Gold World News Flash |

- Protected: Gold Miners Added to Portfolio

- The gold investment demand juggernaut - Public buys dips, saves gold for rainy day

- Gold, Golf, & Silver … are Similar

- Richard Russell – Buy Physical Silver Ahead Of The Coming Chaos

- PEAK GOLD vs. PEAK SILVER: Must See Chart

- Shocker: Kitco finally implies that the gold market IS manipulated

- Bank of England Study: Gold is Best Money but Buying it Risks Offending U.S.

- Jim Sinclair: For China, Treasuries and gold are powerful weapons

- Gold Price Rose $4.50 Closing at $1,090.20

- What Kind Of Investor Are You? The Market Doesn't Care!

- The Rumblings of War

- Payrolls Preview: Goldman Expects Seasonal Bounce In Jobs But Warns Wage Growth May Disappoint

- Gold Daily and Silver Weekly Charts - The Decline and Fall of the Gold Trade on the Comex

- TF Metals Report: JPMorgan gold vault hubbub

- Denver International Airport Very Strange Fema Jade Helm 2015 FEMA SLEEPER CAMPS ACTIVATING

- Gold and Silver - Living With Rigged Markets

- China’s Secret Gold Hoarding Strategy

- Dave Kranzler: GLD looting continues

- Jeffrey Lewis: Living with rigged markets

- U.S. government -- er, JPM -- rescues Comex gold contract

- GATA is a beacon away from the financial swamp, not a stock picker

- Bank of England study: Gold is best money but buying it risks offending U.S.

- Where Is Gold Headed? Here Are The Cold, Hard Charts…

- En Garde! Dueling Fed Members

- I'll Be Buying Gold and Gold Miners Soon

- Gold Leasing Rates Suggest Tightness in the New York Physical Markets

- The Best Way to Buy Gold Today

- Greece, Guns, Bankers, & Gold

- Canaccord Genuity's Joe Mazumdar Tells Gold Investors to Go Underground to Survive

- Silver Institute to Expand Silver Promotion Service Jewelry Marketing Initiative

- Gold and Oil Heading Down for a Secular Count?

| Protected: Gold Miners Added to Portfolio Posted: 07 Aug 2015 12:39 AM PDT There is no excerpt because this is a protected post. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The gold investment demand juggernaut - Public buys dips, saves gold for rainy day Posted: 07 Aug 2015 12:22 AM PDT USA Gold | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Golf, & Silver … are Similar Posted: 06 Aug 2015 11:01 PM PDT GOLD: The precious metal that is globally recognized as real money, a store of value, beautiful, and as lasting savings. GOLF: The compelling game that is played globally, inspires millions, and... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell – Buy Physical Silver Ahead Of The Coming Chaos Posted: 06 Aug 2015 10:30 PM PDT from KingWorldNews:

Time For A Full-Fledged Bear Market? I'm afraid that if the Dow breaks under 17,000 and Transports below 8,000, we will be in a full-fledged bear market. The Nasdaq has become a key leading indicator. If the Nasdaq breaks below 5,000 this will be a very bearish indication. Economist John Williams continues to insist that the US economy is sinking into recession. The Fed must secretly agree with him, since they have still refused to raise short rates. If the Fed's refusal continues, the stock market will suspect that perhaps John Williams is correct in that the US economy is a lot weaker than advertised. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PEAK GOLD vs. PEAK SILVER: Must See Chart Posted: 06 Aug 2015 10:00 PM PDT SRSRocco Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocker: Kitco finally implies that the gold market IS manipulated Posted: 06 Aug 2015 09:20 PM PDT by Jeff Nielson, Bullion Bulls:

Equally, as we go through the daily torture of this endemic market manipulation, Kitco is also a great place for some good laughs. This is something that regular readers already know from previous posts which poked fun at its absurd claims and headlines. And that was my first inclination when I saw this headline today at Basher Central: Gold Weaker On Lack of Bullish News; U.S. Jobs Report Looms

But Kitco is also a source for a different form of ‘mining': Freudian slips. For those readers not familiar with this expression/cliche; a “Freudian slip” is when a person says or does something which shows that what they are thinking privately is different from what they are saying publicly. When I looked at this headline more closely; I spotted a great, big Freudian slip. Asserting that gold is “weaker” just because of a “lack of bullish news” is simply silly. Do we ever see a headline that the U.S. dollar was lower simply because of a “lack of bullish news”? No. How about U.S. Treasuries? No. What about Dow stocks? No…or any other market? No. Then I asked myself a simple a question? Why would any market go down, simply because of a “lack of bullish news”? There is only one rational answer to that question. A market would go down because of the absence of “bullish news” (i.e. upward pressure), if (and only if) there was some constant downward pressure on that market, independent of the fundamentals. And constant pressure on a market, independent of the fundamentals, has a name: M-A-N-I-P-U-L-A-T-I-O-N. When we consider what is implied by Kitco’s inane headline; we get a slightly longer, but much more rational headline: What does Kitco say, again and again, along with all the other Liars of the mainstream media? The gold market is NEVER manipulated. And they say this even after the gold “fix” was just changed, so that it would be LESS-MANIPULATIVE. But (as this headline implies) what the Liars are thinking is totally opposite. Note that the second half of the headline is entirely irrelevant, in terms of “fundamentals”, but highly relevant in terms of the Freudian slip. “Gold is lower because a U.S. jobs report is coming” is not a reason or explanation — at all. There is nothing fundamentally bearish for gold (or any asset class) about a U.S. jobs report. U.S. employment news (or any other economic news) only has an indirect impact on markets, and the impact is entirely dependent on whether the news was/is perceived as “good” or “bad”. But what have we seen on “jobs-report Friday”, again and again and again? Indeed, what did we used to see every month? Irrespective of whether the report was “good news” or “bad news”; the price of gold (and price of silver) would always go straight down, literally the instant the news came out (in other words, before anyone could possibly analyze it). There are two points which flow from this. 1) As has been explained to readers; any (and every) time a market goes straight up or straight down, this is a mathematical representation of an ACT OF MANIPULATION. The only, possible way that any market can ever move in that manner is via an act of brute-force manipulation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank of England Study: Gold is Best Money but Buying it Risks Offending U.S. Posted: 06 Aug 2015 09:00 PM PDT by Chris Powell, GATA:

A Bank of England policy study written in 1988 describes gold as “the ultimate store of value and medium of exchange” because it carries no counterparty risk but cautions against increasing the United Kingdom’s gold reserves because doing so might be construed as a negative comment on the U.S. dollar and thus would risk giving “great offense to the United States.” The study, written by Bank of England staff members, was located recently by gold researcher and GATA consultant Ronan Manly. The study concludes that the British government should seek ways of earning a return on the country’s gold reserves. The United Kingdom’s leasing of gold may have been encouraged by the paper — and certainly would have pleased the United States by helping to suppress the gold price and strengthen the dollar — though the bank told GATA in 2011 that the UK had stopped leasing gold in 2007: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Sinclair: For China, Treasuries and gold are powerful weapons Posted: 06 Aug 2015 07:36 PM PDT 10:35p ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: Mining entrepreneur and market analyst Jim Sinclair writes tonight that China will not take kindly to the International Monetary Fund's postponement of the inclusion of the yuan in the agency's Special Drawing Rights currency. China, Sinclair says, may retaliate by dumping U.S. Treasuries and blowing interest rates upward or forcing the Federal Reserve to monetize billions of bonds. China also may retaliate, he adds, by pulling the veil off the central bank gold market-rigging operation. Sinclair's commentary is headlined "The Rumblings of War" and it's posted at JSMineset.com here: http://www.jsmineset.com/2015/08/06/the-rumblings-of-war/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Rose $4.50 Closing at $1,090.20 Posted: 06 Aug 2015 07:03 PM PDT

Yet still no clear reversal signal from silver and gold prices. The GOLD PRICE has formed a pennant and is running out of time. Must break one way or th'other soon. Silver has drawn out a range from $15.00c to $14.25. We need some signal that removes all doubt. For starters, the price of gold must hold $1,180 and silver $14.25. Up above, gold price must break through $1,105 resistance and silver through $15. Actually gold needs a close above $1,094 first. My outlook and feelings have been swinging back and forth like a German Shepherd trying to watch the ball at a tennis match. I try to wring that out of what I write, but I'm as easy to read as 28 point type. Yesterday silver and gold prices looked puke-green puny. With the dollar turning around yesterday and following through downside today and with silver and gold prices perkier today and stocks skidding, everything looks rosier. I got to throttle back and be patient. Reality is on our side, so we can afford to be patient.

Most everything hangs on this Dollar Index. Should it drop from here and make a lower low than 96.36 (last low), it cancels the chance that the dollar will rise further. If it rises through 98.33, then the "dollar will keep rising" outcome is on. What happens to the dollar will affect silver and gold either like cholera or vitamin C. Euro rose 0.19 to $1.0924 but that changes nothing, just the yen 0.11% higher at 80.18 says nothing.

YEEE-HAAAAH! Dow in gold crossed below its 200 DMA today, closing at 16 oz against the 20 DMA at 16.03. Yes, yes. All indicators point unequivocally down. Dow in silver closed at 1,191.09 oz, also below its 20 DMA (1,200). Both the Dow in Silver and Dow in Gold are within a gnat's eyebrow of breaking their uptrend lines. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Kind Of Investor Are You? The Market Doesn't Care! Posted: 06 Aug 2015 06:15 PM PDT Via ConvergEx's Nick Colas,

In my 25 years doing just about every job in finance I have had the chance to meet a wide array of money managers. This experience has taught me that there are only three kinds of people that can reliably “Beat” the market once you put aside obvious inputs like competent risk management and a stress-resistant personality. These are:

All three types of investors/traders need the same thing to deliver the best results: asset prices that move at least somewhat independently of each other. After all, their special set of skills is in separating the wheat from the chaff, the good from the bad, or the stars from the airplane lights. The more those differences cause divergent prices, the higher the potential profit. For example, consider the S&P 500 – how many names in this index are up more than 20% on the year? The answer is 70 by our count, or just over 1 in 7. Only one name is a clean double in 2015: Netflix. Conversely, there are 60 names in the index that are down more than 20% but only three – Freeport-McMoRan, Consol Energy and Chesapeake Energy – are down by 50% or more. That leaves 372 names in the S&P 500 in a performance band of +20% to -20%. Close down the range to +10/-10%, and we count 197 names in that range. That’s 40% of the entire S&P 500 clinging to a pretty narrow band around the “Unchanged on the year” line. Another way to consider the question of how much opportunity there is in the S&P 500 and other asset classes is to look at stock price correlations – how much the individual sectors of the index move in tandem with the market as a whole. We look at this data on a monthly basis, and there are several tables and charts at the end of this note. Here’s our summary of this month’s numbers:

Now, the #1 question we get after we review correlations every month is “Why are they so high relative to long term historical norms?” Our answer is that Federal Reserve policy has been an unusually important factor in asset prices since 2009. The unusually easy monetary policy since that time (and its planning, implementation, and effect on the economy) has been a powerful unifying story in capital markets. Now, as the Federal Reserve moves to return the economy to a more “Normal” policy stance, correlations should drop. That they have not yet moved convincingly lower is a sign that equity markets may want to see the Fed actually pull the trigger. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Aug 2015 06:04 PM PDT The Rumblings of War Dear CIGAs, Shock of all shocks, the IMF announced the Chinese yuan will not be admitted into the SDR until at least Sept. 2016. http://www.bloomberg.com/news/articles/2015-08-04/imf-says-more-work-needed-before-yuan-reserve-currency-decision What exactly does this mean? I can tell you the gold community is so shell shocked and fearful at this point, it “must be bad for... Read more » The post The Rumblings of War appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payrolls Preview: Goldman Expects Seasonal Bounce In Jobs But Warns Wage Growth May Disappoint Posted: 06 Aug 2015 04:30 PM PDT Via Goldman Sachs' Karen Heichgott,

We forecast nonfarm payroll job growth of 225k in July, in line with consensus expectations. Reported job availability, the employment components of most manufacturing surveys, and ADP employment growth softened, but the employment components of most service sector surveys improved, particularly the ISM nonmanufacturing survey, which surged to its strongest level since 2005. Overall, the July data point to a gain roughly in line with the 223k increase in June. Arguing for a stronger report:

Arguing for a weaker report:

Neutral factors:

We expect the unemployment rate to hold steady at 5.3% in July, from an unrounded 5.285% in June. The headline U3 unemployment rate declined by 0.2pp in June, while the broader U6 underemployment rate declined by 0.3pp to 10.5%. Looking further ahead, we expect U3 to reach 5% by early 2016 and U6 to reach our 9% estimate of its full employment rate by the end of 2016. The participation rate showed a surprising drop of 0.3pp in June to 62.6%. However, the decline likely resulted in large part from a calendar effect caused by the timing of the reference week relative to the end of the school year (Exhibit 1), and we therefore expect an at least partial rebound in July. Exhibit 1: Calendar Effects Probably Depressed Participation in June We expect a 0.2% increase in average hourly earnings for all workers. While the July print should reflect some bounce-back from the flat read in June, this will likely be offset by the late timing of the reference week within the month. Average hourly earnings for all workers rose 2.0% over the year ending in June, while average hourly earnings for production & nonsupervisory workers rose 1.9%. Our Wage Tracker also stands at 2.0% year-on-year as of 2015Q2. While we expect wage growth to pick up somewhat by year-end, it will likely remain well below our 3.5% estimate of the full employment rate.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Decline and Fall of the Gold Trade on the Comex Posted: 06 Aug 2015 01:41 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: JPMorgan gold vault hubbub Posted: 06 Aug 2015 01:06 PM PDT 4p ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today finds suspicious inconsistencies in the gold warehouse data reported by CME Group for the New York Commodities Exchange. His commentary is headlined "JPMorgan Gold Vault Hubbub" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7046/jpmorgan-gold-vault-hubbub CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver International Airport Very Strange Fema Jade Helm 2015 FEMA SLEEPER CAMPS ACTIVATING Posted: 06 Aug 2015 11:56 AM PDT Denver International Airport Very Strange Fema Jade Helm 2015 FEMA SLEEPER CAMPS ACTIVATING The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver - Living With Rigged Markets Posted: 06 Aug 2015 11:39 AM PDT It’s enough that the mainstream financial media seems hell-bent of bashing gold. (Of course, silver gets hardly a mention). But GATA’s Chris Powell has been on a tirade of late, picking apart the lower hanging fruit of these theories and misplaced assumptions, if not outright desperate attempts to rationalize technically driven market prices. The following is answer to a gold insider is a must read. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s Secret Gold Hoarding Strategy Posted: 06 Aug 2015 11:33 AM PDT Stefan Gleason writes: China’s recent stock market gyrations have some analysts now calling China the biggest bubble in history. But those who write off China because of market volatility are missing a more important long-term trend of Chinese geopolitical and monetary ascendancy. That trend shows no signs of abating. China’s leaders have a clever strategy, and Western financial powers may someday wake up in shock when they realize what has occurred. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dave Kranzler: GLD looting continues Posted: 06 Aug 2015 11:15 AM PDT 2:11p ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: Many signs are developing of high demand for gold amid the recent spike down in prices, Dave Kranzler of Investment Research Dynamics reports today, like the bullion bank raiding of the exchange-traded fund GLD. Kranzler's analysis is headlined "Massive Shortages in Gold and Silver Developing -- GLD Looting Continues" and it's posted at IRD here: http://investmentresearchdynamics.com/massive-shortages-in-gold-and-silv... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jeffrey Lewis: Living with rigged markets Posted: 06 Aug 2015 10:35 AM PDT 1:35p ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: In his new commentary, "Living with Rigged Markets," Silver Coin Investor proprietor Jeffrey Lewis notes that the sort of questions GATA lately has been putting to supposed gold market analysts about the gold market apply well to the silver market too. Lewis' commentary is posted at Silver Coin Investor here: http://www.silver-coin-investor.com/Living-With-Rigged-Markets.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government -- er, JPM -- rescues Comex gold contract Posted: 06 Aug 2015 10:22 AM PDT 1:20p ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: Zero Hedge reports that a U.S. government agency -- that is, JPMorganChase & Co. -- rescued the New York Commodities Exchange gold contract from a default this week with a massive reclassification of metal from the "eligible" to "registered" category of warehoused metal. Zero Hedge's report is headlined "JPMorgan Helps Comex Avoid Gold Depletion, Boosts Registered Gold By 78% Overnight" and it's posted here: http://www.zerohedge.com/news/2015-08-06/jpmorgan-helps-comex-avoid-gold... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA is a beacon away from the financial swamp, not a stock picker Posted: 06 Aug 2015 08:48 AM PDT By Michael Ballanger Last night I was moored in a tiny pocket in a part of Georgian Bay called Port Rawson Bay in about 10 feet of crystal-clear fresh water, with huge pines and cedars around the shoreline and rocks jutting 40 feet out of the water but without a cell phone or Internet signal, and that was scary. (Almost as scary as the legions of mosquitoes that blanketed the mesh screens that separated us from them, thanks to hockey socks stuffed into holes in the canvas and citronella candles that the little bastards detest.) It was unusual at first but after about three hours with the brightest full moon illuminating the water with a glorious and almost haunting sheen, I decided to dig up my old iPod, where I had stored a bunch of audiobooks. I sat and sipped a fine pinot and listened to "When Money Dies" by Adam Fergusson, written in 1975, which provided an incredible account of the Weimar hyperinflation of 1921-1923. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. I had read it twice before but last evening, with no distractions other than the mournful loons calling each other, I came across a passage that I want to share with you: "What really broke Germany was the constant taking of the soft political option in respect of money. The take-off point therefore was not a financial but a moral one; and the political excuse was despicable, for no imaginable political circumstances could have been more unsuited to the imposition of a new financial order than those pertaining in November 1923, when inflation was no longer an option. The rentenmark was itself hardly more than an expedient then and could scarcely have been introduced successfully had not the mark lost its entire meaning. Stability came only when the abyss had been plumbed, when the credible mark could fall no more, when everything that four years of financial cowardice, wrong-headedness, and mismanagement had been fashioned to avoid had in fact taken place, when the inconceivable had ineluctably arrived." Think about the "constant taking of the soft political option in respect of money" and "financial cowardice, wrong-headedness, and mismanagement." Here is a magnificent book written 40 years ago about the abuse of fiscal power that sent extremely wealthy families into ruin and despair because of the blatant destruction of "currency," and those sentences above describe exactly what we have been living since 2001. When you are in the northern part of the southern part of Canada, where Mother Nature truly runs the show, you are humbled. If you have even a minor breakdown (which I did), you are immediately instilled with terror: You have no one to call; you have nowhere to go; and you have nothing to bail you out. You are at the mercy of the weather and your own ingenuity and whatever courage you can summon. No light, no heat, spoiled food, and bugs everywhere, but the very experience of finding a way by rigging a battery from the port engine to the systems engine so you can get the lights on and rowing to shore in a kayak to build a fire so you can fry up the big pike you caught using the spoiled food as bait -- well, it is at once as humbling as it is important. We have all been through a nightmare since 2011 and after reading Bob Moriarty's assault on GATA the other night -- http://321gold.com/editorials/moriarty/moriarty072715.html -- I was immediately overwhelmed with the concept of the term "grave dancing." I don't know Bob well but I think I can call him a friend and as much as I was a tad taken aback by his piece, what hit me was the inaccuracy of his premise. For me GATA is not nor has it ever been a stock picking Internet site; it is not a market-timing tout sheet; it is not a financial blog. GATA is, at least for me, a beacon -- and a wonderfully simple, uncompromised, independent light that began to shine on one thing and one thing alone: the constant taking of the soft political option in respect of money. On this point GATA is undeniably on the money. Further, has anyone in the financial blogosphere been more emphatic than GATA's Bill Murphy and Chris Powell in highlighting financial cowardice, wrong-headedness, and mismanagement as they pertain to the way central bankers and their political bum-boys have "managed" things since 1998? Multiple bubbles, flagrant violations of the rule of law, bailouts, bail-ins, TARPS, QEs, ZIRPs, and massive manipulations in all financial markets, all intended to protect the upper tenth of 1 percent of society from one thing: accountability. So when I forgot to check the three marine batteries in the boat and had a power failure the other night, I could not get down on one knee and beg the Georgian Bay Congress for a "rescue package." I had to get in the dinghy, row to shore, build a fire, cook that bony pike, get eaten by mosquitoes that could be superstars in the Calgary Stampede, row the food back to the boat, and feed the family. It's called accountability, and the price was paid. I just wish the Pest Protection Team could have saved my tender flesh from the onslaught of mosquitoes just as the other PPT stick-saves the billionaires from even a 10 percent haircut on their precious portfolio of NASDAQ start-ups. I have no charts to provide tonight; I have no "actionable ideas," to use the old stock-flogging phrase of one of the big retailers a few years back. I have no doubt that in terms of time, we are at a major bottom in the precious metals markets. But as you have seen, if you are early in this game, it is just the same as wrong because at the end of all parabolic moves (up or down), when they go vertical (think Shanghai), you are near the end of the move. Shanghai completed a vertical up move in June; had you shorted it in March, you had bleeding eye sockets by May. If you had the U.S. Treasury meeting your margin call and survived the drawdown, you are now up. Gold and silver are now meeting all the parameters of a vertical down move, but that is only in terms of the X axis, time. The Y axis is price, and since we don't have the U.S. Treasury as our sugar daddy, we have to trade only in the cash market and cannot use leverage. Eye sockets that bleed are no fun, especially when your eyes were taken out eight months ago and the blood bank won't even let you back in the building. One last point: When you think of the cretins who are managing markets these days, all you have to do is look at this: http://www.gata.org/files/BallangerIllustration-08-06-2015.jpg ----- Michael Ballanger is a market analyst based in Toronto who specializes in mining. He writes frequently for GATA Chairman Bill Murphy's LeMetropoleCafe.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank of England study: Gold is best money but buying it risks offending U.S. Posted: 06 Aug 2015 08:01 AM PDT 11a ET Thursday, August 6, 2015 Dear Friend of GATA and Gold: A Bank of England policy study written in 1988 describes gold as "the ultimate store of value and medium of exchange" because it carries no counterparty risk but cautions against increasing the United Kingdom's gold reserves because doing so might be construed as a negative comment on the U.S. dollar and thus would risk giving "great offense to the United States." The study, written by Bank of England staff members, was located recently by gold researcher and GATA consultant Ronan Manly. The study concludes that the British government should seek ways of earning a return on the country's gold reserves. The United Kingdom's leasing of gold may have been encouraged by the paper -- and certainly would have pleased the United States by helping to suppress the gold price and strengthen the dollar -- though the bank told GATA in 2011 that the UK had stopped leasing gold in 2007: Manly produces a text copy of the study at his blog at the Bullion Star Internet site here: https://www.bullionstar.com/blogs/ronan-manly/the-bank-of-englands-revea... A PDF copy of the study is posted at GATA's Internet site here: http://www.gata.org/files/BankOfEnglandGoldPolicyPaper-03-05-1988.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

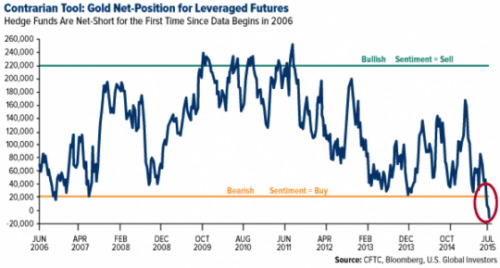

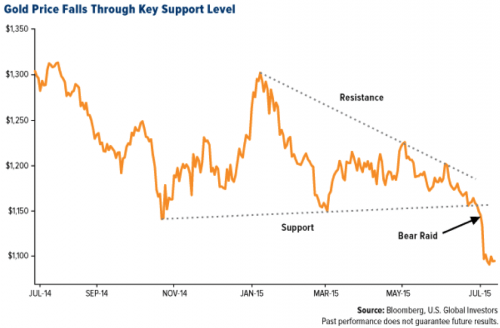

| Where Is Gold Headed? Here Are The Cold, Hard Charts… Posted: 06 Aug 2015 08:00 AM PDT This post Where Is Gold Headed? Here Are The Cold, Hard Charts… appeared first on Daily Reckoning. Dear Resource Hunter, The gold market is at its lowest point in 5 years. Right now, an ounce trades hands at $1,084. Naturally, gold bugs and bears alike have been giving plenty of speculation as to where gold is headed. I've seen downside calls as low as $350 per ounce and upside predictions above $2,000. For a second, though, let's cut the rhetoric and look at some cold, hard charts. Below, Frank Holmes gives a critical look on the gold market. Including a few indications that the Midas metal is a bargain… Gold on Sale, Says the Rational Investor The leveraged gold futures derivatives market is knocking down the precious metal, yet in massive contrast, this drop has ignited a shopping frenzy according to gold coin dealers. I spoke with several friends and industry experts last week who confirmed the record sales numbers for the month. In fact, American Gold Eagle sales reached 161,500 ounces in July, the highest monthly figure since April 2013. What gives? Gold often attracts conspiracy theories when it falls so abruptly, especially on Mondays. Interestingly, in a recent article on Zero Hedge, ABC Bullion out of Sydney, Australia, details some of the speculation behind the precious metal's beatdown, which I've also discussed in my blog. Price manipulation, or a "bear raid," could be a factor. Last week, gold prices experienced a mini "flash crash"—the first one in 18 months—after five tonnes of the metal appeared on the Shanghai market. Whether front-running or fat fingers are to blame, the sell order for what many are calling a bear raid was initially thought to have originated in China, but we now believe it came from New York City. Did investors anticipate China's negative flash purchasing managers' index (PMI) last week? China is the largest consumer of gold, and the PMI is a useful leading indicator of commodities demand as well as job growth. What about the Greek crisis? This type of debt fear crisis often has the effect of boosting the price of gold, but we didn't see that happen. Did European central banks sell gold down to dampen the psychological impact of the event? Understating the seriousness of the debt crisis may have prevented investors from seeking gold as protection. Conspiracy theories or not, I believe none of this tarnishes gold's sustainable allure. It's important to look at the two key demand drivers for gold: the Fear Trade and the Love Trade. The Fear Trade is related to money supply and negative real interest rates. The Love Trade comes from the purchase of gold due to cultural affinity and the rising GDP per capita in Asia and the Middle East. I've always advocated, and continue to advocate, a 10 percent weighting: 5 percent in gold stocks and 5 percent in bullion, then rebalance every year. From Crisis to Opportunity Take a look at the chart, which shows that the bearish trend is obvious.

And yet many investors are still buying. In an interview this week with Money Metals Exchange and in talking to Bart Kitner, founder of Kitco, both conversations confirmed that smart investors are enthusiastically buying gold during this downdraft in prices. Rational Investors Know a Deal When They See One, and Feel One With so much gloom and doom in the media surrounding gold right now, you might wonder why coin sales are soaring at multiyear highs. The reason is pretty simple: Gold is on sale.

High net worth individuals and other savvy investors realize that even now, as herds of people are rushing for the exit, owning gold is one of the best ways to manage systemic risk. They follow that Greeks had their cash in banks frozen like in Cyprus only a few years ago. Ray Dalio, founder of Bridgewater Associates, said it best: "If you don't own gold, you know neither history nor economics." Indeed, some investors fail to take a long-term perspective on gold. Their sentiment toward the metal extends only as far back as the most recent selloff, induced by the strong U.S. dollar, weak global manufacturing activity and fears that interest rates will soon rise. Many investors have that "sinking feeling" with a deterioration in global PMI, leading economic indicators, falling commodity prices and the threat of rising U.S. interest rates. Many have raised their cash levels due to decelerating global growth prospects. I've written that bad news is good news because when governments accelerate monetary policy, this can be a good opportunity for investors to add to their gold exposure.

I'm not the only one who takes this position. Besides the investors gobbling up American Gold Eagles, central banks around the world continue to buy, hold and repatriate bullion. The U.S. Federal Reserve maintains its 8,133 tonnes, the most of any central bank. Germany, the Netherlands and other countries have brought home mounds of the yellow metal in the last 12 months. China has increased its reserves 60 percent in the last six years. And Texas is in the early stages of establishing its own gold depository, the first state to do so. If there were no faith left in the metal, why would banks even bother with it? At the same time, massive amounts of paper money are still being printed. In fact, the International Monetary Fund has asked the Bank of Japan to be ready to increase its monetary stimulus further, according to Bloomberg. Let the paper printing roll! In the U.S., where quantitative easing was supposed to have ended back in October, the Fed's balance sheet is still within 0.3 percent of its all-time high, according to Sovereign Man. Based on Historical Volatility Models Gold Is Extremely Oversold Before the bottom fell out, gold's support seemed to have been around $1,150, whereas the resistance trend line was breaking down. The descending triangle pattern, seen below, indicates that demand was weakening and downside momentum was gathering force.

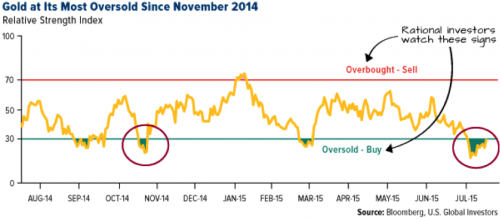

A useful tool that traders and analysts use is Bloomberg's relative strength indicator (RSI). Below is gold's RSI over the same one-year period. It shows that gold has passed below the 30 mark into oversold territory. When this happens, many analysts see it as a buying opportunity. Between November 3—the last time gold fell this significantly below 30—and January 20, the yellow metal ended up rallying 13 percent.

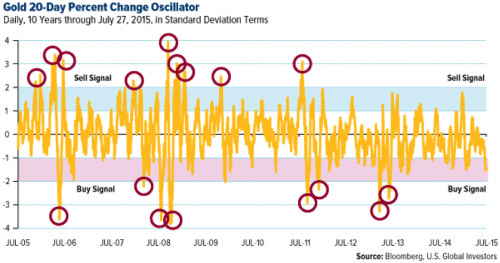

A similar tool we use to identify buy and sell signals is the price oscillator, which I often explain while speaking at conferences. This tool measures how many standard deviations an asset's value has moved from its mean (and in which direction). When the number crosses above two standard deviations, it's often interpreted as an opportunity to take some profits, and when it crosses below negative two, it might be a good time to think about accumulating.

Love Trade and Fear Trade: Gold's Tailwinds and Headwinds I always look at two demand factors for gold, the Fear Trade and the Love Trade. The Love Trade is the purchase of gold for weddings, anniversaries and cultural celebrations while the Fear Trade is gold's reaction to monetary and fiscal policies, particularly real interest rates.

Historically, the Love Trade has been on the upswing starting around this time—late July and early August—in anticipation of international festivals and holidays such as Diwali, Christmas and the Chinese New Year. But as you can see in the oscillator chart above, gold is down 1.4 standard deviations for the 10-year period. This suggests gold may be at an attractive level to accumulate, and gold stocks can offer greater beta when gold begins to revert to its mean. The Fear Trade, on the other hand, involves the Fear Trade and real interest rates (inflation – CPI = real interest rates). Several times in the past I've explained how gold tends to benefit when real interest rates turn negative. When the rate of inflation exceeds the yield on a five-year Treasury note, it makes gold much more attractive to many investors. At this time, the five-year Treasury yield sits at 1.58 percent while inflation is crawling along at 0.1 percent. This means that real rates are a positive 1.48 percent—a headwind for gold. As I told Daniela Cambone during last week's Gold Game Film, the U.S. has some of the highest real rates of return in the world right now. To see gold gain traction again, not only do we need to see negative real interest rates in the U.S. we need to see rising real GDP per capita in China and rising PMI in China. On a final note, there appears to be a battle between the debt markets and equity markets. The debt market yields suggest rates will not be rising next month or quarter, while equity markets suggest they will. I think the bond market is more accurate. With a struggling global economy and commodity deflation odds favor rates will not rise soon in America, and gold will revert back to the mean. Frank Holmes [U.S. Global Investors, Inc. is a boutique investment advisor specializing in emerging markets and natural resources. Their portfolio managers travel the earth researching opportunities and evaluating risk, all in the pursuit of exceptional performance for their funds. The company, headquartered in San Antonio, Texas, manages several no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.] The post Where Is Gold Headed? Here Are The Cold, Hard Charts… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Aug 2015 07:25 AM PDT This post En Garde! Dueling Fed Members appeared first on Daily Reckoning. Today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! Front and center this morning: we had two dueling Fed members speaking yesterday, both with differing opinions on rate hikes. I read what Chris had to write yesterday, regarding how it’s going to be some interesting trading heading into the September FOMC rate decision meeting. Well, then these two Fed members decided to speak their minds and now things are even more interesting! First, Fed member, Lockhart, Atlanta Fed President, had this hawkish statement: The bar is high for not acting in September and that it will take a significant deterioration in the economic picture to not hike rates this year. OK, so the markets heard that and reacted accordingly with the dollar receiving some love. But then along came Jones, Tall thin Jones, Slow walking Jones, slow talking Jones, Along came long, lean, lanky Jones. Well, not really, I don’t think for one minute that Fed member Jay Powell, resembles “Jones”, it was just a play on the lyrics, so please don’t accuse me of calling a Fed Member “slow talking”! But Fed Member Powell came out and defused the Lockhart statement by saying that “it is appropriate to wait and see data before deciding, in September, and if a rate hike is warranted, the path of rate hikes is likely to be gradual.” So, dueling Fed members! I love it! Nothing like confusion for the markets, when the Central Bank members don’t all sing from the same song sheet. UGH! Oh well, the markets don’t seem to care and they just kept buying dollars. And the currencies this morning are, for the most part, sitting with losses. You know, yesterday should have been a wake-up call for the people that make the calls on the economy. The U.S. Trade Deficit blew out the forecasts by widening to $43.84 billion, from $40.94 in May, and a forecast of $43 billion. So, you may be asking, why is this significant? Well, you see the U.S. Trade Deficit weighs on the economy — I don’t care what anyone says that’s contrary, it does in my mind. And why is it widening by so much these past few months? Well, that would be the stronger dollar. It won’t be long now and the boys and girls over at the “Trade Side” of the government, will be claiming that the government must do something about the stronger dollar, or else “trade” is going to come to a standstill. I remember the last time the dollar was stronger for more than a year, as it is now, and I even wrote about the trade side pounding their fists on the podium and asking for help. So it won’t be long now, folks. The Aussie dollar (A$) is down 1/3 of a cent this morning, but was down a full cent in the overnight trading sessions. You see, Australia printed their labor report last night, and although it had a surprise number for the unemployment rate, the overall report was quite good. So, it must have been a bout of profit taking after the huge move we saw in the A$ earlier in the week, because this labor report was just fine! The unemployment rate, as I said, surprised on the upside moving to 6.3% from 6.1% — which was the bad part — but other than that, monthly employment rose 38,500, and there was a very nice rise in the labor participation rate, which is opposite of what we see here each month! Across the Tasman, the New Zealand dollar/kiwi is the opposite of what’s going on in Australia with the A$… and kiwi is one of the few currencies carving out gains vs. the U.S. dollar this morning It’s not because of any strong data. I think it looks like investors switching from A$’s to kiwi, and we’ve seen this before, and it usually don’t last too long. So, let the Big Boys have their fun, and let’s sit this one out. In Germany this morning, German factory orders rose 2% in June. This beat the forecast for a 0.3% rise, and this marks the 3rd consecutive month that the actual beat the forecasts. And there was good news from the Eurozone. As a whole, the Eurozone July Market PMI (manufacturing index) printed at a much better 54.2 vs. the previous month’s print of 50.4. Things are looking up here folks. Is the recession a thing of the past now? I do believe so. But there are still worries about overall debt for the Eurozone, and until those worries dissipate, the euro will remain subject to bouts of weakness. Mom! He’s doing it again! HAHA! The “he” here would be Bank of England (BOE) Gov. Carney, and the “doing it again” is his insistence on continuing to talk about a rate hike, when there isn’t one, in reality. The pound sterling has seen some good performances lately and they are all tied to the talk of a rate hike by the BOE. But get this — the BOE already met today, and they voted 8-1 to keep rates unchanged. Now does that look like a Central Bank that’s on the edge of voting for a rate hike? I could go back to the days of Carney as the Gov. of the Bank of Canada (BOC) and he did the same thing there. And then last summer, when the pound began to rally, and it was all because of the rate hike talk by Carney. But a year has passed, and we haven’t seen a rate hike have we? And we aren’t going to see one either! That’s my opinion of course, and I could be wrong. But was I wrong when I realized what he was doing at the BOC and exposed his bag of promises? Was I wrong last fall when I told you that the pound’s rally would soon stop once the markets figured out that Carney was not going to hike rates soon? Oh. and the pound is getting whacked this morning on the news that it was an 8-1 vote in favor of remaining on hold. Well, there’s been a lot written about China in the past couple of weeks. But not much has changed. We still have the “believers and the non-believers” of China’s economy, currency, and the moves that China’s making to secure their place among the reserve currencies of the world. You all know what side of the fence I’m on. In fact, China should be using my mug as their poster child of progress, for I’ve been on their bandwagon since 2008, when I first recognized what they were doing with their currency swap agreements. The renminbi/yuan was allowed to appreciate a bit last night, but when will it be allowed to float? Well, that won’t be long now, I don’t believe, but even when it does float, it won’t be a “free float”, and it will be the dirtiest of the dirt floats. A dirty float is what we have with most currencies, in that they are subject to central bank intervention, where a central bank either buys or sells the currency, thus taking the “true market value” out of the currency and away from the markets. In Russia yesterday, Russian inflation for July rose 0.8% vs. June and 15.6% year on year. This was pretty much in line with the forecasts, but in my mind it has to be a reminder to the CBR (Central Bank of Russia) that they need to be careful with their rate cuts, as the inflation wolf is always at the door. The ruble has really lost some ground while I was gone, and is now back in the 62 range, which is quite a bit weaker than the 56 range the ruble was in not that long ago! The price of oil continuing to drop is not helping the ruble one iota. On a sidebar — I filled up the gas tank in my car before I left S. Florida earlier this week, and the price for a gallon of premium gas was $3.42. Then I filled up my gas tank here in St. Louis yesterday, and a gallon of premium gas was $2.69. Now, I know the price of gas has been dropping lately, but come on Florida! That’s ridiculous! Well, the U.S. data cupboard is not very full of data today for us to view. The usual weekly initial Jobless Claims will print, and the markets will begin to get ready for the Jobs Jamboree tomorrow. By the way, the ADP Employment Change report that printed yesterday, and is supposed to be a good indicator to what the BLS will have for us tomorrow, and it showed a drop in jobs added in July from 229,000 to 185,000. That’s not a good sign, but remember, the BLS plays games with the Jobs report, and I’ve become so disillusioned about the BLS report that I would like to just forget about it going forward. But the markets won’t forget about it, so I have to pay attention to it, even though I don’t want to! I feel like a little kid at night. But I don’t want to go to bed!… But I don’t want to talk about the BLS jobs report! And gold. UGH. Well, at least the shiny metal isn’t trading with red numbers this morning (losses). But the green numbers are very small. I saw where guitar playing friend, and investment guru, Dr. Steve Sjuggerud said in his most recent letter, that “gold sentiment is lower that it was in February 2001, when gold was around $260 an ounce.” But for all of that know Steve and his trading preferences, this is like manna from heaven for him. Steve has always looked for things that people hate the most, like real estate a few years ago, and then he buys them cheap. Well, I’ll be waiting to hear when the good doctor decides that enough investors hate gold. Well, this news almost slipped right by me. And it’s not good news, as far as I’m concerned, for my view on what’s going to happen to all this dollar strength. But it is what it is, and there’s nothing I can do to change that. I saw this in the 5 Minute Forecast yesterday and Chris’ comments. and about had a heart attack, for I had not seen nor heard of anything near to this. I’m so depressed right now. Here you go: The International Monetary Fund issued a report yesterday saying the Chinese renminbi still isn’t ready for inclusion on the IMF’s “super currency,” formally known as the special drawing right (SDR). At present, the SDR comprises the dollar, the euro, the British pound and the Japanese yen. “China wants to do what the U.S. has done,” our Jim Rickards explained in this space last May, “which is to remain on a paper currency standard but make that currency important enough in world finance and trade to give China leverage over the behavior of other countries.” China will get there — but apparently not this fall, when the IMF is set to formally decide whether to rejigger the SDR. Still, the report left the door open for revisiting the issue next year instead of waiting until the next review in 2020. Chuck again. Well, I want to thank my friend, Dave Gonigam, for his keeping his readers up to date on this. Like I said, I missed it completely, but then I was on vacation! I have to wonder what I’ll do now, given all that I’ve put into the thought that this was going to happen this fall, and that would be the end of the dollar strength. Back to the drawing board, and square one. That’s it for today. I hope you have a tub thumpin’ Thursday! Regards, Chuck Butler P.S. The Daily Pfennig is first published everyday, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post En Garde! Dueling Fed Members appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| I'll Be Buying Gold and Gold Miners Soon Posted: 06 Aug 2015 05:46 AM PDT Dr. Steve Sjuggerud writes: Nobody is expecting a crisis (similar to the one Greece just had) in the U.S., so the prices of classic "hard assets" – like gold and gold miners – are attractively priced today. The price of gold – astonishingly – is at a five-year low. Compare that with stocks, which have run up for six consecutive years. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Leasing Rates Suggest Tightness in the New York Physical Markets Posted: 06 Aug 2015 05:42 AM PDT Gold rarely sees a pronounced backwardation in the futures markets, as we see in some other commodities. Even a slight backwardation over a period of time is unusual. This might be related to the lack of heavy physical delivery coming out (being withdrawn) from the Comex complex, especially in recent times where the number of potential claims are much greater than the ounces of physical bullion actually available for delivery. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Best Way to Buy Gold Today Posted: 06 Aug 2015 05:38 AM PDT Peter Krauth writes: At $1,084 per ounce, gold is scraping multiyear lows, down 42% in four years. And it seems the gold bears dominate the headlines – everywhere you look, each news item seems more negative than the last. There have been calls for gold to hit $800… and even lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Aug 2015 02:43 AM PDT Survive the Crisis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canaccord Genuity's Joe Mazumdar Tells Gold Investors to Go Underground to Survive Posted: 06 Aug 2015 01:00 AM PDT Unlike many analysts, Joe Mazumdar of Canaccord Genuity does not expect a substantially higher gold price any time soon. So what are hard-pressed gold investors to do? In this interview with The Gold Report, Mazumdar argues that they should seek high-grade resources—usually underground—in stable jurisdictions that benefit from the strong American dollar. And he highlights seven near-term developers that offer exactly that. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Institute to Expand Silver Promotion Service Jewelry Marketing Initiative Posted: 05 Aug 2015 09:32 PM PDT New Merchandise Category for Savor Silver Program Participants to be introduced (New York, NY – August 5, 2015) — The Silver Promotion Service (SPS) announced that it is expanding the Savor Silver program (www.savorsilver.com) to include a new merchandise classification. Currently silver jewelry companies selected to participate in Savor Silver are designated as “Designers of Distinction” or “SilverMark Partners”. New participants will be identified as “Silver Style Partners” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Oil Heading Down for a Secular Count? Posted: 05 Aug 2015 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

There are two items that bother me: One, the S&P has had 7 distribution days recently, and two, Apple stock is in full correction mode, down 14% from its recent high, and now below its 200-day moving average. Apple stock is widely held by mutual funds and hedge funds, and its capitalization is so huge that the stock can move markets.

There are two items that bother me: One, the S&P has had 7 distribution days recently, and two, Apple stock is in full correction mode, down 14% from its recent high, and now below its 200-day moving average. Apple stock is widely held by mutual funds and hedge funds, and its capitalization is so huge that the stock can move markets. Getting in front of my computer this morning, I started (as I often do) by perusing the headlines of Basher Central. Obviously one does not do this to be “informed” on precious metals markets, or the economy as a whole. However, it is a good place to identify the propaganda themes of that particular day.

Getting in front of my computer this morning, I started (as I often do) by perusing the headlines of Basher Central. Obviously one does not do this to be “informed” on precious metals markets, or the economy as a whole. However, it is a good place to identify the propaganda themes of that particular day. Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:

No comments:

Post a Comment