Gold World News Flash |

- Meme Machine: Fed Idiocy Goes Unremarked

- Mystery Federal Reserve Bank NY Gold Depositor

- 60 Minutes Raises the Question: Are Dirty Lawyers Running the U.S.

- David Morgan’s Top Reason for Being Bullish on Silver

- The Time for REAL Insurance Has NEVER Been This Great!

- The Hardcore Facts Are Pointing To An Economic Collapse

- Caught On Tape: Chinese Investors Find Out They Got Fleeced By A $7 Billion Ponzi Scheme

- "Surely This Problem Won't Affect Me"

- Willem Middelkoop explains the coming 'big reset' to Grant Williams

- 10 Years After The Greenspan Fed

- Gold Price Bucked Off the Shackles Today and Jumped $11.50 (1.03%) to $1,127.90

- Hong Kong Housing Bubble Suffers Spectacular Collapse: Sales Plunge Most On Record, Prices Crash

- World's Largest Silver Producer Slams LBMA's "Manipulated" Fix

- The End Of Plan A: The Big Reset & $8000 Gold

- Introducing the DR’s Newest Heavyweight

- You Can Make Money in Up or Down Markets

- February 2016 Bible Truth about Zion explained by Bible End Times Scholar David Hocking

- Gold Bullion Inventories at Comex Licensed Facilities

- The War On The Credit Cycle Has Only Just Begun…

- Paul Begley LIVE "The Mark Of The Beast" RFID Is Coming Fast" And Much More

- Fundamental Catalysts in Junior Mining Sector Lead To Bullish Breakouts and Reversals

- The Fed’s Fata Morgana

- After the Collapse: Addiction and Bad Habits

- "PROPHECY ALERT" Biometric Banking Iris Scanners ATM (Illuminati)

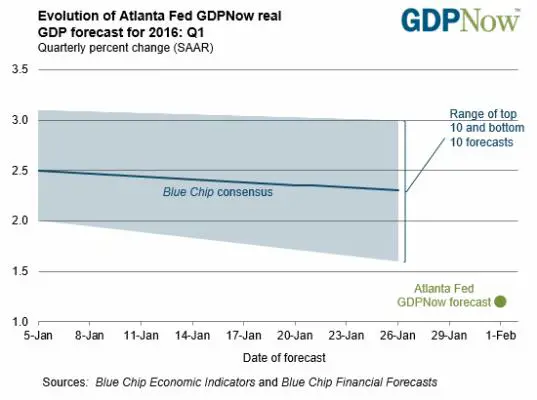

- Atlanta Fed Sees Far Weaker Than Expected Q1 GDP

- There is No Silver Lining for Brazil

- Central Bank Created Silver Price Rally

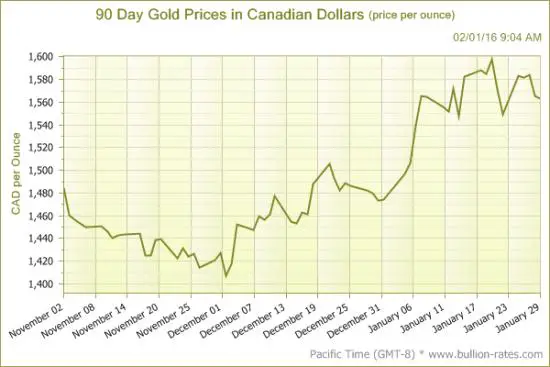

- Gold and Silver Bullion Up 5.3% and 3.4% In January as Stocks Fall Sharply

- U.S. Fourth QTR GDP Only Grows 0.7%

- Bron Suchecki: A mystery gold depositor at the New York Fed

- US Dollar and US Treasury Bonds Big Picture

- U.S. Global's Ralph Aldis on the Life-Changing Magic of an Asset Allocation Plan

- US Consumer Is the Last Defense Against Strong Dollar Drag on the Economy

| Meme Machine: Fed Idiocy Goes Unremarked Posted: 02 Feb 2016 12:00 AM PST from The Daily Bell:

Dominant Social Theme: The Fed will need to readdress the research that resulted in the 25 basis point rate hike. But it’s totally understandable given the complexity of the decisions and the pressures of the job. Free-Market Analysis: If you raised prices on a particular item and caused its entire market to collapse, you’d probably be fired. But that is not what’s happening to Janet Yellen. Instead, we’re exposed to articles like this one in the Financial Times that go on and on – presumably with a soporific strategy. The major media is obviously not enamored with mocking Ms. Yellen. The idea is that we ought to recognize that being the boss of the Fed is an extremely hard job. Yellen doesn’t need our contempt; she needs our understanding. The article is artfully written. Eventually we are supposed to lose track of its point and simply, vaguely recall that Yellen is “watching the markets closely.” It does begin with some criticism of Yellen’s tepid hike, coming a few days before the market disasters. The first weeks of January were the worst EVER RECORDED. It made Yellen’s decision to hike look, well … idiotic – not that FT will use that word. Stung by brutal declines in the S&P 500 index, some Wall Street investors are accusing the Fed of failing to appreciate the dangers brewing overseas. Instead of soothing the markets, US policymakers are accused of fraying nerves and exacerbating outflows from emerging markets by purportedly clinging to a strategy that envisages further increases this year. “The market views tightening as a mistake now,” says Jordi Visser, chief investment officer at Weiss Multi-Strategy Advisers. “I don’t think 25 basis points matters much but the market clearly does. We’re now closer to a recession than we all realise.” While this sort of reporting is at least realistic, the Financial Times can only keep it up for so long before returning to the kind of tone and descriptions that central banking always receives in mainstream media. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mystery Federal Reserve Bank NY Gold Depositor Posted: 01 Feb 2016 11:00 PM PST by Bron Suchecki, Perth Mint:

It is interesting that these phase seem to correspond with economic turmoil – dot.com crash 2000/1, global financial crisis 2007/8, and today? Note that during 2000 and 2001 the FRBNY was able to consistently ship out 40 tonnes a month. That works out at 2 tonnes a day over 20 business days a month. Commercial vaults designed for high throughput can do more than that but if you look at this National Geographic documentary on the Federal Reserve you can see it is not suited to high volumes. As I explained in this post, "those who think Germany could put 300 tonnes in a big plane or warship and move it in one or a few days have been watching too many Die Hard movies". In any case, Germany's 300 tonnes could therefore have been realistically repatriated in one year. During 2014 and 2015 we know that Germany repatriated just under 190 tonnes and the Netherlands around 123 tonnes. Given the reported net withdrawals from the FRBNY (back calculated as they only report balance in millions of dollars @ $42.22, I calculate the following delivery schedule. All figures represent withdrawals, except the one highlighted in yellow, which is a deposit. Note that every figure in this table is a multiple of either a 4.420 tonne or 5.157 tonne "lot", eg 41.991 = (4.420 x 6 + 5.157 x 3). I have tried a number of possibilities but the above is the only realistic one I can find that fits the reported facts in the lot multiples. Out of this comes two observations:

As the FRBNY is reporting physical custodial stocks, the only explanation for the deposit is either another central bank deposited physical, or the FRBNY moved some of its (ie America's) gold reserves into the account of another central bank, which could be the result of: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60 Minutes Raises the Question: Are Dirty Lawyers Running the U.S. Posted: 01 Feb 2016 10:00 PM PST by Pam Martens and Russ Martens, Wall Street on Parade:

In short, New York State is facing an epidemic of corruption and it's long past the time to bring in a Justice Department Taskforce to clean up the mess. In 2013, we warned in an article at CounterPunch that New York was drowning in corruption; that both lawyers and judges were fixing court cases. Five years earlier, reporter Wayne Barrett wrote the following in the pages of The Village Voice, following an in-depth investigation: "It wasn't just that a case could be fixed. The darker secret was that the bench itself had been bought, that its polyester black robes were on a perpetual special-sale rack, that smarmy party bosses, ensconced at 16 Court Street across from the supreme court they ruled, demanded cash tribute to 'make' a judge. The district attorney, Joe Hynes, who first heard the rumor 36 years ago when he was a young prosecutor running the office's rackets bureau, said in 2003 that he'd have to be 'naive to think it didn't happen,' that it was 'common street talk that this has been going on for eons.'" Just last February, the New York Times published its investigative findings on a foreign dirty money epidemic in New York City. The article looked at the luxury condos of the Time Warner Center and opened with these two revealing paragraphs: "On the 74th floor of the Time Warner Center, Condominium 74B was purchased in 2010 for $15.65 million by a secretive entity called 25CC ST74B L.L.C. It traces to the family of Vitaly Malkin, a former Russian senator and banker who was barred from entering Canada because of suspected connections to organized crime. "Last fall, another shell company bought a condo down the hall for $21.4 million from a Greek businessman named Dimitrios Contominas, who was arrested a year ago as part of a corruption sweep in Greece." The Times investigation found further that almost half of luxury homes nationwide worth at least $5 million are being purchased through shell companies. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Morgan’s Top Reason for Being Bullish on Silver Posted: 01 Feb 2016 08:20 PM PST from silver investor.com: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Time for REAL Insurance Has NEVER Been This Great! Posted: 01 Feb 2016 08:02 PM PST by Bill Holter, JS Mineset, SGT Report.com:

Last summer as negative interest rates began to appear in Europe, especially BETWEEN financial institutions I wrote this: Negative Interest Rates. Debt is Better than Cash? …Who's Running the Monetary Asylum Anyway? .Rather than write a complete rehash today on negative rates I encourage you to read a past missive as the mission for today is to look at this from a very broad perspective.

Of course there are all sorts of ramifications with negative interest rates. The most obvious is how it will affect the banking system? Negative rates on deposits will certainly prod some to withdraw actual currency and dig a hole in their backyard. It is said negative interest rates can (will) cause a bank run while others believe a move to digital currency will be used to stem the ability to withdraw from the system. Both of these thoughts are likely. It must be understood that all monetary policy over the last 100 years has been an effort at “reflation”. All monetary policy has been about “growth”. Before you start screaming at me and calling me naïve, I am not talking about economic growth or “for the good of the people”, I am talking about expanding and assuring the global financial PONZI SCHEME continues! You see, for the first 70 years or so, expanding the amount of debt was easy as assets and unencumbered collateral of all sorts were available to be lent against. As the fractional reserve/Ponzi scheme matured it hit an inflection point around 1980 as interest rates spiked. Rates have come down ever since as a means to allowing more and more debt to build up. The next inflection point was 2008 when we reached debt saturation levels and interest rates have basically been zeroed out since then. Any nominal interest rate level since that point would have blown up the game. Now, in order to keep the game going, we must have negative rates because there is nowhere else to go. But what about the Fed raising interest rates last month? We have seen what financial markets think of that decision. Even looking at the Fed’s statement after the last meeting is “telling” as they did not include ANY “risks” in their statement. Before and after the December rate hike, various Fed officials “floated” the possibility of negative interest rates. I believe we will see another round of QE AND negative interest rates hit the U.S. as the current margin call evolves, there is no other option. Over the weekend, Zerohedge put an article out explaining the situation in China. They are in the exact same boat but they do have room to lower rates A Chinese Banker Explains Why There Is No Way Out . The key passage as expressed by a junior banker at a Chinese commercial bank follows: “If I don't issue more loans, then my salary isn't enough to repay the mortgage, and car loan. It's not difficult to issue more loans, but lets say in a years time when the loan is due, if the borrower defaults, then I wont just see a pay cut, I'll be fired, and still be responsible for loan recovery.” China has the exact same problem with too much leverage as does the West. No doubt whether immediately or in the near future, China will also be forced to go the devaluation route. This will send 1 billion+ trying to exit yuan ahead of devaluation. But where will they run? Certainly we will see some funds moving into the dollar (and out as official reserves are sold) but China is a culture who understands “money”. Just as they have officially accumulated gold and urged their citizens to accumulate, a big “exit door” will be into gold. I am of the belief that this accumulated gold will be their trump card …used only after the current currency game has no more breath. Do not be fooled by the jubilation of this past Friday. As I said earlier, “if only it could be this easy”? This goes back to the reality that no central bank or sovereign has EVER printed its way to prosperity. Yes, devaluing does help a nation’s trade in relative terms to their partners but what we have today is the entire system shrinking together. Will a larger slice of a smaller pie “be enough”? Global trade, GDP and consumption are all shrinking at a time debt levels have never been higher. This is akin to going on a buying spree all done on debt and then getting the bad news you are getting a pay cut! As for Japan going “negative”, their action is simply part of the “race to the bottom”. We have said all along we live in a world where central banks are in a “race to the bottom” with their currencies, Japan is only the latest illustration. The world is already well into a collective margin call, the day is coming where investors will SELL into the “good news” of further rate cuts and negative rates. Once this action begins it will say loud and clear “CENTRAL BANKS HAVE LOST CONTROL”! Don’t get me wrong, this has already happened as they have no policy options left other than negative interest rates. However, the key will be when market participants head for the exits and use whatever PPT/negative rate “bids” as their exit door. To finish, negative interest rates are not even “real”. A real and functioning system cannot exist with negative rates. The same thing is true for backwardation in precious metals. In a real system with a rule of law they theoretically cannot exist, in a correctly functioning system, backwardation certainly cannot exist. Negative interest rates are a sign of outright panic by TPTB, the reaction on Friday will not last long once this understanding sinks in. The coming global financial crash will be greater than anything ever before seen in history. The time for REAL INSURANCE has never before been this great! Standing watch, Bill Holter, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Hardcore Facts Are Pointing To An Economic Collapse Posted: 01 Feb 2016 08:01 PM PST from X22 Report: VIDEO: Episode 882a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Caught On Tape: Chinese Investors Find Out They Got Fleeced By A $7 Billion Ponzi Scheme Posted: 01 Feb 2016 07:40 PM PST When it comes to all things China, the old adage "go big or go home" certainly applies. The country's monumental expansion in the wake of the financial crisis was financed by borrowing on a massive scale, as the country's debt burden rose from "just" $7 trillion in 2007 to more than $28 trillion today. That's big. Last year, at the peak of the country's equity bubble, margin financing outstanding amounted to 18% of the SHCOMP's free float market cap. Also big. When the PBoC moved to devalue the yuan last August, Beijing ended up triggering an enormous amount of volatility that reverberated through global markets and culminated with an 8% one-day decline for the SHCOMP on August 24 and a 1,000 point drop in the Dow the same day. Again, big. On Monday we got the latest "big" news out of China when Beijing announced it had arrested 21 people over a $7.6 billion P2P fraud Ezubao. 900,000 people were defrauded, making the fiasco the biggest ponzi scheme in history by number of victims. Ezubao's model was simple: they pitched the "business" as a P2P lending company through which investors could fund a variety of projects. The problem: 95% of the projects didn't exist. Ezubao just made them up and used the new money to repay existing investors who were promised annual returns of between 9% and 15%.

(the locked door at Ezubao's office in Hangzhou) Zhang Min, the former president of Yucheng Group, Ezubao's parent, calls the company "a complete Ponzi scheme." Yes, a "complete ponzi scheme", and one that was quite lucrative for Yucheng chairman Ding Ning who allegedly bought extravagant gifts for friends including a CNY12 million pink diamond ring and a CNY50 million green emerald. The company's assets have been frozen since December. Investments were pitched to unsuspecting Chinese as "high yield, low risk." "According to more than one suspect confessed, Ding Ning and several closely related group of female executives, their private life extremely extravagant, spendthrift to suck money," a highly amusing Google translation of the original Xinhua story reads. Ding Ning paid his brother CNY100 million per month, Xinhua says. "Police used two excavators and dug for 20 hours to unearth 80 bags of evidence that Ezubo executives had buried six meters underground on the outskirts of Hefei, a city in the eastern province of Anhui," Bloomberg adds. On thing we've discussed at length over the past year is the extent to which China is teetering on the verge of social unrest. Between the stock market meltdown, the cratering economy (which will invariably lead to massive job losses) Chinese policymakers are going to have their hands full explaining what went wrong to the country's 1.4 billion people (see here for more). Needless to say, the revelation that 900,000 people were defrauded in a ponzi scheme run through China's largely unregulated P2P space won't help matters. "Cases of illegal fund-raising related to peer-to-peer lending have grown quickly in the past two years, according to the local authorities, and officials pledged in December to tighten regulation of the industry," The New York Times writes. "Because of the enormous sums involved and the large investor base, the collapse of a major online-financing platform could raise concerns over confidence in the security of such investments." Here's a clip of Ezubao's defrauded "clients" protesting late last month. Expect more of this to come. And not just as it relates to ponzi schemes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Surely This Problem Won't Affect Me" Posted: 01 Feb 2016 07:25 PM PST Submitted by Jeff Thomas via InternationalMan.com, On a daily basis, I receive emails from associates in the UK and Europe that speak of the sheer madness of allowing refugees in the millions to pour into Europe. The riot in Cologne, Germany, by some 1,000 men who sexually assaulted 90 women, and robbed and threatened others, offers insight as to the scale of riots that we may expect to see in the future. And the immigration of refugees is just beginning. The shock and horror that my associates express evidences that never before in their lifetimes have events such as these taken place, and that far worse is yet to come. We tend to view this “scourge of the demon” as though it’s something new. Yet, in fact, it’s occurred many times before. Randolph Bourne:

When there is warfare, people will subjugate themselves to the state as at no other time. They will allow themselves to be taxed and used as cannon fodder, and to have their rights stripped away, as they are in an “emergency” condition that requires sacrifice but will (hopefully) be over soon. Unfortunately, it’s not intended to be over soon. Perpetual conflict means perpetual increase in power by political leaders. Therefore, the leaders will claim that they want it to all be over as soon as possible, but they actually will seek the opposite. Of course, the people don’t desire conflict, so they have to be fooled into believing that it’s necessary. The Nazis had a thorough understanding of this principle. Hermann Goering: "Why of course the people don’t want war. But, after all, it is the leaders of the country who determine the policy and it is always a simple matter to drag the people along, whether it is a democracy, or a fascist dictatorship, or a parliament, or a communist dictatorship. Voice or no voice, the people can always be brought to the bidding of the leaders. That is easy. All you have to do is tell them they are being attacked, and denounce the peacemakers for lack of patriotism and exposing the country to danger. It works the same in any country." It’s pretty easy to stop the “invasion” by Muslims into Europe, yet we see the EU making threatening noises to all member countries that if they don’t open the floodgates and let them in, there will be hell to pay. The EU government itself is therefore creating the problem that it will later claim it’s trying to control. The wars (Afghanistan, Iraq, Yemen, Libya, Egypt, Palestine, Syria, and more) are intended, in part, to push tax dollars into the military industry and, in part, to create a distraction from the economic mismanagement of the central government. The creation of large numbers of refugees (both real refugees and opportunists) is an additional benefit to the government, as they will create disharmony and fear throughout Europe as they fail to assimilate. Hitler used the Jews as his excuse for creating a police state and going to war. The EU (and its allies) will create a crisis, then invoke martial law as an “unfortunate necessity” in order to contain the problem they’ve created. Goering, Goebbels, and Hitler knew quite well that you first have to create a demon, then you can subjugate your people in an effort to control that demon. But, in doing so, you need a good marketing programme. You need regular propaganda going out to work the people up into a lather. Joseph Goebbels:

On both sides of the Atlantic, governments, with the eager but blind assistance of the press, are creating a crisis of epic proportions. It’s essential that they do so, as they have already created an economic crisis of epic proportions and they need a distraction from that problem—one which allows them control over the people and the assurance of staying in power. Throughout history, warfare has provided that power for one group of political leaders after another. It’s also important to make the people feel helpless, so that they’ll turn to their government to solve the problem. Therefore, the ability for individual retaliation must be taken out of the hands of the people. Adolf Hitler:

The EU government are presently causing the problem through mass immigration by refugees. But, surely, the very idea that such an influx of uncontrollable people could be a good thing is preposterous. How could anyone ever believe that any good could come of this? Adolf Hitler:

The “Muslim question” has been made into a political issue. Conservatives who see themselves as “sensible” will oppose the immigration, whilst liberals who see themselves as “caring” will support it. The extreme polarisation between factions will ensure that the lie (as absurd as it is) will receive the immovable support of roughly 50% of the population of Europe (and countries abroad). Still, intelligent people are saying to each other every day, “Don’t these politicians get it? Don’t they understand that this influx of Muslims is a disaster in the making?” Well, yes, actually, they understand that all too well, which is why they’re all on board. As in both of the previous world wars, we shall see the charade play out again. Each country in Europe will, in turn, join the war with “the enemy.” At some point, Russia will get dragged in, either through an overzealous military action, or through a false-flag attack, and a world war will be on. The US and Canada, at first, will just contribute armaments and advisors, but, eventually, the American people will be persuaded that, without their involvement, the Muslims will overrun America as well. If the Americans don’t fall into line on cue, false-flag incidents will be created that will cost American lives that point directly to Muslims. Again, this is nothing new. The Americans have been dragged into war repeatedly in the same way in the past. The question is not whether Muslims will overrun Europe. They will. (That’s the objective.) The question is not whether there will be war. There will be. The question is whether you live in a place that will be safe when it occurs or whether your present location will become unlivable at some point. Of course, there will be those who recognise that, in this game, their own government is not their friend. Some will choose to prepare an exit plan, should it become necessary. Internationalisation offers the greatest likelihood of insurance against the threat of an overreaching government. Insurance, after all, is purchased not due to a certainty that something will go badly wrong. It’s purchased when a disastrous outcome is likely enough to warrant having that insurance in place. * * * Unfortunately there’s little any individual can practically do to change the trajectory of this trend in motion. All you can hope to do is to save yourself from the consequences of all this stupidity. We think everyone should own some physical gold. Gold is the ultimate form of wealth insurance. It’s preserved wealth through every kind of crisis imaginable. It will preserve wealth during the next crisis, too. But if you want to be truly “crisis-proof” there's more to do… Most people have no idea what really happens when a government goes out of control, let alone how to prepare… How will you protect yourself in the event of a crisis? This just-released PDF guide Surviving and Thriving During an Economic Collapse will show you exactly how. Click here to download the PDF now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Willem Middelkoop explains the coming 'big reset' to Grant Williams Posted: 01 Feb 2016 07:00 PM PST 9:58p ET Monday, February 1, 2016 Dear Friend of GATA and Gold: Singapore fund manager Grant Williams, editor of the "Things That Make You Go Hmmm" letter and proprietor of Real Vision TV -- -- has done an excellent interview with Dutch fund manager and author Willem Middelkoop about the trend toward a profound reform of the world financial system that entails a major upward revaluation of gold. The interview, conducted in London just before the recent upturn in the gold price, covers what appears to be a balancing of official gold reserves among the United States, Europe, and China. It also covers the gold price suppression by central banks that is happening in the meantime. Middelkoop has just published an expanded edition of his book "The Big Reset: The War on Gold and the Financial Endgame." While the interview is an hour long, it is packed with useful observations and it's posted in the clear at You Tube here: https://www.youtube.com/watch?v=WmuiAY2WiIU CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 Years After The Greenspan Fed Posted: 01 Feb 2016 06:15 PM PST Submitted by Peter Diekmeyer via SprottMoney.com, Ten years ago this week, Alan Greenspan left his post as head of the US Federal Reserve, facing disgrace among hard money advocates, which largely persists to this day. However gold investors can learn an important lesson from how little influence Greenspan, one of the gold standard’s most eloquent backers, had during his 18-year tenure. A lesson that provides important clues as to future central bank monetary policy and its effect on precious metals prices. That Greenspan was, and remains, a hard money advocate, is beyond doubt. His landmark article “Gold and Economic Freedom,” which was published in The Objectivist , an Ayn Rand-backed newsletter, fifty years ago this June, makes the case for a gold standard in layman’s terms, better than anyone before or since. “Gold and economic freedom are inseparable,” wrote Greenspan. “The gold standard is an instrument of laissez-faire (capitalism) and … each implies and requires the other.” Greenspan’s advocacy of the gold standard was a hugely controversial position in the 1960s and 1970s and remains so to this day. That this is so is in an illustration of the economics profession’s almost total support for policies that have turned all Western nations into de facto state-run economies. Why did Greenspan compromise? That Greenspan compromised his views on gold is well-known. During his time there, the US Federal Reserve spawned a series of bubbles, that sowed the seeds of the financial crisis of 2007-2008, as well as of instabilities that remain in the system to this day. However it is also fairly clear from comments that Greenspan made after his time in Washington, that he remains a hard money advocate. “Gold is a currency. It is still, by all evidence, a premier currency,” Greenspan told a meeting of the Council of Foreign Relations last year. “No fiat currency, including the dollar, can match it.” It is also almost certain that Greenspan held that position during his entire time in Washington. Indeed one of his first acts, after he was appointed chairman of the Council of Economic Advisors in 1974, was to invite Rand, author of Atlas Shrugged, a hard money advocate herself, to his inauguration dinner. Indeed according to a 2002 article in SmartMoney's Donald Luskin in a 2002, 40 years after publication of Gold and Economic Freedom, Greenspan apparently told Ron Paul that he stood by his text and "wouldn't change a single word." Why did Greenspan compromise his most profoundly held views? Like most people the Maestro, as he became known, is a complex individual. A desire to advance his career no doubt played a major role. However Greenspan, like many idealists, also likely believed that, by compromising his views, he might be able to change the system from within. Indeed there are signs that he was somewhat successful in that respect, as things got substantially worse after he left. When Ben Bernanke took over as Fed chair in January of 2006, he eventually halted the interest rate hike policy that Greenspan had begun. Later Bernanke reversed all those hikes, cut rates to zero, and began the massive Federal Reserve balance sheet expansion, the effects of which remain with us to this day. Redemption: lessons learned However Greenspan’s most enduring contributions to the gold community may have been the numerous mea culpas that he has issued after he left office. Unlike many politicians, including Bernanke himself, Greenspan has been increasingly candid regarding his challenges in Washington. For example the fact that even a brilliant hard money advocate like Greenspan, had little or no future, unless he towed the political line of those who appointed him, provides a strong signal that things are unlikely to change. Indeed in a widely cited background comment to Marc Faber, a newsletter writer, Greenspan denied that he ever said the Fed was independent. The upshot is that if you believe Greenspan, despite the Yellen Fed’s current pause, the growing currency debasement spiral we are in will likely continue. The question now is will be the effect of such policies on gold prices over the next five years? When asked that question last year at the New Orleans Investment Conference Greenspan had two words for the interviewer.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Bucked Off the Shackles Today and Jumped $11.50 (1.03%) to $1,127.90 Posted: 01 Feb 2016 05:52 PM PST

So clearing $1,128 will throw the price of gold over a huge hurdle. SILVER, silver, silver. High today was $14.42, Comex close came at $11.429, up 10.70¢ (0.7%). Silver, too, is set to pop, BUT must first clear $14.65, the last two highs and the post-2012 downtrend line on the weekly chart. The monthly chart needs to see $15.30 plus for a skyward breakout. Clearly Friday marked the end and low of silver and gold prices little corrections, PROVIDED they march out smartly again tomorrow. Better start buying. Today offers an example of what I try to tell people about governments manipulating markets. If they're all manipulated, they complain, why even try to figure out where they're headed? Because the manipulation never works for long. They can only manipulate at the margin, and that doesn't last. Case in point: on Friday (always before a weekend) the Bank of Japan threw a surprise party by announcing a 0.1% interest rate reduction, taking Japanese interest rates into negative territory. Yes, that means the central bank will CHARGE banks to hold balances. We need not delve into the moronic Keynesianism behind this move, we need only observe that stocks jumped worldwide. The dollar, facing a huge interest rate advantage over the yen, leapt a massive 102 basis points while the yen (I warned y'all the Japanese Nice Government Men would have to do something about that rally) gapped down 160 basis points or 1.35%. Stocks were jumping over the prospect of more central bank money creation, implied in the BoJ move. Leave aside the presupposition that the BoJ always works in concert with the Fed, which would make the timing at January's end perfect, raising stocks' performance at months' end. Can't prove that, only suspect. Several decisive and far reaching events appeared: 1. In the face of a madly rising dollar and buying panic in stocks, silver and gold never wavered but held firm. Magnificent showing, stout and brave. Note and miss not that NEGATIVE interest rates means that the old argument against silver and gold -- they pay no interest -- no longer holds. Negative interest rates mean that you have to PAY to hold cash or government bonds, while holding silver or gold costs nothing. Think long and hard on that. Long and hard. 2. Today the US dollar index sank 0.67% to 98.98, leaving behind another failed attempt to get through 100.04. It also closed BELOW the 50 DMA (98.87). More, it has on Wednesday and Thursday broken down from a rising wedge, but on Friday jumped up into the wedge's middle. Today it gave up all that and fell out again. All this stinks of blubbering weakness, but that needs confirming by a dollar index close below 98.45, and then 97.20. 3. Stocks' hop up merely cannibalized or advanced in time the peak of the reaction rally. Dow reached a high at 16,466 and S&P500 1,940, both near my rally targets of 16,600 and 1,950. Yes, stocks can still move a little higher, to 17,000 and 2,000, but the BoJ's gamble did no more than drive them a little faster than otherwise. Wait and see. TODAY the Dow backed off 17.12 (0.1%) to 16,449.18. S&P500 crawfished 0.86 (0.4%) to 1,939.38. Dow in silver today closed 1,146.84 oz, down 0.72%. Friday took it slightly through its 1,149.74 oz 200 DMA, but today it fell beneath again. Beautiful, and argues the DiS rally may have ended. Watch it. Dow in gold turned down, still below both the 200 (15.36 oz) and 20 (14.83 oz) day moving averages at 14.58 oz. Close below 14.17 oz renews downtrend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hong Kong Housing Bubble Suffers Spectacular Collapse: Sales Plunge Most On Record, Prices Crash Posted: 01 Feb 2016 05:33 PM PST Two months ago, we observed the record plunge in Hong Kong home sales when according to Land Registry data, a paltry 2,826 registered residential transactions were record, down 14.4% from October and what we thought was an amazing 41.7% less than in November last year. This was the lowest print in the history of the series. Little did we know just how bad it would get two months later. As we noted at the time, the weakness was sharp and widespread: sales of new homes also declined to a three-month low, said Centaline. In the primary residential market, the number of home sales also declined 26.4 per cent month on month to 1,023 last month, according to Centaline. The total value reached HK$8.97 billion, down 15.4 per cent from October's HK$10.6 billion. Latly we presented some comments from local analysts, who perhaps unwilling to accept the reality, remained optimistic:

We concluded in early December that while "optimism is good... if and when this global housing luxury weakness mostly due to the withdrawal of the Chinese marginal "hot money" buyer crosses back into the Chinese border, all bets about the so-called tepid Chinese economic will be off, and since it will be just the moment when China resumes cutting rates, devaluaing its currency and maybe even officially (as opposed to the ongoing unofficial iterations) launching QE, that will be when one should buy commodities, as China does everything in its power to keep the house of $30 trillion in cards from toppling and sending a deflationary tsunami around the entire world." So far China has only devalued, and so far there has been no effect on boosting commodity prices; meanwhile the deflationary tsunami is just getting worse as a result of the BOJ entering currency wars most recently by launching NIRP last week. Which brings us to the latest Hong Kong housing data, and we can now officially say that any optimism about Hong Kong is officially dead. First, as the chart below show, January Hong Kong home prices tumbled the most since July 2013, and after a 12 year upcycle, prices are now down a whopping 10% from the recent peak just four short months ago. Some analysts expect prices to fall more than 30 per cent by 2017 according to SCMP. In other words, the bubble has clearly burst.

But not only has the Hong Kong housing bubble burst, it has done so in spectacular fashion: as quoted by the SCMP, the local Centaline Property Agency estimates that total Hong Kong property transactions in January were on track to register the worst month since 1991, when it started compiling monthly figures. In other words, the biggest drop in recorded history! Total transactions are likely to have hit 3,000, it said in a survey released on Sunday. With developers slowing down new launches, only 394 units were sold in the first 27 days of January, 80.3 per cent lower than the 2,127 deals lodged in December. Meanwhile, sales of used homes fell by a fifth to 1,276 deals in January.

In other words, the market is in shock from the collapse in demand, and has effectively been halted until it regroups as sellers, clearly not desperate to chase collapsing bids, simply withdraw offers. Sure enough, according to SCMP, "the recent withdrawals of government land sales as a result of poor bids and the return of negative-equity homeowners are adding to strains in a rapidly weakening Hong Kong property market, with analysts saying developers will be forced to cut prices aggressively to stay afloat." What is causing this unprecedented collapse? One explanation is the infamous Fed butterly flapping its rate hike wings and leading to a housing market crash half way around the world:

There's that, or there is the far simpler Chinese response to the Fed rate hike which has sent shockwaves everywhere from the Chinese forex market to the Hong Kong interbank market where liquidity a few weeks ago virtually disappeared overnight as the PBOC tried to crush and squeeze offshore Yuan sellers. It also means that mainland Chinese buyers, suddenly facing a draconian escalation in capital controls, are suddenly unable to park hot money in the HK market. As for the local housing market expect it to remain in a state of susbended animation for a long time.

And then there was the issue of negative equity mortgages which somehow have appeared despite just a modest 10% correction from all time highs. One can only imagine the kind of leverage involved in these transactions:

Amusingly, last February, the HKMA supposedly tightened the loan-to-value ratio to 60 per cent from 70 per cent for flats under HK$7 million. New owners hence have a 40 per cent equity buffer, said Chow, but said some negative-equity cases would occur among those who have borrowed from non-bank financial companies. That, or the regulations of the monetary authority were simply ignored because, just like in the US in 2005, housing could only go up: just ask Ben Bernanke. Well, now it is not only not going up, but it is crashing, and if the situation on the maring is this bed in one of the world's wealthiest enclaves, one can only imagine what is happening in maindland China. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| World's Largest Silver Producer Slams LBMA's "Manipulated" Fix Posted: 01 Feb 2016 05:20 PM PST Last week's obvious silver market fix manipulation will not go quietly into the night, as we are sure LBMA would prefer.

But it will not, as BullionDesk.com's Ian Walker reports, the world’s largest producer of silver, KGHM, has weighed in on last week’s hugely controversial silver price benchmark, which was set some six percent below the prevailing spot price on Thursday.

The ‘fix’ or ‘benchmark’, as it is now known, is still the global benchmark reference price used by central banks, miners, refiners, jewellers and the surrounding financial industry to settle silver-based contracts.

KGHM produced 40.4 million ounces (1,256 tonnes) of silver in 2014, according to The Silver Institute’s annual report. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End Of Plan A: The Big Reset & $8000 Gold Posted: 01 Feb 2016 04:31 PM PST

Willem Middlekoop, author of The Big Reset – The War On Gold And The Financial Endgame, believes the current international monetary system has entered its last term and is up for a reset. Having predicted the collapse of the real estate market in 2006, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Introducing the DR’s Newest Heavyweight Posted: 01 Feb 2016 01:53 PM PST This post Introducing the DR's Newest Heavyweight appeared first on Daily Reckoning. I have an important announcement to make today… As you know, I've recently added some heavyweights to our editorial team, including Jim Rickards and David Stockman. And now I've just added someone else… I've spent the last decade looking for a super-trader. Someone who could help guide Agora Financial readers during these difficult times. This was no easy task. After all, the best traders in the world are extremely secretive. They hate sharing their moneymaking secrets with everyday investors like you and me. But I found one exception… Michael Covel. Michael is not only willing to share his knowledge with everyday investors. He's made it his mission to show investors how to profit from a little-known strategy that has been minting millionaires for the past two centuries. Ever since discovering the power of this strategy in 1996, he has been teaching investors how to use it. More important, he has personally met and learned trading secrets from some of the greatest traders of our generation. These are traders who make millions in up and down markets. And Covel learned directly from these legendary traders. We couldn't have found a better addition to our team of experts at Agora Financial than Michael. Whether it's writing, interviewing others, managing his own money or helping readers and listeners to his podcast invest, he follows the KISS principle — Keep It Simple, Stupid! The last thing you want your investment strategy to be is complicated. For me, the biggest advantage to Michael's trading approach is not just that you make money in up and down markets… but that he makes the explanation simple. By making his trading strategy clear, Michael helps keep investors' emotions in check and their decisions consistent with what the market can deliver. In 2008, for example, when most people lost their shirts, many of Covel's private clients made a fortune from his strategy. Jeff P., one of his readers from Illinois, tripled his money during the mayhem! He sent Michael a note back in 2009 saying: "We made just under 100% return in 2008. We can't thank you enough for sharing your wisdom with us. Thanks again, Michael!" Peter T., another one of Michael's readers from California, said he made 60% in 2008. Another reader, Patrick M., says, "Our full-year return in 2008 was in excess of 100%." As the trader and author of six books Steve Burns puts it, "Michael Covel has spent over a decade" making his strategy "accessible to the average investor. Those who have listened and taken heed to his advice have done well in the wild markets over the past years, while buy-and-hold investors have ridden the proverbial price roller coaster to zero returns or worse." These reader and investor results are a big reason why I decided to partner with Michael Covel now. We'd been talking for years about working on a project together. But it's especially critical now with the markets entering into another uncertain and potentially disastrous period. As I write this on the first day of February 2016, the markets are coming off the worst start to the year since the Great Depression. And investors are freaking out about the possibility of another 2008-type of meltdown. So I want to be able to put Michael's experience, knowledge and track record in your own quiver of investment arrows. To kick off this partnership, I asked Michael to develop a simple, proprietary trading system for our readers… one that will help you make money in up and down markets. Luckily for you, he's accepted and even relishes the challenge. The government, financial media and Wall Street do not want you to know Michael's secrets. Because you'll realize you don't need any of those people to become successful. Michael will give you all the tools you need to make money in our "boom and bust" economy. Once you become familiar with Michael's work, I promise you will never look at the markets the same way again. Below, Michael blows the lid off one of the biggest lies on Wall Street. Not only that, but he shows you how to make some of the biggest gains you'll ever see, precisely when Wall Street says it's impossible. His proven strategy shows beyond doubt that smart investors can make money in any market, including this one. Read on… Cheers, Addison Wiggin P.S. Whither goes the economy and the financial markets, so goes The Daily Reckoning. You'd think "contrarian" opinions would react counter to the broader trends in the marketplace, but that's just not true. When the markets — stock, bond, housing, credit, you name it — are on fire, the marketplace for new and interesting ideas is on fire too. To make sure you're accessing that entire marketplace — rather than just the small sliver offered you by the mainstream financial media — we invite you to join us in our email edition by signing up for FREE, right here. The post Introducing the DR's Newest Heavyweight appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You Can Make Money in Up or Down Markets Posted: 01 Feb 2016 01:52 PM PST This post You Can Make Money in Up or Down Markets appeared first on Daily Reckoning. These days I am so used to the concept of making money in up markets and down markets that I sometimes forget how foreign that very concept is for the average trader or investor. It's like a roller coaster, up and down, up and down, up, up, down, down — with no predictable pattern as to when up will happen or down will happen. The idea is to wait and let the market move in a direction — either way — and then follow it. That's what allows trend followers to make money in any kind of market. Instead of trying to predict the future, they simply follow the trend. If the trend is up, they buy. If the trend is down, they sell. That's it. And that's how many trend followers made money in 2008. Ben Stein famously said, "If you didn't lose a lot of money during the Panic of 2008, you were probably doing something wrong." I heard those words and wanted to scream. His view could not be any farther from the truth. People made fortunes in 2008 with solid money-making strategies. The winners were not doing anything wrong; they just happened to have had the vision to prepare for the unexpected. And when the big surprises unfolded they cleaned up. Investors have been conditioned for decades to believe that they cannot beat the market. They've been told to buy index funds and mutual funds, listen to CNBC, and trust the government. I have news for you: That does not work! We have all seen one market after another crash for the last decade. But the powers that be keep telling us that the old investing ways are the only ways. Deep in our gut, we know it's not true. Even if we don't know who the winners are, there are winners in the market, especially in the middle of a crash.The world changed in October 2008. Stock markets crashed. Millions of people lost trillions of dollars when their long-held buy-and-hold strategies imploded. The Dow, Nasdaq, and S&P fell like stones, with the carnage carrying over to November 2008. Almost everyone has felt the ramifications: jobs lost, firms going under, and fear all around. Brokers, financial advisors, the financial media, and the government will tell you that no one made money during this time. Everyone lost. But guess what? That's a big fat lie. Wall Street is famous for corporate collapses and mutual fund and hedge fund blow-ups that transfer capital from winners to losers and back again. However, interestingly, the winners always seem to be missing from the after-the-fact analysis of the mainstream media. The press is fascinated with losers. Taking their lead from the press, the public also gets caught up in the dramatic narrative of the losers, oblivious to the real story: who are the winners and why? The performance histories of trend followers during the 2008 market crash, 2000–2002 stock market bubble collapse, the 1998 Long-Term Capital Management crisis, the Asian contagion, the Barings Bank bust in 1995, and the German firm Metallgesellschaft's collapse in 1993 all answer that all-important question "Who won?" There were winners during October 2008, and they made fortunes ranging from 5% to 40% in that single month. Who were the winners? Trend followers. Many of my trend following colleagues from all over the country made a fortune in 2008, a time when most investors got creamed. Consider this: Howard Seidler in Chicago, IL, made 36%. Bernard Drury in Princeton, NJ, made 75%. Gary Davis in San Diego, CA, made 34%. David Druz in Haleiwa, HI, made 48%. Mark J. Walsh in Chicago, IL, made 50%. Tom Shanks in Chicago, IL, made 96%. With such great performances, it's really shocking to me that not many people take advantage of this strategy. But how did they do it? First, let me state how they did not do it: First, trend followers did not predict stock markets would crash in October 2008. Second, trend followers did not make all of their money from shorting stocks in October 2008. What did they do? Trend followers made money in many different markets from oil to bonds to currencies to stocks to commodities. Trend followers always seem to do particularly well in times of wild and extended price swings, in part because their trend following trading systems programmed into computers can make calculated, emotionless buys and sells that human traders might be slower to accept. The market crash of 2008 offered fantastic data to see how trend following is so different from most of the investing world's mindset. But the performance in 2008 wasn't just a fluke. The truth is trend followers have been making a fortune for the past 200 years, regardless of market conditions. Yvis Lemperiere, a PhD from Cambridge University, and his co-authors recently published a paper called "Two Centuries of Trend Following." They back-tested this strategy all the way back to 1800 for stocks and commodities. And they found consistent extraordinary returns across different asset classes. They concluded: The effect is very stable, both across time and asset classes. It makes the existence of trends one of the most statistically significant anomalies in financial markets. Brian Hurst and Yao Hua Ooi, of AQR Capital Management, and Lasse Pedersen, from New York University, recently co-wrote another paper on trend following. They wanted to test if this little-known strategy works in a wide range of economic conditions. So they looked at data going all the way back to 1903. And they compared the performance of trend following against the performance of a typical 60–40 portfolio (60% invested in stocks and 40% in bonds). Specifically, they looked at trend following's performance during the worst ten market crashes of the past 110 years. As you can see in the chart below, trend following experienced positive returns in nine out of ten of these stress periods and delivered significant positive returns during a number of these events. In fact, it outperformed a traditional portfolio in 100% of those stress events. Trend following has outperformed traditional portfolios in all past market crashes

The authors concluded:

And here's their final conclusion:

Tobias Moskowitz, from the University of Chicago, was also intrigued by trend following. After all, most finance academics believe nobody can beat the market. So he decided to analyze whether anyone could beat the market simply by following the trend. Here's what he concluded:

As you can see, you can make money in both up and down markets. But chances are you did not make money in 2008 because you were following the "buy and hold" strategy. I like it to call it the "buy and hope" strategy because that's a more accurate description. It's a very simple strategy that has only two steps. First, you buy stocks. Second, you hope stocks will keep moving higher. That's it. If stocks go up, you make money. If stocks go down, you lose. And if the market crashes, well . . . tough luck. You might just lose half of your retirement account in a matter of months, like what happened in 2008. Does that sound like a good strategy to you? It isn't. There's a better way, and I believe I've found it. There's no reason you can't use it yourself to build your retirement dreams. But the first thing you'll need to do is break one of Wall Street's biggest lies. Click here now to see the rule you need to break. Regards, Michael Covel Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post You Can Make Money in Up or Down Markets appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| February 2016 Bible Truth about Zion explained by Bible End Times Scholar David Hocking Posted: 01 Feb 2016 12:03 PM PST February 2016 Bible Truth about Zion explained by Bible End Times Scholar David Hocking Truth about Zionism Jews Israel Pre tribulation Catholicism replacement theology Calvinism Covenant reformation theology Christian The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion Inventories at Comex Licensed Facilities Posted: 01 Feb 2016 12:00 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The War On The Credit Cycle Has Only Just Begun… Posted: 01 Feb 2016 11:57 AM PST This post The War On The Credit Cycle Has Only Just Begun… appeared first on Daily Reckoning. RHINEBECK, New York – We spent the weekend up north… where people put "Feel the Bern" bumper stickers on their Subarus. In a tavern in Rhinebeck – where we are writing – the "socialist" slap seems to have lost its sting. There is a reverential portrait of FDR near the bar. "He's the only candidate who makes any sense to me," said a local. "You can't trust Hillary. And the Republicans are all nuts." He's right… You can't trust Hillary. The Republicans may all be nuts. And socialism "makes sense"… in a simpleton kind of way. Most voters want more stuff. Sanders offers to take stuff from other people and give it to them. That "makes sense," doesn't it? Too bad. Because as Maggie Thatcher pointed out, you soon run out of other people's money. But the voters of Dutchess County don't seem to be concerned. Back to the markets… Japan Drops the Big One"Thank Goodness That's Over," proclaimed Barron's on Friday, as the Dow added nearly 400 points. But is the bear market really over? What sent the Dow soaring was a surprise rate cut – this time by the Bank of Japan. This left short-term rates in Japan at negative 0.1%. As we covered in the December issue of our monthly publication, The Bill Bonner Letter, in addition to the War on Poverty, the War on Drugs, and the War on Terror, there's also a War on the Credit Cycle. [Paid-up subscribers can catch up here in full.] It is a war to prevent a correction in the credit market. Credit has been increasing for the last 33 years – largely thanks to the feds' undying support. Before the link between the dollar and gold was severed, credit was rationed by a market. When savings are abundant and borrowers are few, supply and demand dynamics caused the price of credit to fall. This lowered the cost of capital, discouraged saving, and allowed businesses to undertake projects that, at higher interest rates, would not have been possible. Thus stimulated, economic activity increased… businesses expanded… wages rose… spending increased… corporate profits, and the stock market, usually went up… and interest rates rose as more and more borrowers competed for fewer and fewer available savings. Higher rates pinched off the credit expansion and encouraged people to save more money. Stocks, now competing with higher yields in the bond market and on bank deposits, went down again. That is how the credit cycle is supposed to work. It naturally corrects – in both directions. Smarter Than GodBut then along came the post-1971 "fiat" dollar… And with it came a credit system that no longer needed savings… central banks that were determined to hold down the cost of borrowing, no matter what… and PhD economists who believed they were smarter than God. Since the big change in the money system, markets have been pushed into the background; the feds now decide how much you pay for credit. Twice this century, markets have fought back. And twice, the Fed has beaten them with a fire hose of rate cuts, bailouts, and bond buying. Last week, we showed you an important chart from Deutsche Bank. It revealed how closely gains in the S&P 500 had tracked the ballooning of the Fed's balance sheet since the start of QE in late 2008. Naturally, investors have gotten used to the idea that central banks have got their backs. So when the Bank of Japan announced it was dropping short-term interest rates into negative territory for the first time ever, investors got the message. On Friday, the U.S. stock market put in a strong rally. The Dow ended the day up 396 points – or about 2.5%. Plenty More "Ammo"We've been getting a lot of feedback on our note about Sarah Palin's use of language. Our favorite was this from a dear reader:

Completely understandable… and to the point. We feel we must alert new readers: Here at the Diary, we are not always so clear… or so direct. When we were younger, we had answers – clear, quick, and confident. Now, all we have is questions. And we're not even sure which ones to ask. Is Sarah Palin really the dumbbell she appears to be? We don't know the answer. More than one wily scoundrel has been elected to office by pretending to be a "man of the people." Does Bernie Sanders have any economic ideas that haven't been proven idiotic? Is the bear market on Wall Street over? Darned if we know that either… But we are pretty sure that the feds' War on the Credit Cycle is not over. In fact, it has barely begun. This is a war that the feds can't afford to lose. The Deep State – the "shadow government" that really rules the U.S. – depends on more and more credit to keep expanding its power and drawing wealth away from the public. Yes, the Fed famously "used up all its ammunition" in driving rates to zero. But it has plenty more weapons such as negative interest rates… "helicopter money"… and banning cash from circulation to prevent us from stuffing it under the mattresses. And the Deep State has plenty of allies. So far this year, the president of the European Central Bank, Mario "Whatever It Takes" Draghi, announced that there would be "no limits" to how far he would go in his fight against the credit cycle. Draghi has already pushed short-term rates in the euro zone into negative territory. It joined Switzerland, Denmark, and Sweden in the world of "NIRP" (negative-interest-rate policy). Now, the Japanese have followed suit. More war ahead… Regards, Bill Bonner Originally posted at Bill Bonner's Diary, right here. P.S. Bill expects a violent monetary shock, in which the dollar — the physical, paper dollar — disappears. And he believes it will be foreshadowed by something even rarer and more unexpected — the disappearance of cash dollars. Many Americans don't see this coming because of what psychologists call "willful blindness." But Bill has taken the extraordinary step of assembling the full shocking details in a special report. To get full details on what Bill calls the "Great American Credit Collapse", click here right now. The post The War On The Credit Cycle Has Only Just Begun… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Begley LIVE "The Mark Of The Beast" RFID Is Coming Fast" And Much More Posted: 01 Feb 2016 11:55 AM PST The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fundamental Catalysts in Junior Mining Sector Lead To Bullish Breakouts and Reversals Posted: 01 Feb 2016 11:42 AM PST Some important developments are taking place in the junior mining sector which must be followed by astute investors who are timing a potential market bottom in the TSX Venture. I recently returned from the Vancouver Resource Investment Conference with some exciting developments. Things could turn quickly for resource investors and when they do one should be ready to sew the rewards of years of plantings during one of the worst bear market cycles in modern history for commodities. For many years I have been studying some of the top performers and believe fundamental developments like what follow are indicative of potential technical breakouts. First off news coming out of Gold Standard Ventures (GSV) that the major gold producer Goldcorp (GG) is investing $16 million is a wonderful development for Nevada junior gold miners as this is a clear signal to the Newmont (NEM) and Barrick (ABX) that Goldcorp is looking for Nevada exploration assets. Jonathan Awde, President, CEO and Director of Gold Standard commented, "We view this investment by Goldcorp as a validation of the exploration success we have had at the Railroad-Pinion project. With the proceeds from the private placement we will look to aggressively expand the 6km Dark Star corridor, the location of the recent North Dark Star discovery, which we believe has the potential to host a significant gold system." This reminds us of the recent $14.6 Mil CAD deal with Eldorado Gold (EGO) and Integra Gold (ICG.V or ICGQF) in Quebec. ”Recent drill results from the Lamaque Project, and specifically the Triangle Zone, continue to demonstrate the excellent upside potential of the deposit, which is situated in the world-class gold district of Val-d’Or, Quebec. The Eldorado investment allows us to substantially increase our current program with the objective of enhancing our confidence in existing mineral resources and adding to an already substantial gold resource base. With five drill rigs operational by the end of the month and almost 100,000 metres of planned drilling in 2015, this investment provides us with the financial resources to more rapidly move forward with an active fall and winter drill program which is anticipated to include ten operating drills at the project,” commented Stephen de Jong, President and CEO of Integra. “Eldorado is a leading gold producer with excellent technical expertise and proven capabilities in developing mines across the globe, and their investment in Integra represents a major endorsement of the Lamaque Project and the team behind it. This investment brings the Company’s cash balance to $27 million which enables us to continue to execute on our exploration and development plans as we build value for our shareholders.” Attention should also be paid to NuLegacy Gold Corp (NUG.V or NULGF) who recently completed a 70% earn-in with Barrick Gold (ABX) on the Iceberg Gold Deposit in the Cortez Trend. Goldcorp or another major should take note of the recent decision by Barrick to retain a minority interest as this could be an excellent way to secure ground in the heart of the Cortez Trend adjacent to three of Barrick’s lowest cost and safest gold mines. Fission Uranium (FCU.TO or FCUUF) just announced that their first wildcat exploration hole hit a whole new high grade area of uranium 135m west of R600W. Ross McElroy, President, COO, and Chief Geologist for Fission, commented,”This is an incredible start to the drill program and shows the continued blue-sky potential of PLS. Our first wildcat exploration drill hole was collared on line 840W, located 135m west along strike of the R600W zone and increases the on-trend mineralized strike length at PLS to 2.47km. Whether this is a continuation of the high-grade R600W zone to the west or a new zone will have to be determined with further drilling. As part of exploration drilling, we had only planned for one drill hole in this area, however, the strength of these results warrants follow up drilling.” I am also closely following Fission 3 (FUU.V or FISOF) which I believe is setting up for a technical breakout at 12 cents as they have a bunch of high priority targets. Watch this interview with Treasury Metals (TML.TO) CEO Martin Walters. This may be the top undeveloped project in Ontario with the highest grades and the lowest capital and operating costs at the advanced mine permitting and engineering stage. They own the Goliath Gold Project right outside Dryden in Northwestern Ontario. Investors are looking for high grade gold projects with low capital costs and this company fits the bill. I would not be surprised if majors such as Goldcorp are looking at this asset as an acquisition. Good news comes out of IDM Mining (IDM.V) that they acquired Oban Mining’s (OBM.TO) Yukon Properties. Please note IDM is run by Rob McLeod who founded Underworld Resources which was bought out by Kinross for $140 Mil after a major gold discovery of 1.4 million ounces in the Yukon. He is well known in the industry as one of the most creative exploration geologists and IDM could be quite exciting if this junior gold market bottoms for Rob to get some capital to explore this amazing land package. IDM has been in a nasty downtrend but that could change soon. Look for a breakout above the 200 day moving average at $.10 CAD. Royal Nickel “RNC” (RNX.TO or RNKLF) made two acquisitions transforming itself from a nickel developer into a base and precious metals producer. "The acquisition of SLM and VMS will provide RNC with cash generating operations, leveraged exposure to nickel, gold and copper production, and serves as a platform for potential growth in two promising and prolific metals producing regions in excellent mining jurisdictions," said Mark Selby, President and CEO of RNC. "With the addition of the SLM and VMS assets, RNC will benefit from exposure to current nickel, gold and copper production, RNC's large scale, shovel ready, Dumont Nickel Project, management synergies, and a pipeline of compelling nickel, copper and gold exploration projects." To be continued in my premium service with new interviews and articles on some of my favorite junior mines… Disclosure: I own Integra, NuLegacy, Fission, Fission 3, Treasury Metals, Idm Mining and Royal Nickel. NuLegacy Fission 3, Treasury and IDM are current sponsors. Integra and Royal Nickel were past sponsors. Please do your own due diligence. I have a conflict of interest as a shareholder and prior/current business relationships and am not a financial advisor. ___________________________________________________________________________________

Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Feb 2016 11:15 AM PST This post The Fed’s Fata Morgana appeared first on Daily Reckoning. A Fata Morgana is a kind of mirage in which distant objects at sea appear to be floating in mid-air or upside down, sometimes both. One famous literary description of a Fata Morgana occurs in Chapter 135 of Herman Melville's masterpiece, Moby Dick. As Ahab is pulled overboard, and the White Whale rams the Pequod, Melville writes: "The ship? Great God, where is the ship? Soon they through dim, bewildering mediums saw her sidelong fading phantom, as in the gaseous Fata Morgana." But, of course the ship was sinking, the vision was an illusion. The Federal Reserve now sees its own mirage. In a real Fata Morgana, the illusion is caused by thermal inversion and light refraction. In the Fed's mirage the illusion is caused by academic dogma with names like "Phillips Curve," "NAIRU," and "FRB/US." Still, an illusion is an illusion regardless of cause. Illusions can persist as long as the conditions that give rise to the illusion dominate. In the case of a Fata Morgana, those conditions involve heat and light. In the case of the Fed, the illusions involve bad models. A change in the weather will shatter a Fata Morgana. A change in the economy will shatter Phillips, NAIRU and Ferbus. Let's consider the Fed's failed dogma. The Phillips Curve is the discredited belief that there is some tradeoff between employment and inflation. Supposedly tight labor markets give rise to demands for higher wages by workers, which lead to higher prices by companies to pay the wages, which lead to higher wage demands, etc. in an inflationary spiral sometimes referred to as "demand-pull inflation." This is neo-Keynesian nonsense. It applies in some special cases (1965-1969), but does not apply in the general case. The Phillips Curve was discredited in the late 1970s (high inflation and recession coexisted, called "stagflation"), and yet Fed Chair Janet Yellen clings to it like Linus with his blanket. What the Phillips Curve and Linus's blanket have in common is they are both in shreds. Today inflation is nowhere in sight and deflation is the greater risk. Only Yellen and a few like-minded Fed officials see inflation as a risk because they're looking at models, not the real world. NAIRU is the acronym for the infelicitously named "non-accelerating inflation rate of unemployment," or the point at which tight labor markets lead to higher inflation. In the past four years, Fed estimates have moved the NAIRU goalposts from 6.5% to 5.5% to 5%, and now to 4.9% and so on. That's strong proof that NAIRU doesn't actually exist. NAIRU is like a unicorn – you can describe it in detail but it never appears in the natural world. FRB/US (affectionately called "Ferbus") is the acronym for Federal Reserve Board US macroeconomic model. The Fed describes it as "a self-contained set of equations, data, programs and documentation that enables various types of simulations." FRB/US is the tool the Fed uses to forecast economic performance. For the record, Fed one-year forward forecasts have been incorrect by orders of magnitude for seven consecutive years. That's because FRB/US is an equilibrium model, and the economy is not an equilibrium system – it's a complex dynamic system requiring completely different tools to model. If you use the wrong model, you'll get the wrong forecast every time. Why does this matter? It matters because the Fed is still on course to raise interest rates later this year. Markets, in their typically moody style, have gone from expecting four rate increases to none in a matter of weeks. Both market estimates are overwrought. In fact, the Fed is tightening into weakness and will persist in doing so. As a result, investors should expect near recessionary conditions, and continued declines in stock prices for the next 6 to 8 months. Expect the Fed to raise twice more, in March and June, (because of their model-based mirage), and then ease (because recessionary reality will hit them like a 2×4 to the forehead by late summer). At that point, Fed ease will take the form of forward guidance; basically an announcement that the Fed is done raising rates for an extended period. Stocks may rally late in the year based on this easing. Forward guidance will be used to ease since the Fed cannot actually cut rates after July due to the election cycle. December 2016 is the earliest possible date for a rate cut. Talk of more quantitative easing ("QE4") is premature at best, and probably incorrect. Evidence is emerging that QE doesn't work as intended. Besides, the Fed has other easing tools they will use first including rate cuts, forward guidance, and a cheaper dollar. QE4 is a mid-2017 event at the earliest, (and the Fed may even experiment with negative interest rates before more QE). Reality is sinking in for the markets, but the Fed will be the last to know because they are fixated on the mirage. That illusion will be gone by late July when Q1 and Q2 2016 GDP data are in hand. Then the easing cycle will begin. Regards, Jim Rickards The post The Fed’s Fata Morgana appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After the Collapse: Addiction and Bad Habits Posted: 01 Feb 2016 10:54 AM PST In this video I discuss the consequences of carrying bad habits over into a grid down situation... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "PROPHECY ALERT" Biometric Banking Iris Scanners ATM (Illuminati) Posted: 01 Feb 2016 10:26 AM PST Citicorp is testing a new "Biometric System" of banking with Iris scanners on all ATM machines The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||