Gold World News Flash |

- Gold and Currency Markets Expose U.S. Recovery Myth

- RED ALERT WARNING: THIS IS YOUR LAST CHANCE — Bill Holter

- State-Sanctioned Theft - The Failed War On Drugs And Cops' Abuse Of Civil Forfeiture

- As Gold & Silver RISE… Mining Shares SKYROCKET — Max Porterfield

- Silver Makes 1 Year High on 5 Year Anniversary of 2011’s Multi-Decade High – Gary Christenson

- Deutsche Bank Unveils The Next Step: "QE Has Run Its Course, It's Time To Tax Wealth"

- SILVER & SILVER STOCKS: Top Performing Assets In 2016

- What Are The Three Signs Of A "Disorderly" Currency Market: Richard Koo Explains

- Taking The 'Petro' Out Of The Dollar

- Nothing Is Real: "It's All Being Played To Keep People Believing The System Is Working"

- WARNING: BELTANE STARTS TONIGHT!

- The Next Technical Price Targets for Gold & Silver

- Dollar will Blow Up and Collapse -- John Williams

- EXPLORING a REAL WW3 Elite Bunker

- The Coming Antichrist

- Shocking News by Imran Hosein | Armageddon -The Evilest of the Evil Times to Begin in 2016

- Peter Schiff : Gold and Currency Markets Expose U.S. Recovery Myth

- Satanic Dictator & His NWO City to Head "One World Government" - Prophecy Alert!

- TIP OF THE ICEBERG: Why The Stock Market May Be About To Crash. By Gregory Mannarino

- GATA Chairman Murphy discusses stark change in silver trading

- Asset Performance for the First Four Months of 2016 - Hi Ho Silver

- Gold Newsletter's Brien Lundin: Manipulations and machinations

- TRUMP RALLY GETS BLOODY!!

- Gold And Silver – A Clarion Alarm Call For All Paper Assets

- Breaking News And Best Of The Web — April 30

- Top Ten Videos

| Gold and Currency Markets Expose U.S. Recovery Myth Posted: 30 Apr 2016 11:30 PM PDT from Peter Schiff: |

| RED ALERT WARNING: THIS IS YOUR LAST CHANCE — Bill Holter Posted: 30 Apr 2016 07:05 PM PDT by SGT, SGT Report.com: Friends, this interview with JS Mineset’s Bill Holter is not for the faint of heart. It contains information you absolutely must share with your friends and family, no matter how closed-minded they are, no matter how many times you may have tried to warn them in the past. This may well be their last chance to protect themselves from an economic calamity so severe that they will never recover. Holter warns, “I think what we are looking at is an EVENT that you’re not going to be able to recover from. If this market snaps and the markets close, and you’re not in position, you’re out. You’re out for the rest of your life. This is going to be an EVENT that you can’t recover from.” As readers of SGT Report know, Silver is the best performing commodity asset of 2016 thus far, and there are some very quantifiable, very important reasons for it. This may well be YOUR last chance to protect yourself from what’s coming. |

| State-Sanctioned Theft - The Failed War On Drugs And Cops' Abuse Of Civil Forfeiture Posted: 30 Apr 2016 07:00 PM PDT Submitted by Lorelei McFly via CopBlock.org, One of the biggest lies our government tells us is that it wages the War on Drugs to keep us safe. More than 40 years after it was started, we know that it has been a colossally-expensive epic failure on its stated goals, was intentionally designed to further disenfranchise marginalized groups, and has become a full-fledged assault on our civil liberties. Even with all the billions of tax dollars it spends each year, and all the flashy photo ops of seized drugs stacked on tables, the Drug Enforcement Agency only stops 1% of the illegal drug supply from being distributed in America, according to the video below. Not only is law enforcement pathetically inept at stemming the flow of drugs, they are active participants in the illicit drug trade at both the federal and local level:

