Gold World News Flash |

- Fort Knox Paradox

- Jim Rickards — The New Case for Gold

- CNBC's Steve Liesman Makes A "Discovery": Americans Are Increasingly Angry And They Want Trump

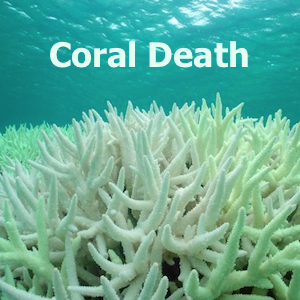

- “Nearly Half Of The Great Barrier Reef To Die In The Next Month”, Abrupt Climate Shift Is Now

- Goldman Questions Rally, Fears Looming Event Risk Amid Record VIX Longs

- On the Brink of Nuclear War: A Conversation with F. William Engdahl

- Refugees Flooding Italy Surge 80%; Proposed Solution in Single Picture

- Was There A Run On The Bank? JPM Caps Some ATM Withdrawals

- The Other Problem With Debt No One Is Talking About

- Russia Relies On Gold To Push Reserves Back Over $380 Billion

- Chris Martenson -- How to Survive The Imminent Global Economic Collapse

- Yellen Ignites Another Robo-Trader Spasm

- Booyah! Jim Cramer Screws Up Again

- Gold Daily and Silver Weekly Charts - Midnight Train To Georgia

- Epic Battle Rages Between the Bullion Banks and Gold Speculators

- The Panama Papers and the Virtual Berlin Wall

- The Story of Your Enslavement

- The Markets are Smitten

- The Failure of Multiculturalism: Sweden's Collapse

- Jim’s Mailbox

- Brussels and Paris Attacks Looks Like Another False Flag. Here’s Why - Top Russian Analyst Starikov

- Silver Bullion Is Coiled Spring and Will “Explode Higherâ€

- The Pitfalls Of Buying Gold And Silver Online, And How To Avoid Them

- BonTerra Resources Delivers Its Own March Madness

- Canadians Switch Out of Canadian Dollars Into U.S. Dollars Now!!...

- Gold Getting Stale? – Charts and COTs

- What New Economic Recovery?

| Posted: 04 Apr 2016 11:01 PM PDT Officially the Fort Knox Bullion Depository contains 147.3 million ounces of gold. However, the last audit was performed over 60 years ago. According to reliable sources "audits" since then have... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Jim Rickards — The New Case for Gold Posted: 04 Apr 2016 09:00 PM PDT from JayTaylorMedia: |

| CNBC's Steve Liesman Makes A "Discovery": Americans Are Increasingly Angry And They Want Trump Posted: 04 Apr 2016 07:01 PM PDT Earlier today, CNBC's Steve Liesman made two very important, in fact "critical", if about one year overdue, discoveries. The first one was that Americans are angry. According to the CNBC All-America Survey, a majority of Americans are angry about both the political and the economic system. Perhaps if CNBC had discovered this sooner, it would have figured out that the reason it no longer reports its ratings to Nielsen has something to do with its underlying "rosy" slant on things, one which perhaps brings out people's, well, anger. That and the occasional informercial for Ferrari and million dollar homes.

The second discovery is that angry Americans largely support Trump over Hillary, something we have discussed since last summer. As Liesman puts it, nearly three-fourths of the public is angry or dissatisfied with the political system in Washington, compared with 56 percent who are angry or dissatisfied about the economy. This group favors Trump on the economy over Clinton 28 percent to 21 percent.

Of those dissatisfied or angry with the economic system, Trump leads on the economy 27 percent to 19 percent for Clinton.

All of these "surprises" should have been obvious. But then the survey revealed several findings which surprised even us. First, and rather curiously, income isn't correlated with anger, with angry respondents found both among the rich and the poor. 55% of people who earn $100,000 or more are dissatisfied or angry with the economic system, the same percentage as those who earn $30,000 or less. Also surprising: the wealthiest Americans are more likely to be angry or dissatisfied with the political system than the lowest income Americans. Another surprise: while conventional wisdom is that Clinton has more of a lock on the Democratic nomination than Trump has on the GOP nod, the CNBC survey shows that on key economic issues, Bernie Sanders is more of a challenge to Clinton than Kasich and Cruz are to Trump. For example, Sanders is virtually tied with Trump 25 percent to 26 percent on which candidate is judged to have the best policy for regulating Wall Street and the big banks. Clinton has the support of only 16 percent of the public on the issue. Clinton leads with support of 25 percent of the public on who has the best policies for the middle class, followed by 21 percent for Sanders and 16 percent for Trump. And finally, since this is CNBC, the channel reported that Trump is seen as best for the stock market by a wide margin. Fully 31 percent say his policies would be best for the stock market's performance, compared with just 17 percent for Clinton. As many Democrats as Republican's think Trump would be best for stocks. Which begs this question: since those who have the most invested in the stock market "run the system", as they say, and ultimately decide who the next president is, why wouldn't they "pick" Trump? And just how much of the most theatrical presidential election in history is, well, just theater? * * * Liesman's full interview below: |

| “Nearly Half Of The Great Barrier Reef To Die In The Next Month”, Abrupt Climate Shift Is Now Posted: 04 Apr 2016 06:35 PM PDT by Dane Wigington, Geoengineering Watch:

The oceans are superheating, along with the rest of the planet. If the oceans die, we die. Recent studies indicate that half of the barrier reef has already been lost in the previous 3 decades. Now, in the next 30 days, half of what is left will be lost. Some want to primarily blame Fukushima for the dying seas, but there is much more to the equation. In the early 90s I participated in 2 private extended dive excursions on the Barrier reef, such a loss is unimaginable to me. Is anthropogenic (human) activity to blame for the explosion of environmental cataclysms on our planet?

With absolute mathematical certainty the answer is YES. The human race and the military industrial complex has decimated the planet in countless ways, the ongoing climate engineering insanity is at the top of the list of destruction. The toxic heavy metal fall out from climate engineering is further fueling the global die off. The destruction of the ozone layer (most directly linked to the ongoing geoengineering assault) is also a massive contributing factor in regard to coral bleaching and the global die-off in general. Earth and its life support systems are in virtual collapse, and even now the vast majority of populations are completely oblivious to what is unfolding around them at absolutely blinding speed. Even now there are countless groups, organizations, and individuals that are still clinging to carefully crafted power structure propaganda and lies of “global cooling”, “global warming is a hoax”, or “we can’t tell if the planet is warming or cooling”. How can there be such an incomprehensible disconnect? Because the majority are still tragically choosing to form their conclusions from ideology and not front line facts. Because the majority choose not do do any objective research fromcredible and verifiable sources on an ongoing basis. The chasm of willful confusion is vast and there is plenty of blame to go around. The environmental/climate science/global warming communities and groups are immersed in inexcusable denial in regard to the geoengineering/solar radiation management atrocities in our skies. How can there be any legitimate discussion of the climate without even mentioning the single largest climate disrupting and damaging factor of all, geoengineering/weather warfare, and SRM programs? Answer? There can’t be. On the other side of the fence there are many who recognize the reality of climate engineering, but unfortunately are in total denial in regard to the unfolding planetary meltdown (that is being made exponentially worse overall by climate intervention programs). The weather makers can create large scale short term chemical cool-downs at the cost of a worsened overall warming. Arctic ice is yet again at record breaking low levels as the ongoing atmospheric spraying continues. Antarctica is also in trouble. The 2 minute video below makes inarguably clear that geoengineering/solar radiation management programs are reality. |

| Goldman Questions Rally, Fears Looming Event Risk Amid Record VIX Longs Posted: 04 Apr 2016 06:00 PM PDT Volatility (VIX) is now at its lowest level since before the August sell-off last summer yet CS Fear Barometer remains elevated leaving the spread between the two options-market-based indicators is at its widest ever. Credit Suisse sees two main reasons for the difference:

But as Goldman Sachs details, with the unemployment rate at 5% the ISM manufacturing index at its current level of 51.8 suggests a VIX level of 19.2. The much higher new orders index (58.3) suggests a VIX level of 16.7. So the VIX is currently pricing further economic improvement...

As the market itself seems to shrugg off the collapse in earnings expectations...

However, Goldman adds, while volatility may be subdued for the next few weeks, perhaps until the next potential major catalyst, such as “Brexit”, if our economists are correct, Fed chatter may pick up again in H2... which is supported by the fact that investors are pouring money into levered long VIX ETPs. Investors often chase strong performance but that has not been the case across the VIX ETP space. As the VIX has fallen, investors have been positioning for a rise in volatility via double levered long ETPs. Levered VIX ETP vega exposure has doubled since the market trough, driven by longs. We monitor vega exposure for a select group of 11 VIX ETPs, with around 4 billion in total market cap. We estimate that the gross vega notional across levered VIX ETPs now stands near a record high at around 244 million vega (in absolute terms), more than doubling since the market bottom in February. The increase has mostly been driven by long and double-levered long VIX ETPs, such as the UVXY and TVIX. Volatility investors are often interested in how much volatility exposure (vega) VIX ETPs carry and what percentage of the overall VIX futures market they account for. How big is the VIX ETP market? We estimate that the gross vega exposure controlled by the six most active VIX ETPs (VXX, VIXY, UVXY, TVIX, XIV, SVXY) which track the front month future is currently running at 320 million vega, which accounts for about 85% of the outstanding open interest in the VIX futures market. Simply put, as Goldman sums up, the options market seems to be questioning the quality of the rally and continues to price in more adverse outcomes. |

| On the Brink of Nuclear War: A Conversation with F. William Engdahl Posted: 04 Apr 2016 05:33 PM PDT In this segment, F. William Engdahl breaks down the current chaotic conditions across the Middle East and Russia's recent decision to pull out of Syria in the fight against ISIS. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Refugees Flooding Italy Surge 80%; Proposed Solution in Single Picture Posted: 04 Apr 2016 05:29 PM PDT Submitted by Mike "Mish" Shedlock of Mishtalk Italy's Interior minister Angelino Alfano warns the refugee "system is at risk of collapse" following an 80 per cent spike in the number of arrivals to Italy across the central Mediterranean Sea in the first quarter of this year compared to 2015. Alfano fears that Syrians headed for Turkey will inetead head for Libya for an even more hazardous Mediterranean Sea crossing to Italy. How many tens of thousands of people can you keep, year after year? Without returns, either you organize real prisons, or it's obvious that the system will collapse," Mr Alfano said. "It doesn't take a prophet to glimpse the future". Costs are about to soar. Alfano wants to secure new deals with African nations, offering economic aid in exchange for taking back their citizens. Here's a picture that explains everything. Refugee Crisis in a Single Picture

Cost Analysis Apparently it does take a prophet because Chancellor Merkel still doesn't get it. And I have yet to see a complete analysis of the cost of these schemes, from anyone. New and Proposed Processes

One country stands out in these preposterous scheme. Saudi Arabia, where art thou? |

| Was There A Run On The Bank? JPM Caps Some ATM Withdrawals Posted: 04 Apr 2016 05:14 PM PDT Under the auspices of "protecting clients from criminal activity," JPMorgan Chase has decided to impose withdrawal limits on certain ATM transactions. As WSJ reports, following the bank's ATM modification to enable $100-bills to be dispensed with no limit, some customers started pulling out tens of thousands of dollars at a time. This apparent bank run has prompted Jamie Dimon to cap ATM withdrawals at $1,000 per card daily for non-customers.

This move appears to have backfired and created a 'run' of sorts on Chase...

Remember Greece?

And, in what appears to the start of a war on cash in America, The Wall Street Journal reports, the bank is cracking down, capping ATM withdrawals at $1,000 per card daily for noncustomers.

However, as we noted last night,

So, there is more than the total US GDP being laundered in offshore tax havens, but yes, let's eliminate the $100 bill to cut down on corruption and money laundering. Of course, we are sure this is just another 'storm in a teacup' as why should anyone question a fine upstanding and trustworthy bank withholding people's money when they are assuredly tax evaders, terrorists, drug dealers and human traffickers. |

| The Other Problem With Debt No One Is Talking About Posted: 04 Apr 2016 04:35 PM PDT Submitted by MN Gordon via EconomicPrism.com, Nearly 7 years have elapsed since the official end of the Great Recession. By now it’s painfully obvious the rising tide of economic recovery has failed to lift all boats. In fact, many boats bottomed out on the rocks in early 2009 and have been taking on water ever since. Last week, for instance, it was reported that U.S. credit card debt topped $714 billion in the third quarter of 2015. That’s up $34 billion from the year before. Shouldn’t the economic recovery allow consumers to pay down their debts? Indeed, it should, if only the economic recovery was the result of real, economic growth. To the contrary, the recovery has been faux growth driven by cheap Fed credit and financial engineering. Mutual increases in prosperity haven’t occurred. In particular, those outside the financial services business, and other bubble industries, like government lobbyists, have largely missed out on any increase in income or living standard. Good paying professional jobs that vaporized during the downturn have been replaced with low paying service jobs. Consumers have used credit card debt to pick up the slack. Unfortunately, this short term solution sets up consumers for pain in the future. At some point, as debt increases faster than incomes, the ability to pay down the principle becomes near impossible. Even making the minimum payment becomes more and more difficult as new debt is added to the burden each month. Playing with Fire“We’re playing with fire now,” said Odysseas Papadimitriou, chief executive of credit statistics and analysis site CardHub. “Either an unexpected economic downtown or the continuation of current spending and payment trends could be enough to unleash an avalanche of defaults.” Papadimitriou is correct in his assertion we are playing with fire and that the continuation of current trends could unleash an avalanche of defaults. But his statement that there could be an “unexpected” economic downturn doesn’t appreciate the natural rhythms of an economy. Specifically, economic downturns are normal occurrences – they should be expected, not unexpected. From what we gather there has been roughly 12 recessions (assuming the 1980 and 1981-82 recessions were two distinct events) in the United States in the post-World War II era. The average interval between these recessions has been about 58 months. Based on the official end date of the Great Recession of June 2009, we are currently 82 months into the current recovery. In other words, we are due for a downturn. What’s more, we may presently be entering one. According the Atlanta Fed’s March 28 GDPNow model forecast, real GDP growth in the first quarter of 2016 is estimated to be 0.6 percent. By the time you read this, the April 1 update will likely have been posted. You can take a look at the Atlanta Fed’s latest forecast here. The point is, GDP is meager. Moreover, present credit card debt is unsustainable. The potential for an avalanche of defaults is already high, regardless of if there’s a recession. Yet, at this point in the recovery, the looming potential for a recession is highly likely. Hence, an avalanche of credit card defaults is practically certain. But that’s not all… The Other Problem with Debt No One is Talking AboutThe other problem with expanding consumer debt that is rarely, if ever, mentioned is that it accompanies expanding waste lines. You can chart the strength of the relationship over time with a near perfect +1.0 positive correlation. Why is this? We don’t know for sure. We haven’t studied the data. Nor have we researched the causation. But gut feel tells us it has something to do with discipline. More precisely lack of discipline. For example, the inclination to charge the purchase of a new flat screen TV complements the proclivity to jumbo size a mega gulp soda pop. Both are entirely unnecessary. But they go hand in hand. Saving up for a flat screen and resisting the jumbo size option takes the sort of self-restraint that’s absent from our debt saturated society. Of course, the federal government is the worst offender. Even with their bloated budgets they still need a half trillion dollar annual deficit to keep the machine humming along. No doubt, the promises politicians have made to voters for a comfortable retirement and free drugs are at the heart of matter. Similar to credit card debt, the promises stack up each month and each year like dead wood in the Angeles National Forest. At some point all it takes is the strike of a single match and the whole mountain conflagrates in a blazing inferno. |

| Russia Relies On Gold To Push Reserves Back Over $380 Billion Posted: 04 Apr 2016 03:13 PM PDT

Whether you define gold as a barbarous relic, a pet rock, "tradition", or "doomed", Russia surely refers to it as a saving grace. As Russia’s foreign reserves dwindled to just under $350 billion in early 2015, many predicted Russia was going |

| Chris Martenson -- How to Survive The Imminent Global Economic Collapse Posted: 04 Apr 2016 03:08 PM PDT Author Chris Martenson from Peak Prosperity.com joins SGT to discuss some of the necessary steps every thinking person ought to take in order to survive the global economic crisis. Chris and co-author Adam Taggart have a brand new book called 'Prosper' which can help us all do just that. Because as... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Yellen Ignites Another Robo-Trader Spasm Posted: 04 Apr 2016 01:39 PM PDT This post Yellen Ignites Another Robo-Trader Spasm appeared first on Daily Reckoning. Simple Janet has attained a new milestone as a public menace with her speech to the Economic Club of New York. It amounted to yelling "stay" in a burning theater! The stock market has been desperately trying to correct for months now because even the casino regulars can read the tea leaves. That is, earnings are plunging, global trade and growth are swooning and central bank "wealth effects" pumping has not trickled down to the main street economy. Besides, there are too many hints of market-killing recessionary forces for even the gamblers to believe that the Fed has abolished the business cycle. So by the sheer cowardice and risibility of her speech, Simple Janet has triggered still another robo-trader spasm in the casino. Yet this latest run at resistance points on a stock chart that has been rolling over for nearly a year now underscores how absurd and dangerous 87 months of ZIRP and wealth effects pumping have become. As we have indicated repeatedly, S&P 500 earnings—–as measured by the honest GAAP accounting that the SEC demands on penalty of jail——-have now fallen 18.5% from their peak. The latter was registered in the LTM period ending in September 2014 and clocked in at $106 per share. As is shown in the graph below, the index was trading at 1950 at that time. The valuation multiple at a sporty 18.4X, therefore, was already pushing the envelope given the extended age of the expansion. Indeed, even back then there were plenty of headwinds becoming evident. These included global commodity deflation, a rapid slowdown in the pace of capital spending and the vast build-up of debt and structural barriers to growth throughout China and its EM supply train, as well as Japan, Europe and the US. In the interim it has all been downhill on the profit and macroeconomic front. By the March 2015 LTM period, S&P reported profits had dropped to $99 per share and have just kept sliding, posting at only $86.44 per share for the December 2015 LTM period just completed. So there you have it. The casino has actually been trying to mark-down the Bubble Finance inflated stock prices that the Fed's wealth effects lunacy has generated since the great financial crisis. Yet our Keynesian school marm and her posse just keep finding one excuse after another to feed the algos. Indeed, Yellen had barely ambled up to the rostrum, and they had the market back up to 2065. After Friday's further bump to 2072, the math of that is a round 24X earnings. That's right. With ample evidence of financial risk and bubbles cropping up everywhere during the past 18 months, Simple Janet stood there at the New York Economics Club podium and threw the robo-traders a big sloppy wet one!

Let's cut to the chase. You can not get more clueless or irresponsible than that. Even if you take the Humphrey-Hawkins mandate as literally and mechanically as the creationists read the scriptures, the Eccles Building should have declared "mission accomplished" long ago. After all, by the writ of the BLS itself, unemployment is at the historical 5.0% full-employment marker and core CPI is at 2.3% and rising. But Simple Janet is willing to nit-pick even the phony Humphrey-Hawkins targets to the second decimal place because she apparently has no idea that a 38 bps money market rate is not a pump toggle on some giant bathtub of GDP; it's an ignition fuse that is fueling the greatest speculative mania in modern history. The longer the Fed perpetuates today's massive 24X bubble with soporific open mouth interventions like Yellen's pathetic speech last week, the more violent and traumatic the risk asset implosion will ultimately be. You would think our monetary politburo might at least notice that after trading in no man's land between 1870 and 2130 on the S&P 500 for the past 700 days, the casino is positioned exactly where it stood in 2007 and 2000.

But Simple Janet is lost in a time warp. The 1960's notion that the US economy is a closed bathtub in which inflation, unemployment and all of the other crude, ill-measured macro-variables on Janet's dashboard can be mushed around by central bank injections of ethers called "aggregate demand" and "financial accommodation" was not true even back then. It was also never true that the financial market is merely a neutral transmission channel to the main street economy that can be used as a pumping device to manage GDP and the dual mandate variables embedded in it. In fact, financial markets are the delicate mainspring of the entire capitalist economy. The nuances of pricing in the money and debt markets, the exact shape of the yield curve, the cost of carry and maturity transformations, the price of options and hedging insurance, capitalization rates on earnings and cash flows and much more are what actually enable sustainable growth, real wealth creation and financial stability. But the blunderbuss Keynesians who have taken control of the Fed and other central banks lock, stock and barrel are clueless. Their massive, chronic, heavy-handed intrusions in financial markets have falsified all prices and turned the financial markets into incendiary gambling casinos. There is no true price discovery left—-just an endless cycle of speculation and front-running that eventually reaches a breaking point and implodes. We are there now. Yellen and her band of Keynesian pettifoggers insist on perpetuating the bubble because they fear a hissy fit in the casino, but pretend to justify their dithering by reference to the "incoming data". Thus, in her New York speech Yellen mentioned three risks that purportedly justified the Fed's decision to punt at the March meeting. The most preposterous was that growth in China is slowing and there is uncertainty about how it will handle the transition from exports to domestic sources of growth. Is she kidding? China is a madcap $30 trillion credit bubble waiting to fracture and bring the world economy down for the count with it. I have actually been in China for the last 10 days and the evidence that this giant construction site will soon grind to a stop is palpable. I will report more on this state made disaster next week. But the very idea that the Fed would base a decision to delay normalization of money market rates after 87 months of ZIRP because the China credit binge is finally cratering speaks volumes. It proves that the Eccles Building is inhabited by monetary crackpots who cannot even recognize a giant Ponzi scheme when it is starring them in the face. Likewise, Yellen unaccountably cited a second risk to the economic outlook that justifies deferral of rate normalization. Namely, that the potential for further commodity and especially oil price weakness could have "adverse" effects on the global economy. Really! Of course there is going to be much more carnage in the oil patch. After all, a decade of coordinated money printing by most of the world's central bank eventually generated spectacular levels of excess capacity and malinvestment in the global oil and gas patch. To wit, between 2004 and 2014 total debt of the global oil and gas industry nearly tripled, rising from $1.1 trillion to nearly $3 trillion. And that was not the free market at work, or proof that "drill baby drill" had anything to do with an upsurge of technological innovation and enterprenurial spirits. Instead, the current massive overhang of surplus stocks and excess production capacity is owing to the drastic mispricing of capital and the temporary bubble in petroleum demand that pushed prices into an artificial and unsustainable triple digit range. Accordingly, the present oil price collapse is just getting started. It will be subtracting from CapEx and production levels in the US and around the world for years to come. Finally, Yellen offered a third excuse, and it was a real whopper. In effect, she said that after nearly 100 months of "extraordinary" monetary policies the Fed dare not risk another recession because it stranded itself on the zero bound and has no dry powder remaining to counteract the next downturn. Does this ship of fools domiciled in the Eccles building really believe they have abolished the business cycle? By the sound of the following, there is no other conclusion possible. I consider it appropriate for the committee to proceed cautiously in adjusting policy," Yellen said Tuesday. "This caution is especially warranted because, with the federal funds rate so low, the FOMC's ability to use conventional monetary policy to respond to economic disturbances is asymmetric." Yes, Yellen is not only guilty of yelling "stay" in a burning theater. Speaking to the Wall Street speculators assembled at the Economic Club of New York, she actually threatened to keep the carry trade gambles in free money until they finally blow the place sky high for the third time this century. Regards, David Stockman P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Yellen Ignites Another Robo-Trader Spasm appeared first on Daily Reckoning. |

| Booyah! Jim Cramer Screws Up Again Posted: 04 Apr 2016 01:35 PM PDT This post Booyah! Jim Cramer Screws Up Again appeared first on Daily Reckoning. CNBC's resident "oracle" is at it again. Jim Cramer, the overexcited host of the cable channel's "Mad Money" show, has once again shown off his unique skills at forecasting the future… and destroying the portfolio of anyone who follows his advice. Cramer is the infamous investing "expert" who clownishly prances about his TV studio while shouting out "buys" and "sells" and yelling "Booyah!" every few minutes. Some find Cramer's antics a refreshing antidote to the sometimes staid business of making money in the markets. (I'm not one of them.) But the harsh truth is that his advice can be poison to your portfolio. In fact, in the past year, he's made one of his most ridiculous and irresponsible calls yet. I just hope you didn't listen to him. Here's a brief résumé of Cramer's not-so-finest moments … 2000: "Sun Microsystems has probably the best near-term outlook of any company I know." Sun's shares nosedived after that call by 98% before the company was eventually acquired by Oracle in 2009. 2004: "[Tesla's] stock is very expensive. I don't like Tesla." Tesla shares skyrocketed nearly 500% after that call. 2008: "Bear Stearns is fine. Do not take your money out. That's just being silly. Don't be silly." Just days later, Bear Stearns went bankrupt, launching a broader stock market collapse. And now, Cramer may have made the worst call of his career… In April 2015, Cramer recommended renewable energy company SunEdison Inc. when shares were trading around $25. After the stock dropped 60%, he went on live TV to apologize for his terrible mistake. In August 2015, when shares were trading at $10, he said this during his TV show: “First, let me just say–mea culpa! Clearly, I was wrong to get behind this one. It was a mistake to recommend SunEdison and I own that." He should have shut up after that apology. But he kept going… "I got SunEdison wrong. The company overextended itself, continuing to make big acquisitions when it became clear that the market had turned against them… I think that long-term investors can start to gradually build a position here on the way down.” Are you kidding me? Averaging a loser on the way down? But wait. It gets worse. A couple of months later, his website, TheStreet.com, got in on the insanity… In October 2015, The Street recommended SunEdison again as a stock "Under $10 to Buy on Weakness." SunEdison shares were hovering just under $10 at the time. Seems like a great bargain, right? Cramer's website thought so. Shares had already dropped from $25 to $10. How much worse could it get? How about $0? SunEdison shares now trade at 49 cents as I write this. And the company is on the brink of bankruptcy. There are many more examples like this from Cramer. But I don't have the patience to go through them all. A Google search will help you if you want more. Three Words That Will Send You to the PoorhouseLook, I'm not telling you this just to pick on a clownish stock picker who's in it for the "entertainment." We can actually learn a few things from him … 1) Grown men should never say "Booyah!" 2) Never try to predict the future. 3) You should never buy on market weakness (don't average losers). The first point above is self-evident. If you don't agree, enter "Booyah!" and "Jim Cramer" into a YouTube search. The prosecution rests, Your Honor. Second, the biggest market myth is that big profits come from predicting future prices. But that's pure fantasy. You don't make money in the markets by guessing what will happen… as Cramer has proven over and over and over again. Will he get some right? Sure… just as a blind squirrel will find a nut now and again. But this is investing, not Vegas. No one can predict the future. If someone tells you they can, clutch your wallet and start running in the opposite direction. Third, you should never buy on weakness. Buying on weakness means you're betting against the trend. Those three words, "buy on weakness," will send you to the poorhouse. History is not kind to investors who invest against the trend. When prices trend lower, they often continue to head south… sometimes all the way to bankruptcy (where SunEdison appears to be headed). You don't want to ride with them. My System vs. Jim CramerLet me be blunt: The world's wealthiest traders don't listen to hyperventilating teleprompter readers on CNBC… they never try to predict the future… and they counterintuitively sell weakness and buy strength. They have a trend following system, similar to the one we use in Trend Following with Michael Covel. Take a look…

My system triggered a sell signal in August when the stock was trading at $10.30. A sell signal means get the hell out… or short the stock. Excited about other solar stocks? Don't go there. The entire sector is in "sell" mode. The main thing is if you are in this just to be entertained by guys like Cramer, just be sure to ignore their advice… or you might end up like SunEdison's shareholders. Please send me your comments to coveluncensored@agorafinancial.com. I want to know what you think of my perspectives – the good, the bad and the ugly. Regards, Michael Covel The post Booyah! Jim Cramer Screws Up Again appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - Midnight Train To Georgia Posted: 04 Apr 2016 01:25 PM PDT |

| Epic Battle Rages Between the Bullion Banks and Gold Speculators Posted: 04 Apr 2016 12:55 PM PDT The battle raging between the Bullion Banks and Gold Speculators is every bit as spectacular as the Ali-Frazier fights of the 1970s, says precious metals expert Michael Ballanger. As a young man of fourteen with my older brother Donny having introduced me to Ring Magazine a few year earlier, I can't remember ever being so hyped up for a heavyweight title fight than when Cassius Clay took on Sonny Liston and "whupped" him to take the title and then repeated in the rematch. From that point onward, the hero of my youth (excluding Bobby Orr, of course) in the world of sports became Cassius Clay-turned-Muhammad Ali, who became the greatest heavyweight fighter of all time and dominated the game for over a decade, despite being banned from boxing for refusing to join the army in 1967. Ali was a big man standing over 6'4" tall but he moved with the fluidity, speed and lethal grace of a jaguar. |

| The Panama Papers and the Virtual Berlin Wall Posted: 04 Apr 2016 12:38 PM PDT This post The Panama Papers and the Virtual Berlin Wall appeared first on Daily Reckoning. We can't prove it — not yet anyway — but we suspect the "Panama Papers" are the work of someone in the global power structure firing an intercontinental ballistic missile in the war on cash. If you're not up to speed yet, 11 million documents have been leaked from a Panamanian law firm called Mossack Fonseca — spilling the beans on offshore tax evasion worldwide from the 1970s up to the present day. The identity of the leaker, for now, is a secret. The papers first landed in the hands of the German newspaper Süddeutsche Zeitung. Now they're being analyzed by 109 media outlets in 76 countries. "The documents show 12 current or former heads of state and at least 60 people linked to current or former world leaders in the data," reports the BBC. They include the current prime minister of Iceland. The government of Australia has already launched an investigation into 800 of that country's residents. In addition, "the documents demonstrate that as much as $2 billion has been shuffled through banks and offshore companies said to be linked to associates and friends of Vladimir Putin, the Russian president," says the Financial Times. Conspicuous by their absence from the initial reporting is a meaningful number of Americans. The most prominent so far is Marianna Olszewski.

No, we've never heard of her either. Her claim to fame is a personal finance book called Live It, Love It, Earn It: A Woman’s Guide to Financial Freedom. We see used hardcover copies available on Amazon for a penny plus shipping. Perhaps it didn't make an impact because it was published in late 2009 — when many women and men alike were more concerned with financial survival than financial freedom. Olszewski's fortune came not from being a "life coach" but from running a broker-dealer. During the Panic of 2008, she had $1.8 million of her personal funds tied up in a secret offshore company, and she wanted it back. But the bank wouldn't release the money without knowing who was behind the offshore company. She contacted Mossack Fonseca, which prompted the following email exchange… Mossack Fonseca executive: “We may use a natural person who will act as the beneficial owner… and therefore his name will be disclosed to the bank. Since this is a very sensitive matter, fees are quite high.” Olszewski: “I do think we should go ahead with the natural person however I want to have your promise that you… will handle this in the most sensitive manner.” It did. The firm dug up a 90-year-old man from Great Britain to be the "natural person" and sign all the requisite paperwork. For this service, Olszewski agreed to pay $10,000 the first year and $7,500 each year after that — a substantial discount off the firm's usual fee. The editor of the German paper that first got the documents is promising more Americans will be exposed. We'll see. So what's it to you if you don't have the sort of substantial assets that you'd willingly pay $7,500 a year to hide from the tax man? It comes back to a theme we've covered in these virtual pages since 2010 — the "virtual Berlin Wall" that's gone up around Americans and their money, locking us up into the U.S. dollar and U.S. banks. It's nearly impossible for Americans to open a foreign bank account nowadays — the compliance requirements with IRS rules are so onerous that most foreign banks can't be bothered. The rules have tightened gradually since the passage of the Foreign Account Tax Compliance Act of 2010 (FATCA). Not coincidentally, the number of Americans giving up their U.S. citizenship has been setting records nearly every year since…

And as we've often documented, it's not the uber-wealthy who dominate the ranks of those surrendering their U.S. passports. Even if they can open a foreign bank account, they can't afford the average $2,000 of annual paperwork required to comply with IRS regulations on folks who live overseas. From where we sit this morning, the Panama Papers aren't about naming and shaming wealthy tax cheats: They're about tightening the noose on everyone. "The fallout from the massive data leak," says the Financial Times, "will force Panama to give up the secrecy that has made it the 'last, ultimate tax haven,' according to the Paris-based OECD, which has been leading a global transparency drive." The OECD comprises most of the world's developed countries and several large developing ones, like Mexico. It's in the forefront of the war being waged against "drug dealers, money launderers and tax evaders." That's the usual list of suspects whenever do-gooders start talking about why cash is such an awful thing and we should all submit to a new and glorious age of digital currency — the better with which every transaction can be tracked and government can slowly siphon off your wealth with negative interest rates. The solution to all these problems — be it the war on cash or the war on financial privacy — is the same. We cited a key passage a few days ago from Jim Rickards' latest book, The New Case for Gold… "The war on cash is mostly over, and the government won," he writes. "But it's not too late to get some gold, which maintains its worth as a physical store of wealth and is not affected by the digitization of other forms of money." Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Panama Papers and the Virtual Berlin Wall appeared first on Daily Reckoning. |

| Posted: 04 Apr 2016 11:28 AM PDT We can only be kept in the cages we do not see. A brief history of human enslavement - up to and including your own. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 04 Apr 2016 09:19 AM PDT This post The Markets are Smitten appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a marvelous Monday! Let’s start today’s letter a little differently than normal. Yes, I still don’t care about the BLS report any longer, but the markets do still care, and the markets move currencies and metals, so I am obligated to play along. And since the dollar seems to be back in control this morning, after Friday’s BLS Jobs Jamboree, I’m going to start today’s letter with thoughts on the Jobs Jamboree. Geez Louise, I totally dislike talking about this stuff, because it’s all smoke and mirrors and I just can’t seem to understand why the markets can’t see that! But here goes anyway… Well, the Jobs Jamboree took place on Friday, last week, and once again amazed me at how brazen the BLS has become with their reports. Just keep printing it, and sooner or later, everyone will believe it. Well, almost everyone! The BLS reported that their surveys and hedonic adjustments brought the total of jobs created in March of 215,000. The Unemployment Rate rose to 5% (from 4.9%), and something that should have been more hailed than the supposedly 215,000 jobs created. And that is the Labor Participation Rate rose to 63%, the highest it’s been for a long time. 64,000 of that 215,000 total were added with the Fed’s Birth/Death Model, that I continue to bang on for its inaccuracy. It is a proven fact that in 2015, there were more “deaths” of businesses than “births”, but that fact didn’t deter the BLS from adding jobs nearly every month in 2015. And with no fundamental changes in what’s going on in the U.S. I don’t know for a fact, yet that is, but I would suspect the same scenario is going on in the U.S. in 2016, that there are more “deaths” than “births”. So, why would the BLS be adding jobs each month to their already suspect “surveys”? So, to me, the even still questionable number of jobs should be 151,000. (215,000 – 64,000). I still believe that the 151,000 total is questionable. But just for fun, let’s say it’s true. I read this weekend that 52% of the jobs went to the lowest paying third of workplaces, and that only 11% of the jobs went to the industries that pay a middle-class wage. I just don’t see how the markets can get all excited about this stuff. Whew! I’m worn out after all that. You should have seen my fat fingers flying around the keyboard. I couldn’t type the words that my mind was thinking fast enough! But that’s my two-cents on the whole thing. The markets are smitten with the strength of the report, and think that the economy in the U.S. isn’t as slow as Fed Chair, Janet Yellen, would have us believe given her dovish speech last week. At least through the Jobs Jamboree last week, the markets were sold on the Yellen-factor, but since the Jobs Jamboree they have dismissed the Yellen-factor and it’s back to thinking that the U.S. economy has turned the corner. Well, IF the markets want to move back to fundamentals instead of Central Bank guidance, I’m all for that! But here’s the problem – the markets have tried going back to fundamentals before, only to be pulled back into the Central Bank guidance trading due to some Central Banker speech, or monetary action. Memo to markets: So, you want to allow fundamentals to dictate currency values? Well, that’s fine with me, but just remember once you go back to fundamentals there’s no switching over to Central Bank guidance again! And the markets will get their first test today, when the U.S. will print Durable Goods, and Capital Goods Orders, along with Factory Orders for February. These will all be final prints, as the preliminaries printed a couple of weeks ago. They’ll still show negative results. What will the markets do then? Oh, did you see that Fed member Dudley, did a kid-like thing when asked about his thoughts on the economy, he did a “what she said” referring to Janet Yellen’s speech. We haven’t heard from the hawks like Bullard, Williams and Lockhart, since the Yellen speech, so when they do come out and talk again, it will be interesting to see if they’ve changed horses in the middle of the stream. So, like I mentioned above, the dollar has taken back the control over the currencies this morning, and it started after the Jobs Jamboree on Friday. The price of oil has fallen again and this time it has fallen below $37 to a $36 handle. The Russian ruble is getting whacked because of this drop in the price of oil and the other petrol currencies are falling in behind the ruble this morning. The Antipodeans (see? I can use big words! HA!) are finding life on the other side of the first QTR difficult. I was doing some reading this weekend, and came across a report that illustrated the Aussie dollar (A$) and N.Z. dollar/kiwi and how for the last few years they’ve really started the year with strong moves, only to give them back the rest of the year. I found this to be very interesting, but you have to remember, the “last few years” we’ve been in a strong U.S. dollar trend, so things could get pretty screwy the rest of the year in a strong dollar trend. But I’m getting the feeling, my spider sense is tingling, that we could be nearing the end of the strong dollar trend.. And if the feeling/sense comes to fruition, then all the things that went on in the past few years would be thrown out with the bath water. The Reserve Bank of Australia (RBA) will meet tonight. And although a rate cut remains on the table at the RBA, they will keep rates unchanged tonight, in my opinion, which could be wrong. Did you know that Australia booked the fastest economic growth in the developed world last year? We have some feeling that commodities like iron ore are seeing recoveries in their prices, and Australia put a budget surplus on the books last year. So, why is the rate cut still on the table, I hear you asking? Well, the problem is the U.S. and the Fed. If the Fed keeps going down this path of not hiking rates further, then the pressure will be on the RBA to cut rates, because the A$ will continue to rise as long as the rate differential is steady between the U.S. and Australia. The RBA can’t have the A$ get out of whack (too strong) with other commodity currencies or Australia loses to the cheaper competition. So, to keep a lid on the A$ as long as the Fed keeps their interest rate powder dry, the RBA will keep the rate cut on the table, just to remind the markets of the risk they take by driving the A$ too high. I wanted to let you in on something early, and that is the next currency of the month is going to be the A$. I’m just now putting together the rough draft for that article – ‘A Return To the Land of Oz’ is what I think I’ll call it! The IMM Futures Positions last week saw more cuts in long U.S. dollar (USD) positions, and cuts in the short positions in euros and A$’s. I think these futures positions reports are good indicators of what the traders are thinking, but they’re always a week in arrears. So, you must take that into consideration. The euro was quite the perky currency last Friday morning, rising to 1.1420, before falling back below the 1.14 figure. I read this past weekend that 1.15 is a real tough psychological level, and should the euro pass 1.15, then it’s going to be a strong indicator that the strong dollar trend has ended. Well, not just pass 1.15, but pass it and remain there, making that a new base to move higher. Remember, the euro is the offset currency to the dollar, and dollar weakness shows up here first, and once dollar weakness is the trading scenario, the euro will rise, no matter what the economy of the Eurozone is doing. No, it can’t withstand another round of Greek problems, but a slow economy is a piece of cake for the weak dollar trend to deal with! There’s an article on the Bloomberg this morning that talks about how Citigroup, which is the world’s biggest currency trader, isn’t buying into the dollar retaining the strength it gained from the Jobs Jamboree on Friday. Citigroup told their clients that until the Fed rhetoric changes and they begin to talk about a rate hike in June, the dollar weakness should remain. Pretty interesting, eh? You would twist that all around and come back to the same thing I’ve been saying. It’s a holiday in China today, so no fixing took place for the renminbi. It’s the Ching Ming Festival in China today, at least that’s what the calendar says! HA! China will see their latest on the PMI’s and FX reserves this week. I don’t foresee any major moves in the PMI’s, (manufacturing index), so the markets’ real attention will be on the FX Reserves, to see if the recent trend to spend these reserves in the economy continued at the fast pace it was on prior to year-end. My thought here would be that spending of the reserves slowed. And that would send a good message throughout the “risk” markets. Or the vice versa would send a bad message to the “risk” markets. The latest poll in the U.K. on whether or not to leave the European Union (EU), which is being called BREXIT, showed a 43% to 37% edge to the “yes” leave the EU camp. That’s actually closer than I would have thought it to be. But then the government hasn’t gotten behind the BREXIT campers yet, and they will, and leaving the EU puts additional pressure on the pound. In Canada this week, we’ll see two data prints that will give us a good idea whether or not the Canadian economy is on terra firma or not. Tomorrow we’ll see the latest Trade Balance, with hopes that the trade deficit narrowed in February. And then on Friday, we’ll see the labor report for March, which is expected to show 10,000 jobs created in March, but I’m of the opinion that the number will be larger than 10K. and that would send the message to the markets that the economy is stronger than they’ve previously thought! And that should reflect in a better valued loonie! The U.S. Data Cupboard on Friday finally showed some life in the ISM (manufacturing index), which rose to 51.8 in March, from 49.5 in Feb. This is the first gain in this data in over a year, and I think it says a lot about the fact that the dollar lost a lot of ground in March, thus allowing exported manufactured goods to be more competitive. I remember writing a letter to the head of the manufacturing sector here in the U.S. back in 2001, reminding him that he should be putting pressure on the Fed and Treasury to weaken the dollar, which at that time in 2001, was quite strong. I don’t for one minute believe that the letter ever made it to his desk and opened in front of his eyes, but I can imagine that it did, and somehow was responsible for the reversal of the strong dollar a year later! Yeah, right, Chuck, I’ve got a bridge to sell you too! I already told you that today’s Data Cupboard has the Factory Orders and the Durable Goods and Capital Goods orders, which will print negative. Will this be the data that makes Friday’s one month in over 12 strong ISM print, one fleeting moment? Gold, which enjoyed its best quarter in the first quarter, in over three decades! And that was with gold getting taken down during March, is starting the new quarter on a down note, the same as it ended the 1st quarter. The shiny metal is down $5 this morning after being $10 on Friday. UGH! I was both pleased and ticked off by stuff that James Rickards said this past weekend about gold. First the thing that ticked me off, Rickards doesn’t believe in unallocated gold or pooled gold. He says that “unallocated gold means no gold”. Well, I beg to differ with him on that point! I have to wonder if he has ever owned unallocated gold and then needed to fabricate it? I have and it worked beautifully, just the way it’s supposed to, without me having to buy the gold again because I already owned it, and if the holding company didn’t own it, they took a HUGE loss, but to prevent against that happening the holding company and EverBank have an agreement that they will never be short to EverBank. So there! The thing he said that made me smile, was that “As interest rates increasingly become negative, gold becomes the high-yield asset”. He went on to say, that…

I found this on Bloomberg this morning. And Bloomberg pulled the article from the Charlotte Observer, and can be found here in its entirety, and here’s the snippet:

Chuck again. I had just mentioned to the family last week that bricks and mortar stores were going to end up being dinosaurs as we go forward with the internet buying and having things shipped to your door, without having to leave your house. They laughed at me. Of course, all mad men get laughed at, at first! HA! And with that I will send you on your way to hopefully having a marvelous Monday, and remember to be good to yourself! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Markets are Smitten appeared first on Daily Reckoning. |

| The Failure of Multiculturalism: Sweden's Collapse Posted: 04 Apr 2016 08:01 AM PDT From paradise to nightmare: Sweden's collapse and the declining west This video is my attempt at turning the tides that is the decline of western civilization, with focus on Sweden. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 04 Apr 2016 07:42 AM PDT Jim, Some uplifting articles on gold. CIGA Elton Hedge Fund Manager Invests 30% Of Total Portfolio Into… GOLD! Has Multi-Decade Track Record Over more than 25 years, hedge fund manager Stan Druckenmiller (https://en.wikipedia.org/wiki/Stanley… ), has built up an incredible amount of credibility in the investment world. Under his management, his firm Duquesne Capital Management has... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Brussels and Paris Attacks Looks Like Another False Flag. Here’s Why - Top Russian Analyst Starikov Posted: 04 Apr 2016 06:08 AM PDT Absurdities surrounding reported terrorist atrocities in Europe are highlighted here by Nikolai Starikov, Russian writer on geo-politics and history. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Silver Bullion Is Coiled Spring and Will “Explode Higher†Posted: 04 Apr 2016 03:56 AM PDT Silver bullion’s reluctant, sluggish participation in early 2016’s powerful gold rally has been glaringly obvious. Instead of amplifying the yellow metal’s big gains as in the past, silver largely failed to even keep pace. The lack of silver confirmation for gold’s big move has certainly raised concerns. But despite silver’s vexing torpidity in recent months, it is a coiled spring ready to explode higher to catch and surpass gold. |

| The Pitfalls Of Buying Gold And Silver Online, And How To Avoid Them Posted: 04 Apr 2016 03:34 AM PDT Back in 2014, online bullion dealer Tulving shocked its many customers by suddenly failing. See Coinweek’s story: How does $40M of Gold and Silver Disappear: The Collapse of Tulving Company Last week another one bit the dust: |

| BonTerra Resources Delivers Its Own March Madness Posted: 04 Apr 2016 01:00 AM PDT |

| Canadians Switch Out of Canadian Dollars Into U.S. Dollars Now!!... Posted: 03 Apr 2016 09:05 AM PDT As a Brit I well understand the deep admiration the Canadians have for their powerful neighbors south of the border, even if it is not always expressed. The good news in this update is that now is the time to "put your money where your mouth is" when it comes to admiring the Yanks, by changing your Canadian dollars immediately into US dollars, the prime reason being that the Canadian looks set to drop after a big rally from mid-January, while the US dollar looks set to surprise by rallying away from the danger zone of the support around 93 on the dollar index. |

| Gold Getting Stale? – Charts and COTs Posted: 03 Apr 2016 03:27 AM PDT Notice on the very short term chart, a 2 hour run, gold has been in a steady decline since the middle of last month with rallies attracting selling at the key resistance levels noted on the chart. Price is currently holding below $1212 – $1210. Initial resistance begins near $1225 and extends higher towards $1228. Above that lies $1237-$1240. |

| Posted: 03 Apr 2016 03:02 AM PDT The rise of the ‘dollar store business model’ caters to a disappearing ‘middle class’ who are incurring shrinking incomes. This has made ‘dollar stores’ prosper, in the last decade. Dollar stores, for most Americans, have carried an odd sort of stigma. In the past, these stores were seen as shopping for the poor, only. We are all now aware that many people who were in the once strong American ‘middle class’ were thrown off of the prosperity path and into ‘lower income’ brackets from business layoffs, downsizing, and salary reduction. While regular product companies struggle the expanding ‘dollar stores’ have found a niche in this economic climate. The shrinking ‘middle class’ means more customers for ‘dollar stores’. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Australia’s

Australia’s

No comments:

Post a Comment