Gold World News Flash |

- UPDATE: Is The Economic Collapse Happening?

- Jack Lew: Puerto Rico is in Economic Collapse, But Things Could Get Even Worse

- Top 15 Richest Pastors In America (We promise that #1 will shock you)

- Bitcoin is Succeeding, Taking Over Gold’s Market Share – Trace Mayer Interview

- Gold Bugs Index (HUI) Drops through 100

- When Correlation Is Causation - The Most Important Chart In The World If You're A Realtor In London Or NYC

- Central banker who admitted gold market rigging muses about debt jubilee

- The Collapse Is Intensifying And Something Terrifying Is On The Horizon

- Price of Gold Lost $1.60 or 0.15 Percent Closing at $1,089.90

- Elite are Satanists -- CIA operative Robert David Steele

- The Perfect Storm is Here! Andy Hoffman on the 2016 Collapse

- Truth about U.S. economy can't be told, Embry tells KWN

- Rich Bast**ds!

- Gold Daily and Silver Weekly Charts

- Precious Metals and US Treasuries Seen as Safe Haven as Oil and Stocks Crash in 2016

- 10 Safest Countries If WW3 Breaks Out

- The Coming Era of Financial Triage

- "Dr. Doom" Stephen Hawking Humanity To be Wiped Out

- Gold Deficits and T-Bond Fantasies

- John Stossel -- The Matter of Marijuana

- US Dollar Drop to Trendline Likely

- Texe Marrs -- Ted Cruz The Jewish Banker's Candidate

- THIS IS ONE OF THE MOST IMPORTANT VIDEOS YOU WILL EVER SEE ON AGENDA 21. ITS HAPPENING RIGHT NOW

- Global BRITAIN - Daniel Hannan

- Gold Price Remained Unchanged at $1091.50

- David Icke : The Public Is Programmed To Become Slaves

- Stock Market Bottoming, but Bear Still Growling

- Oil price Slump Leads To Shale 2.0, The Great Crew Change, And COP21

| UPDATE: Is The Economic Collapse Happening? Posted: 20 Jan 2016 12:00 AM PST from Fabian4Liberty: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jack Lew: Puerto Rico is in Economic Collapse, But Things Could Get Even Worse Posted: 19 Jan 2016 11:30 PM PST from Economic Policy Journal:

Although there are many ways this crisis could escalate further, it is clear that Puerto Rico is already in the midst of an economic collapse… Puerto Rico is already in default. It is shifting funds from one creditor to pay another and has stopped payment altogether on several of its debts. As predicted, creditors are filing lawsuits. The Government Development Bank, which provides critical banking and fiscal services to the central government, only avoided depleting its liquidity by halting lending activity and sweeping in additional deposits from other Puerto Rico governmental entities. A large debt payment of $400 million is due on May 1, and a broader set of payments are due at the end of June. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 15 Richest Pastors In America (We promise that #1 will shock you) Posted: 19 Jan 2016 09:00 PM PST RELATED VIDEO: 15 RICHEST PASTORS IN AMERICA: Is The Love of Money Destroying Christianity from Within? from ET Inside:

It might be argued that the reason why ministers are more likely to make money today is because they utilize more money making opportunities such as writing books, producing movies and speaking engagements. Some of which make enough to have private planes (Eddie Long) refurbished arenas as churches (Joel Osteen) and flourishing press houses (Rick Warren).

There will be many who will say that these pastors shouldn't be making this much money. Before you judge, keep in mind that the average yearly household salary in The Democratic Republic of Congo in Africa is $422, so they could be saying the same about you! This article is not to bash anyone, it is written to inspire you to dream bigger. If you are not interested in making money, then that is your choice but here are men and women who inspire others while achieving their dreams.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin is Succeeding, Taking Over Gold’s Market Share – Trace Mayer Interview Posted: 19 Jan 2016 07:01 PM PST from CrushTheStreet: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bugs Index (HUI) Drops through 100 Posted: 19 Jan 2016 06:38 PM PST

The precious metals mining sector was thrashed again today as the gold and silver producers were sold-off hard.

Stock Trader has long been of the opinion that the HUI would fall and break through the '100' level and in today's session that actually happened. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jan 2016 06:15 PM PST If ever there was any doubts about the narrative of freedom-seeking China capital outflows driving the irrationally exuberant prices of homes in some of the world's largest cities to record highs, the following two charts will extinguish them entirely. As China continues to strengthen (as quietly as possible) its capital controls to slow the leak of money from the devaluing currency nation, and US authorities clamp-down on the anonymity of cash-only transactions, realtors in NYC, Miami, and London better hope that correlation is not causation. Over three years ago, in August 2012, we described how while US regulators and authorities were cracking down on such "illegal" banks as Standard Chartered and HSBC, they were allowing the non-corporate shielded entities, the actual individuals who benefited from the bank crimes, slip through the cracks simply by allowing them to park billions of ill-gotten gains in US real estate:

If after skimming the above, as we detailed recently, readers are still confused what the reason is for the luxury segment of the US housing market continuing to rise in price and hit record highs, even as all other segments of the quadruplicate US housing market as explained here languish, the explanation was very simple (and explained most recently back in October): the "hot money" belonging to Chinese and all other global oligarchs would be laundered by parking into the new "Swiss bank account" that U.S. real estate has become. Still not convinced? Here are the two most important charts in the world if you are a realtor in NYC or London... London home prices have soared on the back of this illicit capital outflow desperate for hard non-Yuan assets to bury itself in (within property rights protecting nations)

And even more so in New York City homes...

Where cash sales have been soaring...

However, as we detailed here, just like Swiss bank accounts lost all their anonymity shortly after the Global Financial Crisis, and led to massive fund outflows from Switzerland (and ironically, into luxury US real estate), so after many years of us explaining how the ultra luxury segment of the US real estate market was being used as a money laundry vehicle, the US government has finally decided to crack down on these "secret" buyers. As the NYT reports, "concerned about illicit money flowing into luxury real estate, the Treasury Department said Wednesday that it would begin identifying and tracking secret buyers of high-end properties."

The logic behind the move is clear: "this initiative is part of a broader federal effort to increase the focus on money laundering in real estate. Treasury and federal law enforcement officials said they were putting greater resources into investigating luxury real estate sales that involve shell companies like limited liability companies, often known as L.L.C.s; partnerships; and other entities."

Our only question is what took so long? What happens next remains to be seen, but now that the buyer anonymity of luxury real estate buyers is gone, and with it the opportunity to launder illegal money in the US, much to the chagrin of the NAR, we would expect a substantial drop in both demand and prices for the one segment that has so far been the most stable support of the entire U.S. housing market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banker who admitted gold market rigging muses about debt jubilee Posted: 19 Jan 2016 05:28 PM PST World Faces Wave of Epic Debt Defaults, Fears Central Bank Veteran By Ambrose Evans-Pritchard DAVOS, Switzerland -- The global financial system has become dangerously unstable and faces an avalanche of bankruptcies that will test social and political stability, a leading monetary theorist has warned. "The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up," said William White, the Swiss-based chairman of the Organization of Economically Developed Countries' review committee and former chief economist of the Bank for International Settlements (BIS). * * * GATA EDITOR'S NOTE: For White's candid 2005 admission of gold market rigging by central banks, see: * * * "Debts have continued to build up over the last eight years and they have reached such levels in every part of the world that they have become a potent cause for mischief," he said. "It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something," he told The Telegraph on the eve of the World Economic Forum in Davos. "The only question is whether we are able to look reality in the eye and face what is coming in an orderly fashion, or whether it will be disorderly. Debt jubilees have been going on for 5,000 years, as far back as the Sumerians." ... ... For the remainder of the report: http://www.telegraph.co.uk/finance/financetopics/davos/12108569/World-fa... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Is Intensifying And Something Terrifying Is On The Horizon Posted: 19 Jan 2016 05:00 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Price of Gold Lost $1.60 or 0.15 Percent Closing at $1,089.90 Posted: 19 Jan 2016 04:57 PM PST

Shenanigans returned to the silver and gold price markets today after a flat day yesterday. In what I have to call an incomprehensible daily chart, the gold price gapped up a little after 3:00 a.m. Eastern from $1,089 to $1,092.5, traced out an island sideways, then gapped down from $1,092 to $1,087. After one more foray toward $1,082 before the US market opened, it turned up and steadily but gently rose the rest of the day. THe SILVER PRICE did the same, only more so. It gapped up from $13.98 to $14.19 -- gapped, as in no trading between those numbers. Formed an island, then gapped down about 5:00 a.m. from $14.12 to $14.05, and crabbed upwards rest of the day. Those big gaps should signal clusters of stop orders -- or something else. Silver and GOLD PRICES keep slamming from one side of the range to the other, but I take as positive silver's better performance than the gold price. Surprising as it sounds, gold remains above its 20 and 50 DMAs and barely after $1,088 support/resistance. Silver daily keeps tapping on the ceiling above. Volume is rising, suggesting silver is gaining strength as it climbs. Silver and gold prices still need to prove their upward intention with closes above $14.40 and $1,113. Frustrating as this range trading may be, it is constructing a base from which silver and gold can launch a rally. The wait shall not be prolonged. If what stocks did today was called a "rally," some mighty bad juju lies in the future. After reaching an early high of 16,171, the Dow sawed lower and lower until it hit a low of 15,900 about 3:00. Right about then, "friends" entered the market to buy, buy, buy and it ended up 27.94 (0.17%) at 16,016.02, squeaking above the 16,000 morale busting mark. Yeah, that's what happened, and the Nice Government Men on the Plunge Protection Team didn't have to lift an index finger or push a BUY button, the market just fixed itself. After a like performance, the S&P500 ended up one (1.00) point at 1,881.33. (If y'all want to view daily charts of the major stock indices, go to nasdaq.com.) Stocks locked in a third wave down I reckon. Fall will accelerate. Dow in gold fishhooked up from a new low yesterday at 14.69 oz, and rose top 14.73 oz. Headed for deeps of the earth. Dow in silver fell 0.61% to 1,142.37 troy ounces. Now below the 200 DMA (1,148.29 oz). Nothing in those charts gainsays my conclusions that they double peaked in the summer and December. Picture in your mind Cassandra, wild look in her reddened eyes, tangled hair filling the air around her head, racing down Wall Street barefooted screaming, "The Dow in Gold and Dow in Silver warn of lower stock prices soon!" True to the curse that rests on her, she always prophesies the truth, yet none believe her. US dollar still looks sickly. Rose 17 basis points today to 99.17, but that's right on the upper boundary of the even-sided triangle it has formed since the year opened. A close below 98.5 shatters the triangle downside, a close below 98 trumpets trouble for the buck. Euro fell 0.5% to $1.0906, just as lazy and feckless as ever. Yen lost 0.56% today to 85.00, which sounds like a bad lick unless you know it made a new high close for the move yesterday at 85.47. Rise much more, and the yen rally gets out of hand. All the safe haven bid is flowing to the yen. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elite are Satanists -- CIA operative Robert David Steele Posted: 19 Jan 2016 04:17 PM PST Former high level CIA operative Robert David Steele gives Alex Jones an inside look into just how corrupt the elite are. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Perfect Storm is Here! Andy Hoffman on the 2016 Collapse Posted: 19 Jan 2016 03:27 PM PST I am sorry to say the next war the US starts will be its last. I recon for the sake of the US people Get out of the US while you Can. The war is with the Banksters and the government not the people. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Truth about U.S. economy can't be told, Embry tells KWN Posted: 19 Jan 2016 12:39 PM PST 3:40p ET Tuesday, January 19, 2016 Dear Friend of GATA and Gold: Anyone who tells the truth about what is happening in the U.S. economy is attacked by the mainstream news media, Sprott Asset Management's John Embry tells King World News today. "Anybody buying a 10-Year Treasury today with less than a 2 percent yield has to be delusional," Embry says. "And although the U.S. stock market is also radically overpriced, gold and silver remain remarkably underpriced due to the chicanery in the paper markets." An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/the-collapse-is-intensifying-and-something-terr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jan 2016 12:36 PM PST This post Rich Bast**ds! appeared first on Daily Reckoning. POITOU, France – Pessimism is a sin against God, said money manager Charles Gave. It suggests ingratitude. And a lack of faith. After all, this is God's world… What, not good enough for you? That's why we are always optimistic at the Diary. Things don't always go the way we would like, but they always go the way they should. Yes, the world may be headed to Hell in a handcart… but it's for its own damned good! $5 Trillion up in SmokeIt is cold and snowy this morning. But we are crossing to the sunny side of the street today. Look how easy it is… About $6 trillion has been lost in the world's stock markets so far this year. Well, boo hoo! It was only "on paper" anyway. Meanwhile, the New York Fed's Empire State Manufacturing Survey – which takes the pulse of New York's manufacturing industry – just hit its lowest level since the last recession. (More on this below in today's Market Insight.) But what do factories make? Stuff… and do we really need more stuff? New York City is also reporting retrenchment in its luxury real estate market. Prices are down for the last eight months in a row. To that, we say: It serves those rich SOBs on Wall Street right. They bought their digs with money they got from the Fed on super sweet terms. It's a pleasure to see them take a loss. You see what we mean? No matter how dreary the weather, you can always use your portfolio statements to start a cozy fire. Recession WarningWith so much bad news coming from the economy, it is amazing we are not already in recession. Perhaps we are. The Atlanta Fed now puts the growth rate in the fourth quarter of last year at just 0.6%. Given the squishiness of the numbers, the economy could have easily shrunk more since then. And now – with even more bad news – the recession may well be deepening. But hey, what's wrong with recessions? Aren't they part of God's plan too? Don't they serve a purpose? Don't they clear the gunk out of the economy? Too much debt. Too many gambles that don't make sense. Too many rich people who don't deserve their money. It will be nice to get this trash out of the system. That's what recessions are for. Meanwhile, CNBC is telling viewers to "watch out" because important economic data in China comes out this week. With $28 trillion in debt outstanding… it wouldn't take much to cause a financial disaster in the "Red Ponzi." Well, que sera, sera. As composed and content as we are with disasters in the U.S., we are even more composed and content when they happen to other people. Rich Bast**ds!Yes, we're basking in the good news – no matter how awful it is. So give us a high-five, dear reader, because a new report from charity Oxfam reveals that members of the "One Percent" now have more wealth than the other 99% combined. And the 62 richest people on the planet have as much wealth as 3 billion of the poorest people. You may be thinking, "Those rich bast**ds! How is that good news?" But wait… Because you, too – dear reader – are most likely among "the rich." According to the Oxfam report all it takes is $68,000 in assets to get into the top 10%. And if you want to be in the top 1%, all you need is $760,000 – which is about the present value of a typical house in the Washington suburbs… or a cheaper house combined with Social Security payments. But the poor Oxfam people see the glass as half empty. Pessimists whine that the "rich have been getting richer." The BBC reported:

Rage, rage against the dying of the light… Gloomy MeddlersOxfam has no faith. It cannot imagine that things can work themselves out. It has no idea what caused the concentration of wealth. It doesn't even seem to care. Had it looked more carefully, it would have seen that the rich got richer because they used the power of government to shove most of the chips to their side of the board. Twice in the last 15 years, nature tried to put the rich in their place. The crash of 2000 reduced their Nasdaq wealth by almost 80%. Then the crisis of 2008-2009 cut their stock market holdings by more than half. Each time, the fix was in. The gloomy meddlers got central bankers to rig the system on their behalf. The phony fiat money flowed. The wealth of the One Percent ballooned. But don't worry. Markets still work. Fate still functions. Bear markets and recession still happen. Have faith. Be happy. The easy wealth earned by the rich since 2009… can vanish as easily as it came. Regards, Originally posted at Bill Bonner's Diary, right here. P.S. Bill expects a violent monetary shock, in which the dollar — the physical, paper dollar — disappears. And he believes it will be foreshadowed by something even rarer and more unexpected — the disappearance of cash dollars. Many Americans don't see this coming because of what psychologists call "willful blindness." But Bill has taken the extraordinary step of assembling the full shocking details in a special report. To get full details on what Bill calls the "Great American Credit Collapse", click here right now. The post Rich Bast**ds! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts Posted: 19 Jan 2016 12:31 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

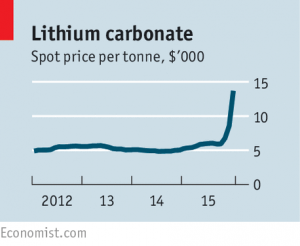

| Precious Metals and US Treasuries Seen as Safe Haven as Oil and Stocks Crash in 2016 Posted: 19 Jan 2016 12:26 PM PST It is important to study the beginning of trading in January as major pools of capital tend to re-position around this time for the new year 2016. So far this year it has been ugly, one of the worst starts in history. Oil is crashing below $30 down over 20% year to date. The Nasdaq and Russell 2000 are already down more than 10% year to date. Mostly all markets are in the red except precious metals and treasuries. China’s stock markets started falling followed by the US. Europe is already in a bear market and the US may be near that zone soon on a few more down days like last Friday. The fear of a global financial crisis is beginning. The US Central banks may once again have to step in. Be careful as this could be a challenging quarter for earnings in the US as the strong US dollar may weigh on sales growth. This is the second major correction in six months for US equities which may signal the four year bull market is in need of a more significant downturn. For weeks I didn’t like this rally in general equities in the US while commodities such as oil and copper fell off a cliff. Eventually the losses in the commodity sector will be felt by the banks as they are sitting on a lot of debt. The 30 year US bond is near record highs at 160 which could be a near term top. The US dollar which has already broken out into new 5 year high territory could also be on the verge of turning over. Investors want liquidity and are moving capital out of junk bonds and equities into precious metals and US treasuries. The Dow has plunged below August support at 16,000 and the four year rally in general equities could be ending as this is the second correction in six months. Capital is searching for safe havens as investors may be realizing the global economy could be on a downswing. Investors are flocking to what they believe are the most liquid assets in US Bonds and precious metals which are continuing to hold value. The strong dollar has made other currencies such as the Canadian, Australian Dollar and British Pound look very weak. However, the rising dollar is going to start making a drag effect on the US markets and the ability of the US to attract foreign investment. The US is getting expensive to foreign investors. They can no longer afford US stocks and real estate and may soon look into the historically discounted precious metals arena and junior mining sector. The opportunity could be in gold and silver as capital flows from stocks to precious metals as a safe haven. If the US markets continue to follow the Chinese markets lower I expect a whole new round of global quantitative easing. One market that is soaring in price despite this carnage is lithium. Watch some of the high quality junior lithium miners in Argentina and Nevada such as Western Lithium (WLC.TO) Dajin (DJI.V) and Pure Energy (PE.V). Argentina appears to be turning positive to mining development and exploration after the recent election. Also keep a close eye on uranium especially after the recent Chinese deal with Fission (FCU.TO). Fission 3 (FUU.V) and Canex (CSC.V) may soon get more interest as grassroots exploration has been dormant in the Athabasca Basin. Plateau Uranium (PLU.V) may be on the verge of publishing an updated Preliminary Economic Assessment on their Macusani project in Peru. Don’t be surprised to see a major rotation into the beaten down juniors which are already way oversold in my opinion. The TSX Venture is below 500 a historic low yet there are many companies coming out with exciting news. Be careful of the naysayers who tell you the junior sector is dead. These are the sort of words that are mentioned at major bottoms. Despite the supposed death of the sector many of the stocks we follow continue to make progress with significant news. 1) Fission Announces Execution of Subscription Agreement and Offtake Agreement with CGN Mining Dev Randhawa, Chairman and CEO, of Fission Uranium, commented, “This is an historic moment for Canada’s uranium industry. It is the first time a Chinese company has invested directly in a Canadian uranium company. We are thrilled that CGN Mining has chosen to invest in Fission, PLS and the Triple R deposit. CGN Mining’s understanding of the uranium business is superb and we are excited at the opportunity to work with them. CGN Mining’s knowledge and expertise will be invaluable as we progress PLS and add to shareholder value.” 2)Ucore Comments on Royalty Conversion and Positive Outlook of New 10% Shareholder "We're extremely pleased to welcome Mr. Johnson as a Reporting Insider of Ucore," commented Jim McKenzie, President and CEO of Ucore. "Randy has built an impressive industrial resume in Alaska and beyond, and his experience in company-building will be a significant asset and resource to us as Ucore enters its early production phase. What's more, his substantial recent investments in Ucore, and his commitment to retaining and progressively expanding his ownership position over the long term, are significant votes of confidence in the prospects of the Company. We look forward to rewarding this commitment with continued growth and return on investment. 3)Pele Mountain Resources Appoints Wayne Richardson as Chairman of its Board of Directors Mr. Richardson is President and Chief Executive Officer of Enirgi Group (“Enirgi“), a privately held specialty chemicals & diversified industrials company headquartered in Toronto, Canada. Enirgi owns and operates a portfolio of diversified assets and operations focused on Power Storage, Chemicals, Resources, Innovation, Environmental Services, and Agriculture. Mr. Richardson is a well-regarded and highly respected results-oriented professional with decades of international business development experience and a history of successful management of turnaround, growth, and start-up companies worldwide. He has led the impressive development and growth of Enirgi Group since its inception and holds Management and Board positions at LeadFX Inc., a TSX listed Canadian public company, and several privately held companies that operate under the Enirgi Group umbrella. 4)Treasury Metals Director Expects Gold to Turn Soon, Says Goliath Could Be a Cash Machine Treasury Director Christophe Vereecke said in the interview, “Every great mining project has two things in place: a good deposit and a competent management team. When I met Treasury's Chairman Marc Henderson I was very impressed with his experience. He's been in the business for over 30 years and has built mines before, so he'd like to see Goliath through to production. Also, the fact that Goliath is located in a mining-friendly country like Canada is important to me as a European – if you want to open a mine in France, for example, it's nearly impossible. I also see potential to increase Goliath's mine life longer than the 10 years that's quoted in the PEA. There's only been a small amount of drilling along the east side of the property, and it's looking very promising.” Disclosure: I own share and/or options/warrants in companies linked above. Companies mentioned are either current or past sponsors of the website. Do your own due diligence as I have a conflict of interest and may be biased as I would benefit if the value of the shares go higher. Please be aware that mineral exploration is very risky. Make sure to read the risk factors on public filings. Do your own due diligence as I have a conflict of interest as I would benefit if share price goes higher. This is not investment advice. ___________________________________________________________________________________ Come hear my top picks for 2016 at the Vancouver Resource Investment Conference this Monday January 25 at Workshop 2, 11:40-12:00 pm. Register for free by clicking here… __________________________________________________________________________________________________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 Safest Countries If WW3 Breaks Out Posted: 19 Jan 2016 12:00 PM PST If the end of the world comes, some countries are safer than others. We'll show you the best places to hide out in the event everything goes wrong The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming Era of Financial Triage Posted: 19 Jan 2016 09:58 AM PST This post The Coming Era of Financial Triage appeared first on Daily Reckoning. Virtually every major program of every major nation-state is financially unsustainable going forward. Though triage is typically used in a medical setting, we are entering an era when financial triage will increasingly be necessary on a household, enterprise and national level. The term triage may have originated during the Napoleonic Wars from the work of Dominique Jean Larrey. The term was used further during World War I by French doctors treating the battlefield wounded at the aid stations behind the front. Those responsible for the removal of the wounded from a battlefield or their care afterwards would divide the victims into three categories: Those who are likely to live, regardless of what care they receive Those who are likely to die, regardless of what care they receive Those for whom immediate care might make a positive difference in outcome. financial triage is the process of sorting financial expenses/ programs that are unsustainable and cannot be “reformed”, those that cannot be saved except with systemic reforms, and those that will survive if simply scaled back. On the household level, financial triage becomes necessary when one of the primary wage earners lose their jobs and cannot find a replacement position. First to go are non-essentials such as cable TV subscriptions, eating out at restaurants, costly coffees from Starbucks, etc. But scaling back these modest expenses may not restore the household’s income to expenses balance. The major expenses of transportation, housing and healthcare may have to be sorted into what can be cut and what must be allowed to expire in order to save the household from insolvency and bankruptcy. A mortgage that exceeds the remaining wage earner’s income is an example of an expense that cannot be “reformed” away. Refinancing to a lower rate of interest may trim the monthly cost a bit, but the history of mortgage “reforms” suggests many if not most households that attempt to lower fundamentally unaffordable mortgage payments end up defaulting anyway. Slashing major expenses is not cost-free. Trying to reduce healthcare insurance costs boils down to accepting high-deductible plans that end up costing as much as gold-plated plans once the full deductible is paid in cash. Financial triage is intrinsically painful and wrenching. Corporations have much more practice in financial triage, as divisions or departments that aren’t generating profits are sold, closed or slashed to save what can still be salvaged. Nation-states typically have near-zero experience with financial triage. Programs are rarely ever shut down or slashed to the bone to save core functions; cuts are modest and as soon as the crisis passes, expenses soar as everyone who suffered minor cuts demands pay raises and benefits that restore whatever was trimmed. Virtually every major program of every major nation-state is financially unsustainable going forward. Every major program is funded by wages and profits, both of which will be eviscerated in the global recession that is just starting. Longer term, the demographics of a shrinking work force and the profit-destroying forces of automation render immensely costly social and military programs unsustainable. The idea that these trillion-dollar programs can be reformed/saved with minor cuts and policy tweaks is delusional; to save these programs, cuts must be deep and permanent–precisely what the status quo cannot accomplish because it is politically impossible to over-ride vested/ entrenched interests. Unfortunately, this inability to save what could be saved with deep cuts/ reforms means programs that could have been saved will collapse, and politically acceptable half-measures of “reform” will end up dragging other programs that could have been saved to the financial morgue. Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post The Coming Era of Financial Triage appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Dr. Doom" Stephen Hawking Humanity To be Wiped Out Posted: 19 Jan 2016 08:29 AM PST hawking is probably still a very well known theoretical physicist but that is overshadowed by men who fly around in armored suits saving the world and big green angry geniuses, or other smart men that are running around stone henge in the nude The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Deficits and T-Bond Fantasies Posted: 19 Jan 2016 08:08 AM PST Fantasy #1: My name is John Q. Public. I live a good life, make lots of money (never mind how) and have debts such as a mortgage on a great house – $375,000, a Cessna – $150,000 (my air force), and a sweet little two mast sailing ship – $78,000 (my navy). Also my wife and children (my army) spend a lot of money. My total credit card debt is $97,000. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Stossel -- The Matter of Marijuana Posted: 19 Jan 2016 08:00 AM PST Drug warriors continue to advocate a tail-chasing policy that serves the black market and the police unions. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Drop to Trendline Likely Posted: 19 Jan 2016 07:41 AM PST The dollar is "crawling" along its 60 dma. When it breaks and closes below the drop into the intermediate cycle low will begin. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texe Marrs -- Ted Cruz The Jewish Banker's Candidate Posted: 19 Jan 2016 06:23 AM PST Texe Marrs - Rense Monday Hour 1 Extended Jan 18, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THIS IS ONE OF THE MOST IMPORTANT VIDEOS YOU WILL EVER SEE ON AGENDA 21. ITS HAPPENING RIGHT NOW Posted: 19 Jan 2016 05:06 AM PST Shock photos in the newspaper that prove with 100% accuracy that the construction of the wildlands project and controlled cities is underway. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global BRITAIN - Daniel Hannan Posted: 19 Jan 2016 03:43 AM PST Daniel John Hannan is a British politician, journalist, and author who is a Member of the European Parliament, representing South East England for the Conservative Party. Wikipedia The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Remained Unchanged at $1091.50 Posted: 19 Jan 2016 03:26 AM PST

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Icke : The Public Is Programmed To Become Slaves Posted: 19 Jan 2016 02:51 AM PST David Icke talks to Alex Jones about how The Public Is Programmed To Become Slaves David Icke live on the Alex Jones Show on Wednesday 6th January 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Bottoming, but Bear Still Growling Posted: 19 Jan 2016 01:26 AM PST Indications suggest a stock market which is currently oversold and bottoming short term, but still has a long way to go to finish this bear. In fact, I believe we could see the SPX fall as low as the 940-950 area by October of this year as we enter the final innings of the crash phase of the 8 year commodity cycle. Gold and especially the gold miners are struggling even though we are showing positive COT figures. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil price Slump Leads To Shale 2.0, The Great Crew Change, And COP21 Posted: 19 Jan 2016 01:22 AM PST Alfidi Capital writes: The oil sector's bear attack shows no signs of abating. OPEC's Saudi-led push for huge overproduction is driving the US shale sector to the brink of collapse. The post-crash survivors can benefit from "Shale 2.0" technologies that keep their costs down. They will need every advantage they can get when the "Great Crew Change" makes finding human talent harder and the UN's COP21 protocols make hydrocarbon production less desirable. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The business of religion for some can be a very profitable profession to enter. Most people think of that sentence in the spiritual sense, but this article is about the physical worldly dollar.

The business of religion for some can be a very profitable profession to enter. Most people think of that sentence in the spiritual sense, but this article is about the physical worldly dollar.

No comments:

Post a Comment