saveyourassetsfirst3 |

- Jim Willie Issues Weekend Alert: “Systemic Lehman Event Is In Progress”

- Alasdair Macleod’s Market Report: Gold Has a Secret!

- SILVER OUTBREAK: Investment Demand Will Totally Overwhelm The Market

- FX And Oil Week Ahead: Oil Of Gladness And Dollar Disappointment

- Gold Juniors Strong in Dark Q4

- Draghi Whips Out His Bazooka; “$1400 Gold Could Happen Quickly” – Alasdair Macleod On SD Weekly Metals & Markets

- Demand For Physical Gold & Silver Will BREAK The System – Craig Hemke

- London Gold Fix Rigging – Fact or Myth?

- A Note Of Caution (And Ambiguity) On Precious Metals

- Gold Stocks Reverse at Resistance Targets

| Jim Willie Issues Weekend Alert: “Systemic Lehman Event Is In Progress” Posted: 13 Mar 2016 12:45 PM PDT A systemic Lehman event is in progress, as the global financial structure is collapsing. The only remedy is the Gold Standard installation… The Gold price will find its true value and price over $10,000 per ounce. Submitted by Jim Willie, GoldenJackass: The current monetary policy is stuck in place. It is highly destructive to banking […] The post Jim Willie Issues Weekend Alert: “Systemic Lehman Event Is In Progress” appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: Gold Has a Secret! Posted: 13 Mar 2016 11:00 AM PDT The gold price is trying to tell us something… Silverbug Island 2nd Release The Kraken Submitted by Alasdair Macleod, GoldMoney: Despite a sharp run-up over the last two months, gold’s consolidation of previous strength has been a three-week sideways affair. Gold’s price started the week at $1260 and as of this morning (Friday 0800 London […] The post Alasdair Macleod’s Market Report: Gold Has a Secret! appeared first on Silver Doctors. |

| SILVER OUTBREAK: Investment Demand Will Totally Overwhelm The Market Posted: 13 Mar 2016 09:00 AM PDT It's no secret to the precious metal community that silver is one of the most undervalued assets in the market. Most physical silver investment is being held TIGHTLY and will not enter back into the market because its owners realize the Global Financial System will get flushed down the toilet when the Central Banks lose […] The post SILVER OUTBREAK: Investment Demand Will Totally Overwhelm The Market appeared first on Silver Doctors. |

| FX And Oil Week Ahead: Oil Of Gladness And Dollar Disappointment Posted: 13 Mar 2016 07:36 AM PDT |

| Gold Juniors Strong in Dark Q4 Posted: 12 Mar 2016 09:01 PM PST With gold miners' stock prices surging dramatically this year, investors' attention is starting to return to the gold juniors. These smaller miners and explorers suffered terribly in recent years, all but abandoned as gold slumped to major secular lows. But even during gold's darkest quarter, the fundamentals of the juniors actually mining gold remained quite […] The post Gold Juniors Strong in Dark Q4 appeared first on Silver Doctors. |

| Posted: 12 Mar 2016 04:00 PM PST Investor Intelligentsia |

| Demand For Physical Gold & Silver Will BREAK The System – Craig Hemke Posted: 11 Mar 2016 01:01 PM PST Someday something will change and the confidence scheme will fail. Every uptick in gold increases the pressure on that confidence scheme which is why the banks are fighting it so hard…in the end they are just not going to be able to… At some point the demand for physical gold/silver will break the system: Submitted […] The post Demand For Physical Gold & Silver Will BREAK The System – Craig Hemke appeared first on Silver Doctors. |

| London Gold Fix Rigging – Fact or Myth? Posted: 11 Mar 2016 12:59 AM PST SunshineProfits |

| A Note Of Caution (And Ambiguity) On Precious Metals Posted: 05 Mar 2016 10:38 AM PST Suddenly, gold and silver are good again. In two short months, they’ve morphed from targets of derision to shiny new toys on the financial playground. Not surprisingly, questions have been pouring in from people who kind-of sort-of know the precious metals story and are wondering if they should jump in with both feet. A reasonable response? “If your time frame is the coming decade, sure, go for it. But if you’re thinking in terms of months rather than years, you should be considering entry points and accumulation strategy.” Which brings us to the Commitment of Traders (COT) report. Most new precious metals investors have never heard of it. And since it seems to be a pretty good indicator of those metals’ short-term price fluctuations, this might be a useful time to define and explain it. So here goes: Gold and silver prices are set in the “paper” market where big players trade futures contracts that enable them to buy (or require them to deliver) large amounts of metal at some point in the future. There are two main groups in this market: The fabricators who buy metal and turn it into coins or jewelry or whatever, and the speculators (hedge funds and other institutional gamblers) who use futures contracts to bet on the metals’ price movements. Over and over again, the fabricators trick the speculators into piling in or out at exactly the wrong time, thus moving prices in ways that benefit the former. They might, for instance, sell a few contracts into the market when most traders are at lunch or home for the night, pushing the price down and activating hedge fund stop-loss orders. Those sales push prices down further, activating technical signals that cause momentum traders to short the market, producing yet another sharp drop. Then the fabricators step in and buy very cheaply — raising prices a bit and leading speculators to go long, pushing prices back up to where the game began. As observers like to say, “rinse, wash, repeat.” The COT report quantifies who’s long and who’s short and by how much, which makes it a snapshot of how the above game is going. Here, for instance, is a chart showing what the speculators are up to. When the blue line depicting their long positions and the red line depicting their shorts diverge, that means hedge funds and other traders have been suckered into betting on a gold price surge. When the lines converge, speculators have been fooled into betting aggressively on a decline. The thin gray line is the price of gold. As you can see it tends to do the opposite of what the speculators expect. What is this chart saying now? Well, the lines have diverged, indicating that speculators are extremely bullish. History says they are now sheep lining up for slaughter, in the form of a gold price correction which forces them to cover at a loss. So — again, based on history — a better entry point for incoming gold investors might be a few months off. However — and this is a very big caveat — indicators work until they don’t. Someday the paper markets will be overwhelmed by a tsunami of demand for physical metal. The commodities exchanges on which futures trade will run out of inventory and default when too many holders of long contracts demand delivery, and gold and silver will rocket higher. On that day everyone who isn’t fully invested in precious metals will be out of luck. And some claim that day is at hand. In a recent King World News interview, metals trader Andrew Maguire noted: "Now that we are entering a negative rate world, I am seeing a lot of very large-sized institutional money looking for a home. Some of this money is flowing into gold, and this is confusing technical traders who are battling what looks like a technically overbought gold market…” So for new precious metals buyers, is it better to get in gradually, using the COT report and other indicators to help define entry points? Or should they ignore the squiggles, stop being cute and just fully commit on the assumption that whatever price they pay today will be dwarfed by what prevails when the system finally breaks down? There isn’t, alas, a one-size-fits-all answer to such a question. So why bother discussing it? Because it’s interesting. And more information is always better than less. |

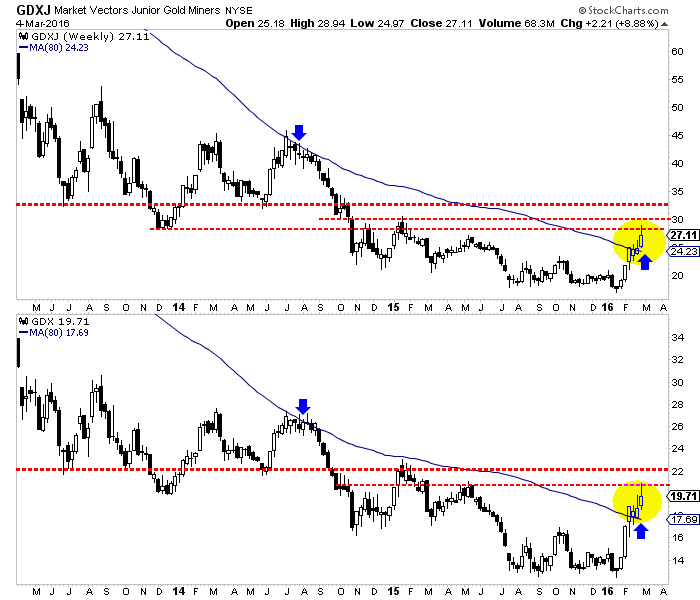

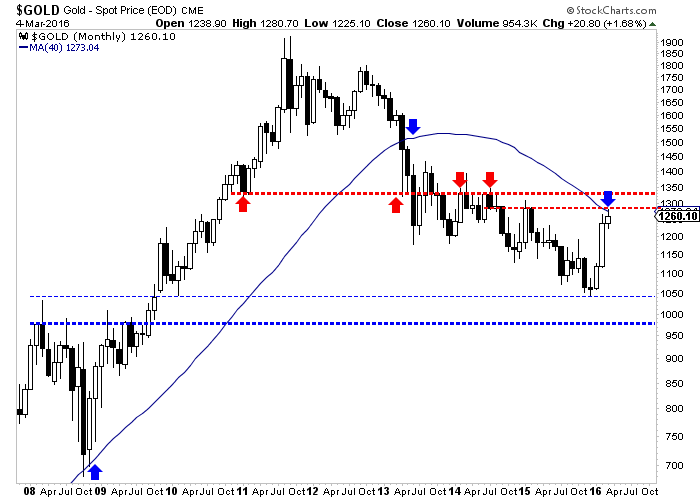

| Gold Stocks Reverse at Resistance Targets Posted: 04 Mar 2016 03:11 PM PST Two weeks ago, regarding the miners we wrote: If it (GDXJ) surpasses its 80-week moving average then its next target is $27-$28. Meanwhile, GDX is holding above previous resistance at $18. Its next strong resistance targets are $21 and $22. Earlier today GDX and GDXJ came within pennies of $21 and $29 respectively while Gold touched $1280 before reversing. While Gold and gold stocks could continue a bit higher, their rebound may have ended Friday morning. A weekly candle chart of GDXJ and GDX is below. The miners over the past six weeks have formed six white candles and taken out their 80-week moving averages, which contained the strongest rallies during the bear market. However, the miners formed a nasty reversal on Friday after touching resistance earlier in the day. The miners could, at the least, test their 80-week moving averages which are now support.  GDXJ, GDX Weekly Candles

The recent rebound was similar to that from the October 2008 lows. Then, GDX rebounded 69% (from low tick to high tick) in five weeks while over the past six weeks GDX surged 68%. Then, GDX corrected 20%. GDX also corrected 29% during that rebound. In recent weeks GDX has not corrected more than 10%. It would not be unreasonable for GDX to correct 20% or even 25% from Friday's high. Meanwhile, Gold reversed course after reaching a confluence of resistance which includes the 40-month moving average. There remains a small chance that Gold could test $1300/oz before correcting. Gold has support at $1240/oz and $1200/oz.

The bearish reversal at resistance coupled with history makes a strong argument that gold stocks could correct recent gains in the days and weeks ahead. A 20% decline would be normal and reasonable given the context. For those of us waiting for a correction, it could be coming. The month of March may provide the best buying opportunity in the miners since December 2015. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

By Jordan Roy-Byrne, CMT

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment