Gold World News Flash |

- Gold Trading Model and COT Data Are in Conflict

- China Launches Yuan-Denominated Gold Price at Shanghai Gold Exchange

- End Of The Petrodollar: Saudi Arabia Threatens To Dump $700b In Treasuries If Blamed For 9/11

- Deutsche Bank Settles Lawsuit for Price Rigging, Turns “State’s Evidence†on Other Banks

- Government Officials Admit to ECONOMIC False Flag Operations

- Paul Craig Roberts: How The American Neocons Destroyed Mankind's Hopes For Peace

- Silver Price Closed up 4.42% at 16.97

- China Launches Yuan Gold Fix To "Exert More Control Over Price Of Gold"

- Gold, Silver JUMP – China Yuan Gold Fix

- "Swimming Naked" - Chinese Corporate Bond Market Worst Since 2003

- Karen Hudes -- Network of Global Corporate Control 4 19

- Stocks Are In "A Far More Precarious State Than Was Ever Truly Believed Possible"

- Why Precious Metal Rally On Track

- Patrick Donnelly – First Mining Finance on the Move

- Eric Hunsader to Chris Martenson: Market rigging is getting worse

- THEY LIT THE FIRST CANDLE

- Silver Shines as Goldman Sachs Dims

- Harry Dent A Bold Warning Financial Meltdown Eminent

- What Did Fed Chairman Yellen Tell Obama?

- Pushing Desperate Measures Too Far

- Stock and Precious Metal Charts At the End of Day - Silver Cup and Handle

- A Tearful Farewell at the Ranch

- Confirmed, The Banking System Has Been Manipulating The Precious Metals Market

- Why government?

- Max Keiser on the Saudi role in 9/11 & 7/7 & MSM propaganda

- China's gold fix is a step toward taking over the market, boosting price, Leeb says

- Eurabia has Arrived : The ISLAMIZATION of the WEST

- Gilad Atzmon & The OHE on kulturspiegel SR TV Germany

- Russia and China plan platform to unite their gold trading

- Free Webcast of Miles Franklin's April 21 monetary metals seminar

- Risk Sentiment Returns With a Bang

- Breaking News Links — April 20, 2016

- Gold and Silver Precious Metals Complex Reverse Symmetry

- Ronan Manly: Is this gold's secret hiding place in London?

- Deutsche Bank's admission, silver's strength covered in GATA chairman's interview

- China starts gold fixing in bid to expand global market sway

- China Gold Bullion Yuan Trading To Boost Power In Gold and FX Markets – End Manipulation?

- A Powerful Signal for the Coming Silver Price Rally

- Gold and Crude Oil - What Can We Infer from This Relationship?

| Gold Trading Model and COT Data Are in Conflict Posted: 20 Apr 2016 12:04 AM PDT Technical Analyst Jack Chan says his trading model is indicating that the gold sector is on a new major buy signal, but the COT data is bearish, so he is waiting for the COT to return to bull market values. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Launches Yuan-Denominated Gold Price at Shanghai Gold Exchange Posted: 20 Apr 2016 12:00 AM PDT Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Of The Petrodollar: Saudi Arabia Threatens To Dump $700b In Treasuries If Blamed For 9/11 Posted: 19 Apr 2016 11:40 PM PDT Every day a new major piece of news comes out showing a system that is on the verge of collapse… and a planned shift to a new global order. In the last two weeks alone, all of this has occurred: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Settles Lawsuit for Price Rigging, Turns “State’s Evidence†on Other Banks Posted: 19 Apr 2016 11:23 PM PDT Prior to last week, Deutsche Bank made headlines for a string of huge losses and massive exposure to risky derivatives. The last time the firm’s shares traded at prices this low, the world was in the midst of 2008’s financial apocalypse. Deutsche Bank didn’t need more bad news, but a group of investors who brought suit against the massive German bank for cheating them by rigging the London “fix” price for gold and silver certainly must be smiling. Last week, the bank offered to settle their class action suit for an undisclosed amount. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government Officials Admit to ECONOMIC False Flag Operations Posted: 19 Apr 2016 09:36 PM PDT False flag attacks don’t just involve physical deaths and wars … They also involve faked economic events and financial casualties. For example, two officials of the International Monetary Fund said last month that they needed the threat of an imminent financial catastrophe to force other players into accepting its measures such as cutting Greek pensions and working conditions, and – as the Greek government put it (via Bloomberg) – the IMF was “considering a plan to cause a credit event in Greece and destabilize Europe.” High-level officials also admitted to intentionally destroying their own nations’ economies in order to “justify” structural economic reforms. For example, Japanese Prime Minister Junichiro Koizumi and Japanese central bank officials admitted that they kept Japan’s economy in a deflationary crisis to promote “structural reform” which would allow the Japanese economy to be looted by foreign interests. Japanese central bank officials admitted the same thing. Japan Times noted in 2003:

Something similar happened in Thailand and the EU. Indeed, the former head of the Bank of England said last month that the depression in the EU was more or less a “deliberate” policy choice. And an economist at insurance giant AIG – and former head of the European Commission’s unit responsible for the European Monetary System and monetary policies – said in 2008 that what European leaders wanted was to create a crisis to force introduction of “European economic government.” Indeed, Greece (more), Italy, Ireland (and here) and other European countries have all lost their national sovereignty to the ECB and the other members of the Troika. ECB head Mario Draghi said in 2012:

Threats of Economic TerrorismThe Saudis said they would sell $750 billion in U.S. treasury securities and other assets in the United States if an investigation of Saudi involvement in 9/11 is allowed to occur. This sound like the mafioso who asks: “We wouldn’t want anybody to get hurt, now would you?” American banks have carried out the same type of terrorist blackmail. For example, the Tarp bank bailouts in the U.S. were passed using apocalyptic – and false – threats. And they were not used for the stated purpose. As I’ve previously reported:

The giant banks also essentially threatened to blow up the American economy if any of them were prosecuted for their massive, economy-destroying fraud. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts: How The American Neocons Destroyed Mankind's Hopes For Peace Posted: 19 Apr 2016 07:30 PM PDT Authored by Paul Craig Roberts, When Ronald Reagan turned his back on the neoconservatives, fired them, and had some of them prosecuted, his administration was free of their evil influence, and President Reagan negotiated the end of the Cold War with Soviet President Gorbachev. The military/security complex, the CIA, and the neocons were very much against ending the Cold War as their budgets, power, and ideology were threatened by the prospect of peace between the two nuclear superpowers. I know about this, because I was part of it. I helped Reagan create the economic base for bringing the threat of a new arms race to a failing Soviet economy in order to pressure the Soviets into agreement to end the Cold War, and I was appointed to a secret presidential committee with subpeona power over the CIA. The secret committee was authorized by President Reagan to evaluate the CIA’s claim that the Soviets would prevail in an arms race. The secret committee concluded that this was the CIA’s way of perpetuting the Cold War and the CIA’s importance. The George H. W. Bush administration and its Secretary of State James Baker kept Reagan’s promises to Gorbachev and achieved the reunification of Germany with promises that NATO would not move one inch to the East. The corrupt Clintons, for whom the accumulation of riches seems to be their main purpose in life, violated the assurances given by the United States that had ended the Cold War. The two puppet presidents - George W. Bush and Obama - who followed the Clintons lost control of the US government to the neocons, who promptly restarted the Cold War, believing in their hubris and arrogance that History has chosen the US to exercise hegemony over the world. Thus was mankind’s chance for peace lost along with America’s leadership of the world. Under neocon influence, the United States government threw away its soft power and its ability to lead the world into a harmonious existance over which American influence would have prevailed. Instead the neocons threatened the world with coercion and violence, attacking eight countries and fomenting “color revolutions” in former Soviet republics. The consequence of this crazed insanity was to create an economic and military strategic alliance between Russia and China. Without the neocons’ arrogant policy, this alliance would not exist. It was a decade ago that I began writing about the strategic alliance between Russia and China that is a response to the neocon claim of US world hegemony. The strategic alliance between Russia and China is militarily and economically too strong for Washington. China controls the production of the products of many of America’s leading corporations, such as Apple. China has the largest foreign exchange reserves in the world. China can, if the government wishes, cause a massive increase in the American money supply by dumping its trillions of dollars of US financial assets. To prevent a collapse of US Treasury prices, the Federal Reserve would have to create trillions of new dollars in order to purchase the dumped financial instruments. The rest of the world would see another expansion of dollars without an expansion of real US output and become skeptical of the US dollar. If the world abandoned the US dollar, the US government could no longer pay its bills. Europe is dependent on Russian energy. Russia can cut off this energy. There are no alternatives in the short-run, and perhaps not in the long run. If Russia shuts off the energy, Germany industry shuts down. Europeans freeze to death in the winter. Despite these facts, the neocons have forced Europe to impose economic sanctions on Russia. What if Russia responded in kind? NATO, as US military authorities admit, has no chance of invading Russia or withstanding a Russian attack on NATO. NATO is a cover for Washington’s war crimes. It can provide no other service. Thanks to the greed of US corporations that boosted their profits by offshoring their production to China, China is modernized many decades before the neocons thought possible. China’s military forces are modernized with Russian weapons technology. New Chinese missiles make the vaunted US Navy and its aircraft carriers obsolete. The neocons boast how they have surrounded Russia, but it is America that is surrounded by Russia and China, thanks to the incompetent leadership that the US has had beginning with the Clintons. Judging from Killary’s support in the current presidential primaries, many voters seem determined to perpetuate incompetent leadership. Despite being surrounded, the neocons are pressing for war with Russia which means also with China. If Killary Clinton makes it to the White House, we could get the neocon’s war. The neocons have flocked to the support of Killary. She is their person. Watch the feminized women of America put Killary in office. Keep in mind that Congress gave its power to start wars to the president. The United States does not have a highly intelligent or well informed population. The US owes its 20th century dominance to World War I and World War II which destroyed more capable countries and peoples. America became a superpower because of the self-destruction of other countries. Despite neocon denials that their hubris has created a powerful alliance against the US, a professor at the US Navy War College stresses the reality of the Russian-Chinese strategic alliance. Last August a joint Russian-Chinese sea and air exercise took place in the Sea of Japan, making it clear to America’s Japanese vassal that it was defenceless if Russia and China so decided. The Russian defense minister Sergey Shoigu said that the joint exercise illustrates the partnership between the two powers and its stabilizing effect on that part of the world. Chinese Foreign Minister Wang Yi said that Russian-Chinese relations are able to resist any international crises. The only achievements of the American neoconservatives are to destroy in war crimes millions of peoples in eight countries and to send the remnant populations fleeing into Europe as refugees, thus undermining the American puppet governments there, and to set back the chances of world peace and American leadership by creating a powerful strategic alliance between Russia and China. This boils down to extraordinary failure. It is time to hold the neoconservatives accountable, not elect another puppet for them to manipulate. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Closed up 4.42% at 16.97 Posted: 19 Apr 2016 06:25 PM PDT

Stopped scratching my scalp about what silver and gold prices will do & just dropped my jaw all the way to the counter when I looked at markets this morning early: Silver over 1700¢. I put down my phone and grabbed something out of the icebox. Durn! I thought, that looked like 1704¢. That can't be right. Oh, yes, it was right, and gold was up over $22. As of today, silver has climbed 23.2% since 2016 began, and gold has risen 18.2%. Now I'm just a durned ol nat'ral born fool from Tennessee, but when I look at the Dow up 3.6% for the year, and the S&P500 up 2.8%, & the Nasdaq Comp down 1.3%, why, it almost looks to me like silver & gold have been a better investment than stocks. Y'all have pity on a fool: tell me what I'm missing. Before I leave this topic, look at what the gold stock indices have done since 31 Dec 2015: GDX, + 69.5%; GDXJ, + 82.3%; XAU, + 83.2%; HUI, + 86.4%. D'y'all ever see those silent movies where the villain ties the heroine to the railroad tracks while the train is jes' a-barreling down on her? Well, that pretty well pictures the US dollar index. It is that close to being run over, and it ain't getting up. Closed today at 94.03, down another 43 basis points or 46%. Folks is getting' mighty nervous about that 94 level. Last low was 93.62, & 92.50 ought to show some support, but below that it's a clear elevator shaft to 80. Rub is, the Dollar index broke out of that falling wedge, but bailed & failed at the 20 day moving average. Look, http://schrts.co/OkJ5UT A day or so of backing up after a breakout is tolerable, but three days, and sinking back below the breakout? Well, it just looks tacky. Betrays a want of breeding, white-trash shamelessness, not to mention puniness abounding. Euro rose 0.46% to $1.1364. Just proves that the world contains a whole PASSEL of bigger fools than me. Yen dropped 0.34% to 91.60. Stocks continue to levitate. Dow traced out a graph that looked like the Valley of Fatigue in that old mattress commercial, but never mind: friends stepped into a drowning market around noon and threw it a life preserver. Dow gained 49.44 (0.27% to 18,053.60. S&P500 added 6.46 (0.3%) to 2,100.80. Dow in Silver hath fallen off the cliff, bounced on the ledge, & fallen again. http://schrts.co/ohwLZP Today lost 45.6 oz (4.11%) to close at 1,063.73 oz. Behaving like greasy bathtub water when you pull the plug. Dow in Gold is tamer, down only 1.35% today to 14.39 oz. Just be patient. At today's Comex close silver was 71.9¢ [sic] or 4.4% higher. No, that ain't a bug on your phone screen, that a 7. Ended at 1696.8¢. Gold popped $19.40 or 1.6% for a $1,253.00 close. Don't y'all know, if this was clear and easy, everybody would do it, & we'd all be living on the French Riviera, sipping fine wine & smoking $40 seegars. But 'tain't never that clear. Take gold, for instance. http://schrts.co/pI1ZgR Today's rise earns respect, and busted through that $1,245 resistance like it was eggshells. However, it hath not exceeded the last ($1,264.70) high, let alone the March $1,287.80 high. With silver gone berserker today, well, gold looks a mite lazy. Slothful. Juberous ("dubious" to you northerners.) Its fundamental as keeping motor oil in a car engine that silver & gold ought not gainsay each other. Okay for a few days, but not long, hence gold must move. Listen to my words: silver has cleared its downtrend line from the April 2011 high. Broken out. Jumped 4.4% in one day so y'all couldn't miss it. Looky here, http://schrts.co/pI1ZgR Whoa! Don't miss that surging volume. Can this go on? It ought to reach 1764¢ at least, and before it's all done, 1875¢. I feel crazy saying it, crazier still looking at that overbought MACD, Stochastic, RSI. But when anything breaks out of a channel upward, you can pretty well flip the channel over for a target. In other words, if the channel is 140¢ high, you can add that to the breakout point, and 1625¢ + 140¢ = 1765¢. But all that overbought-ness means y'all have to keep looking around for a quick, sharp correction. I feel like an economist now, cause I am about to say, "On the other hand." OTOH, overbought can get overboughter, and in bull markets surprises come to the Upside. That Gold/Silver ratio chart bumfuzzles me, too. Look, http://schrts.co/rGnpnj First of all, the ratio was trading in an uptrending channel (green lines). It had already walked through its uptrend from the April 2011 low back last August. Even if you adjust that uptrend line, the ratio has still broken down. Next it formed an even-sided triangle, and collapsed. With gaps, that now look like runaway gaps (but that could be slowing down after that second gap). Target from that triangle measures 72.50, give or take a hundredth. I can measure it another way -- I'm sorry, y'all forgive me, I just have to tell y'all even though I know y'all will laugh at me for a fool -- and get a 65.40 target. I'll be durned if it don't look like silver is running hotter than gold this year. Did anybody see that coming? Anybody swap gold for silver back when the ratio was 83 instead of today's 73.845? Naw, I ain't never heard sech a thang. Y'all, it's time to get down off that fence and BUY silver & gold. Not later, NOW. My brain must have taken a trip to the next county. Ty Bollinger is showing the 9 episodes of his documentary, "Cancer, the Quest for the Cure." Tonight Episode 8 shows at this link at 9:00 p.m. Eastern time. I meant to tell y'all. Everybody ought to watch this -- everybody. I watched all nine episodes by myself, but Susan and my son Zachariah & his wife literally spent an entire Saturday watching it, and when I got home at 6:30 were just opening episode 9. Every single one of you ought to watch this, and buy the whole series like Susan and I did. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Launches Yuan Gold Fix To "Exert More Control Over Price Of Gold" Posted: 19 Apr 2016 06:05 PM PDT Overnight a historic event took place when China, the world's top gold consumer, launched a yuan-denominated gold benchmark as had been previewed here previously, in what Reuters dubbed "an ambitious step to exert more control over the pricing of the metal and boost its influence in the global bullion market." Considering the now officially-confirmed rigging of the gold and silver fix courtesy of last week's Deutsche Bank settlement, this is hardly bad news and may finally lead to some rigging cartel and central bank-free price discovery. Or it may not, because China would enjoy nothing more than continuing to accumulate gold at lower prices. The first Chinese benchmark price, derived from a 1 kg-contract traded by 18 participants on the Shanghai Gold Exchange (SGE), was set at 256.92 yuan ($39.69) per gram on Tuesday, equivalent to $1,234.50/ounce. China's gold benchmark is the culmination of efforts by China over the last few years to reform its domestic gold market in a bid to have a bigger say in the bullion industry, long dominated by London where the global spot benchmark price is currently set. As is well known, as the world's top producer, importer and consumer of gold, China has balked at having to depend on a dollar price in international transactions, and believes its market weight should entitle it to set the price of gold. The new benchmark may not be an immediate threat to London, but industry players say over time China could set the price of the metal, especially if the yuan become fully convertible. Cited by Reuters, Pan Gongsheng, deputy governor of the People's Bank of China which has been disclosing gold purchases every month since last summer, said that "the Shanghai gold benchmark will provide a fair and tradable yuan-denominated gold fix price ... will help improve yuan pricing mechanism and promote internationalization of the Chinese gold market." The mechanics of the Shanghai fix are comparable to those of London: the benchmark price will be set twice a day based on a few minutes of trading in each session. The London benchmark, quoted in dollars per ounce, is set via a twice-daily auction on an electronic platform with 12 participants. The 18 trading members in the yuan price-setting process includes China's big four state-owned banks, foreign banks Standard Chartered and ANZ, the world's top jewelry retailer Chow Tai Fook and two of China's top gold miners. When discussing the Chinese gold fix previously, World Gold Council CEO Aram Shishmanian said that "it is a stepping stone to a new multi-axis trading market consisting of London, New York and Shanghai and signals the continuing shift in demand from West to East." "As the market expands to reflect the growing interest in gold by Chinese consumers, so too will China's influence increase on the global gold market." It may already be working: according to Reuters, one reason for today's spike in silver is due to "heavy buying of silver in Shanghai, and that has triggered buying in gold as well," said Ronald Leung, chief dealer at Lee Cheong Gold Dealers in Hong Kong. Finally, when Chinese capital capital flight into Canadian real estate and offshore tax havens is curbed, we expected that gold could well follow the path of bitcoin, which has doubled since our article presenting it as an attractive alternative to avoiding Chinese capital controls. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver JUMP – China Yuan Gold Fix Posted: 19 Apr 2016 06:00 PM PDT from Junius Maltby: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Swimming Naked" - Chinese Corporate Bond Market Worst Since 2003 Posted: 19 Apr 2016 06:00 PM PDT A week ago we highlight the "last bubble standing" was finally bursting, and as China's corporate bond bubble deflates rapidly, it appears investors are catching on to the contagion possibilities this may involve as one analyst warns "the cost has built up in the form of corporate credit risks and bank risks for the whole economy." As Bloomberg reports, local issuers have canceled 61.9 billion yuan ($9.6 billion) of bond sales in April alone, and Standard & Poor’s is cutting its assessment of Chinese firms at a pace unseen since 2003. Simply put, the unprecedented boom in China’s $3 trillion corporate bond market is starting to unravel. As Bloomberg notes, China’s leaders face a difficult balancing act.

However, as we pointed out previously, economic figures for March reveal a growing dependence on debt. China’s aggregate financing -- a broad measure of credit that includes corporate bonds - grew by over $1 trillion in Q1...

And yet even that wasn’t enough to save the seven Chinese companies that reneged on bond obligations this year. Three of those were part-owned by China’s government, seen not long ago as a provider of implicit guarantees for bondholders. The reaction has been swift in China’s 18.8 trillion yuan corporate bond market (a figure that excludes certificates of deposit). The extra yield investors demand to hold seven-year onshore corporate bonds with top ratings over similar-maturity government notes has jumped by 28 basis points from an almost nine-year low in January, to 91 basis points as of Monday.

At least 64 Chinese firms have postponed or scrapped planned note sales this month, six times more than the same period a year earlier.

While bond yields in China are still well below historical averages, a sustained increase in borrowing costs could threaten an economy that’s more reliant on cheap credit than ever before. The numbers suggest more pain ahead:

As Qiu Xinhong, a Shenzhen-based money manager at First State Cinda Fund Management Co. said...

We leave it to Xia Le to conclude,

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Karen Hudes -- Network of Global Corporate Control 4 19 Posted: 19 Apr 2016 05:38 PM PDT The Spring Meetings of the World Bank and IMF April 15-17 and the Power Transition Model from the US Department of Defense. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

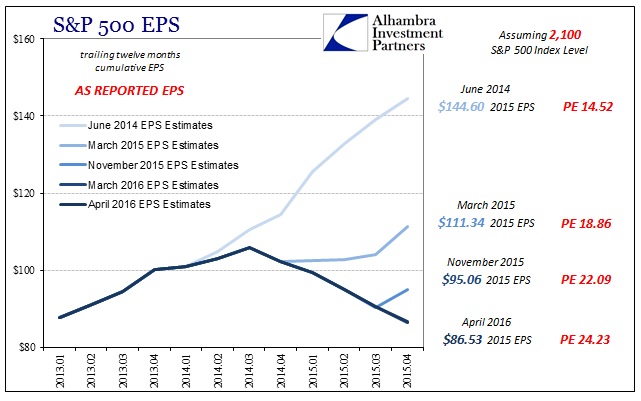

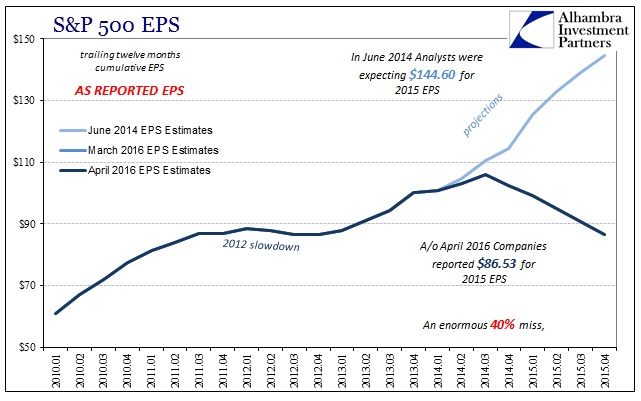

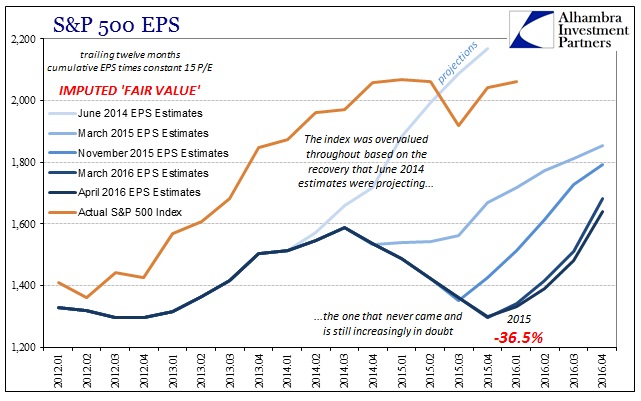

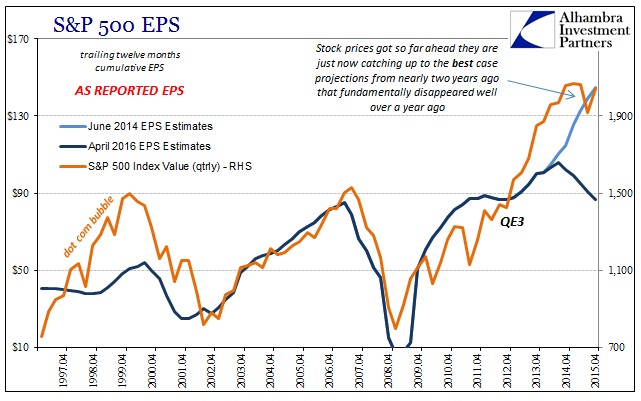

| Stocks Are In "A Far More Precarious State Than Was Ever Truly Believed Possible" Posted: 19 Apr 2016 05:30 PM PDT Submitted by Jeffrey Snider via Alhambra Investment Partners, As the major stock indices overtake or threaten psychological round numbers again (S&P 500 2,100; DJIA 18,000), they have done so with the same problem as occurred in 2015. Stocks have been overvalued for some time in historical comparison especially after QE3 and QE4, but it was supposed to be in anticipation of the full recovery that QE would make. For the longest time, that narrative actually seemed plausible at least in earnings. In June 2014, analysts estimated that total as-reported earnings for the calendar year of 2015 would close out around $144 per share. At an index level of 2,100, it would represent a seemingly low valuation multiple of 14.5 (low because, we were told, low discounting from historically low interest rates, favorable fixed income comparisons, and then high expected growth especially in areas like tech and consumer-related industries). Analysts’ estimates are always overly optimistic and have the hardened habit of being lowered as each particular quarter draws closer, but what happened with 2015 was something else entirely. Instead of $144 per share, 2015 ttm EPS for the index is going to be about $86.50. Rather than leave stock investors assured in their valuations, it meant the S&P 500 was trading around 24 times actual EPS. Worse, than that, the downdraft in earnings wasn’t apparent to analysts until it actually happened (believing in “transitory” as they did) and companies reported.

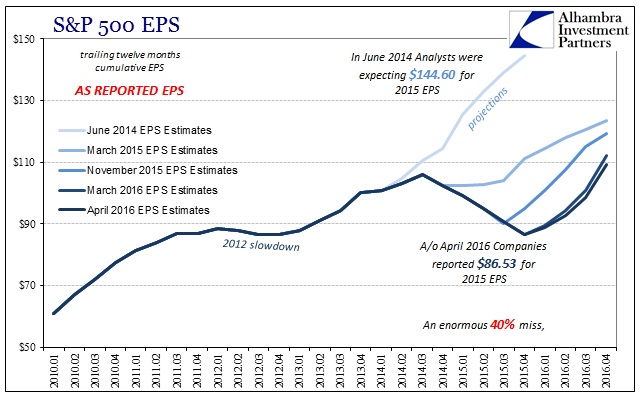

As late as March 2015, analysts had been mugged by the events of late 2014 and the first parts of last year but were still predicting that earnings would grow by about 9% for the full year, including a return to “normal” growth by Q4. Even in November 2015, though the downtrend had been established in almost perfect uniformity, analysts were still expecting Q4 and then Q1 2016 to start a very strong turnaround. From that perspective you can understand why stock investors suddenly became more than a little nervous where only certainty and confidence had existed. On the whole, it was figured that the economy would provide a solid if not historically so valuation floor for stocks that would be pushed up relentlessly by the recovery that economists and the FOMC were describing all the way into the middle of 2015 – only to find by the end of the year that the stock market may have been overvalued by as much as 40% to actual earnings (assuming a multiple of 15 represents “fair value”). As optimism returns again, all that nasty business and “unexpected” uncertainty is being left behind as nothing more than scholarly conjecture suitable only for historians; 2016 is again on the march, or so it might seem. The surge in stocks during this “dollar” interregnum seems to be (outside of raw momentum and risk chasing) resurrecting the same assumptions as early 2015. “Transitory” has regained form only refashioned from a few months deviation to more than a year – but still to the same effect with only a delay in reaching the long-promised recovery.

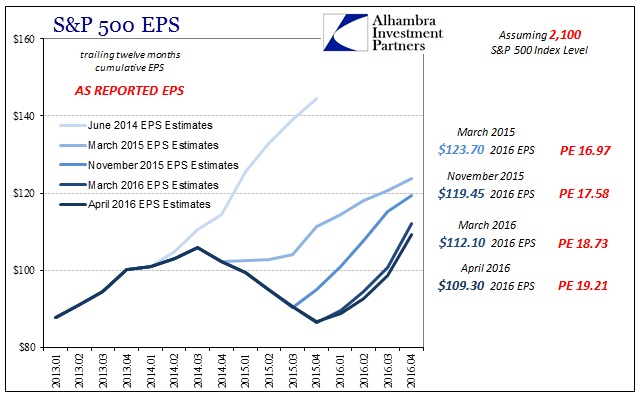

Reality still intrudes, however, on two fronts. Despite analysts’ renewed faith (which sets aside all doubts that should have been their working guesses this whole time) in where earnings will fly in 2016 that still doesn’t recreate the recovery that was once the hardened baseline for projections. The current ttm EPS for 2016 is not even $110 whereas last year was supposed to be $144. It is a huge disappointment even though in relative circumstances $110 is better than $86 – and that is where the focus has returned though it should remain on the recovery’s now nearing permanent disappointment (and thus overvaluation). The second problem is the familiar downgrade which is already severe, more so than “usual” (though less, so far, than 2015). In other words, $110 may be better than $86 but a year ago it was thought to be $124. The difference in valuation is again quite striking.

A forward PE using March 2015 estimates would have been somewhat expensive at about 17 times earnings but is already now more than 19 even as EPS continues to fall. Over just the last month (March to April), 2016 ttm EPS has dropped by almost $3 which again suggests that when all is completed this year a multiple of 19 will be almost certainly the best and least likely case. That would mean the assumed valuation floor is far lower for a second consecutive year, and we still have no idea just how low it may yet reach.

Where the S&P 500 may have been overvalued by perhaps 40% or more based on actual, as-reported 2015 EPS, the current annual EPS estimates suggest only a return to the 1,600 range not 2,100 or better (for the full year 2016 EPS; current estimates still plug “fair value” as something like 1,330 on the index meaning it will take a surge in earnings growth later this year just to get “fair value” back to 1,600!). As you can plainly observe above, had the 2014 version of recovery worked out the actual trajectory of the index would have been at “fair value” (though in this counterfactual it is very likely that the index and all stocks would have kept going up and up rather than sideways to lower these past nearly two years now) or close to it. Instead, the “transitory” weakness in 2015 has opened a gulf that only entrenches the high degree of overvaluation even under scenarios where 2016 isn’t so bad. That would leave stocks especially vulnerable to any further swings in sentiment as the assumed valuation “floor” quite “unexpectedly” remains quite distant. While momentum and risk chasing take about pushing the various indices in the near term, longer term (actual) investors will be forced to reckon with this huge disparity – that prices surged after QE4 in anticipation of the recovery happening and justifying what would have been only temporary overvaluation due to the giddiness of actual discounting. The fact that earnings are now nowhere near vindicating those expectations is a fundamentally different proposition altogether, including that QE was itself a lie. I believe it is this incongruence that explains the very curious and conspicuous sideways behavior in stocks as remnants of the old QE-driven hopes remain but are no longer in such unison or enjoy such widespread support. Doubt is the operative condition now, though especially variable in its short run expressions. It is in shorter supply today but that is no more the case than November 3 when the S&P last closed above 2,100 (just days before more “unexpected” hit) or even August 17 with the S&P 500 at 2,102 and already a week past the great Chinese warning of the intensified “dollar” run and only a week before the mini-crash of August 24 that run fulfilled.

Even if the events of 2015 and early 2016 turn out to be the end of it, it still means that full recovery in earnings and the real economy has been pushed several years farther into the future – a far more precarious state than was believed to ever be truly possible. To figure, then, that there is now much, much more than a trivial chance of still more disruption and contraction does not mix well with such durable overvaluation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Precious Metal Rally On Track Posted: 19 Apr 2016 04:20 PM PDT from GoldSeek: So it was the biggest bounce in stocks since 1933, and best quarter for gold since the 70's. None of this should surprise you based on what's going on out there (think all forms of debasement), but for us the most important observation is gold has signaled it's ready to start its next leg higher. Silver should still have you wondering, which is of course what the establishment wants. When you see silver go through $20 though, it will run to $50 quickly. And if it makes it through $50, which means bullion buyers will have to chew through JPMorgan's (the government's) entire hoard (if it exists), it will be at $400 quickly as well, matching the bull move of the 70's coming out of its mid-cycle correction. We expect to see these trajectories in the 2021 area, a Fibonacci 21-years from the year 2000 turn.

Just to be clear then, what we got in the first quarter was a buy signal in gold, the shares, and key ratios; highly suggestive the bull market is back on. All we need is for silver to join the party in this regard, and we are off to the races. Further to this, and unfortunately for everybody, it appears this buy signal is not a result of political instability, or the threat of war, or any other result of the general state of debasement the 'powers that be' subject us to, but the result of anticipated currency debasement, the old standard. That's the only conclusion one can to given the pictures (charts) below. That's what we are going to do this week – go through these six charts because they confirm this thinking. The delayed positive reaction in the equity complex to Yellen's comments Tuesday was the tell, boosted by the insanity over at the ECB as well. Yup – the ECB is talking 'QE for the people' with the economy grinding to a halt, and the Fed won't be too far behind is the message we got from gold in the first quarter – even if we are only in the first inning of the move. And the thing is, we are getting confirmation of this thinking in the charts, where for example, the S&P 500 (SPX) has turned bullish on all accounts, even the monthly plot with a higher high finish in March. (see below) What's more, and as can be seen on the monthly plot below, although RSI will most likely generate a negative divergence in the indicators set against new highs (now likely), the message is still bearish, a 'topping process' if you will – even if the SPX is able to surge to the Fibonacci resonance related target in the proximity of 2450. Such an outcome would shock a great many traders, finally curbing their desires to hedge every advance in stocks. (See Figure 1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Patrick Donnelly – First Mining Finance on the Move Posted: 19 Apr 2016 03:00 PM PDT from Financial Survival Network:

We spoke with Patrick Donnelly, our partner's president recently. We've been following First Mining Finance (TSX.V FF). They were listed just over a year ago and have already done 5 acquisitions with more on the way. Currently, they have over 9 million ounces of gold in the ground and are looking to close out 2016 with over 15 million. The goal is to find strategic partners to actually develop the mines and handle the extraction process. So far things are looking good, the strategy is working and the stock price has increased of late. With Keith Neumeyer, Patrick and the rest of the team, this is a rare company that is actually shareholder-centric. Their goal is simple, build another billion dollar company, and do it fast while the window of opportunity is still open. Click HERE To Listen | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eric Hunsader to Chris Martenson: Market rigging is getting worse Posted: 19 Apr 2016 02:57 PM PDT 5:58p ET Tuesday, April 19, 2016 Dear Friend of GATA and Gold: Eric Scott Hunsader, founder of the market data firm Nanex in Winnetka, Illinois, and the scourge of market manipulation in the United States, including gold market manipulation, is interviewed by Peak Prosperity's Chris Martenson and describes how market rigging is worse than you think. The interview, headlined "Eric Hunsader: The Financial System is 'Absolutely, Positively Rigged,' and the Abuses are Getting Worse, Not Better," is available as both audio and a transcript at Peak Prosperity here: http://www.peakprosperity.com/podcast/97873/eric-hunsader-financial-syst... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Apr 2016 02:45 PM PDT by Bill Holter, JS Mineset, SGT Report:

Much has happened over the last couple of weeks and a lot of it has to do with “truth” being exposed. The “markets” are no different. China in my opinion is simply trying to aid in markets determining prices of gold and silver. Last Friday we got horrifying (from a contrarian standpoint) COT numbers with nearly record numbers for commercial shorts. With history as any guide, gold and silver should have already been slaughtered, they have not been.

In fact, we now have silver and gold at nearly one year highs and mining equities exploding. Yesterday saw a dozen or more juniors up 25%++ for the day! As I have maintained, I believe today’s action will become more frequent with the Shanghai physical demand pushing prices higher. I believe they lit the first candle of truth today, other candles will follow until the light switch gets flipped on. COMEX/LBMA will either go along in price or they will be arbitraged completely out of inventory. As I wrote several weeks back, “what good is a contract that cannot perform”? It is very possible China will let this “stew” for a while and allow the markets time to adjust to real and free pricing …only then do I see China coming out with a gold backed yuan. If they were to do that today, it would be a declaration of war on the U.S. hegemon, if they wait, they can have cover and say “hey, it was global free markets that pushed gold out of sight”. As mentioned above, commercials are very short gold and silver now, they have lost $billions just today. Maybe they continue to throw paper at gold and silver, Shanghai ain’t buyin’ it! No matter what the apologists say, COMEX can and will default when they can no longer deliver metal. They say “cash settlement” is not a default …who are they kidding? This is the rally you never sell …until you are offered a different “paper” (one that is backed by something, anything) that can be trusted. China may be making this offer in the near future! Standing watch, Bill Holter | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Shines as Goldman Sachs Dims Posted: 19 Apr 2016 02:44 PM PDT from Peter Schiff: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent A Bold Warning Financial Meltdown Eminent Posted: 19 Apr 2016 02:30 PM PDT The governments' need to inflate its way out of the debt hole it's sinking deeper into every day is just another driver of the change to come. Harry S. Dent Harry S. Dent Jr. The Great Depression Ahead Harry S. Dent, Jr. is the Founder and President of the H. S. Dent Foundation, whose... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Did Fed Chairman Yellen Tell Obama? Posted: 19 Apr 2016 01:47 PM PDT This post What Did Fed Chairman Yellen Tell Obama? appeared first on Daily Reckoning. This week, President Obama and Vice President Biden held a hastily arranged secret meeting with Federal Reserve Chairman Janet Yellen. According to the one paragraph statement released by the White House following the meeting, Yellen, Obama, and Biden simply "exchanged notes" about the economy and the progress of financial reform. Because the meeting was held behind closed doors, the American people have no way of knowing what else the three might have discussed. Yellen's secret meeting at the White House followed an emergency secret Federal Reserve Board meeting. The Fed then held another secret meeting to discuss bank reform. These secret meetings come on the heels of the Federal Reserve Bank of Atlanta's estimate that first quarter GDP growth was .01 percent, dangerously close to the official definition of recession. Thus the real reason for all these secret meetings could be a panic that the Fed's eight year explosion of money creation has not just failed to revive the economy, but is about to cause another major market meltdown. Establishment politicians and economists find the Fed's failures puzzling. According to the Keynesian paradigm that still dominates the thinking of most policymakers, the Fed's money creation should have produced such robust growth that today the Fed would be raising interest rates to prevent the economy from "overheating." The Fed's response to its failures is to find new ways to pump money into the economy. Hence the Fed is actually considering implementing "negative interest rates." Negative interest rates are a hidden tax on savings. Negative interest rates may create the short-term illusion of growth, but, by discouraging savings, they will cause tremendous long-term economic damage. Even as Yellen admits that the Fed “has not taken negative interest rates off the table,” she and other Fed officials are still promising to raise rates this year. The Federal Reserve needs to promise future rate increases in order to stop nervous investors from fleeing US markets and challenging the dollar's reserve currency status. The Fed can only keep the wolves at bay with promises of future rate increases for so long before its polices cause a major dollar crisis. However, raising rates could also cause major economic problems. Higher interest rates will hurt the millions of Americans struggling with student loan, credit card, and other forms of debt. Already over 40 percent of Americans who owe student loan debt are defaulting on their payments. If Federal Reserve policies increase the burden of student loan debt, the number of defaults will dramatically increase leading to a bursting of the student loan bubble. By increasing the federal government’s cost of borrowing, an interest rate increase will also make it harder for the federal government to manage its debt. Increased costs of debt financing will place increased burden on the American people and could be the last straw that finally pushes the federal government into a Greek-style financial crisis. The no-win situation the Fed finds itself in is a sign that we are reaching the inevitable collapse of the fiat currency system. Unless immediate steps are taken to manage the transition, this collapse could usher in an economic catastrophe dwarfing the Great Depression. Therefore, those of us who know the truth must redouble our efforts to spread the ideas of liberty. If we are successful we may be able to force Congress to properly manage the transition by cutting spending in all areas and auditing, then ending, the Federal Reserve. We may also be able to ensure the current crisis ends not just the Fed but the entire welfare-warfare state. Regards, Ron Paul P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post What Did Fed Chairman Yellen Tell Obama? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pushing Desperate Measures Too Far Posted: 19 Apr 2016 01:30 PM PDT This post Pushing Desperate Measures Too Far appeared first on Daily Reckoning. Another unsettled week for global markets. Japan's Nikkei equities index rallied 6.5%. Italian bank stocks surged 10%, with the Europe STOXX 600 Bank Index up 8.1%. Germany's DAX equities index rallied 4.5%, with Spanish stocks up 5.0% and Italian 4.3%. Hong Kong’s Hang Seng Financials index surged 5.9%. The EM market rally continued. U.S. bank stocks jumped 7.0%. A Friday evening Bloomberg headline: "Rough Week for Shorts as Banks Send S&P 500 to Four-Month High." Recalling back to 2008, U.S. financial stocks surged 10% in a single session. Reminiscent of 2008 market dynamics, global bonds aren't much buying into the equities market "risk on." Japanese 10-year (JGB) yields fell three bps (to negative 13bps), and German yields increased only four bps (to 13bps). Ten-year Treasury yields rose four bps, taking back only two-thirds of last week's decline. European periphery spreads tightened only marginally. Policy-induced short squeezes do tend to take on lives of their own. This one's no exception. The basic premise is that years of central bank monetary inflation and market manipulation have nurtured a "global pool of speculative finance" of incredible dimensions. The unstable dynamic of "too much 'money' chasing too few real opportunities" – along with the associated "Crowded Trade" phenomenon – has made it extraordinarily difficult for active managers to compete with the indices. And as "money" continues to gravitate to passive bets on the major indices, the markets' dysfunctional trend-following/performance-chasing dynamic becomes only more deeply entrenched (and detached from fundamentals). When markets lurch higher, irrepressible forces begin pulling everyone in. Recall back to the tumultuous January and early February period. Global "Risk Off" was in control. Crude traded down to about $27 a barrel. Global equities were under intense pressure, led lower by commodity producers and financial stocks. EM currencies were under liquidation. Chinese stocks were in free-fall, trading at about half the level of summer highs. The Chinese currency was under pressure, with unprecedented quantities of "money" fleeing the bursting Chinese Bubble. The prevailing bullish view from December was that the U.S. economy was on solid footing, allowing the Fed to finally move forward with rate normalization. The European recovery had gained self-sustaining momentum. In Japan, yen devaluation had successfully boosted corporate profits and stock prices, positioning the economy for decent growth. The world was looking at China through rose-colored glasses, believing Chinese officials were adeptly orchestrating the mythological "soft-landing." At the same time, a compelling argument could be made that an ongoing Chinese boom was all that was holding a global deflationary spiral at bay. A Chinese hard landing would dictate major revisions to large numbers of market and growth assumptions around the globe. Keep in mind that Chinese system Credit ("total social financing") surged 12.4% in 2015, or almost $2.4 TN – a massive amount of Credit still insufficient to levitate global energy and commodity prices. The hard landing scenario – appearing increasingly probable back in January and February – would potentially see a significant slowing, or even halt, to the Chinese Credit boom. It's worth recalling that total U.S. mortgage Credit expanded $1.4 TN in 2006, dropped to $95 billion in 2008 and then contracted $290 billion in 2009. After expanding 10.9% in 1988, U.S. corporate Credit contracted 2.1% in 1991. U.S. corporate Credit expanded about double-digits in both 1998 and 1999, with growth slowing to 3.2% in 2001 and then flat-lining in 2002 and 2003. More dramatically, 2007 saw 11.5% U.S. corporate Credit growth, which turned to a 5.2% contraction in 2009. Have Chinese officials actually convinced themselves that they've repealed the Credit Cycle? Examining further back in U.S. Bubble history, the nineties began with 1990's $688 billion U.S. Non-Financial Debt (NFD). Credit issues (burst late-80s Bubble) and recession saw NFD growth slow to $527 billion (2/3 govt. borrowings) in 1991. The nineties Credit boom gained momentum throughout the decade, with over $1.0 TN of NFD growth in boom-years 1998 and 1999 (NFD growth averaged $770 billion annually throughout the nineties). NFD growth slowed to $884 billion in 2000, before resuming its rapid ascent. NFD growth was up to $1.695 TN by 2003, then surpassed $2.0 TN annually in Bubble years 2004 through 2007. Credit crisis saw NFD growth collapse to $829 billion in 2009, with an outright contraction of private-sector debt offset by massive Treasury borrowings. U.S. data help put the spectacular Chinese Credit boom into clearer perspective. And when it comes to Credit Bubbles, there can be a fine line between burst and boom climax. Rather than the bust that appeared likely in 2016's initial weeks, the first quarter witnessed record Chinese Credit expansion. Friday data showed Chinese March total social financing jumping $360 billion (led by a surge in bank lending). This was somewhat less than January's incredible $520 billion expansion, though it did push Q1 Credit growth above $1.0 TN (historic). Not long ago Chinese officials had set their sights on reining in rampant Credit growth. Having clearly reversed course, Credit expanded during the quarter at a blistering almost 20%. This compares to its recent official target of 13% and China's GDP target of 6.5-7.0%. In such a circumstance, what is the prognosis for Chinese currency stability? Uncharted Territory. With markets in a tailspin and "money" fleeing China, reasonable analysis back in January might have anticipated Chinese 2016 Credit slowing to, say, $1.5 TN. It will instead likely double this amount. When one is pondering the unstable 2016's market backdrop, it's helpful to think in terms of China as the marginal source of global Credit. The immediate good news for equities and commodities is that Chinese central planning still holds astounding sway over the nation's lending and investing. The ongoing good news for global bonds is that this historic experiment in state-directed Credit and economic management is in peril. The extremely bad news for China – as well as global markets and economy – is that $3.0 TN of unsound Credit at this very late stage of the Credit cycle ensures an even more destabilizing bust. It must be tempting for the believers to again revel in the brute power of the "perpetual money machine." Yet the costs associated with the latest round of monetary inflation are steep. Not many months ago it appeared that China was determined to rein in excess, while the U.S. was ready to lead the world toward policy normalization. Today it's become rather obvious that China is out of control and global policymakers are trapped at near zero or negative rates and perpetual QE monetary inflation. What was always sold as temporary extraordinary measures is increasingly recognized as desperate "whatever it takes" indefinitely. To reverse a rapidly strengthening de-risking/de-leveraging dynamic central bankers were compelled to convey to the markets that they were still very much in control with virtually limitless ammunition. Rates could go deeply negative. QE would expand as big as necessary. And, for emphasis, if required central banks still had "helicopter money" – printing 'money' and disseminating it directly to consumers – waiting in the wings. They pushed Desperate Measures Too Far this time. April 12 – Reuters (Gernot Heller and Paul Carrel): "The European Central Bank’s record low interest rates are causing 'extraordinary problems' for German banks and pensioners and risk undermining voters’ support for European integration, Finance Minister Wolfgang Schaeuble told Reuters… Politicians from Chancellor Angela Merkel conservative camp, to which the finance minister belongs, have complained the ECB’s ultra-low rates are creating a 'gaping hole' in savers’ finances and pensioners’ retirement plans as returns have dropped. Schaeuble suggested they risked fuelling the rise of euroscepticism in Germany, where voters flocked to the right-wing Alternative for Germany in state elections last month. 'It is undisputable that the policy of low interest rates is causing extraordinary problems for the banks and the whole financial sector in Germany… That also applies for retirement provisions.' 'That is why I always point out that this does not necessarily strengthen citizens’ readiness to trust in European integration,' he added… A storm of protest erupted in thrifty Germany after ECB President Mario Draghi last month described the idea of so-called helicopter money – sending money directly to citizens – as a 'very interesting', if unexamined, concept." April 10 – Reuters (Michelle Martin): "A chorus of conservative German politicians have criticised the European Central Bank for its interest rate policy, which they say is hitting the retirement provisions of ordinary Germans, could lead to asset bubbles and even boost the right-wing. German Finance Minister Wolfgang Schaeuble partly blamed the ECB’s policy for the success of the right-wing Alternative for Germany (AfD) in recent regional elections, which saw it take up to a quarter of votes in a setback to Schaeuble’s conservatives… The newspaper quoted Schaeuble as saying he had told ECB President Mario Draghi: 'Be very proud: You can attribute 50% of the results of a party that seems to be new and successful in Germany to the design of this [monetary] policy.'" April 14 – CNBC (Matthew J. Belvedere): "BlackRock chief Larry Fink said… that negative and low interest rates around the world are crushing savers, and those policies are 'going to become the biggest crisis globally.' …Fink called on political leaders to step in and provide fiscal reform to complement monetary policy. 'We have become too dependent on central bankers' to boost the global economies, he said, stressing easy money policies were supposed to be a temporary healing. 'I don’t call seven, eight years temporary… I don't see how that [still] has a positive impact.' 'Over 70% of our clients are retirement plans and insurance plans. Our clients are in pain… Our clients are very worried how they're going to be meet their liabilities' because the yields are so low in the bond market.'" April 14 – Bloomberg (Finbarr Flynn and Gareth Allan): "The top executive of Japan's biggest bank delivered a rare criticism of the central bank, saying its negative interest-rate policy has contributed to anxiety among households and companies and prolonging it may weaken financial institutions. 'Both households and businesses have become skeptical about the effectiveness of policy measures to address the current economic problems,' Nobuyuki Hirano, president of Mitsubishi UFJ Financial Group Inc., said… Hirano said there's 'no guarantee' that negative rates will encourage companies to increase capital spending because low borrowing costs and deflation have been 'business as usual for over a decade.'" Albeit the Germans, Japanese bankers, pension fund managers or even the general public, it's been a frustratingly long wait for policy normalization. And just when hope was running high, the rug was pulled right out from under. Around the world many had patiently accepted the favoritism and inequity of reflationary measures. But what was supposed to be extraordinary and temporary morphed into the normal and permanent: egregious wealth redistribution. The course of global monetary policy increasingly lacks credibility. Patience has worn thin. Frustration and anger are being brought to the boil. Sure, global markets have gained momentum. But I actually think "whatever it takes" central banking has about run its course, with momentous ramifications for global market Bubbles. Reminiscent of how I felt in 2008, global markets would be a lot better off had they taken their medicine earlier. Regards, Doug Noland P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Pushing Desperate Measures Too Far appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock and Precious Metal Charts At the End of Day - Silver Cup and Handle Posted: 19 Apr 2016 01:29 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Tearful Farewell at the Ranch Posted: 19 Apr 2016 01:05 PM PDT This post A Tearful Farewell at the Ranch appeared first on Daily Reckoning. GUALFIN, Argentina – When we checked yesterday, the Dow was moving up toward 18,000. Meanwhile, U.S. corporate earnings were sliding. North American shipping volumes were falling. China was borrowing at 10 times the U.S. rate… and its economy was still slowing. Japan was in cuckoo land. And the IMF was joining it, calling for more negative interest rates. And one luxury condo development in the U.S. is giving buyers a free membership in a private-jet chartering club. Bloomberg has the story:

Deals, deals, deals… Old HabitsAnd here in Argentina, word comes from a local contact in Salta that a nearby farm is for sale… "The owner is desperate," says our lawyer. "It's about 25,000 acres. You could probably get it for about $40 an acre." "What?" we replied indignantly. "We paid only $4 an acre for our ranch." "Yes… but your ranch is mostly wasteland." He has a point. But the neighboring ranch is mostly wasteland, too. (To illustrate what a great investment ranches can be, the owner bought it 10 years ago for $80 an acre – twice what he's asking for it today.) On Saturday, our old ranch manager, Jorge, came back to the ranch for his retirement party. He retired in January. But we were away and couldn't mark the event until this past weekend. As luck would have it, his new home down in the valley, near Salta Airport, is also near a farm where we sent the cattle we could no longer keep. We're having a drought up here in the mountains – in the last year, just 2.5 inches of rain fell. The grass has dried up. The cattle are getting thin. We sell them off as fast as we can… or ship them to our friend's farm… which just happens to be near Jorge's new home. Jorge goes over every day to check on his old friends, the cows. He keeps his horse at the farm, too. So, he saddles up and rides around to inspect the animals. He does this for his own amusement; the animals would be fine without him. But old habits are hard to break. For half a century, Jorge has been checking the herd on horseback. He doesn't seem eager to give it up. "For Many Years of Service…"Friends and family came to the retirement party – an asado (or Argentine barbecue) held on the veranda, for a group of about 40 people. .png) The two, about the same age, worked together for almost 40 years. They recalled what it was like when they started: "It was very different… much, much harder. We had about 3,000 head of cattle on the ranch [now we have only 700]. And they were pretty much ranging all over the mountains. "We had to round them up on foot because it is too rough up there for horses. But they were practically wild. They were dangerous. And hard to herd. Sometimes, if we couldn't get them under control, we just had to shoot them with a rifle. "But the worst was in the 1990s. You think this is a bad drought. So far, it's nothing. In the 1990s… I think it was 1995 and 1996… we had two years of drought back to back. With 8 mm [about one-third of an inch] one year and 12 mm [about half an inch] the next. "There wasn't much we could do. Everything was dying. The grass. The trees. Several of the families here packed up and moved out. Even up in the mountains, the little springs dried up, and the grass disappeared. Half the herd died. We had no way to transport them… and nowhere to send them even if we could. It was very sad." After eating several helpings of barbecued lamb and beef – along with salad and big white beans – your editor made a little speech, edited in advance by someone who speaks Spanish correctly. Then we presented Jorge with a silver platter. "For many years of service to the ranch and the people of Gualfin," we had engraved on it. Tears welled up in a few eyes; we weren't sure whether the occasion or our clumsy speech was to blame. A Real GentlemanWe've owned the ranch for 10 years. We told the group how Jorge and his wife, Maria, had always greeted us warmly and made us feel like friends and family, rather than foreigners. And how we would all miss them… We wanted to say more. Jorge is one of the most competent, dignified, and cheerful people we ever met. He has little education. He's had little contact with the world outside our farm. He's never been online. And only once, when he was in the army, did he fly on an airplane. But he is a real gentleman. There was a lot we could have said. But even after a decade, our Spanish is primitive and clunky. This was an occasion that called for careful words. Or maybe not. Maybe we didn't need any words at all. We gave Jorge the platter. He said a few words of thanks. And we hugged each other. (Later, privately, we gave Jorge another little gift… a few dead presidents to make his retirement more pleasant.) After the party was over, Jorge was quick to return to his old ways. "Don Bill, I'd like to ride out and see the cattle, if you don't mind." "Of course not… We'll saddle up a couple of horses. I'll go with you." Riding OutWe trotted down the long, wide entrance, then out between the stone walls to the campo afuera – the field outside. We took the familiar path through the gate and into the huge valley.  We rode down to the river. There was no water in it, just sand. A few birds scared up out of the bushes. The wind picked up. We continued toward the "pass" that leads to a neighboring ranch. The pass is, in fact, impassable, except on foot. In the decade we've been here, we've never ventured over to our neighbor's place. Part of the ranch is owned by a Swiss couple, who invited us to visit. This year, we hope to make it over. Finally, as we approached the pass, the ground turned green. There, the cattle scoured the ground for what was left of the grass. Here and there, a few pools of water remained. "The cows are in remarkably good shape," Jorge observed. "But you better get them out of here as soon as you can. They're losing weight. Try to get the calves and the old cows off the land. You need to save the young cows so you'll have more calves next year. "They'll be okay. We've got some hay stored. And we can buy more in Molinos [the nearby village]. They'll be alright if it doesn't get too bad this winter." We knew all this already. We'd already been over our strategy with the new ranch foreman, Gustavo. But it was good to have Jorge confirm it. No one knows the ranch, or the cattle, better than he does. We left the river bed. Your editor was mounted on an old horse, Regalito, who was a little hard to control. He always wants to run off. As we fought with Regalito, Jorge rode effortlessly up the side of the hill. We followed… making our way around the north side of the riverbed. In the distance, about a half hour away, we could see the sala – the ranch house – surrounded by the alamo trees and irrigated pastures. It was a beautiful sight, reminding us of what we were doing there. We wondered if Jorge now saw it differently. Now, he lives in a suburban area, with a few farms surrounded by houses. Cars drive up and down the road. People rush to get to work. Buses pass on the main road near his house. Airplanes fly overhead. "Our cattle seem to be happy down in the valley," Jorge volunteered. "They ought to be. There's plenty of grass for them. They must feel they have died and gone to heaven. "But it's a big change. The young ones adapt quickly. They start fattening up almost immediately. But the old ones find it harder to adapt. Some of them don't do so well. "That happens to people, too." Regards, Bill Bonner P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post A Tearful Farewell at the Ranch appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Confirmed, The Banking System Has Been Manipulating The Precious Metals Market Posted: 19 Apr 2016 12:00 PM PDT Initial jobless claims just so happened to fall to 43 year lows. While all other indicators show the opposite. Macy's will now take old clothing and give a gift card to purchase new clothing. Deutsche Bank admits it has been manipulating gold and silver. So now we see the banks have been... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Apr 2016 11:22 AM PDT Adam is someone who cares deeply about his country, so much so he weighs carefully the statements of the presidential candidates, selects one who seems most favorable to his views, and casts a vote for him or her on Election Day. Even if Adam is a small-government libertarian he will vote. He will vote because he believes government has a legitimate role in our lives. In that respect he's in the mainstream of political opinion. Would you consider Adam a responsible American? Most people would. Most people have the impression that government exists to protect and further our well-being. This is a democracy, the argument goes, and voters have the ultimate say in how it is run. Therefore it is their responsibility to do their part and vote for the captain who will steer the ship of state in the right direction. If Adam's candidate doesn't win, he lives with the consequences until the next election and tries again. And that's how this great country of ours evolves. Any questions? I see you have a few. Well, look, even if we've abandoned our founding principles we can still try to nudge the government back to its original purpose which as Jefferson wrote was to secure our inalienable and often-trampled rights. What's that? You say you don't hear any of the current candidates talking about founding principles? Except the LP candidate? Who won't win. So you vote for him, or perhaps you decide to risk a vote on a mainstream candidate who once dropped a hint or two about reigning in government. Either way, government continues its inexorable growth. It's not a warm feeling, is it -- voting. But the good news is, in spite of things such as the income tax, the perpetual shooting wars, the various social wars -- drugs and poverty in particular, the Fed-induced booms and busts, Obamacare, the spy agencies, the TSA, low or negative interest rates, the student loan disaster, bad public education, and other such horrors -- we get by. "Getting by" here means staying alive. Of course it's more than that. We have endless entertainment, highlighted this year by the presidential campaigns. We have smartphones. We have the Internet. We can play the lottery. We can heap insults on politicians and not be arrested. If we're innovative and ambitious we can start a company and possibly get rich. Maybe very rich. We can fall in love, get married, raise families, get a job, get a better job, write a novel, grow old and die with negligible government involvement. We have our lives and hanging over our heads we have the government, like storm clouds intruding on a weekend outing. Yet the clouds stay and grow darker year-round. If we can do so much in our private lives without government involvement, what is the argument for having any government at all? Why have we not adopted anarchy? Stefan Molyneux explores these and other questions in his book, Everyday Anarchy: The Freedom of Now. The statist, he says, looks at a problem and always sees a gun as the only solution – the force of the state, the brutality of law, violence and punishment. The anarchist – the endless entrepreneur of social organization – always looks at a problem and sees an opportunity for peaceful, innovative, charitable or profitable problem-solving. . . . if human beings are in general too irrational and selfish to work out the challenges of social organization in a productive and positive manner, then they are far too irrational and selfish to be given the monopolistic violence of state power, or vote for their leaders. There is a contradiction in the foundation of our social order, he asserts. Through the vote we assign to some people the authority to do what we have no moral right to do as individuals. Neither you nor I can delegate to another the authority to shoot a man in cold blood, unless we have a government badge. If I approach you with a gun and demand your money, I'm acting in a criminal manner. But if I work for the IRS I'm cleared. To the statist there is no contradiction. It's a matter of facing facts: Without a government, everyone would be at each other's throats, there would be no roads, the poor would be uneducated, the old and sick would die in the streets etc. etc. etc. If democracy represents the will of the people, and the people don't care about the poor, then democracy is a lie. But people generally do care about helping the poor. Why did we let government take this away from us and make a mess of it? Then there's war, which for the U. S. government brings countless benefits. War is expensive -- that's why we have the income tax. It's also one reason we have a government-blessed counterfeiter manufacturing dollars. Isn't it a coincidence both the 16th Amendment and the Federal Reserve Act became law just prior to war in Europe. Without the money to fund a war – and pay the soldiers, whether they are drafted or not – war is impossible. The actual violence of the battlefield is a mere effect of the threatened violence at home. I have read many books and articles on the root of war – whether it is nationalism, economic forces, faulty philosophical premises, class conflict and so on – none of which addressed the central issue, which is how war is paid for. If we have success in so many areas of our life where anarchy rules -- anarchy in the sense he refers to -- why are we so afraid of it in political matters? In the category of "causing deaths," a single government leader outranks all anarchists tens of thousands of times. . . . Even outside war, in the 20th century alone, more than 270 million people* were murdered by their governments. Compared to the few dozen murders committed by anarchists, it is hard to see how the fantasy of the "evil anarchist" could possibly be sustained when we compare the tiny pile of anarchist bodies to the virtual Everest of the dead heaped by governments in one century alone. Molyneux notes the consistent failure of political "solutions." Long ago American consumers were told "bigness" in business was a threat to their welfare, even as prices steadily declined. (To this day, of course, the Fed insists a little inflation -- rising prices -- is healthy and strives to create it.) A little later the U. S. president announced he was drafting the youth of the nation to fight a "war to end all wars." And the IRS and Fed were right there to help. A decade later came the Fed-created Crash, which the Hoover administration took as an invitation to meddle. Then we got New Deal meddling when FDR took over. Americans loved him. He threatened them with fines and imprisonment if they continued to use gold coins for money, which the intellectual high priests said was delaying recovery, but they still loved him. The "surprise" of Pearl Harbor gave him the excuse to draft men into the military, which solved his unemployment problem. Then we had the Cold War, Korea, the assassinations, Vietnam, Nixon's killing the last trace of the gold standard, the inflation of the 1970s, etc. Hence the reason governments insist on educating children. They want people saluting, not rebelling. Freedom without government is anarchy, and anarchy is bad, bad, bad. Molyneux offers a different perspective: The government does not expand its control because freedom does not work; freedom does not work because the government expands its control. Government -- the popular institution serving those it exploits, asking for your vote to keep it legitimate. * Molyneux's figure of 270 million is high. See Death by Government, Chapter 1, 20th Century Democide by R. J. Rummel, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Max Keiser on the Saudi role in 9/11 & 7/7 & MSM propaganda Posted: 19 Apr 2016 11:00 AM PDT Max Keiser is having a go at mainstrem media propaganda showing Saudis as beneficial to the economy while they 'are effecitvely claiming credit for 9/11 and 7/7'. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's gold fix is a step toward taking over the market, boosting price, Leeb says Posted: 19 Apr 2016 10:54 AM PDT 1:55p ET Tuesday, April 19, 2016 Dear Friend of GATA and Gold: Fund manager Stephen Leeb tells King World News today that China's new daily gold price fixing in yuan is a step toward that nation's taking over the gold market and driving the price up to maximize the value of all the metal that country has acquired surreptitiously. An excerpt from Leeb's interview is posted at KWN here: http://kingworldnews.com/chinas-new-gold-fix-first-step-in-moving-the-pr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||