That drug prohibition causes far more harm than it supposedly prevents would not even be a question of debate were it not for the fact that so many people’s livelihoods now depend on waging it. The ugly unspoken truth is that the War on Drugs is a massive jobs and funding program for law enforcement that is operated under the guise of saving people from the evils of substance abuse. State-Sanctioned TheftEverything we do is suspect, and everything we own is subject to seizure— take cash for an example. The saying used to be that “cash is king,’ however these days it’s “cash is criminal” since cash transactions and even withdrawing or carrying “large amounts,” basically more than a few dollars, of your own money is now considered an indication of criminal activity (see here). Section 31 U.S.C. 5103 states, “United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues,” so why does the government that prints that same money have such a problem with its citizens using it? How Cash Became CriminalCash transactions are anonymous, so it is assumed that people who make cash transactions are trying to avoid leaving records of their activities. And if any aspect of your life is not a traceable, verifiable open book for the government, obviously you must be hiding something. Never mind that the case is often that people simply find using cash allows them to manage their finances more responsibly without risking overdraft or interest fees, or are making a purchase that requires cash, such as buying a used car, or that they simply do not have access to bank accounts due to low income or poor credit history. According to the FDIC, “7.7 percent (1 in 13) of households in the United States were unbanked in 2013. This proportion represented approximately 16.7 million adults.” 20.0 percent of U.S. households, approximately 50.9 million adults, were underbanked in 2013, “meaning that they had a bank account but also used alternative financial services (AFS) outside of the banking system,” such as money orders, check cashing, remittances, payday loans, refund anticipation loans, rent-to-own services, pawn shops, or auto title loans. The FDIC report also states “In many cases, financial life events, such as job loss, significant income loss or a new job, appear to be important reasons why households leave or enter the banking system.” The documentary Spent: Looking for Change, highlights the struggles of the unbanked and underbanked using the personal stories of several individuals. While using cash out of preference or necessity is a perfectly legal activity, it is politically expedient for law enforcement agencies to pretend otherwise because they have incentives to do so. Civil asset forfeiture allows law enforcement agencies to take money, cars, houses, and other property that they suspect of being purchased with the proceeds from criminal activity or of being used in connection with criminal activity. The agencies then either keep or sell the property and use it or the proceeds for their own purposes. It’s such a huge cash cow for law enforcement that in 2014, the amount federal agencies netted through civil asset forfeiture, $5 billion, exceeded the amount Americans lost through burglaries, $3.5 billion. The actual amount seized is even higher than this, since this figure does not include the amounts taken by state and local law enforcement agencies. Taking money from bad guys, sounds great, right? Oh, there’s a catch. Cops don’t have to actually prove you committed any crime. They don’t even have to charge you with one. You, on the other hand, need to go to court and jump through whatever hoops the government requires to prove your innocence and get your property back. See How police took $53,000 from a Christian band, an orphanage and a church for a recent example of how police use civil forfeiture to knowingly steal from innocent citizens who have no involvement in the drug trade. Cops and prosecutors also intimidate people into giving up their property by threatening to pursue criminal charges if they try get it back.From Taken, New Yorker Magazine’s investigation into one Texas town’s massively corrupt civil asset forfeiture program:

Law enforcement agencies say this is a vital tactic for battling drug kingpins and vast criminal enterprises, but the typical value of property seized tends to be low, victimizing citizens who usually have the least resources, and the least ability to fight back. The Institute for Justice, an organization at the forefront of the battle against abusive forfeiture practices, “was able to obtain property-level forfeiture data for 2012 from 10 states, allowing median property values to be calculated. In those states, the median value of forfeited property ranged from $451 in Minnesota to $2,048 in Utah, not much more than an American’s average annual cell phone bill.” Meanwhile what happens to the criminal masterminds who actually are involved in nefarious activities on a grand scale? They get a slap on the wrist. From the Rolling Stone article,Outrageous HSBC Settlement Proves the Drug War is a Joke:

The article continues:

However there is some good news! Last year Montana and New Mexico passed reform measures that require a criminal conviction before assets can be stolen by state agents, and Nebraska just did, too. Of course, several cities in New Mexico refuse to abide by the law andare now being sued by the Institute for Justice as a result, but it’s still progress, right? Also, the Department of Justice announced last year that it was drastically scaling back its equitable-sharing program, which state and local agencies have used to undermine local ordinances restricting forfeiture activities. Well, the impact wasn’t really as big as they first made it out to be, and that doesn’t matter anyway because DOJ already reinstated the program last month. |

| As Gold & Silver RISE… Mining Shares SKYROCKET — Max Porterfield Posted: 30 Apr 2016 06:45 PM PDT by SGT, SGT Report.com: Max Porterfield, the CEO and President of Callinex Mines, Inc joins me live from London where he took a break from a precious metals conference to call in. We discuss the gold and silver market, cartel manipulation laid bare and the skyrocketing price rise of precious metals mining shares. Thanks for listening. |

| Silver Makes 1 Year High on 5 Year Anniversary of 2011’s Multi-Decade High – Gary Christenson Posted: 30 Apr 2016 05:58 PM PDT from CrushTheStreet: |

| Deutsche Bank Unveils The Next Step: "QE Has Run Its Course, It's Time To Tax Wealth" Posted: 30 Apr 2016 05:58 PM PDT Helicopter money may be on the horizon, but if Deutsche Bank has its way, there is at least one intermediate step. According to DB's Dominic Konstam, now that the benefits QE "have run their course", it is time for the next, and far more drastic step: "the ECB and BoJ should move more strongly toward penalizing savings via negative retail deposit rates or perhaps wealth taxes. With this stick would also come a carrot – for example, negative mortgage rates." Here is the big picture unveiling of what is coming next from Deutsche Bank's Dominic Konstam, who is also buying the Treasury long end hand over fist:

Some of the troubling detail:

In short, the real central bank panic is about to be unleashed; who will suffer? Why everyone else. And should wealth taxes really be imminent, we foresee a lot of "boating incidents" in the immediate future. |

| SILVER & SILVER STOCKS: Top Performing Assets In 2016 Posted: 30 Apr 2016 05:35 PM PDT by Steve St. Angelo, SRS Rocco:

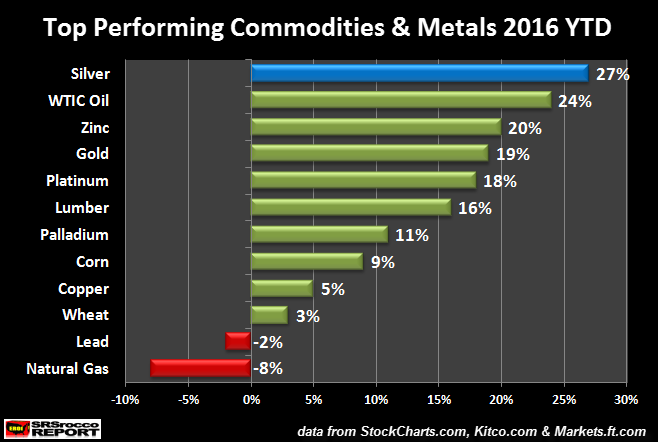

Silver and the silver mining stocks are some of the top performing assets in 2016. Silver was the top performing physical asset in the metal-commodity basket gaining 27% since the beginning of the year. Silver's gains surpassed West Texas Oil which increased 24%, zinc at 20% and gold at 19%: As we scroll down the chart we can see that copper, the king base metal, placed towards the bottom of the list at a mere 5% gain, while lead recorded a 2% loss and natural gas declined the most at 8%.

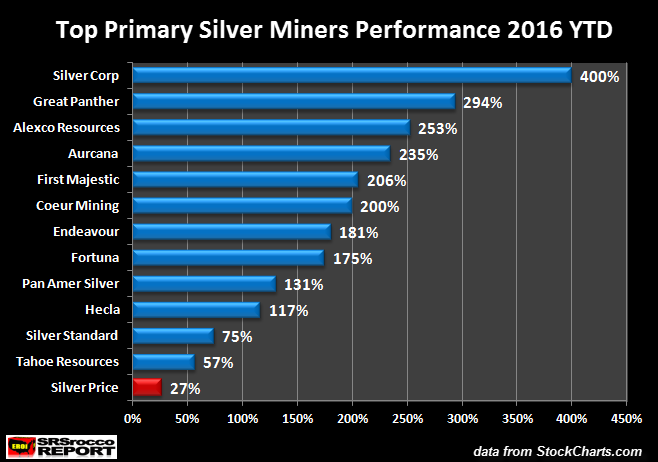

Even though silver's 27% increase for 2016 was the best performing asset in the chart above, gains in the primary silver mining sector were even more astonishing. While silver rose 27% in 2016, some of the best performing primary silver miners stock prices shot up 200-400% in the same period:

Silver Corp Metals enjoyed the best performance in the group by rising 400% since the beginning of the year. Silver Corp Metals has been one of my lowest cost primary silver miners in my group. However, Silver Corp received a lot of bad press several years ago which made it a target of excessive shorting.

Silver Corp Metals was delisted from the New York Stock Exchange with ticker symbol SVM and is now trading as a pink sheet under SVMLF. However, I believe as the price of silver continues to move higher, Silver Corp Metals will be trading once again on the NYSE. As we look down the list we can see next best performers starting with Great Panther at a gain of 294%, Alexco Resources with 253%, Aurcana with 235% and First Majestic at 206%. The interesting thing about the gains in these primary silver stocks is that they were not based upon their low cost or productivity per say. For example, Great Panther is one of the highest cost producers in the group last year, based on my analysis, but enjoyed the second best performance. Moreover, Alexco Resources shut down their only operating silver mine back at the end of 2013, but their stock price had the third best performance jumping 253%. Actually, most of the lowest cost producers, First Majestic (206%), Fortuna (175%) and Tahoe Resources (57%) saw their performance in the mid to lower half of the group. I was actually surprised by the result after tabulating the data. One of my personal favorites is Fortuna because they rank in the top four lowest cost producers in the group and plan on increasing production over the next 3-5 years. Who would have every thought Alexco Resources with a stock price of $0.34 at the beginning of the year, with no producing silver mine, would move up to $1.20 and enjoy a 253% gain?? It seems as if investors piled more into the silver stocks with the lowest price at the beginning of the year: |

| What Are The Three Signs Of A "Disorderly" Currency Market: Richard Koo Explains Posted: 30 Apr 2016 04:48 PM PDT One of the biggest ironies in recent months has been the Bank of Japan's recurring insistence that it would promptly intervene in the FX market if the ongoing "disorderly" moves in the Yen do not stop. This was ironic because it was the BOJ's own insistence in characterizing virtually every move as disorderly that ultimately led to the most disordely move of all this week when following the BOJ's "disappointment" in failing to do anything, the Yen soared the most in years, to a level not seen since October of 2014. Now that was a truly "disorderly" move, which was only made possible by the BOJ's constant and misguided rhetoric.

Then just yesterday, the Treasury unveiled a brand now "monitoring list", on which it put five economies but most notably China and Japan. And once again, that word "disorderly" appeared. This is what the Treasury said:

Not only that, but the Treasury made it clear that it would very explicitly frown on any "disorderly" currency depreciation by US trade partners going forward.

But if the BOJ was so perilously wrong in its characterization of what disorderly exchange rates are, then what are they? For the answer we go to Richard Koo and the following explanation.

Now, as even Jack Lew admits, central bank intervention in a disorderly market is fine. A far bigger risk in game theoretical terms, as well as angering the global reserve currency hegemon, is when a central bank intervenes when the moves are perfectly orderly; this is precisely what the market was convinced the BOJ would do on Wednesday night... and was massively wrong. According to Nomura's Koo, the answer is that "Japanese intervention in orderly forex market could be seen as collapse of cooperative relationship"

It happened once before under Eisuke "Mr Yen" Sakakibara., when the Japanese finance minister intervened in 1999 against US wishes. This is what happened then.

Perhaps the BOJ's January NIRP announcement was also a unilateral decision without prior approval from the US, which explains why the USDJPY instead of soaring, has tumbled to nearly 2 year lows. One thing is increasingly certain: the US has finally put its foot down, not surprisingly at a time when the USD is rapidly sliding. Maybe the period of strong dollar generosity for the rest of the world, has come and gone, and from this point on it is time for the US to reap the benefits of a rapidly depreciation currency especially since the threat of any rate hikes is virtually gone. That said, we won't know for sure until Goldman finally capitulates on its dollar call which has been "long and wrong" for the past six months. Only when Robin Brooks finally throws in the towel, will it be safe to once again go long the USD. |

| Taking The 'Petro' Out Of The Dollar Posted: 30 Apr 2016 04:15 PM PDT Submitted by Alasdair Macleod via GoldMoney.com, Saudi Arabia has been in the news recently for several interconnected reasons. Underlying it all is a spendthrift country that is rapidly becoming insolvent. While the House of Saud remains strongly resistant to change, a mixture of reality and power-play is likely to dominate domestic politics in the coming years, following the ascendency of King Salman to the Saudi throne. This has important implications for the dollar, given its historic role in the region. Last year’s collapse in the oil price has forced financial reality upon the House of Saud. The young deputy crown prince, Mohammed bin Salman, possibly inspired by a McKinsey report, aims to diversify the state rapidly from oil dependency into a mixture of industries, healthcare and tourism. The McKinsey report looks like a wish-list, rather than reality, particularly when it comes to tourism. The religious police are unlikely to take kindly to bikinis on the Red Sea’s beeches, or to foreign women in mini-shorts wandering around Jeddah. It is hard to imagine Saudi Arabia, culturally stuck in the middle ages, embracing the changes recommended by McKinsey, without fundamentally reforming the House of Saud, or even without a full-scale revolution. Nearly all properties and businesses are personally owned or controlled by members of the extended royal family, not the state, nor by lesser mortals. The principal exception is Aramco, estimated to be worth $2 trillion. The state is subservient to the House of Saud. It is therefore hard to see how, as McKinsey recommends, the country can “shift from its current government-led economic model to a more market-based approach”. The country is barely government led: a puppet of the Saudis is more like it. But the state’s lack of funds is making it increasingly desperate. It was for this reason the Kingdom recently placed a $10bn five-year syndicated loan, the first time it has entered capital markets since Saddam Hussein invaded Kuwait. It proposes to raise a further $100bn by selling a 5% stake in Aramco. The financial plan appears to be a combination of this short-term money-raising, contributions from oil revenue, and sales of US Treasuries (thought to total as much as $750bn). The government has, according to informed sources, been secretly selling gold, mainly to Asian central banks and sovereign wealth funds. Will it see the Kingdom through this sticky patch? Maybe. Much more likely, buying time is a substitute for ducking fundamental reform. But one can see how stories coming out of Washington, implicating Saudi interests in the 9/11 twin-towers tragedy, could easily have pulled the trigger on all those Treasuries. Whatever else was discussed, it seems likely that this topic will have been addressed at the two special FOMC meetings “under expedited measures” at the Fed earlier this month, and then at Janet Yellen’s meeting with the President at the White House. This week’s holding pattern on interest rates would lend support to this theory. The White House’s involvement certainly points towards a matter involving foreign affairs, rather than just interest rates. If the Saudis had decided to dump their Treasuries on the market, it would risk collapsing US bond markets and the dollar. Through financial transmission, euro-denominated sovereign bonds and Japanese government bonds, all of which are wildly overpriced, would also enter into free-fall, setting off the global financial crisis that central banks have been trying to avoid. Perhaps this is reading too much into Saudi Arabia’s financial difficulties, but the possibility of the sale of Treasuries certainly got wide media coverage. These reports generally omitted to mention the Saudi’s underlying financial difficulties, which could equally have contributed to their desire to sell. While the Arab countries floated themselves on oceans of petro-dollars forty years ago, they have little need for them now. So we must now turn our attention to China, which is well positioned to act as white knight to Saudi Arabia. China’s SAFE sovereign wealth fund could easily swallow the Aramco stake, and there are good strategic reasons why it should. A quick deal would help stabilise a desperate financial and political situation on the edges of China’s rapidly growing Asian interests, and keep Saudi Arabia onside as an energy supplier. China has dollars to dispose, and a mutual arrangement would herald a new era of tangible cooperation. The US can only stand and stare as China teases Saudi Arabia away from America’s sphere of influence. In truth, trade matters much more than just talk, which is why a highly-indebted America finds herself on the back foot all the time in every financial skirmish with China. Saudi Arabia has little option but to kow-tow to China, and her commercial interests are moving her into China’s camp anyway. It seems logical that the Saudi riyal will eventually be de-pegged from the US dollar and managed in line with a basket of her oil customers’ currencies, dominated by the yuan. Future currency policies pursued by both China and Saudi Arabia and their interaction will affect the dollar. China wants to use her own currency for trade deals, but must not flood the markets with yuan, lest she loses control over her currency. The internationalisation of the yuan must therefore be a gradual process, supply only being expanded when permanent demand for yuan requires it. Meanwhile, western analysts expect the riyal to be devalued against the dollar, unless there is a significant and lasting increase in the price of oil, which is not generally expected. But a devaluation requires a deliberate act by the state, which is not in the personal interests of the individual members of the House of Saud, so is a last resort. It is clear that both Saudi Arabia and China have enormous quantities of surplus dollars to dispose in the next few years. As already stated, China could easily use $100bn of her stockpile to buy the 5% Aramco stake, dollars which the Saudis would simply sell in the foreign exchange markets as they are spent domestically. China could make further dollar loans to Saudi Arabia, secured against future oil sales and repayable in yuan, perhaps at a predetermined exchange rate. The Saudis would get dollars to spend, and China could balance future supply and demand for yuan. It would therefore appear that a large part of the petro-dollar mountain is going to be unwound over time. There is now no point in the Saudis also hanging onto their US Treasury bonds, so we can expect them to be liquidated, but not as a fire-sale. On this point, it has been suggested that the US Government could simply block sales by China and Saudi Arabia, but there would be no quicker way of undermining the dollar’s international credibility. More likely, the Americans would have to accept an orderly unwinding of foreign holdings. The US has exploited the dollar’s reserve currency status to the full since WW2, leading to massive quantities of dollars in foreign ownership. The pressure for dollars to return to America, when the Vietnam war was wound down, was behind the first dollar crisis, leading to the failure of the London gold pool in the late sixties. After the Nixon Shock in 1971, the cycle of printing money and credit for export resumed. In the seventies, higher oil prices were paid for by printing dollars and by expanding dollar bank credit, in turn kept offshore by lending these exported dollars to Latin American dictators. That culminated in the Latin American debt crisis. From the eighties onwards, the internationalisation of business was all done on the back of yet more exported dollars, and wars in Iraq and Afghanistan echoed the earlier wars of Korea and Vietnam. Many of these factors have now either disappeared or diminished. For the last eighteen months, the dollar had a last-gasp rally, as commodity and oil prices collapsed. The contraction in global trade since mid-2014 had signalled a swing in preferences from commodities and energy towards the money they are priced in, which is dollars. The concomitant liquidation of malinvestments in the commodity-exporting countries has been contained for now by aggressive monetary policies from China, Japan and the Eurozone. The tide is now swinging the other way: preferences are swinging out of the dollar towards oversold commodities again, exposing the dollar to a second version of the gold pool crisis. This time, China, Saudi Arabia and the BRICS will be returning their dollars from whence they came. In essence, this is the market argument in favour of gold. Over time, the price of commodities and their manufactured derivatives measured in grams of gold is relatively stable. It is the price measured in fiat currencies that is volatile, with an upward bias. The price of a barrel of oil in 1966, fifty years ago, was 2.75 grams of gold. Today it is 1.0 gram of gold, so the purchasing power of gold measured in barrels of oil has risen nearly three-fold. In dollars, the prices were $3.10 and $40 respectively, so the purchasing power of the dollar measured in barrels of oil has fallen by 92%. Expect these trends to resume. This is also the difference between sound money and dollars, which has worked to the detriment of nearly all energy and commodity-producing countries. With a track-record like that, who needs dollars? It is hard to see how the purchasing power of dollars will not fall over the rest of the year. The liquidation of malinvestments denominated in external dollars has passed. Instead, the liquidation of financial investments carry-traded out of euros and yen is strengthening those currencies. That too will pass, but it won’t rescue the dollar. |

| Nothing Is Real: "It's All Being Played To Keep People Believing The System Is Working" Posted: 30 Apr 2016 03:10 PM PDT Submitted by Mac Slavo via SHTFPlan.com, The stock market may be hovering near all-time highs, but according to Greg Mannarino of Traders Choice that doesn’t mean the valuations are actually real:

Full Interview with USA Watchdog:

President Obama has suggested that people like Greg Mannarino who are exposing the fraud for what it is are just peddling fiction. And just this week the President argued that he saved the world from a great depression and that the closing credits of the 2008 crash movie “The Big Short” were inaccurate when they claimed that nothing has been done to fundamentally curb the fraud and fix the system under his administration. But as Mannarino notes, the President and his central bank cohorts are making these statements because the system is so fragile that if the public senses even the smallest problem it could derail the entire thing:

And when that confidence is finally lost and the fraud exposed – and it will be as has always been the case throughout history – the destruction to follow will be one for the history books. In a previous interview Mannarino warned that things could get so serious after the bursting of such a massive bubble that millions of people will die on a world-wide scale:

And that may be why governments around the world are preparing for nothing short of Armageddon that will see rioting in the streets, violence, civil war and regime change. In the United States, the Federal government and Pentagon have been war-gaming large scale economic collapse scenarios and those preparations began in earnest shortly after the collapse of 2008. Nationally syndicated talk radio host Mark Levin explains:

The entire system is built upon a fraud. The losses have been hidden and papered over with trillion dollar cash infusions by governments and central banks around the world. It is only a matter of time. That we can be sure of. If you’re reading this and haven’t yet done so, it’s time to prepare for a collapse of a magnitude never before witnessed. The elite are feverishly building bunkers for a reason, just as the government is spending billions of dollars on food stockpiles, assault weapons, and hundreds of millions of rounds of ammunition. Why? Because they know. |

| WARNING: BELTANE STARTS TONIGHT! Posted: 30 Apr 2016 01:30 PM PDT WARNING: BELTANE STARTS TONIGHT! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Next Technical Price Targets for Gold & Silver Posted: 30 Apr 2016 01:19 PM PDT I have pointed out earlier, gold is forming a possible short-term top. It is on the verge of completing a bearish ‘Head and Shoulder’ pattern. The pattern is confirmed if gold closes below $1220/oz. The downside pattern target for this setup is $1138/oz. If gold starts to rally and breaks out to the upside, then we should see the $1396 level be reached based on technical analysis. |

| Dollar will Blow Up and Collapse -- John Williams Posted: 30 Apr 2016 01:00 PM PDT Economist John Williams says it is not a matter of if, but when, there is panic dollar selling. Williams says the Fed would try to slow it down. Williams explains, "The Federal Reserve would step in and slow the pace to make it not appear like a panic. If you start to see a panic selloff (in the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| EXPLORING a REAL WW3 Elite Bunker Posted: 30 Apr 2016 12:30 PM PDT Deep Underground: A look inside the hidden world of a WW3 Government nuclear bunker... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 30 Apr 2016 11:30 AM PDT Political commentator and social activist Mark Dice joins the show to break down the coming beast system that the public will be forced to accept or die. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Shocking News by Imran Hosein | Armageddon -The Evilest of the Evil Times to Begin in 2016 Posted: 30 Apr 2016 11:14 AM PDT Shocking News by Sheikh Imran Hosein | Armageddon - The Evilest of the Evil Time to at the End of This Year Sheikh Imran Hosein Latest 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Peter Schiff : Gold and Currency Markets Expose U.S. Recovery Myth Posted: 30 Apr 2016 11:00 AM PDT The Schiff Report 4/30/2016 Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first from within the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Satanic Dictator & His NWO City to Head "One World Government" - Prophecy Alert! Posted: 30 Apr 2016 10:30 AM PDT Satanic Dictator, Nursultan Nazarbayev, the President of Kazakhstan, and His NWO City Built to Head the "One World Government" - Huge Prophecy Alert! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| TIP OF THE ICEBERG: Why The Stock Market May Be About To Crash. By Gregory Mannarino Posted: 30 Apr 2016 10:00 AM PDT Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decisions and any consequences thereof. Please invest wisely. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| GATA Chairman Murphy discusses stark change in silver trading Posted: 30 Apr 2016 09:31 AM PDT 12:30p ET Saturday, April 30, 2016 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy, interviewed by Finance and Liberty's Elijah Johnson, discusses the amazing change in trading in the silver market, which he believes foretells much higher prices. The interview also covers Deutsche Bank's agreement to settle a class-action lawsuit accusing it of manipulating the gold and silver markets with other investment banks. The interview is 15 minutes long and can be heard at You Tube here: https://www.youtube.com/watch?v=SA3dmvj-kBg&list=PLNwUWnJgSq_LsSyEjjIZEt... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Asset Performance for the First Four Months of 2016 - Hi Ho Silver Posted: 30 Apr 2016 09:12 AM PDT |

| Gold Newsletter's Brien Lundin: Manipulations and machinations Posted: 30 Apr 2016 08:43 AM PDT 11:55a ET Saturday, April 30, 2016 Dear Friend of GATA and Gold: For many years Gold Newsletter has been essential to your secretary/treasurer's interest in the gold market generally and in gold, silver, and resource companies particularly. Indeed, your secretary/treasurer's interest was sparked entirely in 1998 by a trial subscription to the newsletter when it was under the editorship of its founder, James U. Blanchard III -- https://www.anthemvault.com/our-legacy -- whose extraordinary efforts restored in 1974, through federal legislation, the legal right of Americans to own monetary gold. Since Blanchard's death in March 1999 Gold Newsletter has been edited by Brien Lundin, proprietor of the New Orleans Investment Conference, and both the newsletter and the conference have generously given voice to GATA and recognition to the issue of gold market manipulation without fear of the resulting controversy. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Lundin's letter this week included a detailed commentary on the issue, which he kindly has approved our sharing with you, so it is appended. Your secretary/treasurer finds it hard to imagine doing without Gold Newsletter, so if you're inclined to check it out, subscription information is posted at the newsletter's Internet site here: http://goldnewsletter.com/subscribe-now/?affiliate=37 CHRIS POWELL, Secretary/Treasurer * * * Manipulations and Machinations By Brien Lundin There's a lot to talk about this subject. In past issues, we've covered the massive bear attacks on gold, the greatest example being April 2013, when traders colluded in obvious illegal fashion to dump gold contracts nominally worth billions in only a few minutes. In this first major attack, the bears were able to drive gold down a couple of hundred dollars in two trading sessions. Since then, we've noted more such attacks, more recently undertaken by high-frequency traders and as tracked by Eric Hunsader of Nanex. We've also covered the longer-term manipulations caused by central banks leasing out their gold through the bullion banks, as first exposed in the late 1990s by Frank Veneroso in the pages of Gold Newsletter and our Gold Book Annual. The efforts of the Gold Anti-Trust Action Committee (GATA), which were largely born out of the results of Veneroso's research, have also been well chronicled in these pages. From a philosophical viewpoint, I've differed from some of GATA's beliefs in that I don't think governments have either the ability or interest to manipulate the gold market on a daily if not minute-by-minute basis. But I do firmly believe that the burden of proof is on those who claim that the gold market is not manipulated. What is so special about gold that it would be the only asset class wherein governments did not exert some level of control? The Federal Reserve fine-tunes the price of money (interest rates) to boost the stock and bond markets, thereby generating a "wealth effect" for the public. Agricultural commodities? Ever hear of ethanol and price supports? And there's an entire Department of Energy, for goodness sake, whose only job is to manipulate the price of various forms of energy to meet political goals. So why would gold -- the ultimate gauge of the government's success or failure in managing the currency -- be somehow excluded from official attentions? The answer is that it isn't. To some degree, the price of gold is manipulated today, and has been for decades. And just as we saw with the London Gold Pool of the 1960s and the U.S. Treasury gold auctions of the 1970s, the current efforts will fail in spectacular fashion. But getting back to the primary subject, today I am more concerned not with short-term or long-term manipulations in gold but with the intermediate-term attempts by the large commercials to move the gold market according to their whims, Again, the most important factor not facing gold right now is the massive net short position in "paper gold" accumulated by the large commercials. We can argue over who is included in this category of traders, and we can dither about their motives. But it cannot be argued that this sector has not exhibited firm control over the direction of gold prices. Now with that said, the cynics and conspiracy-minded among gold investors claim that the large commercials intentionally set up those who are traditionally on the opposite side of the seesaw: the large speculators. According to the theory, the large commercials build up short positions as the price rises, selling gold that the large speculators eagerly take up as they follow the trend higher. At some crucial point the commercials dump enough gold onto the market to send the price plummeting through the speculators' sell-stops, exacerbating the downtrend. It's easy to assign malevolent motives to the exercise, since the commercials almost always end up being correct, and seem able to force the market to their bidding. But commercials, being in the trade and needing to hedge their transactions, are naturally shorting the market to lock in their costs and minimize their exposure. The question of manipulation turns on whether there are other actors within the commercial category who are taking advantage of the natural tendencies of the market. I tend to believe that there are some hijinks involved, if for no other reason than the reliability and amplitude of the cycles. Somebody's making a lot of money, on a regular basis ... and this makes me think that none of it is accidental. And in truth, it really doesn't matter to what degree the paper gold market is manipulated or whatever the precipitating factors may be -- because the results are obvious and irrefutable. As you can see from the accompanying chart via Nick Laird's ShareLynx service, the peaks and troughs in the large commercial short position precisely correspond with the peaks and troughs in the gold price over the long term. Importantly, the current level of net shorts for the commercials is historically extreme, and argues for a sharp and deep correction at any time. Now as I've noted many times over the years, while the commercials are almost always correct, they aren't always so. And when they are wrong, they are wrong in spectacular fashion. You see, on rare occasions the commercials are hoist by their own petard. In these instances gold refuses to halt its rise despite the ever-mounting short positioning of the commercials. Eventually, the commercials are forced to cover their shorts, buying gold in a desperate fashion that only throws gasoline onto the fire and accelerates the gains. They're not able to catch up to the market, and their efforts to constrain the rise only serve to boost it higher. This last occurred in the 2004-2006 time frame. Consider the results: -- 2004: From the spring low to the end of the year peak, gold gained 21 percent. The Gold Bugs Index of gold stocks soared 50%. -- 2005: From the spring low to the year-end peak, gold rose 29 percent. The Gold Bugs Index leaped 70 percent in response. -- 2006: Gold was topsy turvy this year, jumping 36 percent in price from March to May, then losing 10 percent from May to December. The metal ended up gaining 21 percent from the spring low to the year-end peak. The Gold Bugs Index gained 30 percent over that time frame. I haven't researched the statistics, but rest assured that a 30-50 percent gain in the staid Gold Bugs Index translated into a much greater gain in the junior gold stock indices. And for the biggest winners that we were able to pinpoint in Gold Newsletter, we're talking about multi-bagger gains. So that's the scope of the potential we're looking at ... if the commercials are trounced and gold takes off from here. Will the commercials finally break the market? Or will some other factor emerge to prompt even more buying by the speculators -- enough to send the commercials running for the exits? If it's the latter, there are some interesting candidates for the factor that lights the fuse for the next big run. China is both the world's largest consumer and producer of gold, so it's only natural that they've felt like second-class citizens in a market where the price of the metal is set by Western "paper gold" traders. So it was no surprise when China announced months ago that they would launch a twice-daily gold fix based on the physically-settled Shanghai Gold Exchange, and denominated in yuan instead of dollars. That long-anticipated price fix was finally launched on April 19. And the gold price soared higher immediately. Coincidence? Actually, yes, as nearly the entire commodity complex was higher that day thanks to a bout of dollar weakness. But certainly the new yuan gold fix didn't hurt gold's case that day, and it will continue to help support the metal over the long term. That's because the yuan price fix will be rooted in the supply/demand fundamentals at play in a market where investors and savers are buying gold hand over fist. Thus it is likely that the Chinese price fix will have an upward bias compared with London and New York trading, and these Western markets will have to recognize this trend over time. The bottom line is that I expect the new yuan price fix to provide a mild but consistent upward pressure on gold from now on. There's another issue that could be provide much more dramatic impetus for the metal. As you have probably heard, Deutsche Bank is attempting to settle a U.S.-based lawsuit that accused it and other defendant banks of manipulating the London gold and silver price fixes. Moreover, Deutsche Bank is offering to squeal on its co-conspirators, apparently in exchange for some leniency. While the lawsuit was filed a bit over two years ago, I never gave it much credit. I figured everyone knew the London a.m. and p.m. price fixes were, eh, "fixed" to some extent. How could you lock up representatives of five banks in a room, twice daily over some 90 years, to set a somewhat arbitrary price upon which fortunes turned, and not expect them to figure out some way to profit from the exercise? It never really bothered me because the fix couldn't vary too much from the trading trend in place before and after the price setting, and any small differences that did exist would be quickly overwhelmed by the larger trends. But here's what I didn't count on: Deutsche Bank snitching on its cronies. This development now has lawyers around the globe salivating. Already a group of law firms in Canada is proposing a C$1 billion class-action suit that mirrors the U.S. litigation. And rest assured there'll be more to come -- there's blood in the water and the sharks are gathering. If the discovery process turns up more wide-ranging manipulation of the sort we and many other gold bugs have been talking about for years, then the potential damages are mind-blowing. Consider that anyone who has ever invested in not only the metals but any gold or silver stock would have suffered injury. That's the kind of potential payout that will have lawyers searching every nook and cranny. Even proof that the banks manipulated "just" the gold and silver price fixes could be sufficient to justify wider-scale damage claims, since the fixes are used in so many ways to determine the value of contracts and metals purchases. This could get very interesting. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 30 Apr 2016 08:16 AM PDT Anti-Trump protesters rioted, attacked supporters and damaged a cop car outside a Trump rally Thursday night in Costa Mesa, Calif. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold And Silver – A Clarion Alarm Call For All Paper Assets Posted: 30 Apr 2016 05:19 AM PDT Perhaps the most successful Ponzi scheme of all has been the Rothschild-led takeover and sapping of the entire United States since the American Civil War that started in 1861. The final stages were set with the not-so-lawfully-passed but fully implemented Federal Reserve Act on 23 December 1913. The fact that it purportedly passed two days before Christmas, when the custom was for no legislation to be enacted, while most politicians were en route or already home for the holidays, and the main opponents for this specific Act were indeed absent when the vote was made before a select skeleton group that stayed in Washington to ensure “passage” of the Act, this was all a huge red flag that was kept hidden from the public. |

| Breaking News And Best Of The Web — April 30 Posted: 29 Apr 2016 06:19 PM PDT China’s news keeps getting worse. The US economy remains weak. The dollar falls, the yen rises, Japanese and European stocks tank. Deutsche Bank’s numbers are scary bad, and its personnel decisions make the news. Silver and gold are the best performing assets so far this year. Is the Shanghai gold exchange the reason? Best […] |

| Posted: 29 Apr 2016 04:00 AM PDT New videos featuring Peter Schiff, Jim Rickards, and John Williams. First Mining Finance CEO Keith Neumeyer sees “something different going on in the silver marketplace.” Doug Casey likes gold, silver, and Donald Trump. Mike Maloney thinks we’re already in recession. Gordon Long agrees. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

At one point, Silver Corp Metals reached $15 in April 2011. But, over the next five years fell to a low of $0.41 in January this year. Silver Corp Metals increased from $0.47 on Dec 31st 2015 to $2.35 on April 28th 2016. Again, this was an impressive 400% move in less than four months.

At one point, Silver Corp Metals reached $15 in April 2011. But, over the next five years fell to a low of $0.41 in January this year. Silver Corp Metals increased from $0.47 on Dec 31st 2015 to $2.35 on April 28th 2016. Again, this was an impressive 400% move in less than four months.

No comments:

Post a Comment