Gold World News Flash |

- Jim Rickards: The US Dollar Is a Shadow Gold Currency – The New Case for Gold

- Silver Lows – Silver Ratios

- A COLLAPSE IN GOVERNMENT IS INCOMING – Martin Armstrong

- GAO Has Been Telling Congress that Financial Regulation Is in Disarray for 20 Years

- The World Economy Is Drifting Into A Full Blown Collapse

- Why Jim Rogers isn’t Ready to Give up on China, Commodities or the U.S. Dollar

- Americans Have Been Turned Into Peasants – It’s Time to Fight Back

- Frank Holmes – Is This Move in Gold for Real?

- The More Corrupt the State, the More Numerous the Laws

- Gold Price Lost $8.90 or -0.72%

- PBOC Slams Yuan Shorts Again - Strengthens Currency Most Since 2005

- The More Corrupt The State, The More Numerous The Laws

- Yellen-Driven Short-Squeeze Sends Bonds To Best Quarter In 4 Years

- "It's A Big, Scary World Out There," BofA Warns, And Only Janet Can Save Us

- Gold Daily and Silver Weekly Charts - 'The Mother of All Short Squeezes'

- Power Up Your Investment Portfolio with Solar Energy

- Jim’s Mailbox

- Martin Armstrong: â€Collapse In Government Is Incoming, Markets Are Going To Start Responding!â€

- Full Speech: Donald Trump Rally in De Pere, WI at St. Norbert College (3-30-16)

- WW3 is About to Start , and the door of the ark has almost closed

- Tech Startups are Empty Shells

- JSMineset Gold Is Now Live! No PayPal Account Required

- This is What Happens When Doves Talk

- Here’s How You Should Play the Fed’s Latest Market Boost…

- 50,000-watt Toronto radio station airs interview with GATA secretary

- As interest rates turn negative, gold becomes the high-yield asset, Rickards says

| Jim Rickards: The US Dollar Is a Shadow Gold Currency – The New Case for Gold Posted: 31 Mar 2016 01:00 AM PDT from Palisade Radio: Get ready to dispose of your preconceived notions regarding the Federal Reserve and its take on gold! Is it possible that the Fed wants a higher gold price after all? That is what Jim Rickards reveals in this riveting interview with Palisade Radio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Mar 2016 11:01 PM PDT Silver prices as this is written (March 23) are down 60 cents on the day. Scary … no, probably a normal correction. Yes, paper silver prices on the COMEX are "managed" for the benefit of traders,... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A COLLAPSE IN GOVERNMENT IS INCOMING – Martin Armstrong Posted: 30 Mar 2016 11:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAO Has Been Telling Congress that Financial Regulation Is in Disarray for 20 Years Posted: 30 Mar 2016 10:30 PM PDT by Pam Martens and Russ Martens, Wall St on Parade:

During the 20 years that GAO has been warning about an ineffective financial regulatory system, taxpayers have been looted through a nonstop series of massive Wall Street frauds: the Nasdaq price fixing scandal; the rigged Wall Street research scandal leading to the $4 trillion dot.com bust; the four-decade Ponzi scheme of Bernie Madoff that was defined in meticulous written detail to a deaf and blind SEC by Harry Markopolos years before Madoff's confession; and the epic Wall Street collapse of 2007-2009 that took down the entire U.S. economy in the biggest bust since the Great Depression. (Those are just the major milestones. For a look at what just one bank, JPMorgan Chase, has been up to in just the past four years, check out this chronology; or this Citigroup rap sheet. ) And what did Congress do after the 2008 crash to fix the problem? It handed even greater oversight powers to the regulator that didn't see the crash coming and that had defied Congress by secretly funneling over $13 trillion in below-market-rate loans to teetering Wall Street banks – including at least one that was insolvent at the time (Citigroup). We're talking about the Federal Reserve – the agency that still has no Vice Chairman for Supervision of Wall Street banks as required under the homage-to-Wall-Street law known as Dodd-Frank, passed over five years ago. Why the Federal Reserve, the nation's central bank, which has a monetary policy mandate, should also be in charge of supervising the behemoth Wall Street banks' (especially when it abysmally failed in that job leading up to the crash) has yet to be explained to the American people. GAO is a nonpartisan agency that investigates matters requested by members of Congress to determine if taxpayers' money is being spent in the most effective manner. All one has to do is take a quick look at the graphic below that came with the latest GAO study on the "complex and fragmented" structure of the U.S. financial regulatory system to understand that this mess exists because that's the way Wall Street wants it to exist. A fragmented system of silos allows Wall Street to continue to loot the public with impunity by gaming the myriad loopholes in the system. And allowing an industry with this serial history of crime to run its own private justice system is like giving the Mafia their own courthouse. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The World Economy Is Drifting Into A Full Blown Collapse Posted: 30 Mar 2016 10:01 PM PDT from X22Report: Japanese retail sales decline for the 4th consecutive month. Russia has become the top buyer of gold in February. Saudi Arabia is loosing the oil market share in key countries. Government Conference Board for consumer confidence jumps while the Gallup consumer confidence declines. Case Shiller reports increase in home prices but when you take an actual look around the country house prices have been dropping. Corporate defaults are at catastrophic levels. David Stockman reports that the world economy is doomed. Obamacare enrollment misses by 24 million. Business will be dropping health care plans and people will have to pick up the tab. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Jim Rogers isn’t Ready to Give up on China, Commodities or the U.S. Dollar Posted: 30 Mar 2016 09:20 PM PDT from Yahoo: Concerns about China have shaken global markets and oil has been suffering, but Jim Rogers, the iconic founder of Rogers Holdings, remains optimistic. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

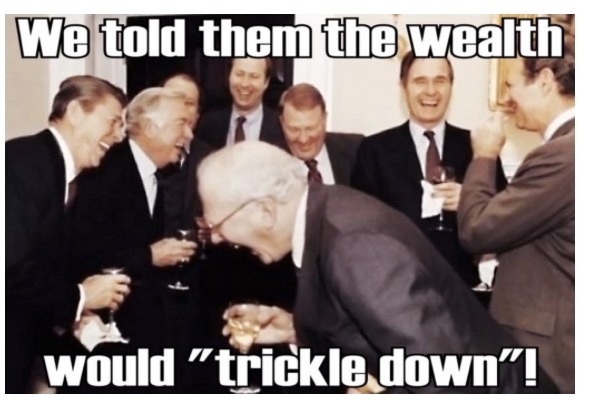

| Americans Have Been Turned Into Peasants – It’s Time to Fight Back Posted: 30 Mar 2016 09:00 PM PDT by Michael Krieger, Liberty Blitzkrieg:

The campaigns have found plenty of things to blame, from free-trade deals to the recklessness of Wall Street. But one problem with American capitalism has been overlooked: a corrosive lack of competition. The naughty secret of American firms is that life at home is much easier: their returns on equity are 40% higher in the United States than they are abroad. Aggregate domestic profits are at near-record levels relative to GDP. America is meant to be a temple of free enterprise. It isn't. – From the recent Economist article: The Problem with Profits In the 1970's, Goldman Sachs CEO Gus Levy famously encouraged his employees to be "long-term greedy." In order to understand how far we have fallen as an economy and culture, it's important to understand the meaning of the phrase and reflect upon it. "Long-term greedy" implies two very important principles that define a well functioning and ethical free market economy. First, is the unrepentant belief that earning a good profit and striving for financial success is a reasonable and admirable goal for both individuals and corporations. Second, is the understanding that such financial success should be earned, not stolen. If one's focus is the long-term, the implication is that you're committing yourself to building something real, and that the marketplace will ultimately reward you handsomely for your product or service. Throughout my childhood, and much of my adult life, I naively assumed this was the way the U.S. economy functioned. This was partly a result of propaganda, and partly a result of it still being somewhat true. What's become abundantly clear; however, is that from my birth in 1978 to the present day, the U.S. economy has been, gradually at first, and then rapidly transformed into a rigged, oligarch-dominated, crony Banana Republic system. Goldman Sachs and other TBTF banks gave up on the "long-term greedy" philosophy long ago. In fact, it was Wall Street's maniacal obsession with short-term greed which led to a systemic culture of fraud in which being even remotely ethical meant sacrificing tens of millions in bonuses and promotions. While a cycle of such greed and criminal behavior is inevitable within any economic system where enormous profits are available, what is not inevitable is how Obama's Justice Department responded to the criminality. By appointing Covington and Burling attorney Eric Holder to head up the DOJ, Obama was building a moat around the TBTF banks to ensure they would never be brought to justice. As I've highlighted previously, many of the largest Wall Street banks are clients of Covington and Burling, and acute observers doubted Holder would prosecute these firms since he was likely to spin right back through the revolving door after shielding the mega-banks from prosecution. This is in fact exactly what he did. Recall from last year's post, Cronyism Pays – Eric "Too Big to Jail" Holder Triumphantly Returns to His Prior Corporate Law Firm Job:

Read that over and over until you get it. This is the sort of crap that happens in Banana Republics. America is a Banana Republic. Although people are finally starting to figure this out (see Trump and Sanders), the elite, status quo, establishment, whatever you want to call them, could never have pulled this off without the unfathomable ignorance of the American public. As someone who was brainwashed for most of his life, I am sympathetic to this dilemma and I try not to be judgmental about it. It's precisely why I have dedicated my life at this stage to informing people about what's going on. There's absolutely no doubt in my mind that we can stop this grotesque merger of crony corporate interests and government if we have the information and the will. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Frank Holmes – Is This Move in Gold for Real? Posted: 30 Mar 2016 08:40 PM PDT from Jay Taylor Media: Frank Holmes gives his view on what is driving the price of gold higher so far in 2016 and tells if he believes the trend will continue. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The More Corrupt the State, the More Numerous the Laws Posted: 30 Mar 2016 07:40 PM PDT by Nick Giambruno, International Man:

I've seen it firsthand in the Middle East as well as many other places. The difference is huge and few people understand it. While laws vary dramatically across countries, almost every country in the world universally considers real crimes immoral. A real crime involves harm or the threat of harm to person or property. Think murder, theft, or arson. Virtually every government prohibits real crimes. Most also prohibit a lot of other things… When someone breaks the law, it's often not a real crime at all. He may have merely violated a particular government's law without threatening or harming anyone or anything. Keep in mind that the idea of a victimless crime is an oxymoron. If there is no victim, there is no real crime. Insulting the Dear Leader in North Korea, being a woman who's driving a car in Saudi Arabia, or possessing certain plants in the U.S. government all violate laws. But none of these activities harm or threaten people or property. They're not real crimes. They simply violate the laws of certain governments. Of course, I am not suggesting that anyone break the law anywhere, even if it wouldn't harm people or property. As a practical matter, it's foolhardy to violate any government's laws while you're within its reach. That is, unless you prefer the lifestyle of an outlaw or a martyr. It would be risky to disparage the Dear Leader while in North Korea, or to possess an unapproved plant in the U.S., and so forth. Distinguishing between real crimes (i.e., harming or threatening to harm people or property) and breaking the law is critical to your personal freedom. The next step is for you to minimize your exposure to arbitrary, make-believe "crimes" invented by your home government. You can do this by diversifying internationally. That means moving some of your savings abroad in the form of physical gold to a safe jurisdiction, owning real estate in another country, opening foreign bank/brokerage accounts, and obtaining a second passport, among other things. Taking these steps will significantly dilute the power bureaucrats in your home country have over you. This is what this publication is all about: maximizing your personal freedom and worldwide financial opportunities. The more laws, regulations, and edicts your home government subjects you to, the more important it is to diversify internationally. This problem is particularly obvious in the U.S., where every level of government is continually passing more laws…especially the federal government. There are so many vague, overly broad federal laws criminalizing mundane activities that it's impossible for anyone to be 100% compliant. Many people think felonies only consist of major crimes like robbery and murder. But that isn't true. An ever-expanding mountain of laws and regulations has criminalized even the most mundane activities. It's not as hard to commit a felony as you might think. Many victimless "crimes" are felonies. A study by civil liberty lawyer Harvey Silverglate found that the average American inadvertently commits three felonies a day. Today, there are thousands of federal crimes, and the number is constantly increasing. It brings to mind the words of the great Roman historian Tacitus: "The more corrupt the state, the more numerous the laws." Here's what Doug Casey says.

Today in the U.S., the government won't necessarily go after you if you break a law. After all, most everyone has technically broken some law. Instead, the government decides whom to go after and chooses which laws to enforce. A creative prosecutor can always find some crime to charge you with if he looks hard enough. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Lost $8.90 or -0.72% Posted: 30 Mar 2016 07:35 PM PDT

On Tuesday the Fed's answer to the Wicked Witch of the East, Janet Yellen, cooked up a spell to help Wall Street. In a speech in New York she waffled (I know that's redundant, "Fed" and "Waffle") on raising interest rates soon. Signal to the market was, "Party animals! Stock party's still on!" Also, "Dollar will get no help from the Fed." Stocks jumped, gold & silver jumped, dollar tanked, and hedge & mutual fund managers get to make better reports for the first quarter. See how easy that was? A simple spell: "N-o-R-a-t-e-R-i-s-e." No doubt she always wanted to throw a bone to oil producers. Just drop it off her broom in a fly-by, as it were, knocking down the US dollar. Whoa! Watch out for them wanged monkeys! Them thangs bite! Stocks today kept rising, but without much inspiration. Dow climbed 83.55 (0.47%) to 17,716.66. S&P500 chugged along at its side, 8.94 (0.44%) higher at 2,063.95. Dow approacheth its last high close at 17,721 (29 December 2015). Yeah, won't they be jubilatin' on Wall Street if it can pass that mark. 2,078.36 is the S&P500's comparable close. I'm not counting on seeing that. Dow in Silver & Dow in Gold appear to be nearing the end of their rallies, so that puts a limit on how much higher stocks can climb. By the way, y'all do understand that raw number gains are meaningless, right? Only thing that counts is PURCHASING POWER GAINS. During the 1921-23 German hyperinflation, for example, stocks soared hugely but lost purchasing power. Raw numbers mean nothing, only purchasing power. Raw number for the Dow look great, until you adjust them for inflation or compare them to gold or silver. US dollar index plunged 33 basis points (0.34%). Chart's here, http://schrts.co/ZhjJhK Come to think of it, all the trouble the Dollar Index has suffered these last 9 months has come from central banks. All those waterfalls you see on the chart were loosed by some central bank's announcement, including the latest one precipitated by Mother Yellen. Dollar has now reached the downtrend line from its March 2015 peak. It's below all its moving averages, and ain't got a friend in the world. Only important thing to watch is 92.50. If the dollar breaks down there, we have a whole new game, because it will sink much further. Euro rose 0.45% to $1.1342, pursuing a reluctant rally. Yen rose 0.22% to 88.95, above its 20 DMA again but indecisive twixt rallying and plunging. Gold tumbled $8.90 (0.72%) to $1,226.90 while silver barely moved, down 1.4¢ (0.09%) at 1520.6¢. Yesterday gold leapt $15.70 (1.3%) on Mother Yellen's broom, but although it climbed over $1,240, its fingers were too slippery to hold on there. What interest me more than yesterday's bound is the limit of the fall. Day before yesterday gold hit $1,206.10, yesterday $1,215.30, today $1,223.40. Hasn't closed below $1,220, so clearly there are enthusiastic buyers below $1,220. Chart: http://schrts.co/kGImYK That $1,206 low came awfully close to the 50 DMA, a frequent target in bull market corrections. My mind is now fermenting (you there! Stifle that smart remark!) on the possibility that gold won't drop any further. That instead of returning to $1,170 it will take off from here and blow past $1,308. I am not yet saying it will, but that idea is invading my mind. One reason it's invading is found on silver's chart. http://schrts.co/kY9doO I've drawn a green uptrend line from the January low, and it has caught every fall since then. It's tautological, but silver would have to break that uptrend in order to make that 1460¢ low I have been anticipating. What if it don't? The low so far, 1506¢, came right close to the 200 dma (1492¢). Might be correction enough. Tomorrow silver needs to close below 1517¢ to break that line. If it does, well, that ends the fermentation in my brain. If it don't, then maybe we ought to start making other plans, cause that chart is preening a flat-topped rising triangle, which forecasts an upside breakout. Not sure yet. Just musing. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PBOC Slams Yuan Shorts Again - Strengthens Currency Most Since 2005 Posted: 30 Mar 2016 07:23 PM PDT It appears the messaging from The People's Bank Of China to The Fed was heard loud and understood. Having exercised its will to weaken the Yuan (implying turmoil is possible), Janet Yellen delivered the dovish goods and so China 'allowed' the Yuan to rally back. In a double-whammy for everyone involved the biggest 3-day strengthening of the Yuan fix since 2005 also pushed Yuan forwards back to their richest relative to spot since Aug 2014 - once again showing their might against the dastardly speculative shorts. As we warned previously, it appeared a 'message' was being sent to The Fed via Yuan weakness - first ahead of The FOMC meeting and then, as several hawks got vocal, ahead of Janet's speech. Her uber-dovishness was rewarded as China 'allowed' the Yuan to rise and thus the USDollar to weaken...

And since Janet delivered, PBOC has strengthened the Yuan Fix by the most since 2005!!

Crushing shorts as Yuan forwards collapse back to their 'richest' relative to spot since Aug 2014...

And just like Keyser Soze, they were gone. So while the old mantra of "Don't fight The Fed" may apply to some, it most certainly does not apply to The PBOC... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The More Corrupt The State, The More Numerous The Laws Posted: 30 Mar 2016 06:50 PM PDT Submitted by Nick Giambruno via InternationalMan.com, Today, I’m going to share one of the most important things I’ve learned traveling around the world: There’s a crucial difference between committing a real crime and breaking the law. I’ve seen it firsthand in the Middle East as well as many other places. The difference is huge and few people understand it. While laws vary dramatically across countries, almost every country in the world universally considers real crimes immoral. A real crime involves harm or the threat of harm to person or property. Think murder, theft, or arson. Virtually every government prohibits real crimes. Most also prohibit a lot of other things… When someone breaks the law, it’s often not a real crime at all. He may have merely violated a particular government’s law without threatening or harming anyone or anything. Keep in mind that the idea of a victimless crime is an oxymoron. If there is no victim, there is no real crime. Insulting the Dear Leader in North Korea, being a woman who’s driving a car in Saudi Arabia, or possessing certain plants in the U.S. government all violate laws. But none of these activities harm or threaten people or property. They’re not real crimes. They simply violate the laws of certain governments. Of course, I am not suggesting that anyone break the law anywhere, even if it wouldn’t harm people or property. As a practical matter, it’s foolhardy to violate any government’s laws while you’re within its reach. That is, unless you prefer the lifestyle of an outlaw or a martyr. It would be risky to disparage the Dear Leader while in North Korea, or to possess an unapproved plant in the U.S., and so forth. Distinguishing between real crimes (i.e., harming or threatening to harm people or property) and breaking the law is critical to your personal freedom. The next step is for you to minimize your exposure to arbitrary, make-believe “crimes” invented by your home government. You can do this by diversifying internationally. That means moving some of your savings abroad in the form of physical gold to a safe jurisdiction, owning real estate in another country, opening foreign bank/brokerage accounts, and obtaining a second passport, among other things. Taking these steps will significantly dilute the power bureaucrats in your home country have over you. This is what this publication is all about: maximizing your personal freedom and worldwide financial opportunities. The more laws, regulations, and edicts your home government subjects you to, the more important it is to diversify internationally. This problem is particularly obvious in the U.S., where every level of government is continually passing more laws…especially the federal government. There are so many vague, overly broad federal laws criminalizing mundane activities that it’s impossible for anyone to be 100% compliant. Many people think felonies only consist of major crimes like robbery and murder. But that isn’t true. An ever-expanding mountain of laws and regulations has criminalized even the most mundane activities. It’s not as hard to commit a felony as you might think. Many victimless “crimes” are felonies. A study by civil liberty lawyer Harvey Silverglate found that the average American inadvertently commits three felonies a day. Today, there are thousands of federal crimes, and the number is constantly increasing. It brings to mind the words of the great Roman historian Tacitus: “The more corrupt the state, the more numerous the laws.” Here’s what Doug Casey says. Corruption can be defined as the taking of bribes of one type or another by officials in order to allow subjects to avoid taxes or regulations. Political corruption doesn't, therefore, occur in totally free markets simply because there's no taxation or regulation to avoid. Inevitably, and completely predictably, the more taxed and regulated a society is, the more necessarily corrupt it is. Today in the U.S., the government won’t necessarily go after you if you break a law. After all, most everyone has technically broken some law. Instead, the government decides whom to go after and chooses which laws to enforce. A creative prosecutor can always find some crime to charge you with if he looks hard enough. This doesn’t sound like the land of freedom and opportunity. It sounds like an out-of-control government. If you think it’s bad now, just wait until American politicians get even more financially desperate. Like most governments in financial trouble, we think the U.S. will keep choosing the easy option…money printing on a massive scale. This is a huge threat to your financial security. Politicians are playing with fire and inviting a currency catastrophe. The socio-political consequences are likely to be even more severe than the financial ones. This is a big reason why we think everyone should own some gold. Gold is the ultimate form of wealth insurance. It has preserved wealth through every kind of crisis imaginable. It will preserve wealth during the next crisis, too. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yellen-Driven Short-Squeeze Sends Bonds To Best Quarter In 4 Years Posted: 30 Mar 2016 06:25 PM PDT After The Fed jawboned the world into the largest aggregate net short position in Treasuries in Q4 since 2010, its rapid realization that all is not well in the real world - and subsequent talking (and walking) back of rate-hike expectations - has sparked the biggest short-squeeze in 6 years and sent Treasuries up by the most since 2012. With odds collapsing for any more rate-hikes in 2016, as Yellen admits their forecasts are worthless, it seems - just as in 2010 - the bonds shorts have a way to go. The Fed should “proceed cautiously” in raising interest rates, Yellen said in New York. The chance of a move by the end of 2016 has declined to 64 percent, from 73 percent at the end of last week, futures prices compiled by Bloomberg indicate.

All driven by the biggest Treasury short-squeeze in 6 years (which was forced upon investors by The Fed's jawboning)... And finally, the constant jabber from The Fed demandingthat investors short bonds continues...

How's that working out for you? It appears fighting The Fed in bond-land has worked very well recently. As The Wall Street Journal reports, bond traders are confused and concerned...

As we have said for a long time, The Fed is Dow Data-Dependent. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "It's A Big, Scary World Out There," BofA Warns, And Only Janet Can Save Us Posted: 30 Mar 2016 05:36 PM PDT On Tuesday, Janet Yellen delivered what some observers called her finest "performance" since ascending to the monetary throne in February of 2014. Of course in the post-crisis world, central bankers are only praised when they make dovish pronouncements. Hawks are heretical. To tighten is to sin. The conundrum for Yellen is that she appears to have been talked into going along with the global easing bias for a few more months at the G20 - data be damned. That is, despite the fact that the US economy is about to hit full employment (and we'll ignore the fact that the numbers are goalseeked and that the only jobs being created are lowly service sector positions), Yellen has to find an excuse to avoid adopting too steep a "flight path" for rates, lest the dollar should soar causing commodities to plunge anew and triggering massive outflows from EM. With no way to justify a dovish tilt based on the dual mandate (inflation isn't exactly where the FOMC would like it to be, but compared to Japan and Europe it looks rather robust), Yellen did the only thing she could this month: she admitted (just as she did in September) that the reaction function now includes international financial markets and, more specifically, China. That admission was greeted with a high degree of skepticism last autumn, but it would appear that now, having proven that it's at least possible to hike 25 bps without the entire world coming to an end, the market is more than happy to see the Fed stand pat if it means forestalling global turmoil. As we noted this morning, some Fed officials didn't get the message and so on Tuesday, Yellen the "mother lion" was forced to "swat her misbehaving cubs back into line" (to quote Bloomberg's Richard Breslow) with an uber dovish speech at the Economic Club of New York. The message the vaunted Fed chair sought to drive home was simple: it wouldn't matter if the unemployment rate dropped to 1% and inflation expectations spiked above the FOMC's target overnight - it's simply too dangerous out there for the Fed to lean hawkish. Or, as BofA puts it in a new note: "It's a big scary world out there." Excerpts are below. * * * From BofA: It's a big scary world out there Fed Chair Janet Yellen, in her speech and subsequent Q&A at the Economic Club of New York, was very clear in conveying her message that the weak global backdrop is preventing the Fed from hiking rates very much. While the Fed's baseline economic scenario was roughly unchanged between the December and March FOMC meetings - given appropriate monetary policy accommodation - uncertainties are higher due to a weaker path of projected global growth. In other words the reduction in the dot plot to two rate hikes this year at the March meeting, from four hikes in December, is thought appropriate to mitigate the impacts of the weaker global backdrop. That reinforces the impression from the last FOMC meeting that the Fed is willing to risk higher inflation over the longer term in order reduce shorter term uncertainties. Hence the increase in 5-year, 5-year forward inflation expectations and simultaneous decline in equity vol following today's comments by Chair Yellen (Figure 1). Why the Fed matters To illustrate why the Fed's clear shift to a more dovish stance is so effective in reducing uncertainties in financial markets, consider our recent survey of US credit investors. Arguably at least three - if not all - of the top-4 investor concerns - China, Oil prices, Geopolitical risk and Slow recovery (in that order, Figure 2) - are mitigated to some extent by the more dovish Fed. First of all a more aggressive Fed rate hiking cycle would likely accelerate China's capital flight which, with an open capital account, leads to the equivalent of monetary policy tightening in China at a time where the weak economy needs the opposite. Furthermore, to stem such capital flight incentivizes the PBOC to pursue more aggressive currency depreciation, which is very deflationary through commodities. Second the stronger dollar associated with a more aggressive Fed puts downward pressure on oil prices - instead the USD weakened 0.8% today. Third to some extent even geopolitical risk is related to lower oil prices. Fourth the stronger dollar and lower oil prices could initially be negative for the US economy through the manufacturing sector - before consumers eventually do react to lower prices at the pump. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - 'The Mother of All Short Squeezes' Posted: 30 Mar 2016 02:20 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Power Up Your Investment Portfolio with Solar Energy Posted: 30 Mar 2016 01:08 PM PDT For years I have been researching clean energy investments in lithium ion batteries, nuclear, rare earths and renewables. However, I haven’t made a solar investment in years until a few months ago. Over the years, I have been a skeptic on solar as I felt the cell technology was not yet advanced to be competitive economically. This past year may have been a turning point in solar investments and the coming 3-5 years could see exceptional growth especially with the advancement in the Lithium-Ion Battery and Power Storage. Solar should continue growing while natural gas and coal go extinct like the dinosaurs. California, Arizona and Nevada are definitely leaders increasing solar capacity, hopefully my home state of Sunny Florida will increase their usage. A lot of the growth depends on tax credits which I believe should be supported to wean ourselves off of dirty fossil fuels. The growth of solar is increasing while costs are coming down. I believe strongly solar will play an increasing role in our future similar to the growth in lithium ion batteries. Investors can look at First Solar (FSLR) which technically looks like its in a uptrend. First Solar has developed, financed, engineered, constructed, and operating some of the world's largest and most successful PV power plants in existence. First Solar is around a $70 stock so it may be more suitable for conservative investors. However, if you are looking for potential outsized gains you should look at Natcore Solar (NXT.V or NTCXF), which is my first solar investment in many years. The company just got engaged to build a solar facility in Belize. Their Research team is working long hours improving the efficiencies of their patented cells. If this goal is reached Natcore could partner with manufacturers as Natcore has a unique product which could be quite exciting for the solar industry. Natcore has created a solar cell with lasers that eliminates the need for silver and high temperature furnaces. This could have dramatic cost savings to the industry. Natcore could be on a path to produce the highest efficiency solar cells in history at the lowest cost. For many months I have been highlighting the increased investment interest in the clean energy space. There is increasing interest to fund developments in renewables especially solar technology. The problem with solar cells is that they need to be made cheaper and have greater output to become more economically viable. Natcore Technology (NXT.V or NTCXF) has 59 patents relating to their nanotechnology research which is focused on improving efficiency and output of solar cells.

Solar cell manufacturers are desperate for technology that could improve efficiencies at a lower cost to have a competitive advantage. Natcore (NXT.V or NTCXF) could be a situation that gets noticed by some larger manufacturers who could become a strategic partner. Some important news developments have taken place recently which may be worthy of a rerating and a breakout as they were selected to develop a solar plant in Belize and they announced commercial efficiency levels that could make them very attractive to a manufacturer. 1)Natcore Technology Engaged To Develop 10 MW Solar FacilityBrent Borland, Managing Director of Catalyst565 said, “Natcore was selected because of the acknowledged expertise of its solar scientists and engineers." 2)Natcore Achieves Commercial-Level Efficiency With Breakthrough Solar Cell"We have reached performance goals that make us ready to present our case to large manufacturers whose scale and resources can help us reach the ultimate, ultra-high-efficiency potential that our cells are capable of," says Chuck Provini, Natcore's president and CEO. The chart looks excellent as the moving average are making a bullish golden crossover. Look for a weekly breakout at $.65. From a technical point of view a confirmed breakout could lead to a measured move to $.95. Disclosure: I own Natcore and the company is a website sponsor so please do your own due diligence as I have a conflict of interest and could benefit if the share price rises. ___________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Mar 2016 12:35 PM PDT Jim/Bill, Actually, it doesn’t matter who wins. Any candidate will be good for gold. The Democrats, of course, will increase spending and debt to support welfare programs. The Republicans, aside from Trump, are all looking to go to war by playing policeman to the world, and thusly increase deficits. Trump on the other hand, although... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Martin Armstrong: â€Collapse In Government Is Incoming, Markets Are Going To Start Responding!†Posted: 30 Mar 2016 12:31 PM PDT FRA Co-founder Gordon T. Long delineates political developments and their consequences on the global economy with Martin Armstrong, founder of Armstrong Economics. Martin Armstrong began his studies into market behavior when first becoming fascinated by the events during the Crash of 1966. He pursued his studies of economics searching for answers behind the cycle of boom and busts that plagued society both in Princeton and in London. He began to do forecasting as a service to institutional cash market players in gold that included Swiss banks.Armstronghad the unusual background in computer science in hardware and software and was perhaps the first to begin to apply his diverse knowledge from two fields together. He began creating a global model in the mid-70s and was publishing the results from about 1972. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Rally in De Pere, WI at St. Norbert College (3-30-16) Posted: 30 Mar 2016 12:00 PM PDT Wednesday, March 30, 2016: GOP Presidential candidate Donald Trump held a campaign event in De Pere, WI at the Walter Theatre at St. Norbert College Full Speech: Donald Trump Rally in De Pere, WI at St. Norbert College (3-30-16) The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WW3 is About to Start , and the door of the ark has almost closed Posted: 30 Mar 2016 11:49 AM PDT 3 powerful Prophetic Dreams , very disturbing. Time is almost up folks, May be your last chance to get inside the ark of GOD. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tech Startups are Empty Shells Posted: 30 Mar 2016 09:28 AM PDT This post Tech Startups are Empty Shells appeared first on Daily Reckoning. How many startups are empty shells filled with glitzy PR designed to appeal to VC newbies? It’s widely accepted that most tech startups will fail. Perhaps the core business proposition didn’t pan out, or the execution was flawed, or the initial success foundered on poor management, or another startup scaled up fast enough to suck up all the oxygen in the room–there are many reasons a startup with a fair chance at success can fail. But what if many if not most of the current batch of startups have zero chance of succeeding because they’re nothing but empty shells of gaseous public relations? Coder Daniel C. recently shared his experiences interviewing at numerous tech firms, both established firms and startups. Here are Daniel’s observations: When I first got into the high-tech field, I thought it was the only place that was safe, in other words, I really thought everyone was innovative and cutting edge. But now I am seeing something you probably have already seen being in the S.F. Bay Area, which is that a lot of companies in the high-tech sector are clueless and full of it. I have recently been on several job interviews with high tech startups and they are the weirdest interviews. They give me a bunch of blather about their company, but they don’t ask me any substantial questions about my technical expertise. Then they tell me within 24 hours that I just don’t have enough experience as they would like. Many of these companies reach out to me like I am their buddy, no formal introduction, “hey, dude, can we talk?” Some of them like to use the F word in their outreach, which totally turns me off. I think they have innovative confused with lack of professionalism. Of the ten-plus job interviews I have been to in the high-tech field, only two actually gave me a coding challenge to prove my skills. I actually have a lot of esteem for those two companies (one of them is in London) because at least they assessed my hard skills via practical application. The rest I have no clue how they are coming to their conclusions based on a unfocused ten-minute talk about nothing. In fact, I am noticing most of these companies are not even reviewing my portfolio, which is leading me to develop questions for them such as “Which one of my apps did you enjoy most?” Anyway, I shared this with you because if you have any knowledge of anything similar, I would love to see an article on it. I have a hunch a lot of these companies lack direction and are probably not really drumming up a lot of business. A lot of good public relations, but not necessarily a steady stream of clients. Thank you, Daniel, for sharing your experiences and for raising a number of key points. The key metric for startups now is not revenues or paying clients–it’s their valuations–as in Unicorn valuations of $1 billion or more. But valuations that aren’t based on revenues, paying clients and profits are notoriously prone to collapse. It is far easier to convince a venture-capital wannabe with millions of investor dollars to fund a PR-heavy startup than it is to actually build a business with paying clients, rising revenues and profits. No wonder we’re seeing accounts like this: Top Silicon Valley VC Laments: Startups Being Funded Are “Mostly Crap & Largely Worthless” Bubbles always seem permanent to those living within them. How many startups are empty shells filled with glitzy PR designed to appeal to VC newbies anxious to find the next Facebook? Perhaps far more than the financial media cares to admit. Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post Tech Startups are Empty Shells appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| JSMineset Gold Is Now Live! No PayPal Account Required Posted: 30 Mar 2016 08:45 AM PDT Dear CIGAs, JSMineset Gold is now live! Click the yellow banner on the top right to sign up. $119.00/year will get you exclusive access to Bill Holter's up to the minute articles, Q&A videos from Jim and Bill, and a number of other postings only available on JSMineset Gold. You also won't have to view... Read more » The post JSMineset Gold Is Now Live! No PayPal Account Required appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This is What Happens When Doves Talk Posted: 30 Mar 2016 08:21 AM PDT This post This is What Happens When Doves Talk appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Ty Keough sent me a note yesterday asking me what Janet Yellen meant when she said something about “Greater Gradualism” in her speech yesterday? I laughed out loud, and then sent him a response saying something about “Fedspeak” and central bank parlance for “we don’t know what’s going on” I mean when you mention your uncertainty about inflation 10 times in a speech, something has to be going awry, don’t you think? Well, that’s what she did yesterday, she mentioned the Fed’s uncertainty with inflation 10 times! Do you think that was the message she wanted to get across? HA! So, yours is no disgrace Janet Yellen, central banks have lost the power to direct an economy, it’s not your fault, so don’t be so downtrodden. I mean didn’t you learn from Big Ben Bernanke, that even in the face of a housing meltdown that you put on a happy face and tell the world that everything is fine? Ok, I could go on but won’t. But if you’re ever in the neighborhood, I invite you to stop by the Butler patio. Once again the Fed members aren’t singing from the same song sheet, as illustrated by the Yellen speech yesterday, which by far, more dovish than anything I’ve heard from the other Fed members recently. Now, don’t get me wrong here. I’m not upset with Yellen, she did what she thought she had to do! And by doing so, she has removed the conn from the dollar. That’s right, you talk dovish, and your currency will suffer the consequences. And the timing couldn’t be better for the currencies that enjoy a positive yield differential to the dollar. You see, we’re coming up on month-end/quarter-end, where normally you see a lot of hedging unwound, and if my thoughts are correct, most of that hedging was long dollars. So, we could have the dovish speech by Janet Yellen, and unwinding of long dollar hedges hitting about the same time. Be careful making any outright calls on whether the strong dollar trend has ended in the next 2 days, because it could very well look that way, but be 1/2- window dressing. The New Zealand dollar/kiwi is pushing the currency envelope across the table this morning, and now trades with a 69-cent handle! WOW! And their central bank, the Reserve Bank of New Zealand (RBNZ), cut rates earlier this month, proving once again that the pain can be forgotten, if given enough time. The Aussie dollar is also rallying this morning, but it appears to be taking a back seat to kiwi. That doesn’t happen very often, but when it does it’s quite interesting to me. The price of oil is steady Eddie with a $38 handle this morning, so it remains in its range that I described for you a day or two ago. And since the Fed looks like they will keep their interest rate powder dry when they meet in April, the petrol currencies are looking pretty perky this morning, led by the Russian ruble. The Canadian dollar/loonie, has enjoyed a very strong month of March, I just say! Late in February, we were talking with some friends from Canada, out on the deck, and they mentioned how badly the loonie had fallen in the last couple of years. So, I took it upon myself to let them know that I thought the loonie was oversold, and could be ready to move higher. The loonie was trading around 71-cents then. Today, the loonie has a 76-cent handle! A better than 5-cent move in March. I remember when if you saw a 5-cent move in a currency in a 1/2-year that would be considered a huge move! But that was then, and this is now, and the volumes reach amazing levels every day in these currencies, causing them to take wild swings that in the days of yore, (HA!) didn’t exist. All the currencies, including the Chinese renminbi, are on the rally tracks vs. the dollar today. More on the renminbi in a minute, but first, one true currency that isn’t on the rally tracks this morning is gold. The shiny metal did react positively to the Yellen speech yesterday with a more than $20 move higher, with more than 400,000 contracts in gold traded on the day! But gold is giving back $5 of that move higher yesterday, in the early morning trading.. Having two-day rallies just doesn’t seem to be in gold’s DNA these days. Platinum had a HUGE jump higher yesterday and is still moving stronger this morning. Yesterday morning Platinum was trading at $949 when I did the currency roundup. This morning platinum is trading around $972. I can’t find anything that tells me why Platinum jumped so much yesterday, and that’s typical for these metals that aren’t gold. So, back to the Chinese renminbi, which saw a larger than the average bear, appreciation at the fixing last night. I’m not surprised by anything the Chinese do with the currency these days. The days of pretty much knowing which way the wind will blow with the Chinese renminbi fixings, are over! But, isn’t it just like the Chinese to do a larger appreciation of the renminbi, right when the markets and every other currency commenter, thought that the Chinese were getting ready to devalue the currency? Consumer Confidence in the Eurozone dropped this month to 103 from 103.9. But that didn’t bother the euro which is still the offset currency to the dollar. The euro has gained back the 1.13 handle it held a couple of weeks ago, the last time the Fed talked dovish after their FOMC meeting where they left rates unchanged. That rally faded quickly for the euro, as will this one once we get through month-end. I just don’t see the euro breaking out of its current trading range, not now, at least. I think the Indian rupee is the proxy today for what happens when the Fed talks dovish. A foreign currency gets to rally, even in the face of things happening in said currency’s country that would normally have the currency on the selling blocks. The rupee is rallying, even in the face of Reserve Bank of India (RBI) Gov. Jaitley, who is keeping his grip on the interest rate cut handle. So, maybe you see what I’m talking about here with the short-term rallies that they are based on the Fed’s dovishness, which will probably fade in a day or two, so don’t get all lathered up over these moves just yet. They have to show me that they have staying power, and not fade like they did two weeks ago. The U.S. Data Cupboard yesterday saw Consumer Confidence surge higher in March from 92.2 to 96.2, but I told you that would probably happen, right? Like I said, it’s not rocket science, folks. And the S&P/Case-Shiller Home Price Index for January also printed, and showed a very small gain in home prices, so nothing here really to see. Today’s cupboard has the pre-Jobs Jamboree labor picture report from ADP for March jobs created. The ADP forecast is for 195,000 print. And that’s it for today for data. The ADP report will start our day, and we’ll go from there. Speaking of data… A dear, and longtime reader, Bob, sent me a note yesterday from a Gary Halbert, a financial newsletter writer, who highlighted the CNBC report last Friday by CNBC’s Steve Liesman, that sheds new light on the inaccuracy of the Commerce Department’s GDP reports. CNBC looked at each quarterly GDP report going back to 1990 and found an average error rate of 1.3 percentage points. So an initial report of 2% growth later could be revised up to 3.3% or down to 0.7% on average, and that, about 30% of the time, the government gets the direction of growth wrong. That is, GDP initially shown to be higher than the previous quarter could in fact be lower, and vice versa. The report was very fair given that they showed both sides of the coin saying the Gov’t could be wrong going either way. I found that to be interesting, because in my opinion, it always seems to me to be overstating GDP not understating it! Still, a great letter by Gary Halbert. and I thank Bob for sending that to me. I saw this headline on Ed Steer’s letter this morning and thought, that it was going to be a good story, given that I’ve talked about the Indian plan to pay interest on gold deposits. This article is funny to me. Here’s the link to the whole story: or here’s the snippet:

Chuck again. Well, if the deposit program had less strings attached, maybe it could be viewed as an option, but when you’re not even promised the return of the exact gold you deposited, well, that pretty much seals the deal for most Indian gold holders. They want no part of this plan. And with that, I’ll get out of your hair for today, and send you on your way to a wonderful Wednesday. Be good to yourself! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post This is What Happens When Doves Talk appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here’s How You Should Play the Fed’s Latest Market Boost… Posted: 30 Mar 2016 06:42 AM PDT This post Here’s How You Should Play the Fed’s Latest Market Boost… appeared first on Daily Reckoning. Stocks are limping into the last few trading days of the month… The major indexes have settled down after a crazy down-and-up start to the year. Traders seem bored. And the recent pause has a lot of folks scratching their head about what's next… "The Dow industrials had a trading range of 90.78 points from the low to high on Monday," MarketWatch reports. "That's the narrowest range since Christmas Eve 2015, when the index had a high/low range of 62.39 points. For the S&P 500, Monday marked the sixth day of a trading range of less than 20 points. That's the longest streak of its kind since a six-day run on Aug. 5, 2015." Yesterday overall was about as exciting as standing in line at the DMV. Until Auntie Janet Yellen released the doves, helping fuel a rally into the closing bell… "In her first comments since the Fed decided to hold rates steady two weeks ago, Yellen again sounded cautious tones about threats to the recovery of the world’s biggest economy," Reuters reports, "appearing to push back on more hawkish recent comments from a handful of her colleagues." You can pretty much rule out an April rate hike. The next chance will come in June. Then September. As of today, the futures markets are placing the chances of a September rate hike below 50%. The broader market immediately reacted to Yellen's comments. Gold jumped a quick $15 on the prospects of a weaker dollar. Bank stocks—which have been thirsting for a hike—slipped even further into the red. Low interest rates hurt banks' profitability because they get nothing on their cash holdings. But the real winner yesterday was the Nasdaq. And that's where we're fixing our sights right now. The tech-heavy index gained 80 points, good enough for a gain of nearly 1.7%. Compared to the Dow and the S&P 500, the Nazzy hit the stratosphere. And boy did it need the boost… If you paid attention to the overall market rally off its February lows, you know the Nasdaq has lagged behind the other major averages. The S&P 500 and the Dow Jones Industrial Average cleared their respective 200-day moving averages a couple of weeks ago, while the Nasdaq Composite just couldn't make the jump. But it's just one small step away from jumping the line after yesterday's performance:

The bigger tech stocks are already on the move. In fact, the most recognizable Nasdaq names are getting pretty darn close to erasing their 2016 losses. Microsoft is just below its highs after a 2% rally yesterday. And Facebook shares actually posted all-time closing highs. The Nasdaq may have lagged its peers as the market bottomed out in February and started rallying. But it looks ready to make up lost ground as we close out the trading month. Futures are rallying this morning. If the market does continue to push higher, it will catch a lot of folks (and pros) completely off guard. That's a great recipe for big gains… Sincerely, Greg Guenthner P.S. Make money in ANY market–sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out. Click here now to sign up for FREE. The post Here’s How You Should Play the Fed’s Latest Market Boost… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50,000-watt Toronto radio station airs interview with GATA secretary Posted: 30 Mar 2016 02:31 AM PDT 4:28p ICT Wednesday, March 30, 2016 Dear Friend of GATA and Gold: Your secretary/treasurer was interviewed March 19 on "The Real Money Show" broadcast on Toronto radio station CFMJ-AM640, discussing the extensive documentation of gold market manipulation by governments and central banks. CFMJ is a 50,000-watt station, the strongest signal allowed in North American radio, and it was unusual for GATA to be offered that much of a broadcast audience, the mainstream news media in Canada being just as determined as the mainstream news media in the United States to avoid the issue of market rigging by government. The interview was conducted by Darren Long of Guildhall Wealth Management, is 45 minutes long, and begins at the 7:50 mark at the show's Internet site here: http://therealmoneyshow.com/guildhall-wealth-management-inc-interviews-c... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| As interest rates turn negative, gold becomes the high-yield asset, Rickards says Posted: 30 Mar 2016 02:01 AM PDT 3:58p ICT Wednesday, March 30, 2016 Dear Friend of GATA and Gold: Wall Street for Main Street's Jason Burack gets some interesting observations out of financial writer and geopolitical strategist James G. Rickards in an interview posted this week. Among other things, Rickards remarks: -- As interest rates increasingly become negative, gold becomes the high-yield asset even as it may pay no interest at all. -- Governments can't reliably dump U.S. government debt instruments to protect themselves against dollar devaluation, since the president can freeze any threatening financial transaction, none more easily than government bond transactions. But governments can hedge their dollar exposure by buying gold, and many indeed are doing so. -- A major Swiss gold refinery can't keep up with orders, especially from China. -- China's government wants a lower gold price at the moment because the government is still pursuing acquiring at least another 3,000 tonnes, so the Shanghai Gold Exchange is not likely to be permitted to boost the gold price for a while. -- The gold price "has been manipulated for over a hundred years" by governments, but investors should buy the monetary metal anyway because "all the manipulations ultimately fail." But do the manipulations necessarily fail within the lifespans of all gold investors? Burack didn't ask and Rickards didn't say. The interview is 38 minutes long and can be heard at YouTube here: https://www.youtube.com/watch?v=Kdd_-w0-_Xc&feature=youtu.be CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Who could blame the researchers at the Government Accountability Office (GAO) for thinking that responding to Congressional requests for studies on how to repair the nation's ineffective maze of financial regulation is an exercise in futility. GAO has been spending boatloads of taxpayer money for the past two decades to define the problems for Congress as our legislative branch has not only failed to take meaningful corrective measures but actually made the system exponentially worse through the repeal of the Glass-Steagall Act in 1999.

Who could blame the researchers at the Government Accountability Office (GAO) for thinking that responding to Congressional requests for studies on how to repair the nation's ineffective maze of financial regulation is an exercise in futility. GAO has been spending boatloads of taxpayer money for the past two decades to define the problems for Congress as our legislative branch has not only failed to take meaningful corrective measures but actually made the system exponentially worse through the repeal of the Glass-Steagall Act in 1999. America used to be the land of opportunity and optimism. Now opportunity is seen as the preserve of the elite: two-thirds of Americans believe the economy is rigged in favour of vested interests. And optimism has turned to anger. Voters' fury fuels the insurgencies of Donald Trump and Bernie Sanders and weakens insiders like Hillary Clinton.

America used to be the land of opportunity and optimism. Now opportunity is seen as the preserve of the elite: two-thirds of Americans believe the economy is rigged in favour of vested interests. And optimism has turned to anger. Voters' fury fuels the insurgencies of Donald Trump and Bernie Sanders and weakens insiders like Hillary Clinton. Today, I'm going to share one of the most important things I've learned traveling around the world: There's a crucial difference between committing a real crime and breaking the law.

Today, I'm going to share one of the most important things I've learned traveling around the world: There's a crucial difference between committing a real crime and breaking the law.

No comments:

Post a Comment