Gold World News Flash |

- Gold, the Misery Index and Insanity - Gary Christenson

- Gold options manipulation is even worse in Europe, Turk tells KWN

- Numbers Don’t Lie: Why Monsanto May Be Facing Its Final Days

- Believe it or Not, it’s happening to Gold

- Marin Katusa: The Most Powerful Weapon Ever – Gold, Uranium, Pen? - The Daily Coin

- Silver’s Bullish Cup And Handle Pattern

- Gold Market Showing “Disconcerting Weakness”… According to Dennis Gartman

- Is Trump Right About NATO?

- Price Controls May Be On the Way

- The Difference Between Capitalism & Communism (Explained To President Obama)

- James Turk Says Today’s Gold Rally Is Definitely Shorts Scrambling To Cover

- Just whom is gold really so dangerous to?

- Japanese Industrial Production Crashes Most Since 2011 Tsunami

- Gold: Yen Lightning and Love Trade Thunder

- Why We Have A Wage-Inequality Problem

- SILVER vs. GOLD: 2 Must See Charts

- The Hard Truth about Soft Currencies

- Are We Becoming a Nation of Silver-Haired Crooks?

- Gold Daily and Silver Weekly Charts - Bubble Up To the Bar - As Time Goes By

- FLAT EARTH & JESUIT GLOBAL CONSPIRACY

- Harry Dent - The Rally is Over, Crash to 6,000 Dow by 2017

- More Soft Data In the U.S.

- Tom Cloud’s Latest Thoughts on Silver

- Marc Faber: Gold Still Most Desirable Currency in Wake of Brussels Attack

- Just whom is gold really so 'dangerous' to?

- Newmarket Gold's Shares Up 75% in 2016 and That Is Just the Beginning

- India's finance minister can't persuade his own wife to paperize her gold jewellery

| Gold, the Misery Index and Insanity - Gary Christenson Posted: 30 Mar 2016 01:00 AM PDT Sprott Money |

| Gold options manipulation is even worse in Europe, Turk tells KWN Posted: 30 Mar 2016 12:19 AM PDT 2:19p ICT Wednesday, March 30, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk, interviewed by King World News, discusses the manipulation of gold prices around futures option expiration dates, manipulation that is even more obvious in Europe than in the United States. Turk's interview is excerpted at KWN here: http://kingworldnews.com/james-turk-says-todays-gold-rally-is-definitely... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Numbers Don’t Lie: Why Monsanto May Be Facing Its Final Days Posted: 30 Mar 2016 12:00 AM PDT by Christina Sarich, Underground Reporter:

If we were to ascertain Monsanto's financial health by their stock price alone, you could safely say that they are suffering. The company recently slashed its 2016 earnings forecast from the $5.10-$5.60 per share it had forecast in December, to $4.40-$5.10, claiming that the reduction was due to a lagging strength in the U.S. dollar — but there's much more to the picture.

In numerous key markets, the company consistently rating among most hated in the world is taking major hits.

|

| Believe it or Not, it’s happening to Gold Posted: 29 Mar 2016 11:11 PM PDT Tonight as I was going over my charts and running my end of analysis the charts jumped out at me with a trade setup and wanted to share my cycle chart for gold with you. The price chart of gold below is exactly what my cycle analysis told us to look for last week WELL ahead of the today’s news and its things play out I as I feel they will then we stand to make some pretty good money as gold falls in value during the month of April. |

| Marin Katusa: The Most Powerful Weapon Ever – Gold, Uranium, Pen? - The Daily Coin Posted: 29 Mar 2016 11:00 PM PDT Sprott Money |

| Silver’s Bullish Cup And Handle Pattern Posted: 29 Mar 2016 10:32 PM PDT Two months ago, we signaled a huge buying opportunity was setting up in gold. Basically, that observation was based on a bullish chart pattern which is known as a ‘cup and handle’. After our call, gold moved higher in an explosive way. Today, we observe a similar chart formation on silver’s chart. The cup and handle resistance line comes in at $16 /oz. |

| Gold Market Showing “Disconcerting Weakness”… According to Dennis Gartman Posted: 29 Mar 2016 09:20 PM PDT by Jeff Nielson, Bullion Bulls:

No one summarizes this change in attitude more perfectly than notorious bankster mouthpiece, Dennis Gartman. Let’s me clear here: Gartman knows nothing about markets. He proves that every time he opens his mouth to talk about gold or silver. However, he is a LOYAL mouthpiece, and will read whatever Script is put in front of him. Thus, a few weeks ago, when this gold perma-bear was talking about “the surprising strength” in the gold market, we knew that this fake-rally was alive and well. But today, Gartman is singing a much different tune…

Gold Market Showing “Disconcerting Weakness” – Dennis Gartman

There are two humorous aspects to Gartman’s vacuous warning. First of all, we see how fickle and mindless are the “technical analysts” like Gartman. Supposedly, their “charts” tell them that markets can flip-flop from “strong” to “weak” in a couple of weeks, or sometimes even a few days. This is all tripe. In the real world, we have something called “trends”. And (back when we had legitimate markets) these “trends” would last not for mere weeks or days, but for many months — and often years. But in the phony world of the momentum-chasing charlatans like Gartman, “trends” can come and go like trains in a train station. The other surreal/absurd aspect to this pseudo-analysis, and all of the bearish B.S. about precious metals is the continual attempts by these Liars to depict gold and silver as changing. One day gold is “weak”, the next day it is “strong”. This is all part of detaching our thought processes from reality. In the real world, an ounce of gold (or an ounce of silver) is always an ounce of gold/silver. It’s value (in the real world) is eternal. All that changes are the PHONY EXCHANGE RATES, created by the banksters, as they perpetually manipulate all of our markets — and manipulate them to differing degrees. It’s not gold and silver which “changes”. Rather, it is the fundamentals of markets and economies which change. Of course we never get any accurate discourse about these fundamentals. Instead, we’re simply given an endless series of meaningless reports, on which Fed-head passed wind most recently.

It’s surreality layered atop more surreality. Whitewashing the world around us with so many coats of B.S. that almost all market participants and/or market-watchers never get even the tiniest glimpse of reality. Then, with ordinary traders/investors utterly clueless about what is really going on (because they never get relevant information), we have the mainstream media telling us we should “listen to the experts” (i.e. liars) like Mouthpiece Gartman. It’s certainly possible that this sudden wave of bearishness could just be a fake-out, within this fake-rally, and gold/silver will then bounce higher for a few weeks longer. However, with April now right in front of us (along with the WINDOW for the Next Crash), it’s certainly possible that the highs are in, in this fake-rally, and we will see the markets now (supposedly) “weaken” further — in the build-up to the actual Next Crash. |

| Posted: 29 Mar 2016 08:20 PM PDT from The Burning Platform:

Of NATO, where the U.S. underwrites three-fourths of the cost of defending Europe, Trump calls this arrangement "unfair, economically, to us," and adds, "We will not be ripped off anymore." Beltway media may be transfixed with Twitter wars over wives and alleged infidelities. But the ideas Trump aired should ignite a national debate over U.S. overseas commitments — especially NATO.

For the Donald's ideas are not lacking for authoritative support. The first NATO supreme commander, Gen. Eisenhower, said in February 1951 of the alliance: "If in 10 years, all American troops stationed in Europe for national defense purposes have not been returned to the United States, then this whole project will have failed." As JFK biographer Richard Reeves relates, President Eisenhower, a decade later, admonished the president-elect on NATO. "Eisenhower told his successor it was time to start bringing the troops home from Europe. 'America is carrying far more than her share of free world defense,' he said. It was time for other nations of NATO to take on more of the costs of their own defense." No Cold War president followed Ike's counsel. But when the Cold War ended with the collapse of the Soviet Empire, the dissolution of the Warsaw Pact, and the breakup of the Soviet Union into 15 nations, a new debate erupted. |

| Price Controls May Be On the Way Posted: 29 Mar 2016 06:00 PM PDT Submitted by Paul-Martin Foss via The Mises Institute, If you thought negative interest rates were as bad as it could get with central banks, you might be in for a surprise. Central banks have been so spectacularly unsuccessful with their accommodative monetary policies that they are discussing pulling out all the stops to get the results they want. They fail to realize that the reason prices aren’t rising is because they really want and need to fall. Bad debts weren’t liquidated during the last financial crisis, the debtors were merely bailed out. Overpriced assets weren’t allowed to be reduced in price. Central banks pumped trillions of dollars into the economy to attempt to paper over the recession. Market forces want to drive prices down, while central banks attempt to prop them up. So what to do when central banks aren’t getting their way? Central bankers may very well recommend price controls in an attempt to “jolt the economy out of its doldrums.” Of course, economies don’t go into doldrums and they can’t be jolted out of them. Recessions are not something endemic to the economy but are rather the result of central bank monetary intervention. Because central banks refuse to acknowledge their culpability for causing recessions, their methods for responding to recessions end up being more of the same thing that caused them in the first place: monetary easing. And now that those methods are proving ineffective, more drastic measures might be on the way. Remember that the last time all-out wage and price controls were implemented in the United States was in the early 1970s, also a time of great monetary turmoil. In fact, the price controls were instituted by President Nixon at the same time as he closed the gold window in 1971. As Ludwig von Mises pointed out many decades ago, once you begin to institute price controls, you inevitably lead to socialism.

That is why no one should be surprised that the governments of Japan, Europe, and the United States might resort to price controls to try to achieve what monetary policy could not. It follows logically, after all, since central bankers are in the price-setting and price control game to begin with. The interest rates that central bankers target or set are themselves prices, prices of money being loaned overnight or of money being deposited with the central bank. The aim of targeting or setting those interest rates is to influence interest rates and prices in the broader economy. So if that limited price-fixing doesn’t work, governments will expand their efforts to fix even more prices. It may not come directly, at least at first, but rather through some sort of incentivization. Pressure may be brought to bear to raise wages, using tax policy as either a carrot or a stick. The aim and the effect, though, will be to move prices to where the government thinks they ought to be, not what the market can actually bear. If price controls are in fact enacted, it will make it all the more obvious that economic planning on the parts of central banks and governments must be firmly opposed. It will separate the wheat from the chaff, those who actually support economic freedom from those who are willing to rationalize central planning. Anyone who claims to stand for free markets, free trade, and limited government but who attempts to defend the existence or importance of the Federal Reserve or central banking is a liar. Either you support free markets and freedom of pricing or you support central bank price-fixing and creeping socialism. There is no third way or middle road — socialism and the free market are mutually incompatible. A little bit of socialism in the form of price-fixing is like a little bit of gangrene, if left unchecked it will eventually infect and kill the whole. Now that governments and central banks may endorse further price controls as a remedy, the monetary policy facade has been torn away to reveal the reality that it is just another tool that leads to intensified central planning. Will enough people rise to the occasion to oppose further transgressions against monetary and economic freedom, or will they shrug their shoulders as our society continues to slouch toward socialism? |

| The Difference Between Capitalism & Communism (Explained To President Obama) Posted: 29 Mar 2016 05:30 PM PDT As President Obama explained in his Townhall in Cuba...

Investors.com's Michael Ramirez succinctly explains the difference...

And we leave it to RedState.com to rage...

|

| James Turk Says Today’s Gold Rally Is Definitely Shorts Scrambling To Cover Posted: 29 Mar 2016 05:15 PM PDT |

| Just whom is gold really so dangerous to? Posted: 29 Mar 2016 05:03 PM PDT GATA |

| Japanese Industrial Production Crashes Most Since 2011 Tsunami Posted: 29 Mar 2016 05:00 PM PDT While we are sure this will not deter Japanese officialdom from declaring that QQE and NIRP is working and that the deflation-mindset is being beaten, the fact is that when February's 6.2% collapse in Japanese industrial production is compared to the devastatingly poor plunge aftwer March 2011's quake, tsusnami, and nuclear 'event', something has gone disastrously wrong in Japan. Across every sub-sector, it was a total disaster...

Find the silver-lining in that - we dare you! |

| Gold: Yen Lightning and Love Trade Thunder Posted: 29 Mar 2016 04:30 PM PDT Graceland Update |

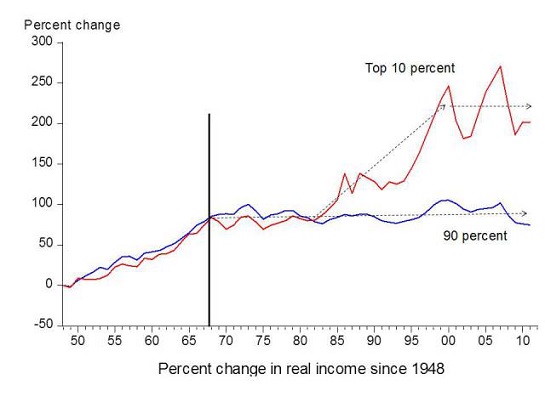

| Why We Have A Wage-Inequality Problem Posted: 29 Mar 2016 04:15 PM PDT Submitted by Gail Tverberg via Our Finite World blog, Wage inequality is a topic in elections around the world. What can be done to provide more income for those without jobs, and those with low wages? Wage inequality is really a sign of a deeper problem; basically it reflects an economic system that is not growing rapidly enough to satisfy everyone. In a finite world, it is easy for an economy to grow rapidly at first. In the early days, there are enough resources, such as land, fresh water, and metals, for each person to get a reasonable-sized amount. Each would-be farmer can obtain as much land as he thinks he can work with; fresh water is readily available virtually for free; and goods made with metals, such as cars, are not expensive. There are many jobs available, and wages for most people are fairly similar. As population grows, and as resources degrade, the situation changes. It is still possible to grow enough food, but it takes large farms, with expensive equipment (but very few actual workers) to produce that food. It is possible to produce enough water, but it takes high-tech equipment and a handful of workers who know how to use the high-tech equipment. Metals suddenly need to be lighter and stronger and have other characteristics for the high tech industry, thus requiring more advanced products. International trade becomes more important to be able to get the correct mix of materials for the advanced products needed to operate the high-tech economy. With these changes, the economic system that previously provided many jobs for those with limited training (often providing on-the-job training, if necessary) gradually became a system that provides a relatively small number of high-paying jobs, together with many low-paying jobs. In the United States, the change started happening in 1981, and has gotten worse recently.  Figure 1. Chart comparing income gains by the top 10% to those of the bottom 90%, by economist Emmanuel Saez. Based on an analysis IRS data; published in Forbes. What Happens When An Economy Doesn’t Grow Rapidly Enough?If an economy is growing rapidly enough, it is easy for everyone to get close to an adequate amount. The way I think of the problem is that as economic growth slows, the “overhead” grows disproportionately, taking an ever-larger share of the goods and services the economy produces. The ordinary worker (non-supervisory worker, without advanced degrees) tends to get left out. Figure 2 is my representation of the problem, if the current pattern continues into the future.  Figure 2. Author’s depiction of changes to workers share of output of economy, if costs keep rising for other portions of the economy. (Chart is only intended to illustrate the problem; it is not based on a study of the relative amounts involved.) The reason for the workers’ declining share of the total is that we live in a finite world. We are using renewable resources faster than they replenish and continue to use non-renewable resources. The workarounds to fix these problems take an increasing share of the total output of the economy, leaving less for what I have called “ordinary workers.” The problems we encounter include the following:

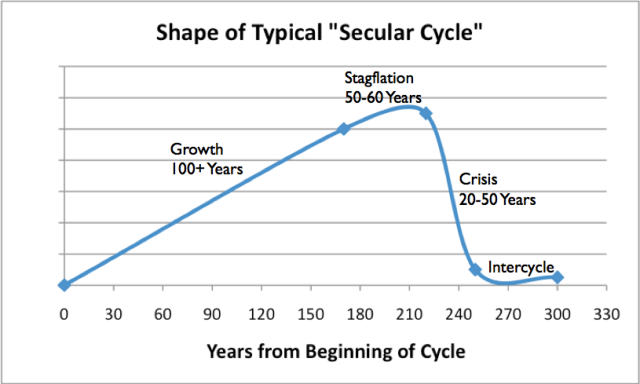

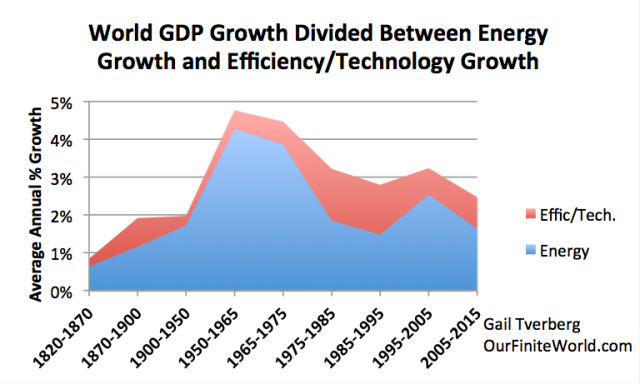

It should be no surprise that this type of continuing pattern of eroding wages for ordinary workers leads to great instability. If nothing else, workers become increasingly disillusioned and want to change or overthrow the government. It might be noted that globalization also plays a role in this shift toward lower wages for ordinary workers. Part of the reason for globalization is simply to work around the problems listed above. For example, if pollution becomes more of a problem, globalization allows pollution to be shifted to countries that do not try to mitigate the problem. Globalization also allows businesses to work around rising the rising cost of oil production; production can be shifted to countries that instead emphasized coal in their energy mix, with much lower energy used in energy production. With increased globalization, people who are primarily selling the value of their own labor find that wages do not keep up with the rising cost of living. Studies of Previous Economies that Experienced Declining Wages of Ordinary WorkersResearchers Peter Turchin and Surgey Nefedov analyzed eight civilizations that collapsed in detail, and recorded their findings in the book Secular Cycles. According to them, the typical economic growth pattern of civilizations that collapsed was similar to Figure 3, below. Before the civilizations began to collapse (Crisis Stage), they hit a period of Stagflation. During that period of Stagflation, wages of ordinary workers tended to fall. Eventually these lower wages led to the downfall of the system.  Figure 3. Shape of typical Secular Cycle, based on work of Peter Turchin and Sergey Nefedov in Secular Cycles. Chart by Gail Tverberg. In many instances, a growth cycle started when a group of individuals discovered a way that they could grow more food for their group. Perhaps they cleared trees from a large plot of land so that they could grow more food, or they found a way to irrigate an area that was dry, again leading to sufficient food for more people. A modern analogy would be discovering how to use fossil fuels to grow more food, thus allowing population to rise. At first, population grew rapidly, and incomes tended to grow as well, as the size of the group expanded to the carrying capacity of the improved land. Once the economy got close to the carrying capacity of the land, a period of Stagflation took place. There no longer was room for more farmers, unless plots of land were subdivided. Would-be farmers were forced to take lower-paying service jobs, or to become farmers’ helpers. In this changing world, debt levels rose, and food prices spiked. To try to solve the many issues that arose, there was a need for more elite workers–what we today would call managers and high-level government officials. In some cases, a decision would be made to expand the army, in order to try to invade other countries to obtain more land to solve the problem of inadequate resources for a growing population. All of these changes led to a higher needed tax level and more high-level managers. What tended to bring the system down was the growing wage inequality and the resulting low wages for ordinary workers. Governments needed ever-higher taxes to pay for their expanding services, but they had difficulty collecting sufficient tax revenue. If they raised taxes to an adequate level, workers found themselves without sufficient money for food. In their weakened state, workers became subject to epidemics. Governments with inadequate tax revenue tended to collapse. Sometimes, rather than collapse, wars were fought. If the wars were successful, the resource shortage that ultimately led to low wages of workers could be addressed. If not, the end of the group might come through military defeat. Today’s Fundamental Problem: The World Economy Can No Longer Grow QuicklyBecause of our depleted resources and because of the world’s growing population, the only the way the world economy can now grow is in a strange way that assigns more and more output to various parts of “overhead” (Figure 2), leaving less for workers and for unemployed individuals who want to be workers. Automation looks like it would be a solution since it can produce a large amount of goods, cheaply. It doesn’t really work, however, because it doesn’t provide enough employees who can purchase the output of the manufacturing system, so that demand and supply can stay in balance. In theory, companies that automate their operations could be taxed at a very high rate, so that governments could pay would-be workers, but this doesn’t work either. Companies have a choice regarding which country they operate in. If a tax is added, companies can simply move to a lower-tax rate jurisdiction, where no tax is required for automation. The world is, in effect, reaching the end of the Stagflation period on Figure 3, and approaching the Crisis period on Figure 3. The catch is that the Crisis period is likely to be shorter and steeper than illustrated on Figure 3, because we live in a much more interconnected world, with more dependence on debt and world trade than in the past. Once the interconnected world economic system starts to fail, we are likely to see a rapid drop in the total amount of goods and services produced, worldwide. This will produce an even worse distribution problem–how does everyone get enough? The low oil, natural gas, and coal prices we are now seeing may very well be the catalyst that brings the economy to the “Crisis Period” or collapse. Unless there is a rapid increase in prices, companies will cut back on fossil fuel production, as soon as 2016. With less fossil fuel production, the total quantity of goods and services (in other words, GDP) will drop. Most economists do not understand that there is a physics reason for this problem. The quantity of energy consumed needs to keep rising, or world GDP will decline. Technology gains and energy efficiency improvements provide some uplift to GDP growth, but this generally averages less than 1% per year.  Figure 4. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends for 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent. Are There Political Strategies to Solve Today’s Wage Inequality Problem?Unfortunately, the answer is probably, “No.” While some strategies look like they might have promise, they risk the possibility of pushing the economy further toward financial collapse, or toward war, or toward a major reduction in international trade. Any of these outcomes could eventually bring down the system. There also doesn’t seem to be much time left. Our basic problem is that the world economy is growing so slowly that the ordinary workers at the bottom of Figure 2 find themselves with less than an adequate quantity of goods and services. This problem seems to be getting worse rather than better, over time, making the problem a political issue. These are a few strategies that have been mentioned for fixing the problem:

|

| SILVER vs. GOLD: 2 Must See Charts Posted: 29 Mar 2016 03:15 PM PDT SRSRocco Report |

| The Hard Truth about Soft Currencies Posted: 29 Mar 2016 01:56 PM PDT This post The Hard Truth about Soft Currencies appeared first on Daily Reckoning. Some countries have consistently strong finances and stable currencies. Others are serial offenders, with high inflation and regular devaluations. Does this matter for you, as an investor in stock markets? The evidence is surprising. Last week I received an email from a reader, Rakesh L., with some interesting suggestions in it. My last article, "Putting options in their place", dealt with some of the issues and risks to do with using put options, a type of financial derivative. Today I'll turn to Rakesh's second point, about the importance (or otherwise) of hard currencies. Here's what Rakesh had to say:

I used to think the same way as Rakesh. I still agree with him in some ways. But evidence I've unearthed in recent years has made me think differently. First off, how do I agree with Rakesh? I agree that financial and economic mismanagement of a country or other currency area (there are 19 countries that use the euro) will result in a mess in the end. In the battle between markets and political incompetence the markets always win, eventually. If the fundamentals are poor then a weak currency will result. That can be a steady and continuous process, or a sudden devaluation when the dam eventually bursts. The main causes are usually too much government debt, too much money printing, large trade deficits, or a combination. Listed companies in a given country usually make most of their underlying profits in the local currency. Most of their assets are valued in that currency as well. This means that if there is a large local currency devaluation then foreign investors will suffer. Those assets and earnings will suddenly be worth a lot less when converted into, say, US dollars. So far so good. Devaluations are bad news in the short term. But this is where things start to get interesting. Taking a longer term view weak currencies appear to matter much less. In fact there is good evidence that stocks from countries with the weakest currencies often go on to be the best investments. Not always of course, but on average. This is completely counter-intuitive. So I'd better back it up with some good evidence if you're going to believe me. In fact I'd better back it up with strong evidence if I'm going to believe it myself. First let's start with some evidence that says the opposite, that strong currencies are best. I'll do this by comparing Switzerland with the USA. Switzerland is generally and correctly seen as a safe and stable country with a strong currency, the Swiss franc. Obviously the US is the world's largest economy. Its stock market makes up about half of the total value of all global stock markets. The US dollar is the world's dominant reserve and trade currency, at least for the foreseeable future. The US is much bigger and more powerful, but in terms of law and order Switzerland is the clear winner. It has the 11th lowest homicide rate in the world, whereas the USA's rate is over six times as high, and the highest among developed countries. The USA's incarceration rate – the proportion of the population serving a jail term – is over eight times as high as in Switzerland. Now let's compare their stock market performances. The following chart compares the MSCI Switzerland (in green) with MSCI USA (in orange) since December 1969, the earliest data point. Both show total return – meaning capital gains plus dividends – before taxes and measured in US dollars. Swiss stocks clearly beat the USA…

Over those 46 and a bit years Swiss stocks have been the clear winners. They're up 12.7 times in US dollars against 9.9 times for the USA. Over that same period the Swiss franc is up 4.2 times against the US dollar. Put another way, the dollar has lost 76% relative to the "swissie". So is that case closed? Does this mean stocks from a country with a strong currency will always beat stocks from a country with a weaker currency? Actually no, for a variety of reasons. The first is to point out that the Swiss stock market is dominated by large international companies. They may report their accounts in Swiss francs, but they actually earn most of their profits overseas. This is different to most countries. The biggest "Swiss" companies by far are Novartis (pharmaceuticals), Nestle (food and drinks) and Roche (pharmaceuticals). Following that – but much smaller – are big international banks and insurance companies (UBS, Credit Suisse, Swiss Re, Zurich Insurance) and a smattering of other international industries. So these companies and their stocks have performed well, but almost certainly not because of the strong Swiss currency. In fact that has been a handicap to some extent, as it has meant high costs in the home country (head offices and so on) in relation to overseas sales. Nestle, Novartis and the rest peddle most of their wares in international markets, far from the Swiss border. A lot of those sales are made in countries with weak finances and weak currencies. In other words, when you buy the Swiss stock index, buried within its companies are the equivalent of stocks from weak currency countries, just with Swiss management at the helm. Let's now turn to countries with a history of especially weak currencies. By way of example let's take another look at Argentina – not least because Rakesh's email was prompted by last week's article on that country. The next chart compares the MSCI Argentina index (blue) with MSCI Switzerland (orange) and MSCI USA (green). The data starts in December 1987, and again shows total return before taxes, and measured in US dollars. ….but Argentine stocks clearly beat them both. Really?

On this shorter time frame – which is still just over 28 years – Argentine stocks were up 26.7 times in US dollar terms, against 9.5 times for Switzerland and 8 times for the USA. This result is extraordinary. Especially when you realise just how weak the Argentine currency has been, and how much turmoil the Argentine economy has suffered at the hands of incompetent politicians. Since December 1987 the peso has lost a staggering 99.997% against the US dollar. In other words if you had owned one US dollar's worth of Argentine pesos in December 1987, and kept them until today, they would now be worth about three thousandths of one US cent. Not a lot! (The dollar has also lost about half of its value over that time, in terms of purchasing power.) Argentina suffered from severe hyperinflation during the late 1980s and early 1990s. Consumer prices were rising at an annual rate of 20,263% in March 1990. Between December 1987 (when the chart starts) and December 1991 the exchange rate went from 5.1 pesos per dollar to 10,028 – a loss of 99.95%. Then – long story short – a new peso was introduced, and it was pegged to the US dollar at one-for-one until late 2001 to curb inflation. Unfortunately it was the "right" policy at precisely the wrong time. Argentina is a commodity exporting country. During the 1990s the US dollar was strong and commodity prices were weak. Export income fell, domestic production prices rose relative to competitors, and imports became cheap. Business suffered. The government borrowed to paper over the cracks. In the end the country defaulted and devalued (again) in 2002. Initially the peso lost three quarters of its value. Savings were decimated, including the forced conversion of dollar bank deposits to pesos just before the devaluation. Dollar debts, such as mortgages, remained. Many people's life savings were wiped out at a stroke. After that the peso bounced a bit, staying stable until 2008. Then the money printing started in earnest once more. The last government sent up its proverbial helicopters full of cash, and showered it down on the public sector in vast quantities. This led to price inflation of up to 40% a year and a further 80% loss of value against the dollar. Overall the peso is down over 93% since the dollar peg broke in 2002. Argentine peso versus US dollar: 1995 to present day

Given this inept economic and financial "management" by successive Argentine governments, it seems amazing that Argentine stocks could have outperformed the USA by such a wide margin – let alone Switzerland. Of course this is just one example, and some of the reasons are specific to Argentina. But, as I'll explain next time, this is a picture that's repeated across the world. (Note: this is not a recommendation to buy Argentine stocks right now. See here for more.) Against all our intuition and expectation, countries with the weakest currencies tend to have the best performing stock markets in subsequent years – measured on a like-for-like basis, such as in US dollars. This is something that all investors need to be aware of if they want the best results. Regards, P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Hard Truth about Soft Currencies appeared first on Daily Reckoning. |

| Are We Becoming a Nation of Silver-Haired Crooks? Posted: 29 Mar 2016 01:18 PM PDT This post Are We Becoming a Nation of Silver-Haired Crooks? appeared first on Daily Reckoning. BALTIMORE – "Ike and Dick Sure to Click" was an exciting election slogan. Their Democratic opponents, Adlai Stevenson and Estes Kefauver, had their snazzy campaign jingle, too: "Adlai and Estes… They're the Bestes." Surely, the men behind these slogans had their private hungers and perversions. But they kept them to themselves. The 1956 presidential election campaign was a dull affair. Google "Adlai Stevenson's wife," and you will get only the barest biographical information. But Google "Melania Trump" or "Heidi Cruz"… oh la la! Just be sure there are no children around. It's all out in the open now. This is the most entertaining election in U.S. history… and the first episode of Reality Democracy, in which the only apparent goal – or effect – is to get the ratings up. When we were in grammar school, the teacher told us that "anybody in this classroom could grow up to be president." We looked around the room with dread and foreboding. But now it looks as though she was right. But this election ought to have a very salutary effect on the public: No one will ever take an election seriously again. Silver-Haired CrooksOn Easter Sunday, we met a smart man who confessed to having voted for Donald Trump in the Florida primary. Of course, we wanted to know: What was he thinking? More on that in a moment… A headline in yesterday's paper jolted us away from the election. "Japan's hard-up retirees turn to crime," begins the headline in the Financial Times. After years of QE (quantitative easing), ZIRP (zero-interest-rate policy), NIRP (negative-interest-rate policy), and Abenomics (Japanese prime minister Shinzō Abe's stimulus-focused economic policies) – which is to say, all the standard deviations of modern central banking – older Japanese people must now break the law… to get "free board and lodging behind bars." Is this what is coming to the U.S.? "Yes," is the safe answer. Japan has been ahead of us on this entire trip. Its stock market crashed in 1989. That led to a Great Recession, which the authorities fought like the Imperial Army defending Okinawa. Japanese policymakers invented QE… and for 26 years, they've held interest rates near zero. Shinzō Abe became prime minister specifically to end Japan's quarter-century-long slump. He failed. The "three arrows" of his Abenomics platform – fiscal stimulus, monetary easing, and structural reform – seem to have driven the defenders even further to ground. Hard ChoicesIt should, by now, be obvious to everyone that William McChesney Martin was right. As the ninth chairman of the Board of Governors of the Federal Reserve, he was the man on duty during the election cycle of 1956. And he was the man responsible for "normalizing" interest rates, after the Fed's war-time deal with the Treasury to help fund the deficit with ultra-low rates. Some feared this would trigger economic calamity. But Martin saw clearly what his homologues of the 21st century would rather go blind than see:

He then described the consequences of what would become the Bernanke-Yellen Money Dictatorship:

So far, Mr. Bernanke and Ms. Yellen seem to have the matter under control. We see no erosion of the value of our financial assets. Instead, stocks and bonds have gone up in price. But the companies behind them are now encrusted with crony barnacles like an old boat. The boat slows… and rides lower and lower in the water. Real capital formation declines… productivity sinks… wages stagnate… And then, you have people who get poorer, not richer… and silver-haired crooks… desperate to be behind bars, where they find warm beds and old friends. Mr. Martin, who lived to be 91 years old and died in 1998, would have understood it. The Genius of TrumpBut let's return to our intelligent friend, casting his vote in the primaries for Donald J. Trump: "I know him well. He's a friend of mine," he began. "A lot of the things he says you can't take literally," he replied under cross examination. "Like that wall. He's not going to build a wall. The Mexicans aren't going to pay for it. But it's a great image. It's one that sticks in your mind. "You get lost when you talk about trade policies and export account deficits. People don't know what you are talking about. And they take you for another Hillary Clinton or some other Beltway Insider. Blah, blah, blah… more of the same. "But the wall is a strong image. It announces that Trump is different. And he's going to protect the American people. That's all it's meant to do. It's not meant to be taken literally. "That's why Donald Trump is a genius. He's able to communicate in a different way. The wall image tells people what they really want to know, without getting lost in details. "He'll do things differently. And that's why the cronies and the Deep State are so afraid of him." Regards, Bill Bonner P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Are We Becoming a Nation of Silver-Haired Crooks? appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - Bubble Up To the Bar - As Time Goes By Posted: 29 Mar 2016 01:11 PM PDT |

| FLAT EARTH & JESUIT GLOBAL CONSPIRACY Posted: 29 Mar 2016 12:00 PM PDT FLAT EARTH & JESUIT GLOBAL CONSPIRACY The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Harry Dent - The Rally is Over, Crash to 6,000 Dow by 2017 Posted: 29 Mar 2016 10:46 AM PDT Harry's Last Predictions Correction Oil Price for 2016: $10 to $60 for Next Decade Evertying in Bubble including Gold China's Economic Deception Biggest Global Bubble Burst in Next 4 Years Central Banks Will Keep Printing into Catastrophe Will Gold Rally or Crash? Not Good in Deflation Dent's... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 29 Mar 2016 09:43 AM PDT This post More Soft Data In the U.S. appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a Tom terrific Tuesday to you! Well, the U.S. Data yesterday was awful, and you’ve got to really get to scratching your head thinking about the Fed members complete turnaround on sentiment toward the economy and the next rate hike. I swear I saw a story headline in my “top stories” app on my phone this morning that said, “Rays of sun seen in the U.S. economy”… would those be the same rays of sunshine that were shining on the “green shoots” that Ben Bernanke saw about 5 years ago? HA! I told you yesterday that the week was going to be all about the U.S. and U.S. data, that culminated in a Jobs Jamboree on Friday. And that’s how it all started yesterday, and will carry on today. Fed member Williams was speaking in Singapore overnight, and said that the thought interest rate hikes would be gradual. That’s a little less aggressive than the James Bullard speech on Saturday. Williams also said something that made me chuckle. He said that “he sees the U.S. economy on track”. To which I immediately said out loud, “on track for what? A recession is all I see!” Williams didn’t say what he thought the economy was on track to do, but I would bet the farm that he and I aren’t singing from the same song sheet! The currencies and metals remained range bound yesterday with most of the currencies finding some solace in the weaker U.S. data, and gold gained $5 on the day. But this morning, it’s a different story, as those gains the currencies carved out yesterday are being given back. But really, it’s just trading in a range, waiting for the next shoe to drop. The Chinese renminbi saw a very nice-sized appreciation in the fixing, and the price of oil slipped below $39. Talk about range trade. Since the beginning of March, the price of oil has traded within a $4 range ($37 to $41). The U.S. will print their latest supply numbers for oil, and they are expected to show a glut of supply remains, and that won’t help oil’s price any. Fed Chair, Janet Yellen, will speak today, and there’s a lot of talk about how she might give some clues as to what she is thinking about the economy and rate hikes. We saw just two weeks ago, that she was down about the softness of the economy, but maybe like I said yesterday all the negative economic data that has printed since the last FOMC meeting two weeks ago, has changed their minds! HA! As if! So, according to the scribes on Bloomberg this morning the anticipation of what Yellen might say has the dollar taking back lost ground this morning. Well, that’s all good for those traders that get fooled by what Central Bankers say and then do. But I’m sticking to my guns here that the U.S. economy isn’t going anywhere but down I don’t care what these guys that want you to believe that everything’s OK, say. Well, I’ve kind of beat around the bush this morning on the weak data yesterday, so I might as well talk about the weak data from yesterday’s Data Cupboard. First of all the PCE that we talked about yesterday, disappointed the forecasters when it didn’t rise closer to the 2% Fed Target rate. So it remained at 1.7% year on year (yoy). The real disappointing data came in the Personal Spending corner… February Personal Income and Spending were up nominally, at 0.2% and 0.1% respectively, but then we have the “real personal spending” data that now exists, and showed just 0.2% in February, but January saw the original 0.4% print, get revised down to 0.0%! Hmmm, I didn’t hear many news outlets talking about this, did you? Those darn revisions! They sneak them in under the cover of night, and then they appear before the markets know what hit them! The U.S. Trade Deficit widened in February to $62.864 billion. Imports rebounded in February, but those darn exports. Pesky little things. And they have that stronger dollar still attached to them. I received an email from my old friend, and former mentor and colleague, Ed Bonawitz yesterday. Ed is always playing the devil’s advocate with me, and making me defend my thoughts on the economy and data etc. Well, yesterday he sent me a link to a NY Times article on the Trade Deficit, which was all about how the Trade Deficit isn’t a scorecard, and cutting it won’t make America great again. A direct shot at the candidate that has signaled that he would make America great again when it comes to trade. That’s all I saw in the article, so I won’t go any further here. I would say that if that’s so true what the NY Times said, then why were things so much better here in the U.S. when we used to have a surplus? I’m just asking the question. And yes, I know all too well that the U.S. has been in a Trade Deficit for several decades, but for most of those decades, the U.S. economy was growing faster than its counter trading partners. That’s changed, hasn’t it? Whew! I certainly didn’t mean to go on and on and on there about the Trade Deficit! OK, I’ll stop with the data talk for now. That stuff can get pretty boring, eh? Hey! At least I spice it up, but sometimes there is no amount of Sriracha sauce you can put on the data that will keep it from being boring! So, what else should we talk about today? Well, I could talk about how Sweden printed a good & bad retail sales report for February, but that’s still data-talk. Or the money supply numbers from the eurozone. Still-data-talk. Oh, I know! Yesterday, I had a story about how corporate profits were negative in 2015. And immediately, the Spin Doctors, and not the ones that sang: Two Princes, came out and began to spin the data, saying that the data was based on flawed calculations. I had to laugh about that one, because where are these “data police” when the BLS prints their jobs numbers each month? Talk about “flawed calculations”! But that’s how things work these days, it’s no longer a case of what’s good for the goose is good for the gander, but more like we’ll pick what goose we want to use and what gander we want to use, and never the two shall meet! HA! So, Sweden’s Retail Sales data for February was good in that the January 0.7% rise was revised upward to 1.1%, but it was bad because the February number was negative -0.2%. I guess the hope here is that February sees just as strong of an upward revision as it did for the January data. In the world of what have you done for me lately, this negative print, for February has the krona on the selling blocks this morning. The euro is pushing higher, inch by inch it seems, but still higher. This morning the Eurozone Money Supply figure was bang on with last month, and this month’s forecast of 5% growth. Steady is what the markets love. Even if when you boil down the peanuts, Money Supply is equal to inflation. But that’s what all central bankers are looking for these days, so let’s print some more money and put it into the economy! YAHOO! HEY! Let’s go bananas with this stuff! Why not? It surely doesn’t hurt anyone to do so! Well, first of all, don’t call me Shirley, and second, when you have inflation up to your eyeballs, you’ll rethink that comment about not hurting anyone! The U.S. Data Cupboard has the S&P/CaseShiller Home Price Index for January for us to see today, along with the stupid Consumer Confidence report for March. The Consumer Confidence report is really just a gauge on the U.S. stock market, and I told you yesterday that the stocks have rebounded in March, so what do you think the Consumer Confidence Index is going to reflect? Come on, this isn’t rocket science! HA! Well, gold gained $5 yesterday, and this morning, it’s giving back $3 of that gain yesterday. Still, gold’s March, even with the HUGE Takedown last week, is going to be a good month for the shiny metal. Let’s hear from a Chinese gold retailer:

I find that the more people that I meet these days still don’t own physical gold or silver. And I find that to be disturbing to me. It’s just something I have to accept, as I can’t hit them over the head and tell them to go buy a physical metal! The reviewers are always telling me to calm down on the pushing people to do something. I remember back in “the day” before there were fears that everyone was out to cheat someone, when you I could say things like, “The Blue light special is shining brightly for ‘X.'” And no one got hurt, or sent to the poor man’s jail. But things change, and so now, I have to beat around the bushes, and lay the message between the lines, because if I put it in writing it will get cut so why waste the time? I saw this headline to the article on Ed Steer’s letter this morning, and knew then I had to go read it, and probably use it myself. And I was right! Here’s the link to an article on the U.K. Telegraph, titled: Helicopter or Bottle the Message is the Same, and here’s the snippet:

Chuck again. This is quite a long read for an article that I read. HA! But still it covers all the points of Helicopter Money, which was a subject we talked about a couple of weeks ago. So, if you have the time click the link above. That’s it for today. I hope you have a Tom terrific Tuesday, and be good to yourself! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post More Soft Data In the U.S. appeared first on Daily Reckoning. |

| Tom Cloud’s Latest Thoughts on Silver Posted: 29 Mar 2016 09:00 AM PDT 40 years of experience with precious metals! Click on his picture for his latest video. {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} This posting includes an audio/video/photo media file: Download Now |

| Marc Faber: Gold Still Most Desirable Currency in Wake of Brussels Attack Posted: 29 Mar 2016 02:55 AM PDT After several years of low gold prices, 2016 has brought a rebound, with the metal rising almost 20% since the first of the year, although recent price corrections have slowed gold's advance. After the Brussels terrorist attacks last Tuesday, gold rose briefly, but then was undercut by a strong U.S. dollar rally. Investors are wondering whether gold is in a temporary correction mode or if the three-month bull has run its course. |

| Just whom is gold really so 'dangerous' to? Posted: 29 Mar 2016 02:22 AM PDT 4:24p ICT Tuesday, March 29, 2016 Dear Friend of GATA and Gold: Gold, Izabella Kaminska of the Financial Times asserts in a 12-minute video posted this month, is "our dangerous obsession," a "frivolous" thing, a "decadent luxury," "anti-social," "a wastage of human potential," a mechanism for "destabilizing society" with selfishness, used to "hoard" wealth by people who should entrust it to banks for investment in financial assets -- like stocks priced at a hundred times earnings or government bonds with negative yields. You know -- the sort of products sold by the primary advertisers of the Financial Times. And yet Kaminska concludes her parody of financial journalism by declaring that "gold is most valuable to society when it becomes a currency" -- as if gold isn't already a currency and as if governments and central banks aren't doing their damnedest to prevent the monetary metal from becoming even more of a currency competing with their own currencies. Of course Kaminska never addresses the matter of why, if gold is so awful, central banks are trading it, in the words of the director of market operations of the Banque de France, "nearly on a daily basis" -- http://www.gata.org/node/13373 -- and, in the words of the executive director of the central bank of Austria, secretly intervening in the gold market even as they are trying to accumulate more for their own reserves: http://www.gata.org/node/15878 If Kaminska is ever really worried about the "anti-social," central banking is actually full of admissions that the gold market is rigged for imperialistic purposes -- http://www.gata.org/node/14839 -- and what could be more "anti-social" than imperialism? Kaminska's video is posted at the FT's Internet site here: http://video.ft.com/4805151190001/Gold-our-dangerous-obsession/Life-And-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Newmarket Gold's Shares Up 75% in 2016 and That Is Just the Beginning Posted: 29 Mar 2016 01:00 AM PDT Newmarket Gold's shares have appreciated 75% since the beginning of 2016, but CEO Douglas Forster believes that is just the beginning. The company's storied founders have set their sights on making Newmarket the next high-quality mid-tier gold producer. In this interview with The Gold Report, Forster puts forth his vision of how, starting with the acquisition of Crocodile Gold, he will make that happen. |

| India's finance minister can't persuade his own wife to paperize her gold jewellery Posted: 28 Mar 2016 11:10 PM PDT Gold Monetisation Scheme Bows to Family Homilies By Timsy Jaipuria There is a conflict between two finance ministers, and it seems the official one is not winning this war. The country's finance minister announced a scheme to monetise the gold holdings of India's families, but the finance minister back at home, the housewife, is having none of it. This came through clearly at a recent meeting between economic affairs secretary Shaktikanta Das and representatives from the Reserve Bank of India, temple trusts, and other bodies to discuss ways to make the scheme more attractive. "I am not even able to convince my wife to part with her jewellery, which she hardly uses," one official reportedly said at the meeting, raising laughter. "It's easy to convince North Block [one of the Indian government headquarters buildings in New Delhi] but very difficult to convince the finance minister at home to participate in this scheme." ... ... For the remainder of the report: http://www.hindustantimes.com/business/gold-monetisation-scheme-bows-to-... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Share prices — plummeting. Royalties — cut. Consumer opinion — in the toilet. Governments — fed up. Monsanto's earnings represent the writing on the wall, but the company's glory days are nearing an end for many reasons ranging from farmer and consumer resistance to government crackdowns on GMO products and even Monsanto's best-selling chemical product, glyphosate. Monsanto's days are about as numbered as a fruit fly's.

Share prices — plummeting. Royalties — cut. Consumer opinion — in the toilet. Governments — fed up. Monsanto's earnings represent the writing on the wall, but the company's glory days are nearing an end for many reasons ranging from farmer and consumer resistance to government crackdowns on GMO products and even Monsanto's best-selling chemical product, glyphosate. Monsanto's days are about as numbered as a fruit fly's. Over the past week, there has been a decided change in the mainstream rhetoric concerning precious metals. Specifically, we’re now seeing exactly the same sort of bearish, nonsensical B.S. to which we have become accustomed over the past 5 years.

Over the past week, there has been a decided change in the mainstream rhetoric concerning precious metals. Specifically, we’re now seeing exactly the same sort of bearish, nonsensical B.S. to which we have become accustomed over the past 5 years.

No comments:

Post a Comment