Gold World News Flash |

- Insolvency Issues: North American Edition

- West vs. BRICS: The New Cold War

- Doorways and Liquidity?

- The Two Worlds of Precious Metals: East and West

- Central Banks Are About To Leave Fiat Addicted Stock Markets In Agony

- PREPARE FOR A CHAIN REACTION COLLAPSE, WIPING EVERYONE OUT — Harley Schlanger

- Full Speech: Donald Trump HUGE Rally in Fayetteville, NC (3-9-16)

- Indian government calls meeting on gold monetization scheme's lack of success

- Why This Sucker Is Going Down - The Case Of Japan's Busted Bond Market

- New Gold hedges nearly all its remaining 2016 gold output

- And then there was none: Canada sells its gold

- Global Economic Collapse -- Italy's Massive Deflation

- Your Investments Hinge on the Next Seven Days

- The Case of Japan’s Busted Bond Market

- Gold Daily and Silver Weekly Charts - And Now the Movie, Folks...

- Hang the Architects!

- Why US Dollar = Global Toilet Paper In 28 May 2016 ? Shocking Video

- Buy Gold Central Bankers Urge Savers

- John Stossel ~ The Failed Liberty Vote

- Cheap Oil, the U.S. Dollar and the Deep State

- What's behind the falling Price of Oil ?

- Is The Gold/silver Ratio “saying” Something?

- Brain Dead Zombies and Lawless Psychopaths

- The Gold Bull Market Is Back... Will It Last?

- The ECB Calls, Draghi Listens

- Gold and Hillary’s Scary New Cash Tax

- Gold Price Could Surge To $8,000/oz On Negative Interest Rates – Lassonde

- Gold’s Next Move And Price Target

- Commodities Jump on US Dollar Weakness

| Insolvency Issues: North American Edition Posted: 10 Mar 2016 12:30 AM PST by Bobby Casey, GlobalWealthProtection:

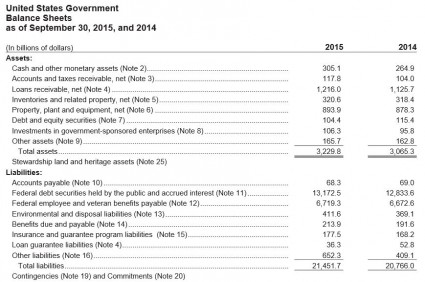

First up, Canada! She sold off ALL her gold reserves! One economist, Ian Lee, thinks if the US can abandon the gold standard, so can Canada! It's CAN-ada, after all… not CAN'T-ada. This just happened in the past month, and the claim is there are other "better assets" to pursue. What they are, or what makes them "better" has yet to be addressed by any Canadian officials. If they are truly following in the US footsteps, then I assume they will be looking to China for some economic favors? If not buying up treasuries then buying up real estate. How can Canada see gold as so dispensable, while the Chinese and Russians sucking it up like a vacuum? Even the US touts its holdings as being still the highest in the world. What does this mean for Canada? I honestly don't know. Like every other crazy event in the world, we must just wait and see how it unfolds. I don't expect anything good to come from this move. The one thing that's for sure, ever since the US left the gold standard, she has been struggling. Unbacked currency is debased and struggling to find worth and value, especially as others seek to back their currencies again. Hedging your entire future or retirement on the "full faith and trust of the government" seems highly irresponsible. Another interesting phenomenon is that Canada is also following in the footsteps of the US on the mortgage and housing front. While their salaries have largely kept in line with the rate of inflation, the cost of real estate has not. It has instead skyrocketed. This isn't shocking, except that the average household debt levels in Canada have gone from 89% of their annual disposable income to nearly 165%. They are walking the same precarious line as the US, and I supposed soon, some Canadian blogger will be pointing out the warning signs of doing so, just as we do with the US and other countries. Next up, the United States. Well, let me just put all the allegations of fear-mongering to rest right now. When I say we are heading toward an economic disaster, people call me some fear-mongering conspiracy theorist. So I'm just going to let the numbers speak for me. I don't care who's word you take for it, this is at best terrifying. The US government just released its financial statement, and it ain't pretty. See the assets and liabilities chart below:

Assets, as defined in the statements are: "loans receivable, net; property, plant, and equipment (PP&E), net; inventories and related property, net; and cash and other monetary assets." Also included as an "asset": "Stewardship Land and Heritage Assets in addition to the Government's sovereign powers to tax and set monetary policy." Easy to see where the nearly $18.2 trillion in national debt comes from now, right? Assets minus liabilities equals how deep in the hole you are. |

| West vs. BRICS: The New Cold War Posted: 09 Mar 2016 09:40 PM PST from The Daily Bell:

This RT article provides us a momentous summary of the world's latest Cold War. It is "The BRICS Versus the Anglosphere." The analysis comes from one of the savviest of global journalists, Pepe Escobar, who regularly publishes well-received books about international power politics.

More on the tensions:

So the proverbial lines have been drawn. After all, the BRICS have set up their own competing version of the International Monetary Fund and are soliciting currency deals around the world that bypass the dollar. |

| Posted: 09 Mar 2016 09:01 PM PST by Bill Holter, JS Mineset:

So why is this a big deal, or is it? First, the JGB market is second or third largest and most liquid in the world behind U.S. Treasuries and maybe Eurobonds. This sort of chaotic movement should not happen. More importantly, I believe the circuit breakers are so “tight” because a panic event can not be allowed to gain ANY momentum. Any “momentum in the wrong direction” at this point could easily become self reinforcing because of leverage or margin used to carry positions today. Please understand I am not picking on JGB’s as the same thing could be said of many if not ALL markets today as markets are so intertwined. The point we are driving at here is “volatility kills”!

This thought that volatility kills has become the absolute center of ALL financial markets on the planet. Because everything has become derivatized, the “leverage” has expanded much further than just credit outstanding or margin balances. You see, derivatives morphed into the tool of choice to “price” or manage markets. Now, because these derivative markets have gotten so large, volatility cannot be allowed. Whether it be circuit breakers, “mysterious software ” problems or simply pulling the plug, volatility must be tamped down at all costs. It is no coincidence volatility is rising now as liquidity has begun to dry up. All you need to do is talk to an institutional bond trader to know this to be true. Even small $10 million trades or less are tough to move …and here is the rub. The “exit door” has drastically shrunk while the population in the room has continually expanded! If we look at only the credit markets alone, the “room” is inhabited by $7 trillion worth of bonds trading at negative interest rates. Stating the obvious, this is the largest “greater fool” trade in all of history. Are bond traders really buying bonds to lock in a negative return? Do they really believe they will “win” because the underlying currency will gain value even though the stated goal of every central bank is to debase? No, the only reason a bond trader would purchase a negative yield is because they believe there is a greater fool out there who will purchase that bond from them at an even greater negative yield. Now you must ask yourself one more question, are negative interest rates the new normal and here to stay? Logically the answer is “no” because mathematically a system based on negative rates is like a snake eating its own tail. Practically speaking, negative rates are an accident waiting to happen when someone finally yells FIRE! Speaking of “doorways and liquidity”, if you understood what was meant in my last writing when JP Morgan testified “Gold is money, everything else is credit” then you probably have an idea where we are going here. The entire system is credit based. Everything you do, use, consume or even touch on a daily basis had the use of credit somewhere along the way, this even includes your dollar bills in your pocket. Put simply, we are living in a credit mania. Gold, and especially silver are ridiculously small markets. “Real” global production is about $80 billion per year for gold and $12 billion for silver. Unless you have been sleeping or just don’t get it, the “stock” of silver and gold has been continually diluted by paper over the last 4 years as a means to control the price. Now, demand has gotten so great they are having a problem creating even paper gold fast enough to contain the price. The “doorway” into real gold and silver is very very minute and will become 100 times smaller than it already is once people with paper receipts find out they hold nothing. What I am trying to say here is this, on top of current and safe haven demand, will also be demand from those who have already “bought”. In reality they own nothing because their previous purchase was deflected from metal into paper air. I know the above is not groundbreaking news to many of you but it needs to be reminded once in a while. The exit door for the massive paper credit buildup is small and getting smaller as liquidity shrinks and leverage grows. The entrance door for real gold and silver may not even exist once people understand they are the very core to the strong dollar fraud. You see, “liquidity” has a direct effect on how functional any door is whether it be an exit or entrance. Not enough shrinks the exit, too much closes the entrance! As an announcement, many of you have been reading my work for the last nine years. My work has been found all over the internet on numerous websites. In the very near future, my work will only be found at JSmineset.com in my partnership with Jim Sinclair. Jim and I plan to do at least once monthly audio question and answer sessions from subscriber questions. We have a couple of other plans for additional content in the works as well, so please visit our website to keep abreast with the upcoming additions! Standing watch, Bill Holter |

| The Two Worlds of Precious Metals: East and West Posted: 09 Mar 2016 07:40 PM PST by Jeff Nielson, BullionBullsCanada:

There is nothing accidental about this. To begin with, gold and silver have obvious aesthetic appeal. Indeed, silver is actually the more-brilliant of the two metals. It is this aesthetic appeal which makes these metals "precious". But they are more than this, they are also (relatively) rare. If diamonds were as common as pebbles, it would be impossible to impress one's potential bride-to-be with such stones, even in a setting of gold. Diamonds have their value (both real and sentimental) not only because of their aesthetic qualities but also because of their perceived scarcity. It is the same with gold and silver. If these metals were as common as iron or zinc, or even copper, they would not be coveted as greatly, even with their aesthetic appeal, because of that abundance. It is the qualities of being "rare" and "precious" which are essential in order for any commodity to be especially suitable as money. This is because those properties make that commodity a store of value. There will always be demand for these metals, thus they will always have value. Because of this, these metals preserve/protect wealth. Gold and silver are both precious and rare. But they are more than that. As metals, they also exhibit uniformity. Once refined, any gold or silver coin is indistinguishable from any other. Conversely, diamonds lack uniformity, thus they would not be a good candidate as "money". Venders would complain that a particular buyer was using "low-grade" diamonds for payment. On the opposite side of the ledger, purchasers with stones of superior size/quality would seek to negotiate premiums on their "money". It would wreak havoc with commerce. Gold and silver are perfect money. But they are also more than that. They are forms of money which are available at what must be termed near-optimal quantities, to fulfill two separate, but equally important functions. Silver is rare enough to be valued for its scarcity, but plentiful enough to be the ideal Peoples' Money. The wages of the workers. The metal of payment for basic commerce. Gold is more scarce than silver. It is because of this greater degree of scarcity that it derives greater value. Yet it is still plentiful enough to be a tool of commerce. However, gold is not the Peoples' Money. Rather, it is the money of nations, or (alternatively) the wealthy. It is the money of investment and industry. It is this additional level of prestige which makes gold ideal as a "standard" for a national (or global) monetary system. A White Paper previously released on this topic explained how and why "a gold standard" was the optimal basis for a monetary system in our modern economy. That same paper then provided extensive, empirical evidence documenting the horrific economic carnage which has resulted from the loss of our gold standard, in the early 1970's. When our nations had gold as the money of governments, and silver as the money of the people, we enjoyed a level of prosperity and economic stability which we have not seen either before or since that era. In the four and a half decades since these metals have lost their official monetary status, our economies have been destroyed, our governments have been bankrupted, and the currency in our wallets is already fundamentally worthless. Decades of relentless brainwashing in the West have convinced the vast majority in our populations that there is no longer a place or role in our modern economy for Perfect Money. Consequently, the masses in the West generally shun gold and silver, storing (and protecting) only a tiny percentage of their wealth with these metals, in comparison to any other era in our society's history. This is how gold and silver stand today, from a Western perspective. What is continually forgotten beneath the veneer of our cultural arrogance is that the Rest of the World (and the vast majority of humanity's population) have a fundamentally opposite perspective regarding the world's only Perfect Money. Unexposed to the decades of monetary brainwashing directed at Western populations, Eastern populations have never forgotten the important role of precious metals in our societies and economies. Even the most-humble peasant understands why we store our wealth in gold and/or silver money – not the diluted/debauched paper currencies of bankers. (Real) money is a store of wealth. Mere currency is only a tool of commerce. As a store of value, these currencies are the equivalent of a "leaky bucket". Over a period of thousands of years, gold has perfectly preserved the wealth of its holders. In the mere century in which the Federal Reserve was entrusted with "protecting" the dollar, it has last 99% of its value (and the wealth contained). |

| Central Banks Are About To Leave Fiat Addicted Stock Markets In Agony Posted: 09 Mar 2016 07:20 PM PST Submitted by Brandon Smith via Alt-Market.com, Many investors today are not very familiar with market history and tend to live only in the day-to-day mainstream narrative while watching little red and green graphs move up and down. This is not so much an issue in a relatively stable economic environment. The problem is, today we live in the most unstable economic conditions possible. These investors and analysts are simply not aware that some of the most exciting stock rallies occur during the most volatile crises, and so they interpret every rally of a few days to a few weeks as a signal for recovery. However, in this kind of fiscal environment, all the gains made in a few weeks can be lost in moments. After the Great Depression began to take hold in U.S. markets, massive rallies unfolded over the span of weeks and sometimes months, only to end in a collapse to even lower depths. For example, in 1930 the Dow Jones enjoyed historic rallies twice, gaining 48% only to lose it all, then gaining more than 16% and crashing down to a 50% loss for the year. Each consecutive year there were multiple rallies of more than 25% and each time they disintegrated. By 1932 stocks were only worth approximately 20% of what they were worth in 1929. Bear market rallies continued to give false hope to investors and the public throughout the crisis, and mainstream banks and economists continued to exploit such rallies to capitalize on those false hopes. I mention this to put our markets today in perspective. Mainstream analysts and some banking moguls are already declaring a reversion of the instability that was launched at the beginning of this year due to the spike in stocks over the past three weeks. I explained the reason behind this comparatively short term rally in my article “Markets Ignore Fundamentals And Chase Headlines Because They Are Dying.” In desperation, the investment world has placed all its hopes on renewed stimulus measures this March by China and the European Central Bank. They have also made bets that the Fed will not raise rates again until the end of this year, if they raise rates again at all. I believe the next two weeks will be very telling in terms of how the rest of the year in markets will progress. If mainstream analysts and investors are placing faith in further central bank intervention, they may be greatly disappointed. Every action of the central bankers this year has indicated a shift away from open intervention. The taper of quantitative easing (QE) has run its course and no new QE has been announced since. The rate hikes were launched in December despite all traditional logic to the contrary and now, Fed officials appear to be staying on track for more hikes in the near term. Kansas City Fed President Esther George told Bloomberg that a fed rate hike in March should “absolutely remain on the table.” San Francisco Fed President John Williams said there has been “no substantial change” in his view of the economy or the rate hikes and that said rate hikes will likely continue as planned. Goldman Sachs argues that there will only be “three” more rate hikes this year, rather than four, although, this is three more rate hikes than the investment world was asking for. Fed statements have given little clue as to the timing of the rate hikes, but all fed statements have so far presented an attitude that they plan to “stay the course.” For now, stock markets do not want to accept this reality. I believe that the Fed will be raising rates again in the near term. I believe there is a possibility for the fed to surprise with a rate hike at their meeting this March 15th and 16th. If this does not occur, the Fed will likely hint of a hike in June in their press statements. Another hike so soon (or even the threat of an assured hike) will absolutely strangle any market gains made in the past few weeks. Another date to watch out for will be tomorrow's meeting of the European Central Bank. All eyes are on renewed ECB stimulus; not only renewed stimulus, but stimulus measures vastly beyond what the ECB has initiated in the past. I am not sure why investors’ expectations are so high for the ECB to save the day. The last time this kind of exuberance hit stock markets over a European stimulus package was in December of last year, and the ECB dashed all those hopes into the dirt with a mediocre response. This aided directly in the stock market volatility that came in January and February. So, the markets are praying for the ECB to “do it right this time.” I highly doubt the ECB's eventual decision will satisfy the unrealistic expectations of the investment community. In fact, I believe the central bank will offer little or nothing, and stocks will come crashing down just as they did after the December meeting. It wasn’t long ago that the entire financial universe was focused on whether China would intervene in their own markets, either with more stimulus or by arresting more investors that were betting against their stocks. The days of outright Chinese stimulus appear to be over as reports come in that the National People’s Congress concluded without any mention of large scale action to artificially support the Chinese economy. This should not be a surprise to anyone who was paying attention; China’s president warned in January that more economic stimulus is “not the answer to the nation’s challenges.” So, what does this mean? Well, first and foremost, it shows that the attitude of central bankers is moving away from intervention. As I have stated many times in the past, actions like the Fed taper of QE3 and the rate hikes only make sense if central banks are planning to ALLOW the markets to decline. The rate hike meetings, stimulus meetings, and the fact that they allow investor conjecture on stimulus to continue without much official contradiction, helps international financiers to control the speed at which this crash occurs. But the fact remains that they are not acting to stop the crash, nor will they act. There are no fundamental economic indicators that are positive enough to support a market recovery or an economic recovery. All moves in stocks are based on nothing but the delusions of fiat addicted stock players waiting for more printing to feed their habit of “buying the dip” without having to think strategically and educate themselves on sound investments. That is to say, investors have become addicted to central bank manipulation of markets, but now the central banks are cutting off their supply of smack. Where is this all going? I have mentioned in past articles the tendency of elitists to warn the public of coming economic collapse, but these warnings are always far too late for anyone to do much to prepare. They do this because they KNOW that a crisis is coming. They know a crisis is coming because THEY created the circumstances which are causing it. The money elites inject warnings into the media not to help the public, or to encourage positive solutions. Rather, they offer these warnings so that after the crash they can present themselves to the public as “good Samaritans,” or fortune tellers who “tried to save us.” They are, of course, neither of these things. The Bank for International Settlements, the central bank of central banks, has released yet another dire warning into the mainstream, stating that “official” global debt is now 200 percent of GDP and that this debt is unsustainable. They have also warned of a “gathering storm” and the “loss of faith in central banks” as 2016 moves forward. On top of this, none other than Lord Jacob Rothschild has released his own cautionary letter on the global economy, stating that we are now “in the eye of the storm.” Why are central banks allowing a controlled demolition of our economy to take place instead of propping up and manipulating markets as they have for the past few years? You can read my many articles on the globalist endgame for a detailed explanation, but to summarize – problem, reaction, solution. International financiers want a completely centralized global economic structure, including a single currency system, the eventual removal of physical currency to be replaced with more easily controlled digital currency, and ultimately a central authority for global economic governance. In the pursuit of a “New World Order,” they must destroy the structure of the “old world.” Covertly engineer an economic problem, get the masses to beg you to save them from that problem, then offer them the solution you always intended to give them. Our current crisis, what the International Monetary Fund calls the “global economic reset,” has only just begun. Though sometimes we must read between the lines or connect a few dots, in most cases the banking elites tell us exactly what they are going to do before they do it. It’s time we start listening, stop buying into the day-to-day hype and hopes of false recovery, and prepare accordingly. |

| PREPARE FOR A CHAIN REACTION COLLAPSE, WIPING EVERYONE OUT — Harley Schlanger Posted: 09 Mar 2016 07:05 PM PST by SGT, SGT Report.com: Harley Schlanger from LaRouchePAC.com joins me for an economic and geopolitical update. Harley says that negative interest rates is a banking term for theft, and Harley warns, “If they start letting the banks steal deposits, what you are looking at is a chain reaction collapse that will wipe everyone out.” But Harley also believes that the Bankster Oligarchs are ripe for a fall, but it will require AMERICAN PATRIOTS to rise up and TAKE them down. We also discuss the 2016 Presidential race which will leave us with the Communist NWO agenda of Hillary Clinton if people allow it. Standing in stark opposition to the Bush-Clinton crime families is Donald Trump. We discuss it. |

| Full Speech: Donald Trump HUGE Rally in Fayetteville, NC (3-9-16) Posted: 09 Mar 2016 05:54 PM PST Wednesday, March 9, 2016: GOP Presidential candidate Donald Trump held a campaign rally in Fayetteville, NC and spoke to a crowds of around 15,000 at the Crown Center Coliseum. Full Speech: Donald Trump Rally in Fayetteville, NC (3-9-16) The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Indian government calls meeting on gold monetization scheme's lack of success Posted: 09 Mar 2016 05:41 PM PST Government Calls Meeting to Review Gold Monetization Scheme By Rajesh Bhayani MUMBAI, India -- Following a tardy progress in the most ambitious gold monetization scheme since its launch on November 5 last year by Prime Minister Narendra Modi, the Finance Ministry has called another meeting of all stakeholders on March 18 to discuss why the scheme is not gaining momentum. Until February a little over 1 tonne of gold was mobilized under the scheme compared to nearly 4 tonnes of sale of sovereign gold bonds in first two tranches while the third tranche is still open. Interestingly, at a time when jewellers are on a strike opposing imposition of excise duty in the Union budget, the government has preferred not to invite all trade bodies. Hence only Indian Bullion and Jewellers Association has been called to meeting while the Gems and Jewellery Foundation has not been invited. From the refiners' side, many representatives have been asked to attend. ... ... For the remainder of the report: http://www.business-standard.com/article/markets/government-calls-meet-t... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

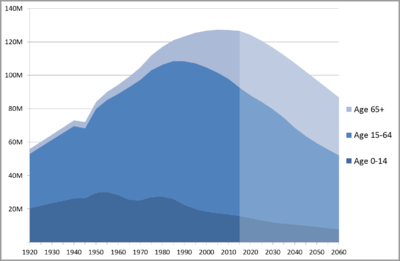

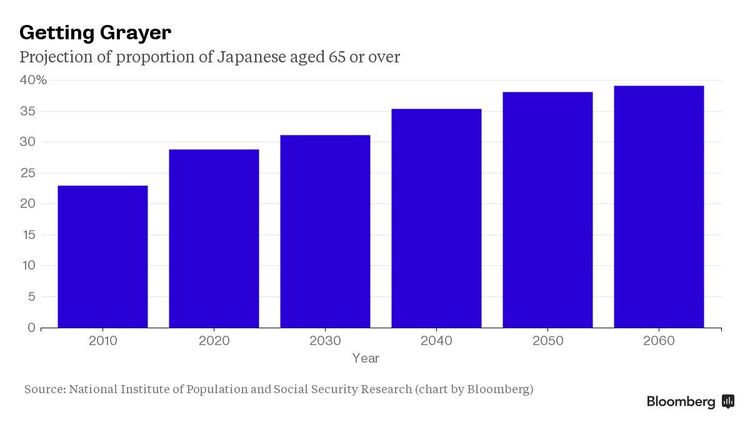

| Why This Sucker Is Going Down - The Case Of Japan's Busted Bond Market Posted: 09 Mar 2016 05:40 PM PST Submitted by David Stockman via Contra Corner blog, The world financial system is booby-trapped with unprecedented anomalies, deformations and contradictions. It’s not remotely stable or safe at any speed, and most certainly not at the rate at which today’s robo-machines and fast money traders pivot, whirl, reverse and retrace. Indeed, every day there are new ructions in the casino that warn investors to get out of harm’s way with all deliberate speed. And last night’s eruption in the Japanese bond market was a doozy. The government of what can only be described as an old age colony sinking into certain bankruptcy sold 30-year bonds at an all-time low of 47 basis points. Let me clear here that we are talking about a record low not just for Japan but for the history of mankind. To be sure, loaning any government 30-year money at 47 basis points is inherently a foolhardy proposition, but its just plain bonkers when it comes to Japan. Here is its 30-year fiscal record in nutshell. Not withstanding years of chronic red ink and its recent 2014 consumption tax increase from 5% to 8%, Japan is still heading straight for fiscal oblivion. Last year (2015) it spent just under 100 trillion yen, but took in hardly 50 trillion yen of revenue, stacking the difference on its already debilitating mountain of public debt, which has now reached 240% of GDP. That’s right. A government which is borrowing nearly 50 cents on every dollar of outlays should be paying a huge risk premium to even access the bond market. But a government with a 240% debt-to-GDP ratio peering into a demographic sinkhole would be hard pressed to borrow at any price at all on an honest free market. The graphs below show what lies 30 years down its demographic sinkhole. To wit, Japan’s population will have declined by 30% to 90 million, while its working age population will have plummeted from 78 million to about 52 million or by 33%. Moreover, its labor force participation rate has been declining for years, but even if it were to stabilize at the current 60% level, it would still mean just 31 million workers.

The trouble is, Japan already has 31 million retirees, and that number is projected to hit 36 million by 2060. In short, at the maturity date of the bonds the Japanese government sold last night, Japan will have more retirees than workers; it will be at a fiscal and demographic dead end.

So how did Japan sell billions of 30-year bonds given these catastrophic fiscal and demographic trends? The short answer is that it didn’t sell anything to investors. Instead, it rented what amounts to a put option to fast money traders. The latter operate from the assumption that they can cop a capital gain in the next while and then sell the paper back to the BOJ. And why wouldn’t they make that bet. The lunatics who run the BOJ have essentially guaranteed that they are the buyer of first and only resort for any Japanese government debt that remains outside of their vaults. Indeed, central bank announcements of negative yield are a form of code in the canyons of Wall Street and other financial markets. It means moar central bank bond-buying ahead, and therefore rising prices on the trading bait infused with the financial Viagra of NIRP. This is another way of saying that the BOJ has essentially destroyed the government bond market. Indeed, during Q4 2015 monthly volume in the JGB market fell to the lowest level since 2004. As one bond market observer explained,

As of last night’s auction, the entire JGB yield curve is now negative out to 13 years. That means that $5 trillion of bonds issued by the most fiscally impaired major government on the planet have been pushed into the netherworld of subzero returns. Needless to say, the government of Japan and the BOJ are not in the midst of some exotic experiment that is off the grid relative to the rest of the global financial system. To the contrary, they are implementing Keynesian central banking and fiscal policies on a state of the art basis. They are doing what Bernanke, Krugman, the IMF and heavyweight (on all counts) Keynesian blowhards like Adam Posen have recommended for years. Indeed, rather than blow the whistle on the obvious lunacy being practiced in Tokyo, the recent G-20 meeting gave Japan a pass on its currency trashing efforts and implied that its Tomorrow, in fact, Draghi will make another plunge in the same direction. Already, more than $2 trillion of European government bonds are trading at negative yields, and for the same reason. To wit, the central bankers of the world have created a front-runners paradise. Yet so doing they have stood the very concept of a government bond in its head. Whereas the legendary British consol traded for nearly 200 years (outside of war interruptions) at par and to a rock solid 3% yield, today’s sovereign debt is being turned into a gambling vehicle where financial gunslingers and hedge funds play for short-run capital gains on 95:1 repo leverage. In a word, the central banks have nearly destroyed the government bond markets. In the process, they have flushed trillions of capital into corporate debt and equity in search of yield and momentary trading gains with scant regard for the incremental risks involved. So, yes, the casino is implanted with FEDs (financial explosive devices) everywhere, including upwards of $60 trillion of sovereign debt that is radically mispriced; and which must eventually implode when the gamblers finally stampede out of the casino. Perhaps last night’s Japanese bond auction was an omen, after all. The JGB 30Y yield is now below the UST 2Y for the first time since, well, the Lehman event of September 2008.

Shortly thereafter, of course, our befuddled President at the time, George W. Bush explained the macroeconomic situation in a way that even the Congressional leadership assembled at the White House could understand. “This sucker is going down”, he told them. He got that right. It was just a matter of time. |

| New Gold hedges nearly all its remaining 2016 gold output Posted: 09 Mar 2016 05:24 PM PST From Reuters New Gold Inc. has hedged nearly all of its remaining 2016 gold production to ensure cash flow for its Rainy River project, the company said, an unusually large amount for a miner after bullion made its biggest rally in 4 1/2 years. The miner said on Tuesday that it hedged 270,000 ounces of gold for the remaining nine months of the year through options contracts at a cost of $2 million, starting in April, giving them a minimum price of $1,200 an ounce and maximum at $1,400 an ounce. That breaks down to 30,000 ounces each month and accounts for 90-100 percent of New Gold's production forecast. Hedging, which can be put in place through options contracts as well as forward or deferred sales, allows miners of the metal to lock in prices for their output. ... ... For the remainder of the report: http://www.reuters.com/article/new-gold-hedging-idUSL1N16H268 ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| And then there was none: Canada sells its gold Posted: 09 Mar 2016 03:11 PM PST Resource Investor |

| Global Economic Collapse -- Italy's Massive Deflation Posted: 09 Mar 2016 02:30 PM PST 12 Charts Prove Italy is Suffering the Deflation Debt Austerity Crisis! Oligarchy, don't give them the pleasure by using words like "Elite" , "Ruling" or "Authority". They are swines, putrid and corrupt, leeches draining the society around them. Words do matter The Financial... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Your Investments Hinge on the Next Seven Days Posted: 09 Mar 2016 01:55 PM PST This post Your Investments Hinge on the Next Seven Days appeared first on Daily Reckoning. Fortunes will be made or lost in seven days based on the actions of just two individuals. Tomorrow, March 10, the Governing Council of the European Central Bank (ECB), led by Mario Draghi, will meet in Frankfurt, Germany. The ECB is meeting to decide whether to make its negative interest rates even more negative, and whether to expand the eurozone version of quantitative easing (QE). Less than a week later, next Wednesday, March 16, the Federal Open Market Committee (FOMC) of the Federal Reserve System, led by Janet Yellen, will meet in Washington, D.C. The FOMC is meeting to decide whether to raise interest rates again after the "liftoff" in interest rates last December. Mario Draghi and Janet Yellen are dominant leaders of their respective central banks, the ECB and the Fed. If they have a definite view of where they want to take monetary policy, they will certainly be able to convince enough of the fellow governors and committee members to go along. The problem now is that there is no definite view. In both Europe and the U.S., recession signs are everywhere, but there are also pockets of strength. Deflation is a genuine concern, yet there are early signs of inflation. Central bankers are making things up as they go along. The truth is they're just as confused as you are about what to do and what the impact of their policies will be. Evidence is beginning to accumulate that negative interest rates produce the opposite effect that central bankers intend. The effectiveness of QE is also being called into question by recent academic research. Yellen may want to raise rates so she has some ammunition to fight a future recession. But by raising rates, she may actually cause the recession she fears. In short, the economic signals are mixed, the policy choices are uncertain and both Draghi and Yellen will probably go right down to the wire before making up their minds. This is the most dangerous possible environment for you. Momentous decisions from the two most powerful central bankers in the world are coming in a matter of days. If these decisions vary from market expectations, they could cause meltdowns for equities, rallies for bonds and wild swings in currency cross rates. We have the tools to analyze these decisions, but even the best tools are challenged when the policymakers themselves haven't made up their minds. That's the situation we face right now. In my premium research service, Intelligence Triggers, my primary analytic tool is called Bayes' Theorem. The mathematical formula for it looks like this: In plain English, this formula says that by updating our initial understanding through unbiased new information, we improve our understanding. The left side of the equation is our estimate of the probability of an event happening. New information goes into right-hand side of the equation. If it's consistent with our estimate, it goes into the numerator (which increases the odds of our expected outcome). If it's inconsistent, it goes into the denominator (which lowers the odds of our expected outcome). Because today's evidence points in both directions, we are much closer to a 50/50 probability than some other central bank policy changes we have seen. The way to deal with close calls is to use scenario analysis to cover all the bases and make sure we're not blindsided. This is what we do at the CIA and other branches of the intelligence community. Let's go through the scenarios: Scenario 1: Draghi gets out his bazooka and eases by cutting interest rates and expanding Euro QE. Yellen then follows suit by not raising interest rates. When the Fed is on a tightening path (which they started in December) and then decides not to raise rates, that's effectively a form of ease. So in this scenario, both the ECB and the Fed resort to different forms of ease. This could give equities a lift (indeed, U.S. equities have already been rallying based on expectations that Scenario 1 will come to pass). The EUR/USD cross-rate would be relatively unchanged (at about $1.09), since both central banks are easing and playing to expectations. Scenario 2: Draghi fires his bazooka, but Yellen shocks markets by raising rates. Yellen could have several reasons for doing this. The February jobs report shows continued strong hiring and increased labor force participation (albeit with weak wage growth). The Atlanta Fed GDP "nowcast" is showing projected U.S. GDP growth of 2.2% in the first quarter of 2016. That's still below long-term trend growth, but it's in line with average growth since 2009. It's also a substantial improvement over the fourth quarter of 2015 and full-year 2015. Yellen is using Phillips curve models that tell her tight labor markets will produce inflation sooner than later. She does not want to get behind the curve in fighting inflation. In this scenario, U.S. equities will see a sharp sell-off as they quickly reprice from expectations of no rate hike to an actual hike. The dollar will strengthen relative to the euro, which may retest its 2015 lows of $1.05. Scenario 3: In this scenario, it's Draghi who shocks the markets. There is some reason to believe that Draghi will not cut interest rates further. Negative rates were meant to stimulate spending by consumers and lending by banks. Why keep your money in the bank if the banks are just going to take some of it away as "negative" interest? Conventional wisdom was that negative rates would stimulate lending and spending instead of more savings. This would produce the inflation that central banks desperately want. But the opposite may be true. Negative interest rates send a signal that deflation is the clear and present danger. In deflation, cash becomes more valuable, even after negative interest is deducted. Also, prices fall, which makes it smart to wait before making purchases. Finally, with negative yields, investors have to save even more to meet their retirement goals. For all of these reasons, Draghi may take a pass on cutting rates. If Draghi and Yellen both stand pat on rates, look for the euro to strengthen, possibly to the $1.15 level. Also look for European equities to sink, and for U.S. equities to rally on a weaker dollar. Scenario 4: Finally, we could have a scenario where Draghi does not cut rates and Yellen raises rates (both for reasons described above). This "double tightening" is the worst of all possible worlds for global equities. It also means that the emerging-market capital flight will resume and the "risk off" mentality will dominate the actions of U.S. market participants. That's good for investors in government bonds. Our scenario analysis is made even more difficult by the fact that Yellen and Draghi are close personal friends and may spend part of the next few days on the phone trying to coordinate their actions. Yellen might throw Draghi a lifeline by raising rates if Draghi chooses the path of not cutting them. That leaves the strong dollar/weak euro dynamic intact. The weak euro gives Draghi the ease he needs even without lower rates. Our indicators are showing some close calls among these four scenarios. With this much uncertainty in the air in such a short period of time, what's the best move for you? The answer is to take advantage of the uncertainty by going long volatility. That's what buying options does for you. When you own an option, you own the volatility. Since volatility is systematically underpriced due to flaws in options pricing models, buying options is a good strategy in highly uncertain times. Another answer is to pursue a strategy that performs well regardless of the scenario that comes to pass. Betting on a decline in the retail sector fills the bill. If Draghi or Yellen eases, that means they are worried about deflation. As we explained, deflation means consumers put off purchases until prices come down. That's disastrous for retail. Conversely, if Draghi or Yellen tighten (because of misplaced inflation fears), that will simply accelerate the recessionary forces gathering on both sides of the Atlantic. Increasing the odds of recession is another setback for the retail sector. So the ideal trade is to bet against the retail sector. See here for my preferred method. That way, you benefit from volatility, and you benefit from easing (because of deflation fears) and tightening (because it hastens the recession). You're covered in every scenario. Regards, Jim Rickards P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Your Investments Hinge on the Next Seven Days appeared first on Daily Reckoning. |

| The Case of Japan’s Busted Bond Market Posted: 09 Mar 2016 01:33 PM PST This post The Case of Japan’s Busted Bond Market appeared first on Daily Reckoning. The world financial system is booby-trapped with unprecedented anomalies, deformations and contradictions. It's not remotely stable or safe at any speed, and most certainly not at the rate at which today's robo-machines and fast money traders pivot, whirl, reverse and retrace. Indeed, every day there are new ructions in the casino that warn investors to get out of harm's way with all deliberate speed. And last night's eruption in the Japanese bond market was a doozy. The government of what can only be described as an old age colony sinking into certain bankruptcy sold 30-year bonds at an all-time low of 47 basis points. Let me clear here that we are talking about a record low not just for Japan but for the history of mankind. To be sure, loaning any government 30-year money at 47 basis points is inherently a foolhardy proposition, but its just plain bonkers when it comes to Japan. Here is its 30-year fiscal record in nutshell. Not withstanding years of chronic red ink and its recent 2014 consumption tax increase from 5% to 8%, Japan is still heading straight for fiscal oblivion. Last year (2015) it spent just under 100 trillion yen, but took in hardly 50 trillion yen of revenue, stacking the difference on its already debilitating mountain of public debt, which has now reached 240% of GDP.

That's right. A government which is borrowing nearly 50 cents on every dollar of outlays should be paying a huge risk premium to even access the bond market. But a government with a 240% debt-to-GDP ratio peering into a demographic sinkhole would be hard pressed to borrow at any price at all on an honest free market. The graphs below show what lies 30 years down its demographic sinkhole. To wit, Japan's population will have declined by 30% to 90 million, while its working age population will have plummeted from 78 million to about 52 million or by 33%. Moreover, its labor force participation rate has been declining for years, but even if it were to stabilize at the current 60% level, it would still mean just 31 million workers.

The trouble is, Japan already has 31 million retirees, and that number is projected to hit 36 million by 2060. In short, at the maturity date of the bonds the Japanese government sold last night, Japan will have more retirees than workers; it will be at a fiscal and demographic dead end.

So how did Japan sell billions of 30-year bonds given these catastrophic fiscal and demographic trends? The short answer is that it didn't sell anything to investors. Instead, it rented what amounts to a put option to fast money traders. The latter operate from the assumption that they can cop a capital gain in the next while and then sell the paper back to the BOJ. And why wouldn't they make that bet. The lunatics who run the BOJ have essentially guaranteed that they are the buyer of first and only resort for any Japanese government debt that remains outside of their vaults. Indeed, central bank announcements of negative yield are a form of code in the canyons of Wall Street and other financial markets. It means moar central bank bond-buying ahead, and therefore rising prices on the trading bait infused with the financial Viagra of NIRP.

This is another way of saying that the BOJ has essentially destroyed the government bond market. Indeed, during Q4 2015 monthly volume in the JGB market fell to the lowest level since 2004. As one bond market observer explained,

As of last night's auction, the entire JGB yield curve is now negative out to 13 years. That means that $5 trillion of bonds issued by the most fiscally impaired major government on the planet have been pushed into the netherworld of subzero returns.

Needless to say, the government of Japan and the BOJ are not in the midst of some exotic experiment that is off the grid relative to the rest of the global financial system. To the contrary, they are implementing Keynesian central banking and fiscal policies on a state of the art basis. They are doing what Bernanke, Krugman, the IMF and heavyweight (on all counts) Keynesian blowhards like Adam Posen have recommended for years. Indeed, rather than blow the whistle on the obvious lunacy being practiced in Tokyo, the recent G-20 meeting gave Japan a pass on its currency trashing efforts and implied that its Later this week, in fact, Draghi will make another plunge in the same direction. Already, more than $2 trillion of European government bonds are trading at negative yields, and for the same reason. To wit, the central bankers of the world have created a front-runners paradise. Yet so doing they have stood the very concept of a government bond in its head. Whereas the legendary British consol traded for nearly 200 years (outside of war interruptions) at par and to a rock solid 3% yield, today's sovereign debt is being turned into a gambling vehicle where financial gunslingers and hedge funds play for short-run capital gains on 95:1 repo leverage. in a word, the central banks have nearly destroyed the government bond markets. In the process, they have flushed trillions of capital into corporate debt and equity in search of yield and momentary trading gains with scant regard for the incremental risks involved. So, yes, the casino is implanted with FEDs (financial explosive devices) everywhere, including upwards of $60 trillion of sovereign debt that is radically mispriced; and which must eventually implode when the gamblers finally stampede out of the casino. Perhaps last night's Japanese bond auction was an omen, after all. The JGB 30Y yield is now below the UST 2Y for the first time since, well, the Lehman event of September 2008. Shortly thereafter, of course, our befuddled President at the time, George W. Bush explained the macroeconomic situation in a way that even the Congressional leadership assembled at the White House could understand. "This sucker is going down", he told them. He got that right. It was just a matter of time.

Regards, David Stockman P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Case of Japan’s Busted Bond Market appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - And Now the Movie, Folks... Posted: 09 Mar 2016 01:14 PM PST |

| Posted: 09 Mar 2016 12:59 PM PST This post Hang the Architects! appeared first on Daily Reckoning. AIKEN, South Carolina – The Chinese are going for broke… As Chris reports below in today's Market Insight, iron ore prices are soaring. Bloomberg:

The markets have gone berserk because the Chinese authorities have gone berserk by increasing credit by a berserk amount. China's Ponzi CrisisHere comes an update that must stagger every sober observer… In the first two months of the year, China's total credit – including "shadow banking" system loans (loans made by unregulated financial firms) – exploded by about $1 trillion. Chinese debt is expanding at a pace equal to 5% of GDP – PER MONTH! OMG! Why would credit increase so much… even as the world economy enters a slowdown? Why would the demand for iron ore and steel go up when demand for finished products is slumpy and falling? Because as it is somewhere recorded in the Bible, a berserk monetary policy begets berserk prices, which beget bad investments, excess capacity, and misallocation of resources… …which beget booms and busts, which beget even more berserk monetary policies. And now, China is in the grip of a misbegotten Ponzi crisis. More than a quarter of its debt cannot be serviced out of revenues. Instead, it must be refinanced – new debt must be taken on to service old debt. More than 50 trillion renminbi ($7.7 trillion) will be needed – a huge increase with no corresponding increase in output. What happens next? As always, we don't know. But most likely, we'll see wild whipsaws in the markets… and a lower exchange value for the renminbi versus other major world currencies. As the price of Chinese imports falls, Everyday Low Prices at Walmart will become Everyday Lower Prices everywhere else. Corporate profit margins, already falling, will drop further. Stock prices will collapse. And the hush of deflation will settle over the world, like a pillow pressed down on the face of a rich, old woman. [Paid-up Inner Circle members can catch up how to protect your portfolio from this deflationary wave here.] Ugly, Dysfunctional, ObnoxiousBut wait… we promised to tell you about our weekend in Charleston. We begin at the end… with a helpful suggestion. Many readers write to question our contribution to civilization. The general tenor of the letters goes like this: "You are always criticizing. But you never offer any solutions." Well, here we offer a helpful suggestion for at least one of the world's woes: ugly, dysfunctional, and obnoxious architecture. The solution is simple: Bad architects should be hanged. And in keeping with the new Donald Trump era and the leitmotif of the day, we will go further: First, they should be publically tortured, by being forced to live in houses of their own design, before the coup de grace is finally delivered. Who designed that horrible building to the south of the Charleston museum, in the direct line of sight of the historic Joseph Manigault House? Don't bother to tell us. We don't want to know. We just want assurance that he has been collared and awaits execution. The building is everything a public edifice shouldn't be: in the wrong place with the wrong design at the wrong time. It might have been perfectly appropriate for, say, a work camp in Siberia in Stalin's Russia. Or even as a reasonably faithful and representative example of the socialist utilitarian style of public buildings popular in 1960s America. But there it is today, like a wart on the face of a beautiful woman. And there in front is a scaffolding. Is it being built… or having a facelift? We don't know, but the only appropriate remodeling would take a wrecking ball or a drone. A Walk Around AikenOur interest in South Carolina architecture began as we were taking a walk around Aiken. Many of the houses are stately, fine, well-proportioned, and graceful. Even many of the cottages are cute and attractive. But almost all of the successful ones seem to have been built before the Great Depression. Houses put up more recently are simpler, lower, often porch-less, and generally charmless. They are often built of brick but without the warmth of 18th-or 19th-century bricks. These bricks are too red, too hard, and too uniform. These new houses seem to have come down here from somewhere else – say, Cleveland or Chicago. They still don't seem to know where they are. They are squat… in a climate that desperately calls for high ceilings and free-flowing air. They have no overhanging roofs or porches; instead, they absorb the sun's heat like a beached whale. And many of them have windows that are directly exposed to the sun without shutters… which must be disastrous in the summer. What is it that causes a people to lose the good taste or penetrating judgment with which they were once endowed? What causes them to stop thinking about things they once considered important? What turns a people who voted for two Jeffersons into Clinton or Trump supporters? We don't know. But we blame the architects for the buildings. They are the ones with the responsibility for the manmade shapes and forms we see around us. As for the churches in the town of Aiken, the Baptists, Methodists, and Episcopalians have done okay. The Baptists have a handsome church complex on York Street. It is not imaginative in any way. Nor is it particularly graceful. But it is solid, in the classical style, and respectable. Later architects added a series of arches and walkways. But the bricks are too harsh and heavy. And the annexes on Richland Street are unfortunate; a heavy band of what appears to be white concrete sits on the brick building like the cap on a tomb. Likewise, near St. John's United Methodist is an imposing, respectable collection of buildings. The Episcopalians seem to have done the best for themselves. St. Thaddeus is a dignified church with four fluted columns holding up a simple classical façade. But what went wrong with the Presbyterians? Their church complex on Barnwell Street is a catastrophe. Poor Presbyterians…None of these churches – Episcopalian, Methodist, or Baptist – is especially attractive. Still, none is an embarrassment to the faithful. But the poor Presbyterians… They are condemned. They pass their solemn moments in a space that looks more like a military outpost or a U.S. embassy than a church. The building is constructed of brick – dirty yellow in color – and crowned with a large cap of grey asphalt shingles that dominate the entire ensemble.

It reminds us of a church in Waterford, Ireland, which, in turn, reminds us of a gambling casino in Macau. All three buildings are marred by a particular upthrust center roof, which in Macau was supposed to represent the center of a roulette table. We doubt the Christians of Waterford or Aiken wished to recall the axis of a roulette table. God knows what the architect had in mind. But whatever it was, he should be punished for it. "This kind of architecture," said an old architect friend, now deceased, "is not just a mistake. It is a sin." He was referring to a house we designed and built ourselves… before we were old enough to appreciate architectural orthodoxy. The sin is pride – the idea that you are so damned smart that you can safely ignore 2,000 years of architectural evolution and create something entirely from your own imagination and ingenuity. In almost every instance, the effort fails. Like mutations, innovations in architecture are almost always sterile dead ends. The architect should be encouraged to experiment; why not? But when his experiments encumber the public with an eyesore that cannot be erased for at least a couple generations, he should suffer a capital punishment; it would put an end to him, if not to his bad architecture. "God Doesn't Care"But here we are… two pages into our tour of Charleston, and we haven't yet left Aiken! Let's hit the road. The road from Aiken to Charleston is an old one. It runs from the highlands down to the lowlands over about 100 miles… coming off the hilly, poor farms of the piedmont and running down into the swampy low country along the Ashley River. Between the two cities is the country that Baltimore newspaper man H.L. Mencken must have had in mind when he wrote his famous indictment of Southern culture, the "Sahara of the Bozart." There is not much of any Bozart along Routes 78 and Route 61. The houses are mean, low, miserable. The farms are poor. But the churches are numerous (in one stretch, we found a new Baptist church about every mile) and almost all disgraceful architecturally. One has a barrel roof and looks like an airplane hangar. Another has a low flat roof, like a plumbing supply store. Still another must be a converted gas station. This is no reflection on the religious fervor or doctrinal purity of the worshippers; we only comment on the buildings in which they do their thing. Readers will accuse us of being a church snob. We do not deny it; we like grace and beauty in all its forms – especially when we are nodding off during a sermon. Obviously, most people don't care about it. "God doesn't care either," the Baptist will reply, as though he had any idea what God would think. But if God doesn't give a hoot, He certainly won't mind if your editor has an opinion. Southern SurrenderThat is one of the sad things about the South… or at least this part of it. It has surrendered its critical spirit. People seem ready to put up with anything – architectural, philosophical, political… you name it. In this bastion of Christendom, for example, there is a curious lack of rigor toward the Christian faith. Driving along Route 78, we come to Bamberg, South Carolina. (Or was it Denmark, South Carolina?) It advertises itself as a "City of Pride." Right there in the Bible (Proverbs 16:18), it warns that "pride goeth before destruction and a haughty spirit before a fall." Our eyes opened widely, expecting to see the "City of Lust" or the "City of Gluttony" coming up next. You'd think Christians and architects – and especially Christian architects – would think twice before calling their city a place of pride… or putting up a church that is either a monument to their own haughty spirit (as is the case of Aiken's Presbyterians). Near the city of Bamberg, by the way, is the Rivers Bridge State Park, the site of where "a small band of Confederate soldiers tried to hold off Sherman's army." Without success, of course. Sherman's troops rampaged through the entire area. They burned and looted the big plantation houses all along the Ashley River and laid thousands of South Carolinians in their graves.

But the residents of the area today don't seem to harbor any hard feelings. Several times, we saw the flag of the conquering army flying from flagpoles. Directly in front of Aiken's Episcopal Church, for example, the side of a building is painted with the Yankee flag, with these words writ large: "In God We Trust." Has anyone bothered to ask… or even wonder… how the two connect? Which master do these Christians serve? Probably nobody asks. Something Lost…Down in the low country, we visited Drayton Hall, an 18th-century plantation. Stopping at the entrance to buy a ticket, the conversation went like this: "Are you ex-military?" "Why do you ask?" "Because if you are, you are entitled to a discount." "Why do you give a discount to ex-military at a plantation house? Why not give a discount to architects or builders? Besides, I thought the U.S. military burned this place down…" "What?" "Never mind…" "Uh… We just give a discount to thank them…" "For what? Arson?" "Are you serious? We thank them for letting us keep speaking English." "Huh?" The habit of critical thinking either has gone out of them… or they never had it in the first place. At the end of the road, in Charleston, we found an urban example of the network effect. A few elegant houses were built in the 18th century – with double-decker side porches, large windows, shutters, gardens, pergolas, high ceilings, and fine woodwork. Then, people who wanted to live among other elegant people in elegant houses joined them. The place took off like Facebook… And now, the old city sits like a bricks-and-mortar reproach to the rest of the state… and maybe to the entire nation. "What's wrong with you?" the dead architects seem to ask. "Did you forget how to build a nice house… a nice city… or a nice life?" At a graveyard back in Aiken, a monument recalls the only invasion of the state of South Carolina in history. "To the Confederate Cavalry," it is dedicated, and to two soldiers, interred beneath it, "who died in defense of this city." "What about us?" voices seem to whisper from below. Regards, Bill Bonner P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Hang the Architects! appeared first on Daily Reckoning. |

| Why US Dollar = Global Toilet Paper In 28 May 2016 ? Shocking Video Posted: 09 Mar 2016 11:29 AM PST Why US Dollar = Global Toilet Paper In 28 May 2016 ? Shocking VideoNo money in human history has had as much reach in both breadth and depth as the dollar. It is the de facto world currency. All other currency collapses will pale in comparison to this big one. All other currency crises have... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Buy Gold Central Bankers Urge Savers Posted: 09 Mar 2016 11:24 AM PST Bullion Vault |

| John Stossel ~ The Failed Liberty Vote Posted: 09 Mar 2016 09:58 AM PST John Stossel ~ The Failed Liberty Vote The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Cheap Oil, the U.S. Dollar and the Deep State Posted: 09 Mar 2016 09:34 AM PST This post Cheap Oil, the U.S. Dollar and the Deep State appeared first on Daily Reckoning. That oil fell off a cliff once the U.S. dollar (USD) began its liftoff in mid-2014 is, well, interesting. Causation, correlation or coincidence? There are a variety of opinions on this, as there should be. What we do know is the soaring USD blew up a bunch of carry trades that borrowed money denominated in USD and invested the cash in emerging markets paying much higher yields. Here’s WTIC oil:

And here’s the USD Index:

We also know the Saudis announced that the kingdom would pump every barrel it could “to maintain market share,” which is generally understood to mean crush competitors such as Russia and U.S. shale producers. We also know that storage facilities are almost full up (Oil Fundamentals Could Cause Oil Prices To Fall, Fast!). We also know that global growth is slowing, so demand could weaken sharply going forward. And lastly, we know that many oil exporters are heavily dependent on oil revenues to fund their oligarchy/monarchy/ruling elites, their military and their vast social welfare programs, which keep the restive masses from overthrowing the oligarchy, etc. Here is the U.S., heavily indebted producers must pump or die, as they need every dime of revenue to service their vast debts. If we add all this up– carry trades blowing up, weakening demand and heavy pressures to maintain production–we get a perfect set-up for a continued decline in oil. Many observers are expecting the Federal Reserve to pull out all the stops to weaken the dollar. They think this because a strong dollar hurts U.S. exports. If oil and the USD are indeed correlated, a weaker dollar would trigger a boost in oil prices–a welcome “saved by the bell” for indebted U.S. producers, and the bankers who lent tens of billions of dollars to them. If you glance at the above chart of the dollar index, you’ll note the Bollinger Bands are tightening. This usually presages a big move up or down. We don’t know which way the USD will move, but since it’s in a Bull market, we might surmise the move will be a continuation of the current trend, i.e. up. Technically, a 20% gain to the 120 level would be quite typical of a long-term uptrend. What would an additional 20% gain in the USD do to oil? If the correlation holds (and perhaps it won’t–there are no guarantees), it would very likely crush oil to new and breathtaking lows. Analyst Art Berman recently suggested a target of $16.50/barrel, and this corresponds rather neatly with USD at 120 (a 20% gain). Lower oil prices are not an unalloyed “win” for the U.S. The U.S. energy sector is getting pummeled, and soon its lenders will start booking staggering losses. The decline in petrodollars also means there is less demand for U.S. Treasuries from oil exporters. Enter the U.S. Deep State, which is only marginally interested in Wall Street bankers’ losses or petrodollar recycling into Treasuries. Global hegemony ultimately rests on issuing the reserve currency in size, and the sheer magnitude of financial resources that can be brought to bear to do what is viewed as necessary. The collapse in oil has led to an unprecedented transfer of wealth from producers to consumers. Oil exporters (the number of which is diminishing, as populations and domestic consumption levels soar throughout the oil-producing world) have far fewer USD to spend on military adventures, social welfare, the tallest buildings in the world, and so on. If global bankers wise up (and they are smart gals/guys), lending to oil producers is about to dry up like the proverbial mist in Death Valley. Why loan money to someone with $35/barrel oil in the ground if oil is heading to $20 or lower? Who goes broke/goes home/is overthrown at sustained $20/barrel oil? You can make your own list, but it pretty much includes every oil exporter. So who wins in a scenario in which the USD gains another 20% and pins oil to new, sustained lows? Consumers, of course, but as Zero Hedge and others have explained, this windfall isn’t leading to robust consumer spending. Rather, households are saving the proceeds, hunkering down in the recessionary winds they see rising. The U.S. oil sector will take some serious lumps, along with every other producer. We can anticipate huge writedowns of uncollectible debt, bankruptcies, and all the other collateral damage (pun intended) of a bust. But who is left relatively unscathed in terms of financial power and hegemony? The U.S. Should the USD soar another 20%, China would be forced to devalue its currency, causing massive capital flows out of China and an immediate loss of trillions of dollars of purchasing power for all who hold yuan/RMB. Not much of a win there. All this is to suggest that those expecting a major weakening in the USD to push oil higher shouldn’t hold their breath awaiting this outcome. Maybe the USD will weaken 20%, but why would it do so when every other central bank is weakening its currency? Wouldn’t it make much more sense to drain wealth and geopolitical leverage from oil exporters? Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post Cheap Oil, the U.S. Dollar and the Deep State appeared first on Daily Reckoning. |

| What's behind the falling Price of Oil ? Posted: 09 Mar 2016 09:28 AM PST With too much global supply and the lowest price in nearly 20 years - there's anxiety about a possible oil market meltdown. US crude prices fell below $30 a barrel on Tuesday, before settling down, but only a bit. While most major oil companies are slashing their budgets and jobs, some of the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Is The Gold/silver Ratio “saying” Something? Posted: 09 Mar 2016 09:24 AM PST Miles Franklin |

| Brain Dead Zombies and Lawless Psychopaths Posted: 09 Mar 2016 09:00 AM PST This post Brain Dead Zombies and Lawless Psychopaths appeared first on Daily Reckoning. Jim Quinn has a nasty pen and he uses it like a switchblade. His words pop off the page. At first blush, I end up saying, "Wow, he goes too far!" Then I think more deeply about his ideas and concepts, and find myself concurring most of the time (even if I might word things differently). In the article below, Jim explains why America has become a nation of zombies. And why only a few good Americans will survive at the end. It's easy for me to see his points made across my podcast with guests such as Jim Rogers and Bill Bonner. They too will say things in their own style, but everyone agrees: zombies abound. I don't expect we will be at Mad Max next week. But then again parts of America already look like third world. Nothing can be predicted. But you better have a plan for Jim Quinn's zombie vision and the alternate "everyone hold hands, and kiss on the cheek" vision. As far as I know, trend following is the only strategy that allows you to make money in both good and bad times. If there is no way out, all evidence says you better be a trend following trader. Please send me your comments to coveluncensored@agorafinancial.com. I'd love to hear your thoughts. Regards, Michael Covel

No Way OutBy Jim Quinn

I know there are many people out there who don't watch the daily drivel emanating from their 72 inch HD boob tubes. I don't blame them. Most of the shows on TV are dumbed down to the level of their audience of government educated zombies. The facebooking, twittering, texting, instagraming generation is too shallow, too self-consumed, and too intellectually lazy to connect the dots, understand symbolism or learn moral lessons from well written thought-provoking TV shows. But there have been a few exceptions over the last few years. Breaking Bad, House of Cards, and Walking Dead are intelligent, brilliantly scripted, morally ambiguous, psychologically stimulating TV shows challenging your understanding of how the world really works. The Walking Dead is much more than a gory, mindless, teenage zombie flick. Personally, I find myself interpreting the imagery, metaphorical storylines, and morality lessons of Walking Dead within the larger context of cultural, political, and social decay rapidly consuming our society today. I don't pretend to know the thought process or intent of the writers, but I see plot parallels symbolizing current day issues plaguing our empire of debt. Their mid-season opener was one of the most intense shocking episodes of the entire series. It was titled No Way Out, as the main characters appeared to be trapped in a no win situation with long odds and little hope of surviving.