saveyourassetsfirst3 |

- Dollar Cost Averaging: A Great Strategy For Bull And Bear Markets

- In A Crisis, Your Paper Dollars Are Worthless: “Real Goods Are The Real Money”

- Gold And Its Miners' Stocks Rocketing Higher In Major New Uplegs

- Something Has Changed in Gold Stocks

- Bankers Pull “Greatest Heist in History”

- We Are Nearing The End — Nomi Prins

- The Bear Is At The Door, Part 1: Momentum Stocks Getting Crushed

- Former Head of the NAACP to Endorse Bernie Sanders

- US Jobs Data Cut Gold Investings Longest Gains Since April as China Prepares to Go Quiet

- Financial Crisis & Collapse: There Will Be No Last Minute Warning! – Mike Maloney

- Judge Tazes Man in Court Because He “Continued To Speak When Ordered To Stop”

- Gold Magically Flows Back Into The GLD

- Jim Willie: China Will Take Control of the Gold Market With These 2 Historic Moves!

- WHATS NEXT FOR LONDON SILVER FIX?

- The Deepening BS of The BLS

- Senior Gold Miner Goldcorp Takes Large Stake in Nevada’s Gold Standard Ventures

- Eric Sprott On Surge in Gold & Silver

- Gold Short term price and Cycle Forecast

- Gold And Silver Best Performing Assets – Up 9% and 8% YTD

- Stranger than Fiction: The Bre-X Gold Scandal

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

| Dollar Cost Averaging: A Great Strategy For Bull And Bear Markets Posted: 05 Feb 2016 01:02 PM PST |

| In A Crisis, Your Paper Dollars Are Worthless: “Real Goods Are The Real Money” Posted: 05 Feb 2016 12:30 PM PST If ATMs, banks and markets close, or if hyperinflation makes the fiat, Federal Reserve note completely worthless overnight, none of these goods will be exchangeable for the money you have sitting in the bank, or on a credit card. By Tom Chatham, Project Chesapeake via SHTFPlan: Editor's Comment: When people hold paper money, they are holding […] The post In A Crisis, Your Paper Dollars Are Worthless: "Real Goods Are The Real Money" appeared first on Silver Doctors. |

| Gold And Its Miners' Stocks Rocketing Higher In Major New Uplegs Posted: 05 Feb 2016 12:28 PM PST |

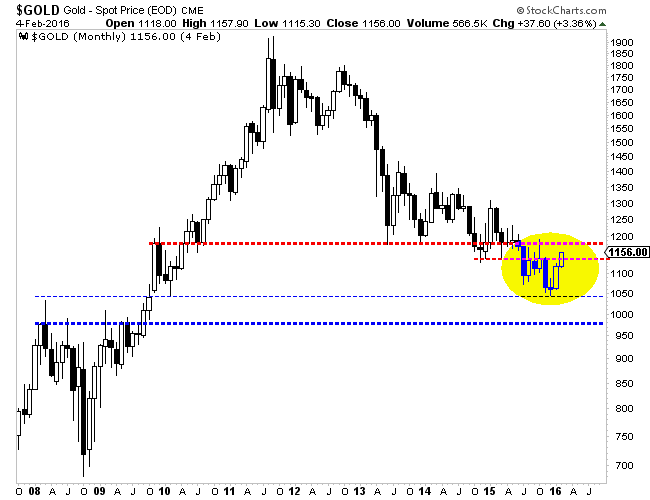

| Something Has Changed in Gold Stocks Posted: 05 Feb 2016 12:04 PM PST In our missive last week we noted that: While good things are happening under the surface for Gold, its lack of a strong rebound in recent months argues that such a rebound is in the future but not imminent. Gold's steady downtrend could resume in the next week or two. As we know, the precious metals complex enjoyed another very strong week. Gains in the metals were somewhat muted in comparison to the gains in the miners. GDX and GDXJ surged nearly 16% and 11% respectively. Last week we said nothing has changed. This week figures to be the week something did change and definitely so for the miners. The strong gains in the miners since their January 19 low (31% in GDX and 23% in GDXJ) typify what could be the start of a new bull market. The current rebound can be compared to the rebounds from the major bottoms in late 2000 and late 2008. We use the HUI gold bugs index for comparison as the ETFs do not go back far enough. The HUI has gained roughly 40% since the January 19 low. That fits well with the analog chart below which puts the three rebounds on the same scale. If the gold stocks are in a new bull market then they should continue to make new highs over the next few months.

Next, rather than chart one of the mainstream indices, we will take a look at our Top 15 index which includes most of our favorite companies. Tuesday the index pulled back from a confluence of major resistance to close at 123. Instead of starting the next leg lower the index exploded through that resistance. Friday's activity is not updated but as you can see, the Top 15 index is on the cusp of a major breakout.

Turning to Gold, I see less evidence that Gold has established a major bottom. To be blunt, Gold needs a monthly close above $1180/oz, which has been a major pivot point since late 2009. First things first, Gold needs to close this month above $1150-$1160/oz. The bear scenario would have Gold making a bearish reversal sometime this month and closing below initial resistance at $1140/oz. The bull scenario would likely have Gold closing above $1160 and testing $1180 fairly soon.

We should also note that while the US Dollar index failed to breakout, it remains well above major long-term support at 92 and 94 with sentiment indicators at constructive levels for bulls. As the US Dollar continues to consolidate, we want to see Gold hold recent gains and push towards $1180-$1200/oz. It would be a bad sign if Gold fizzles below $1160/oz with the US Dollar in correction mode. This past week was likely a major turning point for the gold miners and perhaps Gold itself. The strength of recent gains (in the miners) coming off a false breakdown to new bear market lows suggests that the bear market ended on January 19. We should also note that four of the five largest miners (in GDX) are trading above their 400-day moving averages and at multi month highs. Meanwhile, as shown by our Top 15 index, the strongest companies in the sector are on the cusp of a major breakout. While we have some concerns on the metals we should note that the miners lead at major turning points. The miners are telling us something has changed. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

|

| Bankers Pull “Greatest Heist in History” Posted: 05 Feb 2016 11:52 AM PST More than half a decade into what is supposed to be a recovery, people are finally being forced to admit what this really is — large scale theft. Submitted by Michael Krieger, Liberty Blitzkrieg: The following article from the New York Times is shameful in many ways. While the paper is forced to cover the undeniable […] The post Bankers Pull "Greatest Heist in History" appeared first on Silver Doctors. |

| We Are Nearing The End — Nomi Prins Posted: 05 Feb 2016 10:00 AM PST "We're getting to the end of what's possible in terms of stimulation, I would have thought the end should have happened years ago. But the reason it didn't was because of the epic coordinated efforts between the major central banks… and that element has left markets with the APPEARANCE of health they haven't actually had […] The post We Are Nearing The End — Nomi Prins appeared first on Silver Doctors. |

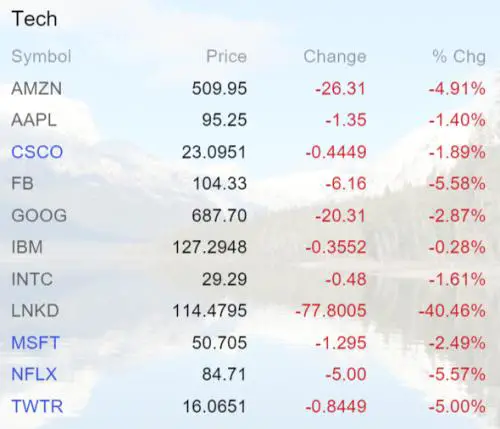

| The Bear Is At The Door, Part 1: Momentum Stocks Getting Crushed Posted: 05 Feb 2016 09:53 AM PST One of the common transitions that bull markets go through as they age and die is a narrowing of leadership. As formerly strong sectors begin to stall out, investors shift into whatever is still looking good — that is, whatever still has upward momentum. Eventually capital becomes concentrated in just a few names. Then those stocks roll over and the game ends. This time around Big Tech was the final category of momentum play, and it ended up attracting astounding amounts of money from both the usual suspects like hedge funds and some new suckers like the Central Bank of Switzerland, now a major holder of Apple shares. But now Big Tech has lost the Big Mo: Amazon, for instance, tripled in 2015, and has now given back about half of that move. Google hit an all-time high very recently and is now falling like a stone. But today’s big story is LinkedIn, which is, as this is written, down 40% on disappointing forward guidance. Here’s a piece from an analyst who offers a strategy for playing this sudden reversal of fortune:

|

| Former Head of the NAACP to Endorse Bernie Sanders Posted: 05 Feb 2016 09:30 AM PST The New York Times is defending the establishment candidate simply because the New York Times IS the establishment. Submitted by Michael Krieger, Liberty Blitzkrieg: In its endorsement of Hillary, the New York Times editorial board did such a sloppy job I can't help but think it may have done permanent damage to its brand. Upon reading it, my initial conclusion was […] The post Former Head of the NAACP to Endorse Bernie Sanders appeared first on Silver Doctors. |

| US Jobs Data Cut Gold Investings Longest Gains Since April as China Prepares to Go Quiet Posted: 05 Feb 2016 09:16 AM PST Bullion Vault |

| Financial Crisis & Collapse: There Will Be No Last Minute Warning! – Mike Maloney Posted: 05 Feb 2016 09:12 AM PST Is a financial crisis being covered up? What do you make of the Fed Capital Account charts? One thing to remember – when these huge financial upheavals occur, you find out the day after they’ve tried to patch things up. There will be no last minute warning. Buy Gold Coins and Bars at SD Bullion The post Financial Crisis & Collapse: There Will Be No Last Minute Warning! – Mike Maloney appeared first on Silver Doctors. |

| Judge Tazes Man in Court Because He “Continued To Speak When Ordered To Stop” Posted: 05 Feb 2016 09:00 AM PST The man apparently went on too long with his passionate defense plea. When the judge had enough, he got zapped. No, this is not from The Onion… Submitted by Mac Slavo, SHTFPlan: The punishments being handed out by courtrooms are starting to look a lot like behaviorists testing rats once imagined – with a […] The post Judge Tazes Man in Court Because He "Continued To Speak When Ordered To Stop" appeared first on Silver Doctors. |

| Gold Magically Flows Back Into The GLD Posted: 05 Feb 2016 08:17 AM PST Even without speculating whether or not the GLD actually holds all of the gold that it claims, the remarkable additions to "inventory" over the past month are certainly noteworthy. |

| Jim Willie: China Will Take Control of the Gold Market With These 2 Historic Moves! Posted: 05 Feb 2016 08:15 AM PST In this MUST LISTEN extended interview, Hat Trick Letter editor Jim Willie forecasts why the Chinese are set to take over the daily gold fix (particularly in the wake of last week’s London silver fix fiasco), and are set to announce RMB gold futures contracts… The post Jim Willie: China Will Take Control of the Gold Market With These 2 Historic Moves! appeared first on Silver Doctors. |

| WHATS NEXT FOR LONDON SILVER FIX? Posted: 05 Feb 2016 08:00 AM PST "This could be the end of the fix." – Ole Hansen, head of commodity strategy for Saxo Bank David Morgan joins us to cover silver and the breaking of the LBMA electronic "silver fix". Have criminal banks involved in the daily price fix finally lost control? The post WHATS NEXT FOR LONDON SILVER FIX? appeared first on Silver Doctors. |

| Posted: 05 Feb 2016 07:45 AM PST Lots of excitement today that the U.S. "unemployment rate" is under 5%. (I started chuckling just typing that!) How can this rate be so low given the paltry jobs numbers? And why are gold and silver down today? C'mon in and we'll explain (again). |

| Senior Gold Miner Goldcorp Takes Large Stake in Nevada’s Gold Standard Ventures Posted: 05 Feb 2016 07:30 AM PST When Gold Standard Ventures announced on February 1 that Goldcorp would be investing CA$16.1 million for 9.9% of the junior’s shares, industry watchers took notice. In this analysis written exclusively for Streetwise Reports, Thibaut Lepouttre, editor of Caesars Report, speculates on why the major acted when and where it did, and what it might mean […] The post Senior Gold Miner Goldcorp Takes Large Stake in Nevada’s Gold Standard Ventures appeared first on Silver Doctors. |

| Eric Sprott On Surge in Gold & Silver Posted: 05 Feb 2016 07:27 AM PST Notwithstanding the slight hit on this morning’s NFP, gold and silver and the shares have had a huge week. Is this just the beginning? Eric Sprott breaks down all the technical action: Click here for Eric Sprott’s full Gold and Silver Analysis: The post Eric Sprott On Surge in Gold & Silver appeared first on Silver Doctors. |

| Gold Short term price and Cycle Forecast Posted: 05 Feb 2016 07:16 AM PST Commodity Trader |

| Gold And Silver Best Performing Assets – Up 9% and 8% YTD Posted: 05 Feb 2016 05:01 AM PST gold.ie |

| Stranger than Fiction: The Bre-X Gold Scandal Posted: 04 Feb 2016 04:00 PM PST CBC |

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow Posted: 04 Feb 2016 03:02 PM PST Le Cafe Américain |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment