saveyourassetsfirst3 |

- The Great Deception

- Eric Sprott Market Wrap: Shanghai Fix & Silver IGNITES!

- Harvey Organ: HUGE Options Expiration RAID!

- Sprott’s John Embry: This is the Most EXPLOSIVE Action I’ve Ever Seen!

- 40 M Oz of Silver Manipulation: The Foul Smell Of Desperation

- All Hail the Mighty Silver Bugs!

- Silver Warming Up Nicely

- Market Update: Gold, Silver And The End Of The Biggest Ponzi Scheme In History

- Sell it All! 20 Reasons to Sell Your Entire Stash of Physical Silver

- World Currency Backed By Gold By 2018 – Jim Rickards

- Is Deutsche Bank’s Gold Manipulation The Main Scam Or Just A Side-Show?

- Gold Miners Reach First Resistance Target but Continue to Outperform Gold

- Gold Capped and Pinned

- U.S. Economy 2016: 3 Classic Recession Signals Are Flashing Red

- In re: London Silver Fixing Ltd. - Antitrust Litigation

| Posted: 23 Apr 2016 06:00 AM PDT Why are many Christians choosing to observe Passover instead of Easter? From Passion for Truth: The post The Great Deception appeared first on Silver Doctors. |

| Eric Sprott Market Wrap: Shanghai Fix & Silver IGNITES! Posted: 23 Apr 2016 05:30 AM PDT In this week’s MUST LISTEN Market Wrap, the Admiral of the Silver Market discusses silver’s HUGE WEEK, the continued impressive strength in the miners, and the new Shanghai Gold Fix: Buy 2016 Silver Maples Lowest Price Online! Buy Silver Rounds Lowest Price Silver Online From 49 Cents Over Spot ANY QTY! The post Eric Sprott Market Wrap: Shanghai Fix & Silver IGNITES! appeared first on Silver Doctors. |

| Harvey Organ: HUGE Options Expiration RAID! Posted: 23 Apr 2016 05:00 AM PDT A HUGE RISE IN SILVER OI COMPLEX AT 199,231 CONTRACTS PLUS OPTIONS EXPIRY WEEK NECESSITATED A 2ND RAID BY OUR CRIMINAL BANKERS… KURODA MAY LOANS BANKS AT NEGATIVE RATES (GET A LOAD OF THAT) AND THUS THE USA/YEN CROSS SKYROCKETS/MARKETS DID NOT RESPOND TO THAT GENEROSITY/CATERPILLAR RESULTS AWFUL AND GUIDANCE IS ALSO SOUTHBOUND/BELLWETHER FOR […] The post Harvey Organ: HUGE Options Expiration RAID! appeared first on Silver Doctors. |

| Sprott’s John Embry: This is the Most EXPLOSIVE Action I’ve Ever Seen! Posted: 22 Apr 2016 10:00 PM PDT With HUGE Action in Gold & Silver This Week As Shanghai Came Online, Sprott’s John Embry Sat Down For An Explosive Interview, Discussing: Banksters Violently Attack After Silver’s Spectacular Day- Will the White Metal Finally Be the Cartel’s Kryptonite? You Can’t Own Enough Silver!: “Inflation is Coming at Us in a Huge Wave” Perfect Storm On the Horizon: Base Metals […] The post Sprott’s John Embry: This is the Most EXPLOSIVE Action I’ve Ever Seen! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| 40 M Oz of Silver Manipulation: The Foul Smell Of Desperation Posted: 22 Apr 2016 04:29 PM PDT The foul smell of DESPERATION is in the air… Submitted by Dave Kranzler: Nearly 40 million ounces of paper silver were launched at the Comex yesterday in the space of seven minutes, which triggered a 92 cent waterfall in the price of silver; over 118 million ounces of paper silver were dumped on the Comex […] The post 40 M Oz of Silver Manipulation: The Foul Smell Of Desperation appeared first on Silver Doctors. |

| All Hail the Mighty Silver Bugs! Posted: 22 Apr 2016 04:20 PM PDT These are simply goldbugs amped up on argentine steroids… Buy 90% Junk Silver Coins at SD Bullion Source: Michael Ballanger: Precious metals expert Michael Ballanger examines silver’s recent moves upward. In my business, there is a great deal of travel, be it to properties in the Peruvian Andes or the Canadian Yukon or to the […] The post All Hail the Mighty Silver Bugs! appeared first on Silver Doctors. |

| Posted: 22 Apr 2016 03:10 PM PDT Silver Analysis |

| Market Update: Gold, Silver And The End Of The Biggest Ponzi Scheme In History Posted: 22 Apr 2016 01:00 PM PDT The truth lies in the fact that the entire U.S. financial system is one gigantic Ponzi scheme. The Shadow Truth podcast show presents another Market Update in which we discuss the fact that the U.S. financial system is a giant mirage that has been fabricated by the Federal Reserve and the U.S. Government. It's not […] The post Market Update: Gold, Silver And The End Of The Biggest Ponzi Scheme In History appeared first on Silver Doctors. |

| Sell it All! 20 Reasons to Sell Your Entire Stash of Physical Silver Posted: 22 Apr 2016 11:32 AM PDT So we’ve all bought silver at stupidly ridiculous manipulated low prices. But WHEN should one SELL the physical silver they’ve accumulated from the banksters’ discount bargain bin? After a good majority of the 20 expectations below are fulfilled I will seriously consider selling my entire stake in physical Silver: Buy Silver Coins at SDBullion Submitted by Bix Weir: […] The post Sell it All! 20 Reasons to Sell Your Entire Stash of Physical Silver appeared first on Silver Doctors. |

| World Currency Backed By Gold By 2018 – Jim Rickards Posted: 22 Apr 2016 11:31 AM PDT While the citizens of China are being taught by their government to protect their wealth from a currency crisis with gold and silver, We're Being Herded Into Digital Pens to be Slaughtered with Negative Interest Rates: Submitted by Rory Hall: Gold – everlasting, beautiful, money. This video, from the Financial Times is a perfect example […] The post World Currency Backed By Gold By 2018 – Jim Rickards appeared first on Silver Doctors. |

| Is Deutsche Bank’s Gold Manipulation The Main Scam Or Just A Side-Show? Posted: 17 Apr 2016 09:44 AM PDT For years now, the easiest way to finesse a debate over whether precious metals markets are manipulated has been to say, “well, if they’re not manipulated they’re the only market that isn’t.” That was unsatisfying, though, because as the big banks got caught scamming their customers on interest rates, mortgage bonds, forex and commodities trades, those […] |

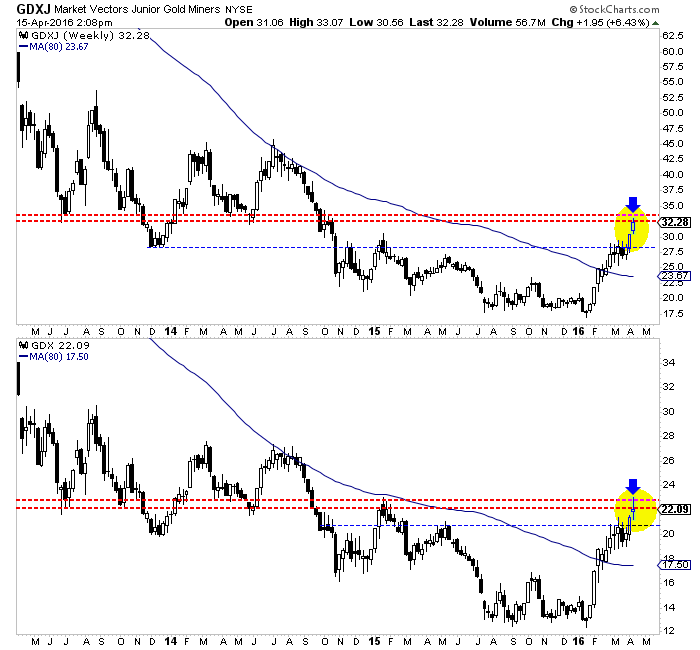

| Gold Miners Reach First Resistance Target but Continue to Outperform Gold Posted: 15 Apr 2016 11:12 AM PDT The gold stocks have been on a tear lately as they continue to move higher in defiance of the bearish calls of numerous pundits and traders. After trading lower mid week and filling Monday's gap, the miners are set to close the week with some strength. While the miners are overbought and could remain below resistance for a little while, their strong outperformance of Gold remains a comforting signal for bulls. The selloff in the miners began once they hit their first resistance targets, as noted in our editorial from last week. We noted immediate upside targets of GDXJ $33 and GDX $22.50. To be exact, GDXJ hit $33.07 and GDX touched $23.06. The resistance lines are visible in both charts below. Because the miners remain a good distance above their 50-day moving averages (GDX $19.58, GDXJ $26.82) it is possible they consolidate beneath resistance for a few weeks.

