillary nor Bernie gets the nod, who will it be? I expect the Dems will find a left-wing general. Americans do love their military at the moment. Which is especially scary. If Trump is the Republican nominee, he'll draw attention to a long string of corruption that surrounds Hillary like a miasma, starting in 1978 with the $100,000 bribe disguised as cattle-trading profits. And her numerous friends and associates that have died suspicious deaths in years past, not the least of them Vince Foster and Ron Brown. And her abetting Bill's sleazy rape episodes with lower-middle-class bimbos. And persistent rumors (which I tend to credit) that she's an aggressive lesbian. These things aren't going to help her. Nor will the fact that she's a woman automatically help her with other women. To believe that is to believe that women are less perceptive than men. In fact, they tend to be shrewder at reading personalities. And Hillary's personality traits scream "liar," "fraud," and "dishonest." What about Cruz? (Editor’s note: Doug wrote this essay before Cruz dropped out.) His shifty, beady, squinty little eyes speak of duplicity. He seems to be a genuinely dislikable person, which itself is the kiss of death in an election. Elections, after all, have very little to do with ideology; they're really just popularity/personality contests among the hoi polloi. He's a borderline religious fanatic, a Christian version of the type of Muslim imams that really scare people. He's a genuine warmonger. And his wife, an ex-Goldman partner, an ex-Condi Rice counselor, and a member of the Council on Foreign Relations, is exactly the kind of Deep State person that voters reject and despise. He may have beaten Trump in a few Heartland states with big fundamentalist populations, but even the tone deaf management of the Republican Party will see that he's a complete nonstarter in a general election. Kasich? A lifelong politician, with nine terms as a congress critter, a stint as a governor, and one as a managing director of Lehman Brothers when it failed. These are the opposite of qualifiers in today's world. He's on the conventional statist side of almost every important issue—guns, global warming, drugs, medical care, and civil liberties. He's about as dangerous as Hillary or Cruz when it comes to involving the U.S. in foreign adventures. He's getting traction only because he seems low-key and "reasonable"—a Republican Obama. My guess is that the Deep State will try to give him the Rep nomination. After all, anyone but Trump… So let's look at Trump. I'm not a fan, per se, but I believe he’s going to go all the way. It's not because I believe polls, or pundits, or keep my finger on the pulse of the capite censi (i.e., those who inhabit the ghettos, barrios, and trailer parks of the U.S.). Why is Trump as popular as he is? Two reasons. First, he's outspoken and politically incorrect. He doesn't read from a script, like all the others. He says what his supporters are thinking, things that no other public figure is willing to say. Second, he's not part of the Establishment, the Deep State. He's the only candidate that's not a professional politician. These are simple things but extremely important characteristics for this election, which is going to take place during a social and economic hurricane. By the time November rolls around, however, three other qualities will come to the fore, and they'll be even more important. |

| With A Historic -150% Net Short Position, Carl Icahn Is Betting On An Imminent Market Collapse Posted: 09 May 2016 10:59 PM PDT from Zero Hedge:

Over the past year, based on his increasingly more dour media appearances, billionaire Carl Icahn had been getting progressively more bearish. At first, he was mostly pessimistic about junk bonds, saying last May that “what’s even more dangerous than the actual stock market is the high yield market.” As the year progressed his pessimism become more acute and in December he said that the “meltdown in high yield is just beginning.” It culminated in February when he said on CNBC that a “day of reckoning is coming.” Some skeptics thought that Icahn was simply trying to scare investors into selling so he could load up on risk assets at cheaper prices, however that line of thought was quickly squashed two weeks ago when Icahn announced to the shock of ever Apple fanboy that several years after his “no brainer” investment in AAPL, Icahn had officially liquidated his entire stake.

As it turns out, Icahn’s AAPL liquidation was just the appetizer of how truly bearish the legendary investor has become. * * * As readers will recall, when it comes to what we believe is one of the world’s most bearish hedge funds, we traditionally highlight the net exposure of Horseman Global, which not only has been profitable for the past four years, it has done so while running a net short book. To the point, as of March 31, Horseman was net short by a record 98%.

As it turns out this was nothing compare to Icahn’s latest net exposure. In the just disclosed 10-Q of Icahn’s investment vehicle, Icahn Enterprises LP in which the 80 year old holds a 90% stake, we find that as of March 31, Carl Icahn – who subsequently divested his entire long AAPL exposure – has been truly putting money, on the short side, where his mouth was in the past quarter. So much so that what on December 31, 2015 was a modest 25% net short, has since exploded into a gargantuan, and unprecedented for Icahn, 149% net short position. This is the result of a relatively flat long gross exposure of 164% resulting from a 156% equity and 8% credit long (a combined long exposure which is certainly far lower following the AAPL liquidation), and a soaring short book which has exploded from 150% as of March 31, 2015 to a whopping 313% one year later, on the back of 277% in gross short equity exposure and 36% short credit. |

| American Billionaire Warns to Get Out of the Stock Markets & Run to Gold Posted: 09 May 2016 10:30 PM PDT from The Dollar Vigilante: |

| This is What Governments Do to People Who Try to Change the World Posted: 09 May 2016 10:00 PM PDT from The Daily Bell:

Sentence by sentence, the US judiciary is creating its own version of the constitution. It is one that forbids people from creating online marketplaces or even putting silver into coins and selling them. Most recently, as we can see above, Arthur Budovsky, founder of Liberty Reserve just got 20 years in prison for allegedly running a money laundering operation. Prior to Budovsky's sentencing, Ross Ulbricht, the founder of Sllk Road, received a life sentence for founding and running a "darknet" marketplace that allowed people to buy illegal items like drugs and guns. Ulbricht is appealing. Before Budovksy and Ulbricht, there was US-based Bernard von NotHaus who invented the Liberty Dollar which contained actual silver, unlike current US coins. NotHaus encouraged buyers to use the coins as money and the US government prosecuted him for trying to undermine US currency. He was sentenced to six months of home detention and three years of probation, which apparently was later reduced. |

| Gold & Silver Conspiracy Theory Now a Proven Fact — Bill Murphy Posted: 09 May 2016 09:30 PM PDT from Reluctant Preppers: |

| Asian stocks at 2-month lows as oil weighs; dollar up Posted: 09 May 2016 09:30 PM PDT The Hindu Business Line |

| Report: 2008 Bank Bailouts Are Still Alive Posted: 09 May 2016 09:00 PM PDT by Pam Martens and Russ Martens, Wall St On Parade:

In addition, as Wall Street On Parade reported last month, the U.S. Treasury agreed to pump in an additional $258.1 billion going forward if Freddie Mac or Fannie Mae run into trouble, on top of the $187.5 billion they have already received from the U.S. taxpayer. In their first quarter earnings reports, both companies reported significant losses in their derivatives books but did not tap their Treasury lifelines further – at least for now. Freddie Mac and Fannie Mae were put into conservatorship by the U.S. government during the 2008 crisis. Wall Street banks are entangled with Freddie Mac and Fannie Mae because they serve as counterparties to each other's trillions of dollars in derivatives. Then there is the Federal Reserve's balance sheet which pre-crisis stood in the neighborhood of $800 billion and today stands at $4.5 trillion. Making up the bulk of the assets on the Federal Reserve's books are the U.S. Treasury securities and mortgage-backed securities (MBS) issued by Fannie Mae, Freddie Mac and Ginnie Mae that the Fed sopped up from markets choking on the stuff during the crash. According to the Fed's March 2016 balance sheet report, it currently holds $2.46 trillion of Treasuries and $1.76 trillion in agency MBS. According to the March 15-16, 2016 minutes of its Federal Open Market Committee meeting, the Federal Reserve plans to continue its reinvestment program and rollover program, which effectively means its balance sheet is not going to shrink back to normal anytime soon. The minutes read: |

| After COT Data Shocker, No Surprise Gold is Down $30 Today Posted: 09 May 2016 08:58 PM PDT Technical analyst Jack Chan shows why Friday's COT data was so shocking and what it means for gold. |

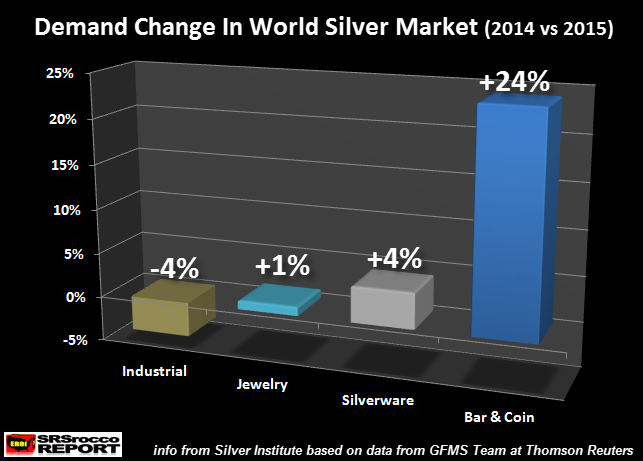

| This Amazing Silver Trend Will Make Short Term Price Movements Irrelevant Posted: 09 May 2016 07:50 PM PDT by Steven St. Angelo, SRS Rocco:

While precious metals investors are concerned about the short-term price movements in silver, the real focus should be on this amazing silver market trend. When the silver market data finally came out in the new 2016 World Silver Survey (released May 5th), it really surprised me. And, it takes a lot to surprise me. Not only did physical Silver Bar & Coin demand hit a new record in 2015, it did so in a huge way. Physical Silver Bar & Coin demand jumped 24% in 2015 versus the prior year reaching a record 292.3 million oz (Moz). Part of the reason for the higher record was the addition of "Private Bars & Rounds" to the statistics. I had mentioned in prior articles that I had an email exchange with the GFMS Team at Thomson Reuters about the Private Bars & Rounds figure. The GFMS Team stated that they were working on including this amount, but I thought it would be in the next few years. However, they updated all their past Silver Bar & Coin demand to include Private Bars & Rounds in the 2016 World Silver Survey. For example, the GFMS Team revised North American Silver Bar demand in 2014 from 10.8 Moz to 42.2 Moz, due the addition of private bars & rounds. The revision was even higher in 2015 as Official Silver coin sales were in severe shortage from July to October. When the GFMS Team first put out their 2015 Silver Interim Report in November 2015, they had estimated total Silver Bar & Coin demand to be 206 Moz: Thus, the GFMS Team revised Silver Bar & Coin demand for 2015 by an additional whopping 86 Moz. Of course, not all of the revision was due to private silver bars and rounds, but I would imagine at least half of it was. If you would like to get your copy of the 2016 World Silver Survey, you can but it isn't cheap. Just click on the link and you can order a copy for yourself. While I realize all the data in this report may not be accurate or some might say, "manipulated", I think it's the best source in the market. I highly recommend it over Jeff Christian's CPM Group 2016 Silver Yearbook. So, why is this increase of Silver Bar & Coin demand so interesting?? Let's look at the following chart: |

| How Much Liberty Do Americans Have Left? Posted: 09 May 2016 07:49 PM PDT This post explains the liberties guaranteed in the Bill of Rights – the first 10 amendments to the United States Constitution – and provides a scorecard on the extent of the loss of each right.

First AmendmentThe 1st Amendment protects speech, religion, assembly and the press:

The Supreme Court has also interpreted the First Amendment as protecting freedom of association. However, the government is arresting those speaking out … and violently crushing peaceful assemblies which attempt to petition the government for redress. A federal judge found that the law allowing indefinite detention of Americans without due process has a “chilling effect” on free speech. And see this and this. There are also enacted laws allowing the secret service to arrest anyone protesting near the president or other designated folks (that might explain incidents like this). Mass spying by the NSA violates our freedom of association. The threat of being labeled a terrorist for exercising our First Amendment rights certainly violates the First Amendment. The government is using laws to crush dissent, and it’s gotten so bad that even U.S. Supreme Court justices are saying that we are descending into tyranny. (And the U.S. is doing the same things that tyrannical governments have done for 5,000 years to crush dissent.) For example, the following actions may get an American citizen living on U.S. soil labeled as a “suspected terrorist” today:

And holding the following beliefs may also be considered grounds for suspected terrorism:

And see this. (Of course, Muslims are more or less subject to a separate system of justice in America.) And 1st Amendment rights are especially chilled when power has become so concentrated that the same agency which spies on all Americans also decides who should be assassinated.

|

| The Agenda 21 Takedown of Uber and Lyft Exposed Posted: 09 May 2016 06:30 PM PDT Alex Jones talks with Infowars reporters Joe Biggs and Lee Ann McAdoo about Austin Texas' recent decision that led to Uber pulling out from the city. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| With A Historic -150% Net Short Position, Carl Icahn Is Betting On An Imminent Market Collapse Posted: 09 May 2016 05:58 PM PDT Over the past year, based on his increasingly more dour media appearances, billionaire Carl Icahn had been getting progressively more bearish. At first, he was mostly pessimistic about junk bonds, saying last May that "what's even more dangerous than the actual stock market is the high yield market." As the year progressed his pessimism become more acute and in December he said that the "meltdown in high yield is just beginning." It culminated in February when he said on CNBC that a "day of reckoning is coming." Some skeptics thought that Icahn was simply trying to scare investors into selling so he could load up on risk assets at cheaper prices, however that line of thought was quickly squashed two weeks ago when Icahn announced to the shock of ever Apple fanboy that several years after his "no brainer" investment in AAPL, Icahn had officially liquidated his entire stake. As it turns out, Icahn's AAPL liquidation was just the appetizer of how truly bearish the legendary investor has become. * * * As readers will recall, when it comes to what we believe is one of the world's most bearish hedge funds, we traditionally highlight the net exposure of Horseman Global, which not only has been profitable for the past four years, it has done so while running a net short book. To the point, as of March 31, Horseman was net short by a record 98%.

As it turns out this was nothing compare to Icahn's latest net exposure. In the just disclosed 10-Q of Icahn's investment vehicle, Icahn Enterprises LP in which the 80 year old holds a 90% stake, we find that as of March 31, Carl Icahn - who subsequently divested his entire long AAPL exposure - has been truly putting money, on the short side, where his mouth was in the past quarter. So much so that what on December 31, 2015 was a modest 25% net short, has since exploded into a gargantuan, and unprecedented for Icahn, 149% net short position. This is the result of a relatively flat long gross exposure of 164% resulting from a 156% equity and 8% credit long (a combined long exposure which is certainly far lower following the AAPL liquidation), and a soaring short book which has exploded from 150% as of March 31, 2015 to a whopping 313% one year later, on the back of 277% in gross short equity exposure and 36% short credit.

Putting this number in context, in the history of IEP, not only has Icahn never been anywhere near this short, but just one year ago when he first started complaining about stocks, he was still 4% net long. Thos days are gone, and starting in Q3 and Q4, Icahn proceeded to wage into net short territory, with roughly -25% exposure, a number that has increased a record six-fold in just the last quarter! What is just as notable is the dramatic leverage involved on both sides of the flatline, but nothing compares to the near 3x equity leverage on the short side (this is not CDS). As a reminder, Icahn Enterprises used to be run as a hedge fund with outside investors, but Icahn returned outside money in 2011, leaving IEP and Icahn as the two dominant investors. According to Barron's, the entire fund appears to be about $5.8 billion, with $4 billion coming from Icahn personally. Which means that this is a very substantial bet in dollar terms. When asked about this unprecedented bearish position, Icahn Enterprises CEO Keith Cozza said during the May 5 earnings call that "Carl has been very vocal in recent weeks in the media about his negative views." He certainly has been, although many though he was merely exagerating. He was not. "We're much more concerned about the market going down 20% than we are it going up 20%. And so the significant weighting to the short side reflects that," Cozza added. Icahn was not personally present at the conference call, however now that his bet on what is arguably a massive market crash has become public, we are confident he will be on both CNBC and Bloomberg TV in the coming days if not hours, to provide damage control and to avoid a panic as mom and pop investors scramble, and wonder just what does one of the world's most astute investors see that they don't. |

| Doomsday Canadian: What can we learn from Fort McMurray wildfire ? notregme Posted: 09 May 2016 05:30 PM PDT Fort McMurray Fire Teaches People What Preppers Already Know A prepper reflects on the colossal fire in Fort McMurray, Alberta that has devastated many Canadians. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| SIGNS OF THE END PART 167 - LATEST EVENTS MAY 2016 Posted: 09 May 2016 05:00 PM PDT God is about to split Babylon(America) into pieces. Be ready, do good to others where you can, when you can. Love your neighbors The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 09 May 2016 04:00 PM PDT My name is Spencer Cathcart and in this video I rant about political correctness and discuss topics such as racism, feminism, religion, censorship, obesity, and more. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Robert KIYOSAKI -- Why the Ultimate STOCK MARKET CRASH Will Begin in 2016!! Posted: 09 May 2016 03:30 PM PDT A low interest loan now is only good if it goes to buy a cash flow asset. You must do your home work finding these assets. When interest rates go up your debt shrinks in nominal terms. The value of your asset depends on cash flow. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| China eases gold trade rules in 6 cities Posted: 09 May 2016 03:19 PM PDT By Leng Cheng http://www.shanghaidaily.com/business/energy/China-eases-gold-trade-rule... China will relax rules for cross-border trading of gold in six cities as the world's biggest gold consumer and producer hopes this move will increase bullion imports. Gold companies will be able to clear customs up to 12 times with just one permit after the rules are eased, a joint statement by the People's Bank of China and the General Administration of Customs said yesterday. The current rules force the companies to apply permits for every import or export of the gold. The rules will be effective from June 1 in the six cities of Shanghai, Beijing, Guangzhou, Nanjing, Qingdao, and Shenzhen, the statement said. "The new measure will simplify the approval procedures and improve the gold trading environment," the statement said. The eased rules followed the setting up of a yuan-denominated gold fix in the Shanghai Gold Exchange two weeks ago in a bid to help China join London and New York as a global hub for bullion trading, said SGE Chairman Jiao Jinpu. Gold consumption in China has been climbing as rising incomes and economic growth boost purchases of jewelry, bars and coins. The gold consumption totaled 985.9 tons last year. Output stood at 450.1 tons in 2015, according to figures from the China Gold Association. ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Australia notices Deutsche Bank's agreement to settle gold, silver rigging claims Posted: 09 May 2016 02:52 PM PDT New York Court Investigates Claims Silver and Gold Prices Rrigged By Trevor Sykes Silver and gold are looking strong again, partly because of interest rate movements but possibly also because of a court case being settled in New York. The interest rate factor is clear. One of the arguments against holding precious metals has always been that they yield no interest. Now we are in an environment where government bonds and bank deposits yield very low interest anyway, so that argument has lost much of its strength. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. The court case, in the Southern District of New York, has so far been unreported in Australia. A group of plaintiffs sued Deutsche Bank, the Bank of Nova Scotia, HSBC, and their private company the London Silver Market Fixing Ltd for breaches of US anti-trust legislation. Another defendant was the Swiss-based UBS. The plaintiffs alleged the banks rigged the silver market by publishing false prices. London Silver Fixing had run the daily silver auctions in London until August 2014, when the London Bullion Market Association (LBMA) took over the auctions. Silver traders sued the banks and the company in 2014, alleging that the banks had abused their controlling position in the silver market to reap illegitimate profits from trading. They were alleged to have hurt traders who invested billions of dollars based on the benchmarks which were set by the banks. UBS did not set the benchmarks, but was accused of conspiring to exploit the silver fix. On April 13, Deutsche Bank shocked the market by unilaterally agreeing to settle. The amount it has agreed to pay remains undisclosed. Deutsche Bank also agreed to cooperate with the plaintiffs by providing "instant messages and other electronic communications". Lawyers for the plaintiffs said the cooperation would "substantially assist plaintiffs in the prosecution of their claims against the non-settling defendants". When one defendant in a lawsuit breaks ranks and settles, it normally puts great pressure on the other defendants to do the same. It will also put pressure on the current LBMA silver auctions, because HSBC and the Bank of Nova Scotia are two of the five LBMA parties. Price manipulation in this market can be prosecuted criminally. Whether such a prosecution is launched will depend on the regulator, Britain's Financial Conduct Authority (FCA). More importantly, the allegations also extend to the gold market. A total of 96 plaintiffs are suing 22 defendants with claims that the gold market has been manipulated. The defendants in the gold case are the Bank of Nova Scotia, Barclays, Deutsche Bank, HSBC, Societe Generale, UBS and The London Gold Market Fixing Ltd. Again, it has been reported that Deutsche Bank is negotiating to unilaterally settle the claims. The repercussions from such a settlement are potentially huge. Traders have suspected for years that the gold market was being rigged. The London fix and the Comex market in New York are the world's dominant gold markets, but prices are set in derivatives. In theory the daily London fix is supposed to be for physical delivery, but in practice trades are settled in cash and only rarely in gold. In the physical markets, the big buyers for many years have been China, India and other Asian nations. The biggest gold hoard in the world is supposed to be in Fort Knox, but there is a strong suspicion that its holdings are much smaller than reported. If that is so, the gold market is truly distorted because the price is being set in US and UK derivative markets and not by the physical market. If the US lawsuit extends into the heart of gold price fixing, the revelations could be explosive. Silver peaked at $43 an ounce in April 2011. It went as low as $19 last January but has since recovered to $23. Gold went as low as $1351 an ounce in November 2011 and has recently been trading above $1,700. ----- Disclosure: Trevor Sykes holds shares in gold exploration companies. The author is not a licensed investment advisor. Views expressed are his own and not a substitute for tailored investment advice. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Trumped! Why It Happened And What Comes Next, Part 3 (The Jobs Deal) Posted: 09 May 2016 01:54 PM PDT This post Trumped! Why It Happened And What Comes Next, Part 3 (The Jobs Deal) appeared first on Daily Reckoning. Donald Trump's patented phrase "we aren't winning anymore" lies beneath the tidal wave of anti-establishment sentiment propelling his campaign and, to some considerable degree, that of Bernie Sanders, too. As we demonstrated in Part 1, what's winning is Washington, Wall Street and the bicoastal elites. The latter prosper from finance, the LA and SF branches of entertainment ( movies/TV and social media, respectively) and the great rackets of the Imperial City—including the military/industrial/surveillance complex, the health and education cartels, the plaintiffs and patent bar, the tax loophole farmers and the endless lesser K-Street racketeers. But most of America's vast flyover zone has been left behind. Thus, the bottom 90% of families have no more real net worth today than they had 30 years ago and earn lower real household incomes and wages than they did 25 years ago. Needless to say, the lack of good jobs lies at the bottom of the wealth and income drought on main street, and this week's April jobs report provided still another reminder. During the last three months goods-producing jobs have been shrinking again, even as the next recession knocks on the door. These manufacturing, construction and energy/mining jobs are the highest paying in the US economy and average about $56,000 per year in cash wages. Yet it appears that the 30 year pattern shown in the graph below——lower lows and lower highs with each business cycle—-is playing out once again. So even as the broadest measure of the stock market—-the Wilshire 5000—–stands at 11X its 1989 level, there are actually 22% fewer goods producing jobs in the US than there were way back then.

This begs the question, therefore, as to the rationale for the Jobs Deal we referenced in Part 1, and why Donald Trump should embrace a massive swap of the existing corporate and payroll taxes for new levies on consumption and imports. The short answer is that Greenspan made a giant policy mistake 25 years ago that has left main street households buried in debt and stranded with a simultaneous plague of stagnant real incomes and uncompetitively high nominal wages. It happened because at the time that Mr. Deng launched China's great mercantilist export machine during the early 1990s, Alan Greenspan was more interested in being the toast of Washington than he was in adhering to his lifelong convictions about the requisites of sound money. Indeed, he apparently checked his gold standard monetary princples in the cloak room when he entered the Eccles Building in August 1987. Not only did he never reclaim the check, but, instead, embraced the self-serving institutional anti-deflationism of the central bank. This drastic betrayal and error resulted in a lethal cocktail of free trade and what amounted to free money. It resulted in the hollowing out of the American economy because it prevented American capitalism from adjusting to the tsunami of cheap manufactures coming out of China and its east Asian supply chain. So what would have happened in response to the so-called "china price" under a regime of sound money in the US? The Fed's Keynesian economists and their Wall Street megaphones would never breath a word of it, of course, because they have a vested interest in perpetuating inflation. It gives inflation targeting central bankers the pretext for massive intrusion in the financial markets and Wall Street speculators endless bubble finance windfalls. But the truth is, sound money would have led to falling consumer prices, high interest rates and an upsurge of household savings in response to strong rewards for deferring current consumption. From that enhanced flow of honest domestic savings the supply side of the American economy could have been rebuilt with capital and technology designed to shrink costs and catalyze productivity. But instead of consumer price deflation and a savings-based era of supply side reinvestment, the Greenspan Fed opted for a comprehensive Inflation Regime. That is, sustained inflation of consumer prices and nominal wages, massive inflation of household debt and stupendous inflation of financial assets. To be sure, the double-talking Greenspan actually bragged about his prowess in generating something he called "disinflation". But that's a weasel word. What he meant, in fact, was that the purchasing power of increasingly uncompetitive nominal American wages was being reduced slightly less rapidly than it had been in the 1980s. Still, the consumer price level has more than doubled since 1987, meaning that prices of goods and services have risen at 2.5% per year on average. Notwithstanding all the Fed's palaver about "low-flation" and undershooting its phony 2% target, American workers have had to push their nominal wages higher and higher just to keep up with the cost of living. But in a free trade economy the wage-price inflation treadmill of the Greenspan/Fed was catastrophic. It drove a wider and wider wedge between US wage rates and the marginal source of goods and services supply in the global economy. That is, US production was originally off-shored owing to the China Price with respect to manufactured goods. But with the passage of time and spread of the central bank driven global credit boom, goods and services were off-shored to places all over the EM. The high nominal price of US labor enabled the India Price, for example, to capture massive amounts of call center activity, engineering and architectural support services, financial company back office activity and much more. At the end of the day, it was the Greenspan Fed which hollowed out the American economy. Without the massive and continuous inflation it injected into the US economy, nominal wages would have been far lower, and on the margin far more competitive with the off-shore. That's because there is a significant cost per labor hour premium for off-shoring. The 12,000 mile supply pipeline gives rise to heavy transportation charges, logistics control and complexity, increased inventory carry in the supply chain, quality control and reputation protection expenses, lower average productivity per worker, product delivery and interruption risk and much more. In a sound money economy of falling nominal wages and even more rapidly falling consumer prices, American workers would have had a fighting chance to remain competitive, given this significant off-shoring premium. But the demand-side Keynesians running policy at the Fed and US treasury didn't even notice that their wage and price inflation policy functioned to override the off-shoring premium, and to thereby send American production and jobs fleeing abroad. Indeed, they actually managed to twist this heavy outflow of goods and services production into what they claimed to be an economic welfare gain in the form of higher corporate profits and lower consumer costs. Needless to say, the basic law of economics—-Say's Law of Supply—-says societal welfare and wealth arise from production; spending and demand follow output and income. By contrast, our Keynesian central bankers claim prosperity flows from spending, and they had a ready solution for the gap in spending that initially resulted when jobs and incomes were sent off-shore.

The de facto solution of the Greenspan Fed was to supplant the organic spending power of lost production and wages with a simulacrum of demand issuing from an immense and contiunuous run-up of household debt. Accordingly, what had been a steady 75-80% ratio of household debt to wage and salary income before 1980 erupted to 220% by the time of Peak Debt in 2007. The nexus between household debt inflation and the explosion of Chinese imports is hard to miss. Today monthly Chinese imports are 75X larger than the were when Greenspan took office in August 1987. At the same time, American households have buried themselves in debt, which has rising from $2.7 trillion or about 80% of wage and salary income to $14.2 trillion. Even after the financial crisis and supposed resulting deleveraging, the household leverage ratio is still in the nosebleed section of history at 180% of wage and salary earnings.

Stated differently, had the household leverage ratio not been levitated in the nearly parabolic fashion shown below, total household debt at the time of the financial crisis would have been $6 trillion, not $14 trillion. In effect, the inflationary policies of the Greenspan Fed and its successors created a giant hole in the supply side of the US economy, and then filled it with $8 trillion of incremental debt which remains an albatross on the main street economy to this day. Then again, digging holes and refilling them is the essence of Keynesian economics.

At the end of the day, the only policy compatible with Greenspan's inflationary monetary regime was reversion to completely managed trade and a shift to historically high tariffs on imported goods and services. That would have dramatically slowed the off-shoring of production, and actually also would have remained faithful to the Great Thinker's economics. After all, in 1931 Keynes turned into a vociferous protectionist and even wrote an ode to the virtues of "homespun goods". Alas, inflation in one country behind protective trade barriers doesn't work either, as was demonstrated during the inflationary spiral of the late 1960s and 1970s. That's because in a closed economy easy money does lead to a spiral of rising domestic wages and prices owing to too much credit based spending; and this spiral eventually soars out of control in the absence of the discipline imposed by lower-priced foreign goods and services. In perverse fashion, therefore, the Greenspan Fed operated a bread and circuses economy. Unlimited imports massively displaced domestic production and incomes—even as they imposed an upper boundary on the rate of CPI gains. The China Price for goods and India Price for services, in effect, throttled domestic inflation and prevented a runaway inflationary spiral. The ever increasing debt-funded US household demand for goods and services, therefore, was channeled into import purchases which drew upon virtually unlimited labor and production supply available from the rice paddies and agricultural villages of the EM. In a word, the Fed's monetary inflation was exported. Free trade also permitted many companies to fatten their profits by arbitraging the wedge between Greenspan's inflated wages in the US and the rice paddy wages of the EM. Indeed, the alliance of the Business Roundtable and the Keynesian Fed in behalf of free money and free trade is one of history's most destructive arrangements of convenience. In any event, the graph below nails the story. During the 29 years since Greenspan took office, the nominal wages of domestic production workers have soared, rising from $9.22 per hour in August 1987 to $21.26 per hour at present. It was this 2.3X leap in nominal wages, of course, that sent jobs packing for China, India and the EM. At the same time, the inflation-adjusted wages of domestic workers who did retain there jobs went nowhere at all. That's right. There were tens of millions of jobs off-shored, but in constant dollars of purchasing power, the average production worker wage of $383 per week in mid-1987 has ended up at $380 per week 29 years later.

During the span of that 29 year period the Fed's balance sheet grew from $200 billion to $4.5 trillion. That's a 23X gain during less than an average working lifetime. Greenspan claimed he was the nation's savior for getting the CPI inflation rate down to around 2% during his tenure; and Bernanke and Yellen have postured as would be saviors owing to their strenuous money pumping efforts to keep it from failing the target from below. But 2% inflation is a fundamental Keynesian fallacy, and the massive central bank balance sheet explosion which fueled it is the greatest monetary travesty in history. Dunderheads like Bernanke and Yellen say 2% inflation is just fine because under their benign monetary management everything comes out in the wash at the end——-wages, prices, rents, profits, living costs and indexed social benefits all march higher together with tolerable leads and lags. No they don't. Jobs in their millions march away to the off-shore world when nominal wages double and the purchasing power of the dollar is cut in half over 29 years. These academic fools apparently believe they live in Keynes' imaginary homespun economy of 1931! The evident economic distress in the flyover zone of America and the Trump voters now arising from it in their tens of millions are telling establishment policy makers that they are full of it; that they have had enough of free trade and free money. What can be done now? The solution lies in the contra-factual to the Greenspan/Fed Inflation Regime. Under sound money, the balance sheet of the Fed would still be $200 billion, household debt would be a fraction of its current level, the CPI would have shrunk 1-2% per year rather than the opposite and nominal wages would have shrunk by slightly less. Under those circumstances, there would have been no explosion of US imports because US suppliers would have remained far more competitive and domestic demand for goods and services far more subdued. To wit, what amounts to a statistical Trump Tower in our trade accounts——where total imports exploded by 6X——- couldn't have happened under a regime of sound money.

For instance, if the CPI had shrunk by 1.5% annually since 1987 and nominal wages by 0.5%, the average nominal production wage today would be $8 per hour, meaning that American labor would be dramatically more competitive in the world economy versus the EM Price than it currently is at $22 per hour. But real wages would be far higher at $500 per week compared to the actual of $380 per week shown above. At the same time, solid breadwinner jobs in both goods and services would be far more plentiful than reported last Friday by the BLS. Needless to say, the clock cannot be turned back, and a resort to Keynes' out-and-out protectionism in the context of an economy that suckles on nearly $3 trillion of annual goods and services imports is a non-starter. It would wreak havoc beyond imagination. But it is not too late to attempt the second best in the face of the giant historical detour from sound money that has soured the practice of free trade. To wit, public policy can undo some of the damage by sharply lowering the nominal price of domestic wages and salaries in order to reduce the cost wedge versus the rest of the world. It is currently estimated that during 2016 Federal social insurance levies on employers and employees will add a staggering $1.1 trillion to the US wage bill. Most of that represents social security and medicare payroll taxes. The single greatest things that could be done to shrink the Greenspan/Fed nominal wage wedge, therefore, is to rapidly phase out all Federal payroll taxes, and thereby dramatically improve the terms of US labor trade with China and the rest of the EM world. Given that the nation's total wage bill (including benefit costs) is about $10 trillion, elimination of Federal payroll taxes would amount to a 11% cut in the cost of US labor. On the one hand, such a bold move would dramatically elevate main street take-home pay owing to the fact that half of the payroll tax levy is extracted from worker pay packets in advance. In the case of a rust belt industrial worker making $25 per hour, for example, it would amount to an additional $4,000 per year in take home pay. Moreover, elimination of payroll taxes would be far more efficacious from a political point of view in Trump's flyover zone constituencies than traditional Reaganite income tax rate cuts. That's because nearly 160 million Americans pay social insurance taxes compared to less than 50 million who actually pay any net Federal income taxes after deductions and credits. At the same time, elimination of the employer share of Federal payroll taxes would reduce the direct cost of labor to domestic business by upwards of $575 billion per year. And as we have proposed in the Jobs Deal, the simultaneous elimina |

| Fort McMurray is a Ghost Town after Wildfire Posted: 09 May 2016 01:30 PM PDT Two teenagers died in Fort McMurray, in Alberta before they could evacuate from the town that was destroyed by a wildfire. The wildfire which started on May 1covers an area larger than New York City. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| $12 Trillion Looted from Developing Countries and Hidden Offshore Posted: 09 May 2016 11:55 AM PDT Tax Justice Network's James S. Henry says authoritarian regimes account for over $11 trillion of "missing" offshore financial wealth from emerging economies The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BHS collapse could cost pensions lifeboat £300m Posted: 09 May 2016 11:26 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Trump’s Latest “Insane” Proposal Posted: 09 May 2016 09:00 AM PDT This post Trump's Latest "Insane" Proposal appeared first on Daily Reckoning. Donald Trump has the establishment scared ****less… That's exciting. I love it. Look at their reaction to his plan to reduce the national debt. The Washington Post, which is owned by a Deep State member, says it's "reckless." Wall Street blowhards call it "absurd." And a former senior U.S. Treasury Department official calls it "insane." So what exactly has Trump proposed to get assorted card-carrying members of the Deep State so worked up? An Indecent ProposalIn an interview with Deep State mouthpiece CNBC, Trump said he's open to negotiating the U.S. national debt down… He proposes cutting a deal with debt holders so that they take less than the full amount they are owed. Critics whine his plan is a de facto U.S. debt default that will cause a global economic calamity. That's the story the media is breathlessly reporting. But, as usual, the true story is buried deeper. And it explains why the establishment wants to destroy Trump with all deliberate speed. We're Screwed…So why is the dealmaker Trump looking to cut the deal of his lifetime with the national debt? Because he's focused on something that the Deep State's candidate, Hillary Clinton, won't say in public… even though she knows it's a ticking economic time bomb. Here's what Trump told CNBC: "We're paying a very low interest rate [on the debt]," he said. "What happens if that interest rate goes two, three, four points up? We don't have a country. I mean, if you look at the numbers, they're staggering." To make Trump's point, consider… In 2015, the U.S. spent $223 billion on interest on the national debt. That's with rates at zero. Historically, interest rates for U.S. government debt have ranged between 4 to 6%. Just before the Great Recession they were between 4.5 and 5.25%. If interest rates returned to those normal levels, the cost of servicing the debt would rise to roughly $1 trillion per year. That's basically the entire U.S. discretionary budget in 2015. If rates go up to historically normal levels, just paying interest on our debt would cost as much as we spend on the U.S. Departments of Defense, State, Health and Human Services, Education, Homeland Security, Housing and Urban Development, Justice—the list goes on. And because the government borrows the money to make interest payments, this starts a vicious chain reaction of paying interest on money borrowed to pay interest. Analysts estimate this spiral would cause the national debt to increase more than $60 trillion in less than 20 years. In other words, we'd be penniless peasants deployed to work on Deep State-owned rice farms. So Trump wants to kick the Deep State in the teeth, so to speak. More Propaganda…Now, let me be clear… This isn't an endorsement of Donald Trump. And it's not an endorsement of his proposal to deal with our massive debt problem. My analysis is to help you see beyond hyperventilating headlines that the establishment feeds you daily. They want you afraid. Scared. They want you to only think that Trump is outrageous. Remember when they used to portray Ron Paul as a lunatic? They're trying to do the same thing with Trump… just because he's anti-establishment. They want you to think that anything beyond Deep State control is damaging to you. But, whatever your current understanding, make sure you pay attention to the real issue: debt is the lifeblood of the Deep State. They get rich and powerful while they bankrupt our nation. The last thing they want is to reduce the addiction to debt. They don't care if our exploding debt ends up ruining millions of Americans in an epic financial collapse. That's why Trump's statement is viewed as blasphemy… And that's why the Deep State will do whatever it can to make sure Trump doesn't get in the White House. Dangerous DonaldThe establishment would rather have Hillary in the White House. She's a safe bet for the shadow government. With the "devil" as the President, we can expect to keep piling trillions of debt on top of debt with no end in sight, until it all comes tumbling down. Then they take what you have left in the name of saving the country. Don't you find it strange that the mainstream media never reports on how much money Hillary has been paid by the Deep State? It's $153 million and counting over the last 15 years. Don't you find it odd that if you were the United States Secretary of State and left national secrets on an email server stored in a bathroom that could easily be hacked from Romania, you would be in jail for life… yet she's on the cusp of becoming President? I mean, even little kids know this is wrong. They know it's crooked. And yet, the media focuses the majority of its time on how irresponsible and non-presidential Trump is. So next time you hear hyperventilating voices from the Deep State railing against Trump and his "dangerous" ideas, just remember… they're right. Trump's ideas are very dangerous… to the wealth and power of the Deep State. And that's why they want him stopped. Please send your feedback to coveluncensored@agorafinancial.com. Let me know what you really think about Clinton vs. Trump. Regards, Michael Covel The post Trump's Latest "Insane" Proposal appeared first on Daily Reckoning. |

| Posted: 09 May 2016 08:51 AM PDT This post Make Believe Money appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a marvelous Monday to you! Well, the so-called “Judgment Day” last Friday, was simply not what it was cut out to be. I guess in the end though, the Jobs Report did put to bed the thought that the Fed would be hiking rates in June. And the rate hike campers looked like they had lost their puppy, as their shoulders slumped, the chin dropped into their chests, and they shuffled off quietly to the wall boards where they came from. Didn’t hear about the Jobs Report from Friday? Well, it’s all just a little ridiculous to me, that the markets get all wound up over surveys and hedonic adjustments, but it is what it is, so let’s go check the numbers before we talk about the currencies and metals, eh? According to the report in the Wall Street Journal (WSJ) on Friday. The U.S. labor market decelerated in April, a sign employers may be turning cautious after the economy slowed early in the year. Payrolls rose by a “seasonally adjusted” 160,000 in April, and the Unemployment Rate remained at 5%. Here’s a little ditty for you that you didn’t see on TV, or hear on the radio or read in the newspaper about the quality of jobs that have been added for the past 2 years: since 2014, the U.S. has added 450,000 waiters and bartenders, and no Manufacturing workers. Boy, I sure get good service when I belly up the bar these days. And here’s another ditty. Since 2014, the oil and gas producers have cut 200,000 jobs. But I don’t recall hearing anyone talk about that. Hmmm… And wanna know something else about the jobs data? Well, notice above that I highlighted the words “seasonally adjusted”. That means 233,000 jobs were added by the BLS with their Birth/Death Model. These are “make believe” jobs folks, and without the “Seasonal adjustment” we would have had negative job growth in April. But we certainly can’t allow the markets and investors know that! Oh heaven! The Humanity! With “make believe” jobs you get “make believe” labor markets, but don’t let that get in the way of all those that keep saying that the U.S. economy is doing fine. Speaking of “make believe”… I’m going to borrow a quote from my friend, James Powell, who had this to say in his latest letter:

Alright, I have to stop there on all this craziness regarding the labor markets. Everyone is searching for straws, as some people looked under the hood, which they normally don’t do, as they take the headline number and run with it, and found that wages firmed. Well, it’s about time, don’t you think? Let’s not get all lathered up about that, given that it should have happened years ago!’ And speaking of a rate hike in June, or the lack of one; The Heavyweights have weighed in with their opinions. Bond King, Bill Gross, his old partner, Mohammed El-Erian, are telling their listeners to “not count the Fed out”. So, here’s my thought on that – these guys got the memo from the Fed, to jawbone about the possibility of a rate hike, so that the Fed members don’t have to, and then have egg all over their collective faces when no rate hike comes in June. Just the way my mind thinks about these things… So, the Jobs Jamboree wasn’t up to snuff on Friday, and gold took off for higher ground. The currencies rallied, and it appeared for the short-time left to trade on Friday while there was still liquidity in the markets, that the dollar rebound would be short-lived. But when I turn on the screens this morning and look at the currencies and metals, I see a lot of red. Gold is giving back $16 at this point of the morning, after climbing $10 on Friday. Once again the price manipulators took their pound of flesh from the gold rally on Friday, as the shiny metal was up over $20 at one point in the day, only to see it get whacked late in the day. And the currencies… Well, Friday’s rebound didn’t have any legs, and Monday’s early trading has the dollar back in the driver’s seat. The euro was 1.14 when I turned on the monitor this morning, but it has already fallen back below that figure. I appears that the Petrol Currencies that include: Russian rubles, Canadian dollar/loonies, Norwegian krone, Brazilian real and Mexican pesos are about the only currencies to see the light of day, and keep their heads above water this morning, as the price of oil is holding steady around $45.50. Things in Brazil continue to unravel for the President, Dilma Rousseff. The Impeachment process will head to the Senate now, and from there, and it only takes a majority vote, if she is impeached, she will have to step down the next day. I believe that the Senate vote has been scheduled for Wednesday, so we won’t have to wait too much longer to find out the fate of the Brazilian President, who has been no friend of the markets since she was first voted into office, and immediately, began to chop the real off at the knees. Germany printed one of the “real economic data pieces” today. Factory Orders for March rose 1.9% VS 0.6% consensus, and previous print of -0.8%… So, a real nice rebound for the German Factory Orders, and while it’s just one report, and I know I always tell you that one report doesn’t make a trend, like one swallow doesn’t make a summer, but, think about this before we rudely dismiss the one month results. We’ve gone from -2.1% to -0.8%, to +1.9%, do you see the momentum building there? I did, I did, said Tweety Bird! Economic growth around the world is suffering. But there’s one large economy, and not some third world country’s economy, that’s outperforming all others. Can you guess who it is? Well, if you said India, then you win the gold star today! Yes, India, and here’s another piece of the puzzle that is in India’s favor as they just printed their April Car Sales report, which showed car sales jumping by 11.1%! And marked the first double-digit prints in back to back years for India! And the Indian people aren’t that different than we are here in the U.S. when it comes to taste in vehicles. The majority of the vehicles purchased were SUV’s and Vans. Of course here in the U.S. Americans are still lining up to buy pickup trucks! The problem the Indian rupee has is that it is so influenced by the Chinese renminbi. And there are times the Indian economic reports would signal a rupee rally, but the renminbi is being treated harshly by the People Bank of China (PBOC) and that leaves rupee traders with their collective hats in their hands. But the renminbi was allowed to appreciate overnight in the fixing, so the rupee is on the rally tracks today, after the strong car sales report. Speaking of China… China’s FX reserves edged higher in April $6.4 billion, and that follows a $10.3 billion gain in March. So, if there’s no so-called Shanghai Accord, in place to stabilize the renminbi, then this is the miracle of Marco Polo! The renminbi is basically flat vs. the dollar so far this year, and that’s a lot like holding the renminbi before the Chinese broke the peg to the dollar in July 2005! But there’s a caveat here that we didn’t have pre-2005, and that is the de-dollarization that’s going on with China and Russia. And speaking of Russia… did you hear what Russia has done now to move their de-dollarization plans further down the road? It appears Russia is close to taking the next big step towards de-dollarization and killing the petro-dollar as Vladimir Putin’s “dream” of ruble-based pricing of its domestically-produced oil is on the verge of realization. SPIMEX (The St. Petersburg International Mercantile Exchange) is actively courting international oil traders to join its emerging futures market, which as Bloomberg reports, is designed “to create a system where Russian oil is priced and traded in a fair and straightforward way.” F. William Engdahl was quoted as saying, “This move could deal a dramatic blow to the petrodollar’s dominance”. You think? WOW. A new Mr. Obvious for us today! And the Japanese yen is weaker again this morning, proving once again that the recent miracle of Japanese yen was just smoke and mirrors. Yes, we had the so-called Shanghai Accord mixed in that pushed yen higher, but in the end, traders have to be wondering: “What the heck am I doing, being long yen? This is craziness and if you looked the word crazy up in the dictionary it would have a picture of a trader holding yen! So, the Japanese government isn’t doing anything they haven’t already done to weaken the yen, so they aren’t ticking off the G20 leaders that called for the so-called Shanghai Accord, calling for the dollar to weaken. The Japanese government can’t help it when traders come to their collective senses! Well, guess what’s back on the calendar to discuss nearly every day going forward? Yes, it’s Greece… And not the movie! Today, Eurozone Finance Ministers (Fin Mins) will meet in Brussels to discuss Greece. The Greek government has been asking for contingency fiscal measures and a restructuring of their debt. Nothing will be decided today, but here are some dates to keep in the back of your mind, should this Greece stuff interest you. First of all May 24, the next Eurozone Fin Mins meeting, and then late July, a scheduled EUR2.3 billion repayment is due to the European Central Bank (ECB). Canada is having some very dangerous and damaging fires in Alberta. These are very bad fires folks, and besides all the things that go with devastating fires like this, Canada’s oil revenue is getting whacked. The loonie has seen a nice recovery this year so far, but this is something that could end up weighing heavily on the loonie, folks. Be careful here… But right now, it doesn’t appear to be affecting the loonie too much, but it could end up doing so. The U.S. Data Cupboard is empty today, and we just have two Fed members speaking today, Evans and Kashkari, will speak about who knows what. And the Data Cupboard will be very disappointing this week as it’s one of those data -void weeks here in the U.S. We won’t see any real data, until Friday, when the April Retail Sales report will print. Let’s see, April we had Easter, the start of the new baseball season, and spring. I would think that Retail Sales would at least be positive for April, at least that’s what the BHI is indicating to me! For What It’s Worth. It’s not every day that I get to quote the great James Grant, he of the Interest Rate Observer newsletter that has strict rules about using snippets of his letter. But when he gives an interview with someone else, then it’s all fair game, and nothing makes me smile larger regarding this stuff than finding an interview with James Grant. So, the interview is really long, but you can find it all at ZeroHedge it was post last Friday, or opt for the snippet:

