Gold World News Flash |

- The Magnetic Field Did Not Collapse This Week

- US Treasuries Will Sink Into A Black Hole

- Gold “Chart of The Decade” – Maths Suggest $10,000 Per Ounce Says Rickards

- On The Edge Of An Economic Meltdown: Gold & Silver Rip Higher

- The US Endgame? Creating A Climate That "Could Easily Be Transformed Into War"

- April 29, 2016 - Michael Savage Donald Trump Interview

- What Happens If Everybody Pulls Their Money Out Of The Bank Today?

- Peter Schiff -- The Depression Is Going To Get Worse

- Full Speech: Donald Trump Speaks at California Republican Convention

- Prepare for the Coming Financial Earthquake

- Gold Stocks: Extended but More Upside Potential

- Did Shanghai Just Blow a Hole in the Old Gold Market?

- This is what happens when you don't issue the world reserve currency

- Silver Miners Strong in Grim Q4

- On The Edge Of An Economic Meltdown: Gold & Silver Rip Higher. By Gregory Mannarino

- Mike Kosares: Did Shanghai just blow a hole in the old gold market?

- OK, Globe & Mail, why do central banks intervene in gold instead of beaver pelts?

- Latino For Trump Reveals Horrors of Socialism

- The World is Getting Crazier, But We No Longer Notice

- More Proof That America Is Toast…

- Deutsche Bank tires quickly of its experiment with integrity

- Is Silver a better bet than Gold in the Near Future?

- What's Going on with Gold? - Video

- Here’s the Dollar Breakdown That Could Propel Gold to New Highs

- US Dollar Meltdown Underway as Fed Credibility Evaporates - Video

- How to Use the CoT Report in Gold Investing?

- Dissatisfied Zero Hedge employee feeds his resentments to Bloomberg

- Gold “Chart of The Decade†– Maths Suggest $10,000 Per Ounce Says Rickards

- Are We or Are We Not in a New Gold Bull Market?

| The Magnetic Field Did Not Collapse This Week Posted: 29 Apr 2016 10:00 PM PDT from SuspiciousObservers: |

| US Treasuries Will Sink Into A Black Hole Posted: 29 Apr 2016 08:20 PM PDT by Egon von Greyerz, Gold Switzerland:

It is of course wonderful to live in Shangri-La and be totally seduced by governments magnificent injection of credit and printed money which creates eternal happiness and wealth. Many of us live in fantasyland where it is irrelevant if you work or not. If there is not enough money, your government will issue food stamps, rent subsidies or help you to buy the latest car on credit. And if the government runs out of money, it can always print some more. There is no limit to how many quadrillions the printing presses or the computers can manufacture. This is the wonderful Keynesian virtuous circle of unlimited deficit spending and debt. And just like in Shangri-La this goes on for ever. At least this is what Krugman and the central bankers believe. No one ever looks at the facts. It would be a real mistake to be confused by the darned facts! The fact that Japan is a basket case doesn't matter. The government is buying all the debt that is currently issued and will soon own over 50% of all the debt they have ever issued. That is the most perfect example of perpetual motion. Print more than half the government spending every year and more if needed. It is really unnecessary to collect any taxes. It is just an administrative irrelevance. Much better to print all the money that the country spends. That way the people can stop working and just enjoy life. With 260% government debt to GDP, it is guaranteed that no one has the intention to ever repay that debt. The fact that the working population will decline by 40% in the next 40 years guarantees that the debt will grow exponentially until the Yen and the Japanese economy disappears into the Pacific. On their way down they will obviously sell over $ 1 trillion of US treasuries just to do their share of global debt implosion. But why should we worry about the fact that the world's fourth largest economy will go back to prehistoric times. Or should we? But the Chinese economic wonder will certainly save the world? Well, the Chinese are extremely clever at copying all the things that we do in the West, good or bad. They are making all the products that the West invented at a fraction of the price and flooding the West with goods which we are buying on credit. The dilemma is that China also thought that Shangri-La had arrived and that this would go on forever. So in this century they bought all the commodities that the world produced to create a massive Emerging Market bubble. They also invested massively in production capacity and infrastructure. This over-investment led to an increase in Chinese debt from $2 trillion to over $30 trillion. So now China has infrastructure and ghost towns that are standing idle. And they have a production capacity that the world can no longer afford to buy enough products from for the Chinese economy to survive. Companies in China are now taking over 6 months' average payment terms. The Chinese shadow banking system is lumbered with bad investments and bad debt and will lead to massive defaults. On top of all that, Chinese demographics is just a bit better than Japan's and will also see a fast declining population that can never repay the debt. As the Chinese financial system implodes the country will dump their $1.2 trillion of US treasuries. So what about Draghi land? Well we know that the banking system in Greece, Italy, Spain and Portugal is bankrupt. But banks in France, UK, and Germany are no better. Deutsche Bank is too big for Germany. Just their worthless derivatives portfolio is 25 times German GDP. This is why the ECB is printing money as fast as they can in order to keep the banks going for a few more months. But this is a race against time that the ECB is guaranteed to lose. And it probably won't take that long before the unelected bureaucrats in Brussels lose their massive benefits and pensions as their megalomaniac EU project collapses. So what about Obama land or is it Yellen land? Well they are clearly both worried since they are having "secret" meetings. They both of course know that the world as well as the US economy are in an irreparable mess. With 23% real unemployment, falling real wages for forty years, 50 million queuing in front of soup kitchens and debt growing exponentially, they are right to worry. |

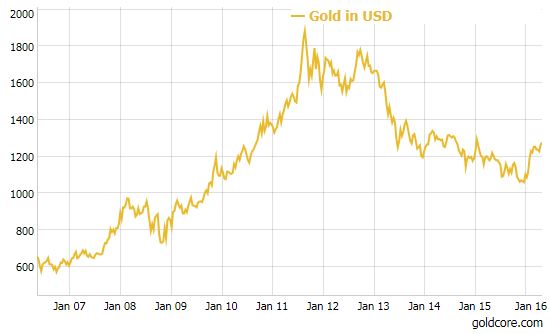

| Gold “Chart of The Decade” – Maths Suggest $10,000 Per Ounce Says Rickards Posted: 29 Apr 2016 07:00 PM PDT from Goldcore, via Market Oracle:

Francine generously acknowledged how Rickards was "bullish on gold for quiet some time and actually you have been proven right … it is the chart of the decade". She said that this "has to do with inflation expectations, it has to do with currency but it is really at the end of the day just a haven so people pile into it – as much as they do yen …" GOLD IS MONEY "Gold is a form of money and not an investment. As money it competes with other kinds of money — the dollar, euro, yen etc.. They're like horses going around a racetrack – place your bets but you have a subjective preference for money. As investors are losing confidence in central banks … that's what's been going on and been clearly revealed. Central bankers have told me that they don't know what they're doing and they sort of make it up as they go along. They experiment.

President Evans of the Chicago Fed has said this and others have said it privately. I spoke to Ben Bernanke and he described that everything he's done was an experiment — meaning you don't know what the outcome is. So in that world where investors are losing confidence in central banks, gold does well. Right now there are tens of trillions of dollars of sovereign debt with negative yields to maturity – bunds and JGBs.. Gold has zero yield. Zero is higher than a negative 50 bps so gold is now the high yield asset in this environment." STOCKS HIGHER ON "FULL DOVE" "Both gold and stocks are going up, and the reason stocks are going up is because Janet Yellen is going "full dove". There's nothing the stock market doesn't like about free money. Plus negative interest rates might be on the table for next year. That's sort of bullish for stocks but it's also bullish for gold. Sometimes gold and stocks go up together and sometimes they don't. There's no long term correlation, but right now in a world of easy money and negative yields it's good for both stocks and gold." GOLD AT $10K/oz "I have a technical level for gold, it is $10,000 U.S. per ounce. That amount gets bigger over time because it's a ratio of physical gold to printed money. The amount of physical gold doesn't go up very much, but printed money goes up a lot, so the dollar target goes up more over time because of all the money printing. $10,000 U.S. per ounce is the implied non-deflationary price for gold. If you have to go back to a gold standard, or anything like it to restore confidence, that is the number you must have to avoid deflation. So $10,000 per ounce is mathematically derived and is not a guess." INTEREST RATES and US ECONOMY "If Janet Yellen begins to normalize then it would probably throw the U.S. into a recession. A 25 basis points hike in December threw the U.S. stock market into a 10% correction in the next two months. The U.S. is hanging by a thread. It looks like first quarter GDP is going to come in at well below 1% according to the Atlanta Fed Tracker. What's the difference between -1% and 1%? Technically not much. One may be a technical recession and one is not, but growth is extremely weak. You don't raise interest rates in a recession. You're supposed to ease in a recession. International spill over as well as the U.S. economy being fundamentally weak is the reason to not raise rates. The time to raise rates was 2011 and that's long gone. But two wrongs don't make a right." |

| On The Edge Of An Economic Meltdown: Gold & Silver Rip Higher Posted: 29 Apr 2016 06:40 PM PDT from Gregory Mannarino: |

| The US Endgame? Creating A Climate That "Could Easily Be Transformed Into War" Posted: 29 Apr 2016 06:00 PM PDT Most readers have been watching, as the U.S. and Russia seem to be positioning themselves along Cold War lines. The posturing is not confined to maneuvering military assets; it also runs along economic lines, in which most warfare is at least based if not a major or the sole impetus. Each power has sought to cement its claims/presence in areas bordering the sphere of influence of, or the actual territory of the other power. Such posturing can be dangerous and lead to an incident that escalates into the uncontrollable. Recently the news media has been abuzz with the Russian fighter aircraft buzzing the U.S. in the face: first the incident with the two fighters coming within 30 feet of an American naval vessel, and another separate incident involving aerial theatrics around a U.S. reconnaissance aircraft (a Boeing RC-135 intelligence-gathering spy plane). The U.S. responded in kind on April 20 by allowing a guided missile destroyer, the U.S.S. Cook to encroach upon Russian borders while conducting maneuvers near Poland. The U.S. claimed that Russian aircraft were doing fly-by’s to intimidate the destroyer. Unlike the puissant response by John Kerry, feigning anger and doing nothing with the Russian aircraft incidences of the past two weeks, Russia is not playing with the destroyer incident. The Russian ambassador to NATO, Alexander Grushko is reported by Reuters to have made the following statement:

This statement by Grushko was not limited to the incident with the Cook. NATO Secretary General Jens Stoltenberg has affirmed in the past week the intention of NATO to deploy command and control centers in Bulgaria, Estonia, Latvia, Lithuania, Poland, and Romania. Exercises are currently being planned and prepared in Estonia by NATO air assets, to include participation by Sweden and Finland, both non-NATO members. The exercises are scheduled to commence on April 28. Although the exercises are superficially being dubbed maneuvers to help with control of civilian airports and coordination with them during “an emergency situation,” in reality they are both posturing and stationing aircraft on Russia’s western flank. Also, the mainstream media barely mentioned the fact that last month, NATO fighter aircraft approached a Russian aircraft carrying Sergei Shoigu, the Russian Defense Minister who was en route to inspect military facilities and readiness in Kalingrad, toward Russia’s western border. Much has also been mentioned by NATO of Russian “aggression and encroachment” regarding Ukraine, still beset by more than a year of fighting in its eastern region between Ukrainian forces and ethnic Russian separatists. NATO has condemned Russia for supplying these separatists with equipment, materials, and personnel. Russia has responded to this accusation by declaring eastern Ukraine to be mired in a civil war. There are also underlying economic issues to all of this. As mentioned in previous articles, the entire involvement of NATO wanting to “assist” Russia in her support of Syria was nothing more than an attempt to oust Assad. This, in turn took a back seat to the desires of NATO and the U.S. to annex a portion of Syria in order to enable a natural gas pipeline from Qatar into Western Europe for the purpose of negating Russia’s Gazprom from supplying Western Europe with natural gas. Basically, the Russians solidified Assad’s position, bombed the insurgents into submission, left supplies and advisers with Assad, and withdrew from the board. The U.S. was left stultified with egg on its face. Now the BRIC nations are starting their markets up in earnest, backing their currencies with gold and trading in Shanghai, China, and Moscow in Russia. These two nations, incidentally are #1 and #3 respectively regarding gold production. The former produced 490 tons in 2015, and the latter put out 295 tons that year. The two nations account for 25% of the gold production for the world. Those are staggering numbers. In addition to production, China and Russia have been building up their reserves of gold astronomically. They are ranked 5th and 6th respective to gold reserves. The U.S. is listed as “#1” but this is another faux pearl attached to others on a string, such as phony employment numbers and the inflated GDP as reported by parrots of the media and business insider networks who are, in reality inside of the pockets of the administration and the Federal Reserve. Another point of interest that may have a great effect is that Congress is in the midst of passing legislation to hold Saudi Arabia partially accountable for the 9-11 attacks. The Saudis responded with informing the state department that they will call in assets and all accounts payable if that is the case. This could really domino and also spell an immediate end to the Petrodollar. Wouldn’t that be interesting? Congress would hit the Saudis up with a bill, and the Saudis would pay us in “fiat” Federal Reserve notes, maybe cutting off the oil supply as well. Payment of the bill then may as well be in toilet paper. To summarize, akin to ancient Rome, the United States has over-extended herself. She has created a climate that could easily be transformed into a war on a slight pretext. Wars, as it is well known are also a means a nation can extricate itself from debt and financial responsibility. The dying Petrodollar system has been on life support for some time, and it appears other nations such as the BRIC’s are taking the initiative to return to a true monetary standard. This is the same gold and silver standard that the U.S. should never have left in the first place. |

| April 29, 2016 - Michael Savage Donald Trump Interview Posted: 29 Apr 2016 05:00 PM PDT ...when speaking he truth , using common sense is a revolutionary concept , you know your living in a messed up country . lord keep this man safe. Michael Savage Donald Trump Interview - April 29, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| What Happens If Everybody Pulls Their Money Out Of The Bank Today? Posted: 29 Apr 2016 04:30 PM PDT For every dollar that you have in the bank there is actually 0.00061 dollars available...in other words, there's 6 cents for every $100 dollars of deposits that you have at the bank. As Mike Maloney explains in this brief clip, we live in an economic system that is made complicated by design. Basically, it’s set up so most people don’t even try to understand it. Got Gold?

|

| Peter Schiff -- The Depression Is Going To Get Worse Posted: 29 Apr 2016 04:26 PM PDT Alex Jones talks with expert economist Peter Schiff about the American economy and where it's going in the future. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Full Speech: Donald Trump Speaks at California Republican Convention Posted: 29 Apr 2016 02:01 PM PDT Friday, April 29, 2016:Full replay of Donald Trump's keynote speech at the California Republican Party Convention's Kickoff Lunch Banquet in San Francisco, CA. Full Speech: Donald Trump Speaks at California Republican Convention The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Prepare for the Coming Financial Earthquake Posted: 29 Apr 2016 01:52 PM PDT This post Prepare for the Coming Financial Earthquake appeared first on Daily Reckoning. We are living in a time of earthquakes that could crush the walls of your portfolio and leave your wealth in ruins. Tragically, major earthquakes have struck in recent days in Japan and Ecuador, causing death and destruction. We're concerned about these, but we're also concerned with financial earthquakes, which are also happening everywhere. Financial earthquakes are just as dangerous to your wealth as physical earthquakes are to your well-being. Physical earthquakes can have ramifications in capital markets as well. Let's survey this new age of earthquakes and help you to find shelter from the ruin and the aftershocks. On Thursday, April 14, a large magnitude-6.2 earthquake struck Japan on the southern island of Kyushu near Kumamoto City. Fortunately, there was relatively little loss of life. But the city was left without electricity, and extensive damage to buildings and roads was reported. Then on Saturday, April 16, a much more powerful magnitude-7.0 earthquake struck the same area of Japan around Kumamoto City. Now the loss of life was greater, with at least 32 killed, and over 2,000 were injured. At least 180,000 people lost homes and were seeking shelter. Over 1,000 buildings were badly damaged and over 90 completely destroyed. With hindsight, scientists could see that the April 14 earthquake was a foreshock and the April 16 earthquake was a major shock. The two earthquakes are an example of how events in complex systems interact in ways that are impossible to predict. Within hours of the April 16 earthquake in Japan, a massive magnitude-7.8 earthquake struck the northwestern coast of Ecuador. Casualties included over 350 dead, and that toll is expected to rise. At least 370 buildings were totally destroyed, and thousands more damaged. Ecuador is a relatively poor country, so the global economic fallout is expected to be minimal despite the horrendous suffering of those on the scene. While the two earthquakes in Japan are clearly connected, scientists do not see any direct connection between the Japanese and Ecuadorian earthquakes. Yet there is no doubt that Japan and Ecuador are part of a single system that produces earthquakes on a continual basis. Japan and Ecuador are both part of the "Ring of Fire" consisting of 25,000 miles of volcanoes and fault lines that circle the Pacific Ocean. The Ring of Fire stretches from Chile, northeast through the west coasts of North and South America, through Alaska, and then south through Japan, Indonesia and finally New Zealand.

The "Ring of Fire" is a band of volcanoes and fault lines that surrounds the Pacific Ocean. It is a good example of a complex system. Financial markets are also complex systems that exhibit connected behavior with timing that is impossible to predict. These events may be front-page news, but what does seismology have to do with your portfolio? Earthquakes and capital markets are both representative of complex dynamic systems. There's a great deal we can learn about capital markets by studying earthquakes using a complexity theory framework. Complexity theory is one of the tools I use to understand risk and make financial forecasts. There is a lot scientists know about earthquakes and a lot they don't know. It is possible to identify fault lines, which enables scientists to locate potential earthquakes. It is also possible to estimate the potential size of future earthquakes based on the extent and nature of the fault lines. The one thing scientists cannot predict is the exact timing of an earthquake. They can tell you a big one is coming, and they can tell you where, but they cannot say exactly when. A monster earthquake could happen tomorrow, next year, in five years or even further in the future. Does this make scientific knowledge of earthquakes useless? After all, investors always say timing is everything when it comes to buying or selling stocks. If you cannot predict the exact timing, what good is the science? The answer is that you can make good use of what you do know, even if there are factors you do not know. For example, you may not know when an earthquake will strike on a particular fault line. But you do know it's not a good idea to build a nuclear reactor right on top of one. The earthquake will strike eventually, and the reactor will melt down. It's foolish to add to the known risks just because the exact timing is unknown. The same is true in financial markets. We can see a financial meltdown is coming and we know how bad it will be. We do not know the exact timing. Although it would be surprising if we made it three years without the equivalent of a magnitude-9.0 financial earthquake. (If the Lehman Bros. and AIG meltdowns of 2008 were an 8.0 financial earthquake, you can imagine how much worse a 9.0 will be.) If a financial earthquake worse than anything you've seen before is definitely coming, then the timing is irrelevant. Since it could be tomorrow, you need to prepare today with strategies that will either preserve wealth or make money when the "big one" hits. This limited but powerful knowledge (we know size and likelihood, but not timing) is not the only common feature of seismology and finance. Both types of complex systems cause "contagion" or "spillover" effects. This is where one surprise event causes other shocks, just like dominoes falling or a house of cards collapsing. The Russian/Long-Term Capital Management panic of August 1998 actually started in Thailand in June 1997. It then spread around the world. The Lehman/AIG panic of September 2008 actually started in the mortgage market in July 2007. Then it spread through Bear Stearns and Fannie Mae before becoming a full-scale panic. The next global panic may have started already, but we won't see the full scope of it for a year or more. Sometimes natural disasters and capital markets interact directly. This is a case of one complex system crashing into another. The most spectacular example of this is the Fukushima disaster in Japan in March 2011. Fukushima began as an underwater earthquake that morphed into a tsunami. The tsunami then crashed into a nuclear reactor that melted down. The reactor meltdown caused a crash on the Tokyo Stock Exchange and a surge in the value of the yen. The yen spike then triggered a G-7 currency market intervention to weaken the yen in an effort to help the suffering Japanese economy. The earthquake, tsunami, reactor, stock market and foreign exchange are all examples of complex dynamic systems. Two are natural (earthquakes and tsunamis) and three are man-made (reactor, stock market and foreign exchange), yet they all crashed into each other as if they were just one row of dominoes. This shows the power of complexity and its ability to shock and surprise investors. Something similar happened as a result of the recent Japanese earthquakes. We had already alerted readers about the "Shanghai Accord," a secret plan agreed among central bankers at the G-20 meeting in Shanghai, China, on Feb. 26. One of the main objectives of the Shanghai Accord is a strong Japanese yen. While the Japanese earthquake had nothing to do with the Shanghai Accord, there was a direct and powerful market connection. When earthquakes strike, insurance companies need to liquidate assets in order to pay claims. After April 14, Japanese insurance companies began selling overseas assets, converting the proceeds into yen and repatriating the yen in order to pay claims and finance rebuilding. This liquidation and repatriation gave us a new data point to update our Shanghai Accord thesis pointing to a stronger yen. That thesis is now stronger. I use a method called inverse probability to make forecasts about events arising in complex systems such as capital markets. Inverse probability is also known as Bayes' theorem, based on an early 19th-century formula first discovered by Thomas Bayes. The formula looks like this in its mathematical form:

In plain English, this formula says that by updating your initial understanding through unbiased new information, you improve your understanding. I use this method in the CIA and in my financial forecasting. The left side of the equation is your estimate of the probability of an event happening. New information goes into right-hand side of the equation. If it's consistent with your estimate, it goes into the numerator (which increases the odds of your expected outcome). If it's inconsistent, it goes into the denominator (which lowers the odds of your expected outcome). What are some of the financial fault lines we are monitoring right now? What are the new data points that are going into the Bayes model to update our forecast of a financial meltdown? Here's a list of the main fault lines leading to disaster:

There's more, but that's enough of a list to make the point that confidence in my forecast of a major financial earthquake ahead is getting stronger by the day. Regards, Jim Rickards P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoning website and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post Prepare for the Coming Financial Earthquake appeared first on Daily Reckoning. |

| Gold Stocks: Extended but More Upside Potential Posted: 29 Apr 2016 12:29 PM PDT What a move in the gold stocks! The sector has refused to correct for more than a few days at a time. All weakness has been bought as a wall of worry has been built and the sector emerges from a historic low that could be on par with the 1942 low in the stock market. I thought the Federal Reserve statement or reaction to it (along with the market’s overbought condition) might cause the sector to correct this week. Instead, GDX and GDXJ powered higher and have gained roughly 13% for the week. |

| Did Shanghai Just Blow a Hole in the Old Gold Market? Posted: 29 Apr 2016 12:25 PM PDT I did not want the day to pass without posting a few words on gold’s significant push to the upside, now trading just shy of the $1300 mark. To be sure, the dual positions with respect to rates on the part of the Bank of Japan (to stand pat) and the Federal Reserve (to remain ultra-dovish) played a role in the dollar’s recent weakness and gold’s strength. Those determinants though, in my view, are only part of the story, and the few percentage point drop in the dollar against the yen over the past week is really not enough to justify a nearly $60 rise in the price of gold over the past five trading sessions. The bigger determinant has been China’s underpinning of the gold price on two different occasions over the past week after it had taken a major turn to the downside in New York trading. |

| This is what happens when you don't issue the world reserve currency Posted: 29 Apr 2016 11:45 AM PDT Venezuelans Add Beer to List of Privations By Andres Schipani Venezuela's largest privately owned company on Friday stopped producing beer, adding to a list of privations facing residents already frustrated by power cuts, water shortages, triple-digit inflation, and grinding recession. "This could mean the end," says Sergio Silva, shopkeeper at a neighbourhood store in Petare, one of Caracas' biggest slums. "If Venezuelans do not have beer ... this country could blow." ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/a64bc010-0d61-11e6-9cd4-2be898308be3.html ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Silver Miners Strong in Grim Q4 Posted: 29 Apr 2016 11:37 AM PDT The silver miners showed impressive fundamental strength during 2015’s grim fourth quarter. That was the worst silver suffered in many years, a perfect-storm trough with major secular lows fueling extreme bearish sentiment. Traders feared this entire industry faced an existential threat, so they fled in terror from silver stocks. But silver miners’ strong operational performances aced that severe trial with flying colors. Q4’15 may seem like ancient history now, but it was exceedingly important for the entire precious-metals realm. Gold slumped to a miserable 6.1-year secular low in mid-December, on the day after the Fed hiked rates for the first time in 9.5 years. That was wildly irrational based on market history, which has proven gold thrives during Fed-rate-hike cycles with big average gains. Gold hadn’t seen lower prices since Q4’09. |

| On The Edge Of An Economic Meltdown: Gold & Silver Rip Higher. By Gregory Mannarino Posted: 29 Apr 2016 11:30 AM PDT EVERYONE IS GETTING OUR TAX MONEY TO PAY THEIR BILLS FROM OBAMA" Except the American People wHO WORK FOR IT... Never have I seen a President do so much for people that hate Us" Unless? He Hate's Us too... Sad The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Mike Kosares: Did Shanghai just blow a hole in the old gold market? Posted: 29 Apr 2016 11:17 AM PDT By Michael Kosares I did not want the day to pass without posting a few words on gold's significant push to the upside, now trading just shy of the $1,300 mark. To be sure, the dual positions with respect to rates on the part of the Bank of Japan (to stand pat) and the Federal Reserve (to remain ultra-dovish) played a role in the dollar's recent weakness and gold's strength. Those determinants, though, in my view, are only part of the story, and the few-percentage-point drop in the dollar against the yen over the past week is really not enough to justify a nearly $60 rise in the price of gold over the past five trading sessions. The bigger determinant has been China's underpinning of the gold price on two different occasions over the past week after gold had taken a major turn to the downside in New York trading. ... ... For the remainder of the analysis: http://www.usagold.com/cpmforum/2016/04/29/did-shanghai-just-blow-a-hole... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| OK, Globe & Mail, why do central banks intervene in gold instead of beaver pelts? Posted: 29 Apr 2016 10:34 AM PDT 2p ET Friday, April 29, 2016 Dear Friend of GATA and Gold: In an interview on CNBC seven years ago, the soon-to-be-ubiquitous James G. Rickards made an observation for the ages, an observation that could be the preface for Chapter 1 of every economics textbook that aspired to be more than disinformation for the financial class. "When you own gold," Rickards said, "you're fighting every central bank in the world": Back then Rickards enjoyed U.S. government security clearance and was even participating in Defense Department war games, so he was already pretty well informed, but even he didn't know the half of it. For when you own gold -- or even when you pursue the truth about government monetary policy -- you're also fighting nearly every mainstream news organization in the world. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. The latest evidence of the second aspect of this fight comes today from the Toronto Globe & Mail, which has published commentary by the newspaper's mining reporter, Ian McGugan, headlined "Gold Bugs and the Inflation Dilemma": http://www.theglobeandmail.com/report-on-business/rob-magazine/gold-bugs... "Gold bugs," McGugan writes, "insist bullion is a currency, and they argue that it's superior to any government-backed paper bill as a store of value because nobody can fiddle with its inherent worth. ... Sure, gold has been around for a long time, but then so have salt and beaver pelts, both of which have also been used as money at times. "Gold may be a currency in the same limited sense that any valuable raw material, from oil to coffee beans, can function as a quasi-currency under the right conditions. However, you'll note that chief executives of gold firms still insist on being paid in dollars, not bullion. ... Gold's price is driven by gusts of emotion." But "gold bugs" are not alone in insisting that gold is a currency. Also insisting on gold's currency function, at least when they don't think anyone else is paying attention, are central banks, which surreptitiously trade the monetary metal every day, confident that McGugan, among others, will never call attention to this. Indeed, to cite just a few of dozens of examples: -- In 2003 the Reserve Bank of Australia candidly acknowledged in its annual report that "foreign currency reserve assets and gold are held primarily to support intervention in the foreign exchange market": http://www.gata.org/files/ReserveBankOfAustraliaAnnualReport2003.pdf In its most recent annual report -- http://www.rba.gov.au/publications/annual-reports/rba/2015/pdf/2015-repo... -- the Reserve Bank of Australia puts it this way: "Australia's official reserve assets include foreign currency assets, gold, Special Drawing Rights (SDRs -- a liability of the IMF), and Australia's reserve position in the IMF. Reserve assets are held primarily to facilitate policy operations in the foreign exchange market." -- The Bank for International Settlements, the central bank of the central banks, acknowledges in its annual reports that it is the gold broker for its members, constantly trading for their accounts not just gold but gold options and other derivatives: http://www.gata.org/node/12717 -- The BIS even advertises that its services to its central bank members include secret interventions in the gold market: http://www.gata.org/node/11012 -- The director of market operations for the Banque de France, Alexandre Gautier, recently admitted that the bank is trading gold for its own account and the accounts of other central banks "nearly on a daily basis": http://www.gata.org/node/13373 -- And a few months ago the executive director of the Austrian central bank, Peter Mooslechner, disclosed, if inadvertently, that Asian central banks are secretly trading and intervening in the gold market while trying to acquire more of the monetary metal. There is even video of this admission: https://www.dropbox.com/s/rtgdc8dkhvabtz2/kitco.mp4?dl=0 So if gold is not a currency as good as any other, why all this secret activity with it by central banks, especially when the salt and beaver pelts cited by McGugan remain available? McGugan overlooks all this when he asserts that "gold's price is driven by gusts of emotion." Well, maybe the emotion of central banks, or, more likely, their policy purpose, which the government archives show usually has been to suppress gold's price but every few decades has been to raise it so as to devalue their currencies and the debts denominated in them. All the major documents of surreptitious intervention in the gold market and the deception of investors by central banks, including those compiled by GATA here -- http://www.gata.org/node/14839 -- and here -- http://www.gata.org/node/16377 -- long have been provided to the Globe & Mail, and the newspaper has been urged to try putting to central banks even one critical, specific question about their involvement in the gold market. That is, the Globe & Mail has been urged to attempt actual journalism. But this week McGugan's column was the best the newspaper could do, and the best he could do was to liken gold to beaver pelts. * * * Also overlooking the documentation, though he is increasingly alone in the gold world, is 321Gold's Bob Moriarty, whose chest thumping this week, headlined "The Two Best Calls Ever on a Gold Bottom" -- http://www.321gold.com/editorials/moriarty/moriarty042816.html -- declares: "While the manipulation and flat-earth crowd doesn't ever mention it, platinum went down more than gold and no one is screeching about how platinum is suppressed. All commodities went down, including gold and silver. Most commodities went down more than silver and gold but that is never mentioned." Not quite. Actually, that central bank policy, exercised through the trading of derivatives, has aimed at the suppression of commodity prices generally was perhaps first explained in detail in 2001 by the British economist Peter Warburton, whose seminal essay, "The Debasement of World Currency -- It's Inflation, But Not as We Know It," has been cited by GATA many times over the years: Further, GATA often has publicized the discovery by Eric Scott Hunsader, founder of the market data firm Nanex in Winnetka, Illinois, of the documents filed with the U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission showing that central banks and governments are secretly trading all the U.S. commodity futures markets: http://www.gata.org/node/14385 http://www.gata.org/node/14411 A week ago GATA called attention to speculation at Zero Hedge that central bank intervention in the commodity markets has shifted to raising prices to avert deflation: http://www.gata.org/node/16400 Moriarty continues: "Early this year gold was higher in relative terms against oil, platinum, and commodities in general than ever in history. But that doesn't fit the manipulation mantra so none of the permabulls will ever mention that any more than they will discuss perfectly normal corrections." But there is no inconsistency in complaints about market manipulation and price suppression if, as GATA has maintained, central banks are surreptitiously intervening in all markets. Of course GATA doesn't know exactly what trades central banks are placing in these markets every day and cannot always distinguish central bank interventions from "normal corrections," if, given the pervasiveness of interventions lately, any market can be trading normally. But at least GATA acknowledges this intervention and would like to know the details. Moriarty merely denies it while declining to dispute any of the documentation -- presumably because his main business is resource stock promotion and recognition of government intervention in the resource markets would make that promotion more difficult. GATA hopes that the resource stocks Moriarty is promoting go up as the truth helps markets break free of surreptitious intervention and the producing class prevails in its seemingly eternal struggle with the financial class. Moriarty seems to hope that his resource stocks go up just because he's promoting them. CHRIS POWELL, Secretary/Treasurer Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Latino For Trump Reveals Horrors of Socialism Posted: 29 Apr 2016 10:00 AM PDT Trump supporters speak out about the leftist mob that threaten to beat them up for voting for trump. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The World is Getting Crazier, But We No Longer Notice Posted: 29 Apr 2016 09:32 AM PDT This post The World is Getting Crazier, But We No Longer Notice appeared first on Daily Reckoning. If we step back and look at what’s happened since the Global Financial Crisis of 2008-09, it’s easy to see that the global leadership has chosen to do more of what’s failed spectacularly. Since the Global Financial Meltdown, central bankers and planners have pursued policies designed to boost global stock markets to create a wealth effect in which people will be psychologically inclined to borrow and spend more because their stock market/IRA portfolios are rising. This supposedly encourages them to spend this “paper wealth.” But the policy runs aground on two realities: 1) only the top 5% of the households own enough stocks to make a difference to their wealth (and their perception of wealth, i.e. the wealth effect), and 2) the wealth effect only occurs in “good times” when people feel the economy is healthy and their prospects are improving. When people sense the economy is unhealthy and their prospects have dimmed, they save more regardless of how much the stock market rises. Signs of financial craziness abound: — 25% of all stock market gains occur after Federal Reserve meetings: in other words, central banks “own the market.” — The Swiss central bank admitted to spending $470 billion on currency market manipulation since 2010. — Other central banks have intervened in the stock and bond markets to the tune of trillions of dollars/yen/euro/yuan. — The central bank of China has spent over $100 billion in a few months propping up the yuan. — China has made it easier to borrow money again, sparking yet another housing bubble in First Tier cities like Shanghai and Beijing–as if another housing bubble will fix what’s broken in China’s economy. — U.S. corporations have borrowed billions of dollars at 1% to buy back their own shares–a dynamic that may account for 50% of the current rise in the stock market. — ObamaCare has added costs to the healthcare system rather than reducing costs; though healthcare spending adds to GDP, it is a form of consumption, not production. — Cheap credit enabled energy companies to boost production to the point that oil is now in over-supply–and the need for revenues to fund the debts taken on to expand production force producers to keep pumping. — Sweden has dropped its interest rate to negative territory, a policy that has sparked an insane housing bubble. And this is considered sane and healthy? In other words, central banks and planners have generated enormous bubbles in debt, housing and stocks to maintain the illusion that doing more of what failed spectacularly will actually fix what’s broken. This is crazy, because these policies are what’s broken. All these massive interventions and manipulations are driving the system off the cliff. Longtime correspondent J.B. recently shared some personal observations about the craziness of the current American economy: Look back to then and attempt to gauge how your thinking has changed. I guess back then I never realized how corrupt the government and Federal Reserve were/are. I actually did think we had a government which cared about the people. How naïve of me. I just thought they were stupid. There have been no jobs created which pay anything except for programmers working on start-ups with billion dollar valuations which make no money. Interest rates have been driven so low that people have stepped out into High Yield and will lose most their money. The stock market really trades on no fundamentals except what the latest Fed head comes out and says that day. The only investment that your gut feel says should go up (gold) has been in the crapper for several years (do you think the Fed is suppressing in?) I have to tell you there seems to be a lot of new restaurants popping up in L.A.; most do not seem to last and many of the old ones seem to disappear. We had friends in from France (she is French but a US citizen and lived in LA for quite a while). The one comment they had was they could not believe how expensive food is. Every government unit in the United States (federal, state, county, etc.) is having to borrow and borrow. Basically they are all bankrupt. I recently posted a link that public university tuition has soared 135% to 145% in the decade from 2004 to 2014–a period in which “official” inflation rose 25%. We recently helped a neighbor get home from the hospital after emergency surgery for acute appendicitis. He told us a visiting-scholar friend from Europe who recently went to the emergency room was billed $12,000 for the visit, which did not include any surgery or procedures. Americans with gold-plated healthcare coverage don’t see what the system bills or what is actually paid, so completely outrageous bills are commonplace. (Note that caregivers aren’t necessarily benefiting from these soaring costs to consumers, insurers, etc.–many physician correspondents have explained that their income has declined significantly in the past few years, extending a decades-long trend. In regions with a shortage of nurses, pay has risen markedly, but in other regions, nurses’ compensation has not risen along with higher healthcare costs.)  High-end restaurants are indeed opening not just in L.A. and San Francisco, but in smaller cities and even towns–as if the populace with sufficient cash or credit to spend $100 on dinner for two is unlimited. With rising rents, regulatory compliance, workers comp and wages, businesses are jacking up the price of their product/service just to cover the increases in their own expenses. Corporations are cutting corners by reducing the contents of packages and reducing the quality of their ingredients/products. Here is the craziness: nothing has actually been fixed in the past 7 years.Rather, everything that was broken in 2008 has been ramped up to an even higher levels of craziness. The crazy solution to bursting housing bubbles is even bigger housing bubbles (see Sweden, China and the U.S.). The failure of central planning (super-low interest rates, easy credit, etc.) has led to extreme extensions of the very policies that made the global financial meltdown inevitable. Yet strangely, we accept this craziness as the New Normal. People with demanding jobs in Corporate America are working harder and longer for less pay (eroded by inflation) to the point of physical, emotional and psychological exhaustion. But the mortgage and bills must be paid, so they continue sacrificing their health for the sake of supporting an unsupportable lifestyle. We now have a TINA economy–there is no alternative. People feel trapped, unable to choose another way of living and another livelihood, because all the alternatives mean sacrificing discretionary income–often by 2/3. The person earning $90,000 in Corporate America or the government can only earn $30,000 if they bailed out and took a less insane job.  Eventually, things start breaking. The overworked person’s health breaks. The corporate bond market breaks, as debt that can’t be paid is not paid. Small businesses break, close their doors and the owners retire or move on to some sort of work that is less stressful. The Venture Capital bubble of throwing millions of dollars at Unicorn startups with no revenues breaks. Blind, destructive craziness has costs. The supposed benefits of doing more of what failed spectacularly are short-term, and they’re finally starting to run out. The banquet of consequences is about to be served. Regards, P.S. The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The World is Getting Crazier, But We No Longer Notice appeared first on Daily Reckoning. |

| More Proof That America Is Toast… Posted: 29 Apr 2016 09:01 AM PDT This post More Proof That America Is Toast… appeared first on Daily Reckoning. Here's something that should scare the hell out of you, but it doesn't surprise me at all… A recent Harvard University poll of young adults between ages 18 and 29, found that 51% do not support capitalism. But it's not just Millennials… A subsequent survey of people of all ages found that the only respondents with a majority in support of capitalism in the U.S. were those 50 years old and over. That's bad news for the future of free enterprise in America. So if capitalism is headed to the morgue here in its former hotbed, is there hope for its survival anywhere else? Yes, without question. And it's somewhere you'd least expect… Good Morning, VietnamToday, I am in Taipei, Taiwan. No doubt the Taiwanese people understand money and commerce. They're driven by economic excellence. This small island nation of 25 million people has built itself into an economic power. But I want you to head a little farther south down the South China Sea with me… to a country with 90 million people… a country that brings forth bad memories for some Americans. The topic today is not war, however, but money… and capitalism. It might surprise people, but I spend much of my time in Ho Chi Minh City, Vietnam (Saigon as it's still known), and when there I can see dozens of construction cranes outside my windows. And that's just in one slice of the city. Most Americans still think of Vietnam as a dreary place where war and communist dogma reigns… keeping the country economically underwater. But that's pure propaganda, divorced from current reality. I know. I see it firsthand. Vietnam is flat-out booming. Those 90 million people I mentioned… 45 million are under the age of 30. Youth and energy rule in Vietnam. And guess what? There is no safety net. No one takes care of you. Hustle or die. And the growth numbers back that hustle attitude. There are more than 40 million Internet users in Vietnam and 30 million smartphone users. Those figures have increased tenfold in less than a decade. The Vietnamese have higher math, science and reading scores than their peers in the U.S. and U.K. That's brought in multinational companies like Samsung and Intel that have opened offices here because of these young, well-educated workers and generous tax incentives from the communist government. These advancements have made Vietnam one of the fastest-growing markets in the world over the past two decades. And it's made the Vietnamese people more pro-capitalist than Americans. A recent poll by the Pew Research Center found that 95% of Vietnamese surveyed now support capitalism. Let that sink in for a moment. The citizens of communist Vietnam have a higher regard for capitalism than U.S. citizens. You see, what many Americans don't realize is that as rigged crony capitalism led by the Deep State chokes out growth in the U.S., opportunity abounds in many parts of the world – especially Asia. In fact, in the decades to come, Asian middle classes are on course to double in size… and maybe even triple, while the West will stagnate. Teach your kids Mandarin as their best piece of education? You bet. To find this success, though, you need to open your mind and break free from thinking that America is the center of the universe. Because the future is taking shape outside America's orbit. That's something my podcast guest this week knows very well. His name is Simon Black, and he's an investor, entrepreneur and the founder of Sovereign Man. Simon is a West Point graduate and former Army intelligence officer. He's devoted his life and businesses to looking outside the U.S. for opportunities to grow and protect more of your own hard-earned money from exposure to America's failing system. In today's podcast, Simon talks about simple, concrete steps you can take to protect your family and assets from the threats we face. It may sound like doom and gloom. But ultimately, Simon's story is one of hope and new opportunity. In today's podcast, you'll discover…

Click here to listen to this week's podcast. As always, I want your uncensored comments. Email me at coveluncensored@agorafinancial.com. Regards, Michael Covel The post More Proof That America Is Toast… appeared first on Daily Reckoning. |

| Deutsche Bank tires quickly of its experiment with integrity Posted: 29 Apr 2016 08:55 AM PDT Head of Deutsche Bank Integrity Committee to Resign By James Shotter http://www.ft.com/intl/cms/s/0/9256f338-0d82-11e6-b41f-0beb7e589515.html Georg Thoma is to resign from Deutsche Bank's supervisory board after coming under fire from other board members in a battle over how to deal with the German bank's past scandals. The veteran corporate lawyer was brought on to the board by chairman Paul Achleitner in 2013 and headed the integrity committee, whose remit includes overseeing the bank's efforts to comply with legal and regulatory requirements. However, Mr Thoma's approach left him at odds with some colleagues, and on Sunday, Alfred Herling, Deutsche's vice-chairman, took the unusual step of publicly criticising his actions in Germany's Frankfurter Allgemeine ... Dispatch continues below ... ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Mr Herling accused Mr Thoma of "overzealousness," saying that he "goes too far when he demands ever wider investigations and more and more lawyers come marching up," and adding that the costs were "no longer proportionate." Meanwhile, Henning Kagermann, the former head of German software group SAP who is also a board member at Deutsche, told the newspaper that "for all the diligence that we have exercised, it is important for us that Deutsche Bank finally ... devotes all its energy to looking to the future." Deutsche said in a statement that Mr Thoma would resign immediately from his role as chairman of the integrity committee and leave the supervisory board after a one-month notice period. The bank has begun the search for a permanent successor. Mr Achleitner said Mr Thoma had given Deutsche "outstanding service" during his time on the board. "He has implemented processes of great importance and benefit to the bank. The supervisory board is determined to continue its work of investigating possible misconduct and to draw lessons for the future," he said. Mr Thoma did not immediately respond to a request for comment. The boardroom spat comes just three weeks before Deutsche's annual shareholder meeting on May 19, at which the bank's One small shareholder has requested a special audit of whether members of Deutsche's supervisory board or management board breached their obligations in how they dealt with some of the bank's legal entanglements. The motion requests that the audit ascertain whether there were management failings in relation to a number of investigations, including the Libor scandal. Among other things, it requests an investigation into whether Deutsche had to pay heavier fines because members of its management or supervisory board obstructed, misled, or failed to co-operate sufficiently with authorities. Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Is Silver a better bet than Gold in the Near Future? Posted: 29 Apr 2016 07:21 AM PDT Last week, the beginning of April 18th, 2016, silver was on fire, rising sharply and forcing ‘Wall Street’ to take note of its move, though, many investors believe that gold and silver are one and the same, one can hold either in your portfolio and earn the same returns? the truth is far from that! In reality, though both silver and gold are considered precious metals and over the long-term, they have a high degree of ‘correlation’ in their movements, but in the short-term, for the active investor, both offer opportunities at different times. |

| What's Going on with Gold? - Video Posted: 29 Apr 2016 07:02 AM PDT Gold is in the final phase of the baby bull rally. This is the stage that causes maximum pain for shorts that were unable to recognize that the bear market is over, or tried to sell short (I warned and warned traders not to short a baby bull). This is also the stage that causes maximum anxiety for longs who aren’t in the market. This is the time when the bull tries to get as many traders as possible to panic in at the top so as to catch them in the first reaction. |

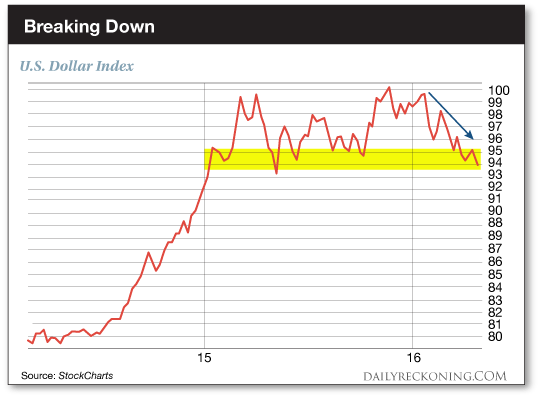

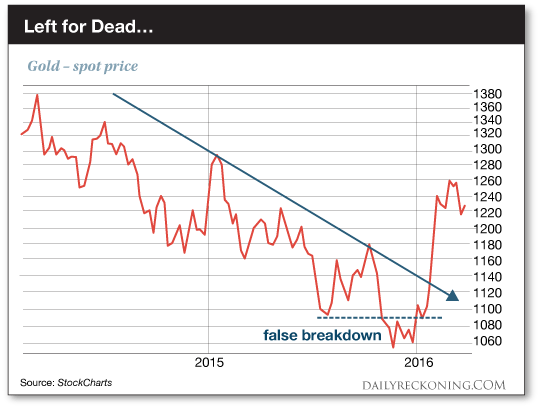

| Here’s the Dollar Breakdown That Could Propel Gold to New Highs Posted: 29 Apr 2016 06:50 AM PDT This post Here’s the Dollar Breakdown That Could Propel Gold to New Highs appeared first on Daily Reckoning. Forget about earnings season for just a minute… Gold is streaking higher once again this morning. While the financial media frets over Apple's slide and Amazon earnings, the yellow metal is pushing toward new 2016 highs. And your precious metals trades are set to go through the roof. It's a perfect storm for gold traders and investors right now. It all comes back to a breakdown in the U.S. Dollar we've been tracking over the past several weeks. "The dollar spot index is at its lowest level since August 2015, with low economic growth in the U.S. backing the Federal Reserve’s dovish stance," Bloomberg reports this morning. "The weakness is also being felt in Asia where the yen dipped below 107 to the dollar this morning while China's central bank reacted by strengthening its currency fixing the most since a peg was dismantled in July 2005." The Greenback has taken a dive this year. Not only has that fueled the gold rally—it's also slammed the U.S. Dollar Index back toward early 2015 levels. I told you weeks ago that if the dollar slips below its 2015 lows, it runs the risk of a much bigger drawdown. And that's exactly what's happening as I type. The U.S. Dollar Index is down another 0.5% this morning and quickly approaching one-year lows. A weekly close at these levels will leave the Dollar Index with one foot in the grave…

As you can see from the chart, the dollar is in the danger zone. It's time to seriously consider what will happen when the dollar begins hemorrhaging the gains it stockpiled during its 2014 bull run… Naturally, this is bullish for the price of gold. I told you earlier this month that gold was primed for another rally. The Midas metal just recorded its best quarter since 1986. Gold jumped double-digits during the first three months of the year for a 16% gain. And now that the dollar is breaking down, we could see more gains in the months ahead. Of course, no one was paying attention when gold started ticking higher in January. Even those closest to the metal were shocked at how quickly it emerged from the dead. "Absolutely no one saw this coming," a bullion dealer CEO told Bloomberg. "Forecasts made at the start of the year were out of date within weeks." Remember the chart I showed you of the false breakdown at the very end of 2015? That move primed the pump for the rally we're enjoying this year…

Even now, many investors probably think the gold rally we've witnessed so far this year will burn out rather than streak higher. But the move lower we're seeing the dollar tells us that this rally could become much more than your standard dead cat bounce. You've had numerous chances to profit from gold's rise so far this year. More are on the way. Our Silver Wheaton Corp. (NYSE:SLW) trade is heating up again this week. You should be sitting on open gains of more than 5% after holding for a little longer than a week. And SLW will give us some nice follow-through today once the market opens… We've witnessed some wild swings and plenty of shakeouts as gold has risen from the dead this year. Comeback moves are never clean or easy. But they are powerful—which is why we've focused so many of our trades in this space over the past couple of months. Get ready for more rapid-fire precious metals plays. This move is just getting started… Sincerely, Greg Guenthner P.S. Make money from the falling dollar–sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Here’s the Dollar Breakdown That Could Propel Gold to New Highs appeared first on Daily Reckoning. |

| US Dollar Meltdown Underway as Fed Credibility Evaporates - Video Posted: 29 Apr 2016 06:28 AM PDT Transcript Excerpt: It's Friday April 29 2016 early here in london it's nine o'clock in the morning so 4 a.m. New York time while in the us- and I'm making this video just to talk about the dollar but the galleries crashing you most people and even I have focused on the dollar yen on the yen been strong but you know we've broken through the lows of the year and we had the lowest level since October 2014 that the dollars at 107 12 right now against the yen we had a key support which was to prove you know earlier this month the low one of seven sixty and we went down way to 10 689 and you know there's talk about that the Bank of Japan |

| How to Use the CoT Report in Gold Investing? Posted: 29 Apr 2016 06:24 AM PDT The CoT report enables investors to peek behind the scenes of the gold futures market and to better understand the psychology of the marketplace and, thus, get a better idea of futures moves on the market. This is because the COT report shows the net long or short positions of different types of traders. The knowledge of how traders are positioned is useful, but what really matters are changes in their positions. Knowing that, for example, non-commercials have 175,000 contracts long is meaningless without the supplementary information whether they are accumulating more or starting to unload contracts over time. |

| Dissatisfied Zero Hedge employee feeds his resentments to Bloomberg Posted: 29 Apr 2016 05:37 AM PDT 8:35a ET Friday, April 29, 2016 Dear Friend of GATA and Gold: A dissatisfied employee has quit Zero Hedge and fed his complaints to Bloomberg News, which gleefully recounts them today: http://www.bloomberg.com/news/articles/2016-04-29/unmasking-the-men-behi... Zero Hedge quickly replies: http://www.zerohedge.com/news/2016-04-29/full-story-behind-bloombergs-at... In any case, Bloomberg will remain a news organization that tells people what the government and financial establishment don't object to their knowing, and Zero Hedge will remain a news organization that tells people what the government and financial establishment would prefer them not to know. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Committee to Destroy the World: This new book by Michael E. Lewitt is a passionate and informed analysis of the struggling global economy. Lewitt, one of Wall Street's most respected market strategists and money managers, updates his groundbreaking examination of the causes of the 2008 crisis and argues that economic and geopolitical conditions are even more unstable today. Lewitt explains how debt has overrun the world's productive capacity, how government policies have created a downward vortex sapping growth and vitality from the American economy, and how greed and corruption are preventing reform. For more information: http://www.wiley.com/WileyCDA/WileyTitle/productCd-1119183545,subjectCd-... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold “Chart of The Decade†– Maths Suggest $10,000 Per Ounce Says Rickards Posted: 29 Apr 2016 02:17 AM PDT James Rickards, economic and monetary expert, joined Bloomberg’s Francine Lacqua on Tuesday to discuss the gold “chart of the decade”, his new book “The New Case for Gold,” why gold is money and why gold is going to $10,000/oz in the coming years. |

| Are We or Are We Not in a New Gold Bull Market? Posted: 29 Apr 2016 02:12 AM PDT Technical analyst Jack Chan has examined the charts and says that if we are in a new bull market, prices in both gold and gold equities should begin to pull back and consolidate soon. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Investors around the world are blissfully ignorant of what will hit them in coming months and years. Virtually no one understands the risks in the world and less than ½% of investors have protected themselves against the destruction of their financial assets.

Investors around the world are blissfully ignorant of what will hit them in coming months and years. Virtually no one understands the risks in the world and less than ½% of investors have protected themselves against the destruction of their financial assets. James Rickards, economic and monetary expert, joined Bloomberg's Francine Lacqua on Tuesday to discuss the gold "chart of the decade", his new book "The New Case for Gold," why gold is money and why gold is going to $10,000/oz in the coming years.

James Rickards, economic and monetary expert, joined Bloomberg's Francine Lacqua on Tuesday to discuss the gold "chart of the decade", his new book "The New Case for Gold," why gold is money and why gold is going to $10,000/oz in the coming years.

No comments:

Post a Comment