Gold World News Flash |

- Global Financial Turmoil: A Severe Worldwide Economic Recession in 2016-17

- The Coming Perfect Storm In Silver

- High Food Pricing Killing Benefits of Low Energy Prices

- Putin Is Winning The Final Chess Match With Obama

- Peak Gold and Silver May Have Come and Gone

- "But It's Only A Manufacturing Recession, What's The Big Deal" - Here's The Answer

- The Rich Are Feeling A Lot Less Rich

- Energy Creditors Lucky To Recover 15 Cents On The Dollar In Bankruptcy

- Norway’s Biggest Bank Demands Cash Ban

- BREAKING THE COMEX: First the Collapse of Registered Gold Stocks, Now Silver??

- How Billionaires Are Investing In 2016: "The Only Winning Move Is Not To Play The Game"

- Norway's Biggest Bank Demands Cash Ban

- Having helped cripple Suriname, IMF swoops down to mortgage the country

- Don't Delay It's Time To Accelerate Your Preps For The Economic Collapse

- Ambrose Evans-Pritchard: China's banking stress looms like Banquo's Ghost in Davos

- Indian government's gold scheme paperizes 9/10ths of a tonne of gold

- JIM ROGERS on OIL PRICE, GOLD, U.S. Dollar in 2016. World on The Brink

- OBAMA To SUSPEND 2016 ELECTION & Become 3rd Term President Under MARTIAL LAW (Prophetic Message)

- What is Gnosticism? | Stuff They Don't Want You to Know

- Food Prices Soar as the Canadian Dollar Collapses

- Harry Dent -- Economic collapse: The Biggest Financial Bubble About to Burst!

- Gold And Silver - Chart Facts Are Market's Message

- The Elite Are Taking Us On An Express Elevator To Hell

- Gold Could Lose Safe-Haven Bid as Equities Rebound

- Gold Will Go to $5,000 In Next Cycle... Best Time in History to Buy Gold Stocks

- Perfect Storm Market Collapse 2016 - #2016Collapse

- Emerging Markets Running Scared with Capital Controls

- Gold Stocks Absurd Price Levels

- Stock Market Swing Baby, Swing!

- Ron Paul Says to Watch the Petrodollar

- Silver Undervalued Versus Stocks, Bonds, Property and Gold

- Peak Gold and Silver - It’s Here!

| Global Financial Turmoil: A Severe Worldwide Economic Recession in 2016-17 Posted: 23 Jan 2016 10:01 PM PST by Prof Rodrigue Tremblay, Global Research:

Many commentators are saying that the epicentre of this unfolding financial and economic crisis is in China, with the Shanghai Composite Index beginning to plummet at the beginning of the year. In my view, reality is more complex and even though China's financial and economic problems are contributing to the collapse in commodity prices, the epicenter of the crisis is still in Washington D.C.

That is because the current unfolding crisis is essentially a continuation of the 2007-08 financial crisis which has been temporarily suspended and pushed into the future by the U.S. central bank, the Fed, with its aggressive and unorthodox monetary policy of multiple rounds of quantitative easing (QE), i.e. buying huge quantities of financial assets from commercial mega-banks and other institutions, including mortgage-backed securities, with newly created money. As a consequence, the Fed's balance sheet went from a little more than one trillion dollars in 2008 to some four and a half trillion dollars when the quantity easing program was ended in October 2014. Other central banks have followed the Fed example, especially the central bank of Japan and the European central bank, which also adopted quantity easing policies in monetizing large amounts of financial assets. Why did the Bernanke Fed adopt such an aggressive monetary policy in 2008? Essentially for three reasons: First, the lame-duck Bush administration in 2008 was clueless about what to do with the financial crisis that had started with the de facto failure of Bear Stearns in the spring of 2008 and of Merrill Lynch in early September 2008, culminating on September 15, 2008, with the failure of the large global investment bank of Lehman Brothers. So the U.S. central bank felt that it had to step in. In fact, it financed the merger of the two first failed mega-banks with the JPMorgan Chase bank and the Bank of America respectively. (For different reasons, it did not intervene in the same way when the Lehman Brothers bank failed.) Secondly, bankers who have a huge influence in the way the Fed is managed did not want the U.S. government to nationalize the American mega-banks in financial difficulties, as it had been done in the 1989 when the George H. Bush administration established the government-owned Resolution Trust Corporation (RTC) to take over some 747 insolvent savings and loans thrift banks. Thirdly, the Bernanke Fed was very worried that the 2007-08 banking crisis would lead to a Japanese-style deflation that would wreak havoc with an overleveraged economy. The hope was to avoid a devastating debt-deflation economic depressionlike the one suffered in the 1930s. By injecting so much liquidity in the system, the Bernanke Fed created a gigantic financial bubble in stocks and bonds, even though the real economy has grown at a somewhat languishing 2 percent growth rate. Stock prices went into the stratosphere while interest rates fell as bond prices rose. Last December 16, the Fed announced officially that it will no longer blow into the financial balloons and that it was raising short-term interest rates for the first time since the financial crisis, setting the target range for the federal funds rate to between 1/4 to 1/2 percent. This was a signal that the financial party was over. And what's more, this means that the stock market and the bond market will once again go in different directions, as a reflection of the state of the real economy, no matter what the Fed does. |

| The Coming Perfect Storm In Silver Posted: 23 Jan 2016 10:00 PM PST SRSRocco Report |

| High Food Pricing Killing Benefits of Low Energy Prices Posted: 23 Jan 2016 07:09 PM PST Lesson Learned One of the places the decline in the Canadian dollar is most evident is in our grocery stores. The University of Guelph's Food Institute estimates the average Canadian household spent an additional $325 on food in 2015 with meat rising 5% and fruit and vegetable prices rising between 9.1-10.1%. |

| Putin Is Winning The Final Chess Match With Obama Posted: 23 Jan 2016 06:50 PM PST Submitted by Ron Holland via PravdaReport.com, The world press is filled with violence and sexual attack horror stories about the Islamic refugees escaping from Syria and other war torn countries of the Middle East to Greece and consequently flooding into all areas of Europe. It is actually very easy to travel from Syria to Lebanon and then take the ferry to Turkey and from there to Greece and subsequently the mainland overland to Europe. This is now big business organized like a one-way tour package from the Middle East to Europe. Although there obviously are some ISIS fighters and Islamic militants slipping into Europe under cover of the humanitarian crises most are simply Sunni Moslems escaping the poverty, death and destruction of foreign military intervention in the region. Yes the sex crimes are a real problem because the majority of those escaping the region are men looking for work coming from a conservative society to the open societies of Europe. Most immigrants enter Europe through the economic basket case of Greece where the economy has already been destroyed by too much government debt, corruption and EU banking excesses so Greece can afford to do little to stem the Islamic refugee tide. While a case can be made that the location of Syria and Lebanon adjacent to Turkey and the ease of transportation to Greek islands just offshore is helping the flow to Europe. Still the organized nature of the operation makes me wonder if this is also an undercover operation designed to create a new mission for NATO at the same time weakening the economy of Europe to further Washington's economic interests today in the Obama Crash of 2016. The world is now in recession at best and maybe flirting with a global depression. This means politicians will do what is best for their national political future and the consequences for the national economy, citizens or business future is of little consequence to them. This also suggests that global alliances will mean little when domestic national politicians are fighting for survival. Here is how the chess matches have turned out so far in the Putin/Obama competition.

A strong and united NATO is necessary to put pressure on Russia and since the collapse of communism and the perceived Soviet threat to Europe, NATO has had little reason to exist. Well now I would suggest that part of the Islamic threat and massive movement of refugees to Europe is being manipulated and manufactured as a means to recreate a mission for NATO forces in Europe. A strong Washington led NATO will allow the United States to bring more pressure against Russia. If I am right here, then what is the checkmate course of action for Russia in Syria and Lebanon? The ultimate solution is for Russia to stop the movement of refugees and Islamic radicals to Europe by forcing ISIS out of Syria and back into Iraq and effectively blocking off the escape routes to Turkey both overland and by ferry. This would probably take more than just Syrian troops as it may mean Russian troops on the ground in both countries after military security requests from Syria and Lebanon to halt the exodus and end ISIS occupation of Syria. Security in Syria and Lebanon would help to halt the refugee flow to Europe and Putin and Russia would then get the credit they deserve for this action to protect Europe. This successful outcome would guarantee good relations between the people of Europe and Russia ultimately forcing more European politicians and governments to restore friendly and close relations with Putin's Russia. This would be the final checkmate needed to force the Obama Administration to reevaluate Neocon policies in the Middle East. American military actions and occupation have already destroyed much of the prosperity of the region. When this is combined with our earlier attempt to weaken Russia and Iran with lower oil prices not taking into account the growing threat of global recession and depression the problem today only gets worse. Today the Middle East is looking at increased instability and a lower standard of living at a time when Europe is suffering economically and can not absorb the inflow of refugees. Finally, take a look at a map of Europe and you will see the 28 members of the European Union and most are in NATO. Then look at the lone country not in the EU or NATO that can still control it's borders and policies and it is the neutral but still independent Switzerland. Neutral Switzerland can be a safe haven for your personal and retirement wealth in the coming global crash and depression. Yes Russia and Europe would do well to work together to counter and halt the flood of Middle East refugees to Europe before the current global recession/depression destroys the prosperity of the region. While the refugee threat might have been a reasonable tool or Washington geopolitical tactic to restore NATO and therefore American leadership over Europe under normal economic conditions, the situation is now getting out of control. With today's global economic slowdown and the risk of depression threatening the economy of Europe this tactic borders on economic genocide for Europe and must be countered and restrained for the peace and prosperity of the region. Let us all work together and hope and pray that the Obama Crash of 2016 does not turn into the Obama Global Depression of 2016 because of some poorly timed geopolitical brinkmanship and maneuvering suggested by Washington neocon advisors. |

| Peak Gold and Silver May Have Come and Gone Posted: 23 Jan 2016 06:00 PM PST by Stefan Gleason, Activist Post:

Have we reached peak precious metals? Many analysts think so. Just to be clear, however, the idea of peak gold and peak silver doesn't refer to a peak prices. The precious metals put in a cyclical price high in 2011. But annual mining production levels may have peaked in 2014-2015. This is what is meant by "peak precious metals." There is good reason to believe that newly mined supplies of gold and silver will decline in 2016 and beyond. The main culprit is low prices. In 2015, gold and silver prices spent most of the year trading below miners' all-in production costs (which average $17/oz for silver and $1,150/oz for gold). Primary silver production is already on the decline in the major producing countries. Last year silver output fell in Chile by 4.6%, in the United States by 6.5%, and in Canada by more than 20%! What Scalebacks in Copper Mining Mean for Silver It's important to keep in mind that the majority of silver that is mined comes as a byproduct of mining operations for other metals. Fully 55% of all silver produced comes from copper, lead, and zinc mining. Another 13% comes as a byproduct of gold mining. In order to understand the supply dynamics of the silver market, you have to take a look at what's happening with base metals mining… Much like gold miners, copper producers are struggling to cope with low spot prices. One of the ways they are trying to survive is by cutting production. Nine of the largest copper producers announced they would cut output by 200,000 metric tons in the first quarter of 2016. |

| "But It's Only A Manufacturing Recession, What's The Big Deal" - Here's The Answer Posted: 23 Jan 2016 05:40 PM PST Despite the services economy starting to turn down towards manufacturing's inevitable recessionary prints, there remains a hope-strewn crowd of status-quo face-savers desperately clinging to the linear-thinking "but manufacturing is only 12% of economic output and thus is no longer a good bellwether for the overall economy" narrative. Here is why they are wrong not to worry...

On the left below, we see the mainstream media's perspective on why a collapse in manufacturing "doesn't matter" and you should buy moar stocks. On the right below, we see why it does... especially since the "doesn't matter" narrative is used only to justify buying moar stocks... h/t @Spruce_gum

Which explains why this is happening!! Self-destructing The Fed's very own wealth-creation scheme. While it is hoped that the economy can continue to expand on the back of the "service" sector alone, history suggests that "manufacturing" continues to play a much more important dynamic that it is given credit for. The decline in imports, surging inventories, and weak durable goods all suggest the economy is weaker than headlines, or the financial markets, currently suggest. And in fact, services are starting to follow...

Of course, as we previously concluded, while recessions are "needed," public opinion is generally quite simple in regard to recession: upswings are generally welcomed, recessions are to be avoided. The “Austrians” are however at odds with this general consensus — we regard recessions as healthy and necessary. Economic downturns only correct the aberrations and excesses of a boom. The benefits of recessions include:

At the end of the corrective process, the foundation for a renewed upswing is more stable and healthy. We thus see deflationary corrections as a precondition for growth in prosperity that is sustainable in the long term. Ludwig von Mises understood this when he observed:

However, in addition to leading to true temporary hardship for the malinvestment-affected areas of the economy, an economic recession in the near future would represent a harsh loss of face for central bankers. Their controversial monetary policy measures were justified as an appropriate means to nurse the economy back to health. That is, their efforts to end or avoid helpful recessions were claimed to contribute to the eagerly awaited self-sustaining recovery. |

| The Rich Are Feeling A Lot Less Rich Posted: 23 Jan 2016 04:50 PM PST Pretend for a minute that you’re a member in good standing of the 1%, with a net worth in the tens of millions of dollars. You aren’t deeply involved in the management of this money, but your financial advisers are heavy hitters and they’ve diversified you appropriately. You’ve got equity stakes in most major and several minor markets. You own three or four trophy properties including a flat in a hot section of London. You also have the obligatory pieces of mid-range “fine art” and, for stability, a generous helping of US, European and Japanese government bonds. For the past few years you’ve felt extremely smart. Your stocks and bonds went up while your real estate and art surged, giving you millions in new paper profits with every quarterly report. But something happened towards the end of 2015. Your emerging-market funds went down and your developed-world equities stopped rising. And a couple of hedge funds in which you’ve invested reported losses rather than their customary gains. Nothing to worry about, said your advisers. When one asset class like equities takes a breather, others like real estate and art go up to compensate. Money, after all, has to go somewhere. But now it’s 2016 and your stocks are cratering (the papers say it’s the worst start to a year ever), with the oil companies whose dividends you were assured were rock-solid standing out among the losers. Looking for a little reassurance, you pick up a Wall Street Journal and the first thing you see is:

As you read this you’re running numbers, calculating losses, and projecting current trends into the near future. Buyers of London penthouses also buy fine art, don’t they, so if they can’t afford the first can they keep bidding up the latter? Probably not. And will laid-off bankers and underwater trophy property owners have to sell their stocks to make ends meet, sending equity prices down even further? Then you turn the page to find:

And you think, okay then. It’s time to stop playing the game. Come Monday you’ll tell your people to sell some stocks. No, a lot of stocks. Cash may yield next to nothing, but at least it won’t go the way of Petrobras or Glencore. |

| Energy Creditors Lucky To Recover 15 Cents On The Dollar In Bankruptcy Posted: 23 Jan 2016 04:28 PM PST This past Wednesday, we reported that in the latest twist of the energy sector collapse, liquidating oil and gas producers, and specifically their creditors, got a nasty lesson in trough cycle asset values when in one after another bankruptcy "stalking horse" aka 363 auction, they were not only unable to cover the outstanding debt (both secured and unsecured) through asset sales, but barely able to cover a tiny fraction of it. "A lot of people got into this business and didn't really understand the ups and downs of price cycles," said Becky Roof, a managing director for turnaround and restructuring with the consulting firm AlixPartners. "They're getting a very bad dose of reality right now." Becky is right as the following bankruptcy liquidation sales tabulated by Bloomberg demonstrate:

Then earlier today we learned that as part of its 363 Asset Sale, the 3rd largest bankruptcy of 2015 after Samson Energy and Sabine Oil, that of Quicksilver, the estate was only able to collect $245 million in cash proceeds from BlueStone Natural Resources. With $2.35 billion in debt, Quicksilver was one of the first casualties of the energy bust when it filed on March 17, 2015. Today's news means that the recovery for its creditors is a paltry 10 cents on every dollar of total debt, most of which will go to partially satisfy secured claims. The problem as the chart below shows is that these bankruptcy auctions confirm recoveries on existing debt will be paltry, and based on our limited dataset, average to roughly 15 cents on total debt exposure, which includes both secured and unsecured debt.

The good news is that our data set won't remain limited for long. Here are several charts from Haynes and Boone showing why all those bankruptcy lawyers and financial advisors who were sitting back twiddling their thumbs for so many years, are now fully back in business. First, the cumulative North American E&P bankruptcy filings, with some of the most notable filers for any given month: Next, the cumulative debt that was gone "under" in the past year: some $17.2 billion: Finally, the full list of all 2015 bankruptcies as of January 6. In other words, the energy bankruptcy party is only just starting. As a reminder, there are currently over 60 companies accounting for $325 billion in debt which are cash flow negative, a number which is about to surge as oil price hedges expire, unless of course oil manages to soar from here. If only 10% of these companies file in 2016, that would mean a doubling of the total amount of defaulted debt in 2015, and a shock to the entire US banking system which despite what it would like you to believe, it very much exposed to the next big default wave. It's only downhill from there. |

| Norway’s Biggest Bank Demands Cash Ban Posted: 23 Jan 2016 04:19 PM PST Why Now? Why are governments suddenly so keen to ban physical cash? from Zero Hedge:

By way of background, as we explained previously, What exactly does a "war on cash" mean?

These limits are broadly called "capital controls." Why Now? Why are governments suddenly so keen to ban physical cash?

Forcing Those With Cash To Spend or Gamble Their Cash

And the benefits of a cashless society to banks and governments are self-evident:

So, when the dust has settled who ultimately benefits by this war on cash – government and the central banks, pure and simple. Which explains why Norway’s biggest bank, DNB, has called for the country to stop using cash which is just the latest move in a country that has been leading the global charge toward electronic money in recent years, with several banks already not offering cash in their branch offices and some industries seeking to cut back on paper currency.

Norway's Ministry of Finance is opposed to the proposal, however, and other critics have raised concerns about privacy issues as well as how the change would affect tourists. Privacy advocates in Norway have expressed worries for years that, without cash, there would be no way for an individual to purchase something without being tracked. image: internationalman.com |

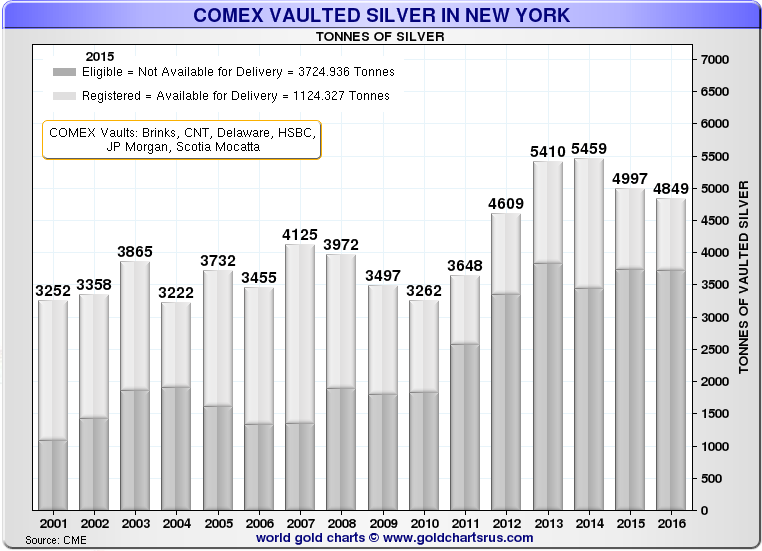

| BREAKING THE COMEX: First the Collapse of Registered Gold Stocks, Now Silver?? Posted: 23 Jan 2016 04:00 PM PST The Breaking Of The Comex Exchange is at hand by Steve St. Angelo, SRS Rocco Report:

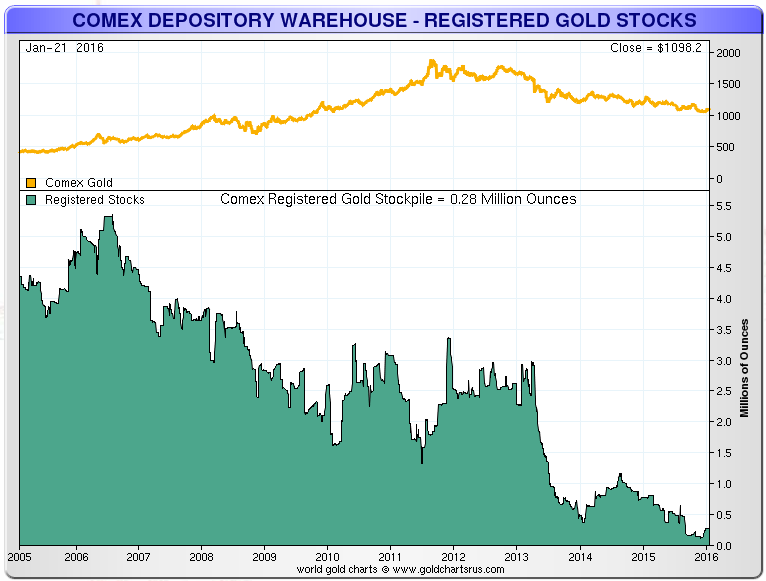

As we can see in the chart, the trend has been lower, with a cliff-like decline at the beginning of 2013. This was during the time when the gold price fell from $1,650 to $1,150 in just six months. Savvy traders who were trying to exit their gold positions by getting the best possible price, did so by knocking the price down by over $100 on many days. Nothing like exiting a trade strategically… CNBC style.

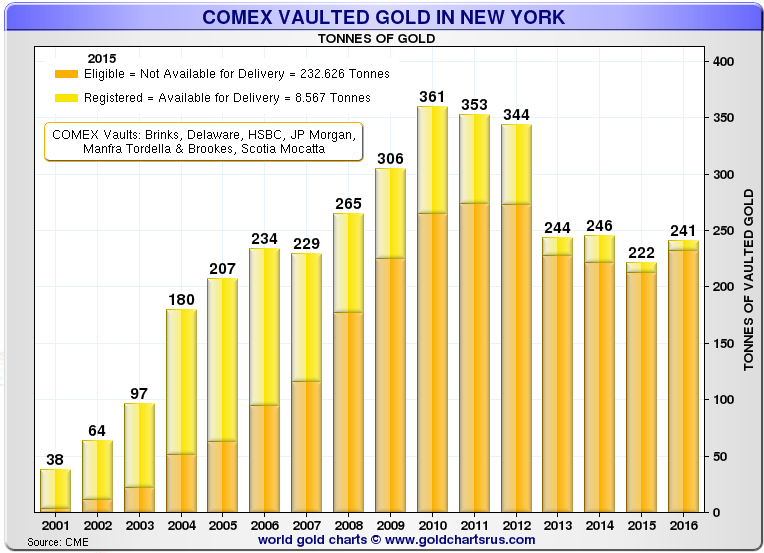

Regardless, the Registered Gold inventories fell from 5.3 Moz in 2006 to a lousy 275,000 oz today. We must remember, Registered Inventories are gold stocks that are ready to be delivered into the market. Some analysts may say this really isn't that big of a deal because there is still 6.4 Moz worth of gold at the COMEX. While this is true, I would imagine most of that 6+ Moz of Eligible Gold stocks are held in tight hands. And who knows of much of that 6.1 Moz of Eligible Gold stocks are actually there at the COMEX or how many claims on put on each ounce? Here is another chart showing the decline of Registered Gold inventories at the Comex (courtesy of Sharelynx.com):

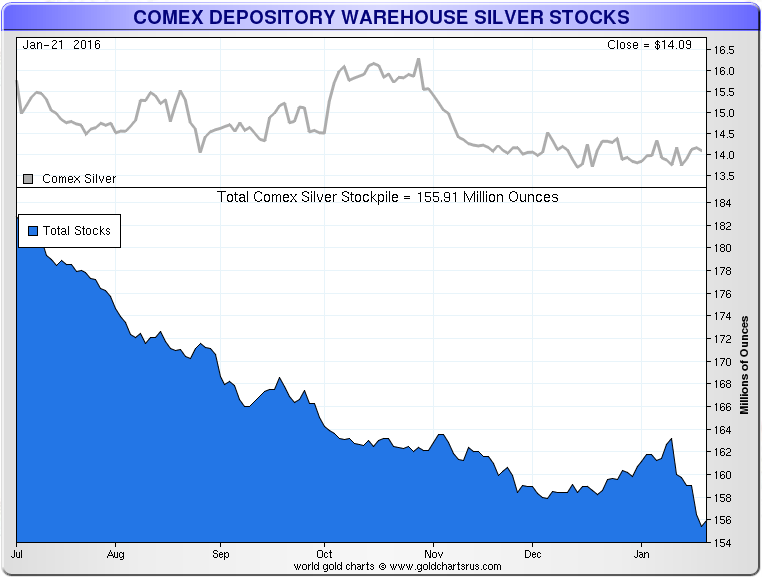

The light yellow bars (on top) are the Registered Gold inventories which the tan-colored bars (bottom) are the Eligible. In 2004 we can see just how large the yellow bar is compared to the tan bar. Thus, Registered Gold inventories were likely 75% of the total inventories in 2004. Today the Registered Gold inventories are shown as that little blemish of yellow on top of the Eligible tan bar which now only represents a lousy 4% of total inventories. Comex Silver Inventories Decline Significantly Over Past 6 Months.Not only have the Registered Gold inventories declined significantly, so have the total Comex Silver stocks over the past 6 months:

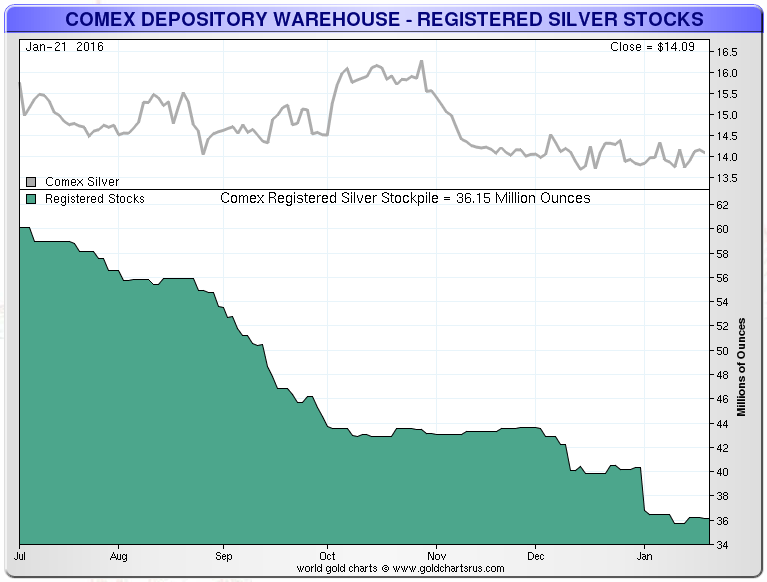

Total Comex Silver inventories fell from a peak of 184 Moz in July to 156 Moz presently. However, the majority of the declines came from the Registered inventories:

In a little more than six month, Registered Silver inventories declines from 60 Moz in July, to 36 Moz currently. Just as with gold, we are seeing a drain of Registered Silver inventories. We can see this trend more clearly in this chart:

In 2007, there was more silver held in the Registered Category (top bar) than in the Eligible (bottom bar). I would assume Registered Silver inventories were about 70% of the total. Over the years it has trended lower. Today, Registered Silver inventories are only 23% of the total at the Comex. While it's true that there is still 36 Moz of Registered Silver inventories, the trend (like gold) has been lower. Furthermore, we have seen some large movements of silver off the Comex in recent days. There was a large 3.2 Moz withdrawal on Jan 19th and another 1 Moz on Jan 20th: |

| How Billionaires Are Investing In 2016: "The Only Winning Move Is Not To Play The Game" Posted: 23 Jan 2016 03:17 PM PST Ever since 2009, when we first showed how broken the capital markets are first at the micro level, thanks to the pervasive spread of parasitic, frontrunning algos, and then at the macro, as a result of constant, artificial central bank intervention and levitation, we have advised readers that the best option is to simply avoid rigged, manipulated markets altogether. Now, 7 years later, the world's richest people agree. Remember when we warned virtually every single day for the past 7 years that constant central bank and HFTs manipulation will lead to a market so broken nobody will have any faith in price discovery or asset valuation until everything collapses and is rebuilt from scratch? Well, we are delighted to announce that this is now conventional wisdom, and as a result every so-called "prominent investor" is now resistant to putting on fresh positions and expected asset prices to head downward, according to the WSJ.

It's not just that: according to WSJ reporting from the just concluded symposium of billionaires, prominent investors and other hypocrites in Davos, the consensus is that "the world's central banks can't save us anymore." The next WSJ sentence is absolutely epic: "Their mood here was irritated, bordering on affronted, with what they say has been central-bank intervention that has gone on too long." Oh yeah, they had no problem with central bank intervention for 1, 2, 3, 4, 5, or even 6 consecutive years... but seven? Now that's just absurd! The WSJ goes on to vindicate all so-called tinfoil fringe websites by admitting that "from this anecdotal sampling, at least, that has created growing distortions in nearly all asset prices—from stocks to bonds to real estate." But... fundamentals? Great job central bankers and other central planners: the one thing you just had to save at any cost, the market, pardon the "market", even if it meant crushing the middle class, is no longer credible - not even to the smartest people in the room.

Or much more: after all the S&P is only in the vicinity of 1900 instead of 666 thanks to 7 years of central bank intervention. Pull the rug, and you get a 70% collapse. Srinivasan said the central banks in the U.S. and Europe have done all that is possible, bringing rates to historic lows, and in Europe weakening the Euro to help sustain exports. Markets need to "stop expecting miracles," he said, "now it's time for the fiscal side to do its job." Actually, all central banks have done is delay mean reversion by injection trillions in liquidity which not only did not end up in the economy where it was not requested due to a complete collapse in demand, but simply inflated asset prices to record levels. Now even the wealthiest admit that the day of reckoning is coming. The sentiment was the same for Axel Weber, the chairman of UBS AG. He said in a panel at Davos that: "There may be no limit to what the ECB is willing to do but there is a very clear limit to what QE can and will achieve," he said, referring to the European Central Bank. "The problem is that monetary policy has largely run its course." Which is funny considering the only reason for the market rebound of the past two days was promises and hopes of more stimulus. Monetary policy may have "run its course" but the same billionaires will be delighted to get a few extra final hits before it all comes crashing down.

One person who has also been warning about this terminal outcome for years is Elliott Management chief Paul Singer who said that "if central banks double down on their policies of QE, ZIRP and NIRP, it could cause a loss of confidence in central bankers, paper money in general, or one or more currencies, and lead to a collapse in bonds and stock prices." He is, of course, right, and incidentally this "thought scenario" is precisely what will happen because as we have repeatedly said, not a single economy or fiat system in the history of the world has disintegrated from deflation: governments and their central bank owners will always find a way to reflate, even if it means dropping money out of helicopters, even if it means destroying a reserve currency. And, as Venezuela most recently found out the very hard way, in the end, only hard assets remain - assets such as gold, which have preserved their value across the centuries. As for these "prominent investors" who were anything but and merely rode the central bank wave for over half a decade, the fun is over. For him, "we call it the new abnormal and we better get used to it." What a coincidence that even the world's richest are suddenly using terms first coined on this website all the way back in 2010, almost as if we were right from day one. Now, anyone interested in a nice game of chess? |

| Norway's Biggest Bank Demands Cash Ban Posted: 23 Jan 2016 02:10 PM PST The war on cash is escalating faster than many had imagined. Having documented the growing calls from the elites and propagandist explanations of the "benefits" to their serfs over the last few years, with China, and The IMF entering the "cashless society" call most recently, International Business Times reports that Norway - suffering from its own economic collapse as oil revenues crash - has joined its Scandi peers Denmark and Sweden in a call to "ban cash." By way of background, as we explained previously, What exactly does a “war on cash” mean?

These limits are broadly called “capital controls.” Why Now? Why are governments suddenly so keen to ban physical cash?

Forcing Those With Cash To Spend or Gamble Their Cash

And the benefits of a cashless society to banks and governments are self-evident:

So, when the dust has settled who ultimately benefits by this war on cash - government and the central banks, pure and simple. Which explains why Norway's biggest bank, DNB, has called for the country to stop using cash which is just the latest move in a country that has been leading the global charge toward electronic money in recent years, with several banks already not offering cash in their branch offices and some industries seeking to cut back on paper currency.

Norway’s Ministry of Finance is opposed to the proposal, however, and other critics have raised concerns about privacy issues as well as how the change would affect tourists. Privacy advocates in Norway have expressed worries for years that, without cash, there would be no way for an individual to purchase something without being tracked. In 2014, Finans Norge, a financial industry organization in Norway, said the country was on pace to be a cashless society by 2020, Ice News reported. While DNB said its proposal will take time to complete, executives suggested the country start phasing out cash by discontinuing the 1,000 kroner note so it could focus on updating its banking system.

If allowed to continue, state wealth control will exist. And thus, as we concluded previously, if you can’t withdraw your money as cash, you have two choices: You can deal with negative interest rates...or you can spend your money. Ultimately, that’s what our Keynesian central planners want. They are using negative interest rates and the War on Cash to force you to spend and “stimulate” the economy. If you ask us, these radical and insane measures are a sign of desperation. The War on Cash and negative interest rates are huge threats to your financial security. Central planners are playing with fire and inviting a currency catastrophe. |

| Having helped cripple Suriname, IMF swoops down to mortgage the country Posted: 23 Jan 2016 01:39 PM PST 4:51p ET Saturday, January 23, 2016 Dear Friend of GATA and Gold: Having helped to cripple the economy of the gold- and commodity-producing South American country of Suriname, the International Monetary Fund is on the way there to put a mortgage on the little multi-racial democracy's vastly undervalued natural resources. The IMF and Suriname's government announced the mission this week. Appended are the IMF's press release and a ham-handed English translation of a news report in De Ware Tijd (The True Times), the country's largest newspaper, based in the capital city, Paramaribo. (As Suriname is the former Dutch Guyana, Dutch remains the official language.) ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Suriname's economy is built on gold and bauxite mining and oil extraction and exploration -- Iamgold, Newmont, and Alcoa have operations there -- and the recent collapse of commodity prices has almost wiped out the country's foreign exchange reserves. But the spectacular hypocrisy here is that the IMF itself is a primary perpetrator of Suriname's problem, as the IMF long has been a crucial part of the gold price suppression scheme of Western central banks. The IMF's participation in the scheme was disclosed three years ago by GATA's publication of the agency's secret March 1999 staff report, which described how the agency was allowing its member central banks to conceal their gold swaps and leases to facilitate their secret interventions in the gold and currency markets: http://www.gata.org/node/12016 GATA appeals to Suriname's government and all Surinamese journalists and patriots to question the forthcoming IMF delegation about the agency's culpability in gold price suppression. No developing country deserves better than Suriname, whose people, Wikipedia notes, "are among the most diverse in the world, spanning a multitude of ethnic, religious, and linguistic groups." People get along there virtually without regard for differences that routinely plunge other countries into chronic political and social turmoil and even civil war. The Reporters Without Borders organization ranks Suriname 29th among 180 nations judged for freedom of the press -- 20 spots above the United States: But like so many other developing countries, Suriname is a rich country insisting on being poor, a country that, while bravely independent, has not yet fully shaken off centuries of imperialism. Suriname doesn't need charity and international debt. It needs a free and transparent market for its primary natural resource, gold -- the world's natural money and reserve currency. CHRIS POWELL, Secretary/Treasurer * * * IMF Statement on Suriname Press Release No. 16/22 http://www.imf.org/external/np/sec/pr/2016/pr1622.htm Mr. Daniel Leigh, the International Monetary Fund's mission chief for Suriname, issued the following statement today: "The Surinamese authorities have approached the fund to discuss the possibility of IMF financial support for their economic reform program in response to the sharp fall in international commodity prices. Several important policies have already been implemented in the context of this program with a view to strengthening the level of international reserves and paving the way for the economy to achieve sustained growth and financial stability. "Together with our sister organizations -- the Caribbean Development Bank, the Inter-American Development Bank, and the World Bank -- we stand ready to help Suriname meet the economic challenges it is currently facing. "At the request of the authorities, an IMF team will visit Paramaribo in the next few weeks for discussions on Suriname's reform program and financing needs." * * * By Ivan Cairo http://www.dwtonline.com/laatste-nieuws/2016/01/23/imf-helpt-economie-ui... PARAMARIBO -- The International Monetary Fund will help Suriname in implementing an adjustment program to bring the derailed economy out of the mud. Thus the stabilization program of the second administration of President Desi Bouterse will get an IMF flavor. In late November Finance Minister Gillmore Hoefdraad, interviewed by De Ware Tijd, insisted that the economic situation had not deteriorated to the point that IMF aid had to be invoked. He left the door open. Hoefdraad said the government would not hesitate to consult with the IMF "if the need is there for stand-by arrangements." He added that there was "ongoing dialogue" with the IMF. Friday the Ministry of Finance announced that the minister has held successful talks in Washington with top officials of the IMF, the World Bank, and the Inter-American Development Bank. The discussions provided clarity on the government's stabilization program. In line with this the government has invited the IMF to visit Suriname in early February to discuss possible financial and technical support. The IMF team will arrive shortly to determine the financial and technical assistance needed by Suriname. The Inter-American Development Bank and the World Bank will also be part of this mission, according to the Finance Ministry. The ministry further stated that an IMF mission to Suriname late last year was "greatly impressed" was the seriousness of the government on the adaptation programs. According to the Finance Ministry the IMF would be satisfied "with the efforts of Suriname on the macroeconomic front and the ongoing and imminent institutional reforms in public finances." The IMF indicated that substantial funding can support the reserve position of the central bank and extended technical assistance can help design and implement reforms and can give a boost to confidence inside and outside Suriname. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Don't Delay It's Time To Accelerate Your Preps For The Economic Collapse Posted: 23 Jan 2016 01:00 PM PST Global unemployment will rise to 3.4 million within 2 years. Shell fires another 10,000 bringing the job loss in the energy sector to 250,000. Housing starts declined. Macy's announced they will be opening discount stores to help with lagging sales. IBM revenue down now for 15 consecutive... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Ambrose Evans-Pritchard: China's banking stress looms like Banquo's Ghost in Davos Posted: 23 Jan 2016 12:41 PM PST By Ambrose Evans-Pritchard Bad debts in the Chinese banking system are four or five times higher than officially admitted and pose a mounting risk to the country's financial stability, the world's leading expert on debt has warned. The expert, Harvard professor Ken Rogoff, said China is the last big domino to fall as the global "debt supercycle" unwinds. This is likely to expose the sheer scale of malinvestment that has built up during the country's $26 trillion credit bubble. Prof Rogoff said the official 1.5 percent rate of non-performing loans held by banks is fictitious. "People believe that as much as they believe the GDP data," he told the World Economic Forum in Davos, Switzerland. The real figure is between 6 and 8 percent. He warned that unexpected problems can come "jumping out of the woodwork" once a debt denouement unfolds in earnest. Banks are disguising the damage by rolling over bad loans and pretending all is well, with the collusion of regulators, but this draws out the agony and ultimately furs up the financial arteries. Ray Dalio, founder of Bridgewater, said the worry is that credit in China is still growing faster than the economy even at this late stage, storing up greater problems down the road. The efficiency of credit has collapsed. It now takes four yuan of extra debt to generate a single yuan of economic growth, compared to a ratio of almost one to one a decade ago. ... ... For the remainder of the report: http://www.telegraph.co.uk/finance/economics/12116535/Chinas-banking-cri... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Indian government's gold scheme paperizes 9/10ths of a tonne of gold Posted: 23 Jan 2016 12:28 PM PST Just 22,999 more to go. * * * By the Indo-Asian News Service http://timesofindia.indiatimes.com/business/india-business/More-than-900... NEW DELHI -- The central government has mobilised more than 900 kilograms of gold [nine-tenths of a metric tonne] under its gold monetisation scheme, a senior official said on Saturday. "Gold Monetisation Scheme: More than 900 kgs gold mobilised so far. Scheme making steady progress. Expected to pick up in coming months," tweeted Shaktikanta Das, secretary economic affairs in the Finance Ministry. The central government had launched the gold monetisation scheme on November 5, 2015, to convert jewellery and other yellow metal assets into interest-bearing deposits. According to the World Gold Council, an estimated 22,000-23,000 tonnes of gold is lying idle with households and institutions in India. The annual imports amount to around 850-1,000 tonnes valued at $35-$45 billion. ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| JIM ROGERS on OIL PRICE, GOLD, U.S. Dollar in 2016. World on The Brink Posted: 23 Jan 2016 11:54 AM PST We are now paying for the excesses of the past and everything is going to go down more than it should, says Jim Rogers, US investor and author. Meanwhile, China may play a key role in the showdown between Saudi Arabia and Iran, he added.This week, crude fell to its lowest level in more than... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| OBAMA To SUSPEND 2016 ELECTION & Become 3rd Term President Under MARTIAL LAW (Prophetic Message) Posted: 23 Jan 2016 11:23 AM PST A dictator Obama seeks to suspend the 2016 election and become 3rd term President under the Martial Law. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| What is Gnosticism? | Stuff They Don't Want You to Know Posted: 23 Jan 2016 10:36 AM PST Gnosticism may be one of the oldest conspiracy theories in human civilization - but what is it, exactly? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Food Prices Soar as the Canadian Dollar Collapses Posted: 23 Jan 2016 09:00 AM PST Think your grocery bill is high? Canadians paying $3 cucumbers, $8 cauliflower, and $15 Frosted Flakes. We are watching a Real Time Currency Collapse In Canada – Is This Is What It's Going To Look Like In the USA? They get really screwed by the US pretending to be an ally. "The US way... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Harry Dent -- Economic collapse: The Biggest Financial Bubble About to Burst! Posted: 23 Jan 2016 08:39 AM PST 2016 As Bad As The Great Depression Alex Jones talks with economic expert Harry Dent about why he thinks the collapse is coming in 2016. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold And Silver - Chart Facts Are Market's Message Posted: 23 Jan 2016 08:30 AM PST We keep reiterating that one need not be expert, nor even conversant, in reading a chart to be able to read and appreciate how charts "talk" and reveal very clear information. Opinions are of no consequence, regardless of how strong or otherwise "informed" one is about a market. A fact is something upon which people of diverging opinions can agree, at least within reason. Each of the following charts contains facts, and it has always been our position that the market has its own message[s] contained in price volume behavior that has a convincing element of reason, no matter what the skill level of one's ability, or lack of, to read a chart. |

| The Elite Are Taking Us On An Express Elevator To Hell Posted: 23 Jan 2016 06:53 AM PST Alex Jones talks with Michael Snyder, the publisher of The Economic Collapse Blog about why the elite want to send the global economy on an express elevator straight to hell. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Could Lose Safe-Haven Bid as Equities Rebound Posted: 23 Jan 2016 06:09 AM PST Gold and Silver have held up well during the recent selloff in equities. From December 28 through Wednesday the broad NYSE lost 10.4% while the S&P 500 lost 9.6%. Precious Metals gained strength during that period. Gold advanced 3.0% while Silver gained 1.7%. Gold relative to the NYSE broke its downtrend and touched an 11-month high. Gold relative to global equities (excluding the US market) reached a 2-year high. Precious metals have clearly benefitted from the equity selloff but therefore figure to lose strength as the equity market begins a relief rally. |

| Gold Will Go to $5,000 In Next Cycle... Best Time in History to Buy Gold Stocks Posted: 23 Jan 2016 05:04 AM PST Ed Bugos is one of the most renowned gold mining analysts in the world, with billionaires often consulting with him on prospective mines. He’s also one of the most reclusive. While he has been writing online since the early 2000s, he has never been recorded in an interview. Until now! |

| Perfect Storm Market Collapse 2016 - #2016Collapse Posted: 23 Jan 2016 04:00 AM PST Perfect Storm Market Collapse 2016 - #2016Collapse What we have become accustomed to in terms of normal is rapidly coming to an end. The global monetary experiment is literally bursting at the seams. Central banks have used the raising and lowering of interest rates for years to... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Emerging Markets Running Scared with Capital Controls Posted: 23 Jan 2016 03:57 AM PST This has not been a good year for emerging markets. Since many of the emerging economies are commodity-reliant (mainly crude oil), the oil price plunge has also crashed their currencies, which prompted money fear and flight. WSJ quoted the Institute of International Finance that emerging markets suffered record net outflows of $732 billion in 2015, with China accounting for the bulk of that. The Russian ruble, Mexican peso and Colombian peso all hit record lows against the dollar. Overall, emerging-market currencies fell 3% in the first two weeks of 2016. |

| Gold Stocks Absurd Price Levels Posted: 22 Jan 2016 11:29 AM PST Gold stocks remain the pariah of the investment world. Despite gold’s strong early-year gains, the stocks of its miners have slumped to new secular lows. This whole forsaken sector continues to languish at fundamentally-absurd price levels, an extreme anomaly that is long overdue to start unwinding. The gold miners will be bid massively higher to reflect their impressive profitability even at today’s dismal gold prices. Just this week, the flagship HUI gold-stock index plunged to a major new secular low. On Tuesday as gold merely slid 0.3%, the HUI plunged 5.6% to 100.7. This was an astounding new 13.5-year secular low, reeking of capitulation since gold’s price action certainly didn’t justify such a disastrous reaction in its miners’ stocks. That left already epically-bearish gold-stock sentiment even worse, which is hard to believe. |

| Stock Market Swing Baby, Swing! Posted: 22 Jan 2016 08:13 AM PST This article assumes one is trading the up and down swings in the stock market. Swing traders are just one segment of a market population that includes those sitting in cash (and/or risk ‘off’ vehicles like Treasury Bonds), maintaining longer-term short positions, our always bullish friends, the “stocks for the long-term” contingent and of course, the indomitable Gold Bug “community”, focusing as ever on one asset class while a world full of other assets is in motion. “Let’s go let’s go, he’s no batter, he’s no batter… (pitch comes to the plate) SWING BATTER!!!” |

| Ron Paul Says to Watch the Petrodollar Posted: 22 Jan 2016 08:08 AM PST By Nick Giambruno The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better. - Ron Paul Ron Paul is calling for the end of the petrodollar system. This system is one of the main reasons the U.S. dollar is the world’s premier reserve currency. |

| Silver Undervalued Versus Stocks, Bonds, Property and Gold Posted: 22 Jan 2016 08:01 AM PST Precious metals continue to look very undervalued vis a vis most asset classes – particularly stocks and bonds. This is especially the case with silver which has fallen by more than 70% from what we believe was an intermediate price high of $49 in 2011 – despite surging demand for silver bullion coins and bars from canny buyers investing in silver. |

| Peak Gold and Silver - It’s Here! Posted: 22 Jan 2016 07:56 AM PST Have we reached peak precious metals? Many analysts think so. Just to be clear, however, the idea of peak gold and peak silver doesn’t refer to a peak prices. The precious metals put in a cyclical price high in 2011. But annual mining production levels may have peaked in 2014-2015. This is what is meant by “peak precious metals.” |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The onset of 2016 has been most chaotic for global financial markets with, so far, a severe stock market correction. As a matter of fact, the first month of 2016 has witnessed the most severe drop in financial stocks ever, with the MSCI All-Country World Stock Index, which measures major developed and emerging stock markets, dropping more than 20 percent, as compare to early 2015. For sure, there will be oversold rallies in the coming weeks and months, but one can expect more trouble ahead.

The onset of 2016 has been most chaotic for global financial markets with, so far, a severe stock market correction. As a matter of fact, the first month of 2016 has witnessed the most severe drop in financial stocks ever, with the MSCI All-Country World Stock Index, which measures major developed and emerging stock markets, dropping more than 20 percent, as compare to early 2015. For sure, there will be oversold rallies in the coming weeks and months, but one can expect more trouble ahead.

The war on cash is escalating faster than many had imagined. Having documented the growing calls from the elites and propagandist explanations of the “benefits” to their serfs over the last few years,

The war on cash is escalating faster than many had imagined. Having documented the growing calls from the elites and propagandist explanations of the “benefits” to their serfs over the last few years,  The once mighty paper price setting Comex Exchange has now become a mere shadow of its former self. Before the U.S. Investment Banking and Housing Collapse in 2008, the Comex held over five million oz in its Registered Gold inventories. At the peak, it held approximately 5.3 million oz (Moz) in 2006:

The once mighty paper price setting Comex Exchange has now become a mere shadow of its former self. Before the U.S. Investment Banking and Housing Collapse in 2008, the Comex held over five million oz in its Registered Gold inventories. At the peak, it held approximately 5.3 million oz (Moz) in 2006:

No comments:

Post a Comment