Chuck again. James Grant says that “we judge that the government’s money is a short sale.” Hmmm… he’s telling us the dollar is a short sale folks. And when James Grant talks, I sure do listen! That’s it for today. Thanks for reading the Pfennig, and I hope you have a marvelous Monday, and be good to yourself! Regards, Chuck Butler P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoningwebsite and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post Make Believe Money appeared first on Daily Reckoning. |

| Commodities Overtake Stocks and Bonds with Best Rally Since 2010! Posted: 09 May 2016 05:11 AM PDT Traders who follow the price of gold and silver, should keep an eye out on the U.S. dollar index. The dollar has been within a trading range for more than a year. During December of 2015, the dollar rose to test the highs at 100, however, since February of 2016, the dollar has been in a downtrend, as shown in the chart below. The FED has reduced the expectations of a rate hike in 2016 from one full percentage point, in the beginning of the year, to a half percent and perhaps to none at all. However, my expectation is that the FED may have to start rolling back this increase before the end of 2016. |

| Showdown: A Bull And A Bear Duke It Out: Will Silver And Gold Skyrocket… Or Collapse? Posted: 09 May 2016 03:00 AM PDT ShtfPlan |

| Is Gold more Important than Silver? Posted: 09 May 2016 12:00 AM PDT Silver Investor |

| The Titillating and Terrifying Collapse of the Dollar...Again Posted: 08 May 2016 05:00 PM PDT |

| MPs bring in new advisers as BHS collapse enquiry begins Posted: 08 May 2016 11:45 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Breaking News And Best Of The Web — May 10 Posted: 07 May 2016 07:34 PM PDT China’s numbers are startlingly bad — and now they admit it. Chaos and volatility are the new normal, with emerging markets the epicenter of the next crisis. All forms of debt, especially corporate, are even higher than before the Great Recession. The debate over gold’s COT report continues. That Canadian fire is getting some rain […] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The candidates…

The candidates…

Creator of online money Liberty Reserve gets 20 years in prison … Before the virtual currency Bitcoin there was Liberty Reserve — and its founder just got sentenced to 20 years in prison. Arthur Budovsky, 42, ran an online digital money business out of Costa Rica called Liberty Reserve. The U.S. government contended that the whole thing was just a massive, $6 billion money laundering operation. – CNN

Creator of online money Liberty Reserve gets 20 years in prison … Before the virtual currency Bitcoin there was Liberty Reserve — and its founder just got sentenced to 20 years in prison. Arthur Budovsky, 42, ran an online digital money business out of Costa Rica called Liberty Reserve. The U.S. government contended that the whole thing was just a massive, $6 billion money laundering operation. – CNN The U.S. is now in its eighth year since the Wall Street bank collapse of 2008 and most members of the general public believe the bailouts are long finished. That's a fallacy. Last Friday, the Government Accountability Office (GAO)

The U.S. is now in its eighth year since the Wall Street bank collapse of 2008 and most members of the general public believe the bailouts are long finished. That's a fallacy. Last Friday, the Government Accountability Office (GAO)

Painting by Anthony Freda:

Painting by Anthony Freda:

No comments:

Post a Comment