GDXJ, GDX Weekly Candles

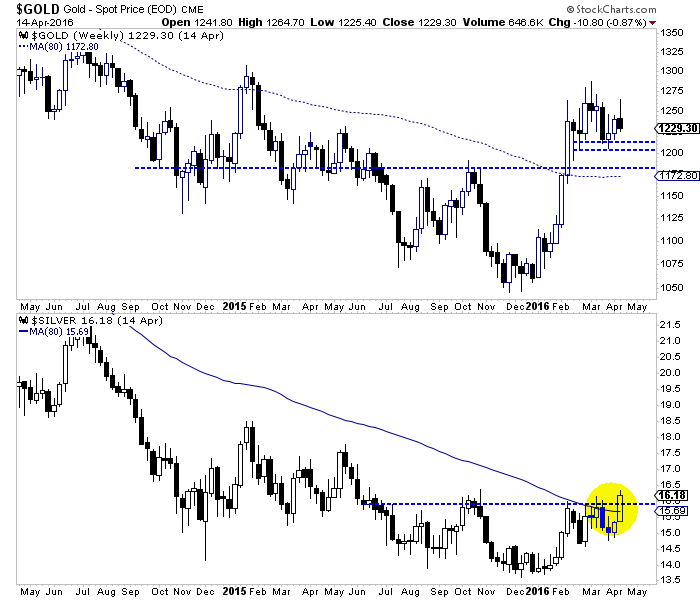

Turning to the metals, Gold continues to consolidate as it works off the excess speculative positions while Silver has broken out and above its 80-week moving average for the first time since late 2012. Both metals will close the week higher than depicted in this chart.

Gold & Silver Weekly Candles

Other than Gold's consolidation and resemblance of a small distribution pattern, the precious metals complex looks quite healthy. The breakout in Silver was telegraphed by the strength in the silver stocks as SIL doubled from its lows and SILJ is up more than 150% from its lows. At the same time, the gold stocks, as already noted have shown the same kind of strength against Gold. Those who are focusing on Gold's CoT and false topping pattern are neglecting the more powerful signals given by the rest of the sector. Because the gold stocks are at resistance and remain well above their 50-day moving averages, it is possible they could correct and consolidate for a few weeks before moving towards higher targets. We want to reiterate that the relative strength in the gold stocks and the relative strength in the silver space are healthy signs for the sector. If the sector were about to plunge (as some expect) Gold would be the leader and not the laggard that is now. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT

|

| Posted: 15 Apr 2016 08:36 AM PDT After having been successfully maneuvered lower by The Bullion Banks, gold is now below it's 50-day moving average and is threatening a weekly close there for the first time on 2016. Is this just another stage of the Spec Wash&Rinse Cycle or a decent entry point for an extension of this rally? |

| U.S. Economy 2016: 3 Classic Recession Signals Are Flashing Red Posted: 14 Apr 2016 05:43 PM PDT

Even I was surprised when the government reported that retail sales had actually fallen in March. Consumer spending is a very large part of our economy, and so if consumer spending is slowing down already that certainly does not bode well for the rest of 2016. The following comes from highly respected author Jim Quinn…

You can view the chart that he was referring to right here. In addition to a decline in retail sales, total business sales have also been falling, and this is another classic recession signal. The following comes from Wolf Richter…

Yes, the stock market has been on quite a run for the past several weeks, but that temporary rebound is not based on the economic fundamentals. The truth is that the real economy is definitely starting to slow down substantially. If you want to break it down very simply, less stuff is being bought and sold and shipped around the country, and that tells us far more about what is coming in the months ahead than the temporary ups and downs of stock prices. Another huge red flag is the fact that the inventory to sales ratio in the U.S. has hit the highest level that we have seen since the last financial crisis…

Because sales have slowed down, inventories are starting to pile up to alarmingly high levels. And when companies see that business is slowing down, they start to let people go. In a previous article, I told my readers that Challenger, Gray & Christmas is reporting that job cut announcements at major firms in the United States are up 32 percent during the first quarter of 2016 compared to the first quarter of 2015. Somehow, most of the talking heads on television don’t seem too alarmed by this. But ordinary Americans are beginning to become alarmed about what is happening. In fact, the percentage of Americans that believe that the U.S. economy is “getting worse” is now the highest it has been since last August…

Personally, I thought that we would be a little further down the road by now, but without a doubt a new economic downturn has begun in America. So far, it is less severe than what most of the rest of the planet is experiencing. Japan’s GDP is officially shrinking, major banks are failing all over Europe, and even CNN admits that what is going on down in Brazil is an “economic collapse”. It’s funny – yesterday I took time out to write an article about the horrible suffering that ISIS sex slaves are enduring, and a few of my critics took that as a sign that there must not be enough bad economic news to write about. Well, the truth is that this isn’t the case at all. The global economic meltdown is steaming along, even if it is moving just a little bit slower than many of us had originally anticipated. We are moving in the exact direction that myself and many others had warned about, and the rest of 2016 is looking quite ominous for the global economy. So hopefully everyone (including the critics) is using whatever time we have left wisely. Because I definitely wish the very best for everyone during the exceedingly hard times that are coming. *About the author: Michael Snyder is the founder and publisher of The Economic Collapse Blog. Michael's controversial new book about Bible prophecy entitled "The Rapture Verdict" is available in paperback and for the Kindle on Amazon.com.* |

| In re: London Silver Fixing Ltd. - Antitrust Litigation Posted: 14 Apr 2016 11:39 AM PDT Our resident legal expert, California Lawyer, has taken time to completely annotate the legal documents surrounding the DeutscheBank civil settlements in the gold and silver price manipulation case. Please be sure to review this entire public thread. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment