Gold World News Flash |

- Favorite Gold and Silver

- Silver: The “Five Year Plan” and the Great Leap Forward

- THE REAL REASON TO INVEST IN SILVER… It’s The Fundamentals

- The Next Battleground for Gold Will Be At 1550 If the Cup and Handle Formation Completes

- SILVER ON FIRE! – News & Think Tank

- Gold Price Closed at $1249.20 up $7 or 0.56%

- Japanese Bloodbath After BoJ Disappoints - Nikkei Drops 1000 Points, USDJPY Crashes

- What Kind Of Silver Should I Buy?

- Paul Craig Roberts: World War III Has Begun

- Central Bankers To The Masses: "Let Them Eat Rate"

- What If The BOJ Disappoints Tonight: How To Trade It

- WW3 or Dollar Collapse Will Come First?

- Is This Making Kids Dumb?

- Another Gary Cooper Rebound

- HUI Gold Stocks Update...Beautiful Chartology

- FOMC statement and the Stock Market

- The Beginning of a Dollar Crash?

- Why Gold Bugs Need to Stop Listening to T...

- Russia's VTB aims to supply up to 100 tonnes of gold to China per year

- CRASH Of The Century HAS BEGUN!

- Aussie CPI Prints Weaker Than Expected

- Podcast: Okay, I’ll Say It: Run For The Hills

- Trump and Hillary win big time in North Eastern part of America

- Why Gold Bugs Need to Stop Listening to The Fear Mongers and Start Thinking for a Change

- Breaking News And Best Of The Web — April 28

- Gold More Productive Than Cash?!

- Venezuela doesn't have enough money to pay for its money

- Grave Silver Mistake

- What Steve Jobs Knew About the Internet that Can Make You a Better Gold Investor

- Silver Plays Catch-Up To Gold, 2016 Could be "Pivotal" Year: CPM Group

- Long Awaited Gold Price Breakout

- Fed Induced Bond Bubble Will Devastate Financial System - Video

- Cyber Fraud At SWIFT – $81 Million Stolen From Central Bank, Digital Gold

- How The Credit Markets Will Blow Up During The Coming Silver Rally

| Posted: 28 Apr 2016 12:30 AM PDT from JayTaylorMedia: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver: The “Five Year Plan” and the Great Leap Forward Posted: 27 Apr 2016 11:01 PM PDT Five years ago paper silver contracts on the COMEX hit a multi-decade high over $48 on April 29, 2011. At the end of April 2016 the silver price is bouncing around $17, down about 65% from its April... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE REAL REASON TO INVEST IN SILVER… It’s The Fundamentals Posted: 27 Apr 2016 10:05 PM PDT by Steve St. Angelo, SRS Rocco:

The best reason to own silver is based upon underlying market fundamentals. However, most of the markets today aren't being valued by fundamentals, but rather on Fed and Central Bank interventions. This has destroyed the ability for investors and markets to properly value most assets. I, as well as many precious metals analysts have received some ridicule for getting it wrong on the price movements of gold and silver since 2012. Of course, no one was complaining when the silver price moved up from an average $6.67 in 2004 to $35.12 in 2011. Sure, we precious metals analysts deserve some criticism for not foreseeing how much monetary printing the Fed and Central Banks would do as well as the massive corruption and deceit conducted by the top banks in the world.

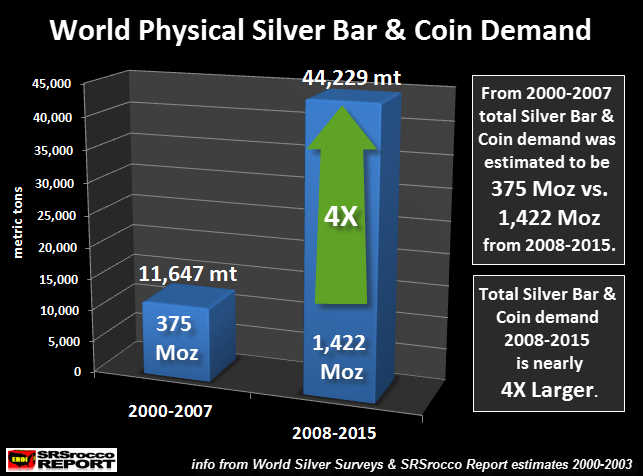

For example the recent announcement that Deutsche Bank Confirms Silver Market Manipulation In Legal Settlement, Agrees To Expose Other Banks. And… this is just what we know about. How about the stuff we don't know about? NOTE: If you haven't checked out our new PRECIOUS METALS INVESTING PAGE, please do. People need to realize the financial markets and global economies are in serious trouble. When I took a drive to a major city this weekend, I noticed that Nissan is financing cars for 0% for 84 months. I imagine there are plenty of other auto dealers doing the same thing. When I was a youngster, the normal financing for vehicles was for 24-48 months. Anyone financing a car or truck for 60 months was a real REAL LOSER. Today, you are a LOSER if you ask the car salesmen for a 24 month plan. The last new vehicle I purchased, I put down 60% of the settled price and financed the remainder for 24 months. I gather I was a LOSER back then too because they said that sort of payment plan was rare (most put very little down and financed as long as they could)… and this was only a little more than ten years ago. I don't buy new cars anymore. I drive an old beat-up Ford ranger. Oh sure, I could go buy a brand new car for cash, but why?? I'd rather own physical precious metals and drive a beat-up old car. Anyhow, my point is this…. the majority of Americans are living a very highly leveraged pay-for-it-later-&-later lifestyle that isn't sustainable. The U.S. economy has been propped by one bubble after another for the past 3+ decades. However, the present bubble since 2008 is much worse. It's a bubble being propped up by extreme leverage by getting Americans to buy things they can't afford for nothing down with and longer and longer payment plans. This has DISASTER written all over it. So, it's extremely hard today to forecast what the market will do based on fundamentals when most Americans have thrown sound financial planning out the window. That being said, we can look at some underlying fundamentals that offer the precious metals investor some important clues. World Silver Bar & Coin Demand Explodes Since 2008One of the fundamentals that tells us something just isn't right in the financial markets is the explosion of Silver Bar & Coin demand since 2008. As we all remember, 2008 was the year the engine stopped and the wheels came off the economy. This was due to the mortgage-backed housing bubble that allowed many Americans to buy houses they couldn't afford. Furthermore, if Americans weren't buying homes they couldn't afford they were using their homes as an ATM machine. Basically, they were extracting the supposed equity from their home to buy more garbage they didn't need. So, to keep the U.S. and world economy from imploding and entering into a new Great Depression, the Fed and Central Banks starting the digital printing presses and pushed Trillions of Dollars (liquidity) into the system. This had a profound impact on the value of most assets… such as silver. The price of silver jumped from $13 in 2007 to a high of $49 in 2011. Savvy investors realizing the Central Banks were insane, starting to purchase record amounts of physical silver. If we look at the chart below, we can see the difference between the two periods:

From 2000 to 2007, total world Silver Bar & Coin demand was an estimated 375 million oz (Moz). However, from 2008 to 2015 it nearly quadrupled to 1,422 Moz or 1.42 billion oz. The World Silver Survey only provided Silver Bar & Coin demand since 2004. So, I had to estimate the figures for 2000-2003 as they only provide Official Coin sales. Regardless, this is one of the fundamentals that gets better every year…… just like a gift that KEEPS ON GIVING. Even though the price of silver has declined from a high of $49 in April 2011 to $17 currently, demand for physical Silver Bar & Coin continues to be in record territory. For example, Silver Eagle sales will likely reach 19 Moz by the end of April compared to only 15.9 Moz during the same period last year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next Battleground for Gold Will Be At 1550 If the Cup and Handle Formation Completes Posted: 27 Apr 2016 09:52 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SILVER ON FIRE! – News & Think Tank Posted: 27 Apr 2016 09:40 PM PDT from Junius Maltby: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1249.20 up $7 or 0.56% Posted: 27 Apr 2016 08:19 PM PDT

Forgive me, I left something out of my recommendation of the movie, "The Big Short." Watch out. It's filled with bad language & some nudity. Not for anybody but adults, absolutely no children. I recommend it not for you to adopt the speech or lifestyle depicted. but for the portrayal of pure blinded greed, as well as an unrelenting resolve on the other side to pursue truth, and even integrity. "The Big Short" is a warning picture of where unrestrained greed ends. Also, one reader tells me it is available for free on YouTube. TODAY'S MARKETS: Janet the Toad opened her mouth wide today, but nothing came out save flies & lies. More croaking about somewhere, someday raising interest rates, a little piping about the economy "moderating," and wheezing lies about how well the economy is faring. None of this act moved markets. Stock indices barely rose, and several just sank further. US dollar index fell, deprived of any interest rate transfusion. Gold stumbled, picked itself up, and stood back straight. At day's end the FOMC announcement was, "A tale told by an idiot, full of sound and fury, signifying nothing." Dow Jones Industrial average rose 51.23 (0.28%) to 18,041.55 & the S&P500 gained 3.45 (0.16%) for a close at 2,095.15. Meanwhile the Nasdaq and Nasdaq-100 dropped (0.51% and 0.82%). Stocks are floating on borrowed time. Watch out below! 10 year treasury note yield fell, which makes sense. If the Fed doesn't intend to raise rates, bond prices must rise and the yield, which had floated higher in hope, must now decline. Fed's refusal to raise rates also made the US dollar less attractive, knocking down the US dollar index. It fell 8 basis points (0.09%) to 94.46 barely below the 94.51 twenty day moving average, but below nonetheless. It is now bouncing in a range bounded by 95.20 and 93.85. It's stuck. Got to beat those numbers up or down to break the paralysis. Euro rose 0.12% to $1.1312, reacting to the dollar's little loss. Yen has more troubles. Fell 0.15% to 89.67 today, and is about to step through its 50 DMA (88.50) into the wild blue yonder below. Silver closed Comex 18¢ (1%) higher at 1728.6¢. Gold added $7.00 (0.6%) to $1,249.20. Gold did close above resistance/support at $1,245, but didn't run away. High came at $1,252.80, low at $1,240.70. Some see-sawing occurred around the time Janet the Toad croaked, but gold quickly recovered. Don't get the wrong idea: "recovered" doesn't imply any particular enthusiasm or strength. MACD & Stochastics are negative, RSI barely breathing. If it plans to move higher immediately, it's keeping it a secret. Frankly I am at a loss to explain silver's strength. The RSI is extremely overbought and all other indicators are stretched like a rubber band around the Sunday New York Times. It is ripe for a correction, & a substantial one ought to arrive before next week ends. Add to that the Gold/Silver Ratio, not painfully oversold, with what looks like a breakaway gap beginning the fall and an exhaustion gap more than a week ago.. The ratio, too, looks ready to correct Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japanese Bloodbath After BoJ Disappoints - Nikkei Drops 1000 Points, USDJPY Crashes Posted: 27 Apr 2016 08:14 PM PDT If there was a sign that nothing else matters but central bank largess, this was it. The moment The Bank of Japan statement hit and proclaims "unchanged" a vacuum hit USDJPY and Japanese stocks. Reflecting that Japan's economy has "continued a moderate recovery trend" which is utter crap given the quintuple-dip recession, Kuroda and his cronies said they will "add easing if necessary" and apparently that is not now. Not so much as a higher ETF purchase or moar NIRP.. and the aftermath is carnage - NKY -1000 points and USDJPY crashed to a 108 handle!!

Incidentally, this is what consensus looked like ahead of today's BOJ decision:

And the result...

Some context...

The BoJ website crashed also.

The fallout is going global... Dow Futures tumbled 150 points to LoD...

And Yuan surged...

Just as we noted earlier, the biggest argument for a BOJ disappointment was that with the G7 Unless, of course, Abe wants to send Lew and Obama a message, that if | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Kind Of Silver Should I Buy? Posted: 27 Apr 2016 07:40 PM PDT from SalivateMetal: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts: World War III Has Begun Posted: 27 Apr 2016 07:25 PM PDT Authored by Paul Craig Roberts, The Third World War is currently being fought. How long before it moves into its hot stage? Washington is currently conducting economic and propaganda warfare against four members of the five bloc group of countries known as BRICS—Brazil, Russia, India, China, and South Africa.

Brazil and South Africa are being destabilized with fabricated political scandals. Both countries are rife with Washington-financed politicians and Non-Governmental Organizations (NGOs). Washington concocts a scandal, sends its political agents into action demanding action against the government and its NGOs into the streets in protests. Washington tried this against China with the orchestrated Hong Kong “student protest.” Washington hoped that the protest would spread into China, but the scheme failed. Washington tried this against Russia with the orchestrated protests against Putin’s reelection and failed again. To destablilze Russia, Washington needs a firmer hold inside Russia. In order to gain a firmer hold, Washington worked with the New York mega-banks and the Saudis to drive down the oil price from over $100 per barrel to $30. This has put pressure on Russian finances and the ruble. In response to Russia’s budgetary needs, Washington’s allies inside Russia are pushing President Putin to privatize important Russian economic sectors in order to raise foreign capital to cover the budget deficit and support the ruble. If Putin gives in, important Russian assets will move from Russian control to Washington’s control. In my opinion, those who are pushing privatization are either traitors or completely stupid. Whichever it is, they are a danger to Russia’s independence. As I have often pointed out, the neoconservatives have been driven insane by their arrogance and hubris. In their pursuit of American hegemony over the world, they have cast aside all caution in their determination to destabilize Russia and China. By implementing neoliberal economic policies urged on them by their economists trained in the Western neoliberal tradition, the Russian and Chinese governments are setting themselves up for Washington. By swallowing the “globalism” line, using the US dollar, participating in the Western payments system, opening themselves to destabilization by foreign capital inflows and outflows, hosting American banks, and permitting foreign ownership, the Russian and Chinese governments have made themselves ripe for destabilization. If Russia and China do not disengage from the Western system and exile their neoliberal economists, they will have to go to war in order to defend their sovereignty. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bankers To The Masses: "Let Them Eat Rate" Posted: 27 Apr 2016 06:35 PM PDT Authored by former Fed Advisor Danielle DiMartino Booth, There never was any cake, just crust. And the French Marie had nothing to do with it. Rather, a Spanish-born queen married to France’s King Louis XIV a century earlier was the ill-mannered Marie who dared to taunt the peasantry. So how then exactly did, “Let them eat cake!” become so universally associated with Marie-Antoinette? In a nutshell: Blackmail. Historians have uncovered the nasty truth, and it can be laid squarely at the feet some far from scrupulous London-based thugs, intent on shaking down King Louis XVI with threats to besmirch his young bride’s reputation. According to Simon Burrows of Leeds University, a criminal network, drawn to the French monarchy’s vast wealth, plotted to profit by producing a series of pamphlets filled with lies about the ill-fated queen. Those lies included a charge that she had callously suggested her subjects eat cake in response to news of a bread shortage plaguing the masses. Though the king paid a dear price for the pamphlets’ destruction, some 30 copies were not burned as promised and found their way into the public’s hands sealing the queen’s fate kneeling before the guillotine. Today, the shortage plaguing angry masses of savers worldwide is not one of bread or cake, but rather one of positive rates of return on their cash holdings. The central bankers know best as they command us to eat one rate cut after another. And like it. For nearly 30 years, central bankers have based their haughty reasoning on the idea that the lower the interest rate, the greater the generation of economic growth. As then Fed Chairman Ben Bernanke explained in 2012, “My colleagues and I are very much aware that holders of interest-bearing assets, such as certificates of deposit (CDs), are receiving very low returns. But low interest rates also support the value of many other assets that Americans hold, such as homes and businesses large and small.” It’s certainly been the case that the prices of homes and businesses have been upheld. Though their appetite may have waned a bit, investors have richly rewarded companies who use low interest rates to finance share buybacks with debt. And there’s no doubt investors of a different ilk did more than their fair share to prop up home prices at the lower end while wealthy individuals have bid up the prices of luxury homes to record highs. The question is, is that what Bernanke intended? It would appear not as one of the stated objectives of the punishing policy of ultra-low rates was to spur income-generating job creation:

Or at least that’s what Bernanke led us to believe. While it is true that returns on risky investments have been stellar, fewer and fewer Americans are comfortable with the risks associated with owning the most common of the pack — stocks. According to an April Gallup poll, the percentage of U.S. adults invested in the stock market has fallen to 52 percent from 65 percent in 2007, a 20-year low. So while there are definitely benefits to some, Bernanke’s “ultimately benefitting most” part has fallen far short, and to an increasing extent. Digging into the data, at -14 percentage points, those aged 18 to 34 were the most aggressive lot to abandon stocks. Meanwhile, at -9 percentage points, those aged 55 and above were the least. There seems to be an intuitive disconnect somewhere in that divide, one that should keep policymakers up at night. There is a very real refute that we’d have to return to the bad old days of rampant inflation, when the degradation of the purchasing power of the dollar more than offsets the plump interest rates on offer at our local bank branch. While we collectively rue that era, it’s fair to say most seniors would gladly settle for a happy medium, a return to the turn of this young century when you could get a five-year jumbo CD sporting a five-percent APR, which was offset by inflation somewhere in the two percent vicinity. Traditionally, two to three percentage points above inflation is where that old relic, the fed funds rate, traded. So the math worked. Of course, it could be worse. At least U.S. yields on savings are positive. That’s more that can be said of the $7 trillion of foreign sovereign bonds trading at negative yields. This dynamic spells disaster for life insurers to say nothing of pensions. Increasingly, foreign pensions are raising retirement ages as well as requiring higher employer and employee contributions, all the while lowering the salaries against which benefits are calculated, even as they segue benefits onto 401k-style platforms. For now, the judiciary in the U.S. is holding the legal line. As long as that’s the case, actions to shore up pension underfunding will be avoided. Of course, at some point drastic measures will be required as the tax bases supporting future benefits shrink in proportion to the highest tax payers fleeing the fleecing. Public pensioners with no back-up savings are sure to be enraged when their day of reckoning arrives. Then, today’s non-pension-backed retirees making crumbs on their cash holdings will be flush in comparison. And yet Bernanke deigns to wonder. Last fall after leaving the Fed, he had this to say to Martin Wolf of the Financial Times: “It’s ironic that the same people who criticize the Fed for helping the rich also criticize it for hurting savers. What’s the alternative? Should the Fed not try to support the recovery?” This coming from the same man who once said, “No one will lend at a negative interest rate; potential creditors will simply choose to hold cash, which pays a zero nominal interest rate.” According to one recent Wall Street Journal story, that last observation certainly does hold true. Negative interest rates do benefit at least one of our contingencies: U.S. companies with European subsidiaries. Now that the European Central Bank (ECB) is in the business of buying corporate bonds, demand for issuance is all but a lock given the ECB can buy up to 70 percent of an issue, at issuance, to boot. Bully for that? Not so fast says Standard & Poor’s (S&P), which just stripped the energy giant ExxonMobil of its coveted since 1949 ‘AAA’ credit rating. Why? Share repurchases and dividend payments have “substantially exceeded” internally generated cash flows in recent years even as its debt load has doubled. That leaves two solitary AAA-rated U.S. credits, Johnson & Johnson and Microsoft. It’s getting mighty lonely at the top. But of course, there’s nothing of the wildcatter in ExxonMobil’s overindulging its shareholders. For seven straight quarters, over 20 percent of the companies in the S&P 500 have reduced their year-over-year share count by at least four percent, which conveniently translates into at least a four percent pop in their PER share earnings. Ain’t math grand? Based on the data thus far, the trend is becoming increasingly entrenched. S&P’s Howard Silverblatt anticipates that public filings will reveal that over one-in-four deep-pocketed (debt-pocketed?) issues were in the aggressively juicing earnings cohort in the first quarter. The end result of all of these financial shenanigans? For starters and enders, a whole lot of nothing productive. According to Bookmark Advisors’ Peter Boockvar, the absolute level of core capital spending (nets out transportation) was $66.9 billion vs. $69 billion in 2011. As for the percentage of capacity that’s being utilized, it remains well below its long-term average seven years into this economic expansion. “Cheap money has created too much excess,” Boockvar noted. “On top of that, some CEOs are more interested in the short term focus on other capital uses such as buying back their own stock in the now second-longest bull market of all time.” Is it any wonder small investors continue to lose faith in the stock market? Should they be chastised for wanting a teensy weensy return on their cash? Dare we brand these conservative souls greedy, wanting to have their cake and eat it too? Perhaps. But maybe the real solution to placate the angry masses is an admission that the original intent of zero-to-negative interest rates has utterly failed. Sufficient economic growth to offset the forced risk taking simply has not materialized leaving Grandma and Grandpa with their life savings hanging in the balance. Perhaps the current conundrum will present an opportunity when the next recession arrives, a chance to recognize the failure of the low interest rate era. As counterintuitive as it would seem, why not use the next period of economic weakness to set a permanently higher floor on interest rates. Will the weakest operators meet their makers at the corporate guillotine? Naturally that will be the case. But isn’t that the American way? A new generation of revolutionary central bankers must be called to arms for all of our sake. Their battle cry: We commit to never returning rates to zero or below again, to never let be money be free and forever ensure there is a true cost associated with borrowing. Release the markets to set interest rates now and forever! Will it work? Stranger things have been known to succeed in capitalistic economies with competitive and freely functioning markets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What If The BOJ Disappoints Tonight: How To Trade It Posted: 27 Apr 2016 06:03 PM PDT It wasn't until a week ago that the loud calls for the Bank of Japan to do much more easing came loud and strong, because it was last Wednesday when Goldman announced it had changed its base-case scenario from one of a June easing to making "easing in April our base-case scenario, given the rising risk that business confidence has been dented by recent financial market instability and the Kumamoto earthquakes, and in view of BOJ governor Haruhiko Kuroda's recent proactive statements on possible additional easing in response to the sharp deceleration in inflation in April." At that moment many Wall Street sellside lemmings promptly followed in Goldman's footsteps and likewise made April their base easing case. Incidentally, moments ago Japan reported its latest March inflation data, according to which prices excluding fresh food slumped 0.3% from a year earlier, the biggest drop since April 2013, suggesting Japan's deflationary black hole is once again sucking everything in and the BOJ may have no choice but to act. It was also one week ago when Goldman proposed that what the BOJ would most likely do was neither more QE (due to collateral limitations) nor more NIRP (due to its devastating effect), but double the pace of ETF purchases:

Goldman floated one more option, namely the "possibility that the BOJ may combine the expansion of ETF purchases with a cut in the interest rate of its loan support scheme." Incidentally this is precisely the "trial balloon" which the BOJ floated via Bloomberg the next day, sending the USDJPY higher by 300 pips - the most since the announcement of QQE - and since the market reaction to that particular "leak" was so positive, it stands to reason that this a combination of rate cuts on bank loans coupled with an increase in ETF purchases is what Kuroda will announce in a few short hours. Then, perhaps to set an even bid/ask range, earlier this week Goldman's FX team came out with an absolutely outlandish research report, according to which the Bank of Japan would go so far as unleashing helicopter money to push the USDJPY to 130 for one simple reason: "the BoJ is already so long into 'the reflationary trade' that it has to continue to deliver further accommodation for the time being." Basically, what Goldman is saying is the BOJ has to crush its currency today at all costs or risk losing even more credibility after the January NIRP fiasco. We doubt that the BOJ will unleash helicopter money today, but it may well boost the amount of equities it purchases by doubling its ETF purchases and it certainly may cut the interest rate of its loan support scheme to benefit Japan's banks. Incidentally, this is what consensus looks like ahead of today's BOJ decision due out in just a few short hours:

This also means that a majority predict the BOJ will do nothing, which judging by the recent pent up market expectations of a major BOJ easing event would likely send the USDJPY plunging, which is ironic considering what Japan has already done to its monetary base and the BOJ's balance sheet...

But if the BOJ does disappoint, and one thinks it will, how should one trade it? For the answer we go to Credit Suisse whose strategists Shahab Jalinoos and Bhaveer Shah write that they suspect there is enough upside risk in the price for USD/JPY to allow for a decent move lower if the BOJ disappoints the market, adding what we said above, namely that the market is pricing in a higher probability of action this week than the economics consensus appears to suggest. This is how they would trade it:

But the biggest argument for a BOJ disappointment is that with the G7 meeting in Japan in on month on 26–27 May 2016, it's unlikely that Japanese policymakers will want to draw attention yet again to the idea that they are in the business of manipulating the JPY lower. After all the most recent G20 meeting once again confirmed that absent "disorderly moves" in the Yen, the US would frown on any attempt to dramatically manipulate its currency lower. Unless, of course, Abe wants to send Lew and Obama a message, that if China can enjoy a weaker dollar (courtesy of its USD peg), then so should the Bank of Japan. In any case, for those who do think the Bank of Japan will disappoint tonight, that is how to profit. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WW3 or Dollar Collapse Will Come First? Posted: 27 Apr 2016 03:00 PM PDT Russia strikes ISIS targets in Syria from sub, Turkey Tanks Troops Iraq Putin ISIS,islamic state turkey iraq syria,A hundred thousand foreign troops, including 90,000 from Saudi Arabia, the UAE, Qatar and Jordan, and 10,000 troops from America will be deployed in western regions of Iraq,WW3 Update... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Apr 2016 01:18 PM PDT This post Is This Making Kids Dumb? appeared first on Daily Reckoning. GUALFIN, Argentina – No major meltdown in the stock market yesterday. Au contraire, stock prices generally moved up. But our focus this week is on the real, the concrete – things that matter. Like cold feet. We have only a few days more at the ranch; we have to pay attention to them. And there is so much to pay attention to! Everything Matters"I read that kids today spend nearly eight hours a day on their cellphones and computers," said Elizabeth yesterday. "I wonder what that does to their minds." "Wait… I usually spend more than eight hours a day on my laptop. You can see what that has done to me." "Yes, it's a shame. You used to be so bright." Here at the ranch, everything matters. Yesterday, we woke up to find a horse outside our bedroom window. "That's El Bayo," said Elizabeth; she knows her horses. "How did he get out?" Investigating further, we found the whole herd enjoying itself in our flower bed… eight horses eating as fast as they could. Not a big deal. But if you forget to close the gates, you make trouble for yourself. Yipping and YellingIt was very cold this morning. The sky was dark with clouds. It was snowing up in the mountains. Down in the valley, the temperature dropped below freezing, but the sun wouldn't shine and the sky wouldn't snow. We brushed our teeth by candlelight – our solar electrical system is still giving us problems, so our promised test of friend Porter Stansberry's new razor would have to wait until the sun came out. Then we put on our boots and chased the horses back to their field. Horses must have some moral sense. They knew they had done wrong. When they saw us coming, they bolted out of the flowers. Then, they held their heads in shame all the way back down the hill to where they were supposed to be. Today, they can continue grazing. They'll get a workout tomorrow. Several of the ranch hands left before dawn for the high pasture, four hours away. They will bring the few animals still there (we took most of them away because of the drought) down to the corral. Tomorrow, we will all mount up early and head out to the big valley. It will take about three hours to reach the end of it. Then, we'll spread out, sweeping along the cattle in front of us… yipping and yelling… until we get them back to the corral. Stay tuned…. Make-Believe World"It's one thing for you to spend time working on a computer," Elizabeth continued, "but it's entirely different for a young person." "They're not working. They don't know what work is… or how the world works… or much of anything. How are they going to learn about the real world unless they get into it? "When almost their entire day is spent in a make-believe world… with games, entertainment, and idle, vapid gossip with one another… what do they learn? How do they know what is real and what is not? "Maybe that's why they get to college and get excited by transgender bathrooms and diversity studies. They don't know what really matters. "People are very adaptable and very resilient. But in the end, all we have is time. And if you use that time doing silly things, what happens? I don't know… but I'm happy to be down here [at the ranch]. There's so much to do… so much to learn." Elizabeth's right. Yesterday, for example, we got Carlos to show us how to plaster a wall the way the locals do. He dug out some rose-colored dirt near the casita. Then, he sifted it through what looked like fly screen to get out the stones… mixed it with about one-third fine sand… and water… and that was all there was to it. He used it to cover the wires we had snaked between the rocks in the walls of the little house. The effect was a soft, rich wall. Of course, we could have learned to do that on the Internet, too. Maybe that is what the kids are up to – learning how to do things by watching YouTube videos. Maybe when we get back to the U.S., we'll find half the country covered with mud plaster. Regards, Bill Bonner P.S. "If you want to be informed rather than disinformed, go to The Daily Reckoning website and sign up for the free Daily Reckoning letter." That's what one leading author said about the free daily email edition of The Daily Reckoning. Don't miss out another day. Click here now to sign up for FREE. The post Is This Making Kids Dumb? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Apr 2016 01:07 PM PDT This post Another Gary Cooper Rebound appeared first on Daily Reckoning. Gary Cooper famously told a Congressional committee investigating communist infiltration of Hollywood in the 1950s that "from what I have heard about it, it isn't on the level." I was put in mind of that observation this morning. First, I heard Jim Cramer saying that the bottom is in for Caterpillar and then I read that Goldman Sachs had upgraded its rating on CAT and Joy Global on the grounds that, "…… the signs of a China recovery now appear to be broadening." By the lights of Wall Street and its media megaphones, therefore, global demand for commodities and oil is purportedly rebounding and a reflationary cycle of growth is again underway. Apparently, its time to buy the dip again because the world economy has gotten back into its growth groove. No it hasn't. What we have here is a Gary Cooper rebound. That is, another unsustainable upward blip of the fundamentally false global credit bubble. But the latter is no more on the level than was Joseph Stalin's new Soviet paradise. This time, of course, capitalism is being supplanted by printing-press happy central bankers rather than tonnage toting commissars reinforced by firing squads. But the end game is much the same. To wit, when the state tries to over-ride the laws of the market and sound money, the experiment will eventually end in tears. We can't be too far away. The BOJ has gotten so desperate, for example, that it is apparently fixing to double down on its leap into negative interest rates on central bank deposits by extending NIRP to its commercial bank funding facility. That is, its going to pay commercial banks to make loans to private sector firms and households which are already buried in debt. At more than 450% of GDP, in fact, Japan's total credit outstanding towers well above the rest of the world. No matter. The madcap money printers at the BOJ have already bought up every Japanese government bond that can be pried loose and own nearly 50% of Japanese issued ETFs. And now comes word that the BOJ has bought so much stock through ETFs and directly that it has become a top holder of most of the stocks in the Nikkei 225.

Needless to say, the Japanese bond and stock markets are not even slightly on the level. They are incendiary artifacts of a central bank that has gone berserk and getting more desperate by the day. Yet the BOJ is hardly an aberration. The affliction is nearly universal as Draghi demonstrated last week and as the Fed will reaffirm this week when it effectively perpetuates ZIRP into its 89th month. So rather than discounting the unmistakable signs of economic weakness and swooning profits everywhere, the casino gamblers keep repairing to any sign that one or another of these rogue central banks will goose the financial markets with one more round of stimulus—-or delay in the inexorable path toward normalization. The flavor of the moment this week is that the BOJ will soon embark on the form of helicopter money referenced above. But that has been mightily reinforced by this morning's Cramer/Goldman proposition that the global economy is in a renewed upswing because the red suzerains of Beijing have now injected a massive new round of stimulus into China's faltering growth machine. Well, that they did. It now appears that total social financing in Q1 hit 7.5 trillion yuan with a "T". In plain USD's that implies a $4.5 trillion annualized rate of credit expansion. It also settles the case. Beijing has completely lost control of the Red Ponzi and in contradiction of every one of its public pronouncements about pro-market reforms and a smooth transition to a consumption and services based economy, it has unleashed the printing presses like never before. But with $30 trillion of debt already smothering the Chinese economy, generating new credit at a rate of nearly 40% of GDP is tantamount to a death wish. It is simply inflating financial bubbles faster than can be tracked, and eliciting yet another borrowing and construction surge in an economy swamped in excess capacity and white elephants. Accordingly, during March Chinese steel production set an all-time record, cement production soared and the "iron rooster" was temporarily back in business. To be sure, the short-term reflationary impulse has been explosive. As the venerable Ambrose Pritchard-Evans observed yesterday regarding China's first quarter boomlet: New home sales jumped 64pc in March from a year earlier. House prices have risen 28pc in Beijing, 30pc in Shanghai, and 63pc in the commercial hub of Shenzhen. The rush to buy has spread to the Tier 2 cities such as Hefei – up 9pc in a single month. "The housing market is on fire," said Wei Yao, from Societe Generale. "In the first quarter, increases in total credit exploded to 7.5 trilion yuan, up 58pc year-on-year. There is no bigger policy lever than this kind of credit injection." "This looks like an old-styled credit-backed investment-driven recovery, which bears an uncanny resemblance to the beginning of the"four trillion stimulus" package in 2009. The consequence of that stimulus was inflation, asset bubbles and excess capacity. We still think that this recovery will not last very long," she said….. The signs of excess are visible everywhere as the Communist Party once again throws caution to the wind . Cement production jumped 24pc in March and infrastructure investment rose 19pc. Yang Zhao from Nomura said the edifice is becoming more dangerously unstable with each of these stop-go mini-booms. "Structural problems and financial imbalances are worsening. We believe this debt-fueled growth is not sustainable," he said. Nomura said the law of diminishing returns is setting in as the economy nears credit exhaustion. The 'incremental credit-output ratio" has deteriorated to 5.0 from 2.3 in 2008. Loans are losing traction and the quality of investment is falling. That's right. China's precisely calibrated GDP grew by $180 billion during Q1, even as its outstanding debt soared by upwards of $1.055 trillion. So it took $6 of new borrowing to coax another dollar of dubious GDP—-that is, more empty roads, train stations and apartments—–out of the Red Ponzi. But what it actually did was trigger another round of Chinese speculation in commodity stockpiles, industrial inventories, real estate and other assets. That impulse, in turn, cascaded through global commodity markets, causing a modest rebound in beaten down prices and thereby reinforcing the Wall Street meme that global reflation is underway. The chart below says otherwise. At the heart of the Wall Street rebound from the February 11th lows was the 55% gain in crude oil prices. The whole proposition was that the Doha disaster didn't matter because global crude oil supply, at length, was beginning to bend downward and that by early next year the market would be back in balance. This, in turn, was to pave the way for prices above $50 and a rebound in the entire commodity and materials complex. Yet even as Cramer was attempting to lure homegamers into CAT, Bloomberg came forward with a cat of a decidedly different strip. Based on an exhaustive empirical investigation that involved tracking oil tankers on the water, it unloaded the following: China is hoarding crude at the fastest pace in at least a decade, filling inventories at a time when oil futures remain about 60 percent below where they were just two years ago. The nation added 787,000 barrels a day to stockpiles in the first quarter, the most for the period since at least 2004 when Bloomberg started calculations based on customs data. Its imports climbed in March from countries including Iran, Venezuela and Brazil. "We've seen crude buying in recent months coming from a very broad range of sources, more coming from Latin America and more from Europe," said Richard Mallinson, an analyst at Energy Aspects Ltd. in London. Shipments are being boosted by so-called teapot refineries and may also be advancing in preparation for the end of refinery maintenance programs in China, he said. Operating rates at teapot refineries in eastern Shandong province rose to about 52 percent in the week to April 22 as two plants completed maintenance and restarted production, according to industry website Oil.chem.net, which surveys 32 of the refineries.

Here's the thing. Global liquids demand in Q1 according to the international energy agency averaged 94.82 million b/d compared to 93.58 million b/d during Q1 2015. So demand was apparently up by 1.24 million b/d (1.3%), but self-evidently much of that was due to backdoor inventory accumulation through China's teapot refinery complex deep in the maw of the Red Ponzi, not growing final demand. In fact, China's inventory accumulation accounted for two-thirds of apparent global demand growth in Q1. So on the margin, oil got a bid because the punters are watching the supply curve, but assuming that "demand growth" is a given. To the contrary, global oil demand is on the precarious edge of rolling over. Most of the apparent demand growth of 800k b/d in Q4 and 1.2 million b/d in Q1 reflected the final burst of credit-fueled inventory accumulation in the Red Ponzi. But as has been demonstrated repeatedly in the copper, iron ore, cotton and other commodity markets, when the Chinese speculators commence a destocking cycle——–then, look out below! What actually happened in Q1, in fact, was that world trade volumes collapsed by double-digit rates in China and throughout the East Asian export complex. What comes next, therefore, is global oil "demand destruction" as economic activity continues to ebb. The modest production drop in the US shale patch expected in the months ahead will be no match for the latter. There is no reflationary cycle just ahead. The commodity complex will soon reverse. CAT's sales have declined for 32 straight quarters for a reason. To wit, the massive CapEx spending boom elicited by the central bank driven credit bubble of the last two decades is over and done. There is enough used big yellow machines floating around the global used machinery markets to last for a decade. Stated differently, the global commodity and CapEx bottom's not in. It's not even in sight. More importantly, this Gary Copper rebound has already reached its sell-by date. Jim Cramer to the contrary notwithstanding, the more prudent thing to do would be not to back-up-the-truck, but to sell it. Today brought still more evidence that the entire global casino is definitely not on the level. Regards, David Stockman P.S. "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Another Gary Cooper Rebound appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| HUI Gold Stocks Update...Beautiful Chartology Posted: 27 Apr 2016 12:40 PM PDT Below is a two year daily chart for the HUI which I first showed you when the HUI broke above the double bottom hump to start its bull market. I call this chart the reverse symmetry chart as shown by the red arrows. How a stock comes down, especially in a strong move, will reverse symmetry back up over the same area. It's more of an art than a science. You can see the rally off of the mid January low found a little resistance at 182 before it broke through. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FOMC statement and the Stock Market Posted: 27 Apr 2016 12:33 PM PDT The algos have taken over after the FOMC release. ZeroHedge reports, “ The kneejerk - USD up, stocks down, bonds down - reaction has faded and with The Fed statement pitching its dovish tent back in domestic concerns while keeping a hawkish eye on global developments. The Long bond is back in the green but it appears machines are busier running oil stops higher and dumping gold.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Beginning of a Dollar Crash? Posted: 27 Apr 2016 09:59 AM PDT This post The Beginning of a Dollar Crash? appeared first on Daily Reckoning. I live in Asia and travel the continent quite a bit. So I've been a big fan of the strong dollar in recent years. The greenback has gone a long way in this part of the world. Flights… hotels… restaurants… It seems like everything's been on sale. But now it looks like the party might be over. The greenback is now in a downtrend. Here are a few ways to play it for profit… Streams of Useless DataFirst, let's look at some typical misinformation campaigns… Here are recent headlines from the chattering media class: 4/5: Dollar Rises as Investors Anticipate U.S. Data 4/6: Dollar Falls on Fed Minutes 4/13: Dollar Climbs Before Data Forecast 4/15: Dollar Falls on Lackluster U.S. Data 4/21: Dollar Rises After Solid U.S. Data 4/25: Dollar Sinks After Q1 Growth Takes Another Hit You got that? Now, ready to pull the trigger on a moneymaking trade with that advice? Good luck! (You'll need it.) You see, there's absolutely nothing there that can help you reliably make money trading the dollar. You can't make a greenback trade by keeping tabs on frenetic, emotional seesawing of media blather. Trust the TrendThis all reminds me of 2008-2009, when everyone said the dollar would go to zero. Of course, that turned out to be the bottom of the U.S. dollar, as you can see in the chart of the dollar index below.

Note: The U.S. Dollar Index measures the performance of the dollar against six major currencies. Don't get me wrong. There are plenty of things wrong with our economy. And at some point the dollar may indeed crash. But nobody can predict the exact timing if it does. That's why we let the trend guide us. And right now, after a big rally, the dollar appears to be entering a downtrend. Why do I say "appears"? Because a signal on the downside doesn't mean I know how low this move might go. That's not the point. The signal says down. I trust my trend following system. And we have our stops in place for peace of mind. Unemotional, disciplined trading is the key to success. So, how can you possibly profit from dollar weakness? Here are some points to keep in mind… Simple, Low-Cost Ways to Play the DollarWhen the U.S. dollar is weaker, it takes more dollars to purchase any commodities priced in greenbacks, like gold, silver, corn, soybeans, wheat and oil. That means those commodities tend to move in the opposite direction of the dollar. I've already mentioned that gold and silver are in an uptrend. But precious metals are not the only way to profit from a weak dollar. A weak dollar is also usually good for emerging markets… See, emerging markets were one of the biggest losers of a strong dollar in recent years. That's because many businesses in emerging countries have debt denominated in U.S. dollars. When the dollar is strong, it's harder for them to pay that debt. So if the dollar continues in a downtrend, we could see a recovery in emerging markets. Logically, a weak dollar also provides incentive for investors to sell U.S assets and chase growth in emerging markets in non-dollar assets. That's the fundamental view of what can happen. But we rely on trend following signals to tell us what to do. For example, some major emerging markets, such as Brazil (EWZ) and Russia (RSX) are already in an uptrend, according to my system. One potential downside for me? If the dollar continues to decline, my travel is going to get more expensive. But I'll have plenty of opportunities to profit from these new trends too. It's always a balancing act. One side goes up, the other side goes down. That's the trend following way. Ride the bucking bronco for profits. And forget predictions. I always want your feedback. Please send your comments to coveluncensored@agorafinancial.com. And make sure they're uncensored. Regards, Michael Covel The post The Beginning of a Dollar Crash? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Gold Bugs Need to Stop Listening to T... Posted: 27 Apr 2016 09:41 AM PDT SafeHaven | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia's VTB aims to supply up to 100 tonnes of gold to China per year Posted: 27 Apr 2016 08:20 AM PDT By Oksana Kobzeva and Polina Devitt MOSCOW -- VTB Bank, Russia's second-largest lender, aims to supply between 80 and 100 tonnes (2.57-3.22 million troy ounces) of gold to China per year, the bank said on Tuesday after it started the shipments. VTB said earlier Tuesday it had dispatched its first batch of gold to China, becoming the first Russian bank to start direct supplies of physical gold to the world's largest buyer and consumer of the precious metal. ... ... For the remainder of the report: http://www.reuters.com/article/russia-bank-vtb-china-gold-idUSL5N17T5IB ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRASH Of The Century HAS BEGUN! Posted: 27 Apr 2016 08:20 AM PDT The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aussie CPI Prints Weaker Than Expected Posted: 27 Apr 2016 08:07 AM PDT This post Aussie CPI Prints Weaker Than Expected appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Front and center this morning is a nasty reaction of the Aussie dollar (A$) to a weaker inflation report. The A$ has lost nearly 1.5-cents because the first Quarter CPI came in at 1.3% (year on year) vs. the consensus of 1.7%, and traders had a knee jerk reaction to report, thinking that the Reserve Bank of Australia (RBA) will cut rates at their meeting next week. Can everyone there just please calm down? I’m going to go out on a big fat limb here, (so it will hold me, without snapping) and say that I think the RBA will most likely look at this CPI report with some reservations about a quick reaction and cutting rates. It will cause them to reinforce their easing bias, but I don’t believe it will lead to a rate cut next week. And that would allow the A$ to look to recover some of this lost ground. The currencies overall are mixed again this morning, kiwi is of course selling off in sympathy of the A$ move, but the euro is up a bit, and is back over 1.13 this morning. Pound sterling is stronger again this morning, as the BREXIT talks continue to move to the side of “no exit”. And of course the U.S. President threw his two-cents into the discussion and told the U.K. that they should remain in the European Union. Boy, I could have all kinds of fun with that but the kinder, gentler Chuck, will just let that slide, and move on to other things. The price of oil has bounced higher after a couple of days of slippage in the price. Yesterday, the initial supply data for oil in the U.S. showing supply dropping. There remains a fear of a supply infusion that could cut this rally to its knees in a heartbeat. But for now, the price of West Texas Intermediate Oil trades with a $45 handle. I talked to some people about oil the other day, and told them that the $50 price for oil would be a HUGE hurdle. And who would have thought we would be talking about the price of oil at $50 a few months ago, when it was trading below $30? The API report on supply that printed yesterday, is a precursor to the official inventory report that will be issued by the Energy Information Administration (EIA) today, so if the API precursor report is any indication of the EIA report will show, the price of oil could very well see another bounce today. I know that doesn’t make everyone happy, but it does make oil people, investors, and bankers with loans to oil producers happy. And, since the price of oil has held the markets’ attention for so long now, it does play into the weak dollar trend theory. Wait, What? Think about that. I’ve been talking about the end of the strong dollar trend, and when it does finally come to an end, the only thing that can be next is a weak dollar trend. The anti-dollar assets have been on a run vs. the dollar and that too plays nicely in the sandbox with the end of the strong dollar trend call that I’m making. Oil, gold, and the euro. Speaking of gold, yesterday morning I was very frustrated with the trading in gold, which was seeing selling after booking a $6 gain on Monday. But, as they say, the cream rises to the top, and gold ended the day on Tuesday with a $5.40 gain. Pretty good, considering it was down $6 in early morning trading. There’s an interesting article on Bloomberg’s website today titled “Sweden Declares Truce In Currency War”. Hmm… Let’s see what it has to say, eh?

Well, the Swedish krona has been one of the beneficiaries of the weaker dollar in the past month. So, it all makes sense, eh? The Norwegian krone has been held hostage by the price of oil, and the euro at times. The Russian ruble is the poster child for a currency that’s tied to the tracks of the oil train. But Norway plays a close second to Russia in that regard, and so currency holders of rubles, krone, real, and even loonies, will want to see the price of oil reach its next hurdle of $50, which in my opinion would carve in concrete a rally for the price of oil. Last Sunday’s Pfennig talked about NIRP – Negative Interest Rate Policy. And I’ll borrow a piece of that Pfennig for this letter:

That thought has been on my mind since Sunday morning. And then later in the day I received my precious bi-monthly letter: Things That Make You Go Hmmm (TTMYGH) written by the great Grant Williams. And in this letter he rips NIRP up one side and down the other, and in doing so, he mentions that he had lunch with the Great analyst, David Rosenberg who had this to say, “Almost $7 Trillion of Gov’t Bonds globally are trading below zero; 27% of value of outstanding sovereign debt”. I just can’t get my dog to hunt in those woods folks. I know to date there hasn’t been anything bad happening in the countries that have implemented NIRP, but does that mean that’s going to go on forever? No, it can’t! Think about this folks. You have consumers of any country, and they are getting taxed for saving and not spending, so the conventional thinking is that these consumers would go out and spend, thus saving the economy. But the opposite has happened. These consumers have decided to save even more to make up for the tax! Hmmm… the problem with this is that savings rates had fallen in the U.S. to very low levels, and while they’ve corrected, they still have a long ways to go to get back to levels seen 30 years ago. Either they save that much more, or they reduce debt they hold and neither of those options are going to help any economy, much less the U.S. economy that’s so dependent on “consumption”. I also have borrowed something from Tony Sagami of Connecting The Dots letter that can be found here. So, some of this next piece is me, and some of it is Tony. I’m feeling quite chatty this morning, so I apologize, but this is important stuff folks so please pay attention to this. I’ve always told you that all debt isn’t bad. Debt that’s used appropriately and paid back is good debt. Bad debt is debt that’s allowed to grow and never be paid back. That’s the kind of debt that we have here in the U.S., and not only with the government debt which is growing faster than our GDP, but with corporate debt, and individual debt. Did you know that in March $16.4 billion of corporate loans went bad, and March wasn’t the first month, in fact, March was the fifth consecutive month of defaults greater than $5 billion! OUCH! Bloomberg ran an article the other day that said that the “Three largest banks in the U.S. – Bank of America, JPMorgan Chase, and Wells Fargo – disclosed that the number of delinquent corporate loans increased by 67% in the first QTR” JPMorgan’s delinquent corporate loans increased 50% to $2.21 billion. Bank of America’s increased 32% to $1.6 billion, and Wells Fargo’s increased 64% to 3.97 billion. I do realize that a lot of the defaults have come in the junk bond arena, but let’s not just blame it all on junk bonds. Just last week, Peabody Coal filed for bankruptcy, they certainly weren’t junk! And for anyone wanting to see the proof of this data they can click here for the whole article. Well, it’s time to visit the U.S. Data Cupboard and see what it has for us today, but first we must review yesterday’s fare, because it was responsible for the turnaround in gold, and the further sinking of the dollar. So, let’s go a little journey back in time to yesterday… The U.S. Data Cupboard was not kind to the dollar yesterday. I told you yesterday that the first of “real economic data” was to print this week in the form of March Durable Goods Orders. I also told you that I thought it would be negative if it weren’t for some expected aircraft orders. Well, the aircraft orders came, and pushed the data to a positive, but the 0.8% increase in March was not anywhere close to expectations which were around 2%. With this data, I’m still tracking GDP at 0.4% in the first quarter. In addition, the April reading of Consumer Confidence, which was expected to remain flat, after falling by a large amount in March, fell again from 96.1 to 94.2. Now that’s two months that I don’t have to chastise the people that took the survey, for the last two months have gone the way the index should be going! So, at what point does the Fed admit they made a mistake in hiking rates in December? I told them not to hike rates. But they didn’t listen, but I’ll betcha a dollar to a Krispy Kreme that they are hearing me now! The economic data, other than the trumped up labor surveys that the BLS puts out monthly, has been awful since the rate hike, and I don’t see it getting any better any time soon. Of course that’s just my opinion and I could be wrong in the end. But I doubt it. And like I said back in December, the Fed wants inflation, but yet, they did something, hike rates, that fights inflation. So, again I ask the question – at what point does the Fed admit they made a mistake in hiking rates in December? The U.S. Data Cupboard today, has some data prints that aren’t as important as yesterday’s disappointing Durable Goods Orders. Wait a minute, I take that back, because headlining the cupboard today is the EIA Petroleum Status Report I talked about above. What the heck were you thinking Chuck? In addition to the EIA report, we’ll also see the Trade Balance, Pending Home Sales and some other third tier stuff. And of course I almost forgot because it’s going to be a non-event, but the Fed’s FOMC two-day meeting comes to an end today, and the Fed will announce that they are not changing anything, and that’s it, because as I told you earlier this week, there’s no press conference following the meeting today. And the focus will shift to June’s FOMC meeting. I’m not even going to go there it’s too far out for me to already be telling you that the Fed won’t hike rates then either. No wait! I just did what I said it was too early to do! You dolt, Chuck! I was going through Ed Steer’s letter quickly this morning, and this article headline caught my eye, so I drilled down to see what it was about. Here’s the title I saw: “Gold Back in Fashion? Why Precious Metal Has Made An Amazing Comeback” See why it caught my eye? Well, it’s over at sputniknews.com and can be found here, or here’s your snippet:

Chuck again. Well, I certainly would like to get some credit for this also, for it was me banging the drum very loudly for a long time about how investors needed to buy physical gold to get the manipulators exposed, and that the global economy can’t continue to juggle all the debt in the world right now. It wasn’t just James Rickards, although he’s more well-known than I am! I’m just a country boy trying to make some noise in the big city. That’s it for today. I hope you have a wonderful Wednesday, and be good to yourself! Regards, Chuck Butler P.S. What's the latest on gold, oil, the Fed, or the stock market? What's China going to do next? You'll find the answers in the free daily email edition of The Daily Reckoning. It provides an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE. The post Aussie CPI Prints Weaker Than Expected appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Podcast: Okay, I’ll Say It: Run For The Hills Posted: 27 Apr 2016 07:23 AM PDT Combine record-high stock prices with weak corporate earnings, a too-strong dollar and rising turmoil in Europe, Asia and Latin America, and the result is a dangerously vulnerable market. Time to go “risk-off”, in other words. But keep stacking gold and silver. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump and Hillary win big time in North Eastern part of America Posted: 27 Apr 2016 07:00 AM PDT Donald Trump "Crushes" Cruz Wins 5 States Trump crushes Cruz and wins with out of the Charts Numbers in 5 States The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Gold Bugs Need to Stop Listening to The Fear Mongers and Start Thinking for a Change Posted: 27 Apr 2016 06:40 AM PDT He that can have patience can have what he will. ~ Benjamin Franklin We are still not convinced that Gold is fully out of the woods. Peter Schiff is busy telling everyone that it was a bad idea to have sold Gold in 2011, we beg to differ for the trend indicates otherwise, and so does the price of Gold. He is coming out with scary scenarios though they are not as grandiose as James Sinclair's scenario that calls for Gold to move to $50,000 an ounce. Even, when we dream we find it hard to envision such a price, so it is interesting that he can come up with such targets without being under the influence of some strong medicine. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web — April 28 Posted: 27 Apr 2016 06:19 AM PDT Bank of Japan fails to ease further; yen soars and Nikkei plunges. Fed does nothing, says next to nothing. Apple sheds $40 billion in market cap while Facebook soars; next up is Amazon. China’s bond market spinning out of control? Trump and Clinton take aim at each other. Gold jumps on Japan news. Best […] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold More Productive Than Cash?! Posted: 27 Apr 2016 05:25 AM PDT Is gold, often scoffed at as being an unproductive asset, more productive than cash? If so, what does it mean for asset allocation? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela doesn't have enough money to pay for its money Posted: 27 Apr 2016 05:10 AM PDT By Andrew Rosati Venezuela's epic shortages are nothing new at this point. No diapers or car parts or aspirin -- it's all been well documented. But now the country is at risk of running out of money itself. In a tale that highlights the chaos of unbridled inflation, Venezuela is scrambling to print new bills fast enough to keep up with the torrid pace of price increases. Most of the cash, like nearly everything else in the oil-exporting country, is imported. And with hard currency reserves sinking to critically low levels, the central bank is doling out payments so slowly to foreign providers that they are foregoing further business. Venezuela, in other words, is now so broke that it may not have enough money to pay for its money. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-04-27/venezuela-faces-its-st... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Apr 2016 01:30 AM PDT Monetary Metals | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Steve Jobs Knew About the Internet that Can Make You a Better Gold Investor Posted: 27 Apr 2016 01:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Plays Catch-Up To Gold, 2016 Could be "Pivotal" Year: CPM Group Posted: 26 Apr 2016 05:56 PM PDT By Daniela Cambone of Kitco News (Kitco News) - This could be a pivotal year for silver prices, this according to one research firm which launched its coveted silver year book on Tuesday. New York based research firm, CPM Group’s Silver Yearbook 2016, suggests that silver prices may see stronger support as fundamentals seem to be lined up in the metal’s favor. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long Awaited Gold Price Breakout Posted: 26 Apr 2016 09:45 AM PDT For the last year or more, not an elephant, not a gorilla, but a dragon has been found at the dinner table. Its breath has just made everybody at the table totally bald with some scorched red faces. Now all are looking at each other, wondering who will first mention the bald guys at the table. The Shanghai levers are finally functioning, starting with the Gold Fix and continuing with the RMB-based gold futures contract (which delivers gold metal oddly). The game is finally on, as in the climax chapter to the End Game. Paper gold is totally disconnected from fundamentals. The paper charade is as impressive as it is corrupt. Its enemy is physical gold and related demand. Silk Road nations have strong gold demand, which will disrupt the entire geopolitical balance of power, extending from trade and non-USDollar platforms. The West has the corner on toilet paper used in the gold market. The United States has the corner on the USDollar, used in fraud and illicit tolls. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed Induced Bond Bubble Will Devastate Financial System - Video Posted: 26 Apr 2016 09:33 AM PDT Transcript Excerpt:Hi it's a Tuesday April 26 2016 I'm gonna be talking about a subject a little bit technical but I think people need to know about this and it's to do with central banks and you know what the bond markets so in my opinion central banks they planted or clean been planting the seeds of a bond market meltdown with the zero interest rate policy and the negative interest rate policy and by the bond markets I mean government bond markets which are supposedly risk-free assets are not of course and then corporate bonds you know all kinds of ratings you know junk bonds but our focus on the bond market government bond market because that's the biggest market in the world so the policy observed with zero interest rates implemented through quantitative easing and officially set raids has resulted in the bond market but never seen before in the history of financial markets basically the only way to get interest rates were is to buy bonds because the ruling bond bond prices and yields is that the bond price goes up goes down if the deal goes up ... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cyber Fraud At SWIFT – $81 Million Stolen From Central Bank, Digital Gold Posted: 26 Apr 2016 09:28 AM PDT Swift, the vital global financial network that western financial services companies, institutions and banks use for all payments and transfer billions of dollars every day, warned its customers yesterday evening that it was aware of cyber fraud and a number of recent “cyber incidents” where attackers had sent fraudulent messages over its system and $81 million was apparently stolen from a central bank. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How The Credit Markets Will Blow Up During The Coming Silver Rally Posted: 26 Apr 2016 09:24 AM PDT During the previous silver bull market, interest rates and silver moved in the same direction (up). This makes sense, given the fact that silver and interest rates move together in the long run – for the last 100 years at least. The current silver bull market (since 2001) has seen a big divergence between silver prices and interest rates. Below, is a comparison of interest rates and silver prices since 1962: |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment