Gold World News Flash |

- China’s Meltdown And Contagion Now Spreading As Central Planners Prepare For Global Economic Chaos

- Staggering Demand for Silver Bullion as Spot Price Heads Toward $0

- COTM: Paying Another Visit To The Chinese Yuan/Renminbi

- Big Chunk Of JP Morgan’s Gold Holdings Withdrawn In One Day

- GUEST POST: The Great Call

- When China Stopped Acting Chinese

- Something Just Snapped: Container Freight Rates From Asia To Europe Crash 23% In One Week

- Is This The Most Successful Trade Of The Last Decade?

- If Price Insensitive Buyers Become Sellers, Will The Entire Market Collapse?

- The Great Call

- In The News Today

- TF Metals Report: July 19 raid on gold was meant to drain GLD

- India's gold imports up 61% at 155 tonnes in April-May

- South African mineworkers union rejects wage hike from gold producers

- Gold And Silver Charts Are The Compelling Story. Fundamentals Do Not Apply

| China’s Meltdown And Contagion Now Spreading As Central Planners Prepare For Global Economic Chaos Posted: 02 Aug 2015 11:00 PM PDT from KingWorldNews:

IMF Warns China But recently the International Monetary Fund (IMF) warned China about its concern over limiting investors’ freedom to take equity out of financial markets. These concerns were raised when the IMF met with officials to discuss the chances of including the yuan in the fund’s basket of currencies, also known as Special Drawing Rights (SDR). |

| Staggering Demand for Silver Bullion as Spot Price Heads Toward $0 Posted: 02 Aug 2015 10:30 PM PDT from drutter: |

| COTM: Paying Another Visit To The Chinese Yuan/Renminbi Posted: 02 Aug 2015 10:00 PM PDT from Chuck Butler, Daily Pfennig:

First, a quick note about reserve currencies. Throughout history, the list of reserve currencies has varied, dating back to the fifth century B.C. when the Chinese liang and Greek drachma ruled supreme, through more recent history where we've seen a number of currencies in the primary spot since the 1400s. And today, the U.S. dollar occupies the top spot and has done so since the mid-1900s.1 |

| Big Chunk Of JP Morgan’s Gold Holdings Withdrawn In One Day Posted: 02 Aug 2015 09:05 PM PDT from SRS Rocco:

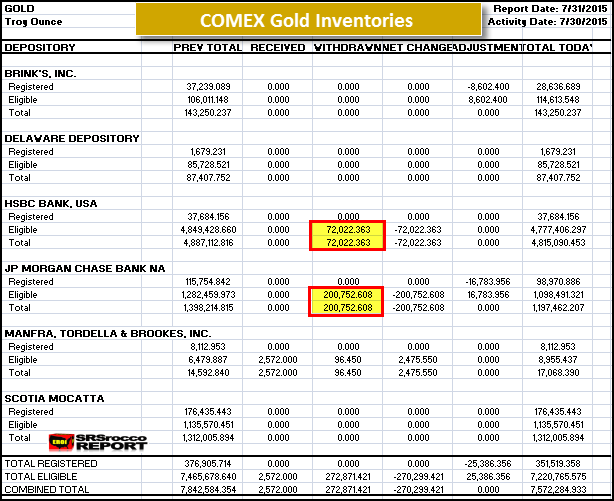

In just one day, a big chunk of JP Morgan’s gold was withdrawn from the COMEX. It’s been a while since we have seen such a large single withdrawal. According to the CME Group’s Friday Warehouse Depository gold stocks, a whopping 200,752 ounces of gold were removed from JP Morgan’s Eligible category. If we look at the table below, we can see JP Morgan’s total gold inventories fell from 1,398,214 oz on Thursday (7/30/2015) to 1,197,462 oz:

Basically, JP Morgan lost nearly 15% of its total gold inventories in one day. You will notice that JP Morgan only has 115,754 oz of gold in its Registered category. This is gold that is ready to be delivered. This 200,752 oz gold withdrawal would have totally wiped out JP Morgan’s Registered gold inventories. Furthermore, there was another large 72,022 oz gold withdrawal from HSBC for a total of 272,871 oz from the two banks. Not only are investors starting to be concerned about the Greek situation in Europe spinning out of control, there is growing fear of a possible meltdown of the broader stock markets this fall. This has sparked a huge increase in physical gold and silver buying shown by the record 170,000 oz of Gold Eagles sold in the month of July, including 5.5 million oz of Silver Eagles (even with the U.S. Mint suspending Silver Eagle sales for two weeks). If you look at the COMEX Gold Inventory table closely, you will notice that the total Registered Gold inventories are a lousy 351,519 oz. This is less than peanuts. Two withdrawals like JP Morgan experienced on Thursday, would totally wipe out the Bankers Registered gold inventories. |

| Posted: 02 Aug 2015 08:31 PM PDT by Bill Holter, SGT Report.com:

Same thing with many retirement accounts. Think about Social Security. When you get your annual statement form, it comes with an asterisk. This is to inform you they “might need to reduce benefits”. With any retirement account you are relying on the custodian to make payments to you upon retirement. Think about state and municipal retirement accounts promising the good life, they are nearly ALL underfunded. Meaning there is not enough money in there to make (promised) future payments unless some sort of magically higher returns are realized. These are underfunded by the TRILLIONS of dollars! Bonds are an obvious asset class where a “promise” is relied on. Dollars on the other hand seem the most misunderstood by the public while being the biggest leap of faith in all asset classes. Dollars rely on the “full faith and credit” of the U.S. government (a bankrupt entity) yet the populace sleeps through the night secure knowing they own dollars. ALL non backed, fiat currencies in the past have failed. The dollar is the widest spread and widely owned fiat the world has ever known, its failure will be spectacular upon arrival! I wanted to point out the above “promises” as a basis to speak about trust or confidence. The financial world turns on the axis of “trust”. This trust was nearly broken in 2008 and is the reason the Federal Reserve needed to secretly lend $16 trillion all over the world. If the Fed had not come up with these funds, failures would have spread and trust would have been broken amongst the banks/other financial institutions and even between the central banks themselves! The Fed’s largesse worked and trust was maintained. Now, I believe we are set for another “test” of trust. We have gone five+ years with QE this and QE that, the reality being outright monetization. In fact, central banks today are buying more sovereign bonds than are even being issued. The public and even the professional funds have backed away from the debt markets, you can’t blame them because the interest received does not even cover inflation not to mention a risk premium. Globally the pace of trade and business activity is slowing or even declining which will bring to a head the difficulties in meeting debt service and other “promises”. I ask, what will happen when inevitably “trust” begins to wane? Or even fully break? It is at this point the system goes into “The Great Call”. Margin call? Of course, because nearly everything financial has leverage behind it but there is more to it than this. The “call” I am speaking of is for contracts of all sorts to “perform”. In particular I am thinking “derivatives” contracts will be called on to perform their contractual duties. All in all, there are over $1 quadrillion worth of derivatives outstanding. The problem with this is the “tail” is bigger than the dog. In other words, the amount of derivatives outstanding dwarfs the total amount of money outstanding and thus the ability to “pay” and make good on the contracts. The other side of this coin are contracts promising to deliver something. Here I am thinking both gold and silver. There are far more (100-1 or more) obligations outstanding than there are ounces or kilos available to deliver. This is a default just waiting to happen. If you listen to the Harry Dents of the world, the dollar will be the safe haven and where all fear capital will go. In a world based on nothing but trust and promises, will fear capital really pile INTO a currency based ONLY on trust and promises …when “trust” is exactly what is come into question. Actually, it can be said the dollar was originally set up in 1971 on a “never pay” model. The dollar (and bonds) only promise to pay “more dollars” and nothing else. This game worked for many years, now it looks like the Saudis after doing many deals with both Russia and China may be set to transact in currency other than dollars. Are they displaying confidence? The Chinese are now net sellers of U.S. Treasuries. Ask yourself this question, if China could sell all of their Treasuries and turn it all into gold, silver, oil, copper and other real tangible assets (without destroying the Treasury market or making gold and silver go no offer), would they? I say yes, they absolutely would love to be out from under their Treasury position. Apologetic others might say China is comfortable, we will soon see. Because confidence is the only thing at this point holding the game together …and its fickle nature, it is important for you to think this through. What will be standing when confidence breaks? Can banks globally survive “runs” when depositors come calling? Can commodity exchanges deliver all they promise? Can borrowers “borrow more” if they cannot redeem past issues with new debt? This is where we are headed both systemically and globally! Before finishing I want to tie two connected thoughts together. First, the great Paul Craig Roberts said last week he feared precious metals could be suppressed forever. I received MANY fearful e-mails regarding this thought process. Mr. Roberts would be entirely correct if it were not for one small detail, REAL gold and REAL silver must be available to deliver. Otherwise the game comes to an end and the fraud is exposed. He is entirely correct, “price” can be jammed or rammed with enough “margin” posted. Dan Norcini once upon a time had it correct when he said, nothing will unnerve the shorts more than the longs standing for delivery …and making a call for the product. I would like to remind you, COMEX currently has only 11.7 tons of gold for delivery. This is roughly $400 million. If I were short, this paltry sum would not add to my confidence. Another thought going hand in hand with this is where we are now versus 2008. Back then we were within overnight hours of the entire system coming down, this is fact. What has changed since then? “Nothing”, but in reality quite a bit. Nothing has changed from the standpoint of “tools used”. We have not altered or changed anything that “got us to the brink”… only done more of it! We have far more debt and more derivatives outstanding now. In fact, central banks and sovereign nations have even sacrificed their balance sheets to prolong the game. It has worked …so far. The only problem is the entire arsenal of the central banks have already been tried and failed to provide the real economy with any stimulus. The result has been capital pushed into financial markets and blowing the bubble(s) far larger than they were. Now, we have far larger markets with far more leverage than 2008. These will need to be met with central banks and sovereign treasuries with weaker balance sheets and almost no ability to borrow in an effort to reflate. It is a recipe for disaster. We already know the sovereign debt markets are very thin on the bid side as liquidity has dried up. We also know equity markets are displaying horrible internal breadth. China is actually nearing a 1929 scenario and will be there shortly if they cannot steady. Confidence is a fickle girl, if it breaks, then we go back to the 2008 scenario and we’ll find out just how powerful the central banks really are. I believe the coming “Great Call” cannot nor will be met and only then will we see what is left standing. It is imperative here and now to position yourself in assets that do stand on their own, everything else will be a broken promise! Standing watch, Ed. Note: If this article resonated with you, then don’t miss my latest discussion with Bix Weir in which we quantify the specific ways that you probably don’t own what you THINK you own! image: acting-man.com |

| When China Stopped Acting Chinese Posted: 02 Aug 2015 08:30 PM PDT by John Mauldin, Gold Seek:

– Anthony Bourdain, Parts Unknown Much of the world is focused on what is happening in Greece and Europe. A lot of people are paying attention to the Middle East and geopolitics. These are significant concerns, for sure; but what has been happening in China the past few months has more far-reaching global investment implications than Europe or the Middle East do. Most people are aware of the amazing run-up in the Shanghai stock index and the recent "crash." The government intervened and for a time has halted the rapid drop in the markets. There have been a number of concerns about what this means for the Chinese economy. Is China getting ready to implode? Certainly there are those who have been predicting that outcome for some time. |

| Something Just Snapped: Container Freight Rates From Asia To Europe Crash 23% In One Week Posted: 02 Aug 2015 06:53 PM PDT One of the few silver linings surrounding the hard-landing Chinese economy in recent weeks has been the surprising resilience and strength of the Baltic Dry Index: even as Chinese commodity demand has cratered in 2015, this "index" has more than doubled in the past few months from all time lows, and at last check was hovering just over 1,100.

Many were wondering how it was possible that with accelerating deterioration across all Chinese asset classes, not to mention the bursting of various asset bubbles, could global shippers demand increasingly higher freight rates, an indication of either a tight transportation market or a jump in commodity demand, neither of which seemed credible. We may have the answer. It appears that the recent spike in shipping rates was analogous to the dead cat bounce in crude oil prices: a speculator-driven anticipation for a sustainable rebound that never took place. And now, just like with crude prices, it is all crashing down.... again. According to Reuters, shipping freight rates for transporting containers from ports in Asia to Northern Europe dropped 22.8 per cent to $400 per 20-foot container (TEU) in the week ended last Friday, data from the Shanghai Containerized Freight Index showed.

Freight rates on the world's busiest shipping route have tanked this year due to overcapacity in available vessels and sluggish demand for transported goods. Rates generally deemed profitable for shipping companies on the route are at about US$800-US$1,000 per TEU. In other words, at current prices shippers are losing half a dollar on every booked contractual dollar at current rates. According to Shanghai data, it was the third consecutive week of falling freight rates on the world's busiest route. Container freight rates have so far increased in 5 weeks this year but fallen in 23 weeks. In the week to Friday, container freight rates fell 24 percent from Asia to ports in the Mediterranean, fell 4.4 per cent to ports on the US West Coast and were down 3.7 per cent to ports on the US East Coast.

Should the dead cat bounce in shipping rates indeed be over, and if the accelerate slide continues at the current pace, not only will shippers mothball key transit lanes, but the biggest concern for global economy, the unprecedented slowdown in world trade volumes, which we flagged a week ago, will be not only confirmed but is likely to unleash yet another global recession. Unless, of course, central planners learn how to print trade and quite soon at that... |

| Is This The Most Successful Trade Of The Last Decade? Posted: 02 Aug 2015 02:45 PM PDT If the longs use VIX products as hedging instruments, then why would anyone take the other side? Especially in light of the fact that, as we discussed previously, only 1 in 20 "skilled" traders profit from VIX ETFs. Because, being short volatility can be very profitable, according to Goldman. Year-to-date this short vol index is up 56%, and selling the front-month VIX has earned a massive 114 vol points...

Shorter-dated VIX futures track VIX spot more closely

Shorter-dated VIX futures track (have more manipulative leverage) the market more closely...

* * * So - in summary - being short vol has been among the best performing trades of the last decade (never mind the risk-side) and, the introduction of weekly VIX futures (and the exponential decay implied by these volatility-inducing instruments) offers, according to Goldman Sachs, even more opportunity for active risk takers to sell vol, scrape premium, and face unlimited downside risk... playing the contango collapse game until there are no more musical chairs left. |

| If Price Insensitive Buyers Become Sellers, Will The Entire Market Collapse? Posted: 02 Aug 2015 02:15 PM PDT One narrative we've been building on for quite some time is the idea that both stocks and bonds have been propped up by a perpetual bid from price insensitive buyers. Put simply, it really doesn't matter how overvalued something is if your primary concern is something other than maximizing your return on investment. Take corporate buybacks for instance. Both equity-linked compensation and the market's tendency to focus on quarterly results at the expense of the bigger picture have compelled corporate management teams to develop a dangerously myopic strategy that revolves around tapping corporate credit markets for cheap cash and plowing the proceeds into EPS-inflating buybacks. Whether or not this is the best use of cash is certainly debatable but when the goal is to manage earnings and appease stockholders, that doesn't matter, and indeed, companies have an abysmal record when it comes to buying back shares at levels that later prove to be quite expensive. In America, the price insensitive corporate management bid simply replaced the monthly flow the market lost when the Fed - the most price insensitive of all buyers - began to taper its asset purchases. Of course QE in all its various iterations playing out across the globe, is price insensitive buying taken to its logical extreme. With the ECB's PSPP for instance, limits on the percentage of an individual issue that NCBs are allowed to own apply to nominal amounts meaning that, to the extent NCBs can buy bonds at a premium to par, they can effectively buy fewer bonds than they otherwise would have and still hit their purchase targets. In other words, if you overpay, it's easier to stay under the issue cap when supply is scarce in eligible paper. So in some respects, the more EMU central banks pay for the bonds they purchase, the better. In Japan, the BoJ has amassed an elephantine balance sheet full of ETFs and because one cannot classify stocks as "held to maturity", Haruhiko Kuroda's equity plunge protection is effectively a self-feeding loop - that is, the more stocks the central bank owns, the more it must buy in order to protect its balance sheet from the damage it would suffer were equities to sell off. And then there are banks, mutual funds, and pension plans which for various reasons (regulatory and otherwise) are forced to accumulate assets at otherwise unattractive prices. The question in all of this - and this may indeed become one of the most important considerations for market participants once every DM central bank bumps up against the Sweden problem - is this: what happens when the price insensitive buyers behind the inexorable rise in financial asset prices become price insensitive sellers? Here with more on that question and more, is GMO's Ben Inker: * * * Price-insensitive sellers The last decade has seen an extraordinary rise in the importance of a unique class of investor. Generally referred to as "price-insensitive buyers," these are asset owners for whom the expected returns of the assets they buy are not a primary consideration in their purchase decisions. Such buyers have been the explanation behind a whole series of market price movements that otherwise have not seemed to make sense in a historical context. In today's world, where prices of all sorts of assets are trading far above historical norms, it is worth recognizing that investors prepared to buy assets without regard to the price of those assets may also find themselves in a position to sell those assets without regard to price as well. This potential is compounded by the reduction in liquidity in markets around the world, which has been driven by tighter regulation of financial institutions, and, paradoxically, a greater desire for liquidity on the part of market participants. Making matters worse, in order to see massive changes in the price of a security, you don't need the price-insensitive buyer to become a seller. You merely need him to cease being the marginal buyer. If price-insensitive buyers actually become price-insensitive sellers, it becomes possible that price falls could take asset prices significantly below historical norms. Monetary authorities The first group of price-insensitive buyers to confound the markets were, arguably, the monetary authorities of emerging countries, who in the 2000s began to accumulate a vast hoard of foreign exchange reserves. These reserves, which served to both protect against a recurrence of the 1997-98 currency crises and to encourage export growth by holding down their exchange rates, needed to be invested. The lion's share of the reserves went into U.S. treasuries and mortgage-backed securities, causing Alan Greenspan and Ben Bernanke to muse about the conundrum of bond yields failing to rise as the Federal Reserve lifted short-term interest rates in the middle of the decade. I have to admit that from a return standpoint, those purchases were ultimately vindicated by the even lower bond yields that have prevailed since the financial crisis. But just because the position turned out to be a surprisingly good one, return-wise, doesn't mean that these central banks were acting like normal investors. Their accumulation of U.S. dollars had nothing to do with a desire to invest in the U.S., in treasuries or anything else, but was rather an attempt to hold down their own currencies. Developed market central banks The financial crisis itself created the second group of price-insensitive buyers, developed market central banks. Quantitative easing policies by a wide array of central banks have had the explicit goal of pushing down interest rates and pushing up other asset prices. While one can argue that the central banks were anything but price-insensitive in that they cared quite deeply about the prices of the assets they were buying, they certainly were not buying assets for the returns they delivered to themselves as holders, and their buying has been driven by an attempt to help the real economy, not an attempt to earn a return on assets. Since 2008, the sum of the U.S., U.K., Eurozone, and Japanese central banks have expanded their balance sheets by over $4 trillion USD, as shown in Exhibit 2. At the moment, the most active central banks in the developed world have been the European government bonds. Defined benefit pension plans Considerations of profit and loss on their portfolios are seldom at top of mind for central bankers, making them obvious candidates as price-insensitive buyers. But regulatory pressure can push otherwise profit-focused entities in similar directions. Successive tightening of the regulatory screws on defined benefit pension funds, particularly in Europe, have forced many of them into the role of price-insensitive buyers of certain assets as well. Risk parity Another group of price-insensitive investors are managers of risk parity portfolios. These portfolios make allocations to asset classes not with regard to pricing of assets, but rather their volatility and correlation characteristics. Their price-insensitivity comes out in a couple of ways. First, as money flows into the strategies, they are levered buyers of bonds and inflation-linked bonds in particular. Like most strategies, if the money flows out, they are forced sellers of a slice of their portfolio. Second, unlike many other investors, they will also tend to buy and sell based on changes in volatility. As the volatility of an asset falls, these strategies will tend to lever it up further, and as the volatility rises they will sell. Given that low volatility tends to be associated with rising markets and high volatility with falling markets, this gives their buy and sell decisions a certain momentum flavor. If bond prices are moving up in a steady fashion, they will tend to buy more and more as volatility falls, and in a disorderly sell-off that sees yields and expected returns rise along with rising volatility, they will sell the assets due to their higher "risk." In fact, rising volatility in bond markets could cause a general delevering of risk parity portfolios, causing them to sell assets unrelated to bonds in order to keep their estimated volatility stable. With hundreds of billions of dollars under management in risk parity strategies and large holdings in some of the less deeply liquid areas of the financial markets such as inflation-linked bonds and commodity futures, it is easy to imagine their selling in unsettling markets under certain circumstances, such as a repeat of 2013's "Taper Tantrum." Traditional mutual funds While the levered nature of risk parity portfolios may cause them to punch above their weight in potentially disrupting markets, in the end it isn't clear that they are more likely to cause trouble than the managers of traditional mutual funds. The mutual funds are at the mercy of client flows. As money has flowed into areas such as high yield bonds and bank loans, they have had little choice but to put it to work, and given their mandates, prospectus restrictions, and career risk, they are largely forced to buy their asset classes whether or not they think the pricing makes sense. But to an even greater degree, when redemptions come, they have no choice but to sell. This is nothing new. But what has changed is the extent to which mutual funds have seen large flows into increasingly illiquid pieces of the markets, particularly in credit, where bank loan mutual funds are 20% of the total traded bank loan market and high yield funds make up another 5%. That may not sound particularly large, but almost half of that market is made up of CLOs, which are basically static holders of loans. This makes the "free float" of the bank loan market perhaps half of the total, and should the bank loan mutual funds sell, there are not a lot of investors for them to sell to. This is particularly true given the changes to the regulatory landscape for the dealer community. Banks are much less likely to take bonds and loans on their balance sheet for any length of time in the course of their market-making activities. Conclusion The size of the price-insensitive market participants is impressive. Monetary authorities and developed market central banks have each bought on the order of $5 trillion worth of assets for reasons that ultimately have nothing to do with earning an investment return on them. Regulatory pressures have caused pension funds, insurance companies, and banks to do likewise. While it is somewhat harder to put precise numbers to the size of these investments, it seems a safe bet that the total is in the trillions as well. Other investors are in analagous positions for different reasons, as strategies such as risk parity and the exigences of life as a mutual fund portfolio manager push such investors to also buy assets for reasons other than the expected returns those assets may deliver. To date, these investors have tended to be buyers, and given their lack of price-sensitivity, they have pushed up prices of assets beyond historically normal levels. At the same time, a natural buffer for many markets against a temporary imbalance between buyers and sellers, the dealer community has been forced to significantly curtail its activities due to the regulatory regime. So if circumstances cause these price-insensitive buyers to turn around and become price-insensitive sellers, there are not a lot of candidates to take the other side. Be prepared for the possibility that some of the same assets that have again and again risen to prices that many investors said were impossible show more downside volatility than investors have bargained for. |

| Posted: 02 Aug 2015 01:29 PM PDT Dear CIGAs, The world is awash with "promises". Nearly everything we think of as having "value" is because of a promise behind it. A few examples; your bank accounts, retirement funds, bonds and even the dollar bills in your pocket. Your bank account for example, once you deposit the money it is no longer yours. ... Read more » The post The Great Call appeared first on Jim Sinclair's Mineset. |

| Posted: 02 Aug 2015 12:38 PM PDT Jim Sinclair’s Commentary Yet the price declines. This is 1978 all over. Gold imports up 61% at 155 tonnes in April-May PTI Aug 2, 2015, 11.14AM IST NEW DELHI: India’s gold imports shot up by about 61 per cent to 155 tonnes in the first two months of the current fiscal mainly due to weak... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| TF Metals Report: July 19 raid on gold was meant to drain GLD Posted: 02 Aug 2015 11:38 AM PDT 2:37p ET Sunday, August 2, 2015 Dear Friend of GATA and Gold: The raid on gold of Sunday night, July 19, was staged by bullion banks to drain more tonnage from the exchange-traded fund GLD to be sent to Asia, the TF Metals Report's Turd Ferguson writes. "As GLD is a readily-accessible source of instantly available gold," Ferguson writes, "its authorized participant bullion banks are once again redeeming their 100,000-share lots for physical gold from the GLD 'inventory.' That this gold is then utilized to settle physical demand from around the globe is hardly arguable, given recent history." Ferguson's commentary is headlined "The Gold Raid of July 19" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7036/gold-raid-july-19 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| India's gold imports up 61% at 155 tonnes in April-May Posted: 02 Aug 2015 11:27 AM PDT From the Press Trust of India NEW DELHI -- India's gold imports shot up by about 61 percent to 155 tonnes in the first two months of the current fiscal mainly due to weak prices globally and the easing of restrictions by the Reserve Bank. In April-May of the last fiscal years, gold imports had aggregated about 96 tonnes, an official said. In the international market, gold has been trading weakly over the past few months. On Friday, it closed at US$1,095.10 in New York market. ... ... For the remainder of the report: http://timesofindia.indiatimes.com/business/india-business/Gold-imports-... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| South African mineworkers union rejects wage hike from gold producers Posted: 02 Aug 2015 11:20 AM PDT By Zandi Shabalala http://www.reuters.com/article/2015/08/02/safrica-gold-unions-idUSL5N10D... Members of South Africa's Association of Mineworkers and Construction Union on Sunday rejected a wage offer from gold producers of increases of up to 17 percent, spokesman Manzini Zungu said. Gold firms Sibanye Gold and AngloGold Ashanti last week offered an additional 1,000 rand ($80) a month to entry-level workers, while Harmony Gold offered 500 rand a month. "Harmony's offer has messed it up -- the offer is too low for the members," Zungu said after a mass rally at Sibanye's Beatrix mine. The union is demanding a more than doubling in wages but gold companies say they cannot afford such increases as they battle falling prices and rising costs. The union will meet with the Chamber of Mines on Tuesday to officially reject what the gold companies called a "final offer." "The final offer is just that -- final," Chamber spokeswoman Charmane Russell said. The Chamber would wait until Tuesday to hear from the union, she said. ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold And Silver Charts Are The Compelling Story. Fundamentals Do Not Apply Posted: 02 Aug 2015 08:03 AM PDT Not in 2013, not in 2014, and so far, nothing positive for the price of gold and silver has developed in what looks like for the balance of 2015. Most of the highly regarded gold and silver sites and bloggers have been expecting an upside breakout, some even saying an explosive breakout. As we have been saying for the past few years, the "eyes" have it. Just by following developing price activity, in chart form, it is more than obvious that price continues to languish at recent 4 -5 year lows with NO signs of ending. It does not matter how much gold China has bought, how many gold/silver coins have been sold to the public, even record numbers. It does not matter how low is the existing supply for silver and its excessive and growing demand. So far, it has not mattered how the miners have been suffering and are closing down operations. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The Chinese stock market recently saw its biggest selloff in eight years as the dramatic 8.5-percent fall in Shanghai "A" shares also rattled markets around the world. For the past few weeks China has been balancing its desire to keep the equity market from a complete meltdown with courting the international investment community in hope of being a dominant player in the capital and currency markets.

The Chinese stock market recently saw its biggest selloff in eight years as the dramatic 8.5-percent fall in Shanghai "A" shares also rattled markets around the world. For the past few weeks China has been balancing its desire to keep the equity market from a complete meltdown with courting the international investment community in hope of being a dominant player in the capital and currency markets. This past month marked the 10th anniversary of the Chinese government's decision in July 2005 to lift the Yuan/Renminbi peg to the U.S. Dollar, commemorating the country's initial move toward joining a select group of economies managing global reserve currencies. So, we thought this currency would be an appropriate one to revisit in the latest installment of Currency of the Month.

This past month marked the 10th anniversary of the Chinese government's decision in July 2005 to lift the Yuan/Renminbi peg to the U.S. Dollar, commemorating the country's initial move toward joining a select group of economies managing global reserve currencies. So, we thought this currency would be an appropriate one to revisit in the latest installment of Currency of the Month.

The world is awash with “promises”. Nearly everything we think of as having “value” is because of a promise behind it. A few examples; your bank accounts, retirement funds, bonds and even the dollar bills in your pocket. Your bank account for example, once you deposit the money it is no longer yours. You can argue this if you wish but we now know this is true for sure after recent “bail in” legislations passed throughout the west. When you deposit funds into a bank, it then becomes “their money” held for you …they “owe” it to you. Do not take this lightly, lawmakers around the world have made this the new reality. A little known fact, in 1845 Britain passed banking law that made depositors (unsecured creditors), this is still precedent to this day. When you deposit money you “accept a liability” from your bank and are classified as an unsecured creditor. In other words, “get in line with everyone else”!

The world is awash with “promises”. Nearly everything we think of as having “value” is because of a promise behind it. A few examples; your bank accounts, retirement funds, bonds and even the dollar bills in your pocket. Your bank account for example, once you deposit the money it is no longer yours. You can argue this if you wish but we now know this is true for sure after recent “bail in” legislations passed throughout the west. When you deposit funds into a bank, it then becomes “their money” held for you …they “owe” it to you. Do not take this lightly, lawmakers around the world have made this the new reality. A little known fact, in 1845 Britain passed banking law that made depositors (unsecured creditors), this is still precedent to this day. When you deposit money you “accept a liability” from your bank and are classified as an unsecured creditor. In other words, “get in line with everyone else”! "The one thing I know for sure about China is, I will never know China. It’s too big, too old, too diverse, too deep. There’s simply not enough time."

"The one thing I know for sure about China is, I will never know China. It’s too big, too old, too diverse, too deep. There’s simply not enough time."

No comments:

Post a Comment