saveyourassetsfirst3 |

- MUST WATCH: “The Veneer Of Justice In The Kingdom Of Crime”

- Eric Sprott Breaks Down CRAZY Market Action in Gold and Silver

- Gold & Silver Update: Silver & the Miners Look Set To Break Higher!

- Harvey Organ: Big Money Taking On the Silver Shorts?

- Alasdair Macleod’s Market Report: FOMC Backs Off

- Gold Stocks’ Tiny Baby Bull

- Cartel Tries to Paint the Tape Right Off Huge Move in Gold!

- Golden Secrets (III) Yamashita’s Gold

- Is Stock Market Bubble About To Explode – Watch this Video!

- Are You Kidding Me? Chinese Exports Plunge 25.4 Percent Compared To Last Year

- China And Fracking: The Pillars Of “The Recovery” Are Crumbling

| MUST WATCH: “The Veneer Of Justice In The Kingdom Of Crime” Posted: 20 Mar 2016 12:15 PM PDT If you really want to know how we were fleeced… SD Guest Contributor: Dave Kranzler The only aspect of the 2008 de facto financial system collapse that was more stunning than the fact that NONE of the big banks were prosecuted for crimes that were obvious to a 2nd grader was that fact that […] The post MUST WATCH: “The Veneer Of Justice In The Kingdom Of Crime” appeared first on Silver Doctors. |

| Eric Sprott Breaks Down CRAZY Market Action in Gold and Silver Posted: 20 Mar 2016 12:00 PM PDT In the excellent interview below, Eric Sprott discusses exciting developments in the physical gold market as well as the historic price discrepancies currently seen in silver: The post Eric Sprott Breaks Down CRAZY Market Action in Gold and Silver appeared first on Silver Doctors. |

| Gold & Silver Update: Silver & the Miners Look Set To Break Higher! Posted: 20 Mar 2016 11:22 AM PDT So what’s the vibe going into next week? Gold looks to be weakening; I really didn’t like seeing gold drop when the USD fell 1% on Thursday. Silver on the other hand looks set to break higher, and possibly the miners also. Submitted by Peak Prosperity: On Friday, gold fell -2.60 to 1256.00 on […] The post Gold & Silver Update: Silver & the Miners Look Set To Break Higher! appeared first on Silver Doctors. |

| Harvey Organ: Big Money Taking On the Silver Shorts? Posted: 20 Mar 2016 10:02 AM PDT GIGANTIC RISE IN SILVER OI AS IT SEEMS THAT SOMEONE BIG IS WILLING TO TAKE ON THE CROOKS… DESPITE THE LOW PRICE OF GOLD/SILVER, GLD ADDS A WHOPPING 11.89 TONNES TO ITS INVENTORY/SLV ADDS 2.665 MILLION OZ/GOLD WHACKED/SILVER HELD UP PRETTY GOOD/GOLD AND SILVER SHARES REFUSE TO BUCKLE/GIGANTIC RISE IN SILVER OI AS IT […] The post Harvey Organ: Big Money Taking On the Silver Shorts? appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: FOMC Backs Off Posted: 20 Mar 2016 09:00 AM PDT The most likely explanation for silver’s sudden spurt is a combination of poor market liquidity and a revival in demand for industrial metals. The rise in industrial metal prices was wholly unexpected in western capital markets, and may be due in part to unexpected Chinese demand, as stockpiled dollars are dumped in favor of stockpiling […] The post Alasdair Macleod’s Market Report: FOMC Backs Off appeared first on Silver Doctors. |

| Posted: 19 Mar 2016 09:01 PM PDT Gold stocks have radically outperformed every other sector in the stock markets this year, blasting higher as investors flock back to gold. This powerful surge is spawning worries that gold stocks' new bull run is in danger of exhausting itself. But such fears are totally unfounded. A longer-term perspective reveals that gold stocks' baby bull […] The post Gold Stocks’ Tiny Baby Bull appeared first on Silver Doctors. |

| Cartel Tries to Paint the Tape Right Off Huge Move in Gold! Posted: 19 Mar 2016 07:18 PM PDT With Massive Movements In Gold & Silver This Week, Craig Hemke Joins the Show to Break Down All the Action, Discussing: Paper Gold Manipulation Play By Play: Hemke Walks Investors Through the Last 5 Sessions in the “Gold” Market The End Game? “Silver’s Gonna Be A Little Higher Than $16…“ This Game Is Moving Toward THE […] The post Cartel Tries to Paint the Tape Right Off Huge Move in Gold! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Golden Secrets (III) Yamashita’s Gold Posted: 19 Mar 2016 05:00 PM PDT Bix Weir |

| Is Stock Market Bubble About To Explode – Watch this Video! Posted: 19 Mar 2016 03:13 PM PDT Is Stock Market Bubble about to Explode?Mike Maloney of Rich Dad fame is the author of Guide To Investing in Gold & Silver: Protect Your Financial Future In this video presentation Mike Maloney presents some convincing graphs that illustrate the extreme stock market bubble that he believes is setting us up for an extreme crash. He also presents some graphs from Dr. Schiller who illustrates the same point. We have never seen these extremely low interest rates and wide swings in the financial health like this until central banks and the FED started manipulating the financial markets with various programs such as quantitative easing. Dr. Schiller shows the trailing stock P/E is over 26 which in extreme bubble territory The demographics in the United States, the Middle age to old age ratio shows a significant correlation with the P/E ratio. In the study 40-49 was defined as middle age and 60-69 was defined as old age. They just took those two numbers and made a ratio. In their paper written in 2011 there was an extremely high correlation between this ration and P/E ratio. He uses the FED's own data to show the financialization of the US government. The Federal government's income is indicated by the tax receipts. The government's income crashes when the stock market crashes. Since the government is desperate for money they pass a lot of new laws whose goal is designed to bring more money in, not benefit the US citizen. Mike has long been an analyst of the precious metals markets. He was the precious metals adviser to Robert T. Kiyosaki of Rich Dad's Guide to Investing: What the Rich Invest in, That the Poor and the Middle Class Do Not! You can get a copy of Mikes book from Amazon by clicking on the image here If you would rather get your precious metals investing tips on your mobile device please subscribe to the Precious Metals Investing podcast. The podcast is available on iTunes Precious Metals Investing podcast on iTunes Some of the latest podcast episodes are also available here on this website on the Podcast page. When you purchase a book through this web site it does not increase your cost at all. I do earn a small commission that helps defray the cost of running this web site. The post Is Stock Market Bubble About To Explode – Watch this Video! appeared first on PreciousMetalsInvesting.com. |

| Are You Kidding Me? Chinese Exports Plunge 25.4 Percent Compared To Last Year Posted: 08 Mar 2016 08:45 PM PST

If someone would have told me a year ago that Chinese exports would be 25 percent lower next February, I would not have believed it. This is not just a slowdown – this is a historic implosion. The following comes from Zero Hedge…

I don’t know how anyone can possibly dismiss the importance of these numbers. As you can see, this is not just a one month aberration. Chinese trade numbers have been declining for months, and that decline appears to be accelerating. Another very interesting piece of news that has come out in recent days regards the massive layoffs that are coming at state industries in China. According to Reuters, five to six million Chinese workers are going to be losing their jobs during this transition…

For years, the Chinese economic miracle has been fueling global economic growth, but now things are changing dramatically. Another factor that we should discuss is the fact that the relationship between the United States and China is going downhill very rapidly. This is something that I wrote about yesterday. China has seized control of several very important islands in the South China Sea, and in response the Obama administration has been sailing military vessels past the islands in a threatening manner. Most recently, Obama decided to have an aircraft carrier task force cruise past the islands, and this provoked a very angry response from the Chinese…

Most Americans are not even paying attention to this dispute, but in China there is talk of war. The Chinese are absolutely not going to back down, and it does not look like Obama is going to either. Needless to say, a souring of the relationship between the largest economy on the planet and the second largest economy on the planet would not be a good thing for the global economy. And of course China is far from the only country that is having economic problems. Yesterday, I discussed how Italy’s banking system is on the verge of completely collapse. A few days before that I discussed the economic depression that has gripped much of South America. A new global economic crisis has already begun, and just because the United States is feeling less pain than the rest of the world so far does not mean that everything is going to be okay. There are huge red flags in Europe, Asia and South America right now. In addition, our neighbor to the north (Canada) is experiencing a very significant slowdown. The irrational optimists can continue to believe that the U.S. economy will somehow escape relatively unscathed if they would like, but that is not going to be what happens. Just like virtually everyone else on the planet, we are heading into hard times too, and this is going to become a dominant theme in the presidential campaign as we move forward into the months ahead. |

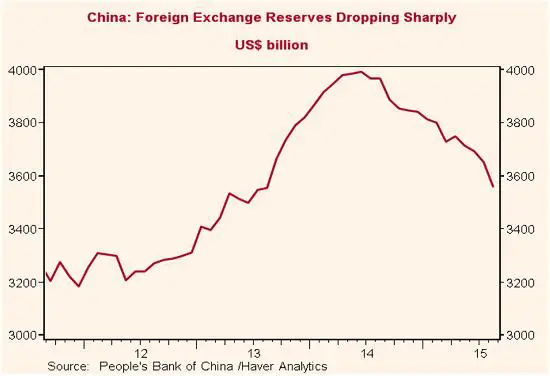

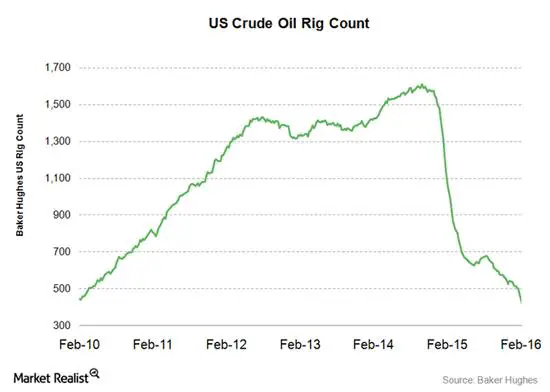

| China And Fracking: The Pillars Of “The Recovery” Are Crumbling Posted: 08 Mar 2016 12:22 PM PST When historians sort out this era of once-a-decade financial bubbles, they’ll marvel at how dissimilar the drivers of each boom were. The junk bonds of the 1980s were essentially leveraged tools for extracting wealth from companies. The dot-coms of the 1990s were vehicles for exotic new technologies and untested business models. The sub-prime mortgages and credit default swaps of the 2000s were semi-fraudulent fee-generation schemes. All, in retrospect, were strange, unsteady foundations on which to build a global economy. But they look positively sane compared to the pillars of the current expansion: China and fracking. As the true extent of China’s debt binge becomes apparent, the only reasonable reaction is awe. To cook the story down to its essence, the world’s biggest developing country decided to become developed in the space of a few years, borrowing nearly as much money as the entire rest of the world and using the proceeds to buy up every conceivable kind of industrial commodity. The result was a natural resources boom that, for a little while, floated the global economy on a rising tide of leverage. For much more detail, see this long Zero Hedge analysis. Then, as all debt binges eventually do, this one ended in a tangle of malinvestment and evaporating cash flows. China’s excess capacity in basic industries like steel and cement is now epic. Mass layoffs are being announced daily. Its velocity of money — a measure of the tempo of economic activity — is the lowest in the world. And external trade is collapsing, with February imports and exports falling 13.8% and 25.4%, respectively. Now in damage control mode, China is spending its foreign exchange reserves in a probably-futile attempt to keep its currency from plunging, while capital is pouring out of the country in search of safe havens and hedge funds are placing billion-dollar bets on a big yuan devaluation. China, in short, has become a drag on the global economy rather than its savior. And much, much worse is coming. Now on to fracking, which involves pumping toxic industrial chemicals into the ground to free up hard-to-reach oil and gas reserves. For a while, this was the Internet of the energy business, captivating bankers and entrepreneurs and igniting a scramble for prime drilling rights. Between 2006 and 2014, US natural gas production rose from 64 billion cubic feet a day to 90 billion while oil production rose from 5 million barrels a day 9 million. Along the way, fracking produced millions of well-paying jobs, lifting whole US regions from bust to boom and generating massive tax windfalls for favored states. But this too was a leveraged mirage. The surge in supply swamped a global market that was already slowing due to China’s bursting credit bubble. The result was a crash in oil and gas prices and a bloodbath in the US oil patch. All those now-idle rigs cost someone a lot of money, much of it borrowed from banks and junk bond investors. So unless oil and gas jump back up to 2011 levels in short order, the year ahead will see a rolling wave of bankruptcies and huge write-offs for lenders, pension funds and yield-seeking retirees. All of which, like China, constitute a drag on growth. In a system that seems incapable of functioning in the absence of bubbles, the question now becomes: What can the monetary authorities convert into the next bubble? And the answer is not at all clear. A case can be made that the rush into negative-coupon German and Japanese bonds is bubble-like. But this doesn’t seem to be generating jobs or income for anyone — just the opposite. Buying a negative interest rate bond is a bet on shrinking capital. In the US, cars were hot for a while but subprime auto lending is already hitting a wall and will likely go the way of China and fracking in the year ahead. Solar power? Maybe, but growth there comes at the expense of coal and natural gas, so it’s a wash in the short run. Finance? Forget it. Negative interest rates are an existential threat to traditional lending, and the big banks are all retrenching. Government funded infrastructure? That’s a liberal politician’s dream, but it sounds a lot like what China just did, and bubbles tend not to repeat in this way. The terrifying conclusion is that other than a major war, there’s nothing out there capable of generating another global bubble. And absent another bubble, there’s nothing between us and the abyss. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment