Gold World News Flash |

- Some Clear Thinking About the Price of Gold

- Yield Purchasing Power: $100M Today Matches $100K in 1979

- Rapidly Mounting Evidence of the Inevitable Precious Metals Shortage

- Richard Sauder - State Of A Dying Planet

- China is Spending 11.6 Million Annual Incomes Per Day Propping Up Stocks

- Avery Goodman: U.S. guarantees Comex gold, hastening offtake there

- Bill Murphy: Silver Shortages In The Fall?

- James McShirley: Kitco inadvertently acknowledges that the gold price is suppressed

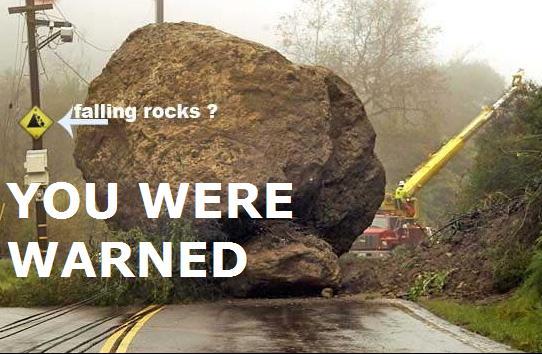

- GUEST POST: They will say “YOU WERE WARNED”!

- IMF staff review recommends delaying currency basket adoption of yuan

- Plunge Protection Team Now Working Overtime To Hold Off The Inevitable Collapse

- They Live, We Sleep: A Dictatorship Disguised As A Democracy

- Chinese Stock Short Squeeze Stalls After IMF Delays Decision On Yuan SDR Inclusion

- Greece, Gold, And Are People Really Prepared For A Bank Collapse?

- Fed Lunacy Is To Blame For The Coming Crash

- North Carolina: Feds charge 3 men accused of prepping for martial law

- Some Clear Thinking About The Price Of Gold

- Peter Schiff: What If "They" Are Wrong (Again)?

- Gold Daily and Silver Weekly Charts - Meh

- Venezuela : A Lesson The World Will Forget - Mike Maloney

- Stefan Gleason: Five extraordinary things that will shake up precious metals

- Something BIG is about to happen! Signs of the end times (July 27-Aug 3 2015)

- Gold Investing: Use the Cockroach Strategy

- Is Gold Doomed?

- Why The US Dollar Will Collapse | Peter Schiff and Stefan Molyneux

- Economist: Socialism To Remain After Financial Collapse

- Windows 10 -- More Big Brother Intrusion

- Why the Government Hates Gold

- Hugo Salinas Price: Will China play the 'gold card'?

- Gold: Accumulation With Prudence

- A Sneaky Way to Grab Your Retirement Savings

- Gold Sentiment Is Just Ugly

- China’s Coming Currency Devaluation

- John Stossel - Global Warming Superstars

- The Next Energy Sector Collapse — Coming SOON…

- RED ALERT -- RFID "Implantable's Are Coming" Obamacare 2017

- Gold is Still a Falling Knife: Why I Remain Bearish in the Short Term

- Investment Silver Demand Draining COMEX Vaults

- Plan for Surviving Gold's Summer of Discontent

| Some Clear Thinking About the Price of Gold Posted: 05 Aug 2015 12:00 AM PDT from Sovereign Man:

Then came a correction; the price started falling, and gold is now on track for 2015 to be its third down year in a row. What's incredible is that, despite its history of gains, and 5,000 years of tradition behind it, gold is rapidly becoming one of the most widely despised assets. |

| Yield Purchasing Power: $100M Today Matches $100K in 1979 Posted: 04 Aug 2015 11:53 PM PDT by Keith Weiner

I wrote a story about poor Clarence who retired in 1979, and even poorer Larry who retired last year. I created these characters to challenge the notion of calculating a real interest rate by subtracting inflation. The idea is that the decline of a currency can be measured by the rate of price increases. This price-centric view leads to the concept of purchasing power—the amount of stuff that a dollar can buy. It's the flip side of prices. When prices rise, purchasing power falls. Recall in the story, Clarence retired in 1979. At the time, inflation was running at 14% but he could only get 11% interest. Real interest was -3%, and Clarence had a problem. He was losing his purchasing power. Suppose Clarence bought gold. The purchasing power of gold held steady for the rest of his life (see this chart of oil priced in gold). Gold does solve this problem. However, gold has no yield. Clarence is only jumping out of the frying pan and into the fire. Sure, he escapes dollar debasement, but then he gets zero interest. Let's look at how zero interest impacts Larry. He makes $25/month on his million dollars. Obviously he can't live on that. So he gives up his nest egg, for eggs. For a year, he feasts on omelets. Since inflation was Through the lens of purchasing power, we don't focus on the liquidation of Larry's wealth. We ignore—or take it for granted—that he's trading his life savings for bread. We only ask how many loaves he got.

If you had a farm, would you consider trading it away, to feed your family for a year? I hope not. A farm should grow food forever. Its true worth is its crop yield, not the pile of bacon from a one-time deal. How perverse is that? It's nothing more than what zero interest is forcing Larry to do. A dollar still buys about as much as it did last year. Larry's purchasing power didn't change much. However, debasement continues to wreak its destruction. Steady purchasing power does not mean that the dollar is holding its value. It means that prices are wholly inadequate for measuring monetary decay. Our monetary disaster becomes clear when we look at the collapse in yield purchasing power. This new concept does not tell you how many groceries you can get by liquidating your capital. It tells how much you can buy with the return on it. In 1979, Clarence's $100,000 savings earned enough to support his middle class lifestyle. In 2014, Larry's million dollars didn't earn enough to pay his phone bill. To live in the middle class, Larry would need over a It also shows that the productivity of capital is collapsing. Back in Clarence's day, businesses earned a high return on capital. It was high enough for Clarence to get 11% interest in a short-term CD. Unfortunately, the dollar rot is in the advanced stage now. There is scant interest to be earned. Return on capital is low, and so borrowers can't pay much. Retirees suffer first, because they can't earn wages. Normally they would depend on interest, but now they're forced to live like the Prodigal Son. They consume their wealth, leave nothing for the next generation, and hope Purchasing power may look fine, but yield purchasing power shows the true picture of monetary collapse.

This article is from Keith Weiner's weekly column, called The Gold Standard, at the Swiss National Bank and Swiss Franc Blog SNBCHF.com. |

| Rapidly Mounting Evidence of the Inevitable Precious Metals Shortage Posted: 04 Aug 2015 11:00 PM PDT by Andrew Hoffman, Miles Franklin:

Less than two months later after this photo was taken, nearly every bullion dealer sold out of silver, causing the Cartel to execute the heinous "Sunday Night Paper Silver Massacre" on a thinly traded Sunday night, in which China was closed for a holiday. Which, by the way, looked eerily like last month's "Sunday Night Paper Massacre II" – only this time, the Cartel's primary target was gold. Today, the TSX-Venture sits at an all-time low of 593 – having just breached 2008's spike bottom low of roughly 600 – and the only reasons it is not significantly lower are 1) dozens of miners have since gone bankrupt, causing their stocks to be delisted; and 2) the "new" TSX-Venture houses a significant amount of non-mining stocks – which, by the way, have been artificially "goosed" by historic Central bank easing and PPT support, both overt and covert. Frankly, on an "apples-to-apples" basis with the TSX-Venture's 2008 composition, I'd guess it's trading closer to 200 than 593, down roughly 95% from its 2007 high. |

| Richard Sauder - State Of A Dying Planet Posted: 04 Aug 2015 11:00 PM PDT Clip from August 03, 2015 - guest Richard Sauder on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| China is Spending 11.6 Million Annual Incomes Per Day Propping Up Stocks Posted: 04 Aug 2015 10:30 PM PDT by Graham Summers, Gold Seek:

This theme was driven by the view that somehow China had obtained the magic balance between free-market capitalism and Central Planning. Globally analysts breathlessly talked about China's insatiable demand for commodities as its economy grew by double digits for three decades straight. Unfortunately all of this overlooked basic common sense… that China was actually just one giant debt-fueled fraud in which the politically connected got rich skimming off the top of an endless sea of loose money funneled into dodgy investments and projects. |

| Avery Goodman: U.S. guarantees Comex gold, hastening offtake there Posted: 04 Aug 2015 09:15 PM PDT Demand for Physical Gold Deliveries Doubles in August By Avery Goodman Last month I wrote about an usual situation at the COMEX futures exchange: http://seekingalpha.com/article/3227026-gold-market-tightness-puts-comex... At that time, only 376,000 ounces of gold were available to back up a delivery requirement of about 550,000 ounces. A day later, JPMorgan Chase bailed out the clearing firms that handle short-side speculators, adding enough registered gold to meet deliveries. In the article, I reached several conclusions. First, given that commercial for-profit institutions don't normally put themselves at financial risk to bail out their competitors, it was likely that JPMorgan was an agent of the U.S. government. I also concluded that the Comex is an excellent place for large physical gold buyers to source gold. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: It appears that many physical gold buyers have now caught on. This month the physical gold that must be delivered by short sellers has almost doubled. As of the first notice day of the August delivery month, short sellers are obligated to deliver a total of 921,500 troy ounces of real physical gold. That amounts to an unprecedented 28.7 tons. It is unusual to see so much delivery demand at COMEX because it is normally a purely paper market. However, the event fits right in with what is happening worldwide. Wall Street's paper-gold gamesters may have lost interest in the yellow metal, but the physical gold market is on fire. Meanwhile, the London gold market is very tight, as nations and institutions repatriate gold the bullion banks are supposedly "storing" there for them. As I noted in the last article, if physical gold demand in 2015 continues the trend set in Q1 2015, demand will total 5,200 tons this year. It is actually way ahead of that now. For example, Indian gold imports in April and May 2015 were actually up by a massive 61 percent! Meanwhile, the Society of Mining Professors says that the supply (including newly mined, scrap, and gold from exchange-traded fund dishoarding) will amount to only 3,845. That means there will be a deficiency of 1,345 tons if gold demand rises by only 19 percent for the entire year. ETF sales filled the deficit in 2013. But who will fill the deficit this year? And who already filled the 600-ton deficit in supply over demand back in 2014? The answer is controversial. No doubt a few bullheaded angry comments will take issue with my conclusion that the supplier of last resort is the U.S. government. But someone is supplying a huge amount of physical gold that cannot be accounted for in any other way. I discussed the available evidence in greater detail here -- http://seekingalpha.com/article/3247676-did-comex-just-receive-a-physica... -- so I won't repeat myself. Regardless of where the gold is coming from, whoever generously decided to bail out smaller Comex clearing members back in June caused physical gold buyers to take notice. Backwardation in London implies very tight gold supplies. Arbitragers seem to have little or no confidence that the physical gold they sell today can be replaced tomorrow by a forward contract on delivery. Frustrated physical buyers seem to be in the first stages of shifting their buying to the New York futures exchanges. This trend is not surprising. After seeing what appeared to be a covert bailout in June, many would naturally conclude that Comex deliveries are backstopped by the U.S. government. Such a guarantee is not available if you buy from a London LBMA member bank. Illustrating the tightness of worldwide gold supplies, registered August COMEX gold stockpiles are once again down to 376,000 ounces of gold. That is nearly the same as just before the bailout in June. This time the same amount of gold faces physical delivery demand of 921,500 troy ounces, compared to 550,000 ounces then. The hot-money momentum chasers have been caught naked short again. Their clearing brokers don't have physical gold to back up their clients' positioning. Being "naked" short is not illegal in the futures market, but a situation like this would ordinarily put short sellers into a severe short squeeze. The "supplier of last resort" prevented that from happening, and it will probably prevent it again. This time it could be accomplished in a way that does not show up, at least so obviously, in the officially published reports. Speculators at Comex play an important role in destabilizing gold prices, both on the way up and down. Let's compare the overall situation now to the situation that existed in 1980. Back then gold skyrocketed from less than $400 to more than $850 per troy ounce in a few months. The demand for paper gold at Comex was on fire but the physical market dried up when prices rose above $400. Upside manipulators were the ones in full control back then. The "supplier of last resort" (the U.S. government) was a hapless nobody when it came to influencing market prices. The Treasury repeatedly tried and failed to control the rise of gold prices, in an up-front and honest manner, by openly selling large quantities of physical gold reserves. It didn't work. Though the physical market for gold died, upside Comex manipulators continued being successful in catalyzing Wall Street-centric paper gold demand. That physical buyers had stopped buying didn't seem to slow them down one bit. For some reason the people on Wall Street paid no attention to the dead physical market, just as they now paying no attention now to the fact that it is booming. In short, in 2015 we see the polar opposite of what happened in 1980. Real-world demand is up dramatically. Up by more than 19 percent in Q1. Since Q1 physical demand has zoomed even higher. It is almost a certainty at this point that the total amount of physical gold sold in 2015 will far exceed the record set in 2013. There is little ETF gold left to liquidate. Thus, as in 2014, some mysterious (or not-so-mysterious) entity must fill the gap. Mining companies and just about everyone else involved in the gold market quietly accept Comex-derived prices as a starting point for setting the price of real gold. They do this for a good reason. They have no choice. Demand may be far outstripping all known sources of supply, but someone is supplying the market with enough gold to meet that gap. The crux of it is that Comex paper players catalyzed higher and higher prices back in 1980, just as they are now catalyzing lower and lower prices. Back then they did it without any government assistance and in the midst of haphazard government attempts to sell physical gold openly. Wall Street denizens bought huge quantities of paper gold. Now Wall Street denizens are selling huge quantities of paper gold short. The Wall Street futures market players conclude that the yellow metal will continue to go down forever. That is the polar opposite of the conclusion their ancestors reached, which was that prices would continue to go up forever. Back then, as prices peaked, bullion bankers went short. Now bullion bankers are accepting the long side of every short position Comex speculators choose to sell. The record physical demand for delivery of real gold at Comex is important. Paper gold is not entirely immune to the realities of the physical world. Physical demand is an economic knife that can kill the Comex market if the supplier of last resort ever stops filling the gold supply deficiency. So far, of course, all we have seen are tiny cuts that can be mended by new bailouts. But reality is forcing its way into the fantasy. The big question is what happens next. Will prices suddenly zoom upward, dramatically, similar to the way prices collapsed in 1980? This is not likely. Remember that back then there was no "buyer of last resort" willing and able to support excessive pricing. Now a "supplier of last resort" will significantly delay what would otherwise be a sudden and violent process of price adjustment. The ability to set worldwide gold prices is important. Stable or slowly advancing gold prices mean doom for government-sponsored paper and electronic currencies, particularly for the reserve function of the U.S. dollar. Everyone is well aware of that. Everyone is also aware that the fantasy at Comex will retain its power over world prices only as long as the exchange can deliver on its promise of physical gold. It is ironic that pricing power relies upon a promise that Comex clearing members are rarely required to keep. The presumed ability to take delivery of real gold at maturity maintains the credibility of Comex pricing, regardless of how far the paper market moves out of synch with physical markets. But if the promise were to be suddenly broken, the pricing power would evaporate overnight. That is exactly why the "supplier of last resort" will bail out Comex clearing members again. They matter for now. For it is faith, and not fact, that drives human emotion and decision making. The bailouts and the steady flow of gold to the other physical markets are all attempts to keep that faith alive until the powers-that-be decide that the price of gold should rise significantly. Because physical buyers have discovered Comex, the exchange will be called on its promise of delivery more frequently. If prices stay low or go lower, the physical knife will cut deeper. The hemorrhaging of yellow metal reserves will flow faster and faster until not even the supplier of last resort can staunch it. Playing a seller, in a fantasy forum, where "sellers" don't have what they purport to sell is fun and easy when buyers don't have money to buy. Once buyers have money, the rules change. The games becomes unpleasant. The gaming casino becomes more difficult to manage. That is important, because physical gold buyers are quite different than their undercapitalized hedge fund manager counterparts. For example, the buyers who will take delivery this month have deposited the full cash value of 921,500 troy ounces of gold. The June bailout saved some Comex clearing members from doom, but it also provided the perception that the U.S. government stands behind Comex deliveries. As the delivery months pass, the demand for forcing physical gold out of Comex will grow ever larger. Will Comex implode? Not necessarily. There are more bailouts to come. World gold price control is a precious resource, as explained in detail here: http://seekingalpha.com/article/3247676-did-comex-just-receive-a-physica... It will not be relinquished easily. But reliable forecasts are suggesting that total gold supplies, including mining, scrap, and ETF selling in 2015 will amount to 4,155 tons, which is 695 tons less than in 2013. Similarly, supplies are expected to shrink even further, to 3,585 tons in 2016, 260 tons less than in 2015. And demand will go higher if prices stay this low or fall further. In 2013 there was a large deficiency of gold, but it was washed away by equally large ETF redemption. In 2014 there was a deficiency of about 600 tons. This year the deficiency looks certain to be at least 1,350 tons. In 2016 there's a decent chance of a 2,603-ton deficiency if current demand trends hold. Even if the supplier of last resort has 8,100 tons of gold on hand, how long can this go on? If the goal is to prevent re-establishment of gold as the world's reserve currency (which it probably is), that goal can be achieved without throwing away all gold reserves. It is much easier and cheaper to catalyze excessive volatility. Systematic price suppression over the next few years is going to be impossible. But the yellow metal will lose more credibility in its supposed role as money if it rises to $4,000 and then collapses to $1,800 than if it is artificially forced to stay at or below a more or less reliable price of $1,100 per ounce. The laws of economics are just as true today as they were back in 1980. Prices must eventually reach a level at which physical demand approximately equals physical supply. That process can be delayed by a determined entity that holds huge amounts of gold and is willing to throw that gold away for a while. But it cannot be delayed forever. Once the big banks are heavily net long, the short-selling speculators had better watch out. Their clearing brokers still won't have any gold, and when the supplier of last resort cuts the spigot, they will find themselves desperately trying to find physical gold at any price. Of course we don't know when that will happen which makes the situation far too dangerous to trade in the short or medium term -- unless you have deeply corrupt connections to policy makers. But what we have now is a nearly perfect situation for long-term investors. With no end in sight to booming physical demand at anything near these prices, gold prices must rise. When the price is finally allowed to do that, it will probably do it by a very large amount. Those who can just buy and hold will be in very good shape. For institutions and the very wealthy, Comex remains the best forum in the world right now. Up to about 9 tons per month can potentially be sourced there, and given the bailouts, there is little chance of default, at least in the near future. It is also possible to game the system and pay a lower premium by the clever use of options. You can surprise everyone by exercising them at maturity, converting to futures contracts and demanding delivery before the exchange has a chance to change the rules. But the minimum delivery at Comex is approximately 100 ounces. That makes it an unaffordable option for small investors. Gold coins and small bars are an alternative. Deliverable trusts, like the Sprott fund (PHYS), are also options, but the yearly fee is high. The Sprott fund is better than the exchange-traded funds GLD and IAU, which also have high storage fees but have no mechanism for physical delivery to small investors. Also, Sprott vaults its gold at the Royal Canadian Mint as opposed to a highly leveraged bullion bank. That means its gold is in safer hands. Of course another way you can take a long-term position in gold is by purchasing shares of gold mining companies. But this means you must accept management and political risk on top of the basic risk involving the price of gold. ----- Avery Goodman is a securities lawyer in Colorado and a close observer of the gold "market." Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bill Murphy: Silver Shortages In The Fall? Posted: 04 Aug 2015 08:39 PM PDT from The News Doctors: Jason Burack and Eric Dubin are back for Episode #5 of the Welcome to Dystopia podcast! Today’s special guest is Chairman of the Gold Anti-Trust Action (GATA) Committee http://www.gata.org/. |

| James McShirley: Kitco inadvertently acknowledges that the gold price is suppressed Posted: 04 Aug 2015 08:22 PM PDT By James McShirley How do you mention manipulation without actually saying it? Well, if you work for Kitco and your name is either Neils Christensen or Peter Hug you do it this way: http://www.kitco.com/news/2015-08-03/U-S-Mint-Reports-469-YoY-Increase-I... Christensen: "The one bright spot for the precious metals market appears to be the physical market as the U.S. Mint reported a 469-percent increase in July coin sales compared to last year." Then Christensen hands it off to Hug: "It is not just the mint that has seen unprecedented demand for bullion as prices significantly dropped last month. In his morning commentary, Peter Hug, global trading director for Kitco.com, said that many bullion dealers have been struggling to obtain a supply of silver coins and small gold bars. However, he added that he does not see this reemergence of physical bullion to help support prices as gold trades under $1,100 an ounce and silver under $15 an ounce." ... Dispatch continues below ... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Huh? So the one bright spot is the actual stuff flying off the shelves? If the physical market is on fire as Neil so coyly reports, then why are there any dull spots? And Mr. Hug declares that not even phenomenal physical demand can overcome the derivative-induced malaise! Neils and Peter both just inadvertently admitted manipulation without ever saying the "M" word. When the only "bright spot" happens to be rip-roaring demand for the actual product, you know you have an out-of-control cartel using derivatives to suppress market prices. If all the collective commodity producers on the planet could ever understand how gold is the linchpin for the suppression of their collective products, GATA would have a million members. In the meantime we have $3 corn, $9 beans, $2 copper, and a gold suppression scheme on steroids. The financial tail continues to wag the working dog. Gold's days of being pinned to the mat are getting numbered. The clock is ticking. The exchange-traded fund GLD is methodically raided, the U.S. Mint is drained, and the Comex shelves are all but bare. All that's left is the potential for a huge rally. Maybe now Kitco could be so kind as to lease the gold in its client pool accounts to the cartel? That ought to buy another week or two of suppression. It's the least they could do as dutiful apologists for their bullion bank buddies. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GUEST POST: They will say “YOU WERE WARNED”! Posted: 04 Aug 2015 08:15 PM PDT by Bill Holter SGT Report:

After the biggest financial and social crash in history occurs, “they” will say you were warned! Who are “they” and how exactly were we warned? For several years and in particular the last 12 months, the IMF (International Monetary Fund) and the BIS (Bank for International Settlements) have been issuing warning after warning. They have truly warned us as I will show you. Do I believe they did this out of the goodness of their hearts? No, I believe it has been in “c.y.a” fashion followed by their laughter because the sheep have and will sleep through it all until it’s too late.

Thanks to Larry White from www.Lonestarwhitehouse. July 2014 – BIS –BIS Issues Strong Warning on “Asset Bubbles” July 2014 – IMF –Bloomberg: IMF Warns of Potential Risks to Global Growth October 2014 – BIS –“No One Could Foresee this Coming” October 2014 IMF Direct Blog — What Could Make $3.8 Trillion in global bonds go up in smoke? October 2014 IMF Report –“Heat Wave”-Rising financial risk in the U.S. ******** December 2014 – BIS –BIS Issues a new warning on markets December 2014 – BIS —BIS Warnings on the U.S. Dollar February 2015 – IMF – Shadow Banking — Another Warning from the IMF – This Time on “Shadow Banking” March 2015 – Former IMF Peter Doyle – Don’t expect any warning on new crisis -Former IMF Peter Doyle: Don’t Expect any Early Warning from the IMF – *******April 2015 IMF – Liquidity Shock –IMF Tells Regulators to Brace for Liquidity Shock May 2015 BIS – Need New “Rules of the Game” –BIS: Time to Think about New Global Rules of the Game? June 2015 BIS Credit Risk Report –BIS: New Credit Risk Management Report June 2015 IMF (Jose Vinals) –IMF’s Vinals Says Central Banks May Have to be Market Makers *******BIS June 2015 (UK Telegrahph, no blog article) —The world is defenceless against the next financial crisis, warns BIS July 2015 – IMF – Warns US the System is Still Vulnerable (no blog article) —IMF warns U.S.: Your financial system is (still) vulnerableJuly 2015 – IMF – Warns Pension Funds Could Pose Systemic Risk (no blog article) –IMF warns pension funds could pose systemic risks to the US And there you have it in black and white! You have been warned! MANY TIMES in fact…and from the most inside and official of sources! Yet on a daily basis we hear from our own mainstream press, Washington and Wall St. …don’t worry be happy! These are very real articles with well thought out and cogent logic. They are not to be ignored! One piece by the BIS last October talked about the “no one could have seen it coming” meme we heard so often back in 2008-09. THEY see it coming and have been telling you for over a year! Please understand this, the BIS is the central bank for central banks. No one knows the inside situation (particularly in derivatives) better than they do. If you don’t believe me or others who have worked so hard to get the warnings out, listen to what both the BIS and IMF are telling you. They have gotten out in front of this and will only say “we tried to warn you” after the fact. As a chuckle to finish, below is a photo of me and CIGA Dave in front of the BIS headquarters after deciding to heed their warnings personally! Bill Holter Holter-Sinclair collaboration Comments Welcome! bholter@hotmail.com photo credit: marpabr.tumblr.com |

| IMF staff review recommends delaying currency basket adoption of yuan Posted: 04 Aug 2015 08:12 PM PDT By David Chance and Krista Hughes WASHINGTON -- The International Monetary Fund should put off any move to add the yuan to its Special Drawing Rights currency basket until September 2016, an IMF staff report said, a move that would effectively end the Chinese currency's chances of an early inclusion. The report, published today, comes after Beijing launched a major diplomatic push for the yuan's inclusion in the IMF basket as part of its long-term strategic goal of reducing dependence on the dollar. The report said the implementation of any formal decision to add the yuan to a basket of currencies comprising dollars, euros, pounds, and yen should be delayed so as not to disrupt financial market trading on the first day of 2016. ... ... For the remainder of the report: http://www.reuters.com/article/2015/08/04/us-imf-currency-china-idUSKCN0... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Plunge Protection Team Now Working Overtime To Hold Off The Inevitable Collapse Posted: 04 Aug 2015 08:00 PM PDT from Kingworldnews:

The most ludicrous one that I recently read cited two academics projecting the true value of gold as somewhere in the area of $350 an ounce. I have never been a great fan of academia when it comes to the subject of money and finance, but that article takes the cake for abject stupidity. |

| They Live, We Sleep: A Dictatorship Disguised As A Democracy Posted: 04 Aug 2015 07:05 PM PDT Submitted by John Whitehead via The Rutherford Institute,

We’re living in two worlds, you and I. There’s the world we see (or are made to see) and then there’s the one we sense (and occasionally catch a glimpse of), the latter of which is a far cry from the propaganda-driven reality manufactured by the government and its corporate sponsors, including the media. Indeed, what most Americans perceive as life in America—privileged, progressive and free—is a far cry from reality, where economic inequality is growing, real agendas and real power are buried beneath layers of Orwellian doublespeak and corporate obfuscation, and “freedom,” such that it is, is meted out in small, legalistic doses by militarized police armed to the teeth. All is not as it seems. This is the premise of John Carpenter’s film They Live (1988), in which two migrant workers discover that the world’s population is actually being controlled and exploited by aliens working in partnership with an oligarchic elite. All the while, the populace—blissfully unaware of the real agenda at work in their lives—has been lulled into complacency, indoctrinated into compliance, bombarded with media distractions, and hypnotized by subliminal messages beamed out of television and various electronic devices, billboards and the like. It is only when homeless drifter John Nada (played to the hilt by the late Roddy Piper) discovers a pair of doctored sunglasses—Hoffman lenses—that Nada sees what lies beneath the elite’s fabricated reality: control and bondage. When viewed through the lens of truth, the elite, who appear human until stripped of their disguises, are shown to be monsters who have enslaved the citizenry in order to prey on them. Likewise, billboards blare out hidden, authoritative messages: a bikini-clad woman in one ad is actually ordering viewers to “MARRY AND REPRODUCE.” Magazine racks scream “CONSUME” and “OBEY.” A wad of dollar bills in a vendor’s hand proclaims, “THIS IS YOUR GOD.” When viewed through Nada’s Hoffman lenses, some of the other hidden messages being drummed into the people’s subconscious include: NO INDEPENDENT THOUGHT, CONFORM, SUBMIT, STAY ASLEEP, BUY, WATCH TV, NO IMAGINATION, and DO NOT QUESTION AUTHORITY. This indoctrination campaign engineered by the elite in They Live is painfully familiar to anyone who has studied the decline of American culture. A citizenry that does not think for themselves, obeys without question, is submissive, does not challenge authority, does not think outside the box, and is content to sit back and be entertained is a citizenry that can be easily controlled. In this way, the subtle message of They Live provides an apt analogy of our own distorted vision of life in the American police state, what philosopher Slavoj Žižek refers to as dictatorship in democracy, “the invisible order which sustains your apparent freedom.” We’re being fed a series of carefully contrived fictions that bear no resemblance to reality. The powers-that-be want us to feel threatened by forces beyond our control (terrorists, shooters, bombers). They want us afraid and dependent on the government and its militarized armies for our safety and well-being. They want us distrustful of each other, divided by our prejudices, and at each other’s throats. Most of all, they want us to continue to march in lockstep with their dictates. Tune out the government’s attempts to distract, divert and befuddle us and tune into what’s really going on in this country, and you’ll run headlong into an unmistakable, unpalatable truth: the moneyed elite who rule us view us as expendable resources to be used, abused and discarded. In fact, a 2014 study conducted by Princeton and Northwestern University concluded that the U.S. government does not represent the majority of American citizens. Instead, the study found that the government is ruled by the rich and powerful, or the so-called “economic elite.” Moreover, the researchers concluded that policies enacted by this governmental elite nearly always favor special interests and lobbying groups. In other words, we are being ruled by an oligarchy disguised as a democracy, and arguably on our way towards fascism—a form of government where private corporate interests rule, money calls the shots, and the people are seen as mere subjects to be controlled. Consider this: it is estimated that the 2016 presidential election could cost as much as $5 billion, more than double what was spent getting Obama re-elected in 2012. Not only do you have to be rich—or beholden to the rich—to get elected these days, but getting elected is also a surefire way to get rich. As CBS News reports, “Once in office, members of Congress enjoy access to connections and information they can use to increase their wealth, in ways that are unparalleled in the private sector. And once politicians leave office, their connections allow them to profit even further.” In denouncing this blatant corruption of America’s political system, former president Jimmy Carter blasted the process of getting elected—to the White House, governor’s mansion, Congress or state legislatures—as “unlimited political bribery… a subversion of our political system as a payoff to major contributors, who want and expect, and sometimes get, favors for themselves after the election is over.” Rest assured that when and if fascism finally takes hold in America, the basic forms of government will remain. As I point out in my book Battlefield America: The War on the American People, fascism will appear to be friendly. The legislators will be in session. There will be elections, and the news media will continue to cover the entertainment and political trivia. Consent of the governed, however, will no longer apply. Actual control will have finally passed to the oligarchic elite controlling the government behind the scenes. By creating the illusion that it preserves democratic traditions, fascism creeps slowly until it consumes the political system. And in times of “crisis,” expediency is upheld as the central principle—that is, in order to keep us safe and secure, the government must militarize the police, strip us of basic constitutional rights, criminalize virtually every form of behavior, and build enough private prisons to house all of us nonviolent criminals. Clearly, we are now ruled by an oligarchic elite of governmental and corporate interests. We have moved into “corporatism” (favored by Benito Mussolini), which is a halfway point on the road to full-blown fascism. Vast sectors of the economy, government and politics are managed by private business concerns, otherwise referred to as “privatization” by various government politicians. Just study modern government policies. “Every industry is regulated. Every profession is classified and organized,” writes economic analyst Jeffrey Tucker. “Every good or service is taxed. Endless debt accumulation is preserved. Immense doesn’t begin to describe the bureaucracy. Military preparedness never stops, and war with some evil foreign foe, remains a daily prospect.” In other words, the government in America today does whatever it wants. Corporatism is where the few moneyed interests—not elected by the citizenry—rule over the many. In this way, it is not a democracy or a republican form of government, which is what the American government was established to be. It is a top-down form of government and one which has a terrifying history typified by the developments that occurred in totalitarian regimes of the past: police states where everyone is watched and spied on, rounded up for minor infractions by government agents, placed under police control, and placed in detention (a.k.a. concentration) camps. For the final hammer of fascism to fall, it will require the most crucial ingredient: the majority of the people will have to agree that it’s not only expedient but necessary. But why would a people agree to such an oppressive regime? The answer is the same in every age: fear. Fear is the method most often used by politicians to increase the power of government. And, as most social commentators recognize, an atmosphere of fear permeates modern America: fear of terrorism, fear of the police, fear of our neighbors and so on. The propaganda of fear has been used quite effectively by those who want to gain control, and it is working on the American populace. Despite the fact that we are 17,600 times more likely to die from heart disease than from a terrorist attack; 11,000 times more likely to die from an airplane accident than from a terrorist plot involving an airplane; 1,048 times more likely to die from a car accident than a terrorist attack, and 8 times more likely to be killed by a police officer than by a terrorist, we have handed over control of our lives to government officials who treat us as a means to an end—the source of money and power. We have allowed ourselves to become fearful, controlled, pacified zombies. In this regard, we’re not so different from the oppressed citizens in They Live. Most everyone keeps their heads down these days while staring zombie-like into an electronic screen, even when they’re crossing the street. Families sit in restaurants with their heads down, separated by their screen devices and unaware of what’s going on around them. Young people especially seem dominated by the devices they hold in their hands, oblivious to the fact that they can simply push a button, turn the thing off and walk away. Indeed, there is no larger group activity than that connected with those who watch screens—that is, television, lap tops, personal computers, cell phones and so on. In fact, a Nielsen study reports that American screen viewing is at an all-time high. For example, the average American watches approximately 151 hours of television per month. The question, of course, is what effect does such screen consumption have on one’s mind? Psychologically it is similar to drug addiction. Researchers found that “almost immediately after turning on the TV, subjects reported feeling more relaxed, and because this occurs so quickly and the tension returns so rapidly after the TV is turned off, people are conditioned to associate TV viewing with a lack of tension.” Research also shows that regardless of the programming, viewers’ brain waves slow down, thus transforming them into a more passive, nonresistant state. Historically, television has been used by those in authority to quiet discontent and pacify disruptive people. “Faced with severe overcrowding and limited budgets for rehabilitation and counseling, more and more prison officials are using TV to keep inmates quiet,” according to Newsweek. Given that the majority of what Americans watch on television is provided through channels controlled by six mega corporations, what we watch is now controlled by a corporate elite and, if that elite needs to foster a particular viewpoint or pacify its viewers, it can do so on a large scale. If we’re watching, we’re not doing. The powers-that-be understand this. As television journalist Edward R. Murrow warned in a 1958 speech:

This brings me back to They Live, in which the real zombies are not the aliens calling the shots but the populace who are content to remain controlled. When all is said and done, the world of They Live is not so different from our own. As one of the characters points out, “The poor and the underclass are growing. Racial justice and human rights are nonexistent. They have created a repressive society and we are their unwitting accomplices. Their intention to rule rests with the annihilation of consciousness. We have been lulled into a trance. They have made us indifferent to ourselves, to others. We are focused only on our own gain.” We, too, are focused only on our own pleasures, prejudices and gains. Our poor and underclasses are also growing. Racial injustice is growing. Human rights is nearly nonexistent. We too have been lulled into a trance, indifferent to others. Oblivious to what lies ahead, we’ve been manipulated into believing that if we continue to consume, obey, and have faith, things will work out. But that’s never been true of emerging regimes. And by the time we feel the hammer coming down upon us, it will be too late. |

| Chinese Stock Short Squeeze Stalls After IMF Delays Decision On Yuan SDR Inclusion Posted: 04 Aug 2015 07:00 PM PDT Yesterday afternoon's meltup short-squeeze in China - after regulators announced their latest restrictions on short-selling - has stalled in the early trading tonight following The IMF's decision to delay inclusion of Yuan in the SDR pending a review in September 2016. Though this will be a disappointment to the Chinese, the door is still open though given waringse from BMW and Toyota over "normalizing" auto sales, the market problems may be morphing quickly into economic problems. Chinese stocks see a modest lift at the open...

The IMF has delayed its decision on including The Yuan in The SDR...

As Bloomberg reports, though there is a delay the endgame remains in sight...

But problems remain...

As Bloomberg reports,

which is neither unequivocally good for refiners or automakers. |

| Greece, Gold, And Are People Really Prepared For A Bank Collapse? Posted: 04 Aug 2015 06:35 PM PDT

Today the man who first predicted Greek bank deposits would be stolen spoke with King World News about the war in the gold and silver markets, Greece, and asked the important question: Are people really prepared for a bank collapse? |

| Fed Lunacy Is To Blame For The Coming Crash Posted: 04 Aug 2015 06:15 PM PDT Submitted by Jim Quinn via The Burning Platform blog, This week John Hussman’s pondering about the state of our markets is as clear and concise as it’s ever been. He starts off by describing the difference between an economy operating at a low level versus a high level. He’s essentially describing a 2% GDP economy versus a 4% GDP economy. We have been stuck in a low level economy since 2008. And there is one primary culprit for the suffering of millions – The Federal Reserve and their Wall Street Bank owners. They are the reason incomes are stagnant, the labor participation rate is at 40 year lows, savers can only earn .25% on their savings, and consumers have been forced further into debt to make ends meet. Meanwhile, corporate America and the Wall Street banks are siphoning off record profits, paying obscene pay packages to their executives, buying off the politicians in Washington to pass legislation (TPP) designed to enrich them further, and arrogantly telling the peasants to work harder. In economics, we often describe “equilibrium” as a condition where demand is equal to supply. Textbooks usually depict this as a single point where a demand curve and a supply curve intersect, and all is right with the world. In reality, we know that economies often face a whole range of possible equilibria. One can imagine “low level” equilibria where producers are idle, jobs are scarce, incomes stagnate, consumers struggle or go into debt to make ends meet, and the economy sits in a state of depression – which is often the case in developing countries. One can also imagine “high level” equilibria where producers generate desirable goods and services, jobs are plentiful, and household income is sufficient to demand all of that output. The problem is that troubled economies don’t just naturally slide up to “high level” equilibria. Low level equilibria are typically supported and reinforced by a whole set of distortions, constraints, and even incentives for the low level equilibrium to persist. In developing countries, these often take the form of legal restrictions, price controls, weak property rights, political and civil instability, savings disincentives, lending restrictions, and a full catastrophe of other barriers to economic improvement. Good economic policy involves the art of relaxing constraints where they are binding, and imposing constraints where their absence allows the activities of some to injure or violate the rights of others. In the United States, observers seem to scratch their heads as to why the economy has shifted down to such a low level of labor force participation. Even after years of recovery and trillions of dollars directed toward persistent monetary intervention, the economy seems locked in a low level equilibrium. Yet at the same time, corporate profits and margins have pushed to record highs, contributing to gaping income disparities. Dr. Hussman presents his case against the Federal Reserve as clearly as anything I’ve ever read. Bailing out criminally negligent Wall Street banks with taxpayer money, allowing fraudulent accounting to cover up insolvency, printing $3 trillion out of thin air and handing it to the Wall Street banks, penalizing savings while encouraging consumers and corporations to go further into debt, and gearing all of your efforts towards creating stock, bond, and real estate bubbles, is the height of lunacy – unless you are a captured entity working on behalf of a corrupt status quo. From our perspective, the fundamental reason for economic stagnation and growing income disparity is straightforward: Our current set of economic policies supports and encourages a low level equilibrium by encouraging debt-financed consumption and discouraging saving and productive investment. We permit an insular group of professors and bankers to fling trillions of dollars about like Frisbees in the simplistic, misguided, and repeatedly destructive attempt to buy prosperity by maximally distorting the financial markets. We offer cheap capital and safety nets to too-big-to-fail banks by allowing them to speculate with the same balance sheets that we protect with deposit insurance. We pursue easy monetary fixes aimed at making people “feel” wealthier on paper, far beyond the fundamental value that has historically backed up that wealth. We view saving as dangerous and consumption as desirable, failing to recognize a basic accounting identity: there can only be a “savings glut” in countries that fail to stimulate investment. We leave central bankers in charge of our economic future because we’re too timid to directly initiate or encourage productive investment through fiscal policy. When zero interest rates don’t do the trick, we begin to imagine that maybe negative interest rates and penalties on saving might coerce people to spend now. Look around the world, and that same basic policy set is the hallmark of economic failure on every continent. Our leaders have failed the American people. We had an opportunity as a country in 2009 to purge our system of our unpayable debt. We could have allowed the orderly liquidation of the Too Big To Fail Wall Street banks, GM, Chrysler, and thousands of other over indebted bloated corporate pigs. We would have had a short deep depression. The excesses would have been wrung out of our economic system and we would have experienced a real recovery based upon savings and investment. Instead we allowed politicians and central bankers to do the complete opposite. We believed their lies. The system was not going to collapse if the Wall Street banks went down. Rich people and bankers would have been wiped out. When a country allows its central bank to encourage yield-seeking speculative malinvestment; suppresses interest rates in a way that punishes those on fixed incomes and destroys the incentive to save; allows too-big-to-fail institutions to use deposit insurance as a public subsidy to expand trading activity instead of traditional banking; focuses fiscal policy on boosting transfer payments to make up for lost income without at the same time encouraging investment – both private and public – that could create new sources of income; that country is going to keep failing its people. Jim Grant, Bill Gross and a number of other truth telling financial analysts have described how QE and ZIRP have done nothing but allow zombie corporations which should have gone bankrupt to survive and contribute to the low level economy we are experiencing. The creative destruction essential to produce a dynamic economy has been outlawed by the Federal Reserve. The encouragement of consumption through low interest rates has failed. Economies grow through investment, not consumption. Every economy funnels its income toward factors that are most scarce and useful. If a country diverts its resources toward consumption and speculation rather than productive investment, it shelters the profitability of existing companies by making their capital more scarce and therefore more profitable, while at the same time discouraging new job creation. A vast pool of unused labor also has little ability to demand more compensation. In contrast, when an economy encourages productive investment at every level, more jobs are created, and yet capital becomes less scarce – so profit margins fall back to normal. The income from economic activity is then available to both labor and capital, rather than funneling income into a basket that reads “winner-take-all.” It seems the Fed’s motto is: “The Lunacy Will Continue Until Moral Improves”. The Fed has accomplished only one thing over the last six years – creating multiple bubbles with no exit plan that will not pop those bubbles. The Fed has trapped themselves and there is no way out. They must either raise rates now and trigger the next market collapse or wait and trigger an even larger collapse. Hussman thinks legislation may be necessary to restrain the Fed, but he fails to realize the politicians are captured by the very banks who control the Fed. We need to re-think which constraints are actually binding us. With trillions of dollars sitting idly in bank reserves, and interest rates next to zero, the Federal Reserve continues to behave as if bank reserves and interest rates are a binding constraint – that somehow loosening those further might free the economy to grow. This is lunacy. Fed policy is no longer relieving constraints; it is introducing distortions. That – not the exact level of wage growth, inflation, or unemployment – is the primary reason to normalize policy, and to start along that path as soon as possible. Current Fed policy discourages saving while diverting the little saving that remains toward yield-seeking malinvestment. If the members of the FOMC cannot restrain themselves from extraordinary policy distortions on their own, it may be time for legislation to explicitly remove the discretion from their hands. Those who think low interest rates will forever sustain extremely overvalued financial markets are kidding themselves. First of all, the Fed can’t ease. When interest rates are at 0%, there is no place left to go. The credibility of the Fed is already declining rapidly. Once faith in their ability to elevate markets is lost, the collapse will commence. The slope of hope will become the crash of cash. The difficulty with creating a bubble of speculative distortion is that there is always hell to pay, and once valuations have already been driven to extreme levels, that hell is baked in the cake. It can’t be avoided, and once investors have shifted toward risk-aversion, history indicates it can’t even be managed well. Recall that the Fed was easing persistently and continuously throughout the 2000-2002 and 2007-2009 market collapses. As a reminder of how fruitless official interventions can be once investors have shifted to risk-aversion, I’ve reprinted the instructive chart that Robert Prechter of EWT published in October 2008, as the S&P 500 was on its way to the 700 level. Investors who actually believe that Fed easing creates a “put option” for stocks have a very short memory of the past two bear market collapses.

As Sergeant Esterhaus used to say on Hill Street Blues, be careful out there. We are presently at the 2nd most overvalued point in stock market history. It’s dangerous out there. The Fed doesn’t have your back. Anyone in the stock market today has a high likelihood of losing 50% of there money in a very short time. If you think you can get out when everyone else decides to get out, you’re a lunatic. Lunacy does seem to be the primary trait amongst our financial elite, political class, and willfully ignorant masses.

Be careful here – deteriorating internals matter. The condition of market internals is precisely the same hinge that – in market cycles across history – has separated overvalued markets that continued to advance from overvalued markets that collapsed through a trap door. Put simply, the recent market peak represents the second most overvalued point in history for the capitalization-weighted stock market, and the single most overvalued point in history for the broad market. When weak participation has been accompanied by rich valuations, scarce bearish sentiment, and recent market highs, the number of instances narrow to some of the worst points in history to invest. When weak participation, rich valuations and scarce bearish sentiment accompanied a record high in the same week, the handful of instances diminish to surround the precise market highs of 1973, 2000, and 2007, as well as 1929 on imputed sentiment data – and the week ended July 17, 2015. Understand that the present deterioration of market internals is broad-based, unusual, and historically dangerous. |

| North Carolina: Feds charge 3 men accused of prepping for martial law Posted: 04 Aug 2015 05:30 PM PDT The only thing they did wrong was making explosive devices. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Some Clear Thinking About The Price Of Gold Posted: 04 Aug 2015 05:30 PM PDT Submitted by Simon Black via Sovereign Man blog, On April 2, 2001, the price of gold closed the market trading session at $255.30. And that was the lowest price that gold has seen ever since. In US dollar terms, gold closed the 2001 calendar year higher than it did in 2000. Then it did the same thing again in 2002. And again in 2003. In fact, after reaching its low in April 2001, gold closed higher for twelve consecutive years– something that had never happened before in ANY financial market with ANY asset. Then came a correction; the price started falling, and gold is now on track for 2015 to be its third down year in a row. What’s incredible is that, despite its history of gains, and 5,000 years of tradition behind it, gold is rapidly becoming one of the most widely despised assets. But before we pronounce it dead and write the final gold eulogy, however, let’s consider the following: 1) Nothing goes up (or down) in a straight line. After 12 straight years of unprecedented gains with any asset class, it’s not unusual to have a meaningful correction. (Just imagine how severe the correction in stocks will be. . .) And like all frantic booms which go way past sustainable levels, corrections also overshoot fair value. This correction in the gold market could easily last for several more years, with prices potentially well below $1,000. But then we could just as easily see another massive surge all the way past $2,000 and beyond. That’s the nature of these markets– to be extremely fickle (and highly manipulated). Even over a period of a few years, the market can show about as much maturity as a middle school lunchroom, complete with pubescent gossip and inane popularity contests. But it’s rather short-sighted to completely lose confidence in an asset that has a 5,000 year track record because of a few down years. 2) The gold price shed nearly 5% after the government of China announced recently that they owned 1,658 metric tons of gold. This amount was lower than what many investors and analysts had been expecting, and the price of gold dropped as a result. My question- since when did anyone start believing official reports from the Chinese government? Seriously. The Chinese have a vested interest in understating their gold holdings. They know that doing so will push the price of gold LOWER, which is exactly what they want. China is sitting on trillions of dollars in reserves right now, a portion of which they’re rapidly trying to rotate OUT of US dollars. So it’s clearly beneficial to the Chinese government if they can sell dollars while they’re strong and buy gold while it’s cheap. And if they can push gold to become cheaper, even better for them. 3) Remember why you own gold to begin with. Gold is a very long-term store of value. Notwithstanding a few down years, gold has maintained its purchasing power for thousands of years. Paper currencies come and go. They get devalued, revalued, and extinguished altogether. How much would you be able to buy today with paper money issued by the 7th century Tang Dynasty? Nothing. It no longer exists. Or a pound sterling from 1817? Very little. It’s barely pocket change today. Yet the gold backing up that same pound sterling from 1817 is worth over $250 today (165 pounds). Even in modern history, the gold backing up a single US dollar from 1971 is worth vastly more than the paper currency that was printed 44 years ago. But even more importantly, aside from being a long-term store of value, gold is a hedge— a form of money that acts as an insurance policy against a dangerously overleveraged financial system. How much will your dollars and euros buy you in the event of real financial calamity? Or if there’s a major government default or central bank failure? No matter what happens in the financial system– whether it collapses under its own weight, or cryptofinance technology revolutionizes how we do business– gold ensures that you’re protected. 4) Resist the urge to value gold in paper currency. We all have this tendency– we invest in something, and then hope it goes up in value. But that’s a mistake with gold. It’s a hard thing for some people to do, but try to stop yourself from thinking about gold in terms of its paper price. (It’s also important to remember that there’s a huge disconnect between the ‘paper price’ of gold, and the physical price of gold.) Remember, gold is not an investment; there are plenty of better options out there if you’re looking for a great speculation. So the notion of trading a stack of paper currency for gold, only to trade the gold back for a taller stack of paper currency misses the point entirely. 5) Having said that, if you find it too difficult to do this, and you catch yourself constantly refreshing the gold price and checking your portfolio, you might own too much. Listen to your instincts; if you’re always feeling frantic about the daily gyrations in the market, lighten your load. Don’t love anything that won’t love you back. Stay rational. Own enough gold that, in the event of a crisis, you will feel comfortable that you have enough ‘real savings’… but don’t own so much that you’re constantly worrying about the paper price. |

| Peter Schiff: What If "They" Are Wrong (Again)? Posted: 04 Aug 2015 05:05 PM PDT Submitted by Peter Schiff via Euro Pacific Capital, While the world can count dozens of important currencies, when it comes to top line financial and investment discussions, the currency marketplace really comes down to a one-on-one cage match between the two top contenders: the U.S. Dollar and the Euro. In recent years the contest has become a blowout, with the Dollar pummeling the Euro into apparent submission. Based on the turmoil created by the European Debt Crisis and the continuing problems in Greece and other overly indebted southern tier European economies, many investors may have come to assume that Euro boosters will be forced to ultimately throw in the towel and call off the entire experiment, thereby leaving the Dollar completely unchallenged as the champion currency, now and for the foreseeable future. This is a stunning turnaround for a currency that was seen just a few years ago as a credible threat to supplant the dollar as the world's reserve. Putting aside the fact that there are many important currency relationships besides the euro/dollar axis, economists, journalists, and investors have forgotten the 16-year history of the Euro and how the currency has survived and prospered after many had assumed it might be consigned to the dustbin of history. The Euro was created in 1992 by the Maastricht Treaty (which created the European Union) but did not come into being as an accounting unit (not a physical currency) until January of 1999. In the lead up to its launch, many had argued that the Euro would become the heir to the rock solid Deutsche Mark, the German currency that had risen to preeminence on the back of Germany's post war resurgence, high savings rate, enviable trade balance, and post-Soviet unification. With German bankers in a firm leadership position in the European Central Bank and the European Union, many had hoped that the new Euro would adopt the virtues of the Mark. As a result, the Euro debuted with a value of 1.18 dollars. But the honeymoon was short-lived. Almost immediately from the point it began freely trading the Euro began to encounter severe headwinds. The Russian debt default and the Asian currency crisis in the late 1990's caused investors to sell assets in the emerging markets and seek safe havens in the dominant economies. This provided a crucial early test for the Euro. But the new currency failed to attract much of this fast flowing transnational investment flow. On the other hand, the U.S. markets and the U.S. Dollar were beckoning as extremely attractive targets. In the second term of Bill Clinton's presidency, America, at least on paper, looked very strong. From 1998-2000, based on Bureau of Economic Analysis (BEA) figures, GDP growth averaged 4.4%, which is roughly four times the rate that we have seen since 2008. The expanding economy and the relative spending restraints that had been made by the Clinton Administration and the newly elected Republican Congress resulted in hundreds of billions of annual U.S. government surpluses, the first such black ink in generations. Many economists comically concluded that the surpluses would become permanent (in fact they lasted just a few years). At the same time, U.S. stock markets were notching some of the biggest gains in their history. From the beginning of 1997 to the end of 1999 the Dow Jones surged by approximately 69%. The tech heavy Nasdaq, the epicenter of the "dotcom" bubble, rallied by an eye popping 294%. As a result, international money began pouring into the Dollar, taking the wind out of the sails of the newly launched Euro. The stretched valuations that had pushed up U.S. stocks to nosebleed levels failed to dissuade investors from piling in well into the mid-point of 2000. Not only had Wall Street spread the gospel of the new economy, where negative earnings and high debt no longer mattered, but many were convinced that the interventionist tendencies of the Alan Greenspan-led Federal Reserve would protect investors against losses. As a result of these forces, the Euro first fell to below parity against the dollar on January 27, 2000 when it closed at 98.9 U.S. cents, a fall of 16% from its debut. After that psychological barrier was breached, the selling intensified. By May 8, 2000 the Euro traded at just 89.5 U.S. cents, an additional 9% decline in just three months. This prompted news stories like a BBC article entitled "Was the Euro a Mistake?" Top economists and investors began wondering if the new currency would last much longer. The Euro's reputation was further tarnished in September of 2000 when Danish voters rejected their country's plans to adopt the Euro. The distaste shown by a small country widely considered squarely in the mainstream of Western European culture was a huge black eye for the Euro experiment. The pessimism sent the currency down another 6% in just one month following the Danish election, reaching what would become an all-time low of just 82.7 U.S. cents on October 25, 2000. At that level the Euro had fallen a full 30% from its debut valuation. It looked like game over. The Euro vs. Dollar was shaping up to be a Bambi vs. Godzilla scenario. By the late 1990's gold had been in a bear market that had lasted almost 20 years. As a result, investor sentiment for the metal, which had historically been considered a safe haven asset, was at an all-time low. As a result, many Europeans moved into the dollar to seek shelter instead. At that time gold was trading below Euros 300 per ounce (FRED, FRB St. Louis). Those who had exchanged their Euros for Dollars (when the Euro was 83 cents) would have seen those holdings decline by 50% over the following eight years. On the other hand gold nearly doubled in Euro terms over the same time frame. As this article is being written, gold is now trading at 1,000 Euros per ounce (even after the recent big drop) while the Euro hovers around $1.10. So Europeans who bought and held Dollars continuouslywhen the Euro hit its low in 2000 would be down 25%, but those who bought and held gold instead would have seen those holdings triple. (Past performance does not guarantee future results).

The bursting of the dotcom bubble in mid-2000 finally caused a decisive break with the investment trends that had predominated in the previous number of years (see my recent article "The Big Picture"). Just as the dotcom wealth began disappearing, taking the U.S. federal budget surpluses with it, the emerging markets began to recover, and the much-maligned Euro started getting some attention. By January 5, 2001 the Euro had hit 95.4 cents, a stunning 15.3% rally in just over two months. And although the Euro zigzagged substantially over the next year and a half (with an early retreat in 2002, causing the Organization for Economic Cooperation and Development (OECD) to wonder whether the Euro was a "Doomed Currency"), by the second half of 2002 the uptrend was firmly in place, with the Euro reaching parity again with the Dollar by July 15, 2002, 30 months after it had fallen below that level. By April 22, 2008 the Euro traded at $1.60 to the Dollar, a price that represented a 36% increase over its debut level and a stunning 93% rally from its October 2000 low. But when the Financial Crisis of 2008 reached full flower in August, September, and October of 2008, investors once again panicked as they had eight years before. In seeking a safe haven, they once again chose the U.S. Dollar (perhaps motivated by the low valuations then assigned to the greenback). As funds began flowing out of the Euro and into the Dollar, the Euro dropped rapidly. By the end of October the Euro only fetched $1.26, a 21% drop from its April high. But when the markets stabilized in 2009 so did the Euro. It essentially traded sideways against the Dollar over the next two years, reaching back to $1.46 by June 6, 2011.  Compiled by Euro Pacific Capital using data from the Federal Reserve Economic Data (FRED) from Federal Reserve Bank (FRB) of St. Louis When the European debt crisis really started grabbing headlines in 2011, with yields on sovereign debt of the so-called PIIGS nations (Portugal, Italy, Ireland, Greece, and Spain) widening to record territory in comparison to the sovereign bonds of Germany, scrutiny of the Euro came into question once again. The uncertainty over possible bailouts for European banks that were holding potentially toxic government debt was too much uncertainty for the market to handle. The pressure on the Euro was intensified by the slowing Eurozone economy. These forces combined helped to push the Euro down steadily during 2012 and 2013. But the straw that really broke the camel's back came at the end of 2014 when it became clear that the European Central Bank, under the new leadership of Mario Draghi, would finally succeed in short-circuiting the anti-bailout restrictions of the Maastricht Treaty and outflank the objections of the German financial and political establishment in order to bring full blown Quantitative Easing (QE) to the Eurozone. The QE program essentially involves creating Euros out of thin air in order to buy government debt and hold down long-term interest rates. Expectations about European QE came at a time when most observers concluded that the U.S. economy was finally on track for a strong recovery in 2015 and that the Federal Reserve (which has already showered the United States with almost six full years of QE) had finally done away with the program and would begin raising rates for the first time in almost 10 years. Despite a languishing economy, the U.S. markets had once again delivered stellar returns, with the S&P 500 rising 64% between 2011 and 2014, doing so without ever experiencing a correction of more than 10%. These movements provided a strong rationale for investors to sell Euros and buy Dollars. In the 12 months from May 2014 to May 2015 the Euro fell by about 20%. When it bottomed out at $1.05 on March 11, 2015, the Euro had fallen 34% from its peak seven years earlier. This revived the opinions that the Euro was dead and that the Dollar would be the only real reserve currency for the foreseeable future. But what if the assumptions about a U.S. economic recovery and Fed rate hikes were wrong? Could observers be mistaken now about the trajectory of the Dollar vs. the Euro as they were back in 2000? While some had warned that the dotcom bubble of 2000 could end badly, very few understood how deeply the mania was the root of the economic expansion and how severely the final flameout would threaten the entire economy. Similarly, very few had foreseen the dangers that the housing and mortgage bubble had presented to the wider economy in 2008. The economic and market contractions in 2000 and 2008 might have been much worse if the Fed had not been able to cut interest rates by almost 500 basis points in the face of the crises. (No such options are available if the economy contracts today). In other words, complacency can be very dangerous, especially if there is no ammunition to combat a crisis if it arrives unexpectedly . Confidence is the only thing that really undergirds modern fiat currencies. But confidence can be very ephemeral...disappearing as quickly as it arrives. The U.S. Dollar benefits from confidence that the Euro currency may just be unworkable, that the U.S. economy will continue to improve, and that the Fed will raise rates throughout the remainder of 2015 and into 2016. If these expectations are unfulfilled, there could be a Euro reversal. When a trend remains in place for a while, people tend to think it will continue forever. When it reverses, the shock can be widespread. Just as currency speculators over-estimated the strength of the U.S. economy in 2000, I believe they are making the same mistake again today. But the U.S. economy is actually much weaker and more vulnerable now than it was in 2000. If the spell of confidence surrounding the Dollar is broken, it may also reverse the fortunes of other beaten down currencies. This could present a sea change in the global investment landscape for which wise investors should be prepared.

|

| Gold Daily and Silver Weekly Charts - Meh Posted: 04 Aug 2015 01:52 PM PDT |