saveyourassetsfirst3 |

- Yamana Gold: More Reasons To Not Bail Out?

- Gold Miners Reach First Resistance Target but Continue to Outperform Gold

- The Goldman Sachs Settlement Is an Abomination and Insult to All American Citizens

- Take Off Your Tin Foil Hat – Banksters Admit to Gold Rigging - Nathan McDonald

- Gold & Silver Trading Alert: Silver’s Bearish Rally

- Gold Capped and Pinned

- Obama Set To Put In New Law That Can Put Everyone In Jail

- Deutsche Bank Silver Settlement: GATA Vindicated!

- Harvey Organ: Manipulation Exposed As Deutsche Bank Prepares to Spill the Beans on Gold & Silver Manipulation!!

- What is Coming? Elite Feverishly Building Survival Bunkers: “Fear of Uprising From the 99%”

- How CalPERS Was Taken By Private Equity Firm Silver Lake and Tried to Hide That (A Tale of Two Spreadsheets)

- Market Report: Silver stars

- Deutsche Bank Concedes a Settlement For Widespread Rigging of the Price of Silver (And Gold)

- Chris Powell: Cowardice of press, miners, financial industry sustains gold market rigging

- U.S. Economy 2016: 3 Classic Recession Signals Are Flashing Red

- Fund Manager Asks: Is The CME Preparing For A Comex Default?

- The April Emergency The Fed Doesn’t Want You To Know About – Mike Maloney

- Prepare For Market Shock And Awe: Three Ways To Take Advantage Of The Coming Silver Surge

- Bits of Australia’s Gold history

- Harvey Organ: Sprott’s $75 Million Silver Order Strikes A Nerve With Banksters

- Deutsche Bank Admits It Also Rigged Gold Prices, Agrees To EXPOSE Other Manipulators!

- Deutsche Bank Silver Settlement: GATA Vindicated

| Yamana Gold: More Reasons To Not Bail Out? Posted: 15 Apr 2016 11:39 AM PDT |

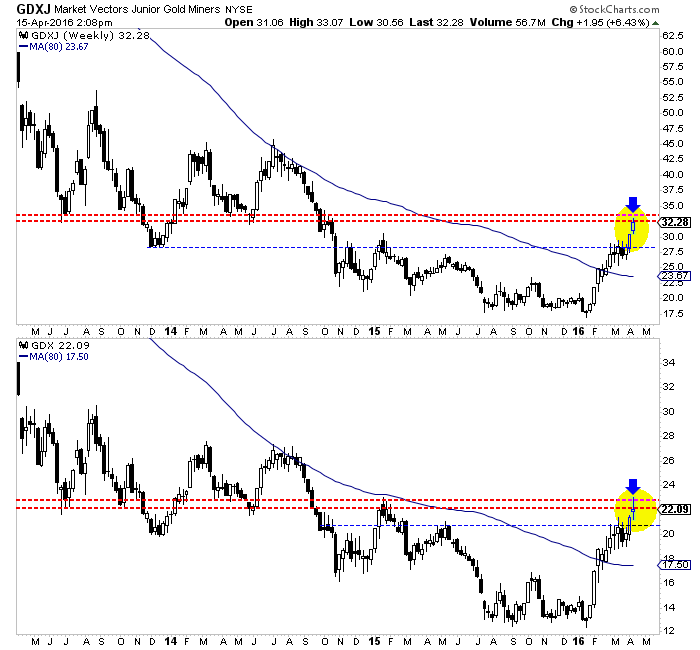

| Gold Miners Reach First Resistance Target but Continue to Outperform Gold Posted: 15 Apr 2016 11:12 AM PDT The gold stocks have been on a tear lately as they continue to move higher in defiance of the bearish calls of numerous pundits and traders. After trading lower mid week and filling Monday's gap, the miners are set to close the week with some strength. While the miners are overbought and could remain below resistance for a little while, their strong outperformance of Gold remains a comforting signal for bulls. The selloff in the miners began once they hit their first resistance targets, as noted in our editorial from last week. We noted immediate upside targets of GDXJ $33 and GDX $22.50. To be exact, GDXJ hit $33.07 and GDX touched $23.06. The resistance lines are visible in both charts below. Because the miners remain a good distance above their 50-day moving averages (GDX $19.58, GDXJ $26.82) it is possible they consolidate beneath resistance for a few weeks.

GDXJ, GDX Weekly Candles

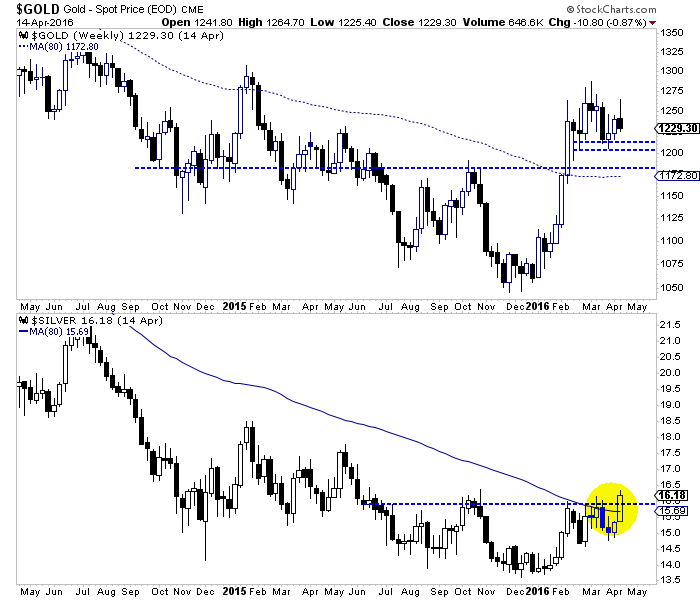

Turning to the metals, Gold continues to consolidate as it works off the excess speculative positions while Silver has broken out and above its 80-week moving average for the first time since late 2012. Both metals will close the week higher than depicted in this chart.

Gold & Silver Weekly Candles

Other than Gold's consolidation and resemblance of a small distribution pattern, the precious metals complex looks quite healthy. The breakout in Silver was telegraphed by the strength in the silver stocks as SIL doubled from its lows and SILJ is up more than 150% from its lows. At the same time, the gold stocks, as already noted have shown the same kind of strength against Gold. Those who are focusing on Gold's CoT and false topping pattern are neglecting the more powerful signals given by the rest of the sector. Because the gold stocks are at resistance and remain well above their 50-day moving averages, it is possible they could correct and consolidate for a few weeks before moving towards higher targets. We want to reiterate that the relative strength in the gold stocks and the relative strength in the silver space are healthy signs for the sector. If the sector were about to plunge (as some expect) Gold would be the leader and not the laggard that is now. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT

|

| The Goldman Sachs Settlement Is an Abomination and Insult to All American Citizens Posted: 15 Apr 2016 09:30 AM PDT A criminal financial organization that engaged in billions upon billions in fraud against the "muppet" public is once again getting off with barely a slap on the wrist, and nobody's going to do a thing about it… Buy 2016 Silver Eagles, Silver Maples, and Silver Buffalo Rounds at the Best Prices Online Submitted by Michael Krieger: […] The post The Goldman Sachs Settlement Is an Abomination and Insult to All American Citizens appeared first on Silver Doctors. |

| Take Off Your Tin Foil Hat – Banksters Admit to Gold Rigging - Nathan McDonald Posted: 15 Apr 2016 09:30 AM PDT Sprott Money |

| Gold & Silver Trading Alert: Silver’s Bearish Rally Posted: 15 Apr 2016 09:19 AM PDT SunshineProfits |

| Posted: 15 Apr 2016 08:36 AM PDT After having been successfully maneuvered lower by The Bullion Banks, gold is now below it's 50-day moving average and is threatening a weekly close there for the first time on 2016. Is this just another stage of the Spec Wash&Rinse Cycle or a decent entry point for an extension of this rally? |

| Obama Set To Put In New Law That Can Put Everyone In Jail Posted: 15 Apr 2016 07:45 AM PDT While you were watching Donald Trump… The post Obama Set To Put In New Law That Can Put Everyone In Jail appeared first on Silver Doctors. |

| Deutsche Bank Silver Settlement: GATA Vindicated! Posted: 15 Apr 2016 07:30 AM PDT “THERE ARE NO MARKETS ANYMORE; JUST INTERVENTIONS.” Buy 2016 Gold Eagles Best Prices Online Most Trusted! Source: Michael Ballanger: Precious metals expert Michael Ballanger riffs on the news that Deutsche Bank is settling U.S. silver pricing litigation. Before I begin, I want to repeat a now famous quote authored by GATA’s Co-founder, Chris Powell, who, […] The post Deutsche Bank Silver Settlement: GATA Vindicated! appeared first on Silver Doctors. |

| Posted: 15 Apr 2016 07:04 AM PDT Deutsche bank is going to spill the beans on the other banks in both gold and silver. DB must provide and they stated that they would supply all the emails between the parties as per the manipulation of silver and gold. The real question is what prompted DB to settle? Buy 2016 American Gold Eagles […] The post Harvey Organ: Manipulation Exposed As Deutsche Bank Prepares to Spill the Beans on Gold & Silver Manipulation!! appeared first on Silver Doctors. |

| What is Coming? Elite Feverishly Building Survival Bunkers: “Fear of Uprising From the 99%” Posted: 15 Apr 2016 06:56 AM PDT "Where will you go when pandemonium strikes?" by Paul Joseph Watson, Infowars.com via SHTFPlan: Editor's Comment: It certainly says something when the individuals with wealth continue to plot their escape from society. Are things crumbling? Teetering on edge? The smart money says get ready to get out. But you don't necessarily need millions to build an […] The post What is Coming? Elite Feverishly Building Survival Bunkers: "Fear of Uprising From the 99%" appeared first on Silver Doctors. |

| Posted: 15 Apr 2016 03:53 AM PDT |

| Posted: 15 Apr 2016 02:20 AM PDT Finance and Eco. |

| Deutsche Bank Concedes a Settlement For Widespread Rigging of the Price of Silver (And Gold) Posted: 14 Apr 2016 09:02 PM PDT Le Cafe Américain |

| Chris Powell: Cowardice of press, miners, financial industry sustains gold market rigging Posted: 14 Apr 2016 08:00 PM PDT GATA |

| U.S. Economy 2016: 3 Classic Recession Signals Are Flashing Red Posted: 14 Apr 2016 05:43 PM PDT

Even I was surprised when the government reported that retail sales had actually fallen in March. Consumer spending is a very large part of our economy, and so if consumer spending is slowing down already that certainly does not bode well for the rest of 2016. The following comes from highly respected author Jim Quinn…

You can view the chart that he was referring to right here. In addition to a decline in retail sales, total business sales have also been falling, and this is another classic recession signal. The following comes from Wolf Richter…

Yes, the stock market has been on quite a run for the past several weeks, but that temporary rebound is not based on the economic fundamentals. The truth is that the real economy is definitely starting to slow down substantially. If you want to break it down very simply, less stuff is being bought and sold and shipped around the country, and that tells us far more about what is coming in the months ahead than the temporary ups and downs of stock prices. Another huge red flag is the fact that the inventory to sales ratio in the U.S. has hit the highest level that we have seen since the last financial crisis…

Because sales have slowed down, inventories are starting to pile up to alarmingly high levels. And when companies see that business is slowing down, they start to let people go. In a previous article, I told my readers that Challenger, Gray & Christmas is reporting that job cut announcements at major firms in the United States are up 32 percent during the first quarter of 2016 compared to the first quarter of 2015. Somehow, most of the talking heads on television don’t seem too alarmed by this. But ordinary Americans are beginning to become alarmed about what is happening. In fact, the percentage of Americans that believe that the U.S. economy is “getting worse” is now the highest it has been since last August…

Personally, I thought that we would be a little further down the road by now, but without a doubt a new economic downturn has begun in America. So far, it is less severe than what most of the rest of the planet is experiencing. Japan’s GDP is officially shrinking, major banks are failing all over Europe, and even CNN admits that what is going on down in Brazil is an “economic collapse”. It’s funny – yesterday I took time out to write an article about the horrible suffering that ISIS sex slaves are enduring, and a few of my critics took that as a sign that there must not be enough bad economic news to write about. Well, the truth is that this isn’t the case at all. The global economic meltdown is steaming along, even if it is moving just a little bit slower than many of us had originally anticipated. We are moving in the exact direction that myself and many others had warned about, and the rest of 2016 is looking quite ominous for the global economy. So hopefully everyone (including the critics) is using whatever time we have left wisely. Because I definitely wish the very best for everyone during the exceedingly hard times that are coming. *About the author: Michael Snyder is the founder and publisher of The Economic Collapse Blog. Michael's controversial new book about Bible prophecy entitled "The Rapture Verdict" is available in paperback and for the Kindle on Amazon.com.* |

| Fund Manager Asks: Is The CME Preparing For A Comex Default? Posted: 14 Apr 2016 05:00 PM PDT It's not a question of "if" the Comex eventually defaults but a question of "when." The move by the CME to ring-fence cash collateral at the Fed expressly suggests that an event of default may be closer than any of us realizes… Buy 2016 Gold Eagle Coins Best Prices Online Submitted by PM Fund Manager Dave […] The post Fund Manager Asks: Is The CME Preparing For A Comex Default? appeared first on Silver Doctors. |

| The April Emergency The Fed Doesn’t Want You To Know About – Mike Maloney Posted: 14 Apr 2016 04:01 PM PDT Is silver about to STUN the markets? Buy 2016 Silver Eagles , Silver Maples, and Silver Buffalo Rounds at SD Bullion – Best Prices Online! Buy 2016 Gold Eagles Lowest Prices Online The post The April Emergency The Fed Doesn't Want You To Know About – Mike Maloney appeared first on Silver Doctors. |

| Prepare For Market Shock And Awe: Three Ways To Take Advantage Of The Coming Silver Surge Posted: 14 Apr 2016 04:00 PM PDT Coupled with silver's demand as a hedge against monetary instability, silver is set to rise to $100 per ounce or more over the next 24 months. Submitted by Mac Slavo, SHTFPlan: Mass layoffs and closures aren't just a phenomenon in the oil industry. In a new micro-documentary from Future Money Trends trend analyst […] The post Prepare For Market Shock And Awe: Three Ways To Take Advantage Of The Coming Silver Surge appeared first on Silver Doctors. |

| Bits of Australia’s Gold history Posted: 14 Apr 2016 04:00 PM PDT Goldoz |

| Harvey Organ: Sprott’s $75 Million Silver Order Strikes A Nerve With Banksters Posted: 14 Apr 2016 03:30 PM PDT It looks like Eric Sprott got on the nerves of our bankers as they lowered the premium in silver to -.73%. Remember that Eric is to get 75 million dollars worth of silver… Buy 2016 Silver Eagles, Silver Maples, & Silver Buffalo Rounds at SD Bullion – Best Prices Online HUGE WITHDRAWAL OF SILVER […] The post Harvey Organ: Sprott’s $75 Million Silver Order Strikes A Nerve With Banksters appeared first on Silver Doctors. |

| Deutsche Bank Admits It Also Rigged Gold Prices, Agrees To EXPOSE Other Manipulators! Posted: 14 Apr 2016 03:20 PM PDT Well, that escalated quickly… Buy 2016 Gold Eagles Best Gold Prices Online From Tyler Durden: Earlier today when we reported the stunning news that DB has decided to “turn” against the precious metals manipulation cartel by first settling a long-running silver price fixing lawsuit which in addition to “valuable monetary consideration” said it would […] The post Deutsche Bank Admits It Also Rigged Gold Prices, Agrees To EXPOSE Other Manipulators! appeared first on Silver Doctors. |

| Deutsche Bank Silver Settlement: GATA Vindicated Posted: 14 Apr 2016 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment