Gold World News Flash |

- How to Prevent Hackers from Erasing Your Bank Account

- The Collapse Continues, US Companies Announced The Most 1Q Layoffs Since 2009

- April Fools in March

- Bill Fleckenstein: The Perils of Short Selling in a World Awash in Central Bank Liquidity

- Silver and Gold Prices Took a Mighty Hit Today

- Why Is Gold & Silver So Popular?

- The Next Big Problem: "Stagflation Is Starting To Show Across The Economy"

- Doug Casey Warns "We're Exiting The Eye Of The Giant Financial Hurricane"

- In The News Today

- April "Fools" In March

- Immigration Meltdown. What Will Sweden Be Like in 2025? Immigration destroying freedom and equality

- April Fools in March

- What Most Gold Bugs Don’t Understand

- Gold Daily and Silver Weekly Charts - April Fools' Day

- Gold Stocks Correcting Through Time Not Price

- CNBC Leaks Secret Yellen-Bernanke Phone Call…

- The Assassination of Donald Trump

- How nuclear threats would change the anti-terror approach in the U.S.

- Hard Profits from Soft Currency Stocks

- Getting Tucked in by Janet Yellen

- It’s a Jobs Jamboree Friday

- No One Believes in Gold. Here’s Why It Will Keep Rising…

- It Could Blow at Any Time, Worldwide Market Collapse - Michael Noonan Interview

- Fed Watchers April Fools in March

- Silver Is Coiled Spring

- Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

- Forex Trading - EUR/USD Increases – What About USD/CAD?

- Epic Battle Rages on: 'Ali-Frazier' in the Crimex Pits. . .

- The Gold-to-Silver Ratio: A Truly Generational PM Stocks Opportunity

- Silver Lows – Silver Ratios

| How to Prevent Hackers from Erasing Your Bank Account Posted: 02 Apr 2016 12:00 AM PDT by Justin Spittler, Casey Research:

On Monday, "terrorists" attacked a major U.S. hospital. They didn't set off a bomb or fire a single bullet. They infected the hospital with a computer virus. The Chicago Tribune reported on Tuesday.

MedStar operates 10 hospitals around Maryland and Washington D.C. It serves more than 4 million patients a year. Its computer systems are still down. • It appears the hackers were after money… The Chicago Tribune explains.

"Ransomware" is a harmful computer program that can take over your computer and lock your files. Once your computer is infected with ransomware, the only way to unlock it is with a special password called a "decryption key." To get this password, users have to pay the hackers a ransom. According to The Baltimore Sun, the hackers are demanding at least $18,500. The FBI is investigating the attack. • Chris Wood, editor of Extraordinary Technology, isn't surprised the hackers targeted a hospital… Chris is Casey Research's technology expert. He's been studying cybersecurity threats for years. And he says hospitals are prime targets for ransomware attacks. Hospitals tend to be way behind the times when it comes to cybersecurity in general. What's more, hackers know hospitals will pay up. They simply can't afford to have their systems down for long periods of time. Lives are at stake, after all. Just last month, hackers hit a small hospital in Los Angeles. They locked the hospital's computer system. It took ten days for the hospital's operations to fully recover. The hospital paid the hackers a $17,000 ransom to regain access to the system. Chris says ransomware attacks are a growing problem. We've been seeing more stories of hackers going after files on people's personal computers, too. They lock you out of your computer. And the only way to regain access is to pay the hackers. Typically, hackers demand anywhere from a couple hundred dollars to a thousand dollars in these kinds of attacks. The amount depends on how much they think you can realistically pay in a short time. They also demand to be paid in bitcoins, an online currency that the authorities can't track. If you don't pay them, they destroy the decryption key and you can never access your files ever again. If you use the Internet, you are at risk of a ransomware attack. And ransomware is just one form of cyberattack… Ransomware attacks are just one kind of cyberattack to be worried about. Hackers also steal credit cards, social security numbers, and other sensitive information. Cybercrime is "big business." It's already bigger than the illicit drug trade according to many sources, including Forbes. The government is now waging a war on cybercrime. But like most wars, this will likely be a costly, never-ending affair. Hackers have proven they can outsmart even the most "intelligent" government agencies. • We've been urging readers to protect themselves against cyberattacks for months… In December, we explained why a cyberattack is the biggest threat to your wealth. To understand why this is such a serious threat, think about the "money" in your bank account. What is it, really? These days, it's certainly not a claim to gold or any other hard asset. It's not even real cash. Most local bank branches keep less than $100,000 onsite. That's not nearly enough to cover everyone's deposits. The money in your bank account is just digital bytes in a computer. If hackers infiltrate your bank's computers, they could wipe out your bank account in an instant. • In 2013, a gang of mostly Russian hackers stole up to $1 billion from bank accounts… The hackers secretly infiltrated computers at over 100 banks. Once they had control of the computers, they ordered bank ATMs to spit out cash at a set time…where an associate would pick up the cash. One bank lost $7.3 million this way. By stealing relatively small amounts per transaction, the hackers kept the scheme going for nearly two years. The names of the hacked banks are still secret. There have been countless cyberattacks like this in recent years. Just last year, we learned of a major cyberattack against JPMorgan Chase, E*Trade, and Scottrade. These are some of the world's most sophisticated financial institutions. Americans trust them with hundreds of billions of dollars. Yet hackers were able to steal the personal data of more than 100 million customers from them. • Not even the government can defend itself against hackers… The Department of Defense, CIA, and IRS have all been hacked. And last month, hackers stole $81 million from the most powerful central bank in the world: the U.S. Federal Reserve. It was the largest bank robbery in history. • If hackers can steal money held at the Fed, they can steal your money, too… Imagine logging into your bank account and seeing a balance of zero. It sounds like a nightmare. But thanks to today's digitized financial system, it's a real threat. Remember, your bank account doesn't represent something tangible like gold. It doesn't even represent cash in a vault. It's just bytes in a computer. And in a cyberattack, it could vanish in an instant. Most folks haven't woken up to this danger yet. They still trust the system. They think, "Surely, my bank will keep my money safe." We believe trusting your bank to protect your entire life savings from hackers is a big mistake. As we've shown, hackers often outsmart banks and government authorities. • We encourage you to move money outside the digital financial system… Start by setting aside enough cash for you and your family to live on for six months. You could store the money in a safe, storage unit, or even under your mattress. We also recommend owning physical gold. Gold is money. It's a tangible asset that hackers can't steal with a click of a button. Plus, gold's value could skyrocket if these massive cyberattacks continue. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Continues, US Companies Announced The Most 1Q Layoffs Since 2009 Posted: 01 Apr 2016 11:30 PM PDT from X22Report: Euro zone economy is flying on one engine. Jobless claims surge the most in 2 years. US companies layoff the most in the first quarter since 2009. Chicago PMI jumped back but still way below January highs. JPM has recalculated GDP lower because of the deteriorating economy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Apr 2016 10:01 PM PDT by Peter Schiff, Euro Pacific Capital:

Just two weeks ago, the release of the Fed’s March policy statement and the subsequent press conference by Chairwoman Janet Yellen should have made it abundantly clear that the Central Bank policy had retreated substantially from the territory it had previously staked out for itself. In December it had anticipated four rate hikes in 2016, but suddenly those had been pared down to two. Based on the conclusion that the era of easy money had been extended for at least a few more innings, the dollar sold off and stocks and commodities rallied. But in the two weeks that followed the dovish March guidance, some lesser Fed officials, including those who aren’t even voting members of the Fed’s policy-setting Open Market Committee, made some seemingly hawkish comments that convinced the markets that the Fed had backed off from its decision to back off. The campaign began on March 19 when St. Louis Fed President James Bullard said that the Fed had largely met its inflation and employment goals and that it would be "prudent to edge interest rates higher." (H. Schneider, Reuters) Two days later Bloomberg reported that Atlanta Fed President Dennis Lockhart had said, "There is sufficient momentum…to justify a further step…possibly as early as April," (J. Randow, S. Matthews, 3/21/16) And it didn’t stop there. On March 22, Philadelphia Fed President Patrick Harker said,"there is a strong case that we need to continue to raise rates…I think we need to get on with it." (J. Spicer, Reuters) On March 24, Bullard chimed in again, saying that rate hikes "may not be far off," appearing to back Lockhart's suggestion for a surprise April hike. Suddenly, chatter erupted on Wall Street that the April FOMC meeting should be considered a "live" one, where a rate hike was possible. With such caution spreading, the markets reacted predictably: the dollar rallied, gold and stocks declined. At the time I said, as I have been saying all year, that the Fed never had an intention to tighten further, and that it would continue to talk up the economy just to create the impression of health. But many believed that Janet Yellen would use her speech this week at the New York Economic Club (her first public comments since her March press conference) to underscore the comments made by her colleagues in the past two weeks. Instead she delivered a double-barreled repudiation of any potential hawkish sentiment. In fact, her talk could be viewed as the most dovish she has ever delivered since taking the Chair. The market reaction was swift. In fact, as the text of her address was released a few minutes before she hit the podium, gold jumped and the dollar dropped even before she started speaking. The only surprise was that there was any surprise at all. If market watchers actually looked at economic data instead of trying to parse the sentence structure of Fed apparatchiks, they would know that the economy is rapidly decelerating, and most likely heading into recession (if it's not already in one). These conditions would prohibit an overtly dovish Fed from any kind of tightening. Just this week February consumer spending increased at a tepid .1%, in line with very modest expectations (Bureau of Economic Analysis). But to get to that flaccid figure, the much more robust .5% growth rate originally reported for January had to be revised down to .1%. If that major markdown had not occurred, February would have come in as a contraction. The sleight of hand may have fooled the markets, but the Fed’s own bean counters had to take it seriously. The figures were the primary justification for the Atlanta Fed's decision to slash its first quarter GDP estimate to just .6%. That estimate had been as high as 1.4% last Thursday and 2.7% back in February. Clearly something isn’t working. But whatever it is, Janet Yellen won’t speak its name. In her speech in New York, Yellen was careful to mention that the Fed has not reduced its full year growth forecast of 2.5% to 3.0% that it had laid out in December. This despite the fact that their first quarter predictions, which must be a big part of their full year predictions, have already been hopelessly shattered by the Atlanta Fed’s updates. If the Fed really believes that we are still on a solid growth track, then two major questions should immediately come to mind: 1) Given that she acknowledges greater than expected financial stresses and expected deceleration abroad, what could possibly be the catalyst that will suddenly reverse our economic trajectory, and 2) If it really does believe that this miracle will occur, why has the Fed abandoned the monetary policy trajectory that it announced in December? The answer to the first question is a mystery. For much of the past year, Yellen stressed the improvements in the labor market, as evidenced by the low unemployment rate. But that figure has been thoroughly debunked by those who correctly point out that job creation in the U.S. has been dominated by low-paying part-time jobs that detract from economic health rather than add to it. But while Yellen clung to her rosy domestic outlook, she acknowledged the significant slowdown abroad. But if these global concerns are sowing caution at the Fed, why does she expect the U.S. to buck the trend? She is correct that that many countries around the world have badly missed First Quarter forecasts. But she totally ignores the fact that the U.S. has been one of the bigger disappointments. For instance, since the end of last year, expectations for Q1 growth have declined 12.5% for Germany, 30% for Canada, 45% for Norway, and 57% for Japan (Bloomberg, 3/30/16). But based on the current estimates from the Atlanta Fed, the U.S. economy is growing at a rate that is 75% slower than the 2.4% projection Yellen and the Fed had forecast back in December. So why does the Fed acknowledge unexpected weakness abroad, yet ignore even greater unexpected weakness in the U.S.? Could it be that Yellen does not want to be seen as one of those "fiction peddlers" that President Obama criticized in his State of the Union address who have the audacity to suggest that the U.S. economy is not strong? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Fleckenstein: The Perils of Short Selling in a World Awash in Central Bank Liquidity Posted: 01 Apr 2016 08:20 PM PDT from Macro Voices:

Erik Townsend welcomes Bill Fleckenstein to MacroVoices. Erik and Bill discuss: A coming correction in equities – what’s different this time? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Took a Mighty Hit Today Posted: 01 Apr 2016 07:21 PM PDT

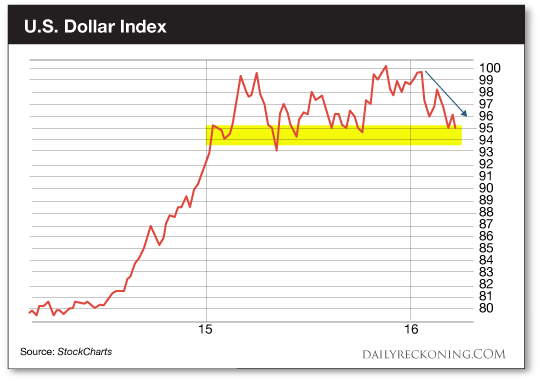

Before we talk about this week's results, let us ponder results for the First Quarter 2016. Gold rose 16.4%, it's greatest quarterly gain since 1986. Silver added 12.2%, Platinum 9.5%, & Palladium 0.4%. Dow Industrials soared 1.5%, S&P500 0.8%, Dow transports 5.8%, Wilshire 5000 0.3%. Losers were the Russell 2000, down 1.9%, the Nasdaq Composite, down 2.7%, and the Nasdaq 100, down 2.4%. Stock indices outside the US did much worse: Euro Stoxx600, down 7.7%, MSCI World, down 2.7%, Shanghai, down 15.1%, and the Nikkei 225 lower by 12%. Since 2016 opened the US dollar index has lost 4.1%. THIS WEEK. Silver and Gold Prices took a mighty hit today, but finished the week not much changed. Stocks profited from Mother Janet Yellen's spell. Dow grabbed 1.6%, S&P500 1.8%, but the same spell knocked the US dollar index into a trance, down 1.6%. Say, that's coincidental: Dow rose 1.6%, same amount the US dollar index fell. I wonder if stocks are just discounting the dollar's loss. Say, y'all don't think Mother Yellen would do something like that, do you? I mean, pick the pockets of 350 million Americans merely to line the pockets on Wall Street. Naaah. If I let myself dwell on the colossal corruption in this country, I'd have to lie down and die. Let's think about something else, or we'll let those rotten midgets keep us from all accomplishment & joy. They ain't that important. TODAY stocks rallied. Dow reached the level of 16 December (roughly), rising 107.66 (.61%) to 17,792.75. S&P500 rose 13.04 (0.63%) to 2,072.78. The partiers at Mother Yellen's ball just ignored that clock striking twelve when Mother Yellen re-filled the punchbowl. With toadstool juice. Be patient. Stocks have about one more week to run before they step into a manhole. Here's a chart for the Dow in Gold, http://schrts.co/8Sv0tc and the Dow in Silver, http://schrts.co/ohwLZP Dow in Gold acts right now as if it will at least reach the 50% correction of the December - February fall, namely, 14.71 oz. At most it might reach the 200 DMA at 15.07 oz. Dow in Silver, always more volatile, has passed through it 200 DMA (1,150.68). It may reach a 75% correction of the foregoing fall, i.e., about 1,206.72 oz. Whatever happens, it should happen in a week, perhaps two. US dollar index stirred a measly 4 basis points today, up to 94.62, shameful for a currency that claims to be first world. Today it upbounced off the downtrend line from the March 2015 high. Penetrating that would be bad juju for the dollar index. Here's a picture, http://schrts.co/jjrq5s Recall the big picture. Since March 2015 the dollar index has been rangebound between 100 and 92.50. If it breaks above 100, it will launch another rally. If it falls through 92.50, no rally, no future, except more shame and disgrace and sorrow for US dollar holders. Either way, the dollar's course will strongly bear on metals. Euro rose 0.1% to $1.1393. It is also rangebound, $1.0550 to $1.1500. Current rally hasn't even been able to reach the top boundary yet. Yen jumped over its 20 DMA and rose 0.84% today to 89.58. Why anybody would buy Yen remains a deep mystery to me, since Japan will be declared one gigantic old folks' home in a few years, and the government has a 250% debt to GDP ratio. Inflation markets have crumpled in the last seven days. Oil fell another 3.9% today to $36.63/bbl (WTIC). Copper has fallen from its $2.32 March high to $2.17 today. CRB commodity index gapped down today and closed 1.46% lower. 'Twill be informative to see how far they correct, that is, whether the bottoms in February will hold. Silver & gold cleared up my confusion from yesterday -- or did they? Silver tanked 41.8¢ (2.7%) to close Comex at 1504.2¢. Gold tumbled $12.00 (1%) to $1,222.20. Clear as air, right? Nope, not clear. Look at the silver chart, http://schrts.co/zsmR7J Silver broke that green uptrend line I've been talking about the last few days, punched through the 200 DMA (1491¢) like General Forrest punching through yankee cavalry, but then it turned right around and climbed above that 200 DMA. Fell as far as 1478¢, right close to my 1460c target, and already a 50% correction. I'm looking over my shoulder at the calendar now, because this correction shouldn't last longer than a week, maybe two. Has silver fallen far enough? I don't know, but I do know that any price lower than 1500¢ attracts buyers like free baloney sandwiches attract hoboes. That argues silver won't fall much further. Here's more smoke over the picture: gold fell off a cliff, from $1,236.20 to $1,209.90, then picked itself up & clawed its way back above $1,220. This is the last in a string of successful defenses of $1,220. Here's the chart,http://schrts.co/mmO0be Today's fall also appears to have occurred on very low volume. And it never broke the uptrend line from the January low. Coincidentally, that uptrend line is following the 50 DMA (now $1,208.73), a frequent target for bull market corrections. So 'tain't clear atall. Silver broke but gold didn't, & silver scrambled back over 1500¢. It's getting to where I'm more nervous about waiting to buy than I am fearful of bigger falls. Almost everybody who calls asks me about Susan's eye, and I deeply appreciate y'all's concern. She tells me it is almost completely healed and only occasionally pains her. I thank y'all again for your prayers. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Is Gold & Silver So Popular? Posted: 01 Apr 2016 06:40 PM PDT from World Alternative Media: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next Big Problem: "Stagflation Is Starting To Show Across The Economy" Posted: 01 Apr 2016 06:10 PM PDT In the past few months, the Bureau of Labor Statistics has gone out of its way to show that U.S. worker compensation is finally rising. There is one problem with that: while that may be true on an hourly basis... ... on a weekly basis, the picture is vastly different. What is happening is that weekly wage growth have gone nowhere in years, but because the average hours worked per week has declined and today hit a 2 year low of 34.4, it translates into more money per hour worked.

But let's assume that wages, or at least the perception thereof, is indeed rising - is this helping the average American? Well, as we showed earlier this week, the net "after expense" income of average Americans measured in real dollars has declined from $17K in 2004 to $6,000 in 2014 because as wages have declined dramatically, expenses have surged. In fact, according to the recent Pew study, by 2014, median income had fallen by 13 percent from 2004 levels, while expenditures had increased by nearly 14 percent, As such a 2.5%, or 3.5% or even 10% increases in wages will not manage to offset the surging expenditures, mostly on rent. All of this you will never see discussed in a sellside research report, which instead relies on the basic hourly earnings headline numbers. Instead, you will see charts like this from Wells Capital's Jim Paulsen. And yet, even the analysts who are only looking at the most rudimentary data are now warning that a new problem is emerging for the US economy, a problem which is always present whenever wages are rising, while overall economic growth is stalling (as it is currently according to the Atlanta Fed with a 0.7% Q1 GDP) and corporate profits are about to plunge by the most since the financial crisis: stagflation. In a note earlier today, Deutsche Bank laid out the following ominous warning:

What Deutsche Bank is referring to is the following chart which shows the explicit and inverse correlation between corporate profits and employee wages. What it demonstrates clearly is that if indeed labor income, i.e., wages, are rising, then profit margins have no choice but to fall even more; this means that if the stock market wishes to continue rising even higher it will only achieve this with margin expansion, which however can only be achieved by even more Fed intervention and more stimulative inflation, which then pushes wages even higher generating a self-defeating feedback loop.

This is something we touched upon early in January when we made an observation on small business operating margins, namely that "If Companies Are Telling The Truth, Profit Margins Are About To Collapse The Most In The 21st Century." Which brings us to the following Bloomberg TV interview with Wells Fargo's Jim Paulsen in which the otherwise jovial permabull focuses on only one thing: the rising threat of stagflation. This is what he said:

... At this point we would like to interject that while we love the strawman argument that real wages are "growing fast" as much as the next guy, the reality is that this is bullshit as the previously shown chart from Pew has demonstrated: whether Americans are spending for more items, or actual prices are soaring, the consumer's net income as shown below, has plunged.

Anyway, back to Paulsen who then says this:

Can this scenario tip us into a recession Paulsen is asked, his answer: "it's possible. I am concerned that the Fed is so dovish in the face of rising core inflation." Which means that now that the "very serious economists" are talking about it, get ready to hear much more about the "threat of stagflation" for the US economy, a threat which the Fed is powerless to defeat unless it is willing to launch another market crash.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Doug Casey Warns "We're Exiting The Eye Of The Giant Financial Hurricane" Posted: 01 Apr 2016 05:01 PM PDT (This is Doug Casey’s foreword to Casey Research’s Handbook for Surviving the Coming Financial Crisis.) Right now, we are exiting the eye of the giant financial hurricane that we entered in 2007, and we’re going into its trailing edge. It’s going to be much more severe, different, and longer lasting than what we saw in 2008 and 2009. In a desperate attempt to stave off a day of financial reckoning during the 2008 financial crisis, global central banks began printing trillions of new currency units. The printing continues to this day. It’s not just the Federal Reserve that’s printing. The Fed is just the leader of the pack. The U.S., Japan, Europe, China… all major central banks… are participating in the biggest increase in global monetary units in history. These reckless policies have produced not just billions but trillions in malinvestment that will inevitably be liquidated. This will lead us to an economic disaster that will, in many ways, dwarf the Great Depression of 1929–1946. Paper currencies will fall apart, as they have many times throughout history. This isn’t some vague prediction about the future. It’s happening right now. The Canadian dollar has lost 25% of its value since 2013. The Australian dollar has lost 30% of its value during the same time. The Japanese yen and the euro have crashed in value. And the U.S. dollar is currently just the healthiest horse on its way to the glue factory. These are gigantic losses for major currencies. After all, we’re not talking about small volatile stocks. We’re talking about the value of money in peoples’ bank accounts. These moves show we’re in the early stages of a currency crisis. At this point, it’s a lock cinch that the world’s premier paper currency – the U.S. dollar – will lose nearly all its value. I just don’t see any realistic way around it. Since the financial crisis began eight years ago, the U.S. government has created 3.5 trillion new dollars. In that same eight years, the U.S. government has borrowed $9 trillion – as much as it has borrowed in the previous 232-year history of the United States. Though politicians would like us to believe otherwise, actions have consequences. You simply cannot quadruple the money supply and double the national debt in eight years without catastrophic results. As this unfolds, your biggest risk isn’t the crashing stock market or the crashing bond market. Your biggest problem, and also the one most people just don’t see, is political. Your government is by far the most serious threat to your money and wellbeing. Why do I say that? Like any organism, the prime directive of a government is to survive. When faced with a threat to its survival, a broke government will do anything it can to stay alive. President Roosevelt confiscated Americans’ gold in 1933. And in just the last few years, we’ve seen broke governments raid private pensions and confiscate cash directly from people’s bank accounts. As we head into a currency crisis for the record books, I think currency controls are a lock. Governments have used currency controls since the days of the Roman Empire. A country debases its currency, raises taxes beyond a certain level, and makes regulations too onerous. Naturally, productive people react by getting their capital, and then themselves, out of Dodge. But the government can’t have that, so it puts on currency controls that prevent people from moving assets outside the country. In effect, currency controls force people to stay with a sinking ship. I’ll be genuinely surprised if some form of currency controls isn’t instituted within two years. If you don’t get significant assets out of your home country now, you may soon find it costly and very difficult to do so. I’ve written many times about the importance of internationalizing your assets, your mode of living, and your way of thinking. I suspect most readers have treated those articles as a travelogue to some distant and exotic land: interesting fodder for cocktail party chatter but basically academic and of little immediate personal relevance. I hope this book will shake you out of that mindset. There’s a very real risk that if you don’t act soon, you may find yourself penned like a sheep and your options extremely limited. This book will teach you how to move some of your money and investments outside the reach of your home government. You’ll learn how to open a foreign bank account… the best ways to store gold for maximum safety… what you need to know before buying foreign real estate, and much, much more. We’ve done most of the legwork for you. But it’s up to you to act. The next few years are going to be quite catastrophic. Hundreds of millions of people will slip into poverty when the currency crisis destroys their savings. The good news? If you take the steps outlined in this book, you won’t be one of them. If you’re interested in obtaining this book, you can obtain a hard copy in the mail. Click here for more details or to download the PDF now. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Apr 2016 04:51 PM PDT SO, WHERE IS THE COLLAPSE? — Bill Holter by SGT, SGT Report.com: Bill Holter from JS Mineset is back to discuss the current state of global economic affairs, and I have one simple question for him. Where is the collapse!? To sign up for premium content at JS Mineset. Click HERE. The post In The News Today appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Apr 2016 03:55 PM PDT Submitted by Peter Schiff via Euro Pacific Capital, It may be almost impossible to underestimate the gullibility of professional Fed watchers. At least Lucy van Pelt needed to place an actual football on the ground to fool poor Charlie Brown. But in today’s high stakes game of Federal Reserve mind reading, the Fed doesn’t even have to make a halfway convincing bluff to make the markets look foolish. Just two weeks ago, the release of the Fed's March policy statement and the subsequent press conference by Chairwoman Janet Yellen should have made it abundantly clear that the Central Bank policy had retreated substantially from the territory it had previously staked out for itself. In December it had anticipated four rate hikes in 2016, but suddenly those had been pared down to two. Based on the conclusion that the era of easy money had been extended for at least a few more innings, the dollar sold off and stocks and commodities rallied. But in the two weeks that followed the dovish March guidance, some lesser Fed officials, including those who aren't even voting members of the Fed's policy-setting Open Market Committee, made some seemingly hawkish comments that convinced the markets that the Fed had backed off from its decision to back off. The campaign began on March 19 when St. Louis Fed President James Bullard said that the Fed had largely met its inflation and employment goals and that it would be “prudent to edge interest rates higher.” (H. Schneider, Reuters) Two days later Bloomberg reported that Atlanta Fed President Dennis Lockhart had said, “There is sufficient momentum…to justify a further step…possibly as early as April,” (J. Randow, S. Matthews, 3/21/16) And it didn't stop there. On March 22, Philadelphia Fed President Patrick Harker said,“there is a strong case that we need to continue to raise rates…I think we need to get on with it.” (J. Spicer, Reuters) On March 24, Bullard chimed in again, saying that rate hikes “may not be far off,” appearing to back Lockhart’s suggestion for a surprise April hike. Suddenly, chatter erupted on Wall Street that the April FOMC meeting should be considered a “live” one, where a rate hike was possible. With such caution spreading, the markets reacted predictably: the dollar rallied, gold and stocks declined. At the time I said, as I have been saying all year, that the Fed never had an intention to tighten further, and that it would continue to talk up the economy just to create the impression of health. But many believed that Janet Yellen would use her speech this week at the New York Economic Club (her first public comments since her March press conference) to underscore the comments made by her colleagues in the past two weeks. Instead she delivered a double-barreled repudiation of any potential hawkish sentiment. In fact, her talk could be viewed as the most dovish she has ever delivered since taking the Chair. The market reaction was swift. In fact, as the text of her address was released a few minutes before she hit the podium, gold jumped and the dollar dropped even before she started speaking. The only surprise was that there was any surprise at all. If market watchers actually looked at economic data instead of trying to parse the sentence structure of Fed apparatchiks, they would know that the economy is rapidly decelerating, and most likely heading into recession (if it’s not already in one). These conditions would prohibit an overtly dovish Fed from any kind of tightening. Just this week February consumer spending increased at a tepid .1%, in line with very modest expectations (Bureau of Economic Analysis). But to get to that flaccid figure, the much more robust .5% growth rate originally reported for January had to be revised down to .1%. If that major markdown had not occurred, February would have come in as a contraction. The sleight of hand may have fooled the markets, but the Fed's own bean counters had to take it seriously. The figures were the primary justification for the Atlanta Fed’s decision to slash its first quarter GDP estimate to just .6%. That estimate had been as high as 1.4% last Thursday and 2.7% back in February. Clearly something isn't working. But whatever it is, Janet Yellen won't speak its name. In her speech in New York, Yellen was careful to mention that the Fed has not reduced its full year growth forecast of 2.5% to 3.0% that it had laid out in December. This despite the fact that their first quarter predictions, which must be a big part of their full year predictions, have already been hopelessly shattered by the Atlanta Fed's updates. If the Fed really believes that we are still on a solid growth track, then two major questions should immediately come to mind:

The answer to the first question is a mystery. For much of the past year, Yellen stressed the improvements in the labor market, as evidenced by the low unemployment rate. But that figure has been thoroughly debunked by those who correctly point out that job creation in the U.S. has been dominated by low-paying part-time jobs that detract from economic health rather than add to it. But while Yellen clung to her rosy domestic outlook, she acknowledged the significant slowdown abroad. But if these global concerns are sowing caution at the Fed, why does she expect the U.S. to buck the trend? She is correct that that many countries around the world have badly missed First Quarter forecasts. But she totally ignores the fact that the U.S. has been one of the bigger disappointments. For instance, since the end of last year, expectations for Q1 growth have declined 12.5% for Germany, 30% for Canada, 45% for Norway, and 57% for Japan (Bloomberg, 3/30/16). But based on the current estimates from the Atlanta Fed, the U.S. economy is growing at a rate that is 75% slower than the 2.4% projection Yellen and the Fed had forecast back in December. So why does the Fed acknowledge unexpected weakness abroad, yet ignore even greater unexpected weakness in the U.S.? Could it be that Yellen does not want to be seen as one of those “fiction peddlers” that President Obama criticized in his State of the Union address who have the audacity to suggest that the U.S. economy is not strong? But the bigger question is not why the Fed is mindlessly cheer-leading, that is after all part of its job description, but how it can justify altering its monetary policy while holding fast to its economic forecasts. To square that circle,Yellen said that the Fed had erred in its assumptions as to what constitutes a “neutral” policy level whereby rates are neither stimulating nor restrictive. She said that based on her global concerns, neutral policy should now be considered close to 0% rather than the 2% that the Fed had hinted at earlier. She also said that the range of factors that the Fed considers in reaching its rate decisions had evolved beyond simply looking at the traditional inputs of GDP growth, inflation and unemployment to include global risk factors that could impact the U.S. In other words, the Fed is not simply “data dependent” but is now “globally data dependent,” a stance that could allow it to point to any potential crisis anywhere in the world as a rationale not to raise rates. Already many observers are suggesting that the June “Brexit” vote in the UK will be a justification to take a rate hike off the table for the June FOMC meeting. Of course, this ever-expanding list of criteria should be viewed as what it really is: a continual shifting of goal posts that will prevent the Fed from EVER having to raise rates again (at least until a rapidly rising CPI forces its hand). It may have incorrectly believed it could get away with a series of increases when it first started raising in December, but those expectations may have wilted when the markets and the economy dropped so decisively in the immediate wake of December’s 25 basis point increase. Yet even though markets have recovered, I believe they have only done so because the Fed has backed off. In fact, if that initial rate hike was a trial balloon for future hikes, its flight was about as successful as the Hindenburg’s. As such, the Fed hardly wants to risk another sell-off that it may be unable to reverse. So the handwriting is on the wall for anyone literate enough to read it. The Fed is stuck in a monetary Roach Motel from which it may never escape. Keynesian economists like to discuss a “liquidity trap” but their policies have created an undeniable “stimulus trap” that I believe will remain in place until the whole merry-go-round spins out of control. The quarter that just ended yesterday saw the biggest quarterly declines in the U.S. dollar in five years (T. Hall, Bloomberg, 3/30/16), and the strongest quarter for gold in 30 years (R. Pakiam, Bloomberg, 3/30/16). These moves completely took the Wall Street establishment by surprise. But given the historic rally enjoyed by the dollar over the past five years, three months’ worth of declines may just be a small down payment on the declines the dollar may experience in the years ahead. Despite having fallen for all of the Fed’s prior head fakes, some economists are taking today’s March payroll report, which showed the creation of 215,000 jobs and a tick up in the labor participation rate to 63.0% (Bureau of Labor Statistics), as a sign that the Fed will now have to shift back into a hawkish stance. Putting aside the fact that the majority of the new jobs were part-time and went to people who already had at least one, and that the official unemployment rate actually ticked up, one wonders how much more of this will we have to witness before economists finally realize that there will likely never be a real ball to kick. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Immigration Meltdown. What Will Sweden Be Like in 2025? Immigration destroying freedom and equality Posted: 01 Apr 2016 02:59 PM PDT If you want more people to see this video: Like it, comment, subscribe, and share! May truth and reason prevail.Mass-immigration of conservative non-Europeans, predominantly reactionary Muslims, are destroying the values that the Swedish left, the social democrats, worked so hard to establish.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Apr 2016 01:45 PM PDT This post April Fools in March appeared first on Daily Reckoning. It may be almost impossible to underestimate the gullibility of professional Fed watchers. At least Lucy van Pelt needed to place an actual football on the ground to fool poor Charlie Brown. But in today's high stakes game of Federal Reserve mind reading, the Fed doesn't even have to make a halfway convincing bluff to make the markets look foolish. Just two weeks ago, the release of the Fed’s March policy statement and the subsequent press conference by Chairwoman Janet Yellen should have made it abundantly clear that the Central Bank policy had retreated substantially from the territory it had previously staked out for itself. In December it had anticipated four rate hikes in 2016, but suddenly those had been pared down to two. Based on the conclusion that the era of easy money had been extended for at least a few more innings, the dollar sold off and stocks and commodities rallied. But in the two weeks that followed the dovish March guidance, some lesser Fed officials, including those who aren’t even voting members of the Fed’s policy-setting Open Market Committee, made some seemingly hawkish comments that convinced the markets that the Fed had backed off from its decision to back off. The campaign began on March 19 when St. Louis Fed President James Bullard said that the Fed had largely met its inflation and employment goals and that it would be "prudent to edge interest rates higher." (H. Schneider, Reuters) Two days later Bloomberg reported that Atlanta Fed President Dennis Lockhart had said, "There is sufficient momentum…to justify a further step…possibly as early as April," (J. Randow, S. Matthews, 3/21/16) And it didn’t stop there. On March 22, Philadelphia Fed President Patrick Harker said,"there is a strong case that we need to continue to raise rates…I think we need to get on with it." (J. Spicer, Reuters) On March 24, Bullard chimed in again, saying that rate hikes "may not be far off," appearing to back Lockhart's suggestion for a surprise April hike. Suddenly, chatter erupted on Wall Street that the April FOMC meeting should be considered a "live" one, where a rate hike was possible. With such caution spreading, the markets reacted predictably: the dollar rallied, gold and stocks declined. At the time I said, as I have been saying all year, that the Fed never had an intention to tighten further, and that it would continue to talk up the economy just to create the impression of health. But many believed that Janet Yellen would use her speech this week at the New York Economic Club (her first public comments since her March press conference) to underscore the comments made by her colleagues in the past two weeks. Instead she delivered a double-barreled repudiation of any potential hawkish sentiment. In fact, her talk could be viewed as the most dovish she has ever delivered since taking the Chair. The market reaction was swift. In fact, as the text of her address was released a few minutes before she hit the podium, gold jumped and the dollar dropped even before she started speaking. The only surprise was that there was any surprise at all. If market watchers actually looked at economic data instead of trying to parse the sentence structure of Fed apparatchiks, they would know that the economy is rapidly decelerating, and most likely heading into recession (if it's not already in one). These conditions would prohibit an overtly dovish Fed from any kind of tightening. Just this week February consumer spending increased at a tepid .1%, in line with very modest expectations (Bureau of Economic Analysis). But to get to that flaccid figure, the much more robust .5% growth rate originally reported for January had to be revised down to .1%. If that major markdown had not occurred, February would have come in as a contraction. The sleight of hand may have fooled the markets, but the Fed’s own bean counters had to take it seriously. The figures were the primary justification for the Atlanta Fed's decision to slash its first quarter GDP estimate to just .6%. That estimate had been as high as 1.4% last Thursday and 2.7% back in February. Clearly something isn’t working. But whatever it is, Janet Yellen won’t speak its name. In her speech in New York, Yellen was careful to mention that the Fed has not reduced its full year growth forecast of 2.5% to 3.0% that it had laid out in December. This despite the fact that their first quarter predictions, which must be a big part of their full year predictions, have already been hopelessly shattered by the Atlanta Fed’s updates. If the Fed really believes that we are still on a solid growth track, then two major questions should immediately come to mind: 1) Given that she acknowledges greater than expected financial stresses and expected deceleration abroad, what could possibly be the catalyst that will suddenly reverse our economic trajectory, and 2) If it really does believe that this miracle will occur, why has the Fed abandoned the monetary policy trajectory that it announced in December? The answer to the first question is a mystery. For much of the past year, Yellen stressed the improvements in the labor market, as evidenced by the low unemployment rate. But that figure has been thoroughly debunked by those who correctly point out that job creation in the U.S. has been dominated by low-paying part-time jobs that detract from economic health rather than add to it. But while Yellen clung to her rosy domestic outlook, she acknowledged the significant slowdown abroad. But if these global concerns are sowing caution at the Fed, why does she expect the U.S. to buck the trend? She is correct that that many countries around the world have badly missed First Quarter forecasts. But she totally ignores the fact that the U.S. has been one of the bigger disappointments. For instance, since the end of last year, expectations for Q1 growth have declined 12.5% for Germany, 30% for Canada, 45% for Norway, and 57% for Japan (Bloomberg, 3/30/16). But based on the current estimates from the Atlanta Fed, the U.S. economy is growing at a rate that is 75% slower than the 2.4% projection Yellen and the Fed had forecast back in December. So why does the Fed acknowledge unexpected weakness abroad, yet ignore even greater unexpected weakness in the U.S.? Could it be that Yellen does not want to be seen as one of those "fiction peddlers" that President Obama criticized in his State of the Union address who have the audacity to suggest that the U.S. economy is not strong? But the bigger question is not why the Fed is mindlessly cheer-leading, that is after all part of its job description, but how it can justify altering its monetary policy while holding fast to its economic forecasts. To square that circle,Yellen said that the Fed had erred in its assumptions as to what constitutes a "neutral" policy level whereby rates are neither stimulating nor restrictive. She said that based on her global concerns, neutral policy should now be considered close to 0% rather than the 2% that the Fed had hinted at earlier. She also said that the range of factors that the Fed considers in reaching its rate decisions had evolved beyond simply looking at the traditional inputs of GDP growth, inflation and unemployment to include global risk factors that could impact the U.S. In other words, the Fed is not simply "data dependent" but is now "globally data dependent," a stance that could allow it to point to any potential crisis anywhere in the world as a rationale not to raise rates. Already many observers are suggesting that the June "Brexit" vote in the UK will be a justification to take a rate hike off the table for the June FOMC meeting. Of course, this ever-expanding list of criteria should be viewed as what it really is: a continual shifting of goal posts that will prevent the Fed from EVER having to raise rates again (at least until a rapidly rising CPI forces its hand). It may have incorrectly believed it could get away with a series of increases when it first started raising in December, but those expectations may have wilted when the markets and the economy dropped so decisively in the immediate wake of December's 25 basis point increase. Yet even though markets have recovered, I believe they have only done so because the Fed has backed off. In fact, if that initial rate hike was a trial balloon for future hikes, its flight was about as successful as the Hindenburg's. As such, the Fed hardly wants to risk another sell-off that it may be unable to reverse. So the handwriting is on the wall for anyone literate enough to read it. The Fed is stuck in a monetary Roach Motel from which it may never escape. Keynesian economists like to discuss a "liquidity trap" but their policies have created an undeniable "stimulus trap" that I believe will remain in place until the whole merry-go-round spins out of control. The quarter that just ended yesterday saw the biggest quarterly declines in the U.S. dollar in five years (T. Hall, Bloomberg, 3/30/16), and the strongest quarter for gold in 30 years (R. Pakiam, Bloomberg, 3/30/16). These moves completely took the Wall Street establishment by surprise. But given the historic rally enjoyed by the dollar over the past five years, three months' worth of declines may just be a small down payment on the declines the dollar may experience in the years ahead. Despite having fallen for all of the Fed's prior head fakes, some economists are taking today's March payroll report, which showed the creation of 215,000 jobs and a tick up in the labor participation rate to 63.0% (Bureau of Labor Statistics), as a sign that the Fed will now have to shift back into a hawkish stance. Putting aside the fact that the majority of the new jobs were part-time and went to people who already had at least one, and that the official unemployment rate actually ticked up, one wonders how much more of this will we have to witness before economists finally realize that there will likely never be a real ball to kick. Regards, Peter Schiff P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics from every possible angle. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post April Fools in March appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

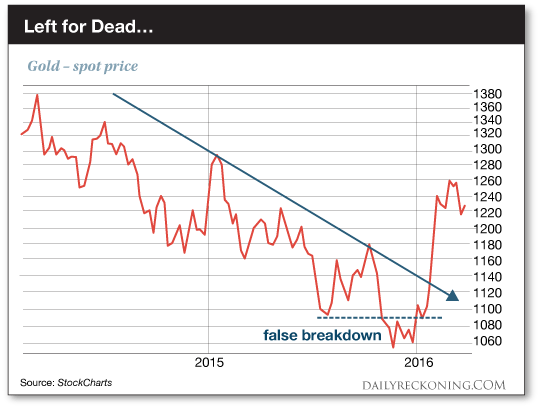

| What Most Gold Bugs Don’t Understand Posted: 01 Apr 2016 01:25 PM PDT This post What Most Gold Bugs Don't Understand appeared first on Daily Reckoning. "There's mounting evidence this gold rally could have legs heading into the summer," says Greg Guenthner of our trading desk. If you're a longtime reader, you'll remember Greg called gold's bear market in February 2013 — as the Midas metal broke below the $1,650 level. If you're a really longtime reader, you might've been among those who hurled a torrent of insults Greg's way — "Antichrist" was the most memorable. But Greg's approach to every asset class is the agnostic one. When the charts turn, he turns. "No one was paying attention when gold started ticking higher in January," Greg writes by way of update this morning. "A false breakdown at the very end of 2015 is what caught everyone off guard." "Gold was locked in a nasty downtrend. Another breakdown was just par for the course.

"As most folks proficient in the 'chart arts' know, from false moves come swift moves in the opposite direction. Once gold regained its footing to start the year it was off to the races. The disbelief rally had begun. And it's still going strong." Going forward, Greg sees dual catalysts for gold as spring moves toward summer — dollar weakness and a growing realization the Federal Reserve has no clue what it's doing (about which more shortly). "Gold's rise won't be picture-perfect," he concludes. "Expect wild swings and plenty of shakeouts. Comeback moves are never clean or easy. But they are powerful." But what of the "ultimate" catalyst for gold, an X-factor we identified in early 2013 even as gold was nose-diving? Back then, we described the potential for a scenario our executive publisher Addison Wiggin labeled "Zero Hour" — a moment when demand for physical metal would far outstrip the "paper gold" market of gold futures traded on the Comex in New York. Since 2014, the momentum toward "Zero Hour" has been building relentlessly. Only last month, Byron King explained in this space that for every ounce of physical metal held by the Comex, there are 500 traders holding gold futures. For the time being, those traders are content to roll their contracts forward or take a cash payout when those futures expire. But hypothetically, they have the right to demand delivery in physical metal. The key word there is "hypothetically." A lot of Internet screamers don't understand the subtleties of "Zero Hour." A lot of their followers wonder what the hell's taking so long. "For years, gold bugs implored futures traders to 'stand for delivery' on the Comex," says Jim Rickards. "If every long in the futures market put in a notification that they wanted to take physical delivery instead of closing out or rolling over their contracts, the result would be one of the greatest short squeezes and price spikes since 'Big Jim' Fisk and Jay Gould tried to corner the private gold market in 1869. (Fiske and Gould's corner failed when the U.S. Treasury unexpectedly made public gold available to bail out the shorts.) "But this scenario is unlikely to play out in the way the gold bugs wish, for several reasons," Jim goes on. "The first is that the Comex has emergency powers to prevent longs from taking delivery in a way that disrupts the orderly functioning of the market. The Comex rule book makes it clear that a futures exchange is for hedging, price discovery and legal speculation, but is not a source of supply. (Physical delivery is permitted, but only enough to keep the paper price 'honest.' The irony, of course, is that the paper price is anything but honest, due to manipulation.) "Another rule allows Comex officials to change the rules as needed in emergencies (something the Hunt brothers experienced when they tried to corner the silver market in 1980). The fact that longs know they cannot take delivery in the end is a major deterrent to the attempt." There's one more reason the gold longs don't squeeze the gold shorts. Jim sums it up in two words: "It's illegal." "Most major participants in the gold market (banks, dealers and hedge funds) are regulated by one or more of the Federal Reserve, U.S. Treasury, SEC or CFTC," he explains. (And he's been a lawyer for banks, dealers and hedge funds, so he'd know.) "Applicable laws contain strict anti-fraud and anti-manipulation rules, including jail time in cases of willful and knowing violations." So a rogue hedge fund manager out there might want to call BS on the whole Comex scheme… but he thinks better of it, lest the full weight of Uncle Sam's prosecutorial apparatus comes crashing down on him. If someone demanding delivery of physical metal from the Comex doesn't bring on "Zero Hour," what will? It comes back to "avalanche theory" — Jim's popularization of the science called complexity theory. "A single snowflake," he reminds us, "can turn a seemingly stable snowpack into a roaring avalanche that destroys everything in its path. Once the snowpack is arranged in an unstable way (like the gold market today), a single snowflake can unleash carnage. Of course, a single snowflake is so small you never see it coming. "What this means is that the super-spike in gold prices will not come from any of the obvious sources but from an unexpected source." It could be the bankruptcy of a medium-size gold dealer. It could be lawmakers in Washington talking about new reporting requirements for gold dealers. Or it could have nothing to do with gold: It could be a war or a pandemic that frightens people into safeguarding wealth. "It doesn't matter," Jim sums up. "Once the avalanche begins, there's no stopping it. "At that point, the hedge funds can demand physical delivery of gold without fear of prosecution. If a hedge funds tries to start an avalanche, it's manipulation. But if the avalanche starts from another source, then a hedge fund piling on is 'normal' market conduct. "Since every gold market participant knows there's not enough physical gold to go around, everyone will demand physical gold at once. No one wants to be left holding the bag." As it happens, one of Jim's contacts in the gold market — the head of the world's largest gold refinery, located in Switzerland — has identified a potential near-term Zero Hour catalyst. "I know of no single individual in the world with a more detailed working knowledge of physical gold flows," Jim says. This coming Tuesday, Jim is holding an online workshop exclusively for people who buy a copy of his latest book, The New Case for Gold through Agora Financial. Jim will share the insights of this insider's insider. "When the buying panic hits, gold will soar past $2,000 per ounce (if it's not there already) and spike to $3,000 per ounce, then higher, in a matter of weeks or months at most." This workshop is one of many pluses you get by ordering The New Case for Gold through us. Your hardcover copy of the book will have a bonus chapter. It will be signed by Jim. You'll get a 60-day no-obligation trial of Rickards' Strategic Intelligence. And all we ask is $4.95 to cover shipping for the book — less than a third of what you'd pay buying the book from Amazon, and you get none of those bonuses. [Time-sensitive announcement: This offer comes off the table Monday night at midnight, because the book's formal publication date is Tuesday. If you want in, time is limited. Here's where to act.] Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post What Most Gold Bugs Don't Understand appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - April Fools' Day Posted: 01 Apr 2016 01:25 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Correcting Through Time Not Price Posted: 01 Apr 2016 01:12 PM PDT The Daily Gold | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CNBC Leaks Secret Yellen-Bernanke Phone Call… Posted: 01 Apr 2016 01:01 PM PDT This post CNBC Leaks Secret Yellen-Bernanke Phone Call… appeared first on Daily Reckoning. BALTIMORE – The first quarter ended yesterday… leaving most people neither worse off nor better off than they were when it began. The Dow is about 1% higher than it was start of the year. The economy is still neither in a recession nor a boom… …and the Janet Yellen Fed hasn't moved an inch toward its destination: "normalization" of interest rates. Bombshell LeakIn a remarkable turn of events, CNBC has released a bombshell – what appears to be a recording of a private conversation between Janet Yellen and her old boss, Ben Bernanke. Apparently, the cellphone conversation was broadcast inadvertently to other cellphones in the Washington D.C. area and captured by CNBC staff. Bernanke began the conversation in a cheerful mood…

The line goes dead. Regards, Bill Bonner P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post CNBC Leaks Secret Yellen-Bernanke Phone Call… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Assassination of Donald Trump Posted: 01 Apr 2016 12:00 PM PDT Radical populists rarely survive long enough to change the system. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How nuclear threats would change the anti-terror approach in the U.S. Posted: 01 Apr 2016 09:30 AM PDT Retired U.S. Navy Captain Chuck Nash discusses how the potential for ISIS to get its hands on chemical or nuclear weapons would change Americas approach to fighting the terrorist group. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hard Profits from Soft Currency Stocks Posted: 01 Apr 2016 09:22 AM PDT This post Hard Profits from Soft Currency Stocks appeared first on Daily Reckoning. We've been picking apart and chewing on a bit of a sacred cow. The most commonly held view is that stocks from countries with strong currencies make better investments than their weak currency cousins. In fact the evidence points precisely the other way. Stocks from countries with the weakest currencies are usually the best performers. Today: more proof and some thoughts on why this is so. Last time I left you with an observation that staggered me when I first noticed it. Argentine stocks have massively outperformed both US and Swiss stocks since December 1987 (the earliest available data), even when both are measured in US dollars (see here if you missed it). Argentina is a serial basket case when it comes to economic and financial matters, although now appears to be on the mend (until next time…). As I pointed out before, one Argentine peso from 1987 would be worth only three thousandths of one percent as much today, in US dollar terms (it's down 99.997%). So how on earth could Argentine stocks have done so well? This is not a marginal result either. Total dollar profits over those 28 and a bit years from the MSCI Argentina index – including price moves and dividend income – were 3.3 times the equivalent US index and 2.8 times the Swiss index. Over the intervening years the US market has seen three major bull markets (1987-2000, 2002-2007, 2009-2015) one bear market (2000-2002) and one severe crash (late 2007 to early 2009). Also, the start of the time series is shortly after "Black Monday" on 19th October 1987, and the period around it. That was when the US market fell 23% in a short time. The end of the time series, today, sees the US market trading at extremely high valuations by any measure you care to choose (my latest take on it can be found here). In other words the US market started low and ended high, yet has still been left for dust by its small South American cousin. So let's dig a little deeper, and see if there was something special about Argentina, or whether this applies in other weak currency countries. First off, Argentina was in the grip of hyperinflation between 1987 and the end of 1991, with rates peaking in March 1989. The currency, and the economy, were in meltdown. This led to extraordinary buying opportunities. Well-known investment guru Marc Faber identified a phenomenon that he calls the "paradox of inflation" in his excellent book "Tomorrow's Gold: Asia's age of discovery", first published in December 2002. Despite the title, most of the book concerns itself with the historical study of market booms and busts: from British canals to US railroads to the hyperinflation in 1920s Germany. If you can get hold of a copy it's highly recommended (I've read it twice). Faber visited Argentina in 1988. According to him the inflation rate was 600% a year at that time and you could buy the entire Argentine stock market for just US$750 million. Six years later in 1994, when inflation had been brought down to less than 10%, the stock market was worth US$34 billion, or 45 times as much! Molinos, an Argentine food company founded in 1902, went from US$20 million market capitalisation in 1987 to US$515 million in 1994 – up nearly 26 times in US dollar terms. Faber highlights some other examples of hyperinflationary bargains as well, and the huge profits on offer as the disease is tamed. Between 1991 and 1994 the Peruvian stock market went up over eight times in US dollar terms. During the famous hyperinflation in Germany you could have bought the market in October 1922 and made over 14 times your money – in US dollars – in just the following 13 months. The point is that high or hyperinflation often leads to a complete lack of confidence. Stock prices may be going up in weak local currency terms, but losing a huge amount in stronger foreign currency terms, such as when measured in US dollars. This can offer exceptional buying opportunities as stocks achieve extreme under valuations in the markets relative to the companies' long term potential. Eventually moves are taken to tame the inflation, confidence returns, and (hard currency) prices soar. The profits can be massive. Obviously hyperinflations are extreme conditions where people will do anything to dump the local currency. A barber in Buenos Aires once told me how he survived the hyperinflation in the late 1980s. He used to cut hair in the morning and take payment in local currency. Every afternoon he would buy his daily groceries, before prices rose again overnight. Any spare cash was exchanged for dollars the same day. But what about less extreme conditions, where currencies are simply weak, losing perhaps 10%, 20%, even 50% in a year? It turns out the stocks of these countries also have an excellent track record. This is something you really need to understand as an investor. Here's a couple of examples. First let's look at my current favourite bargain basement opportunity, Russia. (See "Why I'm still buying Russia and selling the USA" for a recent update.) The Russian rouble has been pretty weak over time. Since the beginning of 1994 it's lost around 96% – mostly during the 1998 Russian crisis, when the country defaulted on its debts, and then in the past couple of years as commodity prices collapsed. Also Russian stocks are currently cheap, with a P/E that's about a third of the US level. Despite this, the total return from Russian stocks has matched US stocks over the past 21 years (and a bit). The following chart compares the MSCI Russia (in orange) to the MSCI USA (in green) since the end of 1994. Both include price moves and dividends, and are measured in US dollars.

Clearly Russian stocks have been pretty volatile, and you'd need a strong stomach to stick with them through thick and thin. There was a huge crash in 1998 during the debt crisis, a massive boom until mid-2008 during the commodity bubble, another bust due to the panic of the global financial crisis, a sharp recovery until second quarter 2011 and then a bear market since. Over the next few years I expect cheap Russian stocks to rise sharply and expensive US stocks to head sideways or downwards. Russia will once again be left clearly in the lead over the long sweep, despite the history of a weak currency. Here's another one: India. This time we can look back to the end of 1992. The Indian rupee has lost 65% against the US dollar since then. But Indian stocks, measured in US dollars, have kept up well with US stocks. See the next chart comparing the MSCI India index (orange) with the MSCI USA (green).

And here's another: Indonesia. The Indonesian rupiah lost around 85% almost overnight during the 1997 Asian crisis, before recovering substantially and then slowly depreciating over time. Overall it's down 85-90% since 1987 (earliest data available), when the next chart comparing its stock market to the US starts.

Again, Indonesian stocks have matched US stocks in US dollar terms, despite the slumping currency. But let's home in on a specific episode to really highlight the potential of stocks from countries with weak currencies. Indonesia's big currency collapse was in 1997. The stock market crashed even in local currency, but even more in US dollar terms. It lost a massive 93% between June 1997 and September 1998. After the crash things settled down and the market took off again. It proved to be a spectacular buying opportunity. Despite another crash in 2008, and a weak market since April 2013 (when Indonesian stocks were distinctly expensive), the MSCI Indonesia is up nearly 24 times since September 1998, measured in US dollars and including dividends. The US market is up a measly 2.6 times by comparison. In other words, after the huge currency drop had happened – and despite ongoing erosion of the rupiah since then – Indonesian stocks outperformed US stocks by a factor of over 9 times over seventeen and a half years.

I've just given you four examples of stock markets that have performed well over many decades, despite having weak local currencies: Argentina, Russia, India and Indonesia. But are these isolated instances? Have I just cherry picked the data? Actually no. The most authoritative source for this is a study done by investment bank Credit Suisse a couple of years ago. Their analysts scrutinised the performance of 23 emerging markets between 1976 and 2013 inclusive, which is 38 years of data (and many hundreds of individual data points). The results were clear and conclusive. Stocks from the countries with the weakest currencies in the preceding year went on to have the strongest dollar returns over the following five years, on average. Here's the chart that summarises their results. They grouped all the data points into quintiles, from weakest to strongest currency countries. Each quintile is 20% of the data points, starting with the weakest 20% of currencies and ending with the strongest 20% of currencies during each point in the time series.

You can see that the weakest currency quintile returned nearly 35% a year on average over the following five years. That was followed by the second weakest quintile with over 20%. The strongest currency countries also did well, but there is no question that it was the weakest 40% that did best. Of course this is only on average. It won't work every time – but that's what diversification is for. You work out your investment strategy, put your money to work, and if the strategy is a good one then most of the investments will perform strongly. The winners will more than make up for the losers. Put this all together and it's strong evidence that the countries that have just had the weakest currencies usually go on to have the best stock market performance over the medium term. "Just had" is the crucial point here. Severe or extreme currency weakness is usually met with corrective policy measures at some point. Price inflation is brought under control, the exchange rate stabilises and the economy gets back to real growth. Confidence returns, profits grow, and the oversold stock market moves to higher valuation multiples. So despite what many, even most people think the historical record is clear. Investing in the stocks of countries that have had weak currencies is likely to be one of the most profitable investment strategies around. Just make sure you're prepared to wait for a few years for it to work out, and ignore the short term price swings. Fortune favours the brave. Regards, P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Hard Profits from Soft Currency Stocks appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Getting Tucked in by Janet Yellen Posted: 01 Apr 2016 09:00 AM PDT This post Getting Tucked in by Janet Yellen appeared first on Daily Reckoning. Today I want to share a story from a reader named Ryan… In 2008, Ryan was a rookie investor in his late 20s. When the financial crisis and stock market crash hit, he got crushed. Taken out to the backyard and beat with a 2×4. He was destroyed. Then Ryan knew very little about investing beyond the mainstream propaganda that "buy and hold" investing was the only way to go. Sit tight and never sell the theory goes. You'll do just fine in the long run. What a load of bunk… in the long run everyone is dead! Ryan's investments took a huge hit on that Wall Street wisdom…. one that can make the recovery back to breakeven extremely difficult (if not impossible). And Ryan's retiree parents got hit even harder. Their investment advisors had them follow the very same "buy and hold" philosophy. And they told Ryan's parents to "hold" all the way down to the bottom. They watched one of their stocks, Citigroup, go from $60 share all the way down to 97 cents. All because "professional" advisors believed Citigroup's "fundamentals" remained strong… despite its share price dropping like a stone month after month after month. After reading my books, Ryan found out not everyone got waterboarded by the 2008 crash. A number of traders made a bloody fortune during the Great Recession. In fact, these same traders have been able to make millions in both bull AND bear markets for decades on end. And they've done it by rejecting the misplaced faith in fundamental analysis and "buy and hold" that dominate the mainstream. Famed traders like David Harding, Martin Lueck, Larry Hite, Paul Mulvaney, Ken Tropin and Ed Seykota saw remarkable success by refusing to accept "wisdom" that says to always be long and never sell. Instead, they chose something different: trend following And as you know now, it's an approach that's made fortunes in both booms and busts. And it's one that Ryan has now chosen to embrace in full. As a trend follower, he no longer worries about the next meltdown or crash… When he wrote me back he was confident: "I will be ready for a new bear market and will embrace it." I'm telling you this story because it's really hard to break free from mainstream thinking. It's so much easier to be like your neighbors, toe the line and do nothing except trust the government to take care of you. Seriously, most people are happy enough that Fed Chairman Janet Yellen tucks them in at night with a kiss to the forehead. She is their god. Never question the queen. They think they can just "buy and hold" because if there's a crash, the Fed will save us all. It will all be OK as long as you trust your rulers. But the few who break free of that reap the rewards. Case in point… I recently spoke to Tom Bilyeu on Trend Following radio. Even though Tom isn't a trader, we can all learn something from him. He's an immensely successful and influential entrepreneur best known as co-founder of Quest Nutrition, the second fastest-growing private company in North America. But Tom wasn't always a wealthy high-achiever. He started out as a self-described "lazy" twenty-something who was so broke he routinely searched through his couch cushions for gas money. Today, he's a 39-year-old multimillionaire and influencer. And it all started when he decided to escape from the mainstream narrative. In this podcast episode, Tom reveals the secrets to his success, including…

Click here to listen to my conversation with Tom Bilyeu. Please send me your comments to coveluncensored@agorafinancial.com. I'd love to hear your thoughts. Please tell me exactly what you think. Don't sugar coat it! Regards, Michael Covel The post Getting Tucked in by Janet Yellen appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||