saveyourassetsfirst3 |

- Silver Philharmonics Only $1.49 Over Spot ANY QTY At SDBullion!

- What’s the last dollar they can print before financial crisis?

- The Next Financial Crisis Is Not Coming…It’s Already HERE!

- Why I Recommend Accumulating Gold In 2016

- THIS IS IT. The Margin Call, The Meltdown, THE COLLAPSE IS HERE! – Bill Holter

- Real Time Currency Collapse In Canada – This Is What It’s Going To Look Like In the USA

- BREAKING NEWS: Mexico’s Silver Production Declined Over Past Two Years

- Financial Apocalypse Accelerates As Middle East Stocks Crash To Begin The Week

- CNN Reassures Investors: “Don’t Panic… America’s Economy Is Still In Good Shape”

- Gold Price Firm Amid Risk Off Turmoil as China Targets Yuan, Crude Oil Falls on Iran News

- Silver, Silliness, Gold, and Risk

- “Time Is Coming Again” for Gold Bullion

- Manhattan Luxury Real Estate Peaked Last February – Prices Now Down 8 Months in a Row

- Five Companies Swiss Asset Manager Florian Siegfried Is Watching

- The Financial Apocalypse Accelerates As Middle East Stocks Crash To Begin The Week

- Bear Market: The Average U.S. Stock Is Already Down More Than 20 Percent

- The Shrinking Global Economy, In Three Charts

| Silver Philharmonics Only $1.49 Over Spot ANY QTY At SDBullion! Posted: 18 Jan 2016 11:41 AM PST The post Silver Philharmonics Only $1.49 Over Spot ANY QTY At SDBullion! appeared first on Silver Doctors. |

| What’s the last dollar they can print before financial crisis? Posted: 18 Jan 2016 11:00 AM PST This is our reality now… Submitted by Tim Price, Sovereign Man: In the field of mathematics, chaos theory studies the behavior of systems that are highly sensitive to initial conditions. The idea in chaos is that, like life itself, where you start today has tremendous influence on what happens next. In chaos, even very […] The post What's the last dollar they can print before financial crisis? appeared first on Silver Doctors. |

| The Next Financial Crisis Is Not Coming…It’s Already HERE! Posted: 18 Jan 2016 10:00 AM PST The stock market is in far worse shape than you are being told. The next financial crisis is not coming… The next financial crisis is already here. An angry bear has been released after nearly seven years in hibernation, and the entire world is going to be absolutely shocked by what happens next. Submitted by […] The post The Next Financial Crisis Is Not Coming…It’s Already HERE! appeared first on Silver Doctors. |

| Why I Recommend Accumulating Gold In 2016 Posted: 18 Jan 2016 09:20 AM PST |

| THIS IS IT. The Margin Call, The Meltdown, THE COLLAPSE IS HERE! – Bill Holter Posted: 18 Jan 2016 09:05 AM PST "This is it. We're watching the meltdown. This is history being made… The margin call, the meltdown, we're watching it in real time… I guess the best way to look at where we are right now is, we're standing at the gates of Hell." The post THIS IS IT. The Margin Call, The Meltdown, THE COLLAPSE IS HERE! – Bill Holter appeared first on Silver Doctors. |

| Real Time Currency Collapse In Canada – This Is What It’s Going To Look Like In the USA Posted: 18 Jan 2016 09:01 AM PST When the debt bubble collapses there is a real possibility that millions of people will die because those goods essential to survival will simply be unattainable for the masses. By Joshua Krause, ReadyNutrition via SHTFPlan: Editor's Note: Though the US Dollar is stronger now than it has been in recent memory, the massive monetary easing from […] The post Real Time Currency Collapse In Canada – This Is What It's Going To Look Like In the USA appeared first on Silver Doctors. |

| BREAKING NEWS: Mexico’s Silver Production Declined Over Past Two Years Posted: 18 Jan 2016 09:00 AM PST In a surprising update, the world largest silver producer actually experienced a decline in silver mine supply over the past two years. This is quite remarkable as several analysts and official sources reported or perceived that Mexico continued to shown an increase in silver production. Global peak silver production is coming (or is here). […] The post BREAKING NEWS: Mexico's Silver Production Declined Over Past Two Years appeared first on Silver Doctors. |

| Financial Apocalypse Accelerates As Middle East Stocks Crash To Begin The Week Posted: 18 Jan 2016 08:39 AM PST It looks like it is going to be another chaotic week for global financial markets. Submitted by Michael Snyder, The Economic Collapse Blog: On Sunday, news that Iran plans to dramatically ramp up oil production sent stocks plunging all across the Middle East. Stocks in Kuwait were down 3.1 percent, stocks in Saudi Arabia […] The post Financial Apocalypse Accelerates As Middle East Stocks Crash To Begin The Week appeared first on Silver Doctors. |

| CNN Reassures Investors: “Don’t Panic… America’s Economy Is Still In Good Shape” Posted: 18 Jan 2016 07:45 AM PST The notion that an economic and financial catastrophe of historic proportions is playing out right before our eyes is the fantasy of internet conspiracy fanatics. Submitted by Mac Slavo, SHTFPlan: Forget for a moment that U.S. stock markets have seen their worst start to a new year since the Great Depression or that some […] The post CNN Reassures Investors: "Don't Panic… America's Economy Is Still In Good Shape" appeared first on Silver Doctors. |

| Gold Price Firm Amid Risk Off Turmoil as China Targets Yuan, Crude Oil Falls on Iran News Posted: 18 Jan 2016 07:02 AM PST Bullion Vault |

| Silver, Silliness, Gold, and Risk Posted: 18 Jan 2016 06:30 AM PST Rig for stormy weather, expect surprises, markets regressing to the mean, pricing mechanisms failing, political systems collapsing, and Middle-East politics exploding. There will be blood and trauma. Do not trust the supposed value of paper assets and find security in real assets such as silver and gold bars and coins stored outside the financial system. […] The post Silver, Silliness, Gold, and Risk appeared first on Silver Doctors. |

| “Time Is Coming Again” for Gold Bullion Posted: 18 Jan 2016 05:02 AM PST gold.ie |

| Manhattan Luxury Real Estate Peaked Last February – Prices Now Down 8 Months in a Row Posted: 18 Jan 2016 05:00 AM PST William Ackman is a wildly successful hedge fund manager. He oversees $17 billion of mostly other people's money. Forbes estimates his personal net worth at $1.7 billion. These facts alone would make him a prime candidate to buy the penthouse condominium at One57, the new luxury tower on West 57th Street. And indeed, Mr. Ackman told […] The post Manhattan Luxury Real Estate Peaked Last February – Prices Now Down 8 Months in a Row appeared first on Silver Doctors. |

| Five Companies Swiss Asset Manager Florian Siegfried Is Watching Posted: 18 Jan 2016 12:00 AM PST |

| The Financial Apocalypse Accelerates As Middle East Stocks Crash To Begin The Week Posted: 17 Jan 2016 01:39 PM PST

Much of the chaos around the globe is being driven by the price of oil. At the end of last week the price of oil dipped below 30 dollars a barrel, and now Iran has announced plans “to add 1 million barrels to its daily crude production”…

It doesn’t take a genius to figure out what this is going to do to the price of oil. The price of oil has already fallen more than 20 percent so far in 2016, and overall it has declined by more than 70 percent since late 2014. When the price of oil first started to fall, a lot of people out there were proclaiming that it would be really good for the U.S. economy. But I said just the opposite. And of course since that time we have seen an endless parade of debt downgrades, bankruptcies and job losses. 130,000 good paying energy jobs were lost in the United States in 2015 alone because of this collapse, and things just continue to get even worse. At this point, some are even calling for the federal government to intervene. For example, the following is an excerpt from a CNN article that was just posted entitled “Is it time to bail out the U.S. oil industry?“…

Is it just me, or is all of this really starting to sound a lot like 2008? And of course it isn’t just the U.S. that is facing troubles. The global financial crisis that began during the second half of 2015 is rapidly accelerating, and chaos is erupting all over the planet. The following summary of what we have been seeing in recent days comes from Doug Noland…

Closer to home, the crisis in Puerto Rico continues to spiral out of control. The following is an excerpt from a letter that Treasury Secretary Jack Lew sent to Congress on Friday…

It isn’t Michael Snyder from The Economic Collapse Blog that is saying that Puerto Rico is “in the midst of an economic collapse”. That is the Secretary of the U.S. Treasury that is saying it. Those that have been eagerly anticipating a financial apocalypse are going to get what they have been waiting for. Right now we are about halfway through January, and this is the worst start to a year for stocks ever. The Dow is down a total of 1,437 points since the beginning of 2016, and more than 15 trillion dollars of stock market wealth has been wiped out globally since last June. Unfortunately, there are still a lot of people out there that are in denial. There are a lot of people that still believe that this is just a temporary bump in the road and that things will return to “normal” very soon. They don’t understand that this is just the beginning. What we have seen so far is just the warm up act, and much, much worse is yet to come. |

| Bear Market: The Average U.S. Stock Is Already Down More Than 20 Percent Posted: 10 Jan 2016 07:11 PM PST

For example, let’s take a look at the Standard & Poor's 1500 index. According to the Bespoke Investment Group, the average stock on that index is down a staggering 26.9 percent from the peak of the market…

So if the average stock has fallen 26.9 percent, what kind of market are we in? To me, that is definitely bear market territory. The rapid decline of the markets last week got the attention of the entire world, but of course this current financial crisis did not begin last week. These stocks have been falling since the middle part of last year. And what Bespoke Investment Group discovered is that small cap stocks have been hurt the most by this current downturn…

After looking at those numbers, is there anyone out there that still wants to try to claim that “nothing is happening”? Over the past six months or so, the sector that has been hit the hardest has been energy. According to CNN, the average energy stock has now fallen 52 percent…

If you go up to an energy executive and try to tell him that “nothing is happening”, you might just get punched in the face. And it is very important to keep in mind that stocks still have a tremendous distance to fall. They are still massively overvalued by historical standards, and this is something that I have covered repeatedly on my website in recent months. So how far could they ultimately fall? Well, Dr. John Hussman is convinced that we could eventually see total losses in the 40 to 55 percent range…

If the market does fall about 40 percent, that will just bring us into the range of what is considered to be historically “normal”. If some sort of major disaster or emergency were to strike, that could potentially push the market down much, much farther. And with each passing day, we get even more numbers which seem to indicate that we are entering a very, very deep global recession. For instance, global trade numbers are absolutely collapsing. This is a point that Raoul Pal hammered home during an interview with CNBC just the other day…

We have never seen global exports collapse this much outside of a recession. Clearly we are witnessing a tremendous shift, and it boggles my mind that more people cannot see it. As for this current wave of financial turmoil, it is hard to say how long it will last. As I write this article, markets all over the Middle East are imploding, stocks in Asia are going crazy, currencies are crashing, and carry trades are being unwound at a staggering pace. But at some point we should expect the level of panic to subside a bit. If things do temporarily calm down, don’t let that fool you. Global financial markets have not been this fragile since 2008. Any sort of a trigger event is going to cause stocks all over the world to slide even more. And let us not minimize the damage that has already been done one bit. As you just read, the average stock on the Standard & Poor's 1500 index is already down 26.9 percent. The financial crisis that erupted during the second half of 2015 has already resulted in trillions of dollars of wealth being wiped out. When people ask me when the “next financial crisis” is coming, I have a very simple answer for them. The next financial crisis is not coming. The next financial crisis is already here. An angry bear has been released after nearly seven years in hibernation, and the entire world is going to be absolutely shocked by what happens next. |

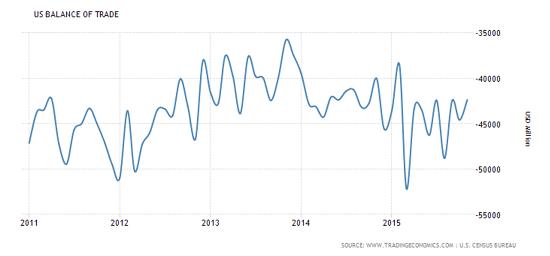

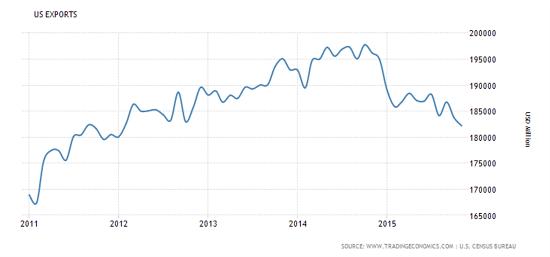

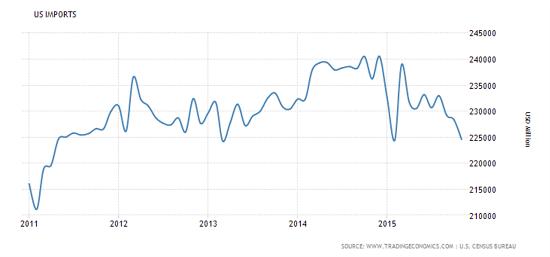

| The Shrinking Global Economy, In Three Charts Posted: 10 Jan 2016 02:04 PM PST Regular contributor Michael Pollaro offers three more charts which tell a story that’s both scary and apparently misunderstood by a lot of mainstream analysts. The US balance of trade (exports minus imports) has been rising lately Since a trade deficit subtracts from GDP growth, a shrinking deficit will, other things being equal, produce a bigger, faster-growing economy (that’s the mainstream take). But other things aren’t equal. It turns out that the components of that trade balance figure are both shrinking. Exports — the stuff we sell to foreigners — have been declining since the dollar spiked in 2014. That’s not a surprise, since a strengthening currency makes exports more expensive and thus harder to sell. So other countries are buying less of our stuff, which though not surprising is a bad sign. Meanwhile, imports — stuff we buy from abroad — have also plunged in the past year, which is partly due to cheaper oil lowering the dollar value of energy and other commodity imports. But it also means that even though French wine and German cars have become less expensive as the dollar has soared against the euro, we’re not buying more of them. So US consumers, even with all the money they’re saving at the gas pump, still can’t (or won’t) take advantage of a sale on imported goods. If imports and exports are both falling, that means consumption is weak pretty much everywhere. And weak consumption means slow or negative growth, which contradicts the recovery thesis that now dominates policy making and the financial media. It also makes last week’s market turmoil easier to understand. Falling trade means lower corporate profits, which, if history is still a valid guide, means less valuable equities. So it could be that the markets are simply figuring this out and revaluing assets accordingly